Global Apr 11

Transcript of Global Apr 11

-

8/7/2019 Global Apr 11

1/38

1

Issue no. 101Monday 18

thApril, 2011

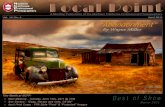

Introduction

Colombo Street, Christchurch

Adversity is like a strong wind. It tears away from us all butthe things that cannot be torn, so that we

see ourselves as we really are

Arthur Golden

-

8/7/2019 Global Apr 11

2/38

2

The earthquake in Christchurch has been our focus for the last two months and we apologise for missingan issue of Global. However, economics and business are of lesser importance than the loss of friendsand work colleagues..and we have been affected more than most in this regard.

It is important now to drift back to normality.

Or, as Joe Bennett put it so brilliantly (Ch.Ch. Press 13/4/11):

As the Condor of Cataclysm swoops across the globe and throws livestock intopanic with the swoosh of its slow-beating wings, and causes Middle Easterntyrants to biff missiles at the subjects they profess to love, and visits financial ruinupon one exhausted European country after another, and sets brother againstbrother in the hellholes of West Africa, and threatens nuclear cataclysm in Japan,and brings earthquake, flood and fire that send the people gibbering through thestreets until the air is thick with the wailing of teeth and the gnashing of infants,and the end of the world is visible if you just walk to the end of the road and peerround the side of the dairy, lo, fluttering down through this apocalyptic maelstromcomes a press release that Womans Day has got a new editor. Her name is SidoKitchin.

Ms Kitchin finds the prospect of editing Womans Day incredibly exciting.

We have a royal wedding on the horizon, she says, so what a wonderful time tobe starting Womans Day

Wonderful indeed the ordinary world.

The New Zealand and Japaneseearthquakes were devastating intheir destruction and also typicallycreated an over-reaction in themarkets.

This set up opportunities theplunging NZD, the 17% fall in theNikkei (in 2 days), the temporaryhike in the Yen (beforegovernment intervention), and thecollapse of uranium companyshares.

In a study of similar catastrophes such as the Kobe earthquake in 1995; the Taiwan earthquake of1999; the US terrorist attacks in 2001; and the 2010 Chilean earthquake in all cases their sharemarkets regained pre-catastrophe levels within 78 days.

It has been estimated that the Christchurch earthquake will cost nearly $16 billion, which would amount toabout 45% of the $36 billion insured losses in the world from catastrophes in 2010.

It is seriously affecting business (particularly tourism) in Christchurch could mean that NZ goes close torecession, and should affect the economy by around 1.4% of GDP (reducing growth to about 0.9% for

2011). The RBNZ has cut the Official Cash Rate by 50 basis points.

Of concern is the ongoing picture of academics, politicians and councillors sitting around waxinglyrical about theirvision for the city, when most of the properties and businesses are in factowned by private enterprise (largely ignored). It is all very well having a highly verbalised image forChristchurch, but the vital element is to get the motor going. Good external appearances areimportant, but very much secondary to having the heart beating. Business must be resurrected..which will lead to the employment of people and the circulation of the life blood (known ascommerce).

-

8/7/2019 Global Apr 11

3/38

3

The massive 8.0 magnitude earthquake, resulting tsunami and nuclear meltdown in Fukushima willprobably cost Japan around US$200 billion, about double that of the great Kobe earthquake in 1995. Themain area impacted is the Tohoku region of north-east Japan, accounting for 6% of Japanese GDP.However, the nearby Kanto and Chubu regions account for 56% of the GDP. On a global basis, Japan isthe 3rd biggest economy, representing about 10% of the worlds GDP. An estimated reduction in JapaneseGDP this year of 1.5% would knock 0.15% off global growth.

The question then arises whether, on a net basis, the reconstruction will be good for either economy. Oneargument (first explored by Frederic Bastiat in 1850) was that if a child broke a window, he creates workfor the glazier, who then has money to buy from the baker, who has more money to buy shoes from thecobbler.and so the initial money circulates, which is good for the economy. Its similar to Keynesiantheory.

The fallacy is that if the owner of the window didnt have to pay the glazier, then he would have thecash himself to generate the money flow. Furthermore, the reconstruction of an asset does not addto anyones wealth.

However, in NZs case, there may be a net benefit for the private sector. If a building is demolished, and aconstruction company rebuilds it, employees get paid, materials are bought.and the money-go-roundstarts from there. The hit is then taken by the large re-insurer, who is inevitably offshore. That can create a

net benefit later ameliorated by higher premiums. There may be less benefit in Japan, which probablycarries more end-product insurance in their own country.

Against that, there will be a net loss to the public sector (estimated at $8.5 billion) for uninsured localgovernment infrastructure (roads, sewerage etc); insurance excesses on schools and hospitals; temporaryhousing; ACC; business support packages and land remediation.

When looking at the opportunities that could arise, an obvious one in NZ is Fletcher Building, which isrunning the Earthquake Commissions (EQC) Canterbury repair project.

A greater number of opportunities arise in Japan, because of its size inthe world markets. A major area relates to its dominant position in theworld technology industries. The country manufactures around 20% ofthe global combined technological products - including 40% of all

electronic components; 44% of audio-visual equipment; 19% of semi-conductors; 30% of flash memory (used in smartphones); 15% of D-Ram memory (used in computers); and 78% of electrode materials forlithium ion batteries.

These supply chains will be materially affected, with manyfactories facing temporary or partial closure.

Competing products will benefit from this, particularly in nations suchas South Korea and Taiwan. These countries can easily be invested inthrough the South Korea iShares (EWY) or Taiwan iShares (EWT), onthe New York Stock Exchange. Or, specifically, Samsung and TexasInstruments (US:TXN) should benefit.

Other opportunities exist with Japanese heavy equipment manufacturer Kohmatsu and waste

management company Clean Harbours (US:CLH which has an excellent chart).

Japan imports 59% of its food intake and radiation into the sea should, in due course, boost the sales ofexcellent products such as NZ King Salmon. However, transport infrastructure will have to be repaired first.

On the nuclear energy side, 4 of the 6 reactors at the Fukushima Daiichi power plant are finished..andthe other two might as well be. Each plant has 7 pools filled with spent fuel rods that have been collectedover 40 years..sitting on the top of the 6 reactor buildings. Each reactor building houses 3,450 fuel rod

Japanese folk wisdomholds that earthquakes arecaused by the thrashingsof a giant catfish that lives

in the mud below the earth.Normally the fish is keptunder control by the god

Kashima, who has placed alarge stone on top of it.Every so often though

Kashima snoozes on thejob and the catfish breaks

free

Financial times11/03/11

-

8/7/2019 Global Apr 11

4/38

4

assemblies and each assembly holds about 63 rods. There is also a common pool holding between 6,000and 7,000 fuel rod assemblies.

As a result there are apparently over 600,000 spent fuel rods in the facility.

Which is why the plant has been elevated to a category 7 rating, alongside Chenobyl.

The shut-down of the nuclear reactors should represent about 1.5 millionpounds of uranium no longer being imported, which is only about 1% of theworld market. However, it will have an effect on nuclear plant development,with Germany reversing a prior plan to extend the life of 17 reactors, andChina has suspended approval of 25 reactors under construction (possiblynot for long).

The situation has affected the share prices of uranium producers such asPaladin Energy (Australia) and the industry giant, Cameco (Canada). Nodoubt the market will calm down in due course, but we would stand asideuntil the dust settles.

Better opportunities probably exist in the energy generating replacementsthat Japan will have to buy to get their electricity production back up to speed

particularly natural gas and thermal coal.

It gives us no joy to be writing about opportunities that arise from catastrophic events.and hope(obviously jinxed - after experiencing two Christchurch earthquakes and the Queensland floods) topersonally avoid them in future.

Global Risk

Last week, Portugal became the latest country to succumb to the European debtcrisis and to apply for a bail-out. But Portugal is a relative tiddler and its

application for a bail-out was actually welcomed by the EU authorities. A Spanishbail-out, if it were to ever happen, would be much bigger

Financial Times11/4/11

Portugal's request for a bailout from its Europeanpartners may have been the most visible symptom ofthe crisis in the eurozone, but the decision taken inFrankfurt to press ahead with an interest rate risecould have a far more corrosive impact on the Euro'slong-term future.

Analysis shows that because the interest rates on the

bailouts provided to Greece and Ireland track theEuropean Central Bank's lending rate, a series ofincreases could push these countries and Portugal into default

The Guardian10/4/11

Anyone who thinkscritically about the

future of energysupply will inevitablydraw the conclusionthat nuclear energywill be a significantpart of our futureenergy portfolio.

The Australian22/3/11

The ECB went aheadThursday and added

the expected 25 basispoints to the main

refinancing rate. Thismay only be a small

move in absoluteterms, but as a signal

its a much biggerdeal.

Wall Street Journal8/4/11

-

8/7/2019 Global Apr 11

5/38

5

As expected, Portugal has become the third Eurozone country to request financial assistance from theEuropean Central Bank (ECB). It has financing needs of at least 20 billion a year until 2013and requiresa total amount of 75 billion. This compares to 110 billion for Greece and 68 billion for Ireland.

The real question, particularly in light of the ECB now movingto tighten monetary policy, is whether or not the debts, risinginterest rates, and new austerity measures are sustainable.

The German led pre-condition for the troubled nations is thatthey must adopt new binding fiscal rules, and an overhaul ofstate pension schemes and labour markets.

However, Portugal has an economy that grew on average by just 1.1% a year between 2001 and 2007.and hasperformed worse since then. Financial retrenchment couldcreate unbearable misery in the economic and social sense,and it is debatable whether the people and the unions willstand for it.

The real problem is a lack of competitiveness. Between 1999and 2007 unit labour costs, relative to Germanys, rose by

31% in Ireland, 27% in Greece (and Spain), and 24% inPortugal. Because these countries cannot adjust theircurrencies, they have to effectively lower their wagestructures to compete in the Zone.

The new rules will require a massive change of culture. InGreece, for instance, corruption is endemic. A recent inquiryinto a public hospital found that they had 45 gardeners on thestaff..but no garden.

Germany is in an interesting position. Because it is an economic powerhouse, the country can issue bondsfor 12 months at an interest rate of around 1.3%. The periphery nations are paying about 6%. Furthermore,Germanys large export industry is benefitting from the Euro being considerably lower than the currencywould have been if they were independent.

However, Germany is not off the hook, because around one-third of the estimated 250 billion owed bycombined public sectors and banks, of these three countries is to German banks (which are reasonablyfragile in themselves). German voters do not want to extend handouts, and German banks cannot afford forthese nations to default.

The structure seems incapable of being resolved without at some stage spooking the global debt markets.However, currently Spain appears to be ring-fenced which is relaxing the markets, but just delaying theinevitable fact that some of these nations will surely default.

*****

In its latest oil market report, released on Tuesday, the International EnergyAgency described the response by OPEC, the oil-producers cartel, to the loss of

Libyan supply as limited. The turmoil in Libya has taken more than 1m barrels aday off the market, leading to an overall fall in production among OPECs 12members of 890,000 barrels a day between February and March

Financial Times12/4/11

Portugal now joins Greece andIreland in the Eurozones intensive-

care ward. Its public debts are

nowhere near as monumental asGreeces; its banks not as reckless

as Irelands. It has succumbedbecause of a humdrum failure to reinin wage increases and to modernisea bureaucracy schooled in tallyingthe quiet remains of the first global

empire, as well as an inability tocoax upstanding family companies,

which for centuries have craftedtextiles, ceramics and shoes, intocompeting with the Chinese. As a

result, harsh as it may seem, acountry whose collective memory is

still scarred by the austeritydemanded by the IMF in the early

1980s must once again subject itselfto tough reforms demanded by

foreigners

The Economist7/4/11

-

8/7/2019 Global Apr 11

6/38

6

The problem with the loss of Libyan oil, in spite of it making up just 2% of global supply, is that it producesa premium light sweet crude that is difficult to replace apart from in countries such as Nigeria andAlgeria (which have their own geo-political problems).

The big swing nation, with regard to extra oil production, is Saudi Arabia. However, it takes three times asmuch heavy Saudi oil to make diesel as Libyan oil.

The Middle East is in a political turmoil which could change the strategic and economic shape of theregion. The implications for oil and the developed nations that depend on it are serious. Tunisia, Egypt andnow Libya have suffered revolt. Still in the firing line are Yemen, Syria, Bahrain, Jordan, Oman, Morocco,and Saudi Arabia.

The crux of the matter relates to the Saudis and the Iranians,the two major oil producing powers. They are on oppositesides of the tension, with the Shiites (who dominate Iran)comprising large parts of the population in Sunni controlledcountries. Saudis are mainly Sunni.

The key place to watch is Bahrain. It is a very strategically placedcountry, as the US 5th fleet is based there (which is why the USwas happy for Saudi Arabia to have a military presence). The

ruling family are Sunnis, while 80% of the population are Shiites,who are natural allies of Iran.

There is now serious potential for a significant hike in oil prices todisrupt the global economy. Each of the last 5 major downturns inglobal economic activity has been immediately preceded by amajor spike in oil prices. Sometimes they were supply shocks,while at other times they were demand surges (as in 2008).Inevitably, an increase in oil prices over 12 months, in excess of100%, leads to a downturn.

The direction that the global powers are taking with regard to the unrest and revolution is dangerous, butpotentially exciting. As the Financial Times (18/3/11) said:

If Europe and America, hitherto wedded to a network of strongmen in the interests ofstability, cheap oil and the security of Israel, now stay realigned with Arabs intent onreclaiming their destiny, that will open the widest, most sunlit avenues towardsdemocratic change in the region for more than half a century

*****

The stock indexes barely budge, trading traffic slows to a crawl, and everyone isholding his breath for the big event. No, not that wedding that has sold out everybalconied room overlooking Buckingham Palace, and not even the first-quarterearnings that companies will begin reporting this week, but the end of the FederalReserve's "quantitative easing" regime

Barrons9/4/11

After two years of rallies and only one major correction, the global bull marketmay soon face its biggest test.

The impending end of the Federal Reserves latest easy money program(quantitative easing or QE2), along with seasonal weakness in stock markets andother events, could cause investors to doubt this bull once again

There has long been badblood between the Saudis andIran. Saudi Arabia is a Sunni

Muslim kingdom of ethnicArabs, Iran a Shiite Islamic

republic populated by ethnicPersians. Shiites first brokewith Sunnis over the line of

succession after the death ofthe Prophet Mohammed in the

year 632; Sunnis have regardedthem as a heretical sect eversince. Arabs and Persians,

along with many others, havevied for the land and resourcesof the Middle East for almost as

long

Wall Street Journal16/4/11

-

8/7/2019 Global Apr 11

7/38

7

MarketWatch16/4/11

Investors will appreciate that we closely follow the US, because (in spite of China) it remains the mostinfluential economy in the world.

To date, this economy has been stimulated in a Keynesian type of approach, by two massive Federal

Reserve programmes of quantitative easing. This means that the Fed adopted an unconventionalmonetary policy to stimulate the economy by buying government bonds and other financial assets, in orderto increase money supply and create greater reserves in the banking system. The total for bothprogrammeswas $2.3 trillion.

It was designed to encourage lending, but to a greater extent has lifted the price of risky assets such asshares and commodities, as well as dropping the USD. It has been of assistance to the US economy.

At the end of June, it will cease. The key question relates to what effectthis will have on the US economy, currencies, inflation, shares,commodities and the bond market. i.e. it has implications for risk orientedassets globally. Stopping this process could unnerve markets andpotentially lead to a rise in risk aversion benefitting safe havens,including the US dollar and Treasuries. It could see risky assets tank

(including equities and commodities).

To a large extent, the effect of QE2 has been psychological rather thanactual as witnessed by the fact that when the Fed started flooding themarket with money interest yields went up rather than down (i.e. it had theopposite effect to what was intended). Effectively the markets tookassurance from the exercise and plunged into risky assets.

The most dangerous thing about the change from QE2 to atraditionally normal environment is the fear of the transition itself.Investors should be very wary of equity, bond, currency andcommodity markets from May onwards.

We believe that there is scope for a significant correctionto markets as the end of June nears, but the Fedwill remain accommodating, with interest rates close to zero, through until 2012 which will still be goodfor equities.

When the dust settles (watch the 50 day moving average) it could be a time to buy.

The Global Economy

The global economy is on firmer ground because the US economy, which is stillglobally dominant, is getting stronger; and the Chinese economy, which is the keycontributor to global growth, is becoming more balanced

Bank Credit Analyst8/4/11

Economies in the developed world are not yet back to normal, with the rate of unemployment in the US sti llabout 4% above the 6-year average, before the pre-financial crisis; while Europe is around 1.5% higher.While acknowledging the terrible human toll caused by Japans disaster, the IMF has said that itseconomic impact would be limited.

The big question iswhat happens when theFed stops handing outthe happy pills. Many

smart analysts think thatthe only way the Fed isaffecting stock prices isby providing investors

with a measure ofconfidence. These

analysts say that the Fedhas been more of aplacebo effect than

anything else

Strategic Advantage5/4/11

-

8/7/2019 Global Apr 11

8/38

8

Of concern though are the underlying current account imbalances caused by the public sectors in countries such as the US, UK andmany Eurozone nations, stimulating their economies after thefinancial crisis. The IMF believes that not enough effort is being put into rectifying these.

At the same time countries such as Japan and China are running

large external surplusesand the balance is badly skewed.

It was fine during the chaotic days of 2008 and 2009, for the badly hitnations to spend heavily on getting their economies kick started, butit is now time to correct the deficits. The developed countries need tocut back on government spending, while the Asian nations shouldattempt to lift their consumer demand.

The world economy needs rebalancing.

However, the IMF said that global activity seems set to accelerate again and has forecast worldeconomic expansion at 4% for 2011, and 4.5% in 2012. The bulk of this is still being generated by theemerging nations.

United States

The US economy roared back to life in thefourth quarter of 2010, recording annualisedGDP growth of 3.1%. A large part of this wasdue to the consumer sector, which has beenbuoyed by the rapid improvement in theunemployment rate - down from 9.8% inNovember, to 8.8% in March (see adjoiningchart).

The private sector has added over 200,000 jobsin each of the last two months, for the first timesince before the recession. The Feds beigebook, which informally surveys economicgrowth at the coal face, also reported last weekthat the economy continued to improve acrossall regions.

However, high fuel prices are starting to take their toll on consumers and businesses alike, and are likely toprovide a drag on economic growth in future months.

Retail sales rose 0.4% in March, from February - but excluding petrol, purchases were only up by0.1%....... as consumers spent more at the pump, and stagnant wage growth meant that they had little leftfor other items. Wage growth is below headline consumer inflation, meaning that in real terms it isnegative.

The Conference Board overall index of consumer attitudes fell from a 3-year high of 72.0 in February, to astill high 63.4 in March.

Businesses remain cautious of the economic recovery, and are delaying their spending and hiringdecisions. The Index of Small Business Optimism dropped 2.6 points to 91.9 in March, and the ServicesSector Purchasing Managers Index fell to 57.3 from 59.7, where readings over 50 signal expansion.

On the brighter side, the outlook for the main driver of the recovery to date, manufacturers,remains very positive. This sectors Purchasing Managers Index slipped only slightly to 61.2 inMarch, from 61.4 a month earlier.

There is an urgent need forthe US to tackle the deficit

in the government'sfinances, according to the

International MonetaryFund (IMF). The

organisation has warned

that the size of the deficitrisks creating instability in

the financial markets.However, the global

economic recovery isgaining strength

BBC News Online12/4/11

-

8/7/2019 Global Apr 11

9/38

9

The IMF expects that the slow pace of job gains, and higher oil prices, will take their toll on US economicgrowth this year, and has lowered its 2011 full year GDP forecast to 2.8%........ rising to 2.9% in 2012.

China

Chinas economy grew at a staggering annual average pace of 11.3% over the last five years.. but thegovernment has now signaled that price stability, rather than immense growth, will be its top priority going

forwards.

Consumer prices increased by 5.4% year-on-year, in March,compared to 4.9% in February which was the biggest jump sinceJuly 2008. This indicates that the focus on inflation is not yetworking...and is a warning for commodity markets. The PeoplesBank of China has raised official interest rates four times in the lastsix months in an attempt to control food inflation (which hastraditionally been a cause of social unrest).

These tightening measures concern some economists who predictthat Chinese growth is set to stall. So far, this has not been the case.

Manufacturing activity continued to expand in March, and the official

Purchasing Managers Index rose to 53.4, compared to 52.2 inFebruary. Exports rose by 35.8%, compared to a year earlier lastmonth, and were up 2.4% on February. Imports also increased 27.3%(year on year). These figures meant that, in March, China registeredits first quarterly trade deficit in seven years which indicates theeconomy might be rebalancing along the lines that Westerneconomists are recommending.

Chinas economy is approaching half the size of the US..but per capita GDP is still well behind.The country has a long way to go in its industrialisation and urbanisation path.

The International Monetary Fund forecasts economic growth of 9.6% in 2011, and 9.5% in 2012.

India

Despite consistently high inflation, Indias economy shows no signs of slowing.

Marchs Manufacturing Purchasing Managers Index stood at 57.9, which was well above the 50-pointexpansion mark. Exports surged by 49.8% in February compared to a year earlier, while imports were upby 21.2%. Industrial output also grew by 3.6%.

The Reserve Bank of India has raised its official borrowing rate by 2.25%, and the lending rate by 1.75%,since March 2010, as it grapples with intolerably high inflation. Currently inflation is running at around 9%.

To match China, India is overdue for a number of reforms. The public-education system is ashambles; no significant publicly owned businesses have been privatised for years; the promisedmodernisation of the financial system has happened only in fits and starts; land reform is neededto stimulate industrialisation and malnutrition remains widespread.

The IMF has forecast economic growth of 8.2% in 2011 (down from 10.4% last year), and 7.8% in 2012.

Japan

The massive earthquake and tsunami that devastated Japans northeast coast in early March will sloweconomic growth to a crawl over the next quarter. While the full impact of the disaster is uncertain, it isunlikely that the country will fall back into recession. Reconstruction efforts will almost certainly accelerategrowth towards the end of the year.

The World Bank chiefeconomist says China has

accounted for about aquarter of global economicgrowth between 2000 and

2009, edging out the U.S. forthe top spot. Most

economists predict anotherbanner year for Beijing andforecast further growth

especially with a boost from

the U.S. economy's gradualrecoveryalthough slightlyless than last year's 10.3%

Wall Street Journal11/4/11

-

8/7/2019 Global Apr 11

10/38

10

Consumer prices were down 0.3% from a year earlier in February,marking the 24

thstraight month of deflation. Unemployment fell to 4.6%,

but this is sure to rise in the coming months.

Industrial output posted a surprise gain of 0.4% (month on month) inFebruary, but this should stall - according to the latest manufacturing

data. The Purchasing Managers Index dropped to 46.4 in March, from52.9 in February (which represents contraction).

Ironically, natural disasters often turn out to be a catalyst in aneconomy..and in due course, this tragedy could be an economicpositive for a nation that has been plagued by debilitating deflation.

The International Monetary Fund is forecasting the economy to achievegrowth of 2.5% this year, and 1.5% in 2012.

Eurozone

With the Eurozone credit crisis recently claiming its third peripheralvictim in the form of Portugal, the chasm between the two tiers of the

economy continues to widen. Portugal will join Greece and Ireland inimposing draconian austerity measures, while other vulnerable states,including Spain and Italy, draw up their own deficit-reduction measures.

The ongoing crisis is having an effect on Eurozone-wide confidence,reflected in the Economic Sentiment Indicator being down in March.The consumer sector is flat with a 0.1% slide in retail sales in February(from January), representing annual growth of just 0.1%.

However, Germany is going from strength to strength. Industrialproduction is rocketing along at an almost Chinese pace, with a1.6% monthly gain in February, and an annual increase of 14.8%.

Germany is also generating a significant proportion of the Eurozones

inflation, ironically leading the hawkish central bank to tighten monetarypolicy for the first time since 2008 (causing more problems for thedown-on-their luck periphery nations).

Whos recommending joint currencies (such as between Australia and NZ) these days?

Nevertheless, the outlook overall for businesses in the Zone remains positive. The Purchasing ManagersIndex (PMI) for the services sector hit a nearly 4 year high in March at 57.2, while the manufacturing sectorindex eased slightly from 59 to 57.5..still signaling expansion. The improving outlook has helped boosthiring, with the unemployment rate dipping under 10% (to 9.9%) for the first time since late 2009.

However, compare this with Spains jobless rate of 20.5% overall..and a record 43.5% of youth (who areavailable for work) unemployed.

The IMF forecasts Eurozone GDP growth of 1.6% in 2011, and 1.8% in 2012.

United Kingdom

On the face of it, things dont look promising for the British economy. GDP contracted (by 0.5%) in thefourth quarter of 2010, and the prospects of ongoing government austerity are likely to continue takingtheir toll on economic growth.

The volume of retail sales

in Germany was 1.1%higher in February than inthe corresponding last year

and 3.9% stronger inFrance. But, in Spain,

where unemployment ismore than twice the euro-zone average, sales were5.6% weaker on the year,while in Portugal they fell4.5% and in Ireland they

were 3.0% weaker

Financial Times5/3/11

-

8/7/2019 Global Apr 11

11/38

11

We enjoyed this statement from the Financial Times (22/3/11) on therestricted nature of the countrys economy:

Guiding the UK economy is rather like playing Gridlock, theaddictive computer game in which a small yellow car issurrounded by large vans and trucks. No move is possiblewithout first shifting about six other vehicles. On the eve of his

annual Budget the chancellor must feel similarly hemmed in

Consumers, the lifeblood of the UK economy, have all but given up hope(despite inflation remaining high) and retail sales dropped by almost 2% forthe year to March.. the biggest fall in 16 years.

Manufacturers, who have been enjoying a robust recovery on the back of a weakened currency, are alsostarting to face worsening conditions. The sectors Purchasing Managers Index slid for the second monthin a row - after reaching a record high of 61.2 in January, the index hit a 5-month low of 57.1 in March.

There is some light at the end of the tunnel services, which is the biggest sector (contributing to75% of output) in the UK economy, surged in March, with the Purchasing Managers Index soaringto 57.1, from 52.6 in February.

The IMF has joined the chorus expecting lower growth in the UK, dropping its 2011 forecast to 1.7%,although it expects a pickup to 2.3% in 2012.

Australia

After a stellar performance in 2009, and early 2010, the Australian economy is now underperforming someof its developed peers. Devastating floods and a cyclone in key mining and agriculture regions earlier thisyear, have temporarily hampered economic growth.

The Consumer Sentiment Index fell 2.4% (month on month) inMarch, hitting a nine month low, and retail volumes remain soft.Sales have risen by a meagre 2.1% over the last year, largelydue to the very hefty rise in consumer savings (as shown in theadjacent chart).

Australian households squirreled away $74 billion insavings last year, equivalent to $3,300 for every man,woman and child. Total borrowings by individuals andcorporations are down by 11% over the last year thebiggest decline on record. For the foreseeable future itappears that economic growth will coming from spendingon business investment, rather than consumption.

According to the Australian(2/4/11):

The soaring Australian dollar is threatening to exacerbate the two-speeddivergence across the sectors in the domestic economy

The difference between the performance of the mining sector and other parts of the economy is alsobecoming more of a problem, as the Australian dollar passed parity with the Greenback last month andthis is hampering the Manufacturing sector (which is basically in recession). The Purchasing ManagersIndex was down to 47.9 in March the 6 th time in seven months that activity has contracted.

The labour market is, however, riding on the back of the resources sector, with almost 48,000 jobs createdin February. Overall unemployment remained steady at 4.9%.

Following the January floods, the IMF has downgraded its assessment of Australias economy, nowpredicting that it will grow by 3% this year, and 3.5% in 2012.

Theres no gettingaway from it:

household spending,the engine of the UKeconomy for the bestpart of two decades,is going in reverse

Wall Street Journal13/4/11

-

8/7/2019 Global Apr 11

12/38

12

New Zealand

NZs economy has narrowly avoided falling into a double dip recession. After falling 0.2% in the June toSeptember period, GDP edged up by 0.2% in the December quarter.

The figures were underwhelming and the latest earthquake,which shattered the countrys second largest city, has thrown a

spanner in the works which will mean further tough timesahead. Building consents for new dwellings are down to thelowest level in two years and consumer confidence (according tothe Westpac McDermott Miller survey) has now fallen to a levelwhere pessimists outnumber optimists.

Growth in manufacturing activity (expectedly) slowed in March,with the Purchasing Managers Index down to 50.1, which is justabove the 50-point expansion mark.

The terms of trade are, however, at an all time high, due to thestrength of the agricultural commodities sector.

Rebuilding in Christchurch and the Rugby World Cup will provide

positive momentum for the economy towards the second half ofthe year.and onwards. Reconstruction in Christchurch shouldlast for 5 years.and much longer at the current rate ofactivity.

Growth forecasts have been slashed by the International Monetary Fund. They now predict economicexpansion of just 0.9% this year, and 4.1% in 2012 (note the drop in one year and large boost in the next).

Inflation & Interest Rates

On Thursday, the European Central Bank (ECB) raised interest rates for the firsttime in three years initially by only a quarter of a percentage point to 1.25%.Jean-Claude Trichet, the President, cited inflationary risks stemming in part fromstrong economic growth in emerging markets, as well as ample liquidity at theglobal level, [which] may further fuel commodity price rises.

It is not just the ECB that looks at China and sees a more inflationary future. Thisweek the Peoples Bank of China, the central bank, raised rates for the fourth timesince October, as well as taking other action against price rises. Others areexpected to follow suit by the end of the year

Financial Times8/4/11

There is an old saying that low interest rates flatter all asset classes and (overall) inflation and interestrates remain low, in traditional terms, in the global economy. This is positive for equities and commodities.

The situation may not remain, as inflation is beginning to track higher, fueled by further improvement in theglobal economy and rising prices in commodities and in the emerging markets.

China has been a major catalyst for falling inflation and interest rates over the last 30 years. Whenthis massive country started integrating with capitalism in the 1980s, it added more than 20% to theglobal workforce, effectively becoming the worlds factory. It delivered a massive labour supplyshock that had a negative effect on inflation rates.

The February 22 earthquake inChristchurch dealt another cruel

blow to the city and the countryas a whole. On top of the humansuffering it inflicted, it has also

set back economic recovery by 3to 6 months. Some businesseswill never reopen, shrinking theeconomys productive base. Thegovernment will bear significant

costs of infrastructure rebuilding,as well as pouring financial aidinto the city. In addition, it willreceive a much lower tax takethan the Treasury forecast just

late last year

ASB14/4/11

-

8/7/2019 Global Apr 11

13/38

13

Because of competition problems, industrial workers indeveloped nations had difficulties when bargaining for wageincreases. It created a shift in emphasis in those countriesfrom blue-collar industries to service sectors.

Chinas share of world merchandise exports rose from 1.1%in 1982 to over 10% at the end of last year. In spite of rapidly

increasing productivity and the migration of factories to thelower cost central areas, wage costs in China are rising. Thegovernment, as always concerned about social unrest, raisedthe minimum wage by 20% earlier this year.

Inflation is also becoming of greater concern across the restof Asia, fueled by high energy and food prices and centralbank interventions into currency markets to maintain theirexport competitiveness is preventing rising currencies fromdoing their work in assisting to tame inflation. Many of thesecountries over-reacted to the 2008/09 financial crisis by overstimulating their economies and now have high capacityutilisation rates that are causing inflationary concerns.Unemployment is below 4% in Malaysia, Thailand, Singapore,Hong Kong and South Korea.

Australia, due to huge benefits in supplying commodities tothe region, can also be included, with unemployment at a low4.9%.

There is not much slack left in Asia.

The situation is different in the US, which is suffering from what hasbeen described as a wageless recovery. The Fed follows coreinflation (excluding energy and food), which currently sits at0.8%......the lowest that it has been since records began in 1959.Furthermore, annualised growth in hourly wages (the most importantelement for inflation indices) is just 1.7%, which is the lowest figure in25 years. In real (CPI inflation adjusted) terms, wage growth is

negative.

The Fed has a mandate to target unemployment (which is currentlyat 8.8%) as well as inflation. Capacity utilisation is still below thelong-term average and house prices are extremely weak.

Of interest to investors is speculation over the effect on interest ratesfrom the completion of the QE2 stimulation programme, at the end ofJune. There are a number of pundits who believe that when the Fedstops buying bonds (which should increase rates) the resultingslowdown in the economy could in fact drop interest yields as it didat the end of QE1.

The Eurozone & UK are mid-stream with regard to inflation. The central banks of both regions followheadline inflation (includingenergy & food) which is being affected by high food and oil prices. Recently,

the European Central Bank raised interest rates for the first time since 2008, due to inflation jumping to2.7% in March.

This however, has led to criticism over the effect that it will have on the besieged peripheral nations. CPIinflation in the UK is running at 4.4%, which is more than twice the Bank of Englands target, also puttingpressure on the bank to raise interest rates.`

Inflation is not a problemfor the G7 economies

(France, Germany, Italy,Japan, United Kingdom,

United States and Canada),although it is causing

substantial policy responsesfrom emerging markets. Theglobal bond market is not

too concerned aboutinflation. However, themedium-term inflationoutlook is uncertain

Bank Credit Analyst8/4/11

Data released on Friday showed asurge in Chinese and Indian

inflation, highlighting the threat tothe global economic recovery asemerging markets overheat and

commodity prices riseConsumer prices in China

increased 5.4% year-on-year inMarch their biggest jump since

July 2008.Headline inflation in India,

meanwhile, rose to almost 9% inMarch, compared with 8.3% in

February.Emerging market countries are

tightening fiscal policy to combatinflation, potentially reducing an

important source of global demandfor advanced economies already

struggling with high unemploymentand fiscal cutbacks

Financial Times15/4/11

-

8/7/2019 Global Apr 11

14/38

14

Confidence is weakening and the economy slowing in NZ, due to the fragile nature of the recovery and theeffect of the Christchurch earthquake. Consumer demand is weak and the Reserve Bank (RBNZ) droppedthe Official Cash Rate by 50 basis points in March. The last RBNZ bulletin (31/3/11) said:

We think that price inflation remains comfortably under control.consequently,it now seems prudent to keep the OCR low until the recovery becomes morerobust and underlying inflation pressures show more obvious signs of increasing

Lets look at NZ & US interest rate trends that we have recorded in previous issues, compared to Friday:

NZ rates are lower at the short end of the curve, because of a 50 basis point cut in the Official Cash Rate.They are higher further out, due to rising rates in the US.

Currencies

Two years of total inactivity on the rate front by the wests biggest central bankscame to an end this week as the European Central Bank (ECB) raised its policyrate.

This was not a surprise when it happened, but it is still a big deal. It is the first timein the ECBs relatively brief history that it has taken the lead in starting to tightenmonetary policy, rather than waiting for the Fed.

There is room for debate between inflations hawks and doves, but plainly the ECBis a better bet than the Fed to raise rates and to combat inflation; and on bothcounts, that points to a stronger Euro and weaker Dollar.

Financial Times8/4/2011

Instrument CurrentRate (%)

Issue No100 (31/1)Rate(%)

Issue No 99(20/12)Rate(%)

Issue No 98(22/11)Rate(%)

Issue No 97(25/10)Rate(%)

Issue No 96(30/8)Rate (%)

Issue No 95(26/7)Rate (%)

New Zealand

Call (OCR)90 Day Bank Bills1 yr Govt Bonds5 yr Govt Bonds10 yr Govt Bonds

United States

Fed Funds Rate90 day T-Bill10 yr Govt Bonds30 Yr Govt Bonds

2.502.672.614.595.77

0 to 0.250.063.414.47

3.003.243.304.555.50

0 to 0.250.143.324.53

3.003.193.394.835.89

0 to 0.250.103.334.44

3.003.173.594.865.66

0 to 0.250.132.874.24

3.003.193.484.385.09

0 to 0.250.122.523.91

3.003.233.494.415.12

0 to 0.250.142.643.69

2.753.273.644.715.40

0 to 0.250.152.994.01

-

8/7/2019 Global Apr 11

15/38

15

The adjoining chart shows that the US dollarwas in a sustained downturn from its peak in2001, until the financial crisis in 2008. aperiod which coincided with strong runningequity and commodity markets.

The chart also explains the long bull run in

gold which has a close negativecorrelation with the USD.

The USD tends to fall during times whenrisk is being sought (and shares are beingbought) as large US investors place theirmoney overseas.

The Greenback has been a counter-cyclical currency for over a decade.

It then bounced and showed its paces as a safe haven currency (with US investors repatriating funds).throughout the global recession (until early 2009).

Fluctuations since then have been largely driven by the sovereign debtcrises in Europe, and the quantitative easing programmes carried out by theUS Federal Reserve.

The USD and EUR are the two biggest currencies in the world and tend to benegatively correlated (currencies do not move in a vacuum). The commoditycurrencies (including NZD) also tend to move in an opposite direction to the USD.

The ongoing debate has recently been whether the USD would rise (due to astronger recovering economy) and EUR fall; or the EUR would instead rise (andUSD fall) due to a greater propensity for the European Central Bank (ECB) to liftinterest rates. We believe that with low core inflation the US has the ability to pushits currency lower, thus boosting their exports. and commerce in general.

In our last newsletter (31/1/11) we said:

The crux of the matter is that the US should win its battle to lower its currency to boostthe economy. America has an infinite amount of ammunition, as there is theoretically nolimit to the amount of dollars that the Fed can create particularly with lower inflationthan most of the rest of the world. The Fed will keep easing until the US economy issatisfactorily reflated. This is negative for the Greenback

The ECB concentrates on headline inflation (including food and energy), while the Fed watches coreinflation (excluding the volatile food and energy figures). The ECB is therefore more concerned about theircurrent inflation figures and have recently started their interest-hiking regime.

This is positive for the Euro and negative for the USD which (in the above chart) is alreadyshowing a technical weakness, with a large double top formation pointing downwards. The AUD

and NZD are rising against the USD..and we expect NZD/USD to go through $0.80.

The above negative USD stance is conditional on the Eurozone being able to ring-fence problems withGreece, Ireland and Portugal and how the markets react to the completion of US quantitative easing (QE2)at the end of June. We anticipate volatility ahead.

With respect to other currencies the Bank of England is faced with increasing inflationary pressures,which will force them to start normalising monetary policy in the coming months. This will widen the interestrate differential with the US.

Theres nosupport for the

dollar, sotraders are

going anywherebut

Wall StreetJournal3/4/11

-

8/7/2019 Global Apr 11

16/38

16

The adjacent chart of the GBP/USD showsa steady appreciation of the Pound againstthe Greenback.which should continue.The NZD remains positive against thePound.

The Bank of Japan should be the last

central bank to begin tightening monetarypolicy following the devastating earthquake,tsunami and nuclear catastrophe suffered inMarch.

The Japanese Government (alongside theG7 nations) has been intervening to keep aceiling above the Yen which is unlikely tostrengthen against the USD (or NZD) whilethe potential for further intervention remains.

The re-emergence of Yen-funded carry trades into high yielding commodity currencies should also assistthe Yen to weaken. The Australian dollar, the highest-yielding developed-world currency, has been a majorcarry trade target.

The NZD is likely to remain weak against the AUD until later in the year, when Christchurch insuranceproceeds are being remitted, and NZ Reserve Bank tightening appears likely to resume.

Share Markets

If the professional economists cant predict economies and professionalforecasters cant predict markets, then what chance does the amateur investorhave? You know the answer already, which brings me to my own "cocktail party"

theory of market forecasting, developed over years of standing in the middle ofliving rooms, near punch bowls, listening to what the nearest 10 people said aboutstocks.

In the first stage of an upward market - onethat has been down awhile and that nobodyexpects to rise again - people arent talkingabout stocks. In fact, if they lumber up to askme what I do for a living, and I answer, "Imanage an equity mutual fund," they nodpolitely and wander away. If they dont wanderaway, then they quickly change the subject tothe Celtics game, the upcoming elections, orthe weather.

Soon they are talking to a nearby dentist aboutplaque. When 10 people would rather talk to adentist about plaque than to the manager of anequity mutual fund about stocks, its likely thatthe market is about to turn up.In stage two, after Ive confessed as to what Ido for a living, the new acquaintances lingerwith me a bit longer - perhaps just longenough to tell me how risky the stock market

Peter Lynch secured hisreputation as probably the

most successful fundmanager in the history of the

equity markets while incharge of the Fidelity

Magellan Fund between 1977and 1990. During this periodhe grew the fund from $20

million in assets to $14billion. A $10,000 investmentin 1977 would have grown to

$288,000 by 1990. Hisaverage annualised returnsover the 13 year period were

29% .and heoutperformed the market onaverage by more than 13% a

year. He had afundamentalist approach

-

8/7/2019 Global Apr 11

17/38

17

actually is - before they move over to talk to the dentist. The cocktail party talk isstill more about plaque than about stocks.

The market is up around 15% from stage one, but few investors are paying muchattention.

In stage three, with the market up 30% from stage one, a crowd of interested

parties ignores the dentist and circles around me all evening. A succession ofenthusiastic individuals takes me aside to ask what stocks they should buy. Eventhe dentist is asking me what stocks he should buy. Everybody at the party has putmoney into one issue or another, and theyre all discussing whats happened.

In stage four, once again theyre crowded around me -- but this time its to tell mewhat stocks I should buy. Even the dentist has three or four tips, and in the nextfew days I look up his recommendations in the newspaper and theyve all gone up.When the neighbours tell me what to buy, and then I wish that I had taken theiradvice, its a sure sign that the market has reached a top and is due for a tumble

Peter LynchOne Up on Wall Street

Equities are currently entering the 3rd

stage. After a two-year bull market, we are moving into the later partof the cycle where the hoards of investors, who so-far have missed out on large scale gains, give up theirresistance and join in.. providing the market with more energy. These periods, often characterised byrising inflation, but still relatively low interest rates, make the later stages more volatile. but they can beextremely profitable.

According to the Financial Times(10/4/11):

The amount of moneywending its way into USequities suggests that themarket is a sanctuary forinvestors.

As the earthquake andtsunami ravaged Japan andthe populist revolts wagedon in North Africa, lastmonth, US equity funds sawnet inflows of as much as$538 million, according tothe latest estimates of theglobal fund tracker EPFR

The current phase is shown in the above chart of the share market cycle. It is approaching the time whenexcited newcomers rely on faith and momentum, rather than knowledge and skill.

It reminds us of the excellent classic book the Extraordinary Popular Delusions and the Madness of

Crowds, when the Victorian writer Charles Mackay describes a company formed during the South SeaBubble, in 1720, which declared in its prospectus that it was for carrying on an undertaking of greatadvantage, but nobody is to know what it is.

After investors hurried to buy shares, the founder set off the same evening for the Continentandwas never heard of again.

-

8/7/2019 Global Apr 11

18/38

18

A well-worn expression is that sharemarkets love to climb a wall of worry.

That is exactly what the Dow Jones WorldIndex has done, as shown in the adjacentchart. There have been pullbacks relatingto the end of the first US quantitative

easing (QE1) programme, and recentlywith regard to the earthquake and tsunamidisasters in Japan but the world markethas more than doubled since the financialcrisis.

The trick in projecting an ongoing upwardstrend in equity markets is to ask(particularly with regard to the leading US

market):

1. Is there still upside to the globaleconomy? The answer is yes.

2. Are inflation and interest ratesunder control? The answer isyes, but less so than before -particularly with regard to food,energy prices, and theemerging nations.

3. Are equities of reasonablevalue? The answer to this isalso yes, with price earningsratios similar to the long-termtraditional average. See theadjacent chart with regard tothe NZ forward P/E multiple.

4. Are corporate earnings continuing to grow? The answer to this is that they are, but not at thesame hectic pace that immediately followed the financial crisis.

This then establishes the fundamentals which are still positive for equities. Because of low interest rates,alternative investments such as cash and bonds are less attractive for investors. In NZ a median marketgross dividend yield of 6.6%, combined with ongoing growth potential, makes equities a compelling story.In a well balanced portfolio, dividends typically make up 50 to 60% of total returns.

The next element to watch for are the headwinds, or black swanevents thatcan derail the markets. We have already discussed the major issues underour Global Risksection with regard to the European sovereign debt issue;conflict in the Middle East, and its effect on oil prices; and the looming end toquantitative easing in the US. If shares were expensive (eg. in NZ, a price

earnings multiple of 16 to 17) then each of these problems would have thepotential to cause a major correction.

However, because the fundamentals are reasonable, the markets have beenable to climb this wall of worry. Indeed, these issues provide a good restraint because if equity markets go straight up, then they dont last for long.

However, the major issues have to be watched to see that they do notbecome overbearing to the extent that investors start to seriously bail out as

Investors arereluctantlyoverweight

equities. The

combination of zerorates and risinginflation makesthem fearful of

bonds and cash

Financial Times12/4/11

-

8/7/2019 Global Apr 11

19/38

19

they did with regard to the 2007/08/09 subprime and financial credit issues (which struck when the marketwas over-valued). We follow sentiment indicators closely to gauge what effect these problems are havingon investors.

As mentioned, our immediate concern is the completion of QE2, in the US, at the end of June.

What of the emerging nation equity markets?

In our last issue (31/1/11), we said:

Emerging markets are currently losing favour as they are being impacted more than thedeveloped world by the escalating prices of energy and food and their central banks arein tightening mode.We have therefore (mostly) stepped aside from this sectorwiththe thought of re-entering at lower prices down the track

After a period of underperformance, theyhave come back, as the adjacent chart ofthe iShares Emerging Markets ETF shows.

While inflation remains elevated, majoremerging nation central banks are late in

their tightening cycle, and are now allowingtheir currencies to gradually appreciate,alleviating the need for excessively highinterest rates, and providing greatercertainty to their share markets.

The IMF is predicting that emerging anddeveloping economies will grow by 6.5%during this year and next; while thedeveloped economies will expand by 2.4%this year, and 2.6% in 2012.

There are still opportunities with regard to these high performing emerging countries particularly whenfood and oil prices start to level off which we are anticipating. We have re-entered this sector, buying

South Korean iShares (US: EWY) a play on technology disruptions in Japan; and Russian (US:RSX)Market Vectors ETF relating to upside to their economy from oil.

This bull market is not yet done. It could be interrupted this week from inflation fears in China, and also inthe next month or so from the end of QE2 (or perhaps an escalation in one of the other major issues). Butin the medium term ongoing economic growth, lowish interest rates and reasonable values should prevail.

International NewsIn Washington today, US President Obama named ex.President George W Bush as his leading adviser on theAmerican excursions into Libya.

The President said that "we are assigning U.S. forcesto a dangerous mission in a Muslim nation that posesno real threat to America, but whose instability couldmire us in an expensive, pointless conflict for years tocome. To that end I thought that no-one knows moreabout this than President Bush."

-

8/7/2019 Global Apr 11

20/38

20

A delighted Mr. Bush immediately leapt into action and can be seen in the above photo working outprecisely where Libya is. He admitted that he was antagonistic when he first got the call because whenLaura said Obama was on the phone again. I got him mixed up with Osama".

He said that he was more than happy to heed the current President's call, because he has already offeredsome advice on the situation in Libya.

I told the President to start wearing a flight suit whenever it is possible a nice green one with the

belts and straps and all that.

President Obama commented that he had also considered ex. President Clinton but said that the last timehe accompanied the Secretary of State to Libya he wound up disappearing for hours with Mr. Gaddafi'sUkrainian nurse."

*****In the bloody clash in the Ivory Coast between strongman LaurentGbago (who was holed up in the Presidential Palace) and thesupporters of the elected new President, Alassane Ouattara, more thanone million people fled their homes and thousands were killed. To addto the chaos Liberian mercenaries were apparently fighting on bothsides.

Representatives of the elected President reported today that they hadapproached France, Great Britain, the US and the United Nations tointervene in the crisis, in the same manner as occurred in Libya.. inorder to establish democracy and justice, and to stop the ex. Presidentfrom killing his own people.

The immediate response was how much oil do you have?

We have cocoa. Lots and lots of cocoa. It is delicious. Chocolateis made from cocoa" they said, dispersing large amounts of M &Ms, Toblerone, and pineapple chunks, its an importantingredient in cake.

This generated loud cackles of mirth from members of the UN Security Council.

The Ivory Coast is also a leading exporter of coffeethey cried, but no-one appeared to give a damn.

They also tried to get them interested in traditional and intricate African ceremonial masks, but this onlyelicited a ripple of laughter .with the US representative saying too bad that it is not Halloween.

Finally, after four months, President Sarkozy of France agreed to bomb the Palace in the hope of gettingdown on some ivory not realising that the country does not possess significant amounts, but wasmerely a continental off-loading point during early colonial times.

*****After viewing the protests in Christchurch relating to thespeed, or lack of it, with regard to the rebuilding of thecity..and their own thoroughly muntedchurches, the

Christchurch Bishops of both the Anglican and Catholicchurches have decided to temporarily remove patiencefrom the official list of virtues.

We used to think that it was virtuous to just sit aroundand wait for stuff to happen, said a spokesman fromboth churches, but we know a lot more about virtuetoday than ever before, and its clear that patiencedoesnt fit that profile.

-

8/7/2019 Global Apr 11

21/38

21

He added that there is underlying evidence supporting our new stance and referred to anAmerican Psychiatric Association study indicating that people who exhibit an abundance ofpatience are very often bipolar.

We therefore do not ask for charitable forbearance, but instead insist that activities get cracking in whatpreviously would be considered as an unseemly manner.

In an unrelated message, Christchurch police have today asked people to desist from the new habit ofwalking in the middle of the street, particularly on the citys busy ring roads - as it presents a danger totraffic who have to weave past these pedestrians. They added that we have put down thousands ofcones to make driving more adventurous and certainly do not want members of the public to assist us inthis regard.

*****You read it here first, we cover the night beat for the Daily!

Commodities, Resources & Precious Metals

Commodities plunged amid a rising chorus ofanalysts warning that high prices were eating intodemand.

Commodities such as corn, copper, and cotton havehit record highs in the past 2 months, and crude oil,which is closely watched due to its widespreadinfluence on the broader economy, hit 2-year highslast week.

Prices have been rising on tight supplies as well as

on many central banks loose monetary policies,which increased the flow of investment into what istraditionally perceived as a risky asset class.

But the magnitude and speed of the latest run up,which started in the second half of last year, isreaching a tipping point, especially given the fragileunderpinnings of developed nations economies

Wall Street Journal12/4/11

The medium-term outlook for commodities remains fairly benign. Above-trendglobal growth, abundant liquidity, and a tight supply backdrop should sustain the

commodity bull market for the next two to three years.

Beyond then, however, the outlook for commodities appears quite worrisome.Higher interest rates and increased supply will weigh on commodity prices andChinas incremental demand for base metals is apt to decline

Bank Credit Analyst8/4/11

In our last newsletter (31/1/11) we said:

An increasing number ofcommodity prices and

related assets are gettinghigh in the tree. This is true

for many of our long-standing favourites,

including corn, copper,aluminium, petroleum crack

spreads, energy servicesstocks, as well as theCanadian and Aussie

dollars. Still it is not yet timeto cut exposure

Bank Credit Analyst5/4/11

-

8/7/2019 Global Apr 11

22/38

22

There is room for a commodities correction as Barclays have estimated that US$60billion was injected by speculative trading into commodities during 2010. Hedge funds, inparticular, have been very bullish

And:

We remain positive on commodities this year, but expect more modest gains and

volatility than in 2010. A 10%+ overbought correction is on the cards

Respected investment bank, Goldman Sachs, issuing a warning last week that sent shivers through thepreviously optimistic commodity markets, and the benchmark Reuters-Jefferies Commodity Index fell byover 3% .after hitting a 15-month high earlier in the month.

High inflation, increasing interest rates, and tightening creditconditions have had investors concerned about an economiccorrection in China. In March, annual inflation rose by 5.4%year-on-year, compared to 4.9% in February which was thebiggest jump since July 2008. The commodity markets arenot going to take this lying down although we believe thatthe biggest contributor, food, will level off; after a year thathas been severely interrupted by bad weather.

China is relevant. In 2010, the country consumed 24% morecopper, 59% more zinc, and 31% more aluminium than themighty US. The inevitable long-term problem is that when theexpansion in this great developing nation starts to tail off, andthey concentrate more on consumer demand than export growth then the extra annual expansion in commodities demand willstart to wane. This happened in the emerging nations of oldsuch as Japan, South Korea and Taiwan.

For instance, if Chinas consumption per capita converges to that of Japan, then Chinese copperdemand growth would only average 3% per year, over the next 20 years, representing a 60% dropin incremental demand.

An economy cannot continue expanding at double-digit growthforever (particularly a rapidly ageing one like China), and so it isonly natural that economic growth will slow in the years ahead.

Currently a soft landing for China remains the most probableoutcome, and manufacturing and trade data were positive lastmonth.. indicating that demand for raw materials remains intact.Waiting in the wings, with an expected longer-term impact, isIndia.

We believe that we are now entering the later stage of thecommodities cycle which can be both profitable and dangerous.Over the next two years, supply constraints are likely to putupwards pressure on prices, but there are huge warning signsafter that. An increase in volatility from now on is almost

guaranteed.

OilLast week at the Public Policy Forum hosted by the U.S. Energy Association, Dr.Robert Simon provided a congressional view of volatile oil prices. Simon is thestaff director of the Senate Energy and Natural Resources Committee. He sharedthe Senate's conclusion that events in the Middle East and North Africa comprisethe major force driving oil prices - which had been set out last month when

The ANZ Commodity Price

Index lifted 4.7% in March, anew record and the 7th

consecutive monthly rise inthe index. This latest month

also recorded strongerincreases in commodity prices

than any of the preceding 6months. For the first time in 17

years there wasn't a singledecrease in the price of anyindividual commodity in thebasket of 17 commodities

Sharechat

4/4/11

-

8/7/2019 Global Apr 11

23/38

23

Senator Jeff Bingaman reported the four factors that the Committee believes arecontributing to increased oil prices:

When the world's key oil producing and exporting region, which is theMiddle East and North Africa, is unstable, world oil markets are alsounstable.

When political unrest threatens major chokepointsin the world oil transit routes, world oil pricesreact, as they have.

When a Member of the Organisation of PetroleumExporting Countries stops exporting oil, which hasvirtually occurred in the case of Libya, world oilmarkets react.

When there are fears that a nearby neighbour andclose ally of Saudi Arabia, home to the world'slargest spare oil production capacity, might begina series of political upheavals in the Persian Gulfregion, world oil markets react as well.

Into this uncertain environment, we now have a new source of even greateruncertainty, that is, the earthquake and the ensuing tsunami and nuclear disasterthat have struck the island nation of Japan"

RealMoney12/4/11

After trading sideways for most of last year, the oil market came to life in 2011.

Prices have risen more than 40% since October last year when conflict first broke out in the Middle East.Protests and fighting in Egypt, Tunisia, Gabon, Nigeria, Bahrain, and Libya have elevated concerns thatmuch-needed supplies will be shut off from the markets.

By far and away the greatest worry has been the ongoing situation in Libya..which is a major producerof oil, and supply has dropped by 85% - from 1.6 million barrels a day to just 250,000.

A major issue is that Libya produces the much sought after light, low sulphur crude, which is not producedin Saudi Arabia. Nigeria (which supplies more than 10% of US oil) is the next best country for this product,and they have their own political upheavals, associated with upcoming elections.

Saudi Arabia and the United Arab Emirateshave boosted production in the last coupleof months to take up some of the slack, butspare capacity is rapidly reducing, and ifthe situation in the Arab region deteriorateseven further then supplies could beseriously tested. However, inventories inthe developed nations are high.

The adjacent graph of the Light CrudeContinuous Contract illustrates the surge inoil prices this year.

The focus in oil markets has also shiftedrecently to worries that high prices couldaffect global oil demand.

Nobody ispredicting a

decline in demandthis year. But highprices are forcinga rethink on the

pace ofconsumption.

Financial Times15/4/11

-

8/7/2019 Global Apr 11

24/38

24

The Organisation of Petroleum Exporting Countries (OPEC) has cut (by 50,000 barrels a day) its world oildemand growth forecast for 2011. They believe that demand will now grow by 1.39 million barrels per day(or 1.61%) to 87.94 million barrels per day.

The International Energy Agency has kept its oil demand prediction unchanged at 89.4 million barrels perday, but also warned that there are risks emerging that the current economic climate cannot handle $100 abarrel-plus prices.

From the investment perspective, if oil prices remain at an average of $100 a barrel or more,Russian oil revenues will increase by between US$100 billion and $350 billion, which would equateto up to 21% of their GDP. To this end, we have purchased shares in the Russian (RSX) MarketVectors Exchange Traded Fund, which tracks the oil dominated Russian stock exchange index.Russia is currently producing more oil than Saudi Arabia, and the IMF expects oil to average $107 abarrel this year, and $108 in 2012.

We anticipate volatility in oil prices over the coming months as the markets focus fluctuates aroundcompeting forces. There is downside in the short-term as speculators take profits, but we are positive inthe medium to longer term.

GoldAs long as the environment remains risky, as long as the peripheral European

sovereign risk remains an issue, as long as the Middle East remains in turmoil,there is always going to be demand for an asset like gold

Mineweb6/4/11

Gold is useless. At its simplest analysis, gold has very little to recommend it. Ithas no metrics, no real valuation, and no commercial use. Its supposed proxy forworld currencies is all based upon the "greater fool theory": Its value as a currencyis derived only from what the next guy believes is its value as a currency. To me,that is a very scary rationale to investment. Gold is the world's most respectedPonzi scheme

RealMoney28/3/11

The above conflicting statements represent the different attitudes with regard to what is known as thebarbarous relic. We have never been a great lover of the metal, mainly because it generates no income(such as interest or dividends) as an investment, and gold mining companies have earnings problems dueto ever increasing costs and ever depleting mines. New gold fields are hard to find and the largercompanies tend to grow mainly from acquisitions.

Having said that, gold does have atendency to act like a quasi-currencynot that it is now, but it once was. Tothis end it tends to be negativelycorrelatedto the worlds largest currency, the USD,which we maintain still has downwardspotential.

This negative correlation is shown in theadjoining 10-year chart.

An additional positive element is China which is the worlds largest goldproducer. It has allowed its residents inrecent times to buy gold, and as a resultthe country imported over 200 tonnes in2010 which was a 5-fold increase on 2009.

-

8/7/2019 Global Apr 11

25/38

25

China is approaching India as the worlds largest consumer.

Our stance this year is that we are positiveon gold until the market anticipates the US Federal Reservestarting its monetary tightening process, in which case the price should correct. We note that GoldmanSachs has stated, in a note to clients, that gold is a compelling tradein the short-term, ratherthan a longterm investment.

We like gold for 2011.

Base Metals

The bottom line is that destocking will eventually lead to restocking in China,which will push copper prices to new highs. Chinese industrialisation has a fewyears to run; power generating equipment, autos, low-housing construction,infrastructure, and alternative energy all require massive amounts of copper.

However, the path will not be in a straight line. Prices remain vulnerable to atechnical correction

Bank Credit Analyst5/4/11

Sentiment towards the base metals sector has flattened in recent months as doubts creep in over thesustainability of current prices, and whether a notable correction is on the way. However, we believe thatalthough China has been tightening its monetary policy, this is coming to an end, and the economy is in fora soft landing only.

Additionally, Japan is now going to ramp up demand for base metals. Everything from the power grid tohousing construction, vehicle replacement, and consumer appliances are required. Japan bought 1.1million metric tonnes of copper last year and (when the dust settles) this will soar.

However, the performance of different metals is diverging. Within the base metals complex we favourcopper and aluminium, over nickel and zinc.

Copper was one of the standoutperformers in 2010, and into early 2011,with prices rising to record highs. However,since peaking in early February, prices fellmore than 5%...... and are now trackingsideways.

This contradicts the reports that we havebeen receiving that the metal will be insupply deficit for the foreseeable future although there is a limit as to how high acommodity can rise, before consumerssubstitute other products and scrapmetal dealers come more into play.

Poor trade data from China in February also made investors fret as to whether the worlds most

voracious consumer is using less copper..and investors reacted negatively to this. There havealso been wild rumours over rogue deals in China including a theory that copper is used as afinancial asset. Non-users get access to credit to import the metal, sell it..and then continueto use the proceeds for property deals. It helps bypass credit restrictions on real estate.

Additionally, there are eyewitness accounts that there are about 600,000 tonnes lying idle in bondedChinese warehouses which are taxed once they are released to domestic buyers. This was not aproblem while prices were rising, but a substantial release of the metal could lead to lower prices.

-

8/7/2019 Global Apr 11

26/38

26

To counter this, March import data (released last week) showed copper imports jumping 29% for themonth, which went some way to easing investors fears and proving that China still remains a strong buyerof the metal. Februarys weak figures also likely reflected a running down in inventories which they dofrom time to time, to confuse the pricing structure. The Chinese New Year period would have also reduceddemand.

Bear in mind that Rio Tinto has estimated that the copper supply deficit could be around 500,000

tonnes for 2011..and continue for at least a couple of years. New exploration projects are alsonot bearing much fruit.

Overall (in our mind) the long term fundamentals for copper (and base metals in general) remains positive,although there could be a continuation of the short-term correction due to destocking followed by aprice recovery from Chinas massive urbanisation plans, and Japans reconstruction efforts.

Aluminium has lagged the general commodity bull-run over the past twoyears, but the outlook is improving. Inventories are steadily trendingdownwards, and demand for the lightweight metal, used in consumer andindustrial products, is increasing.

Japan is Asias biggest importer of the metal, meaning that demand will slip inthe near term.but gain momentum further down the track. Deutsche Bank

estimates that demand for the metal will grow by 5% this year, which is greaterthan the predicted increase in supply. Recent policy changes in China couldalso drive prices upwards.

The Chinese governments push to reduce power consumption and carbonemissions culminated in power being cut off to numerous aluminium smelters late last year. The sharp fallin estimated annual production, from about 17.5 million tonnes last year, to 14.5 million tonnes this year,could mean that they are forced to turn to the international market for supplies potentially creating asupply squeeze.

The metal is widely produced in the Middle East, and could also suffer from supply disruptions over there.

Aluminium is a product that has widespread application and is a ready substitute for other metals, andconsumption remains strong particularly with regard to motor vehicles (where global growth is around 5to 10% per annum). Its price is off its 2008 peak, but we remain positive.

The price of nickel has probably peaked this year, and fundamentals are expected to turnincreasingly sour over the remainder of 2011 as the market moves into surplus.

The International Nickel Study Group expects supplies from the world nickel market to exceed demand,which is negative for prices. This compares with a previous deficit position, due to strong stainless steelproduction (which makes up 60% of nickels end usage).

Overall base metals remain in a late stage of the cyclical bull market meaning that there is upside ahead,accompanied by increased volatility. In the shorter term inflation in China will be a negative.

CoalThermal coal is the largest source of energy for the generation of electricityworldwide and demand could rise still further if nuclear programmes suffer a

setback following the crisis at the Fukushima reactors in Japan

Financial Times1/4/11

Anglo Americans chief executive says that there will be extremely strong mediumand long-term demand for coal as an energy source from the developing world,despite moves to clamp down on carbon emissions around the globe

Aluminiumdemand is

expected to bedriven by the big

emerging markets,including a 12%increase from

China

Financial Times1/4/11

-

8/7/2019 Global Apr 11

27/38

27

The Australian

8/4/11