Central Louisiana Capital Corporation/media/Documents/banking...Dec 31, 2017 · Lake Providence,...

Transcript of Central Louisiana Capital Corporation/media/Documents/banking...Dec 31, 2017 · Lake Providence,...

-

* No LEI is available for any of the companies listed below

Delta Bank Cencap Insurance Community Credit Centers

Vidalia, LA Agency, LLC of Ferriday, LLC

100% Vidalia, LA Ferriday, LA

100% 100%

Louisiana Corp Louisiana Org Louisana Org

Managing Member Managing Member

VIDALIA, LA

Louisiana Corporation

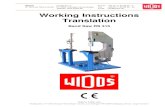

CENTRAL LOUISIANA CAPITAL CORPORATION2017

CENTRAL LOUISIANA CAPITAL CORPORATION

-

(1)(a) (1)(b) (1)(c) (2)(a) (2)(b) (2)(c)

Name & Address (City, State, Country)

Country of Citizenship or Incorporation

Number and Percentage of Each Class of Voting Securities

Name & Address (City, State, Country)

Country of Citizenship or Incorporation

Number and Percentage of Each Class of Voting Securities

Common Stock OnlyBrian D Campbell USA 49,424 NoneBaton Rouge, LA 70884 17.98%

Judith L Campbello USA 30,852 St Francisville, LA 70775 11.22%

Dale C. Fairbanks USA 28,631 Gulf Breeze, FL 32563 10.42%

Central Louisiana Capital Corp ESOP - Brian D Campbell, Trustee

USA 23,826

Vidalia, LA 71373 8.67%

Current Securities Holders with ownership, control or holdings of 5% or more with power to vote as of fiscal year ending 12-31-2017

Securities Holders not listed in 3(1)(a) through (3)(1)(c) that had ownership, control or holdings of 5% or more with power to vote during the fiscal year ending 12-31-2017

Form FR Y-6

Central Louisiana Capital CorpVidalia, LA

Fiscal Year Ending December 31, 2017

Report Item 3: Securities Holders

-

(1)(a)(b)(c) and (2)(a)(b)(c)

Form FR Y-6

Central Louisiana Capital CorpVidalia, LA

Fiscal Year Ending December 31, 2017

Report Item 4: Insiders

Don W Ater Ferriday, LA 71334 Retired

Director/Secretary/Vice Chairman

Director/Secretary Delta Bank

Don W Ater Farms - Owner 4.63% 0.00%

Don W Ater Farms - 100%

Farming Interest Director/Secretary Cencap Insurance Agency LLC

Weecama Farms LLP - Member

Weecama Farms LLP - 50%

Director/Secretary Cencap Insurance Agency LLC

Vidalia Center LLC - Member

Vidalia Center LLC - 33%

Richard B Sharp Marital Trust - TrusteeRichard B Sharp Childrens Trust - TrusteeMasco Wireline Inc - Director

Philip Brown Lake Providence, LA 71254

Farmer Director Director Community Credit Centers of Ferriday, LLC

Philip Brown Trust - Trustee

0.77% 0.00%

Director Cencap Insurance Agency LLC

Brian D Campbell Baton Rouge, LA 70809

Real Estate Developer

Director/ Chairman and CEO

Director/Chairman - Delta Bank

Highland Market Place II LLC - Member

26.65% 0.00% Highland Market Place II LLC - 50%

Director - Community Credit Centers of Ferriday LLC

BDC Davis Island LLC

BDC Davis Island LLC - 85%

-

(1)(a)(b)(c) and (2)(a)(b)(c)

Form FR Y-6

Central Louisiana Capital CorpVidalia, LA

Fiscal Year Ending December 31, 2017

Report Item 4: Insiders

Director/Chairman - Cencap Insurance Agency, LLC

Big Horn Dev, LLC - Member

Big Horn Dev, LLC - 50%

Highland Market Place LLC - Member

Highland Market Place LLC - 75%

Baldwin Rowe Townhomes LLC -Member

Baldwin Rowe Townhomes LLC -35%

Baldwin Rowe Townhomes II LLC -Member

Baldwin Rowe Townhomes II LLC -50%

ABBA V LLC - Member

ABBA V LLC -100%

ABBA III LLC - Member

ABBA III LLC - 100%

Pecue Properties LLC - Member

Pecue Properties LLC - 50%

Hoot Aero, LLC Hoote Aero LLC - 100%

ABR, LLC - Member

ABR, LLC - 33%

Edge Family Properties, LLC - Member

Edge Family Properties, LLC - 33%

Brian D Campbell Family Trust - TrusteeBrian D and Donna M Campbell Trust - Trustee

-

(1)(a)(b)(c) and (2)(a)(b)(c)

Form FR Y-6

Central Louisiana Capital CorpVidalia, LA

Fiscal Year Ending December 31, 2017

Report Item 4: Insiders

Brian and Donna Insurance Trust Trustee

Gerald F Delaune Jr Natchez, MS 39120

Retired Dentist Director Director Community Credit Centers of Ferriday, LLC

Huntington Plaza - Owner

4.40% 0.00% Huntington Plaza - 40%

Director Cencap Insurance Agency LLC

-

(1)(a)(b)(c) and (2)(a)(b)(c)

Form FR Y-6

Central Louisiana Capital CorpVidalia, LA

Fiscal Year Ending December 31, 2017

Report Item 4: Insiders

Bobby D Flurry Natchez, MS 39120

Retired Banker Director and Assistant Secretary

Director and Assistant Secretary Delta Bank

B & J Enterprises LLC - Member

3.77% 0.00% B & J Enterprises LLC - 50%

Director and Assistant Secretary Community Credit Centers of Ferriday, LLC

Director and Assistant Secretary Cencap Insurance Agency LLC

-

(1)(a)(b)(c) and (2)(a)(b)(c)

Form FR Y-6

Central Louisiana Capital CorpVidalia, LA

Fiscal Year Ending December 31, 2017

Report Item 4: Insiders

Darryl J Ellerbee, Jr. Tallulah, LA 71282

Banker Director - Emeritus

Director/President & CEO - Delta Bank

None 0.00% 0.00% South Endzone Investments LLC - 50%

Director/President Community Credit Centers of Ferriday LLC

CDPCS Pulpwood, LLC - 50%

Director/President Cencap Insurance Agency, LLC

Ted E Oliver Tallulah, LA 71282

Farmer Director Director - Delta Bank

Oliver Farming Partnership - Partner

1.75% 0.00% Oliver Farming Partnership - 25%

Director Community Credit Centers of Ferriday, LLC

Oliver Farms Inc - 50% President

Oliver Farms Inc - 50% President

Director Cencap Insurance Agency LLC

Susannah Farms Partnership - Partner

Susannah Farms Partnership - 25%

Rax Rentals LLC - Member

Rax Rentals LLC - 100%

Coastal Investment Properties LLC - Member

Coastal Investment Properties LLC - 33%

Joe Bayou Gin - stockholderWyld Olive LLC - Member

Wyld Olive LLC - 50%

-

(1)(a)(b)(c) and (2)(a)(b)(c)

Form FR Y-6

Central Louisiana Capital CorpVidalia, LA

Fiscal Year Ending December 31, 2017

Report Item 4: Insiders

Jimmy R. Smith, Natchez, MS 39120

Hardware Store Owner and Real Estate Developer

Director Director - Delta Bank

Natchez Hardware Center, Inc - Owner

2.70% 0.00% Natchez Hardware Center, Inc - 39%

Director Community Credit Centers of Ferriday, LLC

Hardware Management, LLC - Member

Hardware Management, LLC - 100%

Director Cencap Insurance Agency LLC

V S Rentals - Member

V S Rentals - 100%

Main and Pearl, LLC - Member

Main and Pearl, LLC - 50%

American Plan and Build, LLC - Member

American Plan and Build, LLC - 50%

Smith-Carter, LLC - Member

Smith-Carter, LLC - 50%

Vidalia Center, LLC - Member

Vidalia Center, LLC - 33%

Riverview Management, LLC - Member

Riverview Management, LLC - 50%

Riverview Real Estate, LLC - Member

Riverview Real Estate, LLC - 50%

Thomas F Terral Lake Providence, LA 71254

Agricultural Business

Director Director - Delta Bank

Tom Rosa Corp - 3% Chairman of the Board

3.02% 0.00% N/A

-

(1)(a)(b)(c) and (2)(a)(b)(c)

Form FR Y-6

Central Louisiana Capital CorpVidalia, LA

Fiscal Year Ending December 31, 2017

Report Item 4: Insiders

Director/Chairman Community Credit Centers of Ferriday, LLC

Ag Resource Mgt - 3.7% Chairman of the Board

Director Cencap Insurance Agency LLC

Terral/Gullick Trust - Trustee

Thomas Bradford Terral Irrevocable Living Trust - TrusteePittman-Hogue LLC Member

Judith L Campbell St. Francisville, LA 70775

Housewife Principal Shareholder

None Edgewood Exploration - Owner

11.22% 0.00% Edgewood Exploration - 100%

Dale C. Fairbanks Gulf Breeze, FL 32563

Artist Principal Shareholder

None Dale Fairbanks Studios - Owner

10.39% 0.00% Dale Fairbanks Studios - 100%

Dale C. Fairbanks Family Trust - TrusteeFairbanks Investment Group of Northwest Florida, Inc - Owner

Fairbanks Investment Group of Northwest Florida, Inc - 50%

ABR LLC - Member ABR LLC - 33%

-

(1)(a)(b)(c) and (2)(a)(b)(c)

Form FR Y-6

Central Louisiana Capital CorpVidalia, LA

Fiscal Year Ending December 31, 2017

Report Item 4: Insiders

Brian Douglas Campbell, Jr. Baton Rouge, LA 70809

Real Estate Developer

Director Director - Delta Bank

Big Horn Dev, LLC - Member

0.67% 0.00% Big Horn Dev, LLC - 50%

Director - Community Credit Centers Inc

Highland Market Place LLC - Member

Highland Market Place LLC - 25%

Director - Community Credit Centers of Ferriday LLC

Baldwin Rowe Townhomes LLC -Member

Director - Cencap Insurance Agency, LLC

Pecue Properties LLC - Member

Pecue Properties LLC - 33%

BDC Management LLC - Member

BDC Management LLC - 100%

Highland Market Place II LLC - Member

Anna Kathryne Kronenberger Baton Rouge, LA 70808

Lawyer Director Director - Community Credit Centers Inc

Kronenberger, Law, LLC - Member

0.67% 0.00% Kronenberger, Law, LLC - 100%

Director - Community Credit Centers of Ferriday LLC

Edgewood Cockfield Project, LLC - Member

Director - Cencap Insurance Agency, LLC

RAC, Jr. Family Bluebonnet, LLC - Member

RAC, Jr. Family Bluebonnet, LLC - 25%

-

(1)(a)(b)(c) and (2)(a)(b)(c)

Form FR Y-6

Central Louisiana Capital CorpVidalia, LA

Fiscal Year Ending December 31, 2017

Report Item 4: Insiders

Brierfield-Hurricane LLC - Member

-

Results: A list of branches for your depository institution: DELTA BANK (ID_RSSD: 975256).This depository institution is held by CENTRAL LOUISIANA CAPITAL CORPORATION (1109571) of VIDALIA, LAThe data are as of 12/31/2017. Data reflects information that was received and processed through 01/04/2

Reconciliation and Verification Steps1. In the Data Action column of each branch row, enter one or more of the actions specified below2. If required, enter the date in the Effective Date column

ActionsOK: If the branch information is correct, enter 'OK' in the Data Action column.Change: If the branch information is incorrect or incomplete, revise the data, enter 'Change' in the Data Act Close: If a branch listed was sold or closed, enter 'Close' in the Data Action column and the sale or closure d Delete: If a branch listed was never owned by this depository institution, enter 'Delete' in the Data Action cAdd: If a reportable branch is missing, insert a row, add the branch data, and enter 'Add' in the Data Action

If printing this list, you may need to adjust your page setup in MS Excel. Try using landscape orientation, pag

Submission ProcedureWhen you are finished, send a saved copy to your FRB contact. See the detailed instructions on this site for If you are e-mailing this to your FRB contact, put your institution name, city and state in the subject line of t

Note:To satisfy the FR Y-10 reporting requirements, you must also submit FR Y-10 Domestic Branch Schedules for The FR Y-10 report may be submitted in a hardcopy format or via the FR Y-10 Online application - https://y1

* FDIC UNINUM, Office Number, and ID_RSSD columns are for reference only. Verification of these values is

Data Action Effective Date Branch Service Type Branch ID_RSSD* Popular NameOK Full Service (Head Office) 975256 DELTA BANK OK Full Service 180153 FERRIDAY BRANCH OK Full Service 599559 LAKE PROVIDENCE BRANCH OK Full Service 3394867 TALLULAH BRANCH OK Full Service 4716484 NATCHEZ OFFICE

-

. 2018.

tion column and the date when this information first became valid in the Effective Date column. date in the Effective Date column.

column. column and the opening or acquisition date in the Effective Date column.

ge scaling, and/or legal sized paper.

more information. he e-mail.

r each branch with a Data Action of Change, Close, Delete, or Add. 10online.federalreserve.gov.

s not required.

Street Address City State Zip Code County Country1617 CARTER ST VIDALIA LA 71373 CONCORDIA UNITED STATES 302 LOUISIANA AVENUE FERRIDAY LA 71334-2830 CONCORDIA UNITED STATES 406 LAKE STREET LAKE PROVIDENCE LA 71254 EAST CARROLL UNITED STATES 401 SOUTH CEDAR TALLULAH LA 71282 MADISON UNITED STATES 173 HIGHWAY 61 SOUTH NATCHEZ MS 39120 ADAMS UNITED STATES

-

FDIC UNINUM* Office Number* Head Office Head Office ID_RSSD* CommentsNot Required Not Required DELTA BANK 975256Not Required Not Required DELTA BANK 975256Not Required Not Required DELTA BANK 975256Not Required Not Required DELTA BANK 975256Not Required Not Required DELTA BANK 975256

-

CENTRAL LOUISIANA CAPITAL CORPORATION AND SUBSIDIARIES

VIDALIA, LOUISIANA DECEMBER 31, 2017 AND 2016

-

CENTRAL LOUISIANA CAPITAL CORPORATION AND SUBSIDIARIES

VIDALIA, LOUISIANA TABLE OF CONTENTS AUDITED CONSOLIDATED FINANCIAL STATEMENTS Page Independent Auditor’s Report 1-2 Consolidated Balance Sheets 3 Consolidated Statements of Income 4 Consolidated Statements of Comprehensive Income 5 Consolidated Statements of Changes in Stockholders’ Equity 6 Consolidated Statements of Cash Flows 7-8 Notes to Consolidated Financial Statements 9-38 SUPPLEMENTAL CONSOLIDATING INFORMATION Consolidating Balance Sheet 39-40 Consolidating Income Statement 41-42

-

AUDITED CONSOLIDATED FINANCIAL STATEMENTS

-

1

February 23, 2018 To the Board of Directors Central Louisiana Capital Corporation and Subsidiaries Vidalia, Louisiana Independent Auditor’s Report Report on the Financial Statements We have audited the accompanying consolidated financial statements of Central Louisiana Capital Corporation and Subsidiaries, which comprise the consolidated balance sheets as of December 31, 2017 and 2016, and the related consolidated statements of income, comprehensive income, changes in stockholders’ equity, and cash flows for the years then ended, and the related notes to the consolidated financial statements. Management’s Responsibility for the Financial Statements Management is responsible for the preparation and fair presentation of these consolidated financial statements in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of consolidated financial statements that are free from material misstatement, whether due to fraud or error. Auditor’s Responsibility Our responsibility is to express an opinion on these consolidated financial statements based on our audits. We conducted our audits in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement. An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the consolidated financial statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the consolidated financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity’s preparation and fair presentation of the consolidated financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements.

-

2

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. Opinion In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Central Louisiana Capital Corporation and Subsidiaries as of December 31, 2017 and 2016, and the results of its operations and its cash flows for the years then ended in accordance with accounting principles generally accepted in the United States of America. Report on Consolidating Information Our audit was conducted for the purpose of forming an opinion on the basic consolidated financial statements taken as a whole. The consolidating information included on pages 39 through 42 is presented for purposes of additional analysis and is not a required part of the basic consolidated financial statements. Such information is the responsibility of management and was derived from and relates directly to the underlying accounting and other records used to prepare the consolidated financial statements. The information has been subjected to the auditing procedures applied in the audit of the consolidated financial statements and certain additional procedures, including comparing and reconciling such information directly to the underlying accounting and other records used to prepare the consolidated financial statements or to the consolidated financial statements themselves, and other additional procedures in accordance with auditing standards generally accepted in the United State of America. In our opinion, this information is fairly stated in all material respects in relation to the consolidated financial statements taken as a whole. Shreveport, Louisiana

-

CENTRAL LOUISIANA CAPITAL CORPORATION AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

DECEMBER 31, 2017 AND 2016

A S S E T S 2017 2016

Assets:Cash and due from banks 9,068,914 6,128,195 Interest-bearing deposits with other financial institutions 17,917,387 11,293,874 Securities available-for-sale 25,045,697 25,540,225 Securities held-to-maturity 24,381,475 23,352,805 Restricted stock 1,066,900 1,055,700 Loans, net of allowance for loan losses 199,323,886 187,921,727 Premises and equipment, net 5,207,437 5,570,631 Accrued interest receivable 2,299,642 2,366,896 Other assets 1,511,664 1,135,763

Total assets 285,823,002 264,365,816

LIABILITIES AND STOCKHOLDERS' EQUITY

Liabilities:Deposits

Noninterest-bearing deposits 62,349,694 56,784,129 Interest-bearing deposits 194,392,151 180,767,550

Total deposits 256,741,845 237,551,679

Federal Home Loan Bank advances 870,872 993,590 Notes payable 1,200,000 - Accrued interest payable 241,752 204,092 Other liabilities 1,378,046 1,459,492

Total liabilities 260,432,515 240,208,853

Stockholders' equity:Common stock of $6 par value; authorized 500,000

shares; 274,859 and 275,684 shares issued and outstanding for 2017 and 2016, respectively 1,649,154 1,654,104

Additional paid-in capital 6,525,302 6,625,952 Retained earnings 17,366,023 15,880,341 Unearned ESOP shares (194,241) (239,138) Accumulated other comprehensive income 44,249 235,704

Total stockholders' equity 25,390,487 24,156,963

Total liabilities and stockholders' equity 285,823,002 264,365,816

The accompanying notes are an integral part of these consolidated financial statements.3

-

CENTRAL LOUISIANA CAPITAL CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME

FOR THE YEARS ENDED DECEMBER 31, 2017 AND 2016

2017 2016Interest income:

Interest and fees on loans 11,501,523 10,726,201 Interest and dividends on investment securities:

Taxable interest 697,714 736,959 Tax exempt interest 845,690 840,936

Interest-bearing bank balances 137,196 54,849 Total interest income 13,182,123 12,358,945

Interest expense:Interest on deposits 1,030,458 889,770 Interest on short-term borrowings 1,036 456 Interest on other borrowings 92,580 71,557

Total interest expense 1,124,074 961,783 Net interest income 12,058,049 11,397,162

Provision for loan losses 574,199 365,800 Net interest income, after provision for loan losses 11,483,850 11,031,362

Other income:Service fees 1,236,706 1,129,389 Other income 1,116,225 850,440

Total other income 2,352,931 1,979,829

Noninterest expense:Salaries and employee benefits 5,629,929 5,567,889 Occupancy expenses 1,242,817 1,220,302 Equipment and data processing expenses 918,684 823,102 Other expenses 1,789,588 1,606,480

Total noninterest expenses 9,581,018 9,217,773

Net income 4,255,763 3,793,418

Net income per share - basic 15.57 13.89

The accompanying notes are an integral part of these consolidated financial statements.4

-

CENTRAL LOUISIANA CAPITAL CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

FOR THE YEARS ENDED DECEMBER 31, 2017 AND 2016

2017 2016

Net income 4,255,763 3,793,418

Other comprehensive income:Changes in unrealized (losses) on securities

available-for-sale (178,033) (214,755)

Reclassification adjustment for gains includedin net income (included in other income in theconsolidated statements of income) (13,422) -

Other comprehensive (loss) (191,455) (214,755)

Total comprehensive income 4,064,308 3,578,663

The accompanying notes are an integral part of these consolidated financial statements.5

-

CENTRAL LOUISIANA CAPITAL CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY

FOR THE YEARS ENDED DECEMBER 31, 2017 AND 2016

AccumulatedAdditional Unearned Other Total

Common Stock Paid-In Retained ESOP Comprehensive Stockholders'Shares Amount Capital Earnings Shares Income Equity

Balances, December 31, 2015 275,684 1,654,104 6,629,936 14,552,052 (296,024) 450,459 22,990,527

Net income - - - 3,793,418 - - 3,793,418

Change in unrealized (losses) onsecurities available-for-sale - - - - - (214,755) (214,755)

Release of unearned ESOP shares - - (3,984) - 56,886 - 52,902

Dividends paid - - - (2,465,129) - - (2,465,129)

Balances, December 31, 2016 275,684 1,654,104 6,625,952 15,880,341 (239,138) 235,704 24,156,963

Net income - - - 4,255,763 - - 4,255,763

Change in unrealized (losses) onsecurities available-for-sale - - - - - (191,455) (191,455)

Repurchase and cancellation of common stock (825) (4,950) (100,650) - - - (105,600)

Release of unearned ESOP shares - - - - 44,897 - 44,897

Dividends paid - - - (2,770,081) - - (2,770,081)

Balances, December 31, 2017 274,859 1,649,154 6,525,302 17,366,023 (194,241) 44,249 25,390,487

The accompanying notes are an integral part of these consolidated financial statements.6

-

CENTRAL LOUISIANA CAPITAL CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE YEARS ENDED DECEMBER 31, 2017 AND 2016

2017 2016Cash flows from operating activities:

Net income 4,255,763 3,793,418 Adjustments to reconcile net income to net cash

provided by operating activities:Provision for loan loss 574,199 365,800 Depreciation 478,637 510,367 Net (gain) on sale of investment securities (13,422) - Net (gain) on sale of premises and equipment - (11,539) Net loss on sale of other real estate owned - 17,134 Net (gain) on sale of other repossessed assets (1,182) - Stock dividends on Federal Home Loan Bank stock (11,200) (5,500) Amortization of investment security premiums 229,861 207,242 Accretion of investment security discounts (8,590) (10,457) Release of unearned ESOP shares 44,897 52,902 Decrease (increase) in accrued interest receivable 67,254 (11,064) (Increase) decrease in other assets (312,344) 541,219 Increase in accrued interest payable 37,660 368 (Decrease) in other liabilities (81,446) (93,600)

Net cash provided by operating activities 5,260,087 5,356,290

Cash flows from investing activities:Decrease in interest-bearing deposits with

other institutions (6,623,513) (7,402,541) Purchases of available-for-sale securities (16,027,275) (1,190,584) Proceeds from maturities of available-for-sale securities 9,035,000 43,766 Proceeds from sales and calls of available-for-sale securities 3,952,700 1,485,000 Principal collected on mortgage-backed securities 3,158,023 1,581,894 Purchases of held-to-maturity securities (2,998,844) (2,592,268) Proceeds of maturities of held-to-maturity securities 1,165,000 891,000 Proceeds from calls of held-to-maturity securities 781,950 671,150 Federal Home Loan Bank stock transactions, net - (244,300) Net increase in loans (12,038,733) (9,005,060) Proceeds from sale of premises and equipment - 32,686 Purchases of premises and equipment (115,443) (164,152)

Net cash (used) provided by investing activities (19,711,135) (15,893,409)

The accompanying notes are an integral part of these consolidated financial statements.7

-

CENTRAL LOUISIANA CAPITAL CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE YEARS ENDED DECEMBER 31, 2017 AND 2016

2017 2016

Cash flows from financing activities:Net increase in demand deposits 5,565,565 7,103,587 Net increase in NOW, savings, and money market

accounts 12,245,627 7,498,933 Net increase (decrease) in certificates of deposit 1,378,974 (757,952) Repayment of Federal Home Loan Bank advances (122,718) (129,937) Principal payments on ESOP note payable - (16,132) Proceeds from notes payable 1,200,000 - Repurchase of common stock (105,600) - Dividends paid (2,770,081) (2,465,129)

Net cash provided by financing activities 17,391,767 11,233,370

Net increase in cash and cash equivalents 2,940,719 696,251

Cash and cash equivalents at beginning of year 6,128,195 5,431,944

Cash and cash equivalents at end of year 9,068,914 6,128,195

Supplemental cash flow information:Interest paid 1,086,414 961,415

Supplemental schedule of significant noncash activities:Loan principal reduction due to foreclosure of real estate

and other collateral 62,375 29,362

(Decrease) in other comprehensive income (191,455) (214,755)

The accompanying notes are an integral part of these consolidated financial statements.8

-

9

CENTRAL LOUISIANA CAPITAL CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS DECEMBER 31, 2017 AND 2016 1. Nature of Operations and Significant Accounting Policies

The accounting and reporting policies of Central Louisiana Capital Corporation and Subsidiaries conform to accounting principles generally accepted in the United States of America and to general practices within the banking industry. The following is a description of the more significant policies. Organization Central Louisiana Capital Corporation was formed on December 22, 1983, as a holding company. Principles of Consolidation The accompanying consolidated financial statements of the Company include the accounts of the Company and its wholly-owned subsidiaries, as follows: Delta Bank Community Credit Centers, Inc.—dissolved, effective July 20, 2017 Community Credit Center of Ferriday, LLC Cencap Insurance Agency, LLC Nature of Operations Delta Bank (“the Bank”) operates as a commercial bank and provides a full range of banking services through banking offices within the states of Louisiana and Mississippi. As a state chartered commercial bank, the Bank is subject to the regulations of certain federal and state agencies and undergoes periodic examination by those regulatory authorities. Community Credit Centers, Inc. and Community Credit Center of Ferriday, LLC (“Ferriday”) operate as finance companies that provide lending services through offices in the states of Louisiana and Mississippi. Effective July 20, 2017, Community Credit Centers, Inc. was dissolved. Ferriday was the only finance company subsidiary that was active during 2017 and 2016. Cencap Insurance Agency, LLC operates as a general insurance agency. Use of Estimates The preparation of consolidated financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reported period. Actual results could differ from those estimates. Material estimates that are particularly susceptible to significant change relate to the determination of the allowance for loan losses, fair value of financial instruments, and the valuation of real estate acquired in connection with foreclosures or in the satisfaction of loans. In connection with the determination of the estimated losses on loans, management obtains independent appraisals for significant collateral. The Bank’s loans are generally secured by specific items of collateral including real property, consumer assets, and business assets. Although the Bank has a diversified loan portfolio, a substantial portion of its debtors’ ability to honor their contracts is dependent on local economic conditions.

-

10

1. Nature of Operations and Significant Accounting Policies (Continued) While management uses available information to recognize losses on loans, further reductions in the carrying amounts of loans may be necessary based on changes in local economic conditions. In addition, regulatory agencies, as an integral part of their examination process, periodically review the estimated losses on loans. Such agencies may require the Bank to recognize additional losses based on their judgments about information available to them at the time of their examination. Because of these factors, it is reasonably possible that the estimated losses on loans may change materially in the near term. However, the amount of the change that is reasonably possible cannot be estimated. Comprehensive Income Accounting policies generally require that recognized revenue, expenses, gains, and losses be included in net income. Certain changes in assets and liabilities, such as unrealized gains and losses on available-for-sale securities, are reported as a separate component of the shareholders’ equity section of the balance sheet. Such items, along with net income, are components of comprehensive income. Cash and Cash Equivalents In the accompanying consolidated statements of cash flows, the Company has defined cash equivalents as those amounts included in the consolidated balance sheet caption “cash and due from banks.” Investment Securities U.S. GAAP requires that debt and equity securities be classified into one of three categories: held-to-maturity, available-for-sale, or trading. The Company has no investments classified as trading. Debt securities are classified as held-to-maturity when the Bank has the positive intent and ability to hold the securities to maturity. Securities held-to-maturity are carried at amortized cost. The amortization of premiums and accretion of discounts are recognized in interest income using methods approximating the interest method over the period to maturity. Debt securities not classified as held-to-maturity are classified as available-for sale. Securities available-for-sale are carried at fair value with unrealized gains and losses reported in other comprehensive income. Realized gains on securities available-for-sale are included in other income and, when applicable, are reported as a reclassification adjustment in other comprehensive income. Gains and losses on sales of securities are determined on the specific-identification method. Unrealized holding gains and losses are reported as a separate component of stockholders’ equity. Amortization of premium and accretion of discount are computed using the interest method. Declines in the fair value of securities available-for-sale below their cost that are deemed to be other than temporary are reflected in earnings as realized losses. In estimating other than temporary impairment losses, management considers (1) the length of time and the extent to which the fair value has been less than cost; (2) the financial condition and near-term prospects of the issuer; and (3) the intent and ability of the Bank to retain its investment in the issuer for a period of time sufficient to allow for any anticipated recovery in fair value.

-

11

1. Nature of Operations and Significant Accounting Policies (Continued) Loans Loans are stated at the principal amount outstanding, net of unearned income and an allowance for loan losses. Interest on loans is calculated using the simple interest method on daily balances of the principal amount outstanding. Interest on finance company loans is recognized as income over the terms of the loans using a method which approximates the interest method. The accrual of interest on loans is discontinued when, in the opinion of management, there is an indication that the borrower may be unable to meet payments as they become due. Upon such discontinuance, all unpaid accrued interest is reversed. Loans are placed on nonaccrual or charged off when collection of principal or interest is considered doubtful. All interest accrued but not collected for loans that are placed on nonaccrual or charged off is reversed against interest income. The interest on these loans is accounted for on the cash-basis or cost-recovery method, until qualifying for return to accrual. Loans are returned to accrual status when all the principal and interest amounts contractually due are brought current and future payments are reasonably assured. Allowance for Loan Losses The allowance for loan losses is established through provisions for loan losses charged against earnings. Loans deemed to be uncollectible are charged against the allowance for loan losses, and subsequent recoveries, if any, are credited to the allowance. The allowance for loan losses is maintained at a level management believes to be adequate to absorb estimated probable loan losses. Management’s periodic evaluation of the adequacy of the allowance for loan losses is based on estimated credit losses for specifically identified loans as well as estimated probable credit losses inherent in the remainder of the loan portfolio. Management considers a number of factors in estimating probable credit losses inherent in the loan portfolio including historical loan loss experience for various types of loans, composition of the loan portfolio, past due trends in the loan portfolio, current trends, current economic conditions, industry exposure, and allowance allocation percentages for various grades of loans. These grades are assigned to loans based on internal and external loan reviews, loan risk, loan performance, the estimated value of underlying collateral, evaluation of a borrower’s financial condition, and other factors considered relevant in grading loans. The allowance consists of specific, general, and unallocated components. The specific component relates to loans that are classified as doubtful, substandard, or special mention. For such loans that are also classified as impaired, an allowance is established when the discounted cash flows (or collateral value or observable market price) of the impaired loan is lower than the carrying value of that loan. The general component covers nonclassified loans and is based on historical loss experience adjusted for qualitative factors. An unallocated component is maintained to cover uncertainties that could affect management’s estimate of probable losses. The unallocated component of the allowance reflects the margin of imprecision inherent in the underlying assumptions used in the methodologies for estimating specific and general losses in the portfolio.

-

12

1. Nature of Operations and Significant Accounting Policies (Continued) A loan is considered impaired when, based on current information and events, it is probable that the Bank will be unable to collect the scheduled payments of principal or interest when due according to the contractual terms of the loan agreement. Factors considered by management in determining impairment include payment status, collateral value, and the probability of collecting scheduled principal and interest payments when due. Loans that experience insignificant payment delays and payment shortfalls generally are not classified as impaired. Management determines the significance of payment delays and payment shortfalls on a case-by-case basis, taking into consideration all of the circumstances surrounding the loan and the borrower, including the length of the delay, the reasons for the delay, the borrower’s prior payment record, and the amount of the shortfall in relation to the principal and interest owed. Impairment is measured on a loan-by-loan basis by either the present value of expected future cash flows discounted at the loan’s effective interest rate, the loan’s obtainable market price, or the fair value of the collateral if the loan is collateral dependent. Management’s evaluation of the allowance for loan losses is inherently subjective as it requires material estimates. The actual amounts of loan losses realized in the near term could differ from the amounts estimated in arriving at the allowance for loan losses reported in the financial statements. Troubled Debt Restructurings In situations where, for economic or legal reasons related to a borrower’s financial difficulties, the Bank grants a concession for other than an insignificant period of time to the borrower that the Bank would not otherwise consider, the related loan is classified as a troubled debt restructuring (TDR). The Bank strives to identify borrowers in financial difficulty early and work with them to modify to more affordable terms before their loan reaches nonaccrual status. These modified terms may include rate reductions, principal forgiveness, payment forbearance, and other actions intended to minimize the economic loss and to avoid foreclosure or repossession of the collateral. In cases where the Bank grants the borrower new terms that provide for a reduction of either interest or principal, the Bank measures any impairment on the restructuring as previously noted for impaired loans. Loan Origination Fees and Costs Loan origination fees and certain direct origination costs are recorded to income in the period in which received. These fees are not material to the financial statements. Premises and Equipment Land is carried at cost. Other premises and equipment are stated at cost net of accumulated depreciation. Depreciation expense is computed principally using the straight-line method and charged to operating expenses over the estimated useful lives of the respective assets. Costs of major additions and improvements are capitalized. Expenditures for maintenance and repairs are charged to expense as incurred. Gain and losses on dispositions are included in current operations. Other Real Estate Owned Real estate properties acquired through or in lieu of loan foreclosure are initially recorded at the fair value less estimated selling cost at the date of foreclosure. Any write-downs based on the asset’s fair value at the date of acquisition are charged to the allowance for loan losses. After foreclosure, valuations are periodically performed by management and property

-

13

1. Nature of Operations and Significant Accounting Policies (Continued) held for sale is carried at the lower of the new cost basis or fair value less cost to sell. Impairment losses on property to be held and used are measured as the amount by which the carrying amount of a property exceeds its fair value. Costs of significant property improvements are capitalized, whereas costs relating to holding property are expensed. The portion of interest costs relating to development of real estate is capitalized. Valuations are periodically performed by management, and any subsequent write-downs are recorded as a charge to operations, if necessary, to reduce the carrying value of a property to the lower of its cost or fair value less cost to sell. Advertising The Company expenses advertising costs as incurred. Advertising expense costs were $374,567 and $307,980 for 2017 and 2016, respectively. Income Taxes The Company, effective January 1, 2001, with the consent of its shareholders, has elected under the Internal Revenue Code to be an S corporation. In lieu of corporation income taxes, the shareholders of an S corporation are taxed on their proportionate share of the Company’s taxable income. The Company and subsidiaries file consolidated income tax returns. The Company and Bank file consolidated federal, Louisiana, and Mississippi income tax returns. The Company does not have uncertain tax positions that are deemed material and did not recognize any adjustments for unrecognized tax benefits. The Company’s policy is to recognize interest and penalties on income taxes in other noninterest expense. The Company remains subject to examination for income tax returns for the years ending after December 31, 2014. Net Income per Share Basic income per share is computed by dividing net income by the weighted average number of shares outstanding during the period. Common shares held in the Employee Stock Ownership Plan that have not yet been released to plan participants are not considered as outstanding shares for the purpose of computing income per share. The weighted average number of shares outstanding were 273,280 in 2017 and 273,016 in 2016. Reclassifications Certain reclassifications have been made to the 2016 financial statements presentation to correspond to the current year’s format. Total shareholders’ equity and net income are unchanged due to these reclassifications. Subsequent Events The Company has evaluated the accompanying consolidated financial statements for subsequent events and transactions through February 23, 2018, the date these financial statements were available for issue, based on FASB ASC 855, Subsequent Events, and have determined that no material subsequent events have occurred that would affect the information presented in the accompanying consolidated financial statements or require additional disclosure. Off-Balance Sheet Financial Instruments In the ordinary course of business, the Bank has entered into off-balance sheet financial instruments consisting of commitments to extend credit, commercial letters-of-credit, and standby letters-of-credit. Such financial instruments are recorded in the financial statements when they become payable.

-

14

1. Nature of Operations and Significant Accounting Policies (Continued) Recent Accounting Pronouncements In January 2016, the FASB issued ASU No. 2016-01, Financial Instruments. The amendments in this Update supersede the guidance to classify equity securities with readily determinable fair values into different categories and requires equity securities to be measured at fair value with changes in the fair value recognized through net income. The amendments allow equity investments that do not have readily determinable fair values to be remeasured at fair value either upon the occurrence of an observable price change or upon identification of an impairment. The amendments in this Update also simplify the impairment assessment of equity investments without readily determinable fair values by requiring assessment for impairment qualitatively at each reporting period. In addition, the amendments supersede the requirement to disclose the fair value of financial instruments measured at amortized cost for entities that are not public business entities. The provisions within this Update require an entity to present separately in other comprehensive income the portion of the total change in the fair value of a liability resulting from a change in the instrument-specific credit risk when the entity has elected to measure the liability at fair value in accordance with the fair value option. This amendment excludes from net income gains or losses that the entity may not realize because those financial liabilities are not usually transferred or settled at their fair values before maturity. The amendments in this Update require separate presentation of financial assets and financial liabilities by measurement category and form of financial asset (that is, securities or loans and receivables) on the balance sheet or in the accompanying notes to the financial statements. The amendments in ASU 2016-01 are effective for fiscal years beginning after December, 15, 2018, including interim periods within those fiscal years. The Bank has elected to early adopt the provision that allow it not to disclose the fair value of financial instruments measured at amortized cost in accordance with guidance in ASC 825 with the exception of investment securities held to maturity. The Bank is currently evaluating the potential impact of adopting the remaining guidance on its financial statements. In June 2016, the FASB issued Accounting Standards Update (“ASU”) No. 2016-13, Financial Instruments – Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments. Under current U.S. GAAP, companies generally recognize credit losses when it is probable that the loss has been incurred. The amendments in this ASU replace the incurred loss model for recognition of credit losses with a methodology that reflects expected credit losses over the life of the loan and requires consideration based on historical experience, current conditions, and reasonable and supportable forecasts. The new standard also requires enhanced disclosures related to the significant estimates and judgments used in estimating credit losses, as well as the credit quality and underwriting standards of an organization’s portfolio. In addition, ASU 2016-13 amends the accounting for credit losses on available-for-sale debt securities and purchased financial assets with credit deterioration. ASU 2016-13 will be effective for fiscal years beginning after December 15, 2020, including interim periods within those fiscal years. The Bank is currently evaluating the potential impact of ASU 2016-13 on its financial statements. In March 2016, the FASB issued ASU 2017-08, Receivables-Nonrefundable Fees and Other Costs (Subtopic 310-20); Premium Amortization on Purchased Callable Debt Securities. This standard amends the amortization period for certain purchased callable debt securities held at a premium. In particular, this amendment requires the premium to be amortized to the earliest call date. The

-

15

1. Nature of Operations and Significant Accounting Policies (Continued) amendments do not, however, require an accounting change for securities held at a discount; instead, the discount continues to be amortized to maturity. Notably, the amendments in this ASU more closely align the amortization period of premiums and discounts to expectations incorporated in market pricing of the underlying securities. Securities within the scope of ASU 2017-08 are purchased debt securities that have explicit, non-contingent call features that are callable at fixed prices and on preset dates. The amendments of ASU 2017-08 become effective for fiscal years, and for interim periods within those fiscal years, beginning after December 15, 2019. The Bank is currently evaluating the potential impact of ASU 2017-08 on its financial statements; however, the adoption is not expected to have a material impact on the Bank’s financial statements.

2. Investment Securities Investment securities have been classified in the consolidated balance sheet according to management’s intent. The following is a summary of the amortized cost and their approximate fair values of securities available-for-sale and held-to-maturity:

Amortized Cost

Gross Unrealized

Gains

Gross Unrealized

Losses Estimated Fair Value

Securities available for sale-December 31, 2017:

U.S. Government agencies 2,632,751 - (26,891) 2,605,860 Mortgage-backed securities 8,585,823 63,211 (49,495) 8,599,539 States and political subdivisions 4,663,040 45,235 (117,476) 4,590,799 Other debt securities 9,301,655 56,099 (108,255) 9,249,499

25,183,269 164,545 (302,117) 25,045,697

Securities held to maturity- December 31, 2017:

States and political subdivisions 24,381,475 615,241 (119,641) 24,877,075

Securities available for sale- December 31, 2016:

U.S. Government agencies 2,643,335 - (52,817) 2,590,518 Mortgage-backed securities 8,788,684 75,772 (57,933) 8,806,523 States and political subdivisions 7,875,784 107,383 (99,754) 7,883,413 Other debt securities 6,238,887 84,888 (64,004) 6,259,771

25,546,690 268,043 (274,508) 25,540,225

Securities held to maturity- December 31, 2016:

States and political subdivisions 23,352,805 503,066 (224,251) 23,631,620

-

16

2. Investment Securities (Continued) The amortized cost and estimated fair value of securities available-for-sale and securities held-to-maturity as of December 31, 2017, by contractual maturity, are as follows:

Available for Sale Held to Maturity Amortized

Cost Fair Value Amortized

Cost Fair Value

Due in one year or less 159,772 159,263 529,823 529,596 Due from 1 year through 5 years 18,172,974 18,051,098 3,832,647 3,895,423 Due from 5 years through 10 years 4,915,257 4,899,370 4,218,382 4,330,297 Due after 10 years 1,935,266 1,935,966 15,800,623 16,121,759

25,183,269 25,045,697 24,381,475 24,877,075

Expected maturities will differ from contractual maturities because issuers may have the right to call or prepay obligations with or without call or prepayment penalties. Proceeds from sales and calls of available-for-sale securities during 2017 and 2016 were $3,952,700 and $1,485,000, respectively. Gross realized gains on sales of available-for-sale securities during 2017 and 2016 were $36,348 and $-0-, respectively. Gross realized losses on sales of available-for-sale securities during 2017 and 2016 were $22,926 and $-0-, respectively. Proceeds from maturities of available-for-sale securities during 2017 and 2016 were $9,035,000 and $43,766, respectively. Principal pay-downs of available-for-sale securities during 2017 and 2016 were $3,158,023 and $1,581,894, respectively. Proceeds from calls of held-to-maturity securities during years 2017 and 2016 were $781,950 and $671,150, respectively. No gains or losses were realized from transactions involving held-to-maturity securities in 2017 and 2016. Proceeds from maturities of held-to-maturity securities during the years 2017 and 2016 were $1,165,000 and $891,000, respectively. In October 2013, management at the Bank chose to transfer $22,445,728 in states and political subdivisions securities from available-for-sale to held-to-maturity. Management has the intent and ability to hold these securities to maturity. The amount of unrealized gain on these securities at transfer date was $582,585. This amount is being amortized over the lives of these held-to-maturity securities. The following is a summary of the amortized cost and fair value of investment securities which were pledged to secure public deposits, short-term borrowings, and for other purposes required or permitted by law:

Available for Sale Held to Maturity Amortized

Cost Estimated Fair Value

Amortized Cost

Estimated Fair Value

December 31, 2017 18,002,257 17,961,159 21,916,998 22,404,008

December 31, 2016 18,450,377 18,461,498 21,903,608 22,416,067

-

17

2. Investment Securities (Continued)

Information pertaining to securities with gross unrealized losses at December 31, 2017 and 2016, aggregated by investment category and length of time that individual securities have been in a continuous loss position, follows:

Less Than 12 Months 12 Months or More Total

Fair Value

Gross Unrealized

Losses Fair Value

Gross Unrealized

Losses Fair Value

Gross Unrealized

Losses Securities available for sale-December 31, 2017:

U.S. Government agencies 2,605,860 (26,891) - - 2,605,860 (26,891) Mortgage-backed securities 5,601,940 (49,200) 19,094 (295) 5,621,034 (49,495) States and political subdivisions 430,426 (5,311) 1,095,279 (112,165) 1,525,705 (117,476) Other debt securities 6,066,590 (85,043) 1,289,884 (23,212) 7,356,474 (108,255)

14,704,816 (166,445) 2,404,257 (135,672) 17,109,073 (302,117)

Securities held to maturity-December 31, 2017:

States and political subdivisions 2,797,513 (28,556) 2,470,390 (91,085) 5,267,903 (119,641)

Securities available for sale-December 31, 2016:

U.S. Government agencies 2,590,518 (52,817) - - 2,590,518 (52,817) Mortgage-backed securities 4,938,803 (57,777) 11,844 (156) 4,950,647 (57,933) States and political subdivisions 1,749,830 (36,366) 1,208,492 (63,388) 2,958,322 (99,754) Other debt securities 4,081,158 (64,004) - - 4,081,158 (64,004)

13,360,309 (210,964) 1,220,336 (63,544) 14,580,645 (274,508)

Securities held to maturity-December 31, 2016:

States and political subdivisions 6,913,514 (223,891) 64,640 (360) 6,978,154 (224,251)

Management evaluates securities for other-than-temporary impairment, at least on a quarterly basis, and more frequently when economic or market concerns warrant such evaluation. Consideration is given to (1) the length of time and the extent to which the fair value has been less than cost, (2) the financial condition and near-term prospects of the issuer, and (3) the intent and ability of the Bank to retain its investment in the issuer for a period of time sufficient to allow for any anticipated recovery in fair value. At December 31, 2017, the forty-three debt securities with unrealized losses have depreciated 1.9% from the Company’s amortized cost basis. All of these securities are guaranteed by state and local governments or secured by mortgage loans. These unrealized losses relate principally to current interest rates for similar types of securities. In analyzing an issuer’s financial condition, management considers whether the securities are issued by the federal government, its agencies, or other governments, whether downgrades by bond rating agencies have occurred, and the results of reviews of the issuer’s financial condition. As management has the ability to hold debt securities until maturity, or for the foreseeable future if classified as available-for-sale, no declines are deemed to be other-than-temporary.

-

18

2. Investment Securities (Continued) Restricted Stock As of December 31, 2017 and 2016, respectively, the bank held $1,066,900 and $1,055,700 in Federal Home Loan Bank stock, which is classified as restricted on the balance sheet.

3. Loans and Allowances for Loan Losses The loan portfolio includes commercial, agricultural, consumer, and real estate loans primarily in the banking and finance subsidiaries’ market areas. Although these subsidiaries have diversified loan portfolios, the subsidiaries have concentration of credit risks related to the agricultural economy, the real estate market, and general economic conditions in the subsidiaries’ market areas. The following is a summary of loans at December 31, 2017 and 2016:

2017 2016

Loans secured by real estate:Construction and land development 5,020,685 3,877,804 Farmland 45,121,260 46,724,170 1-4 family residential 56,244,405 52,041,168 Multi family residential 228,438 233,112 Nonfarm nonresidential 39,385,847 30,212,858

Agricultural production 30,227,227 29,660,071 Commercial and industrial 16,429,017 18,099,009 Loans to individuals 6,307,206 6,478,898 States and political subdivisions 1,448,493 1,262,930 Other loans 1,002,760 1,246,051

Total loans 201,415,338 189,836,071

Allowance for loan losses (2,091,452) (1,914,344) Net loans 199,323,886 187,921,727

An analysis of the change in the allowance for loan losses is as follows:

December 31,2017 2016

Balance-beginning of year 1,914,344 1,769,564 Provision charged to operations 574,072 365,800 Loans charged off (460,754) (268,637) Recoveries 63,790 47,617

Balance-end of year 2,091,452 1,914,344

-

19

3. Loans and Allowances for Loan Losses (Continued) Loans on which the accrual of interest has been discontinued amounted to $231,368 and $469,871 at December 31, 2017 and 2016, respectively. If interest on these loans had been accrued, such income would have approximated $15,719 and $38,717 at December 31, 2017 and 2016, respectively. Loans past due 90 days or longer and still accruing interest amounted to approximately $337,305 and $429,079 at December 31, 2017 and 2016, respectively. The following tables detail the allowance for loan loss disaggregated by impairment method at December 31, 2017 and 2016:

2017Allowance for Loan Losses

Disaggregated by Impairment MethodIndividually Collectively Total

Loans secured by real estate:Construction and land development - - - Farmland - 287,979 287,979 1-4 family residential 43,775 773,875 817,650 Multi family residential - - - Nonfarm nonresidential - 264,636 264,636

Agricultural production - 214,662 214,662 Commercial and industrial 15,000 138,229 153,229 Loans to individuals - 37,095 37,095 States and political subdivisions - - - Other loans - 40,111 40,111 Unallocated - 276,090 276,090

58,775 2,032,677 2,091,452

-

20

3. Loans and Allowances for Loan Losses (Continued)

2016Allowance for Loan Losses

Disaggregated by Impairment MethodIndividually Collectively Total

Loans secured by real estate:Construction and land development - - - Farmland - 431,711 431,711 1-4 family residential 43,775 518,109 561,884 Multi family residential - - - Nonfarm nonresidential 88,095 175,944 264,039

Agricultural production - 234,685 234,685 Commercial and industrial 15,000 113,230 128,230 Loans to individuals - 79,449 79,449 States and political subdivisions - - - Other loans - 49,842 49,842 Unallocated - 164,504 164,504

146,870 1,767,474 1,914,344

The following is an analysis of the allowance for loan losses by class of loans for the years ended December 31, 2017 and 2016:

2017Balance

January 1, 2017

Charge-offs Recoveries

Provision for Loan Losses

Balance December 31, 2017

Loans secured by real estate:Construction and land development - - - - - Farmland 431,711 - - (143,732) 287,979 1-4 family residential 561,884 (55,676) 100 311,342 817,650 Multi family residential - - - - - Nonfarm nonresidential 264,039 - 350 247 264,636

Agricultural production 234,685 - - (20,023) 214,662 Commercial and industrial 128,230 (259,612) 6,209 278,402 153,229 Loans to individuals 79,449 (76,661) 56,113 (21,806) 37,095 States and political subdivisions - - - - - Other loans 49,842 (68,805) 1,018 58,056 40,111 Unallocated 164,504 - - 111,586 276,090 Total 1,914,344 (460,754) 63,790 574,072 2,091,452

-

21

3. Loans and Allowances for Loan Losses (Continued)

2016Balance

January 1, 2016

Charge-offs Recoveries

Provision for Loan Losses

Balance December 31, 2016

Loans secured by real estate:Construction and land development - - - - - Farmland 431,711 - - - 431,711 1-4 family residential 511,546 (12,000) 700 61,638 561,884 Multi family residential - - - - - Nonfarm nonresidential 222,001 - 567 41,471 264,039

Agricultural production 182,051 (2,415) 7,570 47,479 234,685 Commercial and industrial 124,774 (125,000) 3,456 125,000 128,230 Loans to individuals 90,352 (71,642) 33,648 27,091 79,449 States and political subdivisions - - - - - Other loans 44,946 (57,580) 1,676 60,800 49,842 Unallocated 162,183 - - 2,321 164,504 Total 1,769,564 (268,637) 47,617 365,800 1,914,344

Credit Indicators Loans are categorized into risk categories based on relevant information about the ability of borrowers to service their debt, such as: current financial information, historical payment experience, credit documentation, public information, and current economic trends, among other factors. The following definitions are utilized for risk rating, which are consistent with the definitions used for supervisory guidance:

Watch - Loans described as watch have a potential weakness that deserves management’s close attention. Factors that trigger a watch classification include consistently delinquent or sporadic payments, declining cash flow or earnings trends, as well as known adverse economic, industry, or management factors.

Substandard - Loans classified as substandard have a well-defined weakness to the extent the credit is considered a problem. The Bank’s primary source of repayment may have been crippled or rendered inadequate to repay the loan as planned. Collateral pledged, if any, may have deteriorated or be subject to market fluctuations. While ultimate repayment is not seriously in doubt, orderly repayment has ceased or is in jeopardy.

Doubtful - Loans classified as doubtful have all the weaknesses inherent in those classified as substandard, with the added characteristic that the weaknesses make collection or liquidation in full, on the basis of currently existing facts, conditions, and values, highly questionable or improbable.

Loss - Loans classified as loss are to be written off as uncollectible.

Loans not meeting the criteria above that are analyzed individually as part of the above described process are considered to be nonclassified loans.

-

22

3. Loans and Allowances for Loan Losses (Continued)

As of December 31, 2017 and 2016, and based on the most recent analysis performed, the risk category of loans by class of loans is as follows:

2017 Non-

Classified Watch Sub-

standard Doubtful Loss Total

Construction and landdevelopment 5,020,685 - - - - 5,020,685

Farmland 44,904,671 - 216,589 - - 45,121,260 1-4 family residential 53,885,085 1,524,694 831,235 3,391 - 56,244,405 Multi family residential 228,438 - - - - 228,438 Nonfarm nonresidential 39,294,469 91,378 - - - 39,385,847 Agricultural production 30,216,095 11,132 - - - 30,227,227 Commercial and industrial 15,375,450 1,021,926 31,641 - - 16,429,017 Loans to individuals 6,269,279 25,952 11,975 - - 6,307,206 States and political

subdivisions 1,448,493 - - - - 1,448,493 Other loans 936,270 25,018 2,675 38,797 - 1,002,760

197,578,935 2,700,100 1,094,115 42,188 - 201,415,338

2016

Non-Classified Watch

Sub-standard Doubtful Loss Total

Construction and landdevelopment 3,876,429 - 1,375 - - 3,877,804

Farmland 46,482,547 - 241,623 - - 46,724,170 1-4 family residential 50,883,022 496,740 651,759 9,647 - 52,041,168 Multi family residential 233,112 - - - - 233,112 Nonfarm nonresidential 29,820,264 392,594 - - - 30,212,858 Agricultural production 29,645,632 14,439 - - - 29,660,071 Commercial and industrial 17,796,752 199,561 100,463 2,233 - 18,099,009 Loans to individuals 6,447,947 24,914 6,037 - - 6,478,898 States and political

subdivisions 1,262,930 - - - - 1,262,930 Other loans 1,179,103 20,140 9,026 37,782 - 1,246,051

187,627,738 1,148,388 1,010,283 49,662 - 189,836,071 The following tables detail loans by type which were individually and collectively evaluated for impairment at December 31, 2017 and 2016:

-

23

3. Loans and Allowances for Loan Losses (Continued)

2017Loans Evaluated for Impairment

Individually Collectively Total

Construction and land development - 5,020,685 5,020,685 Farmland - 45,121,260 45,121,260 1-4 family residential 581,655 55,662,750 56,244,405 Multi family residential - 228,438 228,438 Nonfarm nonresidential - 39,385,847 39,385,847 Agricultural production - 30,227,227 30,227,227 Commercial and industrial 60,805 16,368,212 16,429,017 Loans to individuals 24,073 6,283,133 6,307,206 States and political subdivisions - 1,448,493 1,448,493 Other loans 38,797 963,963 1,002,760

705,330 200,710,008 201,415,338

2016Loans Evaluated for Impairment

Individually Collectively Total

Construction and land development 1,789 3,876,015 3,877,804 Farmland 241,623 46,482,547 46,724,170 1-4 family residential 686,773 51,354,395 52,041,168 Multi family residential - 233,112 233,112 Nonfarm nonresidential 392,594 29,820,264 30,212,858 Agricultural production - 29,660,071 29,660,071 Commercial and industrial 155,371 17,943,638 18,099,009 Loans to individuals 6,267 6,472,631 6,478,898 States and political subdivisions - 1,262,930 1,262,930 Other loans 46,808 1,199,243 1,246,051

1,531,225 188,304,846 189,836,071 The following tables present loans individually evaluated for impairment as of December 31, 2017 and 2016:

-

24

3. Loans and Allowances for Loan Losses (Continued)

2017

Recorded Investment

Unpaid Principal Balance

Related Allowance

Average Recorded

Investment

Interest Income

RecognizedWith no impairment allowance recorded:

Loans secured by real estate:Construction and land development - - - - - Farmland - - - - - 1-4 family residential 425,573 406,157 - 416,346 16,591 Multi family residential - - - - - Nonfarm nonresidential - - - - -

Agricultural production - - - - - Commercial and industrial 37,608 37,608 - 38,530 2,989 Loans to individuals 26,191 24,073 28,461 2,387 States and political subdivisions - - - - - Other loans 38,797 38,797 - 38,797 6,983

Subtotal 528,169 506,635 - 522,134 28,950

With an impairment allowance recorded:Loans secured by real estate:

Construction and land development - - - - - Farmland - - - - - 1-4 family residential 175,498 175,498 43,775 190,170 15,354 Multi family residential - - - - - Nonfarm nonresidential - - - - -

Agricultural production - - - - - Commercial and industrial 23,197 23,197 15,000 25,079 3,242 Loans to individuals - - - - - States and political subdivisions - - - - - Other loans - - - - -

Subtotal 198,695 198,695 58,775 215,249 18,596

Total:Loans secured by real estate:

Construction and land development - - - - - Farmland - - - - - 1-4 family residential 601,071 581,655 43,775 606,516 31,945 Multi family residential - - - - - Nonfarm nonresidential - - - - -

Agricultural production - - - - - Commercial and industrial 60,805 60,805 15,000 63,609 6,231 Loans to individuals 26,191 24,073 - 28,461 2,387 States and political subdivisions - - - - - Other loans 38,797 38,797 - 38,797 6,983

Total 726,864 705,330 58,775 737,383 47,546

-

25

3. Loans and Allowances for Loan Losses (Continued)

2016

Recorded Investment

Unpaid Principal Balance

Related Allowance

Average Recorded

Investment

Interest Income

Recognized With no impairment allowance recorded:

Loans secured by real estate:Construction and land development 1,789 1,375 - 2,494 228 Farmland 241,623 241,623 - 251,667 12,793 1-4 family residential 482,992 457,625 - 480,825 34,433 Multi family residential - - - - - Nonfarm nonresidential - - - - -

Agricultural production - - - - - Commercial and industrial 125,614 72,939 - 121,384 8,371 Loans to individuals 6,267 6,037 - 6,267 846 States and political subdivisions - - - - - Other loans 46,808 46,808 - 46,808 8,425

Subtotal 905,093 826,407 - 909,445 65,096

With an impairment allowance recorded:Loans secured by real estate:

Construction and land development - - - - - Farmland - - - - - 1-4 family residential 203,781 203,781 43,775 204,986 9,205 Multi family residential - - - - - Nonfarm nonresidential 392,594 392,594 88,095 396,569 15,119

Agricultural production - - - - - Commercial and industrial 29,757 29,757 15,000 29,090 3,771 Loans to individuals - - - - - States and political subdivisions - - - - - Other loans - - - - -

Subtotal 626,132 626,132 146,870 630,645 28,095

Total:Loans secured by real estate:

Construction and land development 1,789 1,375 - 2,494 228 Farmland 241,623 241,623 - 251,667 12,793 1-4 family residential 686,773 661,406 43,775 685,811 43,638 Multi family residential - - - - - Nonfarm nonresidential 392,594 392,594 88,095 396,569 15,119

Agricultural production - - - - - Commercial and industrial 155,371 102,696 15,000 150,474 12,142 Loans to individuals 6,267 6,037 - 6,267 846 States and political subdivisions - - - - - Other loans 46,808 46,808 - 46,808 8,425

Total 1,531,225 1,452,539 146,870 1,540,090 93,191

-

26

3. Loans and Allowances for Loan Losses (Continued) A summary of current, past due, and nonaccrual loans as of December 31, 2017 and 2016, was as follows:

2017Past Due Past Due 90 Days Total Total

30-89 Days Accruing Non-Accrual Past Due Current LoansLoans secured by real estate:

Construction and land development 20,918 - - 20,918 4,999,767 5,020,685

Farmland 50,202 - - 50,202 45,071,058 45,121,260 1-4 family residential 1,127,868 234,635 221,241 1,583,744 54,660,661 56,244,405 Multi family residential - - - - 228,438 228,438 Nonfarm nonresidential 84,249 - - 84,249 39,301,598 39,385,847

Agricultural production - - - - 30,227,227 30,227,227 Commercial and industrial 1,059,976 46,052 - 1,106,028 15,322,989 16,429,017 Loans to individuals 40,427 17,821 10,127 68,375 6,238,831 6,307,206 States and political subdivisions - - - - 1,448,493 1,448,493 Other loans 27,693 38,797 - 66,490 936,270 1,002,760

Total loans 2,411,333 337,305 231,368 2,980,006 198,435,332 201,415,338

2016Past Due Past Due 90 Days Total Total

30-89 Days Accruing Non-Accrual Past Due Current LoansLoans secured by real estate:

Construction and land development 6,891 - 1,375 8,266 3,869,538 3,877,804

Farmland 311,378 - - 311,378 46,412,792 46,724,170 1-4 family residential 1,006,639 236,440 333,972 1,577,051 50,464,117 52,041,168 Multi family residential - - - - 233,112 233,112 Nonfarm nonresidential 29,448 - - 29,448 30,183,410 30,212,858

Agricultural production 13,581 - - 13,581 29,646,490 29,660,071 Commercial and industrial 120,073 145,293 126,191 391,557 17,707,452 18,099,009 Loans to individuals 59,168 22,232 8,333 89,733 6,389,165 6,478,898 States and political subdivisions - - - - 1,262,930 1,262,930 Other loans 18,757 25,114 - 43,871 1,202,180 1,246,051

Total loans 1,565,935 429,079 469,871 2,464,885 187,371,186 189,836,071

The following table summarizes information relative to loan modifications determined to be troubled debt restructurings. As of December 31, 2017 and 2016, all the troubled debt restructurings are included in impaired loans.

-

27

3. Loans and Allowances for Loan Losses (Continued)

2017

Number of Contracts

Pre-Modification Outstanding

Recorded Investment

Post-Modification Outstanding

Recorded Investment

Loans secured by real estate:1-4 family residential 8 559,540 564,491 Nonfarm nonresidential 1 392,594 392,594

Total real estate loans 9 952,134 957,085 Loans to individuals 1 9,741 10,365

10 961,875 967,450

2016

Number of Contracts

Pre-Modification Outstanding

Recorded Investment

Post-Modification Outstanding

Recorded Investment

Loans secured by real estate:1-4 family residential 6 348,499 348,499 Nonfarm nonresidential 1 392,594 392,594

Total real estate loans 7 741,093 741,093

7 741,093 741,093 None of the troubled debt restructurings have subsequently defaulted.

4. Premises and Equipment

The following is a summary of premises and equipment at December 31, 2017 and 2016:

2017 2016

Land 1,078,432 1,078,431 Buildings and improvements 7,881,727 7,836,584 Furniture, fixtures, and equipment 5,058,077 5,089,340

14,018,236 14,004,355 Less-accumulated depreciation (8,810,799) (8,433,724)

5,207,437 5,570,631 Depreciation expense for premises and equipment amounted to $478,637 and $510,367 in 2017 and 2016, respectively.

-

28

5. Other Assets The following is a summary of other assets at December 31, 2017 and 2016:

2017 2016

Other real estate repossessed 62,375 29,362 Cash surrender value of life insurance 641,035 621,457 Prepaid expenses 336,116 236,881 Other assets 472,138 248,063

1,511,664 1,135,763

6. Deposits The following is a summary of categories of deposits at December 31, 2017 and 2016:

2017 2016

Noninterest bearing deposits 62,349,694 56,784,129

NOW, savings, and money market accounts 112,479,427 100,233,800 Certificates of deposit of $250,000 or more 19