How Europe’s cement sector benefits and the climate ... · 2 at Lafarge/AETHER) ... (Project...

Transcript of How Europe’s cement sector benefits and the climate ... · 2 at Lafarge/AETHER) ... (Project...

TheFinalCarbonFatcatHowEurope’scementsectorbenefitsandtheclimatesuffersfromflawsinthe

EmissionsTradingScheme

TheFinalCarbonFatcat–Sandbag–March2016 2

Acknowledgements

ThisreportwasproducedwiththehelpofagrantfromtheEuropeanClimateFoundation,butitsconclusionsremainindependent.

Theauthorsareenormouslygratefultotheindividualsandorganisationswhoseinputandexpertisehasbroughtthisprojecttofruition.Inparticular,wewouldliketoexpressourthanksto:

MrKoenCoppenholle(ChiefExecutive,CEMBUREAU),MsCristianaCiaraldiJolivet(ClimateProtectionandSustainabilityManagerattheWorldBusinessCouncilforSustainableDevelopment),MsClaudeLoréa(DeputyChiefExecutive,CEMBUREAU),andMrAlessandroSciamarelli(HeadofEconomicResearchandStatisticsCEMBUREAU)forhelpingclarifymanyissuesregardingbenchmarks,technologyandindustrydata.

MrRobertFielding(ProgrammeManageratÉcolepolytechniquefédéraledeLausanne),PeterLukas(DirectorGlobalEnvironmentalSustainabilityatHeidelbergCement),MrJanTheulen(DirectorAlternativeResources,HeidelbergCement)andDrGüntherWalenta(ProgramManagerInnovation&CO2atLafarge/AETHER)fordiscussionsontheeffortsofconventionalcementmakerstodecarbonise.

AlexandrosKatsiamboulas(Environment,Quality&SustainableDevelopmentSeniorManageratTitanCementCompanySA)andMrMarcoSollevanti(ControlleratColacemSpa)forverifyingcorporateownershipoftheircementinstallations.

DrPaulaCarey(QualityAssuranceandResearchDirectoratCarbon8AggregatesLtd),MrTomGlasby(ProjectManagerforEarthFriendlyConcreteatWagners),MrTomJensen(HeadofCorporateDevelopmentatJouleUnlimitedTechnologies,Inc.),MrDonalO’Riain(founderofECOCEM),MrMatthiasSpringborn(DeutschesInstitutfürBautechnik),andDrBrianSweeney(SeniorPartneratFastnetEnergyConsultants)fordiscussingthechallengesfacingmakersofnon-conventionalcementandcarbon-negativeproducts,andgettingusuptospeedoncementcarboncapturestoragetechnologies.

MsEleonoraArcese(ResearchAssociateatClimateStrategies),DrAndrzejAncygier(LectureronEuropeanEnvironmentalPolicyatNewYorkUniversity,Berlin),DrFrédéricBranger(GranthamResearchInstituteonClimateChangeandEnvironment),DrKarstenNeuhoff(DepartmentheadofClimatePolicyatDIW),PhilippeQuirion(DirectoratCIRED),andDrMisatoSatoh(GranthamInstitute)fortheirinestimablehelpindevelopingnewresearchmethodology.

MsSimoneCooperandcolleaguesattheUniversityofCambridgefortechnicalfeedbackondecarbonisationlevers.

MrMartijnBroekhof(SeniorAssociateattheEuropeanClimateFoundation)&DrJuliaReinaud(DirectoroftheResearchProgrammeandPartnershipsatIndustrialInnovationforCompetitiveness)forprovidingextensivefeedbackatallstagesofmakingthisreport.

DaveJones,PhilMacDonald,DamienMorris,BenNelmes,JulianRichardson&BaronessBryonyWorthingtonfortheireditinghelp,andTriciaBuckleyforherindefatigablehelpondatastructuring.

Authors:AlexLuta,WilfLytton.Formoreinformation,[email protected].

TheFinalCarbonFatcat–Sandbag–March2016 3

ContentsEXECUTIVESUMMARY.................................................................................................................................4

Cementandemissionstrading.................................................................................................................5

TheETSsofar:Alicencetopollute..........................................................................................................6

Urgentneedtorevisethefreeallocationsystem....................................................................................7

Needtoboostsupportinnovationsinindustrialabatement...................................................................8

SUMMARYOFRECOMMENDATIONS.......................................................................................................9

1. INTRODUCTION:Cement–TheFinalCarbonFatcat........................................................................10

Aboutthisreport....................................................................................................................................10

2. CEMENTINCONTEXT.........................................................................................................................11

3. LEVERSFORDECARBONISINGCEMENT............................................................................................12

4. CEMENTUNDERTHEETS...................................................................................................................13

4.1. Ineffectivedecarbonisationincentives.....................................................................................13

4.2. Problem1:Toolittleadjustment..............................................................................................17

4.2.1. Cause..................................................................................................................................17

4.2.2. Solution:Introduceahighergranularityoffreeallocationadjustments............................20

4.2.3. Expectedresults..................................................................................................................20

4.3. Problem2:Toomuchallocation...............................................................................................21

4.3.1. Cause..................................................................................................................................21

4.3.2. Solution:Adoptatieredsystemofleakageprotection.......................................................21

4.3.3. Expectedresults..................................................................................................................21

5. SUPPORTINGINNOVATION...............................................................................................................22

6. OVERVIEWOFDECARBONISATIONOPTIONS...................................................................................23

6.1. IndustrialCCS.............................................................................................................................24

6.2. Fuelswitching............................................................................................................................24

6.3. Kilnefficiency.............................................................................................................................26

6.4. Clinkershares.............................................................................................................................27

6.5. Non-Portlandcements...............................................................................................................28

6.6. CCUScementsandconcrete......................................................................................................29

7. ANNEX:METHODOLOGY...................................................................................................................31

TheFinalCarbonFatcat–Sandbag–March2016 4

EXECUTIVESUMMARYCementisthemostwidelyusedman-madematerialintheworld,responsiblefor5%ofworldwideman-madegreenhousegasemissions.1ThecementsectorinEuropecontributesasmuchcarbonpollutionasthewholeBelgianeconomy.TheEU’s‘flagship’climatechangepolicy,theEmissionsTradingScheme(ETS),isintendedtoincentiviseemissionscutsandinnovationinthecementsector.However,thisreportfindsthatwhilstmostindustrialsectorsarenowfacingreducingallowancesurpluses,thecementsectorsurpluscontinuestogrow(seeFigure1),hamperingprogresstowardsdecarbonisation.PerverseincentivesinfreeallocationdesignmeanthattheEUETSislikelytohavecausedemissionsinthecementsectortohaverisenbeyondbusinessasusual;weestimatebymorethan15milliontonnes.Ineffect,‘CarbonLeakage’hashappenedinreverse.EmissionshavebeenimportedintotheEUthatwouldnothaveoccurredwithouttheETS.Wealsoidentifyfive“CarbonFatcatCompanies”fromthecementsectorwhohavecollectivelyreceivednearly€1billionworthofspareEUallowances(EUAs)forfreebetween2008and2014.Thisreportshowsthatdeepreductionsincementemissionsarepossible,ifthecarbonpricerises,over-allocationofallowancesisended,andtheETSisredesignedtosupportinnovation,includingnewprocessesbeyondPortlandcement,andCarbonCapture&Storage.

Figure1:ExpecteddevelopmentofallowancesurplusesformajorindustrialsectorsuntiltheendofPhase3.Source:EUTL(Sandbagcalculations).

1LowCarbonTechnologyPartnershipsinitiative.(2015)Cement(link).

0.0

0.5

1.0

1.5

2.0

2.5

3.0

Years'worthofspareEUA

s

Phase3

Cement

Limeandplaster

Ironandsteel(EUTL)

Refineries

Paper

Organicchemicals

Inorganicchemicals

TheFinalCarbonFatcat–Sandbag–March2016 5

CementandemissionstradingEmissionsfromtheproductionofcementareregulatedundertheEU’sEmissionsTradingScheme(ETS).In2014theyaccountedfor6.3%ofETSemissions.Aroundtwothirdsofthesector’semissionsareprocessemissionsfromchemicalreactionsintheproductionofclinker.ClinkerisanintermediarymaterialinthemanufactureofPortlandcement–thevarietythatdominatestheglobalcementmarket.TheCommissionproposaltorevisetheETSpost-2020impliesacompletedecarbonisationofallindustrialsectorsby2058.Tomeetthischallenge,cementcompanieswillneedtofundamentallyreinventthemselves–andevenswifteremissionsreductionsmayyetberequiredofthemifEuropestepsupitsambitionsfollowingtheParisAgreement.Fortunately,manytechnologicaloptionsexisttodecarbonisethesectorbutexistingpolicyleversarepushinginthewrongdirection.TheETScouldassistthistransformation,butitisnotcurrentlyprovidingamarketsignalthatwouldsetthissectoronatransformativepathway,throughinvestmentsintocarboncaptureormassproductionoflow-carbonorcarbon-negativecements.Instead,ouranalysisshowsthattheexistingrulesforfreeallocationactasperverseincentiveskeepingtheproductionlevelofhigh-carbonclinkerartificiallyhigh.PoorruledesigniseffectivelyresultingintheimportofcarbonemissionsintotheEU.Weidentifysixdifferentoptionsfordecarbonisingthecementsector:

1. Capturingandstoring/usingdirectemissions(CCUS)2. Burningcleanerfuels3. Improvingkilnefficiency4. Reducingtheshareofclinkerincement5. ReplacingPortlandcementwithnon-conventionalvarieties6. Developingcarbon-negativevarietiesofcement

ThefirstfourleversliewithinthescopeofactivitiesthattheETScouldinfluencebutanumberofrulesmustbeimprovedbeforecarbonpricingcaneffectivelyencouragethem.Deliveringthelasttwowillrequireadditionalpolicyincentives.OutsidetheETS,ahostofsupportingproductstandardsatboththeEUandMemberStates(MS)levelcertifyingnewlow-carboncementorcementitiousproducts,aswellasdemonstrationprojectsandprocurementrules,willberequiredtofacilitatethediffusionofinnovationinthissector.SofaremissionsreductionsinthesectorhavebeenoverwhelminglyincentivisedbypoliciesoutsidetheETS.Forexample,switchingtobiomassissupportedbytheEU-wide2020renewableenergytarget(RenewablesDirective2009/28/EC)andotherDirectivesandMSpolicies.ThewidelydivergentprogressacrossMSs(seeTable1)demonstratesthatnational-leveltargetsrelatingtowastehandlingandrenewableenergyhavehadastrongerimpactonfuelswitchingthantheETS.Germany Czech

RepublicPoland United

KingdomFrance Spain Italy

64.4% 59.5% 47.3% 49.1% 32.3% 29.4% 13.0%Table1:Weightedaveragesfortheuseofalternativefuelsandbiomassinthethermalenergyconsumptionofgreyclinkerproduction.Source:CSI2013(dataset25aAGFC).

TheFinalCarbonFatcat–Sandbag–March2016 6

TheETSsofar:AlicencetopolluteThedepressedcarbonpriceundertheEUETShasdonelittletoeffectareductioninemissionsfromtheEuropeancementsector.Asurplusofmorethan2billionEUallowances(EUAs)hasbuiltupintheEuropeancarbonmarketsince2008withnoexpectationsforthesituationtochangesignificantlyoverthemediumterm.Industrysourcescitethatthecostsofupgradestobestavailabletechnologyaretantamounttogreenfieldinvestments.Thecurrentlowcarbonpricealoneisnotenoughtorendersuchinvestmentseconomic,especiallyinthecontextofadepressedcementmarket.

ThisappliesevenmoresointhecaseofCCUSwhichatthisstageseemstobeanexpensivetechnologymerelyinthedevelopmentstagesacrossEurope.Therulesgoverningfreeallocationofallowanceshavefailedtoincentiviseabatementinthecementsector.Inparticular,thesector’sinclusiononthelistofsectorsexposedtotheriskofcarbonleakage,aswellasinsensitivitytoproductionchangeswillcauseitsover-allocationtoballoon.AswerevealinFigure1,ifactivitylevelscontinueat2014levels,by2020thissurpluswillbelargerthan2.5years’worthofemissions.Thisismorethanwouldbethecaseforalmostanyoftheothermajorindustrialsectors,practicallyallofwhomexpecttoloseallormostoftheirearliersurplusesbytheendofthisdecade.ThechronicoversupplyofEUAstothecementsectorispartlyduetothefactthatcementfirmsareabletooptimisetheirproductionofdifferentproductsacrossdifferentfacilitiestomaximisetheirfreeallocation.Freeallocationtocementinstallationsisbasedonbenchmarksrelatingonlytothemanufactureofclinker,anintermediateproduct.Manyfirmshavebeenabletoretainmaximumfreeallocation,correspondingtopeakproduction,bykeepingarangeoftheirfacilitiesoperatingatjustabove50%oftheirhistoricactivitylevels–thelevelrequiredtoretain100%freeallocation.Thisfreeallocationloopholehasresultedinbothwindfallprofitsandadefactoproductionsubsidyforhighlycarbon-intensiveclinker.Thisclinker

Figure2:EUnetclinkertrade.Source:UNCOMTRADE(Sandbagcalculations).

Figure3:Differentfactors’contributiontocuttingthecementsector’semissionsEU-wideduring2005-2013.Source:CementSustainabilityInitiative‘GettingtheNumbersRight’database(Sandbagcalculations).

TheFinalCarbonFatcat–Sandbag–March2016 7

istheneitherblendedinhigherthannecessarysharesintocementor,asweshowinFigure2,actuallyexported,asEUcementsubsidisedbyfreeallowanceshasacompetitiveadvantagecomparedtomanufacturersoutsidetheETS.ThiscreatesanetimportofemissionstotheEU–thecompletereverseofthecarbonleakagethreatthatmanyindustrygroupshaveemphasised.AsweshowinFigure3,thisstimulationofclinkerexportstocountriesoutsidetheEUhasbeenthesinglemostdamagingfactortothedecarbonisationofthissector,pushing2013emissionsnearly15milliontonneshigherthantheycouldhavebeen.Aswellascausingasurgeinemissions,theinsufficientlyresponsivefreeallocationrulesleavecementcompaniesstronglyover-allocated.Table2showsthesurplusesweestimatethatthefivecementmajorshaveaccumulated(ormonetised)sincethebeginningofPhase2.Company 2008-2014surplus Value2 2014emissions

(Mill.EUAs) (Mill.EUR) (Mill.tonnes)Lafarge-Holcim 49.8 299.7 18.2Heidelberg-Italcementi 45.8 275.5 28.1CRH 31.9 191.8 10.3Cemex 26.2 157.5 8.0BuzziUnicem 10.4 62.5 7.3

Table2:Largestcementcompanies’surplusesandemissions(millionsofEUAs,eurosandtonnes).3

Source:EUTL(Sandbagcalculations).

Thesefive‘CarbonFatcats’fromthecementsectorhavecollectivelyreceivednearly€1billionworthofspareEUallowances(EUAs)forfreebetween2008and2014.Asthenumberoffreeallowancesavailabletoallindustryisfixed,over-allocationtocementcompaniesreducestheallowancesavailabletoothersectorsthatmightreallyneedprotection.TheETSthereforeprovidesfewincentivesforthesefirmstoinvestindecarbonisationtechnologies.Givenwidespreadexpectationsforanover-suppliedcarbonmarketwellintothe2020sand,consequently,alowcarbonprice,theopportunitycostofholdingontoallowancesisnegligiblewhencomparedtothehighcostofinvestmentinabatementtechnologies.UrgentneedtorevisethefreeallocationsystemIftheETSistoincentivisechangeinthecementsectoritneedstodeliverahighercarbonprice.Companiesmakeongoinginvestmentdecisionsonashort-termbasis.Thedistantprospectofhighcarbonpricesandashortageoffreeallowancesinthe2030sprovidesonlyaweakguideforinvestmentdecisionstoday,particularlyifproductionlevelsandcashflowareindecline.TheeasiestwaytoincreasetheshorttermcarbonpricesignalistomaketheETScarbonbudgetsmoreambitious,therebyreducingthemarketsurpluspre-and/orpost-2020.Thisremainsourleadrecommendation.

2CarbonpricefromMarch9,2016.3Weignoreoffsetusehere,becausetheEUTLstoppedreportinginstallation-leveldataaboutoffsetusein2013.BecauseoffsetsareentirelyfungiblewithEUAs,surpluseswouldbesignificantlyhigher,bothintermsofallowancesandmonetaryvalue.

TheFinalCarbonFatcat–Sandbag–March2016 8

However,irrespectiveofthequestionofambition,itisstillessentialthatpolicymakerschangethefreeallocationrulestomakethembothmoreresponsivetoproductionchangesandmoreinlinewithsectors’actualriskofcarbonleakage.Effectivereformcanbeachievedbyintroducingmoregranularproductionthresholdstoexistingex-postadjustmentstoallocationandbyshiftingfromabinarycarbonleakagesystem(withsectorseitheronorofftheleakagelist)toasystemthatrecognisesdifferenttiersofriskexposure.Thesearetwoofthemosteffectivetoolsforchangingthestatusquo.Moreresponsiveallocationwouldmitigatethegamingofproductionthresholdsandthewindfallprofitstofailingindustries.TieredfreeallocationwouldcontinuetoprotectEurope’smostleakageexposedsectors,notleastbyminimisingtheriskthatacross-sectoralcorrectionfactorwillbetriggered.Itwouldalsoavoidgivingfreeallowancestoinstallationsthatdonotreallyneedthem.NeedtoboostsupportinnovationsinindustrialabatementTheabovementionedreformsoftheETSwouldgoalongwayindrivingemissionreductions.However,theyareunlikelytoraisethecarbonpricetoalevelwhichcouldsupportthedevelopmentanddeploymentoftechnologiesthataddressthemostfundamentalobstacletofullydecarbonisingthecementsector–itsprocessemissions.WithoutCarbonCaptureandUtilisation/Storage(CCUS)therewillbenofutureinEuropeforthePortlandfamilyofcementsasthecapapproacheszerobymid-century.AnInnovationFundproposedforPhase4oftheEUETScouldstimulateinnovationinthisarea.However,wereiterateapreviousrecommendationthat,becausethisFundwouldbefinancedthroughtheauctioningofallowances,itwillneedtobecontainmoreofthemthancurrentlyproposedtocompensateforalowcarbonprice.Itwillalsoneedtobemoretargetedtowardsindustrialsectors.Wethereforere-emphasisethatitwillbenecessarytocontinuefundingthroughprogrammesdedicatingfixedamountsofmoneyforRD&Defforts(e.g.Horizon2020)orforinfrastructure(e.g.theEuropeanFundforStrategicInvestment).4WealsostandbyourearlierrecommendationthatMemberStatesshouldconsiderusingETSrevenuestosupportindeepdecarbonisationtechnologiesinindustrialsectorsthroughinstrumentssuchastheUK’scontractsfordifferenceorotherdiffusion-orientatedmeasures.5PolicymakersneedtocreatefurtherincentivesforthetwodecarbonisationleversbeyondthereachoftheETS–non-Portlandandcarboncapturingcements.Forinstance,sincetheETSregulatesthissectorbyfocusingonthedirectemissionsfromtheproductionofclinkerforPortlandcement,itisunabletorewardthemitigationopportunitiestobefoundintheproductionofotherformsofcement,ortoencouragemanufactureofcementsthatproducenegativeemissionsbyabsorbingcarbondioxidechemically.Unconventionallow-carboncementandconcreteproductswhichattainEuropeancertificationshouldbebackedbypublicprocurementprogrammesandenabledbyclimate-sensitiveproductstandardstosupportthetransitiontoagreenconstructionindustry.Thoughemissionsaredownoverallcomparedto2005,whentheETSwaslaunched,thisisthankstoacollapseindemandandtoincentivespromotingtheuseofrenewableenergy,suchastheRenewablesDirective(2009/28/EC),WasteFrameworkDirective(2008/98/EC)andLandfillDirectives(1999/31/EC).Thedecarbonisationofthecementsectorhasnotyetseriouslybegun.ItistimeforEuropetoprovidetheproperincentivestodevelopzero-carbonsolutionsforthefuture.Ifitdoesnot,othergeographicregionswilldeveloptheseproductsandprocessesforthemselves,hurtingthefuturecompetitivenessofEuropeanindustrymorethananydifferentialsinclimatepolicycould.

4‘Dischargingthepoliticalstorm’.5‘Financingdeepdecarbonisationinindustry’.

TheFinalCarbonFatcat–Sandbag–March2016 9

SUMMARYOFRECOMMENDATIONSSandbagadvocatesstrengtheningtheEU’sclimateambitionasthebestsolutiontoincreaseETSscarcity,raisethecarbonpriceandstimulatethetransitiontowardsalow-carboneconomy–bothgenerallyandinthecaseofthecementsector.Inadditiontothatwemakethefollowingmorespecificrecommendations:EmissionsTradingScheme(ETS):

• Stoptheaccumulationofsurplusallowancestocementcompaniesbymakingcarbonleakageprovisionssensitivetoactualrisk(tieredfreeallocation);

• Introducehighergranularityadjustmentstofreeallocationtoeliminateperverselyrewardingover-productionofhigh-carbonclinker;

• RecycleMemberStates’auctioningrevenuestofinanceindustrialabatement;• IncreasethesizeoftheInnovationFund;• IntroduceanMRVandcreditingmechanismforcarbonnegativeformsofcement.

Non-ETS:

• DevelopanEU-levelframeworktosupportthegenerationanddiffusionofinnovationinindustrialdecarbonisationthroughfixedsumsofmoneythatareunaffectedbyfluctuationsinthecarbonprice;

• HarmoniseEU-widelandfillregulations,aswellasregulationspermittingtheincinerationofthesenon-conventionalfueltypes;

• Phaseoutinefficientproductionfacilitiesthroughintroducingminimumefficiencystandards;• NarrowtherangeofallowableclinkersharesinPortlandcementsinEuropeannormsofcement

andconcrete;• ExtendtheEuropeannormsoncementandconcretebeyondtheparadigmofPortlandcement

andpromoteperformance-basedstandards;• Engageindemandcreationforlow-carbonandcarbon-negativecements.

TheFinalCarbonFatcat–Sandbag–March2016 10

1. INTRODUCTION:Cement–TheFinalCarbonFatcatSinceitsintroductionin2005,theEuropeanEmissionsTradingScheme(EUETS)hasregulatedemissionsofgreenhousegasesfromalllargepointsources,includingpowerandheavyindustry.OvertheyearsSandbaghastrackedtherelationshipbetweentheEUETSandemissionsfromthesectoritregulates.Weuncoveredthefactthatinindustrialsectorsoftenemissionswerewellbelowthelevelofallowancesgiventocompaniesforfree,andcoinedtheterm‘CarbonFatCats’torefertosuchover-allocatedcompanies.In2013newruleswereintroducedthatchangedthewayindustrialsectorsareallocatedallowances.Ourforwardprojectionsfromthatpointonshowedthatthemajorityofthefatcatswehadidentifiedinthepastbegantoslimdown.Onelargesector,however,stoodout,asitcontinuedtogrowsubstantiallyitssurplusemissions,nowandintothefuture:thecementsector.Cementisthemostwidelyusedman-madematerialintheworld,butitisalsoresponsiblefor5%ofworldwideman-madegreenhousegasemissions.6Ifthissectorwereacountry,itwouldcontributeasmuchcarbonpollutionasthewholeBelgianeconomy.Inthisreportweshowthat,ratherthanincentiviseemissionsreductions,thecurrentEUETSrulesareactingincounterproductiveways.Freeallocationofallowancestoindustryislimitedintotalvolume.Therefore,over-allocationtoanyonesectorleadstounderallocationtoothersthatmayneedmoreprotection.AfailuretoaddressthegrowingsurplusesinthecementsectorwilldamagetheETSasawholeandexacerbatetheriskofcarbonleakage,whereitgenuinelyexists.Urgentreformsareneeded,andthisreportcontainsclearrecommendationsthatmustbeimplementedintheforthcomingreviewoftheEUETSDirective.Emissionsaredowninthecementsectorthankstoreduceddemandandtoashifttowardscleanerfuelsthathasbeenbroughtonbysupplementarypoliciesthatsupportswitchingtowasteandbiomass.However,theETScapswilldeclinetozeroeventually.Thecementsectorhasanumberofadditionaloptionsavailabletoittofullyreduceitsemissions,butasyetthereareinsufficientpoliciestodriveinvestmenttowardssuchatransition.InadditiontohighlightingtheflawsintheETSrulesandhowtofixthem,thisreportalsoconsiderswhatmoreneedstobedonetosupportdeepdecarbonisation.Thesetechnologiesexistforcurrentcementproductionprocesses,aswellasfornewapproachesthat,thankstotheirrelianceondifferentfeedstocks,canpotentiallyturncementintoanetcarbonnegativeproduct.AboutthisreportInwritingthisreportSandbagusedin-housedataanalysisbasedonpubliclyavailabledatathatwecurateourselves.InadditiontotheEUETSTransactionLog(emissionsandfreeallocation),otherdatabaseswereliedonincludetheUnitedNationsComtrade(forcementandclinkertrade),theCementSustainabilityInitiative’s(CSI)‘GettingtheNumbersRight’(cementandclinkerproductionandemissions)andtheUSEnvironmentalProtectionAgency(fuelemissionfactors).Muchofouranalysisreliesonanumberofanalyticaltoolswehavedevelopedin-house.ThefirstoneoftheseallowsustoreconstitutewhatdeterminesPhase3freeallocationattheinstallation-level.Buildinguponitsoutput,wearealsoabletocalculate,withahighlevelofaccuracy,futurefreeallocationunderavarietyofpolicyscenarios–alsowithinstallation-levelgranularity.Anotherspin-offsofourworkonPhase3allocationallowustoidentifyvariationsinactivityandinstancesofpartialcessationorclosureattheinstallationlevel.(ItisbrieflydescribedintheAnnex.)6LowCarbonTechnologyPartnershipsinitiative.(2015)Cement(link).

TheFinalCarbonFatcat–Sandbag–March2016 11

WearegratefultotheEuropeanClimateFoundationforfundingthiswork.2. CEMENTINCONTEXTTheproductionofcement(NACE23.51)isthethirdbiggestindustrialsectorintermsofemissions(Figure4).Followingafallinproductionofnearly41%asaresultoftheeconomiccrisessince2008,thecementsector’semissionsaredownby33%relativetoa2007peak.However,asweshowinthisreport,thisfallinemissionsisnotduetomitigationactionpromptedbytheEUETS.

Figure4:2014cementemissionsrelativetootherindustrialsectors(allsectorsdepictedcover75%ofindustrialemissions).Source:Source:EUTL(Sandbagcalculations).

Figure5:Trendsinthecementsectorsince2005.Sources:EUTL(Sandbagcalculations),Cembureau.7

In2014,ETSemissionsfromcementproductionstoodatslightlyover114Mt(justover6.3%ofallETSemissions,andjustover15%ofallnon-poweremissionsundertheETS).AsshowninFigure6,in2014,nineEUMemberStates(MSs)accountedfornearly77%ofemissions-withGermany,SpainandItalyinthelead.Corporateownershipismuchmoreconcentrated:onlyfiveentitieswereresponsibleformore

7Cembureau’sfiguresconsistentlyrepresentthesame28countries,whereastheEUTLdataonlycapturesemissionsascountriesjointheEU.

0% 2% 4% 6% 8% 10% 12% 14% 16% 18% 20%

InorganicchemicalsAluminium

PaperLimeandplaster

PetroleumextractionFertilisers

OrganicchemicalsCement

IronandsteelRefineries

146.4 150.1169.0

157.9

126.5 124.4 122.2 114.7 108.3 112.8245.9261.2 268.4

250.0

208.2191.3 191.3

169.9 157.1 158.7

0

50

100

150

200

250

300

020406080100120140160180

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Milliontonn

esce

men

tprodu

ced

MtC

O2em

issions

Totalemissions(EU-28) EU-28cementproduction

TheFinalCarbonFatcat–Sandbag–March2016 12

than80%ofthissector’sgreenhousegas(GHG)emissions.Thesecompaniesowned8138ofthe232cementproducinginstallationslistedintheEUTLduringthe2014complianceyear.

Figure6:Countrieswiththehighestsharesof2014ETSemissionsfromthemanufactureofcement.Source:EUTL(Sandbagcalculations).

Figure7:Companieswiththehighestsharesof2014ETSemissionsfromthemanufactureofcement.Source:EUTL(Sandbagcalculations).

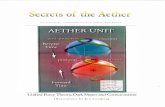

3. LEVERSFORDECARBONISINGCEMENTThevaluechainforwhatisconventionallyreferredtoas“thecementsector”revolvesaroundaproductparadigmdefinedbythePortlandprocess.AsdepictedinFigure8,thisprocessextendsfromlimestonetoconcrete.Thevastmajorityofdirectemissionsinthisvaluechainoccuruptothestageofproductionofclinker.Twothirdsoftotalemissionsemanatefromthecalcinationprocess,i.e.thechemicaltransformationoflimestoneintolime.These“processemissions”areinherenttotheproductionoflimeandarethereforeunavoidableinthecaseofPortlandcement.Theremainingthirdofemissionsarethermalemissionsstemmingfromthecombustionoffuelstocreatetheheatrequiredforthiscalcinationandtheheatrequiredforthefurthertransformationoflimeintoclinkerinkilns–aprocesscalledsintering.Relativelylittledirectemissionsoccurfurtherdownstream.Figure8depictssixmajorleversforachievingemissionreductionsfromthecementsector:applyingcarboncaptureandusageorstorage(CCUS)toprocessemissions;increasingkilnenergyefficiency;usingalternativefuels;substitutingclinkerwithothermaterials;usingnon-Portlandcements;anddevelopingcementsthatcanactuallycapturecarbon.Ofthese,theEU’semissionstradingscheme(ETS)candirectlyincentiviseonlythefirstfour.Additionalpoliciesareneededtotriggertheothers.Section6ofthisreportlooksatthedifferentleversfordecarbonisingthecementsectorinmoredetail.

8By“owned”wemean“heldatleast50%ofshares”.

17.1%

12.2%

11.7%

8.4%8.3%5.4%

5.3%4.2%4.0%

23.3%

Germany

Spain

Italy

Poland

France

UnitedKingdomGreece

Portugal

Romania

Other

28.1

27.5

10.38.07.3

44.1

Heidelberg-Italcementi

Lafarge-Holcim

CRH

Cemex

BuzziUnicem

Other

TheFinalCarbonFatcat–Sandbag–March2016 13

Figure8:SchematicrepresentationofthePortlandcementparadigm.Note:Red=emissionssources.Lightgreen=decarbonisationleversforPortlandcement.Darkgreen=decarbonisationleversfornon-Portlandcement.

4. CEMENTUNDERTHEETS4.1. IneffectivedecarbonisationincentivesPhase3rulesonfreeallocationhaveturnedtheETSintoaproductionsubsidyforclinker–amaterialwithhighembeddedcarboncontent.Thisishugelycounterproductivefordecarbonisingthecementsector.TounderstandwhythishasoccurreditiscrucialtograspthattheETS,thoughnominallyregulatingthecementsector,islargelyfocusedontheproductionofclinker.Bothmeasuresdeterminingfreeallocation,i.e.historicalactivitylevelsandproductbenchmarks,referonlytothisstageofthevaluechain.AlthoughEuropehasindeedsteadilyimprovedtheefficiencyofclinkerproduction(Figure9)thishasverylittletodowiththeETS(seesections6.2and6.3fordetails).Furthermore,datafromtheCSIrevealsthat,insomeregionsoutsideEurope,performanceisbetterthantheEUaverageandthatlaggardregionsarecatchingup.WeacknowledgethatCSIcovers96%ofEuropeancementproductionwhereasthecoverageismuchmoreseverelyrestrictedinotherregions.However,thepointstillholds-theEuropeanaverageefficiencyisbeingheldbackwhilemuchmoreefficiententitiesareemergingelsewhere.WhileEuropemaybeamongtheworld’sleadersinthecarbonefficiencyofclinkerproduction,theefficiencygainsinFigure9areonlyanimprovementof9%relativeto1990.Thisiswhytheemergenceofincentivestooverproduceiscauseforalarm.AsweshowinFigure10,clinkerandcementproductionhistoricallyusedtoevolvehand-in-handuntil2011.However,since2012thetrendhasbeentooverproduceclinkerrelativetocement.Insection6.4weshowthatinsomecountriesthisextraclinker

TheFinalCarbonFatcat–Sandbag–March2016 14

hasgoneintocement,increasingtheproportionofclinkershareinthefinalproduct.Theremainingexcessclinker,asFigure10reveals,hasgoneabroad.

Figure9:RegionaltrendsingrossCO2efficiencyofgreyclinkerproduction.Source:CSI2013(dataset59cAG).

Figure10:Divergenceinclinkerandcementproduction(2009level=100%),againsttheEU’snetclinkertradewiththenon-EUworld.Source:CSI2013(datasets8TG,21TGWcm)andUNCOMTRADE.

Theseexportsofclinkerareanoticeabledragondecarbonisingthesector.AsweshowinFigure12,in2013,thelatestyearforwhichdataoncementproductionparametersisavailable,theproductionoftradedclinkerhaspushedthesector’semissions15milliontonnesabovewhattheywouldhavebeenifthetradebalancehadbeenthesameasin2005.WeshowbelowhowtheETShasdriventhisincreaseincementsectoremissions.

800

850

900

950

1,000

1,050

1,100

1990 2000 2010 2012 2013

kgCO2/tgreyc

linker

EU28 China IndiaCIS MiddleEast NorthAmericaSouthAmericaex.Brazil

2005 2006 2007 2008 2009 2010 2011 2012 2013-15

-10

-5

0

5

10

70%

80%

90%

100%

110%

120%

130%

140%

Clinkern

ettradebalance

(millionsofton

nes)

Prod

uctio

nrelativ

eto2009

Netimports(rightaxis) Netexports(rightaxis) Clinkerproduction Cementproduction

TheFinalCarbonFatcat–Sandbag–March2016 15

Wetracethistendencytowardsoverproductiontonewrulesthatwereintroducedin2013.Thesereducefreeallocationifclinkerproductiondipsbelowcertainthresholdsinapreviousyear(seesection4.2fordetails).Inthecaseofthecementsectortheserulescreateastrongincentivetokeepclinkerproductionlevelsjustabovethosethresholdsinordertocapturefreeallocationinfull.Farfromexposingthesectortocarbonleakage,theETShasincentivisedtheimportationofcarbonemissionstoserveothermarketsbycreatingasubsidyforEuropeanproducers.

Figure12:ExpecteddevelopmentofallowancesurplusesformajorindustrialsectorsuntiltheendofPhase3.Source:EUTL(Sandbagcalculations).

Figure13:EstimatedscaleofallowancesurplusesbyendofPhase3forthefivelargestcementmanufacturersof2014.Source:EUTL(Sandbagcalculations).

Thispossibilitytogainfreeallocationbyoverproducingacarbon-intensivematerialmeansthatthecementsectorcanactuallystillincreaseitssurplus–unlikeothersectorswhichlostthisabilityin2013

0.0

1.0

2.0

3.0

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

Years'worthofspareEUA

s

Phase3 Cement

Limeandplaster Ironandsteel(EUTL)

Refineries Paper

Organicchemicals Inorganicchemicals

0

10

20

30

40

50

60

702008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

MillionEU

As

Phase3 Lafarge-Holcim

Heidelberg-Italcementi Cemex

Buzzi CRH

Figure11:Differentfactors’contributiontocuttingthecementsector’semissionsEU-wideduring2005-2013.Source:CementSustainabilityInitiative‘GettingtheNumbersRight’database(Sandbagcalculations).

TheFinalCarbonFatcat–Sandbag–March2016 16

whenharmonisedproductbenchmarkswereintroduced.Figure12revealsthatthissurpluswillcontinuetogrowineachyearofPhase3–althoughataslowerpacethaninPhase2.9Thisfindingalsoholdsforthelargestcompaniesinthissector,our‘CarbonFatcats’.Thesehavemanagedtoaccumulateconsiderablesurplusessince2008(seeTable3)and,asweshowinFigure13,theirsurplusesmostlycontinuerisingtowards2020.10Thiscreatesaproblemforincentivisingdecarbonisation.Thepricesignalcannotgetthroughwhentheregulatorallocatesmoreallowancesthantherearecorrespondingemissions.Company 2014surplus Value(March9,2016) 2014emissions

Mill.EUAs Mill.EUR Mill.tonnesLafarge-Holcim 49.8 299.7 18.2Heidelberg-Italcementi 45.8 275.5 28.1CRH 31.9 191.8 10.3Cemex 26.2 157.5 8.0BuzziUnicem 10.4 62.5 7.3

Table3:Scaleoflargestcementcompanies’surplusesandemissions(millionsofEUAs,eurosandtonnes).Source:EUTL(Sandbagcalculations).

Figure14:ExpectedsurplusvolumesforcementsectorcompaniesacrossEUMSs–nowandinthefuture.11Source:EUTL(Sandbagcalculations).

9Wepresentsurplusesintermsoftheyears’worthofemissionstheycouldcovertoaccountfordifferencesinsectorsizes.Emissionsareheldconstantat2014levels.10Weacknowledgesomeofthesecompanies’statementsabouthavingsoldofflargepartsofthesesurpluses.Howeverwepointouttwothings:first,thattheyhavereceivedtens,ifnothundreds,ofmillionsofeurofortheseallowances,andsecond,asFigure13implies,therisingslopeofthesurpluscurvesduringPhase3meansthattheycouldrebuildthesesurplusesfromscratchtowards2020.11Futureemissionsareprojectedforwardatconstant2014levels.

-60

-40

-20

0

20

40

60

80

AT BE BG CY CZ DE DK EE ES FI FR GB GR HR HU IE IS IT LI LT LU LV NL NO PL PT RO SE SI SK

MillionsofE

UAs

2014 2020 2030

TheFinalCarbonFatcat–Sandbag–March2016 17

AllowancescontinuetobeallocatedinfulltocompaniesinthecementsectorallacrosstheEUdespitesubstantialfallsinproduction,triggeringchronicsurplusesacrosstheEU(Figure14).ParticularlyegregiousarethecasesofItalyandSpain,wheresurplusesareexpectedtototalover60millionEUAsevenin2020.AlthoughtheCommission’sProposalfortheETSReviewwouldreducetheamountofallowancesallocatedtocementcompanies,aroundhalfofthesevolumescouldpersistuntil2030inthesetwocountries.Morepressingthantheproblemofsurplussizesistheproblemofhowmanyyears’worthofemissionsthesesurplusescouldcover.UnderthecurrentProposal,notonlyinItalyandSpainbutinthemajorityofMSs,thesesurplusescouldinfactlastallthewayto2030,atwhichpointtheywouldstillcoververymanyyears’worthofemissions(seeFigure15).ThismeansthatthesystemoffreeallocationforPhase4mustberadicallyrevisedifincentivestodecarbonisearetoreturntothissector.

Figure15:ExpectedyearsofemissionssurplusescouldcoverforcementsectorcompaniesacrossEUMSs–nowandinthefuture.12Source:EUTL(Sandbagcalculations).

Therearetworeasonswhythecementsectorissostronglyover-allocatedrelativetoothers.First,thevolumeofallowancesitreceivesforfreeisdisproportionatetoitsexposuretothecarbonleakagerisk.Second,itretainsafartoolargevolumeofallowancesinspiteofsignificantfallsinproduction.Belowweexplorethesecausesandhowtosolvethem.4.2. Problem1:Toolittleadjustment4.2.1. CauseThecurrentrulesadjustinginstallations’freeallocationaretoocoarseandmustbechanged.AsofPhase3,ETSinstallationsreceivefreeallocationinproportiontotheirrespectivehistoricactivitylevel.Thisisdeterminedex-antebeforethePhaseevenbegan–lockinginfreeallocationforallyearsuntil2020.So,12Futureemissionsareprojectedforwardatconstant2014levels.

-6

-4

-2

0

2

4

6

8

10

12

AT BE BG CY CZ DE DK EE ES FI FR GB GR HR HU IE IS IT LI LT LU LV NL NO PL PT RO SE SI SK

Yearssurplusesstillexpectedtolast

2014 2020 2030

TheFinalCarbonFatcat–Sandbag–March2016 18

ifproductionsuddenlyfalls,allowancesarestillallocatedeachyeareventhoughtherearenocorrespondingemissions.ThisimbalancebetweensupplyanddemandcausestheETS-widesurplustorise.Furthermore,becauseallowanceshavevalue,installationsinthissituationgainwindfallprofits.Rulesonpartialcessationandclosures(PCC)weredesignedtolimittheimpactofthesetwoproblems.13Unfortunately,asweshowinFigure16,thecurrentrulesonlyadjustallocationifproductionfallsby50%ormore,creatingastrongincentivetomaintainproductionatjustover50%.

Figure16:Currentrulesforadjustingfreeallocation.Source:Decision2011/278/EU.

Figure17:EstimatedabilityofPhase3PCCrulestocapturechangesincementsectorrelativetoothersectors.Source:EUTL(Sandbagcalculations).

Figure18:AbilityofthePCCrulestoadjustthecementsector’sfreeallocationlevelsrelativetovariationsinproduction.Source:EUTL(Sandbagcalculations).

OuranalysisofPhase3freeallocationshowsthat,ofallsectors,thecementsectorseemsparticularlyadeptatgamingthePCCrules(seeFigure17).SofarinPhase3,cementinstallationshavebeennearlya

13Thereisaslightsimplificationhere:freeallocationisactuallydeterminedonthesub-installationlevel.Unfortunately,theEUTransactionLogonlyprovidespublicdataatinstallation-levelgranularity,whichiswhy“installation”iscommonlysubstituted.

0%

20%

40%

60%

80%

100%

0%25%50%75%100%Freeallocatio

nretained

Actualproductionrelativetohistoricalactivitylevels

0%

20%

40%

60%

80%

100%

Percen

tofa

llinstallatio

ns

with

sameNA

CEco

de

Cement

AllotherNACEsectors

0

10

20

30

40

50

60

Nrofinstallatio

ns

2014emissionsvariationrelativetohistoricalemissionslevelAllinstallationsincategory …ofthese,installationswithreducedfreeallocation

TheFinalCarbonFatcat–Sandbag–March2016 19

thirdmorelikelytoreapwindfallprofitsduetothedesignlimitationsofPCCrulesthaninstallationsinanyothersector.Conversely,installationsinallothersectorshavebeenmorethanthreetimesaslikelytosufferPCCadjustmentsatleastonce.PCCrulesseemparticularlyill-suitedforcopingwiththerangeofchangesthathappeninthecementsector.AswealsoshowinFigure18,mostcementsectorinstallationsexperiencevariationsinactivitylevelsthatarebelowthefirstthresholdofthecurrentrulesforwithholdingallowances.14Thefiguregroupsallcementinstallationsintocategoriesbasedonhowmuchtheyhavedivergedfromtheirhistoricalactivitylevels.ItthenalsorevealshowmanyinstallationsthePCCruleshaveactuallycapturedineachcategory.Thedifferencebetweenthosetwovaluesinabsolutelyallcategoriesunequivocallyshowshowpoorlytheseruleslimitsurplusesandwindfallprofitsinthecementsector.Thepoordesignoftheserulesmeansthatemissionsinthecementsectorareactuallyhigherthantheyneedtobe.Largecompaniesthatownmultiplekilnsareabletooptimiseproductionlevelsacrossmultipleinstallationsinordertoget100%freeallocationeventhoughmost,ifnotall,installationsarenotrunningatfullcapacity.Thiskeepsinefficientinstallationswithhighcarbonintensityrunning.AsweshowinFigure19,thevariationinactivitylevelsbetweenpre-crisisyearsand2013inthemostefficientthreecategoriesofkilnsislargerthanthetotal2013productionvolumeintheleastefficientkilns.ThismeansthatthereismorethanenoughefficientproductioncapacityintheEUtomakeinefficientkilnsredundant,butthecrudePCCrules,bygivingtheseinstallationsmillionsofeurosworthallowances,keeptheseinstallationsemittingCO2.

Figure19:Greyclinkerproductiontypeovertime.Source:CSI2013(dataset8TGK).

14BecausetheEUTLdoesnotofferdataoninstallations’activitylevels,wehadtorelyonemissionsasaproxyforactivity.UsingthemethodologydescribedintheBenchmarkingDecision,relyingyearlymeanvalues,wecalculated“historicalemissionslevels”foreachinstallationinthecementsector.Figure18compares2014emissionsagainsttheselevels.

-

50

100

150

200

250

1990 2000 2005 2006 2007 2008 2009 2010 2011 2012 2013

Milliontonn

esofgreyclinker

WET/SHAFTKILN SEMI-WET/SEMIDRY

MIXEDKILNTYPE DRYWITHOUTPREHEATER(LONGDRYKILN)

DRYWITHPREHEATERWITHOUTPRECALCINER DRYWITHPREHEATERANDPRECALCINER

TheFinalCarbonFatcat–Sandbag–March2016 20

4.2.2. Solution:IntroduceahighergranularityoffreeallocationadjustmentsWebelievethatintroducing10%adjustmentstofreeallocationforeach10%variationinactivitylevels,asdepictedinFigure20,wouldbethemosteffectivewayofdealingwiththisproblem.Suchachangewouldnotonlybeabletodealwithsuchproblemsnomatterwhatsectortheyappearin,butwouldalsoallowforincreasingfreeallocationincaseproductionrisesabovethehistoricalactivitylevels–

somethingthatisnotpossibleundercurrentrules.4.2.3. ExpectedresultsWecalculateinFigure21that,ifsuchruleshadbeeninplacealreadyatthebeginningofPhase3,thenetresultafteralsoallocatingallowancesforinstallationsexperiencinggrowthwouldhavebeentowithholdnearly180millionEUAsoverthedurationofthePhase–almost5timesmorethanweestimatewerewithheldunderthecurrentrules.Thiswouldnotonlyhavedampenedcementsurpluses,but,beingsuchanenormousvalue(afifthofallfreeallocationforallstationaryETSsectorsforoneyear),wouldalsohavegonealongwaytowardsreiningintheoverallETSsurplus.

Figure21:EstimatednetadjustmenttothevolumeofallowancesallocatedtocementsectorifSandbagproposalwereintroducedfromthebeginningofPhase3.

AtSandbagweexpectthemarketsurplusin2020tostillbearound2billionallowancesaftertheMSRhasacted.BetterPCCruleswouldhavewithheldnearly10%ofthatvolumefromthecementsectoralone.Thisrepresentsahugemissedopportunity–andwestronglyrecommendincludingsuchprovisionsintothedesignofPhase4freeallocation.

36.3

179.6

0

50

100

150

200

2013 2014 2015 2016 2017 2018 2019 2020 Phase3total

Millionsoffreely

allocatedEU

As

Norules Currentrules Alternativerules Nowwithheld Missedopportunity(net)

Figure20:SuggestedrulesforPhase4freeallocationadjustments.Source:EUTL(Sandbagcalculations),Sandbagproposal.

TheFinalCarbonFatcat–Sandbag–March2016 21

4.3. Problem2:Toomuchallocation4.3.1. CauseIfthecementsectorwerereceivingfreeallocationinaccordancewiththesameprinciplesasmostotherindustrialsectors,thevolumeitwouldgetwouldbemuchlower.TheETSgrantsfreeallocationinordertoshieldedsectorsagainstunfaircompetitionfromjurisdictionswherenocarbonpriceisimposedandtherebypreventrelocationofindustryawayfromEurope,i.e.carbonleakage.ToqualifyforprotectionagainstcarbonleakageriskinPhase3,sectorsneededtomeetminimalcarboncostintensityandtradeintensitycriteria.Cement,aswellastherelatedlimeandplastersector,weretheonlytwoactivitytypesthatwereplacedonthecarbonleakagelistduringPhase3duetotheircarboncostintensityalone.Theyinfactdidnotmeettheminimumthresholdforthetradeintensitycriterion,andthereforearetreatedasafullyleakage-exposedsectorduetoaDirectivearticleestablishinganexceptionfromthegeneralrule.Asaresult,thecementsectorisentitledtoapplytoreceive100%ofitsbenchmarkedfreeallocationforfree,insteadofonlyaprogressivelydiminishingsharethereof.Besidesdilutingtheeffectofthecarbonprice,anothernegativeconsequenceofplacingsuchlargesectorsonthesamefootingasothersintermsofleakageriskisthatallindustrialsectors’freeallocationsuffers.Onlyalimitedamountofallowancesisavailableforfreeallocation.Unfortunately,thePhase3listofrisk-exposedsectorsisovercrowded,soitwasnotpossibletograntallinstallationstheirfullapplication.Thishasresultedintheenforcementofacross-sectoralcorrectionfactor(CSCF)–amathematicalhaircutappliedtoallfreeallocationapplicationswhichuniformlyreducestheamountofallowancesacrossallrecipientstofittheavailableceilingonfreeallocation.Highlyrisk-exposedsectorsareextremelycriticaloftheCSCF,asitresultsinthemreceivinglessprotectionthantheirbenchmarkedentitlement.4.3.2. Solution:AdoptatieredsystemofleakageprotectionPolicy-makersshouldacknowledgethat,duetodifferencesinriskexposure,thecementsectoralongwithothersectors,mightneedfewerallowancesinPhase4thanotherindustrialsectors.WesupporttheCommission’sideatomoveinPhase4frombinaryleakageprovisions(eitheronoroffthelist)toanapproachrecognisingthatsectorsfallintodifferenttiersofprogressivelydiminishingrisk.Underthisapproach,eachactivitytype’sriskexposurewouldbeassessedbycombiningitstradeandemissionsintensityintoasinglemetric.TheCommissionsuggestsfourtiers.Thelessrisk-exposedthetiertowhichaninstallationbelongs,themoreitsapplicationforfreeallocationwouldbereduced–withonlythehighesttiereligibletoreceive100%ofitsapplication.4.3.3. ExpectedresultsAtieredsystemwouldswiftlyreducethecementsector’ssurplus.Thisisbecause,whileitisahighlycarbonintensivesector,ithasamuchlowertradeintensitythanothers.Onewouldthereforeexpectittofallintoalowerrisktier.TheCommission’sImpactAssessmenttotheETSreviewestimates,basedondatathatisnotpublicallyavailable,thecementsectorwouldhaveitsapplicationreducedto80%.Sandbag,basedonpublicallyavailableinformation,expectsareductionto60%.15AsweshowinFigure

15Neitherofthesevaluesaredefinitive,asthedatausedtodeterminetradeintensityislikelytochangeinthefuture.

TheFinalCarbonFatcat–Sandbag–March2016 22

22,adoptingatieredapproachcouldsignificantlybringforwardthedatebywhichcementmajorswillhavetointernalisetheenvironmentalcostoftheiractivitiesandceasetobemerecomplianceactors.16Theadditionalbenefitofatieredfreeallocationsystemwouldbethatallowances,whichwouldotherwisebeallocatedtocement,wouldbecomeavailabletoothersectors.Consequently,sectorsatthehighestriskofcarbonleakagecanapplyfor100%oftheirbenchmarkedfreeallocationwithoutfearingthatthiswouldtriggertheapplicationoftheCSCF.AsweshowinTable4,thesevolumescanbequitesubstantial.Therefore,aswellasincentivisinglow-carboninvestmentincement,tieringcanhaveveryconcreteco-benefitsfortheprotectionofrisk-exposedsectors–allwhileavoidinganyviolationoftheenvironmentalintegrityofthePhase4package.

Figure22:ImpactofbinaryversustieredleakageprovisionsonthesurplusesoflargestfiveEUcementcompanies(Sandbag’sriskassessment).Source:EUTL(Sandbagcalculations).

Tierforcement Metric

Growthscenario+2% +1% +0%

80%MillionEUAsmadeavailabletoothersectors 197.3 190.6 184.1…asshareofallPhase4freeallocation 3.1% 3.0% 2.9%

60%MillionEUAsmadeavailabletoothersectors 394.6 381.2 368.3…asshareofallPhase4freeallocation 6.3% 6.1% 5.6%

Table4:Volumesre-channelledfromcementtoothersectors,asafunctionofcement’sriskexposureandoverallindustrialgrowth.Source:EUTL(Sandbagcalculations).Note:Industrialgrowthisyear-on-year,andcontinuesuninterruptedlyfrom2014onward.

5. SUPPORTINGINNOVATION

16RefertoFigure12toseehowtheseearlierdatesarestillsignificantlylaterthantheyearswhensurplusesareexhaustedinothersectors,e.g.refineries,steelororganicchemicals.

2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030

Lafarge-Holcim

Heidelberg-Italcementi

Cemex

BuzziGroup

CRH

Years

Notiering:freeallocation Tiering:freeallocation Notiering:Verifiedoffsetuse

Tiering:Verifiedoffsetuse Notiering:Stillavailableoffsetuse Tiering:Stillavailableoffsetuse

TheFinalCarbonFatcat–Sandbag–March2016 23

Unlikedecarbonisationthroughtheuseofrenewableenergyinpower,heatandtransport,thelandscapeforsupportingthedecarbonisationofindustryismuchsparser.Thelackofincentivesforinnovationandinvestmenthasforcedallindustrialsectorstofocustheirrequestsaboutclimatepolicyoncompensationpaymentsintheformoffreeallocation.Thedistortionshighlightedintheprevioussectionclearlydemonstratethatadifferentapproachisrequiredtobreaktheimpassepreventingdeepdecarbonisation.TheproposedInnovationFundcanpotentiallyalleviatesomeoftheshortcomingsoftheETSindrivingtechnologicalchange.Intheabsenceofprospectsforahighcarbonprice,industryboardroomsdonotfeelthatitisjustifiabletoinvestintoRD&Dforexpensivetechnologiesforcuttingprocessemissionsorforcreatingcarbon-negativeproducts.TheInnovationFundcanactasanalternativesourceoffundingforfirst-of-a-kindprojectsinindustrialabatement.OvercapacityintheEuropeancementsectorandtheresultingshortfallininvestmentforlongtermdecarbonisationprojectsmeansthatEUfundingisparticularlynecessaryforstimulatingdecarbonisationinthesector.Despitethispromise,wefearthatthevolumeofallowancesintheFundwillnotbesufficienttomakeadifference.TheNER300,theequivalentoftheInnovationFundinPhase3,containedonly300millionallowances,equivalentto37.5millionallowancesperyear.Forthe10yearsofPhase4,theInnovationFundwouldaward40millionallowancesperyear.17SincewedonotexpectthecapandtheMSRtoresolvetheproblemofoversupply,weanticipatethatallowanceswillfetchverylittlerevenuewhenmonetised.Weareconcernedthatthefinancewillbespreadtoothinlyand,aswithNER300,bebiasedtowardslow-budgetprojects,especiallyastheInnovationFundalsohastofinancerenewablesandCCSinadditiontoindustrialabatement.RecognisingtheneedtotightenthecapandtoavoidundulyincreasingsupplythrougharaidontheMSR,wethereforeadvocatealteringthebreak-downofthePhase4capsothatmoreallowancesareplacedintotheFund.However,itwouldbedangeroustoentrustthefinancingofexpensive,yetvital,RD&Dintolow-carbonproductsandproductionmethodsentirelytofundsraisedbyauctioningallowances.Thisisbecausethevolumeoffinancingavailablewouldrenderedunpredictablebycarbonpricefluctuations.Tocircumventthisvolatilityproblem,EU-levelprogrammeswithpre-determinedbudgetsshouldbedrawnuptofinancesuchprojects.Accordingly,theEUshouldplantoincludeindustrialabatementprojectsunderthepost-2020continuationsoftheEuropeanFundforStrategicInvestmentsandHorizon2020.6. OVERVIEWOFDECARBONISATIONOPTIONSInthissectionwetakeamoredetailedlookatthedifferenttechnologicaloptionsforreducingemissionsfromcementproductionincludingusingalternativematerials.Alone,evenareformedETScannotbereliedupontobringaboutthenecessaryinvestmentinlowcarbontechnologies.Wehaveincludedspecificnon-ETSrecommendationstoincentivisetheuptakeofthesetechnologieswhereverwehavebeenabletoidentifythem.ThesesupplementourcorerecommendationsaboveonfixingtheincentiveswithintheETS.

17WeareawarethatinfacttheauctioningoftheallowancesintheNER300wasfrontloadedtothebeginningofPhase3,andthatthescheduleformonetizingallowancesintheInnovationFundhasnotbeensetyet.Therefore,thesefiguresaremeanttomerelyillustratetherelativeimpactofdifferentvolumesofallowancesinphasesofdifferentlengths.

TheFinalCarbonFatcat–Sandbag–March2016 24

6.1. IndustrialCCSCCUShasthelargestemissionsabatementpotentialofanytechnologyfordecarbonisingtheconventionalcement-makingprocess.TotalemissionsfromPortlandcementmanufacturecannotbereducedbymorethan30%withoutusingCCSsincethatistheshareofemissionsresultingfromthermalemissions.TheremainingsharecomesfromprocessemissionsunavoidableunderthePortlandparadigm,andthereforetheseprocessemissionsmustbecaptured.Unfortunately,retrofittingcementplantswithcarboncaptureisoftendifficultandexpensive.Industrysourcesindicatethatintegratingcarboncaptureintonewplantswilldoubleconstructioncostsandincreaseproductioncostsby40-90%pertonneofclinkeroncetransportandstoragecostsaretakenintoaccount.18Also,somelargercementplantsarelocatedatconsiderabledistancesfrompotentialstoragesites.19Wethereforerecommend:

• GrantingfurthersupportfortheRD&Dofcarboncaptureincement.

• DevelopingpoliciessupportingthegrowthofaEuropeansectorforthetransportationandstorageofcarbon.

6.2. FuelswitchingSwitchingfromthetraditionalsourceofthermalenergyforcementplants,suchaspetcokeandcoal,toalternativeenergysourcescanreducethermalemissions(Figure23).Co-incineratingbiomassincementkilnsisapopularwayofreducingETSemissionsandhasbroughtnetCO2intensityfromofgreyclinkerproduction9%belowgrossin2013.TheRenewablesDirective(2009/28/EC),WasteFrameworkDirective(2008/98/EC)andLandfillDirectives(1999/31/EC)havecreatedindirectincentivesforcementmakerstousealternativefuelssuchasbiomassorpre-treatedwastesourcedfromotherindustriesfaceincreasinglandfillingcostsfortheirwastes.Thishasled,asweshowinFigure24,toastrongdivergencebetweengrossandnetcarbonintensityintheEU,markedlyimprovingitsaverageperformancerelativetootherareaswhencomparedtothesituationongrossemissionsintensity(Figure9,onpage14).

18ECRA.(2009).TehcnicalreportonCCS(p.6)(link).19TheEuropeanLimeAssociation.(2014).ACompetitiveandEfficientLimeIndustry(p.41)

TheFinalCarbonFatcat–Sandbag–March2016 25

Figure23:Directemissionfactorsfordifferentfueltypes.Note:MSW=municipalsolidwaste.Source:USEPA2015(link).

Figure24:RegionaltrendsingrossCO2efficiencyofgreyclinkerproduction.Source:CSI2013(datasets71AGand59cAG).

Decarbonisationwouldproceedfasteriftherewereamoreharmonisedapproachtotheuseofalternativefuelsandbiomass.During2005-2013theaverageshareofthermalenergyobtainedfromincineratingwaste-derivedfuelsandfrombiomassinEUcementinstallationsmorethandoubledandtripledrespectively(Figure25).However,theeconomicsofco-incineratingwaste-derivedfuelsdependontheavailabilityofwasteprocessinginfrastructure,therelativecostoffuelsandonnationally-determinedlandfillingtaxeswhichvaryconsiderablybetweendifferentMSs.20AsweshowinFigure26,progressonfuelswitchinghasbeenunevenacrosstheEU–withsomeWesternEuropeancountries,whichweexpectedtobeveryforwardthinkingonclimatepolicy,laggingbehindEasternEuropeanMSs.

Figure25:Thermalenergyconsumptionpertonneofclinkerbyfueltype.Basedongreyclinker

Figure26:Weightedaveragesfortheuseofalternativefuelsandbiomassinthethermal

20ETC/SPC.(2012).OverviewoftheuseoflandfilltaxesinEurope.(link)

4.063.75 3.72 3.60 3.41

2.97 2.97 2.822.10

0

1

2

3

4

5MtC

O2/Mtoe

700

750

800

850

900

950

1,000

1,050

1,100

kgCO2/tclinker

China

CIS

Europe

India

MiddleEast

N.Am.

S.Am.excl.Brazil

0%5%

10%15%20%25%30%35%40%45%

1990

2000

2005

2006

2007

2008

2009

2010

2011

2012

2013

Weightedaverage

Totalalternativefuels

Fossilandmixedwastes

Biomass

0% 20% 40% 60% 80%

DECZGBPLFRESIT

EU28

Percentageoftotalthermalenergyconsumptionforgreyclinker

Fossilandmixedwastes Biomass

TheFinalCarbonFatcat–Sandbag–March2016 26

productioninEU28countries.Source:CSI2013(dataset25aAGFC)

energyconsumptionofgreyclinkerproduction.Source:CSI2013(dataset25aAGFC).

Aproperlyalignedincentivesystemwouldneedtomakeitbothlegallypossibleandfinanciallyattractiveforcementmakerstotakeadvantageofthetechnologicalpossibilitytoburntheselesspollutingfuels.Thiscanbeachievedby:

• HarmonisingEU-widelandfillregulations,aswellasregulationspermittingtheincinerationofthesenon-conventionalfueltypes.Thiswillbroadenthepossiblescopeofthematerialsflowtowardsthecementsector.

• Reducingtheadministrativeburdenofcross-bordertransportofwastesforco-incineration.

6.3. KilnefficiencyImprovementsinenergyefficiencycanbeachievedbyusingbestavailabletechnology(BAT)kilnsandbyoperatingthematclosetonominalproductioncapacity.Upgradestokilnefficiencyaredrivenprimarilybylongterminvestmentdecisionsandcompliancewithregulatoryrequirements.BATinthecementsectorconsistsofdrykilnswithmultistagepreheaterandprecalcinerequipment.Theseusehalfasmuchenergyaswetkilnspertonneofclinkerproduced.21In2013,83%ofcementproductioninEuropewasbasedonthedryprocess(Figure27)comparedto78%in1990.Overthesameperiod,thermalenergyconsumptionforgreyclinkerproductionfellby10%EU-wide.WhilenewkilnsaretypicallybuiltusingBAT,asignificantnumberoflessefficientkilnshaveyettobereplaced.Overcapacityinthecementmarkethasresultedinashortfallininvestment.ThecostlinessofshippingclinkerandcementoverlandreinforcesthisaspectforcompaniesinlandlockedEUcountriesthatmaybecontemplatingsuchinvestments.

21InternationalEnergyAgency.(2009).EnergyTechnologyTransitionsforIndustry.p.78(link)

TheFinalCarbonFatcat–Sandbag–March2016 27

Figure27:Trendsingreyclinkerkilntechnology.Source:CSI2013(datasets25aAGand8TGK).

Furthermore,ourdiscussionswithindustrysuggestthatclimatepolicyisnotstrongenoughtodrivethisreplacement.LafargeforinstanceacknowledgesthatequippingallkilnswithBATcouldreducespecificheatconsumptionto2.9GJ/t(morethan20%lowerthanthe2013EUaveragereportedinFigure25).However,theyalsoaddthatthiswouldcostsinexcessof€100pertonneofCO2saved22–farinexcessofthecurrentcarbonprice.23HeidebergCementandCarbon8alsocorroboratethatupgradingextremelyoldkilnstoBATistantamounttogreenfieldinvestment.246.4. ClinkersharesItispossibletoachieveemissionsreductionsbysubstitutingclinkerwithmaterialsthathavelowerembeddedcarbonsuchaspulverisedflyash,groundgranulatedblast-furnaceslag,limestoneorcalcinedclayminerals.TheEU-widetrendhasbeentowardsusinglessclinkerbutprogressunderthisleverhasbeenuneven.WhileAustriareportedlyreducedclinkercontentfromnearly79%in1997tolessthan70%in2015,25theshareofclinkerinsomeMemberStateshasrisendespitetheintroductionoftheETS.Figure28showshowtheclinkerratiohasrisenfrom76%in2008to80%in2013inSpain,whileinItalyithasbeenrisingcontinuouslyfrom71%in1990to75%in2013.AsweshowinFigure29,theutilisationratesforslag,flyashandpuzzolanaremainlow.Scarcityofthesematerialsisafactorbutthelowcarbonpricemakesitdifficulttoachievehigherlevelsofclinker-substitutionasthebenefitsofsodoingareoutweighedbylogisticalcostssuchastransport.Substantialvolumesofwastearethereforeremainingunused.

22Gimenez,M.[Lafarge].(2015).HarnessingCO2.InternationalCementReview.23EUR4.88/tCO2(ICE–March4,2016).24CEMBUREAU.(2016).PersonalcommunicationwithCEMBUREAUon5February201625CemtechVienna(link,accessedFebruary2,2016).

3.4

3.5

3.6

3.7

3.8

3.9

4.0

4.1

4.2

0%

20%

40%

60%

80%

100%

1990 2000 2005 2006 2007 2008 2009 2010 2011 2012 2013

Thermalene

rgyc

onsumption

(GJ/Tclinker)

Shareofgreyc

linkerp

rodu

ction

WET/SHAFTKILN SEMI-WET/SEMIDRY

MIXEDKILNTYPE DRYWITHOUTPREHEATER(LONGDRYKILN)

DRYWITHPREHEATERWITHOUTPRECALCINER DRYWITHPREHEATERANDPRECALCINER

Thermalenergyconsumption(greyclinker)

TheFinalCarbonFatcat–Sandbag–March2016 28

Figure28:Theclinker-to-cementratiofortheEU28,SpainandItaly

Figure29:UseofcementsubstitutesasapercentageofallgreycementinEU28countries.

Sources:CSI2013(datasets92AGWand19AGW)

Theamountofclinkerusedintheproductionofcementfundamentallydeterminesthissector’sdirectemissions.Itisthereforeimperativetoeliminateincentivestoincludeincreasedlevelsofclinkerincement.Theveryfactthatclinkersharesvaryaccordingtocountrysuggeststhatthisisnotatechnicallychallenginghurdlebut,instead,largelyaproblemofincentives.Wethereforerecommend:

• NarrowingtherangeofclinkerinPortlandcementsinEuropeannormsofcementandconcrete.All27categoriesofcementrecognisedunderEN197prescribeafairlywiderangeofPortlandclinkercontent,e.g.80-94%forCEMIIA-S.Regulatingclinkercontentintothelowerendofthecontentrangemightbeasolutionworthexploring.

6.5. Non-PortlandcementsCementalternativesdifferfromclinker-substitutedPortlandcementsinthattheyareproducedviaseparateprocesses,whichoftenusenoneofthetraditionalrawingredientsofordinaryPortlandcement.Anumberofthesecementshavelowerembeddedcarbon.Examplesincludegeopolymercementandconcrete(Wagners),andmagnesiumcarbonatecements(Novacem).Alteringthechemistryofclinkercanalsoreduceitscarbonintensity.Thisisthecaseforthelow-carbonclinkerskilnedatlowertemperatures(Lafarge).Lackofpropercertificationcanhurtthemarketacceptanceofthesecements.ExistingstandardsprescribechemicalcompositionsthathavebeendeterminedinthepasttoguaranteetheparticularperformanceofaPortlandcement.Non-conventionalcements,eschewingthePortlandprocessentirely,cannotmeetsuchstandardsbydefinition.Thisisunfortunate,asmanynon-conventionalcementscaninfactattaingreaterstrengththanPortlandcement,especiallywhenperformanceisassessedat56daysratherthanthe28-dayperiodspecifiedinNormsforcementsinthePortlandfamily.Asinthecaseofclinkersubstitutes,theeconomicsofnon-Portlandcementsarehighlydependentonmanufacturers’abilitytosourcefeedstocksaffordably.CEMBUREAUestimatesthatnovelcementswill

65%

70%

75%

80%

85%

1990

2000

2005

2006

2007

2008

2009

2010

2011

2012

2013

Clinkertocemen

tratio

Spain Italy EU28

0.0%0.5%1.0%1.5%2.0%2.5%

1990

2000

2005

2006

2007

2008

2009

2010

2011

2012

2013

Ratio

ofcem

entsub

stitu

tes

Slag

Flyashandpuzzolana

Totalcementsubstitutes

TheFinalCarbonFatcat–Sandbag–March2016 29

achievea5%marketshareby2050.26Theycitemarketacceptanceasthemainbarrierslimitingnon-Portlandcementstonicheapplications.YetsomenovelcementscouldreplacePortlandcementsinagreatvarietyofenvironments.Non-Portlandcementssufferfromlackofexperienceofusingthemamongintermediateandfinalconsumers.Theirmarketabilitycanbegreatlyimprovedifbuyersarereassuredthatthesecementsconformtoproductsafetystandards.Currently,Europeannormsoncementandconcrete(EN197&EN206respectively)coverimperfectlyproductsthateschewthePortlandparadigmaltogether,andoftentheimplementationofthesenormsisleftuptoindividualMSs.ThishasresultedinasituationwheredivergingsafetyregulationspreventthesameproductfrombeingmarketeduniformlyacrosstheEU.Furthermore,regulationsshouldnotpreventinnovationstodiffusethroughouttheEU.Intermsofproducts,subsidiarityintheEuropeanNormsoncementandconcrete(EN197&EN206respectively)meansthatseveralformsoflow-carboncementthatalreadyexistcannotbemarketedinmostEUMSs–despitebeingdeemedsafeinothers.

• ExtendingtheEuropeannormsoncementandconcretebeyondtheparadigmofPortlandcement.Standardsshouldbedecidedwithclimatebenefitsinmind,mirroringforinstancetheCaliforniansystemwheretheperformanceassessmentperiodis56dayslong.ThefragmentationofthenormsystemamongMSsshouldbeavoidedasmuchaspossible.

• Engagingindemandcreationfornon-Portlandcements.Evenwithnewstandards,weexpectadoptiontobeslow.Toaddressthis,governmentsshouldshowcasethereliabilityofnon-conventionalcementsthroughdemonstrationprojectsandpublicprocurementprogrammes,andshouldeventuallyintroducemaximumnationalrequirementsfortheaverageembodiedcarbonofcement,whichshoulddecreaseinapredictablemannerovertime.

• Addressingshortcomingsinthebuildingmarketthatcauseconsumerstoselectagainstlow-carboncements.Contractorsfacecompetitivepressurestospecifyshorterconstructiontimeframes.Theyneedincentivestousecementsthatattainpeakperformancemoreslowly.

6.6. CCUScementsandconcreteCementsthatcanre-absorbCO2aresoldasprecastconcreteblocksbyCarbonCure(Canada),andIronShellLLCandSolidiaintheUS.Carbon8intheUKproducesasyntheticcarbon-negativeaggregatewhichcanbemixedwithordinarycementtoformaconcretewithlowerembodiedcarbon.TheseproductsholdgreatpotentialforactingasacarbonsinkbutthemixtureofhighRD&Dandproductionexpensestogetherwithlowcarbonprices,lackofconsumerinterestorincentiveshasastronglynegativeinfluenceonthepossibilitytocommercialisethem.However,questionssurroundingthelongtermperformanceofsuchcementtypesarejustassalientasinthecaseofnon-conventionalcementswhichiswhywemakesimilarrecommendationsforCCUScementsaswell.Aninterestingpointtomakeaboutthesecementtypesisthat,whiletheinducedabsorptionofCO2maysignificantlyreducelifecycleemissions,itsaccountingfallsoutsidethescopeoftheETS.Tocircumventthisproblem,Sandbagstronglysupportstheintroductionofanegativeemissionsaccreditationscheme.26CEMBUREAU.(2013).NovelCements(link,accessedon8March2016)

TheFinalCarbonFatcat–Sandbag–March2016 30

Thiswouldraiseconsumers’awarenessofthevaluethesenovelproductsadd,aswellasprovidingconsumerswithanincentivetopurchasethem.Atransferofwealth,fromMSsobligatedundertheESDtoprojectimplementers,wouldfunddemandcreationforproductstakingadvantageoftheleversforcementsectordecarbonisationthattheETS,byitsverydesign,cannotreach.BeyondthecaptureofcarbondioxideinCCUScements,thiswouldbehelpfulintheproductionofnon-Portlandcementsaswell.ItwouldalsoeliminatetheneedforMSstogeneratetheirownpoliciesbecauseprivateactorswouldbeabletoseekoutmitigationopportunitiesthroughouttheEUonceMRVmethodologieswereenacted.BecauseMSswouldbeacquiringcreditsgeneratedwithintheEUforESDcompliance,itwouldcreateapricesignalunderthenon-tradedtradedsectorwithoutcompromisingthe“domestic-only”natureoftheEU’s2030climateobjective.Therefore,inadditiontotherecommendationsmadefornon-Portlandcements,werecommend:

• CreatingaMRVandcreditingprocessthatallowsforcapturedandstoredCO2andnegativeemissionstobecreditedforuseintheEU’sclimatepolicies.WhileusingsuchcementtypeswillmakecompliancewiththeESDeasierforMSs,acreditingschemegeneratingrevenuesfortheactorsusingthemwouldincreasedemandandacceleratediffusion.Suchademand-creationexercisewouldinturnmakeitmoreattractiveforcementmakerstoinvestintoproductionlinesproducingthesecements.

TheFinalCarbonFatcat–Sandbag–March2016 31

7. ANNEX:METHODOLOGYSandbag’sprojectionsforhowdifferentpolicyscenarioswouldaffectfreeallocationinthecementreliesonasuiteoftoolsdevelopedin-house:

• ThestartingpointisanestimationforthenumericalvaluesthatwereusedtodetermineactualPhase3freeallocationattheinstallation-level,i.e.theirapplicationforfreeallocationbasedontheirsector’sproductbenchmarks.Wemathematicallyback-castedthevaluesfor10,400installationstogeneratethemostaccurateestimationforhowtheirfreeallocationintheEUTransactionLog(EUTL)wascalculated.UponreapplyingthevariouscorrectionfactorsusedduringPhase3,ourestimateswereabletoreproducetheactualEUTLvaluestowithin5allowancesineveryyearforinstallationsamountingto99%of2014freeallocation.

• Weconcludedthataninstallation’sactivityhadpartiallyceasedifourestimatefortheirapplicationforbenchmarkedfreeallocationonlymanagedtoreproducetheEUTLvaluesforalimitedsequenceofyears.

• Wehadtorelyonemissionsinordertoestimatevariationonactivitytypes,astheEUTLdoesnotprovideinstallation-dataonactivitylevels.Becausethereal-lifeHistoricalActivityLevel(HAL)isnotpublicallyavailable,wefollowedthemethodologyimpliedbytheBenchmarkingDecisiontoestimateaHistoricalEmissionsLevel(HEL).Weusedvariationsinemissionstoestimatevariationsinproductionsforinstallationswherewehadbeenunabletomathematicallyverifytheoccurrenceofpartialcessation.

• WemadesuretochangethereferenceyearfortheHELtoaccountforsectorsandinstallationsthathadonlyjoinedtheETSin2013duetoscopechange.

• Weusedasimplelinearadjustmenttoactivitylevelstogenerateapplicationsforfreeallocationforfutureyears.Weadjustedproductbenchmarksuniformlybythe1%/yearsuggestedbytheCommissionproposal.

• WecalculatedeachthecorrectionfactorforcarbonleakageduringPhase4foreachNACEcodebasedoninformationpresentintheCommission’sImpactAssessmentandothersimilardocuments.WeappliedthesecorrectionfactorstoeachinstallationinallNACEcodestogeneratetheirapplicationforfreeallocation.

• Comparingthesumofallinstallations’applicationforfreeallocationwiththePhase4ceilingonfreeallocationimpliedbytheCommission’sProposalfortheETSRevision,wegeneratedacross-sectoralcorrectionfactorforeachyearofPhase4.

• WeappliedthesetwocorrectionfactorstoeachinstallationwegeneratedthefreeallocationvaluesforeachinstallationineachyearofPhase4.

• Thesevalueswerethenaggregatedintodifferententities,e.g.acementcompany,anindustrialsector,acountry,etc.basedonourin-housecurateddatabaseofinstallationownership.

FortheanalysisdecomposingtheeffectofindividualfactorsoncementsectoremissionswereliedontheLog-MeanDivisiaIndexmethoddescribedinBranger&Quirion(2015)“Reapingthecarbonrent:AbatementandoverallocationprofitsintheEuropeancementindustry,insightsfromanLMDIdecompositionanalysis”,EnergyEconomics(availablehere–accessedMarch15,2016).