Final Econs Ass Zanele

Transcript of Final Econs Ass Zanele

TABLE OF CONTENTS

Table of Contents

Question One

1.1 Autonomous and Induced Consumption 2

1.2 Economic Growth and economic Development 2

1.3 Nominal Gross Domestic Product and Real GDP 3

Question Two

2.1 Theory of Absolute Advantage and Comparative Advantage 4

2.2 Full Employment and Zero Employment 4

2.3 Floating Exchange and Fixed Exchange Rate 5

Question Three

Introduction 6

Costs of Inflation 7

Conclusion 8

Question Four

Introduction 9

Obstacles Faced by Businesses in the Informal Sector 10

Possible Solutions 13

Conclusions 15

Question Five

Introduction 16

Government Policy as Regards Trade Barriers 16

The Importance of Trade Barriers 17

The Major Draw Back of Trade Barriers 19

Conclusion 20

Bibliography 21

1

1.1

Autonomous consumption refers to household consumption expenditures that do not depend on

income or production especially disposable income, national income, or even gross domestic

product. That is, changes in income do not generate changes in consumption. Autonomous

consumption is best thought of as a baseline or minimum level of consumption that the

household sector undertakes in the unlikely event that income falls to zero. Induced consumption

on the one hand is consumption which is based on the level income or production as illustrated in

the equation below,

C = a + bY

Where:

C is consumption expenditures,

Y is income (national or disposable),

a is the intercept, and b is the slope. Begg and Ward (2007:244)

An Autonomous Intercept: The intercept of the consumption function (a) measures the

amount of consumption undertaken if income is zero. If income is zero, then consumption is

Ra.

An Induced Slope: The slope of the consumption function (b) measures the change in

consumption resulting from a change in income. If income changes by R1, then

consumption changes by Rb. It is conceptually identified as induced consumption and the

marginal propensity to consume (MPC).

1.2

Economic growth is an increase in the economic activity in an economy of a country. It can be

described as a positive change in the level of production of goods and services by a country over

a certain period of time. Mohr & Fourie (2004:23). It is often measured as the rate of change of

gross domestic product (GDP). Economic growth refers only to the quantity of goods and

services produced; it says nothing about the way in which they are produced. Mohr & Fourie

(2004:576)

2

Economic development on the one hand in its broadest terms refers to the reduction or

elimination of poverty, inequality and unemployment in a growing economy. It focuses more on

the human aspect of growth, that is economic development would emphasise on the quality of

life the members of a society undergo. The level of economic development is measured based on

the level of real GDP per capital, infant mortality rates, life expectancy, literacy, nutrition,

unemployment and inequality. Mohr and Fourie (2004:589)

1.3

The Nominal Gross Domestic Product (GDP) refers to the total face value of all final goods and

services produced within the boundaries of a country during a particular time period usually one

year.

The Real GDP on the one hand would refer to the total actual value of all final goods and

services produced within the boundaries of a country during a particular time period usually one

year. The real GDP eliminates the impact of inflation hence it is generally lower than the

nominal GDP which does not take into account the effects of inflation. Both concepts can be

illustrated on the table below.

Nominal GDP 2009 Nominal GDP 2010 Real GDP in 2010

2 Kg of Meat at R100 R200 4 Kg of Meat at R150 R600 4 Kg of Meat at R100 R400

5Kg of Fish at R80 R400 8Kg of Fish at R100 R800 8Kg of Fish at R80 R640

R600 R1200 R1040

Increase in Nominal GDP between 2009 and 2010

= (1200 - 600)/600 x 100/1

= 100%

Increase in Real GDP between 2009 and 2010

3

= (1040 - 600)/600 x 100/1 = 73% Mohr & Fourie (2004)

QUESTION TWO

2.1

The law of comparative advantage refers to the ability of a firm, or a country to produce a

particular good or service at a lower marginal cost and opportunity cost than the other party. It is

the ability to produce a product most efficiently given all the other products that could be

produced. Absolute advantage on the other hand refers to the ability of a country to produce a

particular good at a lower absolute cost than another country. Begg and Ward (2007:323).

Comparative advantage explains how trade can create value in international trade even when one

country can produce all goods with fewer resources than the other country as illustrated below in

the examples.

If South Africa can produce 80 tons of wheat or 20 cars with a given amount of resources while

France can use those same resources to produce 10 cars and 160 tons of wheat we can say South

Africa has an absolute advantage in the production of cars while France has an absolute

advantage in the production of wheat.

Looking at the case of comparative advantage if France can use a given amount of resources to

produce 20 cars and 80 tons of wheat while South Africa can only produce 10 cars and 60 tons of

wheat, we can say that France has an absolute advantage in the production of both cars and

wheat. But looking at the opportunity cost, France has a lower opportunity cost in the production

of cars while South Africa has a lower opportunity cost in the production of wheat. This

therefore means that France has a comparative advantage in the production of cars while South

Africa has a comparative advantage in the production of wheat.

2.2

Full employment describes a situation in which all available labor resources are being used in the

most economically efficient way that is, all the available labour that is willing and able to work

have been recruited, but it excludes Frictional unemployment. This is because frictional

unemployment is the amount of unemployment that results from workers who are in between

4

jobs, but are still in the labor force. Full employment is attainable within any economy, but may

result in an inflationary period. The inflation would result from workers, as a whole, having more

disposable income, which would drive prices upward.

Zero unemployment on the one hand is an ideal situation in which all economies would like to

be, but in reality it is unattainable. Zero unemployment describes a situation where all those in

the active working population have a job. This is not possible because some jobs are seasonal

and some employees might be in the job market because of frictional unemployment. Peter

(2000:39-40).

2.3

A fixed or pegged exchange rate is a rate the central bank or reserve bank of a country sets and

maintains as the official exchange rate against a particular currency. A set price is determined

against a major world currency usually the U.S. dollar, but also other major currencies such as

the euro, the yen or a basket of currencies can be used. In order to maintain the local exchange

rate, the central bank buys and sells its own currency on the foreign exchange market in return

for the currency to which it is pegged. For example the CEMAC countries run a fixed exchange

rate regime where the French Francs is pegged against the Euro.

www.investopedia.com/terms/floatingexchangerate.sap Accessed on the 24/09/10.

Unlike the fixed rate, a floating exchange rate is determined by the private market through

supply and demand. A floating rate is often termed "self-correcting", as any differences in supply

and demand will automatically be corrected in the market. For example if demand for a currency

is low, its value will decrease, thus making imported goods more expensive and stimulating

demand for local goods and services. This in turn will generate more jobs, causing an auto-

correction in the market. A floating exchange rate is constantly changing. The floating exchange

rate is a policy maintained by the South African Reserve Bank, this explains the strength of the

Rand during the world cup as there was an increase in demand for the home currency by

foreigners.

5

QUESTION THREE

Introduction

Inflation is a consistent, significant and general increase in the prices of goods and services at a

particular time. There are major types of inflation, demand pull and cost push inflation. Demand

pull inflation can be summarized as "too much money chasing too few goods". In other words, if

demand is growing faster than supply, prices will increase. This usually occurs in growing or

emerging economies where there is usually an increase in consumer expenditure, private

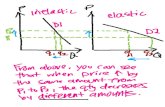

investments, government spending and increase in net exports as illustrated on the diagram

below.

Diagram; Fourie2004:548

An increase in aggregate demand from AD1 to AD2 to AD3 leads to an increase in the price level

from P1 to P2 to P3 respectively. When the economy attains full production Yf any further increase

lead to rapid increase in price thereby leading to demand pull inflation

Cost push inflation rather describes a situation where companies' costs go up, and the companies

in tend increase their prices to maintain their profit margins as would be shown on the diagram

below. Increased costs can include things such as wages, taxes, or increased costs of imports and

raw materials.

6

YfY2Y1

E1

E4

E3

E2

AD1

Y

AD4

AD3

AD2

P4

P3

P2

P1

ASGeneral Price Level

Diagram; Fourie 2004:549

An increase in the cost of production will cause a backward shift of the supply curve from AS1 to

AS2 reducing quantity supplied from Y1 to Y2 and consequently pushing up price level from P1 to

P2.

Costs of Inflation

Inflation is not always looked upon as friendly by governments and citizens of a country, and can

be blamed for some of the tensions and conflicts created in the society. Almost everyone thinks

inflation is evil, but it isn't necessarily so. Inflation affects different people in different ways. As

we shall discuss in the coming paragraphs inflation has a negative impacts on the society and its

citizens.

Inflation is viewed as being undesirable because of some serious economic and social effects.

Inflation impacts on income distribution making a random redistribution of real income. Those

receiving fixed money incomes e.g. pensioners and beneficiaries are usually disadvantaged

because often their incomes are not adjusted upwards fast enough to compensate for the effects

of continually rising prices. Their real incomes i.e., the goods and services their incomes will buy

will fall. Individuals whose incomes rise more rapidly than the inflation rate will experience

increasing real incomes. Generally, the pattern of income distribution tends to become more

unequal than it was before inflation. This has created situation of high wage demands especially

7

E

2

E1

AS2

AS1

AD

P2

P1

Gen

eral

Pri

ce L

evel

in South Africa where for the past few months workers have been demanding a salary increase

higher than the inflation rate.

Inflation tends to increase spending and encourage borrowing at the expense of savings. If prices

are rising quicker than incomes, individuals will tend to buy at current prices before goods and

services become more expensive and less affordable. Some consumers may buy using higher

levels of debt i.e., borrowing than otherwise might be the case. Savings may be discouraged

because with high inflation when the money saved is repaid, it can be worth much less than when

it was lent and the real rate of interest may be low.

Investment in economics means the creation of new capital goods Peter (2000:52-53).

Investment can only take place if there is saving. Inflation encourages spending and discourages

saving, so funds that might otherwise have been available for investment tend to dry up. With

lower levels of investment there is likely to be a slowing of the rate of growth of national output

(GDP). This in turn leads to a reduction in new jobs and so can increase the level of

unemployment.

Inflation can distort market price signals and the market may fail to allocate resources efficiently.

Planning and investment decisions become more difficult to predict as firms are unsure what will

happen to prices and costs during times of inflation. If firms are unable to pass on the increase in

costs to consumers this will impact on profits possibly causing some firms to close or cut back

production and subsequent employment.

Inflation in South Africa at a faster rate relative to our trading partners can harm exporters and

benefit importers. South African firms exporting their products overseas will find it more

difficult to sell their products because they are less competitive price wise. Local producers may

find it difficult to compete in domestic markets because of relatively cheaper foreign imports.

Declining exports and increasing imports can lead to deterioration in the balance of payments.

High inflation in South Africa may see nations trading elsewhere while a lack of business

confidence because of the perceived higher risks may see firms investing elsewhere. This high

inflation will slow growth and employment through the dampening effects on investment and

declining exports.

8

The Reserve in an attempt to reduce the rate of inflation definitely has to increase the repo rate

forcing banks and other financial institutions to increase the prime lending rate. This has a

negative impact on the cost of borrowing which goes up and the rate at which citizens pay their

bonds also goes up thereby reducing their disposable income. This was reflected during the

tenure of Tito Mboweni as Reserve Bank governor where interest rates where double digits and

repossessions of personal property, default in debt repayment was record high.

Conclusion

Besides all the tensions, conflicts and difficulties created by inflation, there are some people

who still benefit from the effects of inflation according to Peter (2000:23); the real rate of

interest rates fail to keep pace with inflation the saver loses purchasing power, i.e., their ability to

buy things falls. Rising prices are a boon to borrowers because the repayment of interest and the

sum borrowed i.e., the principal is with lower valued money. Inflation reduces the real value of

the amount they owe, as the sum repaid has less purchasing power. Of course, any gain by

borrowers must be weighed against the interest they must pay.

9

QUESTION FOUR

Introduction

The informal sector is unorganized, unregulated and mostly legal, but unregistered small

business enterprises operating in a country or region. As observed by Todaro (1997), the massive

additions to the urban labour force by this sector do not show up in formal modern sector

unemployment statistics. The buck of new entrants to the urban labour force creates their own

employment or work for small scale family owned enterprises. The concept of “informal sector”

since its invention in the 1970s has attracted much interest, discussion and disagreement. There

are currently two approaches to defining informal sector activities: the definitional and

behavioural (Farrel, Roman and Fleming, 2000).

Farrel et al defines the informal sector as one which consists of economic activities which are not

recorded in the gross domestic product (GDP) and or the national income accounts. The

behavioural which is at times referred to as the legalistic definition is based on whether or not an

activity complies with the established judicial, regulatory, and institutional framework however,

Sethuraman (1981) defines the informal sector as consisting of small scale units engaged in

production and distribution of goods and services with the primary objective of generating

employment and income, notwithstanding the constraints on capital, both physical and human,

and the technical-knowhow. Common features of operators in the informal sector as identified by

Ademu, (2006) include:

Easier access to production factors which are derivable from social organisation of

family and friends.

Involves entrepreneurs in virtually all branches of the economy ranging from

productive activities general services and specialized services.

Technology is determined more by the constraints of the social relations.

Motivation for production by the operators in the informal sector is becoming more

profit oriented.

The coming section would examine some of the problems businesses in the informal sector go

through and propose possible ways of resolving these problems.

10

OBSTACLES FACED BY BUSINESSES IN THE INFORMAL SECTOR

Enterprises in the informal economy are facing obstacles that are sometimes similar to those

experienced by formal enterprises. However, businesses in the informal sector are much more

vulnerable in relation to these problems which are discussed below:

Lack of Credit

A lack of capital is one of the major constraints faced by participants in the informal sector. As a

result, informal sector workers are forced to use hand driven tools and outdated machinery,

which keeps their productivity low. Due to a lack of working capital, they cannot purchase raw

materials in bulk at lower prices and take their goods to market, where they can attract better

prices.

Since the participants in the informal sector tend to have low incomes, they are unable to save

much of their income for reinvestment in their businesses. To obtain capital for investment,

entrepreneurs in the informal sector usually borrow from their relatives, friends and informal

lenders like shack loans. However, informal lenders tend to lend money at daily, weekly or

monthly rates; if converted on an annual basis, these rates would be extremely high.

Poor Infrastructure

A general lack of access to physical infrastructure and services, such as roads, electricity, water

supply and public transport, dampens the productivity of both the formal and informal sectors.

Participants in the informal sector often use their houses as their work premises. Otherwise, their

businesses may be located in public places, such as on streets or sidewalks, or in unregistered

shops and workshops. Informal entrepreneurs need electricity for both lighting and power tools

in order to improve their productivity. They require water, sanitation services and places to store

their goods. Some government schemes impose the large-scale resettlement of informal sector

businesses to locations considered suitable by policymakers and planners, but such resettlement

is seldom successful.

Informal workers often lack legal property rights or secure tenure of places where they live or

work. This makes it difficult to extend infrastructural services to them. Electric companies may

11

not provide electricity for business owners who do not have secure property rights, as it would be

difficult for them to monitor the services and collect the payments.

No Management Skills / Poor Education and Training

Education and skills training are important for enhancing the productivity of informal workers,

who generally lack education and skills. Many are migrants from rural areas and have few

opportunities to receive a formal education. In addition, children of poor people in urban areas

find it difficult to attend school for economic reasons and end up in the informal sector at a

young age. Informal workers usually acquire skills through on-the-job training or a traditional

apprenticeship system.

Harassment

Various types of regulations are enforced by different government agencies dealing with the

establishment and operation of businesses. In many cases, government officials utilise these

regulations to harass business owners. A lack of awareness of the laws and regulations in the

informal sector is a major reason for informal workers’ susceptibility to the harassment.

Social protection

Participants in the informal sector enjoy little social protection against illness, disability,

unemployment, old age or the death of a main income earner. In fact, even the formal sector in

most developing countries is unable to provide comprehensive social protection for its workers,

as usually enjoyed in developed countries. Social insurance schemes, such as health insurance,

disability allowances or retirement benefits, are financed through a mix of taxation and

contributions from employers and the formal workers themselves. The implementation of social

insurance schemes for the informal sector, which consists largely of self-employed individuals, is

extremely difficult. Informal producers’ and workers’ incomes are usually low, making financial

contributions difficult. Apart from high financial costs, the administration of social insurance

schemes is very challenging.

12

With respect to working conditions, informal workers who are employees usually suffer from

exploitation in the form of long workdays, a lack of a weekly holiday, a lack of job security or

generally low wages.

POSSIBLE SOLUTIONS

There are different views from economist, governments, and lobbyist groups on how to solve the

problems of businesses in the informal sector. Below we have proposed a more general approach

on how the survival of businesses in the informal sector can be sustained given the very

important role they play in the economy of every society and country.

Direct Government Intervention

Governments can provide tax incentives for commercial banks to defray additional transaction

costs. Government can provide subsidized credit for microenterprises and make the procedures

for obtaining such loans less lengthy and cumbersome.

Better still instead of providing subsidized credit to the informal sector, improved access to

credit and other financial services is more important than the cost of credit. The Government can

introduce a concessional credit programme largely aimed at helping youth to become self

employed.

Increasing Access to Credit Finance

One of the main hurdles in obtaining credit from formal financial institutions is the need to

provide collateral, which poor participants in the informal sector usually lack. The government

can introduce a group guarantee method, where small homogeneous groups of poor people are

established for group guarantee loans.

The government can stand as a surety for the loans taken by these young entrepreneurs, for

example the South African government backs most young entrepreneurs to get loans from the

banks after scrutinizing their business plan. In case these businesses fail to repay the loan the

government pays the loan to the bank.

13

Improving on Infrastructure

Besides developing roads, increasing access to power and water the government must ensure that

the informal sector is been provided with property rights or secure tenure of their places of

residence and work. Apart from improving productivity in the informal sector, this would

encourage informal entrepreneurs to bring improvements to their land and its surroundings,

without the fear of eviction.

Human Capital Development

Human capital development is key to making the informal sector more productive and dynamic.

For this to happen, basic education, including primary education, should be made universal.

Universal primary education would help workers in acquiring vocational training and would

make them more flexible and mobile, as they could be trained and retrained more easily. Adult

literacy programmes should be provided in places where informal sector participants live. Apart

from allocating more of their own resources, Governments should encourage NGOs and the

private sector to provide skills training.

Special vocational training institutions can be established for informal workers, and existing

vocational training institutions can be used “after hours”. It is important to upgrade trainers’

skills at regular intervals in order to help avoid the transfer of obsolete skills. The upgrading of

skills can help with the use of modern technology, which in turn raises productivity.

Increased Communication

Information about regulations and laws should be publicized and made easily accessible to

informal businesses. At the same time, government officials dealing with the informal sector

need to be sensitized to the importance of the informal sector in generating employment and in

fulfilling the needs of a large body of customers. The formation of informal business associations

should strengthen the capability of the business owners to articulate their interests and to protect

themselves from harassment. Issuing a membership card for a small fee to association members

can be a useful mechanism for reducing harassment, since the low-level government officials

would be more careful when dealing with a member of an organized group.

14

Increase Social Protection

The informal sector is extremely heterogeneous, and there is a need for a careful analysis of

different options for different categories of workers in specific industries or sectors. Where

participants in the informal sector are organized, the private insurance industry and the

Government can negotiate with them a cost-sharing arrangement for social insurance schemes. It

is important that Governments subsidize the social insurance schemes and that most of the

responsibility for risk coverage is not placed on the poor participants in the informal sector

themselves.

Conclusion

The informal sector, in whatever way one defines it, is quite large, particularly in terms of its

contribution to employment in the developing countries of the region. However, due to a lack of

employment opportunities in the formal sector, people are forced to join the informal sector to

earn their livelihood. Without the informal sector, the intensity of poverty, if not its extent,

would be much higher. Therefore, it is necessary to enhance the productivity and earnings of the

informal sector.

To minimize their exploitation, there is an urgent need for laws and regulations to protect

informal workers. At the same time, however, it is important to remember that the informal

sector is a source of employment for a large number of people. Excessive laws and regulations

can stifle its growth and erode its employment-generating potential. Therefore, a balance

between the protection and welfare of workers and the maintenance of the sector’s employment

potential needs to be found.

15

QUESTION FIVE

Introduction

Trade barriers as defined by Mohr and Fourie (2004:426) as duties or taxes imposed on products

imported into the country and Mohr mentions two reasons why it is necessary; firstly it helps

protect domestic industries against foreign competition and secondly it is a source of government

revenue. We have different types of trade barriers ranging from Specific tariffs, Ad valorem

tariffs, Licenses, Import quotas, Voluntary export restraints and Local content requirements.

Government Policy as Regards Trade Barriers

South Africa participates in a number of preferential trade relationships, both regional and

bilateral. It was a founding member of the General Agreement on Tariffs and Trade in 1947, and

is an active member of the World Trade Organisation. It is committed to the principles of these

organisations, and to increasing South Africa's global competitiveness. Tariffs have been

reduced, and non-tariff barriers are being phased out.

Forming strong trading blocs

Given the high level of competition for foreign direct investment among emerging markets,

South Africa has placed greater importance on forming strong economic trading blocs to gain

access to key markets. The South African government has actively pursued negotiations for an

agreement on trade, development and co-operation with the European Union (EU). South Africa

has also turned its attention to pursuing agreements for greater South-South co-operation. The

move to establish trade relations with Mercusor via a free trade agreement with Brazil, and also

with India, is top of the government's export-oriented trade agenda.

South Africa's participation in the Southern African Development Community (SADC),

comprising 14 sub-Saharan African countries, allows access to a market of approximately 140-

million, which is expected to grow at an annual rate of around 3%.

General Trade Agreements

South Africa has negotiated a host of general trade agreements since 1994 as part of the process

of normalising trade relations with international trading partners. General trade agreements do

16

not make provision for market access in specific sectors, but essentially allow for Most Favoured

Nation tariff treatment, which is the global minimum standard for international trade relations as

established under the World Trade Organisation (WTO).

Free Trade Agreements

In addition to these general trade agreements, South Africa has also negotiated two free trade

agreements, which allow for preferential access via lower tariffs between signatory countries for

specific products across sectors: The one agreement is with the South African Development

Community (SADC), and the other is with the European Union (EU), named the SA-EU Trade

Development Co-operation Agreement.

http://www.southafrica.info/business/trade/relations/traderelations.htm Accessed on 20/09/10

The Importance of Trade Tariffs

Tariffs are often created to protect infant industries and developing economies, but are also used

by more advanced economies with developed industries. Here are five of the top reasons tariffs

are used

Protecting Domestic Employment

The levying of tariffs is often highly politicized. The possibility of increased competition from

imported goods can threaten domestic industries. These domestic companies may fire workers or

shift production abroad to cut costs, which means higher unemployment and a less happy

electorate. The unemployment argument often shifts to domestic industries complaining about

cheap foreign labor, and how poor working conditions and lack of regulation allow foreign

companies to produce goods more cheaply.

Protecting Consumers

A government may levy a tariff on products that it feels could endanger its population. For

example, South Africa may place a tariff on imported beef from the Zambia if it thinks that the

goods could be tainted with disease.

17

Infant Industries

The use of tariffs to protect infant industries can be seen by the Import Substitution

Industrialization (ISI) strategy employed by many developing nations. The government of a

developing economy will levy tariffs on imported goods in industries in which it wants to foster

growth. This increases the prices of imported goods and creates a domestic market for

domestically produced goods, while protecting those industries from being forced out by more

competitive pricing. It decreases unemployment and allows developing countries to shift from

agricultural products to finished goods.

National Security

Barriers are also employed by countries to protect certain industries that are deemed strategically

important, such as those supporting national security. Defense industries are often viewed as

vital to state interests, and often enjoy significant levels of protection.

Retaliation

Countries may also set tariffs as a retaliation technique if they think that a trading partner has not

played by the rules. For example, if South Africa believes that the Zimbabwe has allowed its

wine producers to give its domestically produced wines South African names, it may levy a tariff

on imported meat from the Zimbabwe unless they agrees to crack down on the improper

labeling. Retaliation can also be employed if a trading partner goes against the foreign policy

objectives of the government.

The Major Draw Back of a Trade Barrier

Due to the effects of tariffs the prices of imported goods go up because of this, domestic

producers are not forced to reduce their prices from increased competition, and domestic

consumers are left paying higher prices as a result. Tariffs also reduce efficiencies by allowing

companies that would not exist in a more competitive market to remain open.

The figure below illustrates the effects of world trade without the presence of a tariff. In the

graph, DS means Domestic Supply and DD means Domestic Demand. The domestic price of

goods indicated by P, while the world price is found at P*. At a lower price, domestic consumers

18

will consume Qw worth of goods, but because the home country can only produce up to Qd, it

must import Qw-Qd worth of goods.

Price without the influence of a tariff, Source: www.investopedia.com Accessed on the 24/09/10.

When a tariff or other price-increasing policy is put in place, the effect is to increase prices and

limit the volume of imports. The diagram below shows the price increases from the non-tariff P*

to P'. Because price increases, more domestic companies are willing to produce the good, so Qd

moves right. This also shifts Qw left. The overall effect is a reduction in imports, increased

domestic production and higher consumer prices.

19

Price under the effects of a tariff, Source: www.investopedia.com Accessed on the 24/09/10.

Conclusion

Free trade benefits consumers through increased choice and reduced prices, but because the

global economy brings with it uncertainty, many governments impose tariffs and other trade

barriers to protect industry. There is a delicate balance between the pursuit of efficiencies and the

government's need to ensure low unemployment. But from our discussion above it would

beneficial for the government to impose less barriers when it comes to trade, though it might be

threat to small and medium size enterprises who cannot compete in a whole it leads to better and

higher living standards as quality products can be gotten a cheaper prices as illustrated on the

diagram above.

20

Bibliography

Ademu, W.A (2006)”The informal sector and employment generation in Nigeria: The role of

credit”. NES 2006 Annual Conference

Begg & Ward (2007) Economics for Business New York, USA: McGraw-Hill

Farrell G., Roman J. & Fleming M. (2000) “Conceptualizing the Shadow Economy.” Journal of

International Affairs, 53, 2, Spring, 387-412.

Todaro, M.P. 1997. Economic Development, New York: Longman Publishing

Mohr & Fourie (2004) Economics for South African Students Pretoria, South Africa: Van Schaik

Publishers

Peter K. (2000) Macroeconomic Essentials: Understanding Economics in the News

Massachusetts; USA Omegatype Typography Inc.

Pinelopi K. & Nina P., (January 2003) “The response of the informal sector to trade

liberalization”, National Bureau of Economic Research, Working Paper No. 9443, Cambridge,

Massachusetts, United States.

Sethuraman, S.V (1981) The urban informal sector in developing countries: Employment,

poverty and environment, Geneva. International Labour Organisation.

www.investopedia.com/terms/floatingexchangerate.sap Accessed on the 24/09/10.

http://www.southafrica.info/business/trade/relations/traderelations.htm Accessed on 20/09/10

21