FBP - Policy Document

-

Upload

diwandipesh-sunil -

Category

Documents

-

view

235 -

download

12

Transcript of FBP - Policy Document

i

Disclaimer

The FBP policy reflects the current tax provisions. Any change in the tax provisions, will necessitate a

change in the FBP policy.

Any inappropriate claim for reimbursement made by the employee may result in disciplinary action

against the employee and the employees are required to compensate the company for any actions /

claims from Income Tax department.

Flexible Benefit Plan (FBP)

Policy Document

ii

Table of Contents

Flexible Benefit Plan 4

Salient Features of FBP 4

FBP Amount 5

FBP working mechanism 6

Coverage and Eligibility 7

Definition of Benefits Structure 8

FBP Components 10

House Rent Allowance (HRA) 10

Taxability on HRA 10 Claim process and policy details 11 Proofs required: 13

Medical Reimbursement 14

Taxability 14 Claim process and policy details 14 Apollo medical card offer: 17

Leave Travel Allowance (LTA) 18

Coverage 18 Limit 18 Claim process and policy details 18

Food Reimbursement 21

Superannuation Fund Contribution 22

Taxability 22 Process and policy details 23 LIC Step by step Login Procedure for tracking your Superannuation Fund 24

National Pension System (NPS) 31

Taxability 32 Eligibility 32 Claim process and policy details 32

Mobile Reimbursement 33

Taxability 34 Claim process and policy details 34

Conveyance Allowance 35

Claim process and policy details 35

Car Running Expenses 36

Taxability 36 Claim process and policy details 36

FBP Cards 40

Meal Card 40

Credit Card 43

Credit Card Transactions Confirmation 48

ESA Claim Process 51

iii

Points to Remember 56

Reimbursement dates 56

Only for Policy Related Clarifications 57

Salary / Reimbursement Credit / Tax Related Queries / Approval of FBP bills / Credit card

transactions confirmation 58

Proof of Car Ownership – Submission and Approval 59

Finance Point of Contacts for Claims Submission 59

Superannuation Transfer/Closure: 59

Food Card Bank Contact points 60

Controlled Copy Flexible Benefit Plan

C3: Protected Last Updated on 10/05/2011 Page 4 of 60

Flexible Benefit Plan

Flexible Benefit Plan (FBP) allows associates to structure their benefits to suit their individual needs.

With FBP associates can choose from a bouquet of components that comprise their benefits

structure. A desired value can be assigned to each benefit component chosen. The assignable

value is subject to allowed limits as per FBP policy. The components can be redefined any number

of times within the window period, every month.

This document introduces you to the salient features of the plan, provides detailed information on

each of FBP‟s components, and summarizes important dates for quick reference.

Salient Features of FBP

Bouquet of allowances

Introduces a new set of allowances and benefits as components, in addition to

the existing ones.

Lets associates choose from a bouquet of components.

Selection of Components

Associates can select any combination of components.

Option to redefine

Associates can define their components between the 5th and 25

th of every

month.

Definitions can be made for current and future months only.

Level based entitlements

Entitlements vary with each level (grade).

Criteria per elected benefit

Each component has a minimum and maximum criterion.

Optimize earning structure

Associates can optimize their earnings through a suitable choice of

components.

Portion of salary allocated for FBP – FBP Amount

Associates can only use the amount allocated for FBP to define their set of

components.

Controlled Copy Flexible Benefit Plan

C3: Protected Last Updated on 10/05/2011 Page 5 of 60

FBP Amount

The amount available for definition under FBP is dependent on the grade / level of the associate.

Associates can only use the amount allocated for FBP to define their components. Any unutilized

FBP amount would be paid out as “Special Allowance”.

Up to Associate Level

Senior Associate and Manager Levels

Basic

Contribution to PF

House Rent Allowance

Medical Reimbursement

Conveyance Allowance

Special Allowance

Special Bonus

Annual Gross Compensation

Indicative Incentive

Annual Total Compensation

Basic

Contribution to PF

House Rent Allowance

Medical Reimbursement

Conveyance Allowance

Food Reimbursement

Mobile Reimbursement

Leave Travel Allowance

Superannuation Fund Contribution

Special Allowance

Special Bonus

Annual Gross Compensation

Indicative Incentive

Annual Total Compensation

Am

ou

nt

avai

lab

le u

nd

er F

BP

Co

mp

on

ents availab

le un

der F

BP

Salary Structure (as in Offer Letter)

Basic

Contribution to PF

House Rent Allowance

Medical Reimbursement

Special Allowance

Special Bonus

Annual Gross Compensation

Indicative Incentive

Annual Total Compensation

Basic

Contribution to PF

House Rent Allowance

Medical Reimbursement

Food Reimbursement

Mobile Reimbursement

Leave Travel Allowance

Superannuation Fund Contribution

Car Running Expense

Special Allowance

Special Bonus

Annual Gross Compensation

Indicative Incentive

Annual Total Compensation

Salary Structure (as in Offer Letter)

Am

ou

nt

avai

lab

le u

nd

er F

BP

Co

mp

on

ents availab

le un

der F

BP

Controlled Copy Flexible Benefit Plan

C3: Protected Last Updated on 10/05/2011 Page 6 of 60

Senior Manager & Above Levels

Fixed components

The following are fixed components and cannot be used in FBP:

Basic

Provident Fund

Night shift Allowance

Employee State Insurance (ESI)

Contribution Pay

Special Bonus

Night shift allowance, Employee State Insurance, Contribution Pay and Special Bonus are

applicable only to a select set of associates.

All reimbursable components do not form part of salary and would be paid out as a part of

prescribed reimbursement cycles.

FBP working mechanism

FBP earnings definition in My pay works like a calculator with Special allowance as the adjusting

factor. Upon declaration/re-declaration of any FBP definitions, the amount so defined is deducted

from the associate‟s special allowance and accrued under each FBP Component in the

reimbursement slip available in https://mypay.cognizant.com my statements Reimbursement

slip. Therefore, the FBP components are not part of the associate‟s Payslip. The Payslip

components (HRA, Special allowance etc) are a reflection of the associate‟s FBP earnings definition

Basic

Contribution to PF

House Rent Allowance

Medical Reimbursement

Special Allowance

Special Bonus

Annual Gross Compensation

Indicative Incentive

Annual Total Compensation

Basic

Contribution to PF

House Rent Allowance

Medical Reimbursement

Food Reimbursement

Leave Travel Allowance

Superannuation Fund Contribution

Car Running Expense

Special Allowance

Special Bonus

Annual Gross Compensation

Indicative Incentive

Annual Total Compensation

Salary Structure (as in Offer Letter)A

mo

un

t avail

ab

le u

nd

er

FB

P

Co

mp

on

en

ts a

vaila

ble

un

der F

BP

Controlled Copy Flexible Benefit Plan

C3: Protected Last Updated on 10/05/2011 Page 7 of 60

and not a reflection of the associate‟s offer letter/Eletter. Associate‟s have to claim the deducted

amount under FBP as mentioned in the reimbursement slip by following the procedure for claim

under each FBP Component mentioned in this document.

Coverage and Eligibility

All associates tagged to IT services (India) and BPO services (India) including MarketRX associates

will be eligible to FBP. Refer the benefits eligibility table to know about the grade based availability

of the components.

Component Up to A Level SA and M SM and above

1. House Rent Allowance (HRA) Yes Yes Yes

2. Medical Reimbursement Yes Yes Yes

3. Conveyance Allowance Yes No No

4. Food Reimbursement Yes Yes Yes

5. Mobile Reimbursement Yes Yes No

6. Leave Travel Allowance (LTA) Yes Yes Yes

7. Superannuation Fund

Contribution

Yes Yes Yes

8. Car Running Expenses No Yes Yes

9. NPS Yes Yes Yes

Controlled Copy Flexible Benefit Plan

C3: Protected Last Updated on 10/05/2011 Page 8 of 60

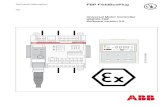

Definition of Benefits Structure

Step 1: Login to https://mypay.cognizant.com

Step 2: Click the Earnings Definition link under Flexible Benefit Plan tab

Controlled Copy Flexible Benefit Plan

C3: Protected Last Updated on 10/05/2011 Page 9 of 60

Step 3: Define the desired components and click the Submit button

Things to Remember

Election of the components for the Flexible Benefit Plan can be made only

between 5th and 25th of every month:

If 5th falls on a weekend or holiday, the system would be available from

the next working day.

If 25th falls on a weekend or holiday, the system would be available till

the previous working day.

All FBP components are available for redefinition on a monthly basis

Definitions can be made only for the current and future months

Defined amount is accrued based on the actual number of days the associate

works in the India Payroll (Proration would be done wherever applicable)

Definition available on the cut-off date would be taken for payroll processing

Associates are required to review the changes to the definition whenever there

is a change in location, person details, travel or compensation

Controlled Copy Flexible Benefit Plan

C3: Protected Last Updated on 10/05/2011 Page 10 of 60

FBP Components

The flexible benefits plan would consist of the following components which can be chosen by

associates based on their eligibility.

House Rent Allowance (HRA)

House Rent Allowance is an allowance extended to the employee towards monthly payment for a

rented accommodation.

Coverage: Associates at all levels.

Limit: Ranges from 0 to 60% of the basic salary.

Taxability on HRA

In accordance to the Income Tax Act, the amount exempted from the taxable income would be the

least of the following:

Amount equal to 50% of basic salary, for persons staying in Mumbai, Chennai, Calcutta

or Delhi and 40%, for others.

The actual amount of house rent allowance received.

The amount of rent actually paid in excess of 10% of basic salary (which is amount of

rent actually paid minus 10% of basic salary).

Associates are advised to go through the below link :

https://ch1blogs.cognizant.com/blogs/140420/2011/09/13/documentation-for-hra/

Only the amount paid towards rent is eligible for exemption. Amount paid towards maintenance

charges, electricity bill and so on; food in case of paying guest accommodation is not eligible for

exemption.

Controlled Copy Flexible Benefit Plan

C3: Protected Last Updated on 10/05/2011 Page 11 of 60

Claim process and policy details

Step 1: Click the HRA, Int. on Housing loan, Higher Edu. Loan link under the

My Update tab.

Step 2: Click the Total Rend Paid during 2009-10 link

Controlled Copy Flexible Benefit Plan

C3: Protected Last Updated on 10/05/2011 Page 12 of 60

Step 3: Fill in the „Rent paid details‟ and „Monthly rent paid‟ information and

click the Save button. (Approval status can be viewed by clicking the Approval

Status button after the Finance Team validates your submission)

Associates should declare the desired amount in the FBP definition system

Associates need to submit the rent receipt / bank statement for one month and the lease

agreement covering the financial year from the landlord.

In case the lease agreement does not cover the entire financial year ; a copy of the

new/renewed rental agreement has to be submitted before 22nd of the month following

the month in which the new accommodation or renewal of the existing accommodation

is taken up.

In absence of lease agreement, rent receipt should have cheque details substantiated

with bank statement providing proof of payment and PAN number of the Land Lord.

In case of hostel accommodation, rent receipt in the hostel‟s letter head or pre-printed

receipt book must be submitted.

Associates can handover the above documents to the location Finance team for

approval.

Exemption will be provided subject to the income tax regulations.

Controlled Copy Flexible Benefit Plan

C3: Protected Last Updated on 10/05/2011 Page 13 of 60

Proofs required:

Monthly Rent is

Rs 3000 or less

1 month‟s original rent receipt

Monthly Rent is

more than Rs

3000

1 month‟s original rent receipt

Copy of Lease Agreement

In absence of lease agreement, rent receipt should have

cheque details (substantiated with proper bank statement) of

the payment and PAN number of the Landlord.

Associates must ensure that their receipt includes all the information mentioned in the

format present in the following link -

https://mypay.cognizant.com/INCLUDE/RequiredDocuments.pdf

Controlled Copy Flexible Benefit Plan

C3: Protected Last Updated on 10/05/2011 Page 14 of 60

Medical Reimbursement

Medical Reimbursement aims towards defraying cost of day-to-day medical expenses (consultation

fee, diagnostic tests, cost of medicines etc). It does not cover hospitalization expenses.

Coverage: Associates at all levels.

Limit: Up to Rs15000 per annum.

Taxability

Claims supported by valid medical bills (only pertaining to current Financial Year) are

reimbursed up to an amount of Rs. 15000 per annum.

Claim process and policy details

Associates should declare the desired amount in the FBP definition system

Associates have to make a reimbursement claim through https://mypay.cognizant.com

as mentioned below:

Step 1: Click the Medical Bills link under the My Update tab

Controlled Copy Flexible Benefit Plan

C3: Protected Last Updated on 10/05/2011 Page 15 of 60

Step 2: Choose the link for the current month to update claim details.

Step 3: Click the Add button; Furnish the bill details and click the Save button.

After entering details of all the bills click the Submit button.

Controlled Copy Flexible Benefit Plan

C3: Protected Last Updated on 10/05/2011 Page 16 of 60

Step 3: Print out and sign the Summary Sheet

Step 4:Send the original bills along with the summary sheet duly signed, by

internal courier to respective location Finance team

Remember to mention the Associate ID and the period in respect of which the

reimbursement is being applied for on the envelope

Associates can accumulate up to an amount of Rs. 1250 per month as medical

reimbursement.

Associates cannot claim more than the accumulated amount at any point.

The amount would be reimbursed only to the extent of valid claims by the associates

and not as an allowance on a monthly basis.

Any amount accrued and not claimed would be carried forward to the subsequent month

Associates need to submit original copies of bills to the payroll team. Please note that

bills should be submitted on or before the last day of the month in order to be processed

as part of the month‟s reimbursement.

Prescriptions to be provided for

Bill amounting to Rs. 500 and above

Multiple bills with the same date, the sum of which exceeds Rs. 500

Ayurvedic / Homeopathic / Unani / Naturopathy medicines (irrespective of the

bill amounts)

Registration charges/annual fee etc. for clinics / health club cannot be claimed.

Bill amount for spectacles / lens is restricted to Rs. 1500 p.a.

Bills for dental treatment need to be supported with prescriptions.

Bills for cosmetics and provisions should not be submitted for Medical Reimbursement

claim.

Bills amounting to the allowance eligible will alone be considered for exemption.

Original bills once submitted will be retained and would not be given back to the

associate at any circumstance

Submission of genuine bills would be prime responsibility of associates.

Bills with any overwriting would not be considered for reimbursements.

Controlled Copy Flexible Benefit Plan

C3: Protected Last Updated on 10/05/2011 Page 17 of 60

Claims would be reimbursed as a part of the reimbursement cycle. Please refer to the

table on “Reimbursement Dates” for further details.

Apollo medical card offer:

Cognizant has always ensured to be an eco-friendly organization. In line with the

philosophy of “Go Green”, Cognizant has entered into a direct tie up with Apollo

pharmacy for a unique and hassle free means of claiming medical reimbursements

online, under FBP.

This presents associates with multiple benefits including time saving:

Free membership with the Apollo pharmacy group with attractive discounts

No need to collect, preserve and submit the hard copy bills anymore

An eco-friendly green solution – which will collectively help eliminate tens of

thousands of paper bills each year and

Time taken to manually verify and approve the bills is reduced.

Offers and Benefits for Cognizant Employees:

10% discount on medicines and 5% discount on FMCG products.

15% discount on Apollo private label products

The discounts will be offered to the Employees outright in the purchase Bill itself.

In any one financial year, associates can avail free „Apollo Doctor Consultations‟ and a

10% discount on MHC (Master Health Check Up) at specified Apollo hospitals in the

form of :

One coupon after the completing the purchase of Medicines (excluding FMCG Products)

for a value of Rs. 8000/-

Second coupon after completing the purchase of Medicines (excluding FMCG Products)

for a value of Rs. 12,000/- and

Third coupon after completing the purchase of Medicines (excluding FMCG Products)

for a value of Rs. 15,000/-

For more information on Apollo offer, please refer to the Apollo offer document and FAQ in

https://mypay.cognizant.com home page.

Controlled Copy Flexible Benefit Plan

C3: Protected Last Updated on 10/05/2011 Page 18 of 60

Leave Travel Allowance (LTA)

Leave Travel Allowance provides for reimbursing the Associates for their domestic travel. The

amount reimbursed is subject to pre-defined limits and conditions.

Coverage

Associates at all levels.

Limit

LTA benefits are subject to the following limits.

Component Up to A Level SA and M SM and Above

Eligibility (Per Annum) 20000 40000 60000

Claim process and policy details

Associates should declare the desired amount in the FBP definition system

Associates have to make an LTA reimbursement claim through ESA as mentioned

below (Refer ESA Claim Process section of this document for detailed explanation with

screenshots):

Step 1: Login to https://compass.esa.cognizant.com

Step 2: Click on Employee Self-Service link

Step 3: Select Expense Report and click on Create

Step 4: Select the INPREIMB – Indian Payroll Reimbursement template. Select

Indian Payroll Reimbursement for category and India as default location

(Workflow available at Quick Reference Guide / Expense Report Creation User

Guide in the ESA site for further reference)

Step 5: Select India Payroll Reimbursement (Code : 1000029779) in the Project

expense details

Step 6: Claim your reimbursements under the LTA expense type (Code –

CI00100) (please note – No need to fax / scan expense report with supporting)

Step 7: Documents to be sent by internal courier to respective location finance.

Original bills

Print out of expense report from ESA

Controlled Copy Flexible Benefit Plan

C3: Protected Last Updated on 10/05/2011 Page 19 of 60

Claim Form duly filled and signed (LTA Claim Form available under the

Forms link at https://mypay.cognizant.com)

Associates accumulate a monthly amount as per their definition for LTA under FBP.

Associates cannot claim more than the accumulated amount at any point.

The amount defined under LTA accumulates on a monthly basis and associates have

the flexibility of changing this definition every month. For example-If you declare 20000/-

in FBP definition system, you will accumulate 20000/12 i.e. 1667/- per month.

Original bills of travel are required to claim this allowance.

Only bills pertaining to travel from the location of employment to the destination would be

considered. Accommodation, recreation and sightseeing expenses cannot be claimed as

part of LTA.

Bills for the associate and the associate‟s family pertaining to a travel to any place in

India can be claimed. Family includes spouse, children, parents, brothers and sisters

wholly dependent on the associate.

The associate must have accompanied the dependant(s) during the travel / vacation to

claim for the dependants‟ travel.

A minimum of five working days of vacation leave is mandatory (vacation leave does not

include weekends and national holidays). The leave records should be updated with

vacation leave for the period on the leave system.

Bills can be submitted any time during the year.

Proofs required: Claims need to be supported by proper documents as stated below.

By Air: Original air tickets and boarding passes.

By Rail: Original train tickets signed by the TTE.

By Road: Original bus tickets, if the travel is by bus.

Payment receipt and trip sheet for rented cab; Toll tax paid and petrol bills for

own cab.

Claims would be reimbursed as a part of the reimbursement cycle. Please refer to the

table on “Reimbursement Dates” for further details.

LTA can be claimed in a block of 4 years with two bills and can be carried forward from

one year to the next year within the block of 4 years.

Controlled Copy Flexible Benefit Plan

C3: Protected Last Updated on 10/05/2011 Page 20 of 60

LTA can be claimed as taxable income at any part of the year by raising expense report

under India Reimbursement template in ESA. (Refer ESA claim process)

Controlled Copy Flexible Benefit Plan

C3: Protected Last Updated on 10/05/2011 Page 21 of 60

Food Reimbursement

Food Reimbursement aims at providing an allowance for food items that an associate requires at the

office premises. Food allowance would be provided through a “meal card”.

Coverage: Associates at all levels.

Limit: Up to a maximum of Rs.3000 per month.

Claim process and policy details:

Associates must declare the amount in the FBP definition system.

The reimbursement would be proportionate to the number of days worked in India.

Associates are required to procure Meal Card from HDFC Bank through the following

website: https://leads.hdfcbank.com/applications/webforms/apply/foodplus.asp (Refer

the FBP Cards section for detailed explanation)

The card would be delivered within 3 to 4 weeks from the time of furnishing the details

On receipt of the meal card, associates have to update the meal card number in

https://Mypay.cognizant.com (Refer the FBP Cards section for detailed explanation)

Associates can reach the customer care center of HDFC Bank for any support at

The amount will be credited as reimbursement to the Meal Card at the end of every

month.

The maximum amount that can be maintained in the Meal Card is Rs. 20000 (According

to RBI Regulations).

According to Governmental regulations, the Meal Card can be used only to buy ready-

to-eat cooked food and the card cannot be used to purchase items for more than Rs.

100 per day

Amount once credited by Cognizant into the meal card based on associate definition

cannot be reversed or credited into the salary account

The meal card shall be used by the associates only for the reimbursement of food items

at outlets specified by HDFC Bank. (Onecognizant.cognizant.com My App Cworld

FBP)

Controlled Copy Flexible Benefit Plan

C3: Protected Last Updated on 10/05/2011 Page 22 of 60

Associates can write to [email protected] and [email protected]

for the following queries/clarifications:

1. Balance Transfer from old food card to new food card

2. Office Address (Pin Code) and mobile no update in HDFC records

3. Per Day amount limit (if any) in your card

4. Food card damage

5. Food card applied and not received after 7 working days

6. Loss of HDFC Food card and application for a new card

Superannuation Fund Contribution

Superannuation Fund is a retirement benefit provided to employees. The amount defined by the

associates under FBP will be deducted from their monthly salaries and contributed towards

superannuation fund under the Group superannuation scheme administered by LIC. There would be

no contribution from the company towards the same.

Coverage: Associates at all levels

Limit: Minimum contribution of Rs. 500 per month and subject to a ceiling of 15% of basic salary or

Rs. 100,000 per annum, whichever is lesser.

Taxability

The contribution made to the fund is totally exempt from income tax.

Enrollment Period

All associates who were in active India payroll as of Jun 30th 2011, as one time

measure can enroll before August 31, 2011.

New Joinees / On-site returnees including associates hired Onsite and deputed to

Cognizant India can enroll for this benefit through their FBP earnings definition in Mypay

on or before the third month‟s Payroll after their joining / return or Travel to

Cognizant, India. Failure to define this benefit as a part of the first FBP definition would

make the Associate ineligible for enrolling for this benefit thereafter.

Controlled Copy Flexible Benefit Plan

C3: Protected Last Updated on 10/05/2011 Page 23 of 60

Process and policy details

Associates can opt for the “superannuation fund contribution” benefit under FBP and

define the contribution amount in the FBP earnings definition system in

https://mypay.cognizant.com, subject to the limits as mentioned above

Once the associate opts for the benefit with the required amount, the company

contributes the same to the superannuation fund on behalf of the associate and the

same is recovered from the associate‟s monthly salary.

Associate who opt for this benefit cannot come out of it till he or she is employed with

Cognizant.

The contributions would be maintained by L.I.C of India and the interest rate is decided

by L.I.C on a yearly basis.

Associates cannot withdraw any amount from the fund during their tenure in Cognizant.

On separation, the associate can transfer the fund to the Superannuation fund

maintained by his / her future employer or request the amount to be paid back in the

form of monthly pension.

Transfer of superannuation fund is a responsibility of the previous employer and the

associate need to request for the same through Form A to his / her previous employer.

(Form A available under the Forms link at https://mypay.cognizant.com

In order to receive the superannuation fund contributions as monthly pension, the

Associate need to request for the same through form for Employees Group

Superannuation Scheme (Form available under the Forms link at

https://mypay.cognizant.com. Please contact HR Shared Services - Benefits Team by

writing an e-mail to [email protected] for assistance in the claim process at time of

separation.

Associates may change the definition of the superannuation fund on a monthly basis,

but the contributions must be within the monetary limits of Rs.500 to Rs.100000.

However the contribution cannot exceed 15% of the basic.

The contributions made towards superannuation fund for the current Financial Year can

be viewed at https://mypay.cognizant.com in the Superannuation Slip page under My

Slips

Associates can track the amount available in the superannuation fund by registering

themselves at the website of L.I.C India (www.licindia.com) using their LIC ID (Available

in the Superannuation Slip under My Statements at https://mypay.cognizant.com

Controlled Copy Flexible Benefit Plan

C3: Protected Last Updated on 10/05/2011 Page 24 of 60

https://gsd.cognizant.com Finance India Payroll

Category* Type* Item*

FBP /Reimbursements Superannuation Fund Enrolling and login

FBP /Reimbursements Superannuation Fund Policy Related

FBP /Reimbursements Superannuation Fund Superannuation closure

FBP /Reimbursements Superannuation Fund Superannuation transfer

LIC Step by step Login Procedure for tracking your Superannuation Fund

Log on to LIC Home page using URL www.licindia.in

Click here

Controlled Copy Flexible Benefit Plan

C3: Protected Last Updated on 10/05/2011 Page 25 of 60

Click here

Controlled Copy Flexible Benefit Plan

C3: Protected Last Updated on 10/05/2011 Page 26 of 60

Enter the policy number that has

been displayed in MyPay >

MyStatements > Superannuation

Slip

Select member

from the option

Controlled Copy Flexible Benefit Plan

C3: Protected Last Updated on 10/05/2011 Page 27 of 60

Enter the LIC ID that has been

displayed in MyPay >

MyStatements > Superannuation

Slip

Enter your date of birth

Click

proceed

Controlled Copy Flexible Benefit Plan

C3: Protected Last Updated on 10/05/2011 Page 28 of 60

Create your own user ID and

password

Controlled Copy Flexible Benefit Plan

C3: Protected Last Updated on 10/05/2011 Page 29 of 60

Click on group schemes details

Controlled Copy Flexible Benefit Plan

C3: Protected Last Updated on 10/05/2011 Page 30 of 60

Policy details are displayed here

Click on contribution history to

view all consolidated contributions

Controlled Copy Flexible Benefit Plan

C3: Protected Last Updated on 10/05/2011 Page 31 of 60

National Pension System (NPS)

National Pension System or new pension system (NPS) is a scheme introduced originally in 2003 by the

Government of India to enable individuals to save for their retirement, and was extended in 2009 to

cover employees of private sector as well. Effective April 1st, 2011, the Government has exempted from

Income tax the contribution through the employer. The scheme is administered and controlled by the

Pension Fund Regulatory & Development Authority – PFRDA (www.pfrda.org.in)

In NPS, a subscriber contributes every year till retirement and the contribution is invested as per the

Investment pattern selected by the subscriber. On retirement, part of the investment corpus (Pension

Wealth) accumulated is paid in lump sum while the remaining goes in purchasing a life annuity which

Will ensure stable monthly income to the subscriber till death. Subscriptions to NPS are towards

Retirement contribution. You are required to properly assess your requirements for retirement before

enrolling for the scheme. Tax savings should not be the only criteria for enrolling into retirement

schemes.

View all contributions in this

page

Controlled Copy Flexible Benefit Plan

C3: Protected Last Updated on 10/05/2011 Page 32 of 60

Coverage

Associates at all levels.

Limit:

Minimum of Rs.500 and a maximum of 10% basic per month

Taxability

The contribution made to the fund is totally exempt from income tax.

Eligibility

Any Indian citizen, whether resident or non‐ resident, can invest in this scheme provided

he is between 18 to 60 years of age as on the date of submission of application. The

applicant would also be expected to complete the regular KYC (Know your customer)

formalities before opening the account.

Claim process and policy details

Contact ICICI bank and complete the documentation formalities. Application form given

below.

Application form.pdf

Establish the PRAN account and share the PRAN details to finance.

If you are already holding PRAN a/c with Points of presence other than ICICI Bank

submit the Change of POP form to the ICICI bank.

Format for change of POP.PDF

Associates to declare the desired NPS Contribution amount in the FBP definition system

after obtaining the PRAN a/c. This can be done through FBP definition, available on

https://MyPay.Cognizant.com

You have an option of setting up your NPS Contribution by reallocating the amounts that

are currently available under the FBP scheme – like Car Running, Medical, Special

allowance etc.

Controlled Copy Flexible Benefit Plan

C3: Protected Last Updated on 10/05/2011 Page 33 of 60

The amount so allocated will be fully tax exempt. You can allocate a minimum of Rs.500

subject to a maximum of 10% of your basic salary.

After the monthly payroll process, Cognizant will deposit the contribution amount to the

Fund Manager of your choice. The details of amount deposited will also be made

available on the MyPay portal.

This entire proposal is based on the current tax laws. Any changes, if done by the

government, will require this to be modified.

Please Contact the below POC‟s for your location.

Location Name

Mobile

Number Email ID

CHENNAI N.ASHOK 9566088400 [email protected]

HYDERABAD RAVI SAKINALA 9959020741 [email protected]

COIMBATORE KARTHIKEYAN 9566094094 [email protected]

COCHIN SHANIL KRISHNAN 8129600701 [email protected]

BANGALORE CHENGAPPA 9731099446 [email protected]

KOLKATA ANUPAM DEY 9051095894 [email protected]

PUNE HARDEEP WALIA 9561087492 [email protected]

DELHI RAJANI JHA 9650748777 [email protected]

MUMBAI RAJESWARI 9004314400 [email protected]

Mobile Reimbursement

Mobile Reimbursement aims at reimbursing the associates for mobile usage for official purposes.

Coverage: Up to M (Manager) grade only.

Limit:

Component Up to A Level SA and M

Eligibility (Per Month) 500 1000

Controlled Copy Flexible Benefit Plan

C3: Protected Last Updated on 10/05/2011 Page 34 of 60

Taxability

Claims up to the eligible amount are exempted from taxable income

Claim process and policy details

Associate must define the amount in the FBP definition system.

Associates should follow the below steps for claiming their Mobile Reimbursements

Step 1: Procure an ICICI / Citibank / HDFC* credit card and use it to pay

mobile phone bills, Fuel and Maintenance bills. Associates who already

possess an ICICI / Citibank / HDFC credit card may use the same for payment

of the above mentioned bills. (Click here for more details - FBP Cards section)

Step 2: On receipt of the card associates have to:

Provide consent to the bank for sharing the reimbursable spend details

with Cognizant (Click here for more details - “Mapping the Credit Card”)

Update the credit card number in https://mypay.cognizant.com (Click

here for more details - FBP Cards section)

Step 2: Bank would share the information on the reimbursable spends which

would be updated in https://mypay.cognizant.com

Step 3: Confirm the spends on mobile bill as “Official”, “Personal” or “Next

Month” in order mark your expenses as claimed, not claimed or carried forward

respectively (Click here for more details - Credit Card Transactions

Confirmation)

Associates are responsible for paying their credit card dues, Cognizant will credit

reimbursements only to the salary accounts specified by the Associates.

The card has to be in the name of the associate

If the claimed amount is less than the amount defined, the excess would be carried

forward for the next month.

Reimbursement will be provided only in respect of one mobile connection, which should

be a “Post Paid” connection registered in the name of Associate.

Claims would be reimbursed as a part of the reimbursement cycle. Please refer to the

table on “Reimbursement Dates” for further details.

* All new joiners are recommended to avail of the services only from HDFC / ICICI Bank

(Despite holding an ICICI Bank credit card already). Associates who are currently

Controlled Copy Flexible Benefit Plan

C3: Protected Last Updated on 10/05/2011 Page 35 of 60

availing the reimbursements through an ICICI credit card can continue to do so by using

the same card.

Note: For SM and above there is a separate telecommunication policy, details of which can be

obtained at https://groups.cognizant.com/corporate/HR/India/Pages/HrPolicyTotalRewards.aspx

Conveyance Allowance

The conveyance allowance is a monthly benefit given to the associates.

Coverage: Up to Associate grade only.

Limit: Employees up to the grade of Associate will get an amount of Rs.800 as a conveyance

allowance.

Claim process and policy details

Associates need to define in FBP definition system.

Proof is not required to claim Conveyance Allowance.

Controlled Copy Flexible Benefit Plan

C3: Protected Last Updated on 10/05/2011 Page 36 of 60

Car Running Expenses

The Car Running Expense is a benefit extended to the associates towards fuel, chauffeur and

maintenance of an employee owned car which is used for official purposes.

Coverage: For SA and above grade only.

Limit: Car running expense can be claimed under the following heads, subject to a maximum

amount as prescribed below.

Component Engine capacity < = 1.6 litres Engine capacity > 1.6 litres

Only Fuel & Maintenance Rs. 1800 (per month) Rs. 2400 (per month)

Fuel & maintenance with

Driver Salary

Rs. 2700 (per month) Rs. 3300 (per month)

You are entitled to claim either Conveyance Allowance (up to a maximum of Rs. 800) or

Car Running Expense and you cannot claim both.

Taxability

Not taxable in the hands of the associate.

Claim process and policy details

Associates must declare the amount in the FBP definition system.

Associates should reimburse their fuel bills by making payments through the

prescribed credit card.

Associates can reimburse their Car Maintenance Expense either through the prescribed

credit card or through ESA claim by producing original bills.

Associates should reimburse Driver‟s Salary expense only through ESA by producing

the Driver Salary Claim Form duly filled and signed (Driver Salary Claim Form available

under the Forms link at https://mypay.cognizant.com)

Associates should follow the below steps for claiming their credit card based Car

Running Expense Reimbursements

Step 1: Procure an ICICI / Citibank / HDFC* credit card and use it to pay

mobile phone bills, Fuel and Maintenance bills (Refer the FBP Cards section

for detailed explanation on process of procuring and updating a Credit Card).

Controlled Copy Flexible Benefit Plan

C3: Protected Last Updated on 10/05/2011 Page 37 of 60

Associates who already possess an HDFC credit card may use the same for

payment of the above mentioned bills.

https://www.hdfcbank.com/applications/webforms/apply/cognizant_cc.asp

Step 2: Bank would share the information on the reimbursable spends which

would be updated in https://mypay.cognizant.com

Step 3: Confirm the spends on mobile bill as “Official”, “Personal” or “Next

Month” in order mark your expenses as claimed, not claimed or carried forward

respectively (Refer the Credit Card Transactions Confirmation section for

detailed explanation on claiming credit card based spends).

* All new joiners are recommended to avail of the services only from HDFC /

Citibank (Despite holding an ICICI Bank credit card already). Associates who are

currently availing the reimbursements through an ICICI credit card can continue to

do so by using the same card.

Associates need to make the Driver Salary / Car Maintenance reimbursement claim

through ESA as mentioned below (Refer ESA Claim Process section of this document

for detailed explanation with screenshots):

Step 1: Login to https://compass.esa.cognizant.com

Step 2: Click on Employee Self-Service link

Step 3: Select Expense Report and click on Create

Step 4: Select the INPREIMB – Indian Payroll Reimbursement template.

Description should be Driver Salary / Car Maintenance Reimbursement, select

Indian Payroll Reimbursement for category and India as default location

(Workflow available at Quick Reference Guide / Expense Report Creation User

Guide in the ESA site for further reference)

Step 5: Select India Payroll Reimbursement (Code : 1000029779) in the Project

expense details

Step 6: Claim your reimbursements under the Car Driver Salary / Car

Maintenance expense type (Code – C100101 for Driver Salary and C100102

for maintenance) (please note – No need to fax / scan expense report with

supporting)

Step 7: Documents to be sent by internal courier to respective location finance.

Original bills ( for Car Maintenance)

Controlled Copy Flexible Benefit Plan

C3: Protected Last Updated on 10/05/2011 Page 38 of 60

Print out of expense report from ESA

Driver Salary Claim Form duly filled and signed (Driver Salary Claim

Form available under the Forms link at https://mypay.cognizant.com)

Car must be registered only in the name of the associate and not any other name

Car should be currently registered in the State of the associate‟s current location. If the

car is registered in any other state; the associate has to submit an NOC and Road Tax

receipt from the State of the associates‟ current location (office).

Proof of ownership (RC book) needs to be submitted.

The associate is required to disclose any transfer of ownership of the vehicle, to the

company.

Associates are required to obtain an ICICI / Citibank / HDFC credit card and use it to

pay for expenses towards fuel and car maintenance. Remember, this card will also be

used to pay for expenses under the Mobile Reimbursement process.

For associates at SA and above grades who are not availing Car Running Expense for

reasons whatsoever but still would like to be provided for their conveyance, can avail of

Conveyance Allowance (Refer conveyance Allowance policy).

Associates cannot avail of Car running expense and Conveyance Allowance both at the

same time.

Claims would be reimbursed as a part of the reimbursement cycle. Please refer to the

table on “Reimbursement Dates” for further details.

Associates should follow the steps mentioned below to submit their documents

of proof for car ownership:

Step 1: Login to https://mypay.cognizant.com and navigate to My Updates then

to Proof of Car Ownership page

Step 2: Fill in the necessary details in the cover sheet and print the same

Step 3: Raise a GSD in https://gsd.cognizant.com under India Payroll Link.

CTI for Car ownership:

Category* Type* Item*

FBP /Reimbursements Car Running Expense Car Ownership – Proof & Registration

Controlled Copy Flexible Benefit Plan

C3: Protected Last Updated on 10/05/2011 Page 39 of 60

Attach the following documents

Scanned copy of filled forms (Cover Sheet)

Scanned copy of Car Registration Certificate (in associate‟s name)

Scanned copy of Road tax certificate (if car is registered in different state)

Scanned copy of NOC (if car is registered in different state)

Associates have to bear in mind the following while availing of this benefit:

The submission of proof of ownership is mandatory, failing which no further

reimbursements would be entertained under this benefit for the future months and

appropriate tax deduction would be made from the March month‟s salary for the

reimbursement already paid out

In case of a new vehicle the RC book of which is not yet delivered, the booking form

which has the proof of payment and name of owner can be used as a provisional

document for proof of ownership. However, the associate needs to submit a copy of the

RC book as soon as it is received. The provisional proof would be accepted only for 3

months from the date of purchase of the vehicle

Fuel expenses – Can only be claimed by Credit card

Driver‟s salary – Only by Cash (Driver Salary receipt and ESA claim process mentioned in the

FBP Policy document)

Car maintenance expenses – Credit card or cash (ESA claim process mentioned in the FBP

Policy doc if paid by Cash)

For queries on Car Ownership registration, Submission and approval of proof of Car

Ownership, associates can raise a GSD

GSD Navigation:

Log-on to https://gsd.cognizant.com with your network id and password

Click on „India Payroll‟ under Finance and chose the respective category, type and item

given above

Associates can call 469181 / 469178 for any queries

Other Queries on the Car Running expenses policy or Reimbursement related queries should be

raised against the contact points mentioned in the last page of this document.

Controlled Copy Flexible Benefit Plan

C3: Protected Last Updated on 10/05/2011 Page 40 of 60

FBP Cards

Meal Card

Associates can procure an HDFC Meal Card by following the process mentioned below:

Step 1: Logon to

https://leads.hdfcbank.com/applications/webforms/apply/foodplus.asp and click

the banner highlighted by the red box.

Step 2: Furnish all necessary details and click the Submit button. The meal card would be delivered at your work location within 10 business days.

Controlled Copy Flexible Benefit Plan

C3: Protected Last Updated on 10/05/2011 Page 41 of 60

Step 3: The Meal Card details have to be updated soon after receiving the

same. Click the Bank Information link under the My Update tab in

https://mypay.cognizant.com

Step 4: Update the Bank name and Meal Card number under the Food Card

Controlled Copy Flexible Benefit Plan

C3: Protected Last Updated on 10/05/2011 Page 42 of 60

Details and click the Submit button. Your Food Reimbursement definitions will

now start getting credited into your Meal Card.

Controlled Copy Flexible Benefit Plan

C3: Protected Last Updated on 10/05/2011 Page 43 of 60

Credit Card

Associates who currently do not possess a credit card for FBP reimbursement purposes can procure

an HDFC / ICICI / Citibank Credit Card.

Application/Procedure for mapping HDFC credit card to Cognizant can be done online by following

the process mentioned below:

Step 1: Logon to

https://leads.hdfcbank.com/applications/webforms/apply/cognizant_cc.asp

Step 2: Click the Yes button if you already possess an HDFC Bank credit card;

Furnish the necessary details and click the Submit button to map your existing

credit card. Once the card gets mapped, HDFC Bank will share your

reimbursable credit card spends to Cognizant for an upload in Mypay.

Controlled Copy Flexible Benefit Plan

C3: Protected Last Updated on 10/05/2011 Page 44 of 60

Step 3: Click the No button (for the first question) if you want to procure a new

card and click the Yes button (for the second question) if you have your salary

account with HDFC Bank. Follow the instructions provided in the webpage to

make an application for a new HDFC Bank credit card within 3 business weeks.

Controlled Copy Flexible Benefit Plan

C3: Protected Last Updated on 10/05/2011 Page 45 of 60

Step 4: Click the No button (for the first question) if you want to procure a new

card; Click the No button (for the second question) if you do not have your

salary account with HDFC Bank and click the Yes button (for the third question).

Follow the instructions provided in the webpage to make an application for a

new HDFC Bank credit card within 3 business weeks.

Associates can write to [email protected] for any queries

on HDFC Credit card.

Associates who wish to use an existing ICICI / Citibank credit card or would like

to procure one for the purpose of FBP reimbursement can follow the normal

process of procuring a personal credit card with these banks. Once the card is

delivered, associates need to provide a letter of consent (in the format

mentioned below) to the Bank for sharing the details of reimbursable spends

with Cognizant. This process is referred to as the process of “mapping the credit

card” for reimbursement purposes.

Controlled Copy Flexible Benefit Plan

C3: Protected Last Updated on 10/05/2011 Page 46 of 60

Process of Mapping Cards – ICICI Bank

Please find below the mail format which need to be used by associates for sending the mail to customer

care for mapping their cards under COG promo code.

Associates can write from their registered mail id to [email protected] with a cc to

[email protected] and [email protected]

Mail Format:

----------------------------------------------------------------------------------------------------------------------------- ------------

*Subject:* Cognizant Technology Solutions

Hi,

ICICI Bank Credit Card No.:

I *Name of Associate*, employee of Cognizant Technology Solutions employee number *xxxxx* am

holding the captioned credit card issued by ICICI Bank Limited. I have no objection in you sharing

the details of spends made on the captioned credit card with Cognizant Technology Solutions.

Regards

(Associate Name)

Process of Mapping Cards – Citibank

Please follow the steps below:

Send in a letter of consent

Please send a mail from your mail id registered with Citibank to [email protected] with the

following message:

“I am an employee of Cognizant Technology Solutions (CTS) employee no ___________ and I

hold a Citibank Credit Card no.___________. I hereby authorize Citibank to share with CTS, the

transaction data from the credit card statement of my above-mentioned credit card.

I understand and hereby acknowledge that Citibank shall disclose my said personal

data/information to CTS only on the basis of this authorization provided by me and that Citibank

shall not be liable to me for any loss or damage that I may suffer/incur as a consequence of

disclosure of the said data/information by Citibank. I shall not, at anytime in future, hold Citibank

liable and shall not bring any legal action against it, for any reason whatsoever, for disclosing

the said information.”

Update your card number

As soon as card number is mapped, you will receive a notification from the FBP Team. Once

you receive this notification, please update your card number in the appropriate place at

https://mypay.cognizant.com.

Start using your card

Please start using the card for the reimbursable expenses only after the above steps are

completed. The bank will not share „spends‟ data if the card is not properly mapped.

Controlled Copy Flexible Benefit Plan

C3: Protected Last Updated on 10/05/2011 Page 47 of 60

Process of Mapping Cards – HDFC Bank

Please refer to Step 2 in the card application section for details regarding the same.

Step 5: The Credit Card details have to be updated soon after receiving the same. Click the Bank Information link under the My Update tab in https://mypay.cognizant.com

Step 6: Furnish the necessary details and click the Submit button. The spends will now be available for your confirmation in Mypay for reimbursement

Controlled Copy Flexible Benefit Plan

C3: Protected Last Updated on 10/05/2011 Page 48 of 60

Credit Card Transactions Confirmation

Associates need to procure a credit card, get it mapped and update the credit card

information at https://mypay.cognizant.com before proceeding to this step (Refer FBP

Cards section for assistance on procuring, mapping and updating credit card details).

Please note that all reimbursable expenses will be credited into the salary account of

the associate and no payment will be directly made by Cognizant towards the credit

bills.

Associates need to confirm specific credit card expenses which are reimbursable in

accordance with the FBP policy for the Payroll Team to credit the same.

After completing the pre-requisite steps associates can follow the process mentioned

below to confirm their credit card transactions.

Step 1: Click the Credit Card Transaction Confirmation link under the My Update

tab

Controlled Copy Flexible Benefit Plan

C3: Protected Last Updated on 10/05/2011 Page 49 of 60

For Queries on Credit card transactions confirmation, Please reach out to Payroll support @

56666 Extn: 3 followed by 2.

Controlled Copy Flexible Benefit Plan

C3: Protected Last Updated on 10/05/2011 Page 50 of 60

Step 2: Click the Edit button available against the specific expense to be claimed

Step 2: Change status to Official to claim reimbursement, Personal to not claim or Next Month to carry forward the expense and claim it later and click the Update link

Controlled Copy Flexible Benefit Plan

C3: Protected Last Updated on 10/05/2011 Page 51 of 60

ESA Claim Process

The Enterprise Service Automation (ESA) system needs to be used to claim the LTA,

Driver‟s salary reimbursement and Car Maintenance reimbursement. (Please note Car

Maintenance expenses can also be claimed through the prescribed credit card)

Associates can follow the process mentioned below to confirm their credit card

transactions:

Step 1: Login to https://compass.esa.cognizant.com

Controlled Copy Flexible Benefit Plan

C3: Protected Last Updated on 10/05/2011 Page 52 of 60

Step 2: Click on Employee Self-Service link

Step 3: Select Expense Report

Controlled Copy Flexible Benefit Plan

C3: Protected Last Updated on 10/05/2011 Page 53 of 60

Step 4: Click the Create link

Step 5: Select the INPREIMB – Indian Payroll Reimbursement template.

Controlled Copy Flexible Benefit Plan

C3: Protected Last Updated on 10/05/2011 Page 54 of 60

Step 6: Description should be Driver Salary / Car Maintenance Reimbursement

/ Leave Travel Allowance, (as the case may be); select Indian Payroll

Reimbursement for category and India as default location (Workflow available at

Quick Reference Guide / Expense Report Creation User Guide in the ESA site

for further reference)

Controlled Copy Flexible Benefit Plan

C3: Protected Last Updated on 10/05/2011 Page 55 of 60

Step 7: Claim your reimbursements under the LTA, Car Driver Salary / Car

Maintenance expense type (Code – C100100 for LTA, C100101 for Driver

Salary and C100102 for maintenance). Please click the “Look up” icon for ease

of selecting the expense type. Click the Submit button to complete the process

of claim.

Step 8: Documents to be sent by internal courier to respective location finance.

Printed Expense Report

Original documents (Refer to the specific benefit component for

information on original documents required)

Associates can reach out to [email protected] in case of any technical issue

Controlled Copy Flexible Benefit Plan

C3: Protected Last Updated on 10/05/2011 Page 56 of 60

Points to Remember

Election of the components for the Flexible Benefit Plan can be made only between 5th

and 25th of every month:

If 5th falls on a weekend or holiday, the system would be available from the next

working day.

If 25th falls on a weekend or holiday, the system would be available till the

previous working day.

All FBP components are available for redefinition on a monthly basis

Kindly note that ICICI / Citibank / HDFC credit card to be used are personal cards and

associate are required to get in touch with the respective bank officials regarding any

issues, including procurement.

If your Date of joining falls on or after 20th

of every month, you will be able to access

Mypay latest by 10th of the following month.

All bills submitted for claim (Medical, Mobile, Car Running Expenses, LTA) will have to

be dated Post the Date of Joining. Any bills date before the Date of Joining of the

associate in Cognizant will not be approved and reimbursed.

Reimbursement dates

FBP Component Deadline for claim /

Declaration

Date of Reimbursement

Leave Travel Allowance (LTA)-

Non Taxable

Bills approved in the current week Paid on the salary day

Leave Travel Allowance (LTA)-

Taxable

Reports submitted in the current

month

Paid as part of salary

Car Running Expenses (Through

ESA)

Bills approved in the current week Within 10 days after the approval

Car Running Expenses (Through

Credit Card)

Bills paid during the month 21st of the following month

Medical Reimbursement Bills submitted for the month 10th

of the following month

Controlled Copy Flexible Benefit Plan

C3: Protected Last Updated on 10/05/2011 Page 57 of 60

Mobile Reimbursement (Through

Credit Card)

Bills paid during the month 21st of the following month

Food reimbursement Definition made during the

current month

Loaded towards the food card on the

salary day

For food card, unless the card details are entered in Mypay, the amount will be loaded to the card on

the salary day. It will be loaded as arrears amount once the card details are entered in

https://mypay.cognizant.com

Though the election mode is available on monthly basis, it is recommended that the

associate makes an election on a yearly basis to have a better plan of his / her salary.

Contact Points – Helpdesks

Only for Policy Related Clarifications

Associates can raise GSD requests in https://gsd.cognizant.com Finance India

Payroll with the below CTIs :

Category* Type* Item*

FBP /Reimbursements Car Running Expense Policy Related - Driver's Salary

FBP /Reimbursements Car Running Expense Policy Related - Fuel

FBP /Reimbursements Car Running Expense Policy Related - Maintenance

FBP /Reimbursements Car Running Expense Procedure for Credit card mapping

FBP /Reimbursements Food Card Policy Related

FBP /Reimbursements LTA Policy Related

FBP /Reimbursements LTA Reimbursement method

FBP /Reimbursements Medical Reimbursement Policy Related

FBP /Reimbursements Mobile Reimbursement Policy Related

FBP /Reimbursements Mobile Reimbursement Procedure for Credit card mapping

FBP /Reimbursements Superannuation Fund Policy Related

VNET: 445560 / 445559

Controlled Copy Flexible Benefit Plan

C3: Protected Last Updated on 10/05/2011 Page 58 of 60

Salary / Reimbursement Credit / Tax Related Queries / Approval of

FBP bills / Credit card transactions confirmation

Call GSD Helpdesk (VNET 56666, Please dial 3 followed by 2 for Payroll Voice Support)

or

Associates can also raise GSD requests in https://gsd.cognizant.com Finance

India Payroll

Category* Type* Item*

FBP /Reimbursements Car Running Expense Car Maintenance, Insurance, Driver's Salary

FBP /Reimbursements Car Running Expense Credit status

FBP /Reimbursements Car Running Expense Missing credit card Transactions

FBP /Reimbursements Credit Card mapping Bank POC not responding

FBP /Reimbursements Food Card Amount not credtied/loaded in Food card

FBP /Reimbursements Food Card Food Card Issue

FBP /Reimbursements Leave travel allowance Unclaimed amount

FBP /Reimbursements LTA Claiming Process

FBP /Reimbursements LTA Credit Status

FBP /Reimbursements LTA Document Submission / Approval Status

FBP /Reimbursements Medical Reimbursement Apollo medical card

FBP /Reimbursements Medical Reimbursement Claiming Process

FBP /Reimbursements Medical Reimbursement Credit Status

FBP /Reimbursements Medical Reimbursement Proofs and credit

FBP /Reimbursements Medical Reimbursement Proofs/Manual bill status

FBP /Reimbursements Mobile Reimbursement Credit status

FBP /Reimbursements Mobile Reimbursement Missing credit card Transactions

FBP /Reimbursements Mobile Reimbursement Payment Issues

FBP /Reimbursements NPS Enrolling

FBP /Reimbursements NPS Status

FBP /Reimbursements Superannuation Fund Enrolling and login

Tax Exemption 80C Query

Tax Exemption Higher education loan Query

Tax Exemption House rental allowance Query

Tax Exemption Loss on House property Query

Tax Exemption Mediclaim Query

Controlled Copy Flexible Benefit Plan

C3: Protected Last Updated on 10/05/2011 Page 59 of 60

Proof of Car Ownership – Submission and Approval

Associates can raise a GSD with the following CTI in https://gsd.cognizant.com

Finance India Payroll

Category* Type* Item*

FBP /Reimbursements Car Running Expense Car Ownership – Proof & Registration

VNET: 469181 / 469178

Finance Point of Contacts for Claims Submission

(For All Reimbursable FBP Components)

Bangalore Girija Damodaran, Finance Team, Baghmane Tech Park, C.V.Raman Nagar

Kolkata Shreya Jain, Finance Team, Saltlake Electronic Complex

Hyderabad Mahesh Maturi, Finance Team, The V Park, Auriga Block

Chennai Payroll department, 6

th Floor, CCO, Menon Eternity Building, St.Mary‟s road

Alwarpet,

Pune Bhagyashri kulkarni, Finance Team, MIDC, Pune Infotech Park, Hinjewadi

Coimbatore Subashini Thiagaraj, Finance Team, Mountain View Campus, Coimbatore

Kochi Ajith Kumar Raveendranadhan Nair, Finance Team, Cochin

Mumbai Vivek Bichkar , Finance Team, Kensington SEZ

Gurgaon Prakash chander, Finance Team, Signature towers

Superannuation Transfer/Closure:

https://gsd.cognizant.com Finance India Payroll

Category* Type* Item*

FBP /Reimbursements Superannuation Fund Superannuation closure

FBP /Reimbursements Superannuation Fund Superannuation transfer

E-mail: [email protected]

Controlled Copy Flexible Benefit Plan

C3: Protected Last Updated on 10/05/2011 Page 60 of 60

Food Card Bank Contact points

Associates can write to [email protected] and [email protected]

for the following queries/clarifications:

1. Balance Transfer from old food card to new food card

2. Office Address (Pin Code) and mobile no update in HDFC records

3. Per Day amount limit (if any) in your card

4. Food card damage

5. Food card applied and not received after 7 working days

6. Loss of HDFC Food card and application for a new card

Please refer to the documents on FBP Policy and FAQ in the below link to know the Eligibility

and claim process for the various FBP Components:

https://groups.cognizant.com/corporate/HR/India/Pages/FlexibleBenefitPlan.aspx

Associates are also requested to read through all the other FBP Documents on the home page of

https://mypay.cognizant.com for better understanding of the FBP Framework.