42ND STREET SW 60 Campion Industrial Park...

Transcript of 42ND STREET SW 60 Campion Industrial Park...

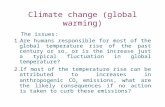

OFFERING MEMORANDUM

CAMPION INDUSTRIAL PARK INVESTMENT225 253 255 42ND STREET SWLoveland, CO 80537

Capital Markets | Investment Properties

Campion Industrial Park Investment

$5,800,000

Price Per Square Foot: $57.85

Projected Cap Rate: 8.63%

Projected NOI: $500,716

Total Buildings Size: 100,250 SF (Approximately)

Total Land Area: 8.3 Acres (Approximately)

Additional 1.792 Acres Available for $25,000

CAMPIONINDUSTRIAL

PARK

287

42ND STREET SW 60

1.792 ACRES

AFFILIATED BUSINESS DISCLOSURE AND CONFIDENTIALITY AGREEMENT

CBRE, Inc. operates within a global family of companies with many subsidiaries and/or related entities (each an “Affiliate”) engaging in a broad range of commercial real estate businesses including, but not limited to, brokerage services, property and facilities management, valuation, investment fund management and development. At times different Affiliates may represent various clients with competing interests in the same transaction. For example, this Memorandum may be received by our Affiliates, including CBRE Investors, Inc. or Trammell Crow Company. Those, or other, Affiliates may express an interest in the property described in this Memorandum (the “Property”) may submit an offer to purchase the Property and may be the successful bidder for the Property. You hereby acknowledge that possibility and agree that neither CBRE, Inc. nor any involved Affiliate will have any obligation to disclose to you the involvement of any Affiliate in the sale or purchase of the Property. In all instances, however, CBRE, Inc. will act in the best interest of the client(s) it represents in the transaction described in this Memorandum and will not act in concert with or otherwise conduct its business in a way that benefits any Affiliate to the detriment of any other offeror or prospective offeror, but rather will conduct its business in a manner consistent with the law and any fiduciary duties owed to the client(s) it represents in the transaction described in this Memorandum.

This is a confidential Memorandum intended solely for your limited use and benefit in determining whether you desire to express further interest in the acquisition of the Property.

This Memorandum contains selected information pertaining to the Property and does not purport to be a representation of the state of affairs of the Property or the owner of the Property (the “Owner”), to be all-inclusive or to contain all or part of the information which prospective investors may require to evaluate a purchase of real property. All financial projections and information are provided for general reference purposes only and are based on assumptions relating to the general economy, market conditions, competition and other factors beyond the control of the Owner and CBRE, Inc. Therefore, all projections, assumptions and other information provided and made herein are subject to material variation. All references to acreages, square footages, and other measurements are approximations. Additional information and an opportunity to inspect the Property will be made available to interested and

qualified prospective purchasers. In this Memorandum, certain documents, including leases and other materials, are described in summary form. These summaries do not purport to be complete nor necessarily accurate descriptions of the full agreements referenced. Interested parties are expected to review all such summaries and other documents of whatever nature independently and not rely on the contents of this Memorandum in any manner.

Neither the Owner or CBRE, Inc, nor any of their respective directors, officers, Affiliates or representatives make any representation or warranty, expressed or implied, as to the accuracy or completeness of this Memorandum or any of its contents, and no legal commitment or obligation shall arise by reason of your receipt of this Memorandum or use of its contents; and you are to rely solely on your investigations and inspections of the Property in evaluating a possible purchase of the real property.

The Owner expressly reserved the right, at its sole discretion, to reject any or all expressions of interest or offers to purchase the Property, and/or to terminate discussions with any entity at any time with or without notice which may arise as a result of review of this Memorandum. The Owner shall have no legal commitment or obligation to any entity reviewing this Memorandum or making an offer to purchase the Property unless and until written agreement(s) for the purchase of the Property have been fully executed, delivered and approved by the Owner and any conditions to the Owner’s obligations therein have been satisfied or waived.

By receipt of this Memorandum, you agree that this Memorandum and its contents are of a confidential nature, that you will hold and treat it in the strictest confidence and that you will not disclose this Memorandum or any of its contents to any other entity without the prior written authorization of the Owner or CBRE, Inc. You also agree that you will not use this Memorandum or any of its contents in any manner detrimental to the interest of the Owner or CBRE, Inc.

If after reviewing this Memorandum, you have no further interest in purchasing the Property, kindly return this Memorandum to CBRE, Inc.

© 2016 CBRE, Inc. The information contained in this document has been obtained from sources believed reliable. While CBRE, Inc. does not doubt its accuracy, CBRE, Inc. has not verified it and makes no guarantee, warranty or representation about it. It is your responsibility to independently confirm its accuracy and completeness. Any projections, opinions, assumptions or estimates used are for example only and do not represent the current or future performance of the property. The value of this transaction to you depends on tax and other factors which should be evaluated by your tax, financial and legal advisors. You and your advisors should conduct a careful, independent investigation of the property to determine to your satisfaction the suitability of the property for your needs.

CBRE and the CBRE logo are service marks of CBRE, Inc. and/or its affiliated or related companies in the United States and other countries. All other marks displayed on this document are the property of their respective owners. Photos herein are the property of their respective owners and use of these images without the express written consent of the owner is prohibited.

Photos herein are the property of their respective owners and use of these images without the express written consent of the owner is prohibited.

C A M P I O N I N D U S T R I A L I N V E S T M E N T

CONTACT US

TABLE OF CONTENTS

JULIUS TABERTCBRE, INC.Vice President+1 970 372 [email protected]

ROBERT MCCONNELLRE/MAX ALLIANCESenior Commercial Advisor+1 970 690 [email protected]

05 EXECUTIVE SUMMARY

07 FINANCIAL OVERVIEW

10 PHOTOS

15 MAPS

5

C A M P I O N I N D U S T R I A L I N V E S T M E N T

THE OFFERING

This vibrant industrial park investment property presents an opportunity to own a substantial asset in a vital area of Northern Colorado. This asset is located just 2 blocks from Highway 287 between South Loveland and North Berthoud with close access to I-25.

The industrial park consists of three buildings with a total of approximately 100,250 rentable square feet, a vacant lot, and a cell tower. The three buildings are demised into a total of 14 condos. Each individual building has its own HOA which are not in effect, but are used by the seller for the proration of common area expenses.

List Price $5,800,000

Building Size (Assessor) 100,250 SF (Approximately)

Land Area ( Assessor) 361,548 SF (8.3 Acres)

Price Per SF $57.85

NOI (Projected) $500,716

Cap Rate (Projected) 8.63%

Year Built (Assessor) 1967

Years Remodeled/Restoration 1975 - 2015

Zoning Industrial - Larimer County

List Price Additional Vacant Land $25,000

Land Area 78,059.52 SF (1.792 Acres)

Price Per SF $0.32

As evident in the rent roll on page 7 many leases have room to be increased since they were written in the previous recession and are currently below market. Also, the new owner could sell off individual condos or entire buildings to the individual tenants at much higher prices.

Additional rentable square footage might be created by adding a new building on the lot that is currently rented as outside storage.

An additional 1.792 acres of vacant ground is also available north of Building 255 which could be suitable for outdoor storage. See agent for details.

GROWTH POTENTIAL: INCOME

E X E C U T I V E S U M M A R Y

The buildings primarily feature clear heights of 12 feet, however, Unit B in Building 253 features a clear height of 23 feet and houses a five-ton bridge crane. All three buildings have dock high access and limited direct drive-in vehicle access. The parking on the property is well above the tenant’s needs.

The vacant lot is currently leased as outside storage to the tenant in 253 Unit C. The ground with the cell tower is leased to Sprint Spectrum LP until 2028.

7 7F I N A N C I A L O V E R V I E W

Unit Tenant SF Start Date Original Lease Term Rent Annual Gross

Income

225 42nd Street SW

A Available 9,350 N/A N/A $7.75/SF $72,463 (Proforma)

B Available 3,011 N/A N/A $6.75/SF $20,324 (Proforma)

C&D White Buffalo, LLC 9,348 01/01/15 60 Months $5.87/SF $53,284

HSun Valley Farms Marketing,

Inc. 9,397 11/01/16 36 Months $6.04/SF $56,757

253 42nd Street SW

A, B & E Ability Composites, LLC 16,394 05/01/13 4 Years $4.66/SF $76,354

CIntegrated Communications

Group, Inc. 4,690 02/01/14 36 Months $6.01/SF $28,166

D Premier Fire Protection 3,843 10/01/14 37 Months $6.70/SF $25,748

255 42nd Street SW

A/E-2 Voice of Prophesy3,165/ 11,320

10/01/14 60 Months $6.27/SF $90,773

B Construction Supply House 8,538 12/12/15 62 Months $7.50/SF $64,035

C Available 14,934 N/A N/A $7.75/SF $115,739 (Proforma)

D ICS Communications Inc. 3,652 03/23/15 36 Months $7.73/SF $28,230

E-1Summit Construction Supply,

LLC 2,608 06/01/15 36 Months $7.50/SF $19,560

Other

Fenced Outside Storage

Integrated Communications Group, Inc.

02/01/14 36 Months$240.31/

Month$2,884

Cell Tower

STC FIVE LLC 11/13/97 25 Years$760.42/

Month$9,125

Total Gross Income $665,031

RENT ROLL AS OF NOVEMBER 1, 2016

C A M P I O N I N D U S T R I A L I N V E S T M E N T

8

INCOME AND EXPENSES

C A M P I O N I N D U S T R I A L I N V E S T M E N T

Potential Gross Annual Income as of June 2016 Rents $665,031

Less Vacancy 10% -$66,315 -$66,315

Effective Gross Annual Income (Estimated) $598,716

Less Operating Expenses (Estimated)

- Management -$40,000

- Administrative/Legal -$10,000

- Voice of Prophesy - taxes, insurance, maintenance -$18,000

- Reserves for Replacement -$30,000

Total Operating Expenses (Estimated) -$98,000 -$98,000

Net Operating Income (Estimated) $500,716

CAP Rate (Estimated) 8.63%

F I N A N C I A L O V E R V I E W

11

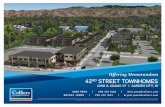

11 BUILDING FROM 4TH STREET

11 11P H O T O S

EXTERIOR PHOTOS BUILDING 253

C A M P I O N I N D U S T R I A L I N V E S T M E N T

12

12 BUILDING FROM 4TH STREET

12 12P H O T O S

EXTERIOR PHOTOS BUILDING 255

C A M P I O N I N D U S T R I A L I N V E S T M E N T

13

13 BUILDING FROM 4TH STREET

13 13

EXTERIOR PHOTOS: GATED STORAGE AND CELL TOWER

C A M P I O N I N D U S T R I A L I N V E S T M E N T

P H O T O S

LOCATION MAP

15M A P S

The equipment towerwill be removed in the near future.

C A M P I O N I N D U S T R I A L I N V E S T M E N T

1.792 Acres

225 253

255

GATED STOR AGE

CELL TOWEREquip.Tes t

Bui ld ing Uni t C

UNIT A

UNIT B

UNIT C

UNIT H

UNIT C

UNIT B

UNIT B

UNIT AUNIT

D

UNIT E

UNIT C

UNIT D

UNIT E-1

E-2

UNIT D

UN

IT A

LOCATION MAP

16

225 253 255 42ND STREET SW

C A M P I O N I N D U S T R I A L I N V E S T M E N T

M A P S

CONTACT US

JULIUS TABERTCBRE, INC.Vice President+1 970 372 [email protected]

ROBERT MCCONNELLRE/MAX ALLIANCESenior Commercial Advisor+1 970 690 [email protected]

Capital Markets | Investment Properties

LOCATION MAP

CAMPIONINDUSTRIALPARK

C A M P I O N I N D U S T R I A L I N V E S T M E N T

1.792 Ac res