ANCILLARY MARKETS

Transcript of ANCILLARY MARKETS

ANCILLARY MARKETS

Rajesh K. Mediratta Director (B.D.) , IEX 10th Apr,13/ New Delhi

In this presentation

• Introduction

• Proposed Market

• Market Design Parameters

In this presentation

• Introduction

• Proposed Market

• Market Design Parameters

Electricity- Charactersitics

• Electricity cannot be stored

– TIME LINE OF PARTICIPATION

– Spot & Forwards

• Quantity- Private good ; Quality- public good

– Any buyer or seller cannot control quality

– Quality is result of collective response of all buyers/sellers

– No one-to-one physical relationship between Buyer-seller

– Need System operator to ensure quality

Transactions needs to be done close to real-time

Electricity as Commodity–market structure

Real-time (TSO) Balancing Market Reserves Market

Near Real-time (MO)

Day-Ahead Intra-day

Short Energy Term (MO)

OTC Trading Exchange based

Long Term (MO)

Capacity Markets Energy Markets - Futures & Forwards

Ancillary Service categories

Frequency Control Ancillary Services (FCAS)

• Maintain frequency

• Load following/imbalance management

Network Control Ancillary Services (NCAS)

• Voltage control

• System Protection

System Restart Ancillary Services (SRAS)

• To restart the system in case of whole or partial system black out

NR frequency … Resources with high ramp-up/down, short periods

Source: NRLDC, 25th May, 2012

Ancillary Market

OTC Markets

Financially settled

Derivatives Exchange/

Options

Time

Ma

rk

et

Ma

tur

ity

Multiple buyers - sellers

Spot Markets on Exchanges

Individual Buyer /Seller

OTC Derivatives

Indian market is here

Capacity Market

Next step in the market development trajectory

Enablers for market based Frequency Control Ancillary Services

Large pool of bottled up generation (~2000MW capacity)

Liquid Day-Ahead Markets

Adequate number of right sized generators available

MW available from each such generator is also adequate

High ramp-rate generators(CCGTs) available

Strong National/Regional Grids

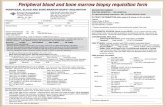

Daily Bids received at IEX >1000 MW Sellers unutilised after DAM (Jan’2013)

0.00

1.00

2.00

3.00

4.00

5.00

6.00

0

20000

40000

60000

80000

100000

120000

140000

160000

1-J

an-1

3

2-J

an-1

3

3-J

an-1

3

4-J

an-1

3

5-J

an-1

3

6-J

an-1

3

7-J

an-1

3

8-J

an-1

3

9-J

an-1

3

10

-Jan

-13

11

-Jan

-13

12

-Jan

-13

13

-Jan

-13

14

-Jan

-13

15

-Jan

-13

16

-Jan

-13

17

-Jan

-13

18

-Jan

-13

19

-Jan

-13

20

-Jan

-13

21

-Jan

-13

22

-Jan

-13

23

-Jan

-13

24

-Jan

-13

25

-Jan

-13

26

-Jan

-13

27

-Jan

-13

28

-Jan

-13

29

-Jan

-13

30

-Jan

-13

31

-Jan

-13

Rs.

/kW

h

Vo

lum

e (

MW

h)

Purchase Bid (MWh) Sell Bid (MWh) Constrained MCV (MWh) Unconstrained MCP (Rs/KWh)

In this presentation

• Introduction

• Proposed Market

• Market Design Parameters

Proposed Market process

DAM Final Solution by 3:30 PM

Qualified generators submit bid for ancillary service

Results Bids arranged in Merit Order stack and sent to NLDC /RLDCs

Sellers on the TSO’s list to remain available for the day

NLDC/RLDCs to direct seller to operate plant as required

Payments released on the basis of Schedule

Salient features

Qualified generators only participate

Non-performance by Enabled generators to be penalised

Selected generators (in stack) to receive small availability fee

Schedules issued to Generators for some minimum periods irrespective of system normalisation

Eligibility for Qualified Generators(QGs)

Minimum quantity to be specified (say 50MW or 0.1% of system size)

Minimum period of operation specified (say 6 time blocks)

Minimum Ramp rate (say 10MW/min) Ramp constraints to be indicated at the time of registration

No. of start/stops and period between two start/stops

In this presentation

• Introduction

• Proposed Market

• Market Design Parameters

Should there be qualifification criteria ?

Qualified Generators only

• Participation by generators with high ramp/down, fast start capability

• Selected resources should perform to meet TSO’s requirement

All Resources

• All unutilised generation can participate

• Performance may not match TSO’s requirement

Auction Type

DAM Auctions

• Leftover Sellers

• Confidentiality of DAM results may be hampered

Re-auction

• PXs can arrange bidding

• Allow qualified generator to post different bid based on Average cost and not Marginal cost

• Balance capacity can bid

Merit Order Stack Basis

Synchronous interconnections

• Bids stacked on the basis of common frequency area

• Area may/may not be interconnected due to congestion

Congestion area specific

• Bids stacked on the basis of congestion area

• Allow to select generators on the basis of area suffering most congestion to least congestion

Regulation Type

Upward Only

• Allow generators to bid for increasing gen or demand to bring down demand (Demand Response)

• Only valleys are handled

Downward and Upward Regulation

• Generators to increase/decrease generation

• Loads to decrease

• Peaks and valleys are handled

Price Discovery

Pay-as-you-bid

• Resources to be paid price quoted by them

• Sellers to strategise bidding

Uniform Price

• All utilised resources to be paid price of highest enabled generators

• Generator may quote near marginal cost to be a part of the ‘stack’

Uniform Price Discovery Mechanism

Balancing power -sorted in merit order

Price

Downward Regulation

Upward Regulation

MW

Highest up regulation Price = Sales price

Lowest down regulation Price = Purchase price,

Market design parameters

Residual from DAM auctions

Re-auction

All Resources Qualified

Generators

Synchronous interconnections

(common frequency areas)

Congestion area specific

Upward only Downward &

Upward

Pay as you bid Uniform Price

Auction /Re-auction

Participation by Resources

Merit Order Stack basis

Regulation Type

Price Discovery

• NLDC (in consultation with CERC) to ascertain rules for selection of Qualified Generators who then register with NLDC/RLDC

Selection of Generators

• Those who appear in TSO’s list for the day should receive a nominal Availability Fee to remain available for the day

Incentive for availability

• Non-adherence should be subjected to UI Penalty

• Re-bids may have ceiling price = UI (max) rate Price Fixation

• Counter-party is a POOL and therefore payment to be made by the TSO

• Those who create such situation to pay TSO

Commercial Settlement

Features of the proposed market design

Demand Response

• Direct Load Control – Load Shedding by utilities

– Involve the remote interruption of customers' energy usage during peak hours

– Value of lost load high, resort to DG sets which is costly

• Pricing Incentive – Variable electricity rates to encourage customers'

voluntary curtailment during demand response events

– Utilities use a variety of pricing schemes including peak time rebates, critical peak pricing, and time of use rates to curtail usage