M&a of kingfisher and deccan

-

Upload

rai-manipat-ray -

Category

Education

-

view

183 -

download

0

Transcript of M&a of kingfisher and deccan

Mergers & Acquisitions

Marriage of

• Origin- Deccan Aviation Ltd.

• Growing demand of Air

connectivity

• Identifying potential Consumer

base

Towards making Air travel more Comfortable

• E-ticketing

• Cut on the Complementary service

- food to passengers

- no meals or company vehicles

- no separate staff

• Dr Vijay Mallya identified the gap

• Launched in 2005 by United Breweries Group

• Ready for take off with 4 flights a day and a fleet of one Airbus320

• Great in-flight experience

- Personalised in-flight entertainment system

- Fashion models as flight attendants

- Designer flight interiors

-Extendable footrests

TH E

MERGER

LOSSES YEAR ENDED

Kingfisher Airlines

Rs.577crs 31st

March,2007

Deccan Aviation

Rs.418crs 30th June,2007

DEAL STRUCTURE

• 1st Phase:

- UB bought 26% stake at Rs.155 p.s. on 9th July,2007

- Paid Rs.550crores

• 2nd Phase:

- Open offer for additional 20% stake

- Additional Rs.418crores

The Acquisition

Post Merger Issues

• Different Cultures

• Expected Job Cuts

• Different Leadership Styles

contd...• Expected Industry impact

Further consolidation

Rise in fares

Greater shareholder value

Higher attrition rates in employees

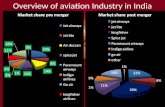

Current Scenario

•Delays in AirCrafts deliveries &Cancellation of Orders

•Industry Making Losses-Oil Concerns