Airline Simulation Performance Report - Atlas Airways

-

Upload

donnacha-mccormack -

Category

Documents

-

view

255 -

download

3

description

Transcript of Airline Simulation Performance Report - Atlas Airways

‘Luxury Travel Has a New Name’

Contents Introduction ....................................................................................................................................... 1

Executive Summary .......................................................................................................................... 2

Inherited Strategy .............................................................................................................................. 3

Our Initial Plan .................................................................................................................................. 4

Our Strategic Vision & Mission Statement ..................................................................................... 5

Our Business Objectives ................................................................................................................ 6

Strategic Evaluation .......................................................................................................................... 7

Consistency ................................................................................................................................... 7

Uniqueness .................................................................................................................................... 8

Offensiveness ................................................................................................................................ 8

Profit Potential .............................................................................................................................. 8

Robustness .................................................................................................................................... 9

Adaptability ................................................................................................................................... 9

Operational evaluation ..................................................................................................................... 10

Marketing .................................................................................................................................... 10

Operations ................................................................................................................................... 10

Machinery ............................................................................................................................... 10

Fuel ......................................................................................................................................... 11

Route Selection ........................................................................................................................ 11

Service quality ............................................................................................................................. 12

Human Resources ........................................................................................................................ 12

Financial Evaluation ........................................................................................................................ 13

Overall Performance .................................................................................................................... 13

Ratio analysis .............................................................................................................................. 14

Unprofitable Q4........................................................................................................................... 14

Expenditure ................................................................................................................................. 15

Teamwork Evaluation...................................................................................................................... 15

Team Leadership ......................................................................................................................... 15

Decision Responsibilities Within our Group ................................................................................ 16

Donnacha- Fleet & Routes: ...................................................................................................... 16

Colm- Marketing: .................................................................................................................... 16

Liam- Fares: ............................................................................................................................ 16

Nuala- Corporate: .................................................................................................................... 17

Mark- Financing: ..................................................................................................................... 17

Meetings & Final Decisions ......................................................................................................... 17

Lessons Learned .............................................................................................................................. 17

Key recommendations for future Management Team taking over ................................................. 17

Observations on Airline Industry & your Organisation ................................................................. 18

What you & team would do differently ........................................................................................ 19

Appendix ........................................................................................................................................ 19

Fig 1.0 – The SWOT Analysis ..................................................................................................... 19

Fig 1.1 – PESTLE Analysis ......................................................................................................... 20

Fig 1.2 – Key Success Factors ..................................................................................................... 20

Fig 2.0 – Stock Price.................................................................................................................... 21

Fig 2.1 – Income & Expenditure .................................................................................................. 21

Fig 2.2 – Net Profit ...................................................................................................................... 21

Fig 2.3 – Ratio Analysis .............................................................................................................. 21

Fig 2.4 – Expenditure Breakdown ................................................................................................ 22

References....................................................................................................................................... 22

Introduction

It was two years ago today that Atlas Airways were involved in a complete overhaul of its

management team. The existing company was at a crossroads and was in desperate need of

decisive decision makers and a decisive strategy.

This report charts the fortunes of Atlas Airways from a humble regional airline to one of the

industry’s leading luxury airlines. Atlas Airways have grown exponentially over the last 8

quarters and within this report we hope to outline how and why this was possible.

Executive Summary

Upon takeover our airline was operating within regional area to towns and cities that were

deemed ‘unattractive’ to larger airlines due to low population figures and the limited facilities

attributed to the local airports in which the company operated.

The environment in which the company currently resides is facing increased competition

however there does exist viable opportunities for growth in serving new routes. The current

situation had been described as a crossroads in which there exists credible potential in

expansion of markets. A lack of capital and unsuitable aircraft represented significant

obstacles. As a result a key challenge for our management team was to craft a successful

expansion in terms of routes, fleet and service quality while remaining conscious of our lack

of working capital.

In terms of strategic choices made by our management team we attempted to make each

decision in accordance with our set out business objectives which you will see later in this

report. Each strategic decision throughout the our management of Atlas Airways was made to

optimise our chances of building a successful airline exhibiting the most complete service in

the industry in terms of quality and reliability. The only restriction placed on this investment

was to do so without compromising on sustainable profits.

Contained in this report you will find details of our initial strategic plan the strategic tools

used to develop it. Following this we will outline our airlines mission, vision and business

objectives. Our report will then discuss an evaluation of how our decisions aligned to this

strategy and we will focus in on decisions made in specific aspects of the business. Finally

this report will outline our financial performance over the 8 quarters in addition to an

evaluation of team performance and our lessons learned.

To give a brief outline of our performance, please refer to our appendix which outlines gross

profits, revenues, stock price etc. In terms of our final position Atlas Airways exhibited

consistent profits over the two year period (with the exception of Q4) and finished as the 3rd

most profitable airline in our industry.

In terms of the future direction for Atlas Airways we feel that our performance over the last

two years will enable future management the perfect platform with which to launch a

luxurious airline into worldwide markets. Our service quality and reliability was highest in

our industry and with these service offerings in addition to a substantial cashflow and

enormous lines of credit available we feel there is no reason why our airline cannot dominate

the high end market in the future.

Inherited Strategy

With the company at a crossroads in terms of expansion potential yet a lack of necessary

resources to capitalise we felt it prudent to conduct both SWOT, PESTLE and analyses to

better determine our strategy in moving forward and these can be seen in the appendix. It is

important to note that in conducting a SWOT analysis it is imperative that action is taken

using insights derived. An effective SWOT analysis cannot simply be a list it must be the

basis for action (Thompson & Strickland, 2001).

Following this analysis of both the company and its environment we looked at identifying

what we deemed the Key Success Factor’s for the airline. Again these can be seen in Fig 1.2.

With the help of these strategic tools we would form a logical basis for our strategy in

moving Atlas Airways forward.

Our Initial Plan

In utilising the various analyses techniques available to us to formulate our strategy we

collectively agreed to pursue a differentiation strategy for Atlas Airways. This strategy is

centred round creating a uniqueness of service which cannot be easily replicated and will

enable us to charge a premium price for our service in multiple markets (Thompson &

Strickland, 2001). Such was the level of opportunity present in expansion following our

SWOT analysis we collectively felt avenue the most suitable to pursue in eliminating cyclical

profit trends and facilitating real growth.

A differentiation strategy is fundamentally linked to our core competencies and in order for

us to create a sustainable competitive advantage it became clear that our strategy must be

driven towards improving these core competencies. We knew that creating unique

differentiation through improving our core competencies would take substantial investment

but also time. As a result we felt that in order to position Atlas Airways as a luxurious high

quality flying experience for our customers we would need to put in place the required

infrastructure necessary before entering the realms of premium pricing.

Our Strategic Vision & Mission Statement

In strategic management there exists five interrelated stages to be followed to enable a

successful strategy formulation and implementation and it all begins with developing a

strategic vision and mission statement (Thompson & Strickland, 2001).

An organisations strategic vision acts as their roadmap to perceived success and thus reflects

the management’s aspirations for the business (Thompson & Strickland, 2001). Its creation is

to outline the long term direction of the business, answering the simple yet imperative

question ‘where are we going?’. The vision must display realistic and credible credentials

should engage and energise people (Nanus, 1992). Another important aspect in the creation

of a strategic vision is to satisfy two key requirements; to illuminate the company’s

directional path and to provide a reference point in making managerial decisions (Thompson

et al, 2010). With these points in mind we have generated our strategic vision as such:

To successfully exhibit an airline defined by its unrivalled flying experience and customer

service. We are wholeheartedly committed to providing the greatest and most prestigious

flying experience on the market.

In terms of our mission statement it was necessary to cultivate something more than just

achieving profitability. Making a profit is a common misconception of what a mission

statement should be (Thompson & Strickland, 2011). An effective mission statement should

incorporate three distinct elements where possible; Customer needs, customers groups and

the company’s activities, technologies and competencies (Thompson & Strickland, 2011). An

effective mission statement should also indicate its differentiation from other competitors

(Thompson et al, 2010). Again in following these critical guidelines we have developed our

mission statement as follows:

To strive to provide a quality of service that ensures our corporate customers who believe a

flying experience should be more than just A to B need not question their choice of airline.

Our Business Objectives

With a specific focus on our KSF’s identified in Fig 1.2 we quickly realised that our success

in incorporating a differentiation strategy in terms of luxury would be based around achieving

closely linked objectives. Effective business objectives should be utilised to convert an

overall strategic vision into specific performance targets (Thompson et al, 2010). It is

important to note however that while business objectives are centred round results, these

parameters should be as specific as possible rather than relying on vague, generic targets like

increasing sales or decreasing costs (Thompson et al). In addition effective business

objectives should outline not only a performance target but also in timeframe in which to

achieve it (Thompson & Strickland, 2001). Our business objectives for Atlas Airways are as

follows:

1. Long term substantial investment in service quality while maintaining our growth

and profit margins.

2. Full fleet overhaul in order to better reflect our mission statement while allowing

for continual growth

3. An expansion of routes to cater for all customers looking for a superior flying

experience within one year of operations

4. Creation of an integrated service worthy of premium pricing within one year of

trading

5. Investment in vibrant marketing and promotional functions in a gradual yet

sustained manner to attract more customers in the short, medium and long term

6. Introduction and continual expansion of Sales Force capable of significantly

stimulating demand

Strategic Evaluation

Consistency Atlas Airways have performed consistently well over the past 10 quarters, both in terms of

implementation of business plan, and the end performance of the company. As said

previously, our aim was to create a competitive advantage with quality and luxury, which

would enable us to charge a premium price. We consistently held fast to this strategy, by

increasing quality and training budgets continuously over each quarter, developing the

amount of routes we entered and entering routes that were the right fit for us (e.g. flights to

major business hubs for our globally minded business clients and holiday destinations for

those clients who want a holiday in style). We were also consistent with our business model

in continuously increasing the amount and quality of our fleet. Revenues consistently grew

throughout starting at $1.235m increasing to $7.596m by quarter 8. As previously mentioned

we felt fare price was another important aspect of our business plan. We felt that it was

important to build a really high quality foundation by investing heavily in quality and

training, which will allow us to charge premium price, which we consistently increased in

line with our quality budget. Our motto was the higher the quality, the more customers will

come, regardless of the price, so along with high quality and training budgets, we had to

ensure that our employees will adhere to our high standards and uphold our philosophies by

compensating them appropriately. Finally, possibly one of the main indicators of our

adherence to our initial business plan and consistency over the quarters is our high stock

price, from a starting point of $20 per share we gained a high share price of $48.07 with a

final share price of $38.17, almost double the price when we started.

Uniqueness In order to achieve uniqueness within our service we felt the need to assess our value chain,

optimising our primary activities to provide our customers with an experience not easily

replicated. To achieve competitive advantage in terms of value organisations must understand

where value is created and lost (Johnson, Scholes & Whittingham, 2006). Porter (1985)

outlined primary value added activities as incorporating inbound and outbound logistics,

operations, marketing and sales and service. In order to create our unique value proposition

we focused on the improvement of these areas with particular attention paid to service and

marketing and sales.

This uniqueness has shone through with an excellent 8 quarters for us with high share price,

healthy profits, and an excellent reputation for customer service.

Offensiveness According to Thompson & Strickland, (2001) a competitive advantage is always achieved in

utilising offensive strategic moves. Effective offensive strategies exist in both the short and

long term and in terms of our strategic plan we focused on a long term competitive

advantage. As a result of committing ourselves to quality and reliability in the long term we

have enjoyed the benefit period of this offensive strategy, clearly shown in our industry

performance.

Profit Potential Due to our aims of reaching the highest price point by having the best quality etc., we had a

high potential for profit. While we did make healthy profits, there were times where we

didn’t reach our potential for profit. For example in quarter 4, we made such a huge loss (-

$688,929) that it affected cashflow, stock price, reputation etc., but once we realised our

mistakes we corrected them immediately and return the next quarter with a massive

$566,241, which shows the importance of sticking to the plan laid out at the very beginning

and being clinical and ruthless in decision making. Quarter 8 held much the same type of

market conditions as quarter 4 did. By learning from our mistakes in quarter 4, we decided to

be ignorant to demand forecasts because once you have the quality the customers will come.

Possibly the greatest comparison and contrasting of our profit potential is these two periods

where there was a difference of $1,000,000, which shows that we created an excellent plan

for profit potential that was effective when implemented and enforced.

Robustness Again a compare and contrast exercise shows just how robust a business plan we had all

along even if we did not implement it correctly. As above we thought we were leaving

ourselves open to market conditions with low demand forecasts in quarter 4 and tried to

counteract it with sales. This confused the customer and gave us massive losses. The

robustness of the initial plan is shown in quarter 8 where we ignored similar market

conditions to quarter 4 and made a $447,490 profit. This clearly shows we created a very

robust business plan that would have been able to withstand almost any market condition.

Adaptability Because our business plan was aimed at the high end non- price weary customers, our plan

did not have to stray from the original intentions of high quality profit, high revenue. We

knew that whatever happened we could keep to our strategy and not have to fundamentally

adapt it. Continuous improvement in overall service quality continuously aligned itself to

profitability. The only adaptation required was in route selection policies and fleet

improvement.

Operational evaluation

Marketing Within our SWOT analysis we had identified a weakness in terms of our current activity in

this area. As a result we felt it of immediate importance to increase our advertising and

promotional budget. Our long term commitment to an increased presence within our industry

resulted in an overall increase in budget of 300% from Q1 to Q8. With this increase we have

enjoyed an increase in our share of the market even during times of fluctuating demand.

As was in our initial strategic plan we slowly increase the fare per mile from 38c on the

medium scale to 51c per mile on the high end scale. We chose this pricing strategy as slowly

move into the luxury market, we made the increase slowly so as to not intimidate customers

with previous knowledge and experience with the firm. In addition to this, market knowledge

was provided to us that extreme fluctuations in our pricing strategy would be likely to

generate a less than favourable financial outcome.

The pricing strategy we choose was important as we chose a differentiated strategy and where

our incline in quality may not have been perceived by new customers or unknowledgeable

clients the pricing strategy was a way of signalling value of the service (Thompson et al

2010).

Operations

Machinery

Upon takeover our fleet was clearly unequipped for exhibiting a luxury airline. Our

Beechcrafts were inadequate in terms of size, range, comfort and customer service. As a

result a priority was a swift and significant upgrade of our fleet. A lack of working capital

and our teams reluctance to secure a long term loan forced us into a leasing strategy.

Our Beechcrafts were quickly sold and in return leases were placed on larger aircraft such as

the Embraer Brasilia & ERJ135, which provided us with a higher quality service. While a key

business objective was to upgrade our fleet we felt a staggered approach in line with our

financial performance was the most desired decision. These upgrades also allowed an

expansion to larger and more profitable routes. Throughout our management our leasing

strategy allowed us to avail of a very dynamic strategy for combating fluctuating demand.

In terms of maintenance it was agreed that a large proportion of our budget would be

designated to ensuring safe and reliable operations. We agreed to commit to continually

spending maximum amounts on maintenance to help achieve our business objectives.

Fuel

We initially continued on the practice of the airline in buying the fuel on the spot at its cost

price but after Q4 when there was a major rise in the price of fuel, we began by buying 50%

of the fuel on contract and 505 on the spot pricing. As we received both stability in the

knowledge out the fuel expenses and cost savings we decided to continue on this practice of

buying the fuel on contract, at least until a time where there could be beneficial savings in

buying the fuel on the spot.

Route Selection

We had identified our target market as business orientated clients looking for a high quality

flying experience and as such we have primary market E. In viewing long term perspective of

the business we decided not to be exclusive in these routes as passengers wishing for the

highest quality would exist in other markets. As a result we wanted to offer our unique

service sporadically in various different markets, ensuring a presence in these markets for

future expansion.

In employing an offensive strategy in terms of building an airline with unrivalled customer

service a goal of ours was to serve as many routes as our budgets could allow in order to

capitalise on our competitive advantage. This can be seen with a rapid expansion of routes

from 5 in Q1 to serving 14 in Q4. We also attempted, where viable to directly compete with

our biggest rival Arcadia who, for large proportions were the only industry rival sustaining

higher profits than ourselves.

Service quality Between quarter one and quarter 4 the training and quality budget had increased 1000% to

60,000 this lead to the increased quality scored rating, which continued to be one of the

highest in the industry. In keep with this image of quality we increased our spending on the

in-flight meals, we also offer free drinks, free magazine and hors d’oeuvres before or during

all flights. Increasing our perception of quality along with offering real quality service to our

customers follows our strategy to attract business traveller who would be willing to spend

extra to have a higher quality service for their clients as well as themselves.

We never decreased our training and quality budget as we felt that it was consistent with our

plan to always offer a better service to our clientele. We believed that by never decreasing

this budget we would always be consistently offering a better service to our customers that

they could rely on which would increase their brand loyalty. This was a priority for our

business from the beginning of the take-over, we learned that as we invested more in the

training and quality budget we gained better scoring and our profits increased.

Human Resources As it was in our best interest to retain the pilots and other employees whom we had already

heavily invested in by training, we decided that is was inherent in the strategy that these

employees needed to see the immediate advantage to staying with the firm, that was chosen

to be given in the form of giving better wages than the industry norm.

It was decided to increase the number of sales persons as we were re-launching the airline

and aiming at a different clientele. Additions to our sales force were frequent throughout our

management. It is important that our sales force reflect the business environment they are

selling in.

In the special incident report it was decided not to hire competitors staff. The basis of this

decision centred round ourselves adapting to our current situation. At the time of this decision

some of our employees had expressed their displeasure at their current salaries. To help

negate this de-motivational trend we wanted to exhibit ourselves as providing a preference

for current staff in terms of promotion, rather than hiring externally. We feel that taking the

decision to promote from within was also better served in maintaining our integrity as an

employer.

Another human resource issue arose when we had to decide on hiring a new station manager,

it was decided that the candidate with five years’ experience as an assistance manager with

good recommendation from former employee was chosen. It was felt that as he was available

to fill the position immediately and because of his experience that he had the relevant know

how to understand and implement our strategic vision.

Financial Evaluation

Overall Performance As we have previously outlined we have been performing well over the last 8 quarters. We

have seen our revenues, profits and cash on hand all rise overall after the 8 quarters. At the

end of quarter 8 we ended with a cumulative net income of $1,053,451 and a stock price of

$38.17. We had 7 out of 8 profitable quarters with the highest income coming in quarter 5

where it made $584,572. In terms of overall income and expenditure (Fig2.1) we have

achieved total gross revenues of $34,024,819 due to a large fleet and luxury prices; it also

subsequently had a total operating expenditure of $29,061,308 in order to maintain the

quality and reliability required to align to our overall strategy. One key set back we suffered

was in Q4 which will be communicated in greater detail a little later. We have continuously

made steady quarterly profits thus breaking past management’s trend of cyclical profit and as

a result we find ourselves in a great financial position. We are currently the 4th most valued

company in its industry and is ranked 3rd by means of overall net income.

Ratio analysis As seen in Fig 2.3 our current assets ratio is 2.263 this is just slightly lower than the industry

average and is a good indicator of how we can meet our short-term financial obligations.

Next is our return on sales which is 0.034 this is much higher than the industry average of

0.003 and indicates we are in a better position than some of our competitor at performing in

our industry. Again our return on equity is also much higher than the industry average this is

good for the ordinary shareholders as they can receive a good return on their investment.

Likewise our return on assets gives a similar indicator. Finally our debt to equity ratio is very

low as we balance our financing while growing with a good mixture of debt and equity.

Unprofitable Q4 As seen in Fig 2.1 income and expenditure Quarter 4 was the only quarter we were not

profitable. The reasons for this are as follows:

Offering sales: In this quarter we conducted different sales on all our flights.

Together with our comparatively low fare price for a luxury airline (48 cents) this had

a huge detrimental effect on our revenue.

Marketing decisions: Again we made a poor decision by not increasing our

marketing budget for this quarter, this is the only time we did not raise our budget and

had an adverse effect on us.

Another reasons for the poor performance in this quarter was due to the lower

demand i.e. the business index was 99, and Winter weather wreaked havoc on airline

schedules this quarter.

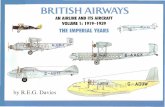

Expenditure As seen in Fig2.4 our fuel and maintenance were very high over the 8 quarters. While this

was an inevitability given our chosen strategy we do feel that in hindsight closer management

of these costs could have increased our bottom line further. Another high expense was lease

payments however we feel these costs to have been unavoidable as any decision to purchase

our fleet would have caused financial ruin. For the “Other Expenses” these include

Depreciation, Interest Expenses, Market Research costs, Social performance budget, training

costs, additional employee compensation amongst others all of which we felt were minimised

while adhering to our strategy.

Teamwork Evaluation

Team Leadership

Donnacha was assigned as our team leader, as we felt he had the best organisational skills

and he had an interest in the airline business. He fulfilled he role extremely well, letting us

know about any issues that arose or any change of meeting times. As the team leader he was

ultimately responsible for gathering all of the decisions made by the team and making sure

the decisions are entered correctly. In addition, he was also responsible for locking in all of

our decisions for every week. Donnacha assigned everyone in the group a particular position

which they were to focus on and we could meet and put all of our decisions together and see

if they were feasible.

Decision Responsibilities Within our Group

Donnacha- Fleet & Routes: The routes decisions focus on the markets / routes we serve and

whether or not to provide a sale fare for a particular route. In addition, to help estimate the

fleet capacity necessary to serve these routes, the number of daily flights to provide must also

be decided upon by choosing particular aircraft for each flight. Fleet decisions were focused

on issues having to do with acquiring, maintaining, and fuelling our fleet of aircraft. We felt

that the fleet decisions were probably the most important part of our operating strategy as it

would be crucial that the type and number of aircraft in our fleet would be aligned with our

markets and routes decisions.

Colm- Marketing: Marketing decisions Colm faced included promotion and advertising

budgets, a cargo marketing budget, sales personnel hired or fired, and whether or not we

would offer an in-flight magazine. Airlines advertise through various media: billboards,

magazines, television, radio, websites, and newspapers. The particular choice of ad

placement and media reflect the market routes and fare structure selected. Salespersons are

generally trying to expand your company’s presence by calling on travel agents. Another

decision was whether we would produce an in-flight magazine, at a price of $500 per aircraft

per quarter.

Liam- Fares: Another crucial aspect of our road to success. As our KSF’s outlined our pricing

strategy would be extremely important. This responsibility fell to Liam who did an excellent

job of ensuring that our value proposition remained consistent. Upon completion of our two

years in management we felt that this area of the business had been optimised in terms of our

revenue growth. Liam decided that any fare increase would have to be easily justified before

being put in place.

Nuala- Corporate: Nuala’s role was to establish a Social Performance Budget, as we felt that

social responsibility is an important aspect of any business. While it would be difficult to

ascertain a cost benefit for this budget item, we believe that supporting the communities in

which we were operating would only increase our business.

Mark- Financing: When everyone had decided what to do in their particular areas, we would

discuss all options at our meeting, and Mark would crunch the numbers and see what options

were financially feasible. He would also keep a close eye on what we were spending and

what we were making to ensure we were not overspending in any particular area.

Meetings & Final Decisions

We set our meeting at a fixed time of two o clock every Wednesday to make our decisions for

the week. We would assess last week’s results and see what areas we could improve or

expand on heading into the next week. We would all have ideas as to what to do in our areas

and we would talk through them and advise our teammates as to where they could make

changes. We would work through the financial aspects of our decisions and then Donnacha

would lock in the decisions we all agreed upon. We would then watch the “special incidents”

video together and read about it before coming up with a solution to the problem. I feel we

worked extremely well together as a team and everyone put in the necessary work to make

our airline an undoubted success.

Lessons Learned

Key recommendations for future Management Team taking over

For management taking over in the future we would recommend them to simply stick with

the luxury airline strategy and don’t be tempted into taking cheaper or easy options to try and

increase sales or profits. We feel that we have certainly handed over the airline in a much

better position than where we started. With the current platform in place we would encourage

the new management to partake in more aggressive expansion in terms of fleet and routes.

We would also suggest that as a luxury airline employing sales strategies are unlikely to yield

successful results. For example the quarter we had our sale proved to be a disaster. We now

feel that sales only work with low cost airlines, as with a luxury airline such was ours it can

be difficult to reduce the costs enough to make a sale profitable. We would also recommend

to future management not to simply rest on their laurels, they should always be looking for

areas to improve and expand in. For example our advertising and promotion budget was

raised significantly and it proved successful in increasing our sales, but instead of just leaving

it we continued to increase the amount put into it every quarter, even if it was only a small

amount. As well as advertising and promotion we would also recommend future management

to use this kind of strategy in the areas of quality & training, cabin service and maintenance.

Observations on Airline Industry & your Organisation

We feel that the airline industry is one of the most diverse, dynamic and perplexing in the

world. It is fast-evolving, labour intensive, capital intensive, hyper-competitive and highly

susceptible to the ebb and flow of business cycles. One of the things that struck us the most

was the unpredictable nature of the industry, “Forecasting what will happen in the airline

industry is about as unpredictable as forecasting the weather”. (CityWire 2012) For example

it can be difficult to estimate the demand for a particular quarter, despite the forecasts

provided. With demand being so hard to figure out, it is almost impossible to have the correct

number of planes and the correct number and types of routes. A perfect example of the

unpredictably of the industry is the varying fuel prices. Buying fuel on the spot can work out

much dearer or even much cheaper than buying it on contract or 50/50. You can try to make

research based decisions but with fuel prices being so hard to predict, you can get it wrong

quite easily.

What you & team would do differently

Looking back the eight quarters we feel that having got the company’s stock price from $20

in quarter 1 up to $38.17 in quarter 8 there is very little we could have done differently or

much better. The primary problem which arose has already been well documented – our Q4

sales. The results of the sale were extremely poor, as we did not cut our costs enough and

quarter 4 was the only one in which our company reported a loss, and as well as that our

stock price dropped dramatically. In addition looking back at the ease in which we eliminated

cyclical profits for sustained ones, our reluctance to resort to external financing in terms of

loans, selling stock etc could have reigned in profitability figures that were actually possible.

In terms of financing at least, we were risk adverse and only desired to pay off existing debts

however looking back, fuelling our fleet expansion quicker could have enabled us to lead the

industry.

Overall we feel we did an excellent job in managing Atlas Airways over the last two years

and we are very satisfied at how the company has developed. We hope that future

management will take head of our experiences and advice and grow Atlas Airways into the

industry’s leading airline.

Appendix

Fig 1.0 – The SWOT Analysis Strengths Weaknesses

Well known and reputable airline within smaller communities

Sizable line of credit available Addition of 1/2 planes to fleet with

little/low additional overheads

Current fleet of aircraft Current maintenance program Cyclical profitability rather than

sustained Low working capital for expansion Slim profits unable to facilitate

expansion Extremely low marketing budgets

Opportunities Threats Significant financial opportunity in

expansion of routes Existence of routes currently not

served with little or no competition

Increased competition within current markets

Increased maintenance costs of Beechcrafts

Fig 1.1 – PESTLE Analysis Political Factors Economic Factors Socio-Cultural Factors

Industry Deregulation Political agendas in

terms of military contracts

Taxation

Demand Forecast Income levels Interest Rates (Loans) Dividend Payouts

Choice of routes Management of

external stakeholders Cultural diversity of

staff Potential Controversies

(heart attack pilot, kickbacks)

Technological Factors Legal Factors Environmental Factors Aircraft Type Industry move toward

e-commerce Maintainence

Potential for lawsuits (employment, customers)

Industry Regulations

Fuel Expenses CSR policy Seasonal Disruption

Fig 1.2 – Key Success Factors

Key Success Factors Quality of Fleet

Quality of Customer Service Significant investment in Marketing and Sales functions to stimulate demand

Choice of routes to serve Adapting strategy to fluctuating market conditions

Stock Price Reliability

Pricing Strategy aligned to Value Proposition

Fig 2.0 – Stock Price

Fig 2.1 – Income & Expenditure

Fig 2.2 – Net Profit

Fig 2.3 – Ratio Analysis Ratios Atlas Industry

Current Ratio 2.263 2.842 Return on Sales 0.034 0.003 Return on Equity 0.095 -0.141 Return on Assets 0.053 -0.000 Debt to Equity 0.097 0.752

Fig 2.4 – Expenditure Breakdown

References Thompson, A et al (2010). Crafting and Executing Strategy. 17th ed. New York: McGraw-Hill/Irwin. p25-30.

Thompson, A.A. & Strickland, A.J. (2001). Crafting and Executing Strategy - Text and Readings. New York: McGraw-Hill.

Nanus, B. (1992). Visonary Leadership: Creating a Compelling Sense of Direction for your Organisation, San Francisco: Jossey-Bass

Johnson, G. Scholes, K. & Whittingham, R (2006). Exploring Corporate Strategy. 7th ed. England: Prentice Hall. p136-138.

$0

$1,000,000

$2,000,000

$3,000,000

$4,000,000

$5,000,000

$6,000,000

Breakdown of Expenditure