Accounting Bellwork

-

Upload

thaddeus-lowery -

Category

Documents

-

view

41 -

download

1

description

Transcript of Accounting Bellwork

Accounting BellworkAccounting Bellwork

3rd Hour: A Matter of Ethics p213.

Section 3 The Balance Sheet

Section 3 The Balance Sheet

What You’ll Learn

The purpose of a balance sheet.

How to prepare a balance sheet.

How to analyze information on

financial reports.

What You’ll Learn

The purpose of a balance sheet.

How to prepare a balance sheet.

How to analyze information on

financial reports.

Why It’s Important

The balance sheet reports the financial position of a business at a specific point in time.

Why It’s Important

The balance sheet reports the financial position of a business at a specific point in time.

Section 3 The Balance Sheet (con’t.)Section 3 The Balance Sheet (con’t.)

Key Terms balance sheet report form ratio analysis profitability ratio return on sales

Key Terms balance sheet report form ratio analysis profitability ratio return on sales

liquidity ratio current ratio current assets current liabilities quick ratio

liquidity ratio current ratio current assets current liabilities quick ratio

The Balance Sheet

The balance sheet is a report of

the balances in all asset, liability,

and owner’s equity accounts at the

end of the period.

Balancing the ALOE

The Balance Sheet

The balance sheet is a report of

the balances in all asset, liability,

and owner’s equity accounts at the

end of the period.

Balancing the ALOE

Section 3 The Balance Sheet (con’t.)Section 3 The Balance Sheet (con’t.)

The Balance Sheet (con’t.)

The balance sheet represents the

basic accounting equation; thus, the

assets section total must equal the

total of the liabilities and owner’s

equity sections. It is prepared in

report form

The Balance Sheet (con’t.)

The balance sheet represents the

basic accounting equation; thus, the

assets section total must equal the

total of the liabilities and owner’s

equity sections. It is prepared in

report form

Section 3 The Balance Sheet (con’t.)Section 3 The Balance Sheet (con’t.)

Assets = Liabilities + Owner’s EquityAssets = Liabilities + Owner’s Equity

The Balance Sheet (con’t.)The Balance Sheet (con’t.)

Section 3 The Balance Sheet (con’t.)Section 3 The Balance Sheet (con’t.)

Point in time

Make sure and get this total from the Statement of Changes In Owners Equity Ending Capital Total

Ratio AnalysisRatio Analysis

Section 3 The Balance Sheet (con’t.)Section 3 The Balance Sheet (con’t.)

Ratio analysis involves the

comparison of two amounts on

a financial statement and the

evaluation of the relationship

between these amounts.

Used to determine the financial

strength, activity, or debt-

paying ability of a business.

Ratio analysis involves the

comparison of two amounts on

a financial statement and the

evaluation of the relationship

between these amounts.

Used to determine the financial

strength, activity, or debt-

paying ability of a business.

Ratio Analysis con’t.Ratio Analysis con’t.

Section 3 The Balance Sheet (con’t.)Section 3 The Balance Sheet (con’t.)

Profitability ratios are used to

evaluate the earnings

performance of the business

during the accounting period.

Profitability ratios are used to

evaluate the earnings

performance of the business

during the accounting period.

Return on SalesReturn on Sales

Section 3 The Balance Sheet (con’t.)Section 3 The Balance Sheet (con’t.)

Determine the portion of each sales

dollar that represents profit.

Determine the portion of each sales

dollar that represents profit.

Net Income $1,150 net income

Sales $2,650 sales

Net Income $1,150 net income

Sales $2,650 sales= = .434 or 43.4%= = .434 or 43.4%

For every dollar of sales you make

43.4 cents of profit.

For every dollar of sales you make

43.4 cents of profit.

Current RatioCurrent Ratio

Section 3 The Balance Sheet (con’t.)Section 3 The Balance Sheet (con’t.)

Relationship between current assets (Accts Rec.,

Cash in Bank, Merchandise Inventory) and current

liabilities {Accts. Payables (Must be paid within

the next accounting period.)}.

Relationship between current assets (Accts Rec.,

Cash in Bank, Merchandise Inventory) and current

liabilities {Accts. Payables (Must be paid within

the next accounting period.)}.

Current Assets $ 37,775

Current Liabilities $11,725

Current Assets $ 37,775

Current Liabilities $11,725= Current Ratio = 3.22 or 3.2:1= Current Ratio = 3.22 or 3.2:1

This ratio indicates that a business is able to pay its debts, that business has current assets which are 3.2 times its current liabilities.

This ratio indicates that a business is able to pay its debts, that business has current assets which are 3.2 times its current liabilities.

Quick RatioQuick Ratio

Section 3 The Balance Sheet (con’t.)Section 3 The Balance Sheet (con’t.)

Cash and Receivables $ 22,575

Current Liabilities $11,725

Cash and Receivables $ 22,575

Current Liabilities $11,725= Quick Ratio = 1.92:1= Quick Ratio = 1.92:1

If a business has a quick ratio of 1:1 or

higher, the business has $1 in liquid

assets for each $1 of its current liabilities.

In this case, the business has $1.92 in liquid assets per $1 in current liabilities.

If a business has a quick ratio of 1:1 or

higher, the business has $1 in liquid

assets for each $1 of its current liabilities.

In this case, the business has $1.92 in liquid assets per $1 in current liabilities.

The relationship between short

term assets (can be quickly turned

to cash) and current liabilities.

The relationship between short

term assets (can be quickly turned

to cash) and current liabilities.

Demonstration Problems Ch9

Problem 9-5 through 9-7

Missing 9-6 & 9-7

Prime Printing Co.Balance SheetJune 30, 200-

AssetsCash in BankAccts. Receivable- Jack DipollaAccts. Receivable- Susan HillowayOffice FurnitureOffice EquipmentAutomobile

Total Assets

Accts. Payable – Fucini Corp.Accts. Payable – H&L Co.

Total LiabilitiesWayne Kay, Capital

Total Liabilities & O.E.

4029.45218.41173.64

2432.174106.808124.--

19084.47

1619.432704.81

4324.24

14760.23Owner’s Equity

Liabilities

19084.47

Prime Printing Co.Worksheet

For the Month ended June 30, 200-

Extra Ratio Demo Problems

Current AssetsCurrent Liabilities

80,000 + 115,000 + 75,000 = 270,000 270,000

115,0002.35=2.35:1

The business has current assets that are 2.35 times the liabilities.

Cash and Receivables

Current Liabilities

80,000 + 115,000 = 195,000195,000

115,0001.70=

1.70:1The business has $1.70 in liquid assets for each $1 in current liabilities.

Net Income

Net Sales

190,000

1,320,000.1439 =14.39%==

The percentage indicates that for each dollar of sales produced, 14.39 cents in profit.

Check Your Understanding p222

Check Your Understanding p222

•Thinking Critically 1 & 2

•Problem 9-3

•Understanding Accounting

Concepts and Procedures p224

•Thinking Critically 1 & 2

•Problem 9-3

•Understanding Accounting

Concepts and Procedures p224

Section 1 Preparing the Work Sheet (con’t.)Section 1 Preparing the Work Sheet (con’t.)

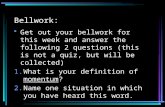

![Bellwork [3min]](https://static.fdocuments.net/doc/165x107/568161a6550346895dd16350/bellwork-3min.jpg)