DFT Preliminary Report€¦ · its latest earnings call, the company guided expenditures for 2017...

Transcript of DFT Preliminary Report€¦ · its latest earnings call, the company guided expenditures for 2017...

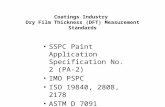

Investment Rationale

USF Student Managed Investment Fund Current Price

50.66

Intrinsic Value

57.89

3-Yr Target Price

71.16

3-Year Price Performance Revenue/FFO Data

Sector Real EstateIndustry Specialized REITs

Recommendation

Analysts L. Arruda, J. Davis, and Q. NguyenBUY

Summary DuPont Fabros Technology is a real estate investment trust (REIT) that owns, acquires, develops and operates wholesale data centers. Its customer base includes Microsoft, Facebook, and Apple.

Stock Statistics

Q1124107102

887869

Q2129114102

928371

Q3134115106

968574

Q4142116108

998674

Year529452418375332287

Revenue (Million $)

201620152014201320122011

Risks

625154393536

875856443640

685654174142

716654463835

289230219147150154

Funds from Operations (Million $)201620152014201320122011

• Loss of key customers could materially affect the firm due to high customer concentration

• Increasing competition as the industry becomes more attractive

• Failure to fully lease new data centers and renew existing leases

• DuPont will benefit from increasing data usage, which will drive the need for large data centers

• DuPont is undervalued relative to its peers and we expect that its multiple will adjust to industry norms

• The cost-efficient and secure nature of external data centers will drive the need for DuPont's services

-10.00%

10.00%

30.00%

50.00%

70.00%

90.00%

110.00%

DFT Vanguard REIT ETF S&P 500

52-Wk RangeMarket Cap

37.54 - 52.034.52B

Beta to S&P 500Beta to REIT ETF

0.750.97

P/E RatioDividend Yield

30.33.94%

Price/BookPrice/Sales

5.17.1

Stock Report | April 18th, 2017 | Ticker: DFT

2

DuPont Fabros Technology is a REIT that leases wholesale data center capacity to some of the world’s largest technology companies. The company operates 11 data centers across the U.S. and serves 32 different customers in three states: California, Virginia, and Illinois. Microsoft and Facebook combined accounted for 45.6% of annualized base rent in 2016, as indicated in the table on the right. DuPont also specializes in cloud as 82% of its annualized based rent comes from cloud and cloud-like customers.

In 2016, the weighted average base rent that DuPont Fabros charged its customers was $102 per kilowatt per month. At the end of the last fiscal year, the firm leased 287,000 kilowatts, totaling $345 million in base rent during the period. In addition, DuPont predominantly adopts a triple net lease system, where the clients are not only responsible for rent costs, but also for energy consumption and certain operating expenses, such as maintenance and security.

Overview of REITs and Data Center REITs

Real estate investment trusts (REITs) are holding companies that own and manage properties, and lease their properties out to lessees. Data center REITs manage facilities that provide all infrastructure necessary to house server equipment, including systems for power distribution, environmental control, fire suppression, and security. The two types of data center REITs are wholesale and retail.

Wholesale data centers are the larger of the two types. The total area of these data centers usually range from 50,000-1,000,000 square feet. REITs that operate these types of data centers usually do so on a contractual basis. Tenants are required to sign 7-20 year leases and are billed monthly based on power usage. Wholesale data centers cater to large technology companies that require massive quantities of power for data storage.

Retail data centers cater to companies that require less power for data storage. Tenants of these data centers are billed monthly based on the number of server cabinets that they occupy.

Business Overview

Stock Report | April 18th, 2017 | Ticker: DFT

Customers % of Base Rent

Microsoft 25.4%Facebook 20.2%Apple 11.2%Rackspace 9.0%Fortune 500 SaaS Provider 8.0%Yahoo! 6.0%

3

Investment Rationale

Increasing Demand for Data Centers

Internet of ThingsThe internet of things (IoT) phenomenon is one of the primary growth catalysts for data centers. As the availability of broadband internet reaches more regions and individuals, more and more devices are becoming connected to the world wide web. Traditional non-tech devices such as watches and vehicle communication systems are now connected to the web. According to a recent research report by investment company, JLL, enterprises are expected to increase their investments in smart office devices by 33% over the next 12 months. As technology companies compete to lead in IoT innovation within their respective markets, data storage capacity will need to expand to support their initiatives, thus increase demand for DuPont Fabros’s services.

Increased Focus on Cloud Servicesand InfrastructurePer the International Data Corporation (IDC), worldwide spending on cloud services and infrastructure will reach $122.5 billion this year, a 24.4% increase over 2016. IDC also projects that spending will grow at a 21.5% compound annual growth rate through 2020. Large companies will continue to be the primary drivers of worldwide public cloud services, with spending expected to account for over 50% of cloud spending throughout the period.

Microsoft, Dupont’s largest customer, is committed to continuous improvement and expansion of its cloud computing infrastructure. Azure, the company’s proprietary business cloud services platform, experienced revenue growth of of almost 100% in 2016. Additionally, revenue attributed to the company’s Office 365 platform, a cloud-based version of its popular Office software, grew 47% in the second quarter of 2016.

Facebook, Dupont’s second largest customer, is also committed to expanding its data storage capacity. In its latest earnings call, the company guided expenditures for 2017 at $7.0-$7.5 billion, an annual increase of 56-67% over last year’s expenditures. The company attributes the capacity expansion need to the growth in its video streaming services.

Stock Report | April 18th, 2017 | Ticker: DFT

98.8

122.5

148.8

180.8

203.4

$95

$115

$135

$155

$175

$195

$215

2016 2017 2018 2019 2020

Worldwide Cloud Services Spending (in Billions)

4

Investment Rationale (Continued)

DuPont is Undervalued Relative to Peers

In the REIT industry, two metrics that are widely used to analyze a firm’s financial health are funds from operations (FFO) and net operating income (NOI). DuPont trades at a lower price-to-FFO and price-to-NOI multiples relative to any of its main competitors even though the firm consistently outperforms the REIT industry. The table below contains different metrics that highlights this case.

We are confident DuPont’s stock price will appreciate given its superior financial health and strong growth prospects. For instance, DuPont benefits from being the only pure-play company in the wholesale data center space, which makes the firm better positioned to capitalize on the trends driving this industry. This pure-play characteristic allows the firm to attract larger clients and creates cost advantages over retail REITs. The table below contains numerous profitability metrics that are commonly used to analyze this industry.

The superior metrics seen above is largely a result of DuPont’s focus into wholesale data centers. Restricting its operations to wholesale has minimized the number of customers the company serves, but allowed it to acquire larger and more profitable clients. Tech giants like Facebook and Microsoft require data centers that are tailored to their specific needs, which allows DuPont to charge higher prices. Moreover, the size of wholesale data centers make them more adequate to supply the increasingly large and complex needs of tech enterprises.

Stock Report | April 18th, 2017 | Ticker: DFT

Dividends and Profitability Ratios DuPont Fabros Tech

Digital Realty Trust

CoreSite Realty

QTS Realty Trust CyrusOne Equinix Average

Dividend Yield 4.6% 3.6% 4.0% 3.1% 3.8% 2.2% 3.6%ROA 4.2 2.8 3.9 1.1 0.8 1.1 2.3ROE 18.1 9.1 16.2 3.0 2.0 3.6 8.7NOI Margin 67.0% 64.0% 69.7% 63.9% 64.6% 49.6% 63.1%FFO Margin 43.9% 40.5% 44.1% 33.1% 39.7% 20.1% 36.9%Gross Margin 67.0% 64.4% 73.2% 63.9% 64.6% 49.6% 63.8%Operating Margin 40.1% 23.2% 23.6% 9.5% 13.3% 17.1% 21.1%Net Profit Margin 23.5% 15.5% 12.6% 5.4% 3.8% 3.5% 10.7%EBITDA Margin 60% 54% 53% 42% 45% 43% 49.5%

Valuation Ratios DuPont Fabros Tech

Digital Realty Trust

CoreSite Realty

QTS Realty Trust CyrusOne Equinix Average

Forward P/E 24.4 53.7 45.5 76.1 94.8 57.1 58.6P/B 5.0 4.1 9.4 2.8 3.9 7.2 5.4P/S 6.9 7.5 7.3 6.6 7.6 7.9 7.3P/NOI 10.4 11.9 10.5 10.7 12.1 15.8 11.9P/FFO 18.1 19.3 24.7 20.7 19.7 39.0 23.6EV/EBITDA 15.6 19.9 18.1 21.8 21.4 23.1 20.0

5

Investment Rationale (Continued)

Advantages of Outsourced Data Centers

More than 70% of data centers are internal. However, having an internal data center exposes businesses to additional security risks and costs. Data center providers such as DuPont Fabros offers businesses significant cost advantages and additional security.

Cost Savings Customers using DuPont’s data centers can save 36% in costs annually as compared to using internal data centers. They also have the flexibility for additional savings by only paying for electricity consumed and using economies of scale to minimize operating expenses. DuPont constantly strives to make its data centers more cost efficient. In 2014, the firm switched to reclaimed water for evaporative cooling at one of its campuses, reducing the cost of water consumption by 50-65%.

Security Information theft is one of the fastest growing forms of business criminality. Each of DuPont’s data center entrances are monitored around the clock by security officers, with numerous security challenge points, including access card and biometric authentication. DuPont Fabros also ensures uninterrupted connectivity for businesses if a downtime was to occur by having a backup secondary line. A downtime can cost a business thousands of dollars, depending on its size.

In conclusion, cost advantages, superior information and connectivity security are attractive features that will continue to draw businesses towards data center outsourcing, thus benefiting DuPont Fabros.

Stock Report | April 18th, 2017 | Ticker: DFT

6

Competitive Landscape

The data center REIT industry is highly competitive and fragmented. The industry is comprised of both multi-billion dollar and small-cap firms. DuPont’s closest competitors are Digital Realty Trust, CoreSite Realty, Equinix, CyrusOne, and QTS Realty Trust. Below is a comparison between these firms:

Despite the competitiveness of the industry, DuPont is capable of maintaining superior metrics across the board. As a result of being a pure wholesale company, DuPont is able to achieve higher margins, lower SG&A costs, and longer contracts than competitors. With only 14% of leases expiring 2017-2018, DuPont is also a safer investment than peers such as CoreSite and QTS, both of which have more than 50% of their leases expiring within the same period.

Stock Report | April 18th, 2017 | Ticker: DFT

Number of Data Centers 11 142 145 39 20 25Occupancy 97% 89% 80% 85% 95% 88%Annualized Base Rent of Leases Expiring ('17-18) 14% 27% N/A 43% 52% 58%

Adjusted EBITDA Margin 60% 54% 43% 45% 53% 42%SG&A as % of Revenue 5% 7% 31% 16% 12% 20%Dividend Yield 4.6% 3.6% 2.2% 3.8% 4.0% 3.1%Net Debt to Adjusted EBITDA 3.6x 4.6x 3.6x 4.8x 2.8x 4.9xCorporate Family Rating Ba1 / BB- Baa2 / BBB Ba3 / BB+ B1 / BB- NR / NR B2 / BB-

7

Competitive Strengths

Long-term Leases to Technology Industry LeadersDuPont has contractual obligations with several of the largest technology companies in the world such as Microsoft and Facebook. Contracts with large companies like these range anywhere from 7-20 years and post-contract switching costs are significant. The average lease term for DuPont’s 2016 customers was 12.2 years, and the current average lease maturity is 5.4 years.

Industry-Leading Occupancy RatesAs of late February, Dupont’s property occupancy rate was 99%. This rate is higher than its peer group average of 89% and is also the highest in the peer group. This demonstrates DuPont’s ability to retain customers and the strong demand for data centers.

Strong Development PipelineDuPont has a strong pipeline for future growth. The company currently has 64 MW of capacity that will become available over the next year. Additionally, the company has 298 MW of potential capacity in land held for future developments. In 2016, DuPont purchased land in Ashburn, Toronto, Portland, and executed a contract to purchase 56 acres in Phoenix.

Stock Report | April 18th, 2017 | Ticker: DFT

Data Center Phase Site Capacity (MW) DeliveryACC9 Phase I Ashburn, VA 14.4 2Q17ACC9 Phase II Ashburn, VA 14.4 3Q17SC1 Phase III Santa Clara, CA 16.0 3Q17TOR1 Phase IA Vaughan, ON 6.0 4Q17CH3 Phase I Elk Grove Village, IL 13.6 1Q18

64.4Total Current Development Projects:

81% 83%

85%

90% 90% 91%

94% 94% 94% 95%

92% 93% 94% 94%

89%

96% 96%

99% 97% 97%

75%

80%

85%

90%

95%

100%

2012 2013 2014 2015 2016

Operating Portfolio Occupancy

8

Risks

The firm will continue to face intense competition from both current peers and new entrants as the industry becomes more attractive.DuPont Fabros operates in the highly competitive data center REIT industry. The firm competes not only with new entrants, but with larger firms that possess competitive advantages over DFT. As data usage increases and the industry becomes more attractive, we expect the supply of data centers to increase and occupancy and rental rates to become more competitive.

Loss of a key customer could materially impact the firm given its level of customer concentration.DuPont Fabros is highly dependent on the relationships and financial health of its top two customers, Facebook and Microsoft. Although those firms have proven to be highly credible and stable over the years, DuPont’s base rent revenue would decline significantly in the event that one of these firms being unable to meet their obligations. In addition, the company could suffer adverse consequences if it is unable to retain customers. DuPont’s long term leases, successful history of lease renewals, and customer's’ credit ratings play an important role offsetting this risk. As of Q4 of 2016, 71% of the firm’s revenue comes from investment grade or equivalent customers.

DuPont Fabros could suffer material damages if it fails to lease new data centers or renew current leases.The company is dependent on its ability to find new lessees and retain its current clients to maintain and expand its business. This risk is intensified by the fact that management expects to have an additional 50.8 MW available for lease during 2017, of which only 18.9 MW is pre-leased. In addition to competition possibly hindering the firm’s ability to renew its leases, DuPont would be negatively impacted if any of its clients opts to develop in-house data management facilities. Historically, existing customers have accounted for 77% of growth.

Stock Report | April 18th, 2017 | Ticker: DFT

One Lease, 23%

Multiple Leases,

77%

Customers' Growthwith DuPont

IG Like, 17%

BBB, 1%

A, 2%

AA, 13%

AAA, 38%

NR, 16%

BB, 13%

% of Revenue byS&P Credit Rating

9

Valuation - Funds from Operations Model

Stock Report | April 18th, 2017 | Ticker: DFT

Funds from OperationsFunds from operations (FFO) is the most commonly used metric to analyze REITS. In this industry, net income is not a meaningful representation of performance given that real estate assets generally appreciate over time. For this reason, we based two of our models on FFO, which adds depreciation, amortization, and subtracts gains from sale of real estate back to net income.

Sensitivity AnalysisWe created a sensitivity analysis to account for the limitations associated with the model. The sensitivity analysis shows what the intrinsic value of the firm would be under different scenarios. The column variable represents different levels of MWs added each year, with 0% being our raw forecast and the other columns being 3% increases and decreases to our raw forecast. The row variable represents different discount rates at which the FFOs are being discounted.

239,553 238,999 251,108 256,200 268,137 3,898,095 Discounted Values

Beta 0.97Risk Free Rate 2.24%Expected Market Return 9%CAPM 8.80%Applied Discount Rate 10.00%

AssumptionsIntrinsic Value of FFO 5,152,092Number of Shares 89,000Intrinsic Value of FFO per share 57.89$

Current Price 50.66$ Implied Return 14.27%

Outputs

59.67$ -9.00% -6.00% -3.00% 0.00% 3.00% 6.00% 9.00%12.00% $44.15 $44.26 $44.36 $44.47 $44.58 $44.68 $44.7911.50% $46.89 $47.00 $47.12 $47.23 $47.34 $47.45 $47.5711.00% $49.98 $50.10 $50.22 $50.33 $50.45 $50.57 $50.6910.50% $53.48 $53.60 $53.73 $53.86 $53.99 $54.11 $54.2410.00% $57.48 $57.62 $57.75 $57.89 $58.02 $58.16 $58.309.50% $62.10 $62.25 $62.40 $62.54 $62.69 $62.84 $62.989.00% $67.50 $67.66 $67.82 $67.98 $68.13 $68.29 $68.458.50% $73.88 $74.06 $74.23 $74.40 $74.57 $74.75 $74.928.00% $81.55 $81.74 $81.93 $82.12 $82.31 $82.50 $82.697.50% $90.92 $91.13 $91.35 $91.56 $91.77 $91.98 $92.19

Discounted FFO Sensitivity Analysis

To obtain the intrinsic value of DuPont Fabros, we created a discounted FFO model. The model adjusts the forecasted net income to FFO available to common shareholders and discounts the expected FFOs to present value. Our model uses a discount rate of 10%, which represents the CAPM rate of 8.8% adjusted (+1.2%) for the risks associated with high customer concentration. We also applied a terminal growth rate of 3% to sales. The model resulted on an intrinsic value of $57.89, which indicates an implied return of 14.27%.

FFO Discount Model 2017E 2018E 2019E 2020E 2021E 2022ENet income 154,458 166,786 197,223 221,476 258,864 260,902Depreciation and amortization 122,961 136,413 151,120 167,869 187,360 192,981Less: Non real estate depreciation and amortization -910 -1,009 -1,118 -1,242 -1,386 -1,428Impairment on investment in real estate 0 0 0 0 0 0Gain on sale of real estate 0 0 0 0 0 0NAREIT FFO 276,509 302,189 347,225 388,102 444,837 452,454Preferred stock dividends 13,000 13,000 13,000 13,000 13,000 13,000Issuance costs from redeemed preferred stock 0 0 0 0 0 0NAREIT FFO attributable to common shares and units 263,509 289,189 334,225 375,102 431,837 439,454

10

We expect DFT’s multiples to appreciate to the industry average as wholesale data centers gain popularity among large tech enterprises. The model above estimates the 3-year price of the stock as this trend intensifies during the next 5 years. Using the forecasted net income to obtain the expected FFOs during the next 5 years, and assuming that the DFT multiple will expand towards 21x at a constant rate during this period, the model retrieved a 3-year target price of $72.80.

Valuation - FFO Multiple Expansion Model

Stock Report | April 18th, 2017 | Ticker: DFT

Valuation - Net Operating Income Model

NOI Multiple Expansion Model 2017E 2018E 2019E 2020E 2021E 2022ETotal Revenue 585,529 649,585 719,621 799,375 892,189 918,955Cost of Revenue 189,285 209,993 232,633 258,415 288,420 297,072Net operating Income 396,244 439,593 486,988 540,959 603,770 621,883NOI per share $5.21 $5.55 $5.91 $6.32 $6.78 $6.98NOI Multiple 10.67x 10.93x 11.20x 11.47x 11.73x 12.00xStock Price $55.52 $60.71 $66.25 $72.44 $79.55 $83.80

Net operating income is also a widely-used metric in the REIT industry since it measures the ability of the firm’s properties to produce an income stream. DuPont Fabros trades at a P/NOI multiple of 10.4x while its closes competitors trade at 11.9x. Using the forecasted net operating income per share, and assuming that the multiple will expand to the industry norm at a constant rate, the model retrieved a 3-year target price of $66.25.

FFO Multiple Expansion Model 2017E 2018E 2019E 2020E 2021E 2022ENet income 154,458 166,786 197,223 221,476 258,864 260,902Depreciation and amortization 122,961 136,413 151,120 167,869 187,360 192,981Less: Non real estate depreciation and amortization -910 -1,009 -1,118 -1,242 -1,386 -1,428NAREIT FFO 276,509 302,189 347,225 388,102 444,837 452,454Preferred stock dividends 13,000 13,000 13,000 13,000 13,000 13,000NAREIT FFO to common shares 263,509 289,189 334,225 375,102 431,837 439,454NAREIT FFO per share $3.46 $3.65 $4.06 $4.38 $4.85 $4.93FFO Multiple 16.10x 17.02x 17.93x 18.53x 19.03x 19.53xStock Price $55.73 $62.16 $72.80 $81.19 $92.30 $96.39

Metric Price Derived WeightFFO $72.80 75%NOI $66.25 25%

Target Price $71.16

3-Year Target Price

Calculation of the 3-Yr Target PriceTo calculate a 3-year price target for Dupont, we used a weighted average of the values derived from our valuation methodologies. Since funds from operations (FFO) is a superior metric than NOI when valuing REITs, we applied a 75% weight to that price. We applied the remaining 25% to the price generated by our net operating income (NOI) model to arrive at a 3-year price target of $71.16.

11

Appendix - Revenue Breakdown

Stock Report | April 18th, 2017 | Ticker: DFT

Rev

enue

For

ecas

t20

12A

2013

A20

14A

2015

A20

16A

2017

E20

18E

2019

E20

20E

2021

E20

22E

Whe

ight

ed P

rice

per M

W p

er M

onth

109

103

101

101

102

102

102

101

100

99Pr

ice G

rowt

h Ra

te-5

.50%

-1.9

4%0.

00%

0.99

%0.

00%

0.00

%-1

.00%

-1.0

0%-1

.00%

MW

of c

ritica

l load

206

219

240

266

287

315

349

390

437

492

Annu

al M

W a

dditio

n13

2226

2128

3441

4755

Base

rent

236,

810

265,

695

285,

716

298,

585

345,

022

385,

682

427,

298

472,

708

524,

364

584,

441

Reco

verie

s fro

m te

nant

s91

,049

104,

271

124,

853

139,

537

169,

668

192,

841

214,

931

239,

190

266,

901

299,

234

Reco

very

from

tena

nt %

of B

ase

Rent

38.4

5%39

.24%

43.7

0%46

.73%

49.1

8%50

.00%

50.3

0%50

.60%

50.9

0%51

.20%

Prop

erty

Rev

enue

327,

859

369,

966

410,

569

438,

122

514,

690

578,

524

642,

229

711,

898

791,

265

883,

674

Oth

er R

even

ue4,

586

5,14

37,

023

14,2

7814

,011

7,00

67,

356

7,72

48,

110

8,51

5Yo

Y gr

owth

%12

.15%

36.5

5%10

3.30

%-1

.87%

-50.

00%

5.00

%5.

00%

5.00

%5.

00%

Tota

l Rev

enue

332,

445

375,

109

417,

592

452,

400

528,

701

585,

529

649,

585

719,

621

799,

375

892,

189

918,

955

YoY

grow

th %

12.8

3%11

.33%

8.34

%16

.87%

10.7

5%10

.94%

10.7

8%11

.08%

11.6

1%3.

00%

12

Inco

me

Stat

emen

t (Th

ousa

nds)

2012

A20

13A

2014

A20

15A

2016

A20

17E

2018

E20

19E

2020

E20

21E

2022

E

Tota

l rev

enue

332,

445

375,

109

417,

592

452,

400

528,

701

585,

529

649,

585

719,

621

799,

375

892,

189

918,

955

Prop

erty

ope

ratin

g co

sts

94,6

4610

3,52

211

7,33

913

0,05

115

4,06

416

6,35

318

4,55

220

4,44

922

7,10

825

3,47

726

1,08

2Re

al e

stat

e ta

xes

and

insu

ranc

e12

,689

14,3

8014

,195

21,3

3520

,180

22,9

3225

,441

28,1

8431

,308

34,9

4335

,991

Cost

of r

even

ue10

7,33

511

7,90

213

1,53

415

1,38

617

4,24

418

9,28

520

9,99

323

2,63

325

8,41

528

8,42

029

7,07

2G

ross

pro

fit22

5,11

025

7,20

728

6,05

830

1,01

435

4,45

739

6,24

443

9,59

348

6,98

854

0,95

960

3,77

062

1,88

3De

prec

iatio

n an

d am

ortiz

atio

n89

,241

93,0

5896

,780

104,

044

107,

781

122,

961

136,

413

151,

120

167,

869

187,

360

192,

981

Gen

eral

and

adm

inist

rativ

e17

,024

16,2

6117

,181

18,0

6423

,043

25,6

7128

,480

31,5

5035

,047

39,1

1640

,290

Impa

irmen

t on

inve

stm

ent i

n re

al e

stat

e0

00

122,

472

00

00

00

0O

ther

exp

ense

s6,

919

3,65

09,

222

16,8

5911

,781

5,85

58,

445

7,19

67,

994

8,92

29,

190

Ope

ratin

g in

com

e11

1,92

614

4,23

816

2,87

539

,575

211,

852

241,

756

266,

255

297,

121

330,

050

368,

372

379,

423

Inte

rest

exp

ense

-51,

261

-49,

792

-36,

563

-43,

661

-52,

006

-62,

299

-74,

470

-74,

898

-83,

574

-84,

508

-93,

521

Gai

n on

sal

e of

real

est

ate

00

00

22,8

330

00

00

0Lo

ss o

n ea

rly e

xtin

guish

men

t of d

ebt

0-4

0,97

8-1

,701

0-1

,232

00

00

00

Net i

ncom

e (lo

ss) f

rom

con

tinui

ng o

pera

tions

60,6

6553

,468

124,

611

-4,0

8618

1,44

717

9,45

819

1,78

622

2,22

324

6,47

628

3,86

428

5,90

2No

n-co

ntro

lling

inte

rest

s-7

,803

-5,2

14-1

8,70

45,

993

-24,

248

-12,

000

-12,

000

-12,

000

-12,

000

-12,

000

-12,

000

Pref

erre

d st

ock

divid

ends

-27,

053

-27,

245

-27,

245

-27,

245

-20,

739

-13,

000

-13,

000

-13,

000

-13,

000

-13,

000

-13,

000

Rede

emed

pre

ferre

d st

ock

issua

nce

cost

s0

00

0-1

2,49

50

00

00

0Ne

t inc

ome

(loss

) to

com

mon

sha

reho

lder

s25

,809

21,0

0978

,662

-25,

338

123,

965

154,

458

166,

786

197,

223

221,

476

258,

864

260,

902

Dilu

ted

shar

es o

usta

ndin

g63

,754

65,4

7466

,086

65,1

8473

,839

76,1

2379

,167

82,3

3485

,628

89,0

5389

,053

Dilu

ted

EPS

$0.4

0$0

.32

$1.1

9($

0.39

)$1

.68

$2.0

3$2

.11

$2.4

0$2

.59

$2.9

1$2

.93

Appendix - Pro Forma Income Statement (in Thousands except Share and Per Share Data)

Stock Report | April 18th, 2017 | Ticker: DFT

Com

mon

Siz

e In

com

e St

atem

ent

2012

A20

13A

2014

A20

15A

2016

A20

17E

2018

E20

19E

2020

E20

21E

2022

E

Tota

l rev

enue

100%

100%

100%

100%

100%

100%

100%

100%

100%

100%

100%

Prop

erty

ope

ratin

g co

sts

28.4

7%27

.60%

28.1

0%28

.75%

29.1

4%28

.41%

28.4

1%28

.41%

28.4

1%28

.41%

28.4

1%Re

al e

stat

e ta

xes

and

insu

ranc

e3.

82%

3.83

%3.

40%

4.72

%3.

82%

3.92

%3.

92%

3.92

%3.

92%

3.92

%3.

92%

Cost

of r

even

ue32

.29%

31.4

3%31

.50%

33.4

6%32

.96%

32.3

3%32

.33%

32.3

3%32

.33%

32.3

3%32

.33%

Gro

ss p

rofit

67.7

1%68

.57%

68.5

0%66

.54%

67.0

4%67

.67%

67.6

7%67

.67%

67.6

7%67

.67%

67.6

7%De

prec

iatio

n an

d am

ortiz

atio

n26

.84%

24.8

1%23

.18%

23.0

0%20

.39%

21.0

0%21

.00%

21.0

0%21

.00%

21.0

0%21

.00%

Gen

eral

and

adm

inist

rativ

e5.

12%

4.34

%4.

11%

3.99

%4.

36%

4.38

%4.

38%

4.38

%4.

38%

4.38

%4.

38%

Impa

irmen

t on

inve

stm

ent i

n re

al e

stat

e0.

00%

0.00

%0.

00%

27.0

7%0.

00%

0.00

%0.

00%

0.00

%0.

00%

0.00

%0.

00%

Oth

er e

xpen

ses

2.08

%0.

97%

2.21

%3.

73%

2.23

%1.

00%

1.30

%1.

00%

1.00

%1.

00%

1.00

%O

pera

ting

inco

me

33.6

7%38

.45%

39.0

0%8.

75%

40.0

7%41

.29%

40.9

9%41

.29%

41.2

9%41

.29%

41.2

9%In

tere

st e

xpen

se-1

5.42

%-1

3.27

%-8

.76%

-9.6

5%-9

.84%

-10.

64%

-11.

46%

-10.

41%

-10.

45%

-9.4

7%-1

0.18

%G

ain

on s

ale

of re

al e

stat

e0.

00%

0.00

%0.

00%

0.00

%4.

32%

0.00

%0.

00%

0.00

%0.

00%

0.00

%0.

00%

Loss

on

early

ext

ingu

ishm

ent o

f deb

t0.

00%

-10.

92%

-0.4

1%0.

00%

-0.2

3%0.

00%

0.00

%0.

00%

0.00

%0.

00%

0.00

%Ne

t inc

ome

(loss

) fro

m c

ontin

uing

ope

ratio

ns18

.25%

14.2

5%29

.84%

-0.9

0%34

.32%

30.6

5%29

.52%

30.8

8%30

.83%

31.8

2%31

.11%

Non-

cont

rollin

g in

tere

sts

-2.3

5%-1

.39%

-4.4

8%1.

32%

-4.5

9%-2

.05%

-1.8

5%-1

.67%

-1.5

0%-1

.35%

-1.3

1%Pr

efer

red

stoc

k di

viden

ds-8

.14%

-7.2

6%-6

.52%

-6.0

2%-3

.92%

-2.2

2%-2

.00%

-1.8

1%-1

.63%

-1.4

6%-1

.41%

Rede

emed

pre

ferre

d st

ock

issua

nce

cost

s0.

00%

0.00

%0.

00%

0.00

%-2

.36%

0.00

%0.

00%

0.00

%0.

00%

0.00

%0.

00%

Net i

ncom

e (lo

ss) t

o co

mm

on s

hare

hold

ers

7.76

%5.

60%

18.8

4%-5

.60%

23.4

5%26

.38%

25.6

8%27

.41%

27.7

1%29

.01%

28.3

9%

13

Appendix - Pro Forma Balance Sheet (in Thousands except Share Data)

Stock Report | April 18th, 2017 | Ticker: DFT

Bala

nce

Shee

t20

12A

2013

A20

14A

2015

A20

16A

2017

E20

18E

2019

E20

20E

2021

E20

22E

ASSE

TSIn

com

e Pr

oduc

ing

Prop

erty

2,38

8,69

62,

496,

942

2,70

7,33

22,

831,

139

3,12

4,25

13,

357,

417

3,60

7,98

33,

877,

250

4,16

6,61

34,

477,

571

4,81

1,73

6Le

ss: a

ccum

ulat

ed d

epre

ciat

ion

-325

,740

-413

,394

-504

,869

-560

,837

-662

,183

-758

,716

-869

,323

-996

,053

-1,1

41,2

59-1

,307

,632

-1,4

98,2

59N

et In

com

e pr

oduc

ing

prop

erty

2,06

2,95

62,

083,

548

2,20

2,46

32,

270,

302

2,46

2,06

82,

598,

700

2,73

8,66

12,

881,

197

3,02

5,35

43,

169,

939

3,31

3,47

6C

onst

ruct

ion

in p

rogr

ess

& pr

oper

ty h

eld

for d

evel

opm

ent

218,

934

302,

068

358,

965

300,

939

330,

983

379,

234

434,

519

497,

863

570,

442

653,

602

748,

884

Net r

eal e

stat

e2,

281,

890

2,38

5,61

62,

561,

428

2,57

1,24

12,

793,

051

2,97

7,93

43,

173,

180

3,37

9,06

13,

595,

797

3,82

3,54

14,

062,

361

Cas

h an

d ca

sh e

quiv

alen

ts23

,578

38,7

3329

,598

31,2

3038

,624

32,9

5438

,131

44,6

2449

,818

50,5

0057

,510

Ren

ts a

nd o

ther

rece

ivab

les,

net

3,84

012

,674

8,11

39,

588

11,5

3312

,591

13,9

6915

,475

17,1

9019

,185

19,7

61D

efer

red

rent

, net

144,

829

150,

038

142,

365

128,

941

123,

058

123,

058

123,

058

123,

058

123,

058

123,

058

123,

058

Leas

e co

ntra

cts

abov

e m

arke

t val

ue, n

et10

,255

9,15

48,

054

6,02

95,

138

5,13

85,

138

5,13

85,

138

5,13

85,

138

Def

erre

d co

sts,

net

35,6

7039

,866

38,4

9523

,774

25,7

7625

,776

25,7

7625

,776

25,7

7625

,776

25,7

76Pr

epai

d ex

pens

es a

nd o

ther

ass

ets

30,7

9744

,507

48,2

9544

,689

41,2

8451

,781

57,4

4563

,639

70,6

9278

,900

81,2

67To

tal a

sset

s2,

530,

859

2,68

0,58

82,

836,

348

2,81

5,49

23,

038,

464

3,22

9,23

23,

436,

697

3,65

6,77

03,

887,

468

4,12

6,09

84,

374,

871

LIAB

ILIT

IES

AND

STO

CKHO

LDER

S EQ

UITY

LIAB

ILIT

IES

Line

of c

redi

t18

,000

060

,000

050

,926

080

,000

080

,000

080

,000

Mor

tgag

e no

tes

paya

ble,

net

of d

efer

red

finan

cing

cos

ts13

9,60

011

5,00

011

5,00

011

4,07

511

0,73

312

4,47

013

2,34

714

0,66

514

9,44

615

8,71

316

8,12

7U

nsec

ured

term

loan

, net

of d

efer

red

finan

cing

cos

ts0

154,

000

250,

000

249,

172

249,

036

275,

694

293,

142

311,

565

331,

015

351,

540

372,

393

Uns

ecur

ed n

otes

pay

able

, net

of d

isco

unt &

def

erre

d fin

anci

ng c

osts

550,

000

600,

000

600,

000

834,

963

837,

323

925,

337

983,

900

1,04

5,73

31,

111,

017

1,17

9,90

41,

249,

896

Tota

l Lon

g-te

rm D

ebt

707,

600

869,

000

1,02

5,00

01,

198,

210

1,24

8,01

81,

325,

501

1,48

9,39

01,

497,

962

1,67

1,47

91,

690,

156

1,87

0,41

6Ac

coun

ts p

ayab

le a

nd a

ccru

ed li

abilit

ies

22,2

8023

,566

26,9

7332

,301

36,9

0941

,341

45,8

6450

,809

56,4

4062

,993

64,8

83C

onst

ruct

ion

cost

s pa

yabl

e6,

334

45,4

4432

,949

22,0

4356

,428

58,5

5364

,959

71,9

6279

,937

89,2

1991

,896

Accr

ued

inte

rest

pay

able

2,60

19,

983

10,7

5911

,821

11,5

9214

,069

15,6

0817

,291

19,2

0721

,437

22,0

80D

ivid

end

and

dist

ribut

ion

paya

ble

22,1

7725

,971

39,9

8143

,906

46,3

5254

,080

59,9

9766

,465

73,8

3182

,404

84,8

76Le

ase

cont

ract

s be

low

mar

ket v

alue

, net

14,0

2210

,530

7,03

74,

132

2,83

04,

241

4,70

55,

212

5,79

06,

462

6,65

6Pr

epai

d re

nts

and

othe

r lia

bilit

ies

35,5

2456

,576

65,1

7467

,477

78,2

3278

,232

78,2

3278

,232

78,2

3278

,232

78,2

32To

tal l

iabi

litie

s81

0,53

81,

041,

070

1,20

7,87

31,

379,

890

1,48

0,36

11,

576,

017

1,75

8,75

41,

787,

933

1,98

4,91

72,

030,

904

2,21

9,03

8Re

deem

able

non

cont

rolli

ng in

tere

sts

oper

atin

g pa

rtner

ship

453,

889

387,

244

513,

134

479,

189

591,

101

650,

211

624,

203

761,

527

738,

681

871,

644

871,

644

STO

CKHO

LDER

S EQ

UITY

Pref

erre

d st

ock,

$.0

01 p

ar v

alue

, 50

milli

on s

hare

s au

thor

ized

:0

00

040

00

00

00

Serie

s A

185,

000

185,

000

185,

000

185,

000

00

00

00

0Se

ries

B16

6,25

016

6,25

016

6,25

016

6,25

00

00

00

00

Serie

s C

00

00

201,

250

201,

250

201,

250

201,

250

201,

250

201,

250

201,

250

Com

mon

sto

ck, $

.001

par

val

ue63

6566

6676

7676

7676

7676

Addi

tiona

l pai

d in

cap

ital

915,

119

900,

959

764,

025

685,

042

766,

732

801,

677

852,

414

905,

984

962,

544

1,02

2,22

51,

082,

863

Ret

aine

d ea

rnin

gs (A

ccum

ulat

ed d

efic

it)0

00

-79,

945

00

00

00

0Ac

cum

ulat

ed o

ther

com

preh

ensi

ve lo

ss0

00

0-1

,056

00

00

00

Tota

l sto

ckho

lder

s eq

uity

1,26

6,43

21,

252,

274

1,11

5,34

195

6,41

396

7,04

21,

003,

003

1,05

3,74

01,

107,

310

1,16

3,87

01,

223,

551

1,28

4,18

9To

tal l

iabi

litie

s an

d st

ockh

olde

rs e

quity

2,53

0,85

92,

680,

588

2,83

6,34

82,

815,

492

3,03

8,46

43,

229,

232

3,43

6,69

73,

656,

770

3,88

7,46

84,

126,

098

4,37

4,87

1

14

Appendix - Common Size Balance Sheet

Stock Report | April 18th, 2017 | Ticker: DFT

Bala

nce

Shee

t20

12A

2013

A20

14A

2015

A20

16A

2017

E20

18E

2019

E20

20E

2021

E20

22E

ASSE

TSIn

com

e Pr

oduc

ing

Prop

erty

94.3

8%93

.15%

95.4

5%10

0.56

%10

2.82

%10

3.97

%10

4.98

%10

6.03

%10

7.18

%10

8.52

%10

9.99

%Le

ss: a

ccum

ulat

ed d

epre

ciat

ion

-12.

87%

-15.

42%

-17.

80%

-19.

92%

-21.

79%

-23.

50%

-25.

30%

-27.

24%

-29.

36%

-31.

69%

-34.

25%

Net

Inco

me

prod

ucin

g pr

oper

ty81

.51%

77.7

3%77

.65%

80.6

4%81

.03%

80.4

7%79

.69%

78.7

9%77

.82%

76.8

3%75

.74%

Con

stru

ctio

n in

pro

gres

s &

prop

erty

hel

d fo

r dev

elop

men

t8.

65%

11.2

7%12

.66%

10.6

9%10

.89%

11.7

4%12

.64%

13.6

1%14

.67%

15.8

4%17

.12%

Net r

eal e

stat

e90

.16%

89.0

0%90

.31%

91.3

2%91

.92%

92.2

2%92

.33%

92.4

1%92

.50%

92.6

7%92

.86%

Cas

h an

d ca

sh e

quiv

alen

ts0.

93%

1.44

%1.

04%

1.11

%1.

27%

1.02

%1.

11%

1.22

%1.

28%

1.22

%1.

31%

Ren

ts a

nd o

ther

rece

ivab

les,

net

0.15

%0.

47%

0.29

%0.

34%

0.38

%0.

39%

0.41

%0.

42%

0.44

%0.

46%

0.45

%D

efer

red

rent

, net

5.72

%5.

60%

5.02

%4.

58%

4.05

%3.

81%

3.58

%3.

37%

3.17

%2.

98%

2.81

%Le

ase

cont

ract

s ab

ove

mar

ket v

alue

, net

0.41

%0.

34%

0.28

%0.

21%

0.17

%0.

16%

0.15

%0.

14%

0.13

%0.

12%

0.12

%D

efer

red

cost

s, n

et1.

41%

1.49

%1.

36%

0.84

%0.

85%

0.80

%0.

75%

0.70

%0.

66%

0.62

%0.

59%

Prep

aid

expe

nses

and

oth

er a

sset

s1.

22%

1.66

%1.

70%

1.59

%1.

36%

1.60

%1.

67%

1.74

%1.

82%

1.91

%1.

86%

Tota

l ass

ets

100.

00%

100.

00%

100.

00%

100.

00%

100.

00%

100.

00%

100.

00%

100.

00%

100.

00%

100.

00%

100.

00%

LIAB

ILIT

IES

AND

STO

CKHO

LDER

S EQ

UITY

LIAB

ILIT

IES

Line

of c

redi

t0.

71%

0.00

%2.

12%

0.00

%1.

68%

0.00

%2.

33%

0.00

%2.

06%

0.00

%1.

83%

Mor

tgag

e no

tes

paya

ble,

net

of d

efer

red

finan

cing

cos

ts5.

52%

4.29

%4.

05%

4.05

%3.

64%

3.85

%3.

85%

3.85

%3.

84%

3.85

%3.

84%

Uns

ecur

ed te

rm lo

an, n

et o

f def

erre

d fin

anci

ng c

osts

0.00

%5.

75%

8.81

%8.

85%

8.20

%8.

54%

8.53

%8.

52%

8.51

%8.

52%

8.51

%U

nsec

ured

not

es p

ayab

le, n

et o

f dis

coun

t & d

efer

red

finan

cing

cos

ts21

.73%

22.3

8%21

.15%

29.6

6%27

.56%

28.6

6%28

.63%

28.6

0%28

.58%

28.6

0%28

.57%

Tota

l Lon

g-te

rm D

ebt

27.9

6%32

.42%

36.1

4%42

.56%

41.0

7%41

.05%

43.3

4%40

.96%

43.0

0%40

.96%

42.7

5%Ac

coun

ts p

ayab

le a

nd a

ccru

ed li

abilit

ies

0.88

%0.

88%

0.95

%1.

15%

1.21

%1.

28%

1.33

%1.

39%

1.45

%1.

53%

1.48

%C

onst

ruct

ion

cost

s pa

yabl

e0.

25%

1.70

%1.

16%

0.78

%1.

86%

1.81

%1.

89%

1.97

%2.

06%

2.16

%2.

10%

Accr

ued

inte

rest

pay

able

0.10

%0.

37%

0.38

%0.

42%

0.38

%0.

44%

0.45

%0.

47%

0.49

%0.

52%

0.50

%D

ivid

end

and

dist

ribut

ion

paya

ble

0.88

%0.

97%

1.41

%1.

56%

1.53

%1.

67%

1.75

%1.

82%

1.90

%2.

00%

1.94

%Le

ase

cont

ract

s be

low

mar

ket v

alue

, net

0.55

%0.

39%

0.25

%0.

15%

0.09

%0.

13%

0.14

%0.

14%

0.15

%0.

16%

0.15

%Pr

epai

d re

nts

and

othe

r lia

bilit

ies

1.40

%2.

11%

2.30

%2.

40%

2.57

%2.

42%

2.28

%2.

14%

2.01

%1.

90%

1.79

%To

tal l

iabi

litie

s32

.03%

38.8

4%42

.59%

49.0

1%48

.72%

48.8

0%51

.18%

48.8

9%51

.06%

49.2

2%50

.72%

Rede

emab

le n

onco

ntro

lling

inte

rest

s op

erat

ing

partn

ersh

ip17

.93%

14.4

5%18

.09%

17.0

2%19

.45%

20.1

4%18

.16%

20.8

3%19

.00%

21.1

3%19

.92%

STO

CKHO

LDER

S EQ

UITY

Pref

erre

d st

ock,

$.0

01 p

ar v

alue

, 50

milli

on s

hare

s au

thor

ized

:0.

00%

0.00

%0.

00%

0.00

%0.

00%

0.00

%0.

00%

0.00

%0.

00%

0.00

%0.

00%

Serie

s A

7.31

%6.

90%

6.52

%6.

57%

0.00

%0.

00%

0.00

%0.

00%

0.00

%0.

00%

0.00

%Se

ries

B6.

57%

6.20

%5.

86%

5.90

%0.

00%

0.00

%0.

00%

0.00

%0.

00%

0.00

%0.

00%

Serie

s C

0.00

%0.

00%

0.00

%0.

00%

6.62

%6.

23%

5.86

%5.

50%

5.18

%4.

88%

4.60

%C

omm

on s

tock

, $.0

01 p

ar v

alue

0.00

%0.

00%

0.00

%0.

00%

0.00

%0.

00%

0.00

%0.

00%

0.00

%0.

00%

0.00

%Ad

ditio

nal p

aid

in c

apita

l36

.16%

33.6

1%26

.94%

24.3

3%25

.23%

24.8

3%24

.80%

24.7

8%24

.76%

24.7

7%24

.75%

Ret

aine

d ea

rnin

gs (A

ccum

ulat

ed d

efic

it)0.

00%

0.00

%0.

00%

-2.8

4%0.

00%

0.00

%0.

00%

0.00

%0.

00%

0.00

%0.

00%

Accu

mul

ated

oth

er c

ompr

ehen

sive

loss

0.00

%0.

00%

0.00

%0.

00%

-0.0

3%0.

00%

0.00

%0.

00%

0.00

%0.

00%

0.00

%To

tal s

tock

hold

ers

equi

ty50

.04%

46.7

2%39

.32%

33.9

7%31

.83%

31.0

6%30

.66%

30.2

8%29

.94%

29.6

5%29

.35%

Tota

l lia

bilit

ies

and

stoc

khol

ders

equ

ity10

0.00

%10

0.00

%10

0.00

%10

0.00

%10

0.00

%10

0.00

%10

0.00

%10

0.00

%10

0.00

%10

0.00

%10

0.00

%

15

Appendix - Debt Overview

Stock Report | April 18th, 2017 | Ticker: DFT

Year Fixed Rate Floating Rate Total % of Total Rates (%)2017 — $8,750 $8,750 0.7 2.32018 — $102,500 $102,500 8.1 2.32019 — — — — —2020 — $50,926 $50,926 4.1 2.42021 $600,000 — $600,000 47.5 5.92022 — $250,000 $250,000 19.8 2.32023 $250,000 — $250,000 19.8 5.6

Total $850,000 $412,176 $1,262,176 100 4.7

DuPont Fabros Debt Maturities ($ in thousands)

Dupont’s cost of debt is composed of fixed and floating rate instruments.The company has one fixed rate instrument that matures within our investment horizon, which will be subject to refinancing at the future period. Although the instrument’s maturity is towards the latter part of our investment horizon, we considered the impact that a refinancing could have on the company’s financial health. We constructed a sensitivity analysis to measure the impact refinancing would have at different borrowing levels and interest rates.

2015 Year End 2016 Year EndAmounts

(thousands)Amount

(thousands)% of Total

Rate (%)

Maturities (Years)

Secured $115,000 $111,250 9 2.3 1.2Unsecured $1,100,000 $1,150,926 91 4.9 5.1Total $1,215,000 $1,262,176 100 4.7 4.8

Fixed Rate Debt:Unsecured Notes due 2021 $600,000 $600,000 47 5.9 4.7Unsecured Notes due 2023 $250,000 $250,000 20 5.6 6.5Fixed Rate Debt $850,000 $850,000 67 5.8 5.2

Floating Rate Debt:Unsecured Credit Facility — $50,926 4 2.4 3.6Unsecured Term Loan $250,000 $250,000 20 2.3 5.1ACC3 Term Loan $115,000 $111,250 9 2.3 1.2Floating Rate Debt $365,000 $412,176 33 2.3 3.8

Total $1,215,000 $1,262,176 100 4.7 4.8

Debt Summary

#REF! 4.40% 4.90% 5.40% 5.90% 6.40% 6.90% 7.40%$450,000 $19,800 $22,050 $24,300 $26,550 $28,800 $31,050 $33,300$500,000 $22,000 $24,500 $27,000 $29,500 $32,000 $34,500 $37,000$550,000 $24,200 $26,950 $29,700 $32,450 $35,200 $37,950 $40,700$600,000 $26,400 $29,400 $32,400 $35,400 $38,400 $41,400 $44,400$650,000 $28,600 $31,850 $35,100 $38,350 $41,600 $44,850 $48,100$700,000 $30,800 $34,300 $37,800 $41,300 $44,800 $48,300 $51,800$750,000 $33,000 $36,750 $40,500 $44,250 $48,000 $51,750 $55,500

Refinancing Sensitivity Analysis

16

Appendix - Lease Expirations

Stock Report | April 18th, 2017 | Ticker: DFT

Expiration Year

# of Leases

Expiring

Expiring Commenced

Leases

% Leased Computer

Sq Ft

Total kW of

Expiring Leases

% Leased kW

% Annualized Base Rent

2017 3 19,000 1.2 3,846 1.4 1.62018 20 177,000 11.1 33,448 12 12.62019 26 330,000 20.7 57,404 20.4 222020 15 182,000 11.4 31,754 11.4 11.72021 16 284,000 17.8 50,092 17.9 17.32022 10 140,000 8.8 24,509 8.8 8.92023 8 92,000 5.8 13,305 4.7 4.32024 8 112,000 7 19,279 6.9 6.82025 4 47,000 2.9 7,750 2.8 3.42026 6 50,000 3.1 10,134 3.6 4After 2026 8 164,000 10.2 28,244 10.1 7.4

Total 124 1,597,000 100 279,765 100 100

Lease ExpirationsAs of January 1, 2017

17

Leadership

Stock Report | April 18th, 2017 | Ticker: DFT

Christopher Eldredge has been the president, CEO, and director at DuPont since 2015. He has nearly 20 years of experience in the IT infrastructure and telecommunications industry. Prior to joining DuPont, Eldredge led all aspects of data center services in the United States for NTT America Inc., a global IT infrastructure services provider.

Jeffrey Foster has served as DuPont’s executive vice president and chief financial officer since 2007. Prior to joining DuPont, Foster was a senior vice president and chief accounting officer at Global Signal Inc., where he was responsible for a $4 billion NYSE-listed cell tower REIT that tripled in size in 2005.

Scott Davis has served as DuPont’s executive vice president and chief technology officer since 2006. Prior to joining DuPont, Davis was a senior director of data center operations at AOL, where he managed the daily operations of AOL’s domestic and international data centers.

Operating Partnership Structure

Similar to many publicly traded REITs today, DuPont Fabros uses a corporate structure referred to as an umbrella partnership REIT, or UPREIT. The firm serves as the general partner of an Operating Partnership and indirectly owns all of its properties. This Operating Partnership is referred to as DuPont Fabros Technology, L.P. As an UPREIT, the firm is able to contribute their real estate property in exchange for operating partnership units that can be converted into REIT shares. This transaction lets DuPont avoid capital gains taxes on appreciated real estate.

DuPont currently owns 85% of the common economic interest in the Operating Partnership, with the remaining interest being owned by investors. As the sole general partner the Operating Partnership, DuPont has exclusive control of the Operating Partnership’s day-to-day management.

Recent Quarter and YTD Highlights

In Q4 of 2016, DuPont experienced double digit growth rates as compared to Q4 of 2015, with revenue, funds from operations, and adjusted funds from operations growing 22%, 23%, and 30%, respectively. As of February 2017, 29% of DuPont’s properties in development have been pre-leased. The firm’s occupancy rates rose to 99% from 97% as of the end of 2016. Going forward, DuPont aims to further diversify its customer base and expand its geographic presence while maintaining a 10% profitability growth rate.