AD1

-

Upload

daniel-kocis-phd-chair -

Category

Documents

-

view

21 -

download

4

Transcript of AD1

Using PRIZM and Nielsen Data to Profile Mortgage Loans

2

Overview

This report summarizes a process that was used to create a quantitative selectionprocess that focuses on characteristics of current business practices and can be used to maximize our TV exposure for funded 1st mortgages by:

* profiling data and comparing it to national profiles

* providing profiles on specific outcomes of our marketing efforts

* describing how to integrate Nielsen TV ratings to these key demographics

* creating key metrics to rate each Channel by daypart

* combining these metrics into a single composite score

* using these scores to pick BEST channels by daypart

* compare this outcome with current AD purchasing

3

Background, rational and setup

We used a data base profiling approach that looked at different outcomes of all 2006business and included

83,996 fundings (26,437 1st Mortgages and 55,229 2nd Mortgages),422,398 cancellations (237,108 1st Mortgages and 162,567 2nd Mortgages), and100,000 dead leads (single time callers).

The first step was to append a commercial segmentation scheme called PRIZM to each record. This segmentation classifies each record into 1 of 66 different clusters based uponage, income, marital status, home owner status, household composition, ethnicity, and geographic location. We calculated an index against the National profile and identified

13 clusters where we over-penetrate (index 135+) for 1st Mortgages19 clusters where we over-penetrate (index 135+) for 2nd Mortgages

13 clusters where we over-penetrate (index 135+) for 1st Mortgages Cancellation18 clusters where we over-penetrate (index 135+) for 2nd Mortgages Cancellation

4

The clusters where is dominant for 1st Mortgages

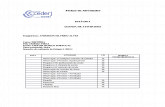

Label COUNT PERCENT HH USPercent index Urbanicity HH Income White Picket Fences 652 2.47 1,403,531 1.25 1.97 Second City MidscaleKids and Cul-de-Sacs 832 3.15 1,828,699 1.63 1.93 Suburban Upper-MidUpward Bound 785 2.97 1,793,920 1.6 1.86 Second City UpscaleAmerican Dreams 1,004 3.8 2,447,099 2.18 1.74 Urban MidscaleNew Homesteaders 919 3.48 2,254,616 2.01 1.73 Town Upper-MidBeltway Boomers 416 1.57 1,079,269 0.96 1.64 Suburban Upper-MidFast-Track Families 713 2.7 1,950,575 1.74 1.55 Town/Rural UpscaleBlue-Chip Blues 489 1.85 1,400,592 1.25 1.48 Suburban MidscaleWinner's Circle 412 1.56 1,239,200 1.1 1.42 Suburban WealthySuburban Sprawl 490 1.85 1,473,003 1.31 1.41 Suburban MidscaleKid Country, USA 489 1.85 1,500,755 1.34 1.38 Town Lower-MidHome Sweet Home 669 2.53 2,062,147 1.84 1.38 Suburban Upper-MidThe Cosmopolitans 422 1.6 1,317,884 1.17 1.36 Urban Midscale

Label HH Age Range HH Comp HH Tenure HH Education HH Employment HH Race & Ethnicity HH IPAWhite Picket Fences Age 25-44 HH w/ Kids Mix, Owners Some College BC, Srv, Mix W, B, A, H, Mix ModerateKids and Cul-de-Sacs Age 25-44 HH w/ Kids Mostly Owners College Grad WC, Mix W, A, H, Mix Above Avg.Upward Bound Age 35-54 HH w/ Kids Mostly Owners College Grad WC, Mix W, A, H, Mix Above Avg.American Dreams Age 35-54 Mostly w/ Kids Homeowners Some College WC, Srv, Mix W, B, A, H, Mix Above Avg.New Homesteaders Age 25-44 HH w/ Kids Mostly Owners College Grad BC, Srv, Mix W Above Avg.Beltway Boomers Age 45-64 HH w/ Kids Mostly Owners College Grad WC, Mix W, B, A, Mix Above Avg.Fast-Track Families Age 35-54 HH w/ Kids Mostly Owners College Grad Management W Above Avg.Blue-Chip Blues Age 25-44 HH w/ Kids Mix, Owners Some College BC, Srv, Mix W, B, A, H, Mix Below Avg.Winner's Circle Age 25-44 HH w/ Kids Mostly Owners Grad Plus Management W, A, Mix HighSuburban Sprawl Age 35-54 HH w/o Kids Homeowners College Grad Professional W, B, A, Mix ModerateKid Country, USA Age 25-44 HH w/ Kids Mix, Owners H.S. Grad BC, Srv, Mix W, B, H, Mix Below Avg.Home Sweet Home Age <55 HH w/o Kids Mostly Owners College Grad Professional W, B, A, Mix Above Avg.The Cosmopolitans Age 55+ Mostly w/o Kids Homeowners Some College WC, Mix W, B, A, H, Mix High

5

The clusters where is dominant for 2nd Mortgages

Label COUNT PERCENT HH USPercent index Urbanicity HH Income Kids and Cul-de-Sacs 2,076 3.76 1,828,699 1.63 2.31 Suburban Upper-MidUpward Bound 1,934 3.50 1,793,920 1.60 2.19 Second City UpscaleNew Homesteaders 2,207 4.00 2,254,616 2.01 1.99 Town Upper-MidWinner's Circle 1,163 2.11 1,239,200 1.10 1.91 Suburban WealthyFast-Track Families 1,724 3.12 1,950,575 1.74 1.79 Town/Rural UpscaleWhite Picket Fences 1,236 2.24 1,403,531 1.25 1.79 Second City MidscaleCountry Squires 1,866 3.38 2,152,742 1.92 1.76 Town/Rural UpscaleBeltway Boomers 900 1.63 1,079,269 0.96 1.70 Suburban Upper-MidGreenbelt Sports 1,294 2.34 1,612,141 1.44 1.63 Town/Rural Upper-MidGod's Country 1,347 2.44 1,735,899 1.55 1.57 Town/Rural UpscaleBrite Lites, Li'l City 1,282 2.32 1,684,994 1.50 1.55 Second City UpscaleHome Sweet Home 1,552 2.81 2,062,147 1.84 1.53 Suburban Upper-MidMovers and Shakers 1,343 2.43 1,807,572 1.61 1.51 Suburban WealthyAmerican Dreams 1,795 3.25 2,447,099 2.18 1.49 Urban MidscaleBig Sky Families 1,472 2.67 2,014,484 1.79 1.49 Rural Upper-MidCountry Casuals 1,274 2.31 1,807,787 1.61 1.43 Town/Rural UpscaleBlue-Chip Blues 970 1.76 1,400,592 1.25 1.41 Suburban MidscalePools and Patios 1,009 1.83 1,470,884 1.31 1.39 Suburban Upper-MidBlue Blood Estates 731 1.32 1,094,703 0.98 1.35 Suburban Wealthy

Label HH Age Range HH Comp HH Tenure HH Education HH Employment HH Race & Ethnicity HH IPAKids and Cul-de-Sacs Age 25-44 HH w/ Kids Mostly Owners College Grad WC, Mix W, A, H, Mix Above Avg.Upward Bound Age 35-54 HH w/ Kids Mostly Owners College Grad WC, Mix W, A, H, Mix Above Avg.New Homesteaders Age 25-44 HH w/ Kids Mostly Owners College Grad BC, Srv, Mix W Above Avg.Winner's Circle Age 25-44 HH w/ Kids Mostly Owners Grad Plus Management W, A, Mix HighFast-Track Families Age 35-54 HH w/ Kids Mostly Owners College Grad Management W Above Avg.White Picket Fences Age 25-44 HH w/ Kids Mix, Owners Some College BC, Srv, Mix W, B, A, H, Mix ModerateCountry Squires Age 35-54 HH w/ Kids Mostly Owners Grad Plus Management W HighBeltway Boomers Age 45-64 HH w/ Kids Mostly Owners College Grad WC, Mix W, B, A, Mix Above Avg.Greenbelt Sports Age 35-54 HH w/o Kids Mostly Owners College Grad WC, Mix W Above Avg.God's Country Age 35-54 HH w/o Kids Mostly Owners College Grad Management W HighBrite Lites, Li'l City Age 35-54 HH w/o Kids Mostly Owners College Grad Professional W, A, Mix Above Avg.Home Sweet Home Age <55 HH w/o Kids Mostly Owners College Grad Professional W, B, A, Mix Above Avg.Movers and Shakers Age 35-54 HH w/o Kids Mostly Owners Grad Plus Management W, A, Mix HighAmerican Dreams Age 35-54 Mostly w/ Kids Homeowners Some College WC, Srv, Mix W, B, A, H, Mix Above Avg.Big Sky Families Age 25-44 HH w/ Kids Mostly Owners Some College BC, Srv, Mix W ModerateCountry Casuals Age 35-54 HH w/o Kids Mostly Owners College Grad Management W HighBlue-Chip Blues Age 25-44 HH w/ Kids Mix, Owners Some College BC, Srv, Mix W, B, A, H, Mix Below Avg.Pools and Patios Age 45-64 HH w/o Kids Mostly Owners College Grad Professional W, A, Mix HighBlue Blood Estates Age 45-64 HH w/ Kids Mostly Owners Grad Plus Management W, A, Mix High

6

Where are cancels and single time callers coming from ?

The same process was repeated for cancellations, but we are reserving identifying these clusters until we can differentiate applications that were denied versus true cancels.

Single time callers that never pursued an application were labeled dead leads (see below)

Label COUNT PERCENT HH USPercent index Urbanicity HH Income Beltway Boomers 611.00 1.35 1,079,269.00 0.96 1.40 Suburban Upper-MidBlue Highways 899.00 1.98 1,644,447.00 1.46 1.36 Rural Lower-MidUpward Bound 985.00 2.17 1,793,920.00 1.6 1.36 Second City UpscaleFast-Track Families 1,071.00 2.36 1,950,575.00 1.74 1.36 Town/Rural UpscaleNew Homesteaders 1,236.00 2.73 2,254,616.00 2.01 1.36 Town Upper-MidKids and Cul-de-Sacs 999.00 2.20 1,828,699.00 1.63 1.35 Suburban Upper-Mid

Label HH Age Range HH Comp HH Tenure HH Education HH Employment HH Race & Ethnicity HH IPABeltway Boomers Age 45-64 HH w/ Kids Mostly Owners College Grad WC, Mix W, B, A, Mix Above Avg.Blue Highways Age 35-54 HH w/o Kids Homeowners H.S. Grad BC, Srv, Mix W ModerateUpward Bound Age 35-54 HH w/ Kids Mostly Owners College Grad WC, Mix W, A, H, Mix Above Avg.Fast-Track Families Age 35-54 HH w/ Kids Mostly Owners College Grad Management W Above Avg.New Homesteaders Age 25-44 HH w/ Kids Mostly Owners College Grad BC, Srv, Mix W Above Avg.Kids and Cul-de-Sacs Age 25-44 HH w/ Kids Mostly Owners College Grad WC, Mix W, A, H, Mix Above Avg.

7

How to identify Total US Mortgage Market through a definitional set of criteria within PRIZM

Segment Nickname Urbanicity HH Income HH Age Range HH Comp HH Tenure HH Education HH Employment HH Race & EthnicityUpper Crust Suburban Wealthy Age 45-64 HH w/o Kids Mostly Owners Grad Plus Professional W, A, MixBlue Blood Estates Suburban Wealthy Age 45-64 HH w/ Kids Mostly Owners Grad Plus Management W, A, MixMovers & Shakers Suburban Wealthy Age 35-54 HH w/o Kids Mostly Owners Grad Plus Management W, A, MixYoung Digerati Urban Upscale Age 25-44 Family Mix Mix, Owners Grad Plus Professional W, A, H, MixCountry Squires Town/Rural Upscale Age 35-54 HH w/ Kids Mostly Owners Grad Plus Management WWinner's Circle Suburban Wealthy Age 25-44 HH w/ Kids Mostly Owners Grad Plus Management W, A, MixMoney & Brains Urban Upscale Age 45-64 Family Mix Mostly Owners Grad Plus Professional W, A, H, MixExecutive Suites Suburban Upper-Mid Age 35-54 HH w/o Kids Mostly Owners College Grad Professional W, A, MixBig Fish, Small Pond Town/Rural Upscale Age 45-64 HH w/o Kids Mostly Owners Grad Plus Management WSecond City Elite Second City Upscale Age 45-64 HH w/o Kids Mostly Owners Grad Plus WC, Mix WGod's Country Town/Rural Upscale Age 35-54 HH w/o Kids Mostly Owners College Grad Management WBrite Lites, Li'l City Second City Upscale Age 35-54 HH w/o Kids Mostly Owners College Grad Professional W, A, MixUpward Bound Second City Upscale Age 35-54 HH w/ Kids Mostly Owners College Grad WC, Mix W, A, H, MixNew Empty Nests Suburban Upper-Mid Age 65+ HH w/o Kids Mostly Owners College Grad Retired WPools & Patios Suburban Upper-Mid Age 45-64 HH w/o Kids Mostly Owners College Grad Professional W, A, MixBeltway Boomers Suburban Upper-Mid Age 45-64 HH w/ Kids Mostly Owners College Grad WC, Mix W, B, A, MixKids & Cul-de-sacs Suburban Upper-Mid Age 25-44 HH w/ Kids Mostly Owners College Grad WC, Mix W, A, H, MixHome Sweet Home Suburban Upper-Mid Age <55 HH w/o Kids Mostly Owners College Grad Professional W, B, A, MixFast-Track Families Town/Rural Upscale Age 35-54 HH w/ Kids Mostly Owners College Grad Management WGray Power Suburban Midscale Age 65+ Mostly w/o Kids Mostly Owners College Grad Retired WGreenbelt Sports Town/Rural Upper-Mid Age 35-54 HH w/o Kids Mostly Owners College Grad WC, Mix WCountry Casuals Town/Rural Upscale Age 35-54 HH w/o Kids Mostly Owners College Grad Management WThe Cosmopolitans Urban Midscale Age 55+ Mostly w/o Kids Homeowners Some College WC, Mix W, B, A, H, MixMiddleburg Managers Second City Midscale Age 45-64 HH w/o Kids Mostly Owners Some College WC, Mix WTraditional Times Town/Rural Upper-Mid Age 55+ HH w/o Kids Mostly Owners Some College WC, Mix WAmerican Dreams Urban Midscale Age 35-54 Mostly w/ Kids Homeowners Some College WC, Srv, Mix W, B, A, H, MixSuburban Sprawl Suburban Midscale Age 35-54 HH w/o Kids Homeowners College Grad Professional W, B, A, MixNew Homesteaders Town Upper-Mid Age 25-44 HH w/ Kids Mostly Owners College Grad BC, Srv, Mix WBig Sky Families Rural Upper-Mid Age 25-44 HH w/ Kids Mostly Owners Some College BC, Srv, Mix WWhite Picket Fences Second City Midscale Age 25-44 HH w/ Kids Mix, Owners Some College BC, Srv, Mix W, B, A, H, MixBlue-Chip Blues Suburban Midscale Age 25-44 HH w/ Kids Mix, Owners Some College BC, Srv, Mix W, B, A, H, MixMayberry-ville Town/Rural Upper-Mid Age 35-54 HH w/o Kids Mostly Owners H.S. Grad BC, Srv, Mix WDomestic Duos Suburban Midscale Age 55+ Mostly w/o Kids Mostly Owners H.S. Grad WC, Mix W, Mix

8

How to get from clusters to TV Nielsen Ratings and Channel dominance

While earlier slides identify where the brand is dominant given their currentadvertising, the previous slide used PRIZM to define the total presence of home mortgage by using the same characteristics that described that current business to estimate a totalMortgage Market. Results came from a key informant that concluded 33 clusters were needed.

This resulted in 6 profiles that can be described from a segmentation perspective usingdominant clusters (Funded 1st and 2nd, Cancelled 1st and 2nd , Dead Leads, and Target 33 )

These profiles were then used to provide TV viewing behavior across 80 cable channels bythe four major dayparts (early morning, day time, early fringe, and prime time) *. For eachchannel Nielsen provides a key audience metric that counts the total eyeball watching at themidpoint of every 15 minute interval within that daypart. These numbers were summed from the first quarter 2007.

Eight unique performance indexes were created to rate each channel and then quantitativelypick out those whose audience is best suited for our 1st mortgage product. Creatively usingthese indicator maximizes our pull and dominance while minimizing cancels and dead leads

* ON and LN are currently available for Target 33 and dead lead only

9

Performance Index Definitions by Daypart

Index33 = (Channel Minute 33 / Total Minute33) / (Total Minute Daypart / Grand Total Minute Daypart)

This used a definitional set of clusters to calculate Total Homeowner Market Potential

FF_Index =(Channel Funded 1st Minutes / Total Funded First Minutes) / (Total Minute Daypart / Grand Total Minute Daypart)

This used PRIZM matches against 26,437 Funded Firsts in 2006 that index 135+

FS_Index =(Channel Funded 2nd Minutes / Total Funded 2nd Minutes) / (Total Minute Daypart / Grand Total Minute Daypart)

This used PRIZM matches against 55,229 Funded 2nd in 2006 that index 135+

CF_Index =(Channel Cancel First Minutes / Total Cancel First Minutes) / (Total Minute Daypart / Grand Total Minute Daypart)

This used PRIZM matches against 237,000 cancelled Firsts in 2006 that index 135+

CS_Index =(Channel Cancel 2nd Minutes / Total Cancel 2nd Minutes) / (Total Minute Daypart / Grand Total Minute Daypart)

This used PRIZM matches against 162,000 cancelled 2nd’s in 2006 that index 135+

10

Performance Index Definitions by Daypart

Deadlead _Index =(Channel Deadlead Minutes / Total Deadlead Minutes) / (Total Minute Daypart / Grand Total Minute Daypart)

Using a sample of 100,000 phone numbers of one time callers that never calledback, a reverse address append resulted in 45,000 PRIZM coded records

Pull_Index = (Channel Minute 33 / Channel Total Minute) / Mean Pull This index measures the percent of total eyeball minutes seen by Target 33’s indexed to the grand average percent for that daypart. The higher the index then more minutes of that channel are being seen by our target 33 profile

pull=target_33_minutes/total_minutes;pull_index=pull / mean pull for that daypart

Dom_index = (Channel Target33 minutes / Grand Total Target33 Minutes) / Mean DominanceThis index measures the dominance in total minutes of each channel indexed to the average dominance for that daypart

dominance=total target33_minutes by channel / grand total target33 minutedom_index=dominance / mean dominance for that daypart

11

Comparison to March 2007 Early Morning Spot PicksTop 10 Quantitative Selections in BLUE

Channel COUNT PERCENT Channel COUNT PERCENT

FIT 171 5.6195 HI 36 1.1830FCS 162 5.3237 GAMC 34 1.1173CW+ 134 4.4035 FXSC 33 1.0845MSNB 131 4.3050 BBCA 32 1.0516FX 116 3.8120 SLEU 32 1.0516A&E 102 3.3520 ESPN2 30 0.9859TOC 98 3.2205 SOAP 28 0.9201STYL 97 3.1876 DIY 27 0.8873HGTV 94 3.0891 BETJ 25 0.8216TMC 93 3.0562 DISM 23 0.7558CNN 91 2.9905 WGNS 23 0.7558OXY 91 2.9905 ESPC 20 0.6572HLN 86 2.8262 GAME 20 0.6572HIST 85 2.7933 FOOD 19 0.6244DSCH 82 2.6947 BIO 17 0.5587FNEW 82 2.6947 TNT 16 0.5258HOM 79 2.5961 TWC 16 0.5258SCFI 78 2.5633 FXRE 12 0.3943TBS 73 2.3989 ANPL 11 0.3615HELV 72 2.3661 DSKD 8 0.2629TTC 69 2.2675 TRAV 6 0.1972CRNT 67 2.2018 HALL 5 0.1643OUTD 61 2.0046 USA 5 0.1643TVL 51 1.6760 DSCN 4 0.1314CNBC 48 1.5774 DISC 2 0.0657CMT 41 1.3474 DIST 2 0.0657CSTV 41 1.3474 FINE 2 0.0657AMC 40 1.3145 FSN 2 0.0657BRAV 39 1.2816 G4 2 0.0657NBA 38 1.2488 SPKE 2 0.0657ESNW 36 1.1830 BFC 1 0.0329

This page shows what thePast purchase plan was forMarch 2007. The top 10Quantitaive selections arehighlighted in BLUE. Commentsare that this appears to beSub-optimal and fragmented.

Note the top select for thisDaypart BBCA is number 35and was purchased at only 1%.

Additional dayparts were alsodone but not included.

Using Jan-March 2007, Grand Total Spots per month rounds to 20,000March07 19,422 spots were distributed over various day parts as follows:

EM= 15.6% DT=37% EF=32.45% PR=7.96% LN=3.9% ON=2.9%

EM= 3,043 DT=7,188 EF=6,303 PR=1,546 LN=773 ON=569

Using the PRIZM coded Nielsen Reports distributions, suggests this pattern

EM= 9.5% DT=30.5% EF=25.7% PR=34.0%

EM= 1,845 DT=5,923 EF=4,991 PR=6,603

The following pages detail each channel’s specific profile using8 unique performance indexes that will weight us heavier into PRIME DaypartAND increase our funded 1st portfolio by focusing our AD buy in targeted spots

Why we should shift our spending to PRIME Daypart

12

13

How to create a pick list from the Master file

• There are many ways to pick from this master list (see attached Updated Master .xls) and some of the indexes are to be included (target33, FF, FS) while others are to be excluded (deadlead, CF and CS). In addition two other indexes profile both the pull or reach of a station to our target 33 profile as well as the dominance of that channel to draw total eyeball minutes within that daypart.

• Cost information is only available for channels that were previously purchased. A linear program was executed by the team to assign an optimal number of spots per daypart (see attached LP solution). One issue with this approach is that fact that NO major shift to Prime Time is delivered

• Using a factoring approach that assigned a statistical distance between channels was calculated. Two composite scores were created – one to maximize our pull of mortgage applicants, then second weighted to maximize FUNDED applicants.The idea is choose channels with HIGH Target 33 AND FF profiles, but LOW cancel first and LOW deadlead profile while pulling HIGH and being dominant with that daypart

14

Best Total Target Early Morning ChannelsNetwork Total_Minutes Target_33_Minutes Index33 FF_Minutes FF_Index CF_Index DEAD_Index pull dominance total_all total_targetBBCA 84,952,460 62,737,370 163 20,896,710 140 104 13 73.8500 0.4924 6.3102 3.3899Court 134,197,900 94,132,610 155 48,888,230 208 199 62 70.1446 0.7388 2.2762 3.2853Soap 269,226,700 133,991,100 110 88,327,400 187 22 265 49.7689 1.0516 3.4923 3.1884E! 280,621,400 187,229,400 148 104,197,700 212 159 273 66.7196 1.4694 0.7496 3.1622DSCI 94,649,300 56,855,230 133 30,022,990 181 151 49 60.0694 0.4462 2.2757 2.5249MIL 80,575,270 56,747,890 156 29,220,140 207 246 109 70.4284 0.4454 -0.4512 2.3823STYL 100,146,700 57,725,000 128 27,843,810 159 78 75 57.6404 0.4530 2.9934 2.2689NGC 36,934,160 22,373,250 134 12,634,200 195 203 65 60.5760 0.1756 0.7699 2.2232MTV2 55,067,770 29,387,620 118 15,273,000 158 123 126 53.3663 0.2306 1.3205 1.8597Trav 60,935,210 36,241,110 132 17,551,360 164 159 280 59.4748 0.2844 -1.4181 1.6352MuchM 6,484,126 4,068,990 139 539,550 48 27 24 62.7531 0.0319 5.2022 1.5479BIO 74,124,040 42,115,320 126 13,215,980 102 87 112 56.8174 0.3305 2.4264 1.2547ESPN 813,867,900 502,066,600 136 159,174,500 112 103 137 61.6890 3.9404 2.1234 1.2150TBS 757,488,300 414,116,800 121 183,759,900 138 123 89 54.6697 3.2501 2.2389 1.1522HI 30,728,500 15,562,070 112 5,978,701 111 60 25 50.6438 0.1221 2.8179 1.0864SciFi 349,713,100 159,552,300 101 104,932,100 171 140 226 45.6238 1.2522 -1.2338 1.0757ENN 81,146,380 48,229,500 131 21,375,620 150 153 225 59.4352 0.3785 -1.9878 1.0109HGTV 523,153,400 309,846,200 131 88,617,340 97 90 161 59.2266 2.4318 0.5552 0.7126VH-1 285,971,800 192,171,200 149 56,011,570 112 136 123 67.1994 1.5082 -0.8649 0.6724Disny 593,034,900 343,234,400 128 113,314,800 109 124 142 57.8776 2.6938 0.8129 0.6138TV1 45,947,240 16,853,480 81 9,574,620 119 78 19 36.6801 0.1323 2.2038 0.6056TLC 146,119,800 77,706,720 118 35,074,620 137 153 103 53.1801 0.6099 -0.9340 0.6006Tdsny 58,077,660 31,187,770 119 9,076,111 89 114 31 53.7001 0.2448 1.4669 0.4924Bravo 45,859,380 22,729,010 110 11,197,250 139 143 130 49.5624 0.1784 -1.2820 0.4889MSNBC 1,089,054,000 657,822,500 134 180,974,800 95 127 95 60.4031 5.1628 1.9416 0.3739GOLF 112,141,300 53,939,430 106 21,197,390 108 103 103 48.0995 0.4233 -0.1764 0.3499FNC 2,046,427,000 1,221,102,000 132 296,121,300 83 76 78 59.6700 9.5835 5.5621 0.3152Univi 1,822,900,000 574,752,700 70 460,249,400 144 99 59 31.5296 4.5108 3.2751 0.2689TNT 1,676,921,000 679,798,200 90 380,926,300 130 115 68 40.5385 5.3352 2.5893 0.2593DTMS 136,483,600 47,523,540 77 28,037,080 117 84 34 34.8200 0.3730 1.4391 0.2463LMN 265,955,200 128,024,400 106 54,883,900 118 110 154 48.1376 1.0048 -0.6644 0.2434Hstry 452,877,000 203,623,300 99 98,284,000 124 122 75 44.9622 1.5981 -0.0791 0.1834GSN 99,831,620 61,920,120 137 8,132,266 47 35 147 62.0246 0.4860 0.6476 0.1524A&E 691,619,100 314,909,200 101 86,223,980 71 68 93 45.5322 2.4715 1.9646 0.0623Nick 831,717,300 386,228,800 103 197,588,400 136 146 196 46.4375 3.0312 -0.9730 0.0523

15

Best Funded Early Morning Channels

Network Total_Minutes Target_33_Minutes Index33 FF_Minutes FF_Index CF_Index DEAD_Index pull dominance total_all total_targetBBCA 84,952,460 62,737,370 163 20,896,710 140 104 13 73.8500 0.4924 6.3102 3.3899FNC 2,046,427,000 1,221,102,000 132 296,121,300 83 76 78 59.6700 9.5835 5.5621 0.3152MuchM 6,484,126 4,068,990 139 539,550 48 27 24 62.7531 0.0319 5.2022 1.5479Soap 269,226,700 133,991,100 110 88,327,400 187 22 265 49.7689 1.0516 3.4923 3.1884Univi 1,822,900,000 574,752,700 70 460,249,400 144 99 59 31.5296 4.5108 3.2751 0.2689STYL 100,146,700 57,725,000 128 27,843,810 159 78 75 57.6404 0.4530 2.9934 2.2689HI 30,728,500 15,562,070 112 5,978,701 111 60 25 50.6438 0.1221 2.8179 1.0864TNT 1,676,921,000 679,798,200 90 380,926,300 130 115 68 40.5385 5.3352 2.5893 0.2593BIO 74,124,040 42,115,320 126 13,215,980 102 87 112 56.8174 0.3305 2.4264 1.2547Court 134,197,900 94,132,610 155 48,888,230 208 199 62 70.1446 0.7388 2.2762 3.2853DSCI 94,649,300 56,855,230 133 30,022,990 181 151 49 60.0694 0.4462 2.2757 2.5249TBS 757,488,300 414,116,800 121 183,759,900 138 123 89 54.6697 3.2501 2.2389 1.1522TV1 45,947,240 16,853,480 81 9,574,620 119 78 19 36.6801 0.1323 2.2038 0.6056ESPN 813,867,900 502,066,600 136 159,174,500 112 103 137 61.6890 3.9404 2.1234 1.2150A&E 691,619,100 314,909,200 101 86,223,980 71 68 93 45.5322 2.4715 1.9646 0.0623MSNBC 1,089,054,000 657,822,500 134 180,974,800 95 127 95 60.4031 5.1628 1.9416 0.3739Tdsny 58,077,660 31,187,770 119 9,076,111 89 114 31 53.7001 0.2448 1.4669 0.4924DTMS 136,483,600 47,523,540 77 28,037,080 117 84 34 34.8200 0.3730 1.4391 0.2463MTV2 55,067,770 29,387,620 118 15,273,000 158 123 126 53.3663 0.2306 1.3205 1.8597Disny 593,034,900 343,234,400 128 113,314,800 109 124 142 57.8776 2.6938 0.8129 0.6138NGC 36,934,160 22,373,250 134 12,634,200 195 203 65 60.5760 0.1756 0.7699 2.2232E! 280,621,400 187,229,400 148 104,197,700 212 159 273 66.7196 1.4694 0.7496 3.1622GSN 99,831,620 61,920,120 137 8,132,266 47 35 147 62.0246 0.4860 0.6476 0.1524HGTV 523,153,400 309,846,200 131 88,617,340 97 90 161 59.2266 2.4318 0.5552 0.7126