Gq pea-presentation-feb-2013

-

Upload

adnet-communications -

Category

Documents

-

view

108 -

download

0

Transcript of Gq pea-presentation-feb-2013

Click to edit Master title style

Tilemsi Integrated Phosphate Fertilizer

Project

PEA Overview

Positive PEA Results

Estimated 20-year Mine Life with NPV US$ 649m (at 10% DR)

and Project IRR 33%

February 2013

TSX-V: GQ

www.greatquest.com

Disclaimer

This presentation contains forward-looking statements or forward-looking information within the meaning of applicable securities legislation (hereinafter collectively referred to as "forward-looking statements") concerning the Company's plans for its properties, projects, operations, subsidiaries and other matters. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management regarding operations of the Company which are subject to a variety of business and market risks, including political and regulatory risks associated with mining and exploration in Mali. Great Quest Metals Ltd. cautions that the PEA is preliminary in nature, as it includes “Inferred Mineral Resources” which are considered too speculative geologically, to have the economic considerations applied to them that would enable them to be categorized as "Mineral Reserves". There is no certainty that the PEA will be realized as Mineral Resources do not demonstrate economic viability.

Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as "expects" or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "estimates" or "intends", or stating that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements.

These forward-looking statements are based on certain assumptions which the Company believes are reasonable, however, forward-looking statements are subject to a variety of business and political risks and uncertainties. Some of the important risks and uncertainties that could affect forward-looking statements are also described in the Company's continuous disclosure filings made with Canadian securities regulatory authorities, which are available at the SEDAR website and on the Company’s website. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, they may adversely affect the Company’s business and prospects and actual results may vary materially from those described in forward-looking statements. Forward-looking statements are made based on management's beliefs, estimates and opinions on the date the statements are made and the Company undertakes no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, other than as required by applicable laws. Investors are therefore cautioned against placing undue reliance on forward-looking statements. The technical information in this presentation has been reviewed by Jed Diner, MSc. P.Geol., a qualified person as defined by National Instrument 43-101.

2

Our Vision:

Our Key Strengths:

3

To unlock West Africa’s fertilizer market by providing cost effective and adapted

solutions to meet growing agricultural needs

Proven

Management & Board

Solid

PEA Results

Mineral Discovery

Track Record

Significant Project

Exploration Upside

Stock 52-Week High:

C$ 3.71

Support from

Key Stakeholders

Great Quest - A Unique Value Proposition

4

PROJECT BACKGROUND

50 million tonnes (Mt) inferred resource on 26 km² drilled surface

High natural grade 24.3% P₂O₅

Significant upside potential, project covers 1,206 km² (3 licenses)

Strategic source of reactive & soluble phosphate for direct application, low cost fertilizer or as a NPK component

Experienced management team with track record in project development and mineral discovery in West Africa

GQ Flagship Tilemsi Phosphate

5

Project positive attributes

• Naturally effective fertilizer product with low OPEX and CAPEX expectations • Strip minable – Near surface deposit (<10 meters on average) • Simple production process as per characterization tests

Upside potential

• 3 phosphate concessions with total surface of 1,206km² • To date only 2% of total area has been drilled (26 km²)

Market potential

• Fast growing population (>2% pa) drive food demand in West Africa • Large agribusiness investments and commercial farming projects in West Africa

Logistical advantage • Proximity to key agricultural markets in West Africa (<1,000 km radius) • Ability to offer low farm-gate price thanks to market proximity

Expertise

• Strong combined management and board expertise in mineral exploration in Africa and the global phosphate and fertilizer industry

Investment Highlights

PEA Consulting Team

6

The independent PEA was written and compiled by Gaya Resources Development Ltd, a full-spectrum engineering management company, specialising in fertilizer projects. The PEA includes sections provided by highly respected international consulting firms:

Coffey Mining (South Africa) for the mining process

GBM Engineering (UK) for the beneficiation process

CFI Holding (France/Singapore) for the granulation/NPK study

Bolloré Africa Logistics (France) for the transportation analysis

Balu & Associates (USA) for the West Africa fertilizer market study

Mintek (South Africa) for the metallurgical testing

8

PEA Project Description

Plants Construction: The project will include a beneficiation and phosphate granulation plant near the Niger River at Bourem, which is situated 95 km from the mine.

Initial Production: To begin in 2016, with staged production ramp-up from 200,000 tonnes to 1 million tonnes, based on conservative expectations for market uptake.

Target Markets: Landlocked markets in West Africa for product delivery, displacing high cost imported fertilizers, and servicing emerging commercial farming projects in the region.

Product Development: Two granulated Hyperphosphate products:

a high grade (>35% P₂O₅) for mixture into standard NPK blends

a medium grade (>27% P₂O₅) for simple direct application.

Planned Project: A vertically-integrated phosphate mining, beneficiation, granulation and NPK blending project in West Africa.

10

PEA Highlights ¹

¹ Great Quest cautions that the PEA is preliminary in nature, as it includes Inferred Mineral Resources which are considered too speculative geologically, to have the economic considerations applied to them that would enable them to be categorized as "Mineral Reserves". There is no certainty that the PEA will be realized as Mineral Resources do not demonstrate economic viability.

Project Parameters Value

Life of Mine (“LOM”) based on the current Inferred Mineral Resource estimate

20 years

Maximum Rock Mined (at full capacity) 1 million tonnes per annum

Pre-Operational Cost US$ 13 million

Initial Capital Cost US$ 143 million

OPEX Phosphate Rock (powder average ex plant) @35% P₂O₅ US$ 49 per tonne

OPEX Hyper Phosphate (granulated avg. ex plant) @35% P₂O₅ US$ 91 per tonne

Fertilizer Products Supplied at Full Capacity 1.18 million tonnes per annum

Sales Mix: NPK / Direct Application 78% / 22%

11

Summary of the Project Economics

Project Economics Value

Project Net Present Value (“NPV”) US$ 649 million

Discount Rate 10%

Project Internal Rate of Return (“IRR”) 33%

Equity Holder IRR (40% equity /60% debt) 43%

Payback Period 4 years

12

Financial Model Assumptions

Assumptions Value

Product Discount Rate against Cost of Moroccan Phosphate in Bamako, Mali

20%

Average Transport Cost Ratio US$ 0.083 per tonne per kilometre

Delivered Price of Diesel for Energy Production US$ 1.10 per litre

Equity to Government on Mining 20%

Royalties on Mine Production 3%

Contingency in Initial Capital Cost (12%) US$ 14 million

Political Risk Insurance Premium (12%) (incl. in CAPEX) US$ 11 million

Interest Rate (LIBOR + Premium) 7.8% per annum

13

Basic Data – Production Capacity

* Four NPK plants are planned, each producing 125,000T/y of Blended NPK. In year 3, two plants will be built in Sikasso (south Mali) and in Cotonou in Benin. In Year 7 , two other plants will be constructed in Tamale in northern Ghana and in Dosso, south of Niamey in Niger.

Years (LOM)

Pro

du

ctio

n (

ton

ne

s)

Intermediary Stage Final Stage

14

NPV Sensitivity Analysis

DR NPV

(US$ ‘000)

6% 1,085

8% 828

12% 492

Inte

rnal

Rat

e o

f R

etu

rn (

%)

Tilemsi Geology - Unique Deposit Attributes

16

TILEMSI PHOSPHATE ROCK

INITIAL INFERRED RESOURCE

50 million tonnes

AVERAGE PHOSPHATE GRADE

24.3% P₂O₅

CONCENTRATE GRADE 25-38% P₂O₅

CONCENTRATE QUALITY

Low levels of contaminants (ie. cadmium)

BENEFICIATION Easy separation and

treatment

DEPOSIT DEPTH Near surface

Strip-minable potential

With a high average phosphate grade and significant exploration upside, the Tilemsi deposit has the potential to become a world-class phosphate resource .

Mining Considerations

17

15.8 Mt at an average grade of 28.1% P₂O₅ mineral inventory have been identified

Tilemsi phosphate mine is a pitable resource

Mining will commence on the Tin Hina mining concession and will operate for 13 years

Mining will continue on the Tarkint Est concession until Year 20.

Mining has been scheduled to comment at approx. 200,000 tpa, increasing by 100,000 tpa to reach 500,000 by year 4.

Production will plateau in Year 8 at 1 million tpa for until Year 20.

Waste stripping (strip ratio) 6.8:1

Exploration Program

18

5 km

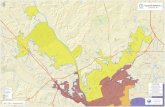

Phases 1 and 2 of Drilling Program

completed

Map of Tilemsi Phosphate Project showing our concessions on remote sensing and drilling program (completed and planned)

589 sq.km

417 sq.km 200 sq.km

Tilemsi Phosphate Rock Characterisation

19

Test Results Impact

BENEFICIATION Screening at 850 microns to

achieve P2O5 grades of 36.8%

Via simple screening process, the product can easily beneficiated to up to 36.8% P2O5 % P₂O₅

SOLUBILITY

71.1% soluble P2O5 in citric acid

62.5% soluble P2O5 in formic acid

The rock solubility shows that it is able to compete with other chemical fertilizers, as fertilizers’ effectiveness is based on immediate

availability of the nutrients

GRANULATION Successfully produced granules

sized 1-4mm

The product can easily be granulated, allowing the product to withstand transportation and be used as a component of NPK

blended fertilizer

Characterization tests indicate:

Tilemsi Natural Phosphate (TNP) meets or exceeds market specifications for beneficiation, solubility and granulation.

TNP can be used as either as very low cost phosphate component for blended NPK fertilizer or as a direct application fertilizer.

Beneficiation Process

21

Beneficiation and granulation plants will be situated near the Niger River in Bourem, approx. 95 km south of planned mine

Proposed beneficiation process includes:

Coarse classification Hydraulic classification Attritioning Milling Wet magnetic separation Filtration Drying

Production plans:

High-grade Hyperphosphate (>35% P₂O₅ ) granulated for NPK blends Medium-grade Hyperphosphate (>27% P₂O₅) granulated for simple direct

application GQ’s own NPK blending plants to produce in-house high quality fertilizers

Granulation Plant

23

Steam granulation process with optional coating

Granulation plant in Bourem consists of 300,000 tpa during the 1st stage of development

Additional 2 lines of 300,000 tpa each to be installed in Year 3 and Year 7 to meet increased production requirements

Granulated phosphate product can be used as:

A low cost direct application fertilizer In NPK bulk blending

Existing Infrastructure

24

Figure 1: Map of West Africa showing

the Tilemsi deposit and the main logistical infrastructure in the

sub-region

Figure 2: One of the 2 types of truck

considered for ore transportation (70-tonne truck)

Milestones and Catalysts

25

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

Prospecting license of Tilemsi phosphate concession granted

Sale of Kenieba gold concession to Avion Gold (now Endeavour)

Phosphate exploration permit granted for Tilemsi & Tarkint Est

Phase I of Exploration Program completed on Tilemsi & Tin Hina

Phase II of Exploration Program completed on Tarkint Est

Tilemsi Phosphate project receives 32.6Mt initial resource estimate

Project area extended to 1,206km² with new concession of Aderfoul

Characterisation tests indicate high grade & reactivity of the rock

Increase of 17Mt of inferred mineral, totalling 50Mt

Complete PEA

Pre-Feasibility Study

Feasibility Study

Project Financing

Construction of Mine Site and Beneficiation Plant

Launch Hyper Phosphate Production

2015 20162010 2011 2012 2013 2014

26

Great Quest Metals Ltd

TSX-V: GQ

Suite 515, 475 Howe Street Vancouver, BC, V6C 2B3

WWW.GREATQUEST.COM

IR Candice Font Tel +1 604.689.2882 Toll Free 1.877.325.3838 Fax +1 604.684.5854 Email [email protected]

![PEA-RP250GA PEA-RP400GA PEA-RP500GA - …H]-RP/2010-2009/... · PEA-RP250GA PEA-RP400GA PEA-RP500GA ... Cautions for units utilising refrigerant R410A ... It is also possible to attach](https://static.fdocuments.net/doc/165x107/5ad5679d7f8b9a075a8cd92b/pea-rp250ga-pea-rp400ga-pea-rp500ga-h-rp2010-2009pea-rp250ga-pea-rp400ga.jpg)