Amitkrshukla 4th Semester MICRO FINANCE Presentation

-

Upload

thisismeamit20103094 -

Category

Documents

-

view

218 -

download

0

Transcript of Amitkrshukla 4th Semester MICRO FINANCE Presentation

7/30/2019 Amitkrshukla 4th Semester MICRO FINANCE Presentation

http://slidepdf.com/reader/full/amitkrshukla-4th-semester-micro-finance-presentation 1/24

Presentation on the topic

“MICRO FINANCE IN INDIA” (PROBLEMS, CHALLENGES &

OPPORTUNITIES)By- amit kumar shukla

m.b.a. 4th semester

Roll no -5

7/30/2019 Amitkrshukla 4th Semester MICRO FINANCE Presentation

http://slidepdf.com/reader/full/amitkrshukla-4th-semester-micro-finance-presentation 2/24

MICRO FINANCE: INTRODUCTION “This is an area where you can do good while doing

well”. -Brigit Helms

“To give away money is an easy matter and in anyman‟s power. But to decide to whom to give it, and how

large, and when, and for what purpose and how, is

neither in every man‟s power nor an easy matter.” –

Aristotle

7/30/2019 Amitkrshukla 4th Semester MICRO FINANCE Presentation

http://slidepdf.com/reader/full/amitkrshukla-4th-semester-micro-finance-presentation 3/24

MICROFINANCE DEFINITION: According to International Labor Organization (ILO),

“Microfinance is an economic developmentapproach that involves providing financial services

through institutions to low income clients”. In India, Microfinance has been defined by “The

National Microfinance Taskforce, 1999” as “provisionof thrift, credit and other financial services and

products of very small amounts to the poor inrural, semi-urban or urban areas for enabling them toraise their income levels and improve livingstandards”.

7/30/2019 Amitkrshukla 4th Semester MICRO FINANCE Presentation

http://slidepdf.com/reader/full/amitkrshukla-4th-semester-micro-finance-presentation 4/24

"The poor stay poor, not because they are lazy but because they have

no access to capital.

"Microfinance is the supply of loans, savings, and other basic

financial services to the poor.” Micro financing is not a new concept. Small microcredit operations

have existed since the mid 1700s. Although most modern

microfinance institutions operate in developing countries, the rate of

payment default for loans is surprisingly low - more than 90% of loans are repaid. It is not just a financing system, but a tool for social

change, specially for women - it does not spring from market forces

alone - it is potentially welfare enhancing - there is a public interest

in promoting the growth of micro finance - this is what makes it

acceptable as a valid goal for public policy.Micro-Finance refers to small savings, credit and insurance services

extended to socially and economically disadvantaged segments of

society, for enabling them to raise their income levels and improve

living standards.

7/30/2019 Amitkrshukla 4th Semester MICRO FINANCE Presentation

http://slidepdf.com/reader/full/amitkrshukla-4th-semester-micro-finance-presentation 5/24

DIFFERENCE BETWEEN MICRO CREDIT AND

MICROFINANCE

Micro credit refers to very small loans for unsalaried borrowers with

little or no collateral, provided by legally registered institutions.

Currently, consumer credit provided to salaried workers based on

automated credit scoring is usually not included in the definition of

micro credit, although this may change.

Microfinance typically refers to micro credit, savings, insurance, money

transfers, and other financial products targeted at poor and low-income people.

WHY MICROFINANCE?

Subsidies are not the solution to eliminate poverty. More than subsidies

poor people need access to credit and opportunity to exploit their talent.Absence of any recognized employment and hence absence of collateral

make them non bankable, thus reducing the opportunities to access

credit. In developing countries like India, lack of loans from any bank

leaves them with no other option but to borrow money from local

moneylenders, who charge them huge interest rates.

7/30/2019 Amitkrshukla 4th Semester MICRO FINANCE Presentation

http://slidepdf.com/reader/full/amitkrshukla-4th-semester-micro-finance-presentation 6/24

To counter this and many such problems, various financial institutions

have come in to existence in the recent years. The main idea behind

microfinance is that poor people, who can provide no collateral, should

have access to some sort of financial services. Microfinance is oftenconsidered one of the most effective and flexible strategies in the fight

against global poverty.

According to the United Nations, microfinance institutions can bebroadly defined as provider of small-scale financial services such assavings, credit and other basic financial services to poor and low-income people. The term ―microfinance institution‖ now refers to a

wide range of organizations dedicated to providing these servicesand includes nongovernmental organizations, credit unions, co-

operatives, private commercial banks, nonbank financialinstitutions and parts of State-owned banks. Microfinance is adynamic field and there is clearly no best way to deliver services tothe poor and hence many delivery models have been developed over

a period of time. Each delivery model has its share of problem andsuccess.

7/30/2019 Amitkrshukla 4th Semester MICRO FINANCE Presentation

http://slidepdf.com/reader/full/amitkrshukla-4th-semester-micro-finance-presentation 7/24

In India, various delivery models have been adopted by microfinance

institutions.

ROLE OF MICROFINANCE

The micro credit of microfinance prename was first initiated in the year 1976 in Bangladesh with promise of providing credit to the poor without collateral , alleviating poverty and unleashing humancreativity and endeavor of the poor people. Credit unions andlending cooperatives have been around hundreds of years. However,the pioneering of modern microfinance is often credited to Dr.Mohammad Yunus, who began experimenting with lending to poor

women in the village of Jobra, Bangladesh during his tenure as aprofessor of economics at Chittagong University in the 1970s. He

would go on to found Grameen Bank in 1983 and win the NobelPeace Price in 2006.Since then, innovation in microfinance has continued and providersof financial services to the poor continue to evolve. Today, the World

Bank estimates that about 160 million people in developingcountries are served by microfinance. Grameen Bank (Bangladesh)

7/30/2019 Amitkrshukla 4th Semester MICRO FINANCE Presentation

http://slidepdf.com/reader/full/amitkrshukla-4th-semester-micro-finance-presentation 8/24

was formed by the Nobel Peace Prize (2006) winner Dr Muhammad

Younus in 1983. This bank is now serving almost 400, 0000 poor

people of Bangladesh. Not only that, but also the success of Grameen

Bank has stimulated the formation of other several microfinanceinstitutions like, ASA, BRAC and PROSHIKA .

1. Microfinance helps poor households meet basic needs and protects

them against risks.

2. The use of financial services by low-income households leads to

improvements in household economic welfare and enterprise

stability and growth.

3. By supporting women‟s economic participation, microfinance

empowers women, thereby promoting gender-equity and improving

household well being.4. The level of impact relates to the length of time clients have had

access to financial services.

7/30/2019 Amitkrshukla 4th Semester MICRO FINANCE Presentation

http://slidepdf.com/reader/full/amitkrshukla-4th-semester-micro-finance-presentation 9/24

Methods Of Micro Finance

SHGS /JLGS / Farmer Clubs

7/30/2019 Amitkrshukla 4th Semester MICRO FINANCE Presentation

http://slidepdf.com/reader/full/amitkrshukla-4th-semester-micro-finance-presentation 10/24

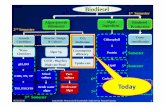

Micro finance

SHG Approach Individual Approach

SHG Bank Linkage Model MFI Bank Linkage Model

SHGs promoted &Financed by bank

SHGs promoted by NGOand Financed by banks

SHGs promoted by MFI

Bulk loan from Bank for

on-lending to SHGs

By Banks On-lending by

MFIs

Micro-enterprises

7/30/2019 Amitkrshukla 4th Semester MICRO FINANCE Presentation

http://slidepdf.com/reader/full/amitkrshukla-4th-semester-micro-finance-presentation 11/24

SWOT ANALYSIS OF MICRO FINANCE

Strength

• Helped in reducing the poverty: The main aim of Micro Finance is to

provide the loan to the individuals who are below the poverty line and

cannot able to access from the commercial banks. As we know that

Indian, more than 350 million people in India are below the poverty and

for them the Micro Finance is more than the life. By providing small

loans to this people Micro finance helps in reducing the poverty.

• Huge networking available: For MFIs and for borrower, both thehuge network is there. In India there are many more than 350 million

who are below the poverty line, so for MFIs there is a huge demand and

network of people. And for borrower there are many small and medium

size MFIs are available in even remote areas.

Weakness

• Not properly regulated: In India the Rules and Regulation of Micro

Finance Institutions are not regulated properly. In the absent of the rules

and regulation there would be high case of credit risk and defaults. In the

shed of the proper rules and regulation the Micro finance can function

7/30/2019 Amitkrshukla 4th Semester MICRO FINANCE Presentation

http://slidepdf.com/reader/full/amitkrshukla-4th-semester-micro-finance-presentation 12/24

properly and efficiently.

• High number of people access to informal sources: According to the

World Bank report 80% of the Indian poor can‘t access to formal source

and therefore they depend on the informal sources for their borrowing

and that informal charges 40 to 120% p.a.• Concentrating on few people only: India is considered as the second

fastest developing country after China, with GDP over 8.5% from the

past 5 years. But this all interesting figures are just because of few

people. India‘s 70% of the population lives in rural area, and that portionis not fully touched.

Opportunity

• Huge demand and supply gap: There is a huge demand and supply

gap among the borrowers and issuers. In India around 350 million of the

people are poor and only few MFIs there to serving them. There is huge

opportunity for the MFIs to serve the poor people and increase their

living standard. The annual demand of Micro loans is nearly Rs 60,000

crore and only 5456 crore are disbursed to the borrower.( April 09)

Employment Opportunity: Micro Finance helps the poor people by not

7/30/2019 Amitkrshukla 4th Semester MICRO FINANCE Presentation

http://slidepdf.com/reader/full/amitkrshukla-4th-semester-micro-finance-presentation 13/24

only providing them with loan but also helps them in their business,

educate them and their children etc. So in this Micro Finance helping in

increase the employment opportunity for them and for the society.

• Huge Untapped Market: India‘s total population is more than 1000

million and out of 350 million is living below poverty line. So there is ahuge opportunity for the MFIs to meet the demand of that unserved

customers and Micro Finance should not leave any stones unturned to

grab the untapped market.

• Opportunity for Pvt. Banks: Many Pvt. Banks are shying away fromto serve the people are unable to access big loans, because of the high

intervention of the Govt. but the door open for the Pvt. Players to get

entry and with flexible rules Pvt. Banks are attracting towards this

segment.

Threat

• High Competition: This is a serious threat for the Micro Finance

industry, because as the more players will come in the market, their

competition will rise , and we know that the MFIs has the high

transaction cost and after entrant of the new players there transaction cost

7/30/2019 Amitkrshukla 4th Semester MICRO FINANCE Presentation

http://slidepdf.com/reader/full/amitkrshukla-4th-semester-micro-finance-presentation 14/24

will rise further, so this would be serious threat.

• Neophyte Industry: Basically Micro Finance is not a new concept inIndia, but that was all by informal sources. But the formal source of

finance through Micro Finance is novice, and the rules are also not

properly placed for it.

• Over involvement of Govt.: This is the biggest that threat that manyMFIs are facing. Because the excess of anything is injurious, so in the

same way the excess involvement of Govt. is a serious threat for the

MFIs. Excess involvement definition is like waive of loans, make new

rules for their personal benefit etc.

7/30/2019 Amitkrshukla 4th Semester MICRO FINANCE Presentation

http://slidepdf.com/reader/full/amitkrshukla-4th-semester-micro-finance-presentation 15/24

BUILDING SUSTAINABLE MICROFINANCE INSTITUTIONS

IN INDIA

India is perhaps the largest emerging market for microfinance. Over the

past decade, the microfinance sector has been growing in India at a fairly

steady pace. Though no microfinance institution (MFI) in India has yetreached anywhere near the scale of the well-known Bangladeshi MFIs,

the sector in India is characterised by a wide diversity of methodologies

and legal forms. However, very few Indian MFIs have achieved

sustainability yet.

7/30/2019 Amitkrshukla 4th Semester MICRO FINANCE Presentation

http://slidepdf.com/reader/full/amitkrshukla-4th-semester-micro-finance-presentation 16/24

Upper class Poor (earning less than $4-5) who can during emergency spend

money on health care and formal education

Poor (earning less than $2 a day) who cannot afford to spend money on health

care and formal education

Ultra poor (earning less than $1 a day) who don't mind not living.

Thus from the above graph we can see that microfinance has been working but not

for the purpose for which it was intended. Only 5% of the ultra poor people have

been helped with microfinance. This is the crowd which is into committing suicide.

This mostly includes farmers who take loan under microfinance but are unaware

of the consequences of the non repayment, which leads to the fact that there land is

being hypothecated and leaving them only with the option of committing suicide.

LOOPHOLES 1. Technology related hurdles such as high costs involved in small loan

transactions for microfinance providers.

Most of the times the rural population in not in the light of the technology being

used for various transaction so either the technology which could be easy

understood by the rural crowd is to be used or they need to be trained as to how

the new technology id to be used. Moreover the transactions which are undertaken

under the micro finance are very small that spending for each transaction becomes

very costly for the bank .

2. Lack of customized solution/ microfinance models for the poor.

G f i i f i i i fi

7/30/2019 Amitkrshukla 4th Semester MICRO FINANCE Presentation

http://slidepdf.com/reader/full/amitkrshukla-4th-semester-micro-finance-presentation 17/24

Government of India has centralizes plans for the entire nations microfinance

which is then customized by the state government but then each village has a

different mentality & financial capability which needs to be catered to.

There is huge chunk of crowd which does not avail the facility of micro credit just

because the scheme is not proper or suitable to them. In normal banking there are

many alternatives available to the general public but in micro finance very few

alternatives are available only from those the people need to choose the credit

schemes.

3. Difficulty in measuring the social performance of MFIs.

There are no special instruments for measuring the progress or output of

microfinance. Various banks and institutions have their own models and criterionon which they measure the performance of their microfinance. But there is no

specific fixed on which the effectiveness or the outcome can be measured. No

proper rating is done for MFIs.

4. High interest rate of loan made to the poor.

Microfinance institutions walk a thin line as they offer financial services to thepoor at high costs. While high interest rates have been justified in many ways,

there are now accusations about microfinance providers using aggressive loan

recovery tactics that pushes clients to commit suicides (crisis in India).

Furthermore, the recent wave of commercialization of microfinance has led many

to question the real motive of practitioners.

7/30/2019 Amitkrshukla 4th Semester MICRO FINANCE Presentation

http://slidepdf.com/reader/full/amitkrshukla-4th-semester-micro-finance-presentation 18/24

5. Political Risk:

The recent microfinance crisis in India is said to be politically motivated as the

governments owns a rival microfinance institution in the same province where

suicides have soared amongst microfinance clients. More over if the state

government is not active as to the development and functioning of MFIs; the state

loses a lot of opportunities for the rural development. Political support is very

much important for upliftment and successful implementation of micro finance

schemes.

6. Lack of understanding consequences of non repayment

Most of the farmers who take microcredit are not aware of the entire structures of

credit or banks do not clarify clearly what would be the consequences of nonrepayment. It is for this reason that there is huge non repayment and in the end

leading to suicides in India. This has lead to bad name of micro credit.

7. Purpose

Banks have to give certain part of their finance in the microfinance sector. It is for

this reason they give loans very easily on a frequent basis. When people get loansso easily they are not using it for the very purpose for which they borrow instead

they use for non productive purpose. E.g. they borrow loan for the purpose of

irrigation but instead they use it for the marriage of their children or for the

renovation of their house. Thus the objective of fulfillment of micro finance is not

achieved.

7/30/2019 Amitkrshukla 4th Semester MICRO FINANCE Presentation

http://slidepdf.com/reader/full/amitkrshukla-4th-semester-micro-finance-presentation 19/24

INTENT

Providing micro credit to Poor as well as

Ultra Poor

Engaging poor in the growth of the country

While microfinance works well for the

upper poor and poor sections of society, the

ultra poor sections of society need much

more than finances.

Ideally, Microfinance's goal should be to

produce social capital.

REALITY

Due to MFI regulation, government rules

and other factors such as access to

commercial banks, ultra poor (who probably need microfinance the most) are

getting ignored

Sure did poor and middle class get

benefited through microfinance, but

question still remains - when will the ultra poor and unreached section will receive

the glorified microcredit

Even though the realization about under-

served ultra poor is there, but very few

NBFC (Non Banking FinancialCorporations) MFI works with such

section of the society. This behavior is

attributed to the focus of MFIs towards

sustainability and profit.

In reality, Microfinance is beingcommercialized in India.

7/30/2019 Amitkrshukla 4th Semester MICRO FINANCE Presentation

http://slidepdf.com/reader/full/amitkrshukla-4th-semester-micro-finance-presentation 20/24

RECOMMENDATIONS AND SUGGESTIONS

1. The concept of Micro Finance is still new in India. Not many people are aware

the Micro Finance Industry. So apart from Government programmes, we the

people should stand and create the awareness about the Micro Finance.

2. There are many people who are still below the poverty line, so there is a huge

demand for MFIs in India with proper rules and regulations.

3. There is huge demand and supply gap, in money demand by the poor and

supply by the MFIs. So there need to be an activate participation by the Pvt.

Sector in this Industry.

4. One strict recommendation is that there should not over involvement of the

Government in MFIs. Because it will stymie the growth and prevent the othersMFIs to enter.

5. the Micro Loan should be given to the women only. Because by this only, MFIs

can maintain their repayment ratio high, without any collaterals.

6. Many people say that the interest rate charge by the MFIs is very high and there

should be compelled cap on it. But what I felt that the high rates are justifiable.Suppose a big commercial bank gives Rs 1 million to an individual and in the same

way a MFI gives Rs 100 to 10.000 customers. So its obvious that man power cost

and operating cost are higher for the MFIs. So according to me rates are

justifiable. But with limitations.

O C O A C

7/30/2019 Amitkrshukla 4th Semester MICRO FINANCE Presentation

http://slidepdf.com/reader/full/amitkrshukla-4th-semester-micro-finance-presentation 21/24

FUTURE OF MICRO FINANCE

Microfinance expansion over the next decade can be expected to be an extension of

what has been achieved so far while overcoming the hurdles that have been posing

difficulty in effective microfinance operation and its expansion. There may be several

participants in this process and their participation may be seen in the following forms.

Existing microfinance institutions can expand their operations to areas where there are

no microfinance programs.

More NGOs can incorporate microfinance as one of their programs. In places where

there are less micro finance institutions, the government channels at the grassroots level

may be used to serve the poor with microfinance. Postal savings banks may participate

more not only in mobilizing deposits but also in providing loans to the poor and onlending funds to the MFIs.

More commercial banks may participate both in microfinance wholesale and retailing.

They many have separate staff and windows to serve the poor without collateral.

International NGOs and agencies may develop or may help develop microfinance

programs in areas or countries where micro financing is not a very familiar concept inreducing poverty.

Considering that the majority of the 360 million poor households (urban and rural)

lack access to formal financial services, the numbers of customers to be reached, and

the variety and quantum of services to be provided are really large. It is estimated that

90 million farm holdings, 30 million non-agricultural enterprises and 50 millionlandless households in India collectively need approx US$30 billion credit annually.

b t 5% f I di ' GDP d d t bl ti t H

7/30/2019 Amitkrshukla 4th Semester MICRO FINANCE Presentation

http://slidepdf.com/reader/full/amitkrshukla-4th-semester-micro-finance-presentation 22/24

about 5% of India's GDP and does not seem an unreasonable estimate. However,

80% of the financial sector is still controlled by public sector institutions.

Competition, consolidation and convergence are all being discussed to improve

efficiency and outreach but significant opposition remains. Many private and

foreign banks have unveiled their plans to enter the Indian microfinance sector

because of its very low NPAs and high repayment rate of more than 95% in spite

of offering loans without any collateral security.

Microfinance is not yet at the centre stage of the Indian financial sector. The

knowledge, capital and technology to address these challenges however now exist

in India, although they are not yet fully aligned. With a more enabling

environment and surge in economic growth, the next few years promise to beexciting for the delivery of financial services to poor people in India Development

of Small-Scale Enterprises through microfinance will not only increase the

outreach but will also help the generation of more employment and income for the

poor.

It is expected that in the following years there will be considerable deepening of

microfinance in this direction along with simultaneous drives to reach and serve

the poorest of the poor. But the crux of the discussion is that, if the over excess

involvement of the government would be there in the Micro Finance sector, than

the growth of the Micro Finance won„t much possible. The Govt. involvement

should limited to the important decisions only, but not to interfere in each and

every matter of the management.

CONCLUSION

7/30/2019 Amitkrshukla 4th Semester MICRO FINANCE Presentation

http://slidepdf.com/reader/full/amitkrshukla-4th-semester-micro-finance-presentation 23/24

CONCLUSION

At the end I would conclude that, Micro Finance Industry has the huge

potential to grow in future, if this industry grows then one day we‘ll all

see the new face of India, both in term of high living standard and

happiness. One solution by which we all can help the poor people, i.e. ina whole year a medium and a rich class people spends more than Rs

10,000 on them without any good reason. Instead of that, by keeping just

mere Rs, 3000 aside and donate that amount to the MFIs, then at the end

of the year the total amount in the hands of poor would be ( average 500million people *Rs 3000)=Rs 1,500,000,000,000 . Just imagine where

would be India in next 10 years. At last I am concluding by presentation

with a very famous saying:

“Don‟t wait; the time will never be just right. Start where you stand

and work with whatever tolls you may have at your commands and

the better tolls will be found as you go a long”

-William Surds

7/30/2019 Amitkrshukla 4th Semester MICRO FINANCE Presentation

http://slidepdf.com/reader/full/amitkrshukla-4th-semester-micro-finance-presentation 24/24

THANK

YOU