ch7.ppt

-

Upload

chang-chan-chong -

Category

Documents

-

view

218 -

download

0

Transcript of ch7.ppt

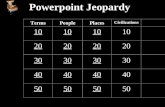

CHAPTER 7

Flexible Budgets,Direct-Cost Variances,

andManagement Control

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-2

Distinguish

a static budget

from a flexible budget.

Learning Objective 1

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-3

Basic Concepts

Static (Master) Budget – is based on the output planned at the start of the budget period.

Flexible budget calculates budgeted revenues and budgeted costs based on the actual level of output in the budget period.

Variance – difference between an actual and an expected (budgeted) amount

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-4

Static and Flexible Budgets

Static BudgetPlanned level ofoutput at start ofthe budget period

Based on

Flexible BudgetBudgeted revenuesand cost based on

actual level of output

Based on

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-5

Static Budget Example

Assume that Pasadena Co. manufacturesand sells dress suits.

Budgeted variable costs per suit are as follows:Direct materials cost $ 65Direct manufacturing labor 26Variable manufacturing overhead 24 Total variable costs/unit $115

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-6

Static Budget Example

Budgeted selling price is $155 per suit.

Fixed manufacturing costs are expectedto be $286,000 within a relevant range

between 9,000 and 13,500 suits.

Variable and fixed period costs are ignored.

The static budget for year 2004 is basedon selling 13,000 suits.

What is the static-budget operating income?

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-7

Static Budget Example

Revenues (13,000 × $155) $2,015,000Less Expenses:Variable (13,000 × $115) 1,495,000Fixed 286,000Budgeted operating income $ 234,000

Assume that Pasadena Co. produced and sold10,000 suits at $160 each with actual variablecosts of $120 per suit and fixed manufacturing

costs of $300,000.

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-8

Static Budget Example

Revenues (10,000 × $160) $1,600,000 Less Expenses: Variable (10,000 × $120) 1,200,000 Fixed 300,000 Actual operating income $ 100,000

What was the actual operating income?

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-9

Static-Budget Variance Example

What is the static-budget variance ofoperating income?

Actual operating income $100,000Budgeted operating income 234,000Static-budget variance of operating income $134,000 U

This is a Level 1 variance analysis.

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-10

Basic Concepts

Static-Budget Variance (Level 1) – the difference between the actual result and the corresponding static budget amount

Favorable Variance (F) – has the effect of increasing operating income relative to the budget amount

Unfavorable Variance (U) – has the effect of decreasing operating income relative to the budget amount

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-11

Static-Budget Variance Example

Static-Budget Based Variance Analysis(Level 1) in (000) Static Budget Actual Variance

Suits 13 10 3 URevenue $2,015 $1,600 $415 UVariable costs 1,495 1,200 296 FContribution margin $ 520 $ 400 $120 UFixed costs 286 300 14 UOperating income $ 234 $ 100 $134 U

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-12

Learning Objective 2

Develop a flexible budgetand compute flexible-budgetvariances and sales-volume

variances.

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-13

Steps in Developing Flexible Budgets

Step 1:Identify actual quantity of output.

In the year 2004, 10,000 suits were produced and sold.

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-14

Steps in Developing Flexible Budgets

Step 2:Identify the flexible budget for revenues

based on budgeted selling price and actual quantity of output.

$155 × 10,000 = $1,550,000

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-15

Steps in Developing Flexible Budgets

Step 3:Identify the flexible budget for costs based on budgeted variable cost per unit, budgeted fixed cost, and actual quantity of output.

Variable costs: 10,000 × $115 = $1,150,000Fixed costs 286,000Total costs $1,436,000

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-16

Steps in Developing Flexible BudgetsFlexible budget:

Units sold 10,000Revenues 1,550,000Variable costs 1,150,000Contribution margin 400,000Fixed costs 286,000Operating income 114,000

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-17

Level 2 variances

Level 2 analysis provides informationon the two components of the

static-budget variance.

1. Flexible-budget variance

2. Sales-volume variance

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-18

Level 2 variances

Static budget variance is broken down into:Sales-volume variance: the difference between output from the flexible budget and the static budget output level. Flexible-budget variance: the difference between actual revenues or costs and the corresponding flexible budget amounts.

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-19

Sales-Volume Variance

Sales-Volume Variance(Level 2) in (000) Flexible Static Sales-Volume

Budget Budget VarianceSuits 10 13 3 URevenue $1,550 $2,015 $465 UVariable costs 1,150 1,495 295 FContr. margin $ 400 $ 520 $120 UFixed costs 286 286 0Operating income $ 114 $ 234 $120 U

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-20

Flexible-Budget Variance

Flexible-budget variance (level 2)= Actual results – Flexible budget

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-21

Flexible-Budget Variance

Flexible-Budget Variance(Level 2) in (000) Flexible

Budget Actual VarianceSuits 10 10 0Revenue $1,550 $1,600 $ 50 FVariable costs 1,150 1,200 50 UContribution margin $ 400 $ 400 $ 0Fixed costs 286 300 14 UOperating income $ 114 $ 100 $ 14 U

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-22

Flexible-Budget Variance

Actual quantity sold: 10,000 suits

Flexible-budgetVariance for OI

$14,000 U

Actualoperating income

$100,000

Flexible-budgetoperating income

$114,000

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-23

Budget Variances

Static-budgetvariance

$134,000 U

Flexible-budgetvariance

$14,000 U

Level 1

Sales-volumevariance

$120,000 ULevel 2

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-24

Flexible-Budget Variance

Flexible-Budget Variance(Level 2) in (000) Flexible

Budget Actual VarianceSuits 10 10 0Revenue $1,550 $1,600 $ 50 FVariable costs 1,150 1,200 50 UContribution margin $ 400 $ 400 $ 0Fixed costs 286 300 14 UOperating income $ 114 $ 100 $ 14 U

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-25

Flexible-Budget Variance

Selling price variance: the flexible-budget variance for revenues arising from the difference from actual and budgeted selling price.

Selling price variance=(Actual selling price – Budgeted selling price) *Actual units sold

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-26

Learning Objective 4

Compute price variancesand efficiency variances

for direct-cost categories.

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-27

Evaluation

Level 1 tells the user very little other than how much Contribution Margin was off from budget. Level 1 answers the question: “How much were

we off in total?” Level 2 gives the user a little more information: it

shows which line-items led to the total Level 1 variance Level 2 answers the question: “Where were we

off?”

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-28

A Flexible-Budget Example

Actual Results Flexible Budget Static Budget

Units Sold 100 - N/A 100 10 F 90

Revenues 3,500$ 500$ F 3,000$ 300$ F 2,700$Variable Costs: Direct Materials 700 100 U 600 60 U 540 Direct Labor 1,000 - N/A 1,000 100 U 900 Variable Factory Overhead 500 (100) F 600 60 U 540

Contribution Margin 1,300 500 F 800 80 F 720

Fixed Costs 600 (100) F 700 - N/A 700

Operating Income 700$ 600$ F 100$ 80$ F 20$

Flexible-BudgetVariances

Sales-VolumeVariances

Level 2 Variances:Sales-Volume

Level 2 Variances:Flexible-BudgetLevel 3

Variances will explore these figures in detail

Level 1 Variance:Static-Budget

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-29

Level 3 Variances

The total variance for direct materials and direct labor can be subdivided into two components—price and efficiency.

These two variances help explain the two reasons that the actual cost differs from the budgeted numbers.

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-30

Level 3 Variances

The price variance (or input-price variance) reflects the difference between an actual input price and a budgeted input price. When referring to direct labor, this is sometimes called the rate variance.

Price Actual Price Budgeted Price Actual QuantityVariance Of Input Of Input Of InputX= { - }

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-31

Actual Data

Direct materials purchased and used:42,500 square yards at $15.95

Labor hours: 21,500 at $12.90

Cost of direct materials = $677,875

Cost of direct manufacturing labor = $277,350

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-32

Static Budget Data

Direct material: 52,000 square yards at $16.25

Direct Labor: 26,000 hours at $13.00

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-33

Price Variance Example

Direct-material price variance

Actual price – Budgeted price

× Actualquantity

($15.95 – $16.25) × 42,500 = $12,750 F=

=

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-34

Price Variance Example

Direct-labor price variance

Actual price – Budgeted price

× Actualquantity

($12.90 – $13.00) × 21,500 = $2,150 F=

=

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-35

Level 3 Variances

The efficiency variance reflects the difference between an actual input quantity and a budgeted input quantity. For direct materials, this is sometimes referred to as the usage variance.

Efficiency Actual Quantity Budgeted Quantity of Input Budgeted PriceVariance Of Input Used Allowed for Actual Output Of InputX= { - }

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-36

Efficiency Variance Example

Direct-labor efficiency variance

Actual quantity – Standard

quantity× Standard

price

(21,500 – 20,000) × $13.00 = $19,500 U=

=

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-37

Efficiency Variance Example

Direct-material efficiency variance

Actual quantity – Standard

quantity× Standard

price

(42,500 – 40,000) × $16.25 = $40,625 U=

=

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-38

Static-budget varianceMaterials $167,125 FLabor 60,650 FTotal $227,775 F

Flexible-budget varianceMaterials $27,875 ULabor 17,350 UTotal $45,225 U

Sales-volume varianceMaterials $195,000 FLabor 78,000 FTotal $273,000 F

Level 1

Level 2

Variance Analysis

Level 2

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-39

Flexible-budget varianceMaterials $27,875 ULabor 17,350 UTotal $45,225 U

Price varianceMaterials $12,750 FLabor 2,150 FTotal $14,900 F

Efficiency varianceMaterials $40,625 ULabor 19,500 UTotal $60,125 U

Level 2

Level 3

Variance Analysis

Level 3

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-40

Learning Objective 3

Explain why standard costs areoften used in variance analysis.

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-41

Standard costs

A standard is a carefully determined price, cost, or quantity that is used as a benchmark for judging performance. A standard can be thought of as a budget for one unit of product.

It is usually expressed on a per-unit basis. A standard input is a quantity of input such

as 2 pounds of raw material for each completed unit .

A standard price is the price a company expects to pay for a unit of input, such as $10 per direct labor hour.

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-42

Standard costs

A standard cost is the cost the company expects a unit of finished product to cost the company.

Standard cost per output unit for each variable direct cost input

= Standard input allowed per output unit

* Standard price per input unit

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-43

Standards

4 square yards allowed per output unit at $16.25 standard cost per square yard.

Standard direct material cost per output unit 4.00 × $16.25 = $65.00

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-44

Standards

2 manufacturing labor-hours of inputallowed per output unit at $13.00 standard

cost per hour.

Standard direct manufacturing labor cost per output unit

2.00 × $13.00 = $26.00

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-45

Advantages of standard costs

Exclude past efficiencies Take into account changes expected to occur

in the budget period. Simplify product costing

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-46

Standard costing system

Inputs are recorded at standard. Each variance may be journalized Each variance has its own account Favorable variances are credits; Unfavorable variances

are debits Variance accounts are generally closed into Cost of

Goods Sold at the end of the period, if immaterial If material, the variance accounts are prorated between

COGS and various inventory accounts.

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-47

Price Variance Example

Direct-material price variance

Actual price – Standard price

× Actualquantity

($15.95 – $16.25) × 42,500 = $12,750 F=

=

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-48

Price Variance Example

What is the journal entry when the materials pricevariance is isolated at the time of purchase?

Materials Control 690,625Direct-Materials Price Variance 12,750Accounts Payable Control 677,875To record direct materials purchased

Standard cost of materials purchased

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-49

Efficiency Variance Example

Direct-material efficiency variance

Actual quantity – Standard

quantity× Standard

price

(42,500 – 40,000) × $16.25 = $40,625 U=

=

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-50

Efficiency Variance

What is the journal entry to record materials used?

Work in Process Control 650,000Direct-Materials Efficiency Variance 40,625

Materials Control 690,625To record direct materials used

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-51

Price Variance Example

Direct-labor price variance

Actual price – Standard price

× Actualquantity

($12.90 – $13.00) × 21,500 = $2,150 F=

=

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-52

Efficiency Variance Example

Direct-labor efficiency variance

Actual quantity – Standard

quantity× Standard

price

(21,500 – 20,000) × $13.00 = $19,500 U=

=

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-53

Price and Efficiency Variance

What is the journal entry for direct manufacturing labor?

Work in Process Control 260,000Direct ManufacturingLabor Efficiency Variance 19,500

Direct-ManufacturingLabor Price Variance 2,150Wages Payable 277,350

To record liability for direct manufacturing labor

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-54

Learning Objective 5

Understand how managers use variances

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-55

Management Uses of Variances

To understand underlying causes of variances

Recognition of inter-relatedness of variances.

Variances should not be interpreted in isolation.

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-56

When to Investigate Variances

Subjective judgments

Rules of thumb as “investigate all variancesexceeding $10,000 or 25% of expected cost,

whichever is lower.”

Variances should be investigated when they are considered material. It is equally important to investigate favorable variances as unfavorable.

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-57

Management Uses of Variances

Managers use variances in three ways:1. To evaluate performance after decisions are implemented. Managerial performance evaluation must occur on two

dimensions—effectiveness and efficiency.

Effectiveness is the degree to which apredetermined objective or target is met.

Efficiency is the relative amount of inputsused to achieve a given level of output.

Variances should not solely be used toevaluate performance.

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-58

Management Uses of Variances

2. To trigger organizational learning

Managers need to understand why variances arise, learn from them, and improve future performance.

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-59

Management Uses of Variances

3. To make continuous improvements

Variances are used to create a cycle of continuous improvement by identifying causes of the variances, initiating corrective actions, and evaluating the results of those actions.

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-60

Learning Objective 6

Perform variance analysis inactivity-based costing systems.

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-61

Activity-Based Costing and Variances

Focusing on the cost hierarchy. Flexible budget calculations are made based on the

level the cost occupies in the hierarchy. For example, because material handling costs are treated as a batch level cost. The flexible budget calculations should be performed at the batch level. The standard would be based on the number of batches required for the given level of output.

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-62

Flexible Budgeting andActivity-Based Costing

Denver Co. produces metal planters (MP).

Assume that material-handling labor costs varywith the number of batches produced rather

than the number of units in a batch.

Material-handling labor costs are direct batchlevel costs that vary with the number of batches.

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-63

Flexible Budgeting and Activity-Based Costing

Static ActualBudget Amounts

Units produced and sold 18,000 15,660Batch size 180 174Number of batches 100 90Material-handling labor-hours per batch 5.00 5.20

Total labor-hours 500 468Cost per material-handling labor-hour $14.00 $14.50Total material-handling

labor cost $7,000 $6,786

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-64

Flexible Budgeting andActivity-Based Costing

How many batches should have been employedto produce the actual output units?

15,660 units ÷ 180 units per batch = 87 batches

How many material-handling hoursshould have been used?

87 batches × 5 hours/batch = 435 hours

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-65

Flexible Budgeting andActivity-Based Costing

What is the flexible budget formaterial-handling labor costs?

435 hours × $14.00/labor-hour = $6,090

Flexible-budget costs $6,090 Actual costs 6,786 Flexible-budget variance $ 696 U

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-66

Price and Efficiency Variances

Price variance = ($14.50 – $14.00) × 468 = $234 U

Efficiency variance = (468 – 435) × $14.00 = $462 U

Total variance $696 U

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-67

Activity-Based Costing and Variances

Possible reasons: Smaller actual batch sizes, resulting in larger

number of batches Higher actual material handing labor-hours

per batch

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-68

Learning Objective 7

Describe benchmarkingand how it is used

in cost management.

To accompany Cost Accounting 12e, by Horngren/Datar/Foster. Copyright © 2006 by Pearson Education. All rights reserved. 7-69

Benchmarking and Variances

Benchmarking is the continuous process of comparing the levels of performance in producing products and services against the best levels of performance in competing companies having similar processes.

Variances can be extended to include comparison to other entities.

![[PPT]Chapter 5: Verbal and Nonverbal Communication in …inanc/team/ppt/ch7.ppt · Web viewTitle Chapter 5: Verbal and Nonverbal Communication in Groups Author dwynn Last modified](https://static.fdocuments.net/doc/165x107/5aabdeed7f8b9a2e088c60b3/pptchapter-5-verbal-and-nonverbal-communication-in-inancteampptch7pptweb.jpg)

![Audit evidence a framework (ppt ch7[1].pdf)](https://static.fdocuments.net/doc/165x107/54becbbb4a79596d138b4570/audit-evidence-a-framework-ppt-ch71pdf.jpg)

![INSTALL GUIDE OEM CH RS CH7 ADS CH7 EN - …cdncontent2.idatalink.com/.../RS-CH7/...CH7-[ADS-CH7]-EN_20160811.pdfU.S. Patent No. 8,856,780 BOX CONTENTS](https://static.fdocuments.net/doc/165x107/5af03fd77f8b9ad0618dd202/install-guide-oem-ch-rs-ch7-ads-ch7-en-ads-ch7-en20160811pdfus-patent.jpg)