Chief Financial Officers time to shift focus

-

Upload

neil-holmes -

Category

Leadership & Management

-

view

16 -

download

1

Transcript of Chief Financial Officers time to shift focus

CHIEF FINANCIAL OFFICERS:TIME TO SHIFT FOCUS

www.normanbroadbent.com

Neil Holmes & David BaileyCFO Practice

Much has been written about the ever changing role of the Chief Financial Officer. From score-keeper and steward, to business enabler and catalyst for change, the CFO is often challenged to ensure that the finance operating model is aligned with the business and able to flex to adapt to increasing digital change and global competition. Whilst change is a constant, the need to stay on top of the numbers and provide accurate guidance to the business and shareholders, at the same time as adapting to new strategic initiatives, can make the CFO role one of the most precarious. It is no coincidence that almost 50% of FTSE 250 CFOs move on within two years of a new Chief Executive being appointed.

The role of finance is changing and the CFO is at the vanguard of this change, increasingly expected to sit alongside the Chief Executive in driving the business forward. CFOs have traditionally been regarded by some as great at looking in the rear view mirror but, in an increasingly digitised economy, Boards are demanding that the CFO also provides greater analysis and commentary of what the numbers imply, supporting the business to meet its strategic goals. At the same time, finance is increasingly embracing advances in data capture and analytics, enabling increased automation of previously mundane procedures.

Today’s CFOs must balance the challenges of avoiding the potholes that lie ahead, including: political, economic, technological and global change, shifts in consumer behaviour and the rise of activist investors; with ensuring that data generated is more than ‘just noise’ and succeeds in simultaneously informing the business about historic achievements and providing look-forward predictions and interpretation.

So, how are CFOs adapting to these circumstances and does the conventional route through which many rise to the top, provide the optimum blend of training and experience to succeed in the number one role in finance?

EXECUTIVE SUMMARY

“The evolution of the role of the CFO has been achieved despite the best efforts of the accountancy profession to stop it”FTSE 100 CFO

“77% of CEOs believe that technological advances are the top global trend which will transform wider stakeholder expectations in the next five years”PwC 19th Annual CEO Survey

Formative professional training remains focussed largely on auditing company performance, checking results are reported in accordance with the latest technical guidance, and ensuring that the business meets regulatory requirements.

Whilst keeping abreast of the numbers is of course still valued as a key responsibility of the finance team, in an increasingly digitised economy Chief Executives are demanding that the CFO also provides greater analysis of what the numbers imply, supporting the business to meet its strategic goals.

The potential to automate and outsource control and governance procedures could arguably lead to these skills becoming a commodity, with the CFO increasingly expected to devote more time to ‘being on the pitch’, supporting the Chief Executive in leading the drive for growth, change and transformation. Blockchain technology and the rise of Artificial Intelligence could revolutionise not only the automation of transactional processes but also the ability to transform corporate reporting, enabling transactions to be recorded and reported in real time.

These changes will have a profound impact on not only the traditional career trajectory of finance professionals, but on the skills and expertise that the finance function will need to deploy, including talent with significant data and digital expertise. It’s no longer enough for finance leaders to oversee a team that assimilates and reports information, but instead, they must develop the capability to identify, analyse, interpret and communicate the most valuable data, in the right language, at the right time. The proliferation of data and analysis means little if the capacity to derive relevance from it is absent.

THE SHIFTING FOCUS OF THE CFO

“The CFO role is being disrupted by digital innovation, the proliferation of data, a volatile risk environment, increasing regulation and a growing circle of demanding stakeholders.”E&Y The DNA of the CFO, 2016

“Finance functions are often struggling to provide CEOs with the support that they need” PwC Breaking Away: How leading finance functions are redefining excellence

The finance profession benefits from the proliferance of support, advice and technical expertise and there are of course a number of models on the nature of the finance function and the changes that they are undergoing.

Building on a number of conversations that Norman Broadbent has held with CFOs and business leaders, we like to think that the CFOs expertise is more three dimensional than two dimensional boxes, segments or faces. CFOs need to demonstrate effectiveness in a range of areas, deploying expertise whilst also ensuring strong bench-strength in areas where they are less at home. As a CFO, you will need to ensure that your talent pipeline and succession gains the necessary experience and expertise to flourish rather than becoming siloed, ensuring that your technical experts are close to your business whilst your business finance partners don’t “go native”. Communication skills become increasingly paramount throughout the CFO function to ensure success as a data analyst interpreter and business partner through to effectively outlining the organisations strategy with a broad range of stakeholders.

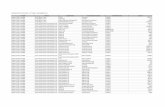

We consider that the CFOs expertise ranges across six key areas of expertise, namely Control, Governance, Operational Integrity, Strategy, Communication and Motivation; reflecting the CFOs impact and influence in Technical, Commercial and Leadership arenas – we call these the “Axis of Influence”.

HOW DO YOU MEASURE UP?

“It’s my job to get us to a better operating model, to add precision and laser focus…”FTSE 100 CFO

Catalyst

Steward Operator

Strategist

Four Faces of the CFO

THE 4-BOXFINANCE MODEL

BUSINESS SKILLSVALUE ADDING ACTIVITIES

ACCOUNTING SKILLSMANDATORY ACTIVITIES

PROACTIVEREACTIVE

Execution

EfficiencyControl

Perform

ance

FinanceFunction

THE CFOS

CONTRIBUTION

communication

score keeper

business partner

diligent caretaker

leading keyinitiatives in financethat supportstrategic goals

funding, enablingand executingstrategy setby ceo

providing insightand analysis tosupport ceo andother seniormanagers

developing anddefining theoverall strategyfor yourorganisation

representing theorganisation’sprogress onstrategic goalsto externalstakeholders

developing anddefining theoverall strategyfor yourorganisation

1

25

3

6

4

ENABLEMENT

DEV

ELO

PMEN

T EXECU

TION

TRUSTING THE NUMBERS

PRO

VID

ING

INSIG

HT

B

USI

NES

S ST

RA

TEG

Y

EXTER

NAL MARKETPLACE

CO

MM

UNICATIO

N TO THE

DEV

ELO

PM

ENT

OF

FUN

DIN

G ORGANISATIONAL GETTING YOUR HOUSE IN

ORD

ER

STRATEGY

In our view there are three main areas of influence where a CFO’s impact on a business is felt most. These are in their Technical Acumen, their Commercial Acumen, and in their Leadership Acumen. As a truly effective CFO, you will need to be able to draw upon and deploy these skills at different times depending upon circumstances. Your focus will naturally flex and change as you grapple with the range of issues that fall at the lap of today’s CFO.

Your ability to effect change and influence as a CFO will also be restricted if your skills are lacking along any one of these axes and even the most naturally gifted technical accountants will struggle to influence if they find it difficult to communicate and engage with others.

Equally, the capabilities and expertise required will change depending on the nature of the business, its size, sector, scope and complexity; as well as the nature of the relationship with the CEO and the Board who may be more comfortable restricting finance to its more traditional remit.

CFO AXIS OF INFLUENCE

COMMUNICATION

LEADERSHIP ACUMEN

GOVERNANCE

TECHNICAL ACUMEN

STRATEGY

COMMERICIAL ACUMEN

MOTIVATION

CONTROL

OPERATIONALINTEGRITY

TechnicalAcumen

CommercialAcumen

What is generally agreed is that there is an increasing shift in focus of today’s CFO away from Control and Governance towards the increasing use of analytics and business partnering, requiring the CFO to play an enhanced role in shaping the company’s future rather than reporting on the past.

CFO AXIS OF INFLUENCE

Drawing on experience and expertise gained leading control and governance functions, ensuring that the business is provided with an accurate record of business performance whilst ensuring it meets latest technical, legal and regulatory requirements. Demonstrate an ability to delve into the detail when required and appreciate the interplay between the “wiring” of the business. Increasingly this involves the effective management of outsourced providers and the utilisation of technology to automate processes.

Broad technical experience is often taken as a given prerequisite and enables the CFO the right to play at the top table.

The CFO’s commercial acumen underpins their influence on the operations and strategic direction of the business. Is the finance function regarded as a true business partner, are they measuring the right KPI’s and is finance helping the operations grow and develop as well as measuring performance?

How involved is the CFO in the development of the corporate strategy? What is the corporate objective, how will technology influence the business and does the balance sheet support the future growth and development of the company?

The CFO’s role is one of leadership and effective communication. CFOs are increasingly leading functional areas outside of their expertise and need to swiftly assimilate the key issues and understand the priorities.

Is the CFO a natural leader, comfortable leading from the front, at home outlining the strategy to shareholders and stakeholders whilst developing the bench-strength of the team supporting them? Are they fully engaged with and aligned with the direction that the CEO and the Board are steering or just going along for the ride?

“In order to drive change it is necessary to be unreasonable, to demand more, to disrupt the status quo. You have to know when to push”FTSE 100 CFO

“Businesses are looking to create advantage by innovating and taking risks, and need the finance team’s support on insight generation, smarter operating capability and robust stewardship”PwC / ACCA September 2016

LEADERSHIPAcumen

So is there still a disconnect between the evolution of the CFO role and how CFOs are appointed?

Understandably, Chairmen and Chief Executives will typically require a qualified accountant as the default starting criteria, together with a strong academic background and a proven track record. Whilst experience provides more than half the value of what a CFO will bring, are Boards biased to looking backwards at what a CFO has done in the past, rather than considering more deeply how today’s finance leaders can contribute to defining future strategy and delivering growth and profitability?

Clearly there will be circumstances where sector expertise will be a necessary requirement, yet are Boards too risk adverse in their appointment strategies and potentially influenced by external scrutiny, preferring proven individuals with a strong control and governance background rather than truly strategic commercial business partners who can drive performance?

When a CEO asks for a “commercial sparring partner”, how often do they really mean a “punch-bag” rather than a truly effective and commercially enriching Board confidante?

How often do Boards ask CFO candidates to demonstrate an understanding of business challenges and priorities, and to offer solutions to develop sustainable future strategies?

THE CFO PARADOX

“Is the future of finance new technology or new people?”E&Y The DNA of the CFO, 2016

“A Board who looks for a CFO who is a “safe pair of hands” is starting entirely in the wrong place”FTSE 250 CFO

The digital revolution is a thing of the present and enlightened Boards are increasingly moving away from prioritising reactive expertise demonstrated through strong technical ability, and towards the appointment of a commercially savvy CFO, able to apply new perspectives and experiences regardless of sector provenance. Job specifications based on history are unlikely to attract the talent to shape the future. The career path to CFO must embrace technological driven change, demonstrate an ability to turn data into meaningful insight and analysis, and the aptitude to influence and communicate effectively.

Strategic thinking and execution skills, together with hard-won front-line business experience has become the baseline criteria for successful CFOs. Creating a robust, reliable and trusted finance function requires continual investment in skills, processes and technology able to keep pace with business change. Developing commercial acumen through taking on roles outside of finance whilst introducing new data analysis skills to the finance armoury will enable the CFO to build a strong platform and partnership with the CEO as a trusted advisor, challenging assumptions and putting into action initiatives that enable businesses to succeed in increasingly competitive environments.

THE FUTURE?

“CFOs are only as good as the people supporting them, so they can in turn, support the CEO’s vision”KPMG, The Rise of the Renaissance CFO, June 2016

CONTRIBUTORS

Neil Holmes | Managing Director Neil brings over 20 years’ experience in executive search and leads Norman Broadbent’s CFO practice in addition to his role within the Board Practice. Neil has considerable experience covering listed and private companies across all sectors ranging from small and medium sized businesses to FTSE 100 and FTSE 250 corporates and has successfully placed over 200 Chairman, Non-Executive Directors, CEO’s and CFOs across industrial, support services, technology, consumer and financial services businesses. An economics graduate, Neil initially worked in the City as a Eurobond Trader with CIBC and was a Consultant within PwC’s Global Advisory Practice advising clients on a variety of strategic resourcing [email protected] | 020 7484 0116

David Bailey | Director David specialises in Board level and senior finance leadership assignments, including CFO talent and succession management projects, Divisional FD roles, Audit, Risk, IR and other related control functions. He operates across the full spectrum of industry sectors within publicly and privately owned companies, or private equity backed businesses. Whilst David’s core focus is on the UK market, he has also delivered assignments in Europe and Asia. He gained direct international experience working for two and a half years in Istanbul, prior to returning to the UK in 2007 with Norman [email protected] | 020 7484 0020

Finally, we are tremendously grateful for the support, contribution, challenge and encouragement from a number of experienced CFOs, HR Directors and Chief Executives in the creation and development of this paper. Your combined experience and perspectives spanning FTSE 100, FTSE 250, Small Cap and Private Equity backed businesses was invaluable.

The CFO Practice at Norman Broadbent brings significant experience working with a range of clients through all phases of the business cycle. From growth, diversification and international expansion, through consolidation, divestment and restructuring, Norman Broadbent’s CFO Practice is a trusted advisor to boards, acknowledged as providing an exceptional level of insight, advice and access to talent. We bring first-hand expertise recruiting FTSE 100 key succession hires, FTSE 250 and Small Cap / AIM CFOs together with finance professionals for privately owned and Private Equity backed businesses built on decades of experience. To find out why Boards are increasingly turning to Norman Broadbent, please speak to either Neil Holmes or David Bailey.

NORMAN BROADBENT GROUP

• Professional Services • Retail • Consumer • Financial Services• TMT • Industrials• Infrastructure • Life Sciences• Private Equity

• CFO, Finance, Tax & Treasury• Risk & Compliance• General Counsel & Legal• Human Resources• Trading and Operations • Logistics and Supply Chain• Commercial and General Management• CIO/CTO/Technology • Sales & Marketing

The Norman Broadbent Group is an established and trusted provider of Talent Acquisition & Advisory services. Our client partners – be they long-standing corporations or high-growth innovators – call on our expertise in Board and Executive Search, Senior Interim Management, Research & Insight, Solutions and Leadership Consulting to help them anticipate and resolve their human capital challenges in innovative, cost effective and time efficient ways.

Established in 1979, we have a strong track record of success across a wide range of industry sectors and functions including;

Key to our longevity is an unrelenting focus on delivery, excellence of service and innovation as well as our strong culture, values and partnership approach.

Since our founding nearly 40 years ago we have listened to our clients and developed a more integrated suite of offerings and flexible way of partnering. This - coupled with a focus on always first seeking to understand a client’s needs and challenges - enables us to craft and successfully deliver the most optimum solution.

Today, no other UK firm offers the same breadth of services and flexibility. It’s for this reason that some of the world’s most complex and demanding companies choose to work with us again and again.

If you’d like to learn more about The Norman Broadbent Group please contact our Chief Executive Officer,Mike Brennan via email [email protected] for an initial confidential discussion.

Norman Broadbent 12 St James’s Square | London | SW1Y 4LB | Tel: +44 (0) 20 7484 0000 | [email protected]

www.normanbroadbent.com