A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars...

-

Upload

babasab-patil-karrisatte -

Category

Documents

-

view

221 -

download

0

Transcript of A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars...

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

1/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

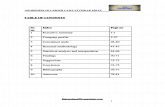

Contents

Part 1 Page no

Exucutive summary 5

Part 2

Tables and Charts

Table no 1 Income statement 43

Table no 2 Profit volume ratio 44

Table no 3 Break even sale 48

Table no 4 Margin of safety 50

Table no 5 Calcution of NOPAT 2007 58

Table no 6 Computtatio of WACC 2007 59

Table no 7 Calcution of NOPAT 2008 60

Table no 8 Computtatio of WACC 2008 61

Table no 9 Calcution of NOPAT 2009 62

Table no 10 Computtatio of WACC 2009 63

Table no 11 Total three years NOPAT 64

Table no 12 Total three years WACC 66

Table no 13 Total three years EVA 68

Table no 14

Consolidated statement of EVA

& N/P 70

Charts

Charts no 1 Income statement 44

Charts no 2 Profit volume ratio 46

Charts no 3 Break even sales 48

Charts no 4 Margin of safety 50

Charts no 5 Total NOPAT 65

Charts no 6 Total WACC 67

Babasabpatilfreepptmba.com1

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

2/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

Charts no 7 Total EVA 68

Charts no 8

Consolidated statement of

EVA & N/P 70

Part 2

Introduction

Profile sugar industry 7-11

Company profile 12-15

Organisation structure 16-23

Departmetwise study 24

Swot analysis 38-39

Part 3

Objectives & Reasearch

designs

Methodology of the study 40

Part 4

Analysis & Interpretation 41-70

Part 5

Findings 71

Suggestions 72

Part 6

Conclusion 73

Part 7

Bibliography 74

Part 8

Annexure 75

Babasabpatilfreepptmba.com2

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

3/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

Babasabpatilfreepptmba.com3

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

4/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

Exucutive summary

The group of SSL was established in rural area for improve of all communities.

Satish Sugars Ltd. (SSL) established with the major objective of serving the

society through economic development and the main motto being Growing

with farmers. SSL has today grown to become a dynamic company that makes

a fine case of youthful spirit and farsighted vision. The Company covered the

path of success adopting innovative approach.

Babasabpatilfreepptmba.com4

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

5/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

This study showing the minimum level of sales to cover the

cost,and effect on the company, flunctuation in profit volume ratio. And also

helps to know the true value of the compny. The study also helps to get more

information like increasing in sales every year, good profit of the company.

Satish sugars economi value added showing negative in 2007 because thecompany has taken major expantion during the year with the help term loan

financial institutions

TITLE OF THE STUDY :

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

Financial statements provide summarized view of the financial position of

the company. That include investors, creditors, lenders, suppliers etc. Many

peoples are interested in financial statement analysis to know about the financial

cost volume profit and economic value added focused on measuring the

economic performance of the compay.

The study will reveal on the financial performance of the company which

enables the management to know their variation of cost and profit with

sales.Economic reports are the diagnostic instruments, they indicate whether

thecurrent strategies of the company is satisfactory or whether a decision

should be made to do something about the business to expand it or to change its

direction or to sell it. The economic analysis of an individual business unity may

reveal that current plan for new strategies.

.

Babasabpatilfreepptmba.com5

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

6/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

INDUSTRY PROFILE

Babasabpatilfreepptmba.com6

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

7/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

The Historical Background Of The Indian Sugar Industry:

The sugar industry is proud to be an industry, which spreads the taste of

sweetness to the mankind. The history of origin of this industry is as old as the

history of main him self. Sugar is generally made from sugarcane and beet. In

India, sugar is produced mainly from sugarcane. India had introduced sugarcane

all over the worlds and is a leading country in the making sugar from sugarcane.

Saint Vishwamitra is known as the research person of the sugarcane in

religious literature. We can find the example of sugarcane in Vedic literature

also as well as sugarcane. We can also find the reference of sugar and the

sugarcane in Patanjalis Mahabashya and the treaty on the grammar of

Panini. Greek traveler Niyarchus and Chinese traveler Tai-Sung have

mentioned in their travelogue that the people of India used to know the

methods of making sugar and juice from sugarcane the great Emperor

Alexander also carried sugarcane with him while returning to his country.

Thus from different historical references and from some Puranas it can be

concluded that method of making sugar from sugarcane was known To the

people of Bihar. The historical evidences of sugar industry prospering in

Babasabpatilfreepptmba.com7

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

8/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

ancient India concrete and this has helped to develop and prosper the co-

operative sugar movement in India.

National Scenario Of Sugar Industry:

The first sugar mill in the country was set up in 1903 in the United

Provinces. There are 566 installed sugar mills, of which 453 were in operation

in the year 2002-03 and utilized 194.4 million ton of sugarcane (69% of total

cane production) to produce 20.14 million tons of sugar. About 5 lakh workmen

are directly employed in the sugar. About 5 lakh workmen are directly

employed in the sugar industry besides many in industries, which utilize by-

products of sugar industry as raw material.

India is the largest consumer and second largest producer of sugar in the

world. The Indian sugar industry is the second largest agro-industry located in

the rural India. Indian sugar industry has been a focal point for socio-economic

development in the rural areas. About 50 million sugarcane farmers and a large

number of agricultural laborers are involved in sugarcane cultivation and

ancillary activities, constituting 7.5% of the rural population. Besides, the

industry provides employment to about 2 million skilled/semi skilled workers

and others mostly from the rural areas. The industry not only generates power

for its own requirement but surplus power for export to the grid based on by-

productBagasse. It also produces ethyl alcohol, which is used for industrial and

potable uses, and can be used to the manufacture Ethanol, an ecology friendly

and renewable fuel for blending with petrol.

The sugar industry in the country uses only sugarcane as input, hence

sugar companies have been established in large sugarcane growing states like

Uttar Pradesh, Maharashtra, Karnataka, Gujarat, Tamil Nadu, and Andhra

Pradesh. In sugar year 2003-04,these six states contribute more than 85%of total

sugar production in the country; Uttar Pradesh, Maharashtra, and Karnataka

together contribute more than 65%of total production.

The government of India licensed new units with an initial capacity of

1250 TCD up to the 1980s and with the revision in minimum economic size to

2500 TCD, the Government issued licenses for setting up of 2500 TCD plants

Babasabpatilfreepptmba.com8

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

9/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

thereafter. The government de-licensed sugar sector in the year of

11.September.1988. The entrepreneurs have been allowed to set up sugar

factories of expand the existing sugar factories as per the techno-economic

feasibility of the project. However, they are required to maintain a radial

distance of 15 kms from the existing sugar factory. After de-licensing, a number

of new sugar plants of varying capacities have been set up and the existing

plants have substantially increased their capacity.

There are 566 installed sugar mills in the country as on March 31 st 2005 ,

with a production capacity of 180 lack MTs of sugar, of which only 453 are

working. These mills are located in 18 states of the country.

International Scenario of Sugar Industry:

Sugar is produced in 110 countries. The leading sugarcane producing countries

are Brazil, India, Australia, Thailand, China and Cuba.

Sugar is extracted from two different raw materials, sugarcane and beet.

Both produce identical refined sugar. Sugarcane is grown in semi-tropical

regions, and accounts for around two-thirds of world accounts for the balance

one third of world production. The Russian Federation, Ukraine and Europe

account for around 80 per count of total beet sugar production. In addition to

weather conditions, diseases, insects, and quality of soil, international trade

agreements and domestic price support programmers affect production of

sugarcane and beet.

International Sugar Industry:

Demand- Supply:

Babasabpatilfreepptmba.com9

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

10/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

Brazil and India are the largest sugar producing countries followed by

China, USA, Thailand, Australia, Mexico, Pakistan, France and Germany.

Global sugar production increased from approximately 125.88 MMT in

1995-1996 to 149.4 MMT in 2002-2003 and then declined to 143.7 MMT

in 2003-2004, whereas consumption increased steadily from 118.1 MMT in

1995-1996 to 142.8 MMT in 2003-2004 as shown in below given chart.

The word consumption is projected to grow to 160.7 MMT by 2010 and

176.1 MMT by 2015.

The worlds largest consumers of sugar are India, China, Brazil, USA,

Russia, Mexico, Pakistan, Indonesia, Germany and Egypt. According to USDA

Foreign Agriculture Service, the consumption of sugar in Asian countries has

increased at a faster rate, as a direct result of increasing population, increasing

per capita income and increased availability.

Babasabpatilfreepptmba.com10

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

11/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

Contribution of Sugar Industry to Indian Economy:

Sugar industry contributes about Rs.1650 crores to the Central

Exchequer as excise duty and other taxes annually. In addition, about Rs.600

crores is realized by the State Governments annually through purchase tax and

cess on cane. At the prevailing sugarcane price, the total sugar cane produced in

the country value at about Rs.24000 crores per year.

World Sugar Trade:

Word trade in raw sugar is typically around 22 MMT and white sugar

around 16 MMT. Brazil is the largest importer, followed by EU, Thailand,

Australia and Cuba. The largest importers are Russia, Indonesia, UK, South

Korea, Japan, Malaysia, the Middle East, and North Africa.

Sugar Prices:

Babasabpatilfreepptmba.com11

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

12/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

World sugar prices fell steadily from 1994-1995 till 1998-1999 and have

been almost stable at those levels. The trend seems to have now reversed and

refined sugar prices have increased by 30% in the last 5 quarters from 9.16

cents per pound in January, 2004 to 12.02 cents in March,2005 (Source: USDA

Foreign Agriculture Services).

Sugarcane Availability:

Table showing sugar cane availability in cultivated area:

Year Cultivated area (%) MMT

1980-81 2.7 154

1990-91 - 241

2000-01 - 296

2002-03 4.3 300

2003-04 3.9 -

2004-05 3.7 236

Sugarcane occupies about 2.7% of the total cultivated area and it is one of the

most important cash crops in the country. The area under sugarcane gradually

increased from 2.7 million hectares in 1980-81 to 4.3 million hectares in 2002-

03, mainly because of much larger diversion of land from other crops to

sugarcane by the farmers for economic reasons. The sugarcane area, however,

declined in the year 2003-04 to 3.9 million hectares and to 3.7 million hectares

in 2004-05, mainly due to drought and pest attacks. From a level of 154 MMT

in 1980-1981, the sugarcane production increased to 241 MMT in 1990-1991

and further to 296 MMT in 2000-2001. Since then, it has been hovering around

300 MMT until last year. In the season 2003-2004, however, sugarcane

production declined to 236 MMT mainly due to drought and pest attacks. Not

only sugarcane acreage and sugarcane production has been increasing, even

Babasabpatilfreepptmba.com12

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

13/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

drawal of sugarcane by the sugar industry has also been increasing over the

years. In India, sugarcane is utilized by sugar mills as well as by traditional

sweeteners like guru and khandsari producers. However, the diversion of

sugarcane to guru and khandsari is lower in states of Maharashtra and

Karnataka, as compared to Northern states like UP.

SUGARCANE UTILIZATION

Year

% Sugarcane utilization for

White Sugar Guru and

Khandsari

Seed, feed

and chewing

1980-1981 33.4 54.8 11.8

1990-1991 50.7 37.4 11.8

2000-2001 59.7 28.8 11.5

2001-2002 57.4 31.5 11.1

2002-2003 68.9 20.1 11.1

2003-2004 56.1 32.5 11.4

Sugar Production:

Most of the sugar in India is manufactured and sold as White

Crystal Sugar which is produced by Double Suspiration Process, while the

norm in developed and emerging nations is refined sugar, which is produced by

the Phosphoflotation Process.

Most of the mills in India are not equipped to make refined sugar Mills

which are designed to produce refined sugar can manufacture sugar not only

from sugarcane but also from raw sugar which can be imported. Therefore, such

Babasabpatilfreepptmba.com13

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

14/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

mills can run their production all the year round, as opposed to single state mills,

which are dependent upon the seasonal supply of sugarcane.

Babasabpatilfreepptmba.com14

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

15/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

Company Profile

INTODUCTION

The group of SSL was established in rural area for improve of all

communities. Satish Sugars Ltd. (SSL) established with the major objective of

serving the society through economic development and the main motto being

Growing with farmers. SSL has today grown to become a dynamic company

that makes a fine case of youthful spirit and farsighted vision. The Company

covered the path of success adopting innovative approach.

Mr. Satish.L.Jarkiholi, the man of the SSL, he established the SSL, he

set the path of the Company to widespread economic activities with an

unwavering commitment and conviction. Employment generation and

community development were the primary goals behind the initiation to the

activities of the Company. Today SSL provides employment to more than 1000

Babasabpatilfreepptmba.com15

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

16/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

people and serving the more families in the region. Indirectly has helped farmer

community to stand in the society with pride & self-respect and provide the

financial facility for the farmers.

The journey of SSL spanning diverse activities such as sugar mill,

agriculture research, organic farming and community development makes an

impressive tale. For every major stride taken by the Company, the community

has taken a corresponding progressive step. Inspired by its success so far, the

SSL Company had more essential plans for the future. The plans are as,

Electronic Media Division, Pilot training centre, super specialty Hospital and

medical college, ayurvedic research centre, sports and cultural academy,

medical and aromatic plant extraction unit and a super market.

Most of these future plans main aim to building the community centric in nature

and have the objective of creating a social atmosphere in Gokak. It shows the

SSL wants to improve the Gokak.

The Satish Sugars Ltd. is one of the sugar producers in the state of

Karnataka. The Company was incorporated on 12th April, 2000 as Khandasari

Sugar plant in the name of Gokak Power, Distilleries & Sugars (P) Ltd., and

name was modified to Satish Sugars Ltd.

In the year of 2004-05, the unit adopted Vacuum Pan Technology

keeping in view its economic value, efficiency and higher return on investment.

The initial capacity of the reformed unit was 1250 TCD and in the trial season,

the unit processed 51,406 tons of sugarcane in 2004-05 and registered a profit of

Rs. 1.76 crores on a turnover of around Rs. 9.2 crores. SSL has set a target of

two lakhs tones of cane crushing for the year 2005-06 with a turnover of

Rs.20.00crore and a net profit of Rs.2.50 crore.

SSL has distributed seeds and fertilizers to needy farmers on a credit at

low rate of interest. This way, it has developed more than

2,500acres of land in 2004-05 and is developing 5,000acres in 2005-06 under

the Registered cane Area Program. The

Babasabpatilfreepptmba.com16

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

17/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

Company has set an ambitious target of achieving a processing capacity of 10

lakhs tones in the next five years. The future plans of the Company include

generation of 45 MW power from by-products and setting up of a 75-Klpd

distillery unit.

SSL is arduously working for the development of sugarcane

cultivators. It regularly sponsors the visit of farmers to various States and

National level agriculture fairs and organizes seminars and workshop on

improved methods of sugarcane cultivation. Free training on scientific farming

to children and encouragement to students with special talent in areas of

education, culture and sports are other prominent community development

activities undertaken by the company.

BOARD OF DIRECTORS

Mr. Satish.L.Jarkiholli Chairman & M.D

Smt. S. S. Jarkiholli Director

Mr. Pradeep.M.Indi Director

Mr. Vittal.R.Parasannavar Director

Auditors:

Mr. B.B.Amanagi

Babasabpatilfreepptmba.com17

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

18/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

Chartered Accountants

Belgaum

Bankers:

Indian Bank

PRODUCT PROFILE

SUGAR

The sugar produced in Satish Sugars Limited factory is both refined confirming

to EC II grade with negligible sulphur content as well as plantation grade white

sugar. The EC II grade sugar meets the European standards of refined sugar.

Sugar is a sweet, white or brown, usually crystalline substance obtained mainlyfrom sugar cane or sugar beets and used commonly in food products. Sugar

means something sweet in form of taste.

BY- PRODUCTS OF SUGARCANE:

The sugar mill produces many by-products along with sugar. A typicalsugarcane complex of 3000 TCD capacity can produce 345 ton of sugar, 6000

Babasabpatilfreepptmba.com18

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

19/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

liters alcohol, 3 ton of yeast, 15 ton of potash fertilizer, 25 ton of pulp, 15 ton of

wax, 150 ton of press-mud fertilizer and 750KW of power from Bagasse.

MOLASSES

Molasses is the final effluent obtained in the preparation of sugar by repeated

crystallization. It is the product from a refining process carried out yield sugar.

Sucrose and invert sugars constitute a major portion (40 to 60%) of molasses.

The yield of molasses per ton of sugarcane varies in the range of 3.5% to 4.5%.

.

ii. BAGASSE

Bagasse is a fibrous residue of cane stalk that is obtained after crushing andextraction of juice. It consists of water, fiber and relatively small quantities of

soluble solids; the composition of Bagasse varies based on the variety of

sugarcane, maturity of cane, method of harvesting and the efficiency of the

sugar mill.Bagasse is usually as a combustible in the furnaces to produce steam,

which in turn used to generate power; it is also used as raw material for

production of paper and as feedstock for cattle.

iii. ETHANOL

The company produces alcohol from the molasses (Molasses is the brown

colored residue after sugar has been extracted from the juice. Molasses still

contains some quantity of sugar, but this sugar cannot be extracted by usual

technology) left after the extraction of sugarcane juice, which can be used bothfor potable purpose as well as an Industrial chemical. Further, this alcohol can

be purified to produce fuel grade ethanol that can be blended with petrol.

iv. BIO-FERTILIZERS

Babasabpatilfreepptmba.com19

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

20/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

The residue product from distillery operations blended with chemicals is sold as

bio-fertilizers

Production System

Babasabpatilfreepptmba.com20

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

21/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

Babasabpatilfreepptmba.com

Cetrifugation

Sugar

AMolasses DryingandCooling

BMassecuite Packed as plantation white

Sugar

Centrifugation

B Sugar used in a

boiling as seedB Molasses

C Massecuite

Centrifugation

FinalMolasses

C Sugarusedin a

boiling

21

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

22/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

Security

Babasabpatilfreepptmba.com22

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

23/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

The company has strict and discipline Security system. The SSL security

maintenance of accounts after the record have closed, the records are keeping in

the room of security department, it is opened only with permission of higher

authority. If the visitors went to inter they have to take prior permission with the

authority and after entering they are not suppose to go any dept other them the

department from whom they took the permission. Also security maintained the

vehicle inward and outward verification, the security working all 24 hours, SSL

has 10 supervisors,1 security officer and 100 security guards.

STAFF

The SSL workers are good and hard working citizens, they play

essential role in the development of company. Employee is the responsible

person of the company. Every employee invold in success of the company. They

may be responsible for the success or failure of the company. In this company

employee following the work is worship. The company has totally 650

workers are working is the company.

They are categorized as following.

1) Permanent workers 400

2) Seasonal workers 110

3) Probationary worker 40

4) Daily wage worker 100

650

Company is paying salary of Rs. 25 lakhs per month to its workers.

VISION AND MISION

Babasabpatilfreepptmba.com23

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

24/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

Mission

Satish Sugars Group has set the goal of becoming a vibrant dynamic andprofessionally managed group of companies having a turnover of over Rs.1000

crore with a net profit of 5% by 2015, 25% of the net profit will be spent on a

board-spectrum of community development activities such as Education,

Healthcare, Culture, Sports and Social Welfare. This is in line with the groups

motto of placing community before self and Social services before self.

Vision

To become the most efficient processor of sugar & the largest marketer of

sugar and compute globally.

FUNCTIONAL DEPARTMENTSFUNCTIONAL DEPARTMENTS

Babasabpatilfreepptmba.com24

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

25/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

STUDY OF FUNCTIONAL DEPARTMENTS

FINANCE DEPARTMENT

ENGINEARING DEPARTMENT

ACCOUNTS DEPARTMENT

CANE DEPARTMENT

PROCESS DEPARTMENT

HRD DEPARTMENT

MAINTENANCE DEPARTMENT

PURCHASE DEPARTMENT

STORE DEPARTMENT

PERSONAL AND ADMINISTRATIVE DEPARTMENT

ACCOUNTS DEPARTMENT

The SSL Gokak Sugar Companys growth in terms of

turnover and profitability besides investment in the block of assets and

working capital has been satisfactory over a period of time. Unless proper

accounting of the various transitions of the companys taking place out

systematically, the real control on the various functional areas of the

company will be lost to the management.

Babasabpatilfreepptmba.com25

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

26/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

All the transactions of the company will be accounted on accrual

basis only except where deviations are permitted by the management

through its accounting policies.

Main Functions are as follows

Registration and scrutiny of sale orders pertaining to equipment and

spare parts.

Preparation and submission of invoice to customers for payment.

Receipt of cash, cheque and bank drafts etc and issue of official

receipts for the same..

Operation of bank accounts.

Maintenance of journal, expense ledger and balance sheet.

Preparation of trail balance, profit and loss account and balance sheet.

ENGINEERING DEPARTMENT

In SSL the engineering department looks after mechanical, civil

construction, improving production method. Simplifying of work and power

generation and also deals with good working condition maintains of go

down, installation of machinery etc.

Babasabpatilfreepptmba.com26

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

27/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

CANE DEPARTMENT

In SSL cane department deals with registration of Sugar Cane with

growers, good quality maintains, developing high yields and also term loans

and subsides to the farmers who are growing sugar cane for this company

and now giving seeds of sugar cane to grow variety sugar cane and this

department has consultant to consult sugar cane and I/P.

SSL has some Developmental Programmes for Cane

The unit is undertaking cane development programmes which will be

a part of its activities are :

Loans are provided to formers to take up new variety of

cane activities.

Subsides are provided to farmers.

MAINTENANCE DEPARTMENT

Maintenance department is a Mechanical department in which all the

machines of this firm are repaired. If there are any major problems the machines

are repaired by General-Shift-Workers. General-shift-workers are fixed for only

one major problem, the general shift workers and other workers work in shift

wise.

Babasabpatilfreepptmba.com27

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

28/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

FINANCE DEPARTMENT

Finance department is very important in an organization. It is not just

confined to raising funds, but extends beyond it to control the over utilization of

funds and helps to monitor the utilization of funds raised. This function

influences the operation of other essential functioning areas of the firm such as

production, marketing and personal.

FUNCTIONS OF FINANCE DEPARTMENT:

Passing of all payment bills

Maintenance of sales ledger

Maintenance of all subsidiary books under the co-operative

societies

Preparation of finance reports

Preparation of annual budgets

Budgetary control

acts like cashbook, debtors, and salary register. Preparing of cost sheet

Direction of internal auditing.

BRIEF OUT LOOK OF THE FINANCIAL STATUS

Share capital Rs.4,167.43 lacks

Raw material consumed year Rs.6420.35 lacks

Year sales Rs.9,308.96 lakhs

Profit for the year ended Rs.833.33 lacks

The balance sheet and the profit and loss account of the firm for the

past few years are shown as below in the table.. From which we analyze the

growth and development of the firm and also we obtain information regarding

sources of funds and their allocation

Babasabpatilfreepptmba.com28

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

29/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

STORES DEPARTMENT

In this department all types of materials are stored. The purchase

department purchases the materials and these materials are sending to stores

department. Storekeepers send the sample of material to the lab for testing

purpose. If the material satisfies all the tests specifications then the material will

be stored and the transactions, which are related to this, are done in this

department. Otherwise the goods will be rejected and sent back. The explanation

should be given for the rejection of goods.

.

HUMAN RESOURCE DEVELOPMENT DEPARTMENT

The activities carried out are planning for human resources,

requirements, welfare, and safety, training and legal matters. It even helps in

providing necessary manpower and skills towards successful implementation of

quality system. It also organizes the training activities of the employees.

AREA OF FUNCTION OF SATISH SUGARS LTD

Man power planning

Recruitment and selection

Babasabpatilfreepptmba.com29

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

30/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

Placement, training and development

Wage and salary administration

Health and safety measures

Employees state insurance benefits

FUNCTIONS:

1. Selection and recruitment of trainee workman, clerical staff .

2. Induction of clerical supervisor staff.

3. Issue and badli of workman.

4. Issue of punching cards.

5. Attendance recording.

6. Leave Management.

7. Wage administration.

8. Bonus calculations and payments.

PERSONNEL AND ADMINISTRATION DEPARTMENT

PERSONNEL DEPARTMENT:

Objectives:

It deals with appointments, job training to new employees.

They deal with safety health measures of the employees.

They provide necessary help or aid to the employees.

Control over the day to day activities.

Workers get their week off but the staff gets holidays on Sunday. This

department sanctions leaves to the employees. The employees get leave on

national festival and so on.

Babasabpatilfreepptmba.com30

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

31/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

PURCHASE DEPARTMENT

Purchasing procedure very considerably according to the needs of the

organization and authority delegated to purchase managers the success of

organization is based on effective inventory management system and UN

interrupted production schedule. This is achieved with adequate purchasing

function.

OBJECTIVES

To invite quotation from a number of suppliers.

To make arrangements for the purchase of appropriate quantities at any

given times.

To ensure the purchase of the correct quality under trade or brand name

by sample, description.

The purpose officer receives the order slip from the marketing officer

and this order slip will be sent to store department to check the raw materialessential; to fulfill the order for a particular product of produce it. Further the

stock statement is sent to the purpose department, which contents the quantity

that is the raw materials required for a particular product or produce it. From

this the purpose officer will come to know that how much quantity is required.

And whenever there is not much stock in stores department the store keeper will

inform the purpose officer and in turn he will give instruction to purchase that

particular material.

ADMINISTRATION DEPARTMENT

The Administration Department looks after the administration of the

company.

Administration Department has an aerial lockout over all the

departments.

Babasabpatilfreepptmba.com31

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

32/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

Progress of the entire department is sent to this department. So that the

administration department prepares the progress sheet after the end of

certain period.

Administration function includes training of administrative staff.

This department looks after the wages and salaries of the staff.

This department has to answer for any Enquire done by the Govt.

This department controls over the flow of funds along with the accounts

department.

Babasabpatilfreepptmba.com32

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

33/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

STRENGTHS

SSL LTD is very integrated player in sugar industry. The company

processes sugarcane into three co products viz. sugar, ethanol, power.

The company has the control on the seasonal affect through producing

sugar not only with sugarcane and also raw sugar.

The company is having prominent marketing employees who have good

knowledge of marketing.

It has maintained excellent relationship with farmers.

Babasabpatilfreepptmba.com33

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

34/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

WEAKNESSES

SSL is bearing extra cost of exporting the sugar to the foreign countries.

Non availability of raw sugar in excess

OPPORTUNITY

It is going to have a largest sugar refinery unit in India, which enables

the co to enjoy better economic scale.

The company has easy excess for importing raw sugar and exporting

white crystal sugar for foreign countries.

SSL is well equipped with superior technology.

THREATS

Babasabpatilfreepptmba.com34

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

35/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

The company has to face the threat of competition from competitors

from like Ugar sugar industry Ltd, Gdavari sugar Ltd, Shree

Prabuligeshwar sugar works ltd.

The sugar pricing policy of the government is also big threat to the

company usually the levy prices fixed by the government are very low

and fall below the cost of production.

Babasabpatilfreepptmba.com35

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

36/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

Objectives of the study.

To ascertain the minimum level of sales to cover the cost and avoid the

loss.

To know the effect on income of the company.

To know the fluctuation in profit volume ratio.

To understand the concept and theory of EVA.

To know the companies true profit.

To ascertain the value of the organization.

To identify the whether a SSL is earning more or less than the capital

invested.

Methodology of information collected.

Primary sources.

Primary sources include information collected through discussion with

the concerned department persons and our external guide.

Secondory sources.

The secondary data is collected for the three years i.e.2007, 2008 and

2009 ,this data is collected from annual report provided by the company.

Assumption

Babasabpatilfreepptmba.com36

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

37/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

The cost of debt and cost of equity constant in three years at the assume

rate of 11% and 8% in satish sugars limited.

Babasabpatilfreepptmba.com37

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

38/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

COST VOLUME PROFIT ANALYSIS

Introduction

As the term itself indicates the cost volume profit analysis is the analysisvariable that is cost, volume and profit. In CVP analysis an attempt is made to

measure the variations of cost and profit with volume. Profit as a variable is the

reflection of a number of internal and external conditions which exert influence

on sales revenue and costs.

The cost volume profit analysis helps or assists the management in profit

planning. In order to increase the profit, a concern must increase the output,

when the output at maximum with in the installed capacity, it adds thecontribution.

In the other words of heiser , the most significant factor is profit planning of

profit.When volume of output increases, unit cost of output decreases, and vice

versa; because the fixed cost remains unaffected .When the output increases, the

fixed cost per unit decreases. Therefore, profit will be more, when sales price

remains constant. Generally, costs may not change direct proportion to the

volume. Thus, a small change in the volume will affect the profit. Cost volumeprofit analysis shows the relationship among the various ingredients of profit

planning, namely unit sales price, variable cost, sales volume, sales mix and

fixed cost.

Essential of cost volume profit analysis:

Total costs can be divided into a fixed component and a component that is

variable with respect to the level of output.

The analysis either covers a single product or assumes that The sales mix when

multiple products are sold will remain Constant as the level of total units sold

Babasabpatilfreepptmba.com38

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

39/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

change.All revenues and costs can be added and compared without taking into

account the time value of money.The unit selling price, unit variable costs and

fixed costs are known and constant

Babasabpatilfreepptmba.com39

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

40/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

Income statement

Table no. 1 (in lack)

Babasabpatilfreepptmba.com

Particulars 2007 2008 2009

Sales

5,340.94 9,281.24 14,184.15

% Increase in sales 42.45% 34.56%

Less:Variable Cost 577.59

1,196.14

968.23

Contribution

4,763.35

8,085.10

13,215.91

Less:Fixed Cost

4,236.95

6,408.88

10,087.89

EBIT

526.40

1,676.22

3,128.01

% increase in EBIT 68.59% 46.41%

Less:Interest

200.50

733.78

1,433.77

EBT

325.90

942.44

1,694.24

Less:Provision Tax

38.72

10,909

113.30

Net Profit

287,18

833.35

1,580.94

% increase in N/P 65.53% 47.28%

40

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

41/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

Chart 1

sale

0

5000

10000

15000

Pa

rticul

%

Le

ss:Fi

%

Le

ss:Pr

%

ebit

netprofit

Interpretation

In the year 2007,08,09 shows that sales and EBIT is highest in the year

2009,the sales in the year 2007 is Rs. 5,340.94,in the year 2008 is Rs.9,281.24

and in the year 2009 is Rs.14,184.15.

Similarly the corresponding EBIT were in the year 2007 is Rs.526.40, in

the year 2008 is Rs.1,676.22 and in the year 2009 is Rs.3,128.01.

And also sales increase in percent in 2008 is 42.45%, in 2009 34.56%

and EBIT increase in percent in 2008 is 68.595,in 2009 is 46.41%,the net profit

is increase in percent in the year 2008 is 65.53%, in the year 2009 is 47.28%.

Profit volume ratio

Profit volume ratio is popularly known as p\v ratio. it express the relationship

between the contribution to sales . The ratio, expressed as a percentage,indicated the relative profitability of different products.

Babasabpatilfreepptmba.com41

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

42/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

The profit of a business can be improved by improving the p/v ratio. A higher

ratio shows a greater profitability and vice versa .To improve the p\v ratio

following are to be adapted.

By increasing sales price per unit

By decreasing variable cost

By increasing the production of products which is having a high p\v ratio and

vice versa.

Profit volume ratio can be calculated using following formula

Profit volume ratio = contribution / sales * 100

Table no. 2 (in lacks)

Year Contribution Sales P/V Ration

2007 4,763.35 5,340.94 89%

2008 8,085.10 9,281.24 87%

2009 13,215.91 14,184.15. 93%

Chart 2

Babasabpatilfreepptmba.com42

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

43/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

Profit volume ratio

0

5000

10000

15000

Year 2007 2008 2009

Interpretation

We can see a slight variation in the P/V Ratio of 2009 higher, the P/V

Ratio higher will be the scope for the high profit. We can see that it has

increased in the year 2009 and the table clearly shows that required amount of

sales is available to cover the fixed cost and to provide operations income to

the firm.

Break even sales

Babasabpatilfreepptmba.com43

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

44/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

Break even analysis is also known as cost volume profit analysis. The analysis is

a tool of financial analysis where by the impact on profit of the changes in the

volume, price, costs and mix can be estimated with reasonable accuracy.

Break even point is a point where the total sales are equal to total cost. Inthis point there is no profit or loss in the volume of sales.

A break even analysis is concerned with the study of revenues and costs in

relation to sales volume and particularly, the determination of that volume of

sales at which the firms revenue and total cost will be exactly equal. Thus break

even point may be defined as point at which the firms total revenue is exactly

equal to total cost, yielding zero income. The no profit, no loss point is a

break even point or a point at which loss cease and profit begins.

Assumption of break even analysis

All costs can be segregated in to fixed cost and variable components.

Variable cost per unit remains constant and total variable cost changes in direct

proportion to the volume of production.

Selling price doesnt change as volume changes

Cost and revenue are influenced only by volume

Stocks are valued at marginal cost.

The formula to calculate break even point is:

B.E.Sales = Fixed Cost

P/V Ratio

Table no. 3 (in thousands)

Year Fixed Cost P/V Ratio B.E.Sales

2007 4,236.95 89% 3,770.88

Babasabpatilfreepptmba.com44

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

45/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

2008 6,408.88 87% 5,575.72

2009 10,087.89 93% 9,381.74

Chart 3

Break even sales

0

5000

10000

15000

Yea

r

2007

2008

2009

year

fixed

cost

Interpretation

There is increasing in B.E.S. position, because of increased in fixed cost

over the years but has affected the profit and MOS, the total sales, profits and

MOS are proportionately increasing in the year 2007,2008,and 2009..

MARGIN OF SAFETY

Margin of safety means total sales minus break even sales at break even point.

In other words, sales over and above break even sales are known as margin of

safety. Higher the margin of safety indicates the soundness of the business.

Small margin of safety indicates the weak position of the business because a

small decrease in the sales and production leads to less profit of the business.

Babasabpatilfreepptmba.com45

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

46/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

When the marginal of safety is not satisfactory, the following steps may be

taken to improve it:

Increase the volume of sales

Increase the selling price

Reduce fixed cost

Reduce variable cost.

Margin of safety can be calculated by using the formula

Margin of safety = Actual sales Break even sales

Table no.4 (in lacks)

Babasabpatilfreepptmba.com

Year Actual Sales B.E.Sales M.O.S.

2007 5,340.94 3,770.88 1,570.05

2008 9,281.24 5,575.72 3,705.51

2009 14,184.15 9,381.74 4,802.40

46

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

47/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

Chart 4

mos

0

5000

10000

15000

Y

ear

2007

200

8

200

9

year

sal

Interpretation

MOS is very high because of high and increasing in fixed cost in all three

years studied, it indicates that profits are made until there is high level of

activity to fixed cost.

Economic Value Added

Introduction

The discussion in this report is focused on measuring the economic performance

of business. Economic reports are the diagnostic instruments, they indicate

whether the current strategies of the business are satisfactory or whether a

decision should be made to do something about the business expand it, shrink it,

changes its direction, or sell it. The economic analysis of an individual business

unity may reveal that current plan for new strategies. Even though each separate

decision seamed at the time it was made.

Traditional Approach to measuring the Share holders value creation have used

parameters such as earning capitalization, market capitalization and present

Babasabpatilfreepptmba.com47

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

48/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

value of estimated future cash flows. But today extensive equity research has

now established that it is not EPS, which is important. A new measure called

Economic Value Added (EVA) is increasing being applied to understand

and evaluate financial performance.

EVA is a residual income after charging the cost of capital for the company

provided by lenders and shareholders. Its represents the value added to

shareholders by generating operating profit in excess of the cost of capital

employed in the business.

Literature Review

The EVA method is based on the past performance of the corporate enterprise.The economic principles are determine whether the firm is earning a higher rate

of return on the entire invest funds than the cost of such funds (Measured in

terms of WACC), if the answer is positive, the firm management is adding to the

shareholder value by earning extra for them. On the contrary, if the WACC is

higher than the corporate earning rate, the firms operations have eroded the

existing wealth of its equity shareholders. In operational terms the method

attempts to measure EVA for equity shareholders by firm operations in a given

year.

WACC take care of financial costs of all sources of provides of invested funds

in a corporate enterprise it is imperative that operating profit after taxes should

be considered to measure EVA. The accounting profit after taxes, as reported by

the income statement, need adjustment for interest cost. The profit should be the

net operating profit after tax and cost of funds will be product of the total capital

supplied (including Retained Earnings) and WACC.

EVA = (Net Operating Profit after Tax (Total Capital * WACC))

The EVA method measure economic value added for equity owners by the firms

operations in a given year, though the MVA and EVA are two different

approaches, the MVA of the firm can be conceived as the present value of all

the EVA profit that the firm is expected to generate in the future year.

The Main Theory behind EVA

Babasabpatilfreepptmba.com48

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

49/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

EVA measures whether the operating profit is enough compared to the total

costs of capital employed. Stewart defined EVA as Net operating profit after

taxes (NOPAT) subtracted with a capital charge:

EVA = NOPAT CAPITAL COST

EVA = NOPAT COST OF CAPITAL x CAPITAL EMPLOYED (1)

Or equivalently, if rate or return is defined as NOPAT/CAPITAL, this turns into

a perhaps more revealing formula:

EVA = (RATE OF RETURN COST OF CAPITAL) x CAPITAL (2)

Where:

Rate of return = NOPAT/Capital

Capital = Total balance sheet minus non-interest bearing debt in the beginning

of the year

Cost of capital = Cost of Equity x Proportion of equity from

capital + Cost of debt x Proportion of debt from capital x (1-tax rate).

Cost of capital or weighted average cost of capital (WACC) is the average cost

of both equity capital and interest bearing debt. Cost of equity capital is the

opportunity return from an investment with same risk as the company has. Cost

of equity is usually defined with Capital asset pricing model (CAPM). The

estimation of cost of debt is naturally more straightforward, since its cost is

explicit. Cost of debt includes also the tax shield due to tax allowance on

interest expenses.

The idea behind EVA is that shareholders must earn a return that compensates

the risk taken. In other words equity capital has to earn at least same return as

similarly risky investments at equity markets. If that is not the case, then there is

no real profit made and actually the company operates at a loss from the

viewpoint of shareholders. On the other hand if EVA is zero, this should be

treated as a sufficient achievement because the shareholders have earned a

return that compensates the risk. This approach - using average risk-adjusted

market return as a minimum requirement - is justified since that average return

Babasabpatilfreepptmba.com49

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

50/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

is easily obtained from diversified long-term investments on stock markets.

Average long-term stock market return reflects the average return that the public

companies generate from their operations.

EVA is based on the common accounting based items like interest bearing debt,equity capital and net operating profit. It differs from the traditional measures

mainly by including the cost of equity. Mathematically EVA gives exactly the

same results in valuations as discounted cash flow (DCF) or Net present value

(NPV) which are long since widely acknowledged as theoretically best analysis

tools from the Shareholders perspective .These both measures include the

opportunity cost of equity, they take into account the time value of money and

they do not suffer from any kind of accounting distortions. However, NPV and

DCF do not suit in performance evaluation because they are based exclusively

on cash flows. EVA in turn suits particularly well in performance measuring.Yet, it should be emphasized that the equivalence with EVA and NPV/DCF

holds only in special circumstances (in valuations) and thus this equivalence

does not have anything to do with performance measurement.

The Background of EVA

EVA is not a new discovery. An accounting performance measure called

residual income is defined to be operating profit subtracted with capital charge.

EVA is thus one variation of residual income with adjustments to how one

calculates income and capital. According to Wallace one of the earliest to

mention the residual income concept was Alfred Marshall in 1890. Marshall

defined economic profit as total net gains less the interest on invested capital at

the current rate. According to Dodd the idea of residual income appeared first in

accounting theory literature early in this century by e.g. Church in 1917 and by

Scovell in 1924 and appeared in management accounting literature in the 1960s.

Also Finnish academics and financial press discussed the concept as early as in

the 1970s. The EVA-concept is often called Economic Profit (EP) in order to

avoid problems caused by the trade marking. On the other hand the name

"EVA" is so popular and well known that often all residual income concepts are

often called EVA although they do not include even the main elements defined

by Stern Stewart & Co. For example, hardly any of those Finish companies that

have adopted EVA calculate rate of return based on the beginning capital as

Stewart has defined it, because average capital is in practice a better estimate of

the capital employed. So they do not actually use EVA but other residual

Babasabpatilfreepptmba.com50

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

51/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

income measure. This insignificance detail is ignored later on in order to avoid

more serious misconceptions.

In the 1970s or earlier residual income did not got wide publicity and it did notend up to be the prime performance measure in great deal of companies.

However EVA, practically the same concept with a different name, has done it

in the recent years. Furthermore the spreading of EVA and other residual

income measures does not look to be on a weakening trend. On the contrary the

number of companies adopting EVA is increasing rapidly. We can only guess

why residual income did never gain a popularity of this scale. One of the

possible reasons is that Economic value added (EVA) was marketed with a

concept of Market value added (MVA) and it did offer a theoretically sound link

to market valuations. In the times when investors demand focus on Shareholder

value issues this was a good bite.

EVA or economic rent is widely recognized tool that is used to measure the

efficiency with which a company has used its resources. In other words EVA is

the difference between return achieved on resources invested and the cost of

resources. Higher the EVA betters the level of resources unitization.

EVA was developed by a New York consulting firm, stern steward and

company in 1982 to promote value-maximizing behavior in corporate managers.

It is a single, value based measure that was intended to evaluate business

strategies, capital projects and to maximize long-term shareholders wealth.

Value that has been created by the firm during the period can be measured by

comparing profit with the cost of capital used to produce them. Therefore,

managers can decide to with draw value destructive activities and invest in the

market value of the company. However, activates that do not increase

shareholders value might be critical to customers satisfaction or social

responsibility. For ex, acquiring expensive technology to ensure that the

environment is not polluted might not be of high value from shareholders

perspective. Focusing solely on shareholders wealth might jeopardize a firm

reputation and profitability in the long run.

EVA sets managerial performance target and links it to reward systems. The

single goal of maximizing shareholders value helps to overcome the traditional

measure problem. Where different measure are used for different purposes with

inconsistent standard and goal. Rewards will be given to managers who are able

to turn investor money and capital into profit efficiency. Researchers have found

that managers are more likely to respond to EVA incentives when making

financial, operational and investing decision allowing them to be motivated to

behave like owners. However this behavior might lead to some managers

pursing their own goal and shareholders value at the expenses of customerssatisfaction.

Babasabpatilfreepptmba.com51

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

52/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

Unlike simple traditional budgeting, EVA focuses on ends and not means as it

does not state how manager can increase companys value as long as the

shareholder wealth are maximized. This allows managers to have discretion and

free range creativity, avoiding any potential dysfunctional short-term behavior.

Rewards such as bonuses from the attainment of EVA target level are usually

paid fully at the end of 3 years. This is because workers performance is

monitored and will only be rewarded when this target is maintained consistently.

Hence, leading to long-term shareholders wealth, EVA should help us identify

the best investments, which are the companies that generate more wealth than

their rivals. All other things being equal, Firm with high Evas should over time

outperform others with lower or negative Evas.

EVA is a financial measure based on accounting data and is therefore historical

in nature. It has the same limitations as other traditional accounting measure andcannot adequately replace all measure within the company especially the non-

financial ones. Due to the historical nature of EVA, manager can benefit in

terms of reward or be punished by the past history of the organization. (Otley,

David performance management 1999), Dodd J and Johns J see the balanced

scorecard as one approach to overcome the potential problem of using a single

financial measure such as EVA.

The following are the important point of EVA.

A value based financial performance measure.

A measure reflecting the absolute amount of shareholders value created

or destroyed during each year.

A useful tool for choosing the most promising financial investments.

An effective protection against shareholders value destruction.

A tool suitable to control operations.

A measure that can be maximized EVA has not steering failures likeROI and EPS (Maximizing these measures might lead to not optimal

outcome; not max, shareholder value).

An estimator for companys true economic value creation, unlike the

traditional measure has focus on shareholders value creation.

A good basis for management compensation systems to motivate

managers to create shareholder value.

A tool for useful than ROI in controlling and steering day-to-dayoperation.

Babasabpatilfreepptmba.com52

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

53/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

A concept practically the same as Economic Profit (EP), Residual

Income (RI), and Economic Value Management (EVM).

A registered trademark owned by Stern Steward & Co, supporting more

than 250 large companies around the world.

Why EVA?

EVA Basic Premise Managers are obliged to create value for their investors

investors invest money in a company because they expect returns. There is a

minimum level of profitability expected from investors called capital charge.

Capital charge is the average equity return on equity markets; investors can

achieve this return easily with diversified, long-term equity market investment.

Thus, creating less return (in the long run) than the capital charge is

economically not acceptable (Especially from shareholders

perspective).Investors can also take their money away from the firm they have

other investment alternatives.

Economic Value Added (EVA)

Now that you've viewed economic profit in action, you've likely observed that

most of its perceived complexity results from two types of adjustments that

convert accounting earnings intonet operating profit after taxes (NOPAT). The

goal of these adjustments is to translate an accounting profit into an economic

profit that more accurately reflects cash invested and cash generated. The

illustration below recaps the process.

To make the conversion, we can start with any income statement line, but it is

easiest to start with earnings before interest and taxes (EBIT). Then we make

Babasabpatilfreepptmba.com53

http://www.babasabpatilfreepptmba.com/http://www.babasabpatilfreepptmba.com/http://www.investopedia.com/terms/e/ebit.asphttp://www.babasabpatilfreepptmba.com/http://www.investopedia.com/terms/e/ebit.asp -

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

54/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

two types of adjustments in order to convert EBIT into NOPAT. First, we

reverseaccruals to capture cash flows, and second, wecapitalize expenses that

ought to be treated like investments. Once we have NOPAT, we need only to

subtract the capital charge, which is equal to total invested capital - which we

find by making appropriate adjustments to invested book capital, found on the

balance sheet - multiplied by theweighted average cost of capital (WACC).

1. In the year 2006-07

1) Calculation of NOPAT Table no.5 (Rs.In lacks)

Babasabpatilfreepptmba.com

Earning Before Interest (EBIT) 526.40

Less : Interest 200.50

Profit Before Tax 325.90

Less : Tax Rate 38.72

Profit After Tax 287.18

Add : Interest 200.50

Net Operating Profit After Tax (NOPAT) 486.78

54

http://www.investopedia.com/terms/a/accrualaccounting.asphttp://www.investopedia.com/terms/a/accrualaccounting.asphttp://www.investopedia.com/terms/c/capitalize.asphttp://www.investopedia.com/terms/c/capitalize.asphttp://www.investopedia.com/terms/w/wacc.asphttp://www.investopedia.com/terms/w/wacc.asphttp://www.investopedia.com/terms/a/accrualaccounting.asphttp://www.investopedia.com/terms/c/capitalize.asphttp://www.investopedia.com/terms/w/wacc.asp -

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

55/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

2) Computation of Weighted Average Cost of Capital (WACC)

Table no.6 (Rs. In lacks)

Now we Calculate Economic Value Added

EVA = NOPAT (Total Capital * WACC)

EVA = 487.68 (7,644.32 * 9.73%)

Babasabpatilfreepptmba.com

Source Total Capital Cost(%) Total Cost

Debt 4,425.96 0.11 486.85

Equity 3,218.36 0.08 257.46.

Total Cost 7,644.32 744.32

WACC 744.32/ 7,644.32 0.0973*100 9.73%

55

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

56/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

EVA = 487.68 743.79

EVA = -256.11

So, in the 2006-07 Economic Value Added is Rs. -256.11

2) In the year 20007-08

EVA = NOPAT (Total Capital * WACC)

Working Notes:

1.Calculation of NOPAT (Rs.In lacks)

Table no.7

Babasabpatilfreepptmba.com56

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

57/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

Babasabpatilfreepptmba.com

Earning Before Interest (EBIT) 1,676.22

Less : Interest 733.78

Profit Before Tax 942.44

Less : Tax Rate 109.09

Profit After Tax 833.35

Add : Interest 733.78

Net Operating Profit After Tax (NOPAT) 1,567.13

57

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

58/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

2) Computation of Weighted Average Cost of Capital (WACC)

Table no.8 (Rs. In lacks)

Source Total Capital Cost(%) Total Cost

Debt 9,242.32 0.11 1,016.65

Equity 4,413.70 0.08 353.09

Total Cost 13,656.02 1,369.75

WACC 1,369.75/ 13,656.02 0.1003*100 10.03%

Now we Calculate Economic Value Added

EVA = NOPAT (Total Capital * WACC)

EVA = 1,567.13 ( 13,656.02* 10.03%)

EVA = 1,567.13 (1,369.69 )

EVA = 197.43

So, in the 2007-08 Economic Value Added is Rs. 197.43.

Babasabpatilfreepptmba.com58

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

59/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

3) In the year 20008-09

EVA = NOPAT (Total Capital * WACC)

Working Notes:-

1. Calculation of NOPAT (Rs. Lacks)

Table no.9

Babasabpatilfreepptmba.com

Earning Before Interest (EBIT) 3,128.01

Less : Interest 1,433.77

Profit Before Tax 1,694.24

Less : Tax Rate 113.30

Profit After Tax 1,580.94

Add : Interest 1,433.77

Net Operating Profit After Tax (NOPAT) 3,014.71

59

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

60/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

2) Computation of Weighted Average Cost of Capital (WACC)

Table no.10 (Rs.in lacks)

Now we Calculate Economic Value Added

EVA = NOPAT (Total Capital * WACC)

EVA = 3,014.71 ( 27,143.15.* 10.33%)

EVA = 3,014.71 (2,803.88 )

EVA = 210.82

So, in the 2008-09 Economic Value Added is Rs. 210.82.

1. Net Operating Profit after Tax (NOPAT)

NOPAT is derived by deducting cash operating expenses and depreciation from

sales. An interest expense is excluded because it is considered as a financingcharge. Adjustments which are referred to as equity equivalent adjustment are

Babasabpatilfreepptmba.com

Source Total Capital Cost(%) Total Cost

Debt 21,132.50 0.11 2,324.57

Equity 6,010.64 0.08 480.85

Total Cost

27,143.15 2,805.42

WACC 2,805.42/ 27,143.15 0.1033*100 10.33%

60

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

61/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

designed to reflect economic reality and move income and capital to a more

economically based value. These adjustments are considered with cash taxes

deducted to arrive at NOPAT.

Table no.11 (Rs.in lacks)

Chart 5

Babasabpatilfreepptmba.com

YEAR NOPAT

2006-07 487.68

2007-08 1,567.13

2008-09 3,014.71

61

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

62/74

ESTIMATION OF COST VOLUME PROFIT AND ECONOMIC VALUE

ADDED FOR SATISH SUGARS LIMITED GOKAK.

nopa

01000200030004000

YEAR

2006

-07

2007

-08

2008

-09

yea

Interpretation

In the year 2006-07 the NOPAT is Rs.487.68. In the year 2007-08 NOPAT is

Rs.156.71. In the year 2008-09 we have seen that NOPAT has increased by

Rs.3,014.71. compared to last year of interest and profits have increased in

current compared year to last year.

2. Weighted Average Cost of Capital (WACC)

WACC is the expected average future cost of fund over the long

run found by weighting the cost of each specific type of capital by its proportionin the firms capital structure.

Babasabpatilfreepptmba.com62

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

63/74

-

7/31/2019 A Project Report on Estimation of Cost Volume Profit and Economic Value Added for Satish Sugars Limited Gokak.

64/74