Industrial Internet of Things Report 2016 · • $1.4 billion in predictive maintenance revenue...

Transcript of Industrial Internet of Things Report 2016 · • $1.4 billion in predictive maintenance revenue...

Industrial Internet of Things

Report2016

McRockCapital.com@McRockCapital

#IIoTReport2016

2

Contents

• The Internet of Very Important Things

• Corporates in Action

• Acceleration Through Standardization

• Making Sense of IIoT Platforms

• Man and Machine

• Trending in the IIoT

• IIoT M&A in 2016

3

4

The Internet of Very Important Things

It has become obvious through consumer technologies that anyone in the possession of timely and accurate information is at a competitive advantage to make smarter and more efficient decisions. Waze, for example, the world’s largest community-based traffic and navigation app, informs a driver that their usual route is not the fastest due to real-time traffic flows and user reports of accidents. The app finds the fastest route and also informs the driver of road hazards and police speed traps. It’s hard to argue that a driver without this technology could make better decisions to avoid unexpected traffic, avoid potential speeding tickets, and, most importantly, arrive at work on time.

Nobel Prize-winning economist Robert Slow has demonstrated that 85% of growth in modern economies is linked to productivity growth and innovation. The days of simply increasing the growth of inputs, primarily capital and labour, can no longer keep pace with the power of technology to turbocharge productivity and the resulting economic growth. It’s expected that after decades of dramatic growth by China’s manufacturing sector, North America and Europe will regain their competitive advantage through technology-driven efficiencies created by the Internet of Things (IoT) and Industrie 4.0.

The Digital Age, which began in 2010, is expected to continue until 2030 and will be 5-10 times bigger than the Information Age which lasted from 1990 to 2010. This Digital Age is driven by the IoT and Cisco estimates it willhave an economic benefit over the next decade of $19 trillion; the equivalent of the US economy today. The Digital Age takes us beyond simply accessing volumes of data and moves us closer to controlling and predicting complex outcomes.

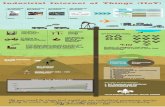

When we compare the key IIoT metrics today against the formation year of McRock in 2012, we have clearly reached an important inflection point of the Digital Age. Here’s the IoT growth by the numbers since 2012:• 18.2 billion things connected to the Internet today versus 8.7 billion;• 13x growth in sensors shipped;• 5.9 billion machine-to-machine connections (M2M) in place today versus 2.6 billion connections;• $779 billion in IoT revenue today versus $450 billion;• 2x growth in M2M service revenue of $122 billion today up from $66 billion; and• $1.4 billion in predictive maintenance revenue versus $400 million.

McRock released its first Industrial Internet of Things report back in 2014. Since that report, the general awareness of the IoT has skyrocketed and landed it at the top of Gartner’s famous technology hype-cycle chart. McRock’s 2016 IIoT report goes beyond the hype and provides some concrete examples of the progress being made by some of the top high-growth IIoT companies and large corporations.

5

6

Corporates in ActionDisrupt or Be Disrupted

The role of large corporations in the evolution of the IIoT has become very evident over the past few years. Corporate leaders like Cisco’s John Chambers and GE’s Jeff Immelt were early to embracing the onset of the Digital Age and both made major bets on the future of their companies. Cisco has embraced the IoT and is embarking on a significant transformation from a hardware vendor to a SaaS business. GE has refocused on its roots as an industrial OEM with the major addition of a horizontal software platform called Predix as it becomes what it calls a “Digital Industrial” company.

Over the past five years, we have seen the number of corporate groups engaged in the IIoT soar. Corporate consortia involvement has grown 50-fold since 2012. Today, more than 350 different corporations belong to IoT consortia as they prepare to survive and thrive in the new Digital Age.

An important focus of our 2016 report is to understand the obvious, and not so obvious, ways that large corporations are engaging in the IIoT. We spoke to thought leaders from a few of these companies and came across some key themes:• Beyond strategy – corporations have taken major action towards executing IIoT strategies and undergone

company-wide transformations• Ecosystem play – partnerships with other large and small tech companies has been key to successful IIoT

implementation and adoption.• 360 Degree Solutions – corporations have found that IIoT solutions can service existing customers, help

access new customers, and be used to drive efficiencies in their own operations.

The following interviews discuss how some of these large corporations are proactively tackling the “disrupt or be disrupted” dilemma in their respective industries.

7

Interview

Maciej KranzVP Corporate Strategic

Innovation GroupCisco Systems

How has Cisco integrated IIoT into its business?

Cisco views IIoT as an enabler of our digital transformation strategy. We first started working on IIoT about 15 years ago. Our main focus was to build out the network infrastructure required for IoT. We needed to create the backbone that the industry relies on for reliable and secure connectivity. A few years ago, we started focusing on specific verticals. Now this is a large practice at Cisco for solution creation and go-to-market. We’re currently developing full platforms for industrial, oil and gas, energy, smart cities, and other exciting new plays. We’re also in the middle of transitioning from a hardware-centric to a recurring software business model. This is a key strategic focus for us. IIoT is helping us go through this transition, because when we sell to our customers, we can now offer our IIoT capabilities and recurring products as the default option.

What pre-existing industry expertise helped Cisco integrate IIoT?

It’s been a fascinating journey. When we started, we came in purely from an IT perspective. At that time, to be honest, we didn't know everything about industrial environments, industrial networks, OT or lines of business (LOB) such as HR, sales, R&D, and other areas that are end users of IT. Our focus at that time was primarily on building secure and scalable networks. We learned a lot over that period about what our customers’ needs were and what other solutions Cisco could offer. We invested heavily in vertical expertise, so we’d have hundreds of people who were experts in manufacturing, health care, oil and gas, smart cities, and so forth.

How has Cisco approached partnerships in the IIoT? Can you give an example where Cisco has partnered with large and small companies?

Cisco’s partnership with Rockwell Automation is a great example of how Cisco partners with other large companies. Our relationship has gone through several stages and developed over time. At the beginning, we started by jointly designing and building network hardware like switches and routers. Rockwell brought their industrial expertise and understanding of the OT world while we

(Continued)

Corporates in Action – Cisco Systems

8

9

“Startups are very important for Cisco. When we’re developing a solution, we might realize we’re missing some functionality that we need to get it done quickly and in a nimble way. Startups fill an important role here.”

Maciej Kranz, Cisco Systems

Cisco pic

“If you go back 10 years or so, we were on a totally different planet than Rockwell, Schneider Electric, Honeywell, and others in that space. Now we work together very closely.”

Maciej Kranz, Cisco Systems

10

Corporates in Action – Cisco Systems

11

(Continued from previous)

brought our IT expertise and understanding of networking. It was a match made in heaven. We moved into market actions, like Converged Plantwide Ethernet (CPwE), our plant-wide Ethernet architecture, followed by rolling out a security architecture together. Then, we moved into joint solution development, and so on. Rockwell is an example of a comprehensive, multifaceted relationship.

With regards to small companies, startups are very important for Cisco. When we’re developing a solution, we might realize we’re missing some functionality that we need to get it done quickly and in a nimble way. Startups fill an important role here. A good example is the company Relayr, based in Berlin. They won Cisco’s IoT Innovation Grand Challenge in 2014 and we introduced them into our OpenBerlin Innovation Centre where their platform is used for IoT prototyping.

We also co-innovate with our customers directly. From oil and gas to mining to automotive — we’ve engaged in co-innovation and co-development across several industries. But there are some caveats. We rarely co-develop a proprietary or custom solution with a customer. It doesn't work for them and it doesn't work for us. For example, a global oil and gas company came to us a few years ago and asked us to work with them on developing a connected refinery solution. However, they didn't want us to do anything proprietary for them, and they also wanted us to take the solution and sell it to all of their competitors. When we asked why, they said they’d have the time-to-market advantage anyway for a couple of years, plus it would ensure that we’d be fully committed to the solution if we were going to sell it to our other customers and it became part of Cisco's service offerings. This is the sort of mantra that we have with co-development. The value proposition we give to the original customer is a time-to-market advantage, but ultimately, the solution benefits the entire industry.

What are some of the benefits Cisco has seen through its IIoT integration?

The first benefit from IIoT is that it enabled Cisco to identify a key new buying center with LOB. Over the past six months, more than 70% of all customers that visited the Cisco campus in San Jose were LOB customers. This has been a great new revenue source. The second benefit is our increased relevance to our customers. When we think about LOB and OT, their main focus is running the business. Through our IIoT activities, Cisco is not just improving their IT infrastructure. We have become a strategic partner because we're helping them with improvements in productivity, uptime, profits, and also allowing them to create new revenue opportunities. The third benefit is that it allowed us to partner with more companies than previously before. If you go back 10 years or so, we were on a totally different planet than Rockwell, Schneider Electric, Honeywell, and others in that space. Now we work together very closely.

Interview

Marie-Pierre BelangerVice President, Digital Solutions and Delivery

Industrial InternetPitney Bowes

Doug MazlishVP, Global Innovation

Operations and AlliancesPitney Bowes

How has Pitney Bowes integrated IIoT into its business?

Pitney Bowes is reinventing mail. Leveraging physical and digital technologies to help our clients, including 90% of the Fortune 500, millions of pieces of customer communications are processed daily utilizing Pitney Bowes technology. We have integrated IIoT into our business in two primary ways. The first is through our large enterprise mail creation equipment, starting with our mail inserters with plans to move to our industrial printers for conventional mail printing. We already capture data about equipment efficiency, alarms, mail piece production and how operators are using our machines. Now we are analyzing that data in the Predix platform so we can better service our equipment and offer additional value-added modules to our clients for real-time analysis and real-time scheduling applications that become smarter over time with more value-add services.

The second way we have integrated IIoT is through our recently released SmartLink offering for our small and medium business (SMB) mail machines. You probably know of Pitney Bowes mainly for our postage meters. Our meters require Internet connectivity to download funds and print postage, so the capability is built into our mail machines. Now we have added more IIoT connectivity, giving us the ability to perform remote software updates for updated postal rates, monitor print levels and initiate AutoInk replenishment, and provide data that helps our call centers increase efficiency. Looking ahead, we plan to use our extensive data sets and location-based analytics to provide asset tracking, ecommerce solutions and cloud services for new and existing clients.

What pre-existing industry expertise helped Pitney Bowes integrate IIoT?

For our enterprise mail equipment and postage meters, it was a logical expansion to IIoT because the operational information was already being collected. The difference now is that we are analyzing the data for descriptive visualization, prescriptive maintenance and other services. Outside of hardware, we collect everything from addresses to points of interest to demographics to weather data, and more. Therefore, we have a huge amount of data that we

(Continued)

Corporates in Action – Pitney Bowes

12

13

“IIoT provides us the ability to not just sell a product but to use the product as part of a service we are providing.”

Marie-Pierre Belanger, Pitney Bowes

“Even if our enterprise machines run only a few percentage points more productively, this can mean millions in overall cost savings and revenue growth for our clients.”

Doug Mazlish, Pitney Bowes

14

Corporates in Action – Pitney Bowes

15

(Continued from previous)

can bring to a number of IIoT use cases. A supply chain customer, for example, will have many questions that can be answered using our data. Where are the major highways? Where are the service stations across from the major highways? What’s the weather and will it possibly impact a supply chain? Is the tractor trailer or train car where it is supposed to be? Our over 350 data sets allow our customers to not only know where an asset is geographically, but add context to it, providing tremendous IIoT value.

How has Pitney Bowes approached partnerships in the IIoT? Can you give an example where you have partnered with large and small companies?

One of our most strategic partnerships is with GE, where we use their Predix platform to analyze data generated from our enterprise level equipment to provide value-add services and improve business outcomes for our clients. We also use Predix to help reduce downtime through predictive maintenance, increase productivity and efficiency and utilize location intelligence. Realizing that location intelligence is a key component of IIoT, GE is now offering the PB location intelligence APIs through its Predix.io marketplace. We also partner with other firms and with large and small companies alike to provide location and data analytic solutions into the IIoT space. A good example of this is Electric IMP, who provides the SmartLink IoT connectivity solution for our SMB postage meter devices.

What are some of the benefits that Pitney Bowes has seen through its IIoT integration?

It’s really a transformation of our service offerings. IIoT provides us the ability to not just sell a product, but to use the product as part of a service we are providing. We are transforming from a product-centric type of model to a business-outcome centric model. In the past, we had traditional break/fix types of service agreements which included throwing multiple resources at problems to solve them. Now, we are taking a much more modern approach by creating solutions that utilize predictive data sets, predictive modeling and productivity algorithms to drive better business outcomes for our clients. Some of our biggest clients are large, multinational corporations and the types of analytics they are looking for are very complex. These customers have literally thousands of statements, invoices and bills handled by us every day and mailed out to their own customers and clients. The type of analytics for these enterprise machines is not unlike a GE jet engine in terms of the amount of machine data that these massive machines create. Even if our enterprise machines run only a few percentage points more productively, this can mean millions in overall cost savings and revenue growth for our clients.

Interview

Michael YoungDirector

Caterpillar Ventures

How has Caterpillar integrated IIoT into its business?

IIoT has been a large part of Caterpillar’s business since before IIoT became a buzzword. We started connecting machines and collecting data starting back around 2008 and we've made several investments, both internally and externally, around IIoT. Caterpillar has a commitment to connect two million assets by the end of 2017, and we're at about half a million today. We want everything from diesel engines to mining trucks to be connected to the internet so we can collect data from it. This means retrofitting tens of thousands of units that are already out there, which has been one of our largest challenges. When the manufacturer of something like a refrigerator wants to connect their product to the internet, they just sell new ones with that added functionality. We do that with new products, but since the life cycle of our machines is designed to be 20 years or more, we have to retrofit everything that’s already out in the field to make meaningful headway in getting everything connected. Caterpillar has reorganized internally to focus on digital, or IIoT, and that's meant setting new, bold goals for the company to add further value to our customers.

How does Caterpillar approach retrofitting older equipment in the field?

There have been a lot of lessons learned. We work with partners to design low-cost communications devices that are easy to install and connect so that, in many cases, the operators can install the devices themselves. We learned a hard lesson on the importance of ease of installation early on. We started connecting everything back in 2008 when the devices were relatively primitive and using 2G, but just last year, the telecoms companies stopped supporting 2G and we had units that turned off all over the world. Originally, we were trying to make communications devices that would last 20 years, like our machines themselves, but then learned that wasn’t going to work because they became obsolete very quickly. This realization changed all of the thinking around how we design the devices; since they will have to be replaced several times during the life of a machine, the focus became more on speed and ease of installation rather than longevity.

(Continued)

Corporates in Action – Caterpillar

16

17

“Caterpillar has a commitment to connect two million assets by the end of 2017, and we’re at about half a million today.”

Michael Young, Caterpillar Ventures

“Caterpillar has reorganized internally to focus on digital, or IIoT, and that’s meant setting new, bold goals for the company.”

Michael Young, Caterpillar Ventures

18

Corporates in Action – Caterpillar

19

(Continued from previous)

What pre-existing industry expertise or data helped Caterpillar integrate IIoT?

More than anything, it's trust from our customers. Everyone today wants to connect everything; their machines, people, materials, and so on. We've been working with our customers and collecting data from their machines for years to provide predictive maintenance and other intelligence, so we have a huge amount of trust built up in that space. For example, a large construction company came to Caterpillar and wanted to connect 10,000 assets, many of which were not our own machines. Why didn’t they go to a telecom company? Because Caterpillar has been providing intelligence for them for years and they trust the results. They trust Caterpillar to select and install the right communications device for every piece of equipment, from a Ford pickup truck to a Komatsu excavator, and understand their requirements.

How has Caterpillar approached partnerships in the IIoT? Can you give an example where you have partnered with large and small companies?

We see three pieces of the IIoT puzzle; in each piece, we do a lot of the work internally but also have partners that we work with closely. The first piece is connection, where we partner with Verizon, Telogis, and others. The second piece is organizing and normalizing data through a platform, where we leverage the capabilities of Uptake, one of our venture investments. The third piece is using the collected data to provide insights back to our customers, where we also use Uptake in addition to some of our other venture investments. Caterpillar uses partnerships to help provide more insight and value to our customers, but also to make us more efficient and effective at accomplishing this.

What are some of the benefits that Caterpillar has seen through its IIoT integration?

The biggest benefit is knowing more about how our machines operate and providing that same knowledge to our customers. The construction company I mentioned earlier that wanted to connect all of their assets? Ultimately, we connected those assets for them and they believed, and we confirmed, that they got 10% greater productivity just by knowing where those assets were and how they were being used. Increased productivity, maintenance prediction, reduced downtime, and asset locations are the biggest things our customers are looking for through connecting their machines, and integrating IIoT in a large scale has allowed Caterpillar to offer those services.

20

Acceleration Through Standardization

The IIoT is, in fact, a long value chain of products and services that starts with a machine and some data generated by that machine. What happens after the data collection takes place is the real value proposition and potential of the IIoT.

In order to scale the IIoT across disparate machines types, middleware vendors, and cloud computing service providers, standards are key in achieving widespread IIoT adoption. The OPC Foundation launched OPC Unified Architecture (OPC UA) in 2008. This has become the interoperability standard for the secure and reliable exchange of data from machine-to-machine and machine-to-enterprise. It is platform independent and ensures the seamless flow of information among devices from multiple vendors using multiple software operating systems.

RtTech Software has experienced the direct benefit of adopting the OPC UA to facilitate adoption and increased confidence with its blue chip customer base.

21

Interview

Keith FlynnFounder & President

RtTech Software

How do standards serve to accelerate industry adoption of IIoT?

The biggest thing is around customer confidence. People don't have confidence if they don't know what they're getting. In order to accelerate the adoption of the IIoT, we need a set of standards for connectivity, security, data transmission, compression, storage, and more to help people across various industries gain confidence and comfort about putting all of their data in the cloud. The original OPC standards, for instance, existed for years before they became prominent, and it wasn't until the OPC Foundation was created to officially maintain and promote those standards that the broader industry started paying attention and gaining confidence. For large industrial players, millions of dollars are at risk through outages or security breaches, so if they decide to start connecting their business to the cloud in a big way, they want to make sure they are approaching it in the way that multiple, intelligent third parties have agreed is the right way.

Aside from accelerating adoption, what are the other key benefits of an IIoT standard for the industry as a whole?

Standards make it much easier for the customers of IIoT solutions and apps to do apples-to-apples comparisons. A customer can focus more on weighing the value-add parts of an app instead of spending time trying to make sure it’s going to work with their other IIoT apps and devices. Another big benefit of an IIoT standard is the development of more apps overall. If people are taking a standardized approach to the key pieces of communications and interoperability, they can develop apps much faster because those pieces are already ready to go. IIoT standards, in that sense, act as a toolkit to use as a starting point for app development. Rather than someone starting from scratch, building something, and then having to adjust it to be OPC-certified, they can start with the requirements for certification and work backwards, using the requirements as guidelines in how they should develop their apps from the beginning.

(Continued)

Acceleration Through Standardization

22

23

“IIoT standards act as a toolkit to use as a starting point for app development.”

Keith Flynn, RtTech Software

“A customer can focus more on weighing the value-add parts of an app instead of spending time trying to make sure it’s going to work with their other IIoT apps and devices.”

Keith Flynn, RtTech Software

24

Acceleration Through Standardization

25

(Continued from previous)

What are the main barriers to adoption for an IIoT standard and how can they be mitigated?

The global scope of IIoT can potentially act as a barrier for adoption as something that meets the standards of one country may not necessarily meet the requirements of another. Writing a universal set of IIoT standards that will be easily accepted globally is going to be tough. What helps accomplish this, however, is when global industry players start trying to influence the standards to meet the needs of their IIoT devices and other hardware. This can be a great thing, such as when someone like GE adopts OPC Unified Architecture (UA); a newer M2M standard built on top of the original OPC standards. This helps a relatively new set of standards get accepted much faster because that company’s devices are all over the world.

26

Making Sense of IIoT PlatformsStarting the IIoT Adoption Avalanche

One of the major trends that emerged from the IIoT in 2016 was the concept of a “platform company.” The platform concept is not new, but in the emerging IoT sector, the idea of a horizontal technology that could sell into any vertical market sounded like the next billion-dollar company.

The perceived value of a complete system that can capture data, mine that data for insights, and take action based on those insights was at the heart of the 2016 Platform Mania. The term “mania” is fitting as there are360 companies that claim to be IoT platforms. This desire to be labeled a valuable horizontal technology, and thus included in the platform club, expanded the definition of platform and caused general industry confusion.

From McRock’s point of view, another reason IIoT startups gravitated towards the platform terminology was that it seemed an acceptable excuse for low revenue traction as the future value of a horizontal technology company was still being built. By the first half of 2016, the bloom was off the rose on the platform concept as customers seeking IIoT solutions became increasingly confused by the word platform and what business outcomes a platform could actually deliver.

Key themes for IIoT platforms:• Even in a horizontal platform, it is important to dominate a vertical market and move to adjacencies after.• Size of the IIoT company doesn’t necessarily matter because everyone is new to the IIoT.• The market is generally at the “connecting things” stage and the value of a platform is the bridge to a higher

level of advanced analytics and drives the ROI for connecting.

There are a handful of IIoT platform companies that have successfully grown revenue by dominating an initial vertical market while still building the capability to be horizontal – perhaps a function of strong business execution and relevant industry domain knowledge within the team. The faster an IIoT platform can demonstrate ROI, the more things its customers can justify connecting.

27

Interview

Paul GlynnCEO

Davra Networks

How can an IIoT platform stand out in a crowded and competitive market?

The market is still in very early stages. The one piece of advice I would give to people is to verticalize. Don't try to be all things to all people. There is a rush out there with platforms for them to say, “Hey, we're agnostic, we don't care, data is just ones and zeroes.” It’s important to create a horizontally focused platform, but the reality is, to win now, in this very early stage of IoT, you need to verticalize. You can't treat IoT on a factory floor in the same way you treat IoT in a school bus or for a consumer; they're all very different. You need to have a focus.

What does your own platform do that makes it stand out amongst its peers?

Fundamentally, the people at Davra are network people. We joke that we know a lot more about the “I” in IoT than the “T.” That works very well for us and allows us to focus on using the network and local computer power to manage the data at the edge. We can do that because we know how the network works so we know how to utilize the boxes and the technology that are already there. This also changes Davra's route to market. We believe that every IoT project starts with connectivity; a system integrator or network VAR gets asked to connect some assets that their client has never connected before. Typically, the client will go to the systems integrator who provides their network infrastructure first when they first want to implement an IoT project, and that system integrator is our customer. Our deep network understanding and focus helps us to understand the systems integrator’s requirements and we've designed Davra's platform to integrate with the types of platforms that the integrators use themselves. The integrators are looking to sell a connected "thing" as a service and don't want to go and sell connectivity on its own as a service, so they use Davra to fill in that piece for them.

(Continued)

28

Making Sense of IIoT Platforms – Davra Networks

29

“Verticalize. Don't try to be all things to all people.”

Paul Glynn, Davra Networks

“Size doesn't really matter in IoT. Everyone is new to this, no matter who they are.”

Paul Glynn, Davra Networks

30

Making Sense of IIoT Platforms – Davra Networks

31

(Continued from previous)

What sorts of IIoT applications are customers looking for in a platform that they might look to a smaller startup company in order to achieve?

Size doesn't really matter in IoT. Everyone is new to this, no matter who they are. What we're seeing lately is large companies focused on building ecosystems or solution sets that are based around five or six different partners to offer a variety of services. A smaller company has the advantage of being able to exist as a partner member of several different ecosystems at the same time while also being able to create new business for themselves. If a smaller company can verticalize, they can get great customers early on by being part of these ecosystems. A big focus for Davra is connected transportation combined with smart cities because they are closely interrelated; we have a strong play there with some big customers and real use cases and that's what draws people in. There's a lot of marketing out there with people telling great stories about what can be done with IoT, but the reality is, if you've got real customers and real use cases, it doesn't matter if you're big or small. If people believe in what you do, they'll go with you.

What is one of the most interesting use cases you have seen for your platform?

One of my favorite use cases for Davra is our project with a major US city that has routers on its tram network to provide Wi-Fi to passengers. These routers have GPS chips inside them and are connected to the trams themselves, so the city uses the GPS location data to push estimated time of arrival (ETA) data to digital signs around the city. This is a great use case where Davra helped a customer take hardware and data they already had and repurpose it for an entirely different use case. This solution works really well, is highly accurate, and saved the city a ton of money in the process.

Interview

Frederic BastienPresident & CEO

mnubo

How can an IIoT platform stand out in a crowded and competitive market?

A good platform should help a client go faster and accelerate their go-to-market plan, strategy, deployment, and their ROI. If they can do this successfully, then they definitely have a nice play as a platform. The ability to defend ROI especially is a big selling point for any successful platform. Clients should ask themselves if a platform is helping them go faster. If so, how much faster? If you go with a platform, but still need to hire forty new developers, is it really making you go faster? And this is where I think people should look at value-add services and not just base-layer platforms on their own. Many companies are trying to sell just a platform as a service, but if you go with SaaS or a turnkey solution that offers analytics and other services, then then you get a whole different layer of additional value. This is where we try to play at mnubo.

What does your own platform do that makes it stand out amongst its peers?

Our first key value proposition is out-of-the box insights. Our customers don't have to worry about what machine learning component to use, what kind of data modeling to do, and so on. We give our customers product scoring, user engagement scoring, session detection, and everything right out of box automatically. Our second key value proposition is our vertical knowledge in the industries that we are active in. Whether someone is doing smart homes, appliances, HVAC, or agtech, we have already developed extensive knowledge in these areas that we can leverage and don’t need to build from scratch.

What sorts of IIoT applications are customers looking for in a platform that they might look to a smaller startup company in order to achieve?

Everything that starts moving towards becoming a commodity – connectivity, device management, cloud storage - is going to be hard for startups to compete in versus the big players because it's a volume game. But when you get to the

(Continued)

32

Making Sense of IIoT Platforms – mnubo

33

“If you go with a platform but still need to hire forty new developers, is it really making you go faster?”

Frederic Bastien, mnubo

“When you get to the higher level of the value chain with analytics, machine learning, and applications, this is where startups can bring much more agility and innovation.”

Frederic Bastien, mnubo

34

Making Sense of IIoT Platforms – mnubo

35

(Continued from previous)

higher level of the value chain - analytics, machine learning, applications – this is where startups can bring much more agility and innovation. At mnubo, we have Fortune 500 customers who work closely with us, eventhough we are relatively small, because we bring them the high level of innovation they are looking for.

What is one of the most interesting use cases you have seen for your platform?

One interesting use case that is quite popular these days is churn or customer retention prediction. There are a lot of applications for this in smart homes, appliances, and in consumer products. We have devised something called an “IoT user engagement score” based on how a user interacts with a product. A simple example would be us analyzing the data of 100,000 smart homes who were all on a subscription service, but 2,000 of them cancelled their subscriptions after a certain period of time. We can look at all of the patterns of activity for those cancelled accounts to determine what factors led to those cancellations and also predict which existing subscriptions are going to cancel in the near future.

Interview

Sacha SawayaCo-Founder & CFOLitmus Automation

How can an IIoT platform stand out in a crowded and competitive market?

A huge thing, especially for a startup, is having key reference customers. This can be hard for an early startup that may not have any customers yet, but being able to name-drop your key customers provides a lot of credibility when meeting with potential new customers. This enables you to show prospective customers in the same industry what some of their competitors are doing, creating a real fire for them to start seriously thinking about IIoT. Reference customers allow you to have real use cases of how your platform has been used in a particular domain and the positive outcomes it provided. Also, a lot of platform companies don't spend enough time focusing on user experience. Many platforms are very tech-focused and the developers don't always understand that, at the end of the day, you can have the customer's full technical team on board, but if the business guys don't understand the value of the project, it's not going to go through.

What does your own platform do that makes it stand out amongst its peers?

At our relatively early stage, one of our key differentiators is our domain expertise in the connected car and industrial spaces. When we started working with Nissan and Renault early on, it enabled us to know what automotive clients want to accomplish with IIoT. When we go into a first meeting with a different prospective customer in the same industry, they aren't going to tell us what they need and they may not fully know themselves. Having domain expertise and experience allows us to tell them exactly what their pain points are before they even illustrate them, and that has gone a long way in building new business.

On the technical side, we pride ourselves on a few key things: interoperability of industrial protocols, device management and our application integration. Litmus has a proprietary data mapping engine that enables the platform to engage easily, securely and seamlessly with any industrial device, regardless of data format or protocol. Litmus also provides an extensive device management suite ready for production deployments with extremely granular control.

(Continued)

Making Sense of IIoT Platforms – Litmus Automation

36

37

“At the end of the day, you can have the customer's full technical team on board, but if the business guys don't understand the value of the project, it's not going to go through.”

Sacha Sawaya, Litmus Automation

“A lot of the bigger platforms are pricing themselves high, expecting that large customers will be willing to pay more, but often it just isn’t cost effective.”

Sacha Sawaya, Litmus Automation

38

Making Sense of IIoT Platforms – Litmus Automation

39

(Continued from previous)

What sorts of IIoT applications are customers looking for in a platform that they might look to a smaller startup company in order to achieve?

Many people are surprised how sensitive even the largest customers can be when it comes to cost. A lot of the bigger platforms are pricing themselves high, expecting that large customers will be willing to pay more, but often it just isn’t cost effective. Some customers are still getting comfortable with any IIoT strategy at all, so the last thing they want is to spend too much money right out of the gate. With that, a lot of customers new to IIoT need help with devising their overall strategy. They know they want to connect something, but they don't know what to do or how to do it and they want help figuring it all out. A lot of the bigger platforms might charge them for this consulting and then use it to try to sell them on their other devices or applications. If a customer sees a startup that's only focused on one thing, such as middleware, they know that the startup probably won’t try and sell them everything but the kitchen sink.

Startups can also differentiate themselves through their ability and willingness to give out quick and low cost (or sometimes free) proof of concepts (POCs). That's how we've been getting in the door for most of our big customers. We can usually turn around a simple POC in under 15 days, and that's huge because the customer gets to actually see firsthand how their device will connect and work for them. This is typically more effective than having sales guys show a fancy PowerPoint that just explains how something is supposed to work. And even if we do the POC but don't end up the business at the end of the day, we now have a use case that we can repurpose for other existing or prospective clients down the road.

What is one of the most interesting use cases you have seen for your platform?

Within the industrial space, we have connected large industrial boilers to Salesforce and analytics. Originally, boiler companies were product companies: build the boiler and sell the boiler. Now, these companies can learn how their clients are using their boilers so they can create better boilers, plus they can better engage with their clients to increase brand affinity. Litmus has also added rules, logic and triggers to enable boiler manufacturers to give their clients the added feature of preventative maintenance. By connecting the machines to Salesforce, salespeople at the boiler company get a new Salesforce “case” in their account whenever a boiler’s specific parameters go beyond a specific threshold. This enables the boiler manufacturer to anticipate a malfunction and help the client before a problem becomes bigger. This service also creates a new revenue stream for the boiler manufacturer since they can now charge for connected boilers and the associated services.

40

Man and Machine

Mankind’s fascination with the melding of man and machine is decades old, not to mention the foundation of some of the best Hollywood sci-fi movies ever created. The concept raises hope as we look to technology to provide us with super-human abilities, yet also drives fear as AI threatens to one day outsmart us.

In 2016, a computer program called Alphago defeated a top professional player in the 2,500-year-old Chinese game of Go. The dream of self-driving vehicles was also pushed even further along this year with the launch of the first self-driving taxi by NuTonomy in Singapore and Uber in Pittsburgh. These miraculous human-machine interactions leave the impression that humanity and machine are already closely-linked. One of the most interesting IIoT themes we see emerging in the near future is the mass adoption and installation of Human Machine Interfaces (HMIs) on fleets of industrial and commercial equipment worldwide.

The essence of the IIoT is based on evolving the interactions between man and machine.By replacing conventional push buttons and knobs for iPhone-like touch screen interfaces, dumb machines will become smart, internet connected, and capable of new features and advanced intelligence through future software updates.

Serious Integrated is at the forefront of elevating human engagement with industrial and commercial machines through beautiful and powerful HMI solutions. We interviewed the CEO to gain some interesting insights into this exciting space.

41

Interview

Terry WestCEO

Serous Integrated

How does Serious’ product differ from that of an embedded PC, tablet, or similar solution?

Serious doesn’t just sell screens or computers; we sell a solution for upgrading and transforming machines into smarter machines with stunning HMIs and cloud-connectivity for secure machine visibility, upgradability, and manageability. The solutions span a price, performance and feature spectrum needed by OEMs who manufacture and sell hundreds of thousands of devices per year that can’t bear the cost and complexity of embedded PCs or tablets, nor can these devices bear the inherent instability and rate of change of those technologies. Embedded PCs and tablets must be reintegrated frequently as the available hardware follows the consumer market driving these technologies. Further, OEM product designers must incorporate major OS upgrades and software changes every few years or else face increased security vulnerabilities and support challenges. These frequent hardware and software changes are a major problem for OEM machines generally designed to be in production for decades. Serious offers a full solution that meets the need of the target market so OEMs can get to market quickly and stay in the market for the long haul.

Why are OEMs using Serious’ solutions instead of developing in-house?

Traditionally, OEMs custom engineer their electronics uniquely for each product;an expensive and long process. At their core, OEMs are domain experts within their specific industry, whether it’s vending machines, ice cream machines, or medical devices, and their existing engineering resources are focused on improving productivity, durability, energy efficiency, etc. As a result, the engineering expertise and capacity to create, deploy, and maintain a modern HMI and IIoT connectivity for their devices is generally beyond their grasp. OEMs that attempt in-house development often under-scope the cost and complexity, finding themselves going through a long learning process and spending millions of dollars over several years trying to get to market. Those few that succeed find the result far behind the need, with limited upgradability, scalability, and adaptability to HMI and IIoT industry trends as well as their own feature

(Continued)

42

Man and Machine – Serious Integrated

43

“Embedded PCs and tablets must be reintegrated frequently as the available hardware follows the consumer market driving these technologies.”

Terry West, Serious Integrated

“We are going to start seeing more sophisticated HMI interaction, particularly around authentication.”

Terry West, Serious Integrated

44

Man and Machine – Serious Integrated

45

(Continued from previous)

roadmap. Serious provides off-the-shelf software and hardware platform ingredients that OEMs can integrate and customize in a fraction of the time and budget with minimal impact on the engineering team while yielding a result that is highly scalable, maintainable, and adaptable to future design needs.

What are some of the largest challenges with integrating an HMI into an established product?

In addition to the difficulties of engineering a custom solution that I mentioned before, another interesting challenge OEMs often face is that they under-scope the transformation that adding HMI and IIoT means for their product, team, and business. Their engineers think, “All we’ve got today is little buttons and lights, so anything with a touch screen will be a big step up.” However, once the engineers start working and deliver a first prototype, Marketing gets involved to a level they’ve never been before. When all you’ve got is lights and buttons, there isn’t much input for Marketing to have around how the machine looks and feels, but the minute you put a user interface in front of their customers, Marketing is all over it. It becomes a creative process for colors, fonts, layout, branding, and so on, which is a great thing, but can take a lot of time and resources. The engineers may not recognize that when they enter the process of adding an HMI, they are also opening up new opportunities for Marketing and the other business people to be far more creative around how their products are presented to customers. Being able to incorporate this type of input requires a whole new level of engineering, far beyond just slapping a screen on a machine, and this is where Serious’ design software solutions add significant value for our customers.

What does the future hold for the HMI industry?

We are going to start seeing more sophisticated HMI interaction particularly around authentication – whether it’s fingerprint, facial, or other biometrics – as well as a seamless HMI to cloud connection that will open up new capabilities. Knowing that someone has the right to use a machine and is also properly trained to use a machine is incredibly important, especially with machinery that can be potentially dangerous. HMIs must be connected so they can be securely updated “over the air” from a remote web dashboard – similar to the experience of a cellphone, tablet, or PC where it can upgrade its experience over time with the same hardware. On our consumer devices, we expect to get better apps, a better experience, and bugs to get fixed. We expect our smart machines to have this same ability to stay current, especially since these industrial, medical, and commercial devices can stay in-service for decades. Further, the true potential of the data trapped in all these smart machines – presented to the user in an attractive HMI – needs to be unleashed as this same level of data visibility and control extends to remote cloud-based applications.

46

Trending in the IIoT

McRock tracks various segments of the IIoT and this year’s list is comprised of three segments that have shown an increased level of company creation, venture financing and general media interest. The hottest emerging segments include physical / cybersecurity, smart farming, and drones / UAVs.

2016 saw renewed interest in both physical security and cybersecurity solutions as IIoT deployments created new endpoint vulnerabilities to cyber attacks. McRock looked at more cybersecurity companies in 2016 than any other segment of the IIoT. Cybersecurity companies are, for the most part, in nascent pilot and proof-of-concept stages, eagerly prodding their customers to expand deployments throughout their organizations. Scaling appears to be a challenge as actual cyber attacks on the industrial sector have been limited; therefore, the software is inherently perceived to be more of an insurance policy. Regardless, security is made a high priority by corporations who recognize the potential risks of adding thousands of potential doors into their networks.

The big business of agriculture is a prime vertical market for the benefits of the IIoT. Commonly referred to as smart farming, the use of sensors, satellite imagery, weather data and farm specific software is a growing trend to drive crop yields and better manage the business of a farm.

Drones are an obvious solution in industrial applications because they are a low cost alternative to current inspection practices. Equipment inspection in remote locations (such as power lines and pipelines) and building energy audits using thermal imagery are natural applications for drones.

We talked to some of the people who are deep in the trenches in each of these segments to learn what makes them tick, the challenges they face, and what new opportunities are on the horizon.

47

Interview

Remi SchmaltzCEO

Decisive Farming

What are the main benefits farmers can achieve by integrating Smart Farming methods into their business?

The main focus for us is increasing profitability for farmers through a number of different ways, such as increasing overall yield, improving equipment efficiency, and simplifying management on the farm. Our customers gain the use of advanced precision tools to accurately seed and fertilize their farm by using our variable rate technology, which is the culmination of decades of farming and agronomy experience. Even if a farmer is using a lot of unskilled labor without extensive farming experience, farmers can still ensure everything is done in the best way possible since many farming activities are preprogrammed and become automatic through our services.

As Smart Farming is potentially becoming a crowded market, how does a player in the market achieve a sustainable and competitive advantage?

Many of the players in the smart farming space are approaching the business in very different ways. You have companies that are pure software, never want to set foot on a farm, and just want to deliver services through the internet. You also have companies that are trying to build the relationship face-to-face on the farms with a brick-and-mortar type approach. For Decisive, our focus is to stand out in terms of the benefits we offer for farmers, but also trying not to unnecessarily disrupt the agriculture industry at the same time. We are more about collaborating and integrating within the industry. We work closely with industry partners like grain companies, ag-retail, equipment dealers, and others and show them value in working with us rather than trying to push them out. At the end of the day, farming is a people and relationship business. The companies out there that are trying to disrupt the local relationships need to think hard about who they are disrupting because it's usually that guy that a farmer goes to church with or plays hockey with on Sundays.

(Continued)

48

Trending in the IIoT – Smart Farming

49

“The companies out there that are trying to disrupt the local relationships need to think hard about who they are disrupting because it’s usually that guy that a farmer goes to church with or plays hockey with on Sundays.”

Remi Schmaltz, Decisive Farming

“Decisive gives our agronomists the tools necessary to scale their expertise and go from servicing around 50,000 acres per year to over 400,000 acres per year instead.”

Remi Schmaltz, Decisive Farming

50

Trending in the IIoT – Smart Farming

51

(Continued from previous)

What are the key barriers to adoption for Smart Farming and how can they be mitigated?

One of the biggest challenges we have seen is with the tech support offered by some equipment dealers and manufacturers. Smart farming is obviously very equipment-based since it’s the tool for how most smart farming applications are applied. For a farmer to be willing to use any of this new technology, he needs really good tech support from his equipment dealer, and that equipment dealer needs really good support from the manufacturer of the equipment itself. Most equipment dealers have started moving forward with a clear plan for improving their chain of support, and this has already led to a visible increase in the rate of adoption. As smart farming technology becomes simpler, more reliable, and better supported, the industry will adopt it fully and it will become the norm – just as it did with technologies like GPS and auto-steer in the past.

On the technology side, what’s the next big thing coming up for Smart Farming?

Typically, farming equipment has gotten bigger and bigger so you can do the same work on a farm but use less people. However, as robotics and other autonomous equipment becomes more advanced, the changing of equipment size is going to turn the other way and start getting smaller instead. Smaller equipment will allow for even more precision on the field, similar to the level of precision before farming machinery had even been invented and everything was done by hand, but instead you’ll be able to use robotics and do it with barely any manpower at all.

Why did you start Decisive Farming?

We started Decisive because we felt there was a real need to provide consistent, high-quality agronomic services on the farm in a scalable way. There's typically a lot of emotion in the decisions that are made on a farm, so our goal was to find a way to quantify those decisions and their results, then provide that information back to the farmer to simplify and improve their decision-making process. Talented agronomists are in short supply, their services are always in high demand, and the typical process is very slow and consulting-based. Decisive gives our agronomists the tools necessary to scale their expertise and go from servicing around 50,000 acres per year to over 400,000 acres per year instead.

Interview

Shiraz KapadiaPresident & CEO

Invixium

What is your opinion of the current state of physical / cybersecurity?

Any time there’s a new technology, the world and industry tend to focus on the newness of it. Everyone gets hyped, analysts give out all sorts of different hockey-stick curves and say it’s going to be a forty billion dollar market, the rat race begins between entrepreneurs and large scale companies, everyone focuses on making faster, cheaper, better products, and so on. The one thing that always gets hidden, because you can’t see it and can’t hype it up as easily, is security. In the IT world, there is a lot of activity and attention around security software and hardware, but in the industrial world, it is often ignored or put on the back burner until something major goes wrong.

My favorite analogy is comparing companies to humans. As humans, we get told by every doctor on the planet that if our body is healthy and our immune system is strong then we won't get sick. Statistically, less than half of people exercise regularly and even less than that eat properly, no one gets enough sleep, and no one does all of the things they know they’re supposed to be doing to stay healthy. It’s only when we actually get sick that we make it a priority to seek professional help and spend money on medicine and preventative measures. This way of thinking is similar to how a lot of companies think about security.

With all of the high-profile security breaches in recent years, why do you think a company may not pay full attention to security?

Because there usually is no easily-explained return on investment (ROI) to security. To implement a proper security solution for a large company, the IT Director or CIO is going to have to go to the board and ask for several million dollars. The first question that poor person is going to get asked is about the ROI of that cost, and saying it might reduce downtime or prevent a hack may not be enough to get an expensive security project over the line. A lot of big companies do see the value in spending a lot of time, money and effort on security, but if you go back through the history of those companies, you can often find a

(Continued)

52

Trending in the IIoT – Physical / Cybersecurity

53

“In the IT world, there is a lot of activity and attention around security software and hardware, but in the industrial world, it is often ignored or put on the back burner until something major goes wrong.”

Shiraz Kapadia, Invixium

“In most cases, if something is secure, it's not convenient, and if something is convenient, it’s not secure. Biometrics is one of those unique things where you actually can provide both security and convenience.”

Shiraz Kapadia, Invixium

54

Trending in the IIoT – Physical / Cybersecurity

55

(Continued from previous)

security breach for them or one of their main competitors that gave them the wake up call.

What do you think is currently the most important security-related threat that industry should be most aware of and trying to mitigate?

The first place to start is the authentication of people that are supposed to have access to your physical and cyber infrastructure. Who is supposed to have access to this door that leads me into the server room? Who is supposed to have access to these particular directories on the server through a smartphone or a laptop? Authenticating people should be the starting point. As for what’s the best technology to authenticate people, of course I'm going to be biased because I've spent my life in biometrics, but I think advanced biometrics are the best solution. Someone can overhear or capture the keystrokes of a password and key fobs can be lost or stolen. Biometrics, and I mean more than just the fingerprint scanner on your iPhone, are near impossible to fake.

Thinking about M2M security, there should, at a minimum, be point to point security like encoding/decoding mechanisms, and most companies are good about doing this. However, ultimately the security of the network in which the “thing” of the IIoT is going to sit – that needs to be secure first. The thing might be secure, but when information goes out, that’s the security of the network. Concepts like Bring Your Own Device (BYOD) are not helping at all. Of course a company wants to retain employees and give them flexibility around their technology, but ultimately, they are putting personal devices on to their network that may not be secure or could be already compromised.

What drives you at Invixium?

There is a prominent industry need to authenticate people and we are on the forefront when it comes to securing physical infrastructure. I can go to an enterprise and tell them that I can provide security technology that is unique because it is both convenient and secure. In most cases, if something is secure, it's not convenient, and if something is convenient, it’s not secure. Biometrics is one of those unique things where you actually can provide both security and convenience, and that’s really exciting for us at Invixium.

Interview

Amit VarmaFounder

True Site View

What has led to the recent increase in industry attention to the use of drones?

On the technology side, major changes happened around the controllers and the flight systems available for drones. In the past, just the basic task of flying a drone required a trained pilot, but today, you don’t need any real piloting skills. Anyone can go to Costco, buy a cheap drone, and start flying it right out-of-the-box.

What has become more important, however, are mission-planning skills: where to take off from, where to land, and how to safely control the drone in between. As you would expect with any operating skill, someone flying a drone needs to know their environment and how to best respond to that environment when something goes wrong.

What is the current regulatory environment around drones in Canada?

Canadian laws around drones are clearly defined and proactive. If you look at most other countries, regulation around drones has been forced on the industry, but in Canada, regulation came first and industry followed. Even though drones are now very easy to fly, most people don’t know or care how to plan a mission properly. Just like driving a car, there are rules you have to learn and then you have to fly in a certain acceptable way. For example, Transport Canada is allowing people to fly drones beyond visual line-of-sight in a designated area in southern Alberta. Pilots can apply for permission to fly without visual line-of-sight, clock mission hours, then Transport Canada will allow them to fly elsewhere.

The future will bring us Unmanned Autonomous Aerial Vehicle, or UAAVs, which will cause the next stage of drone regulation. We will then see flight certification being awarded directly to the technology instead of the pilot since no one will be flying the drone directly. A similar issue is going to arrive with the advent of self-driving cars, and it will be fascinating to see how the general public and government deal with this.

(Continued)56

Trending in the IIoT – Drones / UAV Solutions

57

“Anyone can go to Costco, buy a drone, and start flying it out of the box. What has become more important, however, are mission-planning skills - where to take off, where to land, and how to safely control the drone in between.”

Amit Varma, True Site View

“We will see flight certification being awarded directly to the technology instead of the pilot since no one will be flying the drone directly.”

Amit Varma, True Site View

58

Trending in the IIoT – Drones / UAV Solutions

59

(Continued from previous)

What are the main benefits users of drone technology can achieve through applications such as yours?

The biggest advantage of drones is that they can carry sensors that give more and higher-quality data at a lower cost. We focus on using this data to solve a specific problem, and the problem we chose to tackle right out of the gate at True Site View is in engineering procurement and construction (EPC). As an example, we use drones to digitize facilities in the energy industry and determine errors in construction. Our solution has applications in monitoring, safety inspections, assurance and risk, and more. We are a member of Zone Startups, GE’s startup incubator in Calgary, and we have been able to prove our technology on some major energy facilities that GE works with – many that otherwise may not have been as willing to let a startup fly a drone around their operations. Our relationship with GE also allows us use their Predix platform, which is perfect because it is designed with the IIoT and energy industry in mind and is completely scalable.

60

Platforms

Cybersecurity Sensors

Analytics

IIoT M&A in 2016

Acquirer Target

61

Semiconductors Telematics

HMI

IIoT M&A in 2016

M&A activity in 2016 has been very strong with many multi-billion dollar transactions in the Platforms, Semiconductors, and Telematics sectors. We expect this trend to continue as large corporates further define their IIoT strategies and make targeted acquisitions to fill in any gaps in their service offerings.

62

63

Scott MacDonald Whitney Rockley Jeremy Gilman

Authors

McRock Capital is the first dedicated Industrial Internet of Things (IIoT) venture capital fund focused on the intersection of sensors and software in large industrial markets. The McRock team has a unique background of building high-growth venture-backed IIoT companies while also having worked in the power, water, oil and gas industries. McRock is backed by several leading institutional investors as well as Cisco Systems and Électricité de France (EDF).

McRockCapital.com@McRockCapital