Merger of Kingfisher and Air Deccan Intr

-

Upload

ved-prakash-tiwari -

Category

Documents

-

view

1.632 -

download

4

description

Transcript of Merger of Kingfisher and Air Deccan Intr

[2010]

FINANCIAL MANAGEMENT 1FACULTY GUIDE:PROF.DEEKSHA SINGH KUMAR

SUBMITTED BY: VED PRAKASH TIWARI 10BSP0052

MERGER BETWEEN KINGFISHER AND DECCAN AIRLINES

ACKNOWLEDGEMENT

The success of this final report is the outcome of Guidance and valuable suggestions

provided by all the concerned without whom the report could not fide on the right back.

I would like to express my sincere gratitude to Prof.Deeksha singh kumar and ICFAI,

GURGAON for giving me an opportunity to do this project work.

I express my sense of deep gratitude to faculty of ICFAI, GURGAON for her inclusions

and timely suggestions in the preparation of this final report. Finally, I will be failing in

my duty, if I do not thank my parents, friends and well wishers for their enthusiastic

support and who have directly or indirectly helped in some way or the other in making

this final report a success.

2

TABLE OF CONTENTS

1. Abstract 4

2. Introduction of industry 5

3. Summary of the study 6

4. Concept of merger and Acquisition 7

5. Reverse merger 8

6. Distinction between mergers and acquisitions 9

7. Kingfisher Airlines- A Review 12

8. Deccan Aviation Limited – A Review 13

9. Kingfisher & Air Deccan Merger – Key Features 14

10.Merger Advantage 15

11.Synergies 16

12.Question on working 17

13.Bibliography 19

3

ABSTRACT

Project report is a part of the PGPM Program. The objective of a Project report is to

train the student in designing and implementing a research project in respect of a

business problem. A Project report is the culmination of training provided to the student

on practical applicability of the theoretical concepts learned by them.

In this study we look at the options of experiential learning and embedding to the skills

and how the organization get the accreditation from its training course and develop the

employee exactly and smartly using applying different models like 360o feedback,

training by telephone, group training, mind mapping, perceptual awareness etc.

Training is essential to order to understand how to implement the core principle of

coaching and learning. Most of the people attracted up to the profession or precisely the

once who are likely to make good trainers. People with integrity like helping other and

enjoy making different others. Experiential learning and embedding skills is an action

oriented behavioral situation. The purpose of the action situation is to have participants

generate their own data about each of the key concepts to be studied.

To get the best from experiential learning and embedding skills method, the trainer must

be a good observer of behavior. When the groups start to examine its experiences and

reflect upon them, he is in a position to assist with this process. His responsibilities in

focusing learning, and making it clearer for each participant, are extremely important.

4

INTRODUCTION-About Aviation Industry

India is one of the fastest growing aviation markets in the world. The Airport Authority of India (AAI)

manages a total of 127 airports in the country, which include 13 international airports, 7 custom

airports, 80 domestic airports and 28 civil enclaves. There are over 450 airports and 1091 registered

aircrafts in the country. The genesis of civil aviation in India goes back to December 1912 when the first

domestic air route between Karachi and Delhi became operational. In the early fifties, all airlines

operating in the country were merged into either Indian Airlines or Air India. And, by virtue of the Air

Corporations Act 1953, this monopoly continued for the next forty years.

The Directorate General of Civil Aviation(DGCA) controlled every aspect of aviation,

including granting flying licenses, pilots, certifying aircrafts for flight and issuing all rules

and procedures governing Indian airports and airspace. Finally, the Airports Authority of

India (AAI) was assigned the responsibility of managing all national and international

airports and administering every aspect of air transport operation through the Air Traffic

Control.

Competitive landscape

The air transport services offered are the:

Scheduled Air Transport Services (Passenger)

Non- Scheduled Air Transport Services (Passenger)

Air Transport Services (Cargo

Non-Scheduled Air Transport Services (Charter Operation)

5

A STUDY OF MERGERS BETWEEN KINGFISHER AIRLINES AND DECCAN AIRLINES

Is kingfisher is still the King of Good times?

The Merger/Acquisition Summary

Style: Friendly

Company Status: Public

Intention: Opportunistic

Purpose: Defensive

Predictability of Value: Calculative

Strategic Mode: Development

Management Change: Incremental evolution.

The Deal: Vijay Mallya paid Rs 550 Cr to acquire 26% equity in Deccan. Subsequently,

he paid an additional Rs 418 Cr for a further 20% stake through an open offer.

Enterprise value: Rs 2,115 Cr when Mallya acquired 26%

Market Share of Air Deccan: 18%

Fleet with Air Deccan: 43

Combined market share: 29%

Share bought at 2007 was RS.155/share

CMP=Rs48/share (2009)

6

Mergers and acquisitions

The phrase mergers and acquisitions (abbreviated M&A) refers to the aspect of

corporate strategy, corporate finance and management dealing with the buying, selling

and combining of different companies that can aid, finance, or help a growing company

in a given industry grow rapidly without having to create another business entity.

Acquisition

An acquisition, also known as a takeover or a buyout, is the buying of one company

(the ‘target’) by another. Merger is when two companies combine together to form a

new company alltogether. An acquisition may be private or public, depending on

whether the acquiree or merging company is or isn't listed in public markets. An

acquisition may be friendly or hostile. Whether a purchase is perceived as a friendly or

hostile depends on how it is communicated to and received by the target company's

board of directors, employees and shareholders. It is quite normal though for M&A deal

communications to take place in a so called 'confidentiality bubble' whereby information

flows are restricted due to confidentiality agreements (Harwood, 2005). In the case of a

friendly transaction, the companies cooperate in negotiations; in the case of a hostile

deal, the takeover target is unwilling to be bought or the target's board has no prior

knowledge of the offer. Hostile acquisitions can, and often do, turn friendly at the end,

as the acquiror secures the endorsement of the transaction from the board of the

acquiree company. This usually requires an improvement in the terms of the offer.

Acquisition usually refers to a purchase of a smaller firm by a larger one. Sometimes,

however, a smaller firm will acquire management control of a larger or longer

established company and keep its name for the combined entity. This is known as a

reverse takeover. Another type of acquisition is reverse merger, a deal that enables a

private company to get publicly listed in a short time period.

7

A reverse merger occurs when a private company that has strong prospects and is

eager to raise financing buys a publicly listed shell company, usually one with no

business and limited assets. Achieving acquisition success has proven to be very

difficult, while various studies have shown that 50% of acquisitions were

unsuccessful.The acquisition process is very complex, with many dimensions

influencing its outcome. There is also a variety of structures used in securing control

over the assets of a company, which have different tax and regulatory implications

The buyer buys the shares, and therefore control, of the target company being

purchased. Ownership control of the company in turn conveys effective control

over the assets of the company, but since the company is acquired intact as a

going concern, this form of transaction carries with it all of the liabilities accrued

by that business over its past and all of the risks that company faces in its

commercial environment.

The buyer buys the assets of the target company. The cash the target receives

from the sell-off is paid back to its shareholders by dividend or through

liquidation. This type of transaction leaves the target company as an empty shell,

if the buyer buys out the entire assets. A buyer often structures the transaction as

an asset purchase to "cherry-pick" the assets that it wants and leave out the

assets and liabilities that it does not. This can be particularly important where

foreseeable liabilities may include future, unquantified damage awards such as

those that could arise from litigation over defective products, employee benefits

or terminations, or environmental damage. A disadvantage of this structure is the

tax that many jurisdictions, particularly outside the United States, impose on

transfers of the individual assets, whereas stock transactions can frequently be

structured as like-kind exchanges or other arrangements that are tax-free or tax-

neutral, both to the buyer and to the seller's shareholders.

8

The terms "demerger", "spin-off" and "spin-out" are sometimes used to indicate a

situation where one company splits into two, generating a second company separately

listed on a stock exchange.

Distinction between mergers and acquisitions

Although often used synonymously, the terms merger and acquisition mean slightly

different things.

[This paragraph does not make a clear distinction between the legal concept of a

merger (with the resulting corporate mechanics - statutory merger or statutory

consolidation, which have nothing to do with the resulting power grab as between the

management of the target and the acquirer) and the business point of view of a

"merger", which can be achieved independently of the corporate mechanics through

various means such as "triangular merger", statutory merger, acquisition, etc.]

When one company takes over another and clearly establishes itself as the new owner,

the purchase is called an acquisition. From a legal point of view, the target company

ceases to exist, the buyer "swallows" the business and the buyer's stock continues to be

traded.

In the pure sense of the term, a merger happens when two firms agree to go forward as

a single new company rather than remain separately owned and operated. This kind of

action is more precisely referred to as a "merger of equals". The firms are often of about

the same size. Both companies' stocks are surrendered and new company stock is

issued in its place. For example, in the 1999 merger of Glaxo Wellcome and SmithKline

Beecham, both firms ceased to exist when they merged, and a new company,

GlaxoSmithKline, was created.

9

In practice, however, actual mergers of equals don't happen very often. Usually, one

company will buy another and, as part of the deal's terms, simply allow the acquired firm

to proclaim that the action is a merger of equals, even if it is technically an acquisition.

Being bought out often carries negative connotations, therefore, by describing the deal

euphemistically as a merger, deal makers and top managers try to make the takeover

more palatable. An example of this would be the takeover of Chrysler by Daimler-Benz

in 1999 which was widely referred to in the time.

A purchase deal will also be called a merger when both CEOs agree that joining

together is in the best interest of both of their companies. But when the deal is

unfriendly - that is, when the target company does not want to be purchased - it is

always regarded as an acquisition.

10

Mergers and it’s types and it’s form

Acquisition

11

Merger

(and it’s forms)

a

Absorption Consolidation

Types of merger

Merger

Horizontal

Merger

Vertical

Merger

Conglomerate

Merger

Kingfisher Airlines- A Review

Kingfisher Airlines is a private airline based in Bangalore, India. Currently, it holds the

status of India's largest domestic airline, providing world-class facilities to its customers.

Owned by Vijay Mallya of United Beverages Group, Kingfisher Airlines started its

operations on May 9, 2005, with a fleet of 4 brand new Airbus - A320, a flight from

Mumbai to Delhi to start with. The airline currently operates on domestic as well as

international routes, covering a number of major cities, both in and outside India. In a

short span of time, Kingfisher Airlines has carved a niche for itself in the civil aviation

industry.

History

Kingfisher Airlines proved to be a stiff competition for other domestic airlines of India,

with its brand new aircraft, stylish red interiors, stylishly dressed cabin crew and ground

staff. The airline introduced in-flight entertainment (IFE) systems, for the first time to

Indian consumers. The IFE systems were provided on every seat, even on the domestic

flights. The airline offers attractive services to its on board passengers. Years following

its inception proved to be beneficial for the airline, in terms of its booming business, with

a good track record of customer satisfaction. However, it faced a worsening economic

scenario in 2008.

Kingfisher was engaged earlier in the following businesses:

Scheduled Air Transport ServicesScheduled Air Transport

Ground handling services Training academy

12

Acquisition

Friendly Takeover Hostile Takeover

ServicesCommercial Airline Business

Merger Motive

Vijay Mallaya had a vision. His successful Kingfisher Airlines had completed a merger

agreement with low cost carrier airlines Deccan Aviation on May, 2007. With this deal

he planned to become the dominant low cost carrier in the country.

Deccan Aviation Limited – A Review

Deccan Aviation, promoted by Capt. G.R. Gopinath, Capt. K.J. Samuel and Capt.

Vishnu Singh Rawal, was initially incorporated as a private limited company on June 15,

1995 in Karnataka with the main object of pursuing chartered aviation services both for

commercial and non commercial purposes in India and to provide all aviation related

services. It was converted into a public limited company in 2005. The company’s vision

was “To empower every Indian to Fly” and its mission “To demystify air travel in India by

providing reliable low cost and safe travel to the common man by constantly driving

down the air fares as an ongoing mission”. As is evident from their mission statement,

the strategy was to garner market penetration through cost reduction.

Deccan was engaged earlier in the following businesses:

Scheduled Air Transport ServicesScheduled Air Transport ServicesCommercial Airline Business

Non -Scheduled Air Transport ServicesScheduled Air Transport ServicesCharter Services Operations

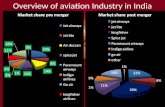

Market Share DataMarket share Data of Oct 2005

Airline PercentageIndian Airlines 28%Jet Airways 35%Air Sahara 12%

13

Air Deccan 11%King Fisher 6%Spice Jet 5%Others 3%Total 100%Market Data of combined entity was 25% at 2007

Market data of Kingfisher on July 2009 is 22%

Kingfisher & Air Deccan Merger – Key Features

• On 1st June 2007, the Board of Air Deccan approved the allotment of equity

share of 26% to UB group & its nominees. The shares were allotted at Rs.155

per share approximately a 10% premium for the current market price (CMP). The

UB group made the money in two phases: Rs.150 Crore as initial investment &

Rs396 Crore at the on or before the end of June.

• Once the investment process is complete, the UB group will become the single

largest share holder in the Deccan Aviation ltd.

• UB group will make an open offer to acquire minimum 20% to all shareholders of

Deccan aviation at a price of Rs.155.

• The Kingfisher-Air Deccan group will be the largest domestic airline with a fleet of

71 aircraft including 41 Airbus aircraft and 30 ATR aircraft. This combined airline

powerhouse will cover all segments of air travel from low fares to premium fares

and offer the maximum number of 537 daily flights covering the single largest

network in India connecting 69 cities whilst taking advantage of unparallel

synergy benefits arising from a common fleet of aircraft.

• For the near future, Kingfisher will continue to serve the corporate and business

travel segment while Air Deccan will focus on serving the low fare segment but

with improved financial prospects for both carriers.

• Kingfisher Airlines and Air Deccan will, henceforth, work very closely together to

exploit the significant synergies that exist in the areas of operations and

14

maintenance, ground handling, vastly increased connectivity, feeder services,

distribution penetration etc.

Kingfisher & Air Deccan- Merger Advantage

The fresh equity capital will allow the Deccan to pay the loans & to fund various

infrastructure projects.

Reduction of cost by sharing infrastructure

The merger ensures that Kingfisher does not need to invest more in

infrastructure or in spare planes, thereby reducing costs and increasing

profitability.

The combined share of the two carriers will increase the Market share.

As per the existing laws Kingfisher Airlines would not be able to operate on

international routes until 2010. However Air Deccan would be eligible from

the second half of next year as its five-year ceiling is coming to an end.

15

Kingfisher & Air Deccan- Synergies

Operational Synergies

Kingfisher and Air Deccan have exactly the same fleet of aircraft, the same

equipment in terms of engine, in terms of brakes and in terms of avionics. This

provides a huge opportunity on saving in engineering and maintenance cost.

The airlines will achieve perfect synergies in the backend (operations and

maintenance, ground handling, vastly increased connectivity, feeder services,

distribution penetration) while preserving the front-end and that will enable both

Deccan and Kingfisher to be profitable.

Apart from ground handling synergies, there is a whole host of items where

duplication is completely unnecessary and can now be avoided.

Infrastructure Synergy

Kingfisher and Air Deccan will now be able to access ground infrastructure at 65

airports, of which more than 28 are common to both the set ups.

The new entity will have over 71 aircraft.

Route Synergy

On the most lucrative of routes, New Delhi-Mumbai, that on its own accounts for

more than half of India's 33 million passenger traffic, the two carriers will now

account for a total of 155 flights.

16

According to Dr.Mallya kingfisher is considering swapping or switching in

coordination with each other to rationalize the fleet structure.

Investment synergy

Both airlines have orders for about 90 aircraft currently placed with European

aircraft major, Airbus Industries.

Kingfisher has placed orders for new aircrafts at higher prices as compared to Air

Deccan. The alliance with Air Deccan may provide it the opportunity to

renegotiate its rates with the manufactures thereby saving substantially.

Are these Airlines Mergers working?

The answer is probably NO.

For two simple reasons:

First Reason is Subjectivity: The business investor can’t resist such a glamorous

business.

The second Reason is objectivity: pricing pressure exerted by other low cast

carriers (LCC)

Subjectivity: The business investor can’t resist such a glamorous business.

Glamour of the airlines: No industry other than film-making industry is as glamorous

as the airlines. Airline tycoons from the last century, like J. R. D. Tata and Howard

Hughes, and Sir Richard Branson and Dr. Vijaya Mallya today, have been idolized.

Airlines have an aura of glamour around them, and high net worth individuals can

always toy with the idea of owning an airline. All the above factors seem to have

resulted in a "me too" rush to launch domestic airlines in India.

Objectivity: Pricing Pressure

Declining yields: LCCs and other entrants together now command a market share of

around 46%. Legacy carriers are being forced to match LCC fares, during a time of

17

escalating costs. Increasing growth prospects have attracted & are likely to attract more

players, which will lead to more competition. All this has resulted in lower returns for all

operators.

Understanding the Competitive Landscape of Airline Industry

The fundamental characteristics of competition in the airline market:

1. It’s a capital intensive industry,

2. With few scale efficiencies,

3. Delivering a highly perishable product,

4. Within a partly regulated infrastructure,

5. Driven by powerful unions,

6. Price elastic demand and

7. Free market entry.

18

Bibliography

1. "The Indian Express, June 01, 2007.

2. "International Business Times, May 31, 2007.

3. "The Hindu Business Line, June 21, 2007.

4. "www.indiaaviation.aero, June 18, 2007

5. "www.expressindia.com, June 01, 2007.

6. "www.livemint.com, June 04, 2007

7. "Khaleej Times, June 11, 2007.

8. "The Hindu Business Line, June 01, 2007

19