Economic and Print Market Trends and Outlooks Ronnie H. Davis, Ph.D. Chief Economist PIA/GATF.

-

Upload

marjory-owens -

Category

Documents

-

view

217 -

download

3

Transcript of Economic and Print Market Trends and Outlooks Ronnie H. Davis, Ph.D. Chief Economist PIA/GATF.

Economic and Print Market Trends and Outlooks

Ronnie H. Davis, Ph.D.

Chief Economist

PIA/GATF

Print Market Trends and Outlooks• A Look Back--The Print Rebound and Current

Market Dynamics• The Re-structuring of the Industry• Outlook for 2005 and 2006• Profit Picture• Global Threats and Opportunities• Keys to Success

The Print Rebound of 2004

Printing Shipments (% Increase 2004 vs 2003)

2.8%

2.3%

4.8%

3.6%

0.8%

0.2%

3.5%

2.0%

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

Total PrintingShipments

Ink-on-Paper Toner Based Ancillary Services

2004 2003

Print Rebound of 2004 by Market Segment

Printing Shipments by Market Segment (% Change 2004 vs 2003)

-0.4% -0.4%

2.6% 2.7%

-4.4%

1.2%

-4.9%

5.5%

8.5%

5.9%

-0.2%

-3.1%

-2.4%

0.8%

-6.3%

6.6%

-8.7%

-1.8%

1.0%

3.6%

7.9%

9.2%

-10.0%

-8.0%

-6.0%

-4.0%

-2.0%

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

Book Printing

Business Form Printing

Financial/Legal Printing

General Comm

ercial Printing

Label, Wrapper Printing

Magazine Printing

Newspaper Printing

Package Printing

PrePress Services

Quick Printing

Trade Binding

2004 2003

PIA/GATF’s Print Market Tracking Model• Based on PIA/GATF surveys, the PIA/GATF

Atlas model on printing plants by market segment and employee count, Ratios data on shipments per employee, adjustments for “survivor bias”, “size bias” and “member bias”.

• The most accurate tracking available--used by the Federal Reserve System

Final Numbers for 2004

Printing Industry 2004

Total Shipments(Increased by)

$161.1 Billion($4.4 Billion)

Printing Plants(Decreased by)

42,997 (4,386 Web Plants)(1,538 Plants)

Employment(Decreased by)

1.1 Million Employees(18,000 Employees)

Reasons for the Rebound

• Strong economic growth (over 4%)• Advertising rebound• Presidential election (a half-point kick)• Stable postage rates

Print’s Restructuring

• Over last 4 years a decline of 4,800 plants and around 150,000 employees

• In 2001 and 2003 a decline of 2.4% in sales each year

• A loss of over 11,000 printing plants since 1994

• Average size plant has increased from around 17 to over 25 employees (50% increase)

• Only larger plants are growing in number

Larger Plants Only Ones Growing in Size

16,780

14,868

12,031

10,778

7,820

6,981

6,1315,461

2,604 2,494

1,574 1,633

727 758

0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

16,000

18,000

Num

ber

of P

lant

s

1-4 5-9 10-19 20-49 50-99 100-249 250+

Number of Employees

Number of Printing Plants by Size (Changes From 2000 to 2004)

Number of Plants 2000

Number of Plants 2004

Print’s Restructuring

• There are still almost 43,000 plants• Over next 10 years projections are for further

declines:–Low-a loss of 4,000-5,000–Middle-loss of 6,000-8,000–High-a loss of 8,000-10,000+

Print and the Economy

• Economy grew over 4% in 2004 and print grew 2.8% (70%)–2.8% is “real” print--printing prices declined by .2% in 2004 (PIA/GATF estimate for FRS)

–Up until mid 90s grew as fast or faster–Still opportunity (3% of $160 billion is almost $5 B)–Some processes/segments growing stronger

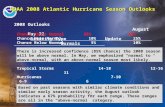

US Economic Growth Continues Strong• After a strong 2004 growth of over 4% the US

economy is still growing strong.• First Quarter 2005 the US Economy grew by

3.5%.• Inflation is remaining in check at 3%.• Unemployment is on the decline.• Remainder of the year we forecast the

economy growing by 3%.

First Quarter Update

Another Strong Quarter

Total Shipments Up 3.6%

Ink-on-Paper Up 4.2%

Toner Based Up 6.3%

Ancillary Services Up only 1.8% (a reversal of ink-on-paper and ancillary services)

The Economy 1st Quarter 2005Overall Economic Growth Up 3.8%

Paper Prices Up over 3%

Print Prices Up 0.3%

“Real Print” Up 3.3%

Outlook for 2005

• Stronger Growth In:- Direct Mail

- Books

- Packaging / Labels

- Periodicals

Another Strong YearTotal Shipments Up 3%

Ink-on Paper Up 2.5%

Toner Based Up 4+%

Ancillary Up 3+%

Printing Shipments From 2005 to 2003

Printing Shipments

3.6%

4.2%

6.3%

1.8%

3.0%

2.5%

4.0%

3.0%2.8%

2.3%

4.8%

3.6%

0.8%

0.2%

3.5%

2.0%

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

7.0%

Total PrintingShipments

Ink-on-Paper Toner Based AncillaryServices

1st Qtr. 2005 Outlook for 2005 Actual 2004 Actual 2003

A Five Year View of Print Markets (2005 – 2010)

• Assuming US economic growth of 3-3.5% per year over the next 5 years total printing shipments should grow around 2-3% per year or slightly less than the overall economy.

• These are “real” numbers in that the number for the economy and print markets has been adjusted for inflation.

Forecast For Average Annual Growth of Print Sales by Sector

Sector Average Annual Sales Change 2005-2010

Direct Marketing Printing 3-3.5%

Labels/Wrappers Printing 2-3%

Packaging 2-3%

Catalog Printing 2-3%

General Commercial/Quick Printing

2%

Periodical/Magazine Printing 2%

Book Printing 1-2%

Directories Printing 1%

Business Forms Printing -3 to -4%

Question Mark for 2006

• Postage Rates are going up• Postage and print relationship:

–Over 40% of $print through USPS–Past history shows “price elasticity” of mail at .50 and increasing

–PIA/GATF estimates that for every 1% increase in postage there is a .175% decline in print volume

A Postage Increase in 2006

• Much lower than anticipated (PIA/GATF led the postal reform effort)

• This could cause around a 1% decline in print volume over a 12 month period

• If the economy holds up and grows 3.5% or so in 2006, and if there is a surge of direct mail before the increase:–2006 printing shipments may edge up around 1.5-2% –2007 depends on economy and postage rates

Profit Picture

• A lagging recovery• In the 90’s --3.5% for all printers and 12% for

profit leaders• Recession--dropped to 1% for all and 8% for

profit leaders. A slow recovery but should see significant improvement this year

Profit Leaders vs. Profit Challengers

Profit as a Percentage of Sales: All Printers and Profit Leaders

2.6%2.0% 2.3% 2.5%

3.3% 3.0% 3.2% 3.3% 3.4% 3.2% 3.1%

1.0% 1.6%

8.9% 8.8% 9.2% 9.6% 9.9% 9.6% 9.8%10.2%10.9%10.5%

8.0% 8.4% 8.6%

1.7%

11.8%

0%

2%

4%

6%

8%

10%

12%

14%

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

All Printers Profit Leaders

Global Threats and Opportunities• US Printing industry still a “net exporter”• Imports growing faster than exports• Exports around 4%/Imports around 3%• Growth of China printing industry--over $700B

in 2003• Growth of global sourcing--almost 4/10

printers say their customers are looking at global print sources

• One in three US printers lost a job to a foreign competitor in 2003

Imports Growing Faster than Exports From 1998 to 2003

37.6%

1.9%

37.7%

14.5%

29.1%

-14.0%

110.6%

-30.9%

61.4%

24.4%

54.3%

13.6%

-40.0%

-20.0%

0.0%

20.0%

40.0%

60.0%

80.0%

100.0%

120.0%

General Comm

ercial

Magazine/Newspaper

Book Printing

Business Forms

Label, Wrapper

Greeting Card

Change in US Imports and Exports by Market Segment 1998 to 2003

Change in US Imports

Change in US Exports

Global Threats and Opportunities• Almost half of those that lost a job indicated it

was lost to a Chinese printer• China has over 92,000 printing plants and

71,000 copy shops• From 2001-2003 China imported 2,400 sheetfed

presses and 540 web presses

Bottom-Line: Import share will grow but vast majority of will print will remain domestic

Keys to Success for Printers

• Have a well developed strategy• Manufacturing efficiency• Administrative efficiency• Be a Learning Organization• Share the Wealth• Offer more ancillary services