Dct 2 26 15

-

Upload

dakota-county-tribune -

Category

Documents

-

view

245 -

download

2

description

Transcript of Dct 2 26 15

TribuneDakota County

Farmington | Rosemountand the surrounding areas

www.dakotacountytribune.comFebruary 26, 2015 • Volume 129 • Number 52

News 952-846-2033Display Advertising

952-846-2011Classified Advertising

952-846-2000Delivery 952-846-2070

INDEX

Opinion . . . . . . . . . . . . 4A

Sports . . . . . . . . . . . . 10A

Announcements . . . . 12A

Classifieds . . . . . . . . . 13A

ONLINE

NEWS

OPINION

THISWEEKEND

SPORTS

To receive a feed of breaking news stories, follow us at twitter.com/Sun-Thisweek.

Rosemount man opening brewery in LakevilleRestaurant will also open in former Ace Hardware spot.

Page 2A

PUBLIC NOTICE

Sun Thisweek and the Dakota County Tribune are official newspapers of the Rosemount-Apple Valley-Eagan School District.

New ideas for studentsConference at DCTC offers up information on educating students on career options.

Page 4A

Clint Black in BurnsvilleCountry music star Clint Black is bound for Burnsville next month with a March 11 concert at the Ames Center.

Page 17A

Rosemount gymnasts compete at stateSchile takes silver on floor exercise, 16th all around.

Page 10A

CHECK US FIRSTOR CHECK US LAST!

District 192 puts numbers on potential referendum leviesDistrict looking for operating,

facility and tech-nology increases

by Andy RogersSUN THISWEEK

DAKOTA COUNTY TRIBUNE

The Farmington School District presented more specific numbers on its operation, facility and technology budget-ary needs and potential referendum levies during Monday’s School Board meeting. Farmington Director of Finance Jane Hauska presented the Farming-ton School Board with both the low estimate

containing the minimum of needs along with its high estimate that would fulfill all needs during Monday’s meeting. They were preliminary numbers used for discus-sion only. “We need to come up with a solution for these needs, not tonight, but at some point down the line,” Hauska said. Using an average home price of $250,000, the operational, facility and technology levy for bare bones would be a combined $192 increase per year and the high end would be $353. The administration is hoping to put it on the ballot in November. It

would likely include sev-eral questions. “What we’ll be asking the community is a lot,” Board Member Melissa Sauser said. “From what I understand what’s being presented here is a dream list, everything that we’d like to see done. I think we definitely need to scale back and look at our priorities and what our needs are, because this is a lot to ask.” Sauser also said that a survey to residents last year noted support for security enhancement, deferred maintenance projects and to maintain the current level of tech-nology, although they weren’t willing to increase

taxes significantly. She also noted that Farmington’s tax base is limited due to a lack of a larger commercial and industrial tax base when compared to neighboring cities. “Even though Lakev-ille might get a few hun-dred dollars more per pupil than we do, the (res-idential taxpayers) may not be paying as much of that as they do in Farm-ington,” Sauser said. Hauska also said many numbers could change based on what happens at the Minnesota State Leg-islature. Superintendent Jay Haugen said there’s a glaring piece of infor-

mation they don’t have yet, which is a budget for 2015-16 and beyond. He said the district is project-ing a budget shortfall for next year and beyond. The district will hold community roundtables with hopes of receiving input on priorities and finances. The first one is scheduled for 7 a.m. March 17 at Farmington High School lecture hall. Two others are scheduled for 5 p.m. March 19 at the North Trail Elemen-tary, and 6 p.m. March 24 at Boeckman Middle School. At Monday night’s meeting, Hauska high-

Driver involved in Farmington homecoming hazing incident pleads guilty The 17-year-old female, of Farmington, in-volved in a homecoming hazing incident on Sept. 28, 2014, pleaded guilty to gross misde-meanor offense of criminal vehicular operation (gross negligence resulting in bodily harm) on Tuesday. The misdemeanor count of assault in the fifth degree (intent to cause fear) was dismissed. The female was the driver of a vehicle that was involved in a crash during a prank war at the beginning of homecoming week. Two juniors were locked in the trunk at the time. The driver is a juvenile, so her name was not released. Judge Michael Mayer sentenced her to six months of probation and 25 hours of commu-nity work service. As part of the conditions of her sentence, she must attend the safe driving course at Dakota County Technical College, at-tend a victim empathy class, and write letters of apology to four victims. There were 15 other youth and young adults involved in this incident. They have all accepted the County Attorney’s Office Youth Account-ability Program (diversion from prosecution) for the offense of misdemeanor disorderly con-duct. This program will require these youth to attend an educational class, pay restitution if owed and complete community work service hours. “We are pleased to have resolved this mat-ter and that all of the youth involved have ac-cepted responsibility for their actions,” Dakota County Attorney James Backstrom said. “We are hopeful the victims and the community can move forward.” Backstrom thanked the Farmington Police Department for its thorough investigation of this case and Assistant County Attorney Ni-cole Nee who prosecuted it.

— Andy Rogers

No snow, no fun It was a lost season for outdoor enthusiasts

by Andy RogersSUN THISWEEK

DAKOTA COUNTY TRIBUNE

Although it’s not every-one’s favorite season, for the people that make the most of it, this winter has been a disaster. The Twin Cities area gen-erally receives 50-60 inches of snow during the winter, but there were many bare patches of ground through much of this winter in Farm-ington. There’s still time for a few more snowflakes, but the end of winter is near with ice rink warming houses closing down and people packing up

their snowmobiles until next year. The Farmington Sno-Ti-gers, a 75-member snowmo-bile club, normally prepares about 150 miles of trails in the area. This year they have had nothing to groom. Ken Zak, club president, said none of the 300-400 miles of trails in the south metro have been groomed. “Usually like to see 8 inches of snow, but that never happened,” Zak said. “The trails are open and le-gal to ride, that is if you want to wreck your snowmobile.” Avid snowmobilers have traveled to northern Wis-

consin, upper Michigan and northern Minnesota be-tween Tower and Red Lake to find adequate conditions. Zak said people will still snowmobile in the area, but the club is actively trying to keep people off certain trails that run through private land. “Some of it goes through their grass,” Zak said. “They don’t like people riding through, digging that up. There’s a respect we have for the landowners not to go through until the groomers do.” The Sno-Tigers club was

Connor Zak, grandson of Farmington Sno-Tigers president Ken Zak, pleads for snow in 2012. This winter has been almost identical due to lack of snow disappointing many outdoor enthusiasts. (Photo submitted)

Kline meets with area franchise owners Recent NLRB decisions causing some concern

by Andy RogersSUN THISWEEK

DAKOTA COUNTY TRIBUNE

A group of franchise owners met with U.S. Rep. John Kline, R-Burnsville, at Rosemount’s Anytime Fitness on Monday to dis-cuss challenges within the industry and recent action by the National Labor Re-lations Board. A recent ruling by the NLRB may affect labors relations between franchi-sors and local franchises. The fear is that fran-chises will be turned into essentially company em-ployees, reducing their in-dependence. The current law rec-

ognizes franchises are in-dependently owned and operated businesses, insu-lating franchisors from li-ability in a situation where a fitness club member is injured because of negli-gence of a franchisee or employee. Franchises have had control over employment, including wages, and while the franchisor focuses on the brand and advertising. The meeting was closed to the public, but follow-ing the meeting, Kline re-leased a statement: “The Obama National Labor Relations Board’s radical agenda is hurting

U.S. Rep. John Kline, R-Burnsville, met with Elise Mademann, middle, who owns Anytime Fitness in Rosemount with her husband Jeff, along with other area franchise business owners on Monday to discuss labor relations. (Photo submitted)

See LEVY, 6A

See KLINE, 8A

See SNOW, 6A

2A February 26, 2015 DAKOTA COUNTY TRIBUNE

PRAIRIE CREEKCOMMUNITY SCHOOLLottery for 2015-2016 School Year

Prairie Creek Community School will conduct its lottery for admissions on

MONDAY, MARCH 16, 2015.(Successful applicants will be notifi ed right away).

All applications for the lottery should be received by 4pm on

THURSDAY, MARCH 12, 2015Siblings of currently enrolled students and children of staff

members will have priority in the Kindergarten lottery.

Apply immediately!Call 507-645-9640 for an application.

wwwprairiecreek.orgPrairie Creek Community School does not discriminate on the basis of

race, creed, color, sexual orientation, disability, national or ethnic origin

in its program admissions or employment.

Former Ace Hardware building to be occupied by summer

Restaurant and brewery-taproom will share building

by Laura AdelmannSUN THISWEEK

DAKOTA COUNTY TRIBUNE

The former Ace Hard-ware building in down-town Lakeville may become a new south-of-the-river hot spot. A rock music-themed restaurant that started as a food truck and Lakeville’s first brewery-taproom will share the building at 20851 Holyoke Ave. starting this summer. Lifelong pals Jon Er-ickson, of Rosemount, and Josh Hebzynski, of Eagan, both 33, will open Angry Inch Brewing on the building’s north side. Motley Crews Heavy Metal Grill food truck owner Marty Richie, of Lakeville, is opening his first brick-and-mortar res-taurant in the building’s south end and will con-tinue to run the food truck on a limited basis. Both businesses are to open in June, in time for Pan-O-Prog, the city’s popular summer festival July 4-12. The business owners each signed 10-year leases, according to Metro Eq-uity Management leasing agent Quenton Sherer. He said the building has been shuttered since Ace Hardware moved to a new facility across the street about five years ago, and added that Metro Equity Management, which owns multiple downtown prop-erties, is talking to four or five other business owners interested in the area. “I think that as more businesses move in, I be-lieve that downtown will become more of a desti-nation for people,” Sherer said. “I believe the traffic is going to increase signifi-cantly down there.” Angry Inch Brewing owners and Richie each plan to design interesting interiors and build patios adjacent to their halves of the building for their cus-tomers’ enjoyment during the summer. Metro Equity’s efforts in matchmaking the busi-nesses appears to be a suc-cess. Richie and Erickson said all owners are all ea-ger to share customers as well as space.

“It’s a good marriage,” Richie said. “Both the restaurant and the brew-ery will complement each other.” Richie said he will con-tinue to offer food truck favorites, including brat burgers, chicken Philly sandwiches and mild and wild pretzels, but in the new space, the menu will have more variety, includ-ing hamburgers, juicy lucys, freshly cut french fries, chicken wings and buffalo shrimp. “If it’s in the budget, we’re going to take a shot at pizza,” Richie said. No food will be served at The Angry Inch, but Er-ickson said Motley Crews Heavy Metal Grill patrons are welcome to bring their food over to eat while sip-ping The Angry Inch’s draft beer. Erickson, a former me-chanic with an interest in cooking, plans to quit his job at a brewery and supply store to run An-gry Inch Brewing when it opens. He said Hebzynski hopes to be able to follow suit if their business takes off. The duo unexpectedly became entrepreneurs af-ter Hebzynski spotted an unopened home brew kit at his house four years ago, according to Erick-son. “Josh saw it sitting in the corner of the garage and said, ‘Why aren’t we doing that?’ ” Erickson said. What started as a fun

pastime soon turned into a passion that led to tast-ing parties with impressed friends who invited more friends to taste the brews. “We had about nine taps in my garage,” Erick-son said. After winning acco-lades and awards in com-petitions, the duo started seriously thinking about opening a brewery and tap house. Their attention turned to Lakeville after Met-ro Equity Management founder Mark Hotzler tasted one of their brews at a local charity event and tracked them down. “He said, ‘What do you think about coming to Lakeville?’ ” Erickson said. “It was just kind of the right time, right place, and we found someone else who just loved our beer.” Erickson said they named their brewery An-gry Inch Brewing as a ref-erence to the movie “Hed-wig and the Angry Inch,” which tells the story of a transvestite whose surgery was not properly complet-ed. “Josh and I are re-ally big supporters of the GLBT (gay, lesbian, bisex-ual and transgender) com-munity,” Erickson said. “They don’t get as much support as they deserve … We’re inspired by a lot of the trials and tribulations that that group of people have to go through.” Erickson said they plan

Marty Richie and girlfriend Lisa Caulfield have operated Motley Crews Heavy Metal Grill as a food truck since 2011. Richie will open the business as a restaurant in half of the former Ace Hardware building this summer while continuing to operate the food truck on a more limited basis. (Photo submitted)

See BREW, 8A

DAKOTA COUNTY TRIBUNE February 26, 2015 3A

Be safeStay clear of downed power lines

NEVER TOUCH A DOWNED POWER LINE. Always assume it is energized and call 911 immediately.

• Stay at least 50 feet away from it and assume it is energized. The ground may also be energized making the entire area extremely dangerous.

• Never touch anything that is touching a downed power line. It is as dangerous as the line itself.

• If a power line falls on your vehicle while you are in it, stay inside your vehicle until help arrives.

POWERFUL STORMS can damage power lines. If you see a downed power line:

Agralite Electric Cooperative • Arrowhead Cooperative, Inc. • BENCO Electric Cooperative • Brown County Rural Electrical Association • Connexus Energy • Cooperative Light & Power • Crow Wing Power • Dakota Electric Association • East Central Energy • Federated Rural Electric Association • Goodhue County Cooperative Electric Association • Itasca-Mantrap Cooperative Electrical Association • Kandiyohi Power Cooperative •Lake Country Power • Lake Region Electric Cooperative • McLeod Cooperative Power Association • Meeker Cooperative • Mille Lacs Energy Cooperative • Minnesota Valley Electric Cooperative • Nobles Cooperative Electric • North Itasca Electric Cooperative, Inc. • Redwood Electric Cooperative • Runestone Electric Association •South Central Electric Association • Stearns Electric Association • Steele-Waseca Cooperative Electric • Todd-Wadena Electric Cooperative • Wright-Hennepin Cooperative Electric Association

Great River Energy—Powering what’s possible

greatriverenergy.com

County commissioners to review new Lebanon Hills plan

by Jessica HarperSUN THISWEEK

DAKOTA COUNTY TRIBUNE

After more than a year of heated debate, public input and revisions, the Dakota County Board will soon vote on a master plan for Lebanon Hills Region-al Park, which borders Ea-gan and Apple Valley. The county’s initial plan released in 2013 in-cluded 24.5 miles of un-paved trails, a new paved 6.5-mile connector trail that runs east and west and a 2-mile paved loop around Holland and Mc-Donough lakes. The plan would keep all existing unpaved trails in Lebanon Hills the same, and would add six miles of unpaved trails. In total, the park would have 46 miles of un-paved trails. The county was met with staunch opposition. More than 300 people at-tended open houses on the topic and expressed concerns about buckthorn removal, bridge repairs and overdevelopment. The hottest topic was the paved connector trail through the middle of the park, which some contend would ruin visitors’ wil-derness experience. Due to the uproar, county commissioners de-cided to create a citizen panel to review the plan and guide the regional park’s development. A re-vised plan was released in January and was open to public comment through Feb. 25. The new plan, which will be reviewed by the County Board’s Physical Development Commit-tee on March 10, shortens the controversial trail and moves it toward the edge of the park. A proposed loop around Holland Lake was tossed from the plans while a paved half-mile loop around McDonough remained. “We thought it was a

little overkill to have two looped trails that close together,” said Tony Nel-son, citizen panel chair. “We thought since Mc-Donough is near the visi-tor center, it made sense to have a paved trail there.” Plans to build picnic shelters by Jensen Lake were scaled back to in-clude new shelters by exist-ing ones and a beachfront shelter near the visitor center. County officials intend to cut the cost of plan implementation by $3 mil-lion. Nelson said he believes the revised plan more closely aligns with the county’s 2001 master plan for Lebanon Hills. Like the 2013 plan, the county’s revised plan has continued to meet resis-tance. In letters to the edi-tor and comments on the county’s website, large numbers of residents have continued to voice con-cerns about the proposed paved trails and a per-ceived lack of ecological restoration. County Parks and Rec-reation Director Steve Sullivan noted that the proposed connector trail would be created on land that was once farmed, not untouched wilderness. “This provides an op-portunity to put more sus-tainable landscape that is long-lasting, more diverse and a better habitat for wildlife,” Sullivan said. The county also plans to add three miles of soft-surface trails for a total of 43 miles of unpaved trails. The new trails are planned to loop around Holland Lake and wind through a section of the park be-tween Johnny Cake Ridge and Pilot Knob roads. Sullivan also noted that the master plan includes ecological restoration ef-forts such as removal of invasive species, water

quality improvements within the park’s lakes and restoration of prairie and forested areas. The new paved trails will provide four-season opportunities for bicy-clists, walkers, skaters and people with disabilities. The revised plan includes enforceable speed limits to ensure safe travel for users, officials say. Recent surveys con-ducted by the county es-timate that more than 30,000 people in Dakota County have a disability. County officials expect this segment to grow as the population ages. “There is currently no accessible trail for anyone with a mobility device to navigate the trails safely and independently,” said Todd Kemery, a member of the county’s citizen panel and advocacy direc-tor for Paralyzed Veterans of America’s Minnesota chapter. “It’s unaccept-able.” Kemery, a paralyzed veteran, said he sympa-thizes with opponents’ concerns for wildlife pres-ervation but insists that portions of the 2,000-acre park must meet Ameri-cans with Disabilities Act requirements. “This spacious park can and should accommo-date many diverse activi-ties and be welcoming to everyone,” he said. “Bird-ers would still be able to walk natural trails. Run-ners who prefer soft sur-faces would have 43 miles at their disposal. And I, with others that use mo-bility devices, could enjoy a portion of the park.” The board is expected to vote on the revised plan on March 17. Jessica Harper is at [email protected] or facebook.com/sunthisweek.

Farmington couple charged with altering odometers on cars, selling them online A Farmington couple was allegedly involved in a large-scale operation of al-tering odometers on vehicles and selling them at a profit, according to a Dakota County criminal complaint. Farmington’s Maxim Vladimir Lit-vinov, 27, and Margarita Aleksandr Sandulyak, 23, were charged with two counts of felony theft by swindle and two gross misdemeanor counts of sell-ing a motor vehicle with an altered odometer by the Dakota County Sher-iff ’s Office. According to the criminal complaint, a Nissan and Toyota with altered odom-eters were sold for more than they were worth on Craigslist. Following a search warrant of their property, several more altered vehicle odometers were discov-ered. Last summer, the Dakota County Sheriff ’s Office began investigating a claim that the two sold a 2003 Nis-san Altima with an altered odometer. An individual purchased the car with 90,000 miles on it in Dec. 2013, but when they took it to get an oil change at a Jiffy Lube, records showed more than 130,000 miles from 2012. Further re-cords on the vehicle from other service agencies confirmed the discrepancy. In September, another alleged victim contacted the Dakota County Sheriff ’s

Office after they purchased a 2002 Toy-ota Avalon from Sandulyak with 90,000 miles. During an Internet search of the vehicle identification number, they later discovered the same Avalon was posted online for sale with 207,000 miles. Law enforcement executed a search of the property where both Litvinov and Sandulyak were living. Officers found many different cars, including two 2002 Toyota Camrya; a 2003 Acura MDX; and a 2004 Toyota Corolla, all with odometers in the 89,000-96,000 range along with several tools. Subse-quent investigations discovered the cars had 80,000 to 185,000 more miles than the odometers indicated. The maximum charges for the of-fenses is 12 years in jail, a $26,000 fine or both. The two were also charged with fel-ony theft by swindle and sale of a mo-tor vehicle with an altered odometer by the Dakota County Sheriff ’s Office in July 2014. An individual sold a Toyota RAV4 to Litvinov and Sandulyak and later discovered the same vehicle on Craigslist advertised with 135,000 fewer miles, sparking the investigation. The case is scheduled to go before a jury on Aug. 3. — Andy Rogers

Uponor plans major expansion by Andrew Miller

SUN THISWEEKDAKOTA COUNTY TRIBUNE

Uponor North America announced plans this week to expand its Apple Val-ley manufacturing facility. The $18 million project, which is set to begin in the spring and be completed by Dec. 1, will see renovation and ex-pansion totaling 88,000 square feet to accommodate manufacturing and office space. Uponor, whose North American headquarters are in Apple Valley with a nearby distribution center and resin-processing plant in Lakeville, is under-

taking the project to meet projected de-mand for its cross-linked polyethylene (PEX) tubing used in plumbing, fire sprinkler, heating and cooling systems for residential and commercial build-ings. “It’s a very exciting time in the build-ing industry, especially after the down-turn we experienced in the market just a few years ago,” said Bill Gray, president of Uponor North America. “We’re seeing significant growth in commercial and residential construc-tion, and this expansion will ensure we

See UPONOR, 7A

4A February 26, 2015 DAKOTA COUNTY TRIBUNE

Letters to the editor policySun Thisweek welcomes letters to the editor. Submitted letters must be no more than 350 words. All letters must have the author’s phone number and address for verification purposes. Anonymous letters will not be accepted. Letters reflect the opinion of the author only. Sun Thisweek reserves the right to edit all letters. Submission of a letter does not guarantee publication.

Required study of Islam at BlackhawkTo the editor: I recently spoke with a friend who got a text from her daughter, an eighth-grader at Blackhawk Middle School in Eagan. The eighth-grader asked her mom why she had to do more stuff on Islam. Mom texted back and asked her to take pictures, so she sent three pages of the assignment. They were predominantly predictable questions on Islam but there were a few on Juda-ism, along with symbols of both religions. Noth-ing about Christianity, no symbol of a cross, noth-ing. So the girl’s mother called the school and when the teacher was far from reasonable, she called the Rosemount-Apple-Valley-Eagan School District of-fice. When she threatened to take her daughter out of the class, they said the “assignment is required” and was about studying the “culture,” not the reli-gion. I was personally sur-prised they did not try the “It’s a study of history” ar-gument. She got nowhere and is hopping mad about it, considering taking her daughter out of school. I told her I wondered what other materials they were pushing on the kids. So the eighth-grader took more pictures and, lo and behold, the material touts Islam as “one of the world’s greatest religions.” Doesn’t sound much like the study of culture to me. But then I noticed on the top of the page, hand-

written directions: “Please don’t remove from class.” Why? Something to hide from Mom and Dad? What else are they teach-ing kids that parents don’t know about? I would like to see all religious history studied. After all, isn’t that what history class is supposed to be about? It’s also what our country was founded upon. But, based on the premise of separation be-tween church and state, no religion should be dis-cussed. To promote one religion over another, sug-gesting Islam is great and Judaism is “old” with no mention of Christianity, is disgusting. It’s not educa-tion, it’s indoctrination. In light of current events and the atrocities being com-mitted in the name of Is-lam, it is also inappropri-ate and unacceptable.

THOMAS CARLSONEagan

Straws are

wastefulTo the editor: Did you know Ameri-cans use 500 million drink-ing straws every day? To understand just how many straws 500 million really is, this would fill over 125 school buses with straws every day. That’s 46,400 school buses every year! Americans use these dis-posable utensils at an aver-age rate of 1.6 straws per person per day. So if you are a consum-er, please ask at restaurants for water without a straw. If you are a waiter or wait-ress, ask your customers if they want a straw. If you

are a manager of a restau-rant, please post this letter for your waitstaff. You’ll help save the Earth for your children and grandchildren.

HARLEY HORSAGERLakeville

Ditch will

destroy

Lebanon Hills To the editor: In a letter to the editor, Dakota County Planning Commission Member Nate Reitz suggests that if you live in the wrong place you cannot comment on the much-disparaged plan for Lebanon Hills. Close to a thousand people have told the coun-ty that this plan — whose central item is a miles-long flat ditch road up to 80 feet wide — will destroy the beauty of the park. Ditches ain’t beautiful. If you remove the two of us who live on the wrong side of the tracks, according to Mr. Reitz, there are still hundreds and hundreds more who are appalled at the destruction of the hills and the beauty of the park. I agree with Mr. Reitz that there will be more bik-ers brought in by the high-speed, bike ditch road. These bikers are mainly from existing trails some-times only a few yards away. Since the speed spec-ification for this ditch road is 20 mph, it will be a haz-ard for any pedestrian us-ers, including the disabled and parents with children. This poor and unsafe de-sign is described in detail

Opinion

Letters

PUBLISHER . . . . . . . . . . . . . . . Julian AndersenPRESIDENT . . . . . . . . . . . . . Marge WinkelmanGENERAL MANAGER . . . . . . . . . . . . Mark WeberFARMINGTON EDITOR . . . . . . . . . . .Andy RogersROSEMOUNT EDITOR . . . . . . . . . . .Tad Johnson

SPORTS EDITOR . . . . . . . . . Mike ShaughnessyNEWS ASSISTANT . . . . . . . . . . . . . .Darcy OddenTHISWEEKEND . . . . . . . . . . . . . Andrew MillerSALES MANAGER . . . . . . . . . . . . . Mike Jetchick

Andy Rogers | FARMINGTON NEWS | 952-846-2027 | [email protected] Johnson | MANAGING EDITOR/ROSEMOUNT | 952-846-2033 | [email protected]

Mike Shaughnessy | SPORTS | 952-846-2030 | [email protected] Odden | CALENDARS/BRIEFS | 952-846-2034 | [email protected]

Mike Jetchick | AD SALES | 952-846-2019 | [email protected] Anderson | DIRECTOR OF NEWS | 952-392-6847 | [email protected]

15322 GALAXIE AVE., SUITE 219, APPLE VALLEY, MN 55124952-894-1111 FAX: 952-846-2010

A division of ECM Publishers, Inc.

TribuneDakota County

New ideas, attitudes, opportunities for studentsby Joe Nathan

SUN THISWEEKDAKOTA COUNTY TRIBUNE

New ideas, attitudes and opportuni-ties are coming for Minnesota students. That was a central theme at the Feb. 6 “Pathways to Post-Secondary” confer-ence, co-sponsored by the Minnesota Department of Education and Minne-sota State Colleges and Universities sys-tem. If things work out as state officials hope, Minnesota students will know more about career options, be better prepared for them, and be more likely to find a good job that pays well. Those are great goals. They are going to require some rethinking by families and some refinements in schools. Joel Vargas, a featured speaker at the conference, helped introduce new ideas to about 140 educators and community members who attended the conference. Vargas is vice president of Jobs for the Future, a Boston-based nonprofit that provides information to educators and legislators. Vargas was not expected to attend college, but a special program provided encouragement and assistance. He ultimately earned a doctorate from Harvard and has dedicated his life to ex-panding opportunity for others.

Vargas promoted several ideas: •It’s important for all kinds of stu-dents to take some form of dual-credit (high school and college) courses. Var-gas emphasized the value of allowing a broad range of students to participate in these courses. He shared several stud-ies showing that students who take these courses, in a high school or on a college campus, are much more likely to gradu-ate from high school, enroll and gradu-ate from some form of higher education. This can be a one-, two- or four-year pro-gram. • Students need accurate information about future jobs. Vargas cited research showing that more than 70 percent of jobs by 2020 will require some educa-tion beyond high school, though not necessarily a four-year degree (read more about this at http://bit.ly/1EXMZgi). • Students should consider that many

high-paying, enjoyable jobs are available in technical fields like welding, digital imaging, advanced manufacturing, etc. These often require a one- or two-year degree or certificate beyond high school. A 90-second video featuring Vargas is at http://bit.ly/1vjmeul. His full presenta-tion is at http://bit.ly/1Dhm6lr. John Christiansen, superintendent of Intermediate School District 917, based in Rosemount, told me “the need is now.” He’s finding that Dakota County employers, and others around the state, are facing shortages of people trained in technical fields. Christiansen encourages students and families to be open to many fine jobs in these fields. This may require new attitudes and a greater openness to such jobs. 2013 Minnesota legislation requires that each student, starting in the ninth grade, develop a personal learning plan. It will be based on their interests, talents and skills. The plan will be updated as students move through high school. This is a terrific idea. Future columns will dis-cuss how it’s being implemented. Sen. Greg Clausen, D-Apple Valley, a former public school educator, attended the conference. He strongly supports the 2013 law and is working to help imple-ment it.

The Feb. 6 conference, held in Rose-mount at the Dakota County Technical College, was the seventh and last in a series of meetings held around the state. Each offered research, strategies and ex-amples of how schools and colleges are partnering to help students develop, as state legislation requires, the “knowl-edge, skills and competencies to pursue a career pathway.” I hope MDE and MnSCU hold more meetings like this. If they do, the confer-ences could benefit from an expanded list of partners and presentations. That could include presentations by students, the University of Minnesota, the Minne-sota Private College Council and charter public schools faculty. Thanks to Christiansen, other educa-tors and state legislators, good informa-tion will be shared with students and families. These new ideas and opportuni-ties are good for students and good for Minnesota.

Joe Nathan, formerly a Minnesota public school teacher, administrator and PTA president, directs the Center for School Change. Reactions are welcome at [email protected]. Columns re-flect the opinion of the author.

Sun Thisweek

ColumnistJoe Nathan

by Nika Davies’ letter of Feb. 12. It is obviously frustrat-ing for government official Reitz to have developed a $13.7 million plan that has no support in the county anywhere outside of gov-ernment circles. He gives us no substance on the plan other than platitudes of how multitudes will en-joy beauty — the beauty of a deep ditch, that is. Please contact the county and tell it to stop the destruction of the beauty of Lebanon Hills with a hazardous ditch.

MIKE FEDDEEagan

Wrong path

for Lebanon

Hills ParkTo the editor: Regarding the Feb. 20 opinion article “Friends of the Eagan Core Greenway oppose trail plan,” I am ecstatic that a well-known and regarded preservation group has come forward in opposition of this bike connector trail through the middle of Lebanon Hills Regional Park. I now feel somewhat validated by this action by FOECG. Validated in the sense that we all need to be good stewards of Lebanon Hills if we want to pre-serve the natural beauty of this park and all parks. I also feel the public needs to know about what is going on in other parks in Dakota County for this connector trail. This is not just a Lebanon Hills prob-lem. Spring Lake Park Re-serve is in the beginning stages of the connector trail. I have gone out to see the destruction of this bike connector trail. The sup-posed 12- to 14-foot-wide bike path is more like a bike roadway. Our Dakota County commissioners have used

eminent domain to scoop up their prized Mississippi River frontage for their bike trail, and of course “eminent domain” of all the animals homes as well. This is not good steward-ship. Too bad FOECG is not involved in all of Dakota County’s preservation ef-forts, because maybe we would not be still fighting to save Lebanon Hills Re-gional Park and surround-ing parks involved with this bike connector trail. Last but not least, I do not consent to, nor do I want my tax money used for, this project.

MARY KANUITEagan

Leave park aloneTo the editor: Why is it so important to have Lebanon Hills Park be a carbon copy of other parks in the metro area? Don’t the terms “di-versity” and “uniqueness” factor in the discussion? The uniqueness of Leb-anon Hills Park is a plus. People get tired of the same-o, same-o. Leave Lebanon Hills Park in the pristine condi-tion. This way, we won’t hear or say, “I remember when … ”

PHYLLIS PETERApple Valley

Peterson’s stance shows no difference between partiesTo the editor: I would like to thank state Rep. Roz Peterson for reminding me in her Feb. 20 article (“Increas-ing pay for families, not politicians, should be fo-cus”) why there is not a dime’s worth of difference between the Republican

and Democrat parties. Let’s start off by re-minding Peterson that the reason take-home pay is not as high as she would like is because the govern-ment takes so much of our money away from us. If she wants to increase take-home pay, she should push for cutting taxes dra-matically and across the board! Instead, she advocates lowering taxes on people and businesses who do exactly as she says: Ei-ther they study subjects (STEM) that she wants people to study or they go to work in industries that she likes (long-term care). She also wants to decide the geographic location of the next big business breakthroughs (Minneso-ta). Let me just say that I’m in favor of any tax de-crease for any person or group, but why not give the lower taxes to every-one, instead of Peterson’s favored groups? Republicans complain about Democrats being “nanny-state liberals” with bills like Obamacare (which is true – they are nannies). Then Republicans turn right around and punish people with higher taxes because they aren’t in the Republican-favored, polit-ically correct line of work. Republicans wonder why only one-third of eligible voters went to the polls in 2014 and so many Republicans stayed home during the 2012 election. Peterson is a perfect example of why so many of us do stay home. She contrasts her position with Gov. Dayton giving pay raises to his staff. Please pass on to Pe-terson that I would gladly give every legislator a pay raise if they would just leave the rest of us alone!

HAL CRANMERLakeville

DAKOTA COUNTY TRIBUNE February 26, 2015 5A

Member FDIC

PLUS:We’ll pay you up to $10

for your unused checks and debit cards from another financial institution when you switch to Think.

Hurry � JIVE Bluetooth speaker shown is available while

supplies last. If unavailable, we may substitute a gift of similar value.

thinkbank.com/checking 1-800-288-3425

��������Sounds great!

Open any new Simply Better Checking Account

and get a

free gift.

Comes in blue, orange, lime, & purple.Embracing Charlie: When a book finds you

by Mindy Lynn HiloSPECIAL TO SUN THISWEEKDAKOTA COUNTY TRIBUNE

It’s been five years since I reclaimed the comfy leather chair in the front room of our home. It had been our oatmeal-colored 10-pound pup’s oasis. I can’t blame him much – it’s the best chair in the house. It came to be the place I’d sneak to as well, usually early in the morning while my house was still quiet. There in the comfy chair with my lap-top and morning coffee is where I did most of my writing. Our affectionate puppy – well, he’d work his way in. He’d snuggle up close, and occasionally I’d need to push his paw from my keyboard. I never imagined myself as a writer, but the telling of our story had pursued me. My son Charlie was getting ready to start preschool. The dust of all that followed his birth had started to settle. A month at Children’s Hospital, one stroke and two heart surgeries were all behind us. Charlie was a bit smaller than the other kids. He lagged behind ever so slightly. But he had a sweet, infectious smile, and we were learning to pilot for-ward with physical, occupational and speech therapies worked into our weekly routines. Nevertheless, I found myself in an endless state of reflection. The most amazing things had happened since that day during my second pregnancy when an ultrasound image sent our world spin-ning. A handful of years prior, we had joined a couples’ small group at Ho-sanna Lutheran Church in Lakeville. We enjoyed friendship and fellowship sup-porting each other as we started families. Over the course of three years, three of the five couples in our small group would

welcome baby boys born with complex, life-threatening congenital heart defects – almost unimaginable, right? Not only did I have our own experiences chasing me, but I had those of two other families as well. I began to write and felt so much bet-ter for it. Looking for some encourage-ment in my writing ability, a handful of chapters in, I sheepishly asked some of my co-workers if they would read what I’d started. I was a full-time wife and mom and a part-time dental hygienist – what business did I have writing any-way? One co-worker asked if she could have her husband read it. “Sure,” I said, thinking that her middle-aged, empty-nester husband certainly didn’t fit my readership demographic. I had assumed I was writing to moms with special-needs children. She came back the next day ex-pressing how much he’d appreciated it, how it brought him to remember a time in his own life when his father was ill. His feedback was such a blessing. It helped me recognize that the things I’d experienced, the things that weighed on my heart weren’t unique. They were, in fact, ordinary, in the most extraordinary way. Each one of us experiences mo-ments in our lives when the things we hold dear are jeopardized – it’s an ordi-nary human experience. The extraordi-nary part is the way in which God desires to comfort us during those times. I con-tinued on, spending 3 1/2 years writing, and was left holding a creative hot mess. Two years of editing followed – first a se-

Guest Columnist

Rosemount author Mindy Lynn Hilo with her daughter Sophie, a seventh-grader at Rosemount Middle School, and son Charlie, a third-grader at Shannon Park Elementary. (Photo submitted)

See BOOK, 8A

6A February 26, 2015 DAKOTA COUNTY TRIBUNE

Apple Valley | Free Parking | (952) 432-3136

W i l l s T r u s t s H e a l t h C a r e D i r e c t i v e s P o w e r s o f A t t o r n e y P r o b a t e E l d e r L a w W i l l C o n t e s t s G u a r d i a n s h i p s C o n s e r v a t o r s h i p s

www . dmsh b .co m

T e r r y M e r r i t t L i s t e d i n 2 0 1 4

M N S u p e r l a w y e r s

E r i n B o e r s c h e l 2 0 1 4 C h a m b e r o f

C o m m e r c e A m b a s s a d o r ( L a k e v i l l e )

B o b B a u e r L i s t e d i n 2 0 1 4

M N S u p e r l a w y e r s

ESTATE PLANS THAT FIT

lighted three different areas of need including an increase in general oper-ating funds, facility funds and technol-ogy. An operating levy is funds used for learning and general expenses. She noted state aid has not kept up with inflation and the district’s limited ref-erendum authority compared to other cities within the South Suburban Con-ference. “If we would have had simple in-creases to the formula based on infla-tion (since 2004), we’d be 9.3 percent higher today than we are,” she said. It would increase spending per pu-pil between $200-$400 per year — with $400 getting the district up to average, Hauska said. The range would be $96-$185 on a $250,000 market value prop-erty. There are also many facility needs that need to be addressed. Hauska said a task force was put together to ensure all districts had adequate, equitable and sustainable facility plans. The district set a priority on proj-ects such as a visitor identification system, new roofs at the middle and el-ementary schools, and cameras/horns/lights system.

There are several other projects that need funding including slab repair at the high school stadium, exterior brick repair on buildings, windows, expand-ing kindergarten classrooms and in-stalling locked alcoves in the entrances of schools. Using the $250,000 estimated resi-dential value, the annual increase for facilities would be between $39-$80. The technology levy is based off a 10-year plan to replace items such as classroom projectors, instructional laptops and computing devices in labs, which are aging. It would also be used for district infrastructure such as firewall replacement, wireless access points and other network and security upgrades. “It’s all of those things we need behind the scenes to make sure every-thing is running smoothly on a day-to-day basis,” Hauska said. She also noted that the district buys in bulk to save on costs and asks for input on staff needs. The range of increases using a $250,000 residence would be between $57-$88 for technology. Email Andy Rogers at [email protected].

LEVY, from 1A

still able to have its Spe-cial Needs Ride on Feb. 7, which served more than 100 children. Members took children for rides at the Dakota County Fair-grounds for a few hours on thin snow before it started to melt. “The kids, just to see them and the look in their eyes, they don’t always get to do stuff like that,” Zak said. “It pulls at your heart strings. We got lucky with that there was just enough snow. We could ride on their grass but we didn’t want to tear it up, so we stopped once it started melting.” Zak also mentioned that the lack of snow hurts the Minnesota economy, saying the average snow-mobiler spends about $4,000 a year. Several types of sleds laid dormant this winter. A new sledding hill at Hillview Park, 5970 183rd St. W. in Farmington tech-nically opened this year.

A few used the hill when there was sufficient shon, but it was minimal. Whitetail Woods, a 456-acre park in Empire Town-ship, officially opened in the fall with a lighted sled-ding hill. Conditions were fair, but a sledding party was canceled on Dec. 20. Whitetail Woods also features a trail system for snowshoeing and cross-country skiing, but events were also canceled as the trails had bare patches. The cross-country ski trails were roller packed but not machine groomed with tracks, which would require more than double the amount of snow. It was often cold enough to ice skate out-doors, but sometimes it was too cold. Of the possible 59 days, Farmington’s warming houses were closed 12 of those days. It was either too cold or too warm the other days. The warming houses officially closed on Feb. 16. The city tradition-

ally closes after Presidents Day, the third Monday of February. City staff is continuing to flood and maintain out-door ice as weather per-mits to extend the outdoor ice season. “We are also leaving the rink lights on during the evening through the end of February to allow skat-ing to occur after sunset,” Parks and Recreation di-rector Randy Distad said. The lights are pro-grammed to turn off auto-matically at 9:30 p.m. On the bright side, this season has called for less shoveling. “A positive from the lack of snow has been a re-duction in the number of times having to clear snow from trails, sidewalks and outdoor rinks, resulting in a reduction in costs associ-ated with this work,” Dis-tad said.

Email Andy Rogers at [email protected].

SNOW, from 1A

DAKOTA COUNTY TRIBUNE February 26, 2015 7A

651 463 4545. .

Kent Boyum - Pastor

SUNDAY SCHOOL - 9 AMWORSHIP - 10 AMEVENINGWORSHIP - 6:30 PMWED. FAMILYNIGHT - 6:30 PM

SUNDAY SCHOOL - 9 AMWORSHIP - 10 AMEVENINGWORSHIP - 6:30 PMWED. FAMILYNIGHT - 6:30 PM

Kent Boyum Pastor

christianlifeag.orgchristianlifeag.org

651-460-2002923 8th St. • Farmington • www.gettan.biz

Corner of Hwy 3 & 50 • In the Farmington Mall

If You Can’t Tone It, Tan It!

“like” us on Facebook

match forecasted growth and demand for our PEX systems.” Uponor, which is seek-ing LEED certification for the project, has applied for financial support from the city of Apple Valley as well as state assistance from the Minnesota Job Creation Fund and Min-nesota Investment Fund to aid the expansion. This year marks Up-onor’s 25th anniversary in Apple Valley. The com-pany plans on adding “a significant number of jobs” as a result of the ex-pansion, Uponor officials said. Uponor employs 4,000 employees world-wide, with about 500 em-ployees in the Twin Cities. “Uponor has been an outstanding job creator since opening its North American headquarters

in Apple Valley in 1990,” said Katie Clark Sieben, Minnesota Department of Employment and Eco-nomic Development com-missioner. “With such a large global presence, we are grateful for the com-pany’s decision to make further investments in Minnesota.” Uponor last under-took an expansion project at its Apple Valley site in

2013, adding 17,500 feet of space for PEX tubing manufacturing. The facility at 5925 148th St. W. houses the company’s North Ameri-can corporate offices, manufacturing plant and Uponor Academy, the company’s on-site training center.

Email Andrew Miller at [email protected].

UPONOR, from 3A

Uponor’s expansion project consists of a 34,000-square-foot remodel to an existing structure at its Apple Valley campus, along with a 54,000-square-foot addition. (Photo submitted)

SUMMER CAMP

Worship DirectoryShare your weekly worship schedule or other activities

with the community. Call 952-392-6875 for rates

and informatilon.

8A February 26, 2015 DAKOTA COUNTY TRIBUNE

Join the Dakota County Regional Chamber for their fi fth annual WomEn’s Conference

Thursday, March 12, 2015Lost Spur Golf and Event Center,

2750 Sibley Memorial Highway, EaganRegistration and Marketplace begin at 11:00am

11:00am – 5:00pm(Lunch and light refreshments provided throughout the day)

Sponsors:

( g p g y)

Presenting Sponsors:

This event will feature keynote speakers Angie Bastian, Co-Founder and President of successful brand Boomchickapop, as well as Kristen Brown, Corporate Trainer and Bestselling Author of “The Happy Hour Effect”. Additionally, for the fi rst time in

WomEn’s Conference history, the event will offer the opportunity for all attendees to take a Predictive Index Assessment offered by PI Worldwide. Attendees will learn about their

results at the Conference.

Registration is available for $149 per person (Members and Non-Members). Corporate tables of 8 available.

For more information, call Chelsea Johnson at 651.288.9202 or go to www.dcrchamber.com

Sponsorship opportunities are available.

www.dcrchamber.comWANAMINGO11555 Hwy 60 Blvd507-824-2256

ST. CHARLES 11906 Hwy 14

507-932-4030

PLAINVIEW 55083 Cnty Rd 4507-534-3116

CALEDONIA201 N Hwy 44/76507-725-7000

NORTHFIELD

507-645-4886

AUSTIN2001 4th St NW

507-437-6625

SPRING VALLEY

507-346-7375

LEROY

507-324-5201

YOUR RURAL LIFESTYLE DEALER

JOHN DEERE D130 LAWN TRACTOR

$1,899save big! SAVE $100!

2014 JOHN DEERE 5085M TRACTOR

$42,900RENTAL RETURNlow hours! save $9,000!

JOHN DEERE X300 TRACTOR 42”

Warranty

$2,599top rated! SAVE $500!

JOHN DEERE Z235 ZERO TURN

$2,499smooth ride! EZTRAK Z235

JOHN DEERE 1023E TRACTOR

$9,599$159/MO SAVE $1,000!

LAWN & GARDEN SERVICE SPECIALSStarting at

FREE $25SEMA BUCKSwith service

14-POINT INSPECTION

JOHN DEERE 825I GATOR

$16,500$458/MO SAVE $700!

JOHN DEERE 323 CTL

$56,899LEASE FOR$830/MO SAVE $9,800!

Browse and compare products online at www.ShopSEMA.com

New! Military Discount

workers and job creators across the country, and right here in Minnesota Congressman Kline heard this morning in Rose-mount from numerous constituents how the NL-RB’s joint employer test — telling small business owners that they don’t ac-tually operate their small businesses — would in-crease costs and signifi-cantly limit small business owners’ freedom to run

their businesses. Congress-man Kline will continue to monitor this issue and take whatever actions are necessary to rein in this activist board and ensure a vibrant and growing economy.” As chairman, Kline’s House Education and the Workforce Committee has held two subcommit-tee hearings on this issue, highlighting the request for briefs in Browning-Ferris Industries and more recently the General

Counsel’s determination that McDonald’s LLC is a joint employer with its franchisees. Monday’s meeting was a part of a series of meet-ings across the country with franchise owners sponsored by the Interna-tional Franchise Associa-tion, which is opposed to NLRB’s position.

Email Andy Rogers at [email protected].

KLINE, from 1A

to serve their beers with higher alcohol levels in 10- to 12-ounce glasses and the rest in 16-ounce glasses; both will cost $5. A news release said they plan to offer nine beers on tap, with two available on six-month rotations and one experimental brew. Erickson said craft beers differ from com-mercially produced beers because the goal is quality and innovation instead of mass production. Erickson said he and Hebzynski plan to “play” with recipes and try new brews “so we never get into a rut.” “We can always be try-ing different things to see what we like and what the people like,” Erickson said. Innovation is also on tap at Motley Crews Heavy Metal Grill, where Richie said customers will find a 1980s classic rock atmosphere. Richie, 45, said there is a huge need for a restau-rant downtown, adding that his will contrast with Babe’s Sports Bar partly because it will not focus on sports. “I wanted something that was a fun atmo-sphere,” Richie said. “I didn’t want the food to be the only star. I wanted a place where people could come and feel comfort-able.”

He said patrons should expect guitars on the walls that are available to play by anyone who feels like entertaining the crowd. He envisions the res-taurant as an affordable (sandwiches for $10 or less), family-friendly venue where “people walk out of there happy at any cost.” Richie said the truck will continue to operate locally and is still booked for events with Minne-apolis breweries including 612 Brew, Bauhaus Brew Labs and Insight Brewing, and will continue to be at events and venues such as the Uptown Art Fair, Canterbury Park and food truck rallies in Burnsville, Blaine and St. Paul. Lakeville City Council members at their Feb. 23 work session expressed excitement about the new businesses moving into downtown. They’ve focused on improving the downtown area, recently upgrading the area in front of the District 194 Area Learn-ing Center, and indicated approval for a $37,000 plan to upgrade Pioneer Plaza, the park-like area between downtown build-ings that’s home to the city’s Christmas tree. The tree is set to be re-placed as part of the proj-ect, as are worn colored pavers and an old, chipped water fountain. Mayor Matt Little sug-gested the city also exam-

ine other cost-effective op-portunities to improve the site that encourage people to use the space. He suggested adding rotating plantings that would draw crowds or ro-tating displays of public art. Parks and Recreation Director Brett Altergott said there could be sea-sonal displays, which may attract donors. Council Member Doug Anderson suggested the Downtown Lakeville Business Association may want to be involved. “It’s important to ad-vance this forward with new businesses coming into town,” Anderson said. Sherer indicated there may be more announce-ments of new businesses coming to downtown Lakeville this year. Sherer said Metro Eq-uity Management is in discussions with numerous potential business owners interested in the down-town area, offering ideas that include three or four more restaurants and an event center. “We’ve looked at a lot of different options,” Sherer said. “But our main goal is to put uses in that are going to drive traffic into downtown.”

Laura Adelmann is at [email protected].

BREW, from 2A

ries of self-edits, then edits with the help of an amaz-ing editor. The result was a mem-oir called “Embracing Charlie – a Story of God’s Grace.” It’s a story of my overwhelming desire to scoop up my child in the midst of his suffering – something I couldn’t do because of all the medi-cal interventions that tied him down – while recog-nizing the parallel way in which God embraced me

through it all. • • •

“Embracing Charlie” won a Finalist Title in the Christian Inspiration-al category of the 2014 USA Book News Best Book Awards. It’s avail-able on Amazon in both paperback and Kindle editions. Other electronic editions can be found on Barnes&Noble.com and Smashwords.com. Lo-cally it can be purchased at Daily Bread Books, part of Hosanna Luther-an Church’s campus in

Lakeville. It is also avail-able at Kaleidoscope Bou-tique in downtown Lakev-ille. Follow Mindy’s blog at www.embracingcharlie.com.

Mindy lives in Rosemount with her husband Paul; daughter Sophie, a sev-enth-grader at Rosemount Middle School; and son Charlie, who is a thriving, healthy third-grader at Shannon Park Elementary. Tucker the oatmeal-colored pup still occupies his space on the comfy leather chair.

BOOK, from 5A

DAKOTA COUNTY TRIBUNE February 26, 2015 9A

10A February 26, 2015 DAKOTA COUNTY TRIBUNE

SportsIt’s the biggest week for local wrestlersLarge contingent heading to state

tournamentby Mike Shaughnessy

SUN THISWEEKDAKOTA COUNTY TRIBUNE

Last weekend was the chance for individual wres-tlers to claim their places in the state high school tour-nament, and more than three dozen from the Sun Thisweek Newspapers cov-erage area are on their way. Among those advanc-ing are three who will take undefeated records into the state tournament – Mark Hall and Gable Steveson, both of Apple Valley, and Adam Hedin of Rosemount. Hall will try to become the fifth five-time state champion in Minnesota history. If he succeeds, he will have a chance for an unprec-edented sixth title in 2016. Hall, Apple Valley’s Bobby Steveson, Taylor Venz of Farmington and Wade Sullivan of Lakev-ille North all know what it’s like to earn the gold medal at state as all four have won at least one state championship.

The state tournament begins Thursday at Xcel Energy Center in St. Paul with team competition. Apple Valley will seek its 10th consecutive state title and 23rd overall in the Class 3A tourney, where the Eagles are the top seed. Apple Valley (19-2) faces unseeded White Bear Lake (20-7) in the quarterfinal round at 9 a.m. Thursday. Farmington (24-10), a first-time state team tour-nament qualifier, takes on last year’s Class 3A run-ner up, Prior Lake (22-9) in another quarterfinal match. The Tigers are seeded fourth and Prior Lake fifth. Team semifinal matches are 1 p.m. Thursday, with championship matches at 7 p.m. Individual competi-tion starts Friday, with the Class 3A first round at 9 a.m. and quarterfinals at 4:30 p.m. Finals in all three classes are at 7 p.m. Satur-day. Following are wrestlers from the Sun Thisweek coverage area who have qualified for the state indi-vidual competition. Wres-

tlers will compete in the Class 3A tournament un-less noted.

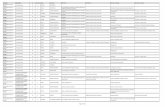

Farmington Victor Gliva (Jr.) – 39-2, Section 1 champion at 106. Skyler Raymond (So.) –21-17, Section 1 runner-up at 113. Jamin LeDuc (Jr.) – 36-3, Section 1 champion at 120. State runner-up at 113 last season. Taylor Venz (Jr.) – 35-6, Section 1 runner-up at 145. Third in state at 126 last season. State cham-pion at 106 in 2013. Kyle Benjamin (Sr.) – 33-4, Section 1 champion at 160. John Walz (Sr.) –28-10, Section 1 champion at 182. Mason Hawkins (Jr.) – 19-7, Section 1 runner-up at 195.

Rosemount Jacob Bottem (So.) – 27-8, Section 3 runner-up at 113. Noah Buck (So.) – 16-6, Section 3 runner-up at 120. Diondre Lodge (Jr.) –

30-9, Section 3 runner-up at 126. Adam Hedin (Jr.) – 41-0, Section 3 champion at 132. Fourth at state last season.

Apple Valley Nate Larson (Fr.) – 29-11, Section 3 champion at 106 pounds. Kyle Rathman (So.) – 31-4, Section 3 champion at 113. Third in state at 106 last season. Seth Elwood (Sr.) – 9-3, Section 3 runner-up at 132. Brock Morgan (Jr.) – 32-8, Section 3 champion at 145. Third in state last season. Andrew Walock (Sr.) – 32-7, Section 3 runner-up at 160. Mark Hall (Jr.) – 38-0, Section 3 champion at 170. Four-time state champion. Bobby Steveson (Sr.) – 32-1, Section 3 champion at 195. State champion at 182 last season. Gable Steveson (Fr.) – 39-0, Section 3 champion at 220. State runner-up at 195 last season. Mitchel Nelson (Sr.) – 28-6, Section 3 champion

at 285.

Eagan Sodan Ka (Sr.) – 33-4, Section 3 runner-up at 106. Joe Dubbels (Sr.) – 32-9, Section 3 champion at 152.

Eastview George Farmah (Sr.) – 32-4, Section 3 champion at 126. State runner-up last season. Casey Dravis (Sr.) – 28-14, Section 3 runner-up at 145. Alex Lindstrom (So.) – 31-12, Section 3 runner-up at 152. Luke Dodd (Sr.) – 38-4, Section 3 champion at 182. Mike Delich (So.) – 34-7, Section 3 runner-up at 195. Tom Delich (Sr.) – 18-9, Section 3 runner-up at 220. Tim Duffy (Jr.) – 28-7, Section 3 runner-up at 285.

Lakeville North Wade Sullivan (So.) – 36-5, Section 2 champion at 126. State champion at

113 last season. Lucas Westrich (Sr.) – 37-3, Section 2 runner-up at 160. State runner-up last season. Tristyn Hanson (Sr.) – 36-1, Section 2 champion at 195. Fifth in state last season.

Lakeville South Brady Bastyr (So.) – 23-17, Section 2 runner-up at 132. Dalton Peterson (Sr.) – 35-3, Section 2 champion at 170. Adam Lucast (Jr.) – 32-9, Section 2 runner-up at 220. Jon Zeidler (Sr.) – 36-5, Section 2 runner-up at 285.

Trinity Jack Ridgway (Fr.) – 24-11, Class 1A, Section 4 runner-up at 113. Bryant Ridgway (Sr.) – 31-6, Class 1A, Section 4 champion at 138. Dietrich Balsbaugh (Jr.) – 36-4, Class 1A, Sec-tion 4 champion at 152.

Email Mike Shaughnessy at [email protected].

Irish on the state stage

Three Rosemount gymnasts competed in the individual portion of the state Class AA meet Saturday at the University of Minnesota Sports Pavilion. Ninth-grader Josie Schlie (left) competes on uneven bars, where she placed 21st. Schlie was second on floor exercise, scoring 9.78, fifth on vault with 9.675 and 16th in the all-around. Rosemount junior Megan Creese (right) waves to the crowd during introductions. Creese competed on vault, placing 17th with 9.475. Eighth-grader Jaden Laundrie finished 32nd on balance beam. (Photos by Mike Shaughnessy)

Tigers, Panthers prepare for rematchTeams meet again for Section 1AA

hockey titleby Mike Shaughnessy

SUN THISWEEKDAKOTA COUNTY TRIBUNE

Farmington has no illu-sions about where it stands going into the Section 1AA boys hockey championship game against Lakeville North. The Tigers are underdogs. Heavy underdogs. They’re trying not to think about that, coach Greg May said. “Our whole thing, since Day 1 of the season, is to get better each day,” May said. “I think that’s the only way you can approach this.” Farmington is the last ob-stacle in the way of Lakeville North returning to the state tournament. The Panthers are 27-0 and defeated two overmatched opponents in the Section 1AA playoffs by a combined 24-0. The Tigers are 19-7-1 after defeating Lakeville South 5-1 in the Section 1AA semifinals, avenging two losses to the Cougars in the regular season. That sent Farmington to the section championship game against North at 7 p.m. Thursday at Rochester Recre-ation Center. It’s a rematch of last year’s section final, won by North 6-0. The winner will advance to the state Class AA quarter-finals Thursday, March 5, at Xcel Energy Center. Farmington has plenty to

play for. If the Tigers beat Lakeville North, they would qualify for the Class AA state tournament for the first time (they have been in two Class A tournaments). They also know what they’re up against. “Obvious-

ly, Lakeville North is an out-standing team,” May said. “If they won the state champion-ship, they might be considered the best Class AA team of all time. “What we need to do is not sit back. If we do, Lakeville

North, with their talent and speed, is the kind of team that can overwhelm you.” Lakeville North defeated Farmington twice during the regular season, but the Tigers came as close as any team to beating the Panthers. In the season opener at Schmitz-Maki Arena, the Tigers took the Panthers to overtime be-fore North’s Jack Poehling scored to give his team a 6-5 victory. Lakeville North dominated the rematch, winning 6-0 at Ames Arena. The Panthers drubbed Rochester Century 10-0 in a Section 1AA semifinal game Saturday afternoon as senior forward Jack Poehling had five goals and one assist. His brother and linemate, Nick Poehling, had two goals and three assists. Senior defense-man Jack Sadek scored once and had four assists. Farmington was outshot by Lakeville South 38-26 in the other semifinal but jumped to a 3-0 first-period lead. Jake Trippel scored twice and Grady Hauswirth once in the first period. Hauswirth added a goal in the second period and Justin Novak scored in the final minute of the game. Noah Rasinski had a sec-ond-period goal for Lakev-ille South, which finished 15-11-1.

Email Mike Shaughnessy at [email protected].

Farmington’s Matt Olund (21) takes Lakeville North’s Jack Mc-Neely into the boards during a Nov. 25 South Suburban Confer-ence boys hockey game. The teams will play for the Section 1AA championship Thursday night. (File photo)

Eagles say they’re ready for playoff pressureAV boys seeded first in Section 3 boys hoops

by Mike ShaughnessySUN THISWEEK

DAKOTA COUNTY TRIBUNE

By now, Apple Valley has learned how to handle other people’s expec-tations. The Eagles have learned to shrug off those who nitpick a boys basket-ball team that lost only two of its 26 regular-season games. They also know better than to expect to breeze through the Class 4A, Section 3 tour-nament simply because they have had success the last several years. Coach Zach Goring said the Ea-gles don’t have a problem with being a high-profile team. “Our kids have fun with it,” he said. “They love going up against good teams and getting to play in big events. It’s fun for them.” The big event the Eagles are pri-oritizing now is the state Class 4A tournament. To get there, they have to win the Section 3 playoffs. No. 1-seeded Apple Valley played Henry Sibley in the first round of the Sec-tion 3 tourney Wednesday night, af-ter this edition went to press. Section 3 has four teams that have won 18 games or more and four that have lost 18 or more. If the Eagles get by Sibley (2-23) in the first round, they would play fourth-seeded East-view (18-8) or fifth-seeded Rose-mount (8-18) in the semifinals Satur-day at Farmington High School. An Apple Valley-Eastview semifi-nal, if it happens, would pair the Ea-gles with one of the teams that beat them in the regular season. Eastview defeated Apple Valley 73-70 on Feb. 3, about one month after the Eagles beat the Lightning 80-61 on their home floor. An Eastview offense that likes to spread the floor and shoot three-pointers proved to be a challenge for the Eagles the second time around. The Lightning also made 19 of 20 free throws in the rematch. Apple Valley continues to work on playing sound defense, and Gor-ing said the Eagles are seeing results. “So much of the defense comes down to playing hard,” Goring said. “Now that we’re in the playoffs, play-ing hard shouldn’t be a problem. The hard part for us is we play so fast of-fensively – push and push and push – that it can be tough to get back.” Forward Gary Trent Jr. and cen-ter Brock Bertram – the team’s lead-ing scorers at 21.3 and 14 points per game – are the only two Eagles who started in last year’s section playoffs, when the Eagles lost to Cretin-Der-ham Hall in the Section 3 final. But they have two other players, Camer-on Kirksey and Jordan Bolton, who average in double figures, and point guard Tre Jones averages 7.5 a game. Riley Parham, Steven Christian-sen and Austin Korba, three seniors who come off the Eagles’ bench, could be key players in the post-season push because all are good defenders, Goring said. Korba also provides another three-point shoot-ing threat should the Eagles need it.

Email Mike Shaughnessy at [email protected].

DAKOTA COUNTY TRIBUNE February 26, 2015 11A

2 Years In A Row!

Kraig J. HaenkeCPA, L.L.C.

offices in St. Louis Park & Lakeville

952-540-0153

We don’t just prepare your taxesWe manage your 1040

RHS students win speech awards Three Rosemount speech team members won multiple awards at the Eastview speech tournament on Feb. 22. Nicole Hutchinson placed sec-ond in varsity storytelling and seventh in varsity humorous. Ryan Poehler placed second in varsity extemp reading and sixth in var-sity prose. Molly Cornell placed seventh in JV prose and earned an honorable mention in extemp read-ing. Other team members placing in their events were Nnamdi Oko-rie, fifth in varsity storytelling, and Joan Yambing, 14th in varsity ex-temp reading. Other students earn-ing honorable mention awards were Busola Adams, Madison More-house, Erica Baumann and Justin Myrah.

RHS students named to honor bands The following Rosemount High School band members were selected for regional and state honor bands during the past four months. This is a record number of participants for the RHS band program. Gustavus Adolphus College: Kristen Andrews, Kari Felland, Luke Gordan, Nathan Loesch, Bai-ley Leuth, Michael St. Ores. University of St. Thomas: Erin Abraham, Carissa Boerboom, Nat-alie Narloch, Alisha Patel. St. Olaf College: Nicole Hutchinson, Jenna Olson, Riley Preator, Neha Sunkum. University of Wisconsin – Eau Claire: Wes Ellison, Tim Gearing, Andrea Gordan, Luke Gordan, Rachel Hoffman, Joe McNamara, Michael St. Ores, Anna Willmott. U of M Honor Band: Lilly Alex-ander, Kristen Andrews, Roz Davis, Nathan Loesch, Jenna Olson, Mi-chael St. Ores, Cole Tindal. MBDA Honor Band – Grades 9-10: Adam Brehmer, Petra Holtze, Tim McNamara, Jason Senthil. MBDA Honor Jazz Band – Grades 9-10: Colin Lamoreaux,

Bailey Leuth. Concordia College Honor Band: Kristen Andrews, Ellie Berg, Wes-ley Ellison, Andrea Gordan, Luke Gordan, Jenna Olson.

Local schools participate in raffle All Saints Catholic School in Lakeville and St. Joseph School in Rosemount are among the nearly 90 Midwest schools participating in the Catholic Schools Raffle. Tick-ets can be purchased from students through March 8.

District 196 Budget Advisory Council meets March 11 The District 196 Budget Ad-visory Council will meet at 6:30 p.m. Wednesday, March 11, at the District Office in Rosemount, 3455 153rd St. W. As always, the public is welcome to attend. Topics for the March 11 meeting include year-to-date budget perfor-mance, the state’s February budget forecast, School Board direction on five-year plan scenarios, an update on the Strategic Planning Facilities and Equipment Task Force, and a new budget format. The BAC advises the District 196 School Board on matters relat-ed to finance. The 12-member BAC is made up of nine parents or resi-dents and three district employees, including a teacher, support staff representative and principal repre-sentative. The director of finance and operations and three School Board members serve as ex-officio members of the BAC. For more information about the BAC, call the office of the director of finance and operations at 651-423-7713.

Farmington Community Education Farmington Community Educa-tion will offer the following classes. Call 651-460-3200 for more infor-mation.

Saturday, Feb. 28: Twist N Tumble Adv Bars Clinic (ISC); Twist N Tumble Jr Floor Ex Clinic (ISC); MN School of Fish – On Ice (DMS); Baby Signs Say and Play Class (DMS); Viking Knitting (Elko New Market Library). Monday, March 2: Comic Cre-ations 4 Kids (MVE); theater pro-duction of “Oliver” (FHS). Tuesday, March 3: Photograph-ing People (MVE-CE); Developing Your Business Plan (Falcon Ridge, Apple Valley); Night Club Slow Dance (Thomas Lake, Eagan); Retro Dances: Disco and Hustle (Thomas Lake, Eagan); Variety Dances (Thomas Lake, Eagan). Wednesday, March 4: Basic Heating and Cooling Workshop (Scott Highlands, Apple Valley). Thursday, March 5: Your Social Security Benefits (MVE-CE). Monday, March 9 (no school): Babysitter’s Training (MVE-CE). Tuesday, March 10: LEGO X: Bats and Towers (ARE). Wednesday, March 11: LEGO X: Bats and Towers (RVE); Be-ginning Cake Decorating (Falcon Ridge, Apple Valley). Thursday, March 12: LEGO X: Bats and Towers (NTE); Grand-masters of Chess (RVE). Saturday, March 14: Twist N Tumble Clinic – Practice Time (ISC); Twist N Tumble Try It Out Clinic (ISC); Spring Swim Les-sons begin (DMS); Riveted Jewelry (Lakeville South HS). Monday, March 16: First Time Homebuyer (MVE-CE); Spring Gymnastics begin (ISC). Tuesday, March 17: Watch Me Draw – Spring Art Studio (RVE). Wednesday, March 18: Watch Me Draw – Spring Art Studio (FES). Thursday, March 19: Watch Me Draw – Spring Art Studio (MVE-CE); Retire Wisely Workshop (MVE-CE). Saturday, March 21: Saluting the Civil War (Lakeville South HS). Monday, March 23: Watch Me Draw – Spring Art Studio (ARE and NTE); Understanding Ac-counting (MVE-CE). Thursday, March 26: Personal Safety (MVE-CE).

Star of the North honorees Several area residents and organizations were recognized recently by U.S. Rep. John Kline, R-Burnsville, and received Congressional Certificates of Special Recognition for their acts of kindness at the ninth annual Star of the North ceremony at Kenwood Trail Middle School in Lakeville. Star of the North hon-orees for 2015 from Rose-mount included: Rosemount High School senior Courtney Boeckman struggles with health issues of her own, but she’s driven to help hospitalized kids. Before checking in for her last surgery at Children’s Hos-pital this year, Boeckman dropped off many gifts for patients. She uses babysit-ting money and gift cards she receives when sick to buy craft materials or stuffed animals for gifts. Last year, she made Val-entine cards for all 380 patients at Children’s Hos-pitals. Rosemount Police Of-ficer Jason Waage is a

big fan of Strong Man competitions, and does weight-lift training to prepare for charity fund-raising pulls. Last July, he harnessed himself to single-handedly pull a 50,000-pound fire truck 100 feet. This pull raised funds for department co-worker Shelly Milton, who was diagnosed with an aggressive form of breast cancer. More than $3,700 was raised to help her with medical bills. Rosemount High School sophomore Kai-tlyn Stock, 16, provides clothing and supplies to mothers and children in need. Last October, Stock started a month-long cru-sade to collect baby cloth-ing, diapers and wipes to donate to the Lewis House in Hastings. She collected 28 boxes of clothing and a variety of supplies in-cluding: 472 diapers and 21 cans of formula. Her latest venture, Kaitlyn’s Kloset, uses a social media website to request and dis-tribute items in need.

Rosemount High School sophomore Kaitlyn Stock received a Star of the North award for providing clothing and supplies to mothers and children in need at the Lewis House in Hastings. (Photo submitted)

Education

Tax GuideTax & Accounting Services

2015

FIND

YOUR

TAX

SERVICES

HERE

12A February 26, 2015 DAKOTA COUNTY TRIBUNE

Obituaries Obituaries

Engagements

Oblak/TowersJohn and Carole Tow-

ers of Damascus, Virginia announce the engagement of their daughter, India Rose Towers to William Thomas Oblak, son of Tom and Jill Oblak, pre-viously of Lakeville, MN.

India is a graduate of Appalachian State Uni-versity and is working on her masters degree.

1st Lieutenant Oblak is a Marine Corps Infantry Officer serving with the 2nd Battalion, 2nd Ma-rine Regiment at Camp Lejune, N.C. He gradu-ated from Lakeville North in 2007 and Penn State University in 2011.

A July 4th wedding is planned in Blowing Rock, N.C. Following the wed-ding, the couple will re-side at Will’s new duty sta-tion near Beaufort, S.C.

651-315-9049

Road Master Driving School, LLCHigh School Students: You can choose your

behind the wheel provider!http://www.roadmasterdrivingschoolmn.com/

651 315 9049651 315 9049

Low CostLow CostNo Other Students in the CarNo Other Students in the Car

Pickup and Dropoff Pickup and Dropoff at Your Residenceat Your Residence

Schedule Today, Schedule Today, Drive Tomorrow!Drive Tomorrow!

Based in Dakota County

Rotary Club hosts Irish for a Day Soiree The Rotary Club of Rosemount will host its an-nual Irish for a Day Soiree fundraising event at 5:30 p.m. Friday, March 13, at the Rosemount Commu-nity Center. The event is a fun and casual affair that serves as the club’s sole fundraising event. Dollars raised sup-port a variety of the club’s service projects, including a fund the Rotary Club of Rosemount recently es-tablished to provide finan-cial support for children at the Rosemount Family Resource Center to attend various camps, workshops, field trips and other edu-cational and leadership ac-tivities during the summer months. The evening will include entertainment by Legacy,

a local Celtic band, Irish dancers, a raffle, silent auc-tion, cash bar and a tradi-tional Irish meal catered by Rosemount’s Las Tortillas Restaurant. Tickets are $40. Individ-uals interested in attending the event should contact any Rosemount Rotarian, call Erin at 952-261-6133 or email [email protected]. The club is also seek-ing silent auction items and sponsors for the event. Email [email protected] or contact any Rosemount Rotarian for details.

Open houses set on Robert Street study The Dakota County Transportation Depart-ment has scheduled two public open houses to pro-vide updates and discuss

the final results of the Rob-ert Street Transitway Alter-natives Study. The open houses will be held at the following times and locations: • 5-7 p.m. Tuesday, March 10, in the Heilmaier Room at Neighborhood House, 179 Robie St. E., St. Paul. • 4-6 p.m. Thursday, March 12, in Room 520 of the Dakota County North-ern Service Center, 1 Men-dota Road W., West St. Paul. Updates on the study’s conclusion, recommenda-tions for next steps and information about how the transit corridor will contin-ue to move forward will be provided. Project staff will make a brief presentation on the conclusion of the study and will be available to answer questions. Dakota County will provide reasonable accom-

modations to persons with disabilities. Contact the Transportation Depart-ment at 952-891-7100 at least seven business days prior to the meeting. The Robert Street Tran-sitway Alternatives Study is a joint local and federal planning effort conducted by the Dakota County Re-gional Railroad Authority and the Ramsey County Regional Railroad Author-ity to determine possible improvements to transit service in St. Paul and northern Dakota County. For more information about the study, visit www.robertstreettransit.com.

Farmington KCs breakfast The Farmington Knights of Columbus will hold a pancake breakfast from 9 a.m. to noon Sun-day, March 1, at the Church

of St. Michael, 22120 Den-mark Ave., Farmington. Pancakes, French toast, sausage links and scram-bled eggs will be served along with coffee, juice and water. Good-will offerings will be accepted. All pro-ceeds will go toward local community needs.