EconS 424 – Strategy and Game Theory Homework #5 – · PDF fileHomework #5 –...

Transcript of EconS 424 – Strategy and Game Theory Homework #5 – · PDF fileHomework #5 –...

EconS 424 – Strategy and Game Theory

Homework #5 – Answer Key

Exercise #1 – Collusion among N doctors

Consider an infinitely repeated game, in which there are 𝑛𝑛 ≥ 3 doctors, who have created a

partnership. In each period, each doctor decides how hard to work. Let 𝑒𝑒𝑖𝑖𝑡𝑡 be the effort chosen by

doctor i in period t, and 𝑒𝑒𝑖𝑖𝑡𝑡 = 1, 2, … , 10. Doctor i’s discount factor is 𝛿𝛿𝑖𝑖 .

Total profit for the partnership: 2(𝑒𝑒1𝑡𝑡 + 𝑒𝑒2𝑡𝑡 + 𝑒𝑒3𝑡𝑡 + ⋯+ 𝑒𝑒𝑛𝑛𝑡𝑡 )

A doctor i’s payoff: 1𝑛𝑛

× 2 × (𝑒𝑒1𝑡𝑡 + 𝑒𝑒2𝑡𝑡 + 𝑒𝑒3𝑡𝑡 + ⋯+ 𝑒𝑒𝑛𝑛𝑡𝑡 )− 𝑒𝑒𝑖𝑖𝑡𝑡

a. Assume that the history of the game is common knowledge. Derive a subgame perfect NE in

which each player chooses effort 𝒆𝒆∗ > 1.

To begin, note that doctor’s payoff can be rearranged to:

�2𝑛𝑛� (𝑒𝑒1 + 𝑒𝑒2 + ⋯+ 𝑒𝑒𝑖𝑖−1 + 𝑒𝑒𝑖𝑖+1 + ⋯+ 𝑒𝑒𝑛𝑛) − �

𝑛𝑛 − 2𝑛𝑛

� 𝑒𝑒𝑖𝑖

Since a doctor’s payoff is strictly decreasing in her own effort, she wants to minimize it. 𝑒𝑒𝑖𝑖 = 1 is

then a strictly dominant strategy for doctor i and therefore there is a unique stage game Nash

equilibrium in which each doctor chooses the minimal effort level of 1.

• Next, note that each doctor’s payoff from choosing a common effort level of e is:

�1𝑛𝑛�× 2 × (𝑒𝑒 + 𝑒𝑒 + ⋯+ 𝑒𝑒) − 𝑒𝑒 = �

1𝑛𝑛� × 2 × 𝑛𝑛𝑒𝑒 − 𝑒𝑒 = 𝑒𝑒

• To determine a doctor’s best deviation, we must take a partial derivative with respect to 𝑒𝑒𝑖𝑖 of their payoff function when all other (n-1) players select e, yielding

𝜕𝜕𝑢𝑢𝑖𝑖𝜕𝜕𝑒𝑒𝑖𝑖

= −�𝑛𝑛 − 2𝑛𝑛

�

This suggests a corner solution where doctor i wants to minimize effort by playing the

lowest e possible, i.e., ei=1.

• We can now describe a grim-trigger strategy. When conditions are met and the strategy is played symmetrically, that will guarantee cooperation at an effort level e>1.

1

Consider the symmetric grim-trigger strategy:

o In period 1: choose 𝑒𝑒𝑖𝑖1 = 𝑒𝑒∗ o In period t ≥ 2: choose 𝑒𝑒𝑖𝑖𝑡𝑡 = 𝑒𝑒∗ when 𝑒𝑒𝑗𝑗𝜏𝜏 = 𝑒𝑒∗ for all j, for all 𝜏𝜏 ≤ 𝑡𝑡 − 1; and

choose 1 otherwise.

This is a subgame perfect Nash equilibrium if and only if

𝑒𝑒∗

1 − 𝛿𝛿𝑖𝑖≥ ��

𝑛𝑛 − 1𝑛𝑛

� 2𝑒𝑒∗ − �𝑛𝑛 − 2𝑛𝑛

� ∗ 1� +𝛿𝛿𝑖𝑖

1 − 𝛿𝛿𝑖𝑖 𝑓𝑓𝑓𝑓𝑓𝑓 𝑎𝑎𝑎𝑎𝑎𝑎 𝑖𝑖.

That is to say, the equilibrium will only hold so long as the payoff from remaining in the equilibrium

is greater than or equal to the one period payoff from deviating plus the payoff from the

‘punishment’ equilibrium played every period thereafter. Solving for 𝛿𝛿𝑖𝑖 yields:

𝛿𝛿𝑖𝑖 ≥𝑛𝑛 − 2

2(𝑛𝑛 − 1)

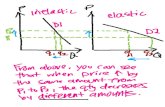

The following figure depicts this cutoff of 𝛿𝛿𝑖𝑖 , shading the region of discount factors above 𝛿𝛿𝑖𝑖 which

would support collusion.

It is now possible to see how the equilibrium responds to changes in n. Differentiating the about

cutoff of 𝛿𝛿𝑖𝑖 with respect to n, we obtain

2

𝜕𝜕𝛿𝛿𝑖𝑖𝜕𝜕𝑛𝑛

=1

2(𝑛𝑛 − 1)2

This partial is positive, indicating that as the group size n increases, 𝛿𝛿𝑖𝑖 has to increase to maintain

the cooperative equilibrium. So it is more difficult to support cooperation as the group size

increases.

b. Assume that the history of the game is not common knowledge, i.e., in each period, only the

total effort is observed. Find a subgame perfect NE in which each player chooses effort 𝒆𝒆∗ > 1.

Consider the strategy profile in part (a), except that it now conditions on total effort. Let 𝑒𝑒𝑡𝑡denote

total effort for period t.

• In period 1: choose 𝑒𝑒𝑖𝑖1 = 𝑒𝑒∗ • In period t ≥ 2: choose 𝑒𝑒𝑖𝑖𝑡𝑡 = 𝑒𝑒∗ when 𝑒𝑒𝜏𝜏 = 𝑛𝑛𝑒𝑒∗ for all j, for all 𝜏𝜏 ≤ 𝑡𝑡 − 1; and

choose 1 otherwise.

This is a subgame perfect Nash equilibrium under the exact same conditions as in part (a).

Exercise #2 - Collusion when firms compete in quantities

Consider two firms competing as Cournot oligopolists in a market with demand:

𝑝𝑝(𝑞𝑞1, 𝑞𝑞2) = 𝑎𝑎 − 𝑏𝑏𝑞𝑞1 − 𝑏𝑏𝑞𝑞2

Both firms have total costs, 𝑇𝑇𝑇𝑇(𝑞𝑞𝑖𝑖) = 𝑐𝑐𝑞𝑞𝑖𝑖 where c > 0 is the marginal cost of production.

a. Considering that firms only interact once (playing an unrepeated Cournot game), find the equilibrium output for every firm, the market price, and the equilibrium profits for every firm. Firm 1 chooses q1 to solve

maxq1 𝜋𝜋𝑖𝑖 = 𝑝𝑝(𝑎𝑎 − 𝑏𝑏𝑞𝑞1 − 𝑏𝑏𝑞𝑞2) − 𝑐𝑐𝑞𝑞1

Taking first order conditions with respect to q1, we find

𝜕𝜕𝜋𝜋1𝜕𝜕𝑞𝑞1

= 𝑎𝑎 − 𝑏𝑏𝑞𝑞1 − 𝑏𝑏𝑞𝑞2 − 𝑐𝑐 = 0

and solving for q1 we obtain firm 1’s best response function

3

𝑞𝑞1(𝑞𝑞2) =𝑎𝑎 − 𝑐𝑐

2𝑏𝑏−

12𝑞𝑞2

and similarly for firm 2, since firms are symmetric,

𝑞𝑞2(𝑞𝑞1) =𝑎𝑎 − 𝑐𝑐

2𝑏𝑏−

12𝑞𝑞1

Plugging 𝑞𝑞2(𝑞𝑞1) into 𝑞𝑞1(𝑞𝑞2), we find firm 1’s equilibrium output:

𝑞𝑞1 =𝑎𝑎 − 𝑏𝑏 �𝑎𝑎 − 𝑏𝑏𝑞𝑞1 − 𝑐𝑐

2𝑏𝑏 � − 𝑐𝑐2𝑏𝑏

=𝑎𝑎

2𝑏𝑏− �

𝑎𝑎 − 𝑏𝑏𝑞𝑞1 − 𝑐𝑐4𝑏𝑏

� −𝑐𝑐

2𝑏𝑏=

2𝑎𝑎 − 2𝑐𝑐 − 𝑎𝑎 + 𝑐𝑐3𝑏𝑏

=𝑎𝑎 − 𝑐𝑐

3𝑏𝑏

Similarly, firm 2’s equilibrium output is

𝑞𝑞2 =𝑎𝑎 − 𝑏𝑏 �𝑎𝑎 − 𝑐𝑐

3𝑏𝑏 � − 𝑐𝑐2𝑏𝑏

=𝑎𝑎

2𝑏𝑏− �

𝑎𝑎 − 𝑐𝑐6𝑏𝑏

� −𝑐𝑐

2𝑏𝑏=

3𝑎𝑎 − 𝑎𝑎 + 𝑐𝑐 − 3𝑐𝑐6𝑏𝑏

=𝑎𝑎 − 𝑐𝑐

3𝑏𝑏

Therefore, the market price is

𝑝𝑝 = 𝑎𝑎 − 𝑏𝑏 �𝑎𝑎 − 𝑐𝑐

3𝑏𝑏� − 𝑏𝑏 �

𝑎𝑎 − 𝑐𝑐3𝑏𝑏

�

=3𝑎𝑎 − 𝑎𝑎 + 𝑐𝑐 − 𝑎𝑎 + 𝑐𝑐

3=𝑎𝑎 + 2𝑐𝑐

3

and the equilibrium profits of each firm are

𝜋𝜋1𝑐𝑐𝑐𝑐𝑐𝑐𝑐𝑐𝑛𝑛𝑐𝑐𝑡𝑡 = 𝜋𝜋2𝑐𝑐𝑐𝑐𝑐𝑐𝑐𝑐𝑛𝑛𝑐𝑐𝑡𝑡 = �𝑎𝑎 + 2𝑐𝑐

3� �𝑎𝑎 − 𝑐𝑐

3𝑏𝑏� − 𝑐𝑐 �

𝑎𝑎 − 𝑐𝑐3𝑏𝑏

� =(𝑎𝑎 − 𝑐𝑐)2

9𝑏𝑏

b. Now assume that they could form a cartel. Which is the output that every firm should

produce in order to maximize the profits of the cartel? Find the market price, and profits of

every firm. Are their profits higher when they form a cartel than when they compete as

Cournot oligopolists?

Since the cartel seeks to maximize their joint profits, they choose output levels q1 and q2 that solve

max 𝜋𝜋1 + 𝜋𝜋2 = (𝑎𝑎 − 𝑏𝑏𝑞𝑞1 − 𝑏𝑏𝑞𝑞2)𝑞𝑞1 − 𝑐𝑐𝑞𝑞1 + (𝑎𝑎 − 𝑏𝑏𝑞𝑞1 − 𝑏𝑏𝑞𝑞2)𝑞𝑞2 − 𝑐𝑐𝑞𝑞2

which simplifies to

max (𝑎𝑎 − 𝑏𝑏𝑞𝑞1 − 𝑏𝑏𝑞𝑞2)(𝑞𝑞1 + 𝑞𝑞2) − 𝑐𝑐(𝑞𝑞1 + 𝑞𝑞2)

4

Notice that this maximization problem can be further reduced to the choice of aggregate output

Q=𝑞𝑞1 + 𝑞𝑞2 that solves

max (𝑎𝑎 − 𝑏𝑏𝑏𝑏)𝑏𝑏 − 𝑐𝑐𝑏𝑏

Interestingly, this maximization problem coincides with that of a regular monopolist. In other

words, the overall production of the cartel of two symmetric firms coincides with that of a standard

monopoly. Indeed, taking first order conditions with respect to Q, we obtain

𝑎𝑎 − 2𝑏𝑏𝑏𝑏 − 𝑐𝑐 ≤ 0

And solving for Q, we find 𝑏𝑏 = 𝑎𝑎−𝑐𝑐2𝑏𝑏

, which is an interior solution given that a>c by definition.

Therefore, ach firm’s output level in the cartel is

𝑞𝑞1 = 𝑞𝑞2 =𝑏𝑏2

=𝑎𝑎 − 𝑐𝑐

2𝑏𝑏2

=𝑎𝑎 − 𝑐𝑐

4𝑏𝑏

And the market price is

𝑝𝑝 = 𝑎𝑎 − 𝑏𝑏𝑏𝑏 = 𝑎𝑎 − 𝑏𝑏𝑎𝑎 − 𝑐𝑐

2𝑏𝑏=𝑎𝑎 + 𝑐𝑐

2

Therefore, each firm’s profits in the cartel are

𝜋𝜋1 = 𝑝𝑝𝑞𝑞1 − 𝑇𝑇𝑇𝑇(𝑞𝑞1) = �𝑎𝑎 + 𝑐𝑐

2� �𝑎𝑎 − 𝑐𝑐

4𝑏𝑏� − 𝑐𝑐 �

𝑎𝑎 − 𝑐𝑐4𝑏𝑏

� =(𝑎𝑎 − 𝑐𝑐)2

8𝑏𝑏

𝜋𝜋1𝑐𝑐𝑎𝑎𝑐𝑐𝑡𝑡𝑐𝑐𝑐𝑐 = 𝜋𝜋2𝑐𝑐𝑎𝑎𝑐𝑐𝑡𝑡𝑐𝑐𝑐𝑐 =(𝑎𝑎 − 𝑐𝑐)2

8𝑏𝑏

Comparing the profits that every firm makes in the cartel, (𝑎𝑎−𝑐𝑐)2

8𝑏𝑏, against those under Cournot

competition, (𝑎𝑎−𝑐𝑐)2

9𝑏𝑏, we can conclude that

𝜋𝜋1𝑐𝑐𝑎𝑎𝑐𝑐𝑡𝑡𝑐𝑐𝑐𝑐 = 𝜋𝜋2𝑐𝑐𝑎𝑎𝑐𝑐𝑡𝑡𝑐𝑐𝑐𝑐 > 𝜋𝜋1𝑐𝑐𝑐𝑐𝑐𝑐𝑐𝑐𝑛𝑛𝑐𝑐𝑡𝑡 = 𝜋𝜋2𝑐𝑐𝑐𝑐𝑐𝑐𝑐𝑐𝑛𝑛𝑐𝑐𝑡𝑡

c. Can the cartel agreement be supported as the (cooperative) outcome of the infinitely

repeated game?

1. First, we find the discounted sum of the infinite stream of profits when firms cooperate in the

cartel agreement (they do not deviate).

5

• Payoff of cartel when they cooperate is (𝑎𝑎−𝑐𝑐)2

8𝑏𝑏

• As a consequence, the discounted sum of the infinite stream of profits from cooperating in

the cartel is

(𝑎𝑎 − 𝑐𝑐)2

8𝑏𝑏+ 𝛿𝛿

(𝑎𝑎 − 𝑐𝑐)2

8𝑏𝑏+ ⋯ =

11 − 𝛿𝛿

(𝑎𝑎 − 𝑐𝑐)2

8𝑏𝑏

2. Second, we need to find the optimal deviation that, conditional on firm 2 choosing the cartel

output, maximizes firm 1’s profits. That is, which is the output that maximizes firm 1’s profits, and

which are its corresponding profits from deviating?

Since firm 2 sticks to cooperation (i.e., produces the cartel output 𝑞𝑞2 = 𝑎𝑎−𝑐𝑐4𝑏𝑏

), if firm 1 seeks to

maximize its current profits (optimal deviation), we only need to plug 𝑞𝑞2 = 𝑎𝑎−𝑐𝑐4𝑏𝑏

into firm 1’s best

response function, as follows

𝑞𝑞1𝑑𝑑𝑐𝑐𝑑𝑑 ≡ 𝑞𝑞1 �𝑎𝑎 − 𝑐𝑐

4𝑏𝑏� =

𝑎𝑎 − 𝑐𝑐2𝑏𝑏

−12𝑎𝑎 − 𝑐𝑐

4𝑏𝑏=

3(𝑎𝑎 − 𝑐𝑐)8𝑏𝑏

which provides us with firm 1’s optimal deviation, given that firm 2 is still respecting the cartel

agreement. In this context, firm 1’s profit is

𝜋𝜋1 = �𝑎𝑎 − 𝑏𝑏 �3(𝑎𝑎 − 𝑐𝑐)

8𝑏𝑏� − 𝑏𝑏 �

𝑎𝑎 − 𝑐𝑐4𝑏𝑏

� − 𝑐𝑐� �3(𝑎𝑎 − 𝑐𝑐)

8𝑏𝑏�

= 3 �𝑎𝑎 − 𝑐𝑐

8� �

3(𝑎𝑎 − 𝑐𝑐)8𝑏𝑏

� =9(𝑎𝑎 − 𝑐𝑐)2

64𝑏𝑏

while that of firm 2 is

𝜋𝜋2 = �𝑎𝑎 − 𝑏𝑏 �3(𝑎𝑎 − 𝑐𝑐)

8𝑏𝑏� − 𝑏𝑏 �

𝑎𝑎 − 𝑐𝑐4𝑏𝑏

� − 𝑐𝑐� �𝑎𝑎 − 𝑐𝑐

4𝑏𝑏�

= 3 �𝑎𝑎 − 𝑐𝑐

8� �𝑎𝑎 − 𝑐𝑐

4𝑏𝑏� =

3(𝑎𝑎 − 𝑐𝑐)2

32𝑏𝑏

Hence, firm 1 has incentives to unilaterally deviate since its current profits are larger by deviating

(while firm 2 respects the cartel agreement) than by cooperating. That is,

𝜋𝜋1𝑑𝑑𝑐𝑐𝑑𝑑𝑖𝑖𝑎𝑎𝑡𝑡𝑐𝑐 =9(𝑎𝑎 − 𝑐𝑐)2

64𝑏𝑏> 𝜋𝜋1𝑐𝑐𝑎𝑎𝑐𝑐𝑡𝑡𝑐𝑐𝑐𝑐 =

(𝑎𝑎 − 𝑐𝑐)2

8𝑏𝑏

3. Finally, we can now compare the profits that firms obtain from cooperating in the cartel

agreement (part i) with respect to the profits they obtain from choosing an optimal deviation (part

6

ii) plus the profits they would obtain from being punished thereafter (discounted profits in the

Cournot oligopoly). In particular, for cooperation to be sustained we need

Firm 1:

11 − 𝛿𝛿

(𝑎𝑎 − 𝑐𝑐)2

8𝑏𝑏>

9(𝑎𝑎 − 𝑐𝑐)2

64𝑏𝑏+

𝛿𝛿1 − 𝛿𝛿

(𝑎𝑎 − 𝑐𝑐)2

9𝑏𝑏

Solving for discount factor δ, we obtain

18(1−𝛿𝛿)

> 964

+ 𝛿𝛿9(1−𝛿𝛿)

, which implies 𝛿𝛿 > 917

Hence, firms need to assign a sufficiently high value to future payoffs, 𝛿𝛿 ∈ � 917

, 1�, for the cartel

agreement to be sustained.

Finally, note that firm 2 has incentives to carry out the punishment. Indeed, if it does not revers to

the NE of the stage game (producing the Cournot equilibrium output), firm 2 obtains profits of 3(𝑎𝑎−𝑐𝑐)2

32𝑏𝑏, since firm 1 keeps producing its optimal deviation of 𝑞𝑞1𝑑𝑑𝑐𝑐𝑑𝑑 = 3(𝑎𝑎−𝑐𝑐)

8𝑏𝑏 while firm 2 produces

the cartel output 𝑞𝑞2𝑐𝑐𝑎𝑎𝑐𝑐𝑡𝑡𝑐𝑐𝑐𝑐 = 𝑎𝑎−𝑐𝑐4𝑏𝑏

. If, instead, firm 2 practices the punishment, producing the Cournot

output 𝑎𝑎−𝑐𝑐3𝑏𝑏

, its profits are (𝑎𝑎−𝑐𝑐)2

9𝑏𝑏, which exceed 3(𝑎𝑎−𝑐𝑐)2

32𝑏𝑏 for all parameter values. Hence, upon

observing that firm 1 deviates, firm 2 prefers to revert to the production of its Cournot output level

than being the only firm that produces the cartel output.

Exercise #3 – Collusion among N firms

Consider n firms producing homogenous goods and choosing quantities in each period for an

infinite number of periods. Demand in the industry is given by , Q being the sum of

individual outputs. All firms in the industry are identical: they have the same constant marginal

costs , and the same discount factor . Consider the following trigger strategy:

• Each firm sets the output that maximizes joint profits at the beginning of the game, and continues to do so unless one or more firms deviate.

• After a deviation, each firm sets the quantity , which is the Nash equilibrium of the one-shot Cournot game.

7

(a) Find the condition on the discount factor that allows for collusion to be sustained in this industry. First find the quantities that maximize joint profits (1 )Q Q cQπ = − − . It is easily

checked that this output level is1

2cQ −

= , yielding profits of

𝜋𝜋 = �1 −1 − 𝑐𝑐

2�

1 − 𝑐𝑐2

− 𝑐𝑐1 − 𝑐𝑐

2=

(1 − 𝑐𝑐)2

4

for the cartel.

Therefore, at the symmetric equilibrium individual quantities are 1 1

2m cq

n−

= and

individual profits under the collusive strategy are 21 (1 )

4m c

nπ −

= .

As for the deviation profits, the optimal deviation by a firm is given by ( ) argmax 1 ( 1)d m m

qq q n q q q cq = − − − − .

where note that all other n-1 firms are still producing their cartel output 1 1

2m cq

n−

= .

It can be checked that the value of q that maximizes the above expression is (1 )( ) ( 1)

4d m cq q n

n−

= + , and that the profits that a firm obtains by deviating from the

collusive output are, hence,

1 1 1 1 11 ( 1) ( 1) ( 1) ( 1)2 4 4 4

d c c c cn n n c nn n n n

π − − − − = − − − + + − + ,

which simplifies to 2 2

2

(1 ) ( 1)16

d c nn

π − +=

Therefore, collusion can be sustained in equilibrium if 1

1 1m d cndπ π π

d d≥ +

− −,

which after solving for the discount factor, δ, yields2

2

(1 )1 6

nn n

d +≥

+ +. For compactness, we

denote this ratio as 2

2

(1 )1 6

cnnn n

d+≡

+ +.

Hence, under punishment strategies that involve a reversion to Cournot equilibrium forever after a deviation takes place, tacit collusion arises if and only if firms are sufficiently patient. The following figure depicts cutoff cnd , as a function of the number of firms, n, shading the region of δ that exceeds such a cutoff.

8

(b) Indicate how the number of firms in the industry affects the possibility of reaching the tacit collusive outcome. By carrying out a simple exercise of comparative statics using the critical threshold for the discount factor, one concludes that

.

(This could be anticipated from our previous figure, where the critical discount factor increases in n.) Intuition: Other things being equal, as the number of firms in the agreement increases, the more difficult it is to reach and sustain tacit collusion. Since firms are assumed to be symmetric, an increase in the number of firms is equivalent to a lower degree of market concentration. Therefore, lower levels of market concentration are associated – ceteris paribus – with less likely collusion.

9

WATSON CHAPTER 24 –EXERCISE 1

Ex. 1 – Chapter 24 Watson

Player 1Player 1Bet

Bet

Fold

Fold

Ace

King

Prob=.5

Prob=.5

Nature

Player 1

BF

bf

2, -2

1, -1

1, -1

-1,1

-1,1

-2,2

Player 2

Player 2 has only two available strategies 𝑆𝑆2 = {𝐵𝐵𝑒𝑒𝑡𝑡,𝐹𝐹𝑓𝑓𝑎𝑎𝐹𝐹}

But player 1 has four available strategies 𝑆𝑆1 = {𝐵𝐵𝑏𝑏,𝐵𝐵𝑓𝑓,𝐹𝐹𝑏𝑏,𝐹𝐹𝑓𝑓}

This implies that the Bayesian normal form representation of the game is

10

Player 2

Player 1

In order to find the expected payoffs for strategy profile (Bb, Bet) top left-hand side cell of the matrix, we proceed as follows:

𝐸𝐸𝑈𝑈1 =12∗ 2 +

12∗ (−2) = 0

𝐸𝐸𝑈𝑈2 =12∗ (−2) +

12∗ (2) = 0

→ (0,0)

Similarly for strategy profile (Bf, Bet),

𝐸𝐸𝑈𝑈1 =12∗ (−1) +

12∗ (−2) = −

32

𝐸𝐸𝑈𝑈2 =12∗ 1 +

12∗ 2 =

32

For strategy profile (Ff, Bet),

𝐸𝐸𝑈𝑈1 =12

(−1) +12

(−1) = −1

𝐸𝐸𝑈𝑈2 =12∗ 1 +

12∗ 1 = 1

For strategy profile (Bb, Fold),

Bet Fold

Bb

Bf

Fb

Ff

11

𝐸𝐸𝑈𝑈1 =12∗ 1 +

12∗ 1 = 1

𝐸𝐸𝑈𝑈2 =12

(−1) +12

(−1) = −1

For strategy profile (Bf, Fold),

𝐸𝐸𝑈𝑈1 =12∗ 1 +

12

(−1) = 0

𝐸𝐸𝑈𝑈2 =12

(−1) +12∗ 1 = 0

Similarly for (Fb, Fold),

𝐸𝐸𝑈𝑈1 =12∗ (−1) +

12∗ 1 = 0

𝐸𝐸𝑈𝑈2 =12∗ 1 +

12

(−1) = 0

Finally, for (Ff, Fold),

𝐸𝐸𝑈𝑈1 =12∗ (−1) +

12

(−1) = −1

𝐸𝐸𝑈𝑈2 =12∗ 1 +

12∗ 1 = 1

We can now insert these expected payoffs into the Bayesian normal form,

Player 2

Player 1

Bet Fold

Bb 0, 0 1, -1

Bf 12

,−12

0, 0

Fb −32

,32

0, 0

Ff -1, 1 -1, 1

12

WATSON CHAPTER 26 –EXERCISE 6

Following the methods used above to convert this game into normal form, we see that players 1&2 have the following strategies spaces:

Player 2 has only two available strategies 𝑆𝑆2 = {𝑈𝑈,𝐷𝐷}

But player 1 has four available strategies 𝑆𝑆1 = {𝐿𝐿𝐿𝐿′, 𝐿𝐿𝑅𝑅′,𝑅𝑅𝐿𝐿′,𝑅𝑅𝑅𝑅′}

The Bayesian normal form game would be constructed as such:

Player 2

Player 1

Making similar calculations as before, we may find the expected values of the different strategy profiles for each person and fill in the normal form table as such:

Player 2

Player 1

U D

LL’

LR’

RL’

RR’

U D

LL’ 2, 0 2, 0

LR’ 1, 0 3, 1

RL’ 1, 2 3, 0

RR’ 0, 2 4, 1

13

It is evident by finding each player’s Best Responses that the BNE is at {LL’, U}

WATSON CHAPTER 26 –EXERCISE 7

Watson Chapter 26 – Ex. 7

Player 1

c=2

Prob=2/3 Prob=1/3

Nature

B

0, 1

Player 2

c=0

A

0, 1

1, 0

1, 0

Player 1

B

0, 1

Player 2

A

2, 1

1, 0

1, 0

A) Player 2 (uninformed) for only two strategies 𝑆𝑆2 = {𝑋𝑋,𝑌𝑌} Player 1 (informed) has four strategies, depending on his type,

𝑆𝑆1 = {𝐴𝐴𝐴𝐴′,𝐴𝐴𝐵𝐵′,𝐵𝐵𝐴𝐴′,𝐵𝐵𝐵𝐵′} Where the first component of every strategy pair denotes what player 1 does when his type is c=2 while the second component reflects his choice when his type is c=0.

14

The Bayesian normal form representation is:

Player 2

Player 1

B) Underlining players’ best responses as usual, we find a unique BNE: {BA’, Y}

X Y

AA’ 0, 1 1, 0

AB’ 1/3, 2/3 2/3, 1/3

BA’ 2/3, 1/3 5/3, 2/3

BB’ 1, 0 4/3, 1

15