camparitive analysis

-

Upload

charlene-benson -

Category

Documents

-

view

55 -

download

2

Transcript of camparitive analysis

1

SUMMER TRAINING PROJECT REPORT

ON

“Blander Pride vs. Royal Challange”

SUBMITTED IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR

THE MASTER’S DEGREE IN BUSINESS ADMINISTRATION

OF

UTTARAKHAND TECHNICAL UNIVERSITY, DEHRADUN

SUBMITTED TO:

INTERNAL GUIDE EXTERNAL GUIDEName Name- Sudershan JoshiDesignation Designation-Marketing IMS Company NameDehradun Location

SUBMITTED BY:

BHUPENDRA SINGH

(MB11B55)

INSTITUTE OF MANAGEMENT STUDIES, DEHRADUNBATCH 2011-13

2

ACKNOWLEDGEMENT

It is said, the most important single word is we and the zero important Single word is I.

This is true even in today’s modern era. It is absolutely impossible for a single

individual to complete the assigned job without help and assistance from others.

It is my greatest pleasure to acknowledge sincere gratitude towards Mr. Sudersan

Joshi (Sales Manager) United Spirits limited, for the completion of the project work.

I would also like to acknowledge to my sincere gratitude to the Director of my institute

Dr. Pawan Aggarwal and my project guide Prof. Ashulekha Gupta for helping me

in this project work.

I am thankful to all of my friends and batch mates for their help in completing this project

work. Finally, I am thankful to my entire family members for their great support and

encouragement.

Bhupendra Singh

3

OBJECTIVES OF STUDY

• Determine The Future Of Premium Segment Of Whisky

• To find out the market leader in premium range of whisky.

• To determine the future of USL in premium segment.

• To understand the actual market size of the industry especially in the particular segment

and growth factor.

• To know the major marketing efforts including the operation along with 4p’s strategy i.e.

Product, price, place and promotion.

INTRODUCTION OF THE TOPIC

Indian Liquor industries share common characteristics arising from a similar policy framework.

Country liquor, Indian made Foreign Liquor (IMFL) and beer are state subject, with each state

controlling the duty structure and distribution. Incidence of import and export duties results in

high cost of interstate movements which has resulted in each state having attributes of a separate

market.

This Market research has been done for comparative analysis of two premium segment brands of

different- different companies as the company is facing neck to neck competition in its semi

premium range. For that I have study the Market size of semi premium whisky and the marketing

strategy of the leaders in that segment and what are the customer’s response with respect to the

particular brand. For this purpose the market of Haldwani has been covered for differentiating

the behavior of consumers in this market and the role of retailers in promoting the brand. Survey

has been conducted through questionnaires and responses of consumers and retailers have been

recorded. The results may not be in accordance to the actual situation in the market because of

small sample size and the limitation of area, but serious efforts have been put into get the best

results.

4

AREA OF STUDY

The main area of study is the marketing segment of the organization. As the market area of the

organization is very vast so it was a great learning experience.

NEED OF THE STUDY

This modern era of liberalization and globalization has opened a broad scope for conducting

marketing of products in business. To -day; marketing management has become more

challenging and exciting than ever before. Generally a group customer who heavily shares a

common a group of customers who heavily share a common need constitute the market. Now

days, market has turned from seller’s market to buyer’s market. Turing of this concept generate a

need to study marketing strategy of wine company for that I took two brands of different

company and compare them with their marketing activities.

SCOPE OF PRESENT STUDY

The topic is very significant, as it gives a unique chance to study and know the different

strategies adopted by the organization to compete and increase its market share and overcome its

rivals. It also helps to understand the importance and need of marketing in wine industry.

5

COMPANY PROFILE

UNITED SPIRITS LIMITED AT A GLANCE

United Spirits Limited (USL) is the largest Alcohol Company in the world by volume and the

Rs. 9103 crores spirits arm of the UB Group. USL was earlier McDowell and Company Limited.

USL is headquartered in Bangalore with a global footprint and has 7500 employees across

various locations. USL has a portfolio of more than 140 brands, of which 22 are millionaire

brands and has over 84 manufacturing and bottling units at locations across the country.

USL represents the merged entities of erstwhile McDowell & Co. Limited, Phipson Distillery

Limited, United Spirits Limited, Herbertsons Limited, Triumph Distillers and Vintners Private

Limited, Baramati Grape Industries Limited, United Distillers India Limited, McDowell

International Brands Limited and Shaw Wallace Distilleries Limited and Shaw Wallace & Co.

Limited.

With the acquisition of Bouvet Ladubay in 2006, the UB Group has made a strategic entry into

of the wines category. Bouvet-Ladubay, located in the Loire valley of the Saumur region in

France, has a heritage of over 156 years.

The company currently has a capacity of 8 million bottles per annum, with further scope for

expansion whenever required. Bouvet Ladubay is sold across the world in over 38 countries.

In 2007, United Spirits acquired the Glasgow-based Whyte and Mackay and ramped up its

premium scotch and single malts portfolio significantly. Whyte & Mackay also owns four malt

whisky distilleries in Scotland and a state-of-the-art bottling facility in Grangemouth with a

capacity of 12 million cases per annum.

In the late Nineteenth Century, Angus McDowell set out from the scenic Northern lands of

Gaelic Britannica. The purpose was to make available the products of the industrial revolution to

6

thousands of expatriate Britons serving the Empire in various parts of the globe. It was this spirit

of adventure that launched McDowell & Company in India.

It had its origins in a warehouse near Fort St.George in Madras (now Chennai), which in those

days were a major trading centre of the British empire. In 1951, McDowell became the prime

acquisition of the United Breweries Group. Under the able guidance of the founder of the UB

Group, Late Mr. Vitthal Mallya the company became the first to Manufacture Indian substitutes

to foreign liquor. A new term - IMFL (Indian Made Foreign Liquor) was coined. Since then,

McDowell has been the indisputable market leader as one of the largest fast moving consumer

goods companies in the country.

The Name

The name ‘McDowell’ originally came from the Gaelic word ‘Macdougall’. ‘Dubh gall’,

meaning dark stranger, possibly to distinguish the dark haired Danes from the fair haired

Norwegians. Angus McDowell, after whose name McDowell and Company Limited came into

being, was a squire of the Dougall ancestary.

He started a firm- McDowell, on the northern islands of Gaelic Britannica, Which was marketing

the finer products of the Industrial Revolution to the Britons staying in various corners of the

empire. In India, McDowell has its warehouses situated about a mile to the north of the Fort St.

George in Chennai.

From being one of the first names to be associated with the import of wines and spirits into India

as early as in 1898, McDowell has now grown to become the country’s undisputed leader in

spirits market.

7

USL CORPORATE BACKGROUND

Vijay Mallya-owned United Spirits Ltd (USL), is among the top three spirits companies in the

world. United Spirits Ltd (United Spirits) was established in 1898 as McDowell & Co Ltd. Later

in 1995, Mcdowell & Co Ltd merged with Carew Phipson Ltd and Consolidated Distilleries Ltd.

2005; it acquired Shaw Wallace and Co Ltd.

United Spirit’s products include whisky, brandy, rum, gin, and vodka. United Spirits' brands

have won the most prestigious of national and international awards across flavors, ranging from

the Mondial to International Wine and Spirit Competition (IWSC) to International Taste and

Quality Institute (ITQI).

The Company is known to be an innovator in the industry and has several firsts to its credit like

the first pre-mixed gin, the first Tetra pack in the spirits industry in India, first single malt

manufactured in Asia and the first diet versions of whisky and vodka in India.

The company recently acquired Tern Distilleries in Andhra Pradesh and set up a Greenfield malt

spirit plant in Nasik in Maharashtra.

These are the various companies which are coming under UB group.

8

United Spirits Limited (USL) – the INR 4000 crore (USD 1 billion) spirits arm of the UB Group

– is India’s largest and world’s third largest spirits company. USL was earlier McDowell and

Company Limited. Besides Whyte and Mackay and Bouvet Ladubay being 100 % subsidiaries of

USL, the company has a portfolio of more than 104 brands, of which 16 are millionaire brands*

(selling more than a million cases a year) and enjoys a strong 59% market share for its first line

brands in India.

United Spirits’ brands have won the most prestigious of awards across flavors, ranging from The

Mondial to International Wine and Spirit Competition (IWSC) to International Taste and Quality

Institute (ITQI); a total of 84 awards and certificates (as of December 2007).

The Company is known to be an innovator in the industry and has several firsts to its credit such

as the first premixed gin, the first Tetra pack in the spirits industry in India, first single malt

manufactured in Asia and the first diet versions of luxury whisky and vodka in India. USL has a

global footprint with exports to over 18 countries. It has manufacturing and Bottling units in 67

locations across the country and in Nepal and supported by a robust Distribution network to

deliver its products to customers located anywhere in India. USL has a committed 6000 strong

workforce spread across its offices and distilleries in the country. USL represents the merged

entities of erstwhile McDowell & Co. Limited, Phipson Distillery Limited, United Spirits

Limited, Herbertsons Limited.

MISSION STATEMENT

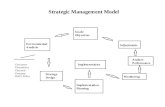

Fig. 2

“To be the most admired global leader in the spirits industry by creating unique high quality

brands for consumers, driven by highly motivated employees and supported by best-in-class

9

processes and continued innovations. United Spirits is and will continue to be responsible

towards its stakeholders and the society”

BUSINESS INTEREST OF UB GROUP

Beverage Alcohol: The UB group is 2nd largest spirits marketer in the world, with overall sales

of 90 million cases. The company offers 140 brands at varying price points. Some of the

famous brands of UB group are bagpiper whisky, McDowell’s No.1 whisky, director special

whisky, McDowell’s No.1 Brandy and McDowell’s celebration rum.

Pharmaceuticals: The group’s company Aventis Pharma Ltd is the second largest

pharmaceutical multinational in India. It develops and markets branded prescription drugs and

vaccines.

Media: The UB group also has a share holding in Asian Age Holdings Ltd, the company that

owns and manages daily newspapers, The Asian Age.

International trading: the group’s company UB group global ltd is recognized export house

engaged in the export of beer, spirits, leather footwear and processed food the company also

exports pharmaceutical products and customized perfumes.

Fertilizers: Mangalore chemicals & fertilizers ltd is under UB group management. It has a

manufacturing capacity of 2,23,700 MT of ammonia and 4.30,000 MT of urea.

Research and development: Vijay Mallaya Scientific Research Foundation (VMSRF) was

established in 1987 with the objective of developing newer and novel technologies that will have

substantial application in industry and health care. The foundation is recognized by the

departments of Scientific & Industrial Research (DSIR) Department of Biotechnology (DPT),

10

Council for Scientific and Industrial Research (CSIR) and the Ministry of Finance, Govt. of

India.

Aviation: UB group entered Aviation sector in 2005 with launch of Kingfisher Airlines Ltd.

Kingfisher Airline has captured an impressive Market Share and has established a Niche

identity for itself.

ORGANIZATIONAL STRUCTURE

Dr. Vijay Mallya, (Chairman)

Dr. Vijay Mallya is the face of the $2 billion UB Group. 52 year-old Dr. Mallya took over the

Reins of the United Breweries Group in 1983.....

S. R. Gupta, (Vice Chairman)

Mr. Subhash Raghunath Gupte, aged 68 years, is a Chartered Accountant. Mr. Gupte has worked

with Caltex India Limited for 5 ½ years.

11

Mr. Vijay K. Rekhi, (President & M. D.)

Mr. Vijay K. Rekhi is the President and Managing Director of United Spirits Limited, India's

Largest and the world's third largest alcohol beverage company.

M. R. D. Iyenger

Mr. M. R. Doraiswamy Iyengar. aged 66 Years is a Graduate in Commerce and a Chartered

Accountant. He is also a post Graduate in Law, holding a B.L. degree.

12

OUR DISTILLERS

UNITED SPIRITS LIMITED, ROSA

UNITED SPIRITS LIMITED, ALWAR

UNITED SPIRITS LIMITED, UDAIPUR

UNITED SPIRITS LIMITED, PATHANKOT

UNITED SPIRITS LIMITED, PALWAL

UNITED SPIRITS LIMITED, BADDI

UNITED SPIRITS LIMITED, MEERUT

UNITED SPIRITS LIMITED, HATHIDAH

UNITED SPIRITS LIMITED, ASANSOL

UNITED SPIRITS LIMITED, SERAMPORE

UNITED SPIRITS LIMITED, KHURDA

UNITED SPIRITS LIMITED, BHADRAKALI

UNITED SPIRITS LIMITED, NARAYANPUR

UNITED SPIRITS LIMITED, BETHORA-PONDA

UNITED SPIRITS LIMITED, NASIK

UNITED SPIRITS LIMITED, BARAMATI

UNITED SPIRITS LIMITED, BHOPAL

UNITED SPIRITS LIMITED, AURANGABAD

UNITED SPIRITS LIMITED, CHERTALA

UNITED SPIRITS LIMITED, NACHARAM- HYDERABAD

UNITED SPIRITS LIMITED, MALKAJGIRI- HYDERABAD

CONTRACT AND ASSOCIATE UNITS

Chandigarh Distillers & Bottles Ltd

13

Batra Breweries & Distilleries Pvt Ltd

Saraya Industries Ltd

Sir Shadilal Distillery & Chemical Works

A B Sugars Ltd

Trishul Bottlers

Gemini Distilleries (Tripura) Pvt Ltd

North East Distilleries Pvt Ltd

Ajantha Bottlers & Blenders Pvt Ltd

Centenary Distilleries Pvt Ltd

M T M Wines & Bottlers Pvt Ltd

Milestone Beverages (P) Ltd

Surma Distillery Pvt Ltd

Mount Distillery – Sikkim

Himalayan Distillery Pvt Ltd

Salson Liquors Pvt Ltd

Ambient Liquors Pvt Ltd

Chitwan Blenders & Bottlers Pvt Ltd

Aegis Beverages (P) Ltd – Bilaspur

14

BRANDS

USL BRANDS

Whisky -

Whyte and Mackay

Dalmore

Jura

Black Dog

Antiquity

Signature

Royal Challenge

McDowell’s No-1

Director’s Special

Bagpiper

McDowell’s No-1 Platinum

Green Lable

15

Vodka -

Pinky

Red Romanov

Premium Romanov

White Mischief

Rum -

McDowell’s No-1 Celebration Rum

Old Cask Rum

PRODUCT OF UNITED SPIRITS LTD. IN PREMIUM SEGMENT :

Generally the spirits products in the premium segment are the perfect blend of aged scotch

whiskies. These are popular among its customers for there finest Blend of rare scotches and

selected grains.

The products which are floating in the premium segment spirits are as follows:

• Antiquity Blue

• Antiquity Rare

• Royal Challenge

• Signature Rare

• Black & White

• Blenders pride

16

PROFILE OF CAMPARITIVE COMPANY

SEAGRAMS INDIA

Seagram Company Ltd.

Industry Alcoholic drinksFate Broken-up, assets soldSuccessor(s) Vivendi, Pernod Ricard, DiageoFounded 1857Defunct 2000Headquarters Montreal, QuebecKey people Joseph E. Seagram, Bronfman familyProducts Beverages

ParentPrivate (1857–1972);Vivendi Universal (2000)

SubsidiariesPolyGramMusic Corporation of America

The Seagram Company Ltd. was a large corporation headquartered in Montreal, Quebec,

Canada that was the largest distiller of alcoholic beverages in the world. Toward the end of its

independent existence it also controlled various entertainment and other business ventures. The

Seagram assets have since been acquired by other companies, notably The Coca-Cola Company,

Diageo, Pernod Ricard.

The Seagram Building, the company's American headquarters office tower at 375 Park Avenue

in New York City, was designed by architect Ludwig Mies van der Rohe with Philip Johnson.

The former Seagram headquarters in Montreal now belongs to McGill University, under the

name Martlet House.

Seagram India, a Pernod Ricard Group Company, the world's second largest wine and spirits

conglomerate, the name that's synonymous with world renowned wine brands such as Jacob's

17

Creek ( Australia), Montana (New Zealand) & Mumms Champagne, and the finest spirit brands

like Royal Salute, Chivas Regal, The Glenlivet & 100 Pipers.

Seagram India Pvt. Ltd. engages in the spirits business in India. It offers Scotch whiskey, wines,

gin, and brandy. The company was founded in 1994 and is headquartered in Gurgaon, India.

Seagram India Pvt. Ltd. is a subsidiary of Pernod-Ricard SA. In the 2001, group Pernod Ricard

acquired part of Seagram’s worldwide, after the divestment of the spirits and wine business by

Vivendi Universal. The acquired part of the Seagram’s business catapulted group Pernod Ricard

into the top three of the global wine & spirits players. The acquisition also brought Seagram’s

India into its fold, making group Pernod Ricard, headquartered in Paris, the biggest MNC in the

spirits business in India. Seagram’s India has shown an average growth rate of 69% per annum

since 95-96 and is today the most profitable company in the spirits business in India.

The main competitor during this study to be targeted is Seagrams India, and the product to be

targeted is Royal Stag Whisky.

HISTORY

In 1857, a distillery was founded in Waterloo, Ontario. Joseph E. Seagram became a partner in

1869 and sole owner in 1883, and the company became known as Joseph E. Seagram & Sons.

Many decades later, Samuel Bronfman founded Distillers Corporation Limited, in Montreal,

which enjoyed substantial growth in the 1920s, in part due to Prohibition in the United States.

In 1928, a few years after the death of Joseph E. Seagram (1919), the Distillers Corporation

acquired Joseph E. Seagram & Sons, and took over the Seagram name. The company was well

prepared for the end of Prohibition in 1933 with an ample stock of aged whiskeys ready to sell to

the newly opened American market, and it prospered accordingly. Thus despite its earlier

Waterloo history, the Seagram name is most closely associated with the Bronfman family.

However, it is not correct to say, as is often done, that Samuel Bronfman founded Seagram, since

the Seagram name itself pre-dated the company he founded.

18

Although he was never convicted of criminal activity, Samuel Bronfman's alleged dealings with

bootleggers during the (US) Prohibition-era have been researched by various historians and are

documented in various peer-vetted chronicles.

After the death of Samuel Bronfman in 1971, Edgar M. Bronfman was named Chairman and

Chief Executive Officer (CEO) until June 1994 when his son, Edgar Bronfman, Jr., was

appointed CEO.

In 1981, cash rich and wanting to diversify, Seagram Company Ltd. engineered a takeover of

Conoco Inc., a major American oil and gas producing company. Although Seagram acquired a

32.2% stake in Conoco, DuPont was brought in as a white knight by the oil company and entered

the bidding war. In the end, Seagram lost out in the Conoco bidding war. But in exchange for its

stake in Conoco Inc, it became a 24.3% owner of DuPont. By 1995 Seagram was DuPont's

largest single shareholder with four seats on the board of directors.

In 1986, the company started a memorable TV commercial campaign advertising its Golden

Wine Cooler products. With rising star Bruce Willis as pitchman, Seagram rose from fifth place

among distillers to first in just two years.

In 1987, Seagrams engineered a $1.2 billion takeover of important French cognac maker Martell

& Cie.

On April 6, 1995, after being approached by Edgar Bronfman, Jr., DuPont announced a deal

whereby the company would buy back its shares from the Seagram company for the amount of

$9 billion. Seagram's was heavily criticized by the investment community—the 24.3% stake in

DuPont accounted for 70% of Seagram's earnings. Standard & Poor's took the unusual step of

stating that the sale of the DuPont interest could result in a downgrade of Seagram's more than

$4.2 billion of long-term debt.

The rationale for this divestiture was that Edgar Bronfman, Jr., grandson of Samuel Bronfman,

wanted Seagram to branch out into the entertainment business. Bronfman, Jr., used the proceeds

of the sale to help acquire Universal Studios, MCA, PolyGram, and Deutsche Grammophon.

Seagram also gained control of a number of Universal theme parks.

19

In 1997, the Seagram Museum, formerly the original Seagram distillery in Waterloo, was forced

to close due to lack of funds. The building is now the home of the Centre for International

Governance Innovation. The two original barrel houses are now the Seagrams Lofts

condominiums. There are also almost 5 acres (2.0 ha) of land that will be the home of the future

Balsillie School of International Affairs. In 2000, controlling interest in Seagram's entertainment

division was acquired by the Vivendi Group, and the beverage division by Pernod Ricard. By the

time Vivendi auctioned off Seagram's drink business, beyond its original high-profile brand

names the once renowned operation consisted of around two hundred and fifty drinks brands and

brand extensions.

In 2002, The Coca-Cola Company acquired the line of Seagram's mixers (ginger ale, tonic water,

club soda and seltzer water) from Pernod Ricard and Diageo, as well as signing a long term

agreement to use the Seagram's name from Pernod Ricard. Seagram's Ginger Ale was named the

winner at the 2009 World Cup of Ginger Ale in Chicago.

On April 19, 2006, Pernod Ricard announced that they would be closing the Seagram

Lawrenceburg Distillery located in Lawrenceburg, Indiana. However, the distillery was instead

sold in 2007 to CL Financial, a holding company based in Trinidad and Tobago which then

collapsed and required government intervention. In October 2011, MGP Ingredients announced

that it had reached an agreement (subject to further approval requirements) to purchase the

distillery.

INDUSTRY PROFILE

INTRODUCTION TO LIQUOR INDUSTRY

20

THE LIQUOR INDUSTRY IN INDIA

In India, ‘drinking’ has remained a bad word, clubbed with the other vices. While the beer and

liquor market continues to grow at an impressive rate even against an economic recession, the

social stigma remains in place, which manifests itself in anti-growth state policies.

Domestic Industry

However, the Rs. 60.0 Billion organized beer and liquor industry has been growing at an

impressive rate. In sharp contrast to the trend the world over, beer is losing ground to hard liquor

in India. Amidst beers, the current trend is that lager beer is giving way to strong beer. Even as

the liquor manufacturers could hope to garner the people who are shifting from beer to liquor,

there is a vast country liquor market and a sizable grey market to contend with.

United Breweries (UB), Shaw Wallace and McDowell (part of the UB Group) presently

dominate the liquor and beer market. The market on its part is set to undergo a sea change with

the arrival of MNCs. The removal of quantitative restrictions (QRs) on the import of bottled

alcoholic beverages only makes the competition tougher.

The MNCs looked forward to good business after the removal of QRs but the Government

nullified it by slapping new taxes. The foreign bottle, therefore, remains as costly as ever.

Latest Trends

To survive in the highly competitive environment, the MNCs as well as the domestic majors are

coming up with various strategies. Acquisitions and alliances appear to be the order of the day.

Several such deals are already underway while more are in the offing. The domestic majors are

also reorganizing their operations so that they can forge a deal with an MNC if the need arises.

For instance, UB, which recently took up a major revamp, has said it is willing to offer a 25.0

percent stake to multinational liquor major.

21

Another trend that seem to be catching up is the consumption of “Coolers” by the discerning

connoisseurs. “Coolers” is typically a cold drink (or cocktail), which is often a mixture of white

wine and fruit juice. As of now there is no definitive data available on the consumption front for

“coolers” either globally or locally. But the fact that this finds mention in most of the wine and

recipe related sites helps us to arrive at the conclusion that the trend of consuming “coolers” in

its various combinations is indeed catching up.

Problem Areas

What plagues the industry most is a very complicated set of laws and taxes. Each state has a

different excise duty structure, import and export levies and other regulations regarding licensing

fees and sales of new brands. This puts tremendous pressure on the industry players. They cannot

transport their products from a market that has excess capacity to one where there is a short

supply. The taxes on alcoholic beverages are some of the highest in the world. In some states it

works out to as high as 200%. The brewers argue that subjecting beer to the same level of taxing,

as hard liquor is uncalled for, since the alcohol content in beer is very low. They are lobbying to

have beer delinked from Imfl so that the taxes will fall, prices will plunge and consumption rise.

Crystal Gazing

Amidst all the competition and tough laws, the industry sees vast potential in the market.

Consumption is set to rise with higher disposable incomes and standard of living. While the beer

market is expected to expand rapidly, hard liquor is not seen losing much market share, either.

The alcohol industry is very important for the government. It generates an estimated Rs. 16,000

crore per annum in spite of the fact that the per capita consumption of liquor in India is the

lowest in the world. The total liquor industry is worth Rs. 2,000 crore. IMFL accounts for only a

third of the total liquor consumption in India. Most IMFLs are cheap and are priced below Rs.

200 per bottle. Alcohol sales proceeds account for 45% of the total revenue collection in the

22

country. Whiskey accounts for 60% of the liquor sales while rum; brandy any vodka account for

17% 18% and 6% respectively. MNC’s share is only 10% and they have been successful only in

the premium and super premium ranges. Post WTO the government may have opened India to

foreign distilleries, but the duty has been increased from 222% to 464-706%. This is due to the

fact that there is a 100% customs duty, 150% contravening duty, local taxes, distributor’s

margin, retailers margin and publicity charges.

The cost is finally borne by the consumer. The government claims that this is being done to

protect the domestic liquor industry, the domestic industry accounts for 99% of the market share.

This protectionist policy could prove to be counterproductive and lead to smuggling. As of now,

only 45% of the sales are through legal channels and only 25% of this is duty paid for. Within

India itself, the policy of alcohol retail differs form state to state. While some states like

Maharashtra. Uttar Pradesh, and Tamil-Nadu have a liberal policy, come states like Haryana and

Andhra Pradesh have had very bitter experience in trying to make these states dry and have

eventually had to withdraw the policy.

Whisky History - The beginning of Whisky

What a lot of people do not know is probably that alcohol was first invented in the 10th Century

by Arab alchemists. This technique was found when trying to make cosmetics and perfume as

Arabs do not really have the need to drink alcohol. But soon the techniques where taken to Spain

and then spread throughout Europe. Two Century later farmers, monks and university scholars

where making alcohol from grape and grain or really any produced that were available to them

with ease. Over in Ireland at this time monks really became the first to distil what we know as

whisky when they used fermented barley. The timing of this was very vague and is believed to

be around the middle of the 11th Century.

Over this time with the travellers going between Ireland and Scotland this process spread quickly

and whisky was starting to be produced by all the local farmers. This is when I would say whisky

finally came to Scotland.

23

Other facts regarding the history of whisky

People will always argue about where whisky was invented. Scotland or Ireland? Well distilling

was brought to Ireland by St. Patrick in 432AD, but the first written recording of it being sold

was in Scotland 1494 and it soon became widespread as knowledge spread on how to distil

whisky and soon afterwards nearly every farmer in Scotland became a maker of whisky. As you

can see there is a lot of time between the two dates. The Celts could be the first to produced

whisky as they named their liquid usquebaugh which means ‘water of life’ and the word whisky

also comes from the gaelic word 'Uisga'.

In the early years of whisky there was no period of ageing and after the whisky was distilled it

was consumed. So the whisky had a raw taste. It was then discovered by accident when a cask

was forgotten about in the mid 18th century and when the owner of the cask tasted the whisky he

found that the whisky mellowed after ageing thus the process of ageing began and why we have

whisky maturing now for years just to have the correct taste that we all love.

At the start of the 17th Century whisky distilling in the Scottish Highlands was massive with

nearly every farmer joining in with the making of whisky. This was because the crop was easy to

produce (barley and oats). These were when whisky became massive in Scotland, but really were

only sold to local people in each of the farming communities. But then came the Act of Union.

In 1707 and the Act of Union, Scotland and England join parliaments and soon after taxes were

introduced on distilleries and malts. Of course this did not go down well and a lot of illegal

whisky was beginning to be produced. But more penalties were brought in to reduce this illegal

trade and smuggling of whisky. The penalties where very steep and in a very short space of time

this practice nearly disappeared.

It was not until the late 1700’s when whisky became very profitable because of the improving

farming methods. So with all the distilleries at this time present in the Highlands of Scotland and

the main population in Scotland being in the Glasgow and Edinburgh area, distilleries began to

be built within this area. This would help get the whisky to the marker quicker as the transport

24

network was very poor in these days. But with taxes very high still and so many costs involved it

was hard to keep this as a profitable business.

So illegal distilling was still happening and with the government really cracking down on this

production the ‘smugglers’ tended to move all there distilling production to small islands around

Scotland where they were very unlikely to be discovered. It was not until excise act of 1823

when taxes fell with the reducing of duty was reduced by 50%. This cut down massively the

operations by smugglers and the whisky industry became legal once again.

Generally whisky was really only sold within Britain, but as time when on it spread around the

world and is sold in most countries. Also with it being sold worldwide other countries producing

their own whisky. Hence why this website is about all the whiskies in the world and not just

relating to whisky in Scotland and Ireland.

With the history of whisky very vague it really has been adopted by Scotland and is one of

Scotland biggest export with it being comsumed in nearly every country in the world. Over the

coming years the whisky industry will keep growing and the making of this site all help the

process.

With regards to Irish whisky they have some amazing brands and deserve so much credit. There

exports are always growing, and the merging of certain distilleries this will keep growing also.

There is such a large market place for whisky that there is enough room for everyone to take a

slice of the action. My own thoughts are Scotland and Ireland are both massive within the

whisky industry and both have to keep growing

Indian whisky and Scotch whisky

The drinking of Scotch whisky was introduced into India during the nineteenth century, during

the period of the British Raj. Scotch style whisky is the most popular sort of distilled alcoholic

beverage in India, though India has traditionally been thought to lack a domestic drinking

culture. Whisky, however, has become fashionable for wealthier Indians, and as such the market

for whisky among affluent Indians is one of the largest in the world.

25

90% of the "whisky" consumed in India is molasses based, although India has begun to distil

whisky from malt and other grains. Brand names of Indian molasses whisky, including

"Bagpiper", "McDowell's No. 1", and the partially malt based "MaQintosh" suggest that the

inspiration behind the Indian whiskies is Scotch whisky, despite these products being chiefly

made from molasses.

Indian Whisky Brands

Mcdowell's No.1

Signature

Bagpiper

Seagrams Blender's Pride

Royal Stag

Imperial Blue

Royal Challenge

Director's special

Colonel's Special

Officer's Choice

Solan No. 1

Black Knight

Red Knight

Aristocrat

Binnie's Fine Whisky

Green Label

Senate

26

Diplomat

Delight Fine Whisky

Malabar Malt Whisky

Cosmopolitan

THE INDUSTRY STRUCTURE

With a size of over 159million cases in fiscal year 2009(each case has 12 bottles, each containing

750 ml of liquor), the IMFL industry can be broadly classified into products based on Extra

Neutral Alcohol (ENA) and Rectified Spirit (RS). ENA-based products, which are of better

quality and have a longer shelf life, are the focus of main players like the UB Group and Shaw

Wallace. The low-priced RS segment is quite price-sensitive and characterized by the presence

of a number of small players.

The IMFL market is categorized primarily into whisky, brandy, rum, vodka and gin, with market

share heavily skewed towards whisky.

DIFFERENT LIQUOR PERCENTAGE%

WHISKY 58

BRANDY 17

RUM 20

WHITE SPIRIT 5

27

PERCENTAGE

WHISKYBRANDYRUMWHITE SPIRIT

The industry has been witnessing an annual growth rate of around 10-12% over the past five

years. Last year (2009), the market grew at the rate of 10-12%

28

Growth Drivers of the Spirits Industry

790 million are in the drinking age group which are increasing by 20 million annually

Deregulation by state governments.

Strong growth opportunities in the coming years

Key drivers for growth of liquor consumption in India

Economic expansion and increasing urbanization is driving the emergence of a larger middle

class that increasingly appreciates premium goods and services, including high end spirits, and is

willing to pay for it.

INCOME GROWTH

India is one of the fastest growing economies in the world with GDP growth of 9% &

6.8% over the last two years.

Per capita income has increased from US$ 450 in FY01 to an estimated US$ 781 in FY09

Growth in per capita income to drive discretionary income growth at much higher pace

than the GDP growth, boosting demand for lifestyle products including alcoholic

beverages

Rural economy is likely to see big upsurge in income levels due to various government

initiative

1989-90 2001-02 2009-10

0

20

40

60

80

100

120

low (<$1000)lower middle (#1000)Middle High (>$2000)

INCOME DISTRIBUTION MILLION HOUSEHOLD

29

YOUNG DEMOGRAPHICS

More than 60% of India’s population is in the age group of 15-64

Nearly 485 million people in the drinking age

Another 150 million are likely to be added to this target population in the next 5 years

Following these favorable demographics, demand for alcoholic beverages is set to rise

2001 2011 2021 2031 2041 205158596061626364656667

% of population in age group 15-60

% of population in age group 15-60

30

UNDERPENETRATED MARKET SPELLING HUGE GROWTH

POTENTIAL

India’s per capita consumption of alcoholic beverages is among the lowest in the world

A small increase in per capita consumption to significantly alter industry growth, given

the large population base

RUSSIA

BRAZIL

THAILA

NDUSA UK

WORLD

INDIA

0

2

4

6

8

10

PER CAPITA CONSUMPTION-LITRE PER ANNUM (LPA)

PER CAPITA CON-SUMPTION-LITRE PER ANNUM (LPA)

REGION WISE CAGR ALCOHOL SALES GROWTH FOR LAST 10 YEARS

WORLD

JAPAN

WES

TERN EU

ROPE

AUSTRALIA

NORTH AMER

ICA

ASIA ex

JAPAN

AFRICA AND M

IDDLE EA

ST

LATIN

AMERICA

CENTR

AL AND EA

STER

N EUROPE

-4

-2

0

2

4

6

8

10

12

14

VOLUMEVALUE

31

India is the fastest growing liquor consuming market in the world and offers

tremendous growth potential in future

32

Liquor Segment

Indian Spirits Segmentation

Industry estimates

Liquor Segment

GROWTH IN IMFL CATEGORIES

PERCENTAGE GROWTH

WHISKYBRANDYRUMGINVODKA

The whisky market is further classified into categories like medium (cheap), regular, prestige,

premium, super deluxe whiskies, and Scotch whisky. The regular segment is the largest,

constituting nearly half the volume of the total whisky market.

33

Liquor Segment

The Indian liquor industry can be analyzed by segmenting into 3 parts:

1. Country Spirit

2. Indian Made foreign liquor

3. Foreign Liquor

1. COUNTRY SPIRIT:

This is the unorganized sector occupying about 70% of the liquor market. Country spirits are

distilled spirits mixed or unmixed with spices or other ingredients in small quantities to import

taste and aroma. This spirit is most common among the lower class; it is manufactured by local

methods and has local names the most common being Tharra.

2. INDIAN MADE FOREIGN LIQUOR:

This liquor is not the contemporary Indian liquor. In these category products like whisky, rum,

brandy and vodka are there. British’s had brought in this liquor to India later they set up

distilleries and brewery to manufacturer it in India. In post independence period there were 28

distilleries and 5-6 breweries. Today there are 233 distilleries and 75 breweries in India. This

shows the tremendous growth and acceptance of IMFL brands in India.

3. FOREIGN LIQUOR:

This is the imported liquor includes Beer and IMFL brands but the most common is scotch.

Imported scotch is in great demand in India but the Indian. Govt. bans the import of bottled

scotch whisky, though a limited quantity can be brought in for duty free shops, five star’s hotels

and in bulk for local bottling by joint ventures.

SUBCATEGORIES

WITHIN WHISKY

GROWTH RATE KEY BRAND

MEDIUM 46 HAYWARDS WHISKY

REGULAR -3 DIRECTOR’S

34

SPECIAL,GILBEYS

GREEN/WHITE,BAGPIPER

PRESTIGE 11 McDOWELL No.1,ROYAL

STAG WHISKY,BAGPIPER

GOLD WHISKY

PREMIUM 18 PETER SCOT, ROYAL

CHALLENGE

DELUX 65 ANTIQUITY,SINGLE

MALT

SCOTCH -15 BLACK DOG, 100 PIPERS,

LONG JOHN, JOHNIEE

WALKER

The Scotch segment consists of two categories - Bottled in India (BI) and Bottled in place of

Origin (BO). Bottled imports of Scotch are still not permitted, but bulk imports are allowed, at

import duties of approximately 240%. The official figure of the number of BO Scotch sold is

85,000 cases per annum. While estimates for the BO Scotch sold through legal channels stood at

110,000, smuggled imports have been estimated at between 300,000 and 500,000 cases per

annum. Having signed the WTO agreement, India will have to allow bottled imports of Scotch

and reduce duties to around 150%, in a couple of years.

The liquor industry in India is constrained by a multitude of factors:

Capacity Restrictions

The industry is not allowed to expand without the prior approval of the Central government, as it

among the few industries still under the licensing policy. In a liberalized scenario, when

molasses have been decontrolled and for the brewery sector too, there is no shortage of

domestically available hops, restrictions on new capacities make little sense. State governments

have a part to play as well, since companies have to get their approval too before commissioning

a unit. However, the situation has changed with the Supreme Court ruling designating alcohol as

35

a State subject. It is expected that companies will no longer face problems on fresh capacity

creation.

High Duty Structure

The manufacture of IMFL is subject to government licensing, while levies on sales are a State

subject. The States earn a significant portion of the revenues from liquor. In some States, the

duty is as high as 200%. The duty structure varies so much with each State that for a company

operating at the national level, it is like dealing with 28 countries. Such duties (including special

levies on inter-State sales) have resulted in a distributed manufacturing base and unique market

characteristics for each State. Market sources feel that since States are strapped for funds,

adverse changes in policies for the alcohol industry are unlikely to happen.

Prohibition

Another problem that the industry faces is that of prohibition. Being a major vote-catching

weapon, prohibition has played havoc with the profitability of many breweries and distilleries.

Examples of States clamping prohibition in the past are Andhra Pradesh and Haryana. Gujarat is

another total dry State.

Ban on Advertising

One major restriction throttling the industry is the ban on advertising. Some States have banned

even surrogate advertising of, say, sodas and lemonades. With none of the State-run television

and radio networks accepting liquor advertisements, advertising is done through private TV

channels. Other media have been sponsorship of sports events, and contests. Recently,

advertising on private/cable television channels has also been banned.

The Black Market

In any industry where there are restrictions, prohibitions and controls, a black market thrives. So

too, in the liquor business.

36

Fragmented Structure

One fallout of the various restrictions is that, except for a few brands, the liquor market is

fragmented. Nearly 40% of it is serviced largely by regional players. In the case of beer industry,

where volume matters more than price, a mere regional presence is a disadvantage. Regional

presence and the consumer aversion to new brands have resulted in most companies avoiding the

risk of introducing new brands. Instead, they concentrate on brand extension, trying to build

upon existing brand values. Brand extensions in the Shaw Wallace stable include Haywards,

Haywards 2000 and 5000 beer. Similar are the brands Kalyani Black Label and Kalyani Strong

in the UB Group’s stable. Beer sales are also affected by seasonality, with the offtake being

generally higher in summer. Also, the restrictions on production capacity and inter-State

movement usually cause supply to fall short of demand.

Distribution and Trading Restrictions

The distribution of liquor is controlled in many States, except in Maharashtra, West Bengal and

Assam, where companies can sell their products freely in the open market. Distribution controls

take various forms like auctions, open-market system, government--controlled markets and the

Army’s Canteen Stores Department.

Under the auction system, the government fixes a floor price for the shops and the bidders have

to quote prices. The licence would go to the highest bidder, and the bid price would have to be

paid in equated monthly installments. This system operates in Punjab, Rajasthan, Bihar, Orissa,

Uttar Pradesh and Madhya Pradesh.

States following the open-market mode gives substantial leverage to the IMFL marketing

company to choose its distributor and to determine pricing and discounts.

In the case of distribution through government channels and distribution rights through the

auction mechanism, strong distributors exert influence on the margins of the IMFL manufacturer.

In the government-controlled system, the distribution of liquor is done through State agencies

such as TASMAC in Tamil Nadu, BEVCO in Kerala, the Andhra Pradesh Beverage Corporation

in AP, the DSIDC In Delhi, and so on. Since these agencies are sole wholesalers, they also have

37

the ultimate say in deciding on the entry of a brand into the State. These restrictions seriously

limit the free availability and marketability of a company's products.

IMFL sales in different States, classified on the basis of the distribution

channel accessible to the manufacturer, are given below:

OPEN MARKET MAHARASTRA,WEST

BENGAL,J&K,GOA,ASSAM,MEGHALYA,TRIPURA,ARUNACHAL

PRADESH

AUCTION

MARKET

UP,RAJASTHAN,MP,BIHAR,PUNJAB,CHANDIGARH,HARYANA

GOVERNMENT

CONTROL

TAMILNADU,DELHI,KERALA,ANDHRA PRADESH

PROHIBITION

STATES

GUJARAT,MANIPUR,MIZORAM,NAGALAND

South India is the largest consumer in the Indian liquor market, with Andhra Pradesh showing

the highest consumption, at 15 mn cases, and a growth rate of 100%. In Kerala too, the

consumption of liquor is high. Consumption in South India has been growing at a very high rate,

compared to North India, which grew at 2% last year. The respective growth rates for different

regions are:

38

REGION-WISE GROWTH RATE

EASTSOUTHWESTNORTH

The State-wise consumption of liquor is : Andhra Pradesh (15 mn cases), Bengal (1.7 mn),

Assam (1.5 mn), Bihar (2 mn), Mumbai (2 mn), Maharashtra (2 mn), Delhi (2 mn), Haryana (2

mn), Punjab (2 mn) and Rajasthan (3 mn).

Retailers' Grip

There are an estimated 25-27,000 licensed retail sales outlets in the country for alcoholic

beverages. Retailers have a major role in popularizing and making available a brand, as they

have a virtual monopoly over the distribution of liquor in each State. The absence of self-service

counters also limits customer choice. There are also restrictions on the business hours of these

outlets as also their location vis-à-vis schools, colleges and so on, apart from where they can

procure their requirements. There are restrictions in selling through restaurants and hotels too.

RECENT TRENDS

Of the few industries that have seen a no-holds-barred entry of MNCs, the alcoholic beverages

industry perhaps tops the list. Most global liquor majors have set up shop in India, over the past

five years, and have actively pursued market opportunities, despite debilitating constraints. This

is because the liquor industry, witnessing a declining trend worldwide, has shown robust growth

in India, bucking the recessionary trends in the economy and the anti-growth liquor industry

policy. Another advantage is that India offers enough raw materials like molasses, barley, maize,

potatoes, grapes, yeast and hops.

39

MNCs face numerous hurdles. They have been hampered by the regulatory framework and

distribution hurdles. Most of the MNCs are confined to the premium segment and denied a level

playing field. The Foreign Investment Promotion Board (FIPB) subjects the MNCs to a capacity

ceiling of 10,000 kl (kilolitres). Some companies, like the International Distillers India (IDI),

have cleverly sidestepped this, by contract manufacture, since there is no ban on outsourcing.

MNCs also face the problem of unfulfilled export obligations arising from the imposition of the

foreign exchange neutrality norm at the time of the FIPB approval. They are lobbying to get the

condition relaxed.

The WTO-mandated removal of import restrictions by April 2001 will permit easy availability of

premium brands. Further, custom duties on alcoholic beverages have come down rapidly in the

last few years, from 400% to 230%. As per the WTO commitments, duties have to be phased out

to 150% by 2003. This is likely to open the floodgates for alcoholic beverages produced in other

countries, particularly so in case of Scotch whiskies, the consumption of which has decreased

substantially globally due to a growing apathy to hard liquor. The Scotch MNCs are anxious to

locate new markets for their surplus whiskies, and they seem to be eyeing the only positive

growth market, India. But India's custom duties are still quite high and would ensure that the

MNC products are priced out of the market.

India is seeing an increasing trend of white spirits being adopted over brown spirits. Though key

brands in the white spirits segment have been growing at a healthy rate of 20-30%, their total

size is small, compared to the overall liquor market.

Exports have been minimal because of the vast market potential within the country. Shaw

Wallace accounts for the largest share in the liquor export market (around 50%). Companies

have been trying to boost exports through technological tie-ups.

PLAYERS IN THE LIQUOR MARKET

The UB group, operating through McDowell & Co. and Herbertsons, are the leaders in the IMFL

market, followed by Shaw Wallace. Mohan Meakin and Jagatjit Industries (both located in the

40

North) are the other important domestic companies, though both are considered to be relatively

passive.

COMPANY MARKET SIZE (MN

CASES)

BRANDS

HERBERTSONS 8 BAGPIPERS

Mc DOWELL & CO. 17 Mc DOWELL No. 1,

DIPLOMAT

SHAW WALLACE 9 DIRECTORS SPECIAL

UDV 3 GREEN LABEL, SMRINOFF

BACARDI 0.8 BACARDI RUM

SEAGRAM 4 ROYAL STAG

COMMON TERMS IN ALCOHOL

Ageing

Process where a whisky spends time in oak barrels to become the whisky flavour we know. Very

important part of the whisky making process. The whisky stays in the barrels till it has reached

the correct age the distillery requires to receive the best taste. Time in the bottle does not count to

the age of the whisky.

Alcohol

The amount of ethyl alcohol obtained by fermentation. The strength of the alcohol changes

depending how long the it has been distilled. Normally distilled spirits are sold with an alcoholic

strength of 40 percent alcohol.

Blended Whisky

Mixing different grains to produce the whisky taste.

Cask

A barrel which is usually made of oak, used for the ageing of whisky.

41

Charring

Charring(firing the barrel) the inside of a new barrel to give the whisky flavour as the whisky

ages. This can also be called "toasting".

Distillation

This is done under heat where the alcohol can be collecting after vaporizing because water will

vaporize at a higher temperature when heat is used. The alcohol is then condensed back to liquid

form.

Fermentation

Yeast consuming sugars and converting them into alcohol & carbon dioxide.

Grist

Ground grains used for whisky making.

Malt

The name given to a grain which is usually barley germinate by steeping it in cold water. In the

end more alcohol will be producted because the grain is high in sugar.

Marrying

Allowing a blended whisky time in large containers which can be oak or stainless steel. This

happens before the bottle of the Whisky

Mashing

Cooking grains to release the starch content.

Mouth Feel

The effect that a whisky has on the palate of the mouth. Lingering is just one effect whisky can

have when your are tasting

Neat

A whisky served neat is when no water or other liquid is added and that includes no ice.

Nose

The aroma of the whisky

42

Oak

The wood used to make barrels for ageing whisky. This is how the whickey receive it's flavours

and develops it's smoothness, finesse, colour and tannin.

Pot Still

The traditional style of still used for distilling whisky. The Pot Still operates in a batch

distillation process.

Rocks

A whisky served "on the rocks" is not diluted, and served over ice cubes.

Tails

This is low in alcohol and is the "tail end" of the distillation. Can be known as feints.

Yeast

This is a living organism that is vital for the fermentation process. It feeds on sugar, and

produces alcohol and carbon dioxide as by-products, but is so important to the whisky making

process.

DIFFERENT ALCOHOLIC DRINKS

1. WHISKY

Whisky is amongst the most popular distilled liquor known all over the world. It is made of malt

and molasses spirit, which is obtained by distillation of mash or cereal grains like maize, rice

barley malt. Better the malt better the whisky. Large quantities of IMFL are manufactured in

India and is the maximum sold alcohol. The content is whisky is 42.8%.

2. RUM

Rum is a distillate from the fermented juice of sugarcane of molasses. RUM is characterized with

its taste and aroma. Best rums are known to come from Jamaica, West Indies etc. The alcohol

content of Rum is 42.8%.

43

3. BRANDY

Brandy is generally obtained from fruits, thought the most commonly used fruit is grapes. The

best quality of brandy is cognac, which is made in France.

4. VODKA

Vodka is a sprit resulting out of distillation at very high proof. This results in virtual NPN

existence of flavor in the resulting sprit,. This is neutral, even after dilution required for

palpability. The traditional source of making vodka has been potatoes.

5. BEER

Beer is not a distillate like the drinks mentioned above but it is a beverage made by fermentation

of malt obtained form carbohydrate rich material barley. Hops are used to add taste while yeast is

used to ferment the beer.

Beer is to two types:

1. Pilsner or Lager

2. Draught

Draught Beer is served chilled in mugs and is generally available in Pubs only. It can be stored

for 72 hours only and does not have any brand name. Mohan Meakins supports Draught Beer.

6. GIN:

It is sweetened or unsweetened grain spirit flavored with essential oil juniper berries and some

other product including angelica roots, orange peel, cardamom, bitter almonds give it a kick and

taste.

44

RESEARCH METHODOLOGY

VARIOUS PARAMETER USED IN RESEARCH

Research Design - Descriptive

Data Source - Primary & Secondary data

Research Instrument - Questionnaire

Types of Questionnaire - Structure and non-disguised

Sample Extent - Haldwani

Sample Size - 84

Sampling method- Personal survey method through questionnaire

45

COMPARISION OF SEAGRAMS INDIA V/S UNITED

SPIRITS LIMITED

SEAGRAMS INDIA

Seagram India, a Pernod Ricard Group Company, the world's second largest wine and spirits

conglomerate, the name that's synonymous with world renowned wine brands such as Jacob's

Creek ( Australia), Montana (New Zealand) & Mumms Champagne, and the finest spirit brands

like Royal Salute, Chivas Regal, The Glenlivet & 100 Pipers.

Seagram India Pvt. Ltd. engages in the spirits business in India. It offers Scotch whiskey, wines,

gin, and brandy. The company was founded in 1994 and is headquartered in Gurgaon, India.

Seagram India Pvt. Ltd. is a subsidiary of Pernod-Ricard SA. In the 2001, group Pernod Ricard

acquired part of Seagram’s worldwide, after the divestment of the spirits and wine business by

Vivendi Universal. The acquired part of the Seagram’s business catapulted group Pernod Ricard

into the top three of the global wine & spirits players. The acquisition also brought Seagram’s

India into its fold, making group Pernod Ricard, headquartered in Paris, the biggest MNC in the

spirits business in India. Seagram’s India has shown an average growth rate of 69% per annum

since 95-96 and is today the most profitable company in the spirits business in India.

The main competitor during this study to be targeted is Seagrams India, and the product to be

targeted is Royal Stag Whisky.

46

UNITED SPIRITS LIMITED (USL)

United Spirits Limited (USL) - the Company is known to be an innovator in the industry and

has several firsts to its credit like the first pre-mixed gin, the first Tetrapack in the spirits industry

in India, first single malt manufactured in Asia and the first diet versions of whisky and vodka in

India.

USL has a global footprint with exports to over 18 countries. It has a sizeable presence in India

with distilleries and sales offices all across the country, and a committed team of over 7500

people dedicated to the fulfillment of the company's mission. It has established manufacturing

and bottling plants in every state of India. In addition, to deliver its products to customers located

anywhere in India, USL has established a robust distribution network covering the whole

country.

47

ROYAL CHALLENGE VS. BLENDER’S PRIDE

Royal Stag has become its largest selling brand across the globe. The Indian brand sold close to

12.3 mn cases in 2011 contributing to more than half of Pernod Ricard Indias volume sales that

were close to 24 mn cases.

Royal stag triumphed over Absolut Vodka which has global sales of 11.3 mn cases to be Pernod

Ricards No 1 brand. With this Royal Stag becomes one of the only brands to topple the MNCs

global offerings. That speaks volumes of PRIs steady nurturing and growth of the brand after

taking over form Seagrams. It also provides a stark difference between the other MNC giant

Diageo which has till now struggled to find its foothold in the Indian Market. Rowsons reserve is

a step towards grabbing more share.

If Vijay Mallya's outburst against the Bangalore Royal Challengers has anything to do with the

impact of the team's rout on his most profitable whisky brand, here's the bad news. Royal

Challenge, the iconic Indian premium whisky and the presenting sponsor of the Bangalore IPL

team, appears to be losing steam in a fast-evolving marketplace.

The brand that came to Mr Mallya as part of a $300 million acquisition of Shaw Wallace & Co

in 2005, which in many ways turned around his fortunes, is no longer the undisputed leader at

48

the premium end of the whisky market. French drinks giant Pernod Ricard's local whisky

Blender's Pride is staking claim to the pole position that clearly belonged to Royal Challenge for

about two decades.

Industry figures for FY08 suggests that Blender's Pride closed the year with 1.10-million cases in

volume depletion, which some sector analysts believe is just ahead of Royal Challenge's 1.08

million. Blender's Pride, with a 30% rise in volume, stormed past the million-cases mark for the

first time on its way to the top.

An official of United Spirits, the flagship of Mr Mallya's spirits empire, told ET that Royal

Challenge sold 1.17-million cases and was still marginally ahead of the rival. Nevertheless,

there's a compelling argument that Royal Challenge's reign as leader is under threat. The UK-

based industry digest The Spirits Business, in its 2007 listing of top brands, put Blender's Pride

ahead of Royal Challenge both by volume and value.

Industry experts believe Mr Mallya's statements reflected his concern about a possible erosion in

brand value linked to the IPL debacle. "It is entirely expected of Mr Mallya to have a hawk's eye

on his brand's fundamentals. By hitching the brand to IPL, Royal Challenge has extended itself

to real-life experience from just a product. And the public at large draw their own conclusions on

the brand from the experience," argued Brand Finance, a UK-headquartered brand valuation

firm, MD Unni Krishnan.

Blender's Pride sold about 1.86-lakh cases in 2002-03, way behind Royal Challenge's estimated

volume of around 6.5-7 lakh-cases during the same period. Shaw Wallace, during 2004-05, just

before its sell-out to Mr Mallya, claimed Royal Challenge sales has touched a million cases, but

the recent set of numbers indicate that the brand has not been accelerating enough.

In contrast, Blender's Pride, with a price premium and an evolving equity linked to fashion and

music, has reported a five-year CAGR of 25-30%. For the record, United Spirits has claimed that

previous Shaw Wallace management had inflated the brand figures ahead of sale, and Royal

Challenge was not exactly a million cases in depletion when it was acquired. Mr Mallya's move

to link Royal Challenge, which one controlled 65% of the domestic premium whisky market, to a

hugely popular sport like cricket was aimed at keeping the brand ahead of the competition.

49

"The original strategy behind it was a masterstroke. But associating with IPL had its own risks

which is getting apparent now. He knows it is unrealistic to believe that the brand's sales and the

team's performance are unrelated even though value erosion may not be overnight," Mr Krishnan

added.

The Vijay Mallya-led United Spirits Ltd (USL), the largest spirits company in the world in terms

of numbers, has initiated a total overhaul of its business structure, with a strategic shift in focus

from mass selling brands to premium brands.

The focus has shifted to premium brands that would bring in a larger profit margin per case,

almost 3.3 times more than the regular segment. The new approach to the business appears to be

a leaf taken from the manufacturer of Royal Stag and Blender's Pride whisky, French spirit

behemoth Pernod Ricard, USL's nearest rival.

For USL, the alarm bell rang in FY11 when Pernod Ricard, whose sales were around one fifth of

USL's, made a profit of about Rs 500 crore when the United Spirits Ltd's profit figure hovered

around Rs 400 crore.

Pernod Ricard India has led the way for the industry by generating handsome profits, from small

volumes. The primary focus of Pernod's business strategy is to focus on premium brands such as

Royal Stag and Blender's pride whiskies. The French company's market share is less than one-

fifth of USL, which controls 55% of the 250-million cases Indian spirit market.

An industry source said the French company generates profit of nearly Rs 350 per case while the

USL's average profit per case is around Rs 200 per case.

"USL's premium brands share of the company's overall contribution pie is at 55% today and

expected to be up by another 5% by the end of this year. This is a significant increase from just

9% in 2005 and is an outcome of sustained premiumisation focus.

Specifically, we have brands cross-lined to Pernod's brands — pricing of Signature is at par with

Blender's Pride nationally while McDowell's No.1 Platinum is cross-lined with Royal Stag," a

senior USL official said.

50

It is the competitor's success in generating larger profits from smaller volumes that had triggered

off a new thought process within the top management of the USL. The focus has shifted to

striking a fine balance between volume and margin.

The strategy, christened "premiumisastion", has been changing the face of the group from one

identified with its mass selling brands such as Bagpiper, the largest selling spirit brand in the

world until recently, to premium brands such as Mcdowell No. 1 Reserve, Mcdowell No. 1

Platinum whisky, Mcdowell Celebration rum, Mcdowell No. 1 Caribou rum , Mcdowell No.

1, Royal Challenge, Signature Premier, Antiquity etc.

DATA ANALYSIS

A. IS THE PRICE OF THE PREMIUM SEGMENT AFFORDABLE OR NOT

Price range Low

Mediu

m High

No. of customers 12 58 14

Low Medium High

12

58

14

51

B. WHAT INFLUENCE A CUSTOMER TO DRINK A PARTICULAR BRAND

INFLUENCING

FACTORS

FRIEN

D

ADVERTISMEN

T

TAST

E

STATUS

SYMBOL

PRIC

E

NO. OF

CUSTOMERS9 16 36 6 17

FRIEND ADVERTISMENT TASTE STATUS SYMBOL PRICE

9

16

36

6

17

52

C. WHAT FACTORS SHOULD BE ENCOUNTERED

REASONABLE

FACTOR

ENVIRONMEN

T

OCCASIO

N

PURCHASING

POWER

ENJOYMEN

T

NO. OF

CUSTOMERS9 16 36 6

ENVIRONMENT OCCASION PURCHASING POWER

ENJOYMENT

46

127

19

53

D. THE CONSUMPTION FREQUENCY OF THE CUSTOMER TO THE WHISKIES

CONSUMPTI

ON

FRQUENCY

ONCE

A

WEEK

3 TO 4

TIMES IN A

WEEK

EVERYDAY/

FREQUENTLY

No. of

customers9 63 12

ONCE A WEEK 3 TO 4 TIMES IN A WEEK EVERYDAY/FREQUENTLY

9

63

12

54

E. WHETHER THEY AGREE WITH ADVERTISING PROGRAMME

AND PROMOTION AFFECTS THE SALE OR NOT?

AD PROGRAMME CONVENTION Yes No

NO.OF CUSTOMER 65 19

Yes No

65

19

55

F. CUSTOMER RATING FOR WINE (PACKGINGWISE)

Brands Blander Pride Royal

Challenge

Any

Other

No. of

Customers24 26 34

Blander Pride29%

Royal Challenge31%

Any Other40%

56

G. CUSTOMER RATING OF WINE (AVAILABILITY WISE)

Brands Blander Pride Royal

Challenge

Any

Other

No. of

Customers28 28 28

Blander Pride33%

Royal Challenge33%

Any Other33%

57

H. CUSTOMER’S PREFERENCE OF WINE WITH RESPECT TO TASTE & COMFORT

Brands Blander Pride Royal

Challenge

Any

Other

No. of

Customers34 29 21

58

Blander Pride40%

Royal Challenge35%

Any Other25%

I. CUSTOMER’S PREFERENCE OF WINE WITH RESPECT TO GOOD VALUE OF

MONEY

Brands Blander PrideRoyal

Challenge

Any

Other

No. of

Customers25 35 24

59

Blander Pride30%

Royal Challenge42%

Any Other29%

FINDINGS

As per packaging concern Blander Profe and Oyal Challenge got near about same ranking

form the customers

As per good value of money concern Royal challenge get good raning with respect to the

other brand its just because of excellent promotional strategy of USL.

On account of taste and Comfert Blander pride and Royal Challenge has neck to neck

cooptation but Blander Pride still lead Royal Challenge.

As per availability of particular brand in baar, restaurant and shop customer easily get

their choice or we can say that availability is not a big issue in wine market retailer usely

hold all demanding brand at their ready stock.

USL has excellent marketing and service network that play a major role in between

customer to buy its products.

60

Only on account of test and comfort Seagram‘s product ‘Royal Stage’ get weatage on

Royal Challange at the time of purchasing the product by customers.

In a country like India, where direct advertisement of liquor is banned, every alcoholic

beverages maker is going in a roundabout way to advertise for their brand Add to that the

complication of a spoof, and the message becomes ever more indirect and confusing. It is

going to be especially confusing for a layman, who does not really connect the Harbhajan

Singh lookalike to the Royal Stag advertisement. They can only see this ad as an

independent, humorous clip, nothing more.

I believe that – a) people who are working in the alcoholic beverages industry, and b)

people who are marketing enthusiasts and watch ads with interest – are the only ones who

would realize the significance of the ad, and define it as a spoof on Royal Stag’s

campaign. And that’s the reason I think the ad is merely a strong statement made

internally from McDowell’s to Royal Stag. The customer doesn’t really seem to be the

target audience of the ad

CONCLUSION

Here during my survey I found that USL Company is undoutely a market leader in wine industry

especially in whisky segment. Its services along with resal value and taste of its product a major

role to mould the custmers towards USL wine. But in case of Royal Challenge’’ USL is in back

foot against Royal Stage and here is a point where Seagram Company capture customers for its

wine but Seagram has to a lot of efforts to make loyal its customer because Seagram is not in

good condition regarding its service, availability and promotional activates.

In short I would like to sum up my research with below mention conclusion:-

On the basis of research data and the personal interview of the respondents, the following

Conclusions have been drawn: -

61

Brand loyalty of regular liquor users is high when compared with occasional drinkers.

Hence brand loyalty is strongest for heavy users.

Taste and Price are the two important attributes.

Brand loyalty is affected by the consumer expenditure, which in turn affects his choice of

quantity of liquor.

• Brand loyalty has a direct relationship with the availability of brand. The respondent

tends to shift if they don’t find their regular brand

Advertisement has the minimum influence on purchase decision of the respondent in

purchase of liquor

LIMITATIONS OF THE STUDY

During the process of a research a person comes across certain restrictions certain limitations.

Some of these limitations are overcome while come have to be overlooked for the smooth

conducting of the research. Some of these restrictions are:

Liquor is such a product that the wholesaler, retailers and consumer fear to come out with

information.

Due to the wide area of the markets, it was impossible to cover each and every retail

shop, hence only few shops were covered.

The project has to be completed in 8-10 weeks, which is not enough time to cover the

market. So time was the major constraints in conducting the study.

In this study it is not possible to collect the opinion of all customers owing to personal

constraints. So the assumptions are drawn on the basis of the information given by the

respondents.

62

The study needs to complete within a specified time and in restricted areas. So the

findings cannot be generalized as a whole.

RECOMMENDATIONS

For Royal Challenge:

The ad should work well with local small town for rural guys In case of TVS..

Company should promote local bar of ‘B’ class city for particular brand “Royal

Challnge” and provide some after sale services.

Company should make some effective marketing plan for rural area’s customers

especially for its Royal challenge product.

For Royal Stage:

The concept of ad is very old, so concept of ad should modify in case of Royal Stage.

63

Company should properly setup its marketing network in small town also.

Company should launch some new (in mid premium segment) product to cover remote

market who either belong to the ‘B’ class city or small town.

SUGGESTIONS

Publications: Companies rely extensively on published materials to reach and influence

target markets, including annual reports, brochures, articles, printed and on-line

newsletters and magazines, and audiovisual materials.

Events: Companies can draw attention to new products or other company activities by

arranging special events like news conferences, on-line chats, contests and competitions,

and sport and cultural sponsorships that will reach the target publics.

News: One of the major tasks of PR professionals is to find or create favorable news

about the company, its products, and its people. The next step is getting the media to

accept press releases and attend press conferences.

Websites: Website is a major tool of advertising as it is free from any kind of restriction

in posting ads and any type of content. A company can post its ad in any website for

promotion. A massive group uses internet and by posting ads on website company can

64

easily communicate with the customer and can promote a new brand.

On premise advertising: On premise advertising is also a good mode of promoting a

brand, as all the customers purchase liquor from the retail outlet only, so company can

post there hoardings and banners in the retail outlets.

REFERENCE

1. MARKETING MANAGEMENT by PHILP KOTLER.

2. RESEARCH METHODOLOGY by C.R.KOTHARI

3. MARKETING WAR-FARE by AL RIES and JACK TROUT

4. THE ART OF WAR - SUN TZU

5. WWW.MCDOWELL.COM

6. WWW.GOOGLE.COM

7. WWW.UNITEDSPIRITS.COM

65