Corproate Profile 2008

-

Upload

khattak-jee -

Category

Documents

-

view

222 -

download

0

Transcript of Corproate Profile 2008

-

8/7/2019 Corproate Profile 2008

1/56

Annual Report for the year ended December 31, 2008

Annual Report for the year ended December 31, 2008www.askaribank.com.pk

Consolidating...

on the wings ofchange

Annual Report for theyear ended ecember 31, 2008

Annual Report for theyear ended December 31, 2008www.askaribank.com.pk

Consolidating...onthe wings ofchange

n l i a t in n t h i n

chan

olive istochange,tochange isto

mature;tomature istogooncreating

onesel endlessly.ndhere atskari ,

we are readyor allthatandmore

through consolidation.e believe

thatwe cannotadoptthe wayo living

thatwassatisactoryewyearsago.Te

worldinwhich we live haschanged,

andwe mustchange with it.

Consolidationisntnew...itisamajor

actor which ensuresthatthere isa

solidpath or everyone whoare willing

tobuildontheir ownterms be it

our customers,our employees,our

stakeholdersor you.

Consolidating...on the wings ochange

Intimes o change,learners inheritthe

uture.We are learningto carryon in

challengingtimesthrough consolidation

bybecominglean, meanand efcient

or the beneto allmovingorward

with us.

Consolidationisntnew... itis amajor

actor which ensuresthat there isa solid

path or everyone whoiswilling to

leadthe change.AtAskari,a palette o

resourcesis realignedto serve youbetter

ineveryseasonandor ustoexplore

opportunitieseven inthe ebbso time.

A bunch o paintbrushes onthe cover

o thisyearsAnnualReport,anda eel

carriedthroughoutthe reportwith hand-

pickedcolour palette andstrategically

renderedlayout,depicts resourcesand

their application,lie, change,people and

businessesandyou with us.

AnnualReportfortheyearendedDecember31,

2008

Designed&

Printedby

www.vantagepakistan.com

-

8/7/2019 Corproate Profile 2008

2/56

Contents

01 FinancialHighlights

02 PakistansEconomic Prole

04 17Yearso B anking

06 W hatW e StandFor

08 Vision& Mission

10 Corporate Inormation

11 Manag em ent

12 RiskManagementFramework

13 Entity R ating s

14 Corporate SocialResponsibility

16 PresidentsMessage

20 Value AddedStatement

21 Askari BanksPresence

22 BusinessandOperationsReview

34 Financial R eview

37 FinancialCalendar

38 Share & DebtInormation

40 A Decade o Perormance

42 Horizontal& VerticalAnalysis

44 Notice o the 17th AnnualGeneralMeeting

46 Directors Reporttothe Shareholders

FinancialStatementsof

AskariBank Limited

57 Statemento Compliance

59 ReviewReporttothe Members

60 Auditors Reporttothe Members

62 B alance Sheet

63 P rotandLossA ccount

64 Statemento ChangesinEquity

65 Cash FlowStatement

66 Notesto the FinancialStatements

ConsolidatedFinancialStatementsof

AskariBank Limitedandits Subsidiaries

119 Auditors Reportto the Members

120 ConsolidatedBalance Sheet

121 ConsolidatedProtandLossAccount

122 ConsolidatedStatemento ChangesinEquity

123 ConsolidatedCash FlowStatement

124 Notesto the ConsolidatedFinancialStatements

176 Patterno Shareholding

177 CorrespondentNetwork

179 Branch Network

186 Balance SheetinUS$

187 Prot& LossAccountinUS$

189 Form o Proxy

www.askaribank.com.pk

-

8/7/2019 Corproate Profile 2008

3/56

1

Financial Highlights 2008

Rupees in million 2008 2007 Change Percent

ProtsOperating prot 4,534 6,222 27.13Prot beore taxation 461 2,300 79.96Prot aer taxation 386 2,681 85.60

Balance SheetShareholders unds 12,971 12,266 + 5.75Customer deposits 167,677 143,037 + 17.23Advances net 128,818 100,780 + 27.82

otal assets 206,191 182,172 + 13.18

Inormation per ordinary sharesEarnings (Rs.) 0.95 6.61 85.63Cash dividend (Rs.) 1.50 Stock dividend (%) 25.00 35.00 28.57Net assets value at year end (Rs.) 31.96 40.80 21.67Market value at year end (Rs.) 14.57 99.75 85.39

Capital adequacy ratio (%) 9.22 9.35 1.39

*Revenues

17%

*Operating Prot

10%otal Assets

13%

Deposits

17%

Advances

28%

over last year

over last year

over last year

over last year

over last year

* excluding one-o gain amounting to Rs. 2.1 billion recognised last year

-

8/7/2019 Corproate Profile 2008

4/56

Annual Reportor the year ended December 31, 2008

Askari Bank Limited - Te Country2

Pakistans Economic Prole

200304* 200405* 200506* 200607* 200708*

Economic indicators

GDP Growth (%) 6.4 8.4 6.6 7.02 5.8

GDP at current actor cost (Pak Rs. in billion) 5,251 6,123 7,159 8,259 9,906

GDP at market prices (Pak Rs. in billion) 5,640 6,500 7,623 8,723 10,478

Ination (%) 4.6 9.3 7.9 7.8 12.0

rade balance decit (USD million) (3,279) (6,207) (12,130) (13,564) (20,914)

Current account balance ex. ocial transers surplus / (decit) (USD million) 1,811 (1,534) (4,999) (7,403) (14,463)

Foreign currency reserves at year end (USD million) 12,389 12,598 13,122 15,647 11,369

Exchange rate (USD) 58.15 59.67 60.18 60.37 68.40

Exchange rate (Euro) 70.90 72.14 76.47 81.70 108.20

Banking system at scal year end CY04 CY05 CY06 CY07 CY08

Networth o banking system (Pak Rs. in billion) 131 191 315 484 548

otal assets o banking system (Pak Rs. in billion) 3,003 3,624 3,884 4,785 5,074

Capital adequacy ratio (%) 10.5 11.3 12.7 13.2 12.1

Advances deposits ratio (%) 65.8 70.2 74.6 69.8 69.8

Return on Assets (%) 1.2 1.9 2.1 1.5 1.7

Stock market at scal year end

KSE 100 index points 5,279 7,450 9,989 13,772 12,289

Market capitalization (Pak Rs. in billion) 1,403 2,037 2,766 3,981 3,744*Pakistans fiscal year starts on July 1 and ends on June 30

GDPGrowth(Percent)

Foreign Exchange Reserves(US$ billion)

6.4

12.4

8.4

12.6

6.6

13.1

7.0

15.6

5.8

11.4

2003

2003

2004

2004

2005

2005

2006

2006

2007

2007

2008

2008

Imports

Agriculture

Exports

Ma nu a ct ur in g S er vi ce s

Foreign rade(US$ billion)

Sectoral Contribution to GDP(Percent)

12.2

4.2

11.2

5.2

15.6

2.4

14.0

12.3

5.8

20.6

6.5

15.5

14.4

8.5

28.6

6.3

8.7

16.5

6.5

30.5

3.7

8.2

16.9

7.6

39.9

1.5

5.4

19.1

8.2

6.9

2003

2003

2004

2004

2005

2005

2006

2006

2007

2007

2008

2008

5.1

10.7

-

8/7/2019 Corproate Profile 2008

5/56

3

Country statistics

Land area (sq. km) 796,100

Population (Million) 163.42

Population growth (%) 1.80

Population density (people/sq. km.) 205

Lie expectancy (years) 64Literacy (%) 53

-

8/7/2019 Corproate Profile 2008

6/56

Annual Reportor the year ended December 31, 2008

Askari Bank Limited - History4

17 Years o Banking

Askari Bank was incorporated in Pakistan on October 9, 1991,

as a public limited company. It commenced operations on April

1, 1992, and is principally engaged in the business o banking, as

dened in the Banking Companies Ordinance, 1962. Te Bank is

listed on Karachi, Lahore and Islamabad Stock Exchanges.

Askari Bank has expanded into a network o 200 branches / sub-

branches, including 20 dedicated Islamic banking branches, and

a wholesale bank branch in Bahrain. A shared network o 2,991

online AMs covering all major cities in Pakistan supports the

delivery channels or customer service. As at December 31, 2008,

the Bank had equity o Rs. 12.97 billion and total assets o Rs.

206.19 billion, with 816,629 banking customers, serviced by our

6,496 employees.

Askari Investment Management Limited and Askari Securities

Limited are subsidiaries o Askari Bank engaged in managing

mutual unds and shares brokerage, respectively.

-

8/7/2019 Corproate Profile 2008

7/56

5

ability to oer valueand service excellencepropels our quest tolead.

-

8/7/2019 Corproate Profile 2008

8/56

Annual Reportor the year ended December 31, 2008

Askari Bank Limited - Corporate6

What we stand or

Our vision to be the bank o rst choice

in the region demands continuous strive

or creation o business opportunities with

innovation while maintaining our core

values to meet our commitment to all our

stakeholders.

Te range o our products aims to serve

our diverse customer base that comprises

o corporates, SMEs, individual savers,

households, armers. At the same time, our

people are constantly engaged in assessingcustomer needs and market dynamics to

redesign our products and realign priorities

to attain brand recognition and competitive

edge. We are reshaping our portolio o

businesses by investing in higher growth

areas, extending and developing our core

competencies and moving out o weak and

noncore segments.

echnology has played a pivotal role in

meeting customer expectations, particularlywith respect to speed and quality o service.

We have ully automated transaction

processing systems or backoce support.

Our branch network is connected online

realtime and our customers have access to

ofsite as well as onsite AMs, all over

Pakistan. Our phone banking service, Askari

eleCare, and internet banking acility

allows customers to enjoy routine banking

service rom anywhere, anytime in the world.

We also pioneered an ecommerce venture

in Pakistan. Our mobile AMs are the rst

in Pakistan.

o urther strengthen and enhance our

technology platorm, the Bank has started

the process o replacing the existing

technology with a comprehensive state o the

art I solution. Te successul completion

will greatly improve our product delivery

and service abilities.

Our values

Integrity is the most valued standard in

whatever we do. We understand that our

commitment to satisy customers needs

must be ullled within a proessional and

ethical ramework. We subscribe to a culture

o high ethical standards, based on the

development o right attitudes. Te intrinsic

values, which are the corner stones o our

corporate behavior, are:

Commitment

Integrity

Fairness

eamwork

Service

Our vision o be the bank o rst choice in the region

Our thinking Consolidation and creating opportunities with innovation

Our values Commitment Integrity Fairness eamwork Service

Our commitment Customers Investors Regulators Employees Communities

to stakeholders Passionate about our A distinctive Exemplary Caring or our people Dedication towards

customers success, investment, delivering compliance, and helping them social development

delighting them with outstanding governance and to grow and improvement in

the quality o our perormance, business ethics quality o lie

service superior returns

and value

-

8/7/2019 Corproate Profile 2008

9/56

7

Our customers

Knowing our customers and their needs is

the key to our business success. Our products

and services are as diverse as our market

segments. Our cl ient relationship managers

are well equipped and well trained to

provide the most ecient and personalized

service to the customers. Askari Bank is

proud o its pioneering role in providing the

most modern and technologically advanced

services to its 816,629 relationships.

Our investors

We believe that the bottom line o any

business is creating shareholder value.

o gain their trust and condence, we

believe in providing our investors timely,

regular and reliable inormation on our

activities, structure, nancial situation and

perormance.

Our regulators

We rmly believe in regulatory discipline

and harmony o our corporate objectives

with regulatory ramework. Our business

methodologies are designed to ensure

compliance with the directives o all our

regulators.

Our employees

We strongly believe that the interests o the

Bank and the employees are inseparable. At

Askari we try to create a we culture where

there is mutual trust and respect or each

other. We encourage ownership behavior

so that everyone eels responsible or the

perormance and reputation o the Bank. We

are committed to develop and enhance each

employees skills and capabilities through

extensive inhouse and external training

programs and job rotations.

Our communities

We ully recognize our corporate social

responsibility and our contributions to

diferent areas o the social sector are aimed

to help improve the quality o lie in our

country.

-

8/7/2019 Corproate Profile 2008

10/56

Annual Reportor the year ended December 31, 2008

Askari Bank Limited - Corporate8

Vision & Mission

Vision

o be the bank o rst choice in the region

Mission

o be the leading private sector bank in

Pakistan with an international presence,delivering quality service through innovativetechnology and efective human resourcemanagement in a modern and progressiveorganizational culture o meritocracy,maintaining high ethical and proessionalstandards, while providing enhanced valueto all our stakeholders, and contributing tosociety.

Corporate Objectives

o achieve sustained growth andprotability in all areas o business.

o build and sustain a high perormanceculture, with a continuous improvement

ocus.

o develop a customerservice orientedculture with special emphasis oncustomer care and convenience.

o build an enabling environment, whereemployees are motivated to contribute totheir ull potential.

o efectively manage and mitigate allkinds o risks inherent in the bankingbusiness.

o maximize use o technology to ensurecostefective operations, ecientmanagement inormation system,enhanced delivery capability and highservice standards.

o manage the Banks portolio obusinesses to achieve strong andsustainable shareholder returns and tocontinuously build shareholder value.

o deliver timely solutions that best meetthe customers nancial needs.

o explore new avenues or growth andprotability.

Strategic Planning

o comprehensively plan or theuture to ensure sustained growth andprotability.

o acilitate alignment o the Vision,

Mission, Corporate Objectives and withthe business goals and objectives.

o provide strategic initiatives andsolutions or projects, products, policiesand procedures.

o provide strategic solutions to mitigateweak areas and to counter threats toprots.

o identiy strategic initiatives andopportunities or prot.

o create and leverage strategic assets andcapabilities or competitive advantage.

-

8/7/2019 Corproate Profile 2008

11/56

9

Code o Ethics and Conduct

Askari Bank seeks to maintain highstandards o service and ethics enabling itto be perceived as impartial, ethical andindependent. In addition to the generalguidelines, the ollowing are the salient

eatures o the Banks code o ethics andconduct.

Presence o a corporate culture thatseeks to create an environment whereall employees are treated equitably andwith respect.

Employees must carry out theirresponsibilities in a proessional mannerat all times. Tey must act in a prudentmanner and must avoid situations thatcould reect unavorably on themselves,the Bank or its customers.

Employees must commit to thecontinued development o the serviceculture in which the Bank consistentlyseeks to exceed customers expectations.Fairness, ruthulness and ransparencygovern our customer relationships indetermining the transactional terms,conditions, rights and obligations.

Employees must saeguard condentialinormation which may come to theirpossession during the discharge o theirresponsibilities. Respect or customerscondential matters, merits the same

care as does the protection o the Banksown afairs or other interests.

Employees must ensure that know yourcustomer principles are adhered byobtaining sucient inormation aboutthe customers to reasonably satisyourselves as to their reputation, standingand the nature o their business activities.

Employees must avoid circumstances inwhich their personal interest conicts, ormay appear to conict, with the interesto the Bank or its customers. Employees

must never use their position in the Bankto obtain an advantage or gain.

Employees must not enter intoan agreement, understanding orarrangement with any competitor withrespect to pricing o services, prot ratesand / or marketing policies, which mayadversely afect the Banks business.

Employees must not accept gis,business entertainment or otherbenets rom a customer or a supplier/ vendor, which appear or may appearto compromise commercial or business

relationship.

Employees must remain alert andvigilant with respect to rauds, thes orillegal activities committed within theBank premises.

-

8/7/2019 Corproate Profile 2008

12/56

Annual Reportor the year ended December 31, 2008

Askari Bank Limited - Corporate10

Corporate Inormation

Board o Directors

Lt. Gen. Javed ZiaChairman

Lt. Gen. (R) Imtiaz Hussain

Mr. Kashi Mateen Ansari, FCMA

Mr. Zaar Alam Khan Sumbal

Mr. Muhammad Riyazul Haque

Mr. Shahid Mahmud

Mr. Ali Noormahomed Rattansey, FCA

Dr. Bashir Ahmad Khan

Mr. ariq Iqbal Khan, FCA(NIT Nominee)

Mr. M.R. MehkariPresident & Chief Executive

Audit Committee

Dr. Bashir Ahmad KhanChairman

Mr. Ali Noormahomed Rattansey, FCA

Mr. Zaar Alam Khan Sumbal

Company Secretary

Mr. Saleem Anwar, FCA

Auditors

A. F. Ferguson & CoChartered Accountants

Legal Advisors

Rizvi, Isa, Aridi & Angell

Shariah Advisor

Dr. Muhammad ahir Mansoori

Registered / Head Oce

AW Plaza, Te Mall,P.O. Box No. 1084

Rawalpindi, Pakistan.

el: (92 51) 9063000

Fax: (92 51) 9272455

E-mail: [email protected]

Website: www.askaribank.com.pk

Registrar & Share ranser Oce

HK Associates (Pvt) Limited

Ground Floor, State Lie Building No. 3,

Dr. Ziauddin Ahmad Road,

Karachi-75530

P.O. Box: 8533, Karachi.

el: (92 21) 5689021, 5686658, 5685681

Fax: (92 21) 5655595

Entity Ratings

Long erm: AA

Short erm: A1 +by PACRA

-

8/7/2019 Corproate Profile 2008

13/56

Head Oce

M. R. MehkariPresident & Chie Executie

Agha Ali Imam, SEVPGroup Head, Consumer Banking Serices

ahir Aziz , SEVPGroup Head, Corporate & Investment Banking

Muhammad Ari MianChie Risk Ocer

S. Suhail Rizvi , EVPGroup Head, Operations

Javed IqbalChie Inormation Ocer

Moghis Bokhari, EVP

Country Head, Human Resource

Rehan Mir , EVPActing Group Head, Treasury & International Banking

Saleem Anwar , EVPCountry Head, Strategic Planning & Corporate Afairs

Khalid Mohammad Khan, EVPCountry Head, Compliance & Data

M. Farooq Abid ung, EVPCountry Head, Agriculture & R ural Business

Rana Shahid Habib, EVPCountry Head, Audit & Inspection

Hashim Khan Hoti, EVPCountry Head, Islamic Banking Serices

ariq Maqbool, EVPCountry Head, Risk Management

Mian Shaukat Ali Ari Sirhindi, EVPCountry Head, Consumer Banking Serices

Mohammad Munir Ahmed, EVPCountry Head, Electronic Technology

Muhammad Ahmed Khan, SVPCountry Head, International

Lubna Azam, SVPChie Credit Ocer

Adil Zaidi , SVPCountry Head, Centralized Foreign Trade Unit

Masood adir , SVPCountry Head, Credit Administration

Brig. (R) Muhammad IzalCountry Head, Establishment

Hassan Aziz Rana, SVP

Country Head, Legal Afairs

Syed Hasan SajjadCountry Head, Operations

Bilal Bin ZaheerSpecial Asset Management

Mahmood Ahmad Nasir, VPActing Chie Financial Ocer

Iikhar Baloch, VPActing Chie Inormation Security Ocer

Regions / Areas / Of-shore Branch

Central Region

Ejaz Ahmed Khan, SEVPRegional General Manager, Central

Sajjad Ahmed QureshiArea Manager, Lahore I

Khawaja Shaukat Iqbal, EVPArea Manager, Lahore II

ahir Yaqoob Bhatti, EVPArea Manager, Faisalabad

Saulat Hameed , SVPArea Manager, Lahore III

Sajjad Ali Sheikh, SVPArea Manager, Multan

Mushtaq Ahmed , SVPArea Manager, Gujranwala

North Region

Haseeb Saulat , EVPRegional General Manager, North

ariq Mahmud Khan, EVPArea Manager, Rawalpindi I

Syed auqir Haider Rizvi, SVPArea Manager, Rawalpindi II

Inamullah Khan Niazi, SV PArea Manager, Azad Kashmir

anveer Azal Khan, SVPArea Manager, Peshawar

aiser Iqbal KhanArea Manager, Islamabad

South Region

Muhammad Jafer Khanani, EVPRegional General Manager, South

Sai-ur Rehman Khan, EVPArea Manager, Karachi II

Nehal Ahmed, EVPArea Manager, Karachi III

Mirajuddin Aziz, SVP,Area Manager, Karachi I

azi A.M. Khalid, SVPArea Manager, Karachi - IV

Niaz Mohammad, SVPArea Manager, Hyderabad

Haeez Ur Rahman QuraishyArea Manager, Quetta

Wholesale bank branch, Bahrain

Muhammad Naim IlyasWholesale Bank Branch, Bahrain

11

Management

-

8/7/2019 Corproate Profile 2008

14/56

Annual Reportor the year ended December 31, 2008

Askari Bank Limited - Corporate12

Risk Management Framework

Strategy, Oversight andBusiness Management

Board

Board Committees

President & Chief Executive

Management Committees

Internal Audit

External Audit / Inspection

IndependentAssurance

Credit Risk Review & Monitoring

Operational / Market Risk Review& Monitoring

Credit Admin and Credit MIS

New Product Review

Business Support,Monitoring and Compliance

Credit Approval Process

ManCom

RiskMgmt

ALCO Credit

-

8/7/2019 Corproate Profile 2008

15/56

13

Entity Ratings

Long term AAShort term A1+Denitions by Pakistan Credit Rating Agency Limited (PACRA) :

AA

Very high credit quality. AA ratings denote a very low expectation o credit risk. Tey indicate very strong capacity or timelypayment o nancial commitments. Tis capacity is not signicantly vulnerable to oreseeable events.

A1+

Obligations supported by the highest capacity or timely repayment.

-

8/7/2019 Corproate Profile 2008

16/56

Annual Reportor the year ended December 31, 2008

Askari Bank Limited - Corporate14

Corporate Social Responsibility

Askari Bank strongly believes that the success o

an entity is directly connected with the well being

o a society in which it operates as business could

not exist or prosper in isolation. It is thus giving

something back to the society in recognition o the

benets and advantages drawn rom it. Tereore

it is our belie that its a privilege, not a right,

which the Bank ought to pay back as a responsible

corporate citizen.

Te business ethics o the Bank are built on the

philosophy o care o both the customers and the

society, o which we are all part o. Our core values

or doing business circle round the ve pillars o

commitment, integrity, airness, teamwork and

service towards our customers, employees and

communities.

We believe in encouraging sports at every level

as nurturing the physical spirit gives rise to

healthy, spiritual and moral values. During 2008,

Askari Bank sponsored various sporting events

to promote healthy activities, which includeBadminton, Swimming, Squash, ennis, Gol,

Polo, Volleyball, Shooting and Squash across the

country.

During the year, Askari Bank has contributed

to charities and community projects, not only

to bring about a better quality o lie to the less

privileged in the community, but also to enrich the

lives o Pakistani citizens. Major contributions to

the society include the nancing or development

o parks, roundabouts, g ymnasiums, industrial

exhibitions, undraisers and tourism estivals.

Health issues have been a particular concern tous. During 2008, Askari Bank sponsored various

programs related to health. As a caring corporate

citizen, Askari Bank has also been actively making

regular donations to charitable institutions

working or social welare.

Askari Bank, in its quest or the equal rights and

empowerment o women, continued to support

Non Governmental Organizations (NGOs),

which are working on issues related to the welareo women.

Sponsorships

Askari Bank has demonstrated a leading role in

supporting a large number o important activities

and signicant events. Major activities during 2008

were:

Sports

Sponsorship o 4th CF Gol ournament

2008

Sponsorship o All Pakistan Multan OpenGol Championship 2008

Sponsorship o Badminton Championship,

organized by NUS

Sponsorship o 9th FINA World Swimming

Championships held at Manchester, UK,

2008

Sponsorship o Askari Bank Polo eam

representing Askari Bank in the Pakistan Cup

and Punjab Polo Cup 2008

Sponsorship o 6th Chie o the Army Staf

International Squash Championship 2008.(March 31 to April 5th, 2008)

A nation as a societyorms a moral person,and every membero it is personally

responsible or hissociety

(Greek Proverb)

Mr. M. R. Mehkari, President Askari Bank giing prize to a winner o Chie o theArmy Sta Squash Championship 2008

Askari Bank sponsored Pakistan eam that participated in FINA World SwimmingChampionship held at Manchester, UK

Askari Bank sponsored Volley Ball Championship held or SAARC countries

-

8/7/2019 Corproate Profile 2008

17/56

15

Sponsorship o Army Polo Cup and Show

Jumping Championship 2008 (April 7 to 12,

2008)

Sponsorship o President o Pakistan Polo

rophy 2008

Sponsorship o the President Cup GolChampionship 2008 held on April 25-27,

2008

Sponsorship o Gol & Polo matches

organized by 106 Air Deence & Ocer 29

Cavalry Kharian Cantt

Sponsorship o IF Pakistan International

Junior U-18 (Boys & Girls) Aug 11-30, 2008

Islamabad

Sponsorship o Pakistan Army Hockey eam

or Donghae Mayor Cup 2008, South Korea

Sponsorship o COAS Open Gol

Championship 2008 at Rawalpindi Gol Club

Sponsorship o Punjab Open Gol

ournament 2008 played at Rawalpindi Gol

Club

Sponsorship o Medium to High Goal Polo

ournament 2008

Sponsorship o 4th South Asian Shooting

Championships 2008 at Gun Club Islamabad

Sponsorship o Punjab Open Squash

Championship 2008 held in Lahore

Social

Sponsorship o Special Program or Mentally

ill Patients organized by Te Agha Khan

University Hospital, Karachi

Sponsorship o SB P Agricultural Workshop

held at Lahore

Sponsorship o Askari Rawal Festival 2008,organized by rance Media Communications

Sponsorship o NUSs SEECS Festival 2008

Sponsorship o Musical Function 2008

organized by DHA Creek Club

Sponsorship o 1st International Conerence

on Psycho trauma, Islamabad

Sponsorship o Fundraising Program or

development work in Katchi Abadies o

Karachi

Sponsorship o Puppet Show held on August

30, 2008 at DHA Islamabad

Sponsorship o Horticulture Drive in Lahore

Sponsorship o Foliage Exhibition organized

by Flora Care, Lahore

Sponsorship o Black Pearl on opening o

Chamalang Coal Mines An International

Film Festival held in Rome

Sponsorship o SBP Agri S eminar / Mela in

Hyderabad

Sponsorship o a Commercial Teatre Play at

PNCA, Islamabad

Education

Sponsorship o 1st International Conerence

on Business and echnology at Margalla

Hotel, Islamabad

Sponsorship o annual program o CFA

Association o Pakistan or 2008-09

Sponsorship o three days exhibition i.e.Mega Industrial & rade Fair at Convention

Centre Islamabad

Sponsorship or 3rd South Asian Capital

Markets Conerence 2008 held in Mumbai,

India

Sponsorship o Annual Sports Festival 2008

arranged by Multan Public School & College,

Multan

Sponsorship o ICMAP Convocation 2008 at

PC Karachi on Dec 14, 2008

Environment

Sponsorship o special campaign elephone a

ree, Lahore

Sponsorship o 150 annual spring ower

show, Bara Dari, Bagh-e-Jinnah, Lahore 2008

Development o ountain at F-10

Roundabout, Islamabad

Askari Bank sponsored Army Polo Cup and Show Jumping Championshipor 2008

A goler in action at the Chie o the Army Sta Open Gol Championship 2008sponsored by Askari Bank

Prize distribution ceremony o the Chie o the Army Sta Open GolChampionship 2008

Askari Bank sponsored Badminton Championship organized by NUS

Askari Bank sponsored Under 18 IF ournament Islamabad

-

8/7/2019 Corproate Profile 2008

18/56

Annual Reportor the year ended December 31, 2008

Askari Bank Limited - Corporate16

Presidents Message

Te macroeconomic stabilization program

to support medium-term reorms under the

aegis o the International Monetary Fund

(IMF) and Governments timely move to

address the most immediate risks has eased

the pressure on Pakistans economy. Te

IMF program has helped in preventing

the immediate risk o deault on external

obligations with the improvement in oreign

exchange reserves. Also, the recent positive

trends in imports and exports and workers

remittances have helped stabilized the Pak

Rupee and may have contributed to some

reduction o inationary pressure.

Te improvement in scal decit appears

largely attributable to the reduction in

Government borrowing rom the State Bank

o Pakistan (SBP), and in development

spending and the elimination o some

major subsidies. In the medium term, such

measures must be supplemented by policies

to discipline growth in non-development

expenditures and broaden the revenue base

to provide the necessary scal space to ensurean appropriate level o public spending

on social and development projects in the

uture. Also, scal planning process must be

kept consistent with a realistic assessment

o revenues, with appropriate adjustments

as the year progresses. Tis will help provide

the banking sector the space to meet the

requirements o private sector credit. Te

Government has already committed to zero

budgetary borrowings rom the SBP. Te

decline in international commodity prices,

especially oil, will also shrink the largecurrent account decit.

It is evident that Pakistans economy

demands efective policies and

implementation o reorms to regain

macroeconomic stability in the midst o a

challenging year. Te GDP growth is likely

to be revised downwards to 2.5 percent or

nancial year 2009 and ination is likely

to breach its target. On a positive note,

both scal and current account decits are

estimated to decline in scal 2009. Amongst

the biggest challenges or the Government

will be to ensure the pass through o decline

in international commodity and oil prices to

the consumers.

Te liquidity problems or the nancial

market during the rst hal o scal 2009

were largely attributable to the deterioration

in external balances, circular debt-inuenced

withdrawals, oreign currency deposit

withdrawals, and higher rates ofered by

national savings schemes. Also, temporary

liquidity shortages with the commercial

banks were perceived as a nancial crisis

triggered by the global nancial and liquidity

turmoil, with which it coincided. Te SBP

has taken a number o positive measures to

ease liquidity in the nancial system and

stabilize the domestic currency.

Te slide in commercial banks deposits

continued throughout the second hal

o 2008 aer peaking in June 2008.

Consequently, the advances to deposits

ratio hit an unprecedented high duringthis period. Te consolidated banking

sector data conrms escalating asset quality

pressures where the NPL to gross advances

ratio reached almost 9 percent during the

rst quarter o scal 2009 with consequent

increase in provisions against NPLs thus

indicating decline in recoveries.

For Askari Bank, 2008 was a tough year in

terms o distributable earnings owing to a

substantial increase in provisions against

non-perorming loans which resulted inthe erosion o most o the prots or the

year. During the year, certain large credit

exposures which had shown signs o

problems in previous years and had remained

under close monitoring were nally classied

by the Bank. Also, the economic downturn

compounded the impact and was a reason

or increase in problem accounts and related

provisions. Te benet o orced sale value

(FSV) o collaterals, which was withdrawn

by the State Bank o Pakistan in 2007, was

partially reinstated or certain types o

M.R. MehkariPresident & Chief Executive

-

8/7/2019 Corproate Profile 2008

19/56

17

collaterals and subject to certain conditions,

or the purposes o computation o loan

loss provisions or 2008. Tis relaxation was

accounted or while computing loan loss

provisions or 2008.

Te Banks prot aer tax declined to Rs.

386 million rom Rs. 2.68 billion last year

mainly due to a one of gain amounting

to Rs. 2.12 billion recognized last year, asdepicted in the above chart.

Te Banks non-perorming loans stood at

Rs.11.69 billion as o December 31, 2008

compared to Rs.6.91 billion the previous

year, an increase o 69 percent. Aggregate

provisions as o December 31, 2008

increased to Rs.11.01 billion, thus providing

a coverage o 94 percent against non-

perorming loans as o December 31, 2008.

During 2008, the Banks gross advancesincreased by 29 percent, to Rs.139.83 billion

rom Rs.108.19 billion at end 2007. Te

Bank has been very cautious and selective

in taking credit exposures and is ocused

on efective risk management and portolio

diversication. Te eforts or efective loan

portolio diversication have started yielding

results and during 2008, the Banks exposure

in textiles, which sector has largely remained

under pressure owing to various internal and

external developments, was reduced to 20.47

percent o the total portolio compared to

24.26 percent in the previous year. Also, the

Bank preerred nancing against collateral

which improved our capital adequacy in

compliance with Basel II.

o expedite recovery o non-perorming and

classied loans, a Special Asset Management

(SAM) division was set-up in 2007 and has

started the process o aggressive monitoring

and ollow-up o problem accounts.During 2008, the Banks eforts resulted in

substantial improvement in the recovery

position over the previous year. SAM will

continue to actively pursue recovery rom

deaulting customers.

Despite weakening banking industry deposit

growth owing to liquidity pressures and

concerns over the stability o local banks in

the backdrop o the international nancial

crisis, Askari Banks deposits registered a

healthy increase o 17 percent and reachedRs.167.68 billion as at December 31, 2008

against Rs.143.04 billion in the previous

year. Growth in oreign currency deposits

remained higher than Pak Rupee deposits.

During the year, the deposit mobilization

strategy was re-organized and our new

deposit products were launched. Tese

products, namely, one year Mahana Bachat

Account, three year Mahana Bachat

Account, Askari Roshan Mustaqbil Deposit,

and Askari Deposit Multiplier Account

were intended or

individuals and

household savers

and ofered market

based returns on

deposit tenures

ranging rom one

to ten years. Tese

products were

launched towards theend o 2008 and have

been well received

by our customers.

Mobilization o core

deposits, always a

ocus area, is being

aggressively pursued

as growth o core deposits has been identied

as a priority or 2009.

Te valuations o our investment portolio,

which primarily comprise o SLR (statutoryliquidity requirement) eligible securities

and other equity and debt securities, were

adversely afected by the trends in money

and stock markets resulting rom a steep

rise in discount rate rom 10 percent to

15 percent during the year. SBPs timely

steps including reduction in cash reserve

requirement and open market operations

addressed the liquidity problem aced by

the banks. In this situation, our reasury

management remained prudent and operated

competitively in the prevailing severeliquidity crisis.

Op er ati ng Pro t Ne t Pro t Be ore a x Ne t Pr o t A er a x

Prots(Rs million)

2,2

10

3,1

58

3,4

61

4,4

76

6,2

22

4,5

34

1,1

03

1,9

23

2,0

22

2,2

50

2,6

81

386

1,9

02

2,8

43

2,8

59 3

,347

2,3

00

461

2003 2004 2005 2006 2007 2008

Advances Deposits

Balance Sheet Growth(Rs billion)

44.8

69.8

85.9

99.2

100.8

128.8

61.7

131.8 1

43.0

167.7

2003 2004 2005 2006 2007 2008

83.3

118.8

-

8/7/2019 Corproate Profile 2008

20/56

otal Assets(Rs billion)

85.4

107.2

145.1

16

6.0

182.2

206.2

CAGR

19.3%

2003 2004 2005 2006 2007 2008

Advances(Rs billion)

44.8

69.8

100.8

128.8

CAGR

23.5%

2003 2004 2005 2006 2007 2008

99.2

86.0

Deposits

(Rs billion)

61.7

83.3

118.8

131.8

143.0

167.7

CAGR

22.2%

2003 2004 2005 2006 2007 2008

Annual Reportor the year ended December 31, 2008

Askari Bank Limited - Corporate18

Presidents Message

sector. As such, this program is g iven the

highest priority. We have deployed the

required means and resources or a timely

and successul implementation, which will be

under close watch or urther support.

Another major initiative on the technology

ront is compliance with ISO 27001

Inormation Security Management System

(ISMS). Major work on this project has been

completed and it is in an advanced stage o

implementation. We are condent that the

Bank will achieve ul l compliance during the

ensuing year.

Our organizational development program

which mainly comprised o various human

resources related initiatives is nearing

completion, although work in certain areas

will continue as improvement in employee

satisaction and motivation is an ongoing

process. In the rst phase, all human resource

policies were reviewed and revised to attain

alignment o compensation and benets

with the market. Aer announcing the rstlayer o revised organization structure which

included restructuring o certain divisions

/ units or better operational eciency,

the process was cascaded to all groups /

divisions / units during the year under

review. An exercise to identiy unique jobs

has been completed and job description

documents have been developed. On one

hand this will ensure efective placement o

staf, standardization and rightsizing, and

on the other, it will enable employee goal

setting which is a prime requisite or anefective perormance management system.

A comprehensive perormance management

system based on well dened goals and

responsibilities has been implemented across

the Bank. Going orward, compensation and

benets will be based entirely on employee

perormance.

In todays competitive environment,

employees proessional development

remains one o the key elements o our

human resource strategy. o keep abreastwith technological developments and other

Te agriculture banking services ofered by

the Bank strengthened during 2008 on the

back o innovative oferings, capacity and

awareness building, and increased market

penetration. Askari Zarai Credit Card

launched in the previous year as the rst ever

credit card or agriculture purposes is gaining

popularity. Also, group-based lending

methodology has been adopted to acilitate

small armers availing agriculture credit.

Askari Islamic banking urther expanded its

outreach during 2008 by adding our new

branches. A comprehensive range o Shariah

compliant banking products and services

are now available at twenty Islamic banking

branches. Despite the strain on earnings

attributable to network expansion, Askari

Islamics contributions to the bottom line

increased while its asset base almost doubled

during 2008.

During the year under review, the Bank has

embarked upon one o the most ambitious

projects in its history by undertaking toupgrade its entire technology platorm.

Te Bank has acquired Oracle Financial

Services Soware (OFSS) (previously

I-ex) as the core banking soware and its

implementation has already commenced.

Te key objectives o this project are to

(a) improve business management, (b)

upgrade customer service, (c) strengthen

the internal control environment, and (d)

improve quality and timing o nancial

and non-nancial inormation. In addition

to OFSS, the Bank has also signed-up oracquisition o Oracle Financial as nance

and MIS soware, PeopleSo as human

resource management soware, and Siebel

as customer relationship management

soware. Tese sowares will be ully

integrated with OFSS and collectively

strengthen our product and service delivery

capacity while improving the overall

operational and internal control standards.

We take ull cognizance o the act that

the implementation o a program o this

magnitude poses a huge challenge and isperhaps unprecedented in our nancial

-

8/7/2019 Corproate Profile 2008

21/56

19

advancement, human capital enrichment

through extensive in-house and external

training is indispensable. During the year,

238 in-house training programs were

conducted in which 4,365 employees

participated. Also, a third training academy

was opened in Karachi to cater or the

training needs o employees based in South

Region i.e. Sindh and Baluchistan. With the

three training academies at Karachi, Lahore

and Rawalpindi and the increased allocation

or external training, we are equipped to

provide ample opportunities or in-house

and external training that will enable our

employees to improve their skills and

proessional competence.

During 2008, a total o 50 branches /

sub-branches were added to our nation-

wide network, increasing our presence to

200 branches / sub-branches, including 20

Islamic banking branches and a wholesale

bank branch in Bahrain. Te strategic branch

expansion will continue; however the process

will be gradual and selective, as under the

current economic and business conditions,

our emphasis will be on consolidation o

recent expansion, which was the highest

since the inception o the Bank.

Te perormance o Askari Investment

Management Limited (AIML), which is

a wholly owned subsidiary o the Bank,

was subdued mainly due to adverse marketconditions. As the stock exchange index

remained rozen or almost our months,

mutual unds aced huge withdrawals and

consequently asset management companies

came under severe stress. Te return on

Askari Income Fund declined by around 9

percent while, Askari Asset Allocation Fund

posted negative return during the year. It is

anticipated that the recent relative stability

in stock exchange index will lead to gradual

turnaround or mutual unds industry.

Observing the trends at the close o 2008,

ination and interest rates scenario will

continue to be among the major deterrents

to the countrys development agenda. Te

impact o ination and energy shortalls will

certainly stress the domestic manuacturing

and export oriented industries in terms o

competitiveness vis--vis other emerging

economies. Given the situation and

challenges aced by the Bank, certain areas

have been identied as key strategic priorities

or 2009 and have been cascaded down

the line. Also, a comprehensive review and

monitoring mechanism has been put in

place or timely identication o gaps and

corrective measures. I am condent that

Askaris management team will continue

to work with dedication and hard work

to accomplish our collective vision to

become the bank o rst choice in the

Region, and continue to strive or every

possible opportunity to add value or our

stakeholders.

My sincere appreciation to the Board o

Directors or their unstinted co-operation

over the year. Tey have taken keen interest

in the afairs o the Bank and in ormulation

o policies and had been an immense source

o support and guidance to me during the

year. I thank them or the wise guidance and

counsel extended to me in managing the

afairs o the Bank. Also, I thank the State

Bank o Pakistan or providing guidance on

policy and operational matters which in act

enhanced the proessional capabilities o the

Bank.

Te loyalty o our customers has been very

encouraging despite intense competition.

Tis situation has helped us maintain a

competitive edge and market share over the

years. I thank them or the condence they

continue to place in us.

I have had the honor and privilege to serve

Askari Bank in a number o positions over

the years, most recently as the President. I

am humbled and sincerely thankul or the

opportunity and the trust reposed in me.

I would like to thank our staf or their

commitment, hardwork and dedication

and to all stakeholders or the trust and

condence they continue to place in Askari

Bank.

M. R. MehkariFebruary 21, 2009 President & Chie Executie

Imports Exports Guarantees

Foreign rade and Guarantees(Rs billion)

48.7

75.2

98.3

119.3

119.3

148.2

14.4

25.3

30.6 3

7.3 4

4.3

55.8

56.8

70.1

92.0 9

7.3

83.0

99.7

2003 2004 2005 2006 2007 2008

Imports:CAG

R24.9%

Exports:CAG

R11.9%

Guarantees:

CAGR31.1%

-

8/7/2019 Corproate Profile 2008

22/56

Annual Reportor the year ended December 31, 2008

Askari Bank Limited - Corporate20

Value Added Statement

2008 2007Rupees in 000 Percent Rupees in 000 Percent

Value Added

Income rom banking services 18,951,365 18,311,293Cost o services 10,763,100 9,314,913

Value added by banking services 8,188,265 8,996,380Nonbanking income 26,548 32,540Provision against nonperorming assets (4,072,597) (3,921,741)

4,142,216 5,107,179

Value Allocated

to employeesSalaries, allowances & other benets 3,169,771 76.5% 2,407,164 47.2%

to providers o capitalCash dividend 450,975Bonus shares 1,052,275

0.0% 1,503,250 29.5%to government

Income tax 75,157 1.8% (381,227) 7.6%

to expansion and growthDepreciation 511,063 400,230Retained in business 386,225 1,177,762

897,288 21.7% 1,577,992 30.9%

4,142,216 100% 5,107,179 100%

-

8/7/2019 Corproate Profile 2008

23/56

21

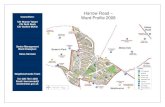

Askari Banks Presence

21

Wholesale bank branch

Bahrain

Karachi

IslamabadPeshawar

Mardan

Muzaffarabad

Mansehra

Mirpur AK

Gilgit

Swat

Lahore

Okara

Phoolnagar

Sahiwal

Jhang

MultanDera Ghazi Khan

Bahawalpur

Vehari

Khanewal

Hyderabad

Mirpurkhas

Nawabshah

Tandu Allah Yar

Ghotki

SukkurLarkana

Daharki

Rahim Yar KhanJacobabad

Shikarpur

Quetta

Gawadar

Chaman

Gujranwala

Sheikhupura

Sialkot

Gujrat

Sargodha

Dera Islmail Khan

Mianwali

Kohat

Chashma

Chakwal

JhelumKharian

Faisalabad

Rawalpindi

Gujar Khan

Khairpur

Jalalpur Bhatian

Nowshera

Kamoke

SOUTH REGION

Karachi I 10Karachi II 10Karachi III 10Karachi IV 10Hyderabad 13Quetta 9Corporate 1Islamic Banking 7

70

CENTRAL REGIONLahore I 10Lahore II 10Lahore III 9Faisalabad 11Gujranwala 10Multan 10Corporate 1

Islamic Banking 869

NORTH REGIONIslamabad 15Rawalpindi I 12Rawalpindi II 10Peshawar 12 Azad Kashmir 6Islamic Banking 5

60

WHOLESALEBANK BRANCH 1

Total branches /sub-branches 200

Branch contact details are gien on page 179 to 185

Our presence, in all cornerso Pakistan, is more than just

being there

-

8/7/2019 Corproate Profile 2008

24/56

Annual Reportor the year ended December 31, 2008

Askari Bank Limited - Corporate22

Business and Operations Review

Corporate & Investment Banking Group

(CIBG) provides nancial services to the

Banks large corporate and institutional

customers, including public sector entities.

Tese include products or meeting

operational unding requirements, as well

as a suite o structured nance solutions

relating to strategic expansions, divestments,

syndications, project nance, underwriting,

cash management, and trade related services .

Te Group operates through a Corporate

Banking Division (CBD) and an Investment

Banking Division (IBD) based upon a client-

centric and distribution-ocused business

model, supported by a culture that prioritises

relationships and economic returns through

a structure that enables an integrated, multi-

product service ofering.

Te combination o CIBGs industry

expertise, strong balance sheet and innovative

product structuring allow us to meet the

evolving needs o our ever-growing client

base. Our Corporate and Investment

Banking teams work hand in hand to identiy

and deliver through a combination o basic

and structured product oferings including

but not limited to:

Despite a dicult 2008 in terms o economic

and business conditions, Askari Bank was able

to improve its nancial perormance oer last

year. 2008 witnessed monetary tightening,

inationary pressures and liquidity shortalls.

In a highly volatile business environment,

Askari Bank acted in a prudent manner

and swily aligned business strategies to

market conditions in order to derie optimal

competitie adantage, maintain conseratie

risk prole and earn higher returns.

On the operations side, while certain initiaties

are nearing completion, new initiaties

hae been launched thus depicting Askaris

continuous desire to improve the ways o

doing business. Te most prominent being the

inormation technology initiatie which is

aimed to improve quality oerings, customer

serice, controls and prepare the Bank or

uture challenges.

erm Finance Facilities;

Working Capital Financing;

Structured rade Finance Facilities;

Guarantees;

Letters o Credit;

Fund ransers / Remittances;

Bill Discounting; Export Financing;

Receivable Discounting;

Corporate and strategic advisory

services;

Loan Syndications;

Project Finance transactions;

Equity inancing;

Debt swaps;

Balance sheet restructuring services;

Debt and equity nancing options

through Capital Markets.

Corporate andInvestment Banking

-

8/7/2019 Corproate Profile 2008

25/56

23

Corporate Banking Division (CBD) works

on a long-term relationship based business

model to provide a s ingle point within the

Bank or meeting all business requirements

o large size customers, with the primary

objective o enhancing customer service,

whilst improving quality o portolio.

As planned, all CBD relationships were

centralized rom various branches into

three corporate centers/regions in Karachi,

Lahore and Islamabad. In addition, dedicated

corporate branches have been established in

the South and Central regions to enhance

service and monitoring, by providing a closer

liaison between the branch/distribution

point and the relationship managers/clients

point-o-contact, thereby improving the

overall response time or servicing customers

nancial needs, as well as enhancing the

depth o business relationships.

Investment Banking Division (IBD) provides

a ull range o nancial advisory and capital

raising services to corporate and institutional

clients. With special emphasis on the ability

to initiate and execute complex transactions,

IBD team provides innovative solutions

based on our clients requirements. IBD

also actively manages the Banks proprietary

investments in the equity and debt markets

through:

Strategic equity investment in group

and listed companies in primary

and secondary market oferings and

building and management o the Banks

corporate bond book with the objective

o maximising return on capital while

closely monitoring business and credit

risk;

Investments and divestments in various

equity and money-market mutual unds

in line with the Banks overall risk

appetite and changing economic and

interest rate outlook;

Supporting the local equity market by

ofering and managing various nancing

products including the Continuous

Funding System.

2008 was a prolic year or the IBD team,

which was involved in the arrangement

and structuring o a number o high prole

debt arrangement and project nance

transactions.

CBD, in conjunction with the Investment

Banking Division and reasury Divisions

showed strong growth in income rom

efective cross selling, bundling o products

using knowledge and experience in targeted

sectors.

Given the recessionary trends CBD

activities centred around consolidation and

efective management o portolio, while

achieving targeted growth in the Power,

Energy, Fertilizer and Cement sectors that

are most critical to the domestic economy.

Active risk management techniques were

also implemented under Basel II guidelines

through development and cultivation o

relationships with externally rated entities/

corporations thus enabling the Bank to

maximise risk adjusted returns on capital

deployed through CBD.

-

8/7/2019 Corproate Profile 2008

26/56

Annual Reportor the year ended December 31, 2008

Askari Bank Limited - Corporate24

Business and Operations Review

CBSGs asset portolio registered a modest

growth o 2 percent during the year 2008

while Askari Debit Card under the brand

name ASKCARD, registered a growth o 5

percent in the number o cards issued over

previous year. Also, sales o Rupee ravelersCheques increased by 9 percent during 2008.

During the year, CBSG has initiated

measures to or improved risk management

o CBSGs portolio. Tese include

implementation o credit-scoring model or

consumer asset products and enhancing the

scope o the Credit Inormation Bureau,

to ensure prudent growth o the portolio.

CBSGs oferings include:

Credit Cards (Platinum, Gold, Silver,& Corporate)

Askari Personal Finance.

Smart Cash ( Running Facility or

customers)

Askari Mortgage Finance (Home loans)

Askari Business Finance (Business

loans)

Askar (Auto loans)

Flexible Credit Plan

AskCard (Askari Debit Card)

i-Net Banking (Internet BankingServices)

Askari ouch N Pay (Electronic Bill

Payment Ser vices)

Cash Management Services.

Rupee raveler Cheques

Askari Value Plus Deposits

Consumer Banking

Services

Consumer Banking Services Group (CBSG)

oferings include auto, mortgage, personal

and business nance and, credit cards under

the MASERCARD brand. Te Group is

organized on a hub and spokes basis where

hubs are located in Rawalpindi / Islamabad,

Lahore, Faisalabad, Multan and Karachi,

with 144 spokes, Consumer Banking Units

(CBUs) spread in all major cities across the

country. 2008 witnessed a general decline in

consumers debt servicing capacity, mainly

due to high ination and general slowdown

in economic activity. In this situation,

-

8/7/2019 Corproate Profile 2008

27/56

25

We believe in building,

nurturing and strengthening

relationships fom one

generation to the next.

-

8/7/2019 Corproate Profile 2008

28/56

Annual Reportor the year ended December 31, 2008

Askari Bank Limited - Corporate26

Business and Operations Review

appropriate training o the human resource

available with the treasury and updating o its

system soware to meet the new challenges

and be more competitive in the market.

International Division primarily manages

correspondent banking arrangements to

acilitate banking or our customers trade

nance businesses. During the year, while

maintaining ocus on the core trade nance

business, the Division made concerted eforts

to rationalize nostro accounts and enhance

the volume o workers inward remittances.

Presently, Askari Bank enjoys multi-aceted

correspondent banking arrangements with

229 banks at over 800 locations around the

globe. Efective management and optimum

utilization o business reciprocity with

correspondent banks enables us to manage

the returns and trade business ows.

Wholesale Bank

Operations (Bahrain)

Askari Bank Bahrain operations

contribution towards the earning o the

Bank have shown improvement during

2008. Net interest margin recorded growth

o 47 percent whereas net prot or the year

increased by 51 percent over last year.

As a wholesale bank branch, our Bahrain

operations serve as an outlet to utilize our

oreign currency resources to generate better

returns. It always endeavors to participate

in appropriate and viable syndication and

other trade business opportunities in the

international market.

Treasury and

International Banking

Te recessionary trends and rising ination

coupled with deteriorating law & order

situation and power shortages made 2008

challenging and dicult. Te State Bank o

Pakistan in line with the tighter monetary

policy, cumulatively increased the discount

rate rom 10 percent to 15 percent during

the year. Te banks aced severe liquidity

shortalls especially in the mid o the year.Te liquidity shortalls prompted the SBP

to reduce the Cash Reserve Requirement

(CRR) rom 9 percent to 5 percent.

Also, Liquidity Requirements (SLR) on

deposits o one year and above maturity was

withdrawn.

Tese measures resultantly increased

liquidity and the rates moved to acceptable

levels.

SBP conducted Open Market Operations

(OMOs) both ways to keep the liquidity in

equilibrium. Furthermore, due to worsening

o external account situation, rupees

depreciated by almost 28 percent during year

2008.

reasury division prudently managed the

liquidity and enabled the Bank to operate

competitively despite severe liquidity crisis.

In addition, treasury operations increased

turnover with a view to developing a more

comprehensive trade/treasury book due to

increase in branch network and efective

utilization o corporate desk, established

at the treasury. Furthermore, treasury

operations are structured in such way to

measure, mitigate and manage the risks

associated with its activities.

Te eciency and efectiveness o treasury

operation are being enhanced by relevant and

-

8/7/2019 Corproate Profile 2008

29/56

27

group, despite being one o the last entrants

in Islamic banking business, out o the 12

conventional banks with separate stand alone

Islamic banking branches.

Despite a strain on protability due to

ongoing set-up o new branches, the prot

stood at Rs. 77.22 million in 2008 compared

to Rs 15.15 mil lion in the previous year. Te

balance sheet ooting more than doubled,

rom Rs. 4,554 million, as at December 31,

2007 to Rs. 10,033 million, as at December

31, 2008. Tis was primarily due to increase

in deposits and correspondingly in earning

assets, including Sukuk investments which

doubled during the year under review.

An eminent scholar, and recipient o the

President o Pakistans Medal or Pride

o Perormance (in Academics), Dr.

Muhammad ahir Mansoori is the Shariah

Advisor o the Bank. He is currently

the Proessor and Dean o the aculty o

Shariah and Law at the International Islamic

University, Islamabad.

As per Shariah requirements, Askari

Islamic ensures that the unds and

Our agriculture credit

brand includes:

Askari Kissan Evergreen

Finance.

Askari Kissan ractor Finance.

Askari Kissan ransport Finance.

Askari Kissan Livestock

Development Finance.

Askari Kissan Farm Mechanization

Finance.

Askari Kissan Aabpashi Finance.

Green House & unnel Finance. Farm Storage Finance.

Model Dairy Finance.

Gold Fish Finance.

White Pearl Finance.

Murghban Finance.

Samar Bahisht Finance.

Gulban Finance.

Asan Mali Sahulat, and

Zarai Credit Card.

Islamic Banking

2008 was efectively the second ull year o

operations or Askari Banks Islamic Banking

Services. During the year, the management

remained ocused on improving customer

service, expansion o the business network

and establishing a rm platorm or Islamic

banking. Te Islamic banking branch

network increased to 20 (including 2 sub-

branches) rom 14 o last year, new premises

added in Hyderabad, SIE in Karachi,

G Road in Peshawar and PECO Road

in Lahore, as well as sub-branches in F10

Markaz in Islamabad and on main Shahrah-

e-Faisal in Karachi. Despite the dicult

economic environment, Islamic Banking

plans to continue with the branch expansion.

By the Grace o Allah, Askari Islamic

Banking Division has perormed well during

the period under review. In a very short span,

it is now amongst the top players in its peer

Agriculture BankingTe credit portolio o this business achieved

a growth o 42 percent during the year,

increasing its share in total Banks advances

to 3.38 percent at end 2008 rom 3.1 percent,

last year.

Agriculture & Rural Business Division

(ARBD) has taken several initiatives in the

last 5 years to increase penetration in agri-

rural market through product innovations,

capacity & awareness building and

developing linkages with stakeholders.

A broad range o products have been

introduced or meeting nancial needs o

the arming community or crop cultivation,

dairy arming, poultry, sheries, orestry,

oriculture and orchids. In order to synergize

all agri-rural nancing needs, products

or greenhouses and tunnel arming, arm

mechanization, transportation, marketing,

storage and aabpashi have also beendeveloped. Te launch o Zarai Credit Card

- the rst ever credit card acility introduced

or agricultural purposes in Pakistan,

and Asan Mali Sahulat being innovative

technique o lending by way o discounting

/ purchase o cane procurement receipts /

deerred payment vouchers are some o the

innovations to provide ull variety o services

to agri-community o the country. Also,

grouped based lending methodology has

been adopted to acilitate small armers inavailing agriculture nancing.

Tematically, as a member o SBP task orce,

the Bank remained proactively engaged in

developing , a) ramework or crop loan

insurance scheme, b) guidelines or Islamic

agriculture nancing, c) innovative lending

techniques or agriculture nancing and d)

revision o agri credit estimates.

-

8/7/2019 Corproate Profile 2008

30/56

Annual Reportor the year ended December 31, 2008

Askari Bank Limited - Corporate28

Business and Operations Review

products o Islamic banking are explicitly

managed without any intermingle with theconventional banking business. All unds

obtained, invested and shared are in Shariah

compliant modes o investments.

o implement Islamic banking products in

their true spirit, training in Islamic banking

is given great importance; over 80 percent o

staf has undergone Islamic banking training;

more than two third o all executives, have

undergone intensive NIBAF certication,

which is considered a premium certication,with widespread acceptability - in the last

course, held in November / December 2008,

the top two positions were etched by Askari

Islamic participants.

Islamic Asset Financing Products include

Islamic Corporate, Investment, syndications,

structured and trade nance needs o the

customers. Whereas, Islamic Consumer

Banking products include Askari Vehicle

Ijarah and Askari Home Musharakahsolutions or buying, building and renovating

homes.

Askari Islamic Banking ofers a wide range

o Halal Deposit products on Shariah based

modes, such as Mudarabah, Musharakah,

ard and Wakal-tul-Istismar. Our branded

range includes AHSAN (Askari Halal

Savings and Notice Accounts), AHIA

(Askari Halal Investment Accounts) range

o term deposit accounts, including AKIDA(Askari Khas Islamic Deposit Accounts),

AHCAMM (Askari Halal Certicates o

Aasan Monthly Mudarabah), AIIC (Askari

Islamic Investment Certicates), AIAD,

and Askari Wakalah tul Istismar etc.

Operations

Te primary aim o Operations Group

is to provide a supporting platorm to all

business segments on operational matters

across branches and business units, by

strengthening internal control environment,

while contributing towards efective

decision making and extended guidance on

operational matters.

During the year, the ollowing improvements

were achieved by this Group:

Inculcation o compliance culture at the

branches thereby ensuring minimum

policy deviations and their prompt

identication and resolution.

Formalization o policies and procedure

manuals or various areas o banking

operations.

Prompt resolution o customer

complaints through implementation

o a more efective monitoring

mechanism.

Introduction o various MIS /

exception reports to mitigate

operational risks.

Use o alternative means o

communication such as e-mail /

intranet to enorce eciency and

minimize communication costs.

o provide continued support to

business units and to ensure smooth

operations at branches, the ollowing

initiatives are in the pipeline.

Complete centralization o critical

operational processes including

account opening, clearing, remittances

and data archiving and quick retrieval.

Continuous reviews o operations

manual or up-gradation o existing

processes, commensurate with modern

banking practices

Expansion o outreach o Centralized

Foreign rade Units (CFUs) to all

branches dealing in oreign trade

Ensuring smooth transition to the new

technology platorm through active

participation in its implementation.

-

8/7/2019 Corproate Profile 2008

31/56

29

Credit & Asset Quality

During the year, the Bank registered a

growth o 29 percent in gross advances

which increased rom Rs. 108.19 Billion

to Rs. 139.83 Billion. Non perorming

loans as percentage o gross advances were

8.36 percent, compared to 6.38 percent at

end 2007. During the year, certain large

accounts were classied as non-perorming

loans (NPLs) and provisions as required by

SBP prudential regulations were made. Te

aggregate provisions upto December 31,

2008 covered 94 percent o NPLs as o that

date.

Te Bank has endeavored to be the strong

market player and has build market

share through ofering superior services,

competitive pricing, and a wide product

range to its valued clients. Te Bank

caters to the needs o small, medium,

SME, Commercial & large corporate,

multinational companies including private

and public sector entities.

Te key objective has been to make risk

management a core competency o the

organization to ensure that risks are

accurately identied & assessed, properly

documented and approved, and adequately

monitored & managed in order to saely

enhance long term earnings.

On one hand, the ocus has been to improve

the early warning system to timely identiy

the problem accounts to address the

issues pro-actively, on the other, systems/

procedures have been developed through

rigorous eforts or recovery o classied

advances.

Te Bank has strived to maintain a well

collateralized and diversied optimal mix oloan portolio relative to its capital, customer

deposit base, and risk appetite.

Basel-II ramework is being implemented

which will help in urther strengthening the

credit risk management practices at the bank,

ofering ollowing products:

erm Loans

Running Finance/overdras.

Short term acilities or local trading. Cheque purchase acility (oreign &

Local)

Letter o credit (local/International)

Guarantees

Cash nance/pledge loans.

Finance against trust receipt.

Stand by letter o credit

Financing against oreign bills.

Foreign currency nancing.

Export renance rom State Bank

Finance against packing credit-I & II.

Finance against imported

merchandized.

Risk Management

Risk Management is a core unction that

perorms critical activities o measuring,

monitoring, controlling and reporting credit,

market, operational and other risks in order

to ensure sustained perormance o the Bank.

Te risk management ramework o the Bank

covers

(i) risk policies and limits structure,

(ii) risk inrastructure and

(iii) risk measurement methodologies.

Risk policies are the main drivers o

creating risk culture and it recognizes the

commitment o management to promote

the risk based decisions. In 2008 the risk

policies were reviewed and revised and

relevant manuals introduced to acilitate

implementation o these policies.

-

8/7/2019 Corproate Profile 2008

32/56

Annual Reportor the year ended December 31, 2008

Askari Bank Limited - Corporate30

Business and Operations Review

Te risk inrastructure at the Bank includes

human resources with dened hierarchy

o roles and responsibilities, risk culture,

systems and procedures and management

oversight. Te Bank has strengthened its

risk management abilities to proactively

manage market, credit and operational risks

by creating awareness o risk culture through

organizing series o training sessions on

capital adequacy and computation o riskadjusted return. Every employee is expected

to be a risk manager at his workplace and can

appreciate the basic concepts o risk based

capital structure o the Bank.

Te Bank is at an advanced stage o

implementing Credit Risk Environment

Administration Management (CREAM)

soware; whereas implementation o a

more wide-ranging soware i.e., Reveleus

is in process. Te complete executiono these sowares will enable the Bank

to automate credit approval and risk

rating system processes and to implement

Basel II Foundation Internal Risk Based

(FIRB) approach or managing credit

risk and VaR model or market risk. In

the rst phase o implementation Basel II

standardized approach o credit risk, basic

indicator approach o operational risk

and standardized approach o market risk

will be automated; while Asset Liability

Management (ALM) module and FIRB

approach or credit risk will be achieved in

the second phase.

During the year, the Risk Management

Committee (RMC) o the Board was

reconstituted as a management committee.

Te RMC assists the Board in ullling its

responsibilities o approving risk policies andstrategies and perormance risk reviews.

Te Bank is exposed to various nancial

risks, including changes in interest rates,

currency rate, equity prices and the

creditworthiness o Bank borrowers. Risk

Management unction has introduced

VaR to measure market risk and credit

risk rating methodologies or credit risk

management, the latter will enable us to

determine probability o deault (PD) and

quantiy expected credit loss as required by

Basel II. Te credit risk is urther controlled

by system o limits by counterparty, by type

o acilities/transactions, geographic area,

internal credit rating in order to disperse

the risk and to avoid concentration in a

particular area.

Te Bank has also established a

comprehensive operational risk management

ramework based on appropriate risk

management architecture. Te rameworkassesses and measures the operational risk

arising rom system, people and processes.

In 2008 Risk Management Group organized

various training workshops to create

awareness among the staf or Basel II, capital

adequacy ratio. It also organized training

sessions or staf and internal auditors on

credit risk, consumer risk and risk & control

sel assessment. Risk impact calculator was

also introduced during the year. Te trainingsessions were designed and delivered to

create awareness, ownership and buy in risk

management at the Bank.

Information

Technology

Our strength in the area o inormation

technology (I) based services has always

been an edge in the competition and has

been a source o considerable strength in the

expansion and management o the customer

base o the Bank.

In line with our policy o providing the most