CHAPTER 9 RECEIVABLES - Erie Community College 27e_SM 09_Final.pdfCHAPTER 9 Receivables PE 9-2B Oct....

Transcript of CHAPTER 9 RECEIVABLES - Erie Community College 27e_SM 09_Final.pdfCHAPTER 9 Receivables PE 9-2B Oct....

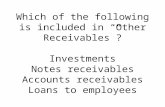

1. Receivables are normally classified as (1) accounts receivable, (2) notes receivable, or(3) other receivables.

2. Dan’s Hardware should use the direct write-off method because it is a small business that has a relatively small number and volume of accounts receivable.

3. Contra asset, credit balance.

4. The accounts receivable and allowance for doubtful accounts may be reported at a net amount of $661,500 ($673,400 – $11,900) in the Current assets section of the balance sheet.In this case, the amount of the allowance for doubtful accounts should be shown separately in a note to the financial statements or in parentheses on the balance sheet. Alternatively, the accounts receivable may be shown at the gross amount of $673,400 less the amount of the allowance for doubtful accounts of $11,900, thus yielding net accounts receivable of$661,500.

5. (1) The percentage rate used is excessive in relation to the accounts written off as uncollectible;hence, the balance in the allowance is excessive.

(2) A substantial volume of old uncollectible accounts is still being carried in the accounts receivable account.

6. An estimate based on analysis of receivables provides the most accurate estimate of the current net realizable value.

7. a. Sailfish Companyb. Notes Receivable

8. The interest will amount to $5,100 ($85,000 × 6%) only if the note is payable one year fromthe date it was created. The usual practice is to state the interest rate in terms of an annualrate rather than in terms of the period covered by the note.

9. Debit Accounts Receivable for $243,600Credit Notes Receivable for $240,000Credit Interest Revenue for $3,600

10. Cash 245,427Accounts Receivable [$240,000 + ($240,000 × 6% × 90 ÷ 360)] 243,600Interest Revenue ($243,600 × 9% × 30 ÷ 360) 1,827

CHAPTER 9RECEIVABLES

DISCUSSION QUESTIONS

9-1© 2018 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 9 Receivables

PE 9-1A

Apr. 15 Cash 800Bad Debt Expense 1,200

Accounts Receivable—Jean Tooley 2,000

Aug. 7 Accounts Receivable—Jean Tooley 1,200Bad Debt Expense 1,200

7 Cash 1,200Accounts Receivable—Jean Tooley 1,200

PE 9-1B

Oct. 2 Cash 600Bad Debt Expense 1,350

Accounts Receivable—Rachel Elpel 1,950

Dec. 20 Accounts Receivable—Rachel Elpel 1,350Bad Debt Expense 1,350

20 Cash 1,350Accounts Receivable—Rachel Elpel 1,350

PE 9-2A

Apr. 15 Cash 800Allowance for Doubtful Accounts 1,200

Accounts Receivable—Jean Tooley 2,000

Aug. 7 Accounts Receivable—Jean Tooley 1,200Allowance for Doubtful Accounts 1,200

7 Cash 1,200Accounts Receivable—Jean Tooley 1,200

PRACTICE EXERCISES

9-2© 2018 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 9 Receivables

PE 9-2B

Oct. 2 Cash 600Allowance for Doubtful Accounts 1,350

Accounts Receivable—Rachel Elpel 1,950

Dec. 20 Accounts Receivable—Rachel Elpel 1,350Allowance for Doubtful Accounts 1,350

20 Cash 1,350Accounts Receivable—Rachel Elpel 1,350

PE 9-3A

a. $363,000 ($48,400,000 × 0.0075)

b.

Accounts Receivable……………………………………………… Allowance for Doubtful Accounts ($22,750 + $363,000)…… Bad Debt Expense…………………………………………………

c. Net realizable value ($3,750,000 – $385,750)……………………

PE 9-3B

a. $231,500 ($46,300,000 × 0.0050)

b.

Accounts Receivable……………………………………………… Allowance for Doubtful Accounts ($231,500 – $12,500)…… Bad Debt Expense…………………………………………………

c. Net realizable value ($3,460,000 – $219,000)…………………… $3,241,000

Adjusted Balance

$3,750,000

363,000(385,750)

231,500

Debit (Credit)

Debit (Credit)

$3,364,250

Adjusted Balance

$3,460,000(219,000)

9-3© 2018 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 9 Receivables

PE 9-4A

a. $367,250 ($390,000 – $22,750)

b.

Accounts Receivable……………………………………………… Allowance for Doubtful Accounts……………………………… Bad Debt Expense…………………………………………………

c. Net realizable value ($3,750,000 – $390,000)……………………

PE 9-4B

a. $257,500 ($245,000 + $12,500)

b.

Accounts Receivable……………………………………………… Allowance for Doubtful Accounts……………………………… Bad Debt Expense…………………………………………………

c. Net realizable value ($3,460,000 – $245,000)……………………

PE 9-5Aa. The due date for the note is September 21, determined as follows:

July …………………………………………………………….……… 8 days (31 – 23)August …………………………………………………………….… 31 daysSeptember …………………………………………………………… 21

Total…………………………………………………………………… 60 days

b. $28,420 [$28,000 + ($28,000 × 9% × 60 ÷ 360)]

c.

Sept. 21 Cash 28,420Notes Receivable 28,000Interest Revenue 420

$3,215,000

$3,360,000

Adjusted Balance

$3,460,000(245,000)

Debit (Credit)

Adjusted Balance

$3,750,000

367,250(390,000)

257,500

Debit (Credit)

9-4© 2018 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 9 Receivables

PE 9-5B

a. The due date for the note is August 7, determined as follows:

April…………………………………………………………………… 21 days (30 – 9)May…………………………………………………………………… 31 daysJune…………………………………………………………………… 30 daysJuly…………………………………………………………………… 31 daysAugust………………………………………………………….…… 7 daysTotal…………………………………………………………………… 120 days

b. $462,000 [$450,000 + ($450,000 × 8% × 120 ÷ 360)]

c. Aug. 7 Cash 462,000Notes Receivable 450,000Interest Revenue 12,000

PE 9-6A

a.

Sales………………………………Accounts receivable:

Beginning of year…………… End of year……………………

Average accts. receivable……

Accts. receivable turnover……

b.

Sales……………………………… Average daily sales……………

Average accts. receivable……

Days’ sales in receivables……

c. The decrease in the accounts receivable turnover from 10.2 to 9.1 and the increase in the days’ sales in receivables from 35.8 days to 40.1 days indicateunfavorable changes in the efficiency of collecting receivables.

9.1

[($280,000 + $300,000) ÷ 2]

10.2

$ 290,000[($300,000 + $340,000) ÷ 2]

$ 340,000 $ 300,000$ 320,000

$ 320,000 $ 290,000

$ 7,978.1 $ 8,104.1($2,912,000 ÷ 365 days) ($2,958,000 ÷ 365 days)

($320,000 ÷ $7,978.1) ($290,000 ÷ $8,104.1)

[($300,000 + $340,000) ÷ 2] [($280,000 + $300,000) ÷ 2]

40.1 days 35.8 days

$2,912,000 $2,958,000

Turnover 20Y2 20Y1

$2,912,000 $2,958,000

Days’ Sales in Receivables 20Y2 20Y1

($2,912,000 ÷ $320,000) ($2,958,000 ÷ $290,000)

$ 300,000 $ 280,000

9-5© 2018 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 9 Receivables

PE 9-6B

a.

Sales…………………………………… Accounts receivable:

Beginning of year……………… End of year………………………

Average accts. receivable…………

Accts. receivable turnover…………

b.

Sales…………………………………… Average daily sales…………………

Average accts. receivable…………

Days’ sales in receivables…………

c. The increase in the accounts receivable turnover from 11.8 to 13.4 and the decrease in the days’ sales in receivables from 30.9 days to 27.2 days indicatefavorable changes in the efficiency of collecting receivables.

$ 600,000 $ 540,000

Accounts Receivable Turnover 20Y9 20Y8

$7,906,000 $6,726,000

Days’ Sales in Receivables

$7,906,000 $6,726,000

13.4 11.8($7,906,000 ÷ $590,000) ($6,726,000 ÷ $570,000)

20Y9

27.2 days 30.9 days

($7,906,000 ÷ 365 days) ($6,726,000 ÷ 365 days)

$ 590,000 $ 570,000

[($600,000 + $580,000) ÷ 2] [($540,000 + $600,000) ÷ 2]

$ 580,000 $ 600,000$ 590,000 $ 570,000

20Y8

$ 21,660.3 $ 18,427.4

($590,000 ÷ $21,660.3) ($570,000 ÷ $18,427.4)

[($600,000 + $580,000) ÷ 2] [($540,000 + $600,000) ÷ 2]

9-6© 2018 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 9 Receivables

Ex. 9-1

Accounts receivable from the U.S. government are significantly different from receivables from commercial aircraft carriers such as Delta and United. In itsfiling with the Securities and Exchange Commission, Boeing reports thereceivables together on the balance sheet but discloses each receivable separately in a note to the financial statements.

Ex. 9-2

a. MGM Resorts International: 15.7% ($89,789,000 ÷ $570,348,000)

b. Johnson & Johnson: 2.4% ($268,000,000 ÷ $11,002,000,000)

c. Casino operations experience greater bad debt risk because it is difficult to control the creditworthiness of customers entering the casino. In addition, individuals who may have adequate creditworthiness could overextend themselves and lose more than they can afford if they get caught up in the excitement of gambling. In contrast, Johnson & Johnson’s customers are primarily other businesses such as grocery store chains.

Note to Instructors: Approximately one-half of MGM’s receivables are related to

its casino operations.

Ex. 9-3

Jan. 19 Accounts Receivable—Dr. Dale Van Dyken 30,000Sales 30,000

19 Cost of Merchandise Sold 20,500Merchandise Inventory 20,500

July 7 Cash 12,000Bad Debt Expense 18,000

Accounts Receivable—Dr. Dale Van Dyken 30,000

Nov. 2 Accounts Receivable—Dr. Dale Van Dyken 18,000Bad Debt Expense 18,000

2 Cash 18,000Accounts Receivable—Dr. Dale Van Dyken 18,000

EXERCISES

9-7© 2018 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 9 Receivables

Ex. 9-4

May 1 Accounts Receivable—Beijing Palace Co. 18,900Sales 18,900

1 Cost of Merchandise Sold 11,200Merchandise Inventory 11,200

Aug. 30 Cash 8,000Allowance for Doubtful Accounts 10,900

Accounts Receivable—Beijing Palace Co. 18,900

Dec. 8 Accounts Receivable—Beijing Palace Co. 10,900Allowance for Doubtful Accounts 10,900

8 Cash 10,900Accounts Receivable—Beijing Palace Co. 10,900

Ex. 9-5

a. Bad Debt Expense 33,550Accounts Receivable—Alliance Inc. 33,550

b. Allowance for Doubtful Accounts 33,550Accounts Receivable—Alliance Inc. 33,550

Ex. 9-6

a. $611,250 ($81,500,000 × 0.0075) c. $407,500 ($81,500,000 × 0.0050)b. $643,250 ($575,000 + $68,250) d. $405,000 ($450,000 – $45,000)

Ex. 9-7

Avalanche AutoBales AutoDerby Auto RepairLucky’s Auto RepairPit Stop AutoReliable Auto RepairTrident AutoValley Repair & Tow 167 (14 + 30 + 31 + 31 + 30 + 31)

108 (16 + 31 + 30 + 31)

June 23September 2September 19July 15

May 17

59 (28 + 31)42 (11 + 31)

68 (7 + 30 + 31)August 24

84 (23 + 30 + 31)20 (31 – 11)130 (7 + 31 + 31 + 30 + 31)

Account Due Date

August 8October 11

Number of Days Past Due

9-8© 2018 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 9 Receivables

Ex. 9-8

a.

Customer

Conover IndustriesKeystone CompanyMoxie Creek Inc. Rainbow CompanySwanson Company

b.

Not Past OverCustomer Balance Due 1–30 31–60 61–90 90

Academy Industries Inc. 3,000 3,000

Ascent Company 4,500 4,500

Zoot Company 5,000 5,000

Subtotals 1,050,000 600,000 220,000 115,000 85,000 30,000

Conover Industries 30,000 30,000

Keystone Company 18,000 18,000

Moxie Creek Inc. 9,000 9,000

Rainbow Company 26,400 26,400Swanson Company 46,600 46,600

Totals 1,180,000 626,400 266,600 124,000 103,000 60,000

Ex. 9-9

Not Past OverBalance Due 1–30 31–60 61–90 90

Total receivables 1,180,000 626,400 266,600 124,000 103,000 60,000Percentage uncollectible 2% 4% 18% 40% 75%

Allowance for doubtfulaccounts 131,712 12,528 10,664 22,320 41,200 45,000

Days Past Due

Days Past Due

Due Date

March 22

Number of Days Past Due

162 days (9 + 30 + 31 + 30 + 31 + 31)July 1July 25

Aging of Receivables ScheduleAugust 31

61 days (30 + 31)37 days (6 + 31)

September 10August 3

Not past due28 days (31 – 3)

9-9© 2018 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 9 Receivables

Ex. 9-10

Aug. 31 Bad Debt Expense 121,600Allowance for Doubtful Accounts 121,600

Uncollectible accounts estimate($131,712 – $10,112).

Ex. 9-11

Balance Percent Amount

Not past due $3,250,000 0.8% $ 26,0001–30 days past due 1,050,000 2.4% 25,200 31–60 days past due 780,000 7.0% 54,60061–90 days past due 320,000 18.0% 57,60091–180 days past due 240,000 34.0% 81,600Over 180 days past due 150,000 85.0% 127,500

Total $5,790,000 $372,500

Ex. 9-12

Dec. 31 Bad Debt Expense 400,900Allowance for Doubtful Accounts 400,900

Uncollectible accounts estimate($372,500 + $28,400).

EstimatedUncollectible Accounts

Age Interval

9-10© 2018 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 9 Receivables

Ex. 9-13

a. Apr. 13 Bad Debt Expense 8,450Accounts Receivable—Dean Sheppard 8,450

May 15 Cash 500Bad Debt Expense 6,600

Accounts Receivable—Dan Pyle 7,100

July 27 Accounts Receivable—Dean Sheppard 8,450Bad Debt Expense 8,450

27 Cash 8,450Accounts Receivable—Dean Sheppard 8,450

Dec. 31 Bad Debt Expense 13,510Accounts Receivable—Paul Chapman 2,225Accounts Receivable—Duane DeRosa 3,550Accounts Receivable—Teresa Galloway 4,770Accounts Receivable—Ernie Klatt 1,275Accounts Receivable—Marty Richey 1,690

31 No entry

9-11© 2018 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 9 Receivables

Ex. 9-13 (Concluded)

b. Apr. 13 Allowance for Doubtful Accounts 8,450Accounts Receivable—Dean Sheppard 8,450

May 15 Cash 500Allowance for Doubtful Accounts 6,600

Accounts Receivable—Dan Pyle 7,100

July 27 Accounts Receivable—Dean Sheppard 8,450Allowance for Doubtful Accounts 8,450

27 Cash 8,450Accounts Receivable—Dean Sheppard 8,450

Dec. 31 Allowance for Doubtful Accounts 13,510Accounts Receivable—Paul Chapman 2,225Accounts Receivable—Duane DeRosa 3,550Accounts Receivable—Teresa Galloway 4,770Accounts Receivable—Ernie Klatt 1,275Accounts Receivable—Marty Richey 1,690

31 Bad Debt Expense 28,335Allowance for Doubtful Accounts 28,335

Uncollectible accounts estimate($3,778,000 × 0.75% = $28,335).

c. Bad debt expense under:

Allowance method………………………...…………………………………… $28,335Direct write-off method ($8,450 + $6,600 – $8,450 + $13,510)…………… 20,110

Difference ($28,335 – $20,110)………………………………………………… $ 8,225

Shipway Company’s income would have been $8,225 higher under the direct write-off method than under the allowance method.

9-12© 2018 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 9 Receivables

Ex. 9-14

a. June 8 Bad Debt Expense 8,440Accounts Receivable—Kathy Quantel 8,440

Aug. 14 Cash 3,000Bad Debt Expense 9,500

Accounts Receivable—Rosalie Oakes 12,500

Oct. 16 Accounts Receivable—Kathy Quantel 8,440Bad Debt Expense 8,440

16 Cash 8,440Accounts Receivable—Kathy Quantel 8,440

Dec. 31 Bad Debt Expense 24,955Accounts Receivable—Wade Dolan 4,600Accounts Receivable—Greg Gagne 3,600Accounts Receivable—Amber Kisko 7,150Accounts Receivable—Shannon Poole 2,975Accounts Receivable—Niki Spence 6,630

31 No entry

9-13© 2018 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 9 Receivables

Ex. 9-14 (Continued)

b. June 8 Allowance for Doubtful Accounts 8,440Accounts Receivable—Kathy Quantel 8,440

Aug. 14 Cash 3,000Allowance for Doubtful Accounts 9,500

Accounts Receivable—Rosalie Oakes 12,500

Oct. 16 Accounts Receivable—Kathy Quantel 8,440Allowance for Doubtful Accounts 8,440

16 Cash 8,440Accounts Receivable—Kathy Quantel 8,440

Dec. 31 Allowance for Doubtful Accounts 24,955Accounts Receivable—Wade Dolan 4,600Accounts Receivable—Greg Gagne 3,600Accounts Receivable—Amber Kisko 7,150Accounts Receivable—Shannon Poole 2,975Accounts Receivable—Niki Spence 6,630

31 Bad Debt Expense 45,545Allowance for Doubtful Accounts 45,545

Uncollectible accounts estimate($47,090 – $1,545).

Computations:

Percent Amount

0–30 days 1% $ 3,200 31–60 days 3% 3,300 61–90 days 10% 2,400 91–120 days 33% 5,940 More than 120 days 75% 32,250

Total receivables $47,090

Estimated balance of allowance account from aging schedule………………… $47,090Unadjusted credit balance of allowance account………………………………… 1,545

Adjustment………………………………………………………………………………… $45,545

* $36,000 – $8,440 – $9,500 + $8,440 – $24,955 = $1,545

Past Due)

AccountsEstimated DoubtfulReceivables

Balance onAging Class

(Number of Days

December 31

$320,000110,000

24,00018,00043,000

$515,000

*

9-14© 2018 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 9 Receivables

Ex. 9-14 (Concluded)

c. Bad debt expense under:

Allowance method………………………………………………………………… $45,545Direct write-off method ($8,440 + $9,500 – $8,440 + $24,955)…………… 34,455

Difference…………………………………………………………………………… $11,090

Rustic Tables’ income would have been $11,090 higher under the direct write-off method than under the allowance method.

Ex. 9-15

$482,800, computed as follows: Net income under direct method……………………………………… $487,500Bad debt expense under direct method……………………………… $27,800Bad debt expense under allowance method

($3,250,000 × 1% )……………………………………………………… 32,500

Less increase in bad debt expense under allowance method…… 4,700Net income under allowance method………………………………… $482,800

Ex. 9-16

$593,000, computed as follows: a. Net income under direct method………………………………… $600,000

Bad debt expense under direct method………………………… $34,000Bad debt expense under allowance method

($4,100,000 × 1% )………………………………………………… 41,000

Less increase in bad debt expense underallowance method………………………………………………… 7,000

Net income under allowance method…………………………… $593,000

b. $11,700, as shown in the following T account:

Year 1 Write-offs 27,800 Year 1 Adj. Entry 32,500

Bal. 4,700Year 2 Write-offs 34,000 Year 2 Adj. Entry 41,000

Bal. 11,700

Ex. 9-17

a. Bad Debt Expense 30,000Accounts Receivable—Shawn Brooke 4,650Accounts Receivable—Eve Denton 5,180Accounts Receivable—Art Malloy 11,050Accounts Receivable—Cassie Yost 9,120

Allowance for Doubtful Accounts

9-15© 2018 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 9 Receivables

Ex. 9-17 (Concluded)

b. Allowance for Doubtful Accounts 30,000Accounts Receivable—Shawn Brooke 4,650Accounts Receivable—Eve Denton 5,180Accounts Receivable—Art Malloy 11,050Accounts Receivable—Cassie Yost 9,120

Bad Debt Expense 39,375Allowance for Doubtful Accounts 39,375

Uncollectible accounts estimate($5,250,000 × 0.75% = $39,375).

c. Net income would have been $9,375 higher under the direct write-off methodbecause bad debt expense would have been $9,375 lower under the directmethod ($39,375 expense under the allowance method versus $30,000 expense under the direct write-off method).

Ex. 9-18

a. Bad Debt Expense 102,500Accounts Receivable—Kim Abel 21,550Accounts Receivable—Lee Drake 33,925Accounts Receivable—Jenny Green 27,565Accounts Receivable—Mike Lamb 19,460

b. Allowance for Doubtful Accounts 102,500Accounts Receivable—Kim Abel 21,550Accounts Receivable—Lee Drake 33,925Accounts Receivable—Jenny Green 27,565Accounts Receivable—Mike Lamb 19,460

Bad Debt Expense 117,150Allowance for Doubtful Accounts 117,150

Uncollectible accounts estimate($109,650 + $7,500).

Computations:

Percent Amount

0–30 days 1% $ 7,150 31–60 days 2% 6,200 61–90 days 15% 15,300 91–120 days 30% 22,800 More than 120 days 60% 58,200

Total receivables $109,650$1,300,000

ReceivablesBalance on

December 31

$ 715,000310,000102,00076,00097,000

Past Due)

AccountsEstimated DoubtfulAging Class

(Number of Days

9-16© 2018 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 9 Receivables

Ex. 9-18 (Concluded)

Unadjusted debit balance of Allowance for Doubtful Accounts($102,500 – $95,000)…………………………………………………………………… $ 7,500

Estimated balance of Allowance for Doubtful Accountsfrom aging schedule…………………………………………………………………… 109,650

Adjustment………………………………………………………………………………… $117,150

c. Net income would have been $14,650 lower under the allowance method becausebad debt expense would have been $14,650 higher under the allowance method($117,150 expense under the allowance method versus $102,500 expense underthe direct write-off method).

Ex. 9-19

Interest

a. $500 [$40,000 × 0.05 × (90 ÷ 360)]b. Sept. 15 720 [$18,000 × 0.08 × (180 ÷ 360)]c. July 5 525 [$90,000 × 0.07 × (30 ÷ 360)]d. Dec. 7 270 [$36,000 × 0.03 × (90 ÷ 360)]e. Jan. 19 180 [$27,000 × 0.04 × (60 ÷ 360)]

Ex. 9-20

a. August 11 (17 + 31 + 30 + 31 + 11)

b. $60,800 [($60,000 × 4% × 120 ÷ 360) + $60,000]

c. (1) Apr. 13 Notes Receivable 60,000Accounts Rec.—Spring Designs &

Decorators 60,000

(2) Aug. 11 Cash 60,800Notes Receivable 60,000Interest Revenue 800

Ex. 9-21

a. Sale on account.

b. Cost of goods sold for the sale on account.

c. Note received from customer on account.

d. Note dishonored and charged face value of note plus interest to customer’saccount receivable.

e. Payment received from customer for dishonored note plus interest earned after due date.

Due Date

Apr. 10

9-17© 2018 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 9 Receivables

Ex. 9-22

20Y3 Nov. 21 Notes Receivable 96,000

Accounts Receivable—McKenna Outer Wear Co. 96,000

Dec. 31 Interest Receivable 320Interest Revenue 320

Accrued interest ($96,000 × 0.03 × 40 ÷ 360).

20Y4 Jan. 20 Cash 96,480

Notes Receivable 96,000Interest Receivable 320Interest Revenue ($96,000 × 0.03 × 20 ÷ 360) 160

Ex. 9-23

June 23 Notes Receivable 48,000Accounts Receivable—Radon Express Co. 48,000

Sept. 21 Accounts Receivable—Radon Express Co. 48,960Notes Receivable 48,000Interest Revenue 960

($48,000 × 0.08 × 90 ÷ 360).

Oct. 21 Cash 49,368Accounts Receivable—Radon Express Co. 48,960Interest Revenue 408

($48,960 × 0.10 × 30 ÷ 360).

9-18© 2018 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 9 Receivables

Ex. 9-24

Apr. 18 Notes Receivable 60,000Accounts Receivable—Glenn Cross 60,000

30 Notes Receivable 42,000Accounts Receivable—Rhoni Melville 42,000

May 18 Accounts Receivable—Glenn Cross 60,350Notes Receivable 60,000Interest Revenue 350

($60,000 × 7% × 30 ÷ 360).

June 29 Accounts Receivable—Rhoni Melville 42,560Notes Receivable 42,000Interest Revenue 560

($42,000 × 8% × 60 ÷ 360).

Aug. 16 Cash 61,557Accounts Receivable—Glenn Cross 60,350Interest Revenue 1,207

($60,350 × 8% × 90 ÷ 360).

Oct. 22 Allowance for Doubtful Accounts 42,560Accounts Receivable—Rhoni Melville 42,560

Ex. 9-25

1. The interest receivable should be reported separately as a current asset. It should not be deducted from notes receivable.

2. The allowance for doubtful accounts should be deducted from accountsreceivable.

A corrected partial balance sheet would be as follows:

Current assets:Cash $ 78,500Notes receivable 300,000Accounts receivable $1,200,000

Less allowance for doubtful accounts 11,500 1,188,500

Interest receivable 4,500

NAPA VINO COMPANYBalance Sheet

December 31, 20Y9Assets

9-19© 2018 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 9 Receivables

Ex. 9-26

a. and b.

Sales………………………………

Average accts. receivable……

Accts. receivable turnover……

Average daily sales……………

Days’ sales in receivables……

The days’ sales in receivables could also be computed by dividing 365 days bythe accounts receivable turnover as follows:

Year 2: 39.7 (365 days ÷ 9.20)Year 1: 34.5 (365 days ÷ 10.59)

c. The accounts receivable turnover indicates a slight decrease in the efficiency of collecting accounts receivable by decreasing from 10.59 to 9.20, an unfavorablechange. The days’ sales in receivables also indicates a decrease in the efficiency of collecting accounts receivable by increasing from 34.5 to 39.7, which is anunfavorable change. However, before reaching a final conclusion, the ratios should be compared with industry averages and similar firms.

Ex. 9-27a. and b.

Sales………………………………

Average accts. receivable……

Accts. receivable turnover……

Average daily sales……………

Days’ sales in receivables……

The days’ sales in receivables could also be computed by dividing 365 days bythe accounts receivable turnover as follows:

Year 2: 29.7 (365 days ÷ 12.27) (Difference due to rounding)Year 1: 28.8 (365 days ÷ 12.67) (Difference due to rounding)

($658.5 ÷ $22.1) ($652.5 ÷ $22.7)

($8,082 ÷ 365) ($8,268 ÷ 365)

29.8 28.7

Year 2 Year 1

$8,082 $8,268

$828,500[($857,000 + $800,000) ÷ 2]

($7,620,000 ÷ 365)

$20,411.0

9.20

$703,500

($7,450,000 ÷ 365)

10.59($7,620,000 ÷ $828,500) ($7,450,000 ÷ $703,500)

[($800,000 + $607,000) ÷ 2]

$20,876.7

34.539.7

$652.5

$22.1 $22.7

($8,082 ÷ $658.5) ($8,268 ÷ $652.5)

($828,500 ÷ $20,876.7) ($703,500 ÷ $20,411.0)

12.27 12.67

$658.5[($647 + $670) ÷ 2] [($670 + $635) ÷ 2]

Year 2 Year 1

$7,620,000 $7,450,000

9-20© 2018 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 9 Receivables

Ex. 9-27 (Concluded)

c. The accounts receivable turnover indicates a decrease in the efficiency of collecting accounts receivable by decreasing from 12.67 to 12.27, an unfavorable change. The number of days’ sales in receivables increased from 28.7 to 29.8 days, also indicating an unfavorable change in collections of receivables. However, before a final conclusion can be reached, both ratios should be comparedwith those of past years, industry averages, and similar firms.

Ex. 9-28

a. and b.

Sales………………………………

Average accts. receivable………

Accts. receivable turnover………

Average daily sales………………

Days’ sales in receivables………

The days’ sales in receivables could also be computed by dividing 365 days bythe accounts receivable turnover as follows:

Year 2: 7.7 (365 days ÷ 47.28) (Difference due to rounding)Year 1: 7.9 (365 days ÷ 46.24)

c. The accounts receivable turnover indicates an increase in the efficiency of collecting accounts receivable by increasing from 46.24 to 47.28, a favorablechange. The days’ sales in receivables indicates an increase in the efficiency of collecting accounts receivable by decreasing from 7.9 to 7.8, also indicating a favorable change. Before a conclusion can be reached, however, the ratios should be compared with industry averages and similar firms.

$3,522 $3,283

Year 2 Year 1

($3,522 ÷ $74.5) ($3,283 ÷ $71.0)

47.28

$71.0$74.5[($81 + $68) ÷ 2] [($68 + $74) ÷ 2]

46.24

($74.5 ÷ $9.6) ($71.0 ÷ $9.0)

7.97.8

$9.6($3,522 ÷ 365)

$9.0($3,283 ÷ 365)

9-21© 2018 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 9 Receivables

Ex. 9-29

a. The average accounts receivable turnover ratios are as follows:

Campbell Soup: 12.47 [(12.27 + 12.67) ÷ 2]American Eagle Outfitters: 46.76 [(47.28 + 46.24) ÷ 2]

Note: For computations of the individual ratios, see Ex. 9-27 and Ex. 9-28.

b. American Eagle Outfitters has the higher average accounts receivable turnover ratio.

c. American Eagle Outfitters operates a specialty retail chain of stores that sells directly to individual consumers. Many of these consumers (retail customers) payusing MasterCard or VISA, which is recorded as cash sales. In contrast, CampbellSoup manufactures foods that are sold to food wholesalers, grocery store chains, and other food distributors that eventually sell Campbell’s products to individualconsumers. Accordingly, because of the extended distribution chain, we would expect Campbell Soup to have more accounts receivable than American Eagle.In addition, we would expect Campbell’s business customers to take a longerperiod to pay their receivables. Thus, we would expect Campbell’s average accounts receivable turnover ratio to be lower than American Eagle, as shown in a.

9-22© 2018 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 9 Receivables

Prob. 9-1A

1. and 2.

Jan. 29 5,850 Jan. 1 Balance 54,200Aug. 9 11,850 Apr. 18 4,000Dec. 31 52,160 Nov. 7 7,000

31 Unadjusted Balance 4,660 Dec. 31 Adjusting Entry 64,660

31 Adj. Balance 60,000

Dec. 31 Adjusting Entry 64,660

3. $1,390,000 ($1,450,000 – $60,000)

4. a. $66,000 ($13,200,000 × 0.0050)b. $61,340 ($66,000 – $4,660)c. $1,388,660 ($1,450,000 – $61,340)

Allowance for Doubtful Accounts

Bad Debt Expense

PROBLEMS

9-23© 2018 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 9 Receivables

Prob. 9-1A (Concluded)

2. Jan. 29 Cash 3,150Allowance for Doubtful Accounts 5,850

Accounts Receivable—Kovar Co. 9,000

Apr. 18 Accounts Receivable—Spencer Clark 4,000Allowance for Doubtful Accounts 4,000

18 Cash 4,000Accounts Receivable—Spencer Clark 4,000

Aug. 9 Allowance for Doubtful Accounts 11,850Accounts Receivable—Iron Horse Co. 11,850

Nov. 7 Accounts Receivable—Vinyl Co. 7,000Allowance for Doubtful Accounts 7,000

7 Cash 7,000Accounts Receivable—Vinyl Co. 7,000

Dec. 31 Allowance for Doubtful Accounts 52,160Accounts Receivable—Beth Connelly Inc. 12,100Accounts Receivable—DeVine Co. 8,110Accounts Receivable—Moser Distributors 21,950Accounts Receivable—Oceanic Optics 10,000

31 Bad Debt Expense 64,660Allowance for Doubtful Accounts 64,660

Uncollectible accounts estimate($60,000 + $4,660).

Prob. 9-2A

1.

Due Date

Adams Sports & Flies May 22, 20Y6 223 days (9 + 30 + 31 + 31 + 30 + 31 + 30 + 31)

Blue Dun Flies Oct. 10, 20Y6 82 days (21 + 30 + 31)

Cicada Fish Co. Sept. 29, 20Y6 93 days (1 + 31 + 30 + 31)

Deschutes Sports Oct. 20, 20Y6 72 days (11 + 30 + 31)

Green River Sports Nov. 7, 20Y6 54 days (23 + 31)

Smith River Co. Nov. 28, 20Y6 33 days (2 + 31)

Western Trout Company Dec. 7, 20Y6 24 days

Wolfe Sports Jan. 20, 20Y7 Not past due

Number of Days Past DueCustomer

9-24© 2018 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 9 Receivables

Prob. 9-2A (Concluded)

2. and 3.

Not

Past Over

Customer Balance Due 1–30 31–60 120

AAA Outfitters 20,000 20,000

Brown Trout Fly Shop 7,500 7,500

Zigs Fish Adventures 4,000 4,000

Subtotals 1,300,000 750,000 290,000 120,000 80,000

Adams Sports & Flies 5,000 5,000

Blue Dun Flies 4,900

Cicada Fish Co. 8,400

Deschutes Sports 7,000

Green River Sports 3,500 3,500

Smith River Co. 2,400 2,400

Western Trout Company 6,800 6,800

Wolfe Sports 4,400 4,400

Totals 1,290,500 754,400 296,800 125,900 85,000

Percentage uncollectible 1% 2% 10% 80%

Estimate of uncollectible

accounts 105,430 7,544 5,936 12,590 68,000

4. Bad Debt ExpenseAllowance for Doubtful Accounts

Uncollectible accounts estimate($105,430 + $3,600).

5. On the balance sheet, assets would be overstated by $109,030 because the allowance for doubtful accounts would be understated by $109,030. In addition, the owner’s capital account would be overstated by $109,030because bad debt expense would be understated and net income overstated by $109,030 on the income statement.

December 31, 20Y6

Aging of Receivables Schedule

109,030

11,360

40%

28,400

8,400

109,030

7,000

—

30%

—

61–90

Days Past Due

20,000

91–120

40,000

4,900

9-25© 2018 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 9 Receivables

Prob. 9-3A

1.

Increase Balance of

Expense Expense (Decrease) Allowance

Actually Based on in Amount Account,Reported Estimate of Expense End of Year

$ 4,500 $ 9,000 $4,500 $ 4,5009,600 12,500 2,900 7,400

12,800 15,000 2,200 9,60016,550 22,000 5,450 15,050

2. Yes. The actual write-offs of accounts originating in the first two years are reasonably close to the expense that would have been charged to those years on the basis of 1% of sales. The total write-off of receivables originating in the first year amounted to $8,500 ($4,500 + $3,000 + $1,000), as compared to baddebt expense, based on the percentage of sales, of $9,000 ($900,000 × 1%). For

the second year, the comparable amounts were write-offs of $11,800 ($6,600 + $3,700 + $1,500) and bad debt expense of $12,500 ($1,250,000 × 1%).

3rd

4th

Bad Debt Expense

Year

1st

2nd

9-26© 2018 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 9 Receivables

Prob. 9-4A

1.

Note

1. $5002. 3603. 8404. 9455. 2706. Jan. 29 300

2. Nov. 17 Accounts Receivable 42,840

Notes Receivable 42,000

Interest Revenue 840

3. Dec. 31 Interest Receivable 154

Interest Revenue 154

Accrued interest.$27,000 × 6% × 32 ÷ 360 = $144

$72,000 × 5% × 1 ÷ 360 = 10

Total $154

4. Jan. 28 Cash 27,270

Notes Receivable 27,000

Interest Receivable 144

Interest Revenue 126($27,000 × 6% × 28 ÷ 360).

29 Cash 72,300

Notes Receivable 72,000

Interest Receivable 10

Interest Revenue 290($72,000 × 5% × 29 ÷ 360).

Apr. 20

Due Date

Jan. 28

(a)

June 22Nov. 17Dec. 5

($27,000 × 6% × 60 ÷ 360)

Interest Due at Maturity

(b)

($72,000 × 5% × 30 ÷ 360)

($80,000 × 5% × 45 ÷ 360)($24,000 × 9% × 60 ÷ 360)($42,000 × 6% × 120 ÷ 360)($54,000 × 7% × 90 ÷ 360)

9-27© 2018 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 9 Receivables

Prob. 9-5A

Apr. 10 Notes Receivable 144,000Accounts Receivable 144,000

May 15 Notes Receivable 270,000Accounts Receivable 270,000

June 9 Cash 145,200Notes Receivable 144,000Interest Revenue 1,200

Aug. 22 Notes Receivable 150,000Accounts Receivable 150,000

Sept. 12 Cash 276,300Notes Receivable 270,000Interest Revenue 6,300

30 Notes Receivable 210,000Accounts Receivable 210,000

Oct. 6 Cash 150,750Notes Receivable 150,000Interest Revenue 750

18 Notes Receivable 120,000Accounts Receivable 120,000

Nov. 29 Cash 212,800Notes Receivable 210,000Interest Revenue 2,800

Dec. 17 Cash 121,000Notes Receivable 120,000Interest Revenue 1,000

9-28© 2018 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 9 Receivables

Prob. 9-6A

Jan. 3 Notes Receivable 18,000Cash 18,000

Feb. 10 Accounts Receivable—Bradford & Co. 24,000Sales 24,000

10 Cost of Merchandise Sold 14,400Merchandise Inventory 14,400

13 Accounts Receivable—Dry Creek Co. 60,000Sales 60,000

13 Cost of Merchandise Sold 54,000Merchandise Inventory 54,000

Mar. 12 Notes Receivable 24,000Accounts Receivable—Bradford & Co. 24,000

14 Notes Receivable 60,000Accounts Receivable—Dry Creek Co. 60,000

Apr. 3 Notes Receivable 18,000Cash 360

Notes Receivable 18,000Interest Revenue 360

($18,000 × 8% × 90 ÷ 360).

May 11 Cash 24,280Notes Receivable 24,000Interest Revenue 280

($24,000 × 7% × 60 ÷ 360).

13 Accounts Receivable—Dry Creek Co. 60,900Notes Receivable 60,000Interest Revenue 900

($60,000 × 9% × 60 ÷ 360).

July 12 Cash 62,118Accounts Receivable—Dry Creek Co. 60,900Interest Revenue 1,218

($60,900 × 12% × 60 ÷ 360).

9-29© 2018 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 9 Receivables

Prob. 9-6A (Concluded)

Aug. 1 Cash 18,540Notes Receivable 18,000Interest Revenue 540

($18,000 × 9% × 120 ÷ 360).

Oct. 5 Accounts Receivable—Halloran Co. 13,500Sales 13,500

5 Cost of Merchandise Sold 8,100Merchandise Inventory 8,100

15 Cash 13,500Accounts Receivable—Halloran Co. 13,500

Prob. 9-1B

1. and 2.

Apr. 3 12,750 Jan. 1 Balance 50,000July 16 16,500 19 2,660Dec. 31 24,000 Nov. 23 4,000

Dec. 31 Unadjusted Balance 3,410

31 Adjusting Entry 56,590

31 Adjusted Balance 60,000

Dec. 31 Adjusting Entry 56,590

3. $2,290,000 ($2,350,000 – $60,000)

4. a. $79,000 ($15,800,000 × 0.005)b. $82,410 ($79,000 + $3,410)c. $2,267,590 ($2,350,000 – $82,410)

Allowance for Doubtful Accounts

Bad Debt Expense

9-30© 2018 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 9 Receivables

Prob. 9-1B (Concluded)

2. Jan. 19 Accounts Receivable—Arlene Gurley 2,660Allowance for Doubtful Accounts 2,660

19 Cash 2,660Accounts Receivable—Arlene Gurley 2,660

Apr. 3 Allowance for Doubtful Accounts 12,750Accounts Receivable—Premier GS Co. 12,750

July 16 Cash 5,500Allowance for Doubtful Accounts 16,500

Accounts Receivable—Hayden Co. 22,000

Nov. 23 Accounts Receivable—Harry Carr 4,000Allowance for Doubtful Accounts 4,000

23 Cash 4,000Accounts Receivable—Harry Carr 4,000

Dec. 31 Allowance for Doubtful Accounts 24,000Accounts Receivable—Cavey Co. 3,300Accounts Receivable—Fogle Co. 8,100Accounts Receivable—Lake Furniture 11,400Accounts Receivable—Melinda Shryer 1,200

31 Bad Debt Expense 56,590Allowance for Doubtful Accounts 56,590

Uncollectible accounts estimate($60,000 – $3,410).

9-31© 2018 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 9 Receivables

Prob. 9-2B

1.

Customer

Arcade Beauty

Creative Images

Excel Hair Products

First Class Hair Care

Golden Images 38 days (7 + 31)

Oh That Hair 32 days (1 + 31)

One Stop Hair Designs 24 days

Visions Hair & Nail

2. and 3.

Not

Past Over

Customer Balance Due 1–30 31–60 61–90 91–120 120

ABC Beauty 15,000 15,000

Angel Wigs 8,000 8,000

Zodiac Beauty 3,000 3,000

Subtotals 875,000 415,000 210,000 112,000 55,000 18,000 65,000

Arcade Beauty 10,000 10,000

Creative Images 8,500 8,500

Excel Hair Products 7,500 7,500

First Class Hair Care 6,600 6,600

Golden Images 3,600 3,600

Oh That Hair 1,400 1,400

One Stop Hair Designs 4,000 4,000

Visions Hair & Nail 9,000 9,000

Totals 925,600 424,000 214,000 117,000 63,500 24,600 82,500

Percentage uncollectible 1% 4% 16% 25% 40% 80%

Estimate of uncollectible

accounts 123,235 4,240 8,560 18,720 15,875 9,840 66,000

Dec. 7, 20Y1

Oct. 30, 20Y1

July 3, 20Y1

Days Past Due

Due Date

Aug. 17, 20Y1

Number of Days Past Due

136 days (14 + 30 + 31 + 30 + 31)

December 31, 20Y1

Sept. 8, 20Y1

Jan. 11, 20Y2

114 days (22 + 31 + 30 + 31)

Not past due

Aging of Receivables Schedule

62 days (1 + 30 + 31)

181 days (28 + 31 + 30 + 31 + 30 + 31)

Nov. 23, 20Y1

Nov. 29, 20Y1

9-32© 2018 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 9 Receivables

Prob. 9-2B (Concluded)

4. Bad Debt Expense 115,860Allowance for Doubtful Accounts 115,860

Uncollectible accounts estimate($123,235 – $7,375).

5. On the balance sheet, assets would be overstated by $115,860 because the allowance for doubtful accounts would be understated by $115,860. In addition, the owner’s capital account would be overstated by $115,860 because bad debt expense would be understated and net income overstated by $115,860 on the income statement.

Prob. 9-3B

1.

Increase Balance of

Expense Expense (Decrease) Allowance

Actually Based on in Amount Account,Reported Estimate of Expense End of Year

$18,000 $31,250 $13,250 $13,25030,200 37,000 6,800 20,05039,900 45,000 5,100 25,15052,600 60,000 7,400 32,550

2. Yes. The actual write-offs of accounts originating in the first two years are reasonably close to the expense that would have been charged to those years onthe basis of 1/4% of sales. The total write-off of receivables originating in the firstyear amounted to $30,600 ($18,000 + $9,000 + $3,600), as compared to bad debtexpense, based on the percentage of sales of $31,250 ($12,500,000 × 0.0025). For the

second year, the comparable amounts were write-offs of $35,600 ($21,200 + $9,300 + $5,100) and bad debt expense of $37,000 ($14,800,000 × 0.0025).

3rd

4th

Bad Debt Expense

Year

1st

2nd

9-33© 2018 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 9 Receivables

Prob. 9-4B

1.

Note

1. $1102. 5253. 6004. 2005. 4806. Feb. 8 240

2. Oct. 10 Accounts Receivable 48,600

Notes Receivable 48,000

Interest Revenue 600

3. Dec. 31 Interest Receivable 452

Interest Revenue 452

Accrued interest.$36,000 × 8% × 46 ÷ 360 = $368

$24,000 × 6% × 21 ÷ 360 = 84

Total $452

4. Jan. 14 Cash 36,480

Notes Receivable 36,000

Interest Receivable 368

Interest Revenue 112($36,000 × 8% × 14 ÷ 360).

Feb. 8 Cash 24,240

Notes Receivable 24,000

Interest Receivable 84

Interest Revenue 156($24,000 × 6% × 39 ÷ 360).

Feb. 13

Due Date

Jan. 14

(a)

Apr. 23Oct. 10Nov. 6

($36,000 × 8% × 60 ÷ 360)

Interest Due at Maturity

(b)

($24,000 × 6% × 60 ÷ 360)

($33,000 × 4% × 30 ÷ 360)($60,000 × 7% × 45 ÷ 360)($48,000 × 5% × 90 ÷ 360)($16,000 × 6% × 75 ÷ 360)

9-34© 2018 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 9 Receivables

Prob. 9-5B

Mar. 8 Notes Receivable 33,000Accounts Receivable 33,000

31 Notes Receivable 80,000Accounts Receivable 80,000

May 7 Cash 33,275Notes Receivable 33,000Interest Revenue 275

16 Notes Receivable 72,000Accounts Receivable 72,000

June 11 Notes Receivable 36,000Accounts Receivable 36,000

29 Cash 81,400Notes Receivable 80,000Interest Revenue 1,400

July 26 Cash 36,270Notes Receivable 36,000Interest Revenue 270

Aug. 4 Notes Receivable 48,000Accounts Receivable 48,000

14 Cash 73,260Notes Receivable 72,000Interest Revenue 1,260

Dec. 2 Cash 49,440Notes Receivable 48,000Interest Revenue 1,440

9-35© 2018 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 9 Receivables

Prob. 9-6B

Jan. 21 Accounts Receivable—Black Tie Co. 28,000Sales 28,000

21 Cost of Merchandise Sold 16,800Merchandise Inventory 16,800

Mar. 18 Notes Receivable 28,000Accounts Receivable—Black Tie Co. 28,000

May 17 Cash 28,280Notes Receivable 28,000Interest Revenue 280

($28,000 × 6% × 60 ÷ 360).

June 15 Accounts Receivable—Pioneer Co. 17,700Sales 17,700

15 Cost of Merchandise Sold 10,600Merchandise Inventory 10,600

21 Notes Receivable 18,000Cash 18,000

25 Cash 17,700Accounts Receivable—Pioneer Co. 17,700

July 21 Notes Receivable 18,000Cash 120

Notes Receivable 18,000Interest Revenue 120

($18,000 × 8% × 30 ÷ 360).

Sept. 19 Cash 18,270Notes Receivable 18,000Interest Revenue 270

($18,000 × 9% × 60 ÷ 360).

22 Accounts Receivable—Wycoff Co. 20,000Sales 20,000

9-36© 2018 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 9 Receivables

Prob. 9-6B (Concluded)

Sept. 22 Cost of Merchandise Sold 12,000Merchandise Inventory 12,000

Oct. 14 Notes Receivable 20,000Accounts Receivable—Wycoff Co. 20,000

Nov. 13 Accounts Receivable—Wycoff Co. 20,100Notes Receivable 20,000Interest Revenue 100

($20,000 × 6% × 30 ÷ 360).

Dec. 28 Cash 20,301Accounts Receivable—Wycoff Co. 20,100Interest Revenue 201

($20,100 × 8% × 45 ÷ 360).

9-37© 2018 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 9 Receivables

CP 9-1

Estimates of uncollectible accounts receivable create a unique financial reporting challenge. Because the company does not know with certainty the amount of accounts receivable that will be uncollectible, there is no “correct” estimate. The company must use its judgment along with historical data to develop an estimate that fairly presents the portion of credit sales that will become uncollectible. These estimates are required under GAAP and should be representationally faithful and accurately match bad debtexpense to revenues generated from credit sales.

In this case, both Tim and Gowen appear to be acting unethically. The historical dataindicate that a higher estimate is needed, and they have both knowingly ignored this data in order to improve the company’s reported earnings. Tim and Gowen have used the subjectivity in these estimates inappropriately. The result is a bad debt expenseamount that does not faithfully represent the potential losses associated with uncollectible accounts receivable.

CP 9-2

By computing interest using a 365-day year for depository accounts (liabilities), Bev is minimizing interest expense to the bank. By computing interest using a 360-day year for loans (assets), Bev is maximizing interest revenue to the bank. However, federal legislation (Truth in Lending Act) requires banks to computeinterest on a 365-day year. Hence, Bev is behaving in an unprofessional manner.

CP 9-3

A sample solution based on Nike Inc.’s Form 10-K for the fiscal year ended May 31, 2015, follows:

1. a. $3,358 million (from balance sheet)b. $78 million (Note 1)c. 21.0% ($3,358 ÷ $15,976) in 2015; 25.1% ($3,434 ÷ $13,696) in 2014.

Accounts receivable as a percentage of total current assets has increased.d. The amount for Nike is so small that it is not reported in the financial

statements.

2. The company’s receivables turnover has improved from 8.5 in 2014 to 9.0 in 2015, as shown below.

2015 2014Sales……………………………………………………… $30,601 $ 27,799

Beginning accounts receivable……………………… $ 3,434 $ 3,117Ending accounts receivable………………………… 3,358 3,434

Average accounts receivable………………………… $ 3,396 $3,275.5

Accounts receivable turnover……………………… 9.0 8.5

CASES & PROJECTS

9-38© 2018 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 9 Receivables

CP 9-4

To: Todd Hurley, CEO

From: A+ Student

Re: Allowance Method for Uncollectible Accounts

Accounts receivable result from the sale of goods to customers on account. Because

payment is received from customers after goods are delivered, there is a risk that

customers will default on their accounts. While the company does not know which

customers will default, it does have historical information on the portion of accounts

receivable that has become uncollectible in the past. The allowance method uses this

information to estimate the amount of accounts receivable that will be uncollectible

at the end of the accounting period. Based on this estimate, an adjusting entry is used to

record bad debt expense. However, because the company does not know which

customer accounts will be uncollectible, the specific customer accounts cannot be

removed. Instead, a contra asset account, Allowance for Doubtful Accounts, is credited

for the estimated bad debts in the adjusting journal entry:

Bad Debt Expense XXX

Allowance for Doubtful Accounts XXX

This adjusting entry affects both the income statement and balance sheet. On the

income statement, bad debt expense is matched against the revenues generated

by the accounts receivable. On the balance sheet, the accounts receivable balance is

reduced by the allowance for doubtful accounts, which is the portion of the accounts

receivable that the company does not expect to collect. This resulting number is the

amount of accounts receivable that the company expects to collect, called the net

realizable value of the receivables.

When a specific customer’s account is identified as uncollectible, it is written off against

the allowance account. This requires the company to remove the specific account

receivable from the accounts receivable ledger and an equal amount from the allowance

account. Because the adjusting entry for bad debt expense is an estimate and the

write-off of accounts receivable is based on actual defaults, the allowance account

will rarely have a zero balance at the beginning or end of a period.

9-39© 2018 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 9 Receivables

CP 9-5

1. a.Addition to Allowancefor Doubtful Accounts

$20,000 $15,000 ($20,000 – $5,000)22,000 18,750 ($5,000 + $22,000 – $8,250)24,000 22,050 ($8,250 + $24,000 – $10,200)25,500 21,300 ($10,200 + $25,500 – $14,400)

2. a. The estimate of 1/2 of 1% of credit sales may be too large because the allowancefor doubtful accounts has steadily increased each year. The increasing balanceof the allowance for doubtful accounts may also be due to the failure to writeoff a large number of uncollectible accounts. These possibilities could be evaluated by examining the accounts in the accounts receivable subsidiaryledger for collectibility and comparing the result with the balance in theallowance for doubtful accounts.

Note to Instructors: Because the allowance for doubtful accounts increased by 188%

[($14,400 – $5,000) ÷ $5,000] while sales increased by 27.5% [($5,100,000 – $4,000,000) ÷ $4,000,000], the increase cannot be explained by an expanding volume of sales.

b. The balance of Allowance for Doubtful Accounts that should exist at December 31, 20Y7, can only be determined after all attempts have been made to collect the receivables on hand at December 31, 20Y7. However, the account balances at December 31, 20Y7, could be analyzed, perhapsusing an aging schedule, to determine a reasonable amount of allowance and to determine accounts that should be written off. Also, past write-offs of uncollectible accounts could be analyzed in depth in order to develop a reasonable percentage for future adjusting entries, based on past history. Caution, however, must be exercised in using historical percentages. Specifically, inquiries should be made to determine whether any significant changes between prior years and the current year may have occurred, which might reduce the accuracy of the historical data. For example, a recent change in credit-granting policies or changes in the general economy (entering a recessionary period, for example) could reduce the usefulness of analyzing historical data.

Based on the preceding analyses, a recommendation to decrease the annual rate charged as an expense may be in order (perhaps Xtreme Co. is experiencing a lower rate of uncollectibles than is the industry average), or perhaps a change to the “estimate based on analysis of receivables” method may be appropriate.

20Y520Y620Y7

b.Accounts Written

Year Off During Year

20Y4

9-40© 2018 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 9 Receivables

CP 9-6

1. and 2.

Sales…………………………………

Average accts. receivable…………

Accts. receivable turnover…………

Average daily sales…………………

Days’ sales in receivables…………

The days’ sales in receivables could also be computed by dividing 365 days bythe accounts receivable turnover as follows:

Year 2: 11.3 (365 days ÷ 32.37)Year 1: 11.7 (365 days ÷ 31.17)

3. The accounts receivable turnover indicates an increase in the efficiency of collecting accounts receivable by increasing from 31.17 to 32.37, a favorable change. The days’ sales in receivables decreased from 11.7 days to 11.3, a favorable change. Thus, based on (1) and (2), Best Buy has increased its efficiency in the collection of receivables.

4. We assumed that the percentage of credit sales to total sales remains constant from one period to the next and no major changes in operations occurred between years. For example, if the percentage of credit sales to total sales is not similar or if the percentage changes between years, then the ratios would be distorted and, thus, not comparable. Also, any major changes in operations could distort the comparison between years.

$1,294$1,221[($1,162 + $1,280) ÷ 2] [($1,280 + $1,308) ÷ 2]

($40,339 ÷ 365)

31.1732.37

($1,221 ÷ $108.3) ($1,294 ÷ $110.5)

11.711.3

($39,528 ÷ $1,221) ($40,339 ÷ $1,294)

$108.3($39,528 ÷ 365)

$110.5

Year 2 Year 1

$39,528 $40,339

9-41© 2018 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 9 Receivables

CP 9-7

1. Year 2: 6.93 {$233,715 ÷ [($35,889 + $31,537) ÷ 2]}Year 1: 6.57 {$182,795 ÷ [($31,537 + $24,094) ÷ 2]}

2. Year 2: 52.7 days [($35,889 + $31,537) ÷ 2] = $33,713.0; [$33,713.0 ÷ ($233,715 ÷ 365)]Year 1: 55.5 days [($31,537 + $24,094) ÷ 2] = $27,815.5; [$27,815.5 ÷ ($182,795 ÷ 365)]

The days’ sales in receivables could also be computed by dividing 365 days bythe accounts receivable turnover as follows:

Year 2: 52.7 (365 days ÷ 6.93)Year 1: 55.6 (365 days ÷ 6.57) (Difference due to rounding)

3. The accounts receivable turnover indicates an increase in the efficiency of collecting accounts receivable by increasing from 6.57 to 6.93, a favorable change. The days’ sales in receivables decreased from 55.5 days to 52.7, a favorable change. Before a more definitive conclusion can be reached, the ratios should be compared with industry averages and similar firms.

9-42© 2018 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 9 Receivables

CP 9-8

1. and 2.

Sales…………………………………

Average accts. receivable…………

Accts. receivable turnover…………

Average daily sales…………………

Days’ sales in receivables…………

The days’ sales in receivables could also be computed by dividing 365 days bythe accounts receivable turnover as follows:

Year 2: 6.0 (365 days ÷ 61.33)Year 1: 5.9 (365 days ÷ 61.91)

3. The accounts receivable turnover indicates a slight decrease in the efficiency of collecting accounts receivable by decreasing from 61.91 to 61.33, an unfavorable change. The days’ sales in receivables increased from 5.9 days to 6.0 days, an unfavorable change. Before a more definitive conclusion can be reached, the ratios should be compared with industry averages and similar firms.

4. Costco’s accounts receivable turnover would normally be higher than that of atypical manufacturing company such as the Campbell Soup Company. This is because many of Costco’s customers charge their purchases to credit cardsor pay with checks or cash. In contrast, the customers of the Campbell Soup Company are other businesses that pay their accounts receivable on a less timely basis. For a recent year, the accounts receivable turnover ratio for Campbell Soup was 12.27 (see Ex. 9-27).

Year 2 Year 1

$116,199 $112,640

$1,894.5 $1,819.5

61.91($112,640 ÷ $1,819.5)

6.0 5.9

[($1,972 + $1,817) ÷ 2]

($116,199 ÷ $1,894.5)

[($1,817 + $1,822) ÷ 2]

61.33

($1,894.5 ÷ $318.4) ($1,819.5 ÷ $308.6)

($116,199 ÷ 365) ($112,640 ÷ 365)

$318.4 $308.6

9-43© 2018 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

CHAPTER 9 Receivables

CP 9-9

1. Note to Instructors: The turnover ratios will vary over time. Recently, the

various turnover ratios (rounded to one decimal place) were as follows:

Alcoa Inc. ……………………………… 11.3AutoZone, Inc. ………………………… 44.6Barnes & Noble, Inc. ………………… 22.9Caterpillar ……………………………… 2.6The Coca-Cola Company …………… 10.5Delta Air Lines ………………………… 15.2The Home Depot ……………………… 57.7IBM ……………………………………… 2.7Kroger …………………………………… 91.1Procter & Gamble …………………… 11.1Wal-Mart ………………………………… 72.2Whirlpool Corporation ……………… 6.8

Based on the above ratios, the companies can be categorized as follows:

Alcoa Inc. AutoZone, Inc.Caterpillar Barnes & Noble, Inc.The Coca-Cola Company Delta Air LinesIBM The Home DepotProcter & Gamble KrogerWhirlpool Corporation Wal-Mart

2. The companies with accounts receivable turnover ratios above 15 are all companies selling primarily to individual consumers. In contrast, companies with turnover ratios below 15 are companies selling primarily to other businesses. Generally, we would expect companies selling to individual consumers to have higher turnover ratios, since many customers will charge their purchases on credit cards. In contrast, companies selling to other businesses normally allow a credit period of at least 30 days or longer.

Below 15 Above 15Accounts Receivable Turnover Ratio

9-44© 2018 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.