DLT developments in finance

-

Upload

alphons-ranner -

Category

Economy & Finance

-

view

19 -

download

0

Transcript of DLT developments in finance

1

DLT developments in finance

“Bitcoin created to reduce consumers’ costs by replacing incumbent finance

not to cut infrastructure costs for traditional finance”

A.P.Ranner, Jan 1, 2017 Financial consultancy

S O V E R E I G N BV

2

2. Essence of blockchain

3. Financial institutions and blockchains

4. Private versus Public ledgers

5. Smart contracts

6. Issues and dilemmas

1. Introduction

3

BLOCKCHAIN defined:

1. Peer internet network of users (nodes) using a shared database and computational logic to record & track either transactions or account balances for a set of assets and users. 2. Users can modify accounts in the DLT and consider it as authoritive even without a central management system 3. Records created are irreversible

Only digital (no physical)

assets

Requires connections to a. Off-chain processes for non-digital assetsb. Processing platforms of financial legacy infrastructures

A.P.Ranner, Jan 1, 2017 Financial consultancy

S O V E R E I G N BV

4

Basic elements

Shared Contract

CryptographyShared Ledger

Consensus

Secure, authenticated & verifiable transactions

Business terms embedded in database & executed with transactions

All or designated parties agree to network verified

transaction

Language and system of transactions and counterparty data

shared across business network

If sufficient participation cheaper, less complexity, increased speed of verification and execution & increased efficiency

Source: IBM

Each blockchain record is cryptographically enforced & hosted on machines working as a datastore

A.P.Ranner, Jan 1, 2017 Financial consultancy

S O V E R E I G N BV

5

Auditable immutable log of database updates

# or hash (unique identifier) > digital fingerprint to associate with a (financial) transaction and registered on blockchain.

# plus immutability > allows time stamping # trust promoted through public & private key cryptography and use of cryptography for

transactions

Essential elements: • Effective consensus rules to prevent double spending• Time stamping, • Anchoring (link to previous block) • Notarization (digital signatures) • Transaction level constraint (no credit)

Decentralised ledger with trust as a built-in feature A.P.Ranner, Jan 1, 2017 Financial consultancy

S O V E R E I G N BV

6

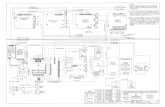

Distributed Ledger network

Source: IBM

External aggregator

of feed

Oracles

Independent permissioned

blockchain

Distributed virtual machine (Turing-complete)

Smart contracts govern off-chain assets

Network achieves settlement finality

Markets

Distributed Ledger - Components A.P.Ranner, Jan 1, 2017 Financial consultancy

S O V E R E I G N BV

7

Source World Economic Forum (WEF)

8

Reasons for banks and FMIs taking on the blockchain challenge

Reduction of back-office costs

Reduction of costs of AML/KYC & ATF

Reduction of costs of hedging of risks and capital

Network effect provides economies of scale

Increase cyber resilience

Flatten value chain

Realising improvement of positions in markets and or value chain

A.P.Ranner, Jan 1, 2017 Financial consultancy

S O V E R E I G N BV

9

Silos of the Financial Services Industry

Source IBM 2015

10

Present internal and

external activities of banks and financial market

institutions

Creating connections to internal operations & collateral management & identity management

Developing multi-party blockchains for specific business to business transactions

Coping with regular requirements regarding identification and certification (ALM / KYC/ ATF )

Developing internal private blockchains in local banks & in multinational banks

Interoperatibility of different DLTs and internationalization require standardization on global scale e.g. IOSCO, CPMI, ISDA, ESMA

Internal operations: starting with selection of inefficient workflows & possibilities for automation1. streamling highly intermediated processes, 2. looking for comparative advantages

Reducing errors, stimulating cost-efficiency & profitability

11

Banks, financial market institutions and (IT) consultants participate in or drive shared ledgers relying on consortia-style arrangements, but also within banks there are groups developing new approaches:

Taking into account the requirements of DVP transactions as well as involvement of many FMIs creation of DLTs for Securities settlement or OTC clearing is difficult.

All pilot approaches are in different stages of development. In Asian, Russian countries innovative schemes are also being created.

• Equity & debt issuance, including payments of interest and dividends

• Wholesale payments• Syndicated loans• Derivatives post trade development• CDSmanagement• Clearing and settlement of stocks

• Reference data• Mortgages• Specialized trading• Cross border financial activities• Digital identities• Recording of financial data

12

Blockchains

Database access Open read / write Permissioned read (need to know basis) and /or write using encryption

Sensitive information in seperate (own ) databases

Consensus Proof of work or proof of stake (miners)

Specific simpeler algoritms / agreements between participants

Transparency High Low

Data Storage volume Large Much less

Speed Slower Faster to enable high throughput

Security Only Proof-of-work /proof of stakeOpen chain allows attacks on codes, on wallets etc

Pre-approved participants

Identity Anonymous /pseudoanonymous Known identities

Assets Native (cryptocurrencies or tokens) Any digital asset

Parties involved Everybody interested: unknown entities can propose/validate transactions

Only Trusted and Accountable institutions in a closed network

Selected Partners , regulators

Information Open to any one(all entities share info)

Open general info, but sensitive info (commercial & business) is private

Confidential info of ledger

public Private or restricted

Goverance Nobody responsible Owners of platforms and or organization of participants responsible

13

Most banks and financial market institutions prefer restricted DLTs as:

Open DLTs a. offer little confidentiality b. allow for illicit behaviour still have coding errors and are cyberattack prone c. have no KYC, AML or ATF provisions d. have inefficient validation methods

Restricted DLTS hardly requires changes in market structure, e. while current relations mainly can stay Intact with little extra costs of connecting with

legacy structures f. costs of verification data and transactions and operating network costs can be reduced

dramatically g. little risk of capacity constraints (scalability, energy & hardware) and

no additional costs related to network operations of public networks h. security can be higher

Banks, financial market institutions and governments in favour of: High level of governance, authentification, confidentiality and accessibility These elements are important for trust of most market participants

14

Major Ecosystems1. Bitcoin2. Ethereum (alternative to bitcoin)3. Hyperledger4. Corda

• In Dec.2016 FMIs only used a few restricted (or private)blockchains

• Limited transparency of data embedded in blockchain or off blockchain

• Risk of collusion due to many individual DLTs ( closed shop situation & relatively less internal checks & balances).

• Risk of reduction in competition between banks and FMI as providers of financial services

Usable as Restricted (private)DLTs

Major options for others1) Reconfigure a public

permissionless DLT network for private use, or

2) Build on top of an available untested restricted(private) DLT network

Lots of start-ups and individual financial institutions in different stages of

development or in niches

15

Bitcoin

Public blockchain platform in widespread production: only payment transactions (attractive for crossing borders) in cryptocurrency

• Trust, tracebility, verifiability and prevention of concentration of power

• No identity on blockchain & no AML / KYC or other border restrictions & immunity to regulatory and monetary policies

• Attractive for a) tax evaders, criminals, terrorists; alternative to gold, silver in countries with weak currencies

b)investors looking for yield (limited supply-demand relationship)

But: Bitcoin scams, hacking scandals, interoperability, governance problems and miners centralization (51% attack), scalability, risk of gouvernement regulations

Orientation toward Enterprise friendly platforms & sidechains (build on bitcoin blockchain)

Recently efforts to increase scalability: Segregated witnes (a.o. modest limit increase) soft fork of bitcoin

16

Ethereum• Blockchain with built-in cryptocurrency contains (Turing complete) “contracts”which are compact computer programs• These contracts are replicated and maintained by every participating node.• Proof of work to be replaced by Proof of stake (“validators” replace “miners”)• Every single node in the network processes every transaction and maintains the entire state• Transaction processing capacity can not exceed that of a single node. • Every user can create a contract• All transactions cost a small amount of cryptocurrency• Scalability improving through “state channels” (of blockchain transactions conducted directly between parties and “sharding” (only limited nodes randomly carry out processing, resulting in parallel operations)• Incorporating privacy using combinations of cryptographic hashes and signatures or advanced cryptographic techniques

to obfuscate the meaning of a transaction) • In development of non-proof –of-work consensus algorithms• Private platforms in development (e.g Quorum for JP Morgan)

Many public and private blockchains & platform based

on forks of Ethereum , eg

Monax

Ethereum virtual machine (EVM) Handling internal state and computation of accounts maintain internal database, execute code & talk to each other

Correct code execution and sharding could be issues in financial blockchains

Standards for Traditional enterprise security & identy architectures to be met

17

Corda 1. Open source release distributed ledger platform including smart contracts, meant to set standard2. Primarily developed for recording and managing financial agreements between regulated financial institutions3. Only parties with a legitimate need to know to see data (privacy protection) so no copy for all participants4. Consensus process is controlled by a pre-selected set of nodes and between institutions at level of individual deals rather than all participants (variety of consensus mechanisms available)5. Validation by parties to the transaction (stakeholders to the deal) on contract by contract basis.6. Regulatory and supervisory observer nodes enabled7. Explicit link between legal prose documents and smart contract code8. No native cryptocurrency

3RCEV (technology provider, IT consultants)Consortium of more than 60 financial institutions

Experiments with more than 5 ledgers

No blockchain, only a business to business protocol!

Interoperability possible

Open sourced in nov. 2016 to Hyperledger and

Microsoft

Problems: 1.Without patents many institutions can copy this approach and build on it. 2.Transparancy of data etc. for institutions not part to the deal is low3.Financial institutions with Blockchain patents will try to build their own standard

18

The Hyperledger project is an open source collaborative effort created to advance cross-industry blockchain technologies. Linux Foundation (non-profit) hosts Hyperledger Platform as a Collaborative Project under the foundation. IBM is a prominent member.

Presently available: a. Corda platform (recently added), b. Sawtooth Lake c. Iroha

Sawtooth

Modular platform initiated by Intel; under development. It uses a single consensus protocol, PoET, for “Proof of Elapsed Time.” This is a lottery protocol that builds on trusted execution environments to address needs of large populations of participants. A second consensus protocol, Quorum Voting, serves to address needs of applications that require immediate transaction finality (finality after production of certain number of blocks) Disadvantage: to be run on Intel's proprietary hardware

Iroha

In incubation: with a simple architecture and reusable C++ components (can call from languages as Go) to increase speed. Mobile usage. Focussed on KYC

19

Modular platform initiated by Intel; under development. It uses a single consensus protocol, PoET, for “Proof of Elapsed Time.” This is a lottery protocol that builds on trusted execution environments to address needs of large populations of participants. A second consensus protocol, Quorum Voting, serves to address needs of applications that require immediate transaction finality (finality after production of certain number of blocks) Disadvantage: to be run on Intel's proprietary hardware.

Sawtooth Iroha

In incubation: with a simple architecture and reusable C++ components (can call from languages as Go) to increase speed. Mobile usage. Focussed on KYC

A.P.Ranner, Jan 1, 2017 Financial consultancy

S O V E R E I G N BV

20

Digital Asset Platform Specifically developed for financial services industry: Post-trading settlement (DTCC & ASX),further syndicated loans and Treasury Repo.

Very recently: Distributed network with privacy protection (confidentiality) defining 2 components:a. Global Synchronization Log (GLS): confidential transaction data including price, transaction party details, other private user data & changes to state of smart contracts, > remains on relevant bank serversb. Public network with digital fingerprints (or Hash): bare minimum of non- confidential blockchain & smart contract data (market-wide rules) coded in DAML (a smart contract language)

• Multi-operator network• Operator initiates blockchain with a predetermined consensus algorithm with a primary rotation for entities that will order transactions and closely monitor behavior for erroneous or malicious activity

Reduced operational risks & costs and no scalability issues (errors eliminated, no reconciliation requirements)

Interaction possible with existing bank protocols

Individual transactions

interpretable only combining both

components

21

1. Concensus mechanism (PBFT) with a signature based chaincode. A financial institution starts and other financial institutions and multinationals act as consenters: verifying and confirming transacions. Other peers only endorse. Ledger replicas are identical.2. Privacy of data at financial institutions is preferred (storage costs)3. Preference for unencrypted info on chain because of riskiness and costs of decrypting keys in case of tracking assets. Chain only used for timestamping and transfer signals.4. Modularity, chain hosts smart contracts (“chaincode”)5. Interconnectivity with other blockchains6. Participants are allowed to share multiple ledgers

Digital assets holding : since October 2016 Hyperledger Fabric (as a DLT)

A.P.Ranner, Jan 1, 2017 Financial consultancy

S O V E R E I G N BV

22

Smart contracts

If-then statement

Digital coded agreement on blockchain concerning self-execution processes Immutability and simplicity enables automation, reduces costs & speeds up financial transactions efficiency gains

Components:a. Identification agreement b. Definition of trigger for transaction (business logic) c. Circumstances causing trigger / execution

d. Signatures (hash or identifier) & time stamp e. Timing of completion of transaction

f. Updating network A.P.Ranner, Jan 1, 2017 Financial consultancy

S O V E R E I G N BV

23

Smart contracts

Requirements: Encrypted private and public keys

Multisig or turing complete contracts

Standards (standardization of language, templates incl. underlying technologies)

Protocols for “legally” executing smart legal agreements

Business and legal prose translated into code

Complete information synchronization & data integrity for partners

Automated escrows

External Oracles (as a single source of proof) / external aggregators of feeds

Verification (trusted agent) confirming compliance with contractual agreements

Arbitration (dispute resolution) agreements

24

Smart contracts

Simplification standardised, automated commands, offering electronic self execution

Management often hesitant:

• No uniform standards and protocols yet • Lack of regulatory guidance and knowledge of cryptology / programming, lack of experience

• Smart contracts only replace those parts of contractual agreements suited to automatic processing

• Doubts about positive business case:

High capital costs

Insufficient cost-benefit analysis

Insufficient knowledge of risks involved

25

Smart contract risks

• Bugs, inaccuracies, errors in coding- & programming language

• Wrong interpretation of agreements between partners

• Wrong coding of activities, circumstances & to implement actions

• Wrong information (or handling thereof) derived from data embedded in blockchain or from external data

• No force majeure clauses, no guaranteed computation

• Uncertainty about legal enforceability of contract

Challenge information synchronisation & data integrity & legal enforceability

Risks Security flaws can be very costly and bad for reputation,

Management & control require knowledge of computer languages, cryptography andlaw (and finance)

Shortage of combined expertise

26

Smart contract risks

• Only short simple and highly standardardized statements & formats (approval of regulators?!)

• Minimal use of code, conservative scripting of language• Professional due diligence by parties involved in smart contract • Escape hatch (?)• Selected pre-agreed terms of smart contract agreement (off blockchain): governing laws, indemnification, jurisdictions etc.• Combination of smart contract with traditional contract (recording terms and conditions of

arrangement) acceptable according to laws and regulations in appropriate jurisdictions CODE IS FREQUENTLY NOT LAW

• Third parties no access to confidential commercial information NO TRANSPARENCY

Challenge information synchronisation & data integrity & legal enforceability

Solutions

27

1. Difficult decisions are required regarding participation and promotion of specific blockchains and their interoperability & the choice of standards. As many blockchains are occurring on a global scale international efforts are needed.

2. Financial institutions have different interests owing to business models, risk profiles, strategies and resources and also differ as the influence of DLTs on their corporate capabilities & the revenues

and costs of integrating the blockchain into their organizations.

3. Each institution has to compare DLT investments with other investment options. DLT investments should be considered in the context of broader ongoing digitalization of the banking industry and the consequences for competitive advantages.

4. Cyber-security protection across distributed nodes should be high.

Challenges and dilemmas

A.P.Ranner, Jan 1, 2017 Financial consultancy

S O V E R E I G N BV

Trust is vital

28

5. DLT Consensus- / validation systems with only a limited number of nodes or with a platform owner in demand can lead tot errors, conflicts of interest and collusion.

6. The network effect is important for DLT take-off, but shape and attractiveness of this network is influenced by broad user acceptance

7. DLTs Governance frameworks should be of same high standard as other banking frameworks

8. Incorporating different DLTs in the accounting / valuation framework of most financial institutions and individual customers has to start yet but requires formidable efforts.

9. Regulators and monetary authorities require complete information (AML/KYC/AFT) but also market- and other statistics. Providing the authorities with DLT-nodes is probably not sufficient. Authorities are most likely to share extra costs however only in exchange for more services.

10. How to create sufficient skills to create, understand & work with DLTs? Solutions easing the interpretability of computer language, cryptography and blockchain / smart contract language are required to enable DLTs to take off.

Challenges and dilemmas

29

Cryptocurrencies and permissionless blockchains

Only with a significant volume increase: 1. Risk of reduced monetary control of supply and circulation of fiat money, 2. Undermining the effectiveness of monetary policies3. Risk of systemic consequences if large unregulated blockchains go down

.National monetary authorities are to issue digital central bank money, in

order to control money supply

A.P.Ranner, Jan 11, 2017 Financial consultancy

S O V E R E I G N BV

National monetary authorities are to promote international harmonization of rules and regulations for DLTs

Contribute to or control suitable use and practices regarding DLTs