Marchapril 2016 maritime review africa

-

Upload

more-maximum-media -

Category

Documents

-

view

255 -

download

30

description

Transcript of Marchapril 2016 maritime review africa

2016JAN/FEB

EMPOWERED EMPLOYERWith over 500 employees, the majority of whom work

on the company’s fleet of 15 owned and managed vessels, SMIT Amandla Marine strives to be the

leading employer of South African seafarers, and actively promotes maritime education and awareness.

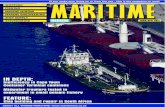

ON THE COVER

AWARDSThe South African maritime sectors recently applauded members of the industry at the Maritime Industry Awards where a number of individuals and companies were recognised for their contributions towards development, empowerment and professionalism.

2016MAR/APR

EDITOR:Colleen Jacka [email protected]

SUB-EDITOR:Natalie Janse [email protected]

ADMIN & ACCOUNTS:Lesley Jacka [email protected]

ADVERTISING SALES:INTERNATIONAL & NATIONAL [email protected] 021 914 1157 021 914 3742

WESTERN CAPELouise Hyam [email protected] 082 881 7099

NAMIBIANelle du Toit [email protected] +264 (081) 683 3542

CONTRIBUTORS: Steve Saunders, Brian Ingpen, Claire Attwood, Dave Japp, Natalie Janse.

LAYOUT & DESIGN:Marilise Engelbrecht [email protected]

OFFICE: 021 914 1157 021 914 3742

POSTAL ADDRESS:PO Box 3842Durbanville7551

COPYRIGHT: No content published in Mar-itime Review Africa may be reproduced in any form without written permission of the editor. Inclusion of any products in features or any product news does not indicate their endorsement by the publishers or staff. Opinions expressed in the editorial are not necessarily those of the publishers, editors or staff of the magazine.

Every effort is made to check the content for errors, omissions or inaccuracies, but the authors, publishers and contributors connected with the magazine will not be held liable for any of these or for conse-quences arising from them.

Published byMore Maximum Media

CONTENTSMARITIME REVIEW AFRICA

REPORT BACK

DURBAN MARITIME SUMMIT 06The first Durban Maritime Summit held in Feb-ruary this year aimed to focus on the concept of Durban as a smart port city with the emphasis on understanding how the port and the city interact to improve the lives and working opportunities of those that reside and work in them.

COLUMNS

SCIENTIFICALLY SPEAKING 08In those exhilarating scientific working group meet-ings, mention the word “transboundary” or the phrase “shared fish stocks” and the members of the group will awaken as if a bolt of lightning had struck the tea trolley. Dave Japp considers the science, and politics, of transboundary resource management.

FISHY BUSINESS 10Shaheen Moolla investigates the Namibian allo-cation of fishing rights by means of a new fishing quota allocation “mechanism” during 2016. The Namibian fishing industry had complained that the political intention of allocating more and more quotas to a larger number of right holders diluted Namibia’s ability to compete with other fish produc-ing states and also created a class of rent-seekers that did not invest in infrastructure and jobs.

THROUGH THE LENS 13Claire Attwood cannot quell her curiosity around what it takes to catch an octopus and its rightful place on the menu. After spending some time with Garry Nel, who has spent the best part of 20 years experimenting with the best way to catch and pre-pare octopus, she believes that she is ready to give this particular cephalopod another try.

MARITIME MEMORIES 40In this month’s column, Brian Ingpen explores the shipping ventures that responded to the initial calls of sugar growers on the South Coast for improved links with Durban. It all started when sugar baron CG Smith chartered the small steamer Somtseu for a service between Durban and Port Shepstone at the mouth of the Umzimkulu River.

FEATURES

ENGINES AND PROPULSION 16• Lubricating Oils – Lifeblood of the ship’s engine systems• Impact of low sulphur fuel on engines• Marine propulsion market driven by economy and the environment• Ship energy and efficiency• Aligning skills to match engine needs• WÄRTSILÄ 31: The most efficient engine in the world• Optimising engine performance for Nigerian gas transporter• Engine supplier adds value to education• Meeting the varied needs of the maritime industry

LAW AND INSURANCE 26• Insuring your best results against fire at sea• Shark team successful in their appeal against liability• Emerging opportunities for marine insurance• Trend of reduced frequency of total losses arrested in 2015• Historic decision by Ports Regulator• Insurers ordered to pay for the loss of Lindsay• A Legal perspective on the Lindsay case• Arrested bulk carriers sold for millions• Comments sought for Marine Spatial Planning Bill• P&I Clubs merger discussions• A boost for marine insurance surveys in Africa• International conference to discuss marine insurance

MARITIME NEWS

AFRICAN NEWS 32• Ambitious plans for a maritime start-up• Committee to address Lagos terminal issues• IMO interacts with Africa• Cape Town shipbuilder secures project for Ivory Coast• Enhancing multi-agency efforts against smuggling at sea in Africa• New port investment for Morocco• Safety certification for ship repairer• Dredging of Maputo Port channel in May

Specialist marine solutions provider Smit Aman-dla Marine won the Maritime Employer Award at the 2016 South African Maritime Industry Awards held in Cape Town.

In accepting the prestigious Award on the com-pany’s behalf, Managing Director Paul Maclons said: “I accept this on behalf of the many men and women at sea and ashore who work to-gether each day to ensure that we can deliver a world class service to our clients. As sharehold-

ON THE COVER

MA

RCH

/ A

PRIL

20

16

• SAR vessels promote safety and security in Kenya• Second container terminal for Mombasa• Briefs• Mombasa statistics reflect growth• MOU for maritime education in Morocco• Report finds that more tertiary educators needed for maritime studies in South Africa• Discussing search and rescue in Africa• FRAP to be concluded by the end of August• Briefs

PEOPLE AND EVENTS

NEWS 43• COVER STORY: Empowerment efforts acknowledged• 40-year milestone for monitoring specialists• Navy award• Fishing company assists with school transport needs• Partnership between diamond miner and university supports education• Cape Town Port Festival returns to calendar• Maritime Industry Soccer Tournament• Appointments

MARITIME INDUSTRY AWARDS

WINNERS 47• Maritime Employer award• Maritime Newcomer award• Commitment to the Environment award• Seafarer of the Year award• Maritime Media award• Maritime Student award• Maritime Maestro award

GREEN MARINE

NEWS AND UPDATES 53• Solutions to ocean acidification will unlock ocean value• The earth’s life support system is at risk• Global seafood traceability campaign launched• Business unusual needed for a thriving ocean• Cruising towards ocean responsibility• GREEN WARRIOR: Managing limited resources for conservation

ers, our employees are the committed and motivated backbone of our company.” With over 500 employees, the majority of whom work on the company’s fleet of 15 owned and managed vessels, he says that Smit Amandla Marine strives to be the leading employer of South African seafarers, and is very active in the maritime education and awareness space.

See full story on page 43

14

42

29

41

22

53

34

COM

MEN

TEXPRESSIONS Comments from the editor

0202 Maritime Review AfricaMARCH / APRIL 2016

ON THE WEB

www.maritime.co.zaIndustry news and headlines.www.maritimematters.netOur editor’s blog.

CONTACT

We look forward to receiving your company news. Please send your press releases to us or invite us to visit your company:[email protected]

Our 23 judges had a mammoth task adjudicating the candidates and it took over a month to fi-

nalise the process. The robust system converted input from the judge for each nomination into a formula that provided an individualised score. Final-ists were chosen based on these scores and judges were asked to review this selection before proceeding. Without exception each category

drew a depth of talent, commitment and perseverance. Three categories, however, stand out for me. The first is the Maritime Media Award that aims to recognise efforts to broadcast the mari-time industry in a relevant, truthful and positive light. Our industry needs to tap into the varied media channels that are available to us and ensure that a posi-tive maritime message is heard beyond our sector. At the award’s evening we challenged

guests to shape the maritime message and deliver positive headlines. The re-sultant feedback is being processed and our mandate for the future as members of the maritime media is to work on channels that broaden the scope of audience that the message receives. The second award category that really

excites me is that of the Maritime New-comer Award. This is not an easy indus-try to break into. Most sub-sectors are capital intensive and require significant financial backing. And so, when individ-uals note potential gaps that need to be filled or provide new products and

services, we need to applaud their ef-forts. I am excited to receive the phone calls

from new companies eager to tell their story and get some coverage in this magazine. There are many that we have watched develop over the years to become bigger companies. Some of the garage start-ups of yesteryear have grown to attract international interest and brought foreign investment into the country. But it is the Maritime Maestro Award

that truly inspires me. We present this trophy in much the same way that the Oscars present the Lifetime Achieve-ment Award. It is about recognising the efforts of individuals in the industry who have gone above and beyond the call of a nine-to-five position. We say they have salt in their veins and their efforts have helped promote and pro-fessionalise the maritime industry over many years. This year’s winner received a standing

ovation when he accepted his trophy. Brian Ingpen has and continues to in-spire so many young people from all over South Africa to pursue a career at sea. But it’s not just about teaching them how to do this – it’s about inspir-ing them to live a dignified and mea-sured life that leads to successful can-didates for the maritime industry both at sea and ashore. But he inspires more than just the

learners he teaches. He inspires just about everyone in the maritime indus-try too.

With the launch of the All Hands On Deck initiative at the Maritime Industry Awards function, we hope to capture a small bit of Brian’s oomph. It’s an initiative that collectively aims to get the industry to promote itself in cre-ative and insidious ways while having a bit of fun and to create an avenue to raise funds for worthy maritime-relat-ed causes. We will be revealing more in the coming months, but our first offer-ing of a maritime-themed deck of play-ing cards has been very well received. While we got rather caught up in em-

phasising excellence at the Maritime Industry Awards, we are fully aware of a number of areas in the industry that require debate and challenge. We are working on doing this and the May/June issue looks set to be one of our most contentious yet.

Colleen Jacka, editor

We celebrated excellence in the maritime industry at the beginning of April with the hosting of the Maritime Industry Awards. The success of the event rests with those who took the time to nominate fellow colleagues and peers in the industry and this year’s call for nominations was met with over 80 quality responses that had to be narrowed down to two or three finalists in each category.

53° 33‘ 47“ N, 9° 58‘ 33“ E

hamburg

setting a course6 – 9 sept 2016

hamburg

5 sept maritime future summit

6 sept global maritime environmental congress

7 sept international conference on maritime security and defence

8 sept offshore dialogue

9 sept maritime career market

twitter.com/SMMfair #SMMfair

youtube.com/SMMfairfacebook.com/SMMfair linkedin.com/company/smmfair

smm-hamburg.com

the leading international maritime trade fair

visit

smm-hamburg.com/trailer

to watch

the SMM trailer

DR_SM_general_210x297_Ingenieursp_001Seitex1von1 1 29.03.16 09:33

QUAY QUOTES Who is saying what in the maritime industry

EXPRESSIONS Quay quotes

0404 Maritime Review AfricaMARCH / APRIL 2016

12 “The Namibian lobster fishery based in Lüderitz is in stagnation and continues to be economically depressed due to the lack of ad-equate facilities to process and export live lob-sters directly from Lüderitz. Namibian lobster right holders earn a pittance for their catches compared to their South African counterparts,” writes Shaheen Moolla.

15 “Producing sufficient volumes is our big-gest problem now,” he says. “We are currently investigating further development and expan-sion of the project now that we feel we have a blueprint that’s working,” says Claire Attwood.

21 “Operating with an engine that is not properly aligned always results in unnecessary wear and tear on the engine, parts and the pro-pulsion system,” says Melvyn Frost of Maritime Mechanicals Consulting.

23 “I have accompanied faculty members several times to Scandanvia where the best tech-nology exists and to inspect various software and hardware equipment,” says Wärtsilä Ship Power Development Partner for Africa, Greg Davids.

26 “Every seaman probably fears the con-sequences of a serious fire at sea, but, unfortu-nately, awareness of the possibility of fire does not always lead to the attitudes and actions necessary to prevent it. Some individuals may be sensitive to the hazards of fire and to the means of preventing it. Others may be completely irre-sponsible. Somewhere between these extremes is the majority who are in some respects very careful — in others, foolishly careless — perhaps from lack of knowledge,” writes Michael Heads from P&I Associates.

27 “This represents a bold and thoughtful decision by the Regulator which, whilst recog-nising the current stresses on the South African

economy as a whole, still allows TNPA a reason-able return of ZAR 2 billion on its investment in the circumstances,” says Andrew Pike, Head of the Ports, Terminals and Logistics Sector Group at Bowman Gilfillan Africa Group.

28 “More than anything else, this judgement vindicates Viking Fishing because it found there was no ‘want of due diligence’,” said Tim Reddell, a director of the Viking Fishing Group.

29 “The number of ship arrests around the world has risen drastically over recent months as banks and creditors seek compensations from ship owners who find themselves unable to pay up on outstanding loans. South Africa has become positioned as a good destination to successfully sell marine assets under such conditions and we believe the recent auction reflected professionalism and credible interna-tional outreach through the global campaign we undertook,” Comments Warren Schewitz, CEO of Clear Asset.

32 “We are still finding our feet, but we will be different to other companies. We will train black female engineers and introduce them to the industry,” said Ngazibini Qongqo.

34 “This is a critically important project for Abidjan that will contribute positively to the economic and social success in Cote d’Ivoire,” states Jacques Brummer, CEO of Southern Power Products.

36 “We believe it will attract more car-go, create more jobs, encourage the growth of smaller businesses associated with the port and highlight the need for more infrastructure devel-opment as well as increase our contribution to the economy of the country,” says Osório Lucas, CEO of MPDC.

37 “Although this performance falls short of

ADVERTISERS’ INDEX

African Maritime Services 11

All Survey Industrial 5,7

Barloworld IBC

Maritime Review 3, 45

Novamarine 30

P&I Associates 29

Peninsula Power Products 20

SCAW Metals OBC

Seascape Marine 17, 21, 23, 25

Servest 35

SMD Telecommunications 39

Smit Amandla Marine OFC, 33

Southern Power Products 19

Wärtsilä 23

Applaud

We applaud all the winners as well as finalists in the Maritime Indus-try Awards held at the beginning of April. We also applaud Transnet Na-tional Ports Authority (TNPA) for re-viving the Port Festivals as a way to promote the maritime industry to a wider audience.

Keelhauled

We keelhaul the South African Presi-dency and the African National Con-gress for diluting the importance of the progress report on Operation Phakisa held in April and turning it into a political rally to garner support for the 2016 local elections.

The maritime community will sure-ly understand the concept of being keelhauled and we have reinstated the practice, which was allegedly instituted by the British Navy as a way of “severely rebuking a sub-ordinate”. But at the same time we will also applaud those individuals and companies in recognition of significant achievements.

& KEEL HAULED APPLAUD

PORT RELIABILITYSeaIntel reports consistent overall improvements in average schedule reliability on both Europe and Asian trades into African ports between July and December in their Global Liner Performance Report, com-pared with the first six months of 2015. Average on-time arrival within +/- 1 day of schedule is significantly up in both directions, with some Af-rica – Europe services experiencing anything up to a 22 percent jump in reliability.

SLEEPING WITH SHARKSIn March Airbnb featured an inter-esting sleeping arrangement as they unveiled the opportunity to lease a fully submerged bedroom in the shark tank at the Paris Aquarium that included 35 sharks as neigh-bours. This underwater bedroom sits within three million litres of wa-ter, in an aquarium ten meters deep and where the only thing separating the guests from the majestic sharks is a 360-degree transparent wall.

CYBER THREATSAccording to the 2015 Crew Con-nectivity survey, 43 percent of crew have sailed on a vessel that had been compromised by a cyber incident, yet almost 90 percent of crew had never received any cyber security or hygiene training or guidelines. It’s essential that ship operators acknowledge the fact that cyber attacks now target users rather than infrastructure, and our greatest threats remain our employ-ees, crew and suppliers.

our target of 1.1 million TEUs for last year by a small margin, it is a manifes-tation that the port traffic is growing at a fast rate. It definitely maintains our position as one of the top container ports globally,” states managing director of the Kenya Port Authority, Catherine Mturi-Wairi.

42 “To us, progressive and sustainable ports are those that co-exist and evolve with the communities where the commercial ports are. These port festivals therefore offer a platform and a workable solution to make our ports community friendly and to expose the public to the opportunities available in this sector, but in a fun and innovative way,” said TNPA Chief Executive Richard Vallihu.

53 “Ocean acidification is a global process with local impacts on fisheries and coastal communities, so there is a need to act urgently at all levels. It is a threat to national growth and development, particularly in the developing nations, and should be reflected in national and subnational developmental plans,” says Dr Louis Celliers, CSIR coastal systems research group leader.

0

5

25

75

95

100

PORT MILESTONESouth Africa’s bulk port, Richards Bay, commemorated its 40th anniversary on Friday, 1st April, with further celebratory events planned for the remainder of the milestone year. The Port of Richards Bay was established in 1976 and – despite being one of the “newcomers” to the industry – has expanded to include a variety of exports, earning it a reputa-tion as one of the most successful of its kind within South Africa’s shores. The Port of Richards Bay was created for the purpose of transporting locally-mined coal to international shores.

RIG COUNTAccording to the Baker Hughes rig count, the number of offshore oil rigs in Africa fell from 26 in January to 20 in March 2016. This marks a decline from 40 in March last year after peaking in 2015 at 45 in January 2015. Internationally the offshore rig count has declined from 242 in January this year to 211 in March. The global figure in March 2015 was 316.

2015 FIRST HALFImports & Exports

First half 2015

Imports

Exportsgrowth year-on-year

Second half 2015

+7%

+7%-5%

-1%

-5%

-6%-4%v.s.

decline year-on-year

2015 FOURTH QUARTERImports & Exports

2015 FIRST QUARTERRefrigerated exports

growth year-on-year

2016 OUTLOOK

Import and export container market

MAERSK GROUP TRADE REPORT SOUTH AFRICA

2015 South Africa import & export container trade market results and outlook

IMPORTS & EXPORTSTOP TRADE LANES2015 FROM SA

source: MAERSK

REPORT BACK Durban Maritime Summit

0606 Maritime Review AfricaMARCH / APRIL 2015

Introspection aims to create broader development and benefits as Port becomes Smart Port City

The first Durban Maritime Summit held in February this year aimed to focus on the concept of Durban as a smart port city with the empha-sis on understanding how the port and the city interact to improve the lives and working opportunities of those that reside and work in them.

It was certainly a refreshing direction for a conference – most of which seem to have an all-Africa or at least sub-region-

al focus. Perhaps a narrower, harder and more purposed look at maritime locations is what is needed to move the maritime agenda forward. It’s a focus that the EThe-kwini Maritime Cluster in Durban has been successfully pushing for some time and has helped them to become the only truly ac-tive maritime cluster in South Africa. The Cluster, of course, recognises that the

Port of Durban is not an isolated piece of infrastructure without any purpose in de-veloping the economy of the country as a whole and the Deputy Mayor of the EThe-kwini Municipality, Nomvuzo Shabalala, said that, although the Port of Durban was

part of the daily lives of Durbanites, it was also an essential muscle for moving trade along the transport corridor to Gauteng.

“This is an important time for us to exam-ine the role that our port can play in not only improving the economic growth of the region, but the country as a whole. The port of Durban is the biggest in South Afri-ca, generating more than 60 percent of the combined revenue of South Africa’s eight ports and handling 80 million tons of cargo annually. It is also a gateway to the rest of Africa and the nucleus of trade within the Southern African Development Communi-ty. Almost daily, we hear that our economy is not growing as it should, that jobs are in short supply and that our currency is ex-

tremely volatile,” she said.

In this context she emphasised the impor-tance of port cities as drivers of economic performance and the need, therefore, to focus on the creation of smart port cities. “Smart Port Cities are at the forefront of in-formation and communications technolo-gy, they are more efficient, work better and use less energy. Creating a Smart Port City means creating a city that enjoys a flour-ishing economy while ensuring the positive coexistence of urban areas with the indus-trial areas of the port. This continues to be a major challenge in the older areas of our city, as proactive town planning did not exist in the early days. Today’s Smart Port City must be liveable while maintaining the competitiveness of its port and down-stream industries,” she said.

“Through the EThekwini Maritime Clus-ter, we aim to fast track enterprise de-velopment and look at ways in which the maritime sector can be opened up for BEE development. We are also working hard to educate our children so that they can be-come part of Durban’s maritime sector and follow careers in this sector, she concluded.

High on the Cluster’s agenda is the devel-opment of skills for the maritime sector. The Deputy Mayor highlighted a number of

Benefits of a Smart Port City:

�� Job creation

�� Enterprise development

�� Boosted investment

�� Improved technology

�� Stimulate exports and economy

�� Stimulate innovation

Characteristics of a Smart Port City

�� Collaboration between stake-holders

�� Strategic partnerships

�� Buy-in from relevant drivers

�� Strengthened communication and information

�� Comprehensive talent devel-opment

�� Funding model

�� Implementation plans

Top: Thato Tsautse (Managing Director of the EThekwini Maritime Cluster), Dr Henriette van Niekerk (Director Clarksons Platou) and Trevor Jones (Director Maritime Studies at UKZN).

Above: EThekwini Deputy Mayor, Nomvuzo Shabalala, Deputy Minis-ter of Transport, Sindisiwe Lydia Chikunga and Thato Tsautse, MD of the EThekwini Maritime Cluster.

Top and above:

Learners engage with the maritime industry at the Maritime Careers’ Exhibition alongside the conference.

Durban Maritime Summit REPORT BACK

0707Maritime Review AfricaMARCH / APRIL 2015

collaborations in this regard and spoke about the 40 graduates, 37 artisans and 10 high schools that were being supported.

“We need to replenish skills for a robust industry. The cluster is need-ed to build the industry through interaction and collaboration,” agreed Zeph Ndluvo, director of the EThekwini Maritime Cluster, who added that more training in seafarers was required and that more could be undertaken to harvest the potential of maritime tourism in the region.

“But above all we need to resuscitate the training and development of maritime skills, with seafarers on South African vessels and to grow the number of vessels registered in South Africa and proudly flying our flag and where possible play a role in growing the maritime tour-ism market,” he said.

“For South Africa's maritime sector to grow, there is a need to create a social and, educational environment that is aligned to the interna-tional convention standards and a legal environment that is attractive to international maritime nations,” said Herschel Maasdorp Executive Head of the Transnet Maritime School of Excellence who added that Improving the quality of basic and tertiary education will be critical to minimise the gap that exists between the trained population and the requirement in the workplace.”

The Summit was relatively well attended, but some potentially inter-ested stakeholders or interested parties may have fallen through the cracks. Social media interaction that followed the event indicated that more could have been done to attract a broader audience.

With Operation Phakisa and Transnet’s Market Demand Strategy high on the agenda at the Summit as well as the need to grow the sector, promote enterprise development and transform the industry mari-time conferences need to, now more than ever, engage more deeply in broadcasting the maritime message.

It was a good start and the addition of a maritime careers’ exhibition alongside the conference will have hopefully helped to garner some more interest from younger South Africans ready to choose a career path.

The Durban Port is the biggest port em-ployer in South Africa and a major employer in Durban. In all it employs around 20,000 people and is a substantial contributor to the city and the economy of the city by as much as 20 percent of local GDP.

Marine & O�shore ServicesHead O�ce for Ship Repair Consortium Associated Marine Engineers (Pty)Ltd

Address: 33 Ixia Street, Milnerton, 7441Postal Address: P.O. Box 394, Milnerton, 7435Tel: +27 21 527 7040 | Fax: +27 21 527 7050Email: [email protected]

www.allsurvey.co.za

FRESHWATER MAKER SYSTEMSThe latest in Reverse Osmosis Technology

The Norwater range of Reverse Osmosis Systems is a range of products developed and manufactured in Norway on the basis of a well-known process which has been under constant development since the

�rst experimental systems were introduced in the 1950´s.

Certi�ed according to NS - EN ISO 9001 and

FPAL Registered

Sole Distributor for Southern Africa

Left: Ken Wurtemberg - Chief US Consulate's Force Protection Division.

Right: Dr Larry Oellermann, Chief Executive of the South African Association for Marine Biological Research.

SCIENTIFICALLY SPEAKING Promoting knowledge through science

0808 Maritime Review AfricaMARCH / APRIL 2016

In the 1950’s to 1970’s hake, horse mack-erel, sardine and tuna were all open to exploitation by international fleets.

If the numbers are to be believed, at the peak of the hake fishery in “South West Africa” more than one million tonnes were caught (more than three times the current combined catch in the waters of the Ben-guela ecosystem). Ask any of the industry’s shrewd “old-timers” and they will relate how negotiations around catch sharing took place through the ICSEAF (Internation-al Commission for the South East Atlantic Fisheries) annual meetings.

Nowadays things are different. The lan-guage of fisheries science challenges man-agers and is loaded with acronyms. We have UNCLOS (United Nations Convention on the Law of the Sea), RFMOs (Regional Fisheries Management Organisations) and the BCC (Benguela Current Commission – a kind of RFMO). Consider the governments of the Benguela region each responsible for and independently managing their Exclusive Economic Zones (EEZs) against the backdrop of globally accepted fisheries management approaches, such as the ecosystem ap-proach to fisheries (EAF) − difficult to con-ceptualise and challenging to implement.

South Africa is a full member of the BCC and subscribes to its obligations, along with Angola and Namibia. These countries are also signatories to UNCLOS with some tough commitments not least of which is Article 63 which refers to straddling fish stocks as:

“Stocks occurring within the exclusive eco-nomic zones of two or more coastal States or both within the exclusive economic zone and in an area beyond and adjacent to it”.

Article 63 expands on the obligations of states:

“Where the same stock or stocks of associ-ated species occur within the exclusive eco-nomic zones of two or more coastal States, these States shall seek, either directly or through appropriate subregional or region-al organisations, to agree upon the mea-sures necessary to co-ordinate and ensure the conservation and development of such stocks without prejudice to the other provi-sions of this Part”.

Another key international instrument re-ferring to the straddling stocks issue is the UN Straddling fish stocks and highly migra-tory fish stocks agreement (1995) which is also ratified by each of the BCC countries. Notably, Article 6 and 7 of this instrument “apply also to the conservation and man-agement of such stocks within areas under

national jurisdiction, subject to the different legal regimes that apply within areas under national jurisdiction and in areas beyond national jurisdiction ….”

Taking stockThe key word in all these instruments is

clearly “stock”. Transboundary fisheries is-sues are very complex and relate directly to how we define stocks, because they are the primary management entity.

A stock means different things to different people, although as a rule a stock could be a species that has a life history that is clearly defined and separated from the life history of another nearby stock of the same spe-cies. If stocks are discrete – that is they do not overlap between countries – then there is no transboundary issue.

However, if, as suggested by Hyashi (1993) a transboundary stock is: “A group of com-mercially exploitable organisms distribut-ed over, or migrating across, a maritime boundary between two or more national jurisdictions, whose exploitation can only be managed effectively by cooperation between the States concerned, but where emigration to or immigration from other ju-risdictions need not be taken into account.”

… then we have a problem!Much of the straddling stocks agreement

refers to “high seas” and “highly migratory” species, including tunas and sharks, which in the Benguela region, is the responsibili-ty of the International Commission for the Conservation of Atlantic Tuna (ICCAT).

The migratory longfin tuna (albacore) is found in the EEZs of the three BCC states but is managed by ICCAT, although each country assumes a degree of autonomy with regard to fishing effort so as to maintain the catch limits set by ICCAT.

Deep-water demersal species such as al-fonsino, orange roughy, patagonian tooth-fish and many other species, are the man-date of SEAFO (South East Atlantic Fisheries Organisation), another RFMO to which the three BCC countries (and others) are signa-tories.

However, orange roughy and alfonsino are recognised commercial species within the Namibian EEZ, are also potential candidates for commercial fisheries in both Angola and South Africa, and are likely to have stock overlaps.

Cooperation is keyAlthough these different instruments

go on a bit, simply put they say that each country, as a signatory to the BCC agrees to

Transboundary – science or politics?In those exhilarating scien-

tific working group meet-ings, mention the word “transboundary” or the

phrase “shared fish stocks” and the members of the

group will awaken as if a bolt of lightning had struck

the tea trolley. Dave Japp considers the science, and politics, of

transboundary resource management.

ReferencesHayashi, M. 1993. The management of trans-boundary fish stocks under the LOS Conven-tion. International Journal of Marine and Coastal Law. 8(2): 245−261.Jansen, T., Kainge, P., Singh, L., Wilhelm, M., Durholtz, D., Strømme, T.,Kathena, J. & Erasmus, V. 2015. Spawning patterns of shal-low-water hake (Merluccius capensis) and deep-water hake (M. paradoxus) in the Ben-guela Current Large Marine Ecosystem inferred from gonadosomatic indices. Fish.Res.,172: 168–180.Kathena, J.N., Nielsen, A., Thygesen, A,U. & Berg, C. 2016. Hake species (Merluccius cap-ensis and M. paradoxus) assessment in the Benguela Current Large Marine Ecosystem. Environmental Development, (In Press)Penney, A.J., Hampton, I., van der Elst, R.P., Wood, A.D., Boyer, H.J., Fennessy, S. & Andrew, T.G. 2003. Enviro-Fish Africa (Pty.) Ltd. report to the SADC Regional Fisheries Information System Project, Windhoek, Namibia. 174 pp.Stromme, T, Lipinski, M.R. & Kainge, P. 2015. Life cycle of hake and likely management impli-cations. Rev J. Fish Biol. DOI 10.1007/s11160-015-9415-9

Promoting knowledge through science SCIENTIFICALLY SPEAKING

0909Maritime Review AfricaMARCH / APRIL 2016

follow a precautionary approach; agrees to share data, apply reference points; do its best to “restore stocks” and develop data collection and research plans, etc.

The BCC recognises this and also makes the statement that the BCC is obligated to “provide a vehicle for the countries of the region to introduce an ‘ecosystem ap-proach to ocean governance’”. This means that the three countries must work togeth-er to manage the marine environment, in-cluding fish stocks that may be shared.

The BCC is a relatively new organisation, but it provides a platform for its three members states to undertake “transbound-ary” research surveys. The focus of these surveys (conducted mostly with the sup-port of the Norwegian government and the United Nations) has been horse mackerel and sardinella in the north and, of course, hake in the south (Figure 1).

Understanding your fish and chips

Recognising that there are other trans-boundary stock issues such as horse mack-erel and sardinella in northern Namibia and Angola, lets focus on hake. Even though we know that fish and chips bought at the cor-ner fish shop or the fish fingers at your su-permarket are, well, “hake”, only a handful of people know that hake are not simply hake.

There are shallow-water (Merluccius cap-ensis or “cape hake”) and deep-water hake (M. paradoxus), white hake, black hake and even brown. There is also Marine Steward-ship Certified (MSC) hake, SASSI green and orange hake and longline and trawl-caught hake.

Most consumers would not know (or care) if hake was caught in Namibia or South Afri-ca. But, thanks to the strides we have taken in fisheries science, we recognise that we are not only dealing with potentially differ-ent stocks, but also two hake species.

Two recently published papers (Stromme et. al, 2015 and Jansen et al, 2016) give some insights on the transboundary re-search on hake conducted by the Dr Fridt-jof Nansen programme. The first focused on deep-water hake. The authors’ conclu-sions are significant because they suggest that “large” M. paradoxus migrate from South African waters into Namibia and then back again! They also suggest that there is no evidence of spawning of this species in Namibia and that there are no “small juve-niles” on the south coast of South Africa.

Another paper from Namibian scientists on the two species dynamics in Namibian

waters contradicts this view, suggesting that there is some evidence of spawning of deep-water hake in southern Namibian waters (see Jansen et al., 2015 in Kathena et al., 2016).

Further, Stromme et al. state that from all the Nansen transboundary surveys since 2000, only 20 individuals of deep-water hake were found to be in a ripe and run-ning stage (meaning spawning state) – i.e. that includes all of the transboundary sur-vey area including SA and Namibian waters.

It is difficult to reconcile these conclu-sions with the assumption that, because no deep-water hake spawn in Namibia, all spawning must occur in South African wa-ters and any adult hake in Namibia have migrated from South Africa.

The authors ask, what “sustains the high exploitation rate (of hake) in Namibian wa-ters” and they go even further to suggest that deep-water hake migrate onto the Agulhas Bank as far east as Port Alfred. While migrations might be happening, there certainly is not sufficient evidence to suggest that the fishery for deep-water hake in the Benguala is entirely sustained by the South African “stock”.

Jansen et al. 2016 used a different meth-odology (spatial mapping) to try and un-derstand the results of the transboundary surveys for shallow-water hake. Their re-sults find there are likely to be three “pri-mary” populations of M. capensis (a Wal-vis, Orange River and Agulhas population) and that there is most likely a migration from the Walvis population to South Africa (Agulhas population). They were cautious about calling these separate stocks sug-gesting that M. capensis catches are taken from one stock with populations that be-have differently.

Genetic investigationsThe transboundary question has also

been investigated using genetics. The ge-netics at least support the separation of the two species based on evolutionary history. Work done by Dr Henriques and her col-leagues at Stellenbosch University suggest that the two species of hake caught in the Bengulea are not “sister species” and have evolved from quite different pathways

Deep-water hake is more closely related to the Angolan hake M.poli while M. capen-sis most likely has its origins from the Euro-pean hake M. merluccius. There is also ev-idence that inter-breeding (hybridisation) between the two hake species may occur, adding further complexity to the joint man-agement options for the two species.

Are we any closer to understanding the transboundary dynamics of hake and oth-er species and should we move to joint assessments? Keep in mind that this im-plies that South Africa negotiates a sharing agreement with Namibia (for deep-water hake at least), that data are provided freely for combined stock assessments and that we have a common management regime.

The big issuesThe big issues would be: who gets the

allocations, how much they get and who pays for the management of the stock? I would venture an opinion that none of this is clear. In my view the genetic studies are inconclusive; the results of the transbound-ary surveys are insuffficient to draw conclu-sions about migrations and there are still many fundamental questions around the life history of the two species.

My personal view is that we as South Af-ricans should get our own house in order before we even think transboundary. We still do not fully understand the early re-cruitment movements of hake in our own waters.

The stakes are high. It is clear, however, that before we think of sharing fish re-sources that “shared stock” status needs to be demonstrated beyond doubt. In my view the ones who really know what is go-ing on are the fishers – those who fished the “stocks” when they were at their peak in the ICSEAF times and those who fish the resources month by month around the coasts.

Or is it just a question of politics? His-torically the South African and Namibian fisheries have been split, separate stock as-sessments are conducted and Total Allow-able Catches set independently.

Is it just a matter of convenience that these “stocks” exist or are we in denial sim-ply for political and economic expediency?

FISHY BUSINESS Shaheen Moolla discusses the fishing sector

1010 Maritime Review AfricaMARCH / APRIL 2016

The Namibian fishing industry had complained that the political inten-tion of allocating more and more

quotas to a larger number of right holders diluted Namibia’s ability to compete with other fish producing states and also creat-ed a class of rent-seekers that did not invest in infrastructure and jobs.

The class of rent-seekers has of course be-come an expensive hallmark of the South African fishing landscape where right hold-ers hold a quota only to seek a monthly rent.

The policy acknowledgement that the performance of right holders would be regularly reviewed against criteria such as investments, employment, value addition and socio-economic factors is an important theoretical step toward moving away from the rent-seeking class of right holders.

Although Namibia’s fishing industry com-prises 10 commercial fisheries (compared to South Africa’s 22 commercial fishery sec-tors), the Namibian industry lands about the same amount of fish, or slightly less depending on the South African anchovy season, worth approximately R7 billion. Namibia’s industry essentially comprises an industrial sector and a recreational com-ponent.

By global standards, the Namibian lobster and line fisheries could be considered the only small-scale commercial or artisanal fisheries while the remaining fisheries are certainly all capital intensive, high value in-dustrial fisheries with a plethora of foreign

investors from South Africa, Spain and even Iceland. Namibia’s hake and horse macker-el fisheries are its two mainstay fisheries accounting for more than 90 percent of its total annual catch allowance.

Rights allocation The scheduled allocation of fishing rights

in late 2016 or early 2017 will be across Namibia’s 10 fishing sectors, including the crab, lobster, hake, pilchard, horse macker-el, large pelagic, monk and sole and contro-versial seal fisheries.

The principal legislative instrument that

will determine the allocation of fishing rights in Namibia is the Marine Resources Act of 2000, and particularly sections 32 and 33. Section 33 provides the broad cri-teria that the Minister may have regard to when considering applications for fishing rights. These criteria include the following:

�� whether or not the applicant is a Na-mibian citizen;

�� where the applicant is a company, the extent to which the beneficial control of the company vests in Namibian cit-izens;

�� the beneficial ownership of any vessel which will be used by the applicant;

�� the ability of the applicant to exercise the right in a satisfactory manner;

�� the advancement of persons in Namibia who have been socially, economically or educationally disadvantaged by discriminatory laws or practices which were enacted or practised before the independence of Namibia;

�� regional development within Namibia; �� co-operation with other countries, es-

pecially those in the Southern African Development Community;

�� the conservation and economic devel-opment of marine resources;

�� whether the applicant has successfully performed under an exploratory right in respect of the resource applied for;

�� socio-economic concerns; and�� the contribution of marine resources to

food security.

Namibia’s fishing rights allocation dis-pensation explicitly recognises that foreign owned entities may not only participate in the fishing industry via joint ventures with Namibians, but may in fact directly hold fishing rights.

Under the current 2009 Namibian Fish-ing Policy, which is presently under review, fishing rights can be allocated to periods of 20 years, 15 years, ten years and seven years. The criteria determining these peri-ods are rather rigid, contradictory and con-fusing and one hopes that they would be reviewed and clarified. At present, 20-year

Namibian media reported in November last year that the

country’s Ministry of Fisheries and Marine Resources

(MFMR) was preparing for the allocation of fishing rights by means of a new fishing quota

allocation “mechanism” during 2016. The Fisheries Minister,

Bernard Esau, mentioned that his ministry had commenced

a review of Namibian fisheries laws and policies earlier in

2015 and that the allocation of fishing rights would be based

on performance and subject to continuous three-year

performance reviews.

A FRAP to the North: The Allocation of Namibian Fishing Rights in 2017

The scheduled allocation of fishing rights in late 2016 or early 2017 will be across Namibia’s 10 fishing sectors, including the crab, lob-ster, hake, pilchard, horse mackerel, large pelagic, monk and sole and controversial seal fisheries.

SOUTHERN AFRICA’S LEADING SUPPLIER OF THE FOLLOWING PRODUCTS AND SERVICES: HIGH PERFORMANCE WIRE ROPES CROSBY LIFTING ACCESSORIES SPOOLING, SOCKETING & RIGGING CHAIN, WEBBING & WIRE SLINGS HOOKS, CONNECTORS, SWIVELS CHAIN, SHACKLES & BLOCKS 200t 19m TENSILE TEST BED SWAGING UP TO 60mm TRAWL MANUFACTURE & REPAIR FLOATS, FENDERS & BUOYS NETTING, TWINES & FIBRE ROPES

LEEA* QUALIFIED ITS LIFTING EQUIPMENT EXAMINERS

*LIFTING EQUIPMENT ENGINEERS ASSOCIATION (UK)

NAMIBIA2003 Ben Amathila AvenueWalvis BayPH: +264 (0)64 209469FAX: +264 (0)64 [email protected] AFRICASOUTH AFRICA1 Kempenfelt RoadPaarden Eiland 7405Cape TownPH:+27 (0)215103532FAX: +27 (0)[email protected]

www.africanmaritime.co.za

LIFTING MOORING TOWING FISHING

AFRICAN MARITIME SERVICES“MORE A PARTNER THAN JUST A SUPPLIER”

FISHY BUSINESS Shaheen Moolla discusses the fishing sector

1212 Maritime Review AfricaMARCH / APRIL 2016

rights are allocated to any entity that per-manently employs 5,000 or more Namib-ians in “on-land” facilities.

Fifteen-year rights are allocated to appli-cants who satisfy the following criteria:

�� Applicants who are at least 90 percent beneficially owned by Namibians with significant investment in vessels or on-shore processing facilities. For this pur-pose 50 percent ownership in a vessel or an operational onshore processing facility in the fishery for which rights are granted is considered a “significant investment”.

�� Namibian applicants who own a “small-er share of a larger venture”, although what a “smaller share of a larger invest-ment” is, is not clear.

�� A venture with “more substantial for-eign ownership” which makes or has the capacity to make “a major eco-nomic contribution and overall devel-opment” in Namibia. For this purpose, 500 Namibian employees working onshore in activities related to the fishery for which the rights are granted is considered as being sufficient to be considered a “major contribution”.

�� Smaller joint or wholly foreign owned ventures can also qualify provided these make an innovative contribution to the development of the fishing in-dustry in Namibia, such as developing new products or new export markets and where a longer term right is neces-sary to secure the investment involved.

Ten-year rights are granted to applicants that:

�� Have at least a 50 percent Namibian ownership profile and own a vessel or operational processing facility in the fishery for which rights are applied for.

�� Have less than a 51 percent Namibian

ownership profile with onshore invest-ments in the fishery for which rights are granted.

Seven-year rights are granted to appli-cants that:

�� Are new entrants to the fishery.�� Are majority Namibian owned ventures

having at least 50 percent ownership in vessels or an operational onshore processing facility in the fishery for which rights are applied for, including ventures which only operate in the fish-ery involved by chartering of vessels or other similar arrangements.

�� Are less than 51 percent Namibian owned with onshore investments in the fishery for which rights are granted.

Confused stateIt is suitably quite confusing. To make

matters even more complicated, the effect of such a fishing rights duration dispen-sation is that one would necessarily have different right holders in the same fishery

with fishing rights of varying periods. This would render the stated performance mea-suring process that the Minister intends implementing near impossible to fairly and rationally oversee.

The Namibian fishing industry has the po-tential to attract substantial foreign invest-ment given the larger horse mackerel and

hake fishery catch allowances compared to its southern neighbour. However, the economic growth of the fishery will largely depend on its ability to steer a path toward clear, flexible and unambiguous fisheries policies.

Rigid and ambiguous policies regarding quota durations as contained in the current 2009 fishing policy should be reviewed and replaced with sector specific fishing right periods aimed fundamentally at attracting investments in sustainable and responsible harvesting, processing and marketing of seafood. It may also be opportune to re-consider Namibia’s over-emphasis on wet-fish hake processing.

The Namibian lobster fishery based in Lüderitz is in stagnation and continues to be economically depressed due to the lack of adequate facilities to process and export live lobsters directly from Lüderitz. Namib-ian lobster right holders earn a pittance for their catches compared to their South Afri-can counterparts.

It is hoped that the policy and legislative review process currently underway will rec-ognise the various economic growth oppor-tunities that exist in the fisheries and that the Minister remains committed to allocat-ing fishing rights to right holders capable of directly participating in the fisheries as opposed to simply seeking resource rents for the next seven, ten, 15 or 20 years.

Rigid and ambiguous policies regarding quota durations as con-tained in the current 2009 fishing policy should be reviewed and replaced with sector specific fishing right periods aimed funda-mentally at attracting investments in sustainable and responsi-ble harvesting, processing and marketing of seafood. It may also be opportune to reconsider Namibia’s over-emphasis on wet-fish hake processing.

A wide-angle perspective on commercial fishing THROUGH THE FISH EYE LENS

1313Maritime Review AfricaMARCH / APRIL 2016

When I was a child, we would spend three weeks every year on the south coast of KwaZulu-Na-

tal. Our annual holiday was always timed to coincide with the fishing season for elf (or shad as my dad always called it) and even though it was a bit peculiar to holiday in winter, the days were always sunny and the trip to the coast was a welcome break from the icy Highveld winter.

When he wasn’t fishing for elf, my dad would roam the rocky shore at low tide and pick his daily quota of 25 black mussels. I would tag along and help with the mussel collecting, but when he went after octopus, I made myself scarce. At a very young age I learnt to loathe and fear the sensation of an octopus crawling up my arm.

My dad always called the octopus he pre-pared for dinner “calamari” and believe me when I tell you it was rubbery and tasteless; if I have come across octopus on a restau-rant menu since then, I certainly would have avoided it. But, after spending a morning with Garry Nel, who has spent the best part of 20 years experimenting with the best way to catch and prepare octopus, I’m ready to give this particular cephalopod another try.

An experiment in trial and errorNel’s company SA Sensational Seafoods

is a right-holder in South Africa’s experi-mental octopus fishery and has been part of each phase of the Department of Agri-culture, Forestry and Fisheries’ (DAFF) oc-topus experiment since 1998.

He operates in False Bay, deploying his traps between Seal Island and Monwabisi beach; from Seal Island out to sea, and all the way around to Hoek van Bobbejaan on the west side of the Cape Peninsula. Nel’s

crew deploys and services the octopus traps from Albatross, a converted tuna pole fishing boat, and targets Octopus vulgaris, a fast growing, cold water species that lives in water of between 5 and 100m depth.

On meeting Nel at Kalk Bay harbour, the first thing he shows me are the sturdy plastic trigger traps that he says have rev-

olutionised his company’s participation in the octopus experiment. The traps are imported from Australia and their success is largely a result of the fact that they are strong and heavy and can stand up to the most ferocious winter storms.

Nel’s first traps were blow moulded plas-tic shelter pots purchased from West Af-rica. They rolled around on the seabed in foul weather, only to emerge crumpled and bent. The imported traps also use a novel method to lure octopus. This has proved very successful and dramatically improved catch rates.

A curious configurationGear configuration consists of three plas-

tic trigger traps seated together on a heavy steel frame. The traps are unbaited, but equipped with a rubber crab that fits over a flashing LED light. The light is activat-ed soon after the trap hits the water (at a depth of 2m) and it blinks once every four seconds – enough to attract the attention of a curious octopus that is moving along the seabed. When the octopus tries to remove the crab from the pot, a trigger is released, the trap door slams shut and the octopus is locked inside.

Each steel frame is joined to a longline and deployed at distance of 20m from the next frame. In total, 40 steel frames (120 individual traps) are deployed on a one ki-lometre longline. A cement anchor on each side of the longline helps to secure them to the seabed.

On the surface, a series of bullet buoys and two radar-reflecting buoys alert other seafarers to the presence of the line. And, this being South Africa, a bold sign discour-ages people (who can be as curious as an

octopus) from tampering with the lines. Incidents of vandalism have taken place, leading to time consuming line detangling operations.

Two to three lines of one kilometre each are deployed at a time and the soak time for the traps is typically seven to nine days, but is always weather dependent.

Curiosity kills the octopus What does it take to catch an octopus? A plastic crab and a blinking light! After

nearly 20 years of trial and error, the experimental oc-topus fishery is taking off.

CLAIRE ATTWOOD PROVIDES A WIDE ANGLE PERSPECTIVE

“Producing sufficient volumes is our biggest problem now,” he says. “We are currently investigating further development and expansion of the project now that we feel we have a blueprint that’s working.”

THROUGH THE FISH EYE LENS A wide-angle perspective on commercial fishing

1414 Maritime Review AfricaMARCH / APRIL 2016

Recovery and removal

Nel showed me a video of the trap re-trieval operation and it really is a very slick affair. Since each line weighs about 1.8 tonnes, a powerful Australian lobster winch is used to haul the traps onto the Albatross.

Hauling is at a rate of 5.2m/second at 1200 rpm. As each pot is opened the oc-topus inside is gently sprayed with a saline solution that paralyses it, allowing a crew-member to easily remove it from the trap. Immediately the animal is submerged in a tank of ice slurry that quickly shocks and

kills the animal. The catch is kept in the ice slurry until it is transferred to shore for pro-cessing.

Processing takes place at the Hout Bay factory of PescaLuna. The factory is HACCP approved which facilitates the export of product to Spain, Australia and the United States. For now, SA Sensational Seafoods is producing a single product: frozen octopus hands in an attractive plastic pouch, but it is in the process of introducing an “octopus flower pack” which is the standard Europe-an presentation for octopus.

Also in the pipeline is a steamed and

pouched product that would dramatically reduce preparation time for both consum-ers and restauranteurs. All products are marketed under the name “Cape Town Oc-topus”.

Nel is upbeat about the future of the oc-topus fishery, saying it has the potential to employ hundreds, if not thousands, of fish-ers and is particularly well suited to fishers who hold rights in other sectors. For exam-ple, at certain times of the year, when tuna catches are good, the Albatross crew leave the octopus traps in the water a day or two longer than usual before servicing them.

Lessons from West AfricaIf you’re dubious about whether Octopus

vulgaris can really form the basis of a full-scale commercial fishery, you need look no further than Northwest Africa; in Maurita-nia, Morocco, Senegal, Guinea and Guin-ea-Bissau, Octopus vulgaris is the most im-portant demersal resource and constitutes about 30 percent of the demersal catch.

In 1980, there were 279 Spanish trawlers catching octopus and cuttlefish in these countries, but access conditions in North-west Africa have become more restrictive and the Spanish cephalopod fleet is today less than one third of its maximum size.

Nel tells me that the catch of Octopus vul-garis in Northwest Africa is around 50,000 tonnes per year. I wasn’t able to verify that figure, but the FAO data that is available suggests that octopus catches (all species) in the region vary considerably – from about 46,000 tonnes to 84,000 tonnes per year.

At present, the South African octopus catch is modest, but the outlook for the fishery is good. Catch rates are general-ly higher than those recorded in Western Australia where a 16-year experimental fishery very recently entered the commer-cial phase, catching about 200 tons per year, although the catch is growing. Aus-tralia has a large Greek population and so far, octopus catchers have been unable to meet demand. Some of the South African catch is helping to make up the shortfall.

Educating a marketJust like my father erroneously referred to

octopus as “calamari” (which is the culinary term for squid) so most South Africans have very little experience of octopus as a food. Nel has worked hard to educate the market and he is pleased to say that the top restau-

Top: Nel removes a large Octopus vulgaris from a trigger trap. Nel has been involved in the experimental octopus fishery since 1998 and is finally seeing a return on his company’s investment.

Avove: Nel is pictured with two purpose-built, Australian designed and manufactured trigger traps seat-ed on a steel frame. The traps have radically improved catch rates in the experimental fishery. A rubber crab and a flashing LED light are used to attract an octopus into the trap. Once the octopus tries to remove the crab from the pot, the trap door slams shut and the animal is trapped. (There is no bycatch caught in this fishery because only an octopus can get into the trap and remove the crab.)

A wide-angle perspective on commercial fishing THROUGH THE FISH EYE LENS

1515Maritime Review AfricaMARCH / APRIL 2016

rants have started buying his products “and it’s gone through the roof.”

One of the problems has been the in-correct labelling of octopus caught in the south coast rock lobster fishery or the trawl fisheries – which is usually the deep-sea species, Enteroctopus megalocyathus (southern giant octopus). Enteroctopus megalocyathus is often labelled as Octopus vulgaris but, says Nel, the former species is of a far lesser quality.

“Octopus Vulgaris has a much higher cooking yield and a better quality of meat that doesn’t vary greatly in flavour and texture,” explains Nel. Added to which, whereas trawl caught octopus is kept on ice before being processed and sold, the trap-caught octopus handled with care on the vessel and frozen immediately after landing and so quality and shelf life is assured.

Nel says the notion that “an octopus is an octopus” has hampered his efforts to pen-etrate local and export markets, but he is working with DAFF and the National Reg-ulator for Compulsory Standards (NRCS) to address the issue of incorrect labelling of octopus products.

That Nel believes in the future of the oc-topus fishery is borne out by his company’s decision to build a purpose-built vessel for deploying and servicing traps. He also believes it will take a partnership with a medium-sized fishing company to take the octopus fishery to the next level.

“Producing sufficient volumes is our big-gest problem now,” he says. “We are cur-rently investigating further development and expansion of the project now that we feel we have a blueprint that’s working.”

As for me, now that I’ve learnt about this fascinating new fishery and seen how in-novation and sheer persistence are finally starting to pay off, I feel a certain responsi-bility to support it. I think it’s time to over-come the octopus phobia of my youth and give it a try. Nel tells me they cook Cape Town Octopus very well at Pesce Azzurro in Woodstock.

From the top: The crew of Albatross with two good-sized Octopus vulgaris specimens. The crew, which has become highly skilled at han-dling octopus, also fishes for tuna.

Processing of raw material takes place at the Hout Bay factory of Pescaluna.

At this stage, SA Sensational Seafoods is pro-ducing frozen octopus hands for the Cape Town Octopus label. More products are in the pipeline.

FEATURE Engines and propulsion

1616 Maritime Review AfricaMARCH / APRIL 2016

Lubricating oils perform a number of critical functions in the mechanical op-eration of the main engines and vessel

gearboxes. The oil provides a protective film between working parts made of steel or other metal alloys, as well as cooling the mating surfaces and removing wear de-bris generated during the operation of the equipment. A lubricant in the form of an engine oil

must separate the mating metal surfaces at journal bearings and gear teeth with a film of lubricating oil that decreases fric-

tion in the engine, removes heat, removes wear debris as well as suspends soot and deposits formed during the combustion process in the engine.

In the gearboxes onboard ship a different type of lubricating oil has to be used to lubricate the meshing gears and rotating rolling element bearings. Here the lubri-cant must remove heat generated during gearbox operation; carry away wear debris; release air entrained in the oil very quickly; resist oxidation by the entrained air and perhaps some water as well as quickly shed

all water that enters the oil sump so that the lubricating film between meshing gear teeth is intact.

The complex chemistry of marine engine oils and marine gear oils means that care and consideration is needed to ensure that the correct oil for an engine or gearbox is selected. A well instituted maintenance program that includes lubricating oil sampling and testing as well as trending of the test results so as to follow the condition of the lubricating oil charge is vital.

The lubrication requirements of marine main engines and high speed auxiliary diesel engines is determined by the Orig-inal Equipment Builders (OEM).

The table on the left shows some of the complex lubricating oil properties that need to be married together to ensure that Slow Speed Crosshead and Medium Speed Trunk piston engines are effectively lubri-cated. Lubricants for high-speed marine diesel engines include most of the above performance characteristics.

The key properties of a lubricating oil for marine engines that must be considered are:

�� The viscosity of the oil and its SAE vis-cosity grade.

�� The Total Base Number (TBN) of the oil so as to neutralise acids formed from fuel sulphur.

�� The Viscosity Index of the oil and its ability to resist changes in viscosity with temperature.

�� The Sulphated Ash content – to avoid deposit formation on rings and pistons.

�� The quality of the oil to resist oxidation and thermal degradation.

�� The detergency and dispersancy of oil to be used in Medium Speed and High Speed engines so as to keep soot and

Lubricating Oils – Lifeblood of the ship’s engine systems

Engineers working in the marine industry and onboard vessels need to realise the key role that lubricating oil plays in ensur-ing that engines, gearboxes, air compressors and hydraulic systems function and work, day in and day out. The lubricating oil and grease remains hidden from view, but the oil is the life-blood of all the working parts onboard a ship.

Low speed crosshead cylinder Medium speed trunk piston system

Crankcase

Sulphur neutralisation High TBN oil = 40-100

Lubricate bearings, crankshaft, chains & running gear

Piston deposit control and ring stick prevention

Detergency & thermal stability Detergency & thermal stability Sludge & lacquer control

Good lubricating oil film formation Good lubricating oil film formation

Stability in the presence of fuel contamination

Anti-wear properties Low emulsibility Must control asphaltene deposits in engines

System oil compatibility Rust & oxidation prevention Keep oil scraper rings clean

SAE 50 - 60 grade SAE 30 grade Thermal stability & oxidation control

Good anti scuffing ability Release of insoluble & water to purifiers

Rust control and alkalinity retention

Importance of viscosity index for optimised wear control and spreadability

Ability to neutralise acids formed during combustion hence TBN 12-55

Combustion acid neutralisation

Ability to control piston deposits by detergent and dispersant functionality

Good water tolerance Bearing corrosion protection+EP properties + Good water tolerance + low emulsibility – SAE 30 / 40 viscosity grade

Slow speed2 StrokeCrosshead engines

3 CA

TEGO

RIES

OF

ENGI

NES

cylinder oilsystem oil

Require 2 lubricants

common sump forcrankcase and cylinder

Requires 1 lubricant

common sump forcrankcase and cylinder

Requires 1 lubricant

Medium speed4 StrokeTrunk piston engines

High speedDiesel engines

Engines and propulsion FEATURE

> <

> <

www.yanmar.eu

> <

> <

call for Yanmar solutionsEconomical, reliable power for

multipurpose workboats.

6AYM High-speed eco

diesel engines:

• Low fuel consumption

• Low NOx emissions

• IMO Tier II compliant

• Mechanical Engine Control

Developed by Yanmar, designers

of quality propulsion and auxiliary

engine packages for over 60 years.

High speed engine series:

Range: 57 to 1340 kW

78 mhp - 1822 mhp

> Unique Situations <

Seascape Marine Services (PTY) Ltd.www.seascapemarine.co.zaE-mail: [email protected]

5092-Yanmar-AanpAdvSMMExhibition.indd 1 25-02-15 15:03

combustion deposits in suspension.

Fuel influencersThe type of fuel used in the various marine

engines will influence the selection of the lubricating oil selected and the level of TBN or alkalinity in the lubricating oil.

If the fuel being used is Residual Fuel Oil (HFO) with a sulphur content of up to 4,5 % m/m then lubricating oils with high TBN need to be selected, however if a low sulphur marine diesel distillate fuel is used then a lower TBN oil will need to be used.

ISO 8217 Marine Fuel Standard provides all the requirements for marine fuel oils.

In 2-stroke crosshead cylinder systems if residual fuels are used then high TBN oils need to be selected. If operating in an Emission Control Area (ECA) where low sulphur or ultra-low sulphur distillate fuels are mandated, then a lubricating oil with lower TBN should be used.

For 4 stroke medium speed engines oper-ating with both High Sulphur Residual Fuels (HFO) and distillate fuels then the following guidelines apply:

For high speed marine engines the use of a high performance multi-grade diesel engine oil with, for example an SAE 15W/40 viscosity rating and API CI-4 or CH-4 perfor-mance level, a TBN of about 12 mg KOH/g of oil should be used.

In summary it is vital that marine engineers seek professional support when selecting marine engine oils for the wide range of engines available on the market and they should also consult the engine OEM.

The changing of fuel types from low sulphur distillate to high sulphur residual fuels and even the variation in sulphur levels amongst distillate fuels makes it imperative that marine engineers seek professional lubrication and fuel technical advice.

Simon Norton

Tables courtesy of CIMAC

Fuel type (permanent operation)

Lubricant TBN – mg KOH/g oil

Residual ( HFO / MFO )

Residual fuel type

30-55

Distillate Distillate type 15

Fuel type (Intermittent operation)

Lubricant for distillate operation

TBN – mg KOH/g oil

Residual + <1000 hrs continuous on distillate

Residual fuel type

30-55

Residual + >1000 hrs continuous on distillate

Residual fuel type

15

About the authorSimon Norton of Chemical Investigation Services is an expert in the field of marine and industrial lubrication and worked for

Shell South Africa and the South African oil industry for more than 15 years. He has been consulting to South Africa industry and commerce for the past 10 years and provides expert consulting in the lubrication of machines as well as failure investigation and corrosion investigation and testing. Mr Norton holds a Bachelor of Science degree in chemistry from the University of Cape Town and is a Member of the South African Chemical Institute and a Member of the Corrosion Institute of Southern Africa.

FEATURE Engines and propulsion

1818 Maritime Review AfricaMARCH / APRIL 2016

Machinery damage is by far the most frequent cause of loss in marine insurance, and the numbers are

likely to increase with the introduction of low-sulphur limits. Historically, 40 percent of hull claims by number are machinery damage and make up 30 percent of costs. The most typical and well known contami-nant that can destroy an engine in a short time is cat fines. Cat fines are an inevitable by-product of

refining and consist of small particles of metal that are deliberately introduced to 'crack' the fuel. Unless removed by purifi-cation, cat fines will become embedded in engine parts and cause serious and rapid engine damage.

Filtration of fuel has been a requirement on board for many years, but crews are now noticeably less experienced and less reliable in operating the systems. Vessel operators and crew often have no idea about the purity of the fuel they use, nor is there any compulsion to find out before using it.

Often, the purifiers installed are inefficient and cannot cope. Cases are known where filters have been removed. Engines need fuel with no more than 15ppm, but fuel is produced at 60ppm and over. There is clearly a need for more crew training and somebody to verify that the equipment and systems installed really remove the cat fines on their way to the engine.

According to the fuel testing agency DNV Petroleum Services, the bunker fuel industry in the US has seen a rise in metals content as a result of regulations to reduce the level of sulphur in bunker fuel. Low sulphur fuels are less lubricating and this combined with the introduction of increased amounts of abrasive materials, causes damage.

Once cat fines become embedded in engine parts, they cannot be removed.

Until fairly recently, such losses have simply been described as engine damage or crew negligence and the real cause not identi-fied. It is only now that definite attributable losses are being reported.

Claims due to cat fines have been identi-fied in the range of USD 300,000 to USD 1.5 million, mostly in low speed engines. Wear is very rapid; for example, if liners are replaced, they could be worn out again in three days. In a technical paper presented at the CIMAC Congress in 2013, cat fines were found in 84 percent of all the cylinder liner high wear cases investigated.

Contributory changes which would help:

�� Sampling and testing of fuel before use.

�� Improved fuel handling on board.

�� Improve the quality of bunkers.

�� Alter the ISO standard1.

�� Charter/bunkering contracts should specify fuel less than 60ppm.

�� Regular cleaning of filters, frequent drainage.

�� Clean the settling and service tanks during dry dock.

�� Check centrifuge capacity on specifica-tions for new buildings.

�� Ensuring optimised fuel system treat-ment.

�� Introducing a new fuel cleaning system layout.

�� Automatic control of the cleaning flow rate.

�� Intensified monitoring of the fuel treat-ment efficiency.

If cat fines are confirmed in the fuel, all necessary work to eradicate them should be carried out immediately. However “immediately” is nearly always impossible as the crew will only realise that there are fuel problems after they have become abnormally severe.

Symptoms could include frequent clogging of fuel valves, malfunction of fuel pumps, abnormally frequent clogging of fuel filters

and abnormal/frequent build-up of sludge in the fuel separator. This is normally asso-ciated with cylinder blow-by and occa-sional fires in the scavenge space. By then substantial damage has already occurred.

The vessel must then reach a suitable repair port to carry out cleaning and repair works, and will likely suffer further engine damage in doing so. Replacement or machining of all affected engine compo-nents would normally require a lengthy stay in the port of repairs as it would be necessary to purchase, take delivery of and fit a large number of spare parts, as well as finding the means to dispose of the bad fuel.

If cleaning and repairs are not carried out thoroughly, and the source of the problem is not totally removed, there is a high prob-ability of recurrent damage. Clearly, costs involved can be very considerable.

Collaboration requiredIUMI raised the need of more class

involvement to ensure that vessels safely can operate on the new fuels required in the future with IACS in January 2011, and attended a meeting with the Machinery Panel in September 2013 to present the insurance industry’s concerns.

Following this meeting, the IACS Machinery Panel decided to review the members’ current requirements on facili-ties provided for handling the fuel on board in order to establish a common baseline.

A Project Team is currently working with industry to develop a Unified Requirement and address all necessary aspects of fuel oil treatment and ability of fuel oil pumps to work with different marine fuels.

Furthermore, recent statistics from the California Department of Fish and Wild-life show that switchovers between heavy fuel oils and distillate fuels to comply with the lower 0.1 percent sulphur limit in the Californian ECA increase the risk of vessels losing power.

The risks related to the complex switch-over will have to be carefully monitored, and proper crew training and awareness is needed.

Nevertheless, 1 January was the imple-mentation date of the 0.1% sulphur content limit for marine fuel on vessels operating in the North American Emission Control Area.

Impact of low sulphur fuel on enginesAccording to information in a recent International Union of Ma-rine Insurance (IUMI) report, the level of cat fines are likely to increase with the introduction of new low sulphur regulations, which will require more refining.

Once cat fines become embedded in engine parts, they cannot be re-moved. Until fairly recently, such losses have simply been described as engine damage or crew negligence and the real cause not identified. It is only now that definite attributable losses are being reported.

Of hull claims by number are machinery damage and make up 30% of costs.

40%

Engines and propulsion FEATURE

1919Maritime Review AfricaMARCH / APRIL 2016

The US Environmental 1 HFO with a cat fines content of up to 60ppm is compliant with the ISO 8217:2010 fuel standard 08.03.2016 8 Protection Agency (EPA) and the US Coast Guard are ramping up their inspection and enforcement efforts to monitor compliance.

The 0.1 percent sulphur limit also became mandatory in the northern European Emis-sion Control Areas (ECAs) as of 1 January 2015. The European Commission has proposed that at least 10 percent of vessels calling in European ports are monitored for compliance, with results being made public. Now in 2016, up to 40 percent of vessels inspected will have their fuel sampled. No escalation of incidents or specific chal-lenges reported thus far from the new northern ECA limits.