CERI Idemitsu Astomos Meeting Midstream Donwstream (2)

description

Transcript of CERI Idemitsu Astomos Meeting Midstream Donwstream (2)

Relevant • Independent • Objectivewww.ceri.ca

Natural Gas Liquids (NGLs) in North America:

Focus on Western Canada

Future outlook and West Coast LPG export

opportunities

Image Sources: Husky, Pembina, and Lyondellbasell

November 13, 2014Peter Howard

President Emeritus&

Carlos A. Murillo Economic Researcher

Canadian Energy Research Institute

(CERI)

1

Relevant • Independent • Objectivewww.ceri.ca

Presentation Outline

• About CERI and our work

• Upstream: Perspectives on Western Canada Gas Development

• Midstream & Downstream: Infrastructure and ongoing investments

• NGLs Market Fundamentals: LPG market dynamics and outlook/opportunities• North American LPG export availability and West Coast opportunity

• Opportunities for cooperation

• Q&A/Discussion

Image Source: Nova Chemicals2

Relevant • Independent • Objectivewww.ceri.ca

Canadian Energy Research Institute (CERI)Founded in 1975, CERI is an independent, non-profit research institute specializing in the

analysis of energy economics and related environmental policy issues in the energy production, transportation, and demand sectors.

Our mission is to provide relevant, independent, and objective economic research in energy and related environmental issues. A central goal of CERI is to bring the insights of scientific research,

economic analysis, and practical experience to the attention of government policy-makers, business sector decision-makers, the media, and citizens of Canada and abroad.

Our core supporters include the Government of Canada (Natural Resources Canada), the Government of Alberta (Alberta Energy), and the Canadian Association of Petroleum Producers

(CAPP). In-kind support is also provided by the Alberta Energy Regulator (AER) and the University of Calgary.

All of CERI’s research is publicly available on our website at:

www.ceri.ca

3

Relevant • Independent • Objectivewww.ceri.ca

Our Work:Current Work (2014 – 2015):

• LNG Update

• Canadian Rail System

• Electricity Requirements for Oil Sands Industry

• Others…

Recently Released Reports (2013 – 2014):

• Canadian Economic Impacts of New and Existing Development in Alberta

• Oil Sands Environmental Impacts

• Natural Gas Liquids (NGLs) in North America: An Update (Parts I – V)

• Others…

Periodicals/Monthly Reports:

• Crude Oil Commodity Report

• Natural Gas Commodity Report

• Geopolitics of Energy (Subscription Service)

Annual Conferences:

• Natural Gas Conference (March 2015)

• Oil Conference (April 2015)

• Petrochemical Conference (June 2015)

4

Relevant • Independent • Objectivewww.ceri.ca

Upstream: Perspectives on Western Canada Gas Developments

Image from Husky5

Relevant • Independent • Objectivewww.ceri.ca

Natural Gas In North America

6Images from US Energy Information Administration (EIA), Canadian Centre for Energy Information, and Government of Alberta (GOA)

Canada

Alberta

Relevant • Independent • Objectivewww.ceri.ca

Ethane (C2)

Non-energy Use:

•Petrochemical Feedstock

•Enhanced Oil Recovery (EOR)

Heating, Other

(left in gas)

Propane

(C3)

Energy: Retail

•Commercial/Institutional

•Residential

•Transportation

•Agriculture

Energy: Wholesale (Industrial)

•Oil & Gas

•Manufacturing

•Construction

Non-energy Use

•Petrochemical Feedstock

•Solvent Flood (EOR)

Butanes

(C4s)

Non-energy use

•Gasoline blending

•Petrochemical Feedstock

•Oil sands diluent

•Solvent Flood (EOR)

Pentanes Plus/ Condensate

(C5+)

Non-energy Use:

•Oil Sands Dliuent

•Gasoline blending

•Petrochemical Feedstock

NGLs in Canada: Sources and End-Uses

7

Natural Gas, Crude Oil, and Crude Bitumen

Gas Plant Liquids (C2, C3, C4s, C5+)

Refinery Liquefied Petroleum Gases (LPGs)

(Primarily C3, C4s)

Upgrader/Off-gas plants Synthetic Gas Liquids (SGLs)

(NGLs/Olefins Mix)

Wellhead or Field Condensate (C5+)

UP

STR

EAM

MID

STR

EAM

DO

WN

STR

EAM

PROCESSING, TRANSPORTATION, AND STORAGE INFRASTRUCTURE

Relevant • Independent • Objectivewww.ceri.ca

Midstream & Downstream:Infrastructure & Ongoing

Investments

Image from Veresen 8

Relevant • Independent • Objectivewww.ceri.ca

NGLs: from Reservoirs to Markets

9

UPSTREAM (SOURCES)

Crude OilTransporation

Infrastructure

Natural Gas

Gas Processing Plants

MIDSTREAM (PROCESSING & TRANSPORTATION) DOWNSTREAM (END-USE MARKETS)

Refineries &

Upgraders

Fractionators

Straddle Plants

Crude Oil & Condensate

Raw Gas

Sales Gas to Local Markets

Spec NGLs

Sales Gas to Export Markets

Spec NGLs

Sales

Gas

Crude Oil &

Condensate

Spec NGLs

Spec NGLs

NGLs Mix

Refined Petroleum Products to Markets

Sales

Gas

~91%

~9%

Images from Canadian Centre for Energy Information, Keyera, Imperial Oil, Inter-pipeline Fund, and US EIA. Figure by CERI

Relevant • Independent • Objectivewww.ceri.ca

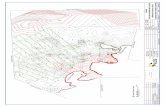

Canadian Midstream Infrastructure: From natural gas to NGLs to end-use markets

- Robust and extensive midstream and marketing infrastructure in Canada

targeting local and US markets

- Large natural gas storage and marketing hub (AECO-C) with takeaway export

capacity exceeding 15 bcf/d out of Western Canada

- Approximately 700 gas extraction plants(including over 50 deep-cut facilities) with over 30 bcf/d of extraction capacity and 15

bcf/d of re-processing or straddle plant capacity with ability to extract large

volumes of NGLs

- Approximately 400 kb/d of NGLs gathering pipeline capacity to Ft. Sk, ~400 kb/d of NGLs pipeline import capacity and ~200

kb/d of NGLs pipeline export capacity

- Over 1 MMb/d of fractionation capacity at the field and merchant levels with 300 kb/d

located at Ft. Sk and >100 kb/d in Sarnia

- ~40 MMb of NGLs storage capacity

- Integrated rail and truck NGL loading and offloading terminals

- Ethylene cracking facilities with capacity to absorb ~300 kb/d of NGLs and produce 11

MMlbs/yr of ethylene derivatives

Figure by CERI, with data from PenWell MAPSearch 10

NATURAL GASNGLs

Relevant • Independent • Objectivewww.ceri.ca

NGLs Pipelines and Storage

11

Bo

real

Figure by CERI, with data from IHS Energy (University of Calgary), AER, BCME, OGJ, SOEP, various industry sources . Logo from Alberta Industrial Heartland Association (AIHA) and City of Edmonton

Pipeline Est. Capacity (kb/d) Product

Peace HVP System (NGLs) 76 C2+/ C3+

Cochrane-Edmonton (Co-Ed) System 68 C3+

Brazeau NGL Gathering System 57 C2+

Peace LVP System (Condensate) 52 C5+ (Includes Crude)

Northern System 49 C2+/ C3+

Boreal 43 NGLs/ Olefins Mix

Bonnie Glen 33 C5+ (Includes Crude)

Judy Creek 30 C3+

Total Raw Mix Pipelines Est. Capacity 408

Alberta Ethane Gathering System (AEGS) 334 Spec C2

Ethylene Delivery System (EDS) 86 Ethylene

Joffre Feedstock Pipeline (JFP) 48 NGLs

Enbridge Mainline (Lines 1/5)* 127 C3+ Mixes

Kerrobert (to Enbridge) 124 C3+ Mixes

Alliance Pipeline 93 NGLs in Gas

Cochin Pipeline 71 Spec C3/ USMW E/P Mix

Petroleum Transmission Company** 27 Spec C3/ C4

Total NGL Export Pipelines Est. Capacity 442

Southern Lights/ Line 13 171 C5+

Mariner West (Late 2013/ Early 2014) 48 Spec C2

Vantage Pipeline (2014) 43 Spec C2

UTOPIA Pipeline (2017-18)*** 59 Spec C2/ Spec C3

Total NGL Import Pipelines Est. Capacity 321

*Net of Kerrobert/ **CERI Estimate/ ***Announced

Raw Mix Pipelines to Ft. Saskatchewan

Petrochemical Feedstock Pipelines

NGL Export Pipelines

NGL Import Pipelines

Ft. Saskatchewan,

AB23.0 61%

Kerrobert, SK2.5 6%

Sarnia/ Corunna, ON

12.4 33%

NGLs Storage Capacity (MMb)

Total: 38 MMb

Relevant • Independent • Objectivewww.ceri.ca

North American Class I Railways and Major Canadian NGL Handling Facilities and Rail Car Fleet

• In 2012, 2/3 (or 88 kb/d) of all Canadian LPG exports (123 kb/d) moved via rail (C3/C4 split: 75/25)

• All exports to US markets

• CERI estimates that about 1,700 pressure-rated tank cars would have been used to transport those volumes, assuming a two-week return trip

• Rail transport is an important component of the LPG supply chain in Canada

• Going forward, most LPG exports from Canada will move via rail

12

Facility Onwer/ Operator Type Capacity (kb/d) Location

Redwater Pembina Pipeline Corporation C5+ rail off load facil ity 75 AB NGL Hub

Alberta Diluent Terminal (ADT) Keyera Corp. C5+ rail off load 50 AB NGL Hub

Edmonton Terminal Keyera Corp. C3,C4, C5+ loading/ offloading 34 AB NGL Hub

Rimbey Rail Terminal Keyera Corp. C3, C4, C5 loading 13 WCSB

Gilby and Nevis Rail Terminals Keyera Corp. C3, C4, C5 loading 7 WCSB

Sarnia/ St. Clair/ Windsor Pembina/ Plains C3, C4, C5 loading 45 Southern ON

Total 225

Facility Onwer/ Operator Type # of Railcars Location

NGLs Infrastructure Altagas Corp./ Petrogas NGLs Rail Cars 1,500 WCSB/ US

NGLs Infrastructure Keyera Corp. NGLs Rail Cars 1,300 AB NGL Hub

Redwater Rail Cars Pembina Pipeline Corporation NGLs Rail Cars 700 AB NGL Hub

Empress/ Sarnia Rail Cars Pembina Pipeline Corporation NGLs Rail Cars 300 AB NGL Hub/ ON

LPG Railcars Gibsons Energy NGLs Rail Cars 500 WCSB/ US

Total 4,300

Figure from AAR. Data from industry sources, tables by CERI

200

176 183

159

146 141 137

129

104 102

123

-

200

400

600

800

1,000

1,200

1,400

1,600

1,800

2,000

-

25

50

75

100

125

150

175

200

225

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

# of

railc

ars

kb/d

of L

PG

Canadian Propane Exports Canadian Butane Exports Total LPG Exports via Rail

Total LPG Exports Estimated # of Railcars required

Relevant • Independent • Objectivewww.ceri.ca

NGLs Pipeline and Fractionation Utilization(1) Overall NGLs gathering system capacity utilization

increasing over the last few years

While overall system utilization levels are estimated at around 80%, utilization levels at certain systems (i.e., Peace system) are estimated to be well above 90% and various expansions have been announced

- Pembina’s Peace NGL pipeline system expected to expand rapidly and significantly between 2011 and 2016/17

- Keyera is currently gauging producers’ interest in an alternative NGLs gathering pipeline system (ALPS) between Gordondale and Ft. Saskatchewan

13

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

-

50

100

150

200

250

300

350

400

450

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

%

kb

/d

Off-Gas SGL Mixes

BC NGL Mixes

Straddle Plants NGL Mixes (Exc. Empress)

C5+/ Condensate

AB Field NGL Mixes

Pipeline Capacity to Ft. Sk.

Total Liquids to Ft. Sk.

Utilization (%)

268

237 227

217 221 209

196 190 192 194

216

60%

65%

70%

75%

80%

85%

90%

95%

100%

-

50

100

150

200

250

300

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

%

kb/d

KFS

DFS

RFS

PFS

Total Ft. Sk. Frac. NGLs

Ft. Sk. Fractionation Cap.

Utilization (%)

1

(2) A similar situation is developing around fractionation plants: utilization increasingRFS (Pembina), KFS (Keyera), and DFS (Dow) are estimated to be running at close to capacity while PFS (Plains) utilization is lower- Expansion announcements by both Pembina and Keyera- Higher NGL mix volumes are estimated to be moving

east on Enbridge system to Sarnia fractionatorExpansion of pipelines and fractionation capacity indicates

confidence on increased NGL production/availability in Western Canada as a long-term sustained trend

2

RESULT: Multi-year, multi-billion $ expansion of NGLs midstream infrastructure in Alberta. Most pipeline and fractionation investments are expansions of existing assets, while new gas processing plants will be developed at the field level Crude oil and condensate storage and transportation logistics infrastructure would also be expanding

Figure by CERI, with data from AER and Pembina Pipelines

Relevant • Independent • Objectivewww.ceri.ca

$2,953 27%

$2,855 26%

$1,385 13%

$1,358 13%

$1,785 16%

$563 5%

Deep Cut Plants Expansion & New Builds / Straddle Plants/ Co-stream Facilities

NGLs Pipelines

Other Gas Processing/ NGLs Extraction Facilities (Mainly Shallow Cut)

Producer-owned Midstream Divestitures

NGLs Fractionation

Other Midstream Assets (Storage & Logistics)

Total: $10,899 MM (2011 - 2016)

$1,500 38%

$1,550 39%

$900 23%

LPG Export Terminals

Ethane/ Ethylene Petrochemicals

Propane Petrochemicals (PDH)

Total: $3,950 MM (2011 - 2016)

Midstream and Downstream Investments

(1) The midstream business in AB is dominated by a few large firms. In 2012, the top 15 companies accounted for 93% of all extracted spec NGLs

- Top third-party midstream players include Keyera Energy, Pembina Pipelines, Plains Midstream, Inter-pipeline Fund, Spectra Energy, and Altagas

- Other large midstream players are integrated either upstream or downstream: Shell, CNRL, Husky, Suncor, Conoco, Dow, etc.

(2) Utilization rates for both NGL pipelines and fractionators are high and expected increases in NGL volumes have led to close to $11 billion (B) in investments on midstream infrastructure (2011 –2016/17) (Average $1.6 B/yr)

- A large portion of these investments is in deep-cut gas processing plants targeting incremental ethane extraction (IEEP)

(3) Meanwhile, close to $4 B in downstream investments have been announced including ethane and propane based petrochemical facilities as well as LPG export terminals (2011 – 2016/17) (Average $0.6 B/yr)

That is a total of close to $15 B (avg. $2.1 B/yr) in midstream and downstream investments between 2011 and 2016-17 to monetize NGLs in Western Canada. Will there be a second wave post-2017?

14

15%

13%

11%

11%10%

9%

8%

7%

3%2%

1%1%1%1%1%

7%

Keyera Energy Ltd.

Pembina NGL Corporation

Plains Midstream Canada ULC

Inter Pipeline Extraction Ltd.

Dow Chemical Canada ULC

Spectra Energy Empress Management Inc.

AltaGas Ltd.

1195714 Alberta Ltd.

Shell Canada Energy

Canadian Natural Resources Limited

ATCO Midstream Ltd.

Husky Oil Operations Limited

Suncor Energy Resources Partnership

SemCAMS ULC

ConocoPhillips Canada (BRC) Partnership

Other (87)

Top 15 = 425 kb/d (93% of Total) Other (87) = 30 kb/d (7%)

Total (107) = 455 kb/d

Spec NGLs

1

2

3

Figures and Analysis by CERI, with data from AER and Industry Data

Relevant • Independent • Objectivewww.ceri.ca

New Markets for WCSB gas and Required Infrastructure: Liquefied Natural Gas (LNG) Proposed Projects and Pipelines

Infrastructure requirements for such projects will be significant and costly: Multiple billions of dollarsRequired infrastructure includes gas gathering systems, gas processing plants, large-diameter/high-volume

gas transportation systems, gas liquefaction plants, NGLs pipelines, fractionation facilities, storage and logistics facilities

15Table and map from NEB

Relevant • Independent • Objectivewww.ceri.ca

Projected Midstream Infrastructure Investments in North America: 2014 – 2035 (ICF International, 2014: INGAA Study)

(1) A recently released study by ICF International completed for the Interstate Natural Gas Association of America (INGAA) estimates that between 2014 – 2035 $641 B in midstream capital expenditures are required in North America of which about 22% or $139 B are required in Canada at an average of $6.7 B/yr

(2) This includes $58 B in natural gas infrastructure (42% of Canada’s total) including gathering and transmission pipelines, compression, lease, storage, and processing facilities ,as well as LNG export facilities (avg. $2.8 B/yr)

(3) Also included are $12 billion in NGLs infrastructure (9% of Canada’s total) including transmission pipelines, fractionation, and export facilities (avg. $0.6 B/yr)

(4) The remaining $69 B are allocated to crude oil infrastructure (49% of Canada’s total) including gathering and transmission pipelines, as well as lease and storage equipment (avg. $3.3 B/yr)

These estimates might be conservative and the largest share is likely to occur at the front-end of the projection period (before

2025). The magnitude is by any means very significant and highlights the capital intensity of midstream infrastructure

investments

16Figures from INGAA study by ICF International

1 2

3 4

Relevant • Independent • Objectivewww.ceri.ca

NGLs Market Fundamentals:Propane/Butanes (LPG) Market

Dynamics & Outlook/Opportunities

Image from Encana 17

Relevant • Independent • Objectivewww.ceri.ca

Canadian Propane Supply & Disposition

Supply (Grey bars): • About 75% of propane supply extracted at gas plants/ fractionators in Canada, other 25% consists of production from refineries, upgraders,

imports, and stock changes• About 50% of propane extracted in Western Canada’s gas plants moves to Ontario as an NGL mix to be fractionated• Increased production of NGLs in Western Canada is being driven primarily by increases in propane productionDisposition (Red bars): • Domestic demand increasing rapidly driven by energy uses in the mining, oil and gas extraction, and manufacturing sectors, followed by increase

propane use as a petrochemical feedstock in Ontario, and increased use for propane in the residential and commercial sectors• In 2012, Ontario (46%), Alberta (32%), and Quebec (8%), combined, accounted for 86% of domestic propane demand• Overall exports to the US have been declining (shrinking LPG market) with the largest drop occurring in regards to exports to the US Midwest

(PADD II), while increased Canadian exports to the US northeast (PADD I) have displaced US overseas propane imports• Majority of exports to the US now move via rail = higher transportation costs • Edmonton prices are the lowest across North America• North America is in an oversupply position and USGC LPG export terminals are acting as a relief valve, keeping prices afloat

Figures and Analysis by CERI, with data from AER, BCMNGD, NEB and Statistics Canada

244

214

229 217 215 220 220

199 189

207

248

(50)

-

50

100

150

200

250

300

S D S D S D S D S D S D S D S D S D S D S D

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

kb/d

Total Exports to US

Non-energy Use

Wholesale

Retail

Statistical Adjustment

Stock Changes

Imports

Off-Gas Plants

Refineries

Gas Plants/ Fractionators

Total Supply

Domestic Demand

Total Disposition

46%

32%

8%

4%4%3%2%

OntarioAlbertaQuebecBritish ColumbiaSaskatchewanAtlantic provincesManitobaYukon, Northwest Territories and Nunavut

2012 Domestic Demand: 147 kb/d

18

Relevant • Independent • Objectivewww.ceri.ca

Company Location Start-up Year Output (tonnes/ yr) Output (t/ d) C3 Feed (t/d) C3 Feed (kb/d)

PetroLogistics Houston, TX 2010 582,400 1,596 2,026 25

PetroLogistics Houston, TX 2014 582,400 1,596 2,026 25

Dow Chemical Freeport, TX 2015 682,500 1,870 2,375 29

Enterprise Chambers Co., TX 2015 623,350 1,708 2,169 27

C3 Petrochemicals Alvin, TX 2015 582,400 1,596 2,026 25

Formosa Plastics Point Comfort, TX 2016 728,000 1,995 2,533 31

Dow Chemical USGC (TX/ LA) 2018 500,500 1,371 1,741 22

Total US 4,281,550 11,730 14,897 185

Williams Strathcona (AIH), AB 2016 500,500 1,371 1,741 22

Total Canada 500,500 1,371 1,741 22

Total North America 4,782,050 13,102 16,639 207

United States

Propane Dehydrogenation (PDH) Projects in North America

Canada Company Location Start-up YearLPG Export Capacity

(MMgal/ yr)

LPG Export

Capacity (kb/d)

Enterprise Houston, TX n/a 3,780 247

Targa Galena Park, TX n/a 1,764 115

Chevron (Acquired by Petrogas) Ferndale, WA n/a 460 30

Other

Miami, Norfolk, NY,

Seatlle, LA n/a 26 2

Total Operating 6,030 393

Sunoco Logistics (Mariner East) Marcus Hook, PA 2014 600 39

Vitol Beaumont, TX 2014 1,500 98

Phill ips 66 Baytown, TX 2014 2,218 145

Enterprise (Expansion) Houston, TX 2015 756 49

Targa (Expansion) Galena Park, TX 2015 1,008 66

Sunoco Logistics (Mariner South) Nederland, TX 2015 3,024 197

Will iams/ Boardwalk Moss Lake, LA 2016 3,532 230

Enterprise (Expansion) Houston, TX 2016 3,528 230

Occidental Corpus Christi, TX 2017 1,150 75

Total Proposed US 17,316 1,130

Pembina Pipeline Corp. Portland, OR 2018 570 37

Altagas Corp./Petrogas/Idemitsu Kosan BC Coast 2017 460 30

Total Proposed Canada 1,030 67

Total Proposed North America 18,346 1,197

Total Existing + Proposed North America 24,376 1,590

Canada

LPG Export Projects in North America

United States

In Operation

Proposed

United States

Increasing Demand for Propane in North America = Feedstock Competition

Figures and Analysis by CERI, with data from Propane Research Council (PRC) and Industry

(1) Various PDH projects have been proposed in North America to take advantage of increased C3 availability and to produce on-purpose propylene as ethylene crackers move to lighter feeds (reducing co-product yields)

• Including a PDH facility in AB (25 kb/d C3 feed) aiming to attract derivative investors. Williams has indicated the possibility of building up to two or three PDH plants

• Feedstock requirements: 50 – 75 kb/d of WCSB C3

(2) High global LPG prices and improved propane netbacks in North America through an existing arbitrage opportunity have resulted in various LPG export project proposals/expansions

• Including two in the West Coast targeting WCSB LPGs with the potential to export ~70 kb/d to the Asia-Pacific market

• Petrogas/Altagas/Idemitsu (JV) recently agreed to purchase Chevron’s Ferndale, WA LPG import/ export terminal (~30 kb/d)

• Altagas indicated this is in addition to their BC coast plans

• Pembina has applied for an NEB export license plus made a deal with the Portland (OR) Port Authority for an LPG export site

• Potential future WCSB LPG exports: 90-100 kb/d of WCSB LPG, primarily C3

1

2

19

Relevant • Independent • Objectivewww.ceri.ca

20

Butanes Supply and Disposition

(1) Butanes

SUPPLY: Production from gas plants flat. Refinery LPG production decreasing. Extraction from synthetic gas liquids is minimal. Flat import volumes from US

DEMAND: Domestic refining and petrochemical demand is flat to declining. Diluent demand is increasing.

Export volumes to the US decreasing similarly as with the case with propane. Need to find new markets such as LPG exports or new local demand sources such as oil sands solvents

118 115 111

96 103

119 123

114 122

115

96

(40)

(20)

-

20

40

60

80

100

120

140

160

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

kb

/d

US Exports

Non-energy Use

Statistical Adjustment

Stock Changes

Imports

Off-Gas Plants

Refineries

Gas Plants/ Fractionators

Total Supply

Domestic Demand

Total Disposition

Figures and Analysis by CERI, with data from AER, BCMNGD, EIA, NEB, Statistics Canada and Industry Data

76 80 80

65

75

95 97

86

98 95

72

-

20

40

60

80

100

120

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

kb

/d

Solvent Flood

Diluent

Petrochemical

Refinery Feedstock

Domestic Demand

Relevant • Independent • Objectivewww.ceri.ca

30%

35%

40%

45%

50%

55%

60%

65%

$-

$2.00

$4.00

$6.00

$8.00

$10.00

$12.00

$14.00

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

% o

f C3

expo

rts

mov

ed v

ia r

ail

USG

C -E

DM

C3

DIF

F ($

/bbl

)

USGC - Edmonton Propane Differential ($/bbl)

% of Propane Exports via Rail

Propane Pricing(1) In North America (NA), prices are set at Mt. Belvieu, TX (USGC). C3 normally trades at a price range between the price of C2 (floor: petrochemical feedstock) and butanes (ceiling: fuels market). Given propane’s widespread use in the heating market, weather is an important pricing factor Across

(2) North American C3 prices: Edmonton trades at a discount to Conway which in turn trades at a discount to Mt. Belvieu (USGC). The USGC-EDM differential has widened to reflect increasing transportation costs as more LPG moves via rail to export markets

(3) Internationally, globally traded prices are set according to the Saudi contract price (CP), which is highly correlated to crude oil prices, thus creating a large arbitrage opportunity between Western Canada and areas served by Saudi CP contracts such as the Asia-Pacific region

21

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

$-

$20.00

$40.00

$60.00

$80.00

$100.00

$120.00Ja

n

Jun

No

v

Ap

r

Se

p

Fe

b

Jul

De

c

Ma

y

Oct

Ma

r

Au

g

Jan

Jun

No

v

Ap

r

Se

p

Fe

b

Jul

De

c

Ma

y

Oct

Ma

r

Au

g

Jan

Jun

No

v

Ap

r

Se

p

Fe

b

Jul

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

%

$/B

BL

PROPANE PRICING RANGE MT BELVIEU ETHANE @ USGC ($/BBL)

MT BELVIEU PROPANE @ USGC ($/BBL) AB PROPANE @ EDM ($/BBL)

MT BELVIEU BUTANES @ USGC ($/BBL) MT BELVIEU % OF WTI

0%

20%

40%

60%

80%

100%

120%

$(20.00)

$-

$20.00

$40.00

$60.00

$80.00

$100.00

$120.00

Jan

Jun

Nov Ap

r

Sep

Feb Jul

Dec

May Oct

Mar

Aug

Jan

Jun

Nov Ap

r

Sep

Feb Jul

Dec

May Oct

Mar

Aug

Jan

Jun

Nov Ap

r

Sep

Feb Jul

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

%

$/BB

L

PRICING BANDWCSB - ASIA PACIFC ARBITRAGE ($/BBL)AB PROPANE @ EDM ($/BBL)MT BELVIEU PROPANE @ USGC ($/BBL)SAUDI PROPANE CP FOB @ ME ($/BBL)SAUDI % OF CRUDE OIL (BRENT)

1

Data from industry and various data sources. All figures by CERI

2

3

Relevant • Independent • Objectivewww.ceri.ca

Butanes Pricing(1) Mixes butanes prices in North America generally trade a price range between the price of propane (floor: petrochemical feedstock/fuel market) and crude oil (ceiling: refining/gasoline market)

(2) Since 2008 prices at Conway have traded at a discount to USGC, while Edmonton has become a premium market, trading at premiums to the USGC, Conway, and even Sarnia

(3) Internationally, globally traded prices are set according to the Saudi contract price (CP), which is highly correlated to crude oil prices, thus creating a small arbitrage opportunity between Western Canada and areas served by Saudi CP contracts such as the Asia-Pacific region

22

0%

20%

40%

60%

80%

100%

120%

140%

$(40.00)

$(20.00)

$-

$20.00

$40.00

$60.00

$80.00

$100.00

$120.00

$140.00

Jan

Jun

Nov Apr

Sep

Feb Jul

Dec

May Oct

Mar

Aug Ja

n

Jun

Nov Apr

Sep

Feb Jul

Dec

May Oct

Mar

Aug Ja

n

Jun

Nov Apr

Sep

Feb Jul

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

%

$/BB

L

PRICING BAND WCSB - ASIA PACIFC ARBITRAGE ($/BBL)

AB BUTANES @ EDM ($/BBL) MT BELVIEU BUTANES @ USGC ($/BBL)

SAUDI BUTANES CP FOB @ ME ($/BBL) SAUDI % OF CRUDE OIL (BRENT)

0%

20%

40%

60%

80%

100%

120%

140%

$-

$20.00

$40.00

$60.00

$80.00

$100.00

$120.00

$140.00

$160.00

$180.00

Jan

Jun

Nov Apr

Sep

Feb

Jul

Dec

May Oct

Mar

Aug Ja

n

Jun

Nov Apr

Sep

Feb

Jul

Dec

May Oct

Mar

Aug Ja

n

Jun

Nov Apr

Sep

Feb

Jul

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

%

$/B

BL

PENTANES PRICING RANGE

AB BUTANES @ EDM ($/BBL)

MT BELVIEU PENTANES PLUS @ USGC ($/BBL)

AB PENTANES PLUS @ EDM ($/BBL)

CANADIAN FURNACE OIL (WHOLESALE RACK PRICE) ($/bbl)

EDM % OF WTI

$(40.00)

$(30.00)

$(20.00)

$(10.00)

$-

$10.00

$20.00

Jan

Jun

Nov Ap

r

Sep

Feb Jul

Dec

May Oct

Mar

Aug

Jan

Jun

Nov Ap

r

Sep

Feb Jul

Dec

May Oct

Mar

Aug

Jan

Jun

Nov Ap

r

Sep

Feb Jul

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

$/BB

L

USGC-EDM ($/BBL)

USGC-CONWAY ($/BBL)

CONWAY-EDM ($/BBL)

1

Data from industry and various data sources. All figures by CERI

23

Relevant • Independent • Objectivewww.ceri.ca

Propane netbacks example

Netback = Price at target market location – marketing costs to get the product to market location

Marketing costs include: processing, fractionation, storage, and transportation costs

In the figure above, work from the black dot (market price at destination) and subtract all the marketing costs (green, orange, and light blue bars) to get to the estimated netback (bright blue bars)

23Data from industry and various data sources. All figures by CERI

$14 $14 $14 $14 $14 $14 $14 $14 $14 $14 $17 $17 $17 $17 $17

$32 $31 $23

$20 $19 $16

$21$15

$5

$17

$33 $32$29

$20

$19

$-

$10.00

$20.00

$30.00

$40.00

$50.00

$60.00

$70.00

$80.00

Jap

an

Ch

ina

Ind

ia

Jap

an

Ch

ina

Ind

ia

Via

Pip

eli

ne

Via

Ra

il

Mt.

Be

lvie

u,

TX

Ed

mo

nto

n,

AB

Jap

an

Ch

ina

Ind

ia

Sa

rnia

, O

N

Mt.

Be

lvie

u,

TX

WCSB to Asia Pacific viaWest Coast

WCSB to Asia Pacific viaUSGC

WCSB to Sarnia WCSB toUSGC

WCSB toLocal

Market

USGC to Asia Pacific USGC toSarnia

USGC toLocal

Market

$/b

bl

Netback @ Wellhead

Port to Port Marine Freight

Terminal Storage and Loading Fees

Rail to Source Port/ Destination

Pipeline Transport to Destination

Spec Product T&S @ Market Source

NGL Mix T&F

Shrinkage Costs/ Heating Value

Market Price @ Destination

Relevant • Independent • Objectivewww.ceri.ca

World/Asia-Pacific LPG Market

• Total worldwide end-use LPG demand in 2012 was 7.7 MMb/, out of which 3.1 MMb/d (or 40% of total) occurred in the Asia-Pacific region (Japan: 0.6 MMb/d)

• Asia-Pacific is fastest growing region in terms of population, economic growth, and energy-use

• Residential/Commercial and petrochemical uses for LPG are the largest and fastest growing end-use sectors

• Global trade in 2012 was about 2.9 MMb/d or 37% of total demand

• Global trade is characterized by large surplus volumes available for exports from OPEC countries and large import requirements from the Asia-Pacific region

• Large degree of import dependency in Asia-Pacific (40% of supply)

• Most local supplies from refineries

• But refined crude is also imported to a large extent

• Pricing dominated by Saudi contract prices

• North American supplies emerging as a new supply source

24

2.3 2.3 2.5

2.6 2.7

2.8 2.7

2.8 2.9

3.1 3.1

-

0.5

1.0

1.5

2.0

2.5

3.0

3.5

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

MM

b/d

Asia-Pacific LPG Supply/DemandRefinery Production

Gas Plant Production

Imports

Statistical Adjsutment

Res./Comm./Agr., For., & Fish.

Petrochemical Feedstock

Transportation

Industrial Use

Transformation Processes

Industry Own-Use

Exports

Total Supply

Estimated Domestic Demand

Image from BP. Data from IEA. Figures by CERI

Relevant • Independent • Objectivewww.ceri.ca

158

140

151

128

119 117 110

100

81 81

99

90 96 95

82 82 89

83

65

84 79

75 74 71 71 76 75 76 77

-

20

40

60

80

100

120

140

160

180

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

2023

2024

2025

2026

2027

2028

2029

2030

HISTORICAL/ACTUAL OUTLOOK

kb/d

Export to PADD V Export to PADD IV Export to PADD III

Export to PADD II Export to PADD I West Coast LPG Eports

Pembina: Portland, OR Altagas/Idemitsu: BC Coast Petrogas: Ferndale, WA

LPG Export Capacity Available for US/LPG Exports

158

140 15

1

128

119

117

110

100

81 81

99

90

96

95 82

82

89 83

65

84

79

75

74

71

71 76

75 76

77

243

213

228 216 213 218 219

198 188

205

246 242 240 243 244

266

288 297 295

330 330 331 335 339 345 356 362

369 378

-

50

100

150

200

250

300

350

400

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

2023

2024

2025

2026

2027

2028

2029

2030

HISTORICAL/ACTUAL OUTLOOK

kb/d

Statistical Adjustment

Stock Changes

US Imports

Off-Gas Plants

Refineries

CAD Gas Plants

Available for US/LPG Exports

Non-Energy Demand

Retail Energy Demand

Wholesale Energy Demand

TOTAL SUPPLY

LNG Tsunami Propane Outlook(1) Canadian Propane S/D

Supply:

- Gas plant production fluctuates with overall increasing volumes (assumes one large BC LNG project recovers C3+ NGLs)

- Off-gas plants production increases

- Refinery LPG production continues to fall

- Assumes UTOPIA pipeline (Marcellus/Utica ON) can bring ~75 kb/d of C3 to Eastern Canada from USNE

Demand:

- Industrial (Wholesale) and Retail demand continue to grow, but at a slower pace than over the last decade

- Petrochemical demand increases rapidly after 2016 as PDH plants get built (assumes 3 PDH plants in Western Canada by 2021)

(2) Exports: Post 2012, an average of 80 kb/d of C3 are available for exports. (Almost enough to fill three LPG export facilities in BC and WA the US West Coast)

Upside potential: - Marcellus/Utica ON C3 volumes above and beyond UTOPIA pipeline capacity

- Wholesale and retail demand could increase at a slower pace than expected freeing up barrels for export market

Downside risk: - No C3+ extraction from BC LNG projects

- Lower flows from US CAD (price competition and market optionality) = lower supply available (BIGGEST RISK!)

- Wholesale and retail domestic energy demand could increase at a faster pace than expected

- Lower supply and higher domestic demand leads to less propane volumes available for petrochemical facilities and exports

25

1

2

Relevant • Independent • Objectivewww.ceri.ca

Evolving Propane dynamics in Canada: What is required for West Coast LPG exports?

26

-

50

100

150

200

250

300

20

02

20

03

20

04

20

05

20

06

20

07

20

08

20

09

20

10

20

11

20

12

20

13

20

14

20

15

20

16

20

17

20

18

20

19

20

20

20

21

20

22

20

23

20

24

20

25

20

26

20

27

20

28

20

29

20

30

HISTORICAL/ACTUAL OUTLOOK

kb/d

Western Canada Propane Supply/Demand

Gas Plants Extraction Upgrader SGLs Refinery ProductionImports Stocks Statistical AdjustmentLocal Demand Est. Transfers to Eastern Canada Available for Exports

89 94 91 91 89

98

82

72 75 80

96 102

96 94 90

72

45

26 35

44 47 50 53 56 60 63 67

71 75

-

20

40

60

80

100

120

20

02

20

03

20

04

20

05

20

06

20

07

20

08

20

09

20

10

20

11

20

12

20

13

20

14

20

15

20

16

20

17

20

18

20

19

20

20

20

21

20

22

20

23

20

24

20

25

20

26

20

27

20

28

20

29

20

30

HISTORICAL/ACTUAL OUTLOOK

kb/d

Est. Transfers to Eastern Canada

83

50

68

54 58 58 59

54

42 44 50

45 45 39

26

19 5 - - - - - - - - - - - -

-

10

20

30

40

50

60

70

80

90

20

02

20

03

20

04

20

05

20

06

20

07

20

08

20

09

20

10

20

11

20

12

20

13

20

14

20

15

20

16

20

17

20

18

20

19

20

20

20

21

20

22

20

23

20

24

20

25

20

26

20

27

20

28

20

29

20

30

HISTORICAL/ACTUAL OUTLOOKkb

/d

Western Canada Exports to US

-

20

40

60

80

100

120

140

160

180

20

02

20

03

20

04

20

05

20

06

20

07

20

08

20

09

20

10

20

11

20

12

20

13

20

14

20

15

20

16

20

17

20

18

20

19

20

20

20

21

20

22

20

23

20

24

20

25

20

26

20

27

20

28

20

29

20

30

HISTORICAL/ACTUAL OUTLOOK

kb/d

Eastern Canada Propane Supply/Demand

Gas Plants Etraction Refinery Production Transfers from Western CanadaUS Imports Stocks Statistical AdjustmentLocal Demand Eastern Canada Exports to US Eastern Canada Supply

- - - - - - - - - - - - 8 18

30

45

79 83

65

84 79

75 74 71 71 76 75 76 77

-

10

20

30

40

50

60

70

80

90

20

02

20

03

20

04

20

05

20

06

20

07

20

08

20

09

20

10

20

11

20

12

20

13

20

14

20

15

20

16

20

17

20

18

20

19

20

20

20

21

20

22

20

23

20

24

20

25

20

26

20

27

20

28

20

29

20

30

HISTORICAL/ACTUAL OUTLOOK

kb/d

Western Canada C3 LPG Exports 75

90 83

74

61 59 52

46 39 38

49 44 44

38

26 18

5 - - - - - - - - - - - - -

10

20

30

40

50

60

70

80

90

100

20

02

20

03

20

04

20

05

20

06

20

07

20

08

20

09

20

10

20

11

20

12

20

13

20

14

20

15

20

16

20

17

20

18

20

19

20

20

20

21

20

22

20

23

20

24

20

25

20

26

20

27

20

28

20

29

20

30

HISTORICAL/ACTUAL OUTLOOK

kb/d

Eastern Canada Exports to US

2 2 2 2 2 1 0 1 2 4 4 4 4 4 4

28

52

76 76 76 76 76 76 76 76 76 76 76 76

-

10

20

30

40

50

60

70

80

20

02

20

03

20

04

20

05

20

06

20

07

20

08

20

09

20

10

20

11

20

12

20

13

20

14

20

15

20

16

20

17

20

18

20

19

20

20

20

21

20

22

20

23

20

24

20

25

20

26

20

27

20

28

20

29

20

30

HISTORICAL/ACTUAL OUTLOOK

kb/d

Eastern Canada US Imports

US Markets

Western Canada Eastern Canada

Global/Asia-PacificLPG Market

Relevant • Independent • Objectivewww.ceri.ca

42

36

32 31

28

24

26 28

24

20

25

17

28 28 28

20

16

8

4

20

16

13 12 11 10

12 13

14 16

-

5

10

15

20

25

30

35

40

45

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030

HISTORICAL/ACTUAL OUTLOOK

kb

/d

Export to PADD VExport to PADD IVExport to PADD IIIExport to PADD IIExport to PADD ILPG ExportsAvaialble for ExportsLPG Terminals Spare Export Capacity Available

42

36

32

31

28

24

26

28

24

20

25

17

28

28

28

20

16

8

4

20

16

13

12

11

10

12

13

14

16

118 115 111

96 103

119 123

114

122 115

96

111 110 112 112 109 107 101 98

117 116 116 117 118 119 123 126 129 131

(20)

-

20

40

60

80

100

120

140

20022003200420052006200720082009201020112012201320142015201620172018201920202021202220232024202520262027202820292030

HISTORICAL/ACTUAL OUTLOOK

kb

/d

Statistical Adjustment

Stock Changes

US Imports

Off-gas Plants

Refineries

Total Gas Plants

Avaialble for Exports

Solvent Floods/Oil Sands Solvents

Diluent

Petrochemical

Refinery Feedstock

TOTAL SUPPLY

LNG Tsunami Butanes Outlook(1) Canadian Butanes S/D

Supply:

- Gas plant production fluctuates with overall increasing volumes (assumes one large BC LNG project recovers C3+ NGLs)

- Off-gas plants production increases

- Refinery LPG production continues to fall

- Assumes flat import levels from US of about 10 kb/d

Demand:

- Refinery and petrochemical demand flat over outlook period

- Demand for C4s as diluent increases slightly

- Increased used of C4s as a solvent in SAGD projects

- (2) Exports: Post 2012, an average of 16 kb/d of C4s are available for exports (Assumes any spare capacity in LPG export terminals from C3 will be filled with C4s)

Upside potential:

- Increased levels of US imports

- Demand levels in the refining and petrochemical could fall overtime resulting in more volumes available for export

Downside risk: - No C3+ extraction from BC LNG projects

- Increased demand from oil sands projects (either as a diluent or as a solvent) could result in lower volumes of C4s available for exports

27

1

2

Relevant • Independent • Objectivewww.ceri.ca

Canadian LPG Export Scenarios

28

POWER WAVE FULL SPEED AHEAD

NOWHERE FAST LNG TSUNAMI

NO LNG PROJECTS

0 0 0 0 0 0 0 0 0 0 0 0

8

18

30

43

76

97 97 97 9794

91

81

71

64

5650

45

-

20

40

60

80

100

120

20

02

20

03

20

04

20

05

20

06

20

07

20

08

20

09

20

10

20

11

20

12

20

13

20

14

20

15

20

16

20

17

20

18

20

19

20

20

20

21

20

22

20

23

20

24

20

25

20

26

20

27

20

28

20

29

20

30

HISTORICAL/ACTUAL OUTLOOK

kb/d

LPG Export Capacity

Butanes

Propane

Total LPG Exports

- - - - - - - - - - - -

8

18

30

43

76

97 97 97 97 97 97 97 91

84

75 69

65

-

20

40

60

80

100

120

20

02

20

03

20

04

20

05

20

06

20

07

20

08

20

09

20

10

20

11

20

12

20

13

20

14

20

15

20

16

20

17

20

18

20

19

20

20

20

21

20

22

20

23

20

24

20

25

20

26

20

27

20

28

20

29

20

30

HISTORICAL/ACTUAL OUTLOOK

kb/d

LPG Export Capacity

Butanes

Propane

Total LPG Exports

0 0 0 0 0 0 0 0 0 0 0 0

8

18

30

43

76

91

69

97 95

88 8682 81

88 88 9093

0

20

40

60

80

100

120

20

02

20

03

20

04

20

05

20

06

20

07

20

08

20

09

20

10

20

11

20

12

20

13

20

14

20

15

20

16

20

17

20

18

20

19

20

20

20

21

20

22

20

23

20

24

20

25

20

26

20

27

20

28

20

29

20

30

HISTORICAL/ACTUAL OUTLOOK

kb/d

LPG Export Capacity

Butanes

Propane

Total LPG Exports

0 0 0 0 0 0 0 0 0 0 0 0

8

18

30

43

76

97 97 97 97 97 97 97 97

85

70

58

47

0

20

40

60

80

100

120

20

02

20

03

20

04

20

05

20

06

20

07

20

08

20

09

20

10

20

11

20

12

20

13

20

14

20

15

20

16

20

17

20

18

20

19

20

20

20

21

20

22

20

23

20

24

20

25

20

26

20

27

20

28

20

29

20

30

HISTORICAL/ACTUAL OUTLOOK

kb/d

LPG Export Capacity

Butanes

Propane

Total LPG Exports

Relevant • Independent • Objectivewww.ceri.ca

Potential North American LPG Exportable Surplus

29

-

200

400

600

800

1,000

1,200

1,400

1,600

20

02

20

03

20

04

20

05

20

06

20

07

20

08

20

09

20

10

20

11

20

12

20

13

20

14

20

15

20

16

20

17

20

18

20

19

20

20

20

21

20

22

20

23

20

24

20

25

20

26

20

27

20

28

20

29

20

30

HISTORICAL OUTLOOK

kb/d

North American LPG Export Surplus by Country

Canadian LPG Exportable Surplus US LPG Exportable Surplus

-

200

400

600

800

1,000

1,200

1,400

1,600

20

02

20

03

20

04

20

05

20

06

20

07

20

08

20

09

20

10

20

11

20

12

20

13

20

14

20

15

20

16

20

17

20

18

20

19

20

20

20

21

20

22

20

23

20

24

20

25

20

26

20

27

20

28

20

29

20

30

HISTORICAL OUTLOOK

kb/d

North American LPG Export Surplus by Type

Propane Exportable Surplus Butanes Exportable Surplus

-

50

100

150

200

250

20

02

20

03

20

04

20

05

20

06

20

07

20

08

20

09

20

10

20

11

20

12

20

13

20

14

20

15

20

16

20

17

20

18

20

19

20

20

20

21

20

22

20

23

20

24

20

25

20

26

20

27

20

28

20

29

20

30

HISTORICAL OUTLOOK

kb/d

Canadian LPG Export Surplus by Type

Propane Exportable Surplus Butanes Exportable Surplus

-

200

400

600

800

1,000

1,200

1,400

1,600

20

02

20

03

20

04

20

05

20

06

20

07

20

08

20

09

20

10

20

11

20

12

20

13

20

14

20

15

20

16

20

17

20

18

20

19

20

20

20

21

20

22

20

23

20

24

20

25

20

26

20

27

20

28

20

29

20

30

HISTORICAL OUTLOOK

kb/d

US LPG Export Surplus by Type

Propane Exportable Surplus Butanes Exportable Surplus

Relevant • Independent • Objectivewww.ceri.ca

Opportunities for CooperationNorth America/Western Canada

• Surpluses above local demand levels are developing across various energy commodities including LPG

• Need to diversify markets

• Proximity to Asia-Pacific market

• Existing robust midstream/marketing infrastructure

• Producers and midstream companies looking for capital to fund growth projects

• Midstream companies provide steady and safe returns with low commodity risk exposure (depending on commercial agreements)

• There are also opportunities for investment in value-added (locally)

30

Asia-Pacific

• Increasing demand for energy and end-use products

• Import dependency on OPEC countries

• Energy security concerns

• Supply diversification

• Local firms have market knowledge and expertise

• Local firms have the ability to work as joint-venture partners with producers and midstream/marketing companies from North America

Relevant • Independent • Objectivewww.ceri.ca

Thank you!

Questions and/or Comments?

Please visit us at:

www.ceri.ca

31