Economic & Fiscal Impact of Introducing Broadband Networks and ...

MARKET STUDY AND ECONOMIC AND FISCAL IMPACT …

Transcript of MARKET STUDY AND ECONOMIC AND FISCAL IMPACT …

MARKET STUDY AND ECONOMIC AND FISCAL IMPACT

ANALYSIS OF WILDERNESS CROSSING DEVELOPMENT

(2020-2030) Orange County, Virginia

Prepared by:

RKG Associates, Inc. Economic, Planning and Real Estate Consultants

300 Montgomery Street, Suite 203 Alexandria, Virginia 22314 Tel: 703.739.0965

www.rkgassociates.com

January 2021

Market Study and Economic and Fiscal Impact Analysis of

Wilderness Crossing Development (2020-2030)

Orange County, Virginia

January 2021

Prepared for:

Mr. Ken Dodson

Keg 3 and Associates LLC 33225 Constitution Highway

Locust Grove, VA 22508

Tel: 540-840-5335

E-mail: [email protected]

Prepared by:

300 Montgomery Street, Suite 203

Alexandria, VA 22314 Tel: 703-739-0965 Website: www.rkgassociates.com

Wilderness Crossing Market, Economic, and Fiscal Impact Analysis Orange County, Virginia January 2021

Page 1-1

1 SUMMARY OF FINDINGS

A. INTRODUCTION Wilderness Crossings is proposed mixed-use development is located in Locust Grove in eastern Orange County, Virginia. RKG was engaged to provide three analyses related to the proposed development:

• Market Analysis – an evaluation of the market opportunity for both residential and commercial land uses

• Economic Impact Analysis – an evaluation of direct, indirect, and induced impacts on employment, wages, and economic output as a result of the proposed development

• Fiscal Impact Analysis – an evaluation of the effects the proposed development would have on Orange County’s municipal service demand and budget.

RKG’s approach to the engagement included an initial site assessment to understand the advantages/disadvantages of the site compared to the broader local and regional market. RKG also gathered data on local and regional economics, demographics, and real estate fundamentals from the client, county, and third-party data providers. This information helped RKG to establish an understanding of existing conditions in the market today and start to understand how market dynamics could evolve in the future. RKG also conducted interviews with market professionals to provide additional insight into the local market. From there, RKG was able to make recommendations around a proposed development program for the first ten years of development at Wilderness Crossing – including pricing, absorption, and market segmentation. After a proposed development program was established, RKG evaluated the economic impacts likely to be generated both from the construction and the continued operation of commercial space at Wilderness Crossing. These impacts were calculated using RKG’s own analysis of construction values and revenues generated, along with the input-output model simulation using IMPLAN, an econometric model that projects the impact resulting from a direct investment or job creation event. In addition to economic impacts, RKG calculated the forecasted fiscal impacts the proposed development program would have on Orange County’s general fund, from both a tax revenue and expenditures perspective. RKG conducted interviews with various county department heads to understand how their operations would be impacted from the proposed developments.

B. SUMMARY OF FINDINGS 1. Market Analysis Summary The table below details the program recommendations for Wilderness Crossing for the first ten years of development (2020-2030). These recommendations came out of the market analysis RKG conducted evaluating the opportunity for new residential and commercial development at Wilderness Crossing.

Wilderness Crossing Market, Economic, and Fiscal Impact Analysis Orange County, Virginia January 2021

Page 1-2

Table 1-1

Development Program Recommendations, 2020-2030

Wilderness Crossing, Orange County, VA

Development

Rec. Pricing Target Market/Segmentation

Townhomes 185 Homes $280K First-time buyers, value-conscious

Small-Lot Single Family (50’) 74 Homes $310K First-time buyers, more purchasing power than townhome customer

Conventional Single Family (60’-100’)

407 Homes $365K-$435K Varied, move-up buyers; out-of-market relocators

Estate Lots (200’) 74 Homes $500K+ Move-up buyers desiring large home on large lot

Rental Apartments 260 Units $1.30 PSF Professionals not read to buy a home; down-sizing lifestyle renters

Retail 125,000 SF ~$18 PSF Shops, restaurants, and services catering to those in local community

Seniors Housing 80 Beds Varies by Care Aging population in Orange County and surrounding areas requiring additional care services

Source: RKG Associates, Inc.

2. Economic Impact Analysis Summary RKG Associates conducted an economic impact analysis to measure the direct, indirect, and induced economic benefits development at Wilderness Crossing would have on Orange County from 2020-2030. These economic benefits where measured for two events: the impacts associated with construction of new development and the impacts associated with the ongoing operation of commercial development. Table 1-2 Wilderness Crossing Construction Phase Economic Impacts (2020-2030) Annual Economic Impacts (in 2019 dollars)

Employment

Direct Effect 2.482 Indirect Effect 513 Induced Effect 324

Total Effect 3,319 Labor Income

Direct Effect $121,392,247 Indirect Effect $20,225,976 Induced Effect $9,927,017

Total Effect $151,545,240 Value Added

Direct Effect $156,306,601 Indirect Effect $36,648,738 Induced Effect $24,967,617

Total Effect $217,922,955 Output

Direct Effect $290,816,034 Indirect Effect $66,746,816 Induced Effect $44,003,914

Total Effect $401,566,765 Source: RKG Associates, Inc. and IMPLAN V.3.1, 2016

Wilderness Crossing Market, Economic, and Fiscal Impact Analysis Orange County, Virginia January 2021

Page 1-3

Table 1-3

Wilderness Crossing Operations Phase Economic Impacts (2020-2030) Annual Economic Impacts (in 2019 dollars)

Employment

Direct Effect 2506

Indirect Effect 355

Induced Effect 142

Total Effect 3004

Labor Income

Direct Effect $63,651,201

Indirect Effect $13,640,810

Induced Effect $4,365,829

Total Effect $81,657,840

Value Added

Direct Effect $97,283,051

Indirect Effect $25,447,965

Induced Effect $10,957,867

Total Effect $133,688,883

Output

Direct Effect $182,363,127

Indirect Effect $53,247,768

Induced Effect $19,317,801

Total Effect $254,928,696

Source: RKG Associates, Inc. and IMPLAN V.3.1, 2016 3. Fiscal Impact Analysis Summary

a.) Municipal Revenue Projections

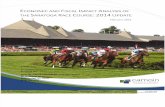

• Real Estate Tax Revenues - By the year 2030, roughly $9 million in real estate taxes will be collected from the new development, both residential and commercial. This represents roughly 55.3% of the $16.4 million in total revenues generated by the project during the 2020-2030 projection period. The largest single source will come from new ownership housing, which will account for $6.6 million (Figure 1-1).

• Personal Property Tax Revenues - For every $1 million in real property value, there is roughly $67,096 in personal property. Based on this

55.3%

10.0%

1.9%

6.8%

0.7%

8.5%

16.9%

Municipal Tax RevenuesWilderness Crossing

(2020-2030)

Total: $16.4 million

Real Estate

Fire & EMT

Recordation

Local Opton Sales

Construction Sales

Meals

Personal Property

Figure 1-1

Source: RKG Associates, Inc., 2020

Wilderness Crossing Market, Economic, and Fiscal Impact Analysis Orange County, Virginia January 2021

Page 1-4

dollar relationship, RKG projects that $2.7 million in personal property taxes will be collected from residential and commercial properties at the Wilderness Crossing development, or roughly 17% of total revenues over 10 years.

• Local Optional Sales Tax and Meal Tax Revenues - Roughly 125,000 SF of new commercial space is planned by 2030 and the cumulative retail sales is estimated at $163.4 million. A 1% local option sales tax will be levied on retail sales and 4% will be levied on drinking and dining sales. In total, RKG projects local sales and meals tax revenues of approximately $2.5 million during the first 10 years or roughly 15.3% of total revenues.

• Countywide Fire & EMT District Taxes - Based on the projected assessed value of real estate at Wilderness Crossing, the new fire and EMT tax would generate $1.6 million in tax revenues by 2030.

• Real Estate Recordation Taxes - Based on the sale of over $337 million in real property value, the recordation tax would generate over $310,000 by 2030, or 1.9% of all revenues.

b.) Municipal Expenditure Projections

• Fire & EMT Services - According to the County Administrator, Chairman of the Board of Supervisors and the Fire Chief, the County will eventually have to invest in a new fire substation in this part of the County. This will include a new substation equipped with a 75-foot ladder truck, a pumper engine, and a medic unit. RKG also estimated the cost of a new 5,800 SF station based on prevailing construction costs for such facilities (Table 1-4).

• RKG estimates that total fire department expenses could equal approximately $2.2 million by 2030, with half of that amount attributable to Wilderness Crossing and the remainder attributable to other growth in the area. Once the vehicles are paid off, the annual operating expenses drop to roughly $470,000/yr. It is worth noting that the County will collect $1.6 million from Wilderness Crossing from its new Fire & EMT tax over the next decade.

• Sheriff’s Department - Over the 10-year projection period, RKG estimates that $384,000 in public safety services from the Sheriff’s Department will be demanded. This amount is roughly 50.4% of the full police expenses during this period and the remaining amount is attributed to other developments in the area.

• Public Education - Based on the number of new housing units constructed at Wilderness Crossing by 2030 (1,000 units), it is estimated that as many as 352 new school-age students could be added to the County’s schools in all grades (Figure 4-2). This would result in a 7.4% increase over 10 years. By 2030, the cumulative education cost will equal roughly $5.4 million, with the peak occurring in 2030 at $1.4 million. Education expense account for 55.3% of all expenses over the first

Table 1-4

Estimated Fire Department Expenses

Route 3 Fire Substation

Vehicles & Equipment Costs Yrs. of Service

Vehicle &

Equipment

Ladder Truck (5 yr. Fiunancing Term) 20 1,000,000$

Engine Truck (5 Yr. Financings Term) 20 700,000$

Medic Unit (3 Yr. Financing Term) 7 305,600$

Staffing Needs 4 Total

Annual Salary - Entry level fire fighters [1] 46,548$ 186,192$

Initial Training 26,000$ 104,000$

Equipment 12,500$ 50,000$

Firefighter/Medic 1 63,553$

New Fire Substation (20 Yr. Financing Term) 20 2,685,625$

Total - Fire Department Operating & Financing Costs

Source: RKG Associates, Inc. and Orange County Adopted Budget Fiscal Year 2021

Wilderness Crossing Market, Economic, and Fiscal Impact Analysis Orange County, Virginia January 2021

Page 1-5

decade. Based on a student:teacher ratio of 20.1 students per teacher, Wilderness Crossing will generate demand for 17.5 new teachers.

• Other General Government Services - Based on RKG’s analysis, roughly $2.7 million in general government expenditures would be incurred during the 10-year study period, with $2.2 million driven by residential households.

c.) Net Fiscal Impacts

• Net Fiscal Impact Results - It should be noted that municipal expenditures contained in the analysis are portrayed as being directly related to new development that is planned over the next decade. Of course, this distorts the fact that thousands of existing households and business are currently located in the eastern part of the county and have an unmet need for these services and will benefit from them. With that being said, Wilderness Crossing still is projected to realize a net positive fiscal impact of approximately $6.6 million over the first 10 years (Table 1-5).

Wilderness Crossing Market, Economic, and Fiscal Impact Analysis Orange County, Virginia January 2021

Page 1-6

Net

Fis

cal

Imp

act

An

aly

sis

Wil

dern

ess C

rossin

g

(20

20

-20

30

)

Yea

r1

23

45

67

89

10

Rev

en

ues b

y T

yp

e2

02

02

02

12

02

22

02

32

02

42

02

52

02

62

02

72

02

82

02

92

03

0

Real Est

ate

Taxes

80

,56

6$

8

0,5

66

$

8

0,5

66

$

2

25

,55

4$

3

70

,54

2$

60

3,4

95

$

89

8,0

16

$

1,1

84

,67

2$

1

,53

0,1

57

$

1,8

60

,46

4$

2

,12

8,0

10

$

9,0

42

,60

7$

County

wid

e F

ire &

EM

T D

istr

ict Taxes

14

,52

8$

1

4,5

28

$

1

4,5

28

$

4

0,6

74

$

6

6,8

19

$

1

08

,82

7$

16

1,9

37

$

21

3,6

29

$

27

5,9

30

$

33

5,4

93

$

38

3,7

40

$

1,6

30

,63

4$

Real Est

ate

Reco

rda

tion T

axes

-$

-

$

-

$

1

9,8

59

$

1

9,8

59

$

1

9,8

59

$

4

3,2

57

$

5

5,5

09

$

4

5,2

20

$

5

2,8

48

$

5

4,1

13

$

3

10

,52

5$

Loca

l O

ptions

Sale

s Taxes

-$

-

$

-

$

-

$

-

$

-

$

7

9,0

13

$

1

58

,02

5$

23

7,0

38

$

31

6,0

50

$

31

6,0

50

$

1,1

06

,17

5$

Const

ruct

ion M

ate

ria

ls -

Loca

l Sale

s and U

se T

axes

(1%

)-

$

-

$

-

$

8

,03

3$

8,0

33

$

8

,03

3$

1

6,7

45

$

2

0,7

72

$

1

5,6

45

$

1

9,3

62

$

1

8,2

48

$

1

14

,87

2$

Loca

l M

eals

Taxes

-$

-

$

-

$

-

$

-

$

-

$

9

9,0

00

$

1

98

,00

0$

29

7,0

00

$

39

6,0

00

$

39

6,0

00

$

1,3

86

,00

0$

Pers

onal Pro

pert

y T

axes

-$

-

$

-

$

6

0,2

01

$

1

20

,40

2$

18

0,6

03

$

26

3,4

89

$

37

1,7

75

$

48

0,0

61

$

59

2,2

11

$

70

3,3

52

$

2,7

72

,09

5$

Tota

l -

Annual Tax R

evenues

95

,09

4$

9

5,0

94

$

9

5,0

94

$

3

54

,32

1$

5

85

,65

5$

92

0,8

18

$

1,5

61

,45

7$

2

,20

2,3

82

$

2,8

81

,05

1$

3

,57

2,4

29

$

3,9

99

,51

3$

1

6,3

62

,90

8$

Ex

pen

dit

ure

s b

y T

yp

e

E

duca

tion

-$

-

$

-

$

9

3,2

86

$

1

86

,57

2$

27

9,8

58

$

51

3,7

91

$

78

3,6

03

$

94

1,4

72

$

1,1

88

,32

1$

1

,43

5,1

71

$

5,4

22

,07

5$

F

ire &

EM

T-

$

-

$

-

$

-

$

-

$

-

$

-

$

-

$

7

8,3

83

$

5

43

,87

8$

46

6,2

57

$

1,0

88

,51

9$

C

ounty

Sheriff

-$

-

$

-

$

-

$

-

$

-

$

-

$

-

$

1

81

,45

2$

10

1,5

42

$

10

1,5

42

$

38

4,5

36

$

P

lannin

g D

epa

rtm

ent

-$

1

2,5

00

$

1

2,5

00

$

2

5,0

00

$

2

5,0

00

$

2

5,0

00

$

1

2,5

00

$

1

2,5

00

$

1

2,5

00

$

1

2,5

00

$

1

2,5

00

$

1

62

,50

0$

Oth

er

Genera

l G

overn

ment Expenditure

s

R

esidentia

l-

$

-

$

-

$

4

1,4

56

$

8

2,9

12

$

1

24

,36

8$

20

3,5

66

$

30

2,9

92

$

37

7,4

32

$

47

0,6

24

$

56

3,8

15

$

2,1

67

,16

5$

C

om

merc

ial

-$

-

$

-

$

-

$

-

$

-

$

3

6,0

84

$

9

1,6

42

$

1

47

,19

9$

15

5,9

56

$

15

5,9

56

$

58

6,8

37

$

Tota

l -

Annual Expenditure

s-

$

1

2,5

00

$

1

2,5

00

$

1

59

,74

2$

2

94

,48

4$

42

9,2

26

$

76

5,9

41

$

1,1

90

,73

7$

1

,73

8,4

39

$

2,4

72

,82

2$

2

,73

5,2

42

$

9,8

11

,63

2$

Net

Fis

cal

Imp

act

(G

ap

/Su

rplu

s)

95

,09

4$

82

,59

4$

82

,59

4$

19

4,5

79

$

29

1,1

71

$

49

1,5

92

$

79

5,5

16

$

1,0

11

,64

5$

1

,14

2,6

12

$

1,0

99

,60

7$

1

,26

4,2

72

$

6,5

51

,27

5$

Sourc

e: R

KG

Ass

oci

ate

s, Inc.

, 20

20

Tota

l Tax

Revenues

(20

20

-

20

30

)

Tab

le 1

-5

Wilderness Crossing Market, Economic, and Fiscal Impact Analysis Orange County, Virginia January 2021

Page 2-1

2 REAL ESTATE MARKET ANALYSIS

A. SITE ANALYSIS The site of the proposed Wilderness Crossing development is located at the eastern edge of Orange County, roughly half a mile from the Orange County/Spotsylvania County border. The site is bordered to the south by Virginia State Road 3 and to the north by the Rapidan River. The site is bound to the west by parcels owned by the Dean Family, another established landowner in the county. The site is located at the intersection of State Route 20 and State Route 3, two well-traveled throughfares running through Central Virginia, and a key artery to travel from northern and western counties into Spotsylvania County and Fredericksburg. Together, the stretch of State Route 20 and State Route 3 support over 26,000 vehicles a day, making the site very visible and is supportive of new development (Map 2-1). Map 2-1: Traffic Counts by Wilderness Crossing

Source: Virginia Department of Transportation; RKG Associates, Inc.

Wilderness Crossing

Wilderness Crossing Market, Economic, and Fiscal Impact Analysis Orange County, Virginia January 2021

Page 2-2

B. DEMOGRAPHIC ANALYSIS 1. Population Trends According to American Community Survey estimates for 2018, the population of Orange County, VA was 32,700. From 2010-2018, Orange County’s population grew 8.8%, slightly above the statewide rate of 7.4%, but was partially driven by the overall small size of Orange County, where relatively small incremental changes in population growth have a large impact. Compared to the state (14.6%), Orange County has a higher share (19.5%) of people aged 65 and older. Additionally, growth in this age cohort fueled Orange County’s population growth between 2010 to 2018, accounting for 45% of total population growth. Another point of contrast with state-wide trends is that Orange County has a smaller share of the population aged 20-34 (15.9% compared to 20.8%). These two demographic trends make the population of Orange County much older than the state. 2. Household Trends From 2010 to 2018, the household base in Orange County grew 6.2% from 12,669 to 13,453 households, roughly in line with the state-wide household growth rate of 6.1% over the same period. However, compared to the state, Orange County has a higher share of two-person and larger households. This trend, coupled with the regions faster-than-state-wide-average population growth, indicates that much of the recent household growth in the region likely emanates from family households. Orange County does have a higher share of family households (70.6% compared to 66%) than the state. Further, Orange County also has a higher share of households with children (32.6% vs. 30.4%) than the state as a whole. These demographic trends would indicate households likely to demand or require larger housing types (e.g., single family homes instead of small rental apartments) compared to the housing likely demanded from all households in the state. 3. Housing Tenure Rates Given the demographic composition of the county detailed above, it is not surprising that Orange County’s housing is predominantly owner-occupied and owned at rates that outpace the state and national averages. According to the American Community Survey, in 2018, 77.7% of all occupied-housing units were owned, compared with 65.9% in the state, and 64.8% nationally. However, between 2010 and 2018, the overall homeownership rate in the County decreased slightly from 78.4% to the 77.7% mentioned previously. This was driven by the growth in renter households as the total number of renter households grew 10%, faster than the growth rate of owner households. Further, during this period, the average household size of renter households increased significantly, growing from 2.46 persons per household to 2.86 which is also significantly higher than the state-wide renter household average of 2.48. This would infer than the growth in renter households was likely driven by an increasing number of family households renting.

D. ECONOMIC ANALYSIS

1. Income and Wealth

Historically, Orange County has lagged the state-wide median income. However, this gap has started to narrow. In 2010, Orange County had a median household income of $54,900 compared to Virginia’s median of $61,400, a difference of 11.1%. In 2018, that gap has narrowed, with Orange County median income of $68,500 and Virginia median income of $71,600, a difference of only 4.5%. The narrowing of the income gap between Orange County and the state was primarily driven by the growth in the share of households earning over $200,000, which grew 72% in the County compared with 60.3% statewide.

Wilderness Crossing Market, Economic, and Fiscal Impact Analysis Orange County, Virginia January 2021

Page 2-3

While Orange County lags the state in terms of median income, Orange County has a higher median net worth, $179,500 compared to $127,500. This is a difference of nearly 30% and is a significantly larger gap than the income gap. This gap is driven by the significantly smaller share of households with net worth under $35,000, with only 27% of households in Orange County with less compared with 38% of households statewide. There is also a gap amongst the higher net-worth households also contributing to the gap. In Orange County, over a third of households have a net-worth of over $250,000 compared to around a quarter of households in the state. The income and net worth dynamics present in Orange County, coupled with the demographic and economic trends above, indicate that many of the households in the region are likely retired or semi-retired with lower incomes than at other points in the career but with high net worth fueled by owning a home and other investments often correlated with age. 2. Employment According to data from EMSI, from 2014 to 2019, employment in Orange County grew 9.1%, faster than the state growth rate of 7.1%. The current employment base in Orange County is predominantly jobs in Government, Manufacturing, Retail Trade, Agriculture, and Accommodation/Food Service which together comprise 60% of all jobs. Compared to the state, Orange County has high concentrations of employment in Agriculture, Manufacturing, and Real Estate/Leasing, with a particularly high concentration of Agriculture employment. Compared to the nation, Orange County has 16 times the number of Agriculture-related jobs, making it one of the more important employment sectors in the region, even though it accounts for only 8.6% of total employment. From 2020 to 2030, Employment in Orange County is anticipated to grow 10.7%, continuing to outpace the state-wide projected growth rate of 7.5%. Much of the anticipated growth is projected to emanate from Manufacturing, Health Care, Government, and Agriculture with growth rates of all five sectors significantly outpacing the growth rates in the state. These sectors account for nearly two-thirds of all employment growth in Orange County and will continue to be important employment sectors for the region over the next ten years. However, compared to its population, Orange County has a small job base. Currently, there were 3.1 people for every job in Orange County, over a person-per-job more than the statewide average of 1.9 people per job. 3. Commuting

According to data from the US Census Bureau’s Longitudinal Employer-Household Dynamics survey, only 14% of workers earning more than $40,000 annually and living in Orange County also work in the County. Other major destinations included Fairfax County (8%), Albemarle County (7.8%), Culpeper County (7.3%), and Spotsylvania County (6.5%). For context, the same “live-work” analysis was run for Loudoun County which found that 30% of workers earning more than $40,000 annually who live in Loudoun County also work there. While it is not expected that Orange County would be able to capture as large of a share of employment from its residents as Loudoun, the large gap between these two geographies coupled with the high person-per-job ratio indicates that Orange County is not a significant employment center and that residents live and are moving to the area for reasons other than to be close to work.

Wilderness Crossing Market, Economic, and Fiscal Impact Analysis Orange County, Virginia January 2021

Page 2-4

E. RESIDENTIAL MARKET ANALYSIS 1. For-Sale Housing Trends According to data from the Orange County Property Assessor, the current housing stock in the county is predominately single-family detached homes, which account for approximately 92% of the total housing stock. Of the remaining 8% of the housing stock, 3% are townhomes and 5% are other types of housing, mostly mobile homes. However, of homes constructed since 2010, approximately 10% are townhomes, indicating that there have been shifting product preferences to include denser, and often cheaper, housing types. Prior to the Great Recession in the late 2000s, Orange County was averaging approximately 450 home sales per year, of which approximately 35% (158 sales) were of newly constructed homes. During the recovery that spanned from 2012 through 2019, the total number of annual home sales in Orange County grew steadily year-over-year, reaching approximately 1,250 homes in 2019, over 2.5 times the average number of home sales annually during the pre-Recession period (Figure 2-1). This rapid increase corresponds with households “discovering” Orange County as a residential destination for both households looking for affordability or a more relaxed lifestyle, as local interviews indicated. While total home sales surpassed pre-recession levels only a couple years into the recovery, the sale of newly constructed homes did not approach pre-Recession levels until 2017 when regional and national production home builders moved into the market. As these builders establish and expand their presence in the County, the number and share of newly constructed home are expected to increase into the future. Figure 2-1: Residential Sales in Orange County

Source: Orange County Property Assessment Records, 2020

2. For-Sale Competitive Analysis To understand the current for-sale housing landscape in the region and to determine the positioning of for-sale units for Wilderness Crossing, RKG identified and surveyed competitive developments currently selling homes in the local market. The competitive set includes communities currently selling in Locust Grove or are proximate to Wilderness Crossing, as well as communities located to the east of Wilderness Crossing in Spotsylvania County. Below are descriptions of the competitive communities:

• Wilderness Shores and Lake of the Woods are the two main communities currently selling homes in Orange County located near Wilderness Crossing. These two communities are the least expensive of the competitive set (Map 2-2).

Wilderness Crossing Market, Economic, and Fiscal Impact Analysis Orange County, Virginia January 2021

Page 2-5

Map 2

-2: M

ap o

f C

om

petitive P

ropert

ies

Sour

ce: Red

fin,

Ora

nge C

oun

ty P

ropert

y A

ssess

ors

Da

ta, Spots

ylv

ani

a C

oun

ty P

rop

ert

y A

ssess

ors

Da

ta

Wilderness Crossing Market, Economic, and Fiscal Impact Analysis Orange County, Virginia January 2021

Page 2-6

• Regency at Chancellorsville is a recently completed Active Adult (55+) residential community. The community offers single-story homes and robust amenities to appeal to owners.

• The three currently selling communities closest to Wilderness Crossing in Spotsylvania County are Mineral Springs Plantation, Estate at Chancellorsville, and Thornburn Estates which offer large estate homes on 2+ acre lots. These communities represent the high-end of the residential market in the region.

• Pennington Estates is a small community of more moderately sized homes, but on larger lots which helps to drive its high per-square-foot pricing and help offset the community’s secondary location within greater Spotsylvania County.

• Fredericksburg Park is a Ryan Home community located towards the heart of Fredericksburg. The community offers a more conventional product type in terms of lot and home sizes compared to the other for-sale communities in western Spotsylvania County.

• New Post is the most value-oriented of the communities in Spotsylvania. While the community offers a decent amenity package, the community is in a more pioneering location.

3. For-Sale Pricing Recommendations

Wilderness Crossing can be positioned above the currently selling communities in Orange County but will need to be priced at a discount compared to the communities in better locations in Spotsylvania. Today in Orange County, Lake of the Woods offers a robust amenity package, including a private lake, but much of the construction is dated and would not compete well against newly constructed product. Additionally, Wilderness Shores is currently a value-oriented option offering townhomes and single- family homes from national builders at relative discounts primarily targeting first-time buyers. A well-executed new home community from a similar regional or national builder should be able to achieve higher pricing by including a variety of products targeting customer segments beyond just first-time buyers.

Of the communities located in prime locations in Spotsylvania County, Fredericksburg Park is the only one offering conventional product and is priced at a relative discount compared to the other communities. While this community offers product like what may be offered at Wilderness Crossing, its superior location gives it a slight pricing advantage. Base prices at Wilderness Crossing should start around $280,000 for townhomes and go up to $500,000 for estate homes. It is important to note that these recommended prices do not include any upgrades or premiums that would contribute to higher sale prices (Figure 2-2).

Wilderness Crossing Market, Economic, and Fiscal Impact Analysis Orange County, Virginia January 2021

Page 2-7

Figure 2-2: Price ($) to Size (SF) Relationship of Competitive Communities and Proposed Pricing

Source: NewHomeSource, Redfin, Orange County Property Assessors Data, Spotsylvania County Property Assessors Data, RKG Associates, Inc.

4. Future Competitive Set and Annual Absorption Projections The future competitive landscape in Orange County was evaluated to understand the share and number of annual home sales that could be captured by Wilderness Crossing. Current development and ownership patterns for the land around Wilderness Shores was evaluated to estimate the number of additional new lots that could be available for development in this community in the near-term. Local market interviews helped to identify communities that had started construction or are going through the development approval process that could be competitive with Wilderness Crossing in the near and medium terms. Lastly, based on local interviews and analysis of current land holdings, large tracts of land surrounding nearby developments were identified as potential long-term competitors. While none of these sites are currently active, they could easily be sold off to developers or home builders and therefore could become competitive in the future. Once all future competitors in the near, medium, and long-term were identified, RKG made assumptions regarding product types and densities to forecast the potential number of homes associated with each of these competitive subdivisions. RKG also made inferences around the timing of these developments and the number of home sales each of the pipeline developments could achieve per year. These values were forecasted based on information obtained from news sources and local interviews regarding product type being offered and historical sales data from property assessment records. Based on these values, the forecasted number of sales Wilderness Crossing could achieve each year relative to the competition was forecasted to calculate Wilderness Crossing’s annual capture rate of total sales (Map 2-3/Table 2-1.

Wilderness Crossing Market, Economic, and Fiscal Impact Analysis Orange County, Virginia January 2021

Page 2-8

Map 2-3: Map of Future Competitive Developments

Source: Local Market Interviews, The Daily Progress, ArcGIS

Based on the capture rates calculated in the analysis detailed above and the total demand for new for- sale housing in Orange County (detailed in the next section), Wilderness Crossing should be able to sell approximately 96 home lots per year over the first ten years of development. Based on the likely product types being offered by the competition, RKG recommended a lot segmentation strategy that prioritizes lots between 50’ and 80’ feet which have historically not been served by new construction at scale in Orange County. However, the strategy also includes a sizable number of townhome and estate lots to be able to offer a diversity of product to appeal to all buyers within Orange County (Table 2-2). Roughly half of the lots are projected to be townhome lots and more conventional quarter-acre lots.

Table 2-1: Projected Annual Absorption – Competitive Subdivisions (2020-2030)

Property Name Total 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030

Wilderness Shores 482 80 80 60 60 60 60 60 22

Ryan Homes Age-Restricted 282 60 60 60 60 42

Signature Station 220 20 20 20 20 30 30 40 40

Dean Properties 0

Brumbelow Property 0

Azimipour Properties by Walmart 0

Wilderness Crossing 740 65 65 65 85 110 110 120 120

1724 0 80 140 205 205 205 207 200 162 160 160

Wilderness Crossing Capture Rate 0.0% 0.0% 0.0% 31.7% 31.7% 31.7% 41.1% 55.0% 67.9% 75.0% 75.0%

Source: Local Market Interviews, The Daily Progress, ArcGIS, RKG Associates, Inc.

Table 2-2: Lot Sales Per Year and Lot Size Wilderness Crossing (2020-2030)

Source: RKG Associates, Inc.

Owner Demand (Annual Units) 278

2+ Acre Homes 20%

Demand for Conventional Lot Homes 223

Wilderness Crossing Capture % (2020-30) 43%

Sales per year 96

RKG

Housing Type and Annual Absorption 100% 96

Townhomes (under 5,750SF) 25.0% 24

50 Foot Lots (5.75K-7.5K) 10.0% 10

60 Foot Lots (7.5K-10K SF) 15.0% 14

80 Foot Lots (10K-20K SF) 25.0% 24

100 Foot Lots (20K-40K SF) 15.0% 14

200 Foot Lots (40K+ SF) 10.0% 10

Wilderness Crossing Market, Economic, and Fiscal Impact Analysis Orange County, Virginia January 2021

Page 2-9

5. Future Housing Demand RKG forecasted the number of new for-sale and rental apartment units Orange County would be able to support from population growth, as forecasted by the Weldon Cooper Center, and induced population growth attracted to Orange County above baseline forecasts due to the unprecedented level of future residential development slated for the region. This forecast for new housing accounts for changes in household composition and shifts in owning/renting preferences. Demand for new for-sale and rental housing emanates from three sources of demand:

• New Renter or Owner Household growth.

• Existing Owners or Renters in turnover, and

• Tenure change (Owners becoming Renters/Renters Becoming Owners). Once total demand for for-sale and rental housing from these three groups was forecasted, and product preferences were accounted for to understand what share of total demand for owner-occupied and renter housing would be for new for-sale housing and new rental housing. This analysis forecasted that there is demand in Orange County for approximately 2,800 new for-sale homes and approximately 260 new rental apartment units from 2020-2030 (Figure 2-4).

6. Rental Apartment Supply Trends

According to data from American Community Survey, in 2018 there were approximately 3,000 renter occupied units in Orange County. Further analysis using Public Use Microdata (PUMS) from the Census Bureau, indicates that of these renter-occupied units, approximately 52% of them were single family detached homes, 21% were townhomes, and only 23.1% were multifamily apartments indicating that the rental housing market in Orange County is overwhelmingly satisfied by a shadow rental market of homes that are traditionally owner-occupied. The ACS PUMS files are a set of records from surveyed individuals, with disclosure protection enabled so that individuals or housing units cannot be identified. The Census Bureau produces American Community Survey (ACS) 1-year and 5-year PUMS files. Of those households renting multi-family units in Orange County, approximately 59% of them have household incomes of less than $35,000 and an additional 18% have household incomes between $35,000 and $50,000. This suggests that the rental properties that exist in the county today caters to

Figure 2-4: Forecasted Housing Demand in Orange County (2020-2030)

Source: Cooper Center for Public Service, American Community Survey, US Census Public Use Microdata

Wilderness Crossing Market, Economic, and Fiscal Impact Analysis Orange County, Virginia January 2021

Page 2-10

lower income households as a value housing option and an upmarket rental apartment market does not truly exist in the county today. 7. Rental Apartment Competitive Analysis Like the for-sale housing analysis, a selection of market rate (i.e., not wholly income restricted) rental apartment communities in Orange County and Spotsylvania were surveyed to understand the current rental apartment market in the region. Most new rental apartment communities are in and around the core of Fredericksburg, near I-95 (Map 2-4). The following are descriptions of the communities in the competitive set:

• The lone market-rate rental apartment building in Orange County is Round Hill Meadow, located in the Town of Orange. While the community has units that are not income-restricted, rents are significantly lower than the other communities in the competitive set due to both location and execution.

• Brittnay Commons is an older rental apartment community that, while located outside the core of downtown, is still well-located. The clubhouse was recently renovated but the units are still from original construction.

• The other three communities in the competitive set, Apartments at Cobblestone Square, The Haven, and Silver Collection at Celebrate, are three relatively new rental buildings with superior locations close to I-95 and the commercial cores along Route 3 and in Downtown Fredericksburg.

8. Rental Apartment Pricing and Development Recommendations Rental apartments at Wilderness Crossing will need to be positioned below the rental apartment communities located in Spotsylvania County due to their locational advantages. However, a well-executed and professionally managed apartment community at Wilderness Crossing should be able to achieve rents just below that of Brittany Commons. While Brittnay Commons will still be able to achieve higher rents due to its superior location, the community is approaching 25 years old and is not as competitive with new construction. As such, there is an opportunity at the site to achieve rents approaching Brittnay Commons. Across the competitive set, approximately 36% of units are one-bedroom units, 49% are two-bedroom units. And 12% are three-bedroom units. Given that the current rental base in Orange County is primarily single-family homes and townhomes and that demographic trends indicate growth in the family rental market in the region, a unit mix more heavily weighted towards three-bedroom units is appropriate (Table 2-3).

Table 2-3: RKG Rental Apartment Recommendations

No. of Bdrm. Unit Mix Avg. Size Avg. Rent Avg. $/SF

1 30% 800 $1,200 $1.50

2 45% 1,200 $1,525 $1.27

3 25% 1,350 $1,600 $1.19

Total 100% 1,120 $1,450 $1.29

Source: RKG Associates, Inc., 2020

Wilderness Crossing Market, Economic, and Fiscal Impact Analysis Orange County, Virginia January 2021

Page 2-11

Map 2

-4: M

ap o

f R

enta

l A

pa

rtm

ent C

om

petitive S

et

Sour

ce: A

part

ment

s.co

m, REI

S, Le

asing

Agent

Int

erv

iew

s

Wilderness Crossing Market, Economic, and Fiscal Impact Analysis Orange County, Virginia January 2021

Page 2-12

F. RETAIL MARKET ANALYSIS 1. Retail Current Trends Retail markets are often analyzed by looking at drive-time radii, particularly for the car-centric retail landscape present in Central Virginia. As such, RKG looked at the supply/demand balance of household retail spending in the 10-, 20-, and 30-minute drive-time radii from Wilderness Crossing to understand the total retail spending potential from households in each of these geographies by type of retail. Retail supply/demand balance is measured through retail spending leakage (local retail spending demand not captured by local businesses) and surplus (excess retail spending demand local businesses capture beyond what local households demand) (Map 2-5). The areas that are within a 10- and 20-minute drive of the site have significant retail leakage, meaning that households are driving outside of these market geographies to accommodate their shopping needs, thus there could be an opportunity to provide retail space to capture some of this spending. However, the 30-minute drive time radius has a significant retail surplus, indicating there is an ample supply of retail to satisfy retail demand from households in this geography (Map 2-6). RKG identified and surveyed shopping centers in the region larger than 100,000 square feet to understand where households in the region were going to shop. As illustrated in the map below, there are eight shopping centers containing over 5.4 million square feet of retail space located just outside of a 20-minute drive from Wilderness Crossing in Spotsylvania and Culpeper counties. As such, demand for retail space at the site is likely to emanate from households living within a 20-minute drive time from the site and should be local-serving in nature.

Wilderness Crossing Market, Economic, and Fiscal Impact Analysis Orange County, Virginia January 2021

Page 2-13

Map 2

-5: R

eta

il S

urp

lus/

Leakage A

naly

sis

by D

rive-T

ime R

adii

Radiu

s

Household

s

(Surp

lus)/

Leakage S

pendin

g

(Surp

lus)/

Leakage P

er

HH

10

-Min

ute

Dri

ve T

ime

6,4

75

$2

22

,50

0,0

00

$

34

,36

3

20

-Min

ute

Dri

ve T

ime

25

,54

8

$3

30

,40

0,0

00

$

12

,93

3

30

-Min

ute

Dri

ve T

ime

75

,54

2

($1

,44

6,5

00

,00

0)

($1

9,1

48

)

Sour

ce: Es

ri B

usin

ess

Ana

lyst

, 202

0

Wilderness Crossing Market, Economic, and Fiscal Impact Analysis Orange County, Virginia January 2021

Page 2-14

Map 2

-6: Sele

cted S

hoppin

g C

ente

rs L

arg

er

than 1

00,0

00

SF

Sour

ce: REI

S, Lo

opne

t, G

oogle

, C

old

well

Bake

r C

om

merc

ial,

Loca

l M

ark

et In

terv

iew

s, 2

020

Wilderness Crossing Market, Economic, and Fiscal Impact Analysis Orange County, Virginia January 2021

Page 2-15

2. Retail Recommendations Demand for retail space at Wilderness Crossing is likely to stem from four main sources:

• Recapture of retail spending leakage from households within a 10-minute drive of Wilderness Crossing

• Recapture of retail spending leakage from households within a 20-minute drive of Wilderness Crossing

• Retail demand from households living at Wilderness Crossing.

• Retail demand from households living in other competitive developments to Wilderness Crossing in Orange County

RKG calculated the amount of retail spending that could be recaptured from households living within a 10- and 20- mile radius of Wilderness Crossing by estimating the share of retail spending leakage by category that could reasonably be recaptured. This analysis forecasted that approximately $15.5 million in retail spending annually can be recaptured by retail offerings at Wilderness Crossing. This $15.5 million equates to approximately 43,000 square feet of retail space (Figure 2-6).

Wilderness Crossing Market, Economic, and Fiscal Impact Analysis Orange County, Virginia January 2021

Page 2-16

A similar analysis was conducted to understand the amount of retail spending from households living at Wilderness Crossing and the other new, competitive developments that could be captured at Wilderness Crossing. This analysis forecasted that Wilderness Crossing could capture $28.7 million of retail spending from households living at Wilderness Crossing or other developments by 2030. This $28.7 million in retail spending could support approximately 82,000 square feet of retail space. In total, between these sources, the site could support approximately 125,000 square feet of retail space by 2030. Of these 125,000 square feet, 90,000 square feet is for general retail stores, 13,000 square feet is for services (e.g., nail salons, fitness studios, dry cleaners, etc.), and 22,000 square feet is for restaurants (both full service and limited service). However, it is important to note that not all capturable building space is adequate to attract a new business but may create opportunities for existing establishments to expand their product lines.

G. SENIOR HOUSING MARKET ANALYSIS 1. Current Market Trends For the purposes of this analysis, Senior Housing is an umbrella term that applies to the following three product types:

• Assisted Living (AL) – Facilities or parts of facilities offering housing and supportive care to residents that require assistance with activities of daily life such as eating, bathing, dressing, etc.

• Independent Living (IL) – Facilities or parts of facilities that cater towards residents who do not require assistance with activities of daily life but can provide services such a meals, housekeeping, transportation, emergency medical care, and social programming for a fee. Often IL facilities are included in facilities that also provide AL to allow for continuing care.

• Memory Care (MC) – Facilities or part of assisted living facilities offering specialized services to residents with dementia and other related illnesses.

The National Investment Center for Senior housing & Care (NIC) tracks senior housing performance metrics for certain geographies in the Washington, DC market area, including Spotsylvania County, which RKG uses as a proxy to understand how the senior housing market in greater Central Virginia compares to other markets in the broader region. Compared to other geographies in Virginia, Spotsylvania County has one of the highest share of households over the age of 75, the key demographic group for senior housing. Additionally, the overall senior housing occupancy rate is the highest among all peer geographies tracked by NIC. An important metric to understanding senior housing markets is penetration rate – which is calculated by dividing the number of units by the number of households aged 75+. Penetration rates are a useful metric to understand: 1) how saturated the market is for senior housing, and 2) if Senior housing is an established product type in the region as a measure of consumer preferences. Spotsylvania’s penetration rate of 13.5% places it in the middle of the other Northern Virginia geographies, indicating that Senior housing is an established product type in the region, but the market is likely not oversaturated. All the market metrics indicate that Spotsylvania County has solid senior housing fundamentals. 2. Senior housing Trade Area and Competitive Environment According to research from Healthcare Transactions Group, the primary trade area for a Senior housing facility in a rural location is approximately 15 miles, with additional demand likely to emanate from outside of the primary trade area. As such, RKG identified and surveyed the 18 senior housing facilities located within a 15-mile radius of Wilderness Crossing to understand the total number of senior housing beds, and by level of care, currently present in the market today. This analysis found that there are

Wilderness Crossing Market, Economic, and Fiscal Impact Analysis Orange County, Virginia January 2021

Page 2-17

currently 1,523 senior housing beds in the market today, which is a penetration rate of 19.6% of households over the age of 75 within the trade area (Table 2-4/Map 2-7).

Table 2-4: Senior housing Comparisons by Selected Submarkets, 2Q2020 NICMAP

Map 2-7: Map of Senior housing Properties in Trade Area

Source: Care.org, A Place for Mom, REIS

Wilderness Crossing Market, Economic, and Fiscal Impact Analysis Orange County, Virginia January 2021

Page 2-18

3. Senior Housing Recommendations Based on the size and services offered by the facilities within the primary trade area, the minimum number of beds needed to support a new Senior housing facility is approximately 80 beds. As such, RKG ran three scenarios to test whether an 80-bed facility could be supported based on varying market penetration rates. The three scenarios tested were:

• If the Penetration Rate stays at 19.6%,

• The Penetration Rate falls in line with the Spotsylvania County rate of 13.5%, and

• The penetration rate falls in line with the DC Metro area average rate of 13.1% (Figure 2-7). All three scenarios were tested considering projected household growth rate among households aged 75+ between 2020-2030 in the primary trade area. The analysis also assumed 20% of demand would emanate from outside the primary trade area, in line with research findings, and that a facility at the site would face some competition and would capture only 25% of total demand. Under all three scenarios, an 80-bed facility would be supported at Wilderness Crossing. As such, the development and operation of a facility is recommended as a near term opportunity. Figure 2-7: Senior housing Demand Scenarios (2030)

Source: NICMAP, REIS, Cooper Center for Public Service, AEW Research, RKG Associates

Wilderness Crossing Market, Economic, and Fiscal Impact Analysis Orange County, Virginia January 2021

Page 3-1

3 ECONOMIC IMPACT ANALYSIS

A. INTRODUCTION To understand the full impacts associated with the proposed Wilderness Crossing development on Orange County, RKG Associates prepared an economic impact analysis to measure the impacts from construction through full operation of the retail uses at Wilderness Crossing over the first ten years of development. Economic impacts are a measure of employment, earnings, and output associated with commercial activities of employers, workers, and residents within a specific geography. Economic analysis examines impacts associated with the construction of improvements, as well as the operations of businesses, and the support of local businesses from residents in the subject area.

B. METHODOLOGY For this economic impact analysis, RKG obtained information from a variety of sources, including local and national research on construction costs and operational data. These direct numbers were then used to drive a series of simulations using the IMPLAN econometric model. IMPLAN measures the direct, indirect, and induced impacts associated with a specific economic event (e.g., new job creation, a change in wages paid, etc.) or industry investment (e.g., construction of a housing or commercial development). These impacts were measured in two events: the one-time impacts related to the construction of the new development at Wilderness Crossing, and 2) the on-going impacts generated by the operation of the development. The following section details the economic impacts associated with the proposed Wilderness Crossing development. The impacts include both construction as well as permanent operations at buildout. RKG developed its own building construction and real estate market value estimates and the information is the best available at this time. It should be noted that at the time of this analysis, there were no final plan drawings or buildout estimates. As such, RKG has prepared the following development scenario based on its market research. All gross annual business sales estimates were prepared by RKG Associates based on reasonable assumptions about the types of businesses that would locate at the development. The economic impacts were calculated using the IMPLAN V.3.1 model.

C. IMPLAN V 3.1 MODEL IMPLAN V 3.1 is a widely accepted and utilized econometric modeling software that was first developed in 1972 in connection with the Rural Development Act of 1972. At the heart of the model is an input-output dollar flow matrix. For a specified region, the input-output table accounts for all dollar flows between different sectors of the economy. Using this information, IMPLAN models the way a dollar injected into one sector is spent and re-spent in other sectors of the economy, generating waves of economic activity, or so-called “economic multiplier” effects. The model uses national industry data and county-level economic data to generate a series of multipliers, which in turn estimate the total economic implications of economic activity. At the heart of the model is a national input-output dollar flow table called the Social Accounting Matrix (SAM). Unlike other static input-output models, which just measure the purchasing relationships between industry and household sectors, SAM also measures the economic relationships between government, industry, and household sectors, allowing IMPLAN to model transfer

Wilderness Crossing Market, Economic, and Fiscal Impact Analysis Orange County, Virginia January 2021

Page 3-2

payments such as unemployment insurance to estimate the economic impacts. For this analysis, RKG Associates obtained the IMPLAN model data for the Orange County, Virginia economy for the most current data year of 2019. 1. Economic Multipliers and Levels of Impact IMPLAN combines this data to generate a series of type-SAM multipliers for the local economy. The multiplier measures the amount of total economic activity that results from an industry (or household) spending an additional dollar in the local economy. Based on these multipliers, IMPLAN generates a series of tables to show the economic event’s direct, indirect, and induced impacts to gross receipts, or output, within each of the model’s 500 industries. These outputs are described below:

• Direct Impacts - Direct impacts refer to the dollar value of economic activity available to circulate through the economy. In the case of the Wilderness Crossing analysis, the direct impacts are equal to the estimated construction costs and annual gross sales of businesses operating at the development in the future. It should be noted that the model measures impact captured within Orange County and not those that are captured in the rest of the region or the Commonwealth of Virginia. Undoubtedly, some economic impacts are captured by nearby communities due to industry purchasing relationships that extend beyond Orange County. Given that fact, most of economic impacts will be realized in the County and we have restricted the analysis to Orange County.

• Indirect Impacts - The indirect impacts refer to the “inter-industry impacts of the input-output analysis.” In the Wilderness Crossing example, indirect impacts result from spending by employees working at businesses located in the development such as retail tenants, service businesses and restaurants, etc., as well as business spending on goods and services to retail establishments, restaurants, personal service providers, and other firms. These businesses then use the payments they receive to buy equipment and supplies, rent space, pay their employees, etc. These expenditures have an impact on the economy.

• Induced Impacts - The induced impacts refer to the impacts of household spending by the employees generated by the direct and indirect impacts. In other words, induced impacts result from the household spending of employees of business establishments that the new employees patronize (direct) and their suppliers (indirect). The model excludes payments to federal and state taxes and savings based on the geography’s average local tax and savings rates. Thus, only the disposable incomes from local workers are included in the model.

D. CONSTRUCTION PHASE Construction-related economic impacts are driven by projected annual construction spending (both hard & soft costs) on a variety of different buildings. Typically, once construction is completed much of the economic impacts will end. As such, employment, wages, and output will ebb and flow depending on the amount spent in any given year. As stated previously, this analysis assumes a multi-year construction period through the first decade. However, the reader should note that RKG does not project the start of construction until 2023. Table 3-1 breaks out the total construction cost associated with the Wilderness Crossing development, which include building construction of: (1) 740 owner-occupied residential units, (2) 260 apartments, (3) 125,300 SF of retail, restaurants, and service establishment and (4) 30,000 SF in a senior assisted living facility. The single-family development is estimated to start in 2023 with the rental housing starting in 2025 (Figure 3-1). The total construction value is projected at nearly $291 million between 2023 and

Wilderness Crossing Market, Economic, and Fiscal Impact Analysis Orange County, Virginia January 2021

Page 3-3

2030. The largest share of construction spending ($231.5 million/79.6%) is associated with the construction of the single-family homes.

1. Construction Impacts

Table 3-2 shows the output of the IMPLAN model in four categories of impacts: (1) Employment, (2) Labor Income, (3) Value Added and (4) Output.

• Employment - Using the estimated annual value of construction (both hard and soft costs) to drive the IMPLAN model simulation, RKG Associates assumed an industry change (construction spending) in several different construction types to cover all building types anticipated for this project. Approximately $290.8 million in construction spending results in the creation of 2,482 direct jobs and 837 indirect and induced jobs. In total, RKG estimates that 3,319 construction

Table 3-1 Wilderness Crossing Development Program (2020-2030)

Source: RKG Associates, Inc.,2020

Development Type No. of Units No. Bldg SF % of Total Total Const. Value

Ownership Housing Construction Value 740 79.6% 231,534,900$

Rental Housing Construction Value 260 14.9% 43,261,733$

Commercial Construction Value 125,300 3.9% 11,277,000$

Assisted Living Facility 30,000 1.6% 4,742,400$

Total Construction Value 1000 155,300 100.0% 290,816,033$

0

100

200

300

400

500

600

700

800

2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030

Cum

ula

tive N

o.

of

Unit

s

Residential Development PhasingCumulative Units Built by Year (2020-2030)

Apartment Units Townhome/Single Family Units

Figure 3-1

Source: RKG Associates, Inc., 2020

Wilderness Crossing Market, Economic, and Fiscal Impact Analysis Orange County, Virginia January 2021

Page 3-4

jobs will be created to develop Wilderness Crossing over the first seven years of construction. It should be noted that the Wilderness Crossing development is projected to develop 375 acres by 203, which is roughly 15% of the property’s total land area (2,542 acres). While hundreds of acres are not likely to be developed due to environmental or open space needs, this multi-phase project could take 30 to 40 years to fully build out.

• Labor Income – Labor income includes all forms of employment income, including employee compensation (wages and benefits) and proprietor income. The direct labor income resulting from the construction is projected at $121.4 million (in 2019 dollars). For all jobs created from these activities (direct, indirect, and induced), total labor income is projected at $151.5 million. While labor income includes more than just worker compensation, the average labor income per direct job equates to nearly $45,660 per year. The actual direct construction jobs equate to nearly $49,000 per year.

• Value Added - The difference between an industry’s or an establishment’s total output and the cost of its intermediate inputs is called value added. It equals gross output (sales or receipts and other operating income, plus inventory change) minus intermediate inputs (consumption of goods and services purchased from other industries or imported). Value added consists of compensation of employees, taxes on production and imports less subsidies. For the Wilderness Crossing project, the value added for construction activities is projected at roughly $217.9 million, with $156.3 million in direct value added.

• Output - Output represents the value of industry production. In IMPLAN these are annual production estimates for the year of the data set and are in producer prices. For manufacturers this would equate to sales plus or minus a change in inventory. For service sectors production equals sales and for retail and wholesale trade, output equals gross margin and not gross sales. The total economic output associated with this project would total $401.6 million, with $290.8 million in direct output.

Table 3-2

Wilderness Crossing

Construction Phase Economic Impacts (2020-2030)

Annual Economic Impacts (in 2019 dollars)

Impact Type Totals

Employment

Direct Effect 2,482

Indirect Effect 513

Induced Effect 324

Total Effect 3,319

Labor Income

Direct Effect $121,392,247

Indirect Effect $20,225,976

Induced Effect $9,927,017

Total Effect $151,545,240

Value Added

Direct Effect $156,306,601

Indirect Effect $36,648,738

Induced Effect $24,967,617

Total Effect $217,922,955

Output

Direct Effect $290,816,034

Indirect Effect $66,746,816

Induced Effect $44,003,914

Total Effect $401,566,765

Source: RKG Associates, Inc. and IMPLAN Model, 2020

Wilderness Crossing Market, Economic, and Fiscal Impact Analysis Orange County, Virginia January 2021

Page 3-5

E. PERMANENT OPERATIONAL PHASE

1. Permanent Operational Impacts Table 3-3 shows the gross annual business sales by business type. After construction is completed, building space will be leased to new or relocating businesses and the economic output they create through their gross sales are captured in these impacts. To drive the IMPLAN Model for permanent operational impacts, RKG projected gross annuals sales for future businesses locating at Wilderness Crossing. Gross annual sales for each business type were estimated based on the type of business and amount of occupied building square feet. The commercial space is not projected to be ready for occupancy until 2026 and the senior assisted living center is projected to be delivered in 2027 (Figure 3-2). The cumulative total sales at the end of 2030 are estimated at $163.5 million and the assisted living center is assumed to be a not-for-profit operation.

Table 3-3 Wilderness Crossing Development Program (2020-2030)

Source: RKG Associates, Inc.,2020

Business Type Building SF Sales Per/SF

Total Business Sales

(2020-2030)

Retail 90,300 350.00$ 110,617,500$

Services 13,000 400.00$ 18,200,000$

Restaurants 22,000 450.00$ 34,650,000$

Cumulative Annual Retail Sales 125,300 163,467,500$

-

20,000

40,000

60,000

80,000

100,000

120,000

140,000

2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030

Cum

ula

tive B

uildin

g S

F

Commercial Development PhasingCumulative SQFT Built by Year (2020-2030)

Commercial Assisted Living Facility

Figure 3-2

Source: RKG Associates, Inc., 2020

Wilderness Crossing Market, Economic, and Fiscal Impact Analysis Orange County, Virginia January 2021

Page 3-6

Gross annual sales were broken out into three business types, retail, services, and restaurants totaling 125,300 SF by Year 2030. Annual business revenues equate to the gross sales for such things as retail goods, restaurant sales, and service sales.

• Employment – Total permanent employment associated with over $163.5 million in cumulative annual sales between 2026 and 2030 generates roughly 1,237 new jobs in the Orange County economy. Unlike construction jobs, which are typically temporary, the employment related to permanent operations are related to the ongoing success of the businesses at Wilderness Crossing. Direct employment impacts equal 1,032 jobs (Table 3-4).

• Labor Income – Approximately $33.6 million labor income is generated by the employment levels reported above, equating to labor income of $25,396/year for direct labor and $27,181 for all jobs. As projected, most of these jobs would be in neighborhood-serving retail, service restaurant business. The job totals in Table 3-4 reflect both full-time and part-time employment.

• Value Added – Total value added equates to over $55 million at buildout and stabilized occupancy.

• Output – Total economic output for the Wilderness Crossing employment center will approach nearly $105 million at buildout and full occupancy.

Table 3-4

Wilderness Crossing

Operational Phase Economic Impacts (2020-2030)

Annual Economic Impacts (in 2019 dollars)

Impact Type Totals

Employment

Direct Effect 1,032

Indirect Effect 146

Induced Effect 59

Total Effect 1,237

Labor Income

Direct Effect 26,209,318

Indirect Effect 5,616,804

Induced Effect 1,797,694

Total Effect $33,623,817

Value Added

Direct Effect 40,057,727

Indirect Effect 10,478,574

Induced Effect 4,512,063

Total Effect $55,048,363

Output

Direct Effect 75,090,699

Indirect Effect 21,925,551

Induced Effect 7,954,389

Total Effect $104,970,639

Source: RKG Associates, Inc. and IMPLAN, 2020

Wilderness Crossing Market, Economic, and Fiscal Impact Analysis Orange County, Virginia January 2021

Page 4-1

4 FISCAL IMPACT ANALYSIS

A. INTRODUCTION The following section details the results of a fiscal impact analysis relative to the proposed Wilderness Crossing development. In the course of the work program, RKG Associates interviewed various Orange County department heads and staff. The objective of the interviews was to develop an understanding of how specific departmental budget expenditure or capital project needs would be impacted by the introduction of new households and businesses at the subject property off Route 3 in Orange County. The Orange County Tax Assessor was also consulted regarding local assessment practices. In addition, RKG Associates reviewed the following public data sources to prepare this analysis.

• Orange County Comprehensive Annual Financial Report, FY Ended June 30, 2019,

• Orange County Adopted Budget, Fiscal Year 2021,

• Orange County Public Schools, Five Year Strategic Plan (2018-2023),

• Orange County FY2021-2025 Capital Improvements Plan,

• Orange County 2013 Comprehensive Plan, and

• Germanna Wilderness Area Plan (2015). B. FISCAL IMPACT ANALYSIS 1. Municipal Revenue Projections This section describes the assumptions used to derive municipal revenues associated with the proposed Wilderness Crossing development. RKG Associates measured major revenues streams with direct benefit to Orange County. While there are other sources of municipal revenues generated by this development, they are minor in nature and not consequential in measuring the revenue impact of this development on the County’s fiscal health. The revenues measured include: (1) real property taxes, (2) personal property taxes, (3) local option sales and use and meals taxes, (4) countywide fire & EMT district taxes, and (5) real estate recordation taxes.

a.) Real Estate Tax Revenues The first step of the fiscal impact analysis is to estimate real property taxes that will be generated from the proposed development at the end of 2030. According to the Orange County Tax Assessor’s Office, non-residential properties (for assessment purposes, rental apartments are also considered non-residential) are typically assessed using the income approach, which recognizes the relationship between the property’s value and the income it is expected to earn. Non-income producing residential properties are assessed based on fair market valuation. Project assumptions such as building square footages, unit counts, rents, price points, occupancy and operating expenses were derived from RKG Associates’ local market research. Based on RKG’s assumptions regarding vacancy rates, unit and per square foot rents, operating expense ratios and capitalization rates, the income approach produced market values very similar to the estimated construction costs estimated for the individual development components, with the addition of land value. For uniformity of the revenue projections, RKG has left all assessed value projections based

Wilderness Crossing Market, Economic, and Fiscal Impact Analysis Orange County, Virginia January 2021

Page 4-2

on initial construction cost estimates. All values are reported in 2019 dollars, like the IMPLAN model described in Chapter 3. The Orange County Budget Committee made the decision to recommend lowering the proposed property tax rate to the equalized rate for 2020. The 2020 adopted regular real estate tax rate ($0.61/$100 in assessed value) and the countywide Fire & EMS District Levy ($0.11/$100), when combined, total the previously advertised equalized rate of 72 cents. This resulted in no effective tax rate increase in 2020.1 Real property taxes for the proposed development were based on the projected assessed values, derived from the estimated construction value of each property type, plus the value of the underlying land. The King Family property is roughly 2,542 acres and the County has assessed the combined property at roughly $13.2 million in its current undeveloped state. That equates to an assessed value of roughly $5,196 per acre. As the project develops, the value of the underlying land will increase in value to reflect the new land uses being constructed. Table 4-1 summarizes the total assessed value per year by the major land use category starting in 2023 and ending in 2030. As described in Chapter 3, some uses are not projected to come on-line until later years. Based on RKG’s estimates, the total assessed value is projected at $348.8 million in 2030. The single-family component accounts for most of the development activity during the first decade and represents approximately 78.1% of the total assessed value in 2030 at $272.4 million. This assessed value is derived from roughly 760 new detached and attached housing units over the first 10 years. By the year 2030, roughly $9 million in real estate taxes will be collected from the new development, both residential and commercial. This represents roughly 55.3% of the $16.4 million in total revenues generated by the project during the 2020-2030 projection period (Figure 4-1/Table 4-2). The largest single source will come from new ownership housing, which will account for $6.6 million. b.) Personal Property Taxes Tangible personal property, as defined by state code, is all personal property not otherwise classified as intangible personal property, merchants’ capital, or as short-term rental property (Code of Virginia, §58.1-3500). In general, tangible personal property is a moveable item that is real, material, substantive, and not permanently affixed to any real property. Examples of tangible property include office furniture, computer hardware, specialized tools, machinery, equipment, and vehicles. Orange County taxes personal property differently for residential and commercial taxpayers. Residential personal property is taxed at a rate of $3.50/$100 in assessed value and commercial is taxed at $2.20/$100 in value.

1 Orange County Adopted Budget Fiscal Year 2021, page 9.

55.3%

10.0%

1.9%

6.8%

0.7%

8.5%

16.9%

Municipal Tax RevenuesWilderness Crossing

(2020-2030)

Total: $16.4 million

Real Estate

Fire & EMT

Recordation

Local Opton Sales

Construction Sales

Meals

Personal Property

Figure 4-1

Source: RKG Associates, Inc., 2020

Wilderness Crossing Market, Economic, and Fiscal Impact Analysis Orange County, Virginia January 2021

Page 4-3

Tab

le 4

-1

Tota

l Est

imat

ed A

nnua

l Ass

esse

d V

alue

Wild

erne

ss C

ross

ing

(202

0-20

40)

2020

2021

2022

2023

2024

2025

2026

2027

2028

2029

2030

Und

erly

ing

Land

Val

ue13

,207

,500

$

13,2

07,5

00$

13

,207

,500

$

13,0

49,5

36$

12

,891

,572

$

12,7

33,6

09$

12

,487