Accounting Bellwork 3 rd Hour: How is the Income Summary account different from other temporary...

-

Upload

alban-ellis -

Category

Documents

-

view

214 -

download

0

Transcript of Accounting Bellwork 3 rd Hour: How is the Income Summary account different from other temporary...

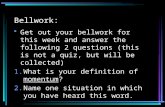

Accounting BellworkAccounting Bellwork

3rd Hour: How is the Income Summary account different from other temporary capital accounts?

1. It is used only at the end of the fiscal year to summarize the balances from the revenue and expense accounts.

2. It does not have a normal balance, which means that it does not have an increase or a decrease side.

Accounting BellworkAccounting Bellwork

Section 2 Posting Closing Entries and Preparing a Post-Closing Trial Balance

Section 2 Posting Closing Entries and Preparing a Post-Closing Trial Balance

What You’ll Learn

How to record closing entries in the general ledger. The purpose of the Income Summary account.

The purpose of a post-closing trial balance.

How to prepare a post-closing trial balance.

What You’ll Learn

How to record closing entries in the general ledger. The purpose of the Income Summary account.

The purpose of a post-closing trial balance.

How to prepare a post-closing trial balance.

Why It’s Important

A post-closing trial balance verifies

that the closing entries are properly

recorded in the general ledger and that

you are ready to start the next

accounting period.

Why It’s Important

A post-closing trial balance verifies

that the closing entries are properly

recorded in the general ledger and that

you are ready to start the next

accounting period.

Section 2 Posting Closing Entries and Preparing a Post-Closing Trial Balance (con’t.)

Section 2 Posting Closing Entries and Preparing a Post-Closing Trial Balance (con’t.)

Key Term

post-closing trial balance

Key Term

post-closing trial balance

Completing the Eighth Step in the Accounting Cycle: Posting Closing Entries to the General Ledger

Completing the Eighth Step in the Accounting Cycle: Posting Closing Entries to the General Ledger

Section 2 Posting Closing Entries and Preparing a Post-Closing Trial Balance (con’t.)

Section 2 Posting Closing Entries and Preparing a Post-Closing Trial Balance (con’t.)

Only difference is

that you write the word

closing in the description

column.

The Ninth Step in the Accounting Cycle: Preparing a Post-Closing Trial Balance

The Ninth Step in the Accounting Cycle: Preparing a Post-Closing Trial Balance

Section 2 Posting Closing Entries and Preparing a Post-Closing Trial Balance (con’t.)

Section 2 Posting Closing Entries and Preparing a Post-Closing Trial Balance (con’t.)

Prepared to make sure total debits equal total credits after the closing entries are posted.

Only accounts with balances are listed (permanent accounts).

Prepared to make sure total debits equal total credits after the closing entries are posted.

Only accounts with balances are listed (permanent accounts).

Allison’s Repair ShopPost-Closing Trial Balance

December 31, 200-13255.--101 Cash In Bank

Specific date.

123.--105 Accounts Receivable-C. Smythe900.--110 Accounts Receivable-Bell & Sons

3100.--115 Computer Equipment5500.--120 Repair Equipment

800.--201 Accounts Payable -Midtown Computers395.--205 Accounts Payable –Nagle Supplies

21683.--301 A. Degaro, Capital22878.--Total 22878.--

Check Your Understanding p.246.

Check Your Understanding p.246.

•Thinking Critically 1 & 2

•Problem 10-3 and 10-4

•p248, Understanding Accounting

Concepts and Procedures 1-14.

•Audit with Alex

•Thinking Critically 1 & 2

•Problem 10-3 and 10-4

•p248, Understanding Accounting

Concepts and Procedures 1-14.

•Audit with Alex

Section 2 Posting Closing Entries and Preparing a Post-Closing Trial Balance (con’t.)

Section 2 Posting Closing Entries and Preparing a Post-Closing Trial Balance (con’t.)

![Bellwork [3min]](https://static.fdocuments.net/doc/165x107/568161a6550346895dd16350/bellwork-3min.jpg)