Biosynthesis of a Cell Wall Glucomannan in Mung Bean Seedlings*

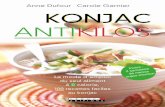

N UTRITION BUSINESSEFSA’s unexpected, first-ever approval of a weight-management claim for a...

Transcript of N UTRITION BUSINESSEFSA’s unexpected, first-ever approval of a weight-management claim for a...

N E W N U T R I T I O N

B U S I N E S Swww.new–nutrition.com NOVEMBER 2010 ISSN 1464-3308VOLUME 16 NUMBER 2

T H E J O U R N A L F O R H E A L T H Y E A T I N G , F U N C T I O N A L F O O D S & N U T R A C E U T I C A L S

Pages 10-12

Continued on page 3

Pages 17-19 Pages 13-16

Companies have become accustomed to the European Food Safety Authority (EFSA) almost routinely rejecting proposed health claims. Certainly the most recent batch of health claim opinions – published on 19th October – maintains EFSA’s tradition of a 90% rejection rate. However, although it’s not often that something good comes out of the EU’s health claims process, on this occasion – incredibly – there might be something positive to say.

Buried in the EFSA dung-heap is a nugget of gold that may help product developers who have the imagination and creativity to do something with it. The nugget is EFSA’s unexpected, first-ever approval of a weight-management claim for a specific food ingredient.

The ingredient approved is glucomannan, better known as konjac fibre. The EFSA review panel concluded that it agreed that a cause and effect relationship has been established between the consumption of glucomannan and the reduction of body weight and it authorised the proposed health claim:

Glucomannan contributes to the reduction of body weight in the context of an energy-restricted diet.

Many companies that have been experimenting with weight management products – such as those based on fi bre and proteins for satiety, which are now not approved by EFSA to make a satiety claim –

suddenly are faced with a unique opportunity to do something in weight management with a claim that’s EFSA-approved.

It’s worth noting that when the cholesterol-lowering brands such as Benecol, Danacol and Becel got EFSA’s approval for their

health claims, marketers began using terms such as “EU approved” in print and radio advertising – and in many markets sales went up markedly.

Not only does konjac now have a unique claim, the clinical evidence is that it actually works, so enabling consumers to “feel the benefi t” – something now well-established as a key success factor in the business of food and health.

Konjac fi bre will be unfamiliar to many product developers, but it is already used in many foods as a gel or thickener (it’s described as E425 on many product labels). It’s a soluble fi bre derived from the root of the konjac plant – enabling marketers to communicate a “natural plant extract” message of the kind that has already worked well for many ingredients.

Konjac forms a viscous, gel-like mass in the stomach when hydrated and this is clinically proven – certainly to the satisfaction of EFSA’s near-pharmaceutical standards of clinical proof – to induce a sense of satiety leading to a decrease in subsequent energy intake. In order to obtain the claimed effect, 3g of glucomannan should be consumed daily.

“I believe the EFSA decision will help enormously to put konjac in a better light,” says Ross Campbell of CyberColloids, a company which provides expert help with innovation for companies using and making hydrocolloids. He adds: “It will certainly encourage food formulation work and I think

An American brand called NeuroTrim is one of the few brands in Europe already offering a weight management benefit based on the presence of konjac.

Weight management surprise win in EU health claims lottery

By Julian Mellentin

Science gives beetroot brand a superfood boost

A 40-year overnight

success story

Mass-market probiotic juice

ready for global rollout

NOVEMBER 2010 2

N E W N U T R I T I O N B U S I N E S Sw w w. n e w - n u t r i t i o n . c o m

C O N T E N T S & C O N TA C T S

All enquiries: Allene BruceCrown House, 72 Hammersmith RoadLondon W14 8TH, UKPhone: +44 (0)20 7617 7032Fax: +44(0)20 7900 [email protected] by Mastercard, American Express and Visa accepted.

For 1 year at $1,050/€795/£675/¥ 90,000/A$1,330/NZ$1,550/C$1,150 (11 issues).For 2 years at $1,790/€1,350/£1140/¥ 150,000/ A$2,250/NZ$2,650/C$1,950 (22 issues).

All including fi rst class or airmail postage, net of any bank transfer charges.

Published 11 times a year byThe Centre for Food & Health Studies

ISSN 1464-3308 All rights reserved, photocopying of any part strictly prohibited.

EditorJulian [email protected]

Dale Buss, New Nutrition Business, 6390 Cherry Tree Ct, Rochester Hills, MI 48306, USA.Tel: 248/651-9648 Fax: 248/[email protected]

Crown House, 72 Hammersmith Road,London, W14 8TH, UK.Tel: +44 (0)20 7617 7032 Fax: +44 (0)20 7900 1937

19 Dryden Street,Grey LynnAuckland, New ZealandTel: +64 (0)9 361 2687

COMPANIES AND BRANDS IN THIS ISSUE

New Nutrition Business uses every possible care in compiling, preparing and issuing the information herein given but can accept no liability whatsoever in connection with it.

© 2010 The Centre for Food & Health Studies Ltd. Conditions of sale: All rights reserved; no part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form by any means, electronic, mechanical, photocopying, recording or otherwise without the prior written permission of the publisher. The Centre for Food & Health Studies does not participate in a copying agreement with any Copyright Licensing Agency. Photocopying without permission is illegal. Contact the publisher to obtain a photocopying license. This publication must not be circlated outside the staff who work at the address to which it is sent without the prior written agreement of the publisher.

LEAD STORY

1,3-4 Weight management surprise win in EU

health claims lottery

EDITORIAL

5-7 Innovating beyond consumers’

imaginings

8 Europe keeps up the pace of health

claim rejections

CASE STUDIES

9 REGULATION: Science key to new

world of claims

10-12 INNOVATION: Mass-market probiotic

juice ready for global rollout

13-16 INNOVATION: A 40-year overnight

success story

17-19 INNOVATION: Science gives beetroot

brand a superfood boost

20-21 START-UP: Cracking the code for

protein drinks

22-23 SNACKING: From bog fruit to big fruit

NEW PRODUCTS

24-27 Functional & healthy-eating new

product launches

NEW

28 Use NNB as a Powerpoint

29 Listen to the audio file of NNB

IMPORTANT NOTICE

30 A polite reminder to our subscribers

NEW REPORTS

31 Fiber for digestive health

32 3 Beverage Reports

USEFUL TO KNOW

33 NNB Consultancy

ORDERING

34 New Nutrition Business Publications

35 Order Form

HOW TO SUBSCRIBE

36 Subscription Order Form

Beet It ........................ 5,6,7,17,18

Craisins............................... 22,23

CyberColloids ........................... 1

Danone ............................... 10,11

Dr Pepper Snapple Group ........ 9

Gefilus .................. 5,6,7,10,11,12

Glaceau Vitaminwater .............. 9

James White Drinks ........... 17,18

MannanLife .............................. 6

Marlow Foods ................ 13,14,15

Nestlé ......................................... 9

NeuroTrim .......................... 1,3,4

Ocean Spray ...................... 22,23

Otsuka Foods’ My Size ............. 3

Pom Wonderful ......................... 9

Premier Foods .................... 15,16

Provita ................................ 20,21

ProViva .............................. 10,12

Quorn ............. 5,6,7,13,14,15,16

Unilever ..................................... 9

Valio ..................... 5,6,7,10,11,12

Wildwood .................................. 3

NOVEMBER 2010 3

N E W N U T R I T I O N B U S I N E S Sw w w. n e w - n u t r i t i o n . c o m

N E W S A N A LY S I S

yoghurt and beverages is an obvious place to start.”

As far as we can see, very few companies will immediately benefi t from the EFSA claim approval. One that will is the maker of NeuroTrim, a fl avoured water with green tea and caffeine that delivers 1g of konjac per 430 ml bottle (said by the maker to be the equivalent of 20g of regular fi bre) and is marketed with label claims as follows:

Weight loss support

Healthy weight loss

Be lean and healthy…with modern science’s greatest blend of natural weight loss support.

NeuroTrim is a US-based brand currently retailed in the UK in the upscale chain Waitrose and through the Ocado home delivery service, between them with a 5% grocery market share, as well as independent stores. It excels at “lifestyle” marketing and has successfully teamed up with a number of celebrities, including Justin Timberlake.

On the down-side, because konjac fibre absorbs water and swells up, it’s not suitable for use in candies, capsules and the like because of the risk it can swell up and cause choking. It’s better suited for use in dairy and beverages or in noodles – in Japan konjac fibre is the main constituent in shiritaki noodles.

COMMENT

Whoever is fi rst to market will need to rely on more than the health claim to succeed – a product with excellent taste, packaged in a convenient format and supported by a weight management programme, such as that used by Kellogg in connection with its Special K brand, will all be critical success factors.

To make the most of this nugget will require innovation in product format, packaging and marketing to achieve truly differentiated products, but for anyone willing to make the effort, the opportunity is there.

Konjac is effectively unknown in the European market, and for that reason most product developers will simply ignore EFSA’s ruling as an irrelevance to them. Another reason that companies will ignore the konjac claim approval is that they will have their sights firmly fixed on a particular ingredient that has occupied their attention in recent years, and what happens all too often is that if that particular favoured ingredient doesn’t

get its claim approved then the companies focused on it plunge into a depression about the future of innovation in Europe and downgrade health benefits in their strategy.

That is a common reaction in our industry – and it is the wrong one. Key to success in business, as on the battlefield, is to be able to react quickly to events and seize new and unexpected opportunities. The approval of a weight management claim for konjac fibre is just such an opportunity, to create products that will be unique in food and beverage in Europe in being able to describe their weight management benefit as “clinically proven” and “EU approved” and so steal significant competitive advantage – an advantage

which will widen as products whose weight management claims are not approved (and in Europe, that’s going to be most of them) are forced to drop their marketing claims.

As an industry, we have been loud in our complaints over the last year that the EFSA health claim process is crushing innovation in Europe. Those complaints are justifi ed.

But when, out of the blue, EFSA presents us with unexpected opportunities to use health claims, then product innovators need to seize the opportunities with both hands. The opportunities may not be the ones you had planned for your business, but what in life runs according to plan?

Continued from front page

Wildwood, America’s biggest tofu manufacturer, has marketed its Pasta Slim fettucini, an Italian version of noodles, since 2008. The product is based on konjac fl our.

In Japan Otsuka Foods recently launched My Size, which offers small single-serve portions in a fl exible pouch. Manan Rice offers Manan Hikari, a konjac product resembling rice developed by the company. It has a 40% reduced calorie content compared to regular rice and contains digestive fi bre equivalent to the amount contained in three heads of lettuce.

Ingredients: Konjac product (starch, polydextrose, refi ned konjac fl our, honey powder), rice, brassica campestris (rapeseed) seed oil, salt, polysaccharide thickener, trehalose, calcium gluconate, pH neutralizer, seasonings (organic acid)

Nutrition: Per 150g serving: Energy 143kcal, Protein 1.1g, Fat 0.8g, Sugars 31.5g, Dietary fi bre 9.9g, Sodium 87mg (Salt Equivalent 0.2g)

KONJAC HAS APPLICATIONS IN MEALS AND SIDE DISHES

Source: Mintel GNPD

NOVEMBER 2010 4

N E W N U T R I T I O N B U S I N E S Sw w w. n e w - n u t r i t i o n . c o m

N E W S A N A LY S I S

CHART 2: KONJAC IN JAPAN

The market for konjac fibre products targeting weight management in Japan has been shrinking after it was revealed that a 21-month-old Japanese boy had choked to death on a frozen konjac jelly from the company MannanLife.

MannanLife today markets a fruit jelly in a pouch under the brand name Konjac Batake. Launched in 2008 it achieved annual sales of JPY1 bn ($12.3m/€8.85m). Even though the company suffered from the sales decline that followed the choking incident, the popularity of the brand still remains. Having focused on advertising in a series of TV commercials, and gained an approval as FOSHU (Food for Specified Health Use) in September 2009, the brand’s sales are expected to achieve estimated annual sales of JPY2.8bn ($34m/€25m).

Product name Konjac Batake Portion Type(5 flavours), Konjac Batake Crushed Type Light (4 flavours, FOSHU approved)

Sales Channel Supermarkets, convenience stores, online

Price 150 yen ($1.80) per 150g pouch

Format Jelly drink

Fiber content 5g per serving(150g) for regular one, 6.7g per serving for Light version

Ingredients

high-fructose corn syrup, polydextrose, galacto-oligosaccharide, Grape fruit juice, liqueur, Konjac powder, gelation agent(polysaccharide thickener), acidulant, Flavouring, calcium lactate, sucralose

RDA -

Features/catch copies

Make Belly Happy

Convenient and Tasty way to eat Konjac (Dietary Fiber)

Website http://mannanlife.co.jp/

Crushed Type is approved as FOSHU in 2009.

Crushed Type Light

Portion Type

Source: Global Nutrition Group Tokyo

CHART 1: NEUROTRIM INGREDIENTS AND NUTRITION FACTS

NeuroTrim Herbal Extract Beverage is said to be formulated to support weight loss. The non carbonated beverage only contains 37 calories per bottle and is free from artificial colours and flavours. It retails in a 430ml bottle.

The brand has excelled at gaining celebrity endorsements.

Ingredients & Nutrition Facts

Ingredients: Filtered water, crystalline fructose, soluble fiber (from konjac), citric acid, malic acid, natural flavors, preservatives (sodium benzoate, potassium sorbate), sweetener (sucralose), stabilisers (gum acacia, glycerol ester of wood rosin), proprietary ingredients (caffeine, green tea)

Nutrition facts: Per 430ml serving: Energy 154kJ/37kcal, Protein 0g, Carbohydrate 9g (of which Sugar 9g), Fat 0g (of which Saturates 0g), Fibre 1g, Sodium 0mg, Konjac Fiber 1,000mg, Caffeine 50mg, Green Tea 20mg

Continued from page 3

NOVEMBER 2010 5

N E W N U T R I T I O N B U S I N E S Sw w w. n e w - n u t r i t i o n . c o m

E D I T O R I A L

This month we take as our prism for thinking about innovation the work of the late CK Prahalad, one of the most influential business thinkers and writers (see references on page 7) of the past 20 years and also Professor at the Stephen M. Ross School of Business at the University of Michigan. The case studies of Gefilus Juice (page 10), Quorn (page 13) and Beet It (page 17) taken individually and together illustrate what the late professor would have viewed as best practice in innovation.

Prahalad authored many works jointly with Dr. Gary Hamel and together they originated the concept of core competencies, which is now hard-wired into how many companies think. In a paper they wrote together called Corporate Imagination and Expeditionary Marketing, they wrote that: “A company must also have the imagination to envision markets that do not yet exist and the ability to stake them out ahead of the competition.”

For companies such as Apple, Microsoft, Nokia and Google, it is this willingness to envision new markets and create them that has been key to their success. And the same willingness to envision that which does not

yet exist and then to create it is also key to success in food and beverages, as Quorn and Valio – the Apple and the Nokia of our industry – have demonstrated. The former created a new type of protein and built a $270 million brand based on this technology, the latter pioneered probiotic dairy and went on to give birth to a new market for probiotic fruit juice.

Unfortunately, the willingness – or perhaps the ability – to envision the new and then create it is all-too-rare in the food and beverage industries. Marketers, often highly risk-averse, fear doing anything that cannot be justified by consumer research – yet there was no consumer research which could have guided anyone to create a new protein (Quorn), create new markets for probiotic dairy and juice (Valio), or reinvent the beetroot as a sports and heart-health drink (Beet It). All of these innovations required a leap of imagination and a leap of faith – backed by the persistence to make faith into a reality.

The strategies of these three companies are a stark contrast to the practices of 95% of the food and beverage industry. Mostly

managers choose to deliver one close-to-the-core-business line extension after another, persuading themselves that they are innovating, all the while steering as far away as they can from anything that looks like risk. And yet, according to researchers as diverse as Mintel and PriceWaterhouseCoopers, less than 5% of new products from our industry can actually be classified as innovative in any way. Perhaps that is the reason why 90% of new product launches fail.

Prahalad and Hamel provide checklists which are a useful way of thinking about innovation. A short review of how Quorn, Valio and Beet It measure up against Prahalad and Hamel’s innovation checklist can be found in the table on page 6, and you should use them to measure your own company’s performance and compare them to the companies we have included.

Prahalad and Hamel outlined a number of elements which they described as essential for enabling the type of active corporate imagination which can envision and create the new. Here are three of them:

Escaping the tyranny of the served market. Instead of viewing every new

Innovating beyond consumers’ imaginings

continued on page 7

NOVEMBER 2010 6

N E W N U T R I T I O N B U S I N E S Sw w w. n e w - n u t r i t i o n . c o m

E D I T O R I A L

STRETCHING THE CORPORATE IMAGINATION

Adapted from the original by Prahalad and Hamel, who believe that companies need to move from mostly operating under the logic in the left column to the logic in the right column, which is where our case study companies – Quorn, Valio and Beet It – can all be found.

THE OLD LOGIC THE NEW MIND-SET

SERVED MARKETS OPPORTUNITY HORIZONSValio: pioneered the probiotic market in Europe, with the first science-based product. Undeterred by geographic limitations and the small population (5 million) of its domestic market Valio expanded its horizons to include the whole world, licensing its probiotic technology for use in dairy products in 35 countries. Now it is creating a new horizon by taking its probiotic technology into fruit juice.Quorn: a new business, creating new markets – in ten countries – based on a new type of protein, derived from a new technology.Beet It: an apple juice-pressing company focused on “taste and quality” moves far beyond its traditional business by embracing a new vegetable juice opportunity created by science.

DEFENDING TODAY’S BUSINESS CREATING NEW COMPETITIVE SPACEValio: created a new probiotic dairy business, now creating a new probiotic fruit juice business – all incremental sales and profits to its traditional milk and yoghurt and cheese business. Quorn: had no pre-existing business, it exists to create a new market. Beet It: decided not to be limited to its traditional core business, it is creating a new market and incremental sales.

THE COMPANY IS A PORTFOLIO OF BUSINESSES

THE COMPANY IS A PORTFOLIO OF CORE COMPETENCIESValio: competence in clinically-proven probiotic dairy technology which it deploys around the world, as well as probiotic supplements and now probiotic fruit juice. The company also has a competence in zero-lactose milk technology, which it is commercialising globally. Technology commercialisation is also a proven competence.Quorn: competence focused in fermenting myco-protein and processing it in innovative ways, using technology, to create convenient foods that consumers can accept.Beet It: developing a competence focused on the all-natural benefits of beetroot juice, its benefits, and delivering it in convenient format, thanks to its skills as a fruit-processing and marketing business.

FOLLOWING CUSTOMERS LEADING CUSTOMERSValio: leading customers to probiotic dairy and juice, creating new markets.Quorn: leading consumers to a new type of protein, by making it good-tasting and highly convenient.Beet It: leading customers to the new idea of drinking beetroot juice for lower blood pressure or better sports performance.

MAXIMISE THE HIT RATE MAXIMISE LEARNINGValio: has acquired massive know-how over the last 20 years both in technologies and markets, which it continues to develop and apply. Learnt how to create new markets (such as probiotic juice) and develop new packaging formats (shots).Quorn: has learnt how to effectively take its new protein to market in multiple countries.Beet It: a small company embraces science and goes into an entirely new and unfamiliar field, learning with enthusiasm about its new customers and embracing new types of packaging, such as the 70ml concentrated dose, which most larger companies lack the courage to adopt.

COMMITMENT = INVESTMENT COMMITMENT = PERSISTENCEPersistence is the skill with which corporates struggle the most, a result of the affliction of constantly seeking short-term profit growth. Yet it is perhaps the single most-important skill, providing the fuel that keeps everything moving forward. Persistence is essential for success in any field that involves science or technology; as Marie Curie said: “I was taught that the way of progress is neither swift nor easy.”Valio: more than 20 years of persistence, including a five-year or more period when it spent more developing its technologies and competences than it earned from them.Quorn: From an idea developed in the 1970s, commercialisation began in 1990 – more than 20 years of persistence.Beet It: a small company showing every sign of persistence in creating a new market.

NOVEMBER 2010 7

N E W N U T R I T I O N B U S I N E S Sw w w. n e w - n u t r i t i o n . c o m

E D I T O R I A L

opportunity through the lens of existing businesses, managers must think outside of current boundaries and explore the white spaces which lie between existing businesses. This is where the core competency mindset helps.

In our industry this usually means “new category creation” – creating markets which are new to the companies concerned (as science-based probiotic dairy and probiotic juice was for a company like Valio, which prior to that was only a traditional dairy business in milk, yoghurt and juice) and indeed creating categories that are new to the consumer (as probiotic juice still is in most countries). This conscious decision to create a new market is what lies at the root of the creation of most of the biggest successes of the last two decades, from probiotic dairy to the energy drinks market and the success of brands like Red Bull.

Overturning traditional price/performance assumptions. Thinking about price and performance in linear terms limits the potential for radical innovation. Instead of using existing product concepts as the starting point for new product development, managers might do well to challenge existing assumptions in the category about price/product trade-offs.

In the case of Valio this meant marketing its Gefilus probiotic juice at a 30%-50% premium to its regular chilled juices – which proved no barrier to Gefilus gaining a 32% market share.

Beet It, the start-up, has not shrunk from creating a super-premium price product with its “concentrated dose” product – and has found that the elite athletes it targets are willing to pay a premium for an effective product.

Getting out in front of customers. “Simply being customer-led is not enough,” say Prahalad and Hamel. Particularly in categories that rely on technology, customers often can’t even imagine what is possible. Companies must lead customers where they want to go – before they even know it themselves.

Valio, Quorn and Beet It are all examples of companies creating product concepts that consumers did not know they needed. They are not led by consumer demand, they create consumer demand.

CK Prahalad has a message that is relevant to beverage companies who question the viability of the probiotic juice concept

that has now been so well proven by Valio in Finland and by the ProViva brand in Sweden: “With the tremendous turbulence and the speed with which industries are changing today, you can’t just sit around and wait. While high levels of profits from existing businesses are a must, companies need to be reinvesting in a consistent fashion to create new businesses, and new products, and to shape the pattern of market evolution. They need to imagine new markets for tomorrow, and to build new core competencies that will give them an advantage in those markets.”

In this case the turbulence will come from Danone’s decision to license both the ProViva technology and brand for global roll-out. The risk for beverage companies is that Danone will reinvent juice in the same efficient way it has reinvented – and so now dominates – the dairy cabinet with its probiotic brands such as Activia. Companies can’t sit around and wait for this to happen.

“Senior managers,” says Prahalad, “should therefore be spending less time looking inward and backward, and more time looking outward and forward. They need to be thinking about the implications of new trends and technologies, and about how their industries might be different in five or ten years. Of course, operational issues are important and legitimate – how to reduce overheads, how to respond to a competitor’s last move, how to improve quality or reduce cycle time – but unless you are growing new markets, new businesses, new sources of profit, you will find yourself on a treadmill, always trying to improve the ever-declining margins and profits from yesterday’s businesses.

All of our case study companies have also behaved in ways that score well on another of Prahalad’s points. He says: “It’s not enough to imagine the future – you also have to build it. Many companies have had incredible industry foresight, but they lacked the capacity to execute it. In order to build the kind of future business which you have imagined, you need to develop this capacity for execution. You need to make a strategic blueprint for turning the dream into reality – a link between the present and the future. You need to carefully work out which new competencies you should be building, which new customer groups you should be trying to understand, which new distribution channels you should be exploring, in order to create a winning position for yourself in a new opportunity arena.”

And finally, our chosen companies also meet all of the following criteria:

“Two things seem to characterize most of the companies that succeed in capturing future opportunities. First, they have aspirations which lie outside the resource base of the company, and they manage to stretch and enlarge their resources in order to succeed in this new market. Second, successful companies have come to a view of the future that provides a sense of direction, a sense of common purpose, a sense of destiny, a single-minded and inspiring challenge which commands the respect and the allegiance of every person in the organization. The role of senior management is to make sure that the company develops this broad aspiration, and in addition that it is clearly articulated, understood and continuously reinterpreted. Every two or three years, management should again interpret its aspiration and say, ‘This is what it means to us in the next two years’, so the challenge is always renewed but the overall strategic intent remains consistent.

“Go back and look at the Fortune 500 or the Fortune 100 over the last 50 years, and ask yourself how many companies have disappeared from the list, and what the survivors do to stay in that league. You will find that they are continually looking forward, not backward. They are continually changing the rules of competition, rather than following the accepted rules. They are regularly defining new ways of doing business, pioneering new product concepts, building new core competencies, creating new markets, setting new standards and challenging their own assumptions. They are taking control of their future. You can’t do that if you are not willing to change and to move from where you are today. The opportunities are out there for everyone, but capturing new business opportunities is like shooting flying ducks – you can’t do it with fixed gun positions.”

To innovate successfully, you too must take your cues from companies like Valio Dairy, Quorn and even the start-up Beet It, and employ vision, purpose and flexibility to capture new opportunities.

SOURCES: Prahalad, C.K., and Hamel, Gary. 1990. “The Core Competence of the Corporation,” Harvard Business Review.Hamel, Gary and Prahalad, CK. 1991. “Corporate Imagination and Expeditionary Marketing,” Harvard Business Review.

continued from page 5

NOVEMBER 2010 8

N E W N U T R I T I O N B U S I N E S Sw w w. n e w - n u t r i t i o n . c o m

R E G U L AT I O N

The European Food Safety Authority (EFSA) is clearly still on top form and in its most recent batch of health claim opinions, published in mid-October, it has sustained the impressive 95% health claim rejection rate which it has consistently achieved in the past.

One of the biggest losers from the latest batch of rejections is whey protein. Among the claims rejected were:

• consumption of whey protein and a sustained increase in satiety leading to a reduction in energy intake.

• consumption of whey protein and contribution to the maintenance or achievement of a normal body weight.

• the claim “supports a gain in lean body mass during periods of energy restriction”

• The claims: “promotes protein synthesis when taken after resistance exercise”, “supports an increase in lean body mass when combined with exercise and a hypercaloric diet”, “muscle mass maintenance in the elderly” and “muscle strength and body composition”. EFSA ruled that no cause and effect relationship had been established between the consumption of whey protein and these benefi ts.

• The claim: “supports a decrease in body fat when combined with exercise and a hypocaloric diet”.

• For the claimed effect of increasing muscle strength, “no cause and effect relationship established between the consumption of whey protein during resistance training and an increase in muscle strength”.

• EFSA ruled that, “no cause and effect relationship has been established between post exercise consumption of whey protein and increase in endurance capacity during the subsequent exercise bout after strenuous exercise” nor for

consumption of whey protein and faster recovery from muscle fatigue recovery after exercise.

While it is clear that new evidence supporting some of these claims has come to light since the original health claim dossiers were prepared some years back and that some would be better substantiated now, the decisions still surprised some, with one research scientist specializing in protein telling New Nutrition Business, on condition of anonymity, that rejecting a satiety claim for whey protein was “very hard to understand. It’s the one thing you can say with complete confidence that whey protein does.”

The same researcher also expressed surprise that EFSA rejected claims that whey protein does not help maintain muscle mass in the elderly or support muscle strength in this group, since whey protein has long been used extensively in clinical nutrition for precisely these benefits.

Whey protein manufacturers are likely to submit fresh health claim applications under article 13.5 of the EU health claims regulation.

Another area where industry interest is high but where EFSA stuck to its policy of rejecting claims is less surprising, that of cocoa fl avanols. Claims relating to “antioxidant properties” and “oxidative stress reduction” were rejected (“a cause and effect relationship has not been established between their consumption and “vascular health” and maintenance of normal blood pressure”).

Unsurprisingly, industry is again questioning EFSA’s process and whether it is following the criteria for a review of the totality of the evidence that the regulation was supposed to have put in place.

“A rejection rate of 95% calls into question whether the criteria applied are appropriate,” said Professor Dr Markwart Kunz, president of the Federation of European Specialty Food Ingredients Industries (ELC), in a statement issued by ELC.

One of the winners from the current batch of EFSA opinions was DHA, and the regulator has proposed the following wordings for permitted claims that can be used on

products on the European market:

• DHA contributes to the maintenance of normal blood triglyceride levels - subject to 2g per day of DHA consumed in one or more servings.

• DHA contributes to the maintenance of normal brain function – for foods that contain 250 mg of DHA in one or more servings.

• DHA contributes to the maintenance of normal vision – for foods that contain 250 mg of DHA in one or more servings

Just how exciting these claims are to marketers and to consumers – and whether they will have any effect on sales of DHA-fortifi ed products on the European market – is another question altogether. While DHA producers are upbeat, the evidence from countries such as Canada, where claims such as these have been permitted for some years, is that brands making these claims sell only on a niche basis. Certainly Danone used the second of these three claims on its Danonino children’s yoghurt brand in Canada for the past three years, with limited results, such that Danone has not taken the concept into other markets.

Sometimes commentators say that the success of a functional food or beverage is only as good as its health claim. That’s actually not correct – often the health claim makes no difference at all to whether consumers buy a product. Taste, packaging design, the credibility of the product format, the amount of the product that needs to be consumer to get the “dose” the person needs – and whether the consumer sees the benefi t as being relevant to them are all more important factors. In Europe DHA products have already struggled with all of these factors, particularly taste (most DHA products have poor taste) and product format (DHA-fortifi ed dairy is rejected by most consumers). The approval of a few health claims that say nothing stronger than “contributes to the maintenance of ” isn’t going to make any difference to these bigger factors.

Europe keeps up the pace of health claim rejections

NOVEMBER 2010 9

N E W N U T R I T I O N B U S I N E S Sw w w. n e w - n u t r i t i o n . c o m

R E G U L AT I O N C A S E S T U D Y

The recent spate of US-government censures of health claims by beverage brands reflects a shift toward a more aggressive regulatory regime. So drink brand marketers and their advisors are busily trying to adapt by backing off the boldest claims for nutritional attributes of their products that may be only marginally supported by science.

The government also hints that it may specifically try to prevent makers of carbonated soft drinks from making health claims for those beverages no matter how they might nutritionally enhance the drinks.

Within the first two years of the Obama administration, in fact, the interplay between agencies such as the Food & Drug Administration, the Federal Trade Commission and beverage marketers has almost completely flipped in tone and practice from the days of the Bush administration, when food and drink manufacturers were continually pushing new health-claims language to regulators’ desks for approval.

“It’s a new world in Washington, D.C.,” said Cathy Kapica, senior vice president of global health and wellness for Ketchum, a marketing-communications firm that advises several big food and beverage companies, noting that FDA Commissioner Margaret Hamburg, Obama’s appointee, “doesn’t let the grass grow under her feet.”

Kapica added: “There is unprecedented cooperation between agencies that, in the past, tended not to be too cooperative. All of these guys are working together to move issues forward.”

Other observers were more critical: “A lot of these regulators are inherently hostile to or mistrustful of business and will do anything they can to make it more difficult,” maintained Brian Wansink, director of the Food & Brand Lab at Cornell University and President George W. Bush’s appointee three years ago to head the 2010 revision of the government’s Dietary Guidelines.

“It’s not necessarily out of looking out for the consumer, either; it’s more out of a dislike they have for business and for food companies.”

“Regulations used to be part of how we viewed the industry,” said Tom Pirko, an Obama supporter and the president of Bevmark Consulting, a consultancy that advises many of the world’s top beverage brands. “But now there is a decided accent,

and it’s called politics. We didn’t have that before.”

Consider:• The FTC sued Pom Wonderful in

October, saying that the Los Angeles-based company’s studies don’t back up its earlier advertising claims that the juice can improve heart and prostate health and treat erectile dysfunction. Pom CEO Lynda Resnick pushed back, accusing the agency of going “crazy” on the issue. But the company already has switched its advertising emphasis to the sex appeal of pomegranates instead of health.

• The FDA scored Dr Pepper Snapple Group in September, objecting to the use of the word “enhanced” rather than “more” to describe the inclusion of 200mg of antioxidants from green tea and vitamin C in the company’s Canada Dry Green Tea Ginger Ale.

• The agency targeted Unilever’s Lipton Green Tea 100% Natural Naturally Decaffeinated, arguing that Unilever was establishing the drink as a “drug” by citing studies in its marketing referring to the cholesterol-reduction benefi ts of tea and tea fl avonoids.

• In July, Nestlé HealthCare Nutrition agreed to drop claims about the health benefi ts of its popular children’s drink Boost Kid Essentials, as part of a settlement resolving the FTC’s fi rst case challenging advertising for probiotics.

A number of other factors are also in play that contribute to greater regulatory attention to beverages than to foods.

One is increasing government and societal concern over childhood obesity, such as the anti-obesity campaign of First Lady Michelle Obama. Carbonated soft drinks have emerged as a particular villain in many of these efforts, including scattered state- and local-level efforts to tax such drinks.

“There’s also the fact that data continues to come out that shows calorically sweetened beverages are a big contributor to excess calories, particularly among kids,” explained Kapica, the former top nutrition-marketing executive at McDonalds. “Beverages are

being looked at very carefully now [by regulators] because in many cases they’re considered non-essential.”

And in its language in the letter to Dr Pepper Snapple Group, the FDA intimated even sharper attention to health claims being made by carbonated beverages. “FDA does not consider it appropriate to fortify snack foods such as carbonated beverages,” the agency wrote.

Regulators are also watching the tightening health-claims standards in Europe. “It’s a new world everywhere, actually,” Kapica said. “On a global basis, we’re seeing stricter and tighter controls around what can be said, including health claims that we almost had taken for granted.”

In turn, more aggressive regulators are encouraging plaintiffs’ attorneys to consider food and beverage health claims as more vulnerable targets. Coca-Cola’s Glaceau Vitamwater, for instance, has been sued by the activist Center for Science in the Public Interest over allegedly unsubstantiated claims that Vitaminwater reduces the risks of chronic disease and eye disease, promotes healthy joints and supports immune function.

Kapica said that Ketchum is advising clients, among other things, to “focus on reducing the caloric content of their beverages” and “showcasing” such changes. Of course, beverage makers have been doing that apace, including as part of the commitment made three years ago by member companies of the Alliance for a Healthier Generation, a not-for-profit joint venture of the American Heart Association and the William J. Clinton Foundation.

The companies committed to removing full-calorie soft drinks from schools across the country and replacing them with lower-calorie, smaller-portion beverages. As a result there was an 88% reduction in calories from beverages shipped to schools since 2004, the Alliance reported earlier this year.

Also, Kapica said, “This is an environment where you need to have science – and good science – to back up any [health] claims. That doesn’t mean one unpublished, or even published, study. The overarching thing we’re seeing happening here is that there is new government skepticism around marketing claims that aren’t based in good science or exceed the base of the science.”

Science key to new world of claims

NOVEMBER 2010 10

N E W N U T R I T I O N B U S I N E S Sw w w. n e w - n u t r i t i o n . c o m

I N N O VAT I O N C A S E S T U D Y

Far-sighted juice drink producers are casting about to find whether they can get their own probiotic fruit juice to market ahead of French dairy giant Danone. The flurry in the world of juice drinks has come in the wake of Danone’s announcement that it plans to commercialise, worldwide, a probiotic juice using Swedish science company Probi’s L. plantarum 299v probiotic strain and the successful fruit juice ProViva, marketed in Sweden since 1994 (see New Nutrition Business September 2010).

A few senior juice industry executives are rightly fearful that the French dairy giant will redefine and dominate the chilled juice cabinet with the same ruthless efficiency with which it has redefined the health section of the dairy cabinet.

Looking for a rival probiotic juice technology, companies have found that for credible, proven products backed by clinical evidence the best – indeed only – place to go is to Valio Dairy, the Finnish dairy company whose successful technology innovations have helped make Finland the Silicon Valley of functional foods.

Valio is one of the pioneers in probiotics and has consistently proven itself to be farsighted – and successful – in creating and commercialising new technologies. The achievement is made all the more impressive by the fact that Valio is a farmer-owned co-operative operating in one of the remotest corners of Europe in a country with a population of just 5 million people. But on the other hand, perhaps it isn’t surprising. Finland is also the country that produced mobile phone giant Nokia, is a world leader in forestry and paper technology, and in health ingredients also produced such global successes as Xylitol and Benecol, to name just two. This small country’s excellent education system – internationally ranked alongside Japan’s as the best in the world – might help

explain why one small country can be so innovative.

In the early 1980s farsighted people in Valio believed that probiotic bacteria offered considerable commercial potential – a radical idea at the time. So the company started asking around the dairy experts at Finland’s universities looking for opportunities for co-operation. This route drew a blank, but Valio did learn about a human probiotic strain that had been isolated in the US. The strain was Lactobacillus rhamnosus GG ATCC 53103, which had been isolated from a healthy human.

The scientific minds behind Lactobacillus GG are two Americans, Dr Sherwood Gorbach and Dr Barry Goldin (hence GG) both of Tufts University, who discovered the strain in the early 1980s. In 1987 Valio signed a worldwide licensing agreement for the rights of Lactobacillus GG with Gorbach and Goldin. LGG is the trade mark of Valio

for Lactobacillus GG, which is also a patented strain. Valio holds world-wide commercial rights for LGG.

Thanks to heavy scientific investment by Valio in the years following, Lactobacillus GG today has the most extensive scientific background of all probiotics in the world, with over 500 clinical studies published. LGG’s credibility got a significant early boost when, in 1996, a yogurt brand based on LGG, called Onaka-He-GG!, produced by Takanashi Milk Products, became the first probiotic food ever to be granted the FOSHU seal of approval in Japan.

Valio launched the first LGG-based dairy product in its domestic market in 1990. Called Gefilus, it was the first clinically-backed probiotic consumer product on the European market – four years ahead of the debut of Danone and Yakult.

Since then the Gefilus brand has grown and grown and has been extended to a

Mass-market probiotic juice ready for global rollout

The juice drink market looks set to be transformed, worldwide, by the advent of probiotic products. One of the pioneers in the field is innovative Finnish dairy company Valio, which has spent the past decade turning its probiotic juice drink brand into a major success. Valio now ready to use the same model which has proven so successful for the company’s dairy probiotics, taking its technology to market through a network of global partnerships. By JULIAN MELLENTIN.

NOVEMBER 2010 11

N E W N U T R I T I O N B U S I N E S Sw w w. n e w - n u t r i t i o n . c o m

I N N O VAT I O N C A S E S T U D Y

wide range of products for almost every dairy consumption occasion, such that per capita consumption of Gefilus in Finland is over 6kg – arguably the highest per capita consumption of probiotic products in the world.

Gefilus products carry an immune health claim, which translates as a “strong dose of immunity”. LGG’s claim will be reviewed by the European health claim regulator in 2011, but with 518 clinical studies, it would be surprising if even European regulators – who thus far have rejected 90% of health claim petitions – can find fault.

Impressively, when Finnish consumers are asked which brands do most to help daily well-being, they rank Gefilus in fourth place – just behind Nivea face cream, ibuprofen and the Lumene cosmetic brand and ahead of L’Oreal (and far ahead of Danone Activia).

Valio has not only commercialised LGG in products in its domestic market but has excelled at commercialising its technology globally – LGG can be found in dairy products in 35 countries, including some of the most successful probiotic brands, such as Emmi Aktifit in Switzerland and Campina’s Vifit in the Netherlands, the Unimilk brand in Russia, the Parmalat Vaalis brand in Australia (that country’s biggest probiotic brand), as well as in supplements in 33 countries.

In fact Valio is something of a role-model for good technology commercialization: the company has also developed patented true lactose-free milk (in response to the needs of the Finnish market, where 15% of consumers are medically lactose intolerant) and rolled out this technology globally too.

PROBIOTIC JUICE INNOVATION

While many dairy companies have limited their innovation to dairy products, Valio has always been more open-minded and – along with Swedish company Skåne Dairy – was one of the first to spot the potential of probiotic fruit juice.

Valio launched its Gefilus probiotic juice in Finland in 1997. Well-supported with advertising and promotions – and delivering an effective benefit – by 2010 Gefilus juice had taken an impressive 32% share of Finland’s chilled juice market, becoming the country’s biggest chilled juice brand.

“In value terms Gefilus juice has become the market leader,” explains Kalle Leporanta, export manager at Valio Dairy Innovative Concepts & Technologies. “In ten years

Gefilus changed the structure of the market, becoming the leading brand despite being a premium juice in a premium market. The effect has been to increase the value of the chilled juice market in Finland.”

Gefilus’s ascent to market leadership was achieved despite selling at a premium. Regular juices, such as Valio Orange juice, typically retail for around €1.09 per litre ($1.51). Valio Gefilus sells at a hefty 100% premium, at €2.05 ($2.83) per litre, although this is still a much lower price than a super-premium brand such as Pepsi-owned Tropicana, whos regular orange juices retail for around €2.95 a litre ($4.07).

The Finnish chilled juice market has a volume of approximately 30 million litres and a retail sales value of around €45 million. The ambient market is much larger, with a volume of 80 million litres and a retail value of €120 million. Taking the two together Gefilus probiotic juice has a 10% value share of the entire Finnish juice market.

When you consider that Finland has a population of just 5 million, you realise that if Finnish per capita consumption of Gefi lus Juice was translated pro rata into a larger country, such as the US, it would be a $800 million (€600 million) annual-sales brand.

Gefi lus comes in multiple fl avour variants, of which the best-selling are Five Fruits and Pineapple-Carrot (see picture on page 10).

The juice range was extended in September of this year with the launch of a 100ml fruit shot, sold in a 4-pack priced at €2.60 ($3.59) per pack, equivalent to €6.50 per litre. It is available in banana-apple-passionfruit-orange-mango flavour.

The idea for the product was stimulated to an extent by the relative success in Finland of Danone’s Actimel 100ml dairy drink for immunity.

“As we have a lot of technology and know-how in the company it made sense,” says Leporanta. “We are trying to make a point of difference from Actimel with probiotic fruit shot and there is also the logic of an alternative to dairy.”

The launch of the shot – sales of which are reportedly going to plan so far – gives another string to Valio’s bow when it comes to commercialising its probiotic fruit juice technology internationally.

“It’s clear that suddenly there’s a lot going on in this field,” observes Leporanta. “For ten years we have been proving the concept in the Finnish market and we have kept a low profile. But now we are activating ourselves. We have learnt many valuable lessons from

building up the international network of licensing agreements for LGG in dairy and that puts us in a good position to work with the juice drink companies and bring them a related but different area of expertise.”

COMMENT: PROBIOTIC FRUIT JUICE THE NEXT NEW CATEGORY

It’s clear that Danone intends to make a major success of probiotic juice drinks. Juice companies face the real possibility that Danone, with its track-record of excellent execution, will redefine the juice market just as it has redefined the dairy market with brands like Activia and Actimel.

As we have also said before in New Nutrition Business, it’s our belief that probiotic fruit juice is one category that can provide consumers with a viable alternative to dairy. Fruit juice is consumed everywhere, appeals to all types of consumers, has little or no negatives associated with it – especially now that product developers are so focused on lowering the calorific value and have an increasing arsenal of ingredients to enable them to do so – and it can be delivered in

INGREDIENTS: Mango puree, orange juice (from concentrate), apple juice (from concentrate), banana puree, passion juice (from concentrate), vitamin C, Lactobacillus rhamnosus GG, vitamin D

NUTRITION: Per 100g: Energy 231kJ/54kcal, Protein 0.4g, Carbohydrate 13g (of which Sugars 12g), Fat 0.2g (of which Saturated Fat 0g), Dietary Fiber <1g, Sodium 0g, Vitamin C 40mg (50% RDA), Vitamin D 1.5µg (30% RDA)

CHART 3: GEFILUS FRUIT SHOT INGREDIENTS AND NUTRITION FACTS

NOVEMBER 2010 12

N E W N U T R I T I O N B U S I N E S Sw w w. n e w - n u t r i t i o n . c o m

highly convenient packages. Its convenience and taste appeal are advantages that few other categories can match. Moreover, in consumers’ minds fruit is a natural and credible vehicle for health messages.

It’s an opportunity that’s so-far under-exploited but, like all good ideas, the idea of probiotic juice drinks for digestive health is a very simple one and it is well-proven and has already been around for a long time – and as Gefilus has shown in Finland and ProViva has shown in Sweden, well-executed it can be very successful.

For every beverage company there is now a narrow window of opportunity to get its own, scientifically credible, probiotic juice to market – and possibly the only place to find that technology is Valio. Happily, Valio’s 20 years of experience of partnering with companies worldwide to roll out its LGG technology in dairy means that the company is well set-up to guide partners in the new probiotic juice market. The next two-to-three years will reveal which juice companies are truly innovative and willing to create this new market – and which are going to be the also-rans in health. It will be a crucial test of managements’ commitment to innovation and their ability to take innovation to market.

I N N O VAT I O N C A S E S T U D Y

CHART 4: THE RISE AND RISE OF GEFILUS PROBIOTIC TECHNOLOGY

Gefilus dairy products in Finland have grown steadily to over 35 million kg per annum.

0

5 000 000

10 000 000

15 000 000

20 000 000

25 000 000

30 000 000

35 000 000

40 000 000Gefilus® total sales (kg)

0

5

10

15

20

25

30

3531,3

21,1

12,48,8

4,7

0,6 1,2 0,7 1,6

32,3

22,7

12,3

8,9

3,41,3 1,2 1,1 0,9

Valio

Gefi lus

chilled

Valio

Juicec

hilled

Tropic

ana c

hilled

Valio

fruit d

rink c

hilled

Eckes-

granin

i Braz

il chil

led

Inex p

artner

s rain

bow ch

illed

Bramhu

lts Bram

hults

chille

d

Skane

meierie

r ProV

iva ch

illed

Eckes-

granin

i Marl

i Vita

l chille

d

CHART 5: GEFILUS MARKET SHARE IN FINLAND

Biggest brands – market share (value)Chilled juices/fruit drinks (for household)

Source: Nielsen Consumer Panel, Finland (all purchase channels)

Mar

ket s

hare

(%) v

alue

26 APR 2009

25 APR 2010

The Gefi lus dairy brand has been established on the market in Finland for 20 years. It encompasses many formats and consumption of Gefi lus products is an amazing 6 kgs per person per year. The active ingredient, LGG, can be found in dairy product in 35 countries around the world, making Valio’s commercialisation of LLG one of the most successful examples of nutrition technology commercialisation in the food industry.

NOVEMBER 2010 13

N E W N U T R I T I O N B U S I N E S Sw w w. n e w - n u t r i t i o n . c o m

I N N O VAT I O N C A S E S T U D Y

Quorn boasts the perfect nutritional profile for today’s consumer – it contains no allergens, it’s low in fat and high in fibre, is an easily digestible protein that’s on a par with meat in terms of essential amino acid content – and it’s supported by a growing body of evidence that regular consumption can lower LDL cholesterol and promote a sense of satiety. What’s more, in a world in which demand for protein is on the rise and is forecast to outstrip supply, it’s a perfect source of high quality protein. And now this remarkable food technology is up for sale.

Quorn – one of the least well-known but most impressive success stories in the nutrition business and recognised as the single greatest food innovation of our lifetimes – has never been fully exploited. The only thing that has stood in the way of Quorn becoming “the fifth protein” is the hyper-conservatism and persistent failure of imagination of many senior food industry executives and, more recently, the fact that the technology fell into the hands of financially-driven companies which had no appreciation of the diamond in their hands.

Quorn had its genesis back in the late 1960s when it was widely believed that the 21st century would witness a protein shortage, with disastrous consequences. A number of food and chemical companies embarked on developing new proteins from bacterial or fungal sources, including the British-owned RHM food group, which successfully isolated an organism from soil – Fusarium sp. A3/5 – which could be processed into an edible protein, called mycoprotein. At the same time diversified chemical and pharma giant ICI (today known as AstraZeneca) was also developing fermentation technology to produce a protein for use in animal feed.

Seeing that their technologies were

complementary, the two companies formed a joint venture in the mid-1980s, today called Marlow Foods, with the goal of commercialising their science.

Although mycoprotein is from a natural source the fact that it had no history of human consumption meant that it had to go through a rigorous process of safety evaluation before regulators finally granted permission for its use in foods – in 1985, some 18 years after the development began.

ESCAPING THE COMMODITY INGREDIENT TRAP

Quorn didn’t get off to an easy start. The first launch was as an ingredient in a pie sold by UK retailer Sainsbury under its own label. Initially growth was slow. Then in 1990 the company launched Quorn pieces – cubes of Quorn – under its own brand, as an ingredient for home cooking.

It was a strategy that threatened to make Quorn a commodity and the partners behind

the technology realized that they were at risk of becoming a supplier of “just another ingredient in other people’s products”, which would make their success solely dependent on the skills of their partners – skills they could see were often lacking.

By 1993 Marlow had started on the path that would make Quorn more than just an ingredient, increasing its production capacity and bringing out an increasingly wide range of convenient and easy-to-prepare products which were launched in the UK and in almost one new country each year. Today the range encompasses over 32 items, both chilled and frozen, such as deli meats in a range of meat flavours and ready meals ranging from spaghetti bolognese to red Thai curry – as well as the more traditional meat-free options of sausages, burgers, mince and nuggets. As the range has widened and consumers have been presented with more choices in familiar flavours and formats, sales have steadily grown from just $5 million in 1993 to $269 million, at retail prices, in 2010.

A 40-year overnight success story

It’s been described by one senior food industry executive as “the greatest food innovation of the last fifty years”, while another has dubbed it “the first new food since the potato”. It’s on sale in 10 countries and has retail sales in excess of £170 million ($269 million/€194 million) and it’s a profitable business. Its massive potential in the Asian market has yet to be developed. So why, in an industry supposedly driven by innovation, has no company had the courage to fulfill Quorn’s potential? By JULIAN MELLENTIN.

The Quorn range extends to over 35 convenient products, marketed in 10 countries.

NOVEMBER 2010 14

N E W N U T R I T I O N B U S I N E S Sw w w. n e w - n u t r i t i o n . c o m

I N N O VAT I O N C A S E S T U D Y

The secret of Marlow’s success is in fact not the result of any one factor or “magic bullet” – in fact Marlow’s innovation manager Tim Finnigan calls it a “40-year overnight success story” – but rather the product of years of paying detailed attention to every aspect of its business. For example, Marlow underpins its position as the category leader by providing retailers with a category management service, monitoring sales of all other non-meat brands (Quorn is usually merchandised alongside chilled vegetarian foods) and recommends to retailers which ones to include in their chiller-cabinets in order to improve their sales in the category. This means that the company can both add value to its retailers and guide the development of the category in ways that complement the Quorn offering.

Nor does Marlow skimp on investment in building its brand. Quorn has also been advertised on television almost every year since 1993.

And the Quorn brand message has been developed over the years, improving the brand’s positioning. In the late 1980s and early 1990s the brand nailed itself into a niche, describing itself as a vegetarian food. But “vegetarian is a turn-off word for most people”, as a former Quorn executive explained.

Since then the brand message has evolved into one focused on taste, convenience and positive health. More people are choosing to include a meat-free option once a week on average in their meal repertoire, and it’s focusing on being that option that has driven sales in Europe so far.

When the brand entered the Swedish market, in 1999, Quorn marketed itself for the first time as “the fifth protein” and by 2002 the positioning had moved clearly away from “meat substitute” or “meat alternative” – both terms which were found to be unattractive to consumers – to “positive health”.

FAMILIAR FOOD FORMS KEY TO BRAND GROWTH

One of Marlow’s main challenges over the years has been overcoming consumers’ unfamiliarity with its product. “Consumers will run the risk of washing a shirt with a totally new powder,” explained the company to New Nutrition Business back in 2001, “but people have a natural resistance to new foods – until they understand what it is they’re putting in their stomach.”

A significant part of Quorn’s success stems from NPD efforts that have increasingly presented Quorn in forms, such as ready meals, which are familiar and acceptable to consumers. Its non-meat deli slices in chicken, ham and turkey flavours were a real innovation at the time of launch and have become the third-biggest selling item in the range after pieces and mince.

To achieve these new formats Marlow has had to innovate in its production processes, beginning in 1992 when it switched over from a rolling and extension-based production process to forming technology. Familiar product formats, coupled with an investment in flavour technology so that consumers also get the familiar tastes that they expect to get from a Thai red curry or a lasagne, make for

an easier entry into the brand for consumers. As part of building familiarity with the

ingredients and inspiring consumers Marlow invests heavily in developing recipes. Recipe requests are the company’s number one consumer information request and the company has developed thousands over the years.

The company generates a third of its sales from mainland Europe. But in the US Quorn has never fulfilled its potential. FDA-approved, Quorn entered the US in 2002 and showed signs of being a rapid hit, taking a 10% share of the meatless sector in natural foods stores and briefly became the number one selling meatless poultry alternative, with a bigger share than Gardenburger or Boca. A spokesperson for natural foods supermarket

CHART 6: EXPLANATION OF THE STRUCTURE AND BENEFITS OF QUORN AND OF THE QUORN PRODUCTION PROCESS

Source: Marlow Foods

NOVEMBER 2010 15

N E W N U T R I T I O N B U S I N E S Sw w w. n e w - n u t r i t i o n . c o m

I N N O VAT I O N C A S E S T U D Y

GROWING EVIDENCE FOR LIPID AND WEIGHT MANAGEMENT BENEFITS

What is mycoprotein?Mycoprotein is the ingredient in the Quorn brand – all Quorn products are processed from it – and a technology which is proprietary to Marlow Foods. In very simple terms, on a weight-for-weight basis mycoprotein has almost as much protein as an egg, more fibre than a baked potato, two-thirds of the fat of skinless chicken and zero cholesterol.

Protein

• Mycoprotein contains high quality and easily digestible protein at a level of 11g per 100g and this translates in processed Quorn products to 12g-15g per 100g.

• All nine essential amino acids are present in significant amounts in mycoprotein – including, for example, lysine – and it is comparable to meat in terms of essential amino acid content.

• Quorn products are 60%-90% mycoprotein.

Fat

• Mycoprotein has 3.1g of total fat per 100g, of which 0.71g is saturated fat. The remainder is polyunsaturates. Mycoprotein is free of cholesterol and trans fats.

• Although in regulatory terms most Quorn products cannot be described as low fat (that is, having less than 3g of fat per 100g) they are always significantly lower in fat than comparable meat products.

• There is approximately (per 100g) 2.8g -9.9g of total fat and 0.5g-2.8g of saturated fat in Quorn products depending on the production process used.All products are trans fat free.

Fibre

• Mycoprotein is an excellent source of dietary fibre. Total fibre is 6g per 100g (wet weight) of which 88% is insoluble and 12% soluble.

• And 65% are beta 1,3 and 1,6 glucans and 35% chitin.

• Quorn products are a good source of dietary fibre – Quorn pieces, for example, have 4.9g per 100g.

Research uncovers intrinsic health effectsThe future direction of Quorn may be governed not only by continuing geographical expansion and NPD, but by clinical research which is uncovering more and more about the intrinsic healthiness of mycoprotein. Mycoprotein has emerging benefits in three areas:

Improving serum lipid profiles: supported by six published peer-reviewed studies so far.To take one example (Turnbull, Leeds, Edwards. Effect of mycoprotein on blood lipid,Am. J. Clin. Nut. 1990;52:646-50), mycoprotein was found to lower LDL cholesterol by 9% while also raising HDL cholesterol by 12%.

Increasing satiety: three studies have found that consumption of mycoprotein has the effect of reducing hunger and subsequent food intake.

Reducing glycemia and insulinemia: a study has found that mycoprotein reduced glycemia post-meal by 13% compared to a control group while insulinemia was reduced by 36%, suggesting that mycoprotein may have a role to play in the management of diabetes.

chain Whole Foods, quoted in the Boston Herald, described Quorn as its most successful launch ever.

However Quorn then came under an unprecedented attack from consumer interest group the Centre for Science in the Public Interest (CSPI). Michael Jacobson, the head of CSPI, came out as anti-Quorn, complaining to the FDA about the product on grounds of safety and issuing a media release, alleging that Quorn had prompted allergic reactions in some consumers. It’s hard to say how much effect the CSPI’s vitriolic

campaign had. A wave of publicity followed with some reporting sensational and one-sided and other publications taking a more balanced view – particularly when the FDA stood by its thorough safety assessment for Quorn.

WHERE NOW FOR QUORN?

Marlow is a company centred around a single technology, but unlike many companies it hasn’t made the mistake of being technology-focused and technology-led. Marlow has

recognised that for the average consumer it’s brands that bring value and it has focused on creating a fast-growing and successful brand with a positioning connected to consumers’ own ideas about positive health.

However, recent years have seen Quorn in the doldrums – the result of being acquired by a private equity group which, typically, didn’t understand the business it was in.

Premier Foods is a stock-market quoted UK food group that has grown through highly leveraged acquisitions, resulting in insufficient funds available for growth or

NOVEMBER 2010 16

N E W N U T R I T I O N B U S I N E S Sw w w. n e w - n u t r i t i o n . c o m

I N N O VAT I O N C A S E S T U D Y

investment in establishing the health benefits of Quorn.

Premier Foods also appears to have had a rather pedestrian management who have never tried to fulfill the potential that lies in owning what is arguably the world’s greatest food innovation and they seem to have been happy to let Quorn sit in the doldrums of the “vegetarian prepared food category”.

What Quorn now needs is a buyer that will invest in the science and marketing and which has sufficient capital to set up a production facility in Asia to supply the region’s growing demand for protein – India with its huge vegetarian population being arguably the biggest opportunity.

If there’s no large food company or a visionary entrepreneur willing to take that course, Quorn will most likely fall into the hands of another finance-driven owner. And if that happens it will only tell us that the boards of directors of many food and beverage companies like to talk about innovation but lack the courage to follow through, even when a proven innovation like Quorn falls into their laps.

CHART 7: QUORN INGREDIENTS AND NUTRITION FACTS, MOZZARELLA AND PESTO ESCALOPES.

CHART 8: PROOF OF CONCEPT – QUORN SALES SUCCESS

Proof of concept: Quorn sales have grown steadily since 1990 and by 2008 it was on sale in eight countries rising to 10 countries by 2010.

Source: Marlow Foods

NOVEMBER 2010 17

N E W N U T R I T I O N B U S I N E S Sw w w. n e w - n u t r i t i o n . c o m

I N N O VAT I O N C A S E S T U D Y

James White Drinks’ development of its innovative juice drinks is a text-book example of how to commercialise nutrition science. Central to its strategy is marketing the intrinsic health benefits of the humble beetroot. The company has begun with a focus on supplying elite athletes, coupled with distribution through health food stores, with a convenient “concentrated dose” package. Meanwhile, it’s deepening its collaboration with scientific researchers to put in place the science that can justify an approved health claim, and it’s looking for partnerships to roll-out the concepts internationally.

The benefits of the company’s Beet It brand are based on beetroot’s naturally high nitrate content. On the face of it, nitrates might seem like an unlikely starting point for a health brand. Commonly used as a preservative in processed meats – as well as occurring naturally in high concentrations in vegetables – from the 1950s nitrates were treated as a potential risk factor for colon cancer when researchers found a link between nitrates and cancer in laboratory rats.

Public health officials adopted the premise that nitrates are detrimental to human health and regulations were introduced in Europe, the US and elsewhere limiting the permitted levels of nitrates found in drinking water, for example, as well as in foods.

There was just one problem – the slur against nitrates was based solely on an extrapolation from the rat studies of the 1950s, and in fact epidemiological studies have never found any association between nitrate intake and disease in humans1.

In fact, far from finding that nitrates had the potential to be harmful, researchers began to suspect that dietary nitrate might play a significant role in supporting human health. As far back as 1994 researchers at the prestigious Karolinska Institute in Stockholm and at the Peninsula Medical School at the University of Exeter, UK, independently observed that the human stomach contains the gas nitric oxide (NO). The question was

where the gas was coming from. Nitric oxide performs several vital functions in the body, including dilating blood vessels, and for these activities, a cellular enzyme called nitric oxide synthase extracts the gas molecule from arginine, an amino acid. Chemists have long known another mechanism: at low pH, nitrite forms a stew of nitrogen-oxygen compounds, including nitric oxide. Bacteria in the mouth convert nitrate to nitrite, which gets swallowed, so the stomach can naturally produce nitric oxide. If nitric oxide were truly beneficial to the stomach, harmless bacteria feeding on nitrate-rich saliva might have a symbiotic relationship with humans.

To test this idea, researchers exposed bacteria responsible for stomach infections to stomach acid both alone and mixed with nitrite. Although acid is often thought to be the stomach’s main line of defense against invading bugs, the researchers found that E. coli, Salmonella and other bacteria could survive for hours in it, whereas high normal concentrations of nitrite plus acid killed the bacteria in less than an hour.

Researchers in Japan, the US and elsewhere also worked on nitrates and found that they lowered diastolic blood pressure, with no effects on systolic blood pressure. Interestingly, the effects were found in people with seemingly normal blood pressure.

The turning point can be said to have come in 2008, when a research team headed by Amrita Ahluwalia, Professor of Vascular Biology, Center for Clinical Pharmacology,

William Harvey Research Institute, Queen Mary University of London, found that consumption of beetroot juice exerted a number of benefi cial effects, including lowering of both systolic and diastolic blood pressure. The study – funded by the British Heart Foundation - was published in the American Heart Association journal, Hypertension.

At that stage the research team was uncertain whether the benefi cial

Science gives beetroot brand a superfood boost

A start-up brand has embraced the science of sports nutrition and blood pressure-lowering and is spearheading the reinvention of beetroot as a superfood. By JULIAN MELLENTIN.

NOVEMBER 2010 18

N E W N U T R I T I O N B U S I N E S Sw w w. n e w - n u t r i t i o n . c o m

I N N O VAT I O N C A S E S T U D Y

cardiovascular effects of beetroot juice were specifi cally attributable to the dietary nitrate content of beetroot, but studies since then (see box) appear to have cleared up that question, affi rming the role of beetroot’s high content of dietary nitrate, which converts into usable nitrate or nitric oxide in the body.

It’s not only blood pressure lowering that is in the spotlight. Researchers at Exeter University Medical School, specializing in sports nutrition, have also found sports performance benefits from consumption of beetroot juice (see box).

It’s a long way from the world of cutting-edge scientific research to a small juice company, but James White’s lucky break came because back in 2008 it was the only company marketing a beetroot juice in the UK and it began supplying its juice to researchers to use in clinical studies.

When the Ahluwahlia study was published, the company told New Nutrition Business back in 2008, sales of its regular beetroot juice grew five-fold in the wake of the publicity. To capitalize on the emerging benefits the company began marketing Heart Beet, an organic beetroot juice, retailing in 250ml bottles and sold through health food stores.

“I’m not a scientist so I’m new to this,” comments Lawrence Mallinson, CEO and founder of James White Drinks. A serial entrepreneur, he was previously one of the founders of the New Covent Garden Soup Company, today the second-biggest soup brand in the UK after Heinz.

“Products with the highest quality ingredients and the best taste are where my marketing experience has been - this world of claims is new to me. Suddenly I find myself in areas where we’re talking about drinking juice because it reduces blood pressure or improves sporting effort.”

While many small companies shy away from the science Mallinson recognized that his company – whose core business is pressed apple juice – needed to embrace it and the company has formed collaborations with the researchers at Exeter University, who are focusing on the sports performance benefits of beetroot juice, and with the researchers at the Karolinska Institute in Sweden, who are investigating the effects on lowering blood pressure. Today the company co-owns patents relating to the effect of beetroot juice jointly with researchers at the Karolinska Institute.

ELITE ATHLETE FOCUS FOR LAUNCH

The company has meanwhile re-positioned Heart Beet as Beet It, a name that is intended to also embrace the sports market opportunity.

In the world of elite athletes there is a never-ending quest for products that will boost performance and word got around among sports nutritionists at the professional level about the research at Exeter University.

“We’re now supplying rugby teams, premiership football teams and athletes. Word of mouth has been very powerful,” observes Mallinson.

Beetrot juice has a polarising taste, adds Mallinson: “About a third of people love it and two thirds find it difficult. To try and get past the taste barrier we said to the sports people that we were thinking about concentrating it, to enable people to down a dose without having to drink a full 250ml bottle.”

The response was positive, so the company launched a 70ml shot version, which contains 5mmol of nitrates, the same as found in 250ml of beetroot juice, called Beet It Concentrated Organic Beetroot Stamina

Shot.“All the sports people have gone to it,”