Exclusive Financing Opportunity into Rare Alpaca Manufacturer

-

Upload

patrice-mueller -

Category

Economy & Finance

-

view

148 -

download

1

description

Transcript of Exclusive Financing Opportunity into Rare Alpaca Manufacturer

Creating a new

reliable luxury supplier in

the Peruvian Alpaca sector !

By Swiss Corpoarte Advisors SAC

February 2014

Important: Disclaimer and Confidentiality Statement This information memorandum (hereafter "Memorandum") is based on information received from the Board of the Company (hereafter the "Board") and from other sources believed to be reliable, which has not been independently verified by Swiss Corporate Advisors SAC (hereafter “SCA"). This Memorandum has been prepared by SCA along with and on behalf of the Board, legal representative of the Company (hereafter the “Company") for the purpose of providing interested parties with general information to assist them in their evaluation of the Company’s project of development (hereafter the “Project"). This Memorandum is for information purposes only and does not constitute, and shall not be interpreted as being, an offer for sale or the basis of a contract. Only those representations and warranties made in a definitive, written financing agreement, and subject to such limitations and restrictions as may be specified therein, shall have any legal effect. By accepting this Memorandum the recipient agrees to keep permanently confidential all information contained herein, as well as any other subsequent written or oral communication transmitted or otherwise made available to a prospective investor. This Memorandum may only be made available to the recipient's members of staff or their professional advisors directly involved in its appraisal. Neither the Memorandum, nor the information which is subsequently furnished, shall be duplicated or made available under any circumstances to any other party without the prior written approval of I&H. The paragraphs herein stipulated in Disclaimer and Confidentiality Statement shall be treated as being in addition to, and not replacing, the terms of the confidentiality letter which was signed by the recipient prior to receipt of this Memorandum. This Memorandum has been completed in good faith. However, neither SCA nor the Board accepts any responsibility for the information contained in this Memorandum or in regard to the assets and business to be financed, or for any omission, and shall not be liable for any loss or damage arising as a result of reliance on this Memorandum. Any prospective investor must make his own investigations as to the accuracy and completeness of this information, and may rely solely on any express representations, warranties and undertakings included only in any final financing agreement entered into. The Board reserves the right to negotiate with one or more prospective investors at any time and enter into definitive agreement for the financing of the Company and or related assets without prior notice to the recipient or other prospective investors. Further, they reserve the right not to finance the Company and or related assets and to terminate at any time further participation in the investigation and proposal process by any party and to modify data, documentation and other procedures without assigning any reason there to. In supplying this Memorandum, neither the Board nor SCA commits to subsequently supplying the recipient with additional information. Nothing contained in the Memorandum is, or shall be considered as, a promise or representation as to the past or the future performance of the Company, nor shall be considered as an indication that there have not been changes in respect of the business or assets of the Company subsequent to the date of preparation of this Memorandum. SCA has been exclusively retained by the Board as its financial advisor for this transaction and does not consider any other person or entity (whether they have received this Memorandum or not) as its client in relation to this transaction. We suggest that any prospective investor interested in the Company retains its own financial advisors in this regard. SAC acts as agent for the Board, and shall incur no personal liability under any contract which may be entered into with the purchaser. This numbered copy of this Memorandum remains the property of SCA and must be returned upon termination of the recipient's appraisal process.

Executive Summary

1. Alpaca Sector in Perù: Perù produced 92% of the World Alpaca fiber output in 2012. All

150’000 breeders are artisanal workers and two Groups of Alpaca yarns concentrated 75% of the

manufacturing sector. In consequence, Perù has suffered from disrupted production and

manufacturing bottle-necks. Emergence of new players will boost the development of the sector and

create a new dynamism within the yarn & textile manufacturing industry …

2. The Company: It is a Peruvian family company which purchases, conditions raw materials,

manufactures semi and finished products and commercialises Alpaca clothes via external retailers.

Fortunately, the Company is a rare fully integrated manufacturer, from purchase of raw fibers to

finished textile products and has significant manufacturing capacities in the central region of Perù…

3. Market opportunity: World personal luxury goods industry, in particular menswear enjoyed

strong growth and this trend is expected to continue up to 2020. Italy, France and USA accounts

71% of the world luxury brands. Italy is the leader in manufacturing luxury menswear and supplies

the major Groups and brands. Alpaca fiber is perceived as an innovative material for luxury

menswear. Only few Italian players are sourcing Alpaca fiber directly from the Peruvian breeders.

But not all…

4. Company development project: The Company is one of the very few Alpaca manufacturers

who is fully integrated and ideally located to reorganize production sector and increase

manufacturing capacities. With enhancement of Alpaca quality, it shall become the new Alpaca

supplier and once can represent the “Supplier of Choice” of all major luxury brands. This

development project request a financing of USD 1’000’000, for interested partners of the luxury

industry, in order to benefit of a reliable high quality Alpaca yarns, fabrics & textile “Supplier of

Choice”. In this regards, partnerships, Joint-Ventures and strategic alliances are welcome…

February 2014

1. World Alpaca production

1.1 World production of Alpaca The world production of Alpaca fiber was 5’300 tons in 2012. Perù is the leading Alpaca fiber

producer. It represents 92% of the world output. Since 2006, Peruvian exports of Alpaca increased

by 39% or 6% yearly !

3 000 000

3 200 000

3 400 000

3 600 000

3 800 000

4 000 000

4 200 000

4 400 000

4 600 000

4 800 000

5 000 000

2006 2007 2008 2009 2010 2011 2012

PERÙ – Alpaca EXPORTS 2006 to 2012

Rest of the WORLD

8%

PERÙ

92%

February 2014

Source: SCA/Customs Perù

Source: SCA/Minagri

1. Peruvian Alpaca sector

1.1 Alpaca supply-chain & market size Peruvian Alpaca sector is structured in two major parts: The family breeders (Production of raw

fiber) and the specialized yarns mills (Manufacturers I) which both represent an equivalent of 97%

of all Peruvian Alpaca products exported in 2012 (excl. by-products). The manufacturing sector is

under-developed.

48 mio Market size 195 mio 350 mio 455 mio

Huacaya

Alpaca

February 2014

Source: SCA

1. Peruvian Alpaca sector

1.2 Alpaca production Over 150’000 families produced 4’900 tonnes of fiber in 2012. These families are selling raw Alpaca

fiber (called “mix”) at USD 10 per kilo to producers associations or independent traders. With 50

animals, breeders earn < USD 120 monthly. Raw fiber represents a market size of USD 48,5 million.

For conditioning purpose, Alpaca raw fiber is cleaned, washed and classified. It is classified in 6

levels of quality, the best Royal Baby Alpaca worth USD 30 per kilo and the Baby Alpaca USD 25.

Depending on the regions or races, 1 kilo of mix Alpaca fiber produces 2% to 5% of Royal and 15%

to 25% of Baby Alpaca. Lowest quality level is sold at USD 1,5 per kilo, dedicated to by-products.

Conditioned fiber represents a market size of USD 136 mio. Peru exports 91% of Alpaca fiber.

1.3 Alpaca manufacture I & II There are 7 specialized mills of Alpaca yarns in Perù. The two majors mills are concentrating 75%

of the sector. Both are located in Arequipa. The other mills are located in Lima, the capital and only

one in Huancayo. Price of 100% top Royal Alpaca yarns reaches up to USD 100. Yarns market size

represents USD 195 million. Peru exports only 6% of Alpaca yarns.

The specialized mills are selling yarns to many local Alpaca fabrics and textile manufacturers.

These textile manufacturers are selling finished clothes to the national market. Only 3 mills are fully

integrated and can commercialize finished textile products to national and international markets.

Finished Alpaca textile products represents a market size of USD 350 million. Peru only exports 1%

of Alpaca fabrics and 1% of Alpaca textiles. It has only 2 recognized brands, Kuna (Inka Group) and

Sol Alpaca (Grupo Mitchell), but they are not relevant in Peruvian exports (0%) and luxury industry.

February 2014

1. Peruvian Alpaca sector

1.4 Production opportunity statement Unfortunately, the Peruvian Alpaca sector remain underdeveloped, ineffective in production, over

concentrated in manufacturing and suffers from a lack of competition to revitalize the internal market

and the Peruvian exports.

■ Lack of investments in industrial production infrastructures for breeders to increase capacity

and to enhance quality of raw fiber of Alpaca.

■ Ineffective and costly organisation system of raw fiber collection between family breeders

and major specialized Alpaca mills, where prices increase sharply without providing any

added-value to the product.

■ Lack of competition and bottle-necks for specialized Alpaca mills to support substential

R&D activities and offer constant innovative high quality yarns in large volume to the national

customers and to international luxury brands,

■ Very limited manufacturing capacity of Alpaca fabrics & textiles to provide serious supply

alternatives and offer significant Alpaca product diversification to national and international

customers.

The is an opportunity for a new strong manufacturer of yarns,

fabrics and textile products within the Peruvian Alpaca sector

February 2014

2. Company profile

2.1 The selected Company It is a Peruvian registered company, with offices in Lima and with manufacturing facility in

Huancayo, Perù. It was found in 2001 by the present CEO and his wife, who are both active in the

Company. The CEO is a well experienced engineer who worked during 15 years at Mitchell & Co -

the major Alpaca integrated group (yarns, fabrics & textile manufacturer and fashion brand Kuna).

The Company purchases raw Alpaca fibre directly from family producers and associations of

producers in the centre of Peru. It conditions, manufactures yarns, fabrics and makes Alpaca textile

products which it commercializes in Peru and to few international clients.

Presently the Company has its own Alpaca yarn, fabric and textile facility in Huancayo. The

manufacture employs 60 local families and has created adapted structure for Peruvian women to

work in good conditions (kindergarten). It produces between 800kg to 1’000kg of Alpaca products

monthly.

The Company commercializes a wide variety of Alpaca fashion products (>250 models) through a

large network of 100 independent multi-brands retailers in key cities and places of Peru. Retailers

are located at the touristic sites (Machu Picchu, Pachacamac), on the traditional touristic routes

(Lima Airport, Cusco city, Paracas seaside…), as well in modern areas of Lima (Miraflorès

Larcomar, Palacio area, Jockey Plaza, Polo Center, …).

February 2014

2. Company profile

2.2 Infrastructures, know-how and Suri The Company is one of the 3 rarest specialized Alpaca

company in Perù with a fully integrated infrastructure

and production know-how, with activities starting from

collection of raw fiber to the production of final textile

products and their commercialization.

It is the only significant manufacturer of Alpaca fiber to

be established in the center of Perù with a dedicated

manufacturing facility (Huancayo). It is also the heart of

the Andean region where the rare population of Suri

Alpaca lives (Suri race is only 5% of the total Alpacas).

Processing unique Suri Alpaca fiber request a specific

know-how and represents significant innovation

opportunity for demanding customers.

It already developed advanced social responsibility

management programs for its employees at the

manufacturing site, in providing “kindergarten” services

to the young family mothers who are working in the

manufacture. Other fair trade programs are planed for

future implementation.

February 2014

Source: SCA

Perù

Suri Alpaca

2. Company profile

2.3 Company opportunity statement The specific location of the Company manufacture in Huancayo, at only 7 hours drive from Lima

offers the Company an exceptional opportunity of development. The central region of Perù - heart of

Suri Alpaca territory -, even more than the country in its whole suffers from:

■ Limited investments in industrial production infrastructures for breeders to increase

capacity and to enhance quality of raw fiber of Alpaca, in particular for Suri Alpaca.

■ Ineffective organisation system of raw fiber collection between family breeders and

the Company, where prices increase without providing any added-value to the product.

■ Lack of Alpaca mills and absence of specific Suri Alpaca yarns production capacity in

the central region of Perù,

■ Absence of manufacturing capacity of specific Suri Alpaca fabrics & textiles to

provide a differentiated supply and to offer innovative Suri Alpaca fashion collections to

demanding national and international customers.

There is a unique opportunity for the Company to develop its

manufacturing infrastructure in the central region of Perù,

where there are no competitors.

February 2014

3. Market Opportunity

3.1 Alpaca natural fiber as luxury raw material Alpaca fiber is a rare natural raw material, and benefits of all qualities and considerations to become

a luxury raw material, Alpaca is:

February 2014

■ RARE: It has a limited production capacity, due to the region where Alpaca

animal can be grown, due to the forbidding export of Alpaca animals, the low

rate of high quality fibers (from 17% to 30%) that each animal produces.

■ RESISTENT: It very resistant to humidity, fire and other micro-organisms.

Clothes keep their appearance and shape over the time.

■ COMFORTABLE: It offer a high level of clothes comfort, because the fiber is

soft, warm and elastic. Its texture has a silky touch.

■ AUTHENTIC & NATURAL: Alpaca is a natural

fiber, produced by authentic wild or domesticated

animals in comparison to synthetic fibers. Most of

fiber colours are natural and clothes made without

chemical treatments. Luxury clothes are “100%

Alpaca” made.

■ GOOD IMAGE: It transmits a positive image of

peaceful and friendly animals which can be

domesticated and use to play with children.

3. Market Opportunity

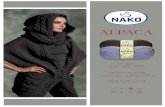

3.2 Luxury fiber alternatives Alpaca fiber is one of the World finest fibers, among famous Vicuña, Mohair and Cashmere.

Fibers have a thinness between

18µ to 26µ, and is easy to

spin and manufacture.

Luxury brands are

offering Alpaca

products 60%

cheaper than

Cashmere

ones.

February 2014

Source: SCA

3. Market Opportunity

3.2 Luxury fiber alternatives Alpaca fiber is complementary to other luxury fibers within the industry, in particular with Cashmere

which has similar characteristics but different prices:

■ Cashmere

Alpaca (approx 4’900 tonnes/year) has similar production volumes with Cashmere (approx. 5’200

tonnes/year), as well as similar high quality fiber characteristics (Use comfort). Presently, high quality

Alpaca (USD 30) has prices 50% to 70% lower than similar Cashmere quality (USD 90 to 100).

Alpaca fiber is much less known by final consumers, even if image of Alpaca (Llama type) animal is

certainly much more attractive than Cashmere coats (Sheep type). Alpaca and Cashmere clothes or

products can be same or sold to the same consumers

■ Vicuña/Guanaco

Vicuña and/or Guanaco fiber is out of competition, it thinness is incomparable to any other luxury

fiber. In consequence, Vicuña products are simply out of access for any other luxury textile products.

■ Mohair, Angora & other natural quality fibers

Mohair is mainly use for its furs, even if thinness and softness is exceptional. Therefore, Mohair,

Angora and Cashmere are facing some hypoallergenic phenomenon which make more difficult for

such products to be sold. Mohair also suffers from the Sheep image, Angora from the Rabbit image.

Rabbit are domesticated directly by end-users and could affect relation between the product and the

consumers.

February 2014

3. Market Opportunity

3.3 Luxury markets & menswear sector Luxury goods industry is one of the world fastest growing market, with 33% constant sales increase

during the last 7 years. Luxury menswear sector was facing double digits growth, and this trend is

expected to continue up to 2020. Italy is the leading menswear industry with world recognition. Major

Italian luxury brands benefit from this positive growth and strong demand.

February 2014

Source: Bain & Co

Source: SCA/Bain & Co

3. Market Opportunity

3.3 Luxury markets & menswear sector Zegna, Ferragamo, Loro Piana, Brioni, Canali…are finding in Alpaca fiber a new and innovative luxury

raw material. They can offer attractive fashion collections to its very demanding clients. USA, Japan,

Europe are the major exports markets, therefore strong growth comes directly from emerging markets

such as China, Russia… Other large fashion brands, most of which belongs to world top Luxury

Groups (LVMH and Kering in France) are facing similar trends.

Major luxury menswear manufacturers in Italy,

UK or USA are looking for new sources of rare

raw materials, who can provides consistant

quality, large volumes at attractive prices.

Italian players are presently looking for sizable

luxury «suppliers» of high quality fibers in their

respective producing countries (Perù for

Alpaca).

Luxury menswear (and also womenswear at

lower pace) is facing very strong demand.

Pressure is transmitted to producing countries.

Luxury menswear is very fragmented, with

some world-known brands and many other

small independent companies – bespoke

tallers.

February 2014

Source: SCA

3. Market Opportunity

3.4 Market opportunity statement Luxury menswear is facing strong World demand and is requesting reliable suppliers of rare raw

materials such as Alpaca. The luxury, in particular the menswear industry is

There is an exceptional opportunity for Perù to create and to

develop a strong manufacturing industry of luxury yarns,

fabrics & clothes and become a reliable supplier

of the world major luxury brands.

■ Facing strong 5% average grow rate since 2006, and it will continue up to 2020 !

Luxury is crisis resilient.

■ Luxury menswear brands are looking for strategic access to rare raw materials, in

order to secure supply and keep exclusive differentiation potential from the competition.

■ Alpaca offers a new & innovative luxury raw material with high potential of

differentiation and with a positive image (peaceful and friendly animal).

■ As major producer of Alpaca, Perù represent the right partner for luxury menswear

brands to purchase luxury fibers.

February 2014

4. Project of Development

4.1 Create a new sizable manufacturer in Central Perù It has the possibility to develop its manufacturing capacity in Central Perù where no competitors and

very little other local low quality producers lives. It will optimize supply-chain, secure integration of all

manufacturing processes internally and develop its production in volume (industrial & semi-industrial).

The Company will:

a) reorganize the purchase of Alpaca fibers directly to the family breeders in the central region of

Perù, eliminating intermediaries margins of 60%. It will purchase in cash to the breeders, mix

Alpaca fiber on site and transport it to the manufacture in the same region, avoiding relevent

transport cost (-30%) to Arequipa (1’300km).

b) build an additional 30’000 m2 manufacturing site (conditioning, spinning, waeving and

confectionning), in order to increase manufacturing capacity by 10 times to 10 tons/months (120

tons yearly) and, so decrease process cost by 10% (salaries are lower than in Arequipa).

c) condition (decontaminate, clean, wash and classifiy) directly in the manufacture all raw fibers

purchased in the region, and process the adequate fiber to manufacture yarns, fabrics and

fashion clothes requested by the clients. It offer a substential competitve advantage to process all

steps internally, in reducing sharply delivery times (time-to-market) comparing to its competitors

located far from the Capital - Lima.

February 2014

4. Project of Development

4.2 Develop a high quality Alpaca yarns & fabrics supplier In a second step, and with the support of an industrial partner, the Company will catch know-how and

integrate technology in order to purchase and manufacture specially high quality fibers, yarns, fabrics

and textiles.

The Company will:

a) develop a technical centre of assistance for manufacturing yarns and fabrics with dedicated

installations and machineries. With the support of FINCYT – Fondo de Ciencia y Tecnologia – the

Company is already implementing the project of manufacturing yarns and colouring fibers.

b) purchase significant stock of fibers to start processing Alpaca yarns and fabrics from the region,

with the financial support of the CMC – Corp. Minera C. – who is financing professional teaching

of farmers in the region and securing the development of the manufacturing sector by the

community.

c) structure a genetic program with breeders to enhance the purity of the Alpaca animals and in

consequence to increase quality of fiber production. Incentive programs could be applicable for

promoting high quality fiber production in the breeders community.

February 2014

4. Project of Development

4.3 Become a reliable supplier to the world luxury brands The Company can deliver major luxury brands and become their reliable “Supplier of Choice”. In this

regard, the Company shall:

February 2014

■ manufacture innovative fabrics of high quality, respecting the luxury industry

standards and consistent product developments.

■ integrate designer’s creation of luxury brands, directly into the Peruvian

manufacture. A specific creation atelier with related designers will be created and

collaborate with creation department of the luxury brands.

■ offer stable supply of unbranded textile products and designed clothes, in close

collaboration with luxury brands.

The Company will not compete with its luxury brand customers and create only own unbranded

products. Close collaboration and strict confidentiality rules shall apply when working with client’s

creation department in order to avoid copies.

It will provide high quality fashion products in volume requested directly to luxury brands, on a long

term partnership relation. It shall keep costs attractive and invest continously on R&D, in order to

present innovations constently.

Finally, the Company will strength its own sale’s department to develop its activity worldwide, opening

new markets, finding new cutomers and promoting the positive image of Alpaca around the world.

4. Project of Development

4.4 Promote Social Responsibility The Company started since its foundation in 1999 to develop Corporate Social Responsibility

programs (community), such as:

1. Corporate Social Responsibility: The manufacture in Huancayo employs 45 family mothers on a

full time basis. All employee benefit from the Kindergarten area were the company takes care of all

children of employee during the working day. Kinderarten service is free and can be used by

employee on request without any condition.

2. Climate Changes & Environment Care: SURITEX management will make aware small family

producers of Alpaca fiber of climate changes and possible living consequences. It will provide

information on how the care the environment and operate production with possible climate changes.

3. Fair Trade: SURITEX is developing a foundation which will signs long term purchase agreement

with family producers to offer them fixed and fair prices for the Alpaca fibers sold. The foundation will

return all extra-profit to the members/family producers and SURITEX.

4. Sustainable Production: SURITEX will develop a sustainable production program of the natural

Alpaca fiber, from sourcing to delivery/exports. This program will explain how to reduce CO2

production, reduce energy and water volumes, and maximize bio-degradable materials.

February 2014

5. The Offer

The Company is looking for a strong partner who can provide it know-hows (increase quality

in production), financial support (financing loan), pre-order of high quality yarns, fabrics and

clothes (turnover projections) base on a win-win situation. In this regard, it is looking for.

1. Loan of USD 1’000’000 within 5 years, at 6% fix interest rate with assets as collaterals: It can offer assets base guaranty and provide 5 years Cash-Flow statement. It involves investment of

USD 250’000 for building of factory 30’000m2 extension, USD 250’000 in acquisition of installation

and purchase of new machines, USD 350’000 in purchase of raw material (working capital) and USD

150’000 dedicated to business development and so increase sales & exports fabrics to international

markets (Europe – Italy, UK, France, Germany)

2. Industrial Partner in order to secure development and production of international high

quality standards of yarns, fabrics and eventually clothes. It will increase production

capacity by 10 times, to 60 Tons/months: It can offer medium and long term production capacity

reservation of high quality production as Strategic Alliance or JV agreement. Partner will be asked to

provide technical support/training to enhance production quality, efficiency and controls

3. Luxury Brand(s) Partner(s) to secure access to luxury goods industry for its unbranded

luxury Royal & Baby Alpaca production: It can offer attractive price within a long term purchase

agreement and in addition the participation to Social Responsibility programs for brand(s)

communication. Partner will be asked to advise on product trends, uses, prices & designs and

promote “100% Alpaca, Made in Perù” trademarks (not a brand !).

February 2014

6. Contact information

SWISS CORPORATE ADVISORS San Isidro, Lima

PERU

E-mail [email protected]

Phone +51 980 795 980

Skype Pseudo SwissCAD001

SWISS CORPORATE ADVISORS Geneva

SWITZERLAND

E-mail [email protected]

Phone +41 79 217 51 15

Skype Pseudo SwissCAD002

February 2014

The Way to Success !

Appendix A - Community care

Social responsibility: The Company will integrate to all its structure of activity a complete social responsibility education and

promote several efficient programs:

1. Kindergarten for workers: The Company has created its own Kindergarten services into the

manufacture, exclusively dedicated to the workers comfort. Children of workers can stay in a safe

environment close to the workers and remain at any time under control.

2. Social events for the community: The Company is also establishing a program of social events

which involves workers, families and the local community.

3. Participation of clients to local social programs: In the future, The Company will propose

client’s involvement into local community social events, in order to create closer ties between workers

and clients and share values.

February 2014

Appendix B - Environment & Animals care

Climate Changes and Environment Care It is projected an increase of temperature between +1C to +3C within the next 20 years:

1. Environment consequences: It will have deep consequences on the weather, water and

temperatures which will affect the Andean regions of Perù. Alpaca animal is expected to move from its

initial life environment to find colder areas with its traditional food.

2. Living conditions consequences: It will present heavy changes on the Alpaca animal and the

family breeders life conditions. The Alpaca population shall migrate to the northern regions of Perù

where… and the Andean family breeders will face water and food issues with much lower rains.

3. Programs of information and education to breeders: The Company with the support of the

Government will provide strong information program on “how the climate changes will affect their

environment” and on “how breeders shall behave in order to maintain their life conditions”.

February 2014

Appendix C - Families & Breeders care

Families and breeders: It is projected a Fair Trade system to increase Family breeders revenue by 25% and offer fix revenues

plus incentives depending on the quality of the fiber production:

1. Poor families of breeders: In Perù as in many regions of the Andes, breeders are poor families.

Owning between 50 to 75 animals, which produces 2,3 kg of fiber per year for a total of 120kg and

selling the raw fiber at USD 10 per kilo, breeders families are living with monthly incomes < USD 100.

2. Lack of good living conditions: Families breeders are often living in desert lands, without water

and energy infrastructure and suffering of lack of hygiene. In addition, children have limited access to

poor education.

3. Program of Fair Trade with breeders: The Company with the support of a newly created

foundation will implement a purchasing system directly with the breeders families, in order to obtain

long term agreement of fiber delivery based on fix prices. In this system, breeders will have the

possibility to have a fix and planed revenues from its Alpaca production activity, in addition to an

incentive system for high quality fiber production. The foundation will purchase at fixed & transparent

prices the fibers, and when resold, the foundation will redistribute part of the profit to the breeders,

depending of the quality produced and the priced obtained by the foundation. Foundation will be

owned by its members, managed by a committee where breeders, manufacturer, ONGs and clients

are represented and accounts duly audited and made public. Recognized ONG could be controlling

the foundation’s activity & transparency for publication. Potentially future financial products could be

used to maintain future prices of fiber (as in the French Bordeaux industry).

February 2014

Appendix D - Production & Products care

Production and products sustainability: It is projected to implement a complete sustainable production and manufacturing activity in Perù, as far as

possible:

1. Efficient use of energy and water: Both are very precious element in the Andean region of Perù.

The Company will implement a continuous program of optimization of Energy (electricity) and Water

uses to minimize quantity of each to produce 1 kg of fiber, yarn, fabric or textile.

2. Use of recycled or biodegradable materials: Special methods of production with recycling of

water and in particular using biodegradable material of colouring processes will be implemented. A

specific attention to natural coloured fibers will be developed to push such natural products instead of

chemically coloured products. Alpaca is a fiber which has high sensitivity to chemical treatments.

3. Traceability of fiber from source to retail: The Company with the support of the Gov. will

implement of Alpaca animal genetic program, with traceability from the birth of animals to the

production of textile finished products. Genetic program shall increase purity of animal race and

increase quality of fiber. In addition, fiber output will be registered in order to track it directly from the

animal source (chips – lots of production – finished products).

February 2014

E. Financial Datas

February 2014

Source: Company

Some financial datas The Company has the following investment considerations to implement its new structure. It is already

partly financed:

Investment Considerations

Existing Project Comments

1. Industrial Building 65 000

2. Atelier of production 90 000

3. Additional walls 28 000

4. Water installation & treatment 14 000

5. Electric installation 85 000

6. Water tanks 30 000

7. Solar installation 18 000

8. Security system, software 20 000

9. Land for construction 200 000 0 loan garanty

10. Machinery & installation 200 000 0 loan garanty

11 Stock (working capital) 200 000

TOTAL 600 000 350 000