Accuride Corporation at Deutsche Bank 2012 Global Auto Industry Conference

Transcript of Accuride Corporation at Deutsche Bank 2012 Global Auto Industry Conference

-

8/2/2019 Accuride Corporation at Deutsche Bank 2012 Global Auto Industry Conference

1/17

Page | 1

1

Investor PresentationJanuary 11, 2012

-

8/2/2019 Accuride Corporation at Deutsche Bank 2012 Global Auto Industry Conference

2/17

Page | 2

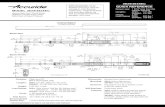

Company Products and Key Brands

ImperialGuniteBrillion

Accuride

Fuel Tank Straps

Fuel Tank StrapsFuel Tank Assemblies

Fuel Tank Assemblies

WindshieldFrames

WindshieldFrames

HoodTops and

Skins

HoodTops and

Skins

Battery/Tool Boxes

Battery/Tool Boxes

GrillAssemblies

Grill Assemblies

Bumpers

BumpersFuel Tank Ends

Fuel Tank Ends

CrownAssemblies

CrownAssemblies

Sunvisors

Sunvisors

EngineCastings

EngineCastings

Steel and Aluminum

Wheels

Chassis &Suspension

Brackets

Chassis &Suspension

Brackets

Fenders

Fenders

Brake Drums, Disc WheelHubs, Spoke Wheels, Rotors

Brake Drums, Disc WheelHubs, Spoke Wheels, Rotors

Exhaust Stacks& Assemblies

Exhaust Stacks& Assemblies

NA Market share:

Steel wheels #1

Aluminum wheels #2

NA Market share:

Brake drums #1

Disc wheel hubs #2

NA Market share:

Metal bumpers #2

Note: Market defined as North American commercial truck market.(1) Bostrom & Fabco

Components

Company Products & Key Brands

Accuride Business Units

Leading Brands

% 2011

Revenuesthrough Q3

42% 26% 13% 15%

Divested

Units

4%

(1)

Top Ten NACasting Operation

-

8/2/2019 Accuride Corporation at Deutsche Bank 2012 Global Auto Industry Conference

3/17

Page | 3

End Markets & Customers

YTD Q3 2011 Revenue by End Market

YTD Q3 2011 Revenue by Customer

Heavy-Duty Truck (Class 8)

Heavy Conventional Transit BusTandem-Axle Van

Medium-Duty Truck (Class 5-7)

Recreational Vehicle Stake

Medium Conventional Walk-In Van School Bus

Single-Axle Van

Van Flat Bed Tanker

Light Truck (Class 3-4)

Pick-Up Sport Utility

Trailer

Class 5-8

43%

Aftermarket

27%

Military

4%

Trailer

7%

Other

19%

Navistar

18%

PACCAR

16%

Daimler Truck

North America

11%

Volvo / Mack

8%

Others

47%

Note: Includes revenue from divested business units.

http://www.macktrucks.com/default.aspx?pageid=2038 -

8/2/2019 Accuride Corporation at Deutsche Bank 2012 Global Auto Industry Conference

4/17

Page | 4

2011 A Year of Transformation

Upgraded, Co-located & Focused Senior Leadership Team New President & CEO

70% of Senior Leadership team replaced or reassigned Revised compensation plan for 2012 ROA and FCF

Revised Strategic Plan Developed & Implementation Initiated: New Vision, Mission, Values Fix & Grow Strategy Developed International Expansion delayed 12-18 months

Core vs. Non-Core Focus Established: Fix & Grow: Accuride Wheels, Gunite Divested: Bostrom Seating, Fabco TBD: Imperial, Brillion Iron Works

Commitment to Restore Operating Excellence & Technological Leadership: Rebuilt Core skills & team: MFG, Product Engineering, Quality, Supply Chain

Two-year CAPEX plan (2011-12) to update manufacturing capability & expand/rationalize capacity: $55M investment in Accuride Wheels business $55M investment in Gunite Wheel-end business

Three-year Product Portfolio plans developed to ensure industry benchmark technology

Re-established Commercial Discipline: Gunite price increases in both OEM and Aftermarket Segments Brillion Iron Works price increases

Successfully pursuing anti-dumping campaign for Steel Wheels

-

8/2/2019 Accuride Corporation at Deutsche Bank 2012 Global Auto Industry Conference

5/17

Page | 5

Strategic Objectives

#1-2 globally in wheel-end systems

ROIC > 20% through a cycle

>80% of revenue from CORE products

Balanced geographical revenues: 40% North America 30% Asia 20% Europe 10% South America

>25% of annual revenues from new &evolutionary products

>95% retention of personnel

Maximize ACW share price

SharePrice

Grow Globally

Create a CompetitiveCost Structure &

LEAN Operating Culture

Divest Non-Core AssetsFix Core Business & Operations

Customer Centric, Technology Leadership

Ethical People, Selfless Leaders, Team Oriented

Accuride Vision: Accuride will be the premier supplier of wheel-end system

solutions to the global commercial vehicle industry

Our Focus

-

8/2/2019 Accuride Corporation at Deutsche Bank 2012 Global Auto Industry Conference

6/17

Page | 6

2012 A Year of Execution

Complete the operational turn-around of our Core assets:

Complete Aluminum wheel capacity expansion Complete rationalization study for Steel Wheel Capacity (4Q)

Upgrade capability and consolidate Gunite manufacturing footprint:

Quality, Delivery, Daily production stability (1Q)

Install & launch 2.1M/year drum machining capacity (2Q/3Q)

Install new & transfer existing capacity while selectively outsourcing hub machining (4Q)

Repair & Selectively upgrade foundry and facility at Rockford (2012-13)

Complete consolidation of Imperial assets (1Q) Implement common LEAN Manufacturing systems (2012-13)

Fully understand and revamp our supply chain (>55% of COGS): Scheduling systems integrated & coordinated

Consolidate MRO buy for key commodities (tools, MRO, chemicals)

Aggressively manage raw material pricing with both suppliers and customers

Focused sales initiatives: Re-negotiate & extend LTAs with the Big 4 Truck OEMs

Dedicate & focus resources on specific fleets, trailer OEMs and key AM customers

Use open capacity & total wheel-end product portfolio for value selling

Fill-up open capacity at Imperial and Brillion

Continue to explore opportunistic strategic opportunities

-

8/2/2019 Accuride Corporation at Deutsche Bank 2012 Global Auto Industry Conference

7/17

Page | 7

Aluminum Capacity Expansion

Market penetration of aluminumwheels continues to grow

Phase 1 complete: Mega-line at 1,000/day Mexico at 300+/day Acquisition & integration of Forgitron

Capacity will be online to meet peak cycle demand in 2013-2014

Phase 2 underway: $20M CAPEX Double capacity in MX and SC

Key customers targeted: Truck OEMs: Volvo, Daimler, Paccar Trailer OEMs Large fleets, Defense suppliers, and

select AM distributors

-

200

400

600

800

1,000

1,200

2010 2011 2012-13

-

8/2/2019 Accuride Corporation at Deutsche Bank 2012 Global Auto Industry Conference

8/17

Page | 8

Footprint Aligned w/ Customers

Kenworth

Daimler

Volvo

Navistar

Peterbilt

Kenworth

Peterbilt

Kenworth

Navistar

Navistar

Mack

Daimler

Daimler

Daimler

Daimler

Kenworth

Please note that the circlesencompass 200, 400, and 600miles from each Wheels facility.

Navistar

Accuride

ACW wheel capacity is located where OUR customers are growing

-

8/2/2019 Accuride Corporation at Deutsche Bank 2012 Global Auto Industry Conference

9/17

Page | 9

Gunite Operational Turn-Around

Gunite operations are stabilizing now we are focused on driving profitability!

8,622

8,248

9,692

7,500

8,000

8,500

9,000

9,500

10,000

Q2 Q3 Q4

Average Daily Drum Production

6.7%

4.8%

2.3%

0.6% 0.6% 0.3% 0.3% 0.1%0.7%

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%7.0%

8.0%

Gunite QualityNon-Conforming Material %

27,760

34,772

15,262

30,145 30,610

23,419

4,289

11,744

1,035-

5,000

10,000

15,000

20,000

25,000

30,00035,000

40,000

Gunite Drums Past DueEnd of Month

Note: Representative customer quality data

DEC10,417

61,872

91,25785,607

40,843

9,368

-

10,000

20,000

30,000

40,000

50,000

60,000

70,000

80,000

90,000

100,000

December January February March April

Gunite Drum Inventory BankEnd of Month

-

8/2/2019 Accuride Corporation at Deutsche Bank 2012 Global Auto Industry Conference

10/17

Page | 10

Gunite Financial Turn-Around

Pricing Activity with customers (1Q) AM (Drums +3%, Spoke Wheels +30%, Other)

OEM (8-18%)

Increased hub pricing from Brillion (1Q)

Eliminate CS2 (1Q) and CS1 (2Q) Inspection

Improved daily production New Drum (3Q) & Hub (4Q) Machining:

Scrap: 4.0% to 2.2%

Tooling: 2.5% to 2.0%

Labor/OT: 13.5% to 10.0%

Freight: 3.5% to 3.0%

Volume & Mix: TBD

Targeted EBITDA performance: 2011: 10%

-

8/2/2019 Accuride Corporation at Deutsche Bank 2012 Global Auto Industry Conference

11/17

Page | 11

Sales & Marketing Initiatives

Voice of the Customer feedback:

Numerous meetings with OEMs

Established Distributor Advisory Council

Completed branding survey

Revised Organization: Eliminated layer between SVP and Big 4

Truck OEM accounts Reduction in headcount/operating

expense (>$1.25M)

Regional alignment to improve emphasison major fleets and trailer OEMs

Rules of Engagement established: Aggressive management of AR Order & Inventory management

Shift from selling on price to selling Accurides value advantages

Accuride85%

Hayes15%

OEM Truck Steel

Accuride33%

Hayes67%

OEM Trailer Steel

Accuride59%

Offshore33%

Hayes8%

Aftermarket Steel

Alcoa66%

Accuride34%

OEM Truck Aluminum

Alcoa81%

Accuride19%

OEM Trailer Aluminum

Alcoa43.0%

Accuride57.0%

Aftermarket Aluminum

Note: Market share based on company estimates

-

8/2/2019 Accuride Corporation at Deutsche Bank 2012 Global Auto Industry Conference

12/17

Page | 12

Sales & Marketing Initiatives

Gunite - A business worth fixing given strong truck & aftermarket positions

Gunite, 59%

ConMet, 31%

KIC, 5%

MotorWheel,

5%

ConMet

10%

Webb

45%

Meritor

8%

MotorWheel

7%

KIC

30%

Gunite, 48%

ConMet, 2%

Webb, 38%

Meritor, 2%

MotorWheel,

2%

KIC, 8%

Note: Market share based on company estimates

Aftermarket (Cast) Drum ShareTrailer OEM (Cast) Drum ShareTruck OEM (Cast) Drum Share

-

8/2/2019 Accuride Corporation at Deutsche Bank 2012 Global Auto Industry Conference

13/17

Page | 13

Supply Chain Initiatives

New SVP on board 10/19/11

Key recent staff additions:

MRO Buyer

Supplier Quality & Development

Metals Buyer

Extension of AP terms 4Q11

Outside advisor engaged to help us fully understand currentsituation and identify opportunities by 1Q12

Concerted efforts to fix scheduling and inventory management

Minimize steel economic headwind 1H12

Opportunities exist for significant operational & financial improvement

Steel21%

Aluminum/Alloy

13%

Scrap/Pig Iron

16%

MRO

9%

Purchased

Services

8%

Other

33%

Annual Spend Breakdown

-

8/2/2019 Accuride Corporation at Deutsche Bank 2012 Global Auto Industry Conference

14/17

Page | 14

150,000

170,000

190,000

210,000

230,000

250,000

270,000

290,000

Class 8 Medium-Duty Trailer

Industry Forecasts

295,545

176,111

271,000

167,900

251,000

246,300

Accuride projections will be on the conservative end of the projections

-

8/2/2019 Accuride Corporation at Deutsche Bank 2012 Global Auto Industry Conference

15/17

Page | 15

Initiatives to Improve Liquidity

Aggressive Working Capital Management: Scheduling systems & inventory management

AR collection (90 days)

AP terms extension

ABL expansion 1Q12

Potential divestiture of non-core asset in 1H12 Improved operating performance:

Gunite (pricing, daily operations, eliminate CS1 & CS2 inspection)

Imperial (capacity consolidation, SGA & premium reduction)

Brillion (pricing, daily operations, capacity utilization)

Execution of key CAPEX projects: Core business (15% IRR)

Non-core business (

-

8/2/2019 Accuride Corporation at Deutsche Bank 2012 Global Auto Industry Conference

16/17

Page | 16

Fix & Grow Strategy developed & being executed

Experienced leadership team on-board & performing

Resources focused on key priorities

All major initiatives on-schedule and on-budget

Market trends favorable heading into 2012

Some headwind on steel pricing in 1H12

Adequate liquidity and initiatives to improve it

Strategic opportunities exist to Fix & Grow the company

We are executing our plan!

Summary

-

8/2/2019 Accuride Corporation at Deutsche Bank 2012 Global Auto Industry Conference

17/17

Page | 17

Financials

Questions