Lsg agm may_2011

-

Upload

lake-shore-gold-corp -

Category

Investor Relations

-

view

263 -

download

0

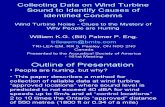

Transcript of Lsg agm may_2011

Annual General and Special MeetingMay 4 2011May 4, 2011

Toronto, Ontario 4:30pm

BUILDING A NEW MID-TIER GOLDA NEW CENTURY OF MINING

BUILDING A NEW MID TIER GOLD PRODUCER

IN A CENTURY-OLD GOLD CAMP AND

A NEW CANADIAN MINING SUCCESS STORY

C t i t t t i thi t ti l ti t L k Sh G ld’ l ti ti iti j t dit d b i l "f d

Forward Looking StatementsCertain statements in this presentation relating to Lake Shore Gold’s exploration activities, project expenditures and business plans are "forward-looking statements" within the meaning of securities legislation. The Company does not intend, and does not assume any obligation, to updatethese forward-looking statements. These forward-looking statements represent management’s best judgment based on current facts andassumptions that management considers reasonable, including that operating and capital plans will not be disrupted by issues such asmechanical failure, unavailability of parts, labour disturbances, interruption in transportation or utilities, or adverse weather conditions, that thereare no material unanticipated variations in budgeted costs, that the Company and contractors will complete projects according to schedule, andthat actual mineralization on properties will not be less than identified mineral reserves. The Company makes no representation thatthat actual mineralization on properties will not be less than identified mineral reserves. The Company makes no representation thatreasonable business people in possession of the same information would reach the same conclusions. Forward-looking statements involveknown and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company tobe materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Inparticular, fluctuations in the price of gold or in currency markets could prevent the companies from achieving their targets. Readers should notplace undue reliance on forward-looking statements. More information about risks and uncertainties affecting the Company and its business isavailable in Lake Shore Gold’s most recent annual information form and other regulatory filings which are posted on sedar at www.sedar.com.

There is no guarantee that drill results reported in this presentation will lead to the identification of a deposit that can be mined economically, andfurther work is required to identify a reserve or resource.

QUALITY CONTROLLake Shore Gold has a quality control program to ensure best practices in the sampling and analysis of drill core. A total of three Quality Controlsamples consisting of 1 blank, 1 certified standard and 1 reject duplicate are inserted into groups of 20 drill core samples. The blanks and thep g , j p g p pcertified standards are checked to be within acceptable limits prior to being accepted into the GEMS SQL database. Routine assays have beencompleted using a standard fire assay with a 30-gram aliquot. For samples that return a value greater than three grams per tonne gold onexploration projects and greater than 10 gpt at the Timmins mine and Thunder Creek underground project, the remaining pulp is taken and fireassayed with a gravimetric finish. Select zones with visible gold are typically tested by pulp metallic analysis on some projects. NQ size drill coreis saw cut and half the drill core is sampled in standard intervals. The remaining half of the core is stored in a secure location. The drill core istransported in security-sealed bags for preparation at ALS Chemex Prep Lab located in Timmins, Ontario, and the pulps shipped to ALSCh A L b t i V B C ALS Ch i ISO 9001 2000 i t d l b t i f ISO 17025 tifi tiChemex Assay Laboratory in Vancouver, B.C. ALS Chemex is an ISO 9001-2000 registered laboratory preparing for ISO 17025 certification.

QUALIFIED PERSONThe Company’s Qualified Persons (“QPs”) (as defined in National Instrument 43-101, “Standards of Disclosure for Mineral Projects”) fordiamond drilling projects at the Timmins deposit surface; Thunder Creek, Gold River Trend and 144 properties; Bell Creek Mine; and CasaBerardi optioned property are Jacques Samson, P.Geo., Stephen Conquer, P.Geo, and Keith Green, respectively. Dean Crick, P.Geo. is the QPfor the Timmins deposit and Thunder Creek underground drilling projects, and Bob Kusins, P.Geo., is the QP for resource estimation at all of the

3

Company’s properties. As QPs, Messrs. Samson, Conquer, Green, Crick and Kusins have prepared or supervised the preparation of thescientific or technical information for their respective properties as provided in this presentation. Messrs., Samson, Conquer, Kusins, Crick andGreen are employees of the Company.

* Example of Forward Looking Statement.

Strategic Land Positions in Timmins

Processing Mill (42kms from

Quebec

HollingerBell Creek Mine

McIntyre

( s oTimmins Mine) Ontario

Toronto

Timmins

70 Million Ounces MinedTimmins Mine – First Discovery

Timmins Mine Deposit Thunder

Creek Deposit

Dome

Deposit

G ld Ri

144 Project –Gold Mineralized

Porphyry at Surface Metasedimentary

Mafic VolcanicsGold River

Trend – 2km of Gold Showings

Ultramafic Volcanics

4

Lake Shore Gold – Strategy

Operating development and exploration performance

Build shareholder value through:

Operating, development and exploration performance

Growth in resources and reserves

Growth in production and cash flow

Ongoing extensions, new discoveries and acquisitions

Plus:

Strong balance sheet and capital management

5

LSG – A Story of Rapid Growth and Discovery…

Rapid growth in resources and production, competitive operating costs and excellent exploration potential

Growing Resource Base(millions of ounces)

Exploration Success

Resources

Rapid Production Growth (ounces)

ResourcesExtensions

New discoveries

1 20.6

1.8

discoveries

0.9 1.2

2009 2010 2011* 2012*

Measured & Indicated

2009 2010 2011* 2012* 2013*

Company guidanceInferred

*Examples of Forward Looking Statements.

Anticipated future growth

6

Company guidance

…. And of Performance – In 2010, LSG…

Doubled resources to 3.0 million ounces

Produced 43,500 ounces Au in 2010, up from 7,700 ounces in 2009

Reached commercial production at Timmins Mine (declared effective Jan 1, 2011)

Drifted into mineralization at Thunder Creek on two levels

Commenced stoping below 300m Level at Bell Creek

Excellent drill results at Thunder Creek, Bell Creek, Gold River Trend, Timmins Mine

7

Lake Shore Gold – Strong Financial Position

Cash at December 31st $108*

$ millions (unless otherwise stated)

Capital expenditures (2010) $103.0(Target: $115.0)

Exploration spending (2010) $26.6(Target: $28)

Long‐term debt Nil

Basic shares outstanding (millions) 382Basic shares outstanding (millions) 382

FD ITM shares outstanding (millions) 404

8*Includes $16 million of gold bullion inventory

Lake Shore Gold – Responsible Capital Management

Company built on equity, no debt prior to production

$400M raised by issuing 145M shares since March 2008Average 17% premium

104M shares issued for acquisition of West Timmins Mining

Extended exploration base

Major transformation of shareholder base beginning in N /10 LSG id l h ldNov./10 – LSG now widely held

9*Includes $16 million of gold bullion inventory

Lake Shore Gold – First Quarter 2011

148,000 tonnes milled at 4.89 gpt for 22,300 ounces

Total gold poured of 25,900 ouncesTotal gold poured of 25,900 ounces

Gold sales of 34,000 ounces

Mill recoveries continue to be excellent at approx. 96%pp

Grade reflects mine sequencing, mining in Ultramafic Zone to resume

Throughput below target at 1,650 tpd – crushing circuit issues being addressed

Cash costs in line with full-year target of US$575/ounce

Continue to target 125 000 ounces in 2011*

y g $

First quarter 2011 financial results to be released May 25, 2011

10

Continue to target 125,000 ounces in 2011

*Examples of Forward Looking Statements.

2011 – Year‐to‐Date Progress

Continued to demonstrate extensive potential of Thunder Creek Drill results near 730 Level included 11.53 gpt over 147.30Wide, high-grade intercepts in virtually every direction

Confirmed and expanded high-grade mineralization in UltramaficZone of Timmins MineZone of Timmins Mine

Discovered new gold zone at 144

Confirmed near-surface resource potential at Gold River Trend and pextended mineralization to 750 metres

Established initial resources at Marlhill & Vogel, total resources at Bell Creek ComplexBell Creek Complex

Completed corporate credit facility for US$50 million

11

Lake Shore Gold – Strategy

Operating, development and exploration performance

Build shareholder value through:

p g, p p p

Growth in resources and reserves

Growth in production and cash flow

Ongoing extensions, new discoveries and acquisitions g g , q

Plus:

Strong balance sheet and capital management

12

LSG – Rapid Growth in Resources

Resources doubled in Dec. 2010, targeted to double again by early 2012*

Growing Resource Baseg(millions of ounces)

Updates to Timmins Mine, Bell Creek, Gold River Trend

Initial Bell Creek Resource Gro th to

Initial Thunder Creek Resource

0 6

1.81.5

3.0 Growth to continue Timmins Mine

Gold River Trend

0.9 1.20.6

2009 2010 2011* 2012*

13

Measured & IndicatedInferred

*Examples of Forward Looking Statements.

Anticipated future growth

Bell Creek 2010Dec. 2010

251,200 ozs M&A1,192,900 ozs Inferred

Between 2,000 and 3,000 ozs per vertical metre below 950L

14

Bell Creek Complex – Opportunities for Growth

NI 43 101 ResourcesNI 43-101 Resources 57,400 ozs Indicated

NI 43-101 Pit Resources 125,000 ozs Indicated

31 700 ozs Inferred

PM-25-56.19/6.00

NI 43-101 Resources 251,200 ozs M&I1,192,900 ozs Inferred

31,700 ozs Inferred

NI 43-101 U/G Resources 137,100 ozs Inferred

BC 10 94C

V-09-1A8.97/3.004.00/5.20 6437

BC-10-94C5.20/50.60

Incl. 12.59/10.90

4.95/4.004.87/22.60

Incl. 8.37/11.00

15

Timmins Mine & Thunder Creek

Timmins Mine3.4M tonnes @ 7.52

gpt for812 000 ozs of

400 metreextension

812,000 ozs of reserve (to date)

extension

Recent favourable

drill

Thunder Creek Initial NI 43-101

resource expected H2/11T t 1 0M 1 5M *results Target: 1.0M – 1.5M ozs*

Open

16

Fold Nose Target250 m wide x 600 m long target

Gold River Trend 250 m wide x 600 m long targetShallow Bulk Mining Potential

North Porphyry‐ 4800High grade/shallowg g /

17

Lake Shore Gold – Strategy

Operating, development and exploration performance

Build shareholder value through:

p g, p p p

Growth in resources and reserves

Growth in production and cash flow

Ongoing extensions, new discoveries and acquisitions g g , q

Plus:

Strong balance sheet and capital management

18

LSG – Achieving Rapid Growth in Production

Achieving rapid production growth, momentum to continue Targeted growth to come from existing assets in production or under development

Rapid Production Growth (ounces)

Three Mines Commercial Production

Thunder Creek

Bell CreekTimmins Mine Commercial Production Thunder Creek

Timmins Mine43 500

125,000Production

Timmins Mine 7,700

43,500

2009 2010 2011 2012* 2013*

19*Examples of Forward Looking Statements.

Company guidance

Anticipated future growthNot all production based on existing resources

Actuals

Timmins Mine Shaft Rockfill

Commercial production declared effective January 1, 2011

Grades reconciliation excellent

Raise

Drift to TC

Cash costs expected to average approx. US$575/oz in 2011

Mining to focus on lower-grade

Veins

Main Zone

200L

Mining to focus on lower-grade upper mine in Q1/11, stoping in Ultramafic Zone to resume late in Q2/11

400L

Main Zone

Footwall

Development below 650 Level to commence in Q3/11

Mining method: mainly longhole

525L

UltramaficMining method: mainly longholestoping 650L Drift to TC

Ultramafic

Fill cycle in Q1/11

20Q4Q3Q2Q1

Thunder CreekThunder Creek TC Vent Raise

U Mi

TC Vent Raise

Upper MineRamp development to be completed to 400 Level by year end Level development every 20 metres Exploration Driftp yContinue diamond drilling to delineate ore bodyMix of cut & fill and longhole stoping

pFrom Timmins Mine

TC V t R iLower Mine

Established exploration driftsSilling on 730 Level

TC Vent Raise

gStoping horizons on 730 and 710 levels to be established Continue diamond drilling to delineate body and develop NI 43-101 resourcebody and develop NI 43 101 resource

Exploration DriftFrom Timmins Mine

21

Q4Q3Q2Q1

Bell Creek Mine*

B ll C k MiBell Creek MineStudy progressing for 1,500m shaft

Pre-feasibility study to be completdfor a 2,500 tpd operation at Bellfor a 2,500 tpd operation at Bell Creek Mine

Complex now expected to produce 100 000 to 150 000 ounces per100,000 to 150,000 ounces per annum

Conceptual shaft to 1,500m

Existing resource

22*Examples of Forward Looking Statements.

Existing resource

Mineralized system

LSG – Improving Cash Cost Performance Cash costs at Timmins Mine to average US$575/ounce in first year of commercial production* Cash costs to improve to approx. US$400/ounce from all sources over next 2 to 3 years* through economies of scale mining & processing optimization and

Target Cash Operating Costs*(US dollars per ounce)

3 years through economies of scale, mining & processing optimization and long-term exchange rates

575

400

2011 2013/14

23*Examples of Forward Looking Statements.

2011 2013/14Company guidance Anticipated future performance

Lake Shore Gold – Strategy

Operating, development and exploration performance

Build shareholder value through:

p g, p p p

Growth in resources and reserves

Growth in production and cash flow

Ongoing extensions, new discoveries and acquisitions

Plus:

g g , q

Strong balance sheet and capital management

24

Timmins West Complex

Timmins Mine

Thunder Creek

144Zone

Gold River East

New Discovery Area 6km

144 S th

144 South

Gold River West

East

6kmSouth

25

Timmins Mine & Thunder CreekPotential for Major Resource Expansion

Timmins Mine Thunder Creek

LSG drilling to test forLSG drilling to test for depth extensions

LSG drilling deep hole

Deep TargetApprox. 2,400 m Testing for Potential Depth E i f h Ti i Mi

LSG drilling deep hole on behalf of JV

Extension of the Timmins Mine and Thunder Creek Deposits

26

144 – New Gold Zone Discovered Timmins Mine

Thunder Creek

144Zone

144 South

Gold River

Gold River East

Gold River West

27

Bell Creek Complex –Potential for Two Mineralized Trends

Marlhill Mine NI 43-101 Resources57,400 ozs Inferred

Shaft

NI 43-101 Resources251,200 ozs M&I1,192,900 ozs Inferred

Future target Future

target

Bell Creek Mine and Mill

Shaft

Vogel NI 43-101 ResourcesPit:125,000 ozs Indicted31,700 ozs InferredU/G:Future U/G137,100 ozs Inferred

Wetmore

target

28

2011 – A Year of Key Catalysts*Mill production to nearly triple to 125,000 ozs

Cash costs at Timmins Mine of approx. US$575/oz.

Release initial resource at Thunder Creek H2/11Release initial resource at Thunder Creek H2/11, advance drilling to update resources at Bell Creek, Gold River Trend and Timmins Mine (by early 2012)

Continued exploration successContinued exploration success Depth extensions at Thunder Creek, Timmins MineDiscovery hole(s) at 144Pit and depth potential at Gold River Trend Deep drilling at Bell Creek Mine

Exploration budget of $31.0 million

Moving forward with staged expansion of millingMoving forward with staged expansion of milling capacity

Remain fully funded through 2011

29*Examples of Forward Looking Statements.

Why Invest in Lake Shore Gold?

A rapidly growing gold mining companyA rapidly growing gold mining companyTwo large land positions, including western extension of Timmins Gold CampFirst mine in commercial production, two others in developmentActively drilling high-potential exploration targetsActively drilling high potential exploration targets

Extensive growth inresources and reserves

Rapid growth in production & cash flow

Resources doubled in Dec. ’10*

To double again by early ’12*

Output to nearly triple in ’11*

Growth to continue in ‘12 & ’13*

Excellent exploration Strong cash cost ppotential

Drilling at depth for extensions

Targeting new discoveries

gperformance

US$575/oz. at Timmins Mine in ’11*

Targeting US$400/oz. in 2 to 3 years*

30

Strong financial position – Well funded with no debt *Examples of Forward Looking Statements.

GOLD

A NEW CENTURY OF MINING

IN A CENTURY-OLD GOLD CAMP