Farm-in opportunity in Kenya 190315 v2 - Edgo Energy

Transcript of Farm-in opportunity in Kenya 190315 v2 - Edgo Energy

KENYA ONSHORE, LAMU BASIN Block L14 FARM-‐IN OPPORTUNITY ___________________________________________________________

1

Lamu Oil and Gas, a joint venture between QFB and Edgo Energy, is seeking one or more partners, to continue exploration of their highly attractive exploration acreage onshore Kenya. Lamu Oil and Gas is seeking a co-‐venturer to acquire a portion of its 100% working interest in the 11,014 km2 exploration acreage in Kenya. In return the co-‐venturer will fund a disproportionate share of the planned 2015/16 2D seismic programme and make a contribution to past costs. The completed 734 km reconnaissance 2D seismic in the initial exploration period has shown two sub basins to exist in the block. The eastern sub basin has elements of a working Tertiary and Cretaceous petroleum system already proven offshore in the Lamu basin. The next step in the first additional exploration period is the acquisition of 1,000, 2 to 4 km spaced 2D infill seismic, mapping the prospects and defining a drill location in the high graded areas with the highest probability of finding a hydrocarbon play in the eastern sub basin. Following interpretation of this data, a first exploration well is scheduled in the 2nd exploration period, which will start in July 2016. The seismic acquisition programme is located within 75 km of the developed coastal area, and is ideally located to supply the increasing local demand for energy.

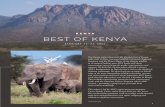

Figure 1. Kenya – License Map with Block L14

KENYA ONSHORE, LAMU BASIN Block L14 FARM-‐IN OPPORTUNITY ___________________________________________________________

2

Introduction and work programme Edgo Energy is an independent upstream oil and gas company with oil and gas properties in Africa and Central Asia and is a subsidiary of the Edgo Group (www.edgo.com), a well established international private company that has for nearly 60 years pioneered businesses in energy, oil field services, water and power, and infrastructure in the Middle East and Africa. QFB is a leading investment bank established in 2008 and regulated by the Qatar Financial Center. The bank has a strong track record of direct investments with over US$1 billion of investments made for its own balance sheet and on behalf of its investors. The bank's target market has been MENA, Turkey, East Africa and Europe. The target sectors include Real Estate, Oil & Gas, Financial Services, Health Care, and Industrials. The bank has a diversified shareholder base comprising investors from Qatar and the rest of the GCC. Block L14 was awarded to Lamu Oil and Gas on the 5th of July 2012. The work commitment for block L14 is: • first exploration period (2 years), US$5,250,000 minimum financial commitment to fund 500

km 2D seismic. Commitments have been satisfied with the acquisition of 734 km of 2D seismic. • first additional exploration period (2 years) entails a $20 million minimum spend commitment

to fund a 1000 km 2D seismic programme or drilling a well to 3000 metre depth. • second exploration period (2 years) entails a $20 million minimum spend commitment to fund

drilling a well to 3000 metre depth.

Lamu Oil and Gas agreed a work scope change for the first additional exploration period, which the Cabinet Secretary of the Ministry of Energy and Petroleum officially approved, on January 14th 2015, replacing the 500 km2 3D seismic programme with a 1000 km 2D seismic infill programme. The start date of the first additional period has been agreed to be 5th of December 2014.

The agreed work program for 2015 has an estimated technical budget of US$7.5 million and notional technical budget for 2016 of US$10 million, which will fund the exploration programme, its interpretation and exploration well proposal in the first additional period.

2012$ 2013$ 2014$ 2015$ 2016$ 2017$ 2018$ 2019$

Ini$al'Period' First'Addi$onal'Period' Second'Period'

734'km'2D'seismic'' 1000'km'2D'seismic' Explora$on'Well''

Gravity/Magne$cs' Prepare'to'Drill'

Commitments'fulfilled' US$20'million' US$20'million'

KENYA ONSHORE, LAMU BASIN Block L14 FARM-‐IN OPPORTUNITY ___________________________________________________________

3

Regional Setting Block L14 is located along the western flank of the Lamu Basin, forming the link between the Anza Graben and the offshore Davie fracture zone, which extends offshore through Tanzania and Mozambique. The dominant North-‐West to South-‐East trends have been formed by rift and strike-‐slip faulting and provides structuration and trapping potential. No wells have been drilled on the block. The onshore Lamu Basin was originally explored in the 1960s to mid 70s by BP/Shell, who drilled 8 wells (2 in the near offshore), and located these wells on low fold dynamite seismic. Most of these wells did not reach beyond the Tertiary, with frequent oil and gas shows and a few tested wells produced hydrocarbons to surface. The petroleum system in the Lamu basin has been recently proven by the Mbawa-‐1 offshore gas discovery drilled by Apache in 2012 (52m net gas column, 110-‐330 bcf gas in Kofia sand reservoir) and the Sunbird-‐1 offshore hydrocarbon discovery drilled by BG in 2014 (oil column 14m gross / 9.2m net and gas zone 29.6m gross / 28.3m net in Miocene limestone pinnacle reef). Prospectivity Since July 2012 Lamu Oil and Gas has undertaken and integrated several technical studies in Block L14 to evaluate the area. Integrated review of BP/Shell seismic paper sections, nearby well logs, well reports and CNOOC acquired aeromagnetic gravity data have identified four plays as exploration targets. • Permian to Lower Jurassic play: prospective in the north western part of L14. The Calub field in

the Ogaden basin in Ethiopia may prove a direct analogue. • Lower Cretaceous play: currently regarded as a secondary target with possible analogue fields

in Sudan. • Upper Cretaceous play: prospective in the central horst and graben system identified in L14

with possible analogue fields in Sudan. • Eocene play: potentially the most prospective due to the presence of oil prone source rocks

offshore. Adequate burial of source rocks required in the central part of the central graben in L14.

These plays have been tested and interpreted with the acquired 735 km 2D seismic survey of 2013/14 that has recently been processed to pre-‐stack time migration. The interpretation has identified two parallel sub basins. The western sub basin appears to be post karoo in age. The age of the sediments is probably Jurassic/Cretaceous. Further play interpretation using the gravity/seismic interpretation, outcrop information and analysis of burial and uplift history of the sub basin will determine the potential of this interesting area.

KENYA ONSHORE, LAMU BASIN Block L14 FARM-‐IN OPPORTUNITY ___________________________________________________________

1

Figure 2. East to west seismic line interpretation of the Tertiary Eastern sub basin and likely permian/jurassic Western sub basin. Sub basins mapped on Gravity map. Lamu Oil and Gas has focused on the petroleum system in the eastern sub basin of Cretaceous/Tertiary age. The eastern sub basin is shown to have excellent reservoir, Kipini sandstone in the Eocene and Kofia sandstone in the upper Cretaceous. Seal potential off the Walu-‐Kipini high exists through good sand-‐seal inter-‐fingering. Miocene reefs might be present in the south of the eastern sub basin in L14, which would be on trend with the BG Sunbird-‐1 oil discovery.

Figure 3. East to West seismic line interpretation of the eastern sub basin showing the reservoir formations, postulated Danian source rock and migration paths. On the right the structural leads that require infill 2D seismic to define a drill location. Source rock modelling shows, using conservative and defendable assumptions as source rocks have yet to be penetrated by a well in the Lamu basin, that well over a billion barrels of oil and multi tcf of gas could have been expelled and have migrated into traps. The seismic 2D infill programme is designed to map the Cretaceous reservoir structural traps sourced up from the faults east and west from the Tertiary sub basin. These interpreted areas are large and therefore provide excellent potential for trapping. Petroleum system timing analysis shows that Cretaceous traps are present throughout all oil expulsion and for the Tertiary traps during later oil expulsion.

Eastern sub-basin

Tertiary age

Western sub-basin

Permian-Jurassic age

L14

L20

L6

Courtesy of Milio for gravity data in L20