“Mark-to-Market” your receivables · PDF fileto optimise the order-to-cash (O2C)...

Transcript of “Mark-to-Market” your receivables · PDF fileto optimise the order-to-cash (O2C)...

Unprecedented organic growth is driving business inAsia, but is also placing many constraints on organ-isational resources. The entire working capital cycleis being challenged with companies often struggling

to optimise the order-to-cash (O2C) cycle. As credit and col-lection is a major driver in the expansion of any company, a“Mark-to-Market” receivables management model is a criticalelement to success and one that requires increased attention ifdynamic growth opportunities in Asia are to be harnessed.

Transforming challenges intoopportunities In Asia, optimising receivables management is a challengingproposition. Firstly, local buyer behavior is diverse and requirescustomisation and flexibility to meet individual requirements.This diversity has resulted in fragmented practices for billing,credit control and collections for sellers when managing theO2C cycle.

Secondly, regional clearing and banking infrastructure influ-ences receivables management. With over 26 clearing instru-ments and channels available for collection regionally, process-ing receivables is not only challenging but also impacts liquiditypositions due to uncertain clearing times. Given such infrastruc-ture impediments in Asia, industry standards, especially regard-ing commercial document exchange and financial transactions,have shown minimal adoption.

Typically, most treasurers find it difficult to control andinfluence the O2C cycle. Instead, they rely on the commercialfunction of the business to drive O2C. Even the most sophisti-cated companies with advanced ERP systems still rely on lesssophisticated techniques like spreadsheets. In Citi’s view, this ischanging rapidly.

Where is the opportunity? Unlocking the value of receivables takes time, but changing atti-tudes in Asia are creating opportunities in receivables manage-ment. In Citi’s experience, proactive companies are maximizingreceivables management by authoring or adopting the followingbest practices:

Automate fragmented manual processesFor several years, leading companies have been leveraging sin-gle-instance ERPs and consolidating entire O2C cycles.

However, for these companies to further capitalize on growthopportunities, the next challenge is to integrate third-partyprocesses for example the current cash application process.Given the strong top-line growth and reduction in invoicevalues, managing the ever-increasing operational workloadand related costs of receivables processing is difficult withfragmented manual processes. Automation of receivablesunlocks the value and optimizes credit risk, cash flow fore-casting and cash visibility.

What receivables automation initiatives are we seeing com-panies deploying? Concepts like consolidated lockbox are prov-ing a popular option, making real-time information across allclearing types a closer reality through standard formats like BAIor EDI. The output can be easily integrated into most ERP sys-tems and custom-rules can also be constructed to automateaccounting rules associated with payer behavior such as deduc-tion accounting for rounding offs. Besides, payer discipline-building efforts are yielding results to improve auto-rates. Thus,companies are now automating their cash applications on anintra-day basis with excellent levels of auto-rates. This results in

“Mark-to-Market” yourreceivables management By Sandip Patil, director, Asia receivables, Citi

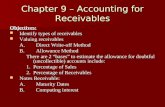

Sample “Mark-to-Market” Model

Theme Best Practices

Automation • Intra-day reconciliations

• Usage of virtual accounts

Operational Cost • Online document and/or

Reduction information exchange

• 2D Bar-coding documents

or pre-encoded envelopes

Client Service • Mobile technology

• Same day confirmation of

receiving payments

Outsourcing • Pick-ups and lockboxes

• Imaging processes

Supply Chain • Structured information-

sharing and dispute handling

• Usage of RFID technology

Centralization • Modular centralization of

entire O2C cycle

• Standardizing simpler

aspects, e.g, billing

reducing book debtors as also, increases sales through credit linereleases and reduced client queries.

To fully gain value from receivables automation, there are anumber of other best practices being utilized regionally. In addi-tion to automation, deploying virtual accounts, electronic pre-sentment of documents, online document exchange with clients,usage of innovative tools like 2D bar coding, OCR data captureand replacing essential but unstructured paper exchanges to struc-tured bar-coded Adobe® documents, all have huge value benefits.

In Citi’s estimate, the cost of a fully loaded business-to-business commercial transaction is approximately US$48, withapproximately one-third related to operations. By using some ofthe aforementioned automation practices, savings betweenUS$3-5 per receivables transaction can be realized- a significantfigure when the transaction growth of many Asian companies isconsidered.

Leverage clearing and banking developmentsAlthough early adopters have welcomed “paper-to-electronic”innovations, many infrastructure developments have yet to pen-etrate the commercial cycle. For example, direct debit is an idealchannel for reducing costs and improving control over receiv-ables. For many companies operating in weak clearing infras-tructure environments, bilateral arrangements and post-datedcheck dematerialisation are proven direct debit solutions. Addi-tionally, concepts like check truncation in markets like China orIndia are signs of improving controls and efficiency, but still inthe initial phase.

Multiple collection accounts is also a reality in many regionalmarkets. Many companies are now utilizing sophisticated sweep-ing and multi-bank initiation services in order to concentrate liq-uidity and consolidate receipt transactions for single statementupload into their ERP systems. Usage of alternate channels likepostal network, ATMs, correspondent banks and conveniencestores are effectively reducing number of such accounts.

Mobile technology, through SMS-based collections andremote area collections, is another banking development addinggreater value and improving client service.

Value through outsourcingOutsourcing is an efficient way of managing a costlier O2C cycleand with over 25 different players servicing receivables withglobal delivery models, industry acceptance is growing amongsophisticated companies. Outsourcing models range from in-house SSCs to independent BPOs to cash management servicebanks like Citi.

Aside from cost benefits, many companies feel outsourcingeffectively helps them implement best practices and strengthencustomer relationships. In managing consumer flows outsourc-ing, is a useful tool for billing and collection. For wholesaleflows, the entire O2C cycle can be covered. Overall, the modelis moving rapidly from labor arbitrage to skill set arbitrage andthus, creating “from-costs-to-performance” shift in managingorder-to-cash.

Step-by-step centralisation driving standardisationCompanies often pinpoint fragmentation and localised practicesas impediments in optimising receivables management. A modu-lar approach to centralizing receivables often solves this problem

and provides required visibility and control across the O2C cycle. In Asia, increasingly we are seeing adoption of receivable

SSCs in the local corporate segment as well. This is clearlyimproving operational efficiencies and is becoming an effectivesource of a number of internal best practices.

Implement supply chain best practices Many sophisticated companies already recognize the impor-tance of supply chain and are connecting all O2C partnersthrough online portals. Best practices like electronic docu-ment exchanges and radio-frequency identification (RFID)technology embedding is being increasingly adopted acrossAsia. Regionally, adoption of supply chain practices forreceivables is growing rapidly. According to one survey, 34%clients reported some level of supply chain practices adoptionin Asia already.

Receivables financing, with or without recourse, is anotherkey driver in unlocking supply chain value. We are now seeingcompanies financing receivables in a paperless mode, signifi-cantly reducing both cycle times and costs.

ConclusionAt Citi, we endeavor to partner with our clients to implementthese and all such best practices- and the results have beenextremely encouraging. Aside from automating cash applica-tions and moving clients to intra-day reconciliations, we haveimproved invoice level first pass auto-matching rates to over90% for certain clients, and brought efficiencies in back-officefunctions including pre and post collections activities throughoutsourcing. On the clearing and channel front, we continue tointroduce newer channels to the market, such as mobile tech-nology. Our track record of partnering with complex SSCs andestablishing these facilities for our clients has been unparalleled,as has the localising impact of our innovative supply chain plat-form CitiConnect.

There are many hurdles in unlocking the value of receiv-ables management, but the solutions are now more practical.As companies travel this path, a trusted advisor is necessary tooptimise the receivables management model. Cash manage-ment banks are going beyond their advisory capacity and are ina strong position to help companies “Mark-to-Market” theirpractices against the best practices in the market. Further, theyassist to unlock the value by partnering with companies toimplement the required change management processes. Startbefore it’s too late. �

The outsourcing model ismoving rapidly from labourarbitrage to skill set arbitrageand thus, creating “from-costs-to-performance” shiftin managing order-to-cash