Accounts Presentation on Electronics

-

Upload

azmi-abdullah-khan -

Category

Documents

-

view

218 -

download

0

Transcript of Accounts Presentation on Electronics

-

7/27/2019 Accounts Presentation on Electronics

1/35

-

7/27/2019 Accounts Presentation on Electronics

2/35

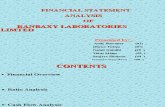

GROUP MEMBERS

SUSHANT INGLE 31

PRAJAKTA 32

SALUM KAZI 33

SUPRIYA JADHAV 34 ABHISHEK JAISWAL 35

-

7/27/2019 Accounts Presentation on Electronics

3/35

INDEX

SONY

TOSHIBA

PANASONIC

SAMSUNG LIFES GOOD

-

7/27/2019 Accounts Presentation on Electronics

4/35

-

7/27/2019 Accounts Presentation on Electronics

5/35

ELECTRONIC INDUSTRY

Consumer electronics is that which is intended foreveryday use, most often in entertainment, communications and office productiviy. Radio

broadcasting in the early 20th century brought the firstmajor consumer product, the broadcast receiver. Later

products include personal computers, telephones, MP3players, audio equipment , televisions, calculators, GPS automotive electronics, digital cameras and playersand recorders using video media suchas DVDs, VCRs or camcorders. Increasingly these

products have become based on digital technologies, andhave largely merged with the computer industry in whatis increasingly referred to as the consumerization ofinformation technology.

-

7/27/2019 Accounts Presentation on Electronics

6/35

HISTORY-The generation of electricity began in the 19th century and

this led to the development of all manner ofinventions. Gramaphones were an early invention and this

was followed by radio transmitters and receivers and

televisions. The first digital computers were built in the 1940swith a slow development in technology and total sales. In the1990s the personal computer became popular. A large part ofthe electronics industry is now involved with digitaltechnology.The industry now employs large numbers of electronicsengineers and electronics technicians to design, develop, test,manufacture, install, and repair electrical and electronicequipment such as communication equipment, medicalmonitoring devices, navigational equipment, and computers.

-

7/27/2019 Accounts Presentation on Electronics

7/35

-

7/27/2019 Accounts Presentation on Electronics

8/35

SONY

Sony Corporation commonly referred to as Sony, is aJapanese multinational conglomerate corporation headquartered inKnan Minato, Tokyo, Japan. Its diversified business is primarily focusedon the electronics, game, entertainment and financial services sectors. Thecompany is one of the leading manufacturers of electronic products for theconsumer and professional markets . Sony is ranked 87th on the 2012 listof Fortune Global 500.Sony Corporation is the electronics business unit and the parentcompany of the Sony Group, which is engaged in business through its fouroperating segments Electronics (including video games, network servicesand medical business), Motion pictures, Music and FinancialServices. These make Sony one of the most comprehensive entertainmentcompanies in the world. Sony's principal business operations include Sony

Corporation (Sony Electronics in the U.S.), Sony PicturesEntertainment, Sony Computer Entertainment, Sony MusicEntertainment,Sony Mobile Communications (formerly Sony Ericsson),and Sony Financial. Sony is among the Worldwide Top 20 SemiconductorSales Leadersand third-largest television manufacturer in the world,after Samsung Electronics and LG Electronics.

-

7/27/2019 Accounts Presentation on Electronics

9/35

HISTORY

Originally called Tokyo Tsushin Kogyo (Tokyo

Telecommunications Engineering Company),Sonys roots go back over half a century to 1946when it was founded by Masaru Ibuka and Akio

Morita. The first Sony branded product was the TR-55 transistor radio which went on sale in 1955.

-

7/27/2019 Accounts Presentation on Electronics

10/35

PARTICULARS 2010 2011 2012 2013

Net sales 6,293,005 6,304,401 5,526,611 5,691,216

TOTAL REVENUES 7,213,998 7,181,273 6,469,112 6,772,819

Cost Of Goods Sold 4,878,217 4,826,612 4,384,332 4,482,304

GROSS PROFIT 1,664,231 1,678,873 1,348,730 1,434,544

Selling General & AdminExpenses, Total 1,480,953 1,468,636 1,354,019 1,413,822

OTHER OPERATING EXPENSES,TOTAL

1,480,953 1,468,636 1,354,019 1,413,822

OPERATING INCOME 183,278 210,237 -5,289 20,722

Interest Expense -22,505 -23,909 -23,432 -26,657

Interest And Investment Income 13,191 11,783 15,101 21,987

Other Non-Operating Expenses,Total

-32,788 24,724 -126,344 -20,754

Other Non-Operating Income8,323 1,365.0 442 -3,446

-

7/27/2019 Accounts Presentation on Electronics

11/35

PARTICULARS 2010 2011 2012 2013

Merger & RestructuringCharges

-97,318 -39,567 -43,170 -46,925

Gain (Loss) On Sale OfInvestments 28,999 36,976 99,398 156,217

Gain (Loss) On Sale Of Assets -45,945 -15,231 5,751 113,059

Other Unusual Items, Total -- -- -5,201 28,032

EBT, INCLUDING UNUSUALITEMS

26,912 205,013 -83,186 245,681

Income Tax Expense 13,958 425,339 315,239 141,505

Minority Interest In Earnings -53,756 -39,259 -58,235 -61,142

Earnings From ContinuingOperations

12,954 -220,326 -398,425 104,176

NET INCOME -40,802 -259,585 -456,660 43,034

-

7/27/2019 Accounts Presentation on Electronics

12/35

RATIO ANALYSIS OF YEAR 2010

1. GROSS PROFIT RATIO=GROSS PROFIT X 100/ NET SALESGROSS PROFIT= 1664231 X 100 / 7213998

=23.44 MILLION YEN (RS 14.76 MILLION )

2. NET PROFIT RATIO = NPAT X 100 / NET SALES

NET PROFIT RATIO= 40802 X 100 / 72139980.56 MILLION YEN (RS 0.36 MILLION))3.OPERATING EXPENSES RATIO=OPERATING EXPENSES X 100 / NET SALES

OPERATING EXPENSES RATIO= 1480953 X 100 / 7213998

=20.52MILLION YEN ( RS 13.13 MILLION)

4.OPERATING RATIO= OPERATING EXPENSES+COGS X 100 / NET SALESOPERATING RATIO =14800953 + 4878217 X 100 / 7213998

=272.7 MILLION YEN (RS 174,5 MILLION)

-

7/27/2019 Accounts Presentation on Electronics

13/35

RATIO ANALYSIS FOR YEAR 2011

1. GROSS PROFIT RATIO= 1678873 X 100 / 7181273

=23.3 MILLION YEN (RS 15 MILLION)

2. NET PROFIT RATIO = 259585 X 100 / 7181273

=4.11 MILLION YEN ( RS 2.6 MILLION)3. OPERATING EXPENSES RATIO= 1468636 X 100 /7181273

= 23.3 MILLION YEN ( RS 14.9 MILLION)

4. OPERATING RATIO = 4826612 + 1468636 X 100 /7181273

=99.8 MILLION YEN (RS 6309 MILLION)

-

7/27/2019 Accounts Presentation on Electronics

14/35

RATIO ANALYSIS OF 2013

1. GROSS PROFIT RATIO= 1434544 X 100 / 677281921.1 MILION YEN ( RS 13 MILLION)

2. NET PROFIT RATIO = 43034 X 100 / 67728190.63 MILLION YEN (RS 0.4 MILLION)

3.OPERATING EXPENSES RATIO = 1413122 X 100 / 6772819 = 20.86MILLION YEN ( RS 13.65 MILLOIN)

4.OPERATING EXPENSES = 1413122 + 4482304 X 100 / 6772819= 27 MILLION YEN (RS 17.5 MILLOIN)

-

7/27/2019 Accounts Presentation on Electronics

15/35

-

7/27/2019 Accounts Presentation on Electronics

16/35

TOSHIBA

Toshiba Corporation is a Japanese multinationalengineering and electronics conglomerate corporationheadquartered in Tokyo, Japan. Its products and servicesinclude information technology and communicationsequipment and systems, electronic components and

materials, power systems, industrial and social infrastructuresystems, household appliances, medical equipment, officeequipment, lighting and logistics.HISTORY-Toshiba was founded in 1939 as Tokyo Shibaura ElectricK.K. through the merger of Shibaura Seisaku-sho (founded in1875) and Tokyo Denki (founded in 1890). The companyname was officially changed to Toshiba Corporation in 1978.Toshiba has made numerous corporate acquisitions during itshistory, including of Semp in 1977, of Westinghouse ElectricCompany in 2006, of Landis+Gyr in 2011, and of IBM's point-

of-sale business in 2012.

-

7/27/2019 Accounts Presentation on Electronics

17/35

-

7/27/2019 Accounts Presentation on Electronics

18/35

Liabilities

Current Liabilities 31 mar 2013 31 mar 2012 31 mar 2011

Accounts Payable 32,171,000 35,211,000 33,158,000

Short/Current Long Term Debt 8,667,000 14,206,000 11,542,000

Other Current Liabilities 4,980,000 5,628,000 5,194,000

Total Current Liabilities 45,820,000 55,046,000 49,895,000

Long Term Debt 9,965,000 9,262,000 9,800,000

Other Liabilities 62,591,000 63,294,000 56,727,000

Deferred Long Term LiabilityCharges

3,971,000 3,457,000 3,695,000

Minority Interest 5,133,000 5,604,000 4,689,000

Negative Goodwill - - -

Total Liabilities 127,481,000 136,664,000 124,805,000

-

7/27/2019 Accounts Presentation on Electronics

19/35

Assets 2009/3 2010/3 2011/3 2012/3 2013/3

Current assets

2,720,631 2,761,606 2,799,668 3,009,513 3,163,707

Long-termreceivables

534,853 622,854 660,380 701,225 706,188

Property, plantand equipment

1,089,579 978,726 900,205 851,365 884,680

Other assets

1,108,162 1,087,987 1,019,066 1,190,634 1,352,157

Total Assets

5,453,225 5,451,173 5,379,319 5,752,737 6,106,732

Li biliti d E it / / / / /

-

7/27/2019 Accounts Presentation on Electronics

20/35

Liabilities and Equity 2009/3 2010/3 2011/3 2012/3 2013/3

Short-term debt 1,033,884

257,364 311,762 326,141 433,128

Other current liabilities 2,033,8

89

2,231,081 2,186,547 2,343,421 2,310,596

Current Liabilities 3,067,773

2,488,445 2,498,309 2,669,562 2,743,724

Long-term debt 776,768 960,938 769,544 909,620 1,038,448

Other long-term

liabilities 849,403 874,168 931,850 943,344 908,038

Long-Term Liabilities 1,626,171

1,835,106 1,701,394 1,852,964 1,946,486

Equity attributable toshareholders of

Toshiba Corporation447,346 797,455 868,119 863,481 1,034,456

Equity attributable tononcontrollinginterests

311,935 330,167 311,497 366,730 382,066

Total Liabilities andEquity 5,453,225 5,451,173 5,379,319 5,752,737 6,106,732

-

7/27/2019 Accounts Presentation on Electronics

21/35

Balance sheet ratios

Fiscal YearEnds

31/03/09

31/03/10 31/03/11

31/03/12

31/03/13

NetGearing

% 327.90 119.24 94.74 118.30 122.04

QuickRatio

r 0.64 0.79 0.78 0.80 0.79

CurrentRatio

r 0.89 1.11 1.12 1.13 1.15

Fi l Y

-

7/27/2019 Accounts Presentation on Electronics

22/35

Fiscal YearEnds 31/03/09 31/03/10 31/03/11 31/03/12 31/03/13

Turnover6,654,567 6,291,208 6,398,505 6,100,262 5,800,281

Expenses

6,933,770 6,256,795.

00

6,202,956.

00

5,954,683.

00

5,644,728

EBITDA-9,436 340,755.00 446,374.00 381,773.00 358,742

EBIT

-359,200 41,757.00 186,770.00 132,127.00 140,990

OperatingProfit(reported)

-279,252 34,413.00 195,549.00 145,579.00 155,5665

OperatingProfit(adjusted)

-362,995 56,207.00 195,571.00 142,134.00 159,183

InvestmentIncome

9,596 22,385.00 18,478.00 17,035.00 21,560

ExceptionalItems

83,743 -21,794.00 -22.00 3,445.00 -3,630

Pre-taxProfit

-279,252 34,413 195,549 145,579 155,566

54 323 0 33 534 0 40 720 0 64 223 0 59 827 0

-

7/27/2019 Accounts Presentation on Electronics

23/35

Tax54,323.0

0

33,534.0

0

40,720.0

0

64,223.0

0

59,827.0

0

Profit After Tax

-333,575 879.00 154,829.00

81,356.00 95,726.00

Minority

Interests

-3,795 14,450.00 8,801.00 10,007.00 18,193.00

Profit ForFinancial Year

-343,5 -19,743.00

137,845.00

70,054.00 77,533.00

OrdinaryDividends

35,592 0.00 8,470.00 29,645.00 33,879.00

Retained Profit

-379,151 -19,743.00

129,375.00

40,409.00 43,654.00

Per Share Data

Dividend perShare c

500 0.00 200.00 0.00 360.00

NormalizedEPS c

-12780 202.20 3317.50 1581.74 1916.72

Reported EPS c-10192 -342 3317.00 1662.00 1831.00

Norm

DiscontinuedEPS c

-426 -151 -185.00 -30.00 0.00

31/03/1

-

7/27/2019 Accounts Presentation on Electronics

24/35

Fiscal Year Ends 31/03/09 31/03/1031/03/1

1 31/03/12 31/03/13

Net Tangible Asset ValuePer Share

-5639.41

4219.73 7293.20

3303.55 2718

Operating Margin

-5.39 0.98 2.63 2.40 2

Profit Margin

-5.46 0.89 3.06 2.33 2.74

ROE -35.44 0.54 9.11 4.13 4.64

ROCE-12.38 3.75 8.03 6.90 7.15

Net Gearing327.90 119.24 94.74 118.30 122.04

Gross Gearing

404.75 152.77 124.56 143.11 142.26

Dividend Cover-25.56 - 16.59 - 5.32

Interest Cover-9.77 2.58 - 5.47 5.87

Quick Ratio0.64 0.79 0.78 0.80 0.79

Current Ratio0.89 1.11 1.12 1.13 1.15

-

7/27/2019 Accounts Presentation on Electronics

25/35

-

7/27/2019 Accounts Presentation on Electronics

26/35

PANASONIC

Panasonic Corporation, formerly known as MatsushitaElectric Industrial Co., Ltd. , is aJapanese multinational electronics corporationheadquartered in Kadoma, Osaka, Japan.The company was founded in 1918, and has grown to become

one of the largest Japanese electronics producersalongside Sony, Toshiba, Sharp Corporation, and Canon. Inaddition to electronics, it offers non-electronic products andservices such as home renovation services.Panasonic isthe world's fourth-largest television manufacturer by 2012market share.

Panasonic has a primary listing on the Tokyo StocKExchange and is a constituent ofthe Nikkei225 and TOPIX indices. It has a secondary listingon the Nagoya Stock Exchange.

-

7/27/2019 Accounts Presentation on Electronics

27/35

HISTORY

Panasonic was founded in 1918 by Konosuke Matsushita as avendor of duplex lamp sockets. In 1927, it began producingbicycle lamps, the first product which it marketed under thebrand nameNational. During World War II the companyoperated factories in Japan and other parts of Asia which

produced electrical components and appliances such as lightfixtures, motors, and electric irons.

After World War II, Panasonic regrouped and began to supplythe post war boom in Japan with radios and appliances, as

well as bicycles. Matsushita's brother-in-law, Toshio Iue,founded Sanyo as a subcontractor for components after World

War II. Sanyo grew to become a competitor to Panasonic, butwas later acquired by Panasonic in December 2009.

Panasonic AppliancesIndia Company

-

7/27/2019 Accounts Presentation on Electronics

28/35

Mar'12

Mar '11 Mar '10 Mar '09 Mar '08

12mths

12 mths 12 mths 12 mths 12 mths

Sources Of Funds

Total Share Capital 8.57 8.57 8.57 8.57 8.57

Equity Share Capital 8.57 8.57 8.57 8.57 8.57Share Application Money 0.00 0.00 0.00 0.00 0.00

Preference Share Capital 0.00 0.00 0.00 0.00 0.00

Reserves -1.77 11.00 10.20 9.27 9.05

Revaluation Reserves 0.00 0.00 0.00 0.00 0.00

Networth 6.80 19.57 18.77 17.84 17.62

Secured Loans 31.56 17.30 5.56 1.69 2.34

Unsecured Loans 0.67 1.00 1.00 0.11 0.30

Total Debt 32.23 18.30 6.56 1.80 2.64

Total Liabilities 39.03 37.87 25.33 19.64 20.26

Mar'12

Mar '11 Mar '10 Mar '09 Mar '08

12mths

12 mths 12 mths 12 mths 12 mths

Application Of Funds

Gross Block 58.55 51.02 38.08 29.84 28.66

Less: Accum. Depreciation 25.92 22.82 20.49 18.89 17.34

Net Block 32.63 28.20 17.59 10.95 11.32

Capital Work in Progress 0.13 0.21 0.95 2.49 0.00

Investments 0.00 0.00 0.00 0.00 0.19

Inventories 15.85 18.62 14.48 13.33 11.03

Sundry Debtors 29.65 21.43 15.48 7.11 6.52

Cash and Bank Balance 0.17 0.85 0.39 0.21 0.25Total Current Assets 45.67 40.90 30.35 20.65 17.80

Loans and Advances 7.13 9.97 8.32 7.08 5.55

Fixed Deposits 0.00 0.00 0.00 1.85 5.11

Total CA, Loans & Advances 52.80 50.87 38.67 29.58 28.46

Deffered Credit 0.00 0.00 0.00 0.00 0.00

Current Liabilities 45.18 34.02 25.49 17.25 13.99

Provisions 1.38 7.39 6.40 6.14 5.71

Total CL & Provisions 46.56 41.41 31.89 23.39 19.70

Net Current Assets 6.24 9.46 6.78 6.19 8.76

Miscellaneous Expenses 0.00 0.00 0.00 0.00 0.00

Total Assets 39.00 37.87 25.32 19.63 20.27

Contingent Liabilities 2.26 0.66 0.28 0.64 0.31

Book Value (Rs) 7.93 22.83 21.91 20.81 20.57

India Company

Standalone BalanceSheet

------------------- in Rs. Cr. -------------------

Panasonic AppliancesIndia Company

Previous Years

-

7/27/2019 Accounts Presentation on Electronics

29/35

India Company

Standalone Profit & Loss account ------------------- in Rs. Cr. -------------------

Mar

'12Mar '11 Mar '10 Mar '09 Mar '08

12

mths12 mths 12 mths 12 mths 12 mths

Income

Sales Turnover 198.78 201.77 144.72 109.91 89.56

Excise Duty 19.16 15.43 9.67 10.73 10.96

Net Sales 179.62 186.34 135.05 99.18 78.60Other Income 0.42 0.15 -0.17 0.09 0.35

Stock Adjustments -3.20 3.27 -1.29 -0.08 2.42

Total Income 176.84 189.76 133.59 99.19 81.37

Expenditure

Raw Materials 115.62 115.85 72.82 56.30 47.26

Power & Fuel Cost 5.17 3.90 2.79 1.81 1.48

Employee Cost 18.37 15.47 11.97 8.93 7.14

Other Manufacturing Expenses 0.58 2.27 1.97 1.17 0.72

Selling and Admin Expenses 0.00 42.84 36.07 25.02 19.09

Miscellaneous Expenses 42.99 1.66 1.39 1.16 0.88

Preoperative Exp Capitalised 0.00 0.00 0.00 0.00 0.00

Total Expenses 182.73 181.99 127.01 94.39 76.57

Mar

'12Mar '11 Mar '10 Mar '09 Mar '08

12

mths12 mths 12 mths 12 mths 12 mths

Operating Profit -6.31 7.62 6.75 4.71 4.45

PBDIT -5.89 7.77 6.58 4.80 4.80

Interest 3.68 2.40 1.12 0.63 0.56

PBDT -9.57 5.37 5.46 4.17 4.24

Depreciation 3.18 2.75 2.27 1.85 1.50

Other Written Off 0.00 0.00 0.00 0.00 0.00

Profit Before Tax -12.75 2.62 3.19 2.32 2.74

Extra-ordinary items -0.03 0.16 0.00 0.50 0.07

PBT (Post Extra-ord Items) -12.78 2.78 3.19 2.82 2.81

Tax 0.00 0.83 1.06 1.17 1.08

Reported Net Profit -12.77 1.79 1.93 1.42 1.45

Total Value Addition 67.11 66.14 54.18 38.09 29.31

Preference Dividend 0.00 0.00 0.00 0.00 0.00

Equity Dividend 0.00 0.86 0.86 1.03 0.86

Corporate Dividend Tax 0.00 0.14 0.14 0.17 0.15

Per share data (annualised)

Shares in issue (lakhs) 85.70 85.70 85.70 85.70 85.70

Earning Per Share (Rs) -14.90 2.09 2.26 1.65 1.69Equity Dividend (%) 0.00 10.00 10.00 12.00 10.00

Book Value (Rs) 7.93 22.83 21.91 20.81 20.57

Fi ed Assets T rno er Ratio 3 16 3 70 3 60 3 39 2 79

-

7/27/2019 Accounts Presentation on Electronics

30/35

Fixed Assets Turnover Ratio 3.16 3.70 3.60 3.39 2.79

Total Assets Turnover Ratio 4.82 5.00 5.46 5.21 3.97

Asset Turnover Ratio 4.67 3.70 6.01 4.97 4.06

Average Raw Material Holding -- 29.44 39.00 28.07 33.57

Average Finished Goods Held -- 23.98 25.08 41.51 37.25

Number of Days In Working Capital 12.53 18.27 18.09 22.50 40.10

Profit & Loss Account Ratios

Material Cost Composition 64.36 62.17 53.91 56.76 60.13

Imported Composition of RawMaterials Consumed

28.22 30.58 32.30 22.78 11.67

Selling Distribution CostComposition

-- 19.23 22.58 20.95 20.06

Expenses as Composition of TotalSales

10.10 7.05 1.36 1.44 1.40

Cash Flow Indicator Ratios

Dividend Payout Ratio Net Profit -- 55.57 51.67 84.92 69.19

Dividend Payout Ratio Cash Profit -- 21.91 23.79 36.85 33.95

Earning Retention Ratio -- 33.13 53.23 -17.62 35.88

Cash Earning Retention Ratio -- 76.53 77.31 58.09 67.32AdjustedCash Flow Times -- 4.31 1.49 0.63 0.86

Mar'12

Mar '11 Mar '10 Mar '09 Mar '08

Earnings Per Share -14.90 2.09 2.26 1.65 1.69

Book Value 7.93 22.83 21.91 20.81 20.57

-

7/27/2019 Accounts Presentation on Electronics

31/35

-

7/27/2019 Accounts Presentation on Electronics

32/35

SAMSUNG

Samsung Group is a SouthKorean multinational conglomerate companyheadquartered in Samsung Town, Seoul. It comprisesnumerous subsidiaries and affiliated businesses, most ofthem united under theSamsung brand, and is the largest

South Korean business conglomerate.Samsung was founded by Lee Byung-chulin 1938 asa trading company. Over the next three decades thegroup diversified into areas including food processing,textiles, insurance, securities and retail. Samsung

entered the electronics industry in the late 1960s and theconstruction and shipbuilding industries in the mid-1970s; these areas would drive its subsequent growth.

-

7/27/2019 Accounts Presentation on Electronics

33/35

HISTORY

In 1938, Lee Byung-chull (19101987) of a largelandowning family in the Uiryeong county came to thenearby) Daegu city and foundedSamsung Sangho , a smalltrading company with forty employees located in Su-dong(now Ingyo-dong). It dealt in groceries produced in andaround the city and produced its own noodles. Thecompany prospered and Lee moved its head office to Seoulin 1947.

In the late 1960s, Samsung Group entered into the

electronics industry. It formed several electronics-relateddivisions, such as Samsung Electronics Devices Co.,Samsung Electro-Mechanics Co., Samsung Corning Co.,and Samsung Semiconductor & Telecommunications Co.,and made the facility in Suwon. Its first product was a

black-and-white television set.

PROFIT AND LOSS A/C OF SAMSUNG

-

7/27/2019 Accounts Presentation on Electronics

34/35

PROFITAND LOSS A/C OF SAMSUNGCurrency inMillions of US Dollars

As of:

Dec 312009RestatedUSD

Dec 312010ReclassifiedUSD

Dec 312011RestatedUSD

Dec 312012USD

4 YearTrend

Revenues 126,999.1 144,053.6 153,715.6 187,348.1

TOTAL REVENUES 126,999.1 144,053.6 153,715.6 187,348.1

Cost Of Goods Sold 88,124.6 95,644.4 104,474.4 117,988.9

GROSS PROFIT 38,874.6 48,409.2 49,241.3 69,359.2

Selling General & Admin Expenses, Total 21,764.1 24,448.1 24,769.9 30,811.3

R&D Expenses 6,881.5 8,477.0 9,274.2 10,744.0

Depreciation & Amortization, Total -- -- 622.9 741.5

Other Operating Expenses 58.0 -248.7 -- --

OTHER OPERATING EXPENSES, TOTAL 28,703.6 32,676.4 34,667.0 42,296.8

OPERATING INCOME 10,171.0 15,732.8 14,574.2 27,062.4

Interest Expense -498.7 -541.3 -600.1 -558.0

Interest And Investment Income 362.5 550.5 689.5 886.5

NET INTEREST EXPENSE -136.2 9.2 89.4 328.5

Income (Loss) On Equity Investments 1,596.1 2,112.0 1,303.5 919.1

Currency Exchange Gains (Loss) -173.8 -167.4 -619.3 -134.1

Other Non-Operating Income (Expenses) -80.3 -30.1 -269.3 236.1

EBT, EXCLUDING UNUSUAL ITEMS 11,376.9 17,656.5 15,078.5 28,412.0

Impairment Of Goodwill 143 4 170 6 190 7

-

7/27/2019 Accounts Presentation on Electronics

35/35

Impairment Of Goodwill -- -143.4 -170.6 -190.7

Gain (Loss) On Sale Of Investments 41.9 384.4 208.2 24.6

Gain (Loss) On Sale Of Assets -61.1 173.5 994.2 -165.2

Other Unusual Items, Total -- -64.4 -94.2 -211.8

EBT, INCLUDING UNUSUAL ITEMS 11,357.7 18,006.6 16,016.0 27,868.8

Income Tax Expense 2,264.8 2,964.5 3,198.1 5,654.6

Minority Interest In Earnings -176.0 -323.7 -350.7 -614.8

Earnings From Continuing Operations 9,092.9 15,042.1 12,817.9 22,214.3

NET INCOME 8,916.9 14,718.4 12,467.3 21,599.5

NET INCOME TO COMMON INCLUDINGEXTRA ITEMS 7,720.9 12,765.4 10,819.0 18,753.1

NET INCOME TO COMMON EXCLUDING

EXTRA ITEMS7,720.9 12,765.4 10,819.0 18,753.1