DUTALAND Presentation

-

Upload

humaizah-mai -

Category

Documents

-

view

215 -

download

1

description

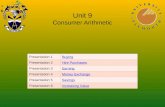

Transcript of DUTALAND Presentation

Suggested Investment

DUTALAND

DUTALAND

FIXED DEPOSIT

BankINTEREST

(r) % SHORT TERM

LONG TERM

5 Year [FV=PV(1+r)ⁿ]10 Year

[FV=PV(1+r)ⁿ]20 Year

[FV=PV(1+r)ⁿ]

Maybank 3.3 117,625.53 138,357.66 191,428.43

Ambank 3.35 117,910.48 139,028.81 193,290.10

RHB 3.45 118,482.03 140,379.91 197,065.18

FUTURE VALUE

FORECASTED FOR 31 DECEMBER 2014

DUTALAND

FORECASTED

Cash 2,902 4.98% 3,192 Account Receivables 16,802 28.84% 18,482 Inventories 12,692 21.78% 13,961 Plant Equipment 448,608 769.90% 493,469 Biological Asset 223,202 383.06% 245,522 Land Held For Property 237,110 406.93% 260,821 Total Assets 941,316 1,035,448

Liabilities & EquitiesAccount Payable 46,489 79.78% 51,138 Borrowing 102,352 No Change 102,352 Deffered Tax Liabilities 25,092 No Change 25,092 Shared Capital 846,118 No Change 846,118 Retained Earnings (165,863) (180,297) Projected Sources of Financing 844,402 Discretionary Financing 191,046 Total Liabilities & Equities 854,188 Total Financing Needed (TFN) 1,035,448

DUTALAND DUTALAND Balance Sheet as at 31 December 2013 Forecasted B/S as at 31 December 2014

Assets RM'000Calculation on % of sales

(RM'000) Projected 2014 (S₁=RM 64,095)

INCOME STATEMENT FORECASTED

RM '000Sales 64,095

Cost of Goods Sold 0.07 x 64,095 (4,487)

Gross Profits 59,608 Operating Expenses 1.22 × 64,095 (78,196)

EBIT (18,588)Interest 0.013 x 64,095 (833)

EBT (19,421)Taxes 0.022 x 64,095 (1,423)

Net Profit After Tax (20,844)Cash DividendTo Retained Earning (20,844)

DUTALANDForecasted Income statement for the year ended 31/12/2014