G. Determining Child Care Hours - Oregon(week 2) Sun Mon Tues Wed Thurs Fri Sat Dad 8a-5p 8a-5p...

Transcript of G. Determining Child Care Hours - Oregon(week 2) Sun Mon Tues Wed Thurs Fri Sat Dad 8a-5p 8a-5p...

FSML - 95 October 1, 2019 Child Care G – Determining Child Care Hours G - 1

G. Determining Child Care Hours

1. Number of allowable child care hours DHS will help pay for the number of child care hours necessary for caretakers to perform their job duties or participate in approved self-sufficiency activities (see CC-G.1). The computer system adds 25 percent to the hours coded by the worker on UCMS or JAS; the extra 25 percent covers the travel time to and from the child care site to the approved activity (work, school or JOBS program), meal time, and can also be used for homework time if the parent was approved for student hours. In a two-parent household only overlapping work hours can be approved unless the second parent has provided documentation that they are physically or mentally unable to provide adequate care for the child(ren). DHS will not help pay for child care hours when free care is available, such as during school hours for school age children who are able to attend school. DHS cannot help pay for school tuition or care for a child in homeschool during the school hours of the local public school.

Example: Paige is school-aged and her sister is in preschool. The child care provider transports Paige to school at 8:20 a.m. and picks her up at 3:00 p.m. The provider cannot bill for the hours that Paige is at school.

Example: Katheryn is going into kindergarten this fall. Her preschool offers

kindergarten classes and charges $700.00 per month for the kindergarten class which includes before and after school care (from 7 a.m. – 5:30 p.m. DHS cannot pay for the kindergarten tuition. Since before and after school care is included in the cost of tuition, there is no remaining cost that DHS can cover.

Example: Morgan is applying for child care. She works during the day and reports homeschooling her child in the evenings and weekends. She is asking for full-time child care for her school-aged child. The worker explains to Morgan that DHS cannot pay for child care during hour when free care is available. This includes school hours for a school-aged child. The worker will authorize Morgan’s work hours. The hours are not reduced based on the only child being school aged. This allows Morgan to have child care during school breaks, closures and when the child is unable to attend school (example: illness).

FSML - 95 G - 2 Child Care G – Determining Child Care Hours October 1, 2019

It is important for Morgan to understand the appropriate use of child care. When full-time hours are billed for a school-aged child, the case is flagged in a School Age Report and the payment is reviewed. If Morgan signs a billing form authorizing payment for school hours, she is liable for the overpayment.

REMEMBER

! When calculating authorized child care hours:

• ALWAYS round up. The preferred method is to round up at the end of the calculation. However, it will not be considered an error if rounding occurs sooner in the calculation as long as it is always rounded up;

• NEVER average.

Example: 31 hours per week x 4.3 – 133.3 (round to 134) 35 hours per week x 4.3 = 150.5 (round to 151)

Determining child care work hours for one-parent families – Code the monthly authorized hours on UCMS. Do not average the hours. Instead, code the highest number of verified work hours.

Example: The parent's verification shows they are working 30 to 35 hours per week, you would code 35 x 4.3 = 150.5 round up to 151 CC Wrk Hrs on UCMS.

Determining child care work hours with shared custody – Split custody situations do not impact ERDC child care hours. Even in shared custody situations, authorized child care hours are calculated based on each caretaker’s highest verified work hours. It is the responsibility of the child care provider and parent to ensure care is being billed for the correct case.

NOTE

! At initial certification and recertification, if the parent states they work more hours per week than the supplied verification, additional verification is needed. If additional verification is received, the new information is used for both the income and authorized hours. For more information on adding child care hours during the certification (see CC-K.3).

FSML - 95 October 1, 2019 Child Care G – Determining Child Care Hours G - 3

Determining child care work hours for two-parent families In two-parent filing groups only child care hours when both parents are working are allowed. This means we need to determine both parents’ schedules and count only the work hours that overlap. Commute time is not included when looking at hours that overlap.

Example 1: Regular Work Schedule

Sun Mon Tues Wed Thurs Fri Sat

Dad 7a-4p 7a-4p 7a-4p 7a-4p 7a-4p

Mom 9a-2p 9a-2p 9a-2p 9a-2p 9a-2p

The parents work schedules do not vary from week to week. Only one week of their work schedule is needed (income verification has different guidelines). The child care need in this situation would be Monday - Friday 9:00 a.m. to 2:00 p.m. = 5 hours x 5 days per week = 25 x 4.3 = 107.5, round to 108 child care work hours.

Example 2: Two-Parent Variable Work Schedule –

These parents have a consistent number of overlapping work days

per week but the hours per day vary.

(week 1)

Sun Mon Tues Wed Thurs Fri Sat

Dad 8a-5p 8a-5p 8a-5p 8a-5p 8a-5p

Mom 12a-5p

8a-12p

10a-2p

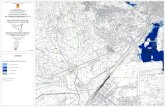

(week 2)

Sun Mon Tues Wed Thurs Fri Sat

Dad 8a-5p 8a-5p 8a-5p 8a-5p 8a-5p

Mom 11a-4p 12p-5p 9a-11a 10a-2p

These parents consistently have three days overlap, but the work hours varied each day. The highest overlapping hours are five per day. These are their highest verified work hours. Calculation: 5 hours x 3 days per week x 4.3=64.5 round to 65 child care work hours.

Example 3: Two-Parent Complex Variable Work Schedule

These parents have a variable number of overlapping days per week and hours per day.

FSML - 95 G - 4 Child Care G – Determining Child Care Hours October 1, 2019

(week 1)

Sun Mon Tues Wed Thurs Fri Sat

Mom 6p-11p 8a-2p 10a-5p 4p-9p 10a-6p

Dad 5p-8p 9a-6p 6a-8a 5p-10p 6a-10a

overlap 0 hrs 7 hrs 4 hrs 0 hrs

(week total – 11)

(week 2)

Sun Mon Tues Wed Thurs Fri Sat

Mom 4p-11p 10a-4p 9a-6p 4p-9p 10a-6p

Dad 3p-11p 11a-6p 9a-6p 6a-8a 5p-10p 10a-7p

overlap 7 hrs 5 hrs 9 hrs 0 hrs 4 hrs 8 hrs

(week total – 33)

(week 3)

Sun Mon Tues Wed Thurs Fri Sat

Mom 8a-12p 10a-4p 10a-7p 11a-6p 10a-5p 4p-9p

Dad 11a-6p 9a-6p 12p-8p 10a-7p 5p-10p

overlap 0 hrs 5 hrs 8 hrs 6 hrs 7 hrs 4 hrs

(week total – 30)

To calculate authorized hours for a family with a varying number of overlapping days and hours per day use the hours from the week with the highest overlap. For this family week 2 of the schedules we received show the highest hours: 33 weekly hours x 4.3 = 141.9 (142)

REMEMBER

! Work hours for two-parent families must also be verified on their pay verification and should make sense when calculating the overlap.

Example: Dad’s pay stubs show he works 25 hours per week, but the schedule

given by the customer shows they have 35 hours per week that overlap. This does not make sense, and additional verification of the work schedule may be needed.

FSML - 95 October 1, 2019 Child Care G – Determining Child Care Hours G - 5

Example 4: Variable Work Schedule with no overlap

Sun Mon Tues Wed Thurs Fri Sat

Dad 8a-5p 8a-5p 8a-5p 8a-5p 8a-5p

Mom 5p-8p 6a-8a 6p-10p

overlap 0 hrs 0 hrs 0 hrs 0 hrs

In this example, there is no child care need because the work schedules do not overlap. We do not consider travel time to and from work as a child care need when determining eligibility.

Calculating work hours when less than minimum wage is earned When an individual earns less than state minimum wage, divide the countable income by the current Oregon minimum wage to determine the number of child care work hours allowed. The resulting figure is the maximum number of hours that can be coded on the computer not to exceed 172 hours. The minimum wage is determined by the business location. For persons in the start-up phase of employment that does not pay an hourly wage or salary such as working on commission, the caretaker must supply verification of an anticipated amount of income. This may include the employer’s statement of average wages for someone just starting out in a similar position.

Example: Earning less than minimum wage: Carissa is applying for ERDC. She has been employed selling kitchen knives for over a year. She is paid on commission only. She provides a statement from her employer, based in Jefferson County, that she is working between 20 to 30 hours a week. Her paystubs show that she earned: Week 1 $200.00 Week 2 $15.00 Week 3 $55.00 Week 4 $122.00 Determine the anticipated ongoing income, then determine the authorized hours. $200.00 + $15.00 + $55.00 + $122.00 = $392.00 $392.00 / 4 weeks = $98.00 x 4.3 = $421.40 $421.40 / (OR Frontier County min. minimum wage) $9.50 = 44.3 (round 45)

FSML - 95 G - 6 Child Care G – Determining Child Care Hours October 1, 2019

Determining which minimum wage to use The current minimum wage will be determined based on the business location. If the business is based out of the caretaker’s home, the resident address will determine the minimum waged used.

Example: Business is based out of home Katherine is working on commission selling kitchen goods from her

home. She holds selling events at her home and hosts online parties. She is living in Washington County. She states that she is working 15 hours a week (x 4.3 = 65 hours a month) and she is paid once a month. Her income for the last month was:

May $550.00 The minimum wage for her business location is $9.75. She is not

earning enough income to allow the worker to authorize 65 hours. The authorized hours are as follows:

$550.00 / $9.75 = 56.4 (round 57)

Example: Caretaker lives in a different minimum wage area than the business

location Janet owns a tattoo shop in Portland and lives in Salem. She is self-

employed. She commutes to Portland 4 days a week to run her business. After costs she is earning $800 a month and reports working 40 hours a week. Her authorized hours are:

$800 / $9.75 (Portland min. wage) = 82.05 (round 83)

Example: Business based out of home and work is completed in various

locations Eric is a self-employed landscaper. His business is based out of his

home in Wilsonville. He has several clients within the Portland Urban Growth boundary. After costs he is earning $1500 per month and working 45 hours a week. His authorized hours are:

$1500 / $9.50 (min. wage for Wilsonville) = 157.8 (round 158)

FSML - 95 October 1, 2019 Child Care G – Determining Child Care Hours G - 7

Medical Documentation; Disability and Other Determinations Rule

461-125-0830 — Medical Documentation; Disability and Other Determinations

Specific Requirements; ERDC Rule

461-135-0400 — Specific Requirements; ERDC

Child Care Eligibility Standard, Payment Rates, and Copayments Rule

461-155-0150 — Child Care Eligibility Standard, Payment Rates, and Copayments

Dependent Care Costs; Deduction and Coverage Rule

461-160-0040 — Dependent Care Costs; Deduction and Coverage

2. Authorizing a higher limit for extra hours DHS can help pay for hours when the child care need is greater than the standard calculation for work hours plus travel time (work hours plus 25 percent). Extra hours are not allowed for self-employment or student hours. For part-time employment: Additional hours for travel can be authorized up to the monthly maximum by increasing the number of hours coded on UCMS. For full-time employment: When a caretaker requires more than 215 hours of care per month, the worker can authorize an additional amount above the monthly maximum limit. This is capped at 50 percent above the monthly maximum. Authorizing extra hours are limited to the following situations:

• The travel time to and from work (and meal breaks) exceeds 25 percent of the authorized hours;

• The caretaker works an overnight shift and care is necessary for both work hours and sleep hours. This would ordinarily not apply during the school year for school age children;

• The caretaker works a split shift and is not able to care for the child between shifts;

• The caretaker consistently works more than 40 hours a week.

Sleep hours: When authorizing extra hours for sleep time for customers who work an overnight shift, sleep hours are not to exceed five (5) hours per work night. Sleep hours cannot be authorized for two-parent households.

FSML - 95 G - 8 Child Care G – Determining Child Care Hours October 1, 2019

The need for extra hours must be determined by the worker. Authorized hours are typically based on the highest verified hours on a pay stub, but this does not always mean that extra hours are required.

Example: Highest verified hours when paid twice a month Barbara is paid twice a month. She turns in two pay stubs. One shows 88 hours and the other shows 80. She reported on the application that she works 40 hours a week. The worker needs to address EXH in the interview.

Barbara states that she never works over 40 hours a week. The pay stub with 88 hours was only higher because of how the pay periods landed for that month. The case is coded with 172 hours, EXH is not given on the case, and the worker narrates the conversation with Barbara regarding her child care need.

Example: No travel time needed

Angela is applying for child care. She is an assistant teacher at a child care center. Her pay stubs show that she is working between 40-45 hours a week. The worker addresses child care need with Angela in the interview. Angela brings her children to the child care center where she works, so she has no need for any travel time. The worker explains that full-time hours (172) will cover 10 hours a day, five days a week. Angela’s schedule of eight to nine hours a day with a half hour lunch break will be covered without authorizing EXH. The worker must narrate this information.

Example: Some travel time needed

Alyssa is applying for child care. Her pay stubs show that she is working between 36-42 hours per week. Before authorizing EXH, the worker asks about her child care need. Alyssa works within five miles of her child care provider and has an hour lunch break. The worker narrates that the standard full-time hours are sufficient to cover Alyssa’s work hours, meal break, travel time and occasional over-time. No EXH is authorized.

Computer coding and 25 percent

The computer system will add 25 percent for travel time and meal breaks when the authorized CC hours are 172 hours or less. Any hours authorized above 172 per month will need to have the 25 percent travel time manually added in by the worker. Because of this, the system will not accept CC hours of 173 to 215.

FSML - 95 October 1, 2019 Child Care G – Determining Child Care Hours G - 9

Take the following actions to authorize additional hours on the system:

• Enter an EXH case descriptor and EXH need/resource entry on UCMS coded to the payee;

• Match the end date of the EXH need/resource entry to the ERDC certification end date. The need for the additional hours should be reviewed with each re-application;

• Enter the actual number of child care hours needed, up to a maximum of 323 hours, in the CC WRK HRS field. The EXH code will not add in 25 percent for travel time. The number of hours entered in this field will appear on the billing form and determine the maximum dollar limit on the provider pay system.

The computer will send an error message when EXH is coded with 215 hours or less. Do not code 216 to bypass the error. Check the hour calculation to make sure you have included all work time and extra hours.

Example: The parent works 45 hours a week. The authorized hours would be coded: 45 x 4.3 = 193.5 work hours 193.5 x 1.25 = 242 work and travel time.

Example: The parent works 40 hours a week from 11 PM to 9 AM Saturday through Tuesday. They are requesting sleep time. You can authorize up to five hours of sleep time per work day. The authorized hours would be coded: 40 x 4.3 = 172 work hours 172 x 1.25 = 215 work plus travel time 5 x 4 days a week x 4.3 = 86 sleep hours 215 + 86 = 301 work, sleep and travel time

Example: The parent is working 40 hours a week and commuting from Salem to Eugene for employment five days a week. They report that their commute time is one hour and 15 minutes to get to work and one hour and 45 min to return (due to traffic). The parent has a half hour unpaid lunch break. The family’s child care need is: 8 hours for work, .5 for the meal break and 3 hours for travel time = 11.5 hours per day 11.5 x 5 = 57.5 57.5 x 4.3 = 247.25 (248) The 1.25 calculation is not used since travel time is already added.

FSML - 95 G - 10 Child Care G – Determining Child Care Hours October 1, 2019

Example: The parent rides the bus to work five days a week and has to transfer several times. It takes her three hours a day to travel from the provider's house to work and back again. She works eight hours a day and is required to take a one-hour lunch break, so she needs 12 hours of care per day. The worker calculates: 12 x 5 x 4.3 = 258 work and travel time EXH Payment: To determine the payment amount to the provider, the computer divides 258 by 215 = 1.2 and increases the maximum limit by 20 percent. If the monthly maximum rate for the child is $550 per month, 258 hours will pay $660.

Example: A parent works an overnight 12-hour shift and needs care for his pre-school children for both work hours and sleep hours, a total of 17 hours per day, five days a week. The parent needs additional travel time because they need to drive from child care to work, to home, and back to child care. The worker calculates: 17 x 5 x 4.3 = 366 work and sleep Since UCMS will accept no more than 323 hours, the worker enters 323 in the CC wrk hrs field. The maximum number of hours has been authorized; there is no need to calculate travel time. The computer divides 323 by 215 = 1.50 and increases the maximum limit by 50 percent.

3. Student hours

Working students may be eligible to have some or all their class time covered for child care assistance. A request for student hours can be made at any time. At initial certification or recertification student hours can be requested on the application form (DHS 415F or DHS 7476). Student hours may also be requested during the certification period by submitting the request on the Change Report for Employment Related Day Care (ERDC) (DHS 862).

When a request for student hours is made, the worker will need to review the case to ensure that all the following criteria are met. Authorized student hours are limited as follows:

• The caretaker must be eligible due to employment, before student hours can be determined;

• Coursework must lead to a certificate, degree or job-related knowledge and skills;

FSML - 95 October 1, 2019 Child Care G – Determining Child Care Hours G - 11

• Authorized student hours cannot exceed authorized work hours (at least 50 percent of all authorized hours must be from employment);

• Total authorized hours, from work and school, cannot exceed 172 (EXH is not allowed on working student child care cases);

• Coursework must be through a school or institution eligible for Federal Student Aid; and

• The working student must submit verification of school registration and current class schedule before student hours can be approved.

NOTE

! Working student hours can be approved for online classes. However, the same criteria listed above applies. The financial aid award letter is required at certification and recertification as verification of income. It should be requested along with proof of registration and class schedule if it has not already been provided. The worker must review the financial aid award letter to see if the child care need is covered by the parent’s financial aid. If so, there is no eligibility for student hours.

Requesting student hours during the certification period If the customer is requesting student hours during the certification and they report a change in their work hours. The worker will need to request verification of current work hours. This is needed to determine how many student hours can be authorized. If the student is not receiving financial aid, you can search for the school on the FAFSA website: https://fafsa.ed.gov/FAFSA/app/schoolSearch to determine if the school meets the Federal Student Aid requirement. If unable to determine, pend the customer for verification. Student Case Descriptor

When a caretaker is approved for additional student hours they must be coded with the STU case descriptor.

Termination of schooling

If a caretaker reports they are no longer attending school or have completed their coursework, the STU case descriptor should be removed. Do not reduce the authorized

FSML - 95 G - 12 Child Care G – Determining Child Care Hours October 1, 2019

hours during the certification period. The caretaker is allowed to use the authorized hours for employment or to maintain the child(ren)’s spot at a child care facility.

Loss of employment

If a caretaker has lost employment, they can continue attending class during Authorized Work Search (AWS), Authorized Medical Leave (AML) or Authorized Military Transition (AMT) periods. ERDC benefits for both employment and education will end at the end of these periods if new employment is not established.

Example: Rich is eligible for ERDC. He is working 25-30 hours a week and is attending GED classes at the community college five hours a week. He supplied verification of his registration and enrollment and is approved for 35 hours a week (30 for employment and five for student hours).

Example: Student hours higher than employment hours Brenda is working 10 hours a week and is attending class full time (14 hours a week) at SOU. Brenda is primarily a student, her work hours are less than her school hours. The worker authorizes 20 child care hours per week, 10 for work hours and 10 for student hours. This does not meet all of Brenda’s child care need, but the allowable student hours are based off the work hours.

Example: Working full time Robert is eligible for ERDC and is working 40 hours a week. He is taking additional classes at an online university and is requesting an additional 10 hours a week for student hours. Robert is not eligible for additional student hours because he is already authorized full time child care, 172 hours per month. The worker does not need to ask for verification of registration or class schedules. The worker should explain to Robert in the ERDC interview that additional hours cannot be given for his class time. The worker does not need to send a notice when student hours are not authorized.

Example: Student hour verification not received Marie is applying for ERDC while she is working and attending school. She has supplied all of the required verification except for a copy of her current class schedule. Marie states that she will have her class schedule within the next week. The case is pended for the verification and the worker explains that we cannot open the child care case until we have proof of Marie’s class schedule. The worker should explain that Marie should contact the office as soon as possible if she decides not to pursue student hours. If Marie does not return the pended item the case will be denied.

FSML - 95 October 1, 2019 Child Care G – Determining Child Care Hours G - 13

Example: Schooling completed Jordan is eligible for ERDC. She was working 20 hours a week and attending school nine hours a week. She reports that she has completed her schooling and is asking about her child care hours. Her children are both enrolled in full-time spots at a local center. The center does not have any part-time spots available and Jordan is concerned that she will lose her child care if they cannot continue to attend full-time. The worker explains that the authorized hours will not be reduced for this certification period. Jordan can continue to take the children to the site full-time, at least 136 hours per month, in order to maintain their current enrollment. At her next re-certification the worker will determine Jordan’s authorized child care hours based on her work hours at that time. Jordan understands that her certification ends in three months and that she will need to increase her work hours if she wants her children to continue attending the center full-time.

Example: Requesting student hours during the certification Cornelius is currently receiving child care benefits for his two children. He was working 25 hours a week at his initial certification. He reports that he is taking 10 hours of coursework a week to become a CNA. He also reports that his work hours have decreased. A DHS 210A is sent requesting verification of his registration, class schedule and work hours (income can be requested if he wants his copay decreased). All verification is received. Cornelius’ work hours have decreased to 20 hours a week. Based on the decreased work hours and the additional school hours, the new authorized hours are 30 hours a week. His copay is decreased based on the new proof of income received.

Example: Requesting student hours during the certification Jean is currently authorized 20 child care hours per week due to employment. She reports reducing her work hours and returning to school full-time to complete her accounting degree. Her current class schedule shows that she is taking 18 hours of classes per week. Her new income verification shows that she is working eight hours a week. No change will be made to her authorized hours. It is explained to Jean that she is approved for student hours, but that her student hours are limited by her work hours. Her authorized hours will not be increased or decreased at this time. If her work hours have not increased by her recertification date her authorized hours will be reduced to 16 per week.

FSML - 95 G - 14 Child Care G – Determining Child Care Hours October 1, 2019

Example: Two parent student hours need to overlap Jack and Diane are eligible for ERDC. Jack is working M-F, 9:00 a.m. – 5 or 6 p.m., and Diane is working M-F, 7 a.m. – noon. Diane is also attending class from 5:30 to 6:30 M, W, & F. She is taking classes to complete her GED at the local community college.

Mon Tues Wed Thurs Fri

Jack 9a-6p 9a-6p 9a-6p 9a-6p 9a-6p

Diane work 7a-12p 7a-12p 7a-12p 7a-12p 7a-12p

Diane class 5:30-6:30 p 5:30-6:30 p 5:30-6:30 p

overlap 3.5 hrs 3 hrs 3.5 hrs 3 hrs 3.5 hrs 16.5 hrs

The overlapping hours are M-F, 9 a.m. – noon and M.E, F from

5:30 p.m. to 6 p.m. The authorized work and student hours are 16.5 x 4.3 = 70.95 (71).

NOTE

! The copay should be compared to the allowable child care need to ensure that the copy is not higher than the cost of care.

Example: No overlapping work hours 2 parent household

Vonda and Ellis are applying for ERDC for employment and student hours. Vonda works M-F 6 a.m. – 2:30 p.m. and Ellis works Th –Su 4 p.m. – 8 p.m. Vonda also attends classes every Saturday from 5 p.m. – 7:30 p.m. Vonda and Ellis do not have any overlapping work hours. Since no hours can be authorized for employment, they are not eligible for student hours. They are not eligible for ERDC.