Final 2011 dip si thesis oliver vit cv

-

date post

22-Oct-2014 -

Category

Documents

-

view

544 -

download

0

description

Transcript of Final 2011 dip si thesis oliver vit cv

Actelion Pharmaceuticals Ltd

The quest for a 2nd partner

A CONFIDENTIAL DISSERTATION SUBMITTED IN PARTIAL

FULFILMENT OF THE REQUIREMENTS FOR A

POST GRADUATE DIPLOMA

IN

ADVANCED STRATEGY

(Dip S&I) 2011

Oliver Vit

Word count: 9,933

i

ABSTRACT

A Schumpeterian wave of creative destruction has swept through the pharmaceutical

industry following the unprecedented growth in biologic products where each success

represents annual revenues in excess of a billion dollars. The source of this revolution was

the discovery of recombinant DNA techniques in the 1970s which enabled researchers to

synthesize large, complex proteins previously unimaginable within the scope of traditional

organic chemistry. The result was a dual market structure in which numerous smaller

innovators linked closely to the cutting edge research of universities rivaled the stable base

upon which the relatively few large incumbents had been built. Several large

pharmaceutical firms which had ignored the full potential of these new products at the

inception of the revolution were later forced to spend valuable resources in an effort to

compete with adversaries who had profited from decisions to embrace the biotech

revolution early on. Various methods have been implemented over the last 30 years in an

effort to harness the growth potential of promising biotechs including mergers, acquisitions,

equity stakes, joint ventures and alliances. The last 20 years have witnessed alliances rise

to displace all other forms of partnerships in terms of sheer quantity primarily due to the

ease with which they can be formed and broken as investment strategies adapt and change

to the results of research.

This paper introduces Actelion Pharmaceuticals and the S1P1 agonist program it wishes to

partner within this complex environment of interwoven alliances between firms of

dissimilar sizes and competences sharing the common goal of returning value to the

Candidate number: DSI1057 Diploma Strategy & Innovation Final thesis

ii

shareholders with the profits from successful development programs which met previously

unaddressed medical needs. A Stage Gate model has been applied to introduce a process

by which the hundreds of registered pharmaceutical firms can be filtered through a series of

three gates in order to identify candidates best matching Actelion’s present and future

needs. The first gate narrows down the list of potential candidates to 26. The second gate

filters the candidates further using a scoring tool which has been developed to evaluate and

compare the core competences of each candidate, i.e., research, clinical development,

marketing, along with indices for resources, growth & resiliency and productivity. The

third gate is a risk analysis of the remaining candidates leaving a robust strategy reflective

of the dual market appropriate for due diligence efforts with 6 appropriate candidates

eligible for due diligence.

Candidate number: DSI1057 Diploma Strategy & Innovation Final thesis

iii

Table of Contents

Abstract i

Figures vi

Tables x

List of Abbreivations and Acronyms ix

INTRODUCTION

Actelion Pharmaceuticals Ltd 1

S1P1 agonist program 2

Autoimmune disorders 7

Product life cycle 8

Core Competences 9

Research 9

Clinical development 11

Marketing & Sales 12

4th competence 14

PARTNERING

General background 15

Types of partnering arrangements 17

Minority holdings 17

Candidate number: DSI1057 Diploma Strategy & Innovation Final thesis

iv

Joint ventures 17

Research, development and marketing pacts & alliances 18

Trends over the past 20 years 18

Genesis to demise, the life cycle of pharmaceutical companies and how

partnering fits to survival in Schumpeterian landscape 22

METHODS

Stage-gate approach 28

RESULTS

Gate I 30

Gate II 32

Scoring tool 32

Research 32

Clinical development 33

Marketing & Sales 33

Resources 34

Growth & Resiliency 34

Productivity 35

Candidate profiling 39

Gate III 50

Risk assessment 50

PESTL 50

Candidate number: DSI1057 Diploma Strategy & Innovation Final thesis

v

Political 50

Economic 51

Social 51

Technological 52

Environmental 52

Legal 53

Geopgraphic risks 53

Long term risks 56

Connection highway 57

DISCUSSION 64

CONCLUSIONS 69

REFERENCES 71

APPENDIX I 74

APPENDIX II 93

APPENDIX III 119

Candidate number: DSI1057 Diploma Strategy & Innovation Final thesis

vi

Figures Figure 1 Life cycle of pharmaceutical products p.9

Figure 2 Growth of newly established R&D partnerships 1960-1998 p.20

Figure 3 % of joint ventures in all newly established R&D partnerships 1960-1998 p.21

Figure 4 % of all contractual modes and joint R&D agreements from 1975-1998 p.22

Figure 5 Stage-gate model for partner selection p.29

Figure 6 Cross comparison with large pharmaceutical firms p.37

Figure 7 Cross comparison with biotechs & others p.38

Figure 8 Pfizer scoring results p.39

Figure 9 Bayer Schering scoring results p.40

Figure 10 Novartis scoring results p.41

Figure 11 Abbott scoring results p.42

Figure 12 Bristol-Myers Squibb scoring results p.43

Figure 13 Roche scoring results p.44

Figure 14 Amgen scoring results p.45

Figure 15 Merck KGaA scoring results p.46

Figure 16 Novo Nordisk scoring results p.47

Figure 17 Biogen IDEC scoring results p.48

Figure 18 Teva scoring results p.49

Figure 19 Distribution of R&D partnerships, economic regions (1960-1980) p.54

Figure 20 Distribution of R&D partnerships, economic regions split by decade p.55

Figure 21 R&D partnerships in pharmaceutical biotechnology 1975-1979 p.58

Candidate number: DSI1057 Diploma Strategy & Innovation Final thesis

vii

Figure 22 R&D partnerships in pharmaceutical biotechnology 1980-1984 p.59

Figure 23 R&D partnerships in pharmaceutical biotechnology 1985-1989 p.60

Figure 24 R&D partnerships in pharmaceutical biotechnology 1990-1994 p.61

Figure 25 R&D partnerships in pharmaceutical biotechnology 1995-1999 p.62

Figure 26 Actelion scoring results as a large pharmaceutical firm p.75

Figure 27 Pfizer complete scoring results p.76

Figure 28 Johnson & Johnson overview p.77

Figure 29 Johnson & Johnson complete scoring results p.78

Figure 30 Bayer Schering complete scoring results p.79

Figure 31 Novartis complete scoring results p.80

Figure 32 GlaxoSmithKline overview p.81

Figure 33 GlaxoSmithKline complete scoring results p.82

Figure 34 Merck & Co overview p.83

Figure 35 Merck & Co complete scoring results p.84

Figure 36 Sanofi overview p.85

Figure 37 Sanofi complete scoring results p.86

Figure 38 Abbott complete scoring results p.87

Figure 39 AstraZeneca overview p.88

Figure 40 AstraZeneca complete scoring results p.89

Figure 41 Eli Lilly overview p.90

Figure 42 Eli Lilly complete scoring results p.91

Figure 43 Bristol-Myers Squibb complete scoring results p.92

Candidate number: DSI1057 Diploma Strategy & Innovation Final thesis

viii

Figure 44 Actelion scoring results as a biotech p.94

Figure 45 Roche complete scoring results p.95

Figure 46 Amgen complete scoring results p.96

Figure 47 Merck KGaA complete scoring results p.97

Figure 48 Baxter overview p.98

Figure 49 Baxter complete scoring results p.99

Figure 50 Novo Nordisk overview p.100

Figure 51 Allergan overview p.101

Figure 52 Allergan complete scoring results p.102

Figure 53 CSL Limited overview p.103

Figure 54 CSL Limited complete scoring results p.104

Figure 55 Biogen IDEC overview p.105

Figure 56 Alexion overview p.106

Figure 57 Alexion complete scoring results p.107

Figure 58 Almirall overview p.108

Figure 59 Almirall complete scoring results p.109

Figure 60 Arena overview p.110

Figure 61 Arena complete scoring results p.111

Figure 62 Receptos overview p.112

Figure 63 Receptos complete scoring results p.113

Figure 64 Daiichi Sankyo overview p.114

Figure 65 Daiichi Sankyo complete scoring results p.115

Candidate number: DSI1057 Diploma Strategy & Innovation Final thesis

ix

Figure 66 Ono overview p.116

Figure 67 Ono complete scoring results p.117

Figure 68 Teva complete scoring results p.118

Figure 69 R&D partnerships in pharmaceutical biotechnology 1975-1979 – reproduced

p.120

Figure 70 R&D partnerships in pharmaceutical biotechnology 1980-1984 - reproduced

p.121

Figure 71 R&D partnerships in pharmaceutical biotechnology 1985-1989 - reproduced

p.122

Figure 72 R&D partnerships in pharmaceutical biotechnology 1990-1994 – reproduced

p.123

Figure 73 R&D partnerships in pharmaceutical biotechnology 1995-1999 – reproduced

p.124

Candidate number: DSI1057 Diploma Strategy & Innovation Final thesis

x

Tables

Table I Properties of sphingosine-1-phosphates p.3

Table II Patented S1Px agonists p.5

Table III Patented S1Px agonists in clinical development p.6

Table IV Bestselling drugs in 2010 p.13

Table V Drug development success rates p.14

Table VI Top 10 pharmaceutical and biotech firms in 2010 p.31

Table VII Scoring tool valuations for large pharmaceutical firms p.36

Table VIII Scoring tool valuations for biotechs & others p.36

Candidate number: DSI1057 Diploma Strategy & Innovation Final thesis

xi

List of Abbreviations and Acronyms

AS Akylosing spondylitis

BRIC Brazil Russia India China

CD Crohn’s disease

CEO Chief Executive Officer

CHF Congestive heart failure

EIM Entry Into Man

EMA European Medicines Agency

ETA Endothelin-A

ETB Endothelin-B

FDA Food and Drug Administration

GDP Gross Domestic Product

GPCR G protein-coupled receptor

HIV/AIDS Human Immunodeficiency Virus/Acquired Immunodeficiency Syndrome

HTS High Through-put Screening

ICH International Conference on Harmonisation of Technical Requirements for Registration of Pharmaceuticals for Human Use

IPO Initial Price Offering

IT Information Technology

JAK Janus Activated Kinase

JIA Juvenile Idiopathic Arthritis

JV Joint Venture

KOL Key Opinion Leader

MA Marketing Authorization

M&A Mergers & Acquisitions

MS Multiple Sclerosis

NPV Net Present Value

PAH Pulmonary Arterial Hypertension

PD Pharmacodynamics

Candidate number: DSI1057 Diploma Strategy & Innovation Final thesis

xii

PESTL Political Economic Social Technological Legal

PK Pharmacokinetics

Ps Psoriasis

PsA Psoriatic arthritis

RA Rheumatoid arthritis

R&D Research and Development

SEC Securities and Exchange Committee

SMI Swiss Market Index

S1P Sphingosine-1-phosphate

UC Ulcerative colitis

USD United States Dollar

WO World Intellectual Property Organization

WWI World War I

WWII World War II

Page 1

INTRODUCTION

Actelion Pharmaceuticals Ltd

In the 1990’s F. Hoffmann-La Roche Ltd (Roche) discovered and began developing

bosentan, the world’s first endothelin-1 receptor antagonist at endothelin-A (ETA) and

endothelin-B (ETB) protein receptor sites found on the layer of vascular cells forming the

endothelium. Endothelin-1 had been identified as an endogenous vasoconstrictor and

bosentan’s ability to counteract these effects by blocking its access to ETA and ETB

receptors was seen to represent a break-through in the treatment of cardiovascular diseases

where high blood pressure is regulated by vasoconstriction. Later Roche took the decision

to halt further development of bosentan following safety findings in an on-going Phase II

congestive heart failure (CHF) trial. Believing in the therapeutic promise of both bosentan

and its mechanism of action, five founders pooled together resources, successfully gained

the backing of venture capitalists, out-licensed two endothelin-1 receptor antagonists from

Roche, i.e., bosentan & tezosentan, and established Actelion Pharmaceuticals Ltd

(Actelion) on December 17, 1997 with the vision to continue the research and development

of drugs targeting endothelial receptors - or as the company’s name implies, to “act on

endothelium”.

Shortly after Actelion’s Initial Public Offering (IPO) in April 2000, bosentan as Tracleer®

was licensed by the U.S. Food and Drug Administration (FDA) in November 2001 and the

European Medicines Agency (EMA) in April 2002 for the treatment of a then little known

orphan disease affecting an estimated 10,000 persons: pulmonary arterial hypertension

Page 2

(PAH). As the market leader enjoying more than 75% market share Tracleer® is

prescribed to more than 40,000 PAH patients worldwide today and accrues nearly 2 billion

USD in annual revenue. Actelion has grown from a single office of 5 persons into one of

Europe’s largest biopharmaceutical industries listed along with Novartis Pharma AG

(Novartis) and Roche as one of the 20 Swiss securities composing the Swiss Market Index

(SMI) and representing more than 2,500 employees throughout 29 affiliates in 13 years

with a pipeline of more than 30 compounds all seeking to address unmet medical needs

with cutting edge research.

S1P1 agonist program

Although first isolated and identified as an endogenous signaling lipid in the late 19th

century sphingosine-1-phosphate’s function remained such an enigma that the root

“sphingo” was assigned as an intentional allegory referring to the Riddle of the Sphinx. To

date five G protein-coupled receptors (GPCR), S1P1-5, have been isolated from various

tissues with distinct attributable functions listed in Table I beneath. Circulating throughout

the body endogenous S1P agonizes any of the five S1Px receptors with physiological

consequences which may play a role in disease pathophysiology.

Page 3

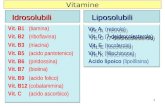

Table I – Properties of sphingosine-1-phosphates

Receptor Distribution Cellular functional expression and consequences S1P1 brain

heart spleen liver lung thymus kidney skeletal muscle lymphoid

Astrocyte: migration B-cell: blockade of egress, chemotaxis Cardiomyocyte: increased β-AR positive inotropy Endothelial cell: early vascular system development, adherens junction assembly, APC-mediated increased barrier integrity Neural stem cell: increased migration Pericyte: early vascular system development (VSMC) T-cell: blockade of egress, chemotaxis, decreased late-stage maturation VSMC

S1P2 brain heart spleen liver lung thymus kidney skeletal muscle

Cardiomyocyte: survival to ischemia-reperfusion Epithelial cell (stria vascularis): integrity/development Epithelial hair cells (cochlea): integrity/development Endothelial cell (retina): pathological angiogenesis, adherens junction disruption Hepatocyte: proliferation/matrix remodeling Fibroblast (MEF) Mast cell: degranulation VSMC: decreased PDGF-induced migration

S1P3 brain heart spleen liver lung thymus kidney skeletal muscle testis

Cardiomyocyte: survival to ischemia-reperfusion Dendritic cell (hematopoietic): worsening experimental sepsis lethality/inflammation/coagulation

S1P4 lung lymphoid

T-cell: migration/cytokine secretion

S1P5 brain skin spleen

NK cell: trafficking Oligodendrocyte: survival OPC: glial process retraction; inhibition of migration

Source: Rosen et al., 2009. Sphingosine 1-Phosphate Receptor Signaling, Annual Review of Biochemistry, 78, p. 749

Page 4

Novartis successfully developed and launched the first non-selective S1P1,3-5 receptor

agonist, Gilenya® (fingolimod), for the treatment of relapsing form of Multiple Sclerosis

(MS) in 2010 and UBS analyst Fabian Wenner (Bloomberg 2011) estimates annual

revenues of Gilenya® to exceed 5.3 billion USD at peak sales. Based on the presumptions

that inhibition of lymphocyte migration offers therapeutic benefit in the treatment of

autoimmune disorders and that this activity was directly linked to the loss of function at the

S1P1 receptor, many research units in the absence of S1P1 antagonists which would block

activation at the receptor site, developed selective S1P1 receptor agonists which internalize

and destroy the receptor in a manner described as functional antagonism. Currently over 20

declared S1Px compounds are specifically patented and undergoing development within 19

pharmaceutical firms listed beneath in Tables II & IIII.

Page 5

Table II – Patented S1Px agonists

S1Px

(unknown)

S1P1

PF-991

PPI-4955

GSK1842799

Selectivity

BMS-520

LAS-189913

CompoundCompany

S1Px

(unknown)

S1P1

PF-991

PPI-4955

GSK1842799

Selectivity

BMS-520

LAS-189913

CompoundCompany

Page 6

Table III – Patented S1Px agonists in clinical development

Actelion has already conducted the research to discover selective S1P1 agonists and

successfully brought two compounds, ponesimod and ACT-334441, into clinical

development. Although Actelion has launched multiple Phase II clinical trials in both MS

and psoriasis (Ps) following the rapid establishment of in-house expertise in both neurology

and dermatology, Actelion does not possess the development experience in many other

autoimmune disease areas, e.g. rheumatology, gastroenterology, metabolic disorders, etc.

and the resources to conduct simultaneous clinical trials in parallel to the on-going MS and

psoriasis programs within the limited patent protection period. Furthermore in all cases

Actelion lacks the marketing experience to effectively launch its first selective S1P1 agonist

ONO4641

Ponesimod (ACT-128800)

ACT-334441

S1P1

Phase IIb

BAF312S1P1,5

LaunchedGilenya®

(fingolimod)S1P1,3-5

Selectivity

2018682

RPC1063

CS-0777

Compound

Phase I

Development phase

Company

ONO4641

Ponesimod (ACT-128800)

ACT-334441

S1P1

Phase IIb

BAF312S1P1,5

LaunchedGilenya®

(fingolimod)S1P1,3-5

Selectivity

2018682

RPC1063

CS-0777

Compound

Phase I

Development phase

Company

Page 7

across these multiple disciplines. Therefore Actelion is interested in establishing an

alliance with a partner who is capable of developing and marketing novel therapeutic

agents in autoimmune disorders.

Autoimmune disorders

Disorders in which the body’s immune system falsely recognizes self tissue as a foreign

antigen and begins an inflammatory T-cell driven response to eliminate the tissue are

termed autoimmune. To date over 130 have been identified inclusive of MS, Ps, psoriatic

arthritis (PsA), Rheumatoid arthritis (RA), Ulcerative colitis (UC), Crohn’s disease (CD),

Ankylosing spondylitis (AS) and Juvenile idiopathic arthritis (JIA) where biologic

therapies such as Avonex®, Copaxone®, Rebif®, Betaseron®, Tysabri®, Enbrel®,

Humira®, Stelara®, Simponi®, and Remicaide® are licensed. Sales with these products in

MS alone breached 10 bio USD in 2010 with < 20 bio USD in cumulative sales across all

indications. All biological therapies suffer from two substantial drawbacks in the form of

(1) the necessity of painful injections over the course of a patient’s lifetime and (2) the

build up of neutralizing antibodies and resultant reduced efficacy over time. Oral S1P1

agonists would possess neither of these disadvantages and could replace biologics in all

autoimmune disorders should equal or better efficacy be established with an acceptable

safety & tolerability profile.

Page 8

Product Life Cycle

All compounds are products of research units and bear tangible costs from the moment of

discovery. A product’s life cycle in the pharmaceutical industry can therefore be expressed

as a sum of expected investments and profits from the overheads involved with its

discovery to the loss of market protection in all major markets worldwide. As WO patents

grant protection for 20 years and there are various means to extending the market life of a

product, e.g. patent extensions, formulation patents, regulatory data protection, etc., the loss

of value due to inflation and amortization over time are factors which must be considered.

Net present value (NPV) which measures the value of an asset by comparing the fully

burdened costs against future revenues discounted for inflation is one common tool used to

appraise assets and relative investment risks across portfolios.

Figure I illustrates a generalized expenditure vs. profit curve across the three critical stages

of research, clinical development and marketing & sales in a successful product’s life cycle

where the revenue magnitude and timing are product specific.

Page 9

Figure 1 – Life cycle of pharmaceutical products

Core Competences Research

Although as postulated by Santos (2003) the methods of research have undergone multiple

changes from learning-by-doing to learning-before-doing, from the discovery of

acetylsalicylic acid by Franz Hoffman a chemist working at Bayer, then a German dye

manufacturer in 1897, to the isolation of penicillin at Oxford in 1937 through the synthetic

revolution of the 1960’s and underlying the astounding success of biotechnology from 1970

time

Profits

Expenses

Net profits

Research Clinical development

Marketing & Sales

Entry into man

Marketingauthorization

Patentloss

Peaksales

time

Profits

Expenses

Net profits

Research Clinical development

Marketing & Sales

Entry into man

Marketingauthorization

Patentloss

Peaksales

Page 10

to present, laboratory research remains unequivocally central to any novel compound’s

origin. Expenditure associated with research units in public hospitals, governmental

organizations, university laboratories or private interests, e.g. pharmaceutical industry, bio-

tech start-ups, etc., represent the first expenses in a product’s life cycle.

In terms of discovery research begins by selecting a medical need and a series of premises

in terms of disease pathology followed by the identification of suitable targets. Thereafter

assays are constructed based on the target(s) and a firm’s library of unique compounds are

tested in an automated fashion called High Through-put Screening (HTS) which permits

analysis of these compounds in the hundreds of thousands to be completed in relatively

short periods of time. Based on the desired activity and known toxicological profiles

structural groups are identified and modified in a continual effort to increase the potency

and selectivity of the molecule until such time as a lead candidate is accepted for further in-

vivo experiments to assess the compound’s pharmacokinetics (PK), pharmacodynamics

(PD), possible efficacy, safety and toxicological potential in two animal species prior to

Entry Into Man (EIM). Throughout the development program following EIM further

research activities are typically conducted including but not limited to long term safety,

new formulations, the search for better follow-up compounds and additional indications for

the lead compound.

Page 11

Clinical Development

Once the PK/PD and safety profile of a clinical candidate has been appropriately defined

and deemed supportive of short term human exposure, the sponsor may decide to proceed

further towards marketing authorization (MA) by entering into the first of three clinical

development phases, Phase I or clinical pharmacology studies. These are small and rapid

investigations studying the effects of the compound on healthy human subjects and the

effects of a healthy human body has upon the compound & its circulating concentrations

under various circumstances, e.g. alone at rest, in combination with other licensed therapy,

comparison of differing formulations of the same compound, under the effect of exercise,

etc.

Patients whose health by definition is jeopardized, are exposed to the compound in the

second clinical development phase, Phase II or dose-finding. In an attempt to determine the

first signs of clinical utility within the dose range explored in the Phase I experience these

clinical trials are conducted to establish both the lowest efficacious dose and its associated

safety & tolerability profile. Phase III trials represent the greatest effort and expenditure

made by a sponsor to validate the results of the Phase II trial in a much larger number of

patients potentially compared to standard of care with a statistically greater degree of

confidence regarding both the promised efficacy as well as the safety of the clinical

candidate.

Page 12

Should the compound prove efficacious with an appropriate safety & tolerability profile,

and cost effective compared to other forms of therapy where available, the sponsor may

decide to file MA dossiers with the health authorities worldwide for a review period of

between 6 to 18 months.

Marketing & Sales

Following successful independent reviews by the health authorities, a new drug can be

launched within a highly competitive marketplace circumscribed by the recommendations

of Key Opinion Leaders (KOLs), behavior of prescribing physicians, patient preferences &

compliance and the annual budgets of payors. However behind every successful launch are

thousands of individuals developing and coordinating the networks supporting the

corporate presence, pricing strategy, reimbursement terms, manufacture, international &

regional distribution, storage, pharmacovigilance and sales. A massive undertaking by any

measure these expenditures dwarf the 1.073 bio USD Tufts (2007) attributes to the average

research & clinical development costs accrued prior to an MA. Furthermore just as

daunting are the enormous potential profits from novel drugs addressing unmet medical

needs as listed in Table IV.

Page 13

Table IV – Bestselling drugs in 2010

Source: MedAdNews 200 - World's Best-Selling Medicines, MedAdNews

These annual revenues may appear discrepant when weighed against the average

profitability of only 15.3% for the eleven Fortune 500 pharmaceutical firms Fein (2011)

identifies in 2010. This apparent discrepancy between annual revenues in the billions per

product and less spectacular yearly profits is easily explained when the success rates are

factored into the evaluation as described in Table V. A cumulative probability of between

4.6 - 28.1 % to reach the market from EIM for any clinical candidate signifies that the vast

majority of drugs in clinical development simply fail to gain approval and all associated

R&D expenditures are born by the sponsor alone.

Rank 2010

Brand Name Company(ies) Disease Medical Use

Sales 2010 (mio USD)

1 Lipitor® Pfizer,Astellas Pharma Cholesterol 11,8

2 Plavix® Bristol-Myers Squibb, Sanofi-Aventis

Thrombotic events 9,4

3 Remicade® Johnson & Johnson, Schering-Plough, Tanabe

Rheumatoid arthritis 8

4 Advair® GlaxoSmithKline Asthma, COPD 7,96 5 Enbrel® Amgen, Wyeth RA, Ps, PsA, JIA, AS 7,4 6 Avastin® Hoffmann La-Roche Oncology 6,8

7 Abilify® Otsuka, Bristol-Meyers Squibb

Schizophrenia, depression, bipolar disorder

6,8

8 Rituxan® Hoffmann La-Roche NHL, CCL, RA 6,7

9 Humira® Abbott Laboratories RA, Ps, PsA, AS, UC, CD, JIA

5,49

10 Diovan® Novartis Pharma AG Hypertension 6,1

Page 14

Table V – Drug development success rates

Source: DeMasi 2001, Kola 2004, Avance cited in Valuation in Life Sciences, 2007, p.14

4th competence

It is standard practice to divide pharmaceutical development into the three preceding

competences of research, clinical development and marketing & sales, yet there is an often

underappreciated 4th competence: the ability to coordinate cross-functional development in

a robust, timely, cost effective manner maximizing a compound’s chances to be discovered,

navigate the hurdles of development, reach the market successfully and achieve its full

potential value. Although fickle and certainly intangible, this competence is represented

exclusively by the cumulative savoir-faire of the employees, the company culture and the

processes managing both the compound’s development path as well as the departments &

employees cum caretakers guiding it in this journey from discovery towards patent expiry

each and every day.

Disease Group Clinical Phase I

Clinical Phase II

Clinical Phase III

Marketing Approval

Cumulative %

Arthritis/Pain 76.9% 38.1% 78.1% 89.1% 20.4% CNS 66.2% 45.6% 61.8% 77.9% 14.5% CV 62.7% 43.3% 76.3% 84.4% 17.5% GIT 66.8% 49.1% 71.0% 85.9% 20.0% Immunology 64.8% 44.6% 65.2% 81.6% 15.4% Infections 70.8% 51.2% 79.9% 96.9% 28.1% Metabolism 47.8% 52.0% 78.9% 92.8% 18.2% Oncology 64.4% 41.8% 65.4% 89.7% 15.8% Ophthalmology 66.0% 39.0% 64.0% 92.0% 15.2% Respiratory 63.4% 41.1% 59.9% 76.9% 12.0% Urology 50.0% 38.0% 67.0% 79.0% 10.1% Women’s Health 39.0% 42.0% 48.0% 59.0% 4.6%

Page 15

Not only does this value proposition differ distinctly between companies, it can mean the

difference between the very tangible outcomes of success and failure.

Partnering

General background

Galambos (1998) and Pisano (1991) note that beginning at Stanford University in the 1972

with the discovery of recombinant DNA techniques which allowed the manufacture of

complex proteins by biologic organisms, a burgeoning scientific knowledge base drove the

pace of innovation and subsquentially a Schumpeterian wave of creative destruction spread

across the pharmaceutical sector. Roijakkers and Hagedoorn (2005) show that this resulted

in a dual market environment characterized by relatively few incumbents juxtaposed

against numerous rival new entrants within an increasingly competitive marketplace.

Large pharmaceutical companies which failed to recognize and invest in the potential of

new technological breakthroughs suffered a temporal state of “lock-out” from lucrative,

previously unforeseen opportunities, and as demonstrated by Cohen and Levinthal (1990)

sought external alliances or lost entirely at greater expense than an earlier investment would

have represented. Partnering with smaller interests active in the early stages of research at

minimal cost became a tool used within the traditional pharmaceutical industry to capitalize

upon innovation and avoid future lock-out episodes. Cohen and Levinthal (1990) coin the

term absorptive capacity to encapsulate a firm’s ability “to recognize the value of new,

external information, assimilate it and apply it to commercial ends” and show that it is

Page 16

indeed proportional to previous exposure and learning as represented by successful R&D

efforts on the part of the assessor.

While in possession of certain intellectual property (IP) representing a capacity towards

radically affecting the shape and scope of future competitive landscapes, Pisano (1991)

shows that smaller more numerous innovators similarly lacked the capital reserves and

downstream capacities of well established incumbents in the form of war chests, clinical

development & regulatory expertise, manufacture, logistics and market access. Galambos

amd Sturchio (1998) explain that larger incumbents offered downstream economies of both

scale and scope in exchange for access to the innovator’s IP.

As a means to conveniently exchange goods or services between two or more parties over a

pre-determined time span there are multiple grounds upon which to build partnerships in

the pharmaceutical industry, e.g., capital investment, in-licensing products, expanding

pipelines, complimenting research activities, market access, etc. However at the essence of

each is the recognition of a unique external competence and the desire to benefit from a

closer relationship hedged against the cost of failure. It is the prohibitive cost of failure

associated with full mergers & acquisitions (M&A) which lends partnering arrangements

particular appeal in the early stages of R&D where the likelihood of failure is distinctly

higher.

An often quoted corporate development director at what was then Glaxo Inc. aptly

summarizes this circumstance: “no emerging or established pharmaceutical company is

Page 17

large enough, or smart enough to meet all of its knowledge needs in isolation” (George

1993).

Types of partnering arrangements

Arora and Gambardella (1990) suggest that the outright purchase of a minority stake along

with the creation of joint ventures (JV), research, development & marketing pacts, and

alliances are the four types of investment tools utilized by pharmaceutical firms to

proactively remain abreast of current innovative research and trends in upcoming

technologies in the hopes of maximizing the probability of enjoying first mover advantage

and simultaneously minimizing the risk of lock-out at quantifiable and reasonable costs.

Minority holdings

Representing no more than 50% of a publically traded corporation’s stock the purchase of a

minority stake in a rival or innovative competitor allows the stock holder to profit from any

success the competitor achieves. This is an equity based strategy which permits a

pharmaceutical firm to diversify risks across an investment portfolio.

Joint ventures

JVs are independent companies founded and financially supported by the partners to further

develop and rapidly market an innovation where the influence of either partner is limited to

holding a financial interest in the JV. Although no direct reporting line continues to exist

between the JV employees and the partners, as investors the original partners continue to

Page 18

exert a direct influence at the level of the board and the informal relations between the

employees who are often recruited from within one or both of the original partners.

Research, development and marketing pacts & alliances

In an effort to limit the risks of permanent investments the instruments of short term

contracts and longer term alliances present themselves. These permit closer co-operation

between the parties without restructuring and provide incentives based on successful

outcomes of joint efforts, e.g., payments for services rendered, up-front payments,

milestone payments, royalties on sales, marketing opportunities, etc. Hagedoorn and van

Kranenberg (2003) note that joint representation on boards and project teams can be

assured with expenses shared by both parties while minimizing interdependence over

shorter investment periods.

Trends over the last 20 years

As a strictly equity based investment strategy minority holdings are certainly of interest,

however as tools to expand a pharmaceutical firm’s access to both cutting edge innovative

technology and effective development & successful marketing teams, minority holdings are

far from effective. Most early investments would be impossible as smaller innovations may

still be privately held companies and although due dividends and returns, investors have no

rights to a company’s IP.

Page 19

Hagedoorn and van Kranenberg (2003) note that the potential of JVs, pacts and alliances in

R&D across all sectors was largely underestimated by academia through the early 1990s as

the locus of academic research centered on 1980’s M&A activity. Håkansson, Kjellberg

and Lundgren (1993) also remark that “alliances are increasingly being used as strategic

tools for corporate survival and growth, shaping the present and future structure of

industries”. These agreements are specific to product(s) or a set of competences and leave

the corporate structure of individual partners largely unchanged in the absence of the large

protracted investments in both capital and infrastructural changes required to enact the

terms of a full merger or acquisition; both parties can limit risk exposure while still

profiting from a mutual association. Thus the larger degree of corporate freedom awarded

to both parties underlies the sheer quantity of R&D partnering arrangements which far

exceed mergers & acquisitions and the increased popularity as witnessed by the growth of

newly established partnerships between 1960 and 1998 as depicted in Figure 2 beneath.

Page 20

Figure 2 – Growth of newly established R&D partnerships 1960-1998

Source: Hagedoorn 2001, Inter-firm R&D partnerships: an overview of major trends and patterns since 1960 p.480

JVs suffer from the high fiscal and organizational costs of set-up as well as equally high

failure rates and as such there has been a clear decline in the number of JVs as a proportion

of new R&D pacts since 1960 as depicted in Figure 3.

Page 21

Figure 3 – % of joint ventures in all newly established R&D partnerships 1960-1998

Source: Hagedoorn 2001, Inter-firm R&D partnerships: an overview of major trends and patterns since 1960 p.481

Ruling out equity based investments and JVs, research & development pacts and alliances

remain as nearly the only form of joint R&D agreements as shown in Figure 4. Roijakkers

and Hagedoorn (2006) demonstrate that as an investment tool pacts & alliances present a

lower risk than either JVs or full M&As as the divestment costs are quantifiable contractual

stipulations and significantly lower on average.

Page 22

Figure 4 – % of all contractual modes and joint R&D agreements from 1975-1998

Source: Roijakkers 2006, Inter-firm R&D partnering in pharmaceutical biotechnology since 1975: Trends, patterns and networks p.434

Genesis to demise, the life cycle of pharmaceutical companies and how partnering fits to survival in a Schumpeterian landscape

No pharmaceutical firm has consistently grown in vacuo marketing products exclusively

developed in-house; all firms large and small are possible M&A targets as well as potential

partners.

Genetic Engineering Technology, Inc. (Genentech) provides a classic example from its

inception as a small innovator founded in 1976 by a venture capitalist and one of the

Page 23

Stanford researchers responsible for the discovery of the recombinant DNA techniques

which launched the biotech revolution through to complete integration with Roche as a

result of complete integration in 2009.

6 years following its founding and 4 years after partnering the human insulin project with

Eli Lilly and Company (Eli Lilly), Genentech received approval to market the first

biologically engineered therapeutic in the form of Humilin® (Roche 2011). Over the next

28 years Genentech received FDA approval for no less than 14 other biosynthetic products

including Rituxan®, Herceptin®, Raptiva®, Avastin®, and Terceva® which were

exclusively developed and marketed with Roche. Nor were Eli Lilly and Roche the only

partners Genentech entertained. Roijakkers and Hagedoorn (2006) show that in the periods

of 1975-1979, 1980-1984 and 1985-1989 Genentech had 3, 14 and 11 R& D partnerships

respectively as registered in the MERIT-CATI databank..

Roche was founded in 1896 primarily as manufacturer of vitamins however following an

intense period of diversification in the mid 20th century it was marketing the results of its

own in-house research programs, e.g., Valium®, Rohypnol®, Ipronaizid® (Roche 2011).

As demonstrated by Galambos and Sturchio (1998) Roche is an example of an incumbent

largely dependent on research devoted to compounds of small molecular weight which

overcame the disadvantages incurred when the biotech revolution took it unawares by

successfully marketing its core competences to smaller partners in the form of R&D

partnerships. Roijakkers and Hagedoorn (2006) demonstrate that with 41 registered

partnerships in the MERIT-CATI databank between 1995 and 1999, Roche led the industry

Page 24

in terms of the shear quantity of alliances. With reference to the Genentech collaborations,

Reuters (2009) reports that Roche began as a development partner and capitalized on its

position by continuing to increase its equity stakes in Genentech until it purchased a

controlling share representing 60% for 2.1 billion USD in 1990 prior to the full merger for

46.8 billion USD in 2009.

Galambos and Sturchio (1998) inform that Chiron Pharmaceuticals Inc. (Chiron) was

founded in 1981 by three academics from University of California as a result of a joint

effort with Merck & Co Inc. to develop Recombivax HB®, a new serum based hepatitis B

vaccine at the same time as AIDS was first recognized. Chiron continued to focus its

research activities on vaccines, biosynthetics, and blood screening techniques and between

the years of 1985 and 1989 Roijakkers and Hagedoorn (2006) list 12 R&D partnerships

with a further 13 in the years of 1990 to 1995 as documented in the MERIT-CATI

database; Fisher (1986) reports that one of its early partners was Ciba-Geigy Ltd (Ciba-

Geigy). After years of maintaining a minority stake Tansey (2006) reports that Novartis

eventually bought Chiron for an additional 5.4 billion USD.

Novartis was the product of several mergers over a period of decades. Geigy AG was a

chemical industry founded in 1901 concentrating on continuing a family interest in the

development and marketing of natural and artificial dyes born in the 18th century (Novartis

2011). The Gesellschaft für Chemische Industrie Basel was formed in 1884 by a separate

group of industrialists which manufactured the Geigy AG dies on an industrial scale

(Novartis 2011). In 1914 Geigy AG changed its name to J. R. Geigy Ltd (Geigy) and in

Page 25

1945 the Gesellschaft für Chemische Industrie Basel adopted the acronym CIBA (Novartis

2011). Both Geigy and CIBA continued as rivals until CIBA-Geigy Ltd was formed in

1971 and continued the search for unique small molecular weight compounds on an even

larger scale (Novartis 2011). CIBA-Geigy Ltd later merged with Sandoz AG, another

group with its roots in 19th century dye manufacture, in 1996 to form Novartis. None of the

research conducted by Geigy, CIBA or Sandoz AG was biologic in nature, and Novartis

much like Roche was forced to market its core competences and use its capital reserves to

invest in smaller biotech research units in an effort to survive.

Serono SA (Serono) is as another example of a biotech wonder. Founded in 1906 as

Institutio Farmalogico Serono S.p.A., it was an Italian family business which extracted

proteins from chicken eggs for medicinal purposes before discovering menotropin a

hormone in the urine of post-menopausal women and marketing it as Pergonal® to treat

fertility disturbances in the post World War II era (Funding Universe 2011). After ousting

a troublesome major share holder, Michele Sindona, in the early 1970s the headquarters

relocated to Geneva and the name was changed to Ares-Serono AG (Ares-Serono) where

research remained focused on diagnostics and infertility treatments (Funding Universe

2011). Pergonal® played an important role in the success of the world’s first test tube baby

and sales increased dramatically in time with the biotech revolution and Serono began to

investigate the possibility of using recombinant DNA techniques to develop novel

biosynthetic compounds for unmet medical needs. Ares-Serono went on to develop and

market biological products for the treatment of infertility, Multiple Sclerosis, HIV/AIDS

and other hormone deficiencies (Funding Universe 2011). In 2000 Ares-Serono renamed

Page 26

itself Serono and following astounding commercial success which brought it to the status of

the world’s 3rd largest biotech Römer and Becker (2006) report that it sold a majority stake

to Merck KGaA for 10.6 billion euros and finally became Merck-Serono.

Merck KGaA was founded by a pharmacist in the late 17th century and is the oldest

pharmaceutical firm by any standard and has its headquarters in Darmstadt, Germany

(Merck 2011). Due to its affiliation with Germany, Merck suffered set backs with the

outcomes of each world war; it lost its US based affiliate following WWI and all other

subsidiaries as a result of WWII (Merck 2011). It refounded itself in the 1950s and

remained a family business through 1995 when it was registered as Merck KGaA a

publically traded company; however the family interests still possess the controlling

majority.

1978 saw the founding of Biogen NV Inc. (Biogen) in Geneva, Switzerland by group of

independent biologists and researchers in an effort to pool the individual talents and tackle

the challenges of recombinant DNA techniques and genetic engineering (Biogen IDEC

2011). IDEC Pharmaceuticals Corporation (IDEC) was founded in San Diego five years

later and focused its research efforts on monoclonal antibody therapy in oncology(Biogen

IDEC 2011). Both companies successfully launched biosynthetics for autoimmune,

neurological and oncological disorders, e.g. Intron A®, Avonex®, Tysabri®, Rituxan®,

etc., prior to a merger in 2003 to form Biogen-IDEC Inc.

Page 27

As pharmaceutical firms grow risks are taken, research opportunities missed, market

dynamics change and occasionally a technological revolution led by numerous smaller

innovators affiliated with universities spawns a period of Schumpeterian creative

destruction. Galambos and Sturchio (1998) have shown that although large

pharmaceutical firms either rapidly develop in-house expertise with the new technology

and apply it across therapeutic areas or contract state of the art research in the form of

licensing, research and equity relationships in an effort to maintain a competitive advantage

and conclude that the latter was the more successful strategy due to IP rights and the limited

number of experts in a new field of technical expertise.

By analogy the gradual increase of equity stake in parallel to the progress made in a

successful alliance were harbingers for the eventual mergers of Roche-Genentech, Merck-

Serono, Novartis-Chiron and serve as one survival strategy for the larger pharmaceutical

firms. However the more recent hostile bid by Sanofi-Aventis SA to purchase Genzyme

Corporation clearly attests to the viability of M&A activity in the absence of a prior R&D

partnership.

Page 28

METHODS

Stage-gate approach

Taking inspiration from Wheelwright and Clark (1992) a stage-gate approach was used to

evaluate and filter the potential partnering candidates. In Stage I the pharmaceutical market

was divided into four categories: the top ten largest pharmaceutical firms ranked by 2010

annual revenues (USD), the top ten biotechs defined as firms where more than 50% of the

2010 annual revenues were attributable to the sales of biologics, those pharmaceutical firms

which have S1P1 agonists in clinical development, and any pharmaceutical company which

markets blockbuster MS product(s) and was not captured by the first three categories.

Passing the Gate I, 28 companies were identified and 26 of which were evaluated in Stage

II based on core competences & performance indices with a scoring tool to arrive at a short

list of 11 candidates. Thereafter these 11 were reviewed for attributes excluded by the

scoring tool, e.g., network, competitive products or interests, etc. in passing Gate III prior

to a due diligence offer in Stage III and eventual negotiation and contractual finalization.

This paper does not concern itself with the results of Stage III.

Page 29

Figure 5 – Stage-gate model for partner selection

In-houseS1P1 agonistprogram or

MS blockbuster

Top tenpharmaceutical

firms

Top tenbiopharmaceutical

firms

All potential pharmaceutical

partners

Selected partners

Approachwith due diligence

offer

Gate I

Gate II

Gate III

Stage I

Stage II

Stage III

Source: Wheelwright and Clark 1992, Revolutionizing Product Development, The Free Press, NY 1992

Page 30

RESULTS

Gate I

Gate I delivered 26 potential candidates, 19 of which based on annual revenues are depicted

in Table V. Additionally 6 companies which are active in the field of S1Px agonists were

identified: Bristol-Myer Squibb, Almirall SA, Arena Pharmaceuticals Inc, Receptos Inc,

Daiichi Sankyo Co Inc, and Ono Pharmaceuticals Co Inc. Marketing Copaxone® a

blockbuster in MS, Teva Pharmaceutical Industries Ltd was also added to the list.

Page 31

Table V – Top 10 pharmaceutical and biotech firms in 2010

Pharmaceutical Biotech

Company

2010

Annual revenues (bio USD)

Company

2010

Annual revenues(bio USD)

67.8 56.3

61.6 15.1

50.7 13.4*

50.6 12.8

46.2 11.7

45.9 4.9˚

43.6 4.7˚

35.2 4.7

33.3 4.1†

23.1 0.5

° Merck Serono is a division of Merck KGaA

* CSL annual revenues declared from Jun09-Jun10 † Genzyme Corporation was purchased by Sanofi-Aventis in Apr11

Source: Contract Pharma for Pharmaceutical and Biopharmaceutical Contract Servicing & Outsourcing report July 2010, individual annual reports

Page 32

Gate II

Scoring tool

In order to efficiently screen and award potential partners points appropriate to desired

strengths & capacities, data was gleaned from 2010 annual reports, SEC filings, websites,

WO patent search, and the FDA website: www.clinicaltrials.gov. Attributes were divided

into 6 categories: research, clinical development, marketing & sales, resources, growth &

resiliency and productivity. All fiscal units are reported in USD (May 2011).

Research

As the most highly guarded resource of any pharmaceutical firm, efforts to evaluate

research pipelines from publically available information are hindered by protective self-

interests of the firm itself. However SEC filings and most annual reports list the R&D

spend and comparison of the absolute values yields insight into the scale of R&D activities.

Although Actelion is not searching for a research partner it would still benefit from the

knowledge of a partner acquainted with the development of S1Px agonists, and so the

results of the WO patent search are added in an unweighted fashion to attribute more value

to those candidates which have filed WO patents in the field.

Page 33

Clinical development

R&D spends include the funds used to support on-going clinical development efforts and so

are inseparable for similar comparison however the FDA website proves a reliable

repository of clinical activity. Sponsors are encouraged to list on-going trials by the fact

that reputable journals, e.g., New England Journal of Medicine, Nature, Science, etc.,

refuse to publish articles related to trials that were not listed on the FDA website prior to

database closure. Searches were made by sponsor, phase and therapeutic area where the

raw results by phase were given a weighted score and those which were relevant to MS, Ps,

PsA, RA, UC, CD, AS or JIA were listed separately to attribute more value to activity in

these indications. Additional points were awarded for compounds which had successfully

submitted authorization packages to health authorities and for any S1P1 compound at any

stage of clinical development.

Marketing & Sales

Phase IV trials are post-marketing efforts to better understand the full capacity of a product

either within a licensed indication or as an effort to expand its therapeutic potential across

new indications. These were scored in a similar manner as Phase I-III trials under Clinical

Development. Each marketed product in the autoimmune disorders of interest or

blockbuster in any indication was awarded an individual unweighted score to allow for this

exceptional and fortunate circumstance to outweigh multiple efforts of much smaller

magnitude and relevance to the task at hand. In an effort to gauge and compare the

economies of scope and scale a candidate had to offer, the number of affiliates &

Page 34

subsidiaries, costs of sales and costs of marketing, selling & administration were given

scores based on magnitude. Lastly as many of the large pharmaceutical firms manufacture

and market non-pharmaceuticals, e.g., commercial health care products, diagnostics,

vaccines, etc., the proportion of pharmaceutical sales was given an ascending weighted

value.

Resources

Annual revenues, net income, cash & cash equivalents and the number of employees

represent capital and resources required for a successful collaboration. These attributes

were scored and recorded.

Growth & Resiliency

The equity markets of the world are another independent manner in which to gauge and

compare both the material success of a firm as well as continued investor confidence. The

global economic crisis of 2008/2009 erased billions of USD from balance sheets of

governments, industry champions and private investors alike. Where available subtracting

the stock price of Jan07 when markets were at a peak from Jan11 two years following the

aftermath has been done in an effort to establish a value reflective of resiliency and

potential continued growth in terms of investor confidence.

Page 35

Productivity

4 indices have been used in an attempt to evaluate the productivity of a potential candidate

and allow for a fair comparison irrespective of the absolute values. Dividing the annual

revenues by the number of employees reveals the productivity of the work force in terms of

capital gains. Similarly dividing the net income by the annual revenue establishes a

profitability index. Lastly an inversely proportional score was awarded to the indices

which divided the cost of sales and cost of manufacturing, selling & administration by the

annual revenues so that those firms with lower proportional costs gained higher scores.

Two different scoring matrices were established; one for large pharmaceutical firms and

one for biotechs & others as witnessed in Tables VI & VII. Actelion was evaluated with

each matrix and then the values of all companies evaluated in each grouping were plotted

on a single graph. Those companies whose aggregate score was significantly higher than

Actelion’s were then considered candidates for due diligence a process by which both

parties agree to granting mutual unrestrained access to all knowledge, processes and

activities potentially affected by a partnering agreement.

Page 36

Table VI – Scoring tool valuations for large pharmaceutical firms

PharmaceuticalsAttribute Absolute value

R&D spend ≥ 10 bio USD 7.5 - 9.9 bio USD 6.5 - 7.4 bio USD 5 - 6.4 bio USD < 5 bio USD

Development compounds per phase ≥ 40 30 - 39 20 - 29 11 - 19 < 10

Clinical trials (historical & ongoing) ≥ 600 450 - 599 300 - 449 150 - 299 < 150

Number of affiliates & subsidiaries ≥ 250 200 - 249 151 - 199 100 - 150 < 100

Cost of sales ≥ 18 bio USD 15 - 17.9 bio USD 10 - 14.9 bio USD 4 - 9.9 bio USD < 4 bio USD

Cost of marketing, selling & administrative ≥ 18 bio USD 15 - 17.9 bio USD 10 - 14.9 bio USD 4 - 9.9 bio USD < 4 bio USD

Annual revenues ≥ 65 bio USD 55 - 64.9 bio USD 45 - 54.9 bio USD 35 - 44.9 bio USD < 35 bio USD

Net income ≥ 12 bio USD 9 - 11.9 bio USD 6.5 - 8.9 bio USD 4 - 6.4 bio USD < 4 bio USD

Cash & cash equivalents ≥ 18 bio USD 13 - 17.9 bio USD 8 -12.9 bio USD 3 - 7.9 bio USD < 3 bio USD

Number of employees ≥ 100,000 80,000 - 99,000 60,000 - 79,999 40,000 - 59,999 < 40,000

Annual revenues/number of employees ≥ 1,000,000 750,000 - 999,000 500,000 - 749,999 250,000 - 499,999 < 250,000

Scoring tool value 5 4 3 2 1

Table VII – Scoring tool valuations for biotechs & others

Biotech & othersAttribute Absolute value

R&D spend ≥ 2 bio USD 1.25 - 1.9 bio USD 600 mio - 1.24 bio USD 100 mio - 599 mio USD < 100 mio USD

Development compounds per phase ≥ 20 20 - 15 10 - 14 5 - 9 <5

Clinical trials (historical & ongoing) ≥400 300 - 399 150 - 299 10 - 149 <10

Number of affiliates & subsidiaries ≥100 75 - 99 50 - 74 25 - 49 < 25

Cost of sales ≥ 5 bio USD 3 - 4.9 bio USD 1.5 - 2.9 bio USD 500 mio - 1.5 bio USD <500 mio USD

Cost of marketing, selling & administrative ≥ 5 bio USD 3 - 4.9 bio USD 1.5 - 2.9 bio USD 500 mio - 1.5 bio USD <500 mio USD

Annual revenues ≥ 15 bio USD 10 - 14.9 bio USD 5 - 9.9 bio USD 1 - 4.9 bio USD <1 bio USD

Net income ≥ 4 bio USD 3 - 3.9 bio USD 2 -2.9 bio USD 1 - 1.9 bio USD < 1 bio USD

Cash & cash equivalents ≥ 3 bio USD 2 - 2.9 bio USD 1 - 1.9 bio USD 500 mio - 900 mio USD < 500 mio USD

Number of employees ≥50,000 35,000 - 49,000 20,000 - 34,999 10,000 - 19,999 < 10,000

Annual revenues/number of employees ≥ 800,000 500,000 - 799,000 250,000 - 499,999 100,000 - 249,000 < 100,000

Scoring tool value 5 4 3 2 1

Gate II reduced the list from these 26 to a short list of 11: Pfizer Corp, Bayer Schering AG,

Novartis Pharma AG, Abbot Laboratories Inc, Bristol-Myer Squibb, F. Hoffmann-La

Roche Ltd, Amgen Inc, Merck KGaA, Novonordisk A/S, Biogen IDEC Inc, Teva

Pharmaceutical Industries Ltd illustrated in Figures 6 & 7. Detailed results can be found in

Appendices I & II.

Page 37

Figure 6 – Cross comparison with large pharmaceutical firms

‐50

0

50

100

150

200

250

Productivity

Growth & Resiliency

Resources

Marketing & Sales

Clinical Development

Research

Page 38

Figure 7 – Cross comparison with biotechs & others

‐50

0

50

100

150

200

250

Productivity

Growth & Resiliency

Resources

Marketing & Sales

Clinical Development

Research

Page 39

Candidate profiling Figure 8 – Pfizer scoring results

‐20

0

20

40

60

80

100

120

Research

Clinical development

Marketing & Sales

Resources

Growth & Resiliency

Productivity

US based Founded in 1849Merged with Wyeth, former division of American Home Products Corp. (2009)Merged with King Pharmaceuticals, Inc. (2010)110,600 employees

Key overlap marketed productsEnbrel® RA, JRA, PsA, Ps, AS (Amgen collaboration)Revatio® PAH

Key overlap development compoundstasocitinib (CP-690550) RA

DivisionsBiopharmaceutical, Diversified

Page 40

Figure 9 – Bayer Schering scoring results

0

5

10

15

20

25

30

35

40

Research

Clinical development

Marketing & Sales

Resources

Growth & Resiliency

Productivity

Germany basedFounded in 1863111,400 employeesAcquired (2010)

Key overlap marketed productsBetaseron® (interferon β-1b) CIS, RMS

Key overlap development compoundsAlemtazumab (Anti CD50) Phase III MS Riociguat (sGC stimulator) Phase III PAH

DivisionsHealthCare, Crop Science, Material Science

Page 41

Figure 10 – Novartis scoring results

‐20

0

20

40

60

80

100

Research

Clinical development

Marketing & Sales

Resources

Growth & Resiliency

Productivity

Switzerland basedFounded in 1996 by merger of CIBA Geigy & SandozMerged with Alcon, Inc. (2010)119,418 employees

Key overlap marketed productsGilenya® RMS

Key overlap development compoundsGilenya® Phase III PPMSBAF312, Phase II, MS & Polymyositis Dermatomyositis

Linked to Roche via Lucentis/Xolair Genentech, holds 33.3% of outstanding shares in Roche holding

DivisionsPharmaceuticals, Vaccines & Diagnostics, Sandoz, Consumer Health, Alcon

Page 42

Figure 11 – Abbott scoring results

0

10

20

30

40

50

60

70

80

90

100

Research

Clinical development

Marketing & Sales

Resources

Growth & Resiliency

Productivity

US basedFounded in 1888Merged with Solvay S.A. in 200990,000 employees

Key overlap marketed productsHumira® (adalimumab) RA, PsA, Ps, CD, UC, AS, JIA

Divisions

Pharmaceuticals, Nutritional Products, Medical Devices, Diagnostics

Page 43

Figure12 – Bristol-Myers Squibb scoring results

0

10

20

30

40

50

60

70

Research

Clinical development

Marketing & Sales

Resources

Growth & Resiliency

Productivity

US basedFounded in 1989 by merger of Bristol-Myers and Squibb Corporations27,000 employeesAcquired Medarex, Inc (2009)Acquired ZymoGenetics, Inc (2010)

Key overlap marketed productsOrencia® (abatacept) RA

Alliances with Sanofi (Avapro/Avalide® hypertension, diabetic nephropathy), Otsuka (Abilify® antipsychotic), Gilead (Sustiva® HIV)

Page 44

Figure 13 – Roche scoring results

Page 45

Figure 14 – Amgen scoring results

‐40

‐20

0

20

40

60

80

100

Research

Clinical development

Marketing & Sales

Resources

Growth & Resiliency

Productivity

France basedFounded in 198017,400 employees

Key overlap marketed productsEnbrel® (etanercept) RA, PsA, Ps, AS, JIA (co-marketed with Pfizer)Kineret® (anakinra) RA

Key overlap development compoundsDenosumab (monoclonal antibody) RA

Page 46

Figure 15 – Merck KGaA scoring results

‐10

0

10

20

30

40

50

Research

Clinical development

Marketing & Sales

Resources

Growth & Resiliency

Productivity

Switzerland basedFounded in 2004 by merger of Merck KGaA and Serono SA40,562 employees

Key overlap marketed productsRebif® (interferon β-1a) CIS, RMSRaptiva® (efalizumab) Ps (co-marketed with Roche)

Key overlap development compoundsMylinax® (cladribine) Phase III CIS, RMS

DivisionsMerck Serono, Pharmaceuticals, Chemicals, Laboratory, Corporate & other

Page 47

Figure 16 – Novo Nordisk scoring results

0

10

20

30

40

50

60

Research

Clinical development

Marketing & Sales

Resources

Growth & Resiliency

Productivity

Denmark basedFounded in 1989 by merger of Novo Industri A/S and Nordisk Gentofte A/S30,483 employees

Key overlap development compounds4 monoclonal antibodies, Phase I/IIa RA

DivisionsDiabetes Care, Biopharmaceuticals

Page 48

Figure17 – Biogen IDEC scoring results

0

10

20

30

40

50

60

Research

Clinical development

Marketing & Sales

Resources

Growth & Resiliency

Productivity

US basedFounded in 2003 by merger of Biogen and IDEC4,850 employees

Key overlap marketed productsAvonex® (interferon β-1a) CIS, RMSTysabri® (natalizumab) RMS, CD, PPMS (off-label) (co-marketed with Elan)Rituxan® (rituximab) RA, MS (off-label) (co-developed/marketed with Roche)Amevive® (alefacept) PsBG-12 (dimethyl fumarate) Ps

Key overlap development compoundsOcrelizumab Phase III RMS (co-developed with Roche)Fampridine Phase III RMSPegylated Interferon β-1ab Phase III RMSBG-12 (dimethyl fumarate) Phase III RMSDaclizumab Phase III MSAnti-Lingo antibody Phase I MSBaminercept (LTßR-Ig) Phase I MS, failure in RADexpramipexole Phase II ALS (co-developed with Knopp Neuroesciences, Inc.)

Page 49

Figure 18 – Teva scoring results

0

5

10

15

20

25

30

35

40

45

Research

Clinical development

Marketing & Sales

Resources

Growth & Resiliency

Productivity

Israel basedFounded in 194439,660 employeesAcquired Laboratoire Théramex (2010)

Key overlap marketed productsCopaxone® (Glatiramer Acetate) CIS, RMS

Key overlap development compoundsLaquinimod (α-4 integrin antagonist) Phase III MS, Phase II CD Copaxone® (Glatiramer Acetate) Phase II CDTLOII Phase II RA

Page 50

Gate III

Risk Assessment

PESTL

Gillespie (2007) introduces the PESTEL analysis as a widely accepted risk assessment tool

which splits possible risks into 6 categories: political, economic, social, technological,

environmental, and legal. Actelion operates exclusively within the pharmaceutical industry

and therefore any collaboration should be viewed in light of these risks the industry as a

whole faces in addition to those specific to each possible collaboration.

Political

The largest political risk to the pharmaceutical industry or any alliance would be a change

in governmental practices which incentivize & reward successful drug development. The

recent actions by the US government to reform health care insurance & re-imbursement

policies in the wake of the world economic crisis highlight first the immediate

repercussions, second particular exposure of the pharmaceutical industry to the political

environment and third the possibility that the ever increasing growth in profits within the

pharmaceutical industry may have peaked. Although not all governments provide public

health care programs, lobbyists from private insurers will continue to hold sway with

governments around the globe.

Governmental health authorities, e.g., FDA, EMA, etc., also regulate the framework for

development and manufacture of new compounds and provide specific guidance in the way

Page 51

of International Conference on Harmonisation of Technical Requirements for Registration

of Pharmaceuticals for Human Use (ICH) guidelines which seek to provide harmonized

international standards. As penultimate guidance strict accordance with these guidelines on

a case by case basis often requires dialog between the pharmaceutical industry and health

authorities at joint meetings throughout development.

Lastly barriers to trade, e.g., tarrifs, import procedures, etc., have been greatly reduced in

the last three decades, however re-introduction as a result of unexpected, protective trade

wars could sincerely disturb the manufacture, distribution and sales units of any

pharmaceutical firm.

Economic

Given the rising development costs and ever higher prices new products are commanding,

the economic risk facing the pharmaceutical industry is considerable. A sustained

economic downturn which left patients and private & public insurers unable to purchase

high priced medicines would be detrimental to the industry as a whole. Eligible partners

with the cash reserves to withstand a second recession would be desirable.

Social

The etiology of autoimmune disorders is not well understood however many speculate that

the rise in incidence which the National Institutes of Health (2009) presented to the US

Congress correlates to a reduction in the general health of the population in the developed

world consequent to the unprecedented economic growth experienced since 1970. Obesity

Page 52

and autoimmune disorders specifically are on the rise; with respect to obesity Sefer Natan

and Ehrenfeld (2009) have shown that the paediatric population’s health has suffered in

relation to the lifestyle options now available. Were social changes beneficial to its general

health to prove effective in reducing rates of autoimmune diseases, the NPV of any product

targeting autoimmune disorders would suffer along with the collaboration supporting it.

Technological

Personalized medicine, proteomics, and genomics all present the pharmaceutical industry

with the next possible Schumpeterian revolution in that at present development assumes a

universal dosage per patient with few exceptions for up-/down-titration based on efficacy &

safety signals. These innovative approaches hold the potential of disrupting future markets

in a revolutionary manner similar to that experienced following the introduction of

recombinant DNA technologies in the1970s. Research efforts by any potential partner

would be advantageous.

Environmental

The apparent increase in the number and intensity of tropical storms driven by rising

atmospheric temperatures may affect the manufacture, distribution and sales of

pharmaceutical goods worldwide. However this effect would be normalized over the entire

sector and should not effect the selection of an appropriate partner.

Page 53

Legal

The largest legal risks the pharmaceutical industry faces would be a changes in patent law

or law regulating fare trade within the market. Radical change would undermine the

manner in which business is conducted to these stalwarts can be considered minimal.

However with reference to partnering in particular, several parties previously identified in

Stage II face lawsuits over IP rights to key products and any alliance could be negatively

affected.

Geographic risks

Although geographic location of a potential partner for co-development and co-marketing

of an S1P1 agonist in autoimmune disorders would be expected to play a minimal role when

reviewing largely international pharmaceutical firms operating in the developed world

where trade barriers have been actively reduced in the past 30 years and ICH guidelines

attempt harmonizing development requirements, it is worth noting that the largest

proportion of partnerships occur between firms registered in North America and

furthermore the growth of alliances between North American and European partners has

not significantly increased between the years of 1980 and 1998 as depicted in Figures 19 &

20 beneath.

Page 54

Figure 19 – Distribution of R&D partnerships, economic regions (1960-1980)

Source: Hagedoorn 2001, Inter-firm R&D partnerships: an overview of major trends and patterns since 1960 p.488

Page 55

Figure 20 – Distribution of R&D partnerships, economic regions split by decade

Source: Hagedoorn 2001, Inter-firm R&D partnerships: an overview of major trends and patterns since 1960 p.489

1960-1969 1970-1979

1990-19981980-1989

1960-1969 1970-1979

1990-19981980-1989

Page 56

Long term risks

The patent life of ponesimod runs through 2028 and any collaboration should be viewed

from this perspective as well. Although predicting specific risks 15+ years into the future

may be an exercise in futility, scenario planning allows any partnering proposal to be

considered in light of unexpected changes in the contextual environment outside of the

transactional environment previously reviewed over this long time span. Two plausible

outcomes are posited beneath.

The US market alone represents sales largely of the same magnitude as those of Europe,

Canada and Japan combined although the US population only represents ~30% of the

combined population of the others. The economic recovery in the US was highly

dependent upon the Federal Reserve reducing interest rates and extending emergency

capital reserves at a time of extreme need. Continued economic stability is reliant upon

restoring federal revenues and encouraging fiscal responsibility upon private institutions

including households. However it is distinctly possible that in a time when the US

Government (2011) reports a debt currently over 90% of annual Gross Domestic Product

(GDP) and predicted to breach 100% in 2011, that these reserves will not be available in

the event of a double-dip recession. Such an occurrence would detrimentally affect the US

market and the revenues accrued by the pharmaceutical industry.

International trade is bound to be affected by the growth in Brazil, Russia, India and China

block (BRIC). As these countries continue to expand and develop stable middle classes

Page 57

health care expenditure will rise alongside. Growth and eventual dependence upon modern

pharmaceuticals in these markets may help to offset the inordinate reliance upon the US

market as a source of revenues.

A partner with a diversified pipeline and operationally active in BRIC would help to hedge

against the undue exposure to the US market and maximize a potential positive outcome of

continued global economic growth.

Connection highway

Knowledge in the form of IP, pre-clinical investigations, clinical relevance & applications,

manufacture, regulatory interactions, marketing prowess, processes and even IT itself is

central to the pharmaceutical industry and any partnership will involve the exchange of

such knowledge in a joint effort to capitalize on a larger body of knowledge and resources

under the competitive pressure of the market; networks in the pharmaceutical industry are

in fact networks of knowledge. Galambos (1998) makes specific mention of the need for

“scientific leaders with diplomatic skills and links to the relevant networks that would

enable building the teams and productive programs necessary to sustain biotech R&D over

the long term” driving the search for partners.

Roijakkers & Hagedoorn (2006) demonstrate that the intensity of partnerships between

large pharmaceutical firms and a growing number of biotechs has nevertheless rapidly

increased since 1975 and that the network dynamics are fluid as depicted in Figures VIII,

Page 58

IX, X, XI & XII (also reproduced in Appendix III for the sake of legibility). This is due

primary to two factors: new technological advances are many yet at the moment of

inception the IP is held in the hands of a few and the magnitude of the annual revenues a

innovative product which effectively meets present unmet medical needs is expected to

yield.

Figure VIII –R&D partnerships in pharmaceutical biotechnology 1975-1979

Source: Roijakkers 2006, Inter-firm R&D partnering in pharmaceutical biotechnology since 1975: Trends, patterns and networks p.436

Page 59

Figure IX –R&D partnerships in pharmaceutical biotechnology 1980-1984

Source: Roijakkers 2006, Inter-firm R&D partnering in pharmaceutical biotechnology since 1975: Trends, patterns and networks p.437

Page 60

Figure X –R&D partnerships in pharmaceutical biotechnology 1985-1989

Source: Roijakkers 2006, Inter-firm R&D partnering in pharmaceutical biotechnology since 1975: Trends, patterns and networks p.438

Page 61

Figure XI –R&D partnerships in pharmaceutical biotechnology 1990-1994

Source: Roijakkers 2006, Inter-firm R&D partnering in pharmaceutical biotechnology since 1975: Trends, patterns and networks p.439

Page 62

Figure XII –R&D partnerships in pharmaceutical biotechnology 1995-1999

Source: Roijakkers 2006, Inter-firm R&D partnering in pharmaceutical biotechnology since 1975: Trends, patterns and networks p.440

The undeniable trend held within these diagrams is that the power of alliances has been

unleashed over the past 3 decades due to the ability to quantify and limit the risk of

exposure and simultaneously reduce the cost of breaking an alliance should either the

compound fail in the course of development or larger corporate pipeline & partnering

strategy re-evaluations result in the need to break ties and promises.

However inherent to the risk of embarking on a closer co-operation with a partner is the

loss of competitive advantage in terms of trade secrets to its other parnters. An example of

which would be the present collaboration between Roche and Biogen-IDEC to develop

Page 63