Atul New Project

-

Upload

9967834602 -

Category

Documents

-

view

237 -

download

0

Transcript of Atul New Project

-

7/29/2019 Atul New Project

1/80

1

CHAPTER 1: OVERVIEW OF BANKING

1.1 INTRODUCTION OF BANK:

Banks are the important component of any financial system. They play an

important role in channelizing the savings of surplus sectors to deficit

sectors. The efficiency and competitiveness of banking system defines the

strength of any economy. That is why the banking is always considered

as the backbone of the economy of any country. Indian economy is not anexception to this and banking system in India also plays a vital role in the

process of economic growth and development of the country. The

primary function of bank is to accept the money from the public in the

form of deposit and further lend it out to the needy people in return for an

income in the form of interest. Banks also gives returns in the form of

interest to the deposit holder which is always less than what bank receivesfrom its money borrowers (Debtors). The secondary functions of bank

includes opening of Letters of credit, Issuing Bank guarantees, issuing

demand drafts, mail Transfers, telegraphic transfers and collection of

instruments, Executor Trustee services, and dealing in Forex related

transactions and offering Safe Deposit Locker facilities, accepting Safe

custody articles and so on.

In modern days, Banks performs variety of agency functions and provides

various other services such as portfolio management, credit cards, ATM

cards, venture capital finance, micro finance, insurance, merchant

banking, etc. under one roof. This concept is popularly known as

Universal banking.

-

7/29/2019 Atul New Project

2/80

2

1.2 WHAT IS BANK?

The origin of the word bank can be traced back to the German word

Bank which translated means heap or mound or joint stock fund. The

Italian word Banco was derived from this to mean heap of money.

Bank as it largely understood in English today is an institution that

accepts money as a deposit for the purpose of lending with a view to earn

profit in the form of interest. In simple words, a bank is an institution

which deals in money and credit. It acts as intermediary who handles

other peoples money for their advantage and profit.

In French bancus or banque means a bench .Business was transacted

by the Jews in France on benches in the market place. The benches

resembled banking counters. If a banker failed, his bench was broken up

by the people, lending to the word bankrupt which means one that has

lost all his money, wealth or financial resources. Today the word bank is

used as a comprehensive term for a number of institutions carrying on

certain kinds of financial business. In practice, the word 'Bank' means

which borrows money.

A bank is now a financial institution which offers various savings as well

as cheque accounts, makes loans and provides other financial services,

making profits mainly from the difference between interest paid ondeposits and those of charged for loans, plus fees for accepting bills and

other services.

http://www.blurtit.com/q361870.htmlhttp://www.anz.com/edna/dictionary.asp?action=content&content=offerhttp://www.anz.com/edna/dictionary.asp?action=content&content=cheque_accounthttp://www.anz.com/edna/dictionary.asp?action=content&content=profithttp://www.anz.com/edna/dictionary.asp?action=content&content=interesthttp://www.anz.com/edna/dictionary.asp?action=content&content=deposithttp://www.anz.com/edna/dictionary.asp?action=content&content=deposithttp://www.anz.com/edna/dictionary.asp?action=content&content=interesthttp://www.anz.com/edna/dictionary.asp?action=content&content=profithttp://www.anz.com/edna/dictionary.asp?action=content&content=cheque_accounthttp://www.anz.com/edna/dictionary.asp?action=content&content=offerhttp://www.blurtit.com/q361870.html -

7/29/2019 Atul New Project

3/80

3

1.3 HISTORY OF BANK:

The first banks were probably the religious temples of the ancient world,

and were probably established in the third millennium B.C. Banks

probably predated the invention of money. Deposits initially consisted of

grain and later other goods including cattle, agricultural implements, and

eventually precious metals such as gold, in the form of easy-to-carry

compressed plates. Temples and palaces were the safest places to store

gold as they were constantly attended and well built. As sacred places,

temples presented an extra deterrent to would-be thieves.

Banking in India originated in the last decades of the 18th century. The

first banks were The General Bank of India which started in 1786, and the

Bank of Hindustan, both of which are now defunct. The oldest bank in

existence in India is the State Bank of India, which originated in the Bank

of Calcutta in June 1806, which almost immediately became the Bank of

Bengal. This was one of the three presidency banks, the other two being

the Bank of Bombay and the Bank of Madras, all three of which were

established under charters from the British East India Company. For The

three banks merged in 1921 to form the Imperial Bank of India, which,

upon India's independence, became the State Bank of India. Indian

merchants in Calcutta established the Union Bank in 1839,. The

Allahabad Bank, established in 1865 and still functioning today, is theoldest Joint Stock bank in India. The first entirely Indian joint stock bank

was the Oudh Commercial Bank, established in 1881 in Faizabad. The

next was the National Bank established in Lahore in 1895, which is now

one of the largest banks in India.

http://en.wikipedia.org/wiki/Bankinghttp://en.wikipedia.org/wiki/Templehttp://en.wikipedia.org/wiki/Goldhttp://en.wikipedia.org/wiki/Bank_of_Bengalhttp://en.wikipedia.org/wiki/Bank_of_Bengalhttp://en.wikipedia.org/wiki/Bank_of_Bombayhttp://en.wikipedia.org/wiki/Bank_of_Madrashttp://en.wikipedia.org/wiki/Imperial_Bank_of_Indiahttp://en.wikipedia.org/wiki/Allahabad_Bankhttp://en.wikipedia.org/wiki/Faizabadhttp://en.wikipedia.org/wiki/Lahorehttp://en.wikipedia.org/wiki/Lahorehttp://en.wikipedia.org/wiki/Faizabadhttp://en.wikipedia.org/wiki/Allahabad_Bankhttp://en.wikipedia.org/wiki/Imperial_Bank_of_Indiahttp://en.wikipedia.org/wiki/Bank_of_Madrashttp://en.wikipedia.org/wiki/Bank_of_Bombayhttp://en.wikipedia.org/wiki/Bank_of_Bengalhttp://en.wikipedia.org/wiki/Bank_of_Bengalhttp://en.wikipedia.org/wiki/Goldhttp://en.wikipedia.org/wiki/Templehttp://en.wikipedia.org/wiki/Banking -

7/29/2019 Atul New Project

4/80

4

Around the turn of the 20th Century, the Indian economy was passing

through a relative period of stability. Indians had established small banks,

most of which served particular ethnic and religious communities.

The period between 1906 and 1911, saw the establishment of banks

inspired by the Swadeshi movement. The Swedish movement inspired

local businessmen and political figures to found banks of and for the

Indian community. A number of banks established then have survived to

the present such as Bank of India, Corporation Bank, Indian Bank, Bank

of Baroda, Canara Bank and Central Bank of India. And as the time

passed on, the Indian economy saw tremendous increase in the number of

banks establishing in India with modern technologies and innovative

ideas.

For the past three decades India's banking system has several outstanding

achievements to its credit. The most striking is its extensive reach. It is no

longer confined to only metropolitans or cosmopolitans in India. In fact,Indian banking system has reached even to the remote corners of the

country. This is one of the main reason of India's growth process.

http://en.wikipedia.org/wiki/Swadeshihttp://en.wikipedia.org/wiki/Bank_of_Indiahttp://en.wikipedia.org/wiki/Corporation_Bankhttp://en.wikipedia.org/wiki/Indian_Bankhttp://en.wikipedia.org/wiki/Bank_of_Barodahttp://en.wikipedia.org/wiki/Bank_of_Barodahttp://en.wikipedia.org/wiki/Canara_Bankhttp://en.wikipedia.org/wiki/Central_Bank_of_Indiahttp://en.wikipedia.org/wiki/Central_Bank_of_Indiahttp://en.wikipedia.org/wiki/Canara_Bankhttp://en.wikipedia.org/wiki/Bank_of_Barodahttp://en.wikipedia.org/wiki/Bank_of_Barodahttp://en.wikipedia.org/wiki/Indian_Bankhttp://en.wikipedia.org/wiki/Corporation_Bankhttp://en.wikipedia.org/wiki/Bank_of_Indiahttp://en.wikipedia.org/wiki/Swadeshi -

7/29/2019 Atul New Project

5/80

5

1.4 DEFINITIONS OF BANK:

According to professor Crowther , A bank is one that collects

money from those who have its spare or who are saving it out of

their income and lends the money to those who required it.

Section 5(b) of the BANKING REGULATION ACT, 1949

defines banking as accepting for the purpose of lending or investment of deposits of money from the public, repayable on

demand or otherwise and withdrawable by cheque, draft, and

order or otherwise. Section 49A prohibits any institution other

than bank to accept deposit money from public withdrawable by

cheque.

In 1899, the United States Supreme define a bank: A bank is an

institution, usually incorporated with power to issue its

promissory notes intended to circulate as money (known as bank

notes); or to receive the money of others on general deposit, to

form a joint fund that shall be used by the institution, for its own

benefit, for one or more of the purposes of making temporaryloans and discounts; of dealing in notes, foreign and domestic

bills of exchange, coin, bullion, credits, and the remission of

money; or with both these powers, and with the privileges, in

addition to these basic powers, of receiving special deposits and

making collections for the holders of negotiable paper, if the

institution sees fit to engage in such business.

-

7/29/2019 Atul New Project

6/80

6

1.5 TYPES OF BANK:

Chart 1:- Types of Bank

Source: Researcher Methodology.

1) Central Bank:

A central bank is the bank for a country. It acts as a lender of banking

system. They are bankers to the government, bankers bank and ultimate

custodian of nations foreign exchange reserves. A central bank, reserve

bank, or monetary authority is a banking institution granted the exclusive

privilege to lend a government its currency. It has a monopoly on creating

Typesof

Bank

CentralBank

ComercialBank

Co-operative

Bank

DevelopmentBank

Exhange

Bank

InternationalBank

-

7/29/2019 Atul New Project

7/80

7

the currency of that nation, which is loaned to the government in the form

of legal tender. It is a bank that can lend money to other banks in times of

need. There are different central banks such as-Reserve Bank of India in

India, Bank of England in U.K., and Federal Reserve System in U.S.

2) Commercial Bank:

A bank which undertakes all kinds of ordinary banking business is called

as commercial bank. A commercial bank is a type of financial

intermediary and a type of bank. Commercial banking is also known as

business banking. It is a bank that provides checking accounts, savingsaccounts, and money market accounts and that accepts time deposits. It

provides money and credit for commercial and trade activities it also

grants loans and advances. They also perform certain agency services.

There are several commercial banks such as Bank of Maharashtra,

Punjab National Bank, Bank of India, Canara Bank, and State Bank of

India.

3) Co-operative Bank:

A co-operative bank is a financial entity which belongs to its members,

who are at the same time the owners and the customers of their bank. Co-

operative banks are often created by persons belonging to the same local

or professional community or sharing a common interest. Co-operative

banks generally provide their members with a wide range of banking and

financial services like loans, deposits, banking accounts. There are some

co-operative banks such as-Thane Bharat Sahakari Bank, Shyamrav

Vitthal Sahakari Bank, Thane Janata Sahakari Bank.

-

7/29/2019 Atul New Project

8/80

8

4) Development Bank:

The banks which look after development in the field of industry,

commerce are called as development banks. They are governed by RBI

norms. The first development bank In India incorporated immediately

after independence in 1948 under the Industrial Finance Corporation Act

as a statutory corporation to pioneer institutional credit to medium and

large-scale. Then after in regular intervals the government started new

and different development financial institutions to attain the different

objectives. There are development banks such as Asian Development

Bank, Industrial Development Bank of India, Small Industry development

Bank.

5) Exchange Bank:

The bank which looks after dealing in foreign currencies are exchange

banks. They have special authority to deal with foreign currencies. They

are governed by rules and regulation of Reserve Bank of India as well asgovernment of India .For example EXIM Bank.

6) International Bank:

The banks whose origin is at outside of the country are called as

International Bank. They have their branches worldwide. They have to

follow the principles of Reserve Bank of India. For example: ICICI Bank,HDFC Bank. International banks offer various financial and legal benefits

to accountholders. In fact, individuals and organizations have been

benefiting from international banking for many years. Usually, only high

net worth clients hold accounts in international banks.

-

7/29/2019 Atul New Project

9/80

9

1.7 FUNCTIONS OF BANK:

Chart No: 2:- Functions of bank:

Source: Researchers Methodology.

Functions

of Bank

PrimaryFunctions

Accepting

Deposits

Lending

Money

SecondaryFunctions

Agency

Functions

-

7/29/2019 Atul New Project

10/80

10

Deriving from the definitions and viewed solely from the point view of

customers, bank essentially performs the following function:

1. PRIMARY FUNCTIONS OF BANK:

The primary functions of a bank is usually accepting deposits from

the public and lending money to the needy people. Both these

functions are explained in detail below:

Accepting deposits from the public.-The primary functions of bank is accepting money in the form of

deposits from the public and further lend that money to the needy

people to earn an income in the form of Interest. The money is accepted

by bank as a deposit for safe keeping. The people or customers of bank

deposits money in the bank to earn interest income instead of keeping

that money idle at home. However, Bank also uses this money to earn

interest from people who are in need of money. In this case, the interest

rate charged to the borrower by the bank is usually higher than from

what it gives to its depositor. This is, in true sense, the actual business

of the bank.

The bank accepts the money from the public in the form of following

deposits:

a) Savings Deposit: The saving deposit is one of the most popular

deposits account among the savers. The main advantage of savings

account is that you easily deposit and withdraw money from the

bank and one can also earn interest on the money lying in the

account. The rate of interest given by the bank on deposit in

savings account is usually less than any other bank accounts. One

-

7/29/2019 Atul New Project

11/80

11

can withdraw money from this account for a fixed number of

times.

b) Current Deposit: Current deposit or current A/c are mainly usedby the business people who need to frequently deposit and make

payments from their accounts. A current holder can withdraw

money from his account any number of times during a month.

However, such a current holder does not earn any interest income

on his deposits. Since the rate of interest provided in the current

deposits is zero.

c) Fixed Deposit: The fixed deposit is also known as term deposit.

Since, the deposits in case of fixed deposit are accepted by a bank

for a fixed term or period. Such an account earns a higher rate of

interest than the savings bank account usually between 8 to 10 %.

However, the money of the a/c holder gets blocked for a fixedperiod of time. The fixed deposit a/c holder gets money back only

on the date of maturity. And if he wishes to withdraw the money

before the end of the fixed period or maturity, he may have to

accept a lower rate of interest as a penalty for not having retained

the deposit with the bank for the specified period.

d) Recurring Deposit: The variation of the fixed deposit is the

Recurring deposit account where the holder of this account need to

deposit a fixed amount of money at fixed interval (every

week/month) for a particular period of time, say a year or two as

per his convenience. However, the holder is not allowed to

withdraw money from this account before the fixed period. He can

do so only at the end of the fixed period.

-

7/29/2019 Atul New Project

12/80

12

Lending money to public.-

The bank acts as an intermediary between the people who have money

to lend and the people who dont have money to carry business

transactions. The bank lends money to the people in the form of loans,

advances, overdrafts, etc.

There are three types of loans depending upon their tenure of

repayment -

i. Short term loan

ii. Medium term loan

iii. Long term loan

Short term loans are those which have to be repaid in a very short

period of time say 1 or 3 years and the rate of interest charged by the

bank in this type of loan is very high since, the repayment period is

very less. Medium term loans are those which are for 5 to 10 years.

The rate of interest charged by the bank is moderate. Long term loans

are those which have to be repaid after a long period of time say 10

years or more and the rate of interest charged by the bank is very less

as compared to others since, the repayment period is very high.

Nowadays, depending upon the nature there are also other types of

loans provided by the banks such as personal loans, housing loans,

vehicle loans, educational loans, agricultural loans , etc.

-

7/29/2019 Atul New Project

13/80

13

2. SECONDARY FUNCTIONS OR AGENCY FUNCTIONS:

The banks in todays modern world perform variety of

functions other than its primary functions. These functions are popularly

known or called as Secondary or Agency functions of the bank. Some of

the agency functions of bank are listed below:

i. Transferring money from one place to other.- Bank transfers the money of both domestic and foreign from one place

to another place. This is known as a remittance services. Bank issues

demand draft, bankers cheque, money order for transferring the

money.

ii. Acts as a trustee.-

Bank acts as trustee of bank for various purposes. Whenever a

company issues a debenture, it has to appoint intermediary to protect

the interest of the debenture holder.

iii. Keeping valuable in custody.-

Bankers are in the business providing the security to the money and

valuable of the general public. Bank provides locker system.

iv. Government Business.- Banks accepts tax and non-tax receipts on behalf of government.

Pension payments and tax refund also take place through bank.

v. Maturity Transformation.- Bank borrow more on demand debt and short term debt, but provide

more long term loan.

Thus, the above all were the primary as well as secondary functions of

banks.

-

7/29/2019 Atul New Project

14/80

14

Chapter 2: BANKING IN INDIA BEFORE LPG

2.1 INSIGHTS FROM INDIAN ECONOMIC HISTORY:

From independence till the later part of the 1980s, India economic

approach was mainly based on government control and a centrally

operated market. The country did not have a proper consumer oriented

market and foreign investments were also not coming in. This did not do

anything good to the economic condition of the country and as such the

standard of living of the people did not go up.

Even if the economic liberalization policies were undertaken, it did not

find much support and the country remained in its backward economic

state. The imports started exceeding the exports and the India suffered

huge balance of payment problems. The IMF asked the country for thebailout loan. The fall of the Soviet Union, a main overseas business

market of India, also aggravated the problem. The country at this stage

was in need of an immediate economic reform.

The Indian Banking sector was also one of the victims of this. And the

failure of banking sector resulted into the worsening of the fall out

situation. Since, Banks are the most important component of any financialsystem. They play important role of channelizing the savings of surplus

sectors to deficit sectors. The efficiency and competitiveness of banking

system defines the strength of any economy. Indian economy was not an

exception to this and even then the banking system in India also played a

vital role in the process of economic growth and development.

-

7/29/2019 Atul New Project

15/80

15

Banking sector is the major sector that contributes substantially to the

finance of national economy, efficiency of commercial banks is one of

the most interesting and important issues for both the government and

private sector. After the series of banking sector reforms in last decade

the Indian commercial banks has pass through certain developments and

challenges. The Indian banking system has been regulated for most of its

subsistence.

Without a sound and effective banking system in India it cannot have a

healthy economy. The banking system of India should not only be hassle

free but it should be able to meet new challenges posed by the technology

and any other external and internal factors.

For the past two decades India's banking system has several outstanding

achievements to its credit. The most striking is its extensive reach. It is no

longer confined to only metropolitans or cosmopolitans in India. In fact,

Indian banking system has reached even to the remote corners of the

country. This is one of the main reasons of India's growth process. And

all this is because of the LPG (Liberalization, Privatization and

Globalization) which was initiated by the Government of India in the year

1991.

The government's regular policy for Indian bank since 1969 has paid rich

dividends with the nationalization of 14 major private banks of India.Not long ago, an account holder had to wait for hours at the bank

counters for getting a draft or for withdrawing his own Money. Today, he

has a choice. Gone are days when the most efficient bank transferred

money from one branch to other in two days. Now it is simple as instant

messaging or dialing a number and ordering a pizza. Money has become

the order of the day.

http://finance.indiamart.com/investment_in_india/banking_in_india.htmlhttp://finance.indiamart.com/investment_in_india/banking_in_india.htmlhttp://finance.indiamart.com/investment_in_india/banking_in_india.htmlhttp://finance.indiamart.com/investment_in_india/banking_in_india.html -

7/29/2019 Atul New Project

16/80

16

This is why it becomes quintessential for all of us to look back and

understand the pre Liberalization, Privatization and Globalization era of

our Indian banking system.

The first bank in India, though conservative, was established in 1786.

From 1786 till today, the journey of Indian Banking System before LPG

can be segregated into three distinct phases. They are as mentioned

below:

Early phase from 1786 to 1969 of Indian Banks Nationalization of Indian Banks and up to 1991 prior to Indian

banking sector Reforms.

New phase of Indian Banking System with the advent of Indian

Financial & Banking Sector Reforms after 1991.

To make this journey more explanatory, we can prefix the scenario as

Phase I, Phase II and Phase III.

-

7/29/2019 Atul New Project

17/80

17

2.2 PHASE - I (Early Phase of Indian banks):

The General Bank of India was set up in the year 1786. The Next was

Bank of Hindustan and Bengal Bank. The East India Company

established Bank of Bengal (1809), Bank of Bombay (1840) and Bank of

Madras (1843) as independent units and called it Presidency Banks.

These three banks were amalgamated in 1920 and Imperial Bank of India

was established which started as private shareholders banks, mostly

Europeans shareholders.

In 1865 Allahabad Bank was established and first time exclusively byIndians, Punjab National Bank Ltd. was set up in 1894 with headquarters

at Lahore. Between 1906 and 1913, Bank of India, Central Bank of India,

Bank of Baroda, Canara Bank, Indian Bank, and Bank of Mysore were

set up. Reserve Bank of India came in 1935.

During the first phase the growth was very slow and banks also

experienced periodic failures between 1913 and 1948. There were

approximately 1100 banks, mostly small. To streamline the functioning

and activities of commercial banks, the Government of India came up

with The Banking Companies Act, 1949 which was later changed to

Banking Regulation Act 1949 as per amending Act of 1965 (Act No. 23

of 1965). Reserve Bank of India was vested with extensive powers for the

supervision of banking in India as the Central Banking Authority.

During those days public has lesser confidence in the banks. As an

aftermath deposit mobilization was slow. Abreast of it

the savings bank facility provided by the Postal department was

comparatively safer. Moreover, funds were largely given to traders.

http://finance.indiamart.com/investment_in_india/banking_in_india.htmlhttp://finance.indiamart.com/investment_in_india/banking_in_india.html -

7/29/2019 Atul New Project

18/80

18

2.3 PHASE - II (Banking in India prior LPG):

Government took major steps in this Indian Banking Sector Reform after

independence. In 1955, it nationalized Imperial Bank of India with

extensive banking facilities on a large scale especially in rural and semi-

urban areas. It formed State Bank of India to act as the principal agent of

RBI and to handle banking transactions of the Union and State

Governments all over the country.

Seven banks forming subsidiary of State Bank of India was nationalizedin 1960 on 19th July, 1969, major process of nationalization was carried

out. It was the effort of the then Prime Minister of India, Mrs. Indira

Gandhi. 14 major commercial banks in the country were nationalized.

Second phase of nationalization Indian Banking Sector Reform was

carried out in 1980 with seven more banks. This step brought 80% of thebanking segment in India under Government ownership.

The following are the steps taken by the Government of India to Regulate

Banking Institutions in the Country:

1949: Enactment of Banking Regulation Act.

1955: Nationalization of State Bank of India.

1959: Nationalization of SBI subsidiaries.

1961: Insurance cover extended to deposits.

1969: Nationalization of 14 major banks.

1971: Creation of credit guarantee corporation.

1975: Creation of regional rural banks.

1980: Nationalization of seven banks with deposits over 200 crore.

-

7/29/2019 Atul New Project

19/80

19

After the nationalization of banks, the branches of the public sector bank

India rose to approximately 800% in deposits and advances took a huge

jumpby11,000%.

Banking in the sunshine of Government ownership gave the public

implicit faith and immense confidence about the sustainability of these

institutions. However, during these days the operational functioning

of the Indian banks was totally restricted to India and also the

foreign investment were totally disallowed.

Also the maximum participation of government in the banking and othersectors created at thick wall which restricted or prevented them from

going global and over a period of time, the whole entrepreneurial abilities

of a people were tied down to the myriad of all controls with a set of

regulations and licenses - so much so that the Indian economy was called

a License Raj . So, When you want to produce something, you needs a

licence, to increase production you needs a licence, to re-allocate yourresources, you needed a licence - every decision was taken by the Babus

(Bureaucrats)) rather than the entrepreneurs themselves. And to these

myriads of controls and regulations, the entire productive potential was

tied down. Later on, in true sense Liberalization was basically initiated

for unleashing the productive potential of people in terms of reducing the

kind of constraints imposed over a period of time upon the entrepreneurs.This is the true meaning of liberalization. And privatization was meant

for the minimizing the participation of the government and instead grant

license for private players while globalization was for opening the doors

for the foreign investment and private new entrants or players from the

outside world.

-

7/29/2019 Atul New Project

20/80

20

2.4 Phase III (Indian Banking after LPG):

This phase has introduced many more products and facilities in the

banking sector in its reforms measure. In 1991, under the chairmanship of

M Narashimham, a committee was set up by his name which worked for

the liberalization of banking practices.

As a result of these reforms or after these reforms, the country is flooded

with foreign banks and their ATM stations. Efforts are being put to give a

satisfactory service to customers. Phone banking and net banking isintroduced. The entire system became more convenient and swift. Time is

given more importance than money. The approach of Indian banks was

transformed from profit oriented to the customer oriented or service

oriented. Customer choice and satisfaction gained more importance.

Since, there is constant bombarding from the foreign competitors.

The financial system of India has shown a great deal of resilience. It issheltered from any crisis triggered by any external macroeconomics

shock as other East Asian Countries suffered. This is all due to a flexible

exchange rate regime, the foreign reserves are high, the capital account is

not yet fully convertible, and banks and their customers have

limited foreign exchange exposure.

http://finance.indiamart.com/investment_in_india/banking_in_india.htmlhttp://finance.indiamart.com/investment_in_india/banking_in_india.html -

7/29/2019 Atul New Project

21/80

21

Chapter 3: LPG A major transformation

in Indian Financial System

3.1 PARADIGM SHIFT IN THE INDIAN ECONOMY:

It is a fact that any national story is often a tale of turning points. When a

catastrophe takes place, the mindset of a nation changes and it decides the

course of its destiny. If August 15, 1947 marked the Indian Independence

- from political slavery to colonial power, then definitely August of 1991could be marked as the beginning of Indian Economic Freedom.

Many of us are alive to see the historical realities of the rise and fall of

nations. We realize that it is those who had the ability to innovate have

always won the day. If you look at the history of human civilization, we

see that those who had the ability to innovate, may be a war horse, may be

cannon or may be a steam engine have won the day.

In early 1990s the Indian economy had similarly witnessed some

dramatic policy changes in the form of LPG. It was in this 1990s period

when the first initiation towards globalization and economic liberalization

was undertaken by Dr Manmohan Singh, who was the Finance Minister

of India under the Congress government headed by P.V. NarashimhamRao. This is perhaps the milestone in the economic growth if India and it

aimed towards welcoming globalization. Since, the liberalization plan,

the economic condition gradually started improving and today India is

one of the fastest growing economies in the world with an average yearly

growth rate of around 6-7%.

-

7/29/2019 Atul New Project

22/80

22

The idea behind the new economic model known as Liberalization,

Privatization and Globalization in India (LPG) , was to make the

Indian economy one of the fastest growing economies in the world. An

array of reforms was initiated with regard to industrial, trade and social

sector to make the economy more competitive. The economic changes

initiated have had a dramatic effect on the overall growth of the economy.

It also heralded the integration of the Indian economy into the global

economy.

-

7/29/2019 Atul New Project

23/80

23

3.2 BUT ESSENTIALLY - WHAT IS LPG?

Since after the post independence period, we had adopted economic

strategy of planned growth. This policy continued up to 1991 in which

the State had to play a major role. Over a period of time, the whole

entrepreneurial abilities of a people were tied down to the myriad of all

controls with a set of regulations and licenses - so much so that the Indian

economy was called a Licen se Raj. When you want to produce

something, you needs a licence, to increase production you needs alicence, to re-allocate your resources, you needed a licence - every

decision was taken by the Babus (Bureaucrats)) rather than the

entrepreneurs themselves. And to these myriads of controls and

regulations, the entire productive potential was tied down. Liberalization

basically meant unleashing the productive potential of people in terms of

reducing the kind of constraints imposed over a period of time upon theentrepreneurs. This is the true meaning of liberalization.

Over a period of time in the 1950-60s when the private sector was not

developed enough, it was only to be expected that the Government would

need to come in a big way and take a lead in the industry as a producer.

But in the spate of enthusiasm we overdid it so much so that by 1991 wewere boasting of PSUs commanding heights in the Indian economy over

the private sector. It turned out that, if you looked at the total investment

made is above Rs.4, 00,000 crore in the Public Sector Undertakings, Rs.2,

50,000 crores for the State level Public Sector Undertakings and what is

the rate of return that the country has given on this, it is really 2.5%. So

we had to face a very strange situation in 1991 where the Government

was borrowing from the market at the rate of 14 % and was investing

-

7/29/2019 Atul New Project

24/80

24

where the rate of return was only 2.5 %. But this Just could not go on.

This was a sure recipe for disaster and indeed it did strike us. No matter

you think how special you are, you are not immune from the basic laws

of economics and we were made to realize that in terms of a crisis which

started in 1991. And as a result privatization was meant or initiated for

the minimizing the participation of the government and instead giving an

opportunity or chance to private players by granting license to them while

globalization was for opening the doors of Indian economy for the

foreign investment and private new entrants from the outside world. And

it was from then onwards that we started changing our policies , mindsets and have now come a long way.

In other words, the need for the Liberalization, Privatization and

Globalization arised due to the Indian economy which was in deep crisis

in July 1991, when foreign currency reserves had plummeted to almost $1

billion; Inflation had roared to an annual rate of 17 percent; fiscal deficitwas very high and had become unsustainable; foreign investors and NRIs

had lost confidence in Indian Economy. Capital was flying out of the

country and we were close to defaulting on loans. Along with these

bottlenecks at home, many unforeseeable changes swept the economies of

nations in Western and Eastern Europe, South East Asia, Latin America

and elsewhere, around the same time. These were the economiccompulsions at home and abroad that called for a complete overhauling

of the Indias economic policies and programs which ultimately paved the

way for economic reforms like LPG (Liberalization, Privatization and

Globalization) in India. These economic reforms initiated by government

of India in early 1990s later on have brought about a sea change in

operational environment, its functioning and outlook of Indian banks and

the financial system on a whole.

-

7/29/2019 Atul New Project

25/80

25

3.3 MEASURES FOR INITIATING LPG IN INDIA:

The Major measures initiated as a part of the liberalization, Privatization

and globalization strategy in the early nineties by the government of India

included the following:

Devaluation: The first step towards globalization was taken with the

announcement of the devaluation of Indian currency by 18-19 percent

against major currencies in the international foreign exchange market. In

fact, this measure was taken in order to resolve the BOP crisis.

Disinvestment - In order to make the process of globalization smooth,

privatization and liberalization policies are moving along as well. Under

the privatization scheme, most of the public sector undertakings have

been/ are being sold to private sector.

Dismantling of The Industrial Licensing Regime At present, only six

industries are under compulsory licensing mainly on accounting of

environmental safety and strategic considerations. A significantly

amended locational policy in tune with the liberalized licensing

policy is in place. No industrial approval is required from the government

for locations not falling within 25 kms of the periphery of cities having apopulation of more than one million.

Allowing Foreign Direct Investment (FDI) across a wide spectrum of

industries and encouraging non-debt flows. The Department has put in

place a liberal and transparent foreign investment regime where most

activities are opened to foreign investment on automatic route without

any limit on the extent of foreign ownership. Some of the recent

-

7/29/2019 Atul New Project

26/80

26

initiatives taken to further liberalize the FDI regime, inter alias, include

opening up of sectors such as Insurance (upto 26%); development of

integrated townships (upto 100%); defence industry (upto 26%);

tea plantation (upto 100% subject to divestment of 26% within five years

to FDI); enhancement of FDI limits in private sector banking, allowing

FDI up to 100% under the automatic route for most manufacturing

activities in SEZs; opening up B2B e-commerce; Internet Service

Providers (ISPs) without Gateways; electronic mail and voice mail to

100% foreign investment subject to 26% divestment condition; etc. The

Department has also strengthened investment facilitation measuresthrough Foreign Investment Implementation Authority (FIIA).

Non Resident Indian Scheme the general policy and facilities for

foreign direct investment as available to foreign investors/ Companies are

fully applicable to NRIs as well. In addition, Government has extended

some concessions especially for NRIs and overseas corporate bodieshaving more than 60% stake by NRIs.

The reduction of the peak customs tariff from over 300 per cent prior

to the 30 per cent rate that applies now. Severe restrictions on short-term

debt and allowing external commercial borrowings based on external debtsustainability.

Wide-ranging financial sector reforms in the banking, capital

markets, and insurance sectors, including the deregulation of interest

rates, strong regulation and supervisory systems, and the introduction of

foreign/private sector competition.

-

7/29/2019 Atul New Project

27/80

-

7/29/2019 Atul New Project

28/80

28

Chapter 4: IMPACT OF GLOBALIZATION ON

INDIAN BANKING INDUSTRY

4.1 AFTERMATH EFFECT OF LPG IN INDIA :

The most important thing that happened in 1991 is that the Indian

economy started increasingly integrating into the world economy. India

certainly will be not left out in the way side in the industrial revolution of our time. Sure enough Indian is already in the forefront of Information

Technology which is beginning to change our lives so dramatically.

With the onset of these reforms to liberalize the Indian economy in July

of 1991, a new chapter has dawned for India and her billion plus

population. This period of economic transition has had a tremendousimpact on the overall economic development of almost all major sectors

of the economy, and its effects over the last decade can hardly be

overlooked. Besides, it also marks the advent of the real integration of the

Indian economy into the global economy.

This era of reforms has also ushered in a remarkable change in the Indianmindset, as it deviates from the traditional values held since

Independence in 1947, such as self reliance and socialistic policies of

economic development, which mainly due to the inward looking

restrictive form of governance, resulted in the isolation, overall

backwardness and inefficiency of the economy, amongst a host of other

problems. This despite the fact, that India had always the potential to be

on the fast track to prosperity.

-

7/29/2019 Atul New Project

29/80

29

Now that India is in the process of restructuring her economy, with

aspirations of elevating herself from her present desolate position in the

world, the need to speed up her economic development is even more

imperative. And having witnessed the positive role that Foreign Direct

Investment (FDI) has played in the rapid economic growth of most of the

Southeast Asian countries and most notably China, India has embarked

on an ambitious plan to emulate the successes of her neighbors to the east

and is trying to sell herself as a safe and profitable destination for FDI.

Globalization has many meanings depending on the context and on theperson who is talking about. Though the precise definition of

globalization is still unavailable a few definitions are worth viewing,

Guy Brainbant, says that the process of globalization not only includes

opening up of world trade, development of advanced means of

communication, internationalization of financial markets, growingimportance of MNCs, population migrations and more generally

increased mobility of persons, goods, capital, data and ideas but also

infections, diseases and pollution.

The term globalization refers to the integration of economies of the world

through uninhibited trade and financial flows, as also through mutualexchange of technology and knowledge. Ideally, it also contains free

inter-country movement of labour.

In context to India, this implies opening up the economy to foreign direct

investment by providing facilities to foreign companies to invest in

-

7/29/2019 Atul New Project

30/80

30

different fields of economic activity in India, removing constraints and

obstacles to the entry of MNCs in India, allowing Indian companies to

enter into foreign collaborations and also encouraging them to set up joint

ventures abroad; carrying out massive import liberalization programs by

switching over from quantitative restrictions to tariffs and

Import duties, therefore globalization have been identified with the policy

reforms of 1991 in India.

Globalization in India has allowed companies to increase their base of

operations, expand their workforce with minimal investments, andprovide new services to a broad range of consumers.

The process of globalization has been an integral part of the recent

economic progress made by India. Globalization has played a major role

in export-led growth, leading to the enlargement of the job market in

India.

One of the major forces of globalization in India has been in the growth

of outsourced IT and business process outsourcing (BPO) services and

also banking as well as other financial services. The last few years have

seen an increase in the number of skilled professionals in India employed

by both local and foreign companies to service customers in the US and

Europe in particular. Taking advantage of Indias lower cost but educated

and English-speaking work force, and utilizing global communications

technologies such as voice-over IP (VOIP), email and the internet,

international enterprises have been able to lower their cost base by

establishing outsourced knowledge-worker operations in India.

http://www.economywatch.com/economy-articles/globalization-in-india.htmlhttp://www.economywatch.com/economy-articles/globalization-in-india.htmlhttp://www.economywatch.com/economy-articles/globalization-in-india.htmlhttp://www.economywatch.com/economy-articles/globalization-in-india.htmlhttp://www.economywatch.com/economy-articles/globalization-in-india.htmlhttp://www.economywatch.com/economy-articles/globalization-in-india.html -

7/29/2019 Atul New Project

31/80

31

Globalization in India has been advantageous for companies that have

ventured in the Indian market. By simply increasing their base of

operations, expanding their workforce with minimal investments, and

providing services to a broad range of consumers,

large companies entering the Indian market have opened up many

profitable opportunities.

But Globalization, of course, was as much as an opportunity as it was

a challenge.

First and foremost, an opportunity of specializing in areas of comparativeadvantage and thus achieving the benefits of skill especially as there is

now increasingly the possibility of gradual access to worlds best

technology determined by commercial terms of trade rather than

patronizing the terms of aid.

When LPG came in India in 1991 it was a major turning point. When weall recall that for the first time we had a situation where the Indian

economy was almost a marginalized one. Our people had forgotten about

the glories of the Indian economy, foreign exchange reserves dwindled to

a level of less than one billion dollars and the nation was on the verge of

bankruptcy. We were very close on the brink of default and that was the

time when finally changes started taking place in a positive manner.Economic reforms started taking place in a big way.

http://www.economywatch.com/economy-articles/globalization-in-india.htmlhttp://www.economywatch.com/economy-articles/globalization-in-india.html -

7/29/2019 Atul New Project

32/80

32

4.2 EFFECT OF LPG ON INDIAN BANKING SECTOR :

If we look at the Indian economic reforms, we can think of two distinct

facets - technically we call them micro economic stabilization and

structural adjustments. Micro economic stabilization is basically meant to

Stabilize the economy, whereas structural advantage essentially involved

re-structuring of the whole economy and that process is divided into three

core areas

i) Liberalization

ii) Privatizationiii) Globalization.

These three are popularly known as LPG. Although LPG (Liquid

Petroleum Gas) is explosive but this LPG combination has been a

welcome sign throughout the world.

As far as banking in India is concerned, there are three distinct spells of development of banking industry in post independent India, the pre-

nationalization era from 1947 to 1969, the post-nationalization cum pre

liberalization era from 1969 to 1991 and the neo-liberalization era from

1991 onwards. The first phase was mostly city-centric private Banking

marked by frequent failures and liquidation of Banks and consequent

pauperization of numerous poor and middle class depositors and loss of jobs for the employees.

The post-nationalization era saw a sea change in the Banking scenario:

financial stability of Public Sector Banks (PSBs) controlling more than

84% of Banking business of the country, PSBs commanding trust and

confidence of the Banking-public, expansion of Branch net-work of

Banks particularly in hitherto unbanked rural and semi-urban centres ,

-

7/29/2019 Atul New Project

33/80

33

opening up the banking services accessible to the rural poor, expansion of

credit to agriculture, small scale industries and small entrepreneurs,

artisans even to the marginal farmers, small shop owners, vegetable

vendors etc. Such expansion of Branch network, coupled with such mass-

banking, created considerable job opportunities on the one hand, and, on

the other, it helped a green revolution on the agricultural sector, obviating

dependence of import of food grains, as also a spurt in the development

of Small and Medium Scale Industries. It also rescued a vast section of

the rural poor from the exploitation by village-money-lenders. By tapping

the hitherto untapped huge rural savings, the PSBs could help the growthof large-scale and capital intensive industries too. Even the most ardent

critics of Public Sector too have had to recognize and appreciate the

laudable role of PSBs towards development of economic self reliance.

During this post nationalization era, Regional Rural Banks (RRBs) were

established in 1975 onwards under the auspices of PSBs to cater to thecredit needs of rural-India. Till 1990, priority sector lending constituted

over 70% of the advance portfolio of RRBs giving further fillip to the

rural economy. During the last four decades of their productive existence,

the PSBs have taken up the services of employees and the liability of

depositors of number of Private Banks going on liquidation due to

mismanagement by and the greed of their private owners.

With the onset of World Bank-IMF dictated reforms, euphemistically

called liberalization, successive Governments at the centre then were

consistently been trying to undo all the good work of the PSBs as also to

dismantle and privatize the PSBs altogether.

-

7/29/2019 Atul New Project

34/80

34

On 14th August 1991, the Government of India (GOI) appointed a

Committee headed by Mr. M. Narashimham (called Narashimham

Committee I) to suggest the modus operandi for reforms of the

Banking Sector. On 16th November 1991, the said Committee submitted

its Repost suggesting downsizing of PSBs through closure of Branches,

merger of PSBs, reduction of priority sector lending from the then

prevailing 40% to 10% of total advance portfolio, abolition of Banking

Service Recruitment Board, granting of more autonomy to PSBs in

respect of both financial and administrative matters, to reduce the

supervisory and regulatory control of Reserve Bank of India (RBI), theCentral Bank of the country, and, to top it all, dilution of Government

Holding in PSBs through suitable amendment of relevant legislations.

Thereafter, a number of committees, such as Narashimham Committee

II, Khan Committee, Verma Committee, S.C.Gupta Committee,

Raghuram Rajan Committee, Anwarul Hoda Committee, to name a few,

have been appointed to assess the progress in implementation of theRecommendations of the Narashimham Committee I as also to

suggest measures for carrying forward the reforms of the Banking Sector

further as per dictates of the World Bank-IMF.

Following the Recommendations of these Committees, successive

Governments have persistently been trying to carry forward the reformsdictated by World Bank-IMF. In the process, law has been amended to

pave the way for reduction of Govt. holding of shares in PSBs from 100%

to 51% and, in pursuance of such amendment, most of the PSBs (except

two major PSBs and two subsidiaries of State Bank of India) have made

public issue of shares, thus, reducing Government holding. Instead of

filling up more than one-hundred thousand vacant posts through

employment, the PSBs have reduced its workforce through Voluntary

-

7/29/2019 Atul New Project

35/80

35

Retirement Scheme on the one hand, and, on the other outsourcing even

the regular and core banking jobs to outside agencies. The role of RBI, as

the regulatory and supervisory authority over the banks have been

redefined and undermined considerably. RRBs have been directed to give

more emphasis on conventional Banking and, consequently, its priority

lending stands reduced to around 40% (from 70%) of total advances

today.

Still, all is not yet lost altogether, as least, so far our country, India, is

concerned. Bank employees in India have been fighting relentlesslyagainst the machinations of the successive Governments to the reform the

Banking Sector at the dictates of the World Bank-IMF combine. It is

most encouraging that all the nine unions having all-India presence in the

Banking Industry five Workmens Unions and four Officers Unions

representing almost 100% of the workforce in the Industry have joined

hands to form a United Forum of Bank Unions (UFBU). All the Unionsare, in the main, united in principle, against the reforms. Since the onset

of the reforms regime in 1991, the Bank employees have undertaken,

apart from other forms of struggle-programmes, not less than 19 one-day

strike and 3 two-day strike programmes (total 25 days of strike); these

strikes are apart from the strikes undertaken jointly with other sections of

Trade Union movement on popular demands.

Because of all these strike/struggle of Bank Employees and the role

played by the left parties, the successive Governments have not been able

to push through their much cherished reforms-programme to the fullest

extent they wished they could have done, to dismantle the PSBs that they

would have liked. The PSBs still retain their Nationalized character, save

and except State Bank of Sourastra (a subsidiary of State Bank of India)

-

7/29/2019 Atul New Project

36/80

36

which has been merged with State Bank of India, no other PSB has so far

been merged with any other by way of reform (merger of New Bank of

India with Punjab National Bank was actuated by commercial

considerations and not by way of reforms; hence no TU opposed the said

merger). The top echelons of PSBs, on their part, have not yet been able

to introduce outsourcing to the extent they would have liked.

The result is there for all of us to see. Because of the presence of a strong

and dominant Public Sector, the financial sector in our country, though

affected, has not crushed down with the melt down of the financial sectorin the United States of America and other major economies of the

capitalist world; not a single copper of public money has to be spent to

dole out/save any PSB, none of the depositors in any Bank has lost a

single farthing of his/her deposit; when the financial giants all over the

world have been happily off-loading their employees in thousands to tide

over the crisis, not a single Bank-employee in India has lost his job just toaccommodate the financial health of his/her employer. Pension, the only

post superannuation succor of employees, still remains assured. It is

therefore very much important to understand the changing way or pattern

of the Indian banking sector after the reforms.

The financial sector reforms in general and the banking reforms inparticular have been a key ingredient of the Indian reforms process. As a

result of these reforms, statutory pre-emption of banks (in the form of

high cash reserves and statutory liquidity ratio) got reduced to a great

extent so was the extent of financial repression. Interestingly the asset

quality of the Indian banks has improved to a great extent with a distinct

improvement in capital to risk adjusted assets ratio (CRAR) of banks

which is much above the stipulated level (9 percent) and drastic reduction

-

7/29/2019 Atul New Project

37/80

37

in NPA levels, notwithstanding the transition to 90 day delinquency norm

in 2004.

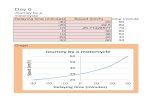

Table 3: Indicators of Indian banking reforms

(Percent)

Period

Quality of

Assets

Extent of Competition

(Percentage share in total Bank

Assets)

GrossNPL /

Assets

NetNPL /

Assets

ForeignBanks

PrivateSector

Banks

PublicSector

Banks

1996 - 97 7.0 3.3 7.9 7.7 84.4

2000 - 01 4.9 2.5 7.9 12.6 79.5

2002 - 03 4.0 1.8 6.9 17.5 75.7

2003 - 04 3.3 1.2 6.9 18.6 74.5

2004 - 05 2.5 0.9 6.5 18.2 75.3

2005 - 06 1.9 0.7 7.2 20.4 72.3

Source: Reserve Bank of India Survey, 2005 - 06

-

7/29/2019 Atul New Project

38/80

38

The major impact of banking sector reforms can also be viewed from the

following chart:

Chart 4: Indian Banking on the Reforms Path

Reforms Initiatives Impact on Banks

1. Deregulation of deposit

interest rate

2. Increase in CapitalAdequacy Ratio

3. Deregulation of lending

rates

4. Lower CRR & SLR

5.

Asset classification andprovisioning norms

6. Increase competition

7. Entry into new business

lines

8. Increased thrust on

banking supervision

and risk management

1. Helped banks to gain control

over cost of deposits

2. More stability in the bankingsystem

3. Flexibility to price loan products

and competitive pricing

4. Availability of more funds for

lending

5.

Encourage banks to strengthentheir credit and this brought

down the NPA generate rate

6. Pressure to retain customers,

enhance service quality and

efficiency

7. Emerge as financial super

markets and build the top and

bottom line

8. Help banks in proper allocation

of funds across various business

lines and adapt global best

practices of risk management to

enhance their competitiveness.

-

7/29/2019 Atul New Project

39/80

39

Source: Researchers methodology

The implications of globalization for a national economy are many.

Globalization has intensified interdependence and competition between

economies in the world market. These economic reforms have yielded the

following significant benefits:

Globalization in India had a favorable impact on the overall growth

rate of the economy. ( This is major improvement given that Indias

growth rate in the 1970s was very low at 3% and GDP growth in

countries like Brazil, Indonesia, Korea, and Mexico was more thantwice that of India. Though Indias average annual growth rate

almost doubled in the eighties to 5.9%, it was still lower than the

growth rate in China, Korea and Indonesia).

The pickup in GDP growth has helped improve Indias global

position. Consequently Indias position in the global economy hasimproved from the 8 th position in 1991 to 4th place in 2001; when

GDP is calculated on a purchasing power parity basis.

During 1991-92 the first year of Raos reforms program, t he Indian

economy grew by 0.9%only. However, the Gross Domestic

Product (GDP) growth accelerated to 5.3 % in 1992-93, and 6.2%1993- 94. A growth rate of above 8% was an achievement by the

Indian economy during the year 2003- 04. Indias GDP growth rate

can be seen from the following graph since independence.

-

7/29/2019 Atul New Project

40/80

40

Chart 5 : India GDP growth rate

Source: Economic survey 2001

Due to globalization not only the GDP has increased but also the

direction of growth in the sectors has also been changed. Earlier

the maximum part of the GDP in the economy was generated from

the primary sector but now the service industry, especially banking

industry, is devoting the maximum part of the GDP. The services

sector remains the growth driver of the economy with a

contribution of more than 57 per cent of GDP.

India is ranked 18th among the worlds leading exporters of

services (including banking as well as other) with a share of 1.3 per

cent in world exports. The services sector is expected to benefit

from the ongoing liberalization of the foreign investment regime

into the sector. Software, Banking and the ITES-BPO sectors have

-

7/29/2019 Atul New Project

41/80

41

recorded an exponential growth in recent years. Growth rate in the

GDP from major sectors of the economy can be seen from the

following Table.

Table-6: Structure of the Economy (Percentage)

(% of GDP) 1984-85 2002-03 2003-04 2004-05

Agriculture 35.2 26.5 21.7 20.5

Industry 26.1 22.1 21.6 21.9

Services 38.7 51.4 56.7 57.6

Source: Economic Survey 2000 & 2005

Not only this, globalization also brought about significant changes in theoverall attitude and outlook of Indian financial sector especially in the

banking sector. The entry of new banks has resulted in the paradigm shift

in the ways of banking in India. The growing competition, growing

expectations led to increased awareness amongst banks on the role and

importance of technology in banking. The arrival of foreign and private

banks with their superior sate of the art technology based services pushed

Indian Banks also to follow suit by going in for the latest technologies so

as to meet of competition and retain their customer base.

The economic reforms initiated by Government of India have brought

about a sea change in operational environment, its functioning and

outlook of Indian banks. The Indian banking industry has been

-

7/29/2019 Atul New Project

42/80

42

undergoing a metamorphosis since the commencing of liberalization,

Privatization and Globalization in India.

Today, post liberalization, privatization and globalization our Indian

financial system is rapidly changing. Some of the features of this change

are:

Increasing sophistication of capital markets Emergence of global investments. Industry consolidation.

Heightened focus on customer relations. Proliferation of new players entering the market.

In broader economic view, an efficient financial sector is an engine for

economic growth. It converts the fuel of savings into the kinetic energy

for the machine of the economy. The banking industry which is at the

core of the financial sector must take the lead.

And exactly same our Indian banking industry is doing right now. This

dominant position in the financial sector of banking has come from the

reform process started in the 90s which gave the banking an opportunity.

In this new environment, old methods of intermediation will not serve the

purpose. However, it has been empirically proved that every problem is

an opportunity in disguise.

-

7/29/2019 Atul New Project

43/80

43

Chapter 5: BANK OF MAHARASHTRA

Bank Profile

5.1 INTRODUCTION AND HISTORY:

i. The fledgling First Steps:

The bank was founded by a group of visionaries led by the

late Prof. V.G.Kale and the late Shri. D.K.Sathe and registered as a

banking company on 16th September, 1935 at Pune. The authorized

capital was Rs.10 lakhs and issued capital of Rs. 5 lakhs. Their vision was

to reach out and serve the comman man and meet all their working needs.

Successive leadership of the Bank and the employees has endeavoured to

fulfill their vision. Today, Bank of Maharashtra has over 12 millioncustomers across the length and breadth of the country served through a

network of 1428 branches in 22 states and2 union territories a truly pan

India bank.

-

7/29/2019 Atul New Project

44/80

44

Milestones in the journey for nation building:

The Bank of Maharashtra was registered on 16-09-1935

Commitment as stated in the prospectus issued on 21-10-1935:

Steadily to spread its business operations all over Maharashtra and as

opportunity allows, outside that area offering varied services to the

general public while trying to be useful to trade, commerce and industry

consistently with high standards of safety and efficiency

1936 : Commenced operations on 08-02-1936 in Pune

1938 : Second branch of the bank was opened in 1938 at Fort, Bombay.

1940 : Third branch came up at Deccan Gymkhana, Pune

1944 : Status as Scheduled Bank obtained

1946 : Deposits crossed Rs One crore mark

Formed fully owned subsidiary, The Maharashtra Executor &

Trustee Company

First branch outside Maharashtra opened in Hubli (Mysore

Starte, Now Karnataka)

1949 : Expansion to Andhra Pradesh: Hyderabad branch opened

1963 : Expansion to Goa: Panjim Branch opened

1966 : Expansion to Madhya Pradesh: Indore branch opened

Entered in Gujarat: Baroda branch opened

1969 : Nationalized along with 13 other Banks

Entry in Delhi by opening Karol bagh branch on 19-12-69

-

7/29/2019 Atul New Project

45/80

45

1974 : Deposit base crossed Rs. 100 Crore mark

1976 : Marathwada Grameena Bank, first RRB established on 26-08-1976

1978 : New Head Office building inaugurated by Hon'ble Prime

Minister of India Shri. Morarji Desai. Deposits crossed the figure

of Rs.500 Crores

1979 : Mahabank Agricultural Research and Rural Development

Foundation, registered as a public trust, was established for

undertaking research and extension work and to provide more

extensive services to farmers.

1985 : 500th branch in Maharashtra state was opened at the hands of the

then Prime Minister, Mrs. Indira Gandhi at Nariman Point,

Mumbai.

First Advanced Ledger Posting Machine (ALPM) was installed

at the branch.

Golden Jubilee Year Celebrations launched at the hands of Dr.

Manmohan Singh, Governor Reserve Bank of India

1986 : Thane Grameena Bank sponsored

1987 : The 1000th branch of the Bank was inaugurated at Indira

vasahat, Bibwewadi, Pune at the auspicious hands of Dr.Shankar

Dayal Sharma, the Honorable Vice President of India

1991 : "Mahabank Farmer Credit Card " was launched

Entered in to Domestic Credit Card Business

Main Frame Computer installed

Became member of the SWIFT

-

7/29/2019 Atul New Project

46/80

46

1995 : Diamond Jubilee Celebrations - Dr C Rangarajan the RBI

Governor was the Chief Guest

Deposits crossed Rs 5000 crore mark

1996 : Moved into A category from the earlier C category.

Autonomy obtained

2000 : Deposits crossed Rs 10000 crore mark

2004 : Public Issue of Shares 24% owned by Public

Listed in BSE and NSE

2005 : Bancassurance and Mutual Fund distribution business started2006 : Crossed total business level of Rs.50,000 Crore

Branch CBS Project started

2009 : Entered in to 75th year of dedicated service to the Nation

Adopted 75 underdeveloped villages for integrated overall

development

2010 : 100% CBS of branches achieved

Total Business crossed Rs One lakh crore

Opened 76 branches in the Platinum Year taking the total to 1506

ii. Mission:

To ensure quick and efficient response to customer expectations. To innovate products and services to cater to diverse sections of

society.

To adopt latest technology on a continuous basis. To build proactive, professional and involved workforce. To enhance the shareholders wealth through best practices and

corporate governance.

-

7/29/2019 Atul New Project

47/80

47

To enter international arena through branch network.

iii. The Birth:

The Bank of Maharashtra was registered on 16th Sept 1935

with an authorized capital of Rs 10.00 lakh and commenced business on

8th Feb 1936.

iv. The Childhood:

The Bank of Maharashtra, known as a common man's bank

since inception, its initial help to small units has given birth to many of

today's industrial houses. After nationalization in 1969, the bank

expanded rapidly. It now has 1428 branches all over India. The Bank has

the largest network of branches by any Public sector bank in the state of Maharashtra.

v. The Adult:

The bank has fine tuned its services to cater to the needs of

the common man and incorporated the latest technology in banking

offering a variety of services.

vi. Vision Statement 2010:

To be a vibrant, forward looking, techno-savvy, customer

centric bank serving diverse sections of the society, enhancing

shareholders and employees value while moving towards global

presence.

-

7/29/2019 Atul New Project

48/80

48

vii. Logo:

The Deepmal - With its many lights rising to greater heights. The Pillar - Symbolizing strength of organization. The Diyas - Symbolizing service of branches. The 3 M's Symbolizing

a. Mobilization of Money

b. Modernization of Methods and

c. Motivation of Staff.

viii. Aim: The bank wishes to cater to all types of needs of the entire family,

in the whole country. Its dream is "One Family, One Bank, Bank

of Maharashtra ".

ix. The Autonomy:

-

7/29/2019 Atul New Project

49/80

49

The Bank attained autonomous status in 1998. It helps in giving

more and more services with simplified procedures without

intervention of Government.

x. Social Aspect: The bank excels in Social Banking, overlooking the profit aspect; it

has a good share of Priority sector lending having 38% of its

branches in rural areas.

xi. Other Attributes: Bank is the convener of State level Bankers committee. Bank offers Depository services and Demat facilities at 131

branches.

Bank has a tie up with LIC of India and United India InsuranceCompany for sale of Insurance policies.

All the branches of the Bank are fully computerized.

-

7/29/2019 Atul New Project

50/80

50

xii. Organization Structure and Hierarchy:

Organization structure changed from four-tier to a three

tier structure since Feb 2008.

Three-tier structure consists of three levels:

1. Central Office

2. Regional Offices

3. Branches

Organization Hierarchy Chairman Managing Director Executive Director General Manager Deputy general Manager

Assistant Manager Chief Manager Senior Manager Manager Deputy Manager Clerk.

-

7/29/2019 Atul New Project

51/80

51

xiii. Key Personnel:

Shri Allen C A Pereira

(Chairman and Managing Director)

Shri M.G. Sanghvi

(Executive Director)

Shri V.P. Bhardwaj

(Director (Government nominee)

Shri S.K. Gogia

Director (RBI nominee)

Shri T Parameswara Rao

(Director)

Shri Anand Kamalnayan Pandit

(Shareholder Director)

Dr. Dinesh Shantilal Patel

(Shareholder Director)

Dr. S. U. Despande

(Officer Director)

Shri S.H. Kocheta

(Director)

-

7/29/2019 Atul New Project

52/80

52

ix. CORPORATE SOCIAL RESPONSIBILITIES (CSR)

ACTIVITIES OF BANK OF MAHARASHTRA:

The Bank of Maharashtra being one of the oldest public sector banks in

India has wholeheartedly accepted its responsibility towards the

development and upliftment of the society. That is why the bank has so

far made and still making several attempts in the upliftment of the poor

farmers, destroying unemployment, women empowerment and education.

In this context, the bank of Maharashtra has initiated many social

programmes and activities. The Bank of Maharashtras Bank Rural

Development Centres at Hadapsar and Bhigwan in Pune region are

undertaking various developmental activities for the benefit of the famers.

Its object is to set up Lab to Land project, reuse / rehabilitation of Saline

Soil and advice on scientific use of inputs for optimum results.

The Mahabank Agricultural Research and Rural DevelopmentFoundation (MARDEF) is active in socio-economic development of

villages by encouraging farmers to take diversified activities like dairy,

EMU farming, goat rearing, grape cultivation, horticulture and scientific

use of various inputs like fertilizers etc. The foundation assists farmers,

especially small and marginal farmers, in receiving timely bank credit.

a) Mahabank Self Employment Training Institute (M-SETI):

The Bank has established Five Mahabank Self Employment Training

Institutes (MSETI), one each at Pune, Aurangabad, Nagpur, Nasik and

Amravati. These provide training to rural youth and women for self

-

7/29/2019 Atul New Project

53/80

53

employment. A total of 4605 candidates have been trained by the

institutes so far.

M -SETI was established in December 2001 under the aegis of MARDEF with a view to fostering entrepreneurship skill development

for educated unemployed youths, especially from rural areas.

Various Rural Entrepreneurship Development Programmes and

Entrepreneurship Development Programmes courses are conducted

through 3 M-SETI centres at Pune, Aurangabad and Nagpur.

These M -SETI centres have conducted 187 programmes and trained

3905 unemployed youths of which 2696 have successfully started their

own livelihood activities.

-

7/29/2019 Atul New Project

54/80

54

b) Gramin Mahila VA Balak Vikas Mandal (GMBVM)

Gramin Mahila VA Balak Vikas Mandal (GMVBVM), an NGO formed

in 1989 by Bank of Maharashtra, is actively involved in formation,

nurturing of SHGs and facilitating linkage to Bank Credit. TheGMVBVM also helps SHGs to market their products through two sales

outlets in Pune City named SAVITRI. GMVBVM assists the SHGs to

secure quality raw material and inputs for their products and extends

marketing and sales support. Matured SHGs are assisted to upgrade into

Small and Medium Enterprises. GMVBVM has been declared as Mother

NGO by Govt. of Maharashtra.

Gramin Mahila VA Balak Vikas Mandal is a Trust sponsored by the

bank in 1989. Its objective is the empowerment of rural women through

the medium of Self help groups. Today GMBVM is working in 5 lead

districts of Bank of Maharashtra i.e. Pune, Satara, Nasik, Thane and

Jalna, nuturing self help groups covering over 1 lakh women.

-

7/29/2019 Atul New Project

55/80

55

The trust has the following thrust areas of work:

1. It is the only NGO which not only guides SHGs in taking up income

generating activities but also markets the products of SHG. Towards this

end the bank has made available space at Model Colony, Pune to run an

emporium called SAVITREE

2. Educating of SHG members

3. Insurance of SHG members

4. Training in all activities to become a successful SHG

5. Credit linkages with banks

Upto 31st March 08 GMBVM has formed 15739 SHG s and credit liked

13175 SHGs. Out of which, 8974 SHGs are credit linked through

branches of bank.

-

7/29/2019 Atul New Project

56/80

56

c) Councelling for farmers in Vidharbha:

The Mahabank Vidharbha Shetkari Jagruti Abhiyan, a joint effort of