AMPLE REAL ESTATE - Dearborn€¦ · Real Estate Guaranty Fund (Title 17, Subtitle IV) 21 ......

Transcript of AMPLE REAL ESTATE - Dearborn€¦ · Real Estate Guaranty Fund (Title 17, Subtitle IV) 21 ......

FOURTEENTH EDITIONDonald A. White

REAL ESTATEPractice & Law

Maryland

Ma

ryland REAL ESTA

TE Practice & Law

| FOU

RTEENTH

EDITIO

N

SAMPLE

Practice & LawREAL ESTATEMaryland

FOURTEENTH EDITION

Donald A. White

MD_RE_Practice_Law.indb 1 6/13/2014 10:49:22 AM

SAMPLE

This publication is designed to provide accurate and authoritative information in regard to the subject matter covered. It is sold with the understanding that the publisher is not engaged in rendering legal, accounting, or other professional advice. If legal advice or other expert assistance is required, the services of a competent professional should be sought.

President: Dr. Andrew TemteChief Learning Officer: Dr. Tim SmabyExecutive Director, Real Estate Education: Melissa Kleeman-MoyDevelopment Editor: Adam Bissen

MARYLAND REAL ESTATE PRACTICE & LAW FOURTEENTH EDITION©2014 Kaplan, Inc.Published by DF Institute, Inc., d/b/a Dearborn Real Estate Education332 Front St. S., Suite 501La Crosse, WI 54601

All rights reserved. The text of this publication, or any part thereof, may not be reproduced in any manner whatsoever without written permission from the publisher.

Printed in the United States of America

ISBN: 978-1-4754-2181-1 / 1-4754-2181-8PPN: 1510-0814

MD_RE_Practice_Law.indb 2 6/13/2014 10:49:22 AM

SAMPLE

iii

Preface ix

About the Author x

Acknowledgments xi

How to Use This Book xii

C H A P T E R 1

Maryland Real Estate License Law and Related Regulations 1Key Terms 1

Overview 1

History and Sources of Maryland License Law 2

Definitions of Terms [§17-101] 3

Licenses and Certificates Issued by the Commission (Title 17, Subtitle III) 3

The Maryland Real Estate Commission [§17-201–§17-214] 5

Requirements for Licensure 7

License Term, Transfer, and Renewal [§17-314] 13

Processing Complaints 18

Real Estate Guaranty Fund (Title 17, Subtitle IV) 21

Prohibited Acts [§17-322] 24

Additional Prohibited Acts Punishable by Imprisonment 27

Real Estate Brokerage Practice in Baltimore City 28

Maryland Securities Act 28

Real Estate Appraisers and Home Inspectors Act 28

Comparative Market Analysis (CMA) 28

Building Inspections 29

Changes in the Maryland Real Estate Brokers Act and Related Regulations 29

Chapter 1 Quiz 31

C H A P T E R 2

Real Estate Agency 35Key Terms 35

Overview 35

Brokerage and Agency: Not Always the Same 36

Agency 36

The Challenge of Dual Agency 39

A Firm’s Agency Options in Representation 43

Categories of Representation [§17-530] 43

Presumed Buyer’s Agency Relationship [§17-533] 47

Agency Disclosure: Understanding Whom Real Estate Agents Represent 48

The Client’s Right of Confidentiality [§17-532] 49

Agency Relationship Not Determined By Which Party Pays [§17-534] 50

Contents

MD_RE_Practice_Law.indb 3 6/13/2014 10:49:22 AM

SAMPLE

iv Contents

Disclosure and Fairness [COMAR 09.11.02.02 A] 51

Chapter 2 Quiz 52

C H A P T E R 3

Real Estate Brokerage 55Key Terms 55

Overview 55

Brokerage [§17-101] 56

Organization of Brokerage Firms [§17-321] 56

Supervision [§17-320 and COMAR 09.11.05] 58

Personal Assistants 59

Real Estate “Teams” [§ 17-543 thru § 17-548] 61

Places of Business: Offices [§17-517] 65

Disclosure of Licensee Status When Buying, Selling, or Renting 67

Advertising 67

Telemarketing and “Broadcast” Fax Solicitation 69

Funds of Others Held in Trust (Title 17, Subtitle V, Part I) 70

Chapter 3 Quiz 73

C H A P T E R 4

Listing Agreements and Buyer Representation Agreements 75Key Terms 75

Overview 75

Residential Brokerage Agreements 76

Other Provisions 77

Listing Agreement Property Information 83

Residential Property Disclosure and Disclaimer Form [Real Property Article §10-702] 85

Termination of Agency Agreement [§17-322(10), §17-534] 87

Determining Amount and Distribution of Brokerage Fees 87

Local Requirements 91

Out-of-State Listings 91

Chapter 4 Quiz 92

C H A P T E R 5

Interests in Real Estate 93Key Terms 93

Overview 93

Easement by Prescription and Adverse Possession 94

Riparian Rights 94

Agricultural Land Preservation Easement 94

Chapter 5 Quiz 95

MD_RE_Practice_Law.indb 4 6/13/2014 10:49:22 AM

SAMPLE

vContents

C H A P T E R 6

How Ownership Is Held 97Key Terms 97

Overview 97

Forms of Concurrent Ownership (Co-Ownership) 98

Condominiums [Real Property Article, Title 11] 99

Time-Share Ownership 103

Maryland Cooperative Housing Corporation Act [Corporations and Associations Article, Titles 5–6B] 106

Maryland Homeowners Association Act [Real Property Article §11B] 106

Cancellation Periods 106

Chapter 6 Quiz 108

C H A P T E R 7

Legal Descriptions 111Key Terms 111

Overview 111

Examples of Legal Descriptions Used in Contracts 112

Survey Markers 112

Location Drawings and Boundary Surveys 113

Subdivision Plats 113

Chapter 7 Quiz 114

C H A P T E R 8

Real Estate Taxes and Other Liens 115Key Terms 115

Overview 115

Assessment 116

Payment 116

Property Tax Relief Programs 118

Transfer and Recordation Taxes 119

Corporate Franchise Tax 119

Property Tax Assessments, Agricultural Use 119

Ad Valorem Tax Delinquency and Redemption 120

Mechanics’ Liens 120

Chapter 8 Quiz 122

C H A P T E R 9

Real Estate Contracts 123Key Terms 123

Overview 123

General Contract Rules: Competency, Statute of Frauds, and Limitation of Actions 124

Contracts for the Sale of Real Estate 124

Information Required in Contracts 136

Option Agreements 140

Construction Contracts 141

New Home Warranties and Deposits 141

MD_RE_Practice_Law.indb 5 6/13/2014 10:49:23 AM

SAMPLE

vi Contents

Installment Contracts 142

Disclosure Requirements of Initial Sales of Condominiums 142

Residential Property Disclosure and Disclaimer Statement 142

Retention of Agency Disclosure Forms 143

Powers of Attorney 143

Duties and Obligations of Licensees 144

Equitable Title and Risk of Loss 144

Residential Sales Contract Provided for Maryland REALTORS® 144

Chapter 9 Quiz 145

C H A P T E R 10

Transfer of Title 147Key Terms 147

Overview 147

Transfer of Title by Descent 148

Transfer of Title by Action of Law 148

Transfer of Title by Will 149

Transfer of Title by Deed 149

Taxes on Conveyances 150

Agricultural Transfer Tax 150

Maryland Uniform Transfers (Gifts) to Minors Act 150

Chapter 10 Quiz 151

C H A P T E R 11

Title Records 153Key Terms 153

Overview 153

Details of Recordation 154

Title Evidence 155

Prerequisites to Recording 156

Uniform Commercial Code 156

Chapter 11 Quiz 157

C H A P T E R 12

Real Estate Financing 159Key Terms 159

Overview 159

Note to Student 159

Mortgage and Deed of Trust Loans 160

Default, Foreclosure, and Deficiency 160

Avoiding Frequent Future Foreclosures 160

Reducing Residential Mortgage Defaults and Foreclosures 161

Short Sales and Real Estate Licensees 162

Mortgage Interest Rate Limits and Prepayment 164

Mortgage Expense Accounts 165

Discrimination 165

Ground Rent: FHA/DVA Loans 165

MD_RE_Practice_Law.indb 6 6/13/2014 10:49:23 AM

SAMPLE

viiContents

Release of Mortgage Lien 166

Mortgage Presumed Paid 166

Foreclosures and Trustee Sales 166

Land Installment Contracts 167

Junior Financing 167

Residential Property Loan Notices 168

Chapter 12 Quiz 169

C H A P T E R 13

Leases 171Key Terms 171

Overview 171

Maryland Ground Rents 172

Maryland Residential Leases 174

Miscellaneous Requirements 176

Sale of Leased Premises 177

Termination of Periodic Tenancies 177

Prohibited Residential Lease Provisions 179

Withholding Rent 180

Lease Agreement Forms 181

Retaliatory Evictions 181

Peaceable and Quiet Entry 181

Safety Requirements 181

Lease Option Agreements 182

Mobile Home Parks 182

Sources of Assistance 183

Chapter 13 Quiz 184

C H A P T E R 14

Environmental Issues and Real Estate Transactions 187Key Terms 187

Overview 187

Multiple Challenges 188

Multilevel Approaches 188

Enforcement 188

The Chesapeake Bay 188

Filling of Wetlands Resisted 189

Impact on Residential Real Estate 189

Maryland Department of the Environment 190

Reduction of Lead Risk in Housing Act 191

Federal Law Also Applies 193

Chapter 14 Quiz 197

MD_RE_Practice_Law.indb 7 6/13/2014 10:49:23 AM

SAMPLE

viii Contents

C H A P T E R 15

Fair Housing 199Key Terms 199

Overview 199

Commission on Human Relations 200

Fair Housing Laws 201

Protected Groups and Categories 203

Discrimination in Housing 203

Commercial Property 205

The Real Estate Brokers Act 206

Enforcement 207

Discrimination in Financing 208

HUD Fair Housing Advertising Guidelines 208

The Maryland Statute 209

Education Requirements 209

Chapter 15 Quiz 210

C H A P T E R 16

Closing the Real Estate Transaction 211Key Terms 211

Overview 211

Evidence of Title 212

Settlements 212

Closing and Tax Statements 212

Evidence of Release 213

Chapter 16 Quiz 215

A P P E N D I X A

Maryland Real Estate License Examinations 217

A P P E N D I X B

Practice Exam 223

A P P E N D I X C

Complaint Procedure 231

A P P E N D I X D

Maryland Real Estate–Related Websites 235

A P P E N D I X E

Various Forms Required in Many Maryland Residential Real Estate Sales Transactions 239

Answer Keys 243

Index 255

MD_RE_Practice_Law.indb 8 6/13/2014 10:49:23 AM

SAMPLE

ix

Preface

As a student entering a real estate prelicensing course, you face exciting chal-lenges. You must learn a large body of theory and understand how it applies to real estate practice. You will want to know legal principles and real estate theory so well that when you get your license, you will be able to do the right thing almost automatically.

If you fail to understand and appreciate law and theory, you can suffer devastating financial and legal consequences. On the other hand, if you build your educa-tional foundation in real estate carefully, you should be able to make the money you want and not lose the money you’ve made through costly mistakes.

The purpose of this book is to present, as clearly as possible, many of the laws and operating requirements for real estate brokerage in the State of Maryland. It builds on basic information presented in Dearborn™ Real Estate Education’s real estate principles texts. The author has been careful to avoid duplicating information presented in the principles texts. Therefore, you should study each subject area in both the basic text and in this book (see Figure P.1 under “How to Use This Book”). Additional information can be accessed online using the web addresses found throughout the text and in Appendix D.

When you have studied each chapter, be certain that you can both answer every question and understand the explanations given in the answer keys found at the end of the book.

You will want to make frequent use of Appendix D, “Maryland Real Estate-Related Websites.” It contains several carefully chosen “hub” sites that give you access to multiple official sources for real estate law and regulation at various levels of government.

While the author has exercised care in providing information pertaining to the laws governing the practice of real estate in Maryland, the reader is urged to con-sult with legal counsel regarding any statutory enactment and should not rely solely on this publication as legal authority for compliance with any statute.

Throughout your real estate course, you’ll be studying and taking practice tests in preparation for the Maryland Real Estate Licensing Examination. That examina-tion is prepared and administered for the State Real Estate Commission by an independent testing service, PSI Examination Services Inc., Las Vegas, Nevada. Maryland Real Estate Practice & Law is designed to familiarize you with the Mary-land-specific subject matter you will find on that examination. The questions at the end of each chapter are prepared in a multiple-choice format similar to the one used in the licensing examination.

The statutes and regulations discussed in this book are those enacted at the time of its publication.

MD_RE_Practice_Law.indb 9 6/13/2014 10:49:23 AM

SAMPLE

x

Maryland Real Estate Practice & Law (14th edition) is written by Donald A. White, who was licensed as a Maryland real estate salesperson in 1967 and as an associ-ate broker in 1972. He holds degrees in music (BS MusEd), religious education (MRE), and business (MA). He is professor emeritus in the Department of Busi-ness at Prince George’s Community College, where he taught real estate licensing courses continuously from 1972 to 2013. He served several terms as chair of the Education Committee of the Prince George’s Association of REALTORS®. A past president of the Maryland Real Estate Educators Association, he also served on the Educational Advisory Committee to the Education Committee of the Maryland Real Estate Commission.

The author, a charter member of the Real Estate Educators Association, taught frequently in REALTORS’® continuing education seminars. He also was the prin-cipal author of Questions and Answers on Maryland Real Estate and coauthor, with Maurice Boren, of the Study Guide to Maryland Real Estate License Examinations.

Mr. White lives with his wife, Elizabeth Gill White—a concert pianist—at Rider-wood Village, a senior living community in Silver Spring.

About the Author

MD_RE_Practice_Law.indb 10 6/13/2014 10:49:23 AM

SAMPLE

xi

The author appreciates constructive suggestions on the updating and revision of this text provided by the following reviewers: William B. Frost, GRI, Frost and Associates; Sharyn J. Kotrosa, instructor, Long and Foster Real Estate Inc.; Colin McGowan, CDEI, The Frederick Academy of Real Estate; Pam Nunzio, professional development trainer and senior instructor, Weichert Institute of Real Estate; Marie S. Spodek, DREI, Professional Real Estate Services; and Linda L. Wise, Coldwell Banker Residential Brokerage/Southern Maryland Association of REALTORS®.

He also extends thanks to his wife, Elizabeth, for her keen eye and constant encouragement.

Acknowledgments

MD_RE_Practice_Law.indb 11 6/13/2014 10:49:23 AM

SAMPLE

xii

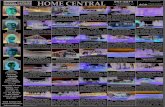

The chapter conversion, Figure P.1, provides a ready reference for using Mary-land Real Estate Practice & Law in conjunction with various principles books. For instance, Maryland Real Estate Practice & Law’s Chapter 16, “Closing the Real Estate Transaction,” may be read in conjunction with Chapter 22 in Modern Real Estate Practice, Chapter 17 in Real Estate Fundamentals, or Chapter 12 in Master-ing Real Estate Principles.

Maryland Real Estate Practice & Law (14th edition)

Modern Real Estate Practice,

19th Edition

Modern Real Estate Practice,

18th Edition

Real Estate Fundamentals,

8th Edition

Mastering Real Estate Principles,

6th Edition

1. Maryland Real Estate License Law and Regulations

— — — 16

2. Real Estate Agency 9 4 7 13

3. Real Estate Brokerage 10 5 7 13

4. Listing and Buyer Representation Agreements

11 6 7, 8 15

5. Interests in Real Estate 4 7 3 4, 7

6. How Ownership Is Held 5 8 5 9

7. Legal Descriptions 6 9 2 6

8. Real Estate Taxes and Other Liens 13 10 3, 10 5, 25

9. Real Estate Contracts 12 11 8 14

10. Transfer of Title 7 12 4 10

11. Title Records 8 13 6 11

12. Real Estate Financing 14, 15 14, 15 12, 13 Unit VII

13. Leases 18 16 9 8

14. Environmental Issues and the Real Estate Transaction

21 21 16 3

15. Fair Housing 3 20 15 17

16. Closing the Real Estate Transaction 17 22 17 12

F I G U R E P.1

Chapter Conversion Table

How to Use This Book

MD_RE_Practice_Law.indb 12 6/13/2014 10:49:23 AM

SAMPLE

1

Maryland Real Estate License Law and Related Regulations

■■ KEY TERMS

administrative lawaffiliates associate brokers clock hoursCode of Maryland

Regulations (COMAR)common law irrevocable consent

jointly and severally liablejudicial activismlatent defectsnatural persons nonresidential property precedentreal estate

real estate broker real estate brokerage

servicesred flags salespersonsstatutesstrict construction

■■ OVERVIEW

In this chapter, you will learn some of the history of brokerage regulation in Mary-land; learn which Maryland statutes and regulations govern the industry today; come to understand the structure, duties, and powers of the Maryland Real Estate Commission; and begin to appreciate the mechanics of obtaining, maintaining, and upgrading a brokerage license. You will also be introduced to various require-ments and prohibitions that guide the everyday life of a real estate licensee.

1C H A P T E R

MD_RE_Practice_Law.indb 1 6/13/2014 10:49:24 AM

SAMPLE

2 Maryland Real Estate Practice & Law Fourteenth Edition

■■ HISTORY AND SOURCES OF MARYLAND LICENSE LAW

The Maryland Real Estate Brokers Act, a law designed to protect the public inter-est, became effective June 1, 1939. Since then, there have been frequent revisions. All the work of real estate licensees is affected by this important statute. It is, therefore, the basis of much of this chapter.

The Maryland Real Estate Brokers Act appears as Title (Chapter) 17 in the Busi-ness Occupations and Professions Article of the Annotated Code of Maryland. This textbook refers to that statute as the “Brokers Act” and as “Title 17.” It is helpful to note that each book that contains Maryland law is called an Article; each article is divided into chapter-like titles.

Real estate brokerage is governed both by statutory law, such as the Brokers Act mentioned above, and by administrative law, found in the Code of Maryland Regulations (COMAR). Regulations governing the practice of real estate broker-age are enacted and enforced by the Maryland Real Estate Commission—a body within the executive branch of government. The Maryland Real Estate Brokers Act was enacted by the legislative branch of Maryland government: the Gen-eral Assembly. Therefore, it is an example of legislative (statutory) law, while COMAR is administrative law.

In addition to statutes and regulations, some aspects of common law apply to real estate brokerage in Maryland. Common law is called the unwritten law because it is not written by a legislative body; it is found in numerous volumes of decisions from courts of appeal. That’s where the unwritten law is written. Such court deci-sions are needed in situations for which no relevant statute exists or when an existing statute is challenged as unconstitutional. They also arise in cases of ambi-guity where uncertainty of language or intent makes a statute difficult to apply.

On occasion, older laws no longer seem to make sense to the courts called on to give their opinions. Judges may then “modernize” the law. This is in contrast to strict construction, which takes statutes at their face value and defers to the origi-nal intention of their writers. For example, in 1965, the U.S. Supreme Court held that the Civil Rights Act of 1866 still applied literally—word for word—and was still the law of the land almost a century after it was written. Their decision was an example of strict construction and greatly advanced the cause of civil rights.

Statutes are voted into law by legislative bodies, but common law is handed down by judges. Decisions made by courts of appeal become binding on lower courts within their judicial area. The higher the court of appeal making a decision, the more numerous the lower courts in which that decision becomes the standard—the precedent—for their decisions.

The Maryland Real Estate Commission, one of the largest licensing boards within the Department of Labor, Licensing, and Regulation, adopts and enforces regula-tions to implement the Brokers Act. These regulations are administrative law. Regulations apply statutes to the details of particular situations. The Code of Maryland Regulations (COMAR) contains regulations adopted by all 18 of Mary-land’s licensing boards.

The Brokers Act and regulations from COMAR relating to real estate can be found in many college and public libraries in bound volumes in the legal reference section. They are also available to the public through the Real Estate Commission website: www.dllr.state.md.us/license/law/mreclaw.shtml.

MD_RE_Practice_Law.indb 2 6/13/2014 10:49:24 AM

SAMPLE

3Chapter 1 Maryland Real Estate License Law and Related Regulations

■■ DEFINITIONS OF TERMS [§17-101]

As used in Title 17, certain terms have specific definitions that apply to either a section of the law or the entire statute. For example, a real estate broker is defined as an individual who provides real estate brokerage services. Consideration in this section refers to compensation (payment) for brokerage services, defined as any of the following acts:

■■ For consideration and for another person—selling, buying, exchanging, or leasing any real estate or collecting rent for its use

■■ For consideration, assisting another person to locate or obtain for purchase or lease any residential real estate

■■ Engaging regularly in a business of dealing in real estate or leases or options on real estate

■■ Engaging in a business, the primary purpose of which is promoting the sale of real estate through a listing in a publication issued primarily for promotion of real estate sales

■■ Engaging in a business that subdivides land located in any state into lots and then selling those subdivided lots

■■ For consideration, serving as a consultant for any of the activities in this list

Although Maryland law generally defines persons as “individuals, receivers, trust-ees, guardians, personal representatives, fiduciaries, or representatives of any kind and any partnership, firm, association, or other entity,” only natural persons (individuals) may hold Maryland real estate licenses. However, a broker’s license, rather than showing the broker’s actual name, may show the name under which the broker is operating—typically a company name. This is called the broker’s designated name. Branch offices are issued certificates rather than licenses. Time-share licenses are issued to brokerage firms that deal in time-shares.

In the statute and in this book, Commission refers to the State Real Estate Com-mission. When the term licensed is used, it refers to the status of an individual licensed by that Commission.

■■ LICENSES AND CERTIFICATES ISSUED BY THE COMMISSION (TITLE 17, SUBTITLE III)

The Commission issues three levels of license for individuals delivering real estate brokerage services: broker, associate broker, and salesperson. It issues branch office certificates. It also registers time-share developers. Currently, there are over 38,000 active licensees, including more than 4,400 brokers, 3,000 associate brokers, and almost 30,000 salespersons; these totals do not include the 2,000 plus inactive licenses. Licenses may be kept on inactive status no longer than three years, after which they expire. Expired licenses are then held three years from the date of their expiration, during which time they may be reinstated as discussed later in this chapter. Persons named on inactive or expired licenses may not perform acts of real estate brokerage. For instance, they may not receive compensation from participation in referral companies.

In addition to the three basic levels of license, each level has subtypes. Broker licenses may be resident, nonresident, reciprocal, or temporary/for commercial only. Associate broker and salesperson licenses include resident, nonresident, and reciprocal. (Maryland has reciprocal licensing agreements only with Pennsylvania

MD_RE_Practice_Law.indb 3 6/13/2014 10:49:24 AM

SAMPLE

4 Maryland Real Estate Practice & Law Fourteenth Edition

and Oklahoma.) In addition to being licensed, some associate brokers and sales-persons may also be registered to manage branch offices.

To have an active license, a salesperson or an associate broker must be affiliated with and under the authority of a licensed broker. Individuals affiliate with brokers either as employees or nonemployees of their broker. Currently, the vast major-ity of Maryland real estate brokerage affiliates are in a nonemployee relationship with their brokers. Affiliates, although fully subject to supervision and control by their brokers, can still meet Internal Revenue Service (IRS) requirements for qualified real estate agent—also called statutory nonemployees—and be treated as self-employed from the point of view of reporting income for taxation.

Affiliates meet the IRS requirements for statutory nonemployee (self-employed) status when their broker does not withhold federal or state income taxes or pay their Social Security or Medicare assessments. Affiliates’ paychecks are “net” to them, leaving them responsible for paying all of their own taxes. Section 3508 of the IRS Code specifies that such Qualified Real Estate Agents may report their income as “self-employed” persons using Schedule 1040C. To be recognized as a qualified real estate agent, affiliates must:

■■ be licensed real estate agents (hold an active real estate license);■■ receive “substantially all”—meaning at least 90%—of their brokerage remu-

neration for production rather than for hours worked; and■■ act pursuant to written contracts with their brokerage firms, which state

that, for federal tax purposes, the affiliates will not be treated as employees.

Throughout this book, affiliate (the noun) refers either to a licensed associate bro-ker or a licensed salesperson. Associate brokers are individuals who have met the educational, experience, and testing requirements for becoming real estate bro-kers but who request licenses that authorize them to provide real estate brokerage services only under a broker with whom they affiliate as associate brokers. Despite their education and experience, their duties and authority are no greater than those of salespersons. Salespersons and associate brokers are individuals who aid brokers, with whom they are affiliated, in providing real estate brokerage services. Salespersons and associate brokers are general agents of their broker. Note, how-ever, that brokers are special agents of their clients.

Real estate, as used in the Brokers Act, is defined as any interest in real property anywhere. It even includes interests in condominiums, time-share estates, and time-share licenses, as those terms are defined in the Real Property Article, as well as fee estates and life estates.

In the Brokers Act, the term state refers to any state in the United States, its territories, possessions, or the District of Columbia. In this book, when State is capitalized, it refers to the State of Maryland. In the statute, Department refers to the Department of Labor, Licensing, and Regulation under whose authority the Commission operates. Secretary refers to the chief executive of that department.

Persons not Subject to the Brokers Act When Performing Acts of Real Estate Brokerage [§17102]

Certain persons are permitted to perform real estate brokerage activities without being licensed or governed by the provisions of the Brokers Act. However, like

MD_RE_Practice_Law.indb 4 6/13/2014 10:49:24 AM

SAMPLE

5Chapter 1 Maryland Real Estate License Law and Related Regulations

all persons in the State, they are governed in their real estate dealings by other Maryland laws, such as those in the Real Property Article. Examples are:

■■ persons acting under a judgment or order of a court,■■ public officers performing the duties of their office,■■ landlords or owners of any real estate, unless their primary business is provid-

ing real estate brokerage services, ■■ persons engaging in a single transaction selling or leasing real estate, if they

are acting under a power of attorney executed by the owner of that real estate,

■■ auctioneers, licensed by various jurisdictions within Maryland, to sell real estate at public auction, and

■■ persons acting as receivers, trustees, personal representatives, or guardians.

Persons who Must Conform to the Brokers Act When Performing Acts of Real Estate Brokerage Although They are not Required to Hold Brokerage Licenses [§17-301(b)]

In contrast, other persons, when performing acts of real estate brokerage, are gov-erned by and must still conform to the relevant requirements of the Brokers Act, although they need not hold real estate licenses. They are:

■■ financial institutions in the leasing or selling of property they have acquired through foreclosure or by receiving a deed or an assignment in lieu of foreclosure;

■■ lawyers who are not regularly engaged in the business of providing real estate services and who do not advertise that they conduct such business;

■■ homebuilders in the rental or initial sale of homes they have constructed (although homebuilders and their salespersons must be registered with the Home Builder and Home Builder Sales Representative Registration Unit of the Consumer Affairs Division in the Office of the Attorney General);

■■ agents of a licensed real estate broker or of an owner of real estate, while managing or leasing that real estate for that broker or for the property’s owner;

■■ persons who negotiate the sale, lease, or transfer of businesses when the sale does not include any interest in real property other than the lease for the property where the business operates; and

■■ owners who subdivide and sell not more than six lots of their own unim-proved property in any one calendar year. (Note that if they or their family have owned the property for 10 years or more, there is no limit on the num-ber of the lots they may sell.)

■■ THE MARYLAND REAL ESTATE COMMISSION [§17-201–§17-214]

The Maryland Real Estate Commission is one of several commissions within the Department of Labor, Licensing, and Regulation. It consists of nine members; five of which hold real estate licenses and are chosen—one each—from the Eastern Shore, Baltimore Metropolitan Area, Baltimore City, Southern Maryland, and Western Maryland. These five members must have held Maryland real estate licenses for at least 10 years and have resided in the areas from which they are appointed for at least five years, both immediately prior to their appointment. The other four members are consumer members who shall not have had an ownership interest in or received compensation from an entity regulated by the Commission

MD_RE_Practice_Law.indb 5 6/13/2014 10:49:24 AM

SAMPLE

6 Maryland Real Estate Practice & Law Fourteenth Edition

in the year just before their appointment. They shall not be licensees or otherwise be subject to regulation by the Commission.

Members are appointed by the Governor with the advice of the Secretary and the advice and consent of the Senate. Membership terms, which are staggered to ensure regulatory continuity, begin on June 1, and end four years later, either with reappointment or on the appointment of a qualified replacement. Members may be removed before the end of their terms by the Governor in cases of incompe-tence or misconduct.

Each year, members of the Commission elect, from among themselves, a chair-person to preside at their meetings. This officer is covered by a surety bond. The Commission meets each month with a majority of the members then under appointment constituting a quorum. Meetings are open to the public.

The Commission has adopted bylaws for the conduct of its meetings and regula-tions for the conduct of hearings and for issuance of licensing applications. With 10 days’ advance written notice, a member of the public may speak before the Commission.

The Commission’s Executive Director, who is appointed by and serves at the pleasure of the Secretary, is not a member of the Commission. Neither is the Executive Director the chairperson of the Commission. The Executive Director, a State employee who is also covered by a surety bond, attends and participates in the monthly meetings, directs the day-to-day operations of the Commission, and supervises its office staff and field inspectors between monthly meetings.

Duties and Powers [§17-209, §17-212]

The Commission’s primary duties are administration and enforcement of the Bro-kers Act through the licensing process. To carry out this duty, the Commission is empowered to

■■ investigate complaints of unlicensed brokerage activity,■■ investigate complaints about licensee behavior,■■ conduct hearings and administer oaths,■■ issue subpoenas for attendance of witnesses or production of evidence, ■■ take depositions, and■■ seek injunctions (in certain circumstances).

The Commission adopts, maintains, and enforces General Regulations and a Code of Ethics that set forth standards of conduct for all individuals who are under the authority of the Brokers Act. The General Regulations (09.11.01) and the Code of Ethics (09.11.02) are found in COMAR under 09.11. Such subsections of COMAR are called “Chapters.” The Code of Ethics addresses licensees’ relations with the client, the public, and with other licensees; it is separate and distinct from the Code of Ethics of the National Association of REALTORS®. However, the two codes are complementary in that neither contradicts the other. Other portions of COMAR relating to the work of the Commission are Chapter 3, Hear-ing Regulations; Chapter 4, Time Share Regulations; Chapter 5, Supervision; Chapter 6, Continuing Education; Chapter 7, Residential Property Disclosure/Disclaimer; Chapter 8, Agency Relationship Disclosure/Dual Agency Consent; and Chapter 9, Fees.

MD_RE_Practice_Law.indb 6 6/13/2014 10:49:24 AM

SAMPLE

7Chapter 1 Maryland Real Estate License Law and Related Regulations

The Commission must investigate any written, sworn complaint alleging that an unauthorized person has provided real estate brokerage services. The Commission has statutory authority to hold hearings on alleged violations and to impose penal-ties not to exceed

■■ $5,000 for the first proven violation of any Title 17 provision, ■■ $15,000 and/or two years’ imprisonment for the second violation, and ■■ $25,000, and/or three years’ imprisonment for the third or subsequent

violation.

(An “unauthorized person” is one who neither holds a required license nor is exempt from the requirement to have one.)

Other Powers and Duties [§17-208–§17-214]

The Commission has many powers and duties. In the course of its operation, it routinely:

■■ issues, renews, suspends, or revokes licenses; ■■ orders investigations and holds hearings as needed;■■ after hearings, reprimands and/or fines licensees who are found to have vio-

lated laws or regulations;■■ forwards the license fees it collects to the Comptroller, who distributes such

funds to the State Real Estate Commission Fund;■■ collects fines and forwards them to the General Fund of the State;■■ submits an annual report of its activities to the Secretary; ■■ certifies, on request of any person and payment of the required fee, the

licensing status and qualifications of any person who is the subject of the request;

■■ approves the content of educational courses for licensing and for continuing education;

■■ adopts regulations and a code of ethics to implement Title 17;■■ convenes hearing boards (panels) of three members, at least one of whom

must be a consumer member and one a professional member (licensee) from among the commissioners; and

■■ maintains and administers a Guaranty Fund to reimburse members of the public as much as $50,000 for actual losses caused by licensees and their employees.

■■ REQUIREMENTS FOR LICENSURE

Before providing real estate brokerage services in the State, individuals generally must be licensed by the Commission either as real estate brokers or as associ-ate brokers or salespersons affiliated with and working under the authority of a licensed broker. Licenses are granted for a two-year term beginning on the date they are issued.

Brokers [§17-305]

To qualify for the real estate broker license, applicants must

■■ be of good character and reputation and at least 18 years of age;■■ have completed a 135-hour course in real estate—including three clock

hours of real estate ethics—approved by the Commission;

MD_RE_Practice_Law.indb 7 6/13/2014 10:49:24 AM

SAMPLE

8 Maryland Real Estate Practice & Law Fourteenth Edition

■■ have been licensed as real estate salespersons actively and lawfully for at least three years; and

■■ have passed the broker prelicensing examination.

For applicants who are qualified to practice law in this State, the Commission waives the education and experience requirements but not the examination requirement. Broker education requirements for all others persons are in addi-tion to the salesperson (60-hour) requirements they may have previously met. However, an individual who has been engaged in real estate practice as a licensed real estate broker in another state for at least three of the five years immediately preceding submission of application is considered to have satisfied the broker edu-cational requirements.

Associate Brokers [§17-304]

To qualify for the associate real estate broker license, an applicant must meet the education and experience requirements for a broker license. The applicant must also obtain written commitment from a licensed real estate broker to accept the applicant as an associate broker of the firm when all other associate broker requirements have been satisfied.

Salespersons [§17-303]

To qualify for issuance of the salesperson license, an applicant must

■■ be of good character and reputation;■■ be at least 18 years of age;■■ successfully complete a basic (60-hour) course in real estate—including

three clock hours of real estate ethics—approved by the Commission;■■ pass the required examination; and ■■ obtain written commitment from a licensed real estate broker to accept the

applicant as a salesperson of the firm when all other salesperson licensing requirements have been satisfied.

General Rules [§17-307]

The usual steps leading to a license are education, examination, and application. Applicants must successfully complete prelicensing education requirements before taking salesperson or broker examinations. The specific time limits for salesperson and broker are presented in Figure 1.1. The Commission’s application forms must be used, and the required fees, shown in Figure 1.2, paid.

MD_RE_Practice_Law.indb 8 6/13/2014 10:49:25 AM

SAMPLE

9Chapter 1 Maryland Real Estate License Law and Related Regulations

Deadlines for Testing and Licensure Time Requirement

Consequences of Failing to Meet the Requirement Authority

Deadline for candidate to pass the salesperson licensing exam

Not more than one year after completing education requirements

Any prior or partial test results become invalid. Candidate must complete a new salesperson prelicensing course before taking (or re-taking) licensing exam.

Gen Reg .11-FGen Reg .11-G (1)

Deadline for candidate to apply for salesperson license

Not more than one year after passing both portions of the salesperson exam

Complete a new salesperson prelicensing course.

Gen Reg .11-G (1)

Deadline for candidate to pass the broker licensing exam

Not more than one year after satisfying education requirements

Any prior or partial test results become invalid. Candidate must complete a new broker prelicensing course before taking (or re-taking) licensing exam.

Gen Reg .14-H(1)

Deadline for candidate to apply for broker license

Not more than one year after passing both portions of the broker exam

Complete a new broker prelicensing course.

Gen Reg .14-I

F I G U R E 1.1

Deadlines for Testing and Licensure

Original License

Fee

Guaranty Fund

Assessment*

Total Original

Fees

Renewal or Exchange of License Fee

Broker $210 $20 $210 $190

Associate Broker $150 $20 $150 $130

Salesperson $110 $20 $110 $90

The proper fees must accompany every application. These fees are set and subject to annual change by the Commission. Applicants are also required to pay the testing service a $66 examination fee to register, take, or retake all or part of either real estate examination. Standard examination registration fees, which are neither refundable nor transferable, may be paid by check, money order, company check, or cashier’s check. Cash is not accepted.

Fees for other services:

Certificate of License History (5-yr.) $25 Reactivate Inactive License $50

Certificate of License History (full) $75 Reinstatement of License/Late Fee $150

Broker Business Address Change $5 Transfer to Another Broker $25

Broker Business Name Change $25 Time-share Registration $100

Branch Office License $25 Duplicate License or Pocket Card $25

Personal Name Change $25 Dishonored Check $25

* The Guaranty Fund initial assessment, paid on issuance of the first license to an applicant, is not paid on renewals unless needed to replenish the Guaranty Fund. This has happened only once in the past 35 years.

F I G U R E 1.2

Usual License Fees

MD_RE_Practice_Law.indb 9 6/13/2014 10:49:25 AM

SAMPLE

10 Maryland Real Estate Practice & Law Fourteenth Edition

Requirements for Nonresidents [§17-514]

Salesperson, associate broker, and broker applicants who are not residents of the State must submit to the Commission their irrevocable consent, which allows them to be served with official documents without the server having to travel to a foreign (out-of-state) jurisdiction to present them. Applicants are required to submit any additional documentation that the Commission requires to determine their professional competence, good character, and reputation. Broker applicants must also submit or pay for a credit report.

Licenses for Nonresidents to Perform Commercial Brokerage [§17-536–§17-540]

In the previous sections, a “nonresident real estate broker” is a person licensed by a jurisdiction other than Maryland to provide real estate brokerage services there. That broker may either be an individual, a partnership, joint venture, lim-ited liability company, limited liability partnership, or corporation depending on the jurisdiction. “Nonresident real estate salespersons” (and associate brokers) are individuals who are licensed, not by the Commission but by another state, to pro-vide real estate brokerage services under a nonresident real estate broker—in this context, a broker who has complied with the Commission’s detailed requirements for a temporary license to perform acts of brokerage involving Maryland commer-cial property. Nonresident brokers may qualify for such a license only if their own state grants similar privileges to Maryland licensees. The nonresident broker may deal with commercial property only through and under a licensed Maryland real estate broker with whom the nonresident has a written agreement detailing their entire relationship for specific proposed transactions. Nonresident commercial licenses are rarely issued: only two have been issued in the past 11 years.

Waiver of Requirements for Licensure [§17-308]

The Commission may waive any requirement for individual licenses for appli-cants who hold comparable or equivalent licenses granted by another state if those applicants pay the required application fees, meet the relevant requirements, and submit certification of license history from the other state. If applicants are seek-ing broker licenses based on their comparable licenses in another state, they must provide adequate evidence of actively maintaining brokerage offices there.

Reciprocity [§17-3A-01–§17-3A-10]

To facilitate transactions involving parties from other states seeking to buy, rent, or sell property in Maryland and Maryland residents seeking to buy, rent, or sell in other states, the 2006 legislative session made provisions for reciprocal real estate brokerage licensing. Under the terms of any reciprocal licensing agreement, the Brokers Act requires the following:

■■ That each state recognize the previous education, experience, and exami-nation of applicants for any of the licensure classes authorized in the applicants’ home state as satisfying the requirements for licensure in the reciprocal state

■■ That applicants submit consent to service of process, in a form required by the Commission (similar to the irrevocable consent required of traditional nonresident applicants by §17-514)

■■ That applicants verify they have read and agree to comply with all laws of the state for which they are seeking reciprocal licensure

MD_RE_Practice_Law.indb 10 6/13/2014 10:49:25 AM

SAMPLE

11Chapter 1 Maryland Real Estate License Law and Related Regulations

■■ That applicants, other than brokers, provide certification from their broker that the broker is currently licensed and will actively and personally super-vise the applicants performing real estate brokerage services in the state where they would be receiving the reciprocal licensure

■■ That neither state requires additional continuing education to renew recip-rocal licenses

■■ That applicants furnish to Maryland, Certificates of Licensure or Records of Good Standing from the state from which the applicants are applying. (Such statements must contain the applicants’ names, addresses, licensure classifi-cations, and history of past or present disciplinary proceedings. Applicants themselves must give written statements as to whether they are subjects of any disciplinary proceedings or criminal investigations anywhere and whether they have been convicted in the United States of any felony or cer-tain misdemeanors or of any crimes that violate the Maryland Brokers Act.)

■■ That each state requires that brokers holding reciprocal licenses, who later open principal places of business in the state that granted them reciprocal licenses, promptly notify that state and obtain a standard nonresident license within 90 days after establishing those principal places of business

■■ That applicants for standard nonresident licenses may be required to pass the state portion of a licensure examination required by the state granting the reciprocal licenses.

■■ That states have the right, for cause, to deny applications for reciprocal licensure

Maryland has signed reciprocity agreements with only Pennsylvania and Okla-homa but is negotiating with other states. Many states have multiple reciprocity agreements, often found on each state’s website. In each situation, the details of the reciprocity may be very different from those of the Maryland program. The Maryland Real Estate Commission appears to be proceeding with great care to establish the reciprocity authorized by the 2006 legislation. Barriers to agreement between states sometimes include unwillingness to renew without the recipro-cal license holder completing the host state’s continuing education requirements, passing a host state’s law exam, or taking the same number of prelicensure hours as required by the host state. Maryland law requires mutual concession in all these areas. In January 2014, there were 81 reciprocal brokers, 23 reciprocal associate brokers, and 155 reciprocal salespersons.

Pocket Cards and License Certificates [§17-309]

License certificates and pocket cards issued by the Commission show

■■ the name of the licensee,■■ the designated name of the licensed real estate broker with whom a salesper-

son or associate broker is affiliated,■■ the date the license will expire, and■■ the licensing registration number of the licensee.

License certificate and pocket card images issued for affiliates are downloaded digi-tally by their brokers. Pocket card images are detached and given to affiliates to sign and carry. Affiliates also sign their license certificate images. Each signed license certificate image is retained in the office out of which each licensee oper-ates. Although no such requirement is explicitly stated anywhere in the Brokers Act or in any regulation, the Commission states that licensees are expected to carry their pocket cards whenever they engage in real estate brokerage activity.

MD_RE_Practice_Law.indb 11 6/13/2014 10:49:25 AM

SAMPLE

12 Maryland Real Estate Practice & Law Fourteenth Edition

Unlicensed Activity: A Violation of Title 17 [§17-613 (d)]

Real estate broker licenses authorize their holders to provide real estate brokerage services to the public. Persons who hold associate broker and salesperson licenses may never provide real estate brokerage services in their own name or in the name of any broker with whom they are not affiliated. They may only provide brokerage services in the name of the broker under whom they are licensed.

Salespersons and associate brokers on inactive status have no broker. Therefore, they have no one under whom they are authorized to provide brokerage services. Their licenses and pocket cards have been returned to the Commission. Perform-ing any act of real estate brokerage while on inactive status is a violation of law, which is a misdemeanor punishable initially by a fine as much as $5,000 and by as much as two years’ imprisonment and a fine of $15,000 for a second conviction for the same offense. Any person found guilty of a third or subsequent violation of any provision of the sections listed in subsection (a) of 17-613 is subject to a fine not exceeding $25,000 or three years’ imprisonment or both.

Exchange of Licenses and Additional Licenses and Affiliations [§17-311–§17-313]

A licensed real estate broker may also hold licenses as a real estate salesperson or associate broker, affiliated under another licensed real estate broker. This requires submission of additional proper applications to the Commission and payment of additional license fees. A broker in one company who works at the same time for the broker of another company as an affiliate must obtain a commitment for such affiliation from that other broker and must inform that broker of the other license. A broker may operate more than one real estate company, but for each additional real estate brokerage company, the broker must obtain a separate real estate broker’s license. Therefore, it is legally possible for an individual to hold two or more broker licenses simultaneously. For example, an individual may hold one license for a broker’s residential resale company in town and another license for the broker’s vacation rental property firm at the shore.

Licensees who hold salesperson, associate broker, or broker licenses may exchange those licenses for other levels of license by complying with procedures established by the Commission and paying the required additional fees. Affiliates may obtain additional licenses and become affiliated with additional Maryland brokers by obtaining a commitment from each additional broker, paying the required addi-tional licensing fees, and giving notice of such multiple relationships to all their brokers.

Reinstatement after Nonrenewal [§17-314]

Reinstatement of a license that has expired due to nonrenewal is possible within the three-year period following the date of its expiration. Reinstatement requires that applicants show proof of having met all applicable continuing education requirements for the period(s) since expiration, having paid all past-due renewal fees, and having paid a $150 reinstatement fee. They must also meet the require-ment of good character and reputation. Neither timely nor late renewal of a license affects the power of the Commission to bring charges for prior acts or conduct.

MD_RE_Practice_Law.indb 12 6/13/2014 10:49:25 AM

SAMPLE

13Chapter 1 Maryland Real Estate License Law and Related Regulations

Transfer of Affiliation [§17-311]

Affiliates may apply to the Commission to transfer their affiliation from one bro-ker to another after obtaining, from the new broker, a commitment stating that, upon termination of the current affiliation and issuance of new license certificates and pocket cards, they will become affiliated with the new broker. They shall also submit to the Commission, either from their former brokers or from themselves, a statement confirming termination of their prior relationship with their transfer applications. It is advisable in every case, although not clearly required by law or regulation, that the former broker be informed of the details of the transfer.

Dishonored Checks [§17-521]

In the event of a dishonored check, licensees are not considered to have properly renewed their licenses until they pay both the original amount of the renewal fees and a collection fee of $25 for each dishonored check.

■■ LICENSE TERM, TRANSFER, AND RENEWAL [§17-314]

If the Commission has the brokers’ current email addresses, license expiration date reminders and renewal application forms for brokers and their affiliates are emailed no less than 30 days before the licenses expire. The notices state:

■■ the dates on which the current licenses expire,■■ the dates by which the Commission must receive the renewal applications, if

licensees use hard copy (paper) applications for renewal, and ■■ the amount of the renewal fees (see Figure 1.2).

Although the usual mode of application for renewal is online—a method that enables instantaneous and less expensive processing—the Commission continues to accept and process hard-copy renewal and upgrade applications.

Continuing Education Requirements [§17-315]

Continuing education for license renewal is measured in clock hours, with credit allowed only for approved, individual courses of not less than one and a half and not more than six hours in length. A clock hour is defined in COMAR 09.11.06.01 B(3) as 50 minutes of actual instruction per 60-minute hour [§1-101].

Completion of the specified number of continuing education hours, including some in specific subjects, is required for renewal of any level of license (see Fig-ure 1.3). The standard requirement for all levels of license is 15 hours of approved instruction made up of:

■■ three clock hours of local, state, and federal legislative and regulatory updates;

■■ one and a half clock hours dealing with fair housing;■■ three clock hours of “Maryland Real Estate Commission’s Code of Ethics,

Flipping, and Predatory Lending”;■■ three clock hours of “Principles of Agency and Agency Disclosure” (all

licensees) at alternate renewals on or after January 1, 2012;■■ three clock hours of Requirements of “Broker Supervision” (brokers, branch

managers, and team leaders) at alternate renewals on or after January 1, 2012; and

■■ additional electives needed to reach the required total hours.

MD_RE_Practice_Law.indb 13 6/13/2014 10:49:25 AM

SAMPLE

14 Maryland Real Estate Practice & Law Fourteenth Edition

CategoryDesignation on

Certificate

Subject Matter and Those Required to Complete Specific Courses

Course Length and When Required

A Legislative Update 3 hrs

C Fair Housing (Licensees performing only commercial transactions may substitute Federal Americans with Disabilities Act)

1.5 hrs

D Ethics, Flipping, and Predatory Lending 3 hrs

H Principles of Agency and Agency Disclosure† 3 hrs*

I Requirements of Broker Supervision†† 3 hrs*

B, E, F, G Other Approved Courses 1.5 hrs**

Total Hours Required 15 hrs† All licensees†† Brokers, branch managers, and team leaders

* At the first renewal after January 1, 2012; then, at alternate subsequent renewals

** In years when “Agency” and “Supervision” are NOT required

F I G U R E 1.3

Continuing Education Requirements

There are certain exceptions:

■■ Licensees who are qualified to practice law in the state and those who hold graduate degrees in real estate from accredited colleges or universities—and are not brokers, branch managers, or team leaders—need to complete only seven and a half hours (legislative update, fair housing, and ethics) of con-tinuing education.

■■ Licensees who perform only nonresidential brokerage may substitute one and a half hours of instruction in the Americans with Disabilities Act for the fair housing requirement, but they still must complete a total of 15 hours.

■■ Holders of reciprocal licenses of any level are not required to complete any Maryland-approved hours of instruction when renewing their licenses, but they must comply with continuing education requirements in their home state.

In the Brokers Act, nonresidential property is defined in detail as

(1) real property improved by five or more single-family units; (2) improved and unimproved real property zoned for commercial, industrial, or non-residential use by the local zoning authority of the county or municipality in which the property is located; and (3) unimproved real property zoned for improvement as multifamily units by the local zoning authority of the county or municipality in which the property is located, [but not includ-ing]: (1) property zoned for agricultural use; or (2) single-family units, including a condominium or co-op unit, for sale or for lease, or otherwise conveyed or to be conveyed on a single basis.

All required continuing education must be completed before one’s license can be renewed. Those renewing in a timely manner pay the Commission the required renewal fees and affirm that they have completed the required number of hours of continuing education. Licensees renewing electronically are notified at the end of their online session if they have been chosen for an audit of their course claims. If chosen, they will be required by the Commission to submit certificates for all of the courses they claimed in their renewal application.

MD_RE_Practice_Law.indb 14 6/13/2014 10:49:25 AM

SAMPLE

15Chapter 1 Maryland Real Estate License Law and Related Regulations

A person whose license has expired for nonrenewal may normally apply for rein-statement of that license at any time within three years after its expiration date at a cost of $150. However, those who have made false claims of educational comple-tion may be given one month to complete the missing education requirements, must pay a $1,500 penalty for the false application, as well as pay a $150 reinstate-ment fee. Their names, their violations, and their fines are then displayed on the Commission’s website for several years.

There are several alphabetical categories for subject matter approved for continu-ing education courses:

A. Federal, state, or local legislative and regulatory changes

B. Antitrust law

C. Fair housing law

D. Real estate ethics or professional standards

E. Disclosure

F. Professional enhancement for practicing licensees

G. Technology relating to real estate brokerage services (not more than three hours allowed per renewal)

H. The principles of agency and agency disclosure

I. The requirements of supervision by brokers, branch office managers, and team leaders

To be approved by the Commission, all continuing education course subject mat-ter must relate to real estate.

Approved courses may be presented by the Maryland Association of REAL-TORS® or its member boards, the Real Estate Brokers of Baltimore City, Inc., or any similar professional association or by an educational institution approved by the State Board of Higher Education. These courses must be taught by qualified instructors who are experienced in the real estate industry. The Commission’s guidelines require that continuing education instructors have experience and expertise in the area or activity about which they are teaching.

When licensees complete each unit of study, the training institution that con-ducted the course issues certificates of completion to each student stating the

■■ number of clock hours,■■ name and date of the course taken,■■ code letter of the subject category, and■■ names of the teacher and/or the organization presenting the training.

The education provider has 10 days to upload reports of credits earned to the Commission’s database system.

The Commission may waive continuing education requirements for licensees who show good cause for being unable to meet the requirement.

MD_RE_Practice_Law.indb 15 6/13/2014 10:49:25 AM

SAMPLE

16 Maryland Real Estate Practice & Law Fourteenth Edition

Inactive Status [§17-316]

The Commission will place the licenses of associate real estate brokers and real estate salespersons into inactive status when they are no longer affiliated with licensed real estate brokers, and their license certificates and pocket cards are returned to the Commission.

A licensee whose license is on inactive status may not provide real estate brokerage services through that license. This prohibition forbids accepting fees for referrals. An inactive licensee is not affiliated with any broker and may not be compensated for any act of real estate brokerage. Individuals with inactive licenses may not be paid by a referral company.

The placement of a license on inactive status does not affect the power of the Commission to suspend or revoke the license or to take any other disciplinary action against the licensee.

Unless an inactive license is reactivated, it expires three years after the date it is placed on inactive status. Renewal of an inactive license requires complying with continuing education requirements. Please note that renewal is not reactivation.

The Commission will reactivate the license of real estate brokers on inactive sta-tus and reissue license certificates and pocket cards to them if they request reac-tivation and pay to the Commission the $50 reactivation fee. Salespersons and associate brokers returning from inactive status must do the same and also submit broker affiliation commitments, contingent on the reactivations. While on inac-tive status, a salesperson or an associate broker has no broker.

Location of Certificates; Loss or Destruction [§17-317]

Licensed real estate brokers are required to maintain their own license certificates in their offices at all times. The license certificates of licensees who are affiliated with a real estate broker must be retained at the office location out of which each of them usually work.

The Commission must immediately be notified of the loss or destruction of a license certificate or pocket card. Upon receipt of an affidavit of loss or destruc-tion and payment of the required fee ($25) for a lost or destroyed pocket card or license certificate, the Commission will issue appropriate duplicates.

Change of Name [§17-318]

When a licensee or a firm takes a new name, upon receipt of the required applica-tion fee ($25), the old certificate, pocket card, and any required documentation, the Commission will issue the licensee a new license certificate and pocket card that reflect the change.

Licensure and the Deceased Broker [§17-319]

On the death of a licensed real estate broker, any adult member of the family may carry on the brokerage firm for up to six months to close and terminate the busi-ness. To do this, the certificate and pocket card of the deceased broker must be surrendered to the Commission. Any information required by the Commission must also be submitted.

MD_RE_Practice_Law.indb 16 6/13/2014 10:49:25 AM

SAMPLE

17Chapter 1 Maryland Real Estate License Law and Related Regulations

Before the end of the six-month period for carrying on the business of a deceased real estate broker, an individual may qualify for and receive from the Commission the license of the deceased broker, if that individual

■■ is a member of the immediate family of the decedent,■■ has been continuously licensed as a real estate salesperson for the immedi-

ately preceding three years,■■ passes the real estate broker examination required by this subtitle, and■■ either physically or electronically surrenders their real estate salesperson

license certificate and pocket card to the Commission.

There must also have been compliance with the conditions for carrying on the business as stated in the first paragraph of this section.

A person receiving the reissued license of a deceased real estate broker may hold and use that license for as long as four years without meeting the 135-hour edu-cational requirement. However, if the requirement has not been met within four years, the license expires.

Return of Licenses; Terminating Affiliation [COMAR 09.11.01.08]

The license certificates and pocket cards of an affiliate must be returned to the Commission by the affiliate’s broker

■■ on the request of an affiliate (a real estate salesperson or associate real estate broker),

■■ on the death of an affiliate, or■■ after a hearing before the Commission and on a finding that the license of

an affiliate is to be suspended or revoked.

Real estate brokers are required to surrender to the Commission, promptly on demand, any such person’s license that may be in their possession or control. Fail-ure to do so is grounds for disciplinary action.

In the event of an affiliate’s termination (discharge), a broker must:

■■ immediately mail to the licensee, at the last known address of that individ-ual, notice of such termination;

■■ submit written notice to the Commission, including a copy of the notice mailed to the licensee; and

■■ return the license certificate of the licensee to the Commission.

Licensing Out-of-State Applicants [§17-514]

The Commission will issue licenses only to those nonresident applicants who file with the Commission a signed statement of irrevocable consent in addition to all other required documents and fees. By submitting this statement, applicants agree that suits and actions may be commenced against them without their actually being served papers notifying them of forthcoming legal actions. They are also consenting that official delivery of papers to the executive director of the Com-mission shall bind them in any action, suit, or proceeding brought against them in any county in which the cause of action arose or the complaining party resides.

When serving process on the executive director of the Commission, persons filing must immediately send a copy of the filing, by certified mail, to the principal office of the person against whom the action is directed.

MD_RE_Practice_Law.indb 17 6/13/2014 10:49:25 AM

SAMPLE

18 Maryland Real Estate Practice & Law Fourteenth Edition

Note that the signature block on license examination applications contains these words: “If the address of this registration is not within the State of Maryland, I do hereby irrevocably consent that suits and actions may be commenced against me in the proper courts of the State of Maryland as required by the Maryland Anno-tated Code.”

Maryland law states that if any nonresident real estate broker, associate broker, or salesperson participates in any real estate transaction, divides a fee, and/or holds deposits from any such transaction in Maryland, that very act is construed (con-sidered) to give irrevocable consent.

■■ PROCESSING COMPLAINTS

The Commission’s website provides a downloadable form on which complaints against licensees may be submitted. Upon receiving a properly completed com-plaint form, the Commission sends a copy of it to the broker of the company involved, together with a letter from the Commission’s executive director, stating that the broker must respond in writing with a full explanation of the allegations and what action the broker recommends. A broker’s failure to respond to this inquiry may be considered grounds for disciplinary action. A chart indicating the steps in handling a complaint against a licensee is found in Appendix C of this book.

A copy of the executive director’s letter is also sent to the complainant. Later, when the broker’s answer is received, the Commission sends its own reply, together with a copy of the broker’s response, to the complainant.

The Commission may commence proceedings on a complaint made by a Commis-sion member or by other persons (who must make such complaints under oath). Complaints must be in writing and state specifically the facts on which the com-plaint is based, and they may be accompanied by documentary or other evidence.

After reviewing the content of the complaint, the Commission may refer it for investigation if it appears an infraction has occurred. A complaint not referred for investigation is considered dismissed. Within 30 days of such dismissal, any member of the Commission may file an exception disagreeing with the dismissal. If such exception is taken, the full Commission will hold a hearing to consider proceeding with an investigation.

If an exception is not filed, the dismissal is considered a final decision of the Com-mission. “Final decision” means that any party aggrieved by the decision may then appeal to the appropriate court; decisions may not be appealed until they are final. Only final decisions may be appealed.

If the Commission or its designee, based on an investigative report, determines that grounds exist for disciplinary action, the matter is referred for a hearing. Complaints not referred for a hearing after investigation must be dismissed. This has the same effect as a final decision: any party aggrieved by that dismissal may make judicial appeal.

Hearings and Notices

Except as otherwise provided in the State Government Article (e.g., situations where summary action is needed), before the Commission takes any final action,

MD_RE_Practice_Law.indb 18 6/13/2014 10:49:25 AM

SAMPLE

19Chapter 1 Maryland Real Estate License Law and Related Regulations

it gives the individual against whom the action is contemplated an opportunity for a hearing before the Commission or a hearing board.

At least 10 days before the hearing, notice is served personally on the individuals against whom complaints have been made, or it is sent by certified mail to their last known addresses. If the individuals are licensees other than brokers, at least 10 days before the hearing, the Commission shall serve notice of the hearing to each real estate broker with whom the individuals are affiliated.

The individuals may have attorneys represent them at hearings. This does not mean they can fail to appear and merely send their attorneys. It means that they can bring attorneys to represent them in their hearings. If the individuals against whom action is contemplated fail or refuse to appear, the Commission may pro-ceed to hear and determine the matter without their presence. Unlike the meet-ings of panels to hear complaints and examine reports of investigators, these final meetings of panels are open to the public.

Real Estate Hearing Board [§17-324]

The Commission establishes two or three real estate hearing boards—often called panels—each consisting of three Commission members. At least one member of each panel must be a professional member, and at least one must be a consumer member. From among each hearing board’s members, the Commission designates a chairperson.

Referral of Cases

The Commission (or one of its hearing panels) may order a final public hearing on any complaint that has been filed with the Commission or on any other matter for which a hearing may be required.

Before deciding to hold hearings, a panel will meet privately to

■■ review complaints and consider whether they provide a reasonable basis for disciplinary hearings, and

■■ review claims against the Guaranty Fund to determine what further action to take.

Panels meet publicly to

■■ hear licensees’ responses to and defenses against complaints; and ■■ then decide whether to authorize punitive actions against them.

Hearing boards exercise the same powers as, and conduct hearings for, the Com-mission. They report their decisions and actions to the Commission. Panels spe-cifically advise the Commission of any action they take against licensees involved in monetary loss, misappropriation of funds, or fraud.

Hearing Regulations [COMAR 09.11.03]

COMAR—the Code of Maryland Regulations—provides for four types of hearings:

■■ Judicial hearings■■ Applications for licensure■■ Revocation or suspension of licenses■■ Claims against the Guaranty Fund

Hearings are conducted under several levels of overlapping hearing regulations.

MD_RE_Practice_Law.indb 19 6/13/2014 10:49:25 AM

SAMPLE

20 Maryland Real Estate Practice & Law Fourteenth Edition

On dismissal of a complaint, the complainant and the licensee are notified in writing. The dismissal of a complaint after investigation is not reviewable fur-ther. Other complaints substantially based on the same facts are usually similarly dismissed.

Summary Actions [§17-328]

Summary actions are those taken before holding hearings to protect the public quickly against imminent loss. They are then followed by hearings for which for-mal, timely notice is given.

Revocation after Actions of Other Agencies [§17-327]

The Commission may summarily order the revocation of the license of any licensee after that licensee is convicted in a court of law of a violation of this title, the conviction is final, and the period for appeal has expired.

The license of any nonresident licensee may be revoked if the real estate regula-tory agency of the state where the licensee is a resident revokes the license issued by that state and certifies its order of revocation to the Commission.

When the Commission orders summary revocations under this section, it gives licensees written notice of the revocations and the findings on which they were based. After the revocations are effective, the Commission grants the licensees whose licenses have been revoked an opportunity to be heard promptly, either before the Commission or before a hearing board.

Rather than summarily order revocations of licenses under this section, the Com-mission may elect not to revoke the licenses until after the licensees are given opportunity for hearings. If the Commission elects to give the licensees opportu-nity for hearings before revoking the license, the Commission gives notice and holds those hearings in the manner required for other hearings.

In any hearings held because of convictions or revocations by other agencies, the Commission considers only evidence of whether or not the alleged convictions or revocations, in fact, occurred. However, in such hearings, licensees may present matters in mitigation of the offenses charged.

Summary Suspension for Trust Fund and Other Violations [§17-328]

The Commission may summarily order the suspension of a licensee who:

■■ fails to account promptly for any funds held in trust; ■■ on demand, fails to display to the Commission all records and books, and

fails to account for any funds held in trust;■■ has been convicted of a crime as defined in §17–322(B)(24) (i.e., a felony,

a misdemeanor that is directly related to the fitness and qualification of the applicant or licensee to provide real estate brokerage services, or a crime that constitutes a violation of any provision of the Brokers Act); or

■■ fails, within 10 days after the conviction or within 10 days following release from incarceration as a result of the conviction, whichever is later, to dis-close to the Commission that the licensee has been convicted of a crime as previously defined.

MD_RE_Practice_Law.indb 20 6/13/2014 10:49:25 AM

SAMPLE

21Chapter 1 Maryland Real Estate License Law and Related Regulations

The Commission gives the licensee notice and supporting reasons for its action and offers the opportunity to be heard later.

A summary suspension may start immediately or at any later date set by the order, and it shall continue until the licensee complies with the conditions set forth by the Commission in its order or until the Commission orders a different disposition after a hearing held under this section.

Judicial Review [§17-329]

A party who strongly disagrees with a final decision of the Commission may appeal to a circuit court. Upon appeal, that court may set a bond not to exceed $50,000 and stay (delay) the suspension or revocation. The bond money would be for the use and benefit of any member of the public who might suffer financial loss because of any further violations of the Brokers Act by the plaintiff licensee.

Notice of Revocation or Suspension [§17-330]

Whenever a licensee’s license is revoked or suspended and a stay is not ordered by the Commission or a court, the Commission notifies

■■ the licensee,■■ the real estate broker with whom the licensee is affiliated,■■ the Maryland Association of REALTORS®, and■■ the local Board or Association of REALTORS® and the Realtist organiza-

tion in the area of the licensee’s office.