Imperfect reversibility of air transport demand - effects of air fare fuel price and price...

-

Upload

institute-for-transport-studies-its -

Category

Environment

-

view

219 -

download

2

Transcript of Imperfect reversibility of air transport demand - effects of air fare fuel price and price...

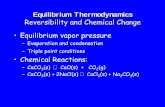

Imperfect Reversibility of

Air Transport Demand: Effects of Air Fare, Fuel Price & Price Transmission

Zia WadudCentre for Integrated Energy Research

Institute for Transport Studies

TRB Annual Meeting, January 2015

Centre for Integrated Energy Research

Institute for Transport Studies

Background Conclusions

Results

Methodology

Objectives

Structure

Centre for Integrated Energy Research

Institute for Transport Studies

Background Conclusions

Results

Methodology

Objectives

Centre for Integrated Energy Research

Institute for Transport Studies

Background

• Air transport demand: an important planning parameter

• Traditional demand models perfectly reversible

• In practice demand could be ‘imperfectly’ reversible:

• Asymmetry and/or

• hysteresis

Centre for Integrated Energy Research

Institute for Transport Studies

Background

• Asymmetry: magnitude of response during a rise of the

factor is different from that during a similar fall

P

Q Q

P

Y

Q Q

Y

Centre for Integrated Energy Research

Institute for Transport Studies

Background

• Hysteresis: response depends on previous history

P

Q Q

P

Y

Q Q

Y

Centre for Integrated Energy Research

Institute for Transport Studies

Background

• Why ‘imperfectly’ reversible:

- Prospect theory

- Habits and practices

- Asset fixation

• Is air transport demand perfectly reversible

w.r.t. income and jet fuel prices?

Centre for Integrated Energy Research

Institute for Transport Studies

Background

• Air transport demand imperfectly

reversible w.r.t –

Income &

Jet fuel price

• Both asymmetry & hysteresis effect –

for both variables

• Fuel price to ticket price/air fare?

Wadud (2014) the asymmetric effect of income

and fuel price on air transport demand

Centre for Integrated Energy Research

Institute for Transport Studies

Background Conclusions

Results

Methodology

Objectives

Centre for Integrated Energy Research

Institute for Transport Studies

Role of price transmission?

Fuel price Ticket pricePassenger

demand

Imperfectly

reversible reversible

Imperfectly

Imperfectly reversible

Centre for Integrated Energy Research

Institute for Transport Studies

Role of price transmission?

Fuel price Ticket pricePassenger

demandReversible reversible

Imperfectly

Imperfectly reversible

Centre for Integrated Energy Research

Institute for Transport Studies

Role of price transmission?

Fuel price Ticket pricePassenger

demand

Imperfectly

reversible Reversible

Imperfectly reversible

Reversibility in

price transmissionReversibility in

Behavioural response

Objective

• Is air transport demand imperfectly reversible wrt air fare?

• Is air fare imperfectly reversible wrt jet fuel prices?

Centre for Integrated Energy Research

Institute for Transport Studies

Background Conclusions

Results

Methodology

Objectives

Centre for Integrated Energy Research

Institute for Transport Studies

Methodology

Fuel price Ticket pricePassenger

demand

Imperfectly

reversible Reversible

Imperfectly reversible

Demand Elasticityfuel price = Fare elasticityfuel price× Demand Elasticityair fare

𝑙𝑛𝐷 = 𝛼′ 𝑙𝑛𝑌 + 𝛾𝑙𝑛𝑃 + 𝜽′𝑿′ 𝑙𝑛𝐷 = 𝛼𝑙𝑛𝑌 + 𝛽𝑙𝑛𝐹𝐴𝑅𝐸 + 𝜽𝑿

Centre for Integrated Energy Research

Institute for Transport Studies

Methodology

• Time series econometric modelling

• 1979-2012 monthly data for US: RPEN/capita/day

• Decompose the explanatory factors into three series:

• All variables in logarithms- Cobb-Douglas

• Two demand equations: jet fuel price & air fare

𝑉𝑡𝑚𝑎𝑥 = 𝑚𝑎𝑥(𝑉0, … . , 𝑉𝑡)

𝑉𝑡𝑟𝑒𝑐 = 𝑚𝑎𝑥 0, (𝑉𝑖−1

𝑚𝑎𝑥 − 𝑉𝑖−1) − (𝑉𝑖𝑚𝑎𝑥 − 𝑉𝑖)

𝑡

𝑖=0

𝑉𝑡𝑐𝑢𝑡 = 𝑚𝑖𝑛 0, (𝑉𝑖−1

𝑚𝑎𝑥 − 𝑉𝑖−1) − (𝑉𝑖𝑚𝑎𝑥 − 𝑉𝑖)

𝑡

𝑖=0

Historical maximum

Recovery/rise,

below maximum

Fall/cut

Centre for Integrated Energy Research

Institute for Transport Studies

Methodology: Decomposition

Air fare decomposition

Income decompositionFuel price decomposition

-1.0

-0.5

0.0

0.5

1.0

1.5

2.0

-12

-10

-8

-6

-4

-2

0

2

4

6

8

10

Jan-79 Jan-82 Jan-85 Jan-88 Jan-91 Jan-94 Jan-97 Jan-00 Jan-03 Jan-06 Jan-09 Jan-12

Fuel

pri

ce a

nd

its

dec

om

po

siti

on

(in

log)

Time

fuel price - recovery seriesfuel price - cut seriesfuel price (right axis)fuel price - maximum series (right axis)

5.3

5.4

5.5

5.6

5.7

5.8

5.9

6.0

6.1

6.2

6.3

-5

-4

-3

-2

-1

0

1

2

3

4

Jan-79 Jan-82 Jan-85 Jan-88 Jan-91 Jan-94 Jan-97 Jan-00 Jan-03 Jan-06 Jan-09 Jan-12

Air

fare

an

d it

s d

eco

mp

osi

tio

n (i

n lo

g)

Time

air fare - recovery seriesair fare - cut seriesair fare (right axis)air fare-maximum series (right axis)

10.0

10.1

10.2

10.3

10.4

10.5

10.6

10.7

-1.0

-0.5

0.0

0.5

1.0

Jan-79 Jan-82 Jan-85 Jan-88 Jan-91 Jan-94 Jan-97 Jan-00 Jan-03 Jan-06 Jan-09 Jan-12

Inco

me

and

its

dec

om

po

siti

on

(in

log)

Time

per capita income - recovery seriesper capita income - cut seiresper capita income (right axis)per capita income-maximum series (right axis)

Centre for Integrated Energy Research

Institute for Transport Studies

Methodology: Model Specification

𝑅𝑃𝐸𝑁𝑡𝑐𝑑 = 𝜇 + 𝛼𝑚𝑎𝑥 𝑌𝑡

𝑚𝑎𝑥 + 𝛼𝑟𝑒𝑐𝑌𝑡𝑟𝑒𝑐 + 𝛼𝑐𝑢𝑡 𝑌𝑡

𝑐𝑢𝑡 + 𝛾𝑚𝑎𝑥 𝑃𝑡𝑚𝑎𝑥 + 𝛾𝑟𝑒𝑐 𝑃𝑡

𝑟𝑒𝑐 + 𝛾𝑐𝑢𝑡 𝑃𝑡𝑐𝑢𝑡

+ 𝜅𝑈𝑡 + 𝜆𝑗𝐷𝑗𝑡

4

𝑗=1+ 𝜑𝑘𝑀𝐷𝑘𝑡

12

𝑘=2+ 𝛾𝑖𝑅𝑃𝑀𝑡−𝑖

𝑐𝑑𝑙

𝑖=1+ 𝜀𝑡

Income decomposition Price/Fare decomposition

Unemployment

Event dummies

9-11 attack etc.

Monthly dummies

Lagged dependent

• Dynamic model

• Cointegration tests

αmax = αrec = αcut; γmax = γrec = γcut

Centre for Integrated Energy Research

Institute for Transport Studies

Background Conclusions

Results

Methodology

Objectives

Centre for Integrated Energy Research

Institute for Transport Studies

Results: Parameter Estimates

Air fare model Fuel price model

RPEN lag 1 0.596*** 0.607***

RPEN lag 12 0.132*** 0.112***

Ymax (income, max series) 0.156*** 0.370***

Yrec (income, cum. recovery series) 0.826*** 0.716***

Yfall (income, cum. fall series) 0.635*** 0.436***

FAREmax/Pmax (fare or price, max series) -0.229*** -0.097***

FARErec/Prec (fare or price, cum. recovery

series) -0.143*** -0.014***

FAREcut/Pcut (fare or price, cum. fall series) -0.113*** -0.001

Full estimation results suppressed

Centre for Integrated Energy Research

Institute for Transport Studies

Results: Tests for Reversibility

Hypothesis Test restrictions F-stat

Fare model

F-stat

Price model

Imp. rev.: Income αmax = αrec = αcut18.63*** 9.78***

Asymmetry: Income αrec = αcut8.03*** 11.67***

Asymmetry: Income αmax = αcut14.53*** 0.18

Hysteresis: Income αmax = αrec33.17*** 7.20***

Imp. Rev.: Fare/Price βmax = βrec = βcut or γ’s 5.37*** 8.91***

Asymmetry: Fare/Price βmax = βcut or γ’s 7.54*** 7.52***

Asymmetry: Fare/Price βrec = βcut or γ’s 3.94** 17.80***

Hysteresis: Fare/Price βmax = βrec or γ’s 2.17 17.38***

Centre for Integrated Energy Research

Institute for Transport Studies

Results: The Elasticities

Demand elasticity

wrt fuel price (γ)

Demand elasticity

wrt air fare (β)

Air fare elasticity

wrt fuel price

Maximum series -0.097*** -0.229*** 0.423***

Sub-maximum

recovery series

-0.014*** -0.143*** 0.100***

Fall series Insig. -0.113*** Insig.

= ×

Demand elasticityair fare > Demand Elasticityfuel price

Centre for Integrated Energy Research

Institute for Transport Studies

Background Conclusions

Results

Methodology

Objectives

Centre for Integrated Energy Research

Institute for Transport Studies

Summary

With respect

to ..

Air transport demand Air fare (price transmission)

Asymmetry Hysteresis Overall Asymmetry Hysteresis Overall

Income Yes Yes Yes

Fuel price Yes Yes Yes Yes Yes Yes

Air fare Yes No? Yes

• Evidence of imperfect reversibility in air travel demand

- With respect to income, fuel price, air fare

• Evidence of imperfect reversibility in price transmission

Centre for Integrated Energy Research

Institute for Transport Studies

Implications

• Reversible elasticity estimates can be biased

- yet long run demand forecast okay-ish

• Larger income elasticity during post-recession recovery

- short-term forecasting, planning, revenue management?

• Larger price/fare elasticity for increases above maximum

- fuel tax/carbon pricing policies

• Falling fuel price benefits not passed on to consumers

- regulatory oversight?

Centre for Integrated Energy Research

Institute for Transport Studies

Future Work

• Heterogeneity in market types lost in aggregation:

- travel purpose, travel class, travel distance, presence &

type of competition, business model, O-D type, etc.

• Effect of fuel price hedging

• Test in other countries

Centre for Integrated Energy Research

Institute for Transport Studies

Thank you!

Wadud (2015) Imperfect reversibility of

aviation demand: Effects of fuel prices, air

fare and price transmission

Centre for Integrated Energy Research

Institute for Transport Studies

Results: Reversible vs. Imperfectly Reversible

Imperfectly reversible,

asymmetry + hysteresis

Perfectly

reversible

Asymmetry only

Ymax 1.684***

Yrec 3.503***

Yrise 1.803***

Ycut 2.102*** 1.381**

Y 1.821***

Pmax -0.510***

Prec -0.052**

Prise -0.089***

Pcut 0.009 -0.063*

P -0.099***

AIC/BIC -1898.6/-1785.1 -1879.3/-1782.0 -1877.0/-1771.6