July 12- July18

-

Upload

admissions-office -

Category

Documents

-

view

224 -

download

3

description

Transcript of July 12- July18

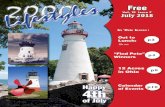

NEWSLETTER

12 Pages 12th July 2012 – 18th July 2012 www.xedintellect.com

BUSINESS NEWS

ECONOMIC INDICATORS 2 COVER STORY 3 PERSONALITIES OF THE WEEK 4

CORPORATE INTELLIGENCE 5 NEWS ANALYSIS 6 JOB PROFILE 11

NEWS DIGEST…

IN BRIEF

PERSONALITIES OF

THE WEEK

CORPORATE INTELLIGENCE

Rupee: 55.49/$

Gold: 29191/10g (as on 18th July)

ECONOMIC

INDICATORS

Infosys fails on Q1 results. Rival TCS grows stronger

in April-June

COVER STORY

Obama says it is still hard

to invest in India

GLOBAL NEWS

US Senate: HSBC allowed drug & terror money to

pass through its banks

Duvvuri Subbarao

STATE BANK OF INDIA

… a weekly news bulletin

IINNDDIIAA:: IISS TTHHEE GGRROOWWTTHH SSTTOORRYY CCUUTT SSHHOORRTT??

MISCELLANEOUS NEWS

Join us on Facebook…

PART TWO

Rakesh Jhunjhunwala

1. Infosys fails on Q1 results. Rival TCS grows stronger in April-June quarter 2. New microfinance companies provide cheaper loans 3. Pre-owned car market to see more than two-fold rise this year 4. US Senate: HSBC allowed drug & terror money to pass through its banks 5. Obama says it is still hard to invest in India

Rupee closed at 55.49/$ (as on 18 July) Source: Reuters The rupee weakened to its lowest level and closed at 55.49 on Wednesday. It tracked losses in the euro after the German Chancellor Angela Merkel expressed her doubts on the success of the European project (Euro crisis solution) and eventually resulting in the euro fall. Dollar demand from oil firms and defence companies also impacted rupee as Federal Reserve Chairman Ben Bernanke didn't hint at any clear stimulus or easing. On the contrary, he offered a gloomy view of the US economy's prospects. Traders are now focusing on the presidential polls on Thursday, following which the government is expected to revive stalled reforms like foreign direct investment in retail and aviation as well as an increase in diesel prices, among other things. Gold closes at Rs. 29191/10 gm (as on 18 July) Source: Reuters Gold fell for a second session on Wednesday on renewed fears over Europe's debt crisis and as speculations receded that more stimulus to boost a slowing U.S. economy were imminent. The metal was under pressure after comments from German Chancellor Angela Merkel, cited in a media report, raised concerns about the future of the euro zone. Bullion, a traditional inflation hedge, has also been more sensitive than equities and other commodities to expectations of U.S. monetary easing. Traders expect more near-term weakness in gold against a disappointing economic scenario.

he electronics industry accounts for two-fifths of manufacturing output in Asia, according to calculations by HSBC. So when electronics grows quickly, Asia's GDP tends to speed up too, to the tune of almost 0.2 percentage points for each full-point increase in the electronics sector. Unfortunately this correlation also applies

when things slow down. And recent signs are that Asia‟s electronics industry is doing just that: HSBC‟s lead indicator, which gives a rough two-month preview of future production, has slowed sharply in recent months, in contrast to the latest available output figures. One bright side, given the economic woes of Europe and America, is that Asian manufacturing is no longer as closely tied to Western markets as it was. Three of the five components that comprise HSBC's lead indicator measure conditions within Asia. So when the next rebound occurs, it is likely to be home-grown.

T

TTTOOOPPP FFFIIIVVVEEE HHHEEEAAADDDLLLIIINNNEEESSS OOOFFF TTTHHHEEE WWWEEEEEEKKK

EEECCCOOONNNOOOMMMIIICCC IIINNNDDDIIICCCAAATTTOOORRRSSS

CCCHHHIIIPPPSSS AAARRREEE DDDOOOWWWNNN Graphic Detail: The Economist

Ok, it seems US is taking a dig at India. First it was the esteemed TIME magazine which called our PM an „Underachiever‟ and now it is US President Obama who thinks that the Indian economy needs to open up more. These recent developments bring into mind at least three perplexing questions if not more. One, why a sudden halt in the otherwise fabulous India growth story? Two, how other countries are fairing in the slowdown? Three, why India is being looked upon to act as some sort of savior when her own economic numbers are less than satisfactory? Not long ago, there was big chatter about India overtaking China as an economic superpower. The whole world was enchanted with her impressive growth rate. India was „the‟ market. Period. Investors lined up thick while companies queued to get into the Indian market. All of a sudden, all such talk has vanished into thin air. Why? Though India did pull out some scary surprises for Investors with her retrospective taxation, GAAR guidelines, FDI reluctance and massive corruption, but the actual reason of the slowdown appears global. Let’s mull over the probable reasons accounted for the slowdown. Answer One: Sharp deceleration in investment: Gross fixed capital formation (GFCF), the productive part of aggregate investment, grew by 5.4 % in 2011-12 resulting in a growth rate of 6.9 %. In the worst crisis hit year 2008-09 however, GFCG grew by a mere 3.4 %, and in that year GDP grew by 6.8 %. So, the steep decline in growth this year cannot be ascribed entirely to the investment slowdown. High fiscal deficit: Analysts believe India has scored poorly on fiscal deficit. Its unchecked subsidies and social sector spending has crowded out private investment through a rise in interest rates. But fiscal deficit in 2011-12 is estimated at 5.9%. In 2009-10, it was even higher, 6.5%. The above analysis substantiates that there is much more to India‟s underperformance than simply India herself, though her policy logjam didn‟t either help matters much.

Answer Two: US GDP growth rates have been continuously falling from 4% in 2010 to 2% in 2012. US fiscal deficit, is $ 5 trillion. Its deficit-to-GDP ratio is 30 % which makes the eurozone deficit of 7 % appear like a joke. Moreover the Bush era tax cuts will expire by the end of this year and automatic budget cuts could start kicking in from January 2013. Analyst believe US could fall off a „fiscal cliff‟ if these things are not avoided. The only way US can get out of this mess and get money to pay its huge bills is by yet another round of printing of dollars. Europe too is following US footsteps. The ECB‟s (European Central Bank) core interest rate is 0.75% and will probably be pulled down to 0.5% by the end of this year. It is likely that EU will also have to print more Euros. It is prescribed that if

Euro is to survive as a single currency state, it should not remain as just a monetary union but become a fiscal union dissolving sovereignty of individual countries & create a single authority to govern Europe‟s finances. In Japan, deflation has been continuing for last 20 years. So it doesn‟t inspire hope. China is also witnessing slowdown. It cannot keep exporting to the rest of the world when they have no money to buy. China is now trying to boost domestic consumption as exports take a hit. Its second cut in interest rates in less than a month is indicative of her desperation to get things going on the domestic front. Answer Three: Brent Crude Oil has fallen below $100 per barrel from its peak value of $126 per barrel in March 2012. As per the analysts, every $10 decline in oil prices results in 0.3% decline in India‟s fiscal deficit. It means the fiscal deficit can finally see some shrinkage in the foreseeable future boosting Investor confidence. Also, RBI repo rate is 8% while interest rates are near zero in US, Europe and Japan making rupee a likely investment bet. It also means that India has a greater leeway in terms of cutting rates to arrest the domestic GDP slide than probably any other country. India can also benefit if the world further slides down into recession, similar to what happened in 2008-10 when the oil price crash brought down our inflation rates to zero from 12.5 %. Final word: There are ups and down but India has its basics in place. And hence the growth story is not yet over. If India puts up a brave front and implements some of the pending reforms, it can catch up fast. The slowdown is a combined effect of global forces and India‟s own indecisiveness in carrying out economic reforms. But trying to tell exactly what is responsible for that and quantify it, is like chasing the elusive. After all, its economics not physics.

CCCOOOVVVEEERRR SSSTTTOOORRRYYY::: IIINNNDDDIIIAAA::: IIISSS TTTHHHEEE GGGRRROOOWWWTTTHHH SSSTTTOOORRRYYY CCCUUUTTT SSSHHHOOORRRTTT???

Duvvuri Subbarao – Governor, Reserve Bank of India RBI governor – Duvvuri Subbarao is juggling between two major responsibilities - controlling inflation and inducing growth in the nation where dark clouds have recently shadowed the industrial output and policy flip flops have led to gloomy economic outlook. He is under constant pressure from the government & industry leaders to reduce interest rates, which is believed to push economic growth. But he is firm in his stand to not mellow down the rates, as the move is against anti-inflation measures.

Academician Par Excellence: Subbarao was born in Andhra Pradesh in 1949. He completed his bachelor‟s degree in Physics from IIT-Kharagpur and pursued his master‟s degree from IIT-Kanpur. Unlike normal IIT graduates who generally preferred making their career in corporates, Subbarao had different dreams. He always wanted to work for the civil services and soon after his masters he appeared for the tough All India Civil Service (IAS) examination. He ranked first in the exam and was one of the first IIT grads who entered administrative services. Subbarao also holds a master‟s degree in economics from Ohio State University; has studied Quantitative Economic Modelling as a “Humphrey Fellow” from MIT and later acquired a PhD in Economics from Andhra University for his thesis named "Fiscal reforms at the sub-national level".

Government’s White Knight: The chief economist has held various key positions with the government in the past. He served as the joint secretary in major departments like economic affairs, finance ministry and the Government of India. He was a Finance secretary in AP government, lead economist in World Bank, member of the Prime Minister‟s Economic Advisory Council and Finance secretary before his elevation to the post of RBI governor in 2008. As the finance secretary of Andhra Pradesh, he chalked out a turnaround plan that brought the state out of a major crisis. Subbarao took over RBI when inflation was running high at 12.5% and he had to design monetary policy that would curtail price rise. He was elected to hold the office for three years ending September 2011 but his services were extended for another two years owing to his good performance in bringing down the inflation under 8%. He is known for implementing a strict monetary policy and increasing the number of policy reviews from every four months to eight times in a year to avoid off-cycle rate fluctuations.

Rakesh Jhunjhunwala – Premiere Indian Investor and Trader Known as India‟s Warren Buffet, Rakesh Jhunjhunwala is the man who has earned huge sums of money from the stock market. He is a poster boy for the Bull Run in markets and has joined India‟s billionaire club with Forbes ranking him under “India‟s Top 50 billionaires list” with net worth of around $1.1 billion in 2010. He is supposed to have a “Midas Touch” as the shares he invests in rise to their highest within months. His investments are religiously followed by small traders and investors blindly invest in the companies that make it into his stock portfolio. Jhunjhunwala got fascinated with the stock market when he was 15. His father was an Income tax commissioner and his guide, who in the initial days helped him make sense of the fluctuations in share prices and its relation to news reports. He soon found out about the effect of company‟s annual reports on stock prices and thus started following them. It was a habit that started off as a curiosity for more knowledge but ended up helping him make billions. He completed his graduation from Sydenham College, Mumbai and acquired a degree in Chartered Accountancy.

Breakthrough: His first major break in the market was in 1986 with the stock of Tata Tea. He invested in those shares as he believed that the company was undervalued and shall yield benefits in the future. His predictions were right and within months the price of shares that he had bought for Rs.43 rose to Rs.143, thus making a profit of Rs 5 Lakh at one go. The second major success came with Sesa Goa. He acquired shares at Rs. 60 and sold it at a price of Rs.2, 200. He gives SENSEX the credit for his success over the years. As the SENSEX rose, his wealth increased.

A self made man: He is a self made man who has seen all ups and downs in life as well as in the stock market. The now touted India‟s most successful investor says he has seen his share of failures and has no plans to quit the investing business to start a financial corporation like Uday Kotak – who also started as an investor and ended up building the Kotak Mahindra Bank. He owns an asset management company Rare enterprises and is on the board of several companies like BNP Paribas, Bilcare and Provogue India.

“I must hasten

to add that

sacrificing

growth is only

in the short-

term. In the

medium-term,

there is no

trade-off

between

growth and

inflation”

“You have to

wait for right

moment before

investing in

stocks. Never

invest in any

stock without

proper idea on

its business

and

fundamentals.”

PPPEEERRRSSSOOONNNAAALLLIIITTTIIIEEESSS OOOFFF TTTHHHEEE WWWEEEEEEKKK

Founded: 1st July 1955 Head quarters: Mumbai, Maharashtra, India Revenues: $37 billion (as on Mar 2012) Employees: 2.92 lakhs Products: Credit cards, Consumer banking, corporate banking, finance & insurance, investment banking, mortgage loans, private banking & wealth management.

Banking all the way: The State Bank of India is the country‟s oldest bank and a premier in terms of balance

sheet size, number of branches, market capitalization and profits. Earlier known as the Imperial Bank of India, it got its current name in 1955 after its nationalization by the government of India. The public sector State Bank Group, with over 19,000 branches and more than 45,000 ATMs, has the largest banking branch network in India. SBI has 14 Local Head Offices and 57 Zonal Offices that are located at important cities throughout the country. It also has around 170 branches in over 35 countries. It has a market share among Indian commercial banks of about 20 per cent in deposits and loans. It has been rated as the 29th most reputed company by Forbes. State bank is one of the Big four banks of India with ICICI, PNB and HDFC. Even though the group has the Government‟s backing which gives it enviable security, the bank was behind private sector banks in

certain key areas like technology and branding. This however changed with OP Bhatt taking over.

Elephant Danced: When OP Bhatt took over the reins of SBI in 2006, ICICI with the market cap of $508 bn and a growth rate of 40-50 per cent as against that of 13-15 per cent of SBI was looking to become the largest bank in India. Mr. Bhatt made regaining market share his first priority. Mr. Bhatt projected an aggressive image of SBI in people‟s mind by focusing on marketing and pricing. The banker for every Indian ad campaign comes to mind. Consequently, total assets of SBI more than doubled in the past five years, while that of ICICI only increased by 76 per cent. SBI‟s shares rose by 250 per cent since 2006 & its market share touched Rs 167554 cr in 2010. The market capitalization of SBI rose Rs 70,000 cr in one year — which is the highest among all listed companies. Loans and deposits grew more than five-fold during his tenure when he spread the blue & green branding of SBI ATM to remote locations of the nation & increased the number of branches all over India. In order to attract more customers, SBI offered home loan at 8 per cent initially and then increasing it later according to the market price (also called as Teaser loan). This step irked RBI and eventually had to withdraw this product. Before retiring, OP Bhatt announced the merger of all five associate banks with the parent bank SBI by the end of 2013 as part of its consolidation efforts. Today SBI is the largest player in the Indian banking industry and has come way ahead of its competitors, something which other Public sector players would do well to emulate.

Current Scenario: SBI‟s Nonperforming assets increased because of the grounding of Kingfisher airlinesand its merger with its associate bank (State Bank of Indore) and at present it has the largest NPAs followed by ICICI bank. SBI’s profit plunged in Q4, FY11 by 99 per cent to Rs. 21 cr from Rs. 1,870 cr in the past year, as a result of higher provisioning for sticky assets, retirement benefits and operating profit. This provisioning was referred to as a „one time clean up‟ by the new Chairman of SBI, Mr. Prateep Choudhari. SBI’s Capital Adequacy Ratio (which is used to protect depositors) decreased by 141 basis points to 11.98 per cent and consequently its credit ratings were also downgraded by Moody’s. Eventually, the government decided to infuse Rs. 7900 cr in SBI. The government had budgeted Rs 6,000 crore for bank capitalization in the current year. It has also got approval for another Rs 14,000 cr from the Planning Commission. The government will infuse capital through preferential allotment. The infusion will also increase government‟s holding in SBI to 66 per cent from the current 59.6 per cent and increase Tier 1 capital to 9 percent.

Intelligence Bytes: 1) SBI gave a loan of Rs. 100 bn to NTPC, making it the largest loan SBI had ever given to any single customer in its entire history. 2) SBI denied Kingfisher airlines further loans as it already has a debt of $1.4 bn which was restructured by SBI and other lenders.

CCCOOORRRPPPOOORRRAAATTTEEE IIINNNTTTEEELLLLLLIIIGGGEEENNNCCCEEE::: SSSTTTAAATTTEEE BBBAAANNNKKK OOOFFF IIINNNDDDIIIAAA

1) Infosys fails on Q1 results. Rival TCS grows stronger in April-June quarter – BS/ Moneycontrol/ TOI IMPACT: India‟s second largest IT Company, Infosys, fell on investor expectations when it posted its April-June results. The company announced that it will not be able to meet previously announced growth target of 8%-10% and cut the revenue growth target to half at 5%. It is much lower than growth estimated by Nasscom of about 11%-14% in the IT sector for FY13. Infosys results showed lower than expected 32.9% rise in net profit at Rs 2,289 crore and the sequential (compared to previous quarter) net profit fell by 1.2%. The revenue figure went up by 28.5% at Rs 9,616 crore compared to last year quarter‟s results, showcasing a tepid performance. However, India‟s top software exporter, Tata Consultancy Services (TCS), reported a net quarter profit of 38% year on year to Rs 3,280.5 crore and the sequential net profit increased by 14.6%. The revenues also grew by 38% at Rs 14,869 crore. KEY PLAYERS: Infosys, TCS WHY IT IS IMPORTANT? Infosys said the dismal performance was due to market volatility, loss of an important contract – which dented the company‟s revenues by $15 million, high attrition rate, rising billing rates and shooting visa costs. Barclays Capital downgraded Infosys shares to “equal-weight” after the quarter results were out and replaced them with Hindalco on the top ten stock picks list in India. The chief executive of Infosys, S. D. Shibulal, has also said that as part of the Infosys 3.0 strategy, the company is looking for acquisitions to expand its presence in consulting & product platforms. 2) New microfinance companies provide cheaper loans – BS/TOI/ET IMPACT: The microfinance industry has in the past months seen the fall of SKS Microfinance – India‟s largest microfinance institution (MFI) and other such firms owing to high interest rates. But new players entering the scene are reviving the industry with a funding model that is completely new to the Indian market. Start-ups like MicroGraam & Rang De have used the internet based funding model wherein sourcing is done by peer-to-peer approach. Investors are attracted by the internet & the capital raised is disbursed to rural entrepreneurs at cheaper interest rates. Typically industry rates are between 24%-36%, but these firms are operating with interest rates of 10% to 15% & still making profits; and also giving returns to investors. MicroGraam which has been started by an ex-Infosys employee has managed to acquire funds worth Rs 2 crores till date and has distributed the amount across four Indian states. Traditional microfinance companies take funds from banks and lend it to entrepreneurs. Since banks increased their rates from 9%-12% to 15%-18%, these firms had to push the burden on end consumers, leading to their failure.

KEY PLAYERS: Microfinance sector, MicroGraam, Rang De, SKS Microfinance WHY IT IS IMPORTANT? MFIs have been going through a tough time as RBI norms regarding their capital adequacy, provisioning needs and their net worth barred them from releasing fresh loans. RBI had earlier introduced qualifying asset criterions for registering as Non-Banking Financial Corporations – MFIs. Many small MFIs bore the brunt of the policy bottleneck and they could not lend money as it did not come under priority sector lending. SKS Microfinance which had started its operations from Andhra Pradesh had to shut down its operations in the state owing to unsustainable conditions.

3) Pre-owned car market to see more than two-fold rise this year – Hindustan Times/TOI/BS IMPACT: According to industry experts, used car market will grow up to 11 percent this year whereas new car market will see a slow growth at 3% to 4%. In developed countries per single car sale, three used cars are sold. But in India, the size of used cars & new cars market is the same. The organized sector, which accounts for only 11% of the used car market, is supposed to grow by around 15%-17% this year. Besides, the larger chunk of the organised sector is ruled by OEMs or vehicle manufacturers like Maruti, M&M and so on. Over two million pre-owned cars are sold per year in India. The major challenge for the used car market is financing. The interest rates for loans on used cars are very high compared to loans for new cars. KEY PLAYERS: Used car market, Mahindra First Choice, Carnation, Maruti True Value WHY IT IS IMPORTANT? With the growing demand for used cars, industry biggies are doing their best to push up sales. Mahindra First choice, which deals with buying and resale of used cars aims at acquiring over 34% growth in this year and has increased its distribution network across Indian states. Maruti True Value – the used car business of Maruti group has also geared up for a 20% growth in FY13. Similarly Carnations – a venture started by an ex-Maruti executive, which also deals in sale of pre-owned cars is now making an online platform for the used car market. Customers can buy and sell pre-owned cars on this web portal.

NNNEEEWWWSSS AAANNNAAALLLYYYSSSIIISSS

4) Gujarat State Petroleum Corp (GSPC) to buy BG’s stake in Gujarat Gas Co Ltd (GGCL) – DNA/TOI IMPACT: Britain based BG group is planning to exit Gujarat and is in talks with GSPC for selling off its 65.12% stake in the Gujarat Gas Co. The GSPC consortium has offered a price of Rs 3,000 crore for the stake that BG had valued for Rs. 4,500 crores when it announced its plan to sell the stake in November last year. But share prices have come down since then. Though the current market price of the GGCL stock is Rs. 313, GSPL offered only Rs.300 per share, which is lower than expected by BG and it is in talks over the bid amount. Adani Group & Torrent Group that operate in Gujarat were eager to buy the stake but it is speculated that Gujarat government asked leaders of the two companies not to bid for the stake & thus GSPC became the sole bidder. It is also believed that GSPC‟s partners in the

consortium ONGC & BPCL find that the price offered by GSPC to be very high. GSPC has 50% stake in the consortium and ONGC & BPCL own 25% stake each. KEY PLAYERS: GGCL, GSPC WHY IT IS IMPORTANT? Incidentally, last year GSPC had filed a complaint against GGCL in Competition Commission of India (CCI) for overpricing gas in Surat. BG group had entered Gujarat in 1997 when it acquired a majority stake in GGCL. If the deal goes through, GSPC will have monopoly in major parts of

Gujarat. Though the two companies have been in the same business for years, but have never competed against each other. State owned GSPC is the largest distribution company in Surat & GGCL the largest private player in the sector. 5) Reebok India operations in troubled waters – TOI/BS/Livemint/ET IMPACT: Latest advancements in the Reebok India case suggests that it is not about “corporate fraud” as it was earlier touted to be, but a case of “tax evasion”. Adidas had earlier terminated the CEO and COO of Reebok India and filed a case against them for an alleged scam of Rs.870 crores. I-T department has found that there is no money laundering but have sensed wrong doings in the book of accounts. It has found misrepresentations in the dealer discounts and discrepancies in financial accounts. This has ultimately led to evasion of taxes worth Rs.140 crores. The department has also filed a case against two auditing companies handling accounts of Reebok India. Another revelation by Enforcement Directorate states that Reebok has violated Foreign Exchange Management Act (FEMA) & has been operating un-authorized retail outlets in India. Reebok was allowed to enter India on two conditions – first – to export goods worth Rs.8000 crores within 10 years of starting operations and second – to manufacture goods locally. However, it has come to light that neither has exported goods to other countries and has imported most of the goods. KEY PLAYERS: Reebok, Adidas, Indian government WHY IT IS IMPORTANT? Reebok is the leading international sports brand in India ahead of Puma, Nike & Adidas – its parent company. Adidas had in 2005 acquired Reebok, but the two companies have been operating as separate entities. Now Reebok India wants to get out of the financial fraud (and associate complications) and has hired management consulting firm Ernst and Young for a major restructuring drive. 6) Finance Ministry asks public sector companies to invest surplus cash in expansion – BS/ET IMPACT: The Indian government has asked PSU‟s to invest excess capital for their overseas expansion & growth. Earlier in January, the Prime Minister‟s Office (PMO) has asked the public companies to invest in infrastructure sector which needs huge investments. The PSUs have surplus capital of Rs. 1 lakh crore which should be invested in the growth of the economy. Generally these PSUs including Coal India, NTPC, ONGC & others just deposit surplus cash in the banks and gain interest. The government has given the go ahead for PSUs to invest in mutual funds & other investment instruments. However, the Odisha Mining Corporation (OMC), which is sitting on a Rs.4,500 crore surplus held in banks, has recently announced that it does not have any plans to invest in the market.

The Department of Public Enterprises and the Department of Economic Affairs Additional Secretary are in the process of reviewing the guidelines for PSUs surplus cash investments. They have also approached SEBI for consultation on the matter. KEY PLAYERS: The Finance Ministry, PSUs WHY IT IS IMPORTANT? The infrastructure sector requires a huge investment of over one trillion dollars in the next five years. The government is not in favor of making such a big investment and is hence promoting public private partnerships in this sector. By this move the government wants to reduce the fiscal deficit,

which had earlier risen to 5.9% of GDP in FY12.

7) Flipkart likely to run out of money in next nine months- TOI/Forbes IMPACT: By latest estimates Flipkart will need investments worth $150 million to continue operations beyond nine months. The news comes amidst investors‟ growing concern about the company‟s plan to launch an IPO in the US. Its long time partners Tiger Global & Accel Partners have already invested $100 million this year and are unlikely to invest more. This means the company will be looking out for new investors now. The company might expect some funding from PE giants like Kohlberg Kravis Roberts and Bain Capital, but they too want better perspective on Flipkart‟s financials & management processes before it floats its shares in the US market. This is the very same concern which was raised last year when the company‟s founders visited New York for funds. Analysts say that Flipkart has been looking for IPO openings outside India since 2010. It is because SEBI norms make it mandatory for companies to show profits before they register in local bourses. The company with a 5000 strong workforce has relied on schemes like Cash on Delivery, Money back and free delivery to become popular in a short span of time. However sustaining these processes has become a huge headache for Flipkart. KEY PLAYERS: Flipkart, Indian e-commerce industry, Tiger Global, Accel Partners WHY IT IS IMPORTANT? To maintain investor‟s confidence, Flipkart hopes to show Rs 2,500 crore revenues in this fiscal year. This translates to 400 percent growth over last year‟s numbers. The company which sells more than 17 thousand items on daily basis is facing huge competition from companies like Homeshop18.com, myntra & Snapdeal.com. It has invested heavily in logistics and delivery infrastructure. However, investors of late have become apprehensive about the company‟s operations. One can keep track of related stories to stay abreast of India‟s e-commerce Industry. 8) RBI asks Finance Ministry to stop micro-management of banks- BS/ET IMPACT: Governor Duvvuri Subbarao has raised his voice against government‟s constant interference with functioning of public sector banks (PSBs). He pointed that there is already a „board mechanism‟ via which government should exercise control. PSBs have many government appointed officials in their boards while their top management is also selected by the government. Still it‟s RBI which has to play the role of regulator when it comes to financial institutions, and not government. However, Finance Ministry seems to have overlooked this fact quite frequently in

recent days, issuing not less than 40 directives to PSBs. The Governor had earlier challenged the ministry for its efforts to form an independent debt management office, a role which RBI used to handle so far. In recent days he has also complained about misuse of government-subsidised agricultural credit. KEY PLAYERS: RBI, PSBs Duvvuri Subbarao, Finance Ministry WHY IT IS IMPORTANT? The recent comments by RBI Governor have come off as a result of government directive asking PSBs to cap the share of bulk deposits in total deposits at 10%. Such diktats possibly undermine the role of RBI. It is important for India to have a

capable and independent regulator for financial institutions as governments have more than often engaged themselves in populist measures like offering loan waivers, beyond reason. 9) US Senate: HSBC allowed drug & terror money to pass through its banks- BBC/TOI/ET IMPACT: A US Senate report has found that HSBC bank has failed to check suspicious funds like drug money from Mexico and possible terror funds from Saudi Arabia, Syria & Iran to pass through its banks. The money laundering allegations have been accepted by the bank. The bank‟s compliance executive has also resigned after the revelations. These findings have come after a year-long investigation by the senate committee. Now the bank has to appear before the Senate and has said that it will submit a formal apology at the hearing. It is not the first instance when a major financial institution has been found engaged in such activities. In 2010, a financial services company Wachovia (now a part of Wells Fargo) was held accountable for handling Mexican drug money, for which Justice Department imposed a penalty of $150 million. In June 2012, ING was made to pay around $600 million for violation of certain US sanctions against Cuba and Iran. In fact UK based HSBC has been facing money-laundering allegations for nearly a decade now. KEY PLAYERS: HSBC, US Justice Department WHY IT IS IMPORTANT? According to the senate report HSBC was doing business with Saudi Arabia's Al Rajhi Bank. It is widely known that one of the main founders of Al Rajhi bank funded terror group Al-Qaida in the initial years. The report also links HSBC with certain terror funds from Bangladesh. These findings clearly indicate that the bank has not only violated financial norms but exposed many countries, including India, to probable terror activities.

Sachin Bansal(left) and Binny

Bansal

10) FIIs pouring tonnes of cash in India, SEBI in alert mode- BS/TOI IMPACT: A glance at major business news headlines in India gives a fair bit of an idea about slow growth, downgrade and ridicule by global rating agencies, weak monsoon, policy paralysis and so on. Foreign Institutional Investors (FIIs) probably aren‟t reading any of those. They have invested more than Rs 8000 Crore in first 17 days of July. In the same period DIIs (Domestic Institutional Investors) have pulled out more than Rs 3600 Crore from the market. It‟s worth noting that the same FIIs were selling heavily for three consecutive months prior to beginning of July. The sudden reversal in trading trend, analysts say, is caused by developments like monetary easing by global central banks along with rise in apprehensions about Chinese markets. This has made emerging markets more lucrative than the developed ones. The FIIs have also shown interest in Indian government bonds as they offer higher interest rates than any other country. Indian government has also increased the limit for foreign investment in its bonds. Market

regulator SEBI on the other hand has sent letters to FIIs seeking details about their end-beneficiaries along with original sources of capital investments in Indian companies. It‟s concerned that 10 per cent foreign individual investment cap in Indian companies could be violated by many, in case of lax in vigil. KEY PLAYERS: FIIs, SEBI, Indian Government WHY IT IS IMPORTANT? Analysts say that a weak Rupee has made investment in India cheaper for FIIs which might benefit them in the long term. Bankex, Healthcare, realty & consumer durables have remained the centre of attraction for

FIIs. Stock markets are vital for growth of industry and commerce and eventually affect the economy of countries to a great extent. The news is important from macroeconomic perspective. 11) WPI Inflation comes down marginally to 7.25%- TOI/BS IMPACT: Inflation eased marginally in June to 7.25% against 7.55% in May. A year ago in June 2011 it was at 9.51%. Higher vegetable and pulses prices have however restricted Food Inflation from coming down to single digit figure. The Food inflation has remained in double digits for the fourth consecutive month. At the same time there was some relief for the common man as prices of milk, egg, meat, fish and fruits have come down. Commenting on the figures, C Rangarajan, who heads Prime Minister's Economic Advisory Council, said that inflation might rise again if the monsoon is not up to expectations. This is going to be a crucial factor in shaping the policies of RBI, which is going to have a policy review on July 31. KEY PLAYERS: Indian Government, RBI WHY IT IS IMPORTANT? Inflation data corresponds to rise in prices with standard level of purchasing power as one of the constraints. Indian government has been using WPI (Wholesale Price Index) data for working its policies. However, it is not an accurate method of monitoring the real trend. Voices for adoption of Consumer Price Index have been raised many times in the recent past. It is because an increased divergence between WPI & CPI figures (WPI graph coming down & CPI graph going up) makes it difficult to gauge real Inflation trend. Pointing at the same issue, RBI Governor D Subbarao said recently that India should use PPI (Producer Price Index). 12) Corporate Affairs Ministry seeks CCI probe on possible cartel linked to airfare rise- ET/DNA IMPACT: Corporate Affairs Ministry has noted that in the last two months there has been a considerable rise observed in the pricing of Air Tickets on domestic routes. It has notified the observation to the Competition Commission of India (CCI), which recently imposed a penalty of more than Rs 6000 crore on 11 cement manufacturers for forming a cartel. Corporate affairs minister Veerappa Moily‟s observations are however not new. Last month Directorate General of Civil Aviation (DGCA) had instructed the domestic-carriers to be careful about increasing route-wise fares. However, DGCA reacted to the reports and said that the situation is not alarming. It says that the airfares, though high are within prescribed „price bands‟. It further clarified that price hikes on certain routes is probably justified. It may be recalled that Delhi has increased the UDF (User Development Fee) by 345%, while there has been a consistent pressure on other airlines due to Kingfisher-crisis.

KEY PLAYERS: DGCA, CCI, Corporate Affairs Ministry, Domestic Air Carriers WHY IT IS IMPORTANT? The competition watchdog had started a similar probe on airlines (suo moto investigation) in 2010 during festival season but later closed it citing lack of evidence. Voices are often raised about the cartelization practice among the telecom operators in India. Moreover, Telecom department even sought Union Cabinet approval on setting the communications sector free from CCI‟s jurisdiction in March 2012. It‟s important that the CCI hold enough powers to ensure interests of consumers are not hit by maintaining competition in the markets.

13) Obama says it is still hard to invest in India- TOI/Forbes/Indian Express/The Hindu IMPACT: Obama was cautious when he used American business community to mask his comments criticizing the investment environment in India. However, it still attracted a lot of backlash from almost every corner of Indian business community, government and even opposition. The US President has gone on record urging India to go for a „wave of reforms‟ as it is still „too hard to invest in India‟. Obama also pointed that India has restricted foreign investment in too many sectors. Reacting to this Anand Sharma, who handles Commerce & Industries Ministry, said that Obama‟s perception and doubts are misplaced. India Inc reciprocated similar sentiments, while BJP simply found US head‟s remarks laughable. Among the only few who supported Obama‟s view was CII President Adi Godrej. He said India needs to relax its multi-brand FDI norms and announce other Confidence Building Measures (CBRs). KEY PLAYERS: Barack Obama, Indian Government WHY IT IS IMPORTANT? Obama‟s comments, for a while have given Indian media yet more “masala” to experiment with. However, it seems that it has not affected the business or markets to any extent. At best it reflects the general perception of Americans about Indian economy. It remains to be seen if government is serious about changing that. 14) Indonesia becomes most bullish consumer, India loses top position: Nielsen- Reuters/DNA IMPACT: A Nielsen report on Consumer confidence, which measures the degree of general optimism about overall state of the economy along with individual‟s personal financial situation, has found Indonesia as the most bullish consumer. It replaces India where Consumer confidence has come down for the first time in nine quarters. One of the officials present at the release of report said that optimism in Indonesia is further fuelled by investment-upgrades from global rating agencies like Moody's & Fitch. India on the other hand has suffered a hit due to falling employment sentiment & reduced spending. Analysts say that rising fuel prices and inflation are also responsible for this fall. The

report also indicates that consumer confidence has risen sharply in Egypt, which selected a new president just last month. It is now among the top 10 most confident nations in Nielsen‟s list. On the other hand Italians, who are not so happy with new austerity measures, have brought the country to third-lowest rank in the Nielsan‟s list. KEY PLAYERS: Nielsen, India, Indonesia WHY IT IS IMPORTANT? Consumer Confidence is an economic indicator which is readily used by companies‟ policy makers, investors, banks and various other government agencies. For manufacturers it even helps in deciding on production volumes. The news is important from macro-economic perspective.

15) America’s double standards for Healthcare Policies – Livemint/Firstpost/The Hindu Business Line IMPACT: The US has upped its ante against the Indian government for allowing Natco Pharma to make cheaper generic version of Nexavar – Bayer AG‟s product used to treat cancer. The deputy director of US Patent & Trademark Office, Teresa Rea, recently said during a meeting that by allowing “Compulsory Licensing”, India was violating rules of World Trade Organization (WTO) & that it shall take this issue to WTO. Compulsory licensing allows other pharmaceutical firms to make patented drugs without taking patent holders permission. In February, Indian Patent‟s Office allowed Hyderabad based Natco Pharma to make generic copy of Nexavar which costs about Rs. 8,800 compared to the original drug worth Rs. 2.8 lakhs. Natco also pays six percent royalty to Bayer. India has retaliated saying that it is not violating any rules of WTO. As a matter of fact, The Trade-Related Aspects of Intellectual Property Rights (TRIPs) of WTO allows members to grant compulsory licences on drugs in case of emergencies. The government had allowed compulsory licence on Nexavar as the drug was too expensive and did not benefit the general public. KEY PLAYERS: The US Government, Indian Government, Bayer, Natco Pharma WHY IT IS IMPORTANT? On one side, the Obama administration is trying to win the election for the second time by pushing the Obama Healthcare Initiative, which would allow medical facilities to non-insured or under-insured Americans. On the other hand it is opposing the governments of developing & under developed nations who are trying to bring down cost of drugs in their own countries. The US is thus allowing pharmaceutical giants to mint money from poor countries and safeguarding its own healthcare system.

MMMIIISSSCCCEEELLLLLLAAANNNEEEOOOUUUSSS NNNEEEWWWSSS

Continued from last week…

Question: That’s impressive alright! And by internal channels you mean?

Answer: We had prospect details coming from multiple channels in Citi, like from prospect inquiries, corporate

deployments, mall events,etc. It is how most banking organizations operate though the exact details are classified

information.

Question: Was this, I mean prospect conversion, the most difficult part of your job? If not then what was?

Answer: I think the most difficult part was the start of every

month, knowing that all you got for the bank last month is

redundant now and you need to start fresh. One thing about

banking is that you have certain time gap required between two

financial products. It‟s a norm, so the client whom I brought in Jan

2012, will be pretty useless for the next few months. Except for

liability products, most other products do have such a clause,

which is very valid but just affects you on the sales side. Also, the

customer who signs up with you for a product, no matter whether

he stays loyal for two months or ten years, you don‟t get benefited

by it. I would say that these are the general issues faced by a

front-end executive. Also the fact is that banking is a push

product, and it deals with mostly "need based products" which people take when there is a need and that‟s why I feel

a person who can sell a financial product can sell anything.

Question: Now keeping this in mind, what would you say are the most important skill sets required for the

job?

Answer: To get ahead in this job, you need to have the passion for all the products, you can‟t just stick to one and be

happy because it‟s not doing justice to what you are enrolled for. You need to be very open; a customer who might

have just asked you about a Personal loan might actually have been misdirected by someone and might actually need

a home loan. You need to be alert, because a prospect for an "x" product can become a customer for "y" product. You

also need to have your strategies because this is a market based on numbers and rates. If you plan smartly, you will

never lose a customer just because of 1% higher rate. Just a small instance, a 1 Lakh loan running for 1 year for 15%

and 16% has a difference of Rs.30 per EMI. I don‟t know how many people actually check this difference. Yes 16% is

high, but we need to be ready and be tactical to make them feel it‟s worth that price. Much like Apple does.

Question: That does make sense, pity not many people

know this. Now can you tell us, what is the one thing about

your job that you loved the most?

Answer: The work culture, transparency and the freedom to

approach even the country head. It‟s your choice, if you want you

can sit in your cabin and be content, otherwise it‟s an open field to

explore, learn and enjoy. Citi has been a very special place and to

be part of Citi has helped me grow as a better professional and

human.

Question: That’s nice to hear. Did this extend to your relationship with your immediate reporting seniors?

How were they? Was there any mentoring?

Answer: Yes, it has a lot to do with the mentoring and guidance I received from my boss, who was the Sales

Manager. He put in me, the right thoughts in the right manner. People talk about bad bosses, arrogant bosses. I had

been blessed with a boss who advised me like a brother and who interacted with me like a friend. I think who you are

has a lot to do with the people around you. I don‟t think we can build a great monument without pillars, my

foundation was God and I got some strong pillars in my manager and a few other colleagues.

JJJOOOBBB PPPRRROOOFFFIIILLLEEE::: IIINNNTTTEEERRRVVVIIIEEEWWW WWWIIITTTHHH MMMRRR... PPPHHHIIILLLIIIPPP GGGEEEOOORRRGGGEEE PART TWO

Part 2

Question: That’s inspiring, now coming to something that a lot of people want to know. What kind of

stress levels did you experience in your job? Were you able to maintain a work life balance? What kind of

targets did you have to deal with?

Answer: As I said, industry wise the stress level is pretty high. In Citi

also we had pressure of targets. But it was too hard only when you fell

very short of your set numbers. Personally I never went through too

much of stress. Nevertheless, I didn‟t feel we had the best work life

balance. It was fine, but there were weekend deployments which were

stressful especially after five days of continuous sales. Targets were

revenue based, and it was for every product. Well devised but very

challenging. I think that‟s where your passion matters, it‟s impossible to

do 5 different products in a month unless you really want to. The

revenue target can be achieved by doing a huge number for one product

but the model requires equal participation across products. In fact, lots

of people have personally told me about the difficulty of handling all the

products. So stress and work-life balance depends a lot on the person.

Question: That’s enlightening. Now coming to what everybody works towards. What was your appraisal

structure? Was there any kind of rewards and recognition system in place? Also was the job financially

rewarding, in terms of incentives etc?

Answer: In my opinion, there was something lacking in the appraisal structure and the system that rewarded its

people. Incentives were pretty tough to earn as the revenue targets set were pretty high, you had to put it in for

every 30 days to get to your target. After which whatever you do, you get half of that as a payout. The recognition

system again was a generic one which makes everyone compete, but where it‟s impossible to judge two executives of

two departments. I think there was failure in sending in Awards in time. Some initiatives didn‟t even go on to

announce the results. I think it is something Citi can always work on and get in a better system that gives an

employee the recognition he or she deserves.

Question: Looks like there is room for improvement. What motivates you to achieve excellence?

Answer: I think the model just didn‟t do justice to a lot of people who

excelled, so many people are still unsure about where and when after this

role. This is a state that Citi needs to move out from. Here excellence now

is again an individual goal, what motivated me was the thought that,” I am

going to learn and it‟s too early to think way ahead”. I am not saying we

shouldn‟t dream big, I walked into Citi without too many dreams but the

more I performed the more I dreamt. I think the recipe for excellence is

not something or someone who needs to motivate you, it‟s about what you

want to be today when you are a sales guy. I wanted to be the best here

and to an extent I did do well.

Question: So the final question. Where do you see yourself in the near future?

Answer: I chose to move out of India due to family commitments and I have chosen a very challenging industry. I

am now going to join a general insurance company in Qatar, Libano Suisse Insurance Company. I am joining as an

"Account Executive" basically to handle company accounts, to cover & insure their premises, exports, cargo, assets &

workmen. It‟s a growing market and I am looking ahead to doing my best. 3-5 years from now, I cannot be sure, but

I am planning on becoming a Chartered Insurer and manage a unit in this company.

SOURCES

SOURCES FOR ECONOMIC INDICATORS, STATS & GRAPHS

http://in.reuters.com/article/2012/07/18/markets-india-rupee-dollar-idINDEE86H07T20120718 http://af.reuters.com/article/metalsNews/idAFL4E8II29020120718

http://www.economist.com/blogs/graphicdetail/2012/07/focus-2

SOURCES FOR COVER STORY http://indiatoday.intoday.in/story/pm-manmohan-singh-finance-ministry-economy-revival/1/204089.html-

http://www.business-standard.com/india/news/rules-for-reform/480689/ http://economictimes.indiatimes.com/opinion/editorial/why-blame-telcos-for-the-huge-debt-imposed-on-them-by-bad-

policy/articleshow/15024836.cms http://economictimes.indiatimes.com/opinion/editorial/let-us-focus-on-our-own-problems-as-we-identify-them-here-in-

india/articleshow/15012864.cms http://economictimes.indiatimes.com/news/economy/indicators/india-must-carry-out-difficult-economic-reforms-barack-

obama/articleshow/14948648.cms http://economictimes.indiatimes.com/opinion/editorial/governor-where-we-stand-depends-on-where-we-sit-in-the-world-of-banking-

as-well/articleshow/14978276.cms http://www.firstpost.com/economy/3-reasons-why-india-and-the-sensex-still-have-hope-374147.html

http://www.firstpost.com/economy/revisiting-sensex-60000-why-india-is-back-in-the-game-370852.html http://economictimes.indiatimes.com/opinion/columnists/swaminathan-s-a-aiyar/indians-getting-outraged-at-criticism-abroad-

shows-immaturity-inferiority-complex/articleshow/15023646.cms?curpg=2 http://economictimes.indiatimes.com/opinion/editorial/interest-rate-tweaks-wont-boost-growth-but-determined-policy-action-

will/articleshow/14815250.cms http://economictimes.indiatimes.com/opinion/columnists/t-t-ram-mohan/economic-slowdown-do-we-know-

why/articleshow/13877688.cms?curpg=3

SOURCES FOR PERSONALITIES OF THE WEEK: http://www.rbi.org.in/scripts/governors.aspx/#dsrao

http://en.wikipedia.org/wiki/Duvvuri_Subbarao http://in.reuters.com/article/2011/04/08/idINIndia-56211120110408

http://www.firstpost.com/economy/subbarao-opens-two-more-fronts-in-battle-with-finmin-377000.html http://www.business-standard.com/india/storypage.php?autono=333254

http://timesofindia.indiatimes.com/business/india-business/All-eyes-on-RBI-Governor-Duvvuri-Subbarao-as-rate-cut-expectations-rise/articleshow/14204723.cms

http://en.wikipedia.org/wiki/Rakesh_Jhunjhunwala http://ibnlive.in.com/news/i-am-not-warren-buffett-rakesh-jhunjhunwala/266124-7.html

http://www.indiansharemarket.org/rakesh-jhunjhunwala-holdings-portfolio-equity-investment-track/ http://www.myjourneytobillionaireclub.com/2010/08/rakesh-jhunjhunwala.html

http://www.investorzclub.com/2011/05/rakesh-jhunjhunwala-quotes.html

CORPORATE INTELLIGENCE http://en.wikipedia.org/wiki/State_Bank_of_India

http://www.investopedia.com/terms/c/capitaladequacyratio.asp http://www.moneycontrol.com/financials/sbi/consolidated-balance-sheet/SBI

http://www.moneycontrol.com/news/business/how-is-op-bhatt-steering-sbi-through-troubled-times_409323.html

http://articles.economictimes.indiatimes.com/2011-03-30/news/29361951_1_op-bhatt-state-bank-om-prakash-bhatt http://www.livemint.com/2011/05/17134120/SBI8217s-profit-plunges-99.html

http://www.livemint.com/2011/05/17222749/SBI-the-elephant-takes-a-nast.html?h=A2 http://www.thehindu.com/opinion/columns/C_R_L__Narasimhan/article2543209.ece

http://articles.economictimes.indiatimes.com/2012-02-07/news/31033905_1_sbi-chairman-pratip-chaudhuri-priority-sector-advances-loan

http://www.thehindubusinessline.com/industry-and-economy/banking/article1685093.ece?homepage=true http://articles.economictimes.indiatimes.com/2012-05-19/news/31778104_1_retail-loans-bad-loans-retail-lending

SOURCES FOR NEWS ANALYSIS (1-15)

1) Infosys fails on Q1 results. Rival TCS grows stronger in April-June quarter – BS/ Moneycontrol/ TOI http://business-standard.com/india/news/infosys-results-disappoint-market-again/480297/

http://www.moneycontrol.com/news/results/tcs-rubs-saltinfosys-woundsstrong-q1-earnings_729530.html http://in.reuters.com/article/2012/07/16/idINL4E8IG1JP20120716

http://timesofindia.indiatimes.com/tech/news/software-services/TCS-gains-from-fall-Infy-feels-the-pinch-of-client-exits/articleshow/14862084.cms

http://articles.timesofindia.indiatimes.com/2012-07-12/software-services/32649722_1_infosys-bpo-d-swaminathan-challenges-of-slow-demand

2) New microfinance companies provide cheaper loans – BS/TOI/ET http://timesofindia.indiatimes.com/business/india-business/Microfinance-companies-take-over-industry-with-low-cost-

loans/articleshow/14837493.cms http://business-standard.com/india/news/rbi-may-relax-norms-to-revive-microfinance-industry/177442/on

http://articles.economictimes.indiatimes.com/2012-07-13/news/32663789_1_sks-microfinance-lower-outstanding-portfolio-

operational-income

3) Pre-owned car market to see more than two-fold rise this year – Hindustan Times/TOI/BS http://timesofindia.indiatimes.com/business/india-business/Used-car-market-growth-to-more-than-double-this-

year/articleshow/14879410.cms

http://timesofindia.indiatimes.com/business/india-business/Mahindra-First-Choice-to-ramp-up-used-car-

business/articleshow/14861179.cms http://www.hindustantimes.com/News-Feed/Auto/Second-hand-car-sales-zoom-as-slowdown-bites/Article1-881785.aspx

http://www.business-standard.com/india/news/carnation-says-faster-bloom-needs-branch-regraft/480535/ 4) Gujarat State Petroleum Corp (GSPC) to buy BG’s stake in Gujarat Gas Co Ltd (GGCL) – DNA/TOI

http://www.dnaindia.com/india/report_gujarat-gas-is-a-good-buy-for-gujarat-state-petroleum-corporation_1714552 http://timesofindia.indiatimes.com/business/india-business/Adani-and-Torrent-stopped-from-bidding-for-BG-stake-in-Gujarat-

Gas/articleshow/14857686.cms http://www.dnaindia.com/money/report_bg-group-wants-gujarat-gas-deal-sealed_1716138

http://timesofindia.indiatimes.com/business/india-business/Can-BG-spoil-Modis-BIG-picture/articleshow/14879586.cms 5) Reebok India operations in troubled waters – TOI/BS/Livemint/ET

http://timesofindia.indiatimes.com/business/india-business/Tax-evasion-not-corporate-fraud-at-Reebok-India/articleshow/14966932.cms

http://www.business-standard.com/generalnews/news/i-t-summons-reebok-auditors-for-recording-statement/33276/ http://economictimes.indiatimes.com/news/news-by-industry/services/retailing/enforcement-directorate-books-reebok-for-retail-

sale-in-india/articleshow/15027043.cms http://videos.livemint.com/2012/07/16215714/Reebok-India-said-to-hire-Eam.html?atype=tp

http://economictimes.indiatimes.com/news/news-by-industry/services/retailing/sfio-finds-dubious-deals-between-reebok-india-parent-adidas-ag/articleshow/15024690.cms

6) Finance Ministry asks public sector companies to invest surplus cash in expansion – BS/ET http://economictimes.indiatimes.com/news/economy/infrastructure/government-asks-cash-rich-psus-including-coal-india-bhel-and-

ongc-to-invest-funds-in-expansion/articleshow/15030160.cms http://www.business-standard.com/india/news/invest-surplus-funds-in-expansion-govt-to-cash-rich-psus/179183/on

http://www.business-standard.com/india/news/omc-sittingrs-4500-cr-cash-surplus/480789/ http://www.thehindubusinessline.com/markets/article3565670.ece

7) Flipkart likely to run out of money in next nine months- TOI/Forbes

http://forbesindia.com/article/boardroom/can-flipkart-deliver/33240/0

http://timesofindia.indiatimes.com/business/india-business/Flipkart-needs-big-money-to-keep-delivering/articleshow/14966970.cms 8) RBI asks Finance Ministry to stop micro-management of banks- BS/ET

http://articles.economictimes.indiatimes.com/2012-07-16/news/32698503_1_psbs-base-rate-central-banks http://www.business-standard.com/india/news/rbi-asks-ministry-not-to-micromanage-banks/480279/

9) US Senate: HSBC allowed drug & terror money to pass through its banks- BBC/TOI/ET http://www.bbc.co.uk/news/business-18866018

http://timesofindia.indiatimes.com/world/us/HSBC-exposed-US-India-to-terror-funding-risk/articleshow/15025418.cms http://economictimes.indiatimes.com/news/international-business/hsbc-allowed-drug-money-laundering-apologizes-

senate/articleshow/15021701.cms 10) FIIs pouring cash in hoards in India, SEBI in alert mode- BS/TOI

http://www.business-standard.com/india/news/fiisstock-picking-spree/480703/ http://articles.economictimes.indiatimes.com/2012-07-17/news/32714307_1_bond-funds-india-exposure-benchmark-bond

http://business-standard.com/india/news/sebi-asks-fiis-for-detailsend-beneficiaries/480752/ 11) WPI Inflation comes down marginally to 7.25%- TOI/BS

http://timesofindia.indiatimes.com/business/india-business/Inflation-eases-to-7-25-in-June/articleshow/15012670.cms http://www.business-standard.com/india/news/rbi-wantsproducer-price-index-for-inflation/480721/

http://www.tradingeconomics.com/india/inflation-cpi 12) Corporate Affairs Ministry seeks CCI probe on possible cartel linked to airfare rise- ET/DNA

http://www.dnaindia.com/india/report_airfares-up-due-to-kingfisher-crisis-dgca-sees-no-alarming-trend_1715840

http://articles.economictimes.indiatimes.com/2012-07-18/news/32730646_1_air-fares-route-wise-fares-suo-moto http://articles.economictimes.indiatimes.com/2012-03-19/news/31210591_1_trai-competition-act-telecom-regulatory-authority

13) Obama says it is still hard to invest in India- TOI/Forbes/Indian Express/The Hindu http://www.thehindu.com/news/international/article3642607.ece?homepage=true

http://timesofindia.indiatimes.com/business/india-business/Barack-Obama-cant-dictate-what-to-do-India-Inc/articleshow/14966878.cms

http://www.indianexpress.com/news/follow-obama-order-on-fdi-reforms-cii/975697/ http://www.forbes.com/sites/kenrapoza/2012/07/16/india-official-criticizes-obamas-comment-on-countrys-investment-climate/

http://articles.economictimes.indiatimes.com/2012-07-17/news/32699649_1_fdi-policy-policy-regime-india-s-fdi 14) Indonesia becomes most bullish consumer, India loses top position: Nielsen- Reuters/DNA

http://in.reuters.com/article/2012/07/16/india-indonesia-global-confidence-nielse-idINDEE86F0B920120716 http://www.dnaindia.com/india/report_consumer-confidence-falls-first-time-in-9-quarters-nielsen_1716088

15) America’s double standards for Healthcare Policies – Livemint/Firstpost/The Hindu Business Line http://www.firstpost.com/economy/us-may-take-india-to-wto-over-cheap-cancer-drug-licence-368043.html

http://videos.livemint.com/2012/07/16194244/US-steps-up-lobbying-efforts-a.html?atype=tp http://www.thehindubusinessline.com/companies/article3613741.ece?homepage=true&ref=wl_home

http://www.firstpost.com/india/how-obamas-double-standards-could-make-your-healthcare-costlier-376854.html