Ken Mare May 2011

-

Upload

garunkumar1976 -

Category

Documents

-

view

217 -

download

0

Transcript of Ken Mare May 2011

-

8/4/2019 Ken Mare May 2011

1/30

Rating

Buy

Market Cap

1,053m

Muna Muleya

+353 1 240 4137

Kenmare ResourcesDate 25th May 2011 IRELAND Basic Resources

Published By: Merrion Stockbrokers

This re ort is sub ect to im ortant disclosures and disclaimers which can be found at the end of this re ort and which form an inte ral art of it.

Current Price

42.46p

Merrion Stockbrokers3rd Floor, Block C, The Sweepstakes CentreBallsbridge, Dublin 4, IrelandTel: +353 1 240 4100Fax: +353 1 240 4101

Reuters JEV.LI / Bloomberg KMR LNTarget Price

63p

Source: Bloomberg

Expanding into a sweet spot

We initiate coverage of Kenmare Resources with a Buy recommendation and atarget price of 63p, 48% upside from current levels. While Kenmare has been astrong performer over the last year, we believe that the stock remainsundervalued. We expect that prices for its products, which have almost doubledover the last two years still have upside potential. We also believe conditions arefavourable for further mine expansion beyond announced levels which will notonly make Kenmare a significant mineral sands player but significantly add tovaluation.

YTD abs perf (%) 34.1

12 mth abs per (%) 338.5

52 week high/low (p) 51.50/8.59

Year ended Dec 10 11f 12fRevenue (US$m) 92 144 296

EBITDA (US$m) 21 70 211

EBITDA Margin 23% 48% 71%

Net profit (US$m) -16 22 161

EPS (dil)(USc) 0.01 1.0 6.7

Source: Company data, Merrion estimatesand Bloomberg

Favourable mineral sands marketA strong recovery in demand, coupled with constrained supply, has seen published mineralsands prices for Q2 2011 reach almost double the 2009 lows. With demand continuing togrow and no new major supply coming on stream in the medium term, industry forecastsenvisage a structural deficit in titanium feedstock of 28% of total annual demand by2016. We are confident that pricing momentum will be positive for an extended period.Current contract prices for ilmenite are some 40% lower than current spot prices.

Comparative advantagesKenmares large resource base, with a life of mine well in excess of 100 years, operatingcosts at the lower end of the industry average and a favourable tax regime, gives itcomparative advantages in mineral sands mining that will make it a significant andefficient producer. Its revenue to cash cost ratio of about 3 times at full capacitycompares favourably with the industry average of 1.5 times.

Aggressively expanding into a favourable marketCurrent conditions present Kenmare with a window of opportunity to become a muchlarger player in mineral sands. A 50% expansion is currently under way, even though themine has yet to fully reach its original design capacity. This will increase its titaniumfeedstock market share from 5% to more than 10%. Further expansion is already beingconsidered, with a prefeasibility study being conducted. We expect an announcement on

the results of a prefeasibility study by early 2012. We believe that a positiverecommendation makes sense and will be the most likely outcome. It would add 14p toKenmares NPV valuation.

Earnings momentum and improving financial positionThe combination of the production ramp up, expansion and rising prices will drive a rapidincrease in Kenmares earnings. We forecast EPS CAGR of 240% from 2011 to 2014.Strong cash flow will see net debt drop significantly over the next two years. This shouldenable Kenmare to readily fund further production expansion from its own cash resourcesor from borrowings.

Target price points to 48% upsideWe set a target price for Kenmare of 63p per share based on our NPV valuation, pointing

to 48% upside from the current level. Our target price factors in a 50% probability of

further expansion. If we fully factor this in, our target price would be 69p.

-

8/4/2019 Ken Mare May 2011

2/30

Merrion Stockbrokers 2

Table of Contents

Investment case -------------------------------------------------------------- 3The case for Kenmare --------------------------------------------------------- 4

Favourable markets and product pricing momentum -------------------- 4

Titanium dioxide market ------------------------------------------ 5

Zircon market --------------------------------------------------- 11

Tight markets to lead to significant price increases ---------------- 12

A new entrant with significant comparative advantages ---------------- 14

Resource size --------------------------------------------------- 14

Competitive operating costs ------------------------------------- 14

Favourable tax regime ------------------------------------------- 15

Aggressive expansion ------------------------------------------------- 16

Strong earnings momentum and financial position --------------------- 17

Valuation and financing ---------------------------------------------------- 18Valuation ------------------------------------------------------------ 18

Target price ---------------------------------------------------------- 18

Sensitivity ----------------------------------------------------------- 19

Valuation risks ------------------------------------------------------- 19

Financing ------------------------------------------------------------ 20

Company overview --------------------------------------------------------- 21Introduction --------------------------------------------------------- 21

Reserves and resources ----------------------------------------------- 22Basic production process --------------------------------------------- 23

Production expansion ------------------------------------------------ 24

Management -------------------------------------------------------- 24

Financial forecasts --------------------------------------------------------- 26

-

8/4/2019 Ken Mare May 2011

3/30

Merrion Stockbrokers 3

Investment Case

Although Kenmare has been a strong performer over the last year, we believe that the

investment case for Kenmare remains strong. Commodity pricing, expansion and earnings

as well as cash flow momentum are some of the factors we expect will drive furtherperformance;

Commodity prices may continue to surprise on the upside - Kenmares strong

performance over the last year was largely on the back of upside surprises in

announced mineral sands prices. We believe that these prices will continue to rise as

the widening deficit (estimated at 25% of market by 2016) drives prices higher.

Demand drivers are holding up and no new supply is expected to come on stream in

the near future. Spot prices are above our peak forecasts and some 60% above

recently announced contract prices, indicating potential for a significant increase

going forward.

Earnings and cash flow momentum - Once current expansion is completed, Kenmare

will become the most efficient producer in mineral sands mining as measured by its

revenue to cash operating ratio, the standard most commonly used in the industry.

The effect of that operating efficiency and rising production is a substantial increase in

Kenmares earnings over the next three years. We expect substantial earnings growth

as the effect of the legacy contracts subsides and production expansion comes on

stream. We are forecasting an EPS CAGR of 240% from 2011 to 2014.

Likely further expansion not priced in - We believe that Kenmare is the best placed

among the titanium feedstock producers to take advantage of the expected shortfall

in supply as it has the largest reserves and resources and will be the lowest cost

producer. Management has commented about further expansion beyond that which is

already underway. We expect a positive conclusion from the prefeasibility study to be

announced by early 2012. Assuming a further expansion of 800,000 tonnes of ilmenite

capacity to 2 million tonnes per year in total, this would be worth 14p per share on a

NPV basis and has yet to be reflected in the share price in our view.

Share price weakness presents a buy opportunity - The share price has fallen by 16%

since the beginning of April 2011 compared to 9% for the FTSE Basic Resources Index.

However, mineral sands are not traded and prices reflect actual rather than

speculative demand. These prices are still rising. We expect third quarter prices to be

announced in July to be 15 to 20% higher than the second quarter prices. We believe

the recent share price weakness presents an opportunity for investors to acquire the

stock.

-

8/4/2019 Ken Mare May 2011

4/30

Merrion Stockbrokers 4

The case for Kenmare

Favourable markets and product pricing momentum

Kenmare owns 100% of its sole operating asset, the Moma Titanium Minerals Mine in

Mozambique. The mine produces the mineral ilmenite as its primary product, with zircon

and rutile as co products. Ilmenite and rutile are titanium based minerals, mainly used as

feedstock in titanium dioxide (TiO2) pigment production, which accounts for approximately

89% of global titanium feedstock consumption (Exhibit 1). Pigment is then consumed in

the manufacture of paints and other coatings, plastics and as a whitener for paper, as well

as a number of other applications, including cosmetics, food additives, ceramics, inks and

textiles.

The remaining 11% of the demand for titanium feedstock is largely accounted for by

titanium metal and welding electrode applications.

Zircon is a raw material for the ceramics industry as an opacifier (gives ceramics an

opaqueness that allows colours to stay fixed in varying light). It is also used in the foundry

and refractory industries and in a growing number of chemical applications.

Developments in mineral sands prices over the next few years will have the most significant

effect on Kenmare. Conditions are favourable for near term product price increases and for

these price levels to be sustained for an extended period, as demand rises and supply remains

sluggish. Mineral sands market pricing is opaque, with products usually sold on long term

confidential contracts. However, independent reports suggest Q2 2011 contract price ranges

of $130 to $175 per tonne for ilmenite and $1,400 to $1,600 per tonne for zircon, with spot

prices higher, at more than $200 for ilmenite and $3,000 for zircon.

Pigment

89%

Metal5%

Other6%

Ceramics

56%

Refractory

10%

Foundry

11%

Other

4%

Zirconiaand

chemicals

19%

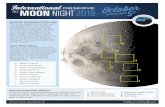

Exhibit 1 Titanium feedstock consumption by end use

Source: Kenmare ResourcesSource: Kenmare Resources

Exhibit 2 Zircon consumption byend use

-

8/4/2019 Ken Mare May 2011

5/30

Merrion Stockbrokers 5

We detail below the market developments in mineral sands and the effect on our price

forecasts.

Titanium dioxide marketsMarket structureTitanium dioxide feedstock is largely used to make titanium dioxide pigment (Exhibit 1). The

feedstock miners sell their product to pigment manufacturers who then sell to end user

manufacturers. The industry is highly concentrated with both the feedstock supply and

pigment manufacturing controlled by a handful of players.

Demand growing steadily, in line with GDP per capita growthOver the last twenty years, world titanium dioxide pigment demand has grown at a CAGR of

3.3%, largely in line with world GDP growth. Consumption is mainly concentrated in North

America and Europe, which account for more than half of the worlds demand. China , which

currently accounts for 18% of global pigment consumption has, in recent years become a

major player, with consumption growing at approximately 16% per annum over the last

twenty years as opposed to 2.2% for the world excluding China. Exhibit 4 illustrates this

demand growth.

Pigment demand dropped sharply during the 2008 recession, with a more than 10% drop in

European demand reported, mainly due to decreased demand from the automotive and

construction industries. It recovered strongly in 2010 due to recovery in both developed and

emerging markets. Industry consultant TZMI estimated 2010 pigment consumption at 5.3m

tonnes, compared to 4.7m tonnes for 2009 (+13%).

Exhibit 3 Titanium dioxide pigment market structure

Source: Kenmare Resources, TZMI

-

8/4/2019 Ken Mare May 2011

6/30

Merrion Stockbrokers 6

Demand outlookThe growth in titanium dioxide consumption largely follows per capita GDP growth and is

mainly a late economic cycle product. Mature western economies, which account for more

than half of world consumption, have per capita pigment consumption rates higher than

4/kg per person per year, while consumption in emerging markets is lower. Chinese

consumption is currently about 1/8th that of developed countries. With consumption

intensity dependant on the level of per capita GDP (Exhibit 5), rising per capita income in

developing countries should provide support for future demand growth.

0

1

2

3

4

5

6

1990 1992 1994 1996 1998 2000 2002 2004 2006 2008

World China World excl. China

Exhibit 4 Pigment demand trend

Source: Kenmare Resources, TZMI

Exhibit 5 TiO2 consumption intensity historical and forecast

Source: Iluka Resources

1991 2010CAGR = 3.3%

1991 2010CAGR = 2.2%

1991 2010CAGR = 16.0%

Mt

-

8/4/2019 Ken Mare May 2011

7/30

Merrion Stockbrokers 7

Demand drivers sustained mineral TiO2 demand growthWith leading indicators in developed markets indicating moderate expansion, we expect TiO2

demand to be at least stable over the short to medium term.

TZMI, the mineral sands consultant, is forecasting pigment demand growth of 3% to 4% per

year, line with world economic growth and the total market to reach 8.8 million tonnes

titanium dioxide units in annual demand by 2020. Conditions are favourable for this demand

growth to be sustained as demand drivers in emerging markets, especially China, will continue

to grow strongly. We expect continued per capita GDP growth, increased urbanisation and

increases in vehicle sales to be the key drivers of this growth. We also expect niche

applications for titanium to take a larger proportion of the metal.

Strong growth in housing development in China - The Chinese National Bureau of Statisticsreported that floor space of houses under construction in the first four months of the 2011was up 33.2% year-on year, with floor space of newly started houses up by 24.4%. According

to the Economist Intelligence Unit, Chinas urban population is expected to continue growing

until 2039. The urban population will grow by 26% or 160m people by 2020. At the same

time, floor space per person is expected to increase from 30sqm in 2008 to 41sqm by 2020.

Large increase in motor vehicle sales - Motor vehicle sales are also expected to be asignificant demand driver for pigments. In its projection for motor vehicle sales in China,

Argonne National Laboratory, part of the US Department of Energy, is forecasting annual salesof 20 million units per year by 2022, almost four times the current level. Vehicle stock is

expected to increase by 100 million units in just 10 years.

30

35

40

45

50

55

60

65

03/2006 11/2006 07/2007 03/2008 11/2008 07/2009 03/2010 11/2010

Europe PMI

China PMI

US ISM

Exhibit 6 Indicators in key markets

Source: Bloomberg

-

8/4/2019 Ken Mare May 2011

8/30

Merrion Stockbrokers 8

Pigment manufacturers adding capacity - DuPont announced in May 2011 that it will spendmore than $500million to expand titanium dioxide production capacity by 350,000 tonnes in

North America. This was the first investment announcement in the region for several years

and it shows manufacturers confidence in the growth of pigment demand in North America.

Other manufacturers commentary suggests that they are all running at full capacity at the

moment and may need to expand in the near future. TZMI expects additional capacity to be

added in China over the next few years with Huntsman expecting to add capacity in the

region within the next few years.

Additional demand from niche applications - Titanium metal and welding electrodes are theother major uses of titanium feedstock and these are finding growing use. Titanium metal

demand is expected to grow by 50% over the next five years as it finds applications in

lightweight composite material. Titanium is used extensively in aircraft manufacturing and

estimates are that the number of aeroplanes will almost double by 2030. The Boeing

Dreamliner aircraft will be 18% by weight titanium, more than any other aircraft.

Photocatalysts are a growing market for titanium.

Source: Argonne National Laboratory

Exhibit 7 Projected vehicle units in China

-

8/4/2019 Ken Mare May 2011

9/30

Merrion Stockbrokers 9

Supply growth sluggish at bestA combination of low investment in exploration and development over the last decade due to

low feedstock prices, significant depletion of existing resources and the closure of a numberof large mines in the past three years has resulted in tighter supply. TZMI estimates that,

without new projects, resource depletion for existing operations will see total supply from

existing producers decline to less than 6 million TiO2 units by 2018, which is below the

global peak production level in 2007 (Exhibit 8).

A combination of factors will limit any growth in supply:

South African power costs have been increasing at 25% per year over the last two

years and are expected to continue to increase. This will add significantly to unitproduction costs and higher product prices will be needed to increase supply. More

importantly, there will not be much capacity for power supply to new large scale

industrial projects in South Africa for the foreseeable future.

Most existing operations are running at full capacity, with limited potential to

expand production. Only Rio Tinto has the ability to increase production at its mine

in Madagascar, but this will largely replace declining production at its operation in

Canada.

New supply faces significant barriers including the substantial capital cost, the timeto production as projects generally take longer than planned to bring on stream and

to ramp up to capacity, and the possibility of project failures. This means the timing

of any new supply is highly uncertain.

Exhibit 8 TZMI Ilmenite study forecast

Source: TZMI

This outlook is the result of

serious underinvestment in the

feedstock industry over the

last five years because of low

industry profitability. This

leaves the supply industry with

very little scope for new

output expansion in the short

to medium term and higher

prices are clearly needed to

induce new project

development Exxaro, 2010

Annual Report

-

8/4/2019 Ken Mare May 2011

10/30

Merrion Stockbrokers 10

Market balance in favour of suppliersTitanium dioxide pigments are manufactured through two different processes: chloride and

sulphate. Chloride ilmenite has a higher titanium dioxide content, at above 57%, comparedto sulphate ilmenite at 50% to 54%. Currently, Kenmares ilmenite production is about 60%

sulphate ilmenite and 40% chloride ilmenite.

Demand growth for both chloride and sulphate ilmenite titanium feedstock, coupled with

supply constraint, is expected to create a significant supply deficit over the next five years.

Exhibit 9 shows TZMIs updated estimate of supply and demand for titanium feedstock for

both chloride and sulphate titanium dioxide units up to 2016, including Kenmares current

expansion. This shows a modest deficit of titanium feedstock from 2011 and, with no newsupply, this deficit should increase to about 1.7m tonnes, or 28% of total demand by 2016.

Ilmenite contains about 50% to 60% TiO2, hence a 1.7m tonne TiO2 shortfall translates into

about 3 to 3.5 million tonnes of ilmenite.

Although pricing for mineral sands is opaque, reported pricing trends clearly reflect the

effects of this supply deficit.

Exhibit 9 Titanium feedstock supply and demand balance

Deficit about 28% of globalsupply by 2016

Source: Kenmare Resources

It used to just be a given that if

you build the TiO2 to capacity

that the ore will always be there.

And Im not saying that the ore

will not be there. Im just saying

that it may not be as plentiful as

weve seen it in years past

Peter R Huntsman, CEO,

Huntsman, Feb 2011

-

8/4/2019 Ken Mare May 2011

11/30

Merrion Stockbrokers 11

Zircon marketsZircon is a co-product at the Moma Mine, accounting for about 35% of revenue. The largest

consuming regions for zircon are Mediterranean Europe and Asia. China has a particularly

large influence in this market. Recent years have seen a surge in Chinese demand for zircon,

with the share of Chinese consumption rising from an estimated 35% of the global total in

2008 to an estimated 45% in 2010. Zircon is used mainly in ceramics. Urbanisation and

rising per capita income in China and other emerging markets will drive demand growth in

the medium term.

Like titanium feedstock, zircon supply will also be constrained over the short to medium

term. South Africa and Australia produce more than 70% of the worlds zircon, with

Australias Iluka Resources controlling more than a third of world supply. The closure of

Ilukas Western Australia operation and the reduced output from South Africa have

constrained supply growth over the last two years. Although new projects coming on stream

in the near term will increase zircon supply, it will not be enough to meet the expected

demand increase.

TZMIs demand and supply forecast for zircon (Exhibit 10) envisages a supply deficit of

500,000 tonnes per annum by 2020.

.

Reported zircon prices have risen from $1,100 to $1,300 in the first quarter of 2011 to

$1,400 to $1600 in the second quarter, almost double 2010 realised prices. With demand

expected to grow due to urbanisation in developing economies and supply largely

Source: Astron

Exhibit 10 Zircon demand and supply balanceSupply deficit

-

8/4/2019 Ken Mare May 2011

12/30

Merrion Stockbrokers 12

constrained for the same reasons as with titanium feedstock, zircon prices should continue

to be strong, with prices greater than $2,000 per tonne by 2012 being forecast by market

analysts. Our zircon price forecast for Kenmare reflects these estimates.

Tight markets to lead to significant price increasesThe demand drivers for mineral sands, being urbanisation and per capita GDP growth in

China and other emerging markets, coupled with steady demand from the developing world,

are unlikely to let up in the near to medium term. At the same time, supply will be

constrained with no new major projects likely to come on stream.

Our price forecasts reflect this near to medium term demand and supply imbalance. We

forecast Kenmares realised prices for products to rise significantly over the next few years.

Prices ($) 2010 2011f 2012f 2013f 2014f 2015f 2016f Spot*

Ilmenite 88 130 196 220 235 200 150 240

Zircon 809 1,100 2,000 2,400 2,400 2,200 1,500 3,200

Prices could be higher than forecastAlthough we are forecasting significant price increases from current levels, we believe thatour forecast prices could be conservative. TZMIs forecasts (Exhibits 8 and 10) suggest that

the market the imbalance between supply and demand will only start modestly from 2012.

However, prices have so far surprised on the upside and conditions are favourable for

continued upside surprise:

Demand drivers remain strong - As stated above, economic growth in developing

countries is expected to be stable and hold up consumption. We expect a substantial

increase in demand from emerging markets, especially China as per capita GDP

increases and urbanisation continues.Demand should be price inelastic We expect the price of mineral sands to be price

inelastic as there are no suitable substitutes for their applications and the cost

constitutes a small part of the cost to the end consumer. For example, titanium

feedstock represents about 2% to 4% of the price of a can of paint. We believe that

even a doubling of the price is unlikely to lead to demand destruction as it can be

easily passed on to the final consumer.

Evidence from pigment manufacturers suggest higher prices - Comments from large

pigment manufacturers suggest more of the value in the pigment chain is likely to go

to miners. DuPont, Huntsman and Kronos have all recently commented on titanium

feedstock pricing. They have been increasing pigment prices in anticipation of raw

Exhibit 11 Ilmenite and Zircon price forecast

Could we double our

prices and get it? Yes,

today we could just

double our prices and get

it

Aron Ain, CEO, Kronos,

April 2011

Source: Merrion estimates * Spot prices from press reports

-

8/4/2019 Ken Mare May 2011

13/30

Merrion Stockbrokers 13

material price increases, with Kronos reporting a 32% year on year increase in prices in

the first quarter of 2011. They have indicated that pricing will move towards shorter

term contracts (see below) and closer to spot. They also expect prices increases to be

gradual allow more time for customers to adjust to new pricing levels.

Spot prices already higher than our peak forecasts - Current reported spot prices are

already higher than our peak forecasts shown above. Prices for ilmenite are reported

at $240 per tonne and at more than $3,000 per tonne for zircon. Historically, prices

have been negotiated on long term contracts, typically running for one year or longer.

However, as with other bulk commodities like iron ore and coal, the market is moving

more frequent re-pricing, with contract prices moving closer to spot. This, as was also

the case with other bulk commodities, will move more of the value in the chain to

miners. For Kenmare, this is unlikely to have an effect for 2011 pricing as pricing has

already been dtermined. However, 2012 pricing may be significantly higher.

Long term pricingWe forecast a reduction in long term prices of mineral sands prices from 2016 as we

anticipate new projects will come on stream. To arrive at a long term price forecast, we have

made the following assumptions:

From Ilukas cost comparison for mineral sands producers (Exhibit 10), the average

revenue to cash operating ratio in the industry is about 1.3. A new operation is

assumed to have this ratio.

Ilmenite to zircon ratio of 0.2 (Kenmares ratio is much lower at under 0.1), and 5%

THM in ore.

Capital intensity of $25.00 per annual tonne.

A 25 year life of mine.

Assuming a 20% IRR is required to obtain project approval, we estimate that the required

long term prices to induce new investment would be $185 for ilmenite and $1,800 for zircon.However, due to the small size of the mineral sands markets (currently 6mt for TiO2 and

1.2mt for Zircon), a new start-up could have a significant influence on the market. We have

therefore applied a discount to these prices and set our long term price for ilmenite at $150

and $1,500 for zircon.

-

8/4/2019 Ken Mare May 2011

14/30

Merrion Stockbrokers 14

A new entrant with significant comparative advantages

Kenmare is a relatively new entrant to mineral sands mining. In spite of this status, we

believe that it has comparative advantages to its peers that will make it a significant and

efficient mineral sands mining operation. These stem from the size ofKenmares resources, its

lower than average cash operating costs and a favourable tax regime in Mozambique.

Resource sizeKenmares total reserves and resources are approximately 218 million tonnes of ilmenite, 14

million tonnes of zircon and 4.6 million tonnes of rutile. With exploration and drilling

continuing, the resource is yet to be fully defined and we expect that it will continue to

expand. At current production rates, the life of mine is well in excess of 100 years.

The size of resource compares favourably with the other large mineral sands producers.

Mineral reserves and resources

Reserves Mt Ilmenite Mt Zircon Mt Rutile

Kenmare 220 14 5

Exxaro 102 6 -

Iluka 62 16 8

With current tight mineral sands supply and favourable pricing momentum, Kenmares

extensive resource gives it the flexibility to significantly increase production to become a

large and significant mineral sands producer.

Competitive operating costsIluka Resources published an industry wide comparison of cost competitiveness, based on the

ratio of revenue to cash operating costs (Exhibit 13) for the period 2011 to 2013.

As Exhibit 13 shows, Iluka is targeting a revenue to cash ratio of 1.8x for 2011 to 2013 vs

1.3x for 2006 to 2008. In comparison, we forecast that Kenmare will be more efficient with a

revenue to cash cost ratio at full production, post expansion to 1.2 million tonnes per year

ilmenite, of about 3 times, making it one of the most cost competitive players in the industry.

The reason for Kenmares lower costs include:

Nature of its oreThe nature of Kenmares ore resource makes it amenable to the low costdredge mining method.

Efficient materials handlingAll of Kenmares operations are located within a 2 mile radius,including the on sea terminal where ore is exported. There are no long distance haulage costs.

Exhibit 12- Comparison of resources

Source: Company reports

Kenmare will be one of the

lowest cost producers in the

industry.

-

8/4/2019 Ken Mare May 2011

15/30

Merrion Stockbrokers 15

No additional beneficiation costs Unlike other titanium producers, Kenmare does not have afurther beneficiation stage (smelting) post concentration, due to the higher grades of its

ilmenite concentrate (51% to 60% compared to less than 50% for some producers). Smelting

introduces additional operational complications as well as substantial power costs.

Cheaper labour and power costs The company has negotiated power costs of 2.5c per kWhfor the first phase of production and we expect it to be 5c per kWh for the expansion,

significantly lower than levels prevailing in South Africa and Australia, the other large

producers. (As a comparison, South Africas electricity cost is about 11c per KWh). Labour

costs are also lower compared to other major producers.

Favourable tax regimeFor tax purposes in Mozambique, Kenmare has structured its operations into two operating

companies, mining and processing.

The mining company sells its product (contained heavy minerals) at cost plus mark-up

to the processing company. The mark-up is set at a floor of 15% and is adjusted by the

extent to which the increase in product prices exceed inflation. The current mark-up is

23%. The mining company also incurs much of the capital cost and is able to write this

off on an accelerated basis in the year incurred. It is then taxed at a rate of 32%.

According to our estimates, given the level of capital expenditure to date, the mining

company is not expected to pay tax in the medium term. However, it is subject to a 3%

royalty tax on revenues.

The processing company, which sells the final product, is located in a tax free zone and

is not subject to income tax. However, it will also pay a 1% royalty on revenues from

mid 2013.

Source: Iluka Resources

Exhibit 13 Industry competitiveness - revenue to cash cost ratios

Kenmares effective tax

rate will be less than 10%

of pre-tax profit for the

foreseeable future

-

8/4/2019 Ken Mare May 2011

16/30

Merrion Stockbrokers 16

The net effect is that, in spite of its good operating margins, Kenmares tax burden will be

less than 10% of pre-tax profit for the foreseeable future.

Aggressive expansion

Kenmares comparative advantages and prevailing market conditions provide it with a

window of opportunity to expand production and become a significant player in mineral

sands. A 50% expansion to 1.2 million tonnes ilmenite capacity per year is already underway,

even though the mine is yet to fully reach its original design capacity of 800,000 tonnes.

Post expansion, Kenmare will have a more than 10% share of the titanium dioxide feedstock

market, making it one of the top four producers.

A further expansion of production capacity beyond 1.2 million tonnes per year is already

being considered. A pre-feasibility study is underway and will be completed by the end of

2011, with a full feasibility study to follow.

We expect a positive conclusion from the pre feasibility study given that:

The market outlook is favourable with forecasts indicating a supply shortfall of 1.7

million tonnes titanium dioxide units by 2016 (Exhibit6);

Kenmare is in a unique position to take advantage of this supply shortfall as it has

the resources and, being one of the most cost competitive in the industry, will be

most efficient in adding capacity.

With strong cash flows expected from its operations, Kenmare will have the

financial ability to carry out the expansion from its own cash resources and short

term project financing.

We believe that management will be aggressive in taking advantage of this window of

opportunity and add an additional 800,000 tonnes per year ilmenite capacity, the same as

Kenmares current operation. Post this further expansion, production capacity would increase

to 2.0 million tonnes per year, making Kenmare the worlds second largest titanium dioxidefeedstock producer. The additional production will add supply of just over 400,000 titanium

dioxide units and, as industry forecasts suggest (Exhibit 7), this incremental production will

not be sufficient to fill the expected supply deficit.

An extra 800,000 tonnes per year ilmenite capacity expansion will entail the construction of

a new dredge mine and wet concentrator plant (WCP) at the Nataka de posit, Kenmares

largest, and the construction of a new mineral separation plant. As the ore grades at the

Nataka deposit are slightly lower, we anticipate that there may be a need for ilmeniteupgrade to meet customer requirements. As a result, we have factored in higher unit

operating costs that the current operation. We estimate the capital cost of new capacity to

be about $600 million and the project to be completed by end of 2015.

We anticipate Kenmare

adding an additional

800,000 tonnes per year

capacity the end of 2015.

-

8/4/2019 Ken Mare May 2011

17/30

Merrion Stockbrokers 17

Strong earnings momentum and financial position

The effect of production ramp up, expansion and rising prices should lead to a rapid and

significant increase in earnings over the next three years. We forecast diluted earnings

growth from 1.0USc per share in 2011 to 14.1USc per share in 2014, a CAGR of 240%.

Earnings momentum will also lead to significant cash flow for Kenmare. Net debt, expected

to increase to $260m at the end of 2011, should decrease significantly and, excluding any

additional capacity expansion, there should be no net debt by the end of 2013. Our forecasts

suggest that Kenmares cash flow generation, with some reliance on short term debt, should

be enough to fund further production expansion.

-

8/4/2019 Ken Mare May 2011

18/30

Merrion Stockbrokers 18

Valuation and financing

NPV Valuation

We value Kenmare on a NPV based on two scenarios:

1. Assuming no additional expansion once the current 50% expansion to 1.2 million

tonnes per year ilmenite is complete.

2. Assuming an additional 800,000 tonnes per year ilmenite capacity expansion to 2

million tonnes per year in total. We believe this is the most likely outcome, as

Kenmare has the resources whilst the market and operating dynamics are

supportive.

To arrive at our NPV valuation, we have made the following assumptions:

Increases in titanium feedstock and zircon prices over the next three years and forthese prices to ease off as new supply comes on stream. Appendix 1 shows our

price forecasts.

We have assumed completion of Kenmares expansion programme by the first

quarter of 2012, with ramp up to 1.2 m tonnes per year ilmenite capacity at the end

of 2012.

Any further expansion to 2 million tonnes per year capacity will be at a capital cost

of $600m and will be completed by the end of 2015.

Assuming no further expansion and at a 10% real discount rate, our NPV valuation is 91USc

per share or 56p at an exchange rate of USD1.61 per GBP. With further expansion to

capacity of 2 million tonnes of ilmenite per year, our NPV is 111USc (69p) per share.

Target priceWe set our target price at 101USC (63p) being the average of the two valuation methods

above.

-

8/4/2019 Ken Mare May 2011

19/30

Merrion Stockbrokers 19

SensitivityShown below is the sensitivity of our NPV valuation. As is clear from the chart, the NPV is

very sensitive to changes in the prices of products.

Comparative valuationWe show below the comparative metrics between Kenmare and Iluka, its closest peer. Ilukas

estimates are based on Bloomberg consensus figures.

Company

Price

(US$)

Market

cap (US$)

2012 PE

Ratio

2012 Adjusted

PE Ratio

2012

EV/EBITDA

2012 Adjusted

EV/EBITDA P/NPV

Iluka 15.30 6,435 10.2* 10.2* 6.75* 6.75* 0.9

Kenmare 0.71 1,670 10.3 5.9** 9.57 5.46** 0.8

Kenmare compares favourably, trading at a discount to Iluka, even though it has a superior

near term earnings growth profile.

Valuation risks

Mineral sands prices We have assumed tight markets for mineral sands and significantlyrising prices over the short to medium term. However, pricing for mineral sands is opaque as

prices are usually determined through confidential forward sales contracts and are, therefore,

hard to forecast. Though we do not envisage any significant new mineral sands supply

-20.0%

-15.0%

-10.0%

-5.0%

0.0%

5.0%

10.0%

15.0%

20.0%

-10% -5% 0.0% 5% 10%

%C

hangeinPrice

% Change in NPV

Product prices

Capex

Opex

Exhibit 14 NPV sensitivity

Source: Bloomberg and Merrion estimates * Bloomberg consensus ** Adjusted to take into account Kenmares expansion to 1.2mtpa ilmenite

Exhibit 15 Kenmare comparison with Iliuka

-

8/4/2019 Ken Mare May 2011

20/30

Merrion Stockbrokers 20

sources, prices may be affected by significant previously unforeseen supply coming on

stream.

Production rates We have assumed certain rates of production for Kenmares existing andexpansion projects. As with Kenmares experience at the start up of the Moma Mine,

production ramp to design capacity can take longer. Mineral grades and recoveries may alsobe different to forecast. As a result, the rate of production may be different to forecast.

Regulatory changes Mozambique is a largely stable democracy and policy changes are notanticipated. However, potential changes to tax legislation and other commercial terms in

Mozambique may affect future cash flows and hence valuations.

Financing

Kenmare raised $257m net through a share placement in 2010 and had cash resources of

$238m as at 31 December 2010. We forecast strong operating cash flows over the next threeyears as production is ramped up and mineral sands prices rise. We detail below Kenmares

cash flow and cash requirement over the next four years.

2011f 2012f 2013f 2014fCash from operations 67 199 322 385

Capex (200) (35) (25) (10)

Free cash flow (133) 168 297 375Opening bal net cash/(debt) (102) (260) (118) 160Debt servicing (25) (22) (18) (15)Closing bal net cash/(debt) (260) (118) 160 520

We have factored in $600m further capacity expansion to 2 million tonnes per year ilmenite.

Actual outlay is unlikely to commence until late 2013 to 2014. At that stage, our forecasts

suggest Kenmare will have the resources to fund this additional expansion from its own cash

resources or short term project debt, without having to raise further capital.

Exhibit 16 Kenmare cashflow and cash requirement

Source: Merrion estimates

We believe that Kenmare will

have sufficient cash flows to

fund further expansion from

its own cash resources.

-

8/4/2019 Ken Mare May 2011

21/30

Merrion Stockbrokers 21

Company Overview

IntroductionKenmare Resources is a mining company with a primary listing on the London Stock

Exchange and a secondary listing on the Irish Stock Exchange. It owns 100% of its sole

operating asset, the Moma Titanium Minerals Mine in Mozambique. The mine produces the

mineral ilmenite as its primary product, with zircon and rutile as co products.

llmenite and rutile are titanium bearing minerals, with ilmenite containing between 45% and

62% of TiO2 and rutile between 94% and 96%. Titanium based minerals are mainly used as

feedstock in the production of titanium dioxide (TiO2) pigment, accounting for about 90%

of consumption. The pigment is, in turn, used in the manufacture of paints and other

coatings, plastics and paper, as well as a number of other applications, including cosmetics,

food additives, ceramics, inks and textiles. The production of titanium metal and welding

electrodes are other and growing important uses.

Titanium feedstock production is highly concentrated, with a few players making up the bulk

of production. Rio Tinto, Iluka and Exxaro control more than 50% of the world market (2009)

(Exhibit3). Following its 50% ilmenite expansion programme currently under way, Kenmare

will account for approximately 11% of world production.

Exhibit 17 Moma Mine and mineral resources location

Source: Kenmare Resources

-

8/4/2019 Ken Mare May 2011

22/30

Merrion Stockbrokers 22

Zircon is a hard, glassy mineral used for the manufacture of ceramics and refractories and

also in a range of other high-tech industrial and chemical applications. It is used for ceramic

glazes, most commonly applied in kitchen tiles, dinner-ware, bathroom products and

decorative ceramics. It is also used as refractory material and in foundry sands and in thechemicals industry.

Reserves and resourcesKenmares mineral resource is extensive and is spread over a series of dunes in northern

Mozambique (Exhibit 15), the main deposits being Namalope, where mining is currently

taking place, and Nataka, a much larger resource and the long term future of the mine.

Exhibit 18 shows the mines estimated resources as at 31 December 2010. The total mine

reserve and resource was approximately 208 million tonnes of ilmenite, 14 million tonnes ofzircon and 4.6 million tonnes of rutile. The company believes that the resource will continue

to expand and become more fully defined with ongoing exploration and drilling activity. At

the current planned rate of mining and taking into account the planned 50% expansion in

2013, the life of mine is well in excess of 100 years.

Zones Category Mt % THM

%

ilmenitein THM

%

ilmenitein ore

Million

tonnesTHM

Million

tonnesilmenite

Million

tonnesrutile

Million

tonneszircon

Reserves

Namalope Proved200 4.7 81 3.9 9.5 7.7 0.19 0.58

Namalope Probable280 3.7 82 3 10 8.4 0.19 0.61

Nataka Probable445 3.2 84 2.7 14 12 0.21 0.73

Total reserves 925 3.7 82 3 34 28 0.59 1.9

ResourcesNamalope Indicated 320 3.3 81 2.6 10 8.5 0.2 0.62

Nataka Inferred 5,800 2.8 82 2.3 160 130 2.7 8.6

Congolone Measured 167 3.3 77 2.5 5.4 4.2 0.1 0.4

Pilivili Inferred 227 5.4 80 4.3 12 9.8 0.3 0.8

Mualadi Inferred 327 3.2 80 2.6 10 8.4 0.2 0.7

Mpitini Inferred 287 3.6 80 2.9 10 8.3 0.2 0.7

Marrua Inferred 54 4.1 80 3.3 2.2 1.8 0.1 0.1

Quinga North Inferred 71 3.5 80 2.8 2.5 2 0.1 0.2

Quinga South Inferred 71 3.4 80 2.7 2.4 1.9 0.1 0.2

Total resources 7,400 2.9 82 2.4 220 180 4.0 12

Total reserves and resources 8,325 3.0 82 2.5 254 218 4.59 13.9Source: Kenmare Resources THM = Total Heavy Minerals

Besides the mineral sands shown above, Kenmare has identified the presence of rare earth

elements in the tailings of the Mineral Separation Plant (MSP). A study has commenced

investigating how best to separate and recover monazite from the reject stream. As monazite

Exhibit 18 Kenmare Reserves and Resources

-

8/4/2019 Ken Mare May 2011

23/30

Merrion Stockbrokers 23

is part of the heavy minerals, its content is accurately known (Exhibit 17). We have not

included any Monazite recovery in our forecasts. However, it represents potential upside

should it prove economical.

Zones Category

Ore

(Mt) % THM

%

Monazite

in THM

Monazite

(Mt)

Reserves

Namalope Proved 200 4.7 0.59 0.056

Namalope Probable 280 3.7 0.57 0.059

Nataka Probable 445 3.2 0.54 0.078

TOTAL RESERVES Proved & Probable 925 3.7 0.57 0.190

Basic production processThe mining method is dredge mining in artificial ponds. The dredges cut the ore at the base

of the ore face, allowing the mineral bearing sands to collapse into an artificial freshwater

dredge. The mineral-bearing sands are pumped by the dredges to a wet concentrator plant

(WCP) which separates the heavy minerals (HMC) from the silica sand and clays (tailings).

The HMC contains the valuable mineral sands, and is about 5% by weight of mined material.

This is pumped to the mineral separation plant (MSP) which separates the three valuable

minerals in several stages and produces further waste material or tailings.

The mine has a design capacity to produce 800,000 tonnes of ilmenite, 50,000 tonnes per

annum zircon and 14,000 tonnes per annum. When the mine came on stream in 2007, it

initially faced production issues and it took longer than expected to ramp up production to

design capacity. These issues have largely been resolved and design production capacity is

expected to be achieved in 2011 to 2012. Exhibits 18 and 19 show Kenmares historical

ilmenite and zircon production since 2008

0

5,000

10,000

15,000

20,000

25,000

1H08 2H 08 1H 09 2H 09 1H 10 2H 100

100,000

200,000

300,000

400,000

1H08 2H 08 1H 09 2H 09 1H 10 2H 10

Exhibit 19 Monazite reserves and resources

Exhibit 20 Ilmenite production profile

Source: Kenmare Resources

Exhibit 21 Zircon production profile

Source: Kenmare ResourcesSource: Kenmare Resources

-

8/4/2019 Ken Mare May 2011

24/30

Merrion Stockbrokers 24

Production expansionTo take advantage its of resources and the current market conditions, Kenmare is currently

undergoing an expansion programme to increase ilmenite production by 50%. It is envisaged

that, at the end of the expansion, the Moma mine will be producing 1.2m tonnes of ilmenite,

80,000 tonnes of zircon and 22,000 tonnes of rutile per annum.

The main elements of the expansion are:

An upgrade of the capacity of the existing two dredges and WCP to increase spiral

feed capacity from 3,000 tph to 3,500 tph;

The installation of a second WCP with a spiral feed capacity of 2,000 tph in a

separate dredge pond, utilising a new third dredge on the Namalope reserve;

The addition of a Wet High Intensity Magnetic Separation (WHIMS) circuit at the

front of the ilmenite circuit of the MSP. WHIMS technology is commonplace within

the mineral sands industry and will be used to separate magnetic and non-magnetic

fractions within the HMC whilst in a wet state. This will replace the dry primary

separation stage and its associated costs;

The existing MSP will require some modifications, including an auxiliary 80tph

ilmenite circuit, to increase throughput capacity from 135 tph to 220 tph;

An upgrade of the product storage facilities to increase capacity of final products

from 140,000 tonnes to 220,000 tonnes.

Further expansion being investigatedGiven the likely market deficit over the medium term, the company intends to take

advantage of its resource flexibility by planning a further expansion. A pre feasibility study is

underway and is expected to be completed by the end of 2011. If successful, a full feasibility

study will be commissioned.

Management

Kenmare has experienced and qualified management in key positions. Listed below is a brief

resume of the companys key personnel.

Michael Carvill CEOMichael Carvill holds a BSc in Mechanical Engineering and an MBA (Wharton School,

University of Pennsylvania). He worked as a contracts engineer in Algeria and as a project

engineer at Tara Mines, Ireland. He has been the Managing Director of Kenmare since 1986.

Jacob Deysel, Chief Operations DirectorJacob Deysel was appointed Chief Operations Officer in February 2009 and was co-opted to

the Board in June 2009. He joined Kenmare from Richards Bay Minerals, the worlds largest

single producer of titanium dioxide feedstocks (part of the Rio Tinto Group). He holds a BSc

-

8/4/2019 Ken Mare May 2011

25/30

Merrion Stockbrokers 25

in Mine Engineering and a Masters in Business Administration, both from the University of

Witwatersrand in South Africa. He has worked in the titanium dioxide feedstock industry

since 2003. Previously, he worked with Gold Fields Limited at Driefontein Mine where he was

Operations Manager for the West Complex consisting of seven operating shafts. At Richards

Bay Minerals, he has had responsibility for the mines five plants in addition to geology, mineplanning and maintenance.

Terence Fitzpatrick, Technical DirectorTerence Fitzpatrick is a graduate of University of Ulster (Mech. Eng.). He worked as Project

Manager and then Technical Director of Kenmare from 1990 to 1999. He was responsible for

the development of the Ancuabe Graphite Mine in Mozambique, which achieved completion

on schedule and budget in 1994. He was appointed to the Board of Kenmare in 1994. He

served as a Non-Executive Director from 2000 to 2008. He was appointed as TechnicalDirector in February 2009.

Tony McCluskey, Financial DirectorTony McCluskey has worked with Kenmare since 1991. He was originally appointed as

Company Secretary and Financial Controller, before becoming Finance Director in 1999. He

holds a Bachelor of Commerce degree from University College Cork and is a Fellow of the

Institute of Chartered Accountants. Before joining Kenmare, he worked for a number of years

with Deloitte & Touche as a senior manager in Dublin and also worked overseas.

Riaan Lombard, General manager, Moma MineRiaan Lombard has over 15 years experience in the mining industry. He was previously

Mining Manager at AngloGold Ashantis mine in Mali where he was responsible for the

mining operations of both the Sadiola and Yatela gold mines. He was General Manager of

Weatherly Mining in Namibia and he also worked in various senior roles with De Beers at

their Namdeb mine in Namibia. Riaan was appointed as General Manager of the Moma Mine

in June 2010.

-

8/4/2019 Ken Mare May 2011

26/30

Merrion Stockbrokers 26

Financial ForecastsAssumptions 2009 2010 2011f 2012f 2013f 2014f 2015f

Prices

Ilmenite 87.5 135 196 220 235 200

Zircon 809 1100 2000 2400 2400 2200

Production

Ilmenite 472 678 700 850 1050 1150 1200

Zircon 22 37 40 60 65 68 80

INCOME STATEMENT 2009 2010 2011f 2012f 2013f 2014f 2015f

$'000 $'000 $'000 $'000 $'000 $'000 $'000

Revenue 26,721 91,587 143,601 296,060 438,590 515,253 489,040

YoY increase 242.8% 56.8% 106.2% 48.1% 17.5% -5.1%

Operating profits (13,050) (59,071) (63,219) (63,800) (77,400) (84,200) (104,600)

EBITDA 6,347 20,883 71,793 212,257 330,966 395,314 351,371

EBITDA Margin % 23.8% 22.8% 50.0% 71.7% 75.5% 76.7% 71.8%Depreciation (18,458) (18,670) (20,537) (25,671) (32,089) (32,089) (32,089)

Net Finance costs (15,331) (29,502) (25,085) (21,839) (18,460) (15,242) (12,025)

Other (2,910) 10,955 0 0 0 0 0

Profit before tax (30,352) (16,334) 26,171 164,747 280,417 347,983 307,257

Taxation/Royalties 0 0 (2,181) (2,201) (7,056) (8,057) (8,499)

Net Profit -30,352 -16,334 23,990 162,546 273,361 339,925 298,758

Shares in issue (diluted) 0 2,403.9 2,403.9 2,403.9 2,403.9 2,403.9 2,403.9

EPS USc (diluted) 0.045 -0.68 1.00 6.76 11.37 14.14 12.43

BALANCE SHEET 2009 2010 2011f 2012f 2013f 2014f 2015f

Fixed Assets 540,924 552,786 732,249 741,578 1,134,489 1,312,400 1,290,311

Current assets

Inventories 21,951 24,618 27,080 35,204 36,964 38,812 40,753

Trade and other receivables 13,311 12,974 14,271 18,553 19,480 20,454 26,591

Cash and cash equivalents 17,408 238,515 53,804 154,874 (8,720) 111,175 323,974

52,670 276,107 95,155 208,630 47,724 170,442 391,318

Total assets 593,594 828,893 827,404 950,208 1,182,213 1,482,841 1,681,628

Equity

Share capital and premium 237,817 495,690 495,690 495,690 495,690 495,690 495,690

Retained losses (57,501) (43,694) (19,704) 142,842 416,203 756,128 995,135

Other reserves 41,795 14,103 14,103 14,103 14,103 14,103 14,103

Total equity 222,111 466,099 490,089 652,635 925,996 1,265,921 1,504,928

Liabilities

Non-current liabilities

Bank loans 358,381 340,560 313,560 272,982 230,748 190,529 150,310

Provisions 4,347 6,750 6,750 6,750 6,750 6,750 6,750

303,845 261,579 320,310 279,732 237,498 197,279 157,060

Current liabilities

Provisions 650 279 279 279 279 279 279

Trade and other payables 8,105 15,205 16,726 17,562 18,440 19,362 19,362

8,755 15,484 17,005 17,841 18,719 19,641 19,641

Total liabilities 371,483 362,794 337,315 297,573 256,217 216,920 176,701

Total equity and liabilities 593,594 828,893 827,404 950,208 1,182,213 1,482,841 1,681,628

-

8/4/2019 Ken Mare May 2011

27/30

Merrion Stockbrokers 27

Cashflow statement 2009 2010 2011f 2012f 2013f 2014f 2015f

Profit For the Year (30,352) (16,334) 23,990 162,546 273,361 339,925 315,758

Adjusment for:

Foreign exchange movement 2,910 (16,691) 0 0 0 0 0

Share based payments 796 2,374 0 0 0 0 0

Finance costs 15,533 29,852 25,085 21,839 18,460 15,242 12,025

Depreciation 12,871 20,955 20,537 25,671 32,089 32,089 32,089

Increase in provisions 739 3,911 0 0 0 0 0

Operating cash flow 2,295 22,545 69,612 210,056 323,910 387,257 359,872

Working capital (8,551) 4,503 (2,239) (11,569) (1,810) (1,900) (8,077)

Cash used by operations (6,256) 27,048 67,373 198,486 322,100 385,357 351,795

Net cash used in operating activities (17,920) 28,570 67,373 198,486 322,100 385,357 351,795

Investing cashflows 0 0 0 0 0 0 0

Capital expenditure (40,197) (34,790) (200,000) (35,000) (25,000) (10,000) (10,000)

Further expansion 0 0 0 0 0 0 0

Net cash used in investing activities (40,197) (34,790) (200,000) (35,000) (25,000) (10,000) (10,000)

Financing cashflows 0 0 0 0 0 0 0

Proceeds on the issue of shares 19,582 257,873 0 0 0 0 0

Dividends paid 0 0 0 0 0 0 0

Repayment of borrowings (336) (26,962) (27,000) (40,578) (42,234) (40,219) (40,219)

Increase in borrowings 15,890 0 0 0 0 0 0

Interest paid (11,866) (10,191) (25,085) (21,839) (18,460) (15,242) (12,025)

Finance leases (286) 0 0 0 0 0 0

Net cash from financing activities 34,850 220,720 (52,085) (62,417) (60,694) (55,461) (115,395)

Net decrease in cash (23,267) 214,500 (184,711) 101,070 236,406 319,895 226,399

Cash at the beginning of the year 40,536 17,408 238,515 53,804 154,874 391,280 711,175

Effect of exchange rate changes 139 6,607 0 0 0 0 0

Cash at the end of the year 17,408 238,515 53,804 154,874 391,280 711,175 937,574

Net cash/(debt) (340,973) (102,045) (259,756) (118,108) 160,532 520,646 787,264

-

8/4/2019 Ken Mare May 2011

28/30

Merrion Stockbrokers 28

DisclosuresMerrion Stockbrokers Limited ('Merrion') is a member firm of the Irish Stock Exchange and the London Stock Exchange and is regulated by the Central Bank of Ireland.

For further information relating to research recommendations and conflict of interest management please ref er to www.merrion-capital.com.

The information contained in this publication was obtained from various sources believed to be reliable, but has not been independently verified by Merrion. Merrion does not warrant the completeness or accuracy of suchinformation and does not accept any liability with respect to the accuracy or completeness of such information, except to the extent required by applicable law.

This publication is a brief summary and does not purport to contain all available information on the subjects covered. Further information may be available on request. This report may not be reproduced for further publicationunless the source is quoted.

This publication is for information purposes only and shall not be construed as an offer or solicitation for the subscription or purchase or sale of any securities, or as an invitation, inducement or intermediation for the sale,subscription or purchase of any securities, or for engaging in any other transaction.

Any opinions, projections, forecasts or estimates in this report are those of the author only, who has acted with a high degree of expertise. They reflect only the current views of the author at the date of this report and are subjectto change without notice. Merrion has no obligation to update, modify or amend this publication or to otherwise notify a reader or recipient of this publication in the event that any matter, opinion, projection, forecast or estimatecontained herein, changes or subsequently becomes inaccurate, or if research on the subject company is withdrawn. The analysis, opinions, projections, forecasts and estimates expressed in this report were in no way affected orinfluenced by the issuer. The author of this publication benefits financially from the overall success of Merrion.

The investments referred to in this publication may not be suitable for all recipients. Recipients are urged to base their investment decisions upon their own appropriate investigations that they deem necessary. Any loss or otherconsequence arising from the use of the material contained in this publication shall be the sole and exclusive responsibility of the investor and Merrion accepts no liability for any such loss or consequence. In the event of anydoubt about any investment, recipients should contact their own investment, legal and/or tax advisers to seek advice regarding the appropriateness of investing. Some of the investments mentioned in this publication may not bereadily liquid investments. Consequently it may be difficult to sell or realize such investments. The past is not necessarily a guide to future performance of an investment. The value of investments and the income derived fromthem may fall as well as rise and investors may not get back the amount invested. Some investments discussed in this publication may have a high level of volatility. High volatility investments may experience sudden and largefalls in their value which may cause losses. International investing includes risks related to political and economic uncertainties of foreign countries, as well as currency risk.

To the extent permitted by applicable law, no liability whatsoever is accepted for any direct or consequential loss, damages, costs or prejudices whatsoever arising from the use of this publication or its contents.

Merrion has written procedures designed to identify and manage potential conflicts of interest that arise in connection with its research business.

United States:This report is only distributed in the US to major institutional investors as defined by S15a-6 of the Securities Exchange Act, 1934 as amended. By accepting this report, a US recipient warrants that it is a majorinstitutional investor as defined and shall not distribute or provide this report or any part thereof, to any other person.

Further details are available on our websitehttp://www.merrion-capital.com/disclaimer.htmland/or by contacting our Compliance Officer.

Other countries: Laws and regulations of other countries may also restrict the distribution of this report. Persons in possession of this document should inform themselves about possible legalrestrictions and observe them accordingly

http://www.merrion-capital.com/http://www.merrion-capital.com/disclaimer.htmlhttp://www.merrion-capital.com/disclaimer.htmlhttp://www.merrion-capital.com/disclaimer.htmlhttp://www.merrion-capital.com/disclaimer.htmlhttp://www.merrion-capital.com/ -

8/4/2019 Ken Mare May 2011

29/30

Merrion Stockbrokers 29

Legal informationThe information contained in this publication was obtained from various sources believed to be reliable, but has not been independently verified by Merrion. Merrion does not warrant the completeness or accuracy of suchinformation and does not accept any liability with respect to the accuracy or completeness of such information, except to the extent required by applicable law.

This publication is a brief summary and does not purport to contain all available information on the subjects covered. Further information may be available on request. This report may not be reproduced for further publicationunless the source is quoted.

This publication is for information purposes only and shall not be construed as an offer or solicitation for the subscription or purchase or sale of any securities, or as an invitation, inducement or intermediation for the sale,subscription or purchase of any securities, or for engaging in any other transaction.

Any opinions, projections, forecasts or estimates in this report are those of the author only, who has acted with a high degree of expertise. They reflect only the current views of the author at the date of this report and aresubject to change without notice. Merrion has no obligation to update, modify or amend this publication or to otherwise notify a reader or recipient of this publication in the event that any matter, opinion, projection, forecastor estimate contained herein, changes or subsequently becomes inaccurate, or if research on the subject company is withdrawn. The analysis, opinions, projections, forecasts and estimates expressed in this report were in noway affected or influenced by the issuer. The author of this publication benefits financially from the overall success of Merrion.

The investments referred to in this publication may not be suitable for all recipients. Recipients are urged to base their investment decisions upon their own appropriate investigations that they deem necessary. Any loss orother consequence arising from the use of the material contained in this publication shall be the sole and exclusive responsibility of the investor and Merrion accepts no liability for any such loss or consequence. In the event ofany doubt about any investment, recipients should contact their own investment, legal and/or tax advisers to seek advice regarding the appropriateness of investing. Some of the investments mentioned in this publication maynot be readily liquid investments. Consequently it may be difficult to sell or realize such investments. The past is not necessarily a guide to future performance of an investment. The value of investments and the income derivedfrom them may fall as well as rise and investors may not get back the amount invested. Some investments discussed in this publication may have a high level of volatility. High volatility investments may experience sudden andlarge falls in their value which may cause losses. International investing includes risks related to political and economic uncertainties of foreign countries, as well as currency risk.

To the extent permitted by applicable law, no liability whatsoever is accepted for any direct or consequential loss, damages, costs or prejudices whatsoever arising from the use of this publication or its contents.

Merrion has written procedures designed to identify and manage potential conflicts of interest that arise in connection with its research business. Merrions research analysts and other

staff involved in issuing and disseminating research reports operate independently to other areas of the business. Chinese Wall procedures are in place between the research analysts and

staff involved in securities trading for the account of Merrion or clients to ensure that price sensitive information is handled according to applicable laws and regulations.

United States:This report is only distributed in the US to major institutional investors as defined by S15a-6 of the Securities Exchange Act, 1934 as amended. By accepting this report, a US recipient warrants that it is amajor institutional investor as defined and shall not distribute or provide this report or any part thereof, to any other person.

Other countries: Persons in possessionof this document should inform themselves about possible legal restrictions and observe them accordingly.Further details are available on our websitehttp://www.merrion-capital.com/disclaimer.htmland/or by contacting our Compliance Officer.

Other countries: Laws and regulations of other countries may also restrict the distribution of this report. Persons in possession of this document should inform themselves about possible legalrestrictions and observe them accordingly

http://www.merrion-capital.com/disclaimer.htmlhttp://www.merrion-capital.com/disclaimer.htmlhttp://www.merrion-capital.com/disclaimer.htmlhttp://www.merrion-capital.com/disclaimer.html -

8/4/2019 Ken Mare May 2011

30/30

Merrion Stockbrokers3

rdFloor

Block CThe Sweepstakes Centre

BallsbridgeDublin 4Ireland

Switch: +353 1 240 4100Institutional Trading Desk: +353 1 240 4200Private Clients: +353 1 240 4111Fax: +353 1 240 4101

Website: www.merrion-capital.come-mail: [email protected]: MSTK

Equity Research/StrategyGerard Moore: [email protected] Holohan : [email protected]

Ross McEvoy: [email protected]

Muna Muleya: [email protected] Wyer : [email protected]

Institutional SalesLiam Boggan: [email protected]

Robert Murphy: [email protected]

Martin Harte : Martin.Harte merrion-ca ital.com

Private Client Account ManagersKen Costello: [email protected]

David Gorman : [email protected] Relihan : [email protected]

David Wilson : [email protected]

Graham ODonoghue: Graham.ODonoghue@merrion-

capital.com

Cork :Jennifer Dennehy : [email protected]

Anthony Lynch : [email protected]

TradersSimon Tuthill: [email protected]

Aidan Cronin : [email protected]

Hannah Meyer: [email protected]

Jimmy Swaine: [email protected]

Client ServicesMary Ellen Holmes : [email protected]

Amy Kennedy : [email protected]

Wealth Advisory/PropertyMark Roche : [email protected]

Jason Drennan: [email protected]

Damien Conway : [email protected]

Cork :Claire Brosnan : [email protected]

Willie Cronin : [email protected]

PensionsLaura Reidy: [email protected]

Jean Masterson: [email protected]

Cork :Claire Brosnan : [email protected]

Administration/SupportNiamh Donnellan : [email protected]

Patricia Lawlor : [email protected]

Rory Connell : [email protected]

Cork :Marie Morton : [email protected]

Deirdre OBrien: [email protected]

Institutional Trading DeskPhone: +353 1 240 4200Fax: +353 1 240 4242e-mail: [email protected]

Private Client Dealing DeskPhone: +353 1 240 4111Fax: +353 1 240 4286Cork Office: ` +353 21 4551950