KFC HOLDINGS (MALAYSIA) BHD 65787-T - Pocketzila

Transcript of KFC HOLDINGS (MALAYSIA) BHD 65787-T - Pocketzila

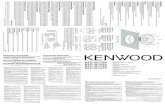

1KFC Holdings (Malaysia) BHd (65787-T)

annual Report 2011

annual Report 2011KFC HOLDINGS (MALAYSIA) BHD 65787-T

2KFC Holdings (Malaysia) BHd (65787-T)

annual Report 2011

after 38 years of ‘Finger lickin’ good’, we have changed our tagline to simply ‘so good’. ‘so good’ reflects our

commitment to product, place, people, price and promotion. ‘so good’ is that great experience of a good meal shared

between family and friends. at KFC, it is all about building a brand that brings people together and creates that ‘so good’ moments. Thus, the choice of the cover illustrates ‘so good’

which is what the brand is all about.

2KFC Holdings (Malaysia) BHd (65787-T)

annual Report 2011

Shareholders’ OverviewFinancial Highlights 6

notice of annual general Meeting 9statement accompanying notice of annual general Meeting 14

Our Performance in 2011Corporate statement 18Review of operations 32

Reliable Corporate CitizenCorporate social Responsibility 48

The Corporation Board of directors 60

Top Management Committee 76Head of division 77

shariah advisory Council 80Corporate information 81

group structure 82

AccountabilityCorporate governance statement 84

audit Committee Report 93statement on internal Control 97

additional Compliance information 100

Financial Statementsdirectors’ Report 127

statements of Financial Position 131statements of Comprehensive income 132

Consolidated statement of Changes in Equity 133statement of Changes in Equity 135

statements of Cash Flows 137notes to the Financial statements 139

statement by directors 204statutory declaration 204

independent auditors’ Report 205list of Properties Held 207

analysis of shareholdings 220analysis of Warrant Holdings 223

Form of Proxy

Contents

What We Bring To The Table...

we bring

a So Good Family Meal...

... with a side of

Happiness.

Bringing families together is at the heart of everything that we do. We take great pride in knowing that enjoying a sumptuous meal together not only opens line of communications, but in addition is a healthy and complete feast for the entire family to enjoy. We ensure the quality of all our food, taking great care in each step of the way to deliver wholesome, delicious and healthy products for all.

6KFC Holdings (Malaysia) BHd (65787-T)

annual Report 2011

2007 2008 2009 2010 2011

RM ’000 RM ’000 RM ’000 RM ’000 RM ’000

REVENUE

KFC Malaysia 1,043,438 1,284,429 1,365,542 1,496,907 1,655,340

KFC singapore 280,200 330,771 342,666 368,586 409,126

KFC Brunei 11,679 13,676 15,469 16,347 20,424

KFC india - - - 6,232 19,813

integrated Poultry 316,985 445,018 484,132 533,397 586,706

Education - - - 1,068 4,725

ancillary 78,069 105,894 89,622 99,821 102,646

Total 1,730,371 2,179,788 2,297,431 2,522,358 2,798,780

Profit Before Tax 150,624 167,457 190,015 221,833 215,493

Profit after Tax 105,543 120,350 132,797 159,702 146,571

net Profit attributable to

owners of the Company 104,269 118,535 130,403 156,848 144,005

EBiTda 224,160 241,986 281,326 312,785 330,606

Property, Plant and Equipment 593,599 678,900 773,241 999,984 1,228,459

Total assets 1,006,128 1,154,407 1,290,470 1,583,032 1,838,226

Total Borrowings 122,987 141,055 116,436 152,547 254,249

share Capital (number) 793,099 793,099 793,099 793,231 793,266

shareholders’ Equity 602,021 692,158 791,757 990,247 1,074,215

Return on shareholders’

Equity (%) 17.32 17.13 16.47 15.84 13.41

Return on Total assets (%) 10.36 10.27 10.11 9.91 7.83

gearing Ratio (net debts/

shareholders’ Equity) (%) - 6.22 - 2.10 14.08

Basic Earnings Per share (sen) 13.15 14.95 16.44 19.78 18.18

net assets Per share (RM) 0.76 0.87 1.00 1.25 1.36

gross dividend Per share (sen) 20 22 24 15.5 3

share Price as at 31 december (RM) 6.40 7.45 7.40 3.82 3.84

NO. OF RESTAURANTS

KFC Malaysia 403 436 475 515 539

KFC singapore 69 73 77 77 80

KFC Brunei 7 8 9 9 12

KFC india - - - 7 13

Kedai ayamas 20 25 35 49 75

RasaMas Malaysia 22 34 40 39 25

RasaMas Brunei - 2 3 3 2

521 578 639 699 746

Financial Highlights

7KFC Holdings (Malaysia) BHd (65787-T)

annual Report 2011

Financial Highlights

2011

1000

2000

3000

500

1500

2500

0

2010

2009

2008

2007 1,730

2,180

2,297

2,799

2,522

REVENUERM (Million)

2011

2010

2009

2008

2007 151

167

190

215

222

0 50 100

150

200

250

PROFIT BEFORE TAxRM (Million)

2011

2010

2009

2008

2007 1,006

1,154

1,290

1,838

1,583

0 400

800

1200

1600

2000

TOTAL ASSETSRM (Million)

2011

2010

2009

2008

2007 602

692

792

1,074

990

0 250

500

750

1000

1250

SHAREHOLDERS’ EqUITYRM (Million)

8KFC Holdings (Malaysia) BHd (65787-T)

annual Report 2011

2007 40369

7

2007 2022

2008 43673

8

2008 2534

2

2010 51577

97

2010 4939

3

3

2011 53980

1213

2011 7525

2

2009 47577

9

2009 3540

0 100

200

300

400

600

500

0 15 30 45 60 9075

TOTAL KFC RESTAURANTSno. of Restaurants

TOTAL AYAMAS OUTLETSno. of outlets

KFC Malaysia

KFC singapore

KFC Brunei

KFC india

Kedai ayamas

RasaMas Malaysia

RasaMas Brunei

Financial Highlights

9KFC Holdings (Malaysia) BHd (65787-T)

annual Report 2011

Notice of Annual General Meeting

AGENDA

1. To receive and adopt the audited Financial statements of the Company for the year

ended 31 december 2011 and the Reports of the directors and auditors thereon.

2. To approve the payment of directors’ fees in respect of the financial year ended

31 december 2011.

3. (a) To re-elect the following directors retiring pursuant to article 89 of the Company’s

articles of association:

(i) ahamad bin Mohamad

(ii) datuk ismee bin ismail

(iii) Hassim bin Baba

(b) To re-elect the following director retiring pursuant to article 96 of the Company’s

articles of association:

(i) yaM Tengku sulaiman shah alhaj ibni almarhum sultan salahuddin abdul aziz

shah alhaj

4. To re-appoint Messrs KPMg as auditors of the Company and to authorize the directors

to fix their remuneration.

5. as special business:

To consider and, if thought fit, to pass the following resolutions: -

(a) Ordinary Resolution - Authority to allot and issue shares pursuant to Section

132D of the Companies Act 1965 (the “Act”)

“THAT pursuant to section 132d of the act, full authority be and is hereby given to

the directors to issue shares of the Company from time to time upon such terms and

conditions and for such purposes as the directors may in their absolute discretion

deem fit provided that the aggregate number of shares to be issued pursuant to

this resolution does not exceed ten percent (10%) of the issued share capital of the

Company and that such authority shall continue in force until the conclusion of the

next annual general Meeting (“agM”) of the Company, and that the directors be

and are hereby empowered to obtain the approval of the Bursa Malaysia securities

Berhad (“Bursa securities”) for the listing and quotation for the new shares to be

issued.”

Resolution 1

Resolution 2

Resolution 3

Resolution 4

Resolution 5

Resolution 6

Resolution 7

Resolution 8

NOTICE IS HEREBY GIVEN that the 32nd annual general Meeting of KFC Holdings (Malaysia) Bhd will be held at level 3, Wisma KFC, no 17, Jalan sultan ismail, 50250 Kuala lumpur on Tuesday, 22 May 2012 at 11:30 a.m. for the following purposes:-

10KFC Holdings (Malaysia) BHd (65787-T)

annual Report 2011

Notice of Annual General Meeting

(b) Ordinary Resolution - Proposed Renewal of the Share Buy-Back Authority

“THAT subject to the act, rules, regulations and orders made pursuant to the act,

provisions of the Company’s Memorandum and articles of association and the

listing Requirements of Bursa securities (“listing Requirements”) and any other

relevant authority, the Company be and is hereby authorized to purchase and/or

hold such amount of ordinary shares of RM0.50 each in the Company’s issued and

paid-up share capital (“Proposed Renewal of the share Buy-Back authority”) through

Bursa securities upon such terms and conditions as the directors may deem fit in the

interest of the Company provided that:-

(a) the aggregate number of shares so purchased and/or held pursuant to this

ordinary resolution (“Purchased shares”) does not exceed ten percent (10%) of

the total issued and paid-up share capital of the Company at any one time; and

(b) the maximum amount of funds to be allocated for the Purchased shares shall

not exceed the aggregate of the retained profits and/or share premium of the

Company;

AND THAT the directors be and are hereby authorized to decide at their discretion

either to retain the Purchased shares as treasury shares (as defined in section 67a

of the act) and/or cancel the Purchased shares and/or to retain the Purchased

shares as treasury shares for distribution as share dividends to the shareholders

of the Company and/or be resold through Bursa securities in accordance with the

relevant rules of Bursa securities and/or cancelled subsequently and/or to retain part

of the Purchased shares as treasury shares and/or cancel the remainder and to deal

with Purchased shares in such other manner as may be permitted by the act, rules,

regulations, guidelines, requirements and/or orders of Bursa securities and any other

relevant authorities for the time being in force;

AND THAT the directors be and are hereby empowered to do all acts and things

(including the opening and maintaining of a central depositories account(s) under

the securities industry (Central depositories) act, 1991) and to take such steps

and to enter into and execute all commitments, transactions, deeds, agreements,

arrangements, undertakings, indemnities, transfers, assignments, and/or guarantees

as they may deem fit, necessary, expedient and/or appropriate in the best interest

of the Company in order to implement, finalise and give full effect to the Proposed

Renewal of the share Buy-Back authority with full powers to assent to any conditions,

modifications, variations (if any) as may be imposed by the relevant authorities;

AND FURTHER THAT the authority conferred by this ordinary resolution shall be

effective immediately upon passing of this ordinary resolution and shall continue in

force until the conclusion of the next agM of the Company or the expiry of the period

within which the next agM of the Company is required by law to be held (whichever is

earlier), unless earlier revoked or varied by ordinary resolution of the shareholders of

the Company in general meeting, but shall not prejudice the completion of purchase(s)

by the Company before that aforesaid expiry date and in any event in accordance

with provisions of the listing Requirements and other relevant authorities.” Resolution 9

11KFC Holdings (Malaysia) BHd (65787-T)

annual Report 2011

Notice of Annual General Meeting

(c) Ordinary Resolution - Proposed Renewal of Existing Shareholders’ Mandate

for Recurrent Related Party Transactions (“RRPT”) of a Revenue and/or

Trading Nature and New Mandate for Additional RRPT of a Revenue and/or

Trading Nature (“Proposed Shareholders’ Mandate for RRPT”)

“THAT authority be and is hereby given in line with Paragraph 10.09 of the listing

Requirements, for the Company, its subsidiaries or any of them to enter into any of the

transactions falling within the types of the RRPT, particulars of which are set out in the

Circular to shareholders dated 27 april 2012 (“the Circular”), with the Related Parties

as described in the Circular, provided that such transactions are of revenue and/or

trading nature, which are necessary for the day-to-day operations of the Company

and/or its subsidiaries, within the ordinary course of business of the Company and/

or its subsidiaries, made on an arm’s length basis and on normal commercial terms

which those generally available to the public and are not detrimental to the minority

shareholders of the Company;

AND THAT such authority shall commence immediately upon the passing of this

ordinary Resolution until:-

(i) the conclusion of the next agM of the Company following the general meeting

at which the ordinary resolution for the Proposed shareholders’ Mandate for the

RRPT is passed, at which time it shall lapse, unless the authority is renewed by a

resolution passed at the next agM; or

(ii) the expiration of the period within which the next agM after the date it is required

by law to be held; or

(iii) revoked or varied by ordinary resolution passed by the shareholders of the

Company at a general meeting of the Company,

whichever is earlier.

AND FURTHER THAT the directors of the Company be authorized to complete

and do all such acts and things (including executing all such documents as may be

required) as they may consider expedient or necessary to give effect to the Proposed

shareholders’ Mandate for RRPT.”

Resolution 10

12KFC Holdings (Malaysia) BHd (65787-T)

annual Report 2011

6. To transact any other ordinary business of which due notice shall have been given.

FURTHER NOTICE IS HEREBY GIVEN THAT for the purpose of determining a member

who shall be entitled to attend this 32nd agM, the Company shall be requesting Bursa

Malaysia depository sdn Bhd in accordance with article 64 of the Company’s articles of

association and Paragraph 7.16 of the listing Requirements to issue a general Meeting

Record of depositors (“Rod”) as at 14 May 2012. depositors whose names appear on the

Rod as at 14 May 2012 are entitled to attend, speak and vote at the said meeting.

By oRdER oF THE BoaRd

IDHAM JIHADI BIN ABU BAKAR, ACIS (MAICSA 7007381)

HENG AI LENG (MAICSA 7017245)

Company secretaries

Kuala lumpur

27 april 2012

Notice of Annual General Meeting

NOTES:

1. a member of the Company entitled to be present and vote at the above agM may appoint a proxy or proxies to be present and vote instead of him. a Proxy may but need not be a member of the Company.

2. The instrument appointing a proxy shall be in writing under the hand of the appointor or his attorney duly authorized in writing or if the appointor is a corporation, either under its common seal or under the hand of an officer or attorney duly authorised.

3. a member of the Company may appoint more than two (2) proxies to attend the agM. Where a member of the Company appoints two (2) or more proxies, the appointment shall be invalid unless the member specifies the proportion of his shareholdings to be represented by each proxy.

4. Where a member of the Company is an authorized nominee as defined under the securities industry (Central depositories) act, 1991, he may appoint at least one (1) proxy in respect of each securities account he holds with ordinary shares of the Company standing to the credit of the said securities account.

5. Where a member of the Company is an exempt authorized nominee as defined under the securities industry (Central depositories) act, 1991, there will be no limit to the number of proxies which the exempt authorized nominee may appoint.

6. any alteration made in this form should be initialed by the person who signs it.

7. The Proxy Form and the Power of attorney or other authority, if any, under which it is signed or a notarially certified copy of that power of authority must be deposited at Tricor investor services sdn Bhd, level 17, The gardens north Tower, Mid Valley City, lingkaran syed Putra, 59200 Kuala lumpur not less than forty-eight (48) hours before the time for holding the meeting or any adjournment thereof.

13KFC Holdings (Malaysia) BHd (65787-T)

annual Report 2011

ExPLANATORY NOTES ON SPECIAL BUSINESS

1. Resolution Pursuant to Section 132D of the Companies Act 1965 The ordinary Resolution proposed under item 5(a), if passed, will give the directors of the Company, from the date of the above

general Meeting, authority to issue and allot ordinary shares from the unissued share capital of the Company being for such purposes as the directors consider would be in the interest of the Company. This authority will, unless revoked or varied at a general Meeting, expire at the conclusion of the next agM of the Company.

The Company had, at the 31st agM held on 27 april 2011, obtained its shareholders’ approval for the general mandate for issuance of shares pursuant to section 132d of the act. The Company did not issue any new shares pursuant to this mandate obtained as at the date of this notice. The ordinary Resolution 8 proposed under item 5(a) of the agenda is a renewal of the general mandate for issuance of shares by the Company under section 132d of the act. at this juncture, there is no decision to issue new shares. if there should be a decision to issue new shares after the general mandate is obtained, the Company will make an announcement in respect of the purpose and utilisation of proceeds arising from such issue.

The authority will provide flexibility to the Company for any possible fund raising activities, including but not limited to further placing of shares, for purpose of funding future investment project(s), working capital and/or acquisitions.

2. Resolution pursuant to the Proposed Renewal of the Share Buy-Back Authority This resolution proposed under item 5(b) will empower the directors of the Company to purchase the Company’s shares up to

ten percent (10%) of the issued and paid-up share capital of the Company by utilizing the funds allocated which shall not exceed the total retained earnings and share premium of the Company. This authority will, unless revoked or varied at a general Meeting, expire at the conclusion of the next agM of the Company.

Further information on the Proposed Renewal of the share Buy-Back authority are set out in the Circular to shareholders of the Company which is dispatched together with the Company’s annual Report for the year ended 2011.

3. Resolution pursuant to the Proposed Shareholders’ Mandate for RRPT This resolution proposed under item 5(c) will enable the Company, its subsidiaries or any one of them to enter into any recurrent

transactions of a revenue or trading nature which are necessary for the Company and/or its subsidiaries day-to-day operations, subject to the transactions being in the ordinary course of business, made at arm’s length and on normal commercial terms and are not to the detriment of the minority shareholders of the Company.

Further information on the Proposed shareholders’ Mandate for RRPT are set out in the Circular to shareholders of the Company which is dispatched together with the Company’s annual Report for the year ended 2011.

Notice of Annual General Meeting

14KFC Holdings (Malaysia) BHd (65787-T)

annual Report 2011

Statement Accompanying Notice of Annual General Meeting

1. DIRECTORS WHO ARE STANDING FOR RE-ELECTION AT THE ANNUAL GENERAL MEETING

(a) The directors retiring by rotation pursuant to article 89 of the articles of association are:-

(i) ahamad bin Mohamad

(ii) datuk ismee bin ismail

(iii) Hassim bin Baba

(b) The director retiring by rotation pursuant to article 96 of the articles of association is:-

(i) yaM Tengku sulaiman shah alhaj ibni almarhum sultan salahuddin abdul aziz shah alhaj

The details of the directors seeking re-election are set out in the directors’ Profiles which appear on pages

62 to 71 of the annual Report.

2. DETAILS OF ATTENDANCE AT BOARD MEETINGS HELD IN THE FINANCIAL YEAR ENDED

31 DECEMBER 2011

There were six (6) Board Meetings held during the financial year ended 31 december 2011 and the following

are the details of the Board attendance:-

Name of Directors No of Meetings Attended

1. Kamaruzzaman bin abu Kassim 6/6

2. ahamad bin Mohamad 6/6

3. Jamaludin bin Md ali 6/6

4. Hassim bin Baba 6/6

5. Kua Hwee sim 6/6

6. Tan sri dato’ dr yahya bin awang 6/6

7. datuk ismee bin ismail 3/6

8. datin Paduka siti sa’diah binti sheikh Bakir 4/6

9. yaM Tengku sulaiman shah alhaj ibni almarhum 3/4

sultan salahuddin abdul aziz shah alhaj

(appointed on 1 June 2011)

3. THE 32ND ANNUAL GENERAL MEETING WILL BE HELD AT LEVEL 3, WISMA KFC, NO 17, JALAN

SULTAN ISMAIL, 50250 KUALA LUMPUR ON TUESDAY, 22 MAY 2012 AT 11.30 A.M.

16KFC Holdings (Malaysia) BHd (65787-T)

annual Report 2011

we bring

Cheery Smiles...

17KFC Holdings (Malaysia) BHd (65787-T)

annual Report 2011

18KFC Holdings (Malaysia) BHd (65787-T)

annual Report 2011

... with a splash of

Mouth-watering Varieties.

at our restaurants, we are proud to provide our customers with only the best value everyday. From our meals for one, to meals shared with family and friends, you will find a delicious meal that suits you at a great price.

19KFC Holdings (Malaysia) BHd (65787-T)

annual Report 2011

18KFC Holdings (Malaysia) BHd (65787-T)

annual Report 2011

Corporate Statement

The Group Continuously Achieves Spectacular Growth

CONSOLIDATING ACHIEVEMENTS

Fellow stakeholders,

The growth achieved by the KFC Holdings (Malaysia) Bhd (KFCH) group between 2006 and 2010 was phenomenal. in just five years, the number of KFC outlets increased from 443 to more than 600, as the group not only entrenched its leadership of the Malaysian food service sector but expanded its network in singapore, Brunei and into india. Moreover, this massive increase in outlets was matched by a consistent and spectacular growth in both revenues and profits.

against this background, 2011 was yet another year of outstanding achievement for KFCH. Most importantly, a fundamentally stellar financial performance has enabled the group to continue making major capital investments that will secure the future of the group for years to come, while maintaining a healthy bottom line for the period under review.

in short, for KFCH, after five years of remarkable growth, 2011 was a story of consolidation that has positioned the group to take the next leap forward in 2012 and beyond.

19KFC Holdings (Malaysia) BHd (65787-T)

annual Report 2011

From left to Right :

aHaMad Bin MoHaMadDeputy Chairman

KaMaRUZZaMan BinaBU KassiMChairman

JaMalUdin Bin Md aliManaging Director

Corporate Statement

ECONOMIC BACKGROUND

The global economy remained fragile throughout 2011. The still unfolding financial turmoil in Europe began to impact developing and other high-income countries. in certain parts of the world, this effectively depressed stock markets and pushed up borrowing costs, while capital flows to developing nations fell sharply.

Towards the year end, these conditions dampened southeast asia’s growth outlook and started to weigh down on the near-term prospects for the Malaysian economy.

20KFC Holdings (Malaysia) BHd (65787-T)

annual Report 2011

Corporate Statement

nevertheless, in 2011 the Malaysian economy

remained resilient, achieving gdP growth of 5.1%,

underpinned by strong domestic demand and an

improvement in the external sector arising from firm

regional demand.

However, growth moderated in the last quarter on

account of external developments, while towards the

year end both manufacturing sector sentiment and

consumer sentiment declined, albeit slightly.

in singapore, gdP stood at 4.9%, with a healthy

7.6% growth in the manufacturing sector offsetting

a contraction in the electronics cluster and slower

growth in the precision engineering and chemicals

clusters. The accommodation & Food services and

other services industries grew by 5.8% and 6.7%

respectively on the back of healthy visitor inflows.

gdP growth in india fell to around 7% in 2011, with

the economy hampered by a mix of domestic and

global events, including the Eurozone crisis, a rising

fiscal deficit, high inflation and a lack of policy reforms

to help industry and agriculture.

DELIVERING RESULTS

against this background, although all the group’s

business segments experienced inflationary

pressures with higher food, commodity and energy

costs, KFCH once again achieved commendable

sales growth. Total revenue for the year increased to

a record high of RM2,798.8 million, up 11% on the

RM2,522.4 million achieved in 2010.

not surprisingly however, given the strategic

decision to make major capital investments, profit

before tax (PBT) dipped 2.8% to RM215.5 million

from RM221.8 million the year before. specifically,

the group invested some RM104.2 million during the

year in vital supply chain facilities, while its operations

in KFC india and KFCH international College incurred

initial start-up cost as they build the critical mass that

will soon carry them from break-even to profit.

in addition, the 2010 profit included a net surplus

from revaluation of properties of RM6.7 million. on

a comparable basis, the group’s PBT therefore

improved slightly by 0.2% or RM 0.4 million against

the prior year.

2011 Key Financial Highlights:

• Revenue of all KFC restaurants of the Group

climbed 11.5% to RM2,104.7 million

• RevenueatKFCMalaysiahitRM1,655.3million,

10.6% up on last year, and achieved same store

sales growth of 4.6%

• KFCSingaporeachieved11%revenuegrowthto

RM409.1 million

• KFC Brunei advanced its revenue to RM20.5

million, a 25% increase on 2010’s figure

• KFCIndiageneratedRM19.8millionofrevenue,

217.9% higher than the previous year

• KFCMarketingSdnBhd(KFCMarketing)posted

a 23.3% jump in revenue to RM273.1 million

• KedaiAyamassales shotup41.1% toRM77.7

million

• KFC Events Sdn Bhd (KFC Events) reported

RM4.1 million in revenue arising from commission

generated from RM41 million sales, contributed

by catering, site selling and voucher marketing of

KFC, Pizza Hut, RasaMas and Kedai ayamas to

various corporate clients

• Revenue (including intercompany sales) at the

group’s integrated Poultry segment improved to

RM1,472 million, a 13.8% gain on 2010

21KFC Holdings (Malaysia) BHd (65787-T)

annual Report 2011

Corporate Statement

DIVIDENDS

The group declared a total interim dividend of 3 sen less tax of 25% per ordinary share for the financial year ended 31 december 2011. no final dividend was proposed for the financial year 2011.

INVESTING IN STRONG FOUNDATIONS

KFCH’s expansion in 2011 was dedicated to three vital aspects of the group’s operations: regional expansion; people and supply chain.

Investing in Expansion

2011 saw KFC’s Malaysian network expand by another 24 outlets. With the rapid growth of the KFC restaurant chain in Malaysia, our nation can now boast one of the highest ratios of KFC restaurants per capita in the world.

Major initiatives implemented during the year included the construction of nine drive-thru outlets in Peninsular Malaysia, and the penetration of KFC into small towns especially in the east coast of Peninsular Malaysia, sabah and sarawak.

Two new outlets were opened in Kelantan, in Kota Bharu and Koh lanas. other small towns in Peninsular Malaysia that welcomed KFC included Padang serai, Pekan Changlun and Kuala nerang in Kedah and sabak Bernam in selangor. Meanwhile three new outlets were launched in sabah and sarawak in Kota Kinabalu, Kunak and Betong.

Meanwhile, KFCH has built a strong presence in singapore and Brunei, and in 2011 increased its network by three outlets in each country.

But the biggest opportunities lie with the group’s more recent venture into india, where in 2011 the number of outlets grew to 13. The potential of the indian market is tremendous, but this is a volume game and it will need more than 50 outlets before the indian operations achieve profitability. KFCH’s 2011 investment of RM12.9 million in its indian network therefore represents the foundation of a long-term plan for ongoing, aggressive expansion that before long will start to pay dividends in the future.

Major Initiatives Implemented During the Year Included the Construction of Nine Drive-Thru Outlets in Peninsular Malaysia, and the Penetration of KFC into Small Towns Especially in the East Coast of Peninsular Malaysia, Sabah and Sarawak.

22KFC Holdings (Malaysia) BHd (65787-T)

annual Report 2011

Corporate Statement

KFCH’s subsidiaries are also poised for continual expansion. ayamas shoppe sdn Bhd entered into a joint venture agreement with Rastamas Trading sdn Bhd (Rastamas) to form a joint venture company, ayamas shoppe (sabah) sdn Bhd to kick-start Kedai ayamas operations in sabah. Rastamas is the biggest poultry integrator in sabah. The first Kedai ayamas commenced its East Malaysia operations in Tawau in april 2011. There are currently three Kedai ayamas outlets in sabah.

Investing in the Supply Chain

The rapid growth of KFCH’s restaurant business in Malaysia has resulted in an increasing demand for chicken related products. To meet this demand, in 2011 the group continued to invest RM104.2 million in facilities to increase the capacity of its upstream operations. This will stand KFCH in good stead as even more people flock to its restaurants.

in august 2011, the group invested RM25 million in a breeder farm and hatchery in sidam Kiri, Kedah. The 19-hectare breeder farm will produce 25% of the total day-old-Chicks (doC) generated by the group’s five company-owned farms. The new hatchery has the capacity to produce one million doC per month. Combined with the other company-owned hatchery in salak Tinggi which produces three million doC per month, total output of doC will rise to four million per month, making KFCH self-sufficient in doC supply.

The group has also built new broiler farms in sedenak. The first phase, completed in 2010, has a capacity of 400,000 broilers per cycle. The second

Kedai Ayamas Commenced its East Malaysian Operations in Tawau in April 2011. There are Currently Three Kedai Ayamas Outlets in Sabah.

23KFC Holdings (Malaysia) BHd (65787-T)

annual Report 2011

Corporate Statement

phase was completed in mid 2011, with a capacity of 600,000 broilers per cycle, increasing the combined capacity of both phases to one million broilers per cycle. The total investment cost for the two phases came to RM22 million.

The KFCH-owned broiler farms in sedenak and Mantin currently supplies broilers to the group’s processing plants in Port Klang, Bukit Mertajam and Johor. They supply 16% of the group’s total broiler requirements by producing 580,000 broilers per month, with the remaining 84% coming from contract farms. in 2011, the group also invested in new broiler houses using a ‘cages’ system, which will increase capacity by a further two million broilers per year.

in addition, end of april 2012 saw the commissioning of a new RM27.7 million sausage plant which increases the output of sausage production from 430 metric tonnes to 800 metric tonnes per month.

Meanwhile, Region Food industries sdn Bhd (RFi) invested RM2.4 million to boost production capacity of its sachet line to meet current demand. This raises the maximum sachet production capacity from 325 metric tonnes per month to 650 metric tonnes per month.

The logistics division opened its new warehouse in Port Klang in november 2011. The new RM7.5 million facility, at 300,000 square feet, is nearly seven times the size of its previous warehouse in glenmarie, shah alam.

The group also purchased a site at the Bukit Minyak industrial area in Penang and plans to relocate its iPi Plant there from its present location in Bukit Mertajam. once approval has been granted by the land office, construction will take approximately two and a half years. The new plant will be able to process 40,000 birds per day, which, when added to the existing two plants, will bring the group’s processing capacities to 160,000 birds per day.

Investing in People

it is essential for KFCH to constantly deliver, maintain and enhance its customer service. But delivering consistent customer service depends on recruiting quality staff – a task that in recent years has become increasingly challenging.

To tackle this issue, in 2010 the group acquired Paramount international College in Puchong and set about transforming it into what is now known as KFCH international College. in 2011, the group purchased a 4.5-hectare parcel of land within the Bandar dato’ onn township in Johor for the College’s second campus. The Johor campus located in the iskandar development Region will be developed in phases, with completion due in 2017, at which time its intake capacity will be 12,000 students per year.

The first phase of the development of the Bandar dato’ onn campus which was completed in March 2011 and the upgrading of its Puchong campus facilities incurred a total investment cost of RM25 million. as a result, the two campuses now provide a conducive learning environment for students, with state-of-the-art teaching and learning facilities, including kitchen labs, a demo kitchen, a pastry lab, a sensory lab, a computer lab, an English language lab, a modern library and an auditorium.

as of december 2011, the total enrolment at the Puchong and Johor campuses was 681 students.

The group’s vision for KFCH international College is for it to be Malaysia’s premier educational institution specialising in the hospitality and food services industries, particularly restaurant management, culinary arts, hotel management, tourism management and event management.

24KFC Holdings (Malaysia) BHd (65787-T)

annual Report 2011

Corporate Statement

The College has obtained full Malaysian Qualifications agency (MQa) accreditation for its diploma in Business administration, diploma in information Technology and diploma in Hotel Management, plus provisional accreditation for its diploma in Restaurant Management, diploma in Culinary arts, diploma in Event Management and diploma in Tourism Management. The College is now preparing the MQa documentation for two new additional programmes, namely diploma in Food science & Technology and diploma in Halal Toyyibban & Food safety.

The curriculum is expanding as well. The College has offered its first three-month Halal Executive Program, completion of which earns a certificate from the Halal industry development Corporation (HdC). The College is currently collaborating with HdC to develop a comprehensive programme in this subject.

in future, the College will act as a crucially important conduit to provide KFCH with a reliable source of skillful manpower.

RESTRUCTURING THE BUSINESS

on 14 december 2011, Johor Corporation (JCorp), the group’s ultimate holding corporation, in partnership with CVC Capital Partners asia iii limited (CVC), made a formal offer via a special purpose vehicle, Massive Equity sdn Bhd (MEsB), to acquire substantially all the business and undertakings of the group’s holding company, QsR Brands Bhd (QsR), and the entire business and undertaking of KFCH. JCorp holds 51% equity interest in MEsB while CVC owns the balance 49%.

at present, JCorp holds a 55% equity interest in Kulim (Malaysia) Berhad, which controls 56% of QsR, which in turn owns 51% of KFCH.

The conditional offer by MEsB to acquire the entire KFCH’s businesses and undertakings, including all assets and liabilities, is for an aggregate cash consideration equivalent to:

• RM4.00perordinaryshareof KFCHofRM0.50each multiplied by the total outstanding KFCH shares (less treasury shares, if any) at a date to be determined later; and

• RM1.00perKFCHwarrantmultipliedbythetotaloutstanding number of KFCH warrants in issue at a date to be determined later.

25KFC Holdings (Malaysia) BHd (65787-T)

annual Report 2011

Corporate Statement

The proposed acquisitions of QsR and KFCH are inter-conditional, and subject to the execution of the sale & Purchase agreement. The proposed acquisition offer is also subject to approval by both KFCH shareholders and yum! Brands, inc. (yum!).

Upon completion of the exercise, the Board intends to return the cash proceeds to all KFCH shareholders and warrantholders via a capital repayment exercise.

ACCELERATING PERFORMANCE ExCELLENCE

Performance goals must be measurable if they are to be met, and thus KFCH has defined a framework of Key Performance indicators (KPis) to establish goals, monitor progress, and boost performance. Every organisational unit and each staff member has an appropriate set of KPis against which to measure achievement, and there are also indicators to establish guidance for less concrete values such as service quality and leadership skill. The KPi system has given the group a supremely useful tool for analysing and quantifying new processes and procedures, and modifying them for greater efficiency if necessary.

The Balanced score Card methodology for the management’s control of its restaurant operations complements the KPi framework. This is another tool that the group uses to identify areas that

require improvement and provide a basis to develop programmes to improve operations. The Balanced score Card also helps management to align strategic goals across the whole enterprise and thus maintain a more unified focus, allowing separate business units to align towards improving the group’s performance.

26KFC Holdings (Malaysia) BHd (65787-T)

annual Report 2011

Corporate Statement

The group’s holding company, QsR organises a popular annual event, Quality day or better known as Hari Mekar. Hari Mekar brings teams of employees together for one day every december to take part in competitions. it is a vibrant forum in which staff pitch their best ideas for new methods and projects to increase productivity and reduce costs. The winners of the QsR Hari Mekar then progress to the JCorp Hari Mekar, where they compete against teams from JCorp and all its subsidiaries. They also go on to represent the group at the Malaysia Productivity Corporation (MPC) awards.

at the JCorp Hari Mekar, these teams vie for prizes in three categories: innovative Creative Circle (iCC), Poster design, and Cempaka (suggestions & ideas) and in 2011 three KFCH teams emerged as winners. optimus Prime won for the iCC Cross Functional category, golden dream won for iCC Technical, while Eagle won for the Cempaka category. The overall winner at the JCorp Hari Mekar for the fifth consecutive year was KFCH’s holding company, QsR.

subsequently, at the MPC awards, optimus Prime achieved second place in the service sector category at national level.

in 2011, KFC employees participated in a series of workshops organised by yum! in areas including Marketing, Finance, Restaurant Excellence, and Human Resource. These sessions provided an opportunity for personnel in all the yum! markets regionwide to share best practices and improvements to operational efficiency.

BOOSTING qUALITY

KFCH undertakes a range of initiatives to identify areas that are not operating at optimal levels. Teams convene and collaborate to find ways to standardise procedures, implement new methods and tools, and adopt industry-standard best practices to achieve peak efficiency.

For the period of 2007-2011, these efforts generated significant collective cost savings for the group which includes savings realized from the Best Practices project. The cost savings for projects that began in 2011 proved to be positive and is expected to produce higher savings when the projects are rolled out to other business areas and outlets.

IMPROVING GOVERNANCE

KFCH’s success depends on the integrity and conduct of its people, and the group is totally committed to conducting business in a responsible, accountable and ethical manner. in 2011, further efforts were dedicated to improving stewardship and governance processes for the benefit of stakeholders.

27KFC Holdings (Malaysia) BHd (65787-T)

annual Report 2011

Corporate Statement

For several years, the group participated in the JCorp Remuneration and nomination Committee which ensured transparency both to staff and to external stakeholders. in 2011, KFCH formed its own Remuneration and nomination Committee with a more specific and focused mandate.

To empower staff at every level of the organisation to address governance issues, the group continued to implement the Work Ethics declaration Form, by which employees can safely and anonymously report suspected ethical violations.

Further, KFCH has two additional mechanisms in place to allow personnel to raise concerns with the higher management. The Voice of Champions and Voice of Managers surveys allow team members and managers to express what they feel about their working environment, and their feedback provides insights on what needs to be done to make the restaurant a better place to work. Both surveys are carried out in a confidential manner, and the survey results are distributed to the operations leaders who then develop constructive actions to address employees’ concerns.

Multi-directional annual performance appraisals are another area in which the group incorporates transparency and encourages constructive feedback. Traditionally, managers write unilateral evaluations of the employees reporting to them. in contrast, KFCH employees at every level participate in peer performance appraisals, and reverse appraisals give staff an opportunity to evaluate the managers to whom they report.

TAKING SOCIAL RESPONSIBILITY TO HEART

KFCH has always believed that with success comes responsibility. This is why Corporate social Responsibility (CsR) remains a group priority. From enhancing products and services to reaching out to the communities in which it operates, KFCH continues to seek ways to enrich the lives of those around us.

in 2010, KFCH and its holding company, QsR, established yayasan amal Bistari (yaB), a nongovernmental, non-profit foundation that coordinates all QsR and KFCH’s CsR activities, endeavours and programmes. Based on six CsR

pillars – championing the halal cause, improving educational standards, encouraging entrepreneurial development, promoting a healthy lifestyle, fostering a sense of national unity, and helping the less fortunate – yaB conducts a wide range of initiatives to benefit both stakeholders and the wider community.

one of the group’s most successful CsR campaigns in 2011 raised RM2.1 million for the famine-stricken around the world. To mark its fifth year of participation in the World Hunger Relief Programme, a joint effort with yum! and the United nations’ World Food Program, KFCH together with its holding company QsR, organised a 5km charity walk in Putrajaya, and over 10,000 people took part.

ACHIEVING RECOGNITION

2011 was a year of significant recognition for KFCH and its subsidiaries.

KFC received the 2010/2011 Brandlaureate award for the Best Brand in Brand strategy. KFC also won a series of yum!’s 2011 Franchise awards for development Excellence (KFC Malaysia) and advertising Excellence (KFC singapore).

28KFC Holdings (Malaysia) BHd (65787-T)

annual Report 2011

Corporate Statement

ayamas had an outstanding year as well. The Malaysia Women’s Weekly magazine recognised two ayamas products in their domestic diva awards 2011. The Breaded drummets & Midwings won the “straight from the Fridge: Best Ready-to-Fry-Frozen Meat” category, and ayamas QuikBurger took the prize for the “Best Processed Meat”. Brandlaureate selected ayamas as their winner of the 2010/2011 Best Brand in Consumer – Chicken-Based Products award. The ayamas Chicken satay emerged at the top of the MiFT Product innovation Platinum award 2011 Competition in Malaysia.

STRATEGISING 2012

Operational Excellence

in the years ahead KFCH will be further expanding its network of restaurants, focusing especially on opening new drive-thru outlets, which offer exceptional convenience to people leading busy lives who need a quick and tasty meal. at the same time, the group will be enhancing its restaurant ambiance to provide a more contemporary feel and create a pleasant place for families and friends to get together. KFCH will also be expanding into small towns to increase its market coverage.

in tandem with its network expansion, the group will be improving its KFC restaurants’ service quality and speed by investing in new iT infrastructure. a new Kitchen display system (Kds), which positions packers at each cashier counter and cuts service time, especially during peak periods, will be introduced at high sales volume restaurants in Malaysia in early 2012. a self-service order kiosk is currently being tested to further reduce queue time.

in 2012, KFC is launching a vigorous programme of initiatives to boost its market leadership position. of these strategies, the overall driver is the ‘so good’ campaign, designed to bring the group ever closer to achieving its vision to be the leading integrated food services group in the asia Pacific region, based on consistent quality products and exceptional customer-focused service.

launched in april 2012, the ‘so good’ campaign aims to deliver an experience that is so loved by customers that they describe it as ‘so good’. it also provides an opportunity to relaunch the brand, refocus on the basics, generate internal pride, and strengthen the relationship between the brand and its customers.

With the systematic improvements that the customers will experience, the campaign will enhance the total customer experience at the restaurants in terms of the ‘Five Ps’: product, place, people, price and promotion.

Meanwhile, to improve customer service, all managers and staff will be recertified, and staff will go through the learning Zone. The new learning Zone initiative gives Restaurant Managers and team members access to web-based training. This provides a ‘virtual’ classroom and online meetings as well as online assessments, tests and surveys.

a staff competition will also be held, which will recognise and reward the best cooks and cashiers.

29KFC Holdings (Malaysia) BHd (65787-T)

annual Report 2011

Corporate Statement

other initiatives will also be effected to address the

challenges of 2012. To reaffirm product superiority

against all its competitors, KFC will leverage its

strengths – Chicken on Bone (CoB), freshly prepared

in-store meals, signature recipes, and products

tailored for different times of day, namely breakfast,

lunch, snacking and dinner.

Meanwhile, KFCH is looking into the viability of a

KFC home delivery service. if this proves promising,

the service will begin in the third quarter of 2012.

Overseas Expansion

overseas expansion is high on KFCH’s agenda. in

singapore, the group plans to leverage on product

excellence and a series of imaginative campaigns

and menu enhancements to bolster the market

share. in Brunei, the group will be opening two new

in-line restaurants and two drive-thrus, as well as

refreshing the image of the KFC Berakas facilities.

But the biggest opportunities lie in the vast indian

market where KFCH aims to get closer to achieving

critical mass by opening 16 new outlets in 2012. By

offering an appealing range of vegetarian options

alongside its traditional menu, the group is confident

that it will quickly make KFC one of Mumbai and

Pune’s most popular restaurant chains. The long-term

prospects for the indian venture are outstanding.

Upstream Business

To meet the ever-growing demands of KFCH

restaurants, the group will continue to grow its

upstream business by investing in plants and

increasing product capacity.

as well as catering to its internal market, the

group will be growing its external market share.

KFC Marketing now aims to introduce a variety of

renowned international brands to Malaysia so as to

become one of the nation’s biggest trading houses.

To this end, in 2011 it clinched a number of exclusive

deals with such brands as Kewpie, divella, leggo’s,

Mission and simplot and is continually pursuing

additional businesses in the domestic, asian and

Middle Eastern markets.

30KFC Holdings (Malaysia) BHd (65787-T)

annual Report 2011

looking ahead, the demand for raw chicken, chicken parts and further processed chicken (such as nuggets, sausages, etc.) will continue to be boosted by Kedai ayamas. Kedai ayamas is the pioneer brand in Malaysia to sell chicken and chicken-based products through a network of air-conditioned stores, and the first to offer an array of chicken roasters and light, chicken-based snacks. The Kedai ayamas chain markets high quality, halal, branded chicken that is hygienically processed and packed in the company’s own plants.

in 2011, sKU numbers increased to 902 from 507 the year before, and in 2012, the target is to reach 1060. Kedai ayamas also launched its delivery service in december 2010, which is now available at 40 outlets in the Klang Valley as well as most stores in Johor and Melaka. in 2012, the service will be extended to seremban and selected stores in Penang, ipoh and Kedah. By the year end the total number of outlets offering delivery is expected to have risen to 67. Kedai ayamas will also be making further inroads into Brunei in the coming year.

KFCH International College

By capitalising on its state-of-the-art facilities and outstanding academic foundation, the group aims to grow the number of students at KFCH international College from 681 in 2011 to 2000 in 2012, at which point the College will break even. 40 agents have been appointed to facilitate growth by recruiting students both locally and internationally. in addition, an international marketing office has been set up to boost recruitment of international students. The College will be offering a number of new courses by collaborating with other accredited local and overseas universities. KFCH international College aims to achieve University College status by 2015.

Profit Centres

although consolidation is a priority, the group is also aiming to turn its logistics division into a profit centre in the future. The new double-storey warehouse facility in Port Klang, with its vast square footage, 16 loading bays and advanced equipment, currently serves 921 of the group’s restaurants and outlets but has the capacity to serve third parties as well as the other group’s subsidiaries.

LOOKING AHEAD

The global economic outlook still appears uncertain in view of the lingering debt crisis in Europe, although there are nascent signs of recovery in the Us economy judging by the improving job market and corporate earnings released thus far. The positive data from Us appears to outweigh concerns in Europe at this moment and, if sustainable, will be pivotal to win back investors’ and consumers’ confidence in the global economy.

Corporate Statement

31KFC Holdings (Malaysia) BHd (65787-T)

annual Report 2011

The Malaysian economy will be sustained by the implementation of projects under the government’s ETP as well as private capital spending. Together with the incentives announced during the 2012 Budget, this is expected to boost consumer confidence and stimulate domestic demand, and gdP growth of 5% is expected in 2012.

The economies of the other markets where the group operates, namely Brunei and india, are still robust with relatively healthy gdP growth. The singapore economy on the other hand is expected to grow between 1%-3%. The group plans to continue growing in these markets through the sustained development and refurbishment of stores and the delivery of operational excellence.

The food sector is relatively healthy but faces inflationary cost pressures. The group expects profit margins to be tight and it plans to generate earnings growth by continuing to drive topline aggressively through new and repeat customer purchases. it will strive to develop and introduce new winning products, launch successful promotions that provide value for its consumers, invest in new facilities and refurbish existing ones, and improve customer service and experience. The group is also continuously seeking better cost efficiencies as well as improving productivity in all its business segments.

While the operating costs of the KFCH international College remain high, the College is confidently expected to break even in 2012, and the group anticipates starting to reap the rewards of its recent major capital investments in the coming years.

all in all, the Board is confident of maintaining the group’s current growth for the year.

ExPRESSING GRATITUDE

in 2011, KFCH once again consistently delivered top quality products and customer service. on behalf of the Board, we offer each of our employees heartfelt congratulations and gratitude.

We also profoundly appreciate the support we received from customers, investors, financiers, suppliers and various governmental and regulatory authorities. We are equally grateful to yum! for their continued confidence and for the guidance received from them throughout the year.

Finally, on a personal note, we would like to thank our colleagues on the Board and the entire management team for their outstanding contribution. Their commitment to the long term growth of the business has again produced results the group can be proud of. The KFCH Board of directors grew from eight members to nine last year, and we offer a warm welcome to the newest member, yaM Tengku sulaiman shah alhaj ibni almarhum sultan salahuddin abdul aziz shah alhaj, whose appointment took effect on 1 June 2011.

KAMARUZZAMAN BIN ABU KASSIM

Chairman

AHAMAD BIN MOHAMAD

deputy Chairman

JAMALUDIN BIN MD ALI

Managing director

Corporate Statement

32KFC Holdings (Malaysia) BHd (65787-T)

annual Report 2011

Customers Remain the Group’s Number One Priority

INTRODUCTION

groupwide, 2011 was a year of commendable

achievement. The KFC network continued to expand

in Malaysia, singapore, Brunei as well as india, and

an imaginative programme of enticing new menu

items, irresistible special promotions and appealing

outlet enhancements continued to draw ever larger

crowds.

subsidiaries also made considerable progress,

particularly the integrated Poultry operations and

ancillary operations, while the KFCH international

College has already attracted more than 800

students to date, many of whom are expected to join

the group as staff members in due course.

KFC MALAYSIA

in 2011, KFC Malaysia revenue jumped to RM

1,655.3 million, 10.6% up on the RM1,496.9 million

recorded the year before.

The Malaysian team achieved this success with a

combination of compelling marketing and promotional

campaigns and irresistible new products to draw

customers into the outlets. simultaneously, a range

of service enhancements and facilities upgrades

improved comfort and efficiency, whether customers

are eating in, taking away or driving through.

Review of Operations

JAMALUDIN BIN MD ALIManaging Director

33KFC Holdings (Malaysia) BHd (65787-T)

annual Report 2011

Review of Operations

The division initiated three projects during the year

to increase operational efficiency. a new Kitchen

display system (Kds) had its trial run at Wisma

KFC. The Kds is effectively a packing monitor, and

its use has resulted in much improved service time,

especially during lunch and dinner time. Having

packers at each cash counter during peak periods

have meant shorter queues and higher transaction

counts. in early 2012, the Kds will be rolled out to

our high sales volume restaurants in Malaysia.

KFC also installed a self-order service Kiosk on a

trial basis at Wisma KFC, which further cuts queue

time by allowing customers to use the kiosk to place

their orders, then collect their food and pay at the

counter. initial results have been encouraging.

The group’s third quality initiative was the

development of two customer service ‘squads’.

This concept clarified managerial roles in the

restaurants by establishing the Customer Mania

34KFC Holdings (Malaysia) BHd (65787-T)

annual Report 2011

Review of Operations

squad, involving cashiers and dining staff, and the

Product Champion squad for the cooks and backup

staff. Each manager is accountable for recruiting,

training, engaging and energising his or her squad

to deliver the most effective service. The goal is to

achieve higher training levels and a better working

environment in the restaurants.

To keep the menu vibrant, eight new items were

introduced throughout the year, each product

launch celebrated with a well-advertised promotion.

offerings such as the Fish donut, Chicken Chop

with Mushroom gravy, Quarter Chicken with Black

Pepper sauce, olè Pocketful, Tom yum Crunch,

double Zinger Burger and Krushers with new flavours

enticed customers eager for variety.

The group implemented a comprehensive marketing

programme in 2011. The large number of promotions

throughout the year meant that customers could

always find something exciting happening at KFC,

and via several channels, customers were informed

of the latest events. The year kicked off with a

celebration to mark the opening of KFC’s 500th

restaurant. as an expression of gratitude to loyal

customers, KFC Malaysia offered a Celebration

Combo, which came with a limited edition 24-karat

gold-inscribed Celebration Mug.

Chinese new year followed soon after, and the

outlets introduced the Fish donut, either a la carte

or in a combo meal with two pieces of chicken. This

was a very successful limited time offer, accounting

for about 10% of the total sales for the promotional

period.

in april 2011, the spotlight shone on the new ‘so

good’ tagline. But this is not just a tagline – the

objective is for customers to be so delighted with

KFC’s food and service that they cannot help but

exclaim that it is ‘so good’! The marketing team

pitched a 5-star campaign to spread the word, and

a new Chicken Chop with Mushroom gravy was the

anchor product.

The group also focused its attention on breakfast,

offering customers a different experience during

the morning hours by providing a Breakfast Corner

with free coffee refills, daily newspaper and radio

playing in the background. The breakfast menu

was rejuvenated by the introduction of the new a.m.

35KFC Holdings (Malaysia) BHd (65787-T)

annual Report 2011

Review of Operations

Cheezy Egg Bun Combo, an improved a.m. Chicken

Porridge Combo, and an a.m. Riser Combo.

KFC Malaysia honoured the fasting month of

Ramadan and the Hari Raya holidays in July and

august 2011 by offering a delectable Quarter

Chicken with Black Pepper sauce.

in november, the team kicked off a season of kids’

marketing efforts and got into the spirit of the Happy

Feet 2 movie release. as parents and children flocked

to the cinemas, they also celebrated the beginning of

the school holidays by feasting on the KFC Happy

Feet 2 Combo. in mid-december, promotional offers

continued to entice parents and children with the

Ben 10 and PowerPuff girls Chicky Meals. Both of

these offerings included movie-themed buckets and

collectible figurines.

Reflecting the commitment to provide customers

a fresh and inviting dining ambience, the group

renovated 18 restaurants during the year. 24 new

outlets expanded the network’s reach further, and

KFC aimed to better accommodate the needs of

busy customers by increasing the number of outlets

offering drive-thru service.

With 539 restaurants in total – 455 in Peninsular

Malaysia and 84 in East Malaysia – the group

retained its market dominance. KFC remains

Malaysia’s largest restaurant chain. another 15 new

restaurants are planned in 2012.

KFC SINGAPORE

singapore’s economic growth, especially in early

2011, and an increased store count led KFC

singapore to achieve record sales of RM409.1

million, up RM40.5 million (or 11%) on 2010.

To celebrate Chinese new year, the menu featured

the new KFC Fortune Feast – signature food in a

collectible bucket with complementary cushion

covers. The Egg Tart (first launched in 2010) made

another appearance, this time transformed for the

festive season. The Mandarin orange Egg Tarts were

sold individually and in colourful boxes of six.

KFC singapore officially launched its ‘so good’

tagline in February. This campaign highlighted fresh

preparation techniques that sets KFC apart from

its competitors. all KFC’s cooks were recertified

to ensure consistently excellent quality. special

promotions and a ‘so good’ photo contest engaged

singaporeans in the celebration.

36KFC Holdings (Malaysia) BHd (65787-T)

annual Report 2011

Review of Operations

2011 was a year of exceptional product innovation.

Blueberry Pancakes injected novelty and renewed

interest in the KFC breakfast menu. The Ultimate

Boxes were introduced in January 2011, and in

april, the box meal range was expanded to include

the Ultimate Roasta Box. in conjunction with the

highly anticipated Transformers 3 – dark of the Moon

movie, the team launched a new ‘big eat’ targeting

Transformers fans with hearty appetites. a series of

collectible action figures and a limited edition beach

mat added to the campaign’s popular appeal. in

July, chicken and two cheeses merged to create

the Cheesy Crunch, which was received with great

enthusiasm.

in august, the group focused on publicity for the

KFC a.m. breakfast offerings. singaporeans have

embraced online media, and they responded warmly

to the ‘i a.m.’ campaign, which invited them to share

via Facebook how KFC a.m. touches their lives. The

four most inspiring stories were made into three-

minute ‘webisodes’ and shown online and on TV.

The new KFC singapore Facebook page now has

over 130,000 fans and counting! during this period,

customers were delighted by the double Chocolate

Egg Tart boasting the perfect blend of egg tart with

dark and milk chocolate.

in october, KFC added a seventh wonder to its range

of six snackers – a pasta shrimp flavour. For every

snackers and meal coupon purchase, RM0.48 was

donated to the World Hunger Relief Programme.

in 2011, KFC singapore collected RM336,380 for

victims of the continuing famine in the Horn of africa,

a 12% increase over 2010.

The final campaign of 2011 returned to the ‘so

good’ tagline, using television and digital media

to convey the warm emotional connection that

singaporeans have with KFC, sharing authentic

customer testimonials.

KFC singapore was the proud recipient of the Caring

Employer award from singapore Compact CsR and

the leader award from Enabling Employers network,

as well as four Markies awards from Marketing

Magazine.

2011 ends with a count of 80 stores, which includes

six new openings or relocations, offset by three

closures.

The group predicts that 2012 will present challenges

in the area of employment, as singapore’s

unemployment hit a low of 2% in 2011. Competition

for market share will also increase as new restaurant

chains open outlets on the island. as always, the

staff will respond to challenges positively and are

confident that a programme of imaginative campaigns

and products will continue to draw singaporeans to

KFC.

37KFC Holdings (Malaysia) BHd (65787-T)

annual Report 2011

Review of Operations

KFC BRUNEI

KFC Brunei expanded from nine to 12 restaurants in 2011, and total revenue surged 25% to RM20.5 million.

The Brunei team came up with a full calendar of new product releases, activities, and premiums to keep KFC in the public eye. seven intriguing new products such as the Fish donut and Tom yum Chicken successfully caught popular attention, and the team joined corporate marketing partners for ten assorted month-long activities and promotions. KFC Brunei also pursued a very energetic programme of in-house training, with staff attending nine different seminars. Expansion plans for 2012 include two new in-line restaurants, two drive-thrus, and image enhancements for the KFC Berakas facilities.

KFC INDIA

in its second year of operations, KFC india reported revenue of RM19.8 million, an impressive increase on 2010 sales of RM13.6 million.

To capitalise on the indian passion for Cricket, KFC india was an official Partner in the 2011 iCC World Cup. The staff got into the spirit by wearing special tournament t-shirts, and customers took advantage of the limited time offer of meals served in a cricket-themed Fan Bucket.

in June, customers stayed cool with a new range of Kafeccino iced coffee drinks. The Frappe, iced Kapuccino and iced Mochaccino start with a base of strong, cold coffee then gain extra allure from vanilla cookie crumble, whipped cream, and chocolate.

Catering to the 40% of indians who are vegetarian, KFC india launched two new meatless combos in august. The Veg Rizo Meal comprises of flavourful rice and spicy gravy, served with three veg strips and a regular Pepsi. The Veg Zing Kong Box contained a spicy, crunchy Veg Zinger, three veg strips, regular fries, a regular Pepsi and a chocolate.

Targeting young working adults, the september launch of the Fiery grilled featured a unique combination of KFC’s signature spices grilled with the ‘steam roast’ technology in a combi oven. This offering accounted for 15% of total sales during the launch period.

Currently, KFC india has 16 outlets, of which three were opened in early 2012.

RASAMAS & KEDAI AYAMAS

RasaMas reduced the number of outlets in Malaysia and Brunei from 42 to 27 during 2011. With fewer restaurants in service, 2011’s sales of RM19 million were 23% down on 2010.

38KFC Holdings (Malaysia) BHd (65787-T)

annual Report 2011

More positively, vigorous marketing campaigns used

varied media and creative tactics to reach consumers

throughout 2011. RasaMas devised a new menu in

February, and in april commenced a campaign to

celebrate the brand’s ‘Typically Malaysian’ identity.

The redesigned website came online in april,

and by July, the visitor count exceeded 10,000.

The marketing team maximized the use of social

media – Twitter, Facebook, blog and website – as

well as e-mail and sMs to publicise 16 promotions

throughout the year, including Chinese new year and

Ramadan specials, new product announcements as

well as coupon offers.

Meanwhile, Kedai ayamas sales jumped by 41.1%

to RM77.7 million, and the new Kedai ayamas

(sabah) contributed an additional RM743,000 to the

2011 revenue stream. The store count increased

from 49 at the beginning of 2011 to 75 at the end

of the year.

40 outlets now offer delivery services, and august

saw the installation of e-pay terminals in the

branches to give customers yet another level of

convenience. 2011’s new products included the

Percik Roaster, and ayamas re-launched the highly

Review of Operations

The Integrated Poultry Operations Segment Saw Another Year of Growth in 2011. Revenue Including Intercompany Sales Advanced 13.8% from 2010, Climbing to RM1,472 Million.

39KFC Holdings (Malaysia) BHd (65787-T)

annual Report 2011

popular auspicious and spicy siam roasters on

a limited-time basis during the festive seasons. in

addition, corporate partners digi and Bank Rakyat

helped publicise two other innovative special offers.

INTEGRATED POULTRY OPERATIONS

The integrated Poultry operations segment saw

another year of growth in 2011. Revenue including

intercompany sales advanced 13.8% from 2010,

climbing to RM1,472 million.

ayamas Food Corporation sdn Bhd (aFCsB)

processing plants contributed greatly to the increase,

up by 8.5% on 2010 levels. The group’s expanding

restaurant chains and stores – KFC, RasaMas and

Kedai ayamas – continue to increase their order

volumes, thus boosting internal sales figures.

2011 was not without challenges, as rising chicken

prices made an impact upon the group’s

performance. demand for chicken products,

however – especially processed foods such as

sausage, nuggets, etc. – continues to rise steadily,

so this subsidiary took steps toward greater self-

sufficiency and expansion into niche markets.

Under the group’s Breeder Farm and Hatchery

division, the breeder farms produce eggs which

are sent to hatcheries to be hatched into day-old-

Chicks (doC). in 2011, the division produced 38.6

million doCs with a value of RM48.8 million.

KFC Marketing

KFC Marketing sdn Bhd (KFC Marketing) was

incorporated in 2001 as a sales, marketing and

trading arm for KFC Holdings (Malaysia) Bhd

(KFCH) and external markets, both domestically

and internationally. With a vision to be the preferred

distributor of superior quality halal brands, the

subsidiary performed exceptionally well in 2011, with

sales growing by 23.3% to reach RM273.1 million.

sales to the domestic open market increased once

again, and open market export sales also jumped to

RM15.9 million in 2011.

in addition to the group’s own products, KFC

Marketing distributes third-party international brands

such as simplot, divella, Mission, Kewpie and

leggo’s. datuk Redzuawan bin ismail, better known

as Chef Wan, now acts as brand ambassador for

KFC Marketing, further strengthening the company’s

position.

Review of Operations

40KFC Holdings (Malaysia) BHd (65787-T)

annual Report 2011

Ayamazz Roti Impit

ayamazz sdn Bhd was established in 2009 as a

wholly owned subsidiary of KFCH. it began by selling

quick, affordable chicken dishes from push-carts

in Malaysia’s college, university and polytechnic

campuses. Each push-cart is independently

operated, and the Ministry of Higher Education

has recognised the ayamazz Roti impit business

model as a successful means of nurturing young

entrepreneurs.

2011 was the second year that ayamazz Roti impit

hot dog carts have plied Peninsular Malaysia’s

higher education campuses, and there was a

commendable 330.4% rise in gross sales, which

reached RM581,000.

looking forward, ayamazz has collaborated with Jati

Bestari sdn Bhd and other companies to expand

its business by more aggressively marketing and

promoting the programme and by establishing more

ayamazz Roti impit kiosks nationwide, including in

sabah and sarawak. The business model has also

grown to include kiosks, flip-counters, and hawker

vans, and the goal for 2012 is to add 100 new open

market outlets by the end of the year.

Usahawan Bistari Ayamas

Usahawan Bistari ayamas sdn Bhd (UBasB) is a

wholly-owned subsidiary of KFC Marketing, and is

a key element in the group’s CsR commitment to

assist those in need. UBasB was established in

2009 to bring the ayamas brand to the lower-income

market sector.

UBasB’s business model engages housewives,

single mothers and other lower income individuals

who are interested in business to become Sudut

Ayamas operators. Parallel objectives are to provide

an opportunity for the operators to generate extra

income and to inculcate entrepreneurship among

their children and family members. The Sudut

Ayamas operators are the front-line stocking and

sales agents for the UBasB products. although they

are packaged differently and sold at lower prices, the

products all maintain ayamas’ hygiene, quality and

halal certification.

The pilot project was introduced in Pasir gudang,

Johor in collaboration with the local city council and

Johor Corporation’s Waqaf dana niaga. at the end

of 2011, there were 819 Sudut Ayamas operators all

over Malaysia.

UBasB’s success has attracted the attention and

support of several government agencies such as

Majlis agama islam negeri, Majlis amanah Rakyat

(MaRa), Jabatan Tenaga Kerja (JTK), Jabatan

Kebajikan Masyarakat (JKM), the Ministry of

Review of Operations

41KFC Holdings (Malaysia) BHd (65787-T)

annual Report 2011

international Trade and industry (MiTi), yayasan

Pembangunan Keluarga (yPK), FElda and also

Pusat Pemulihan dalam Komuniti (PdK). With

the support of these partners, UBasB expects to

continue on its rapid growth curve.

Feedmill Division

The Feedmill operations made good progress in

the past year. sales revenue for 2011 rose 8.6% to

RM208 million. increased broiler production to meet

the group’s chicken requirements translated to

137,000 metric tonnes of feed milled, an increase

of 1,000 metric tonnes over the previous year’s

production. Estimates of broiler requirements

for 2012 are higher still, and feed volume is also

expected to grow.

Breeder Farms & Hatchery

in 2011, the revenue achieved by the Breeder

Farms and Hatchery division rose to RM93.8 million.

Meanwhile, the division considerably boosted its

production by investing in additional facilities.

ANCILLARY OPERATIONS

during the year under review, the group’s ancillary

operations made further commendable progress.

Sauce Manufacturing

Region Food industries sdn Bhd (RFi), which

manufactures sauces both for the group and for

external markets under the brand name ‘life’,

reported an impressive sales growth of 12.5% from

RM89.9 million to RM101.1 million in 2011.

at RM46.2 million, internal sales accounted for

45.8% of the revenue, a rise of 9% over the previous

year. Meanwhile, external domestic sales of RM38.6

million and export sales of RM16.3 million contributed

38.1% and 16.1% of the revenue respectively.

Review of Operations

2011 was the Second Year that Ayamazz Roti Impit Hot Dog Carts have Plied Peninsular Malaysia’s Higher Education Campuses, and there was a Commendable 330.4% Rise in Sales, which Reached RM581,000.

42KFC Holdings (Malaysia) BHd (65787-T)

annual Report 2011

Bakery & Commissary

in 2011, the Bakery division recorded sales of RM31.2

million. it also achieved a 7.7% increase in bun

production and introduced the Butter scotch Bun to

the KFC product line. The rectangular Butter scotch

Bun has a rich butter caramel and milk flavour and is

already proving a popular addition to the KFC menu.

Meanwhile, a new pizza dough line – a 700 square

metre facility providing dough for 42 PHd outlets to

date – began operations in February 2011.

The renewal of the Bakery’s HaCCP (Hazard

analysis Critical Control Point) and iso 9001:2008

certifications demonstrated its continued high

production standards. in compliance with HaCCP

requirements, the Bakery completed a flooring

upgrade in november 2011.

The Commissary division generated sales of RM1.7

million plus a 4.3% increase in coleslaw production,

amounting to over two million packets in total. The

coleslaw facilities also received flooring upgrades in

april and May 2011 to meet yum! requirements.

in addition to continuing upgrades to existing

equipment in 2012, the Bakery division will initiate

the planning phase of a new bakery line to support

KFC and Pizza Hut business expansion. likewise,

the Commissary’s ongoing improvements will

include primary and secondary wash and spin-dry

equipment, which will both enhance quality and

reduce costs.

Tepak Marketing

Tepak Marketing sdn Bhd (Tepak), a wholly owned

subsidiary of KFCH produces, markets, and sells

beverages and nutritional drinks for the domestic and