2015 Master Builders SA Builder Magazine Aug-Sep

-

Upload

crowther-blayne-media-specialists -

Category

Documents

-

view

228 -

download

5

description

Transcript of 2015 Master Builders SA Builder Magazine Aug-Sep

AU

G/

SEP

201

5

T H E O F F I C I A L J O U R N A L O F T H E M A S T E R B U I L D E R S A S S O C I A T I O N O F S O U T H A U S T R A L I A

also:

Kitchens and Bathrooms 33

Unlocking hidden capacity by closing the gaps 38

Erosion and sediment control on building sites: part 1 41

The Flying Doctor 46

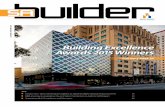

Electra House Heritage RefurbishmentFull story page 43

2015

®

WIN an AFL Grand Final experience thanks to unbreakable HiLux.

toyota.com.au

As a Master Builders Association member, you can enjoy Gold Fleet Discounts on the unbreakable HiLux or any car you choose from the Toyota range.*

Talk to your local Fleet Specialist today about the right deal for you.

To fi nd your local Fleet Specialist Dealer, call 1800 444 847.*Excluding Special Edition models.

For more information, head to myfleet.toyota.com.au/hiluxexperience

TFM

1838

MB

A 0

7/15

A deal builtfor you

TFM1838_Aug Sept_AFL experience MBA_C1.indd 1 17/07/2015 3:35 pmUntitled-2 1 21/07/2015 3:03 pm

Renault VAN RANGE

*Recommended drive away price for the Kangoo Manual Short Wheelbase, Master Manual Short Wheelbase and New Trafic Short Wheelbase Single Turbo each with non-metallic paint. Valid for vehicles ordered between 01/07/2015 & 30/09/2015 while stocks last. Renault reserves the right to vary, extend or withdraw this offer. Offer available to ABN holders only and excludes fleet & government buyers. †5-years/200,000km warranty (which includes two (2) years Extended Manufacturer Warranty) and 5 years/200,000km Roadside Assistance both apply to all new or demonstrator Kangoo models ordered between 1/07/2015 & 30/09/2015 while stocks last. Warranty and Roadside Assistance both valid for 5 years or 200,000km (whichever comes first) from new. Demonstrator vehicles receive balance of new vehicle warranty and Roadside Assistance. Renault reserves the right to vary, extend or withdraw this offer. ‡3-years/200,000km warranty and 3 year/200,000km Roadside assistance both apply to Master and Trafic III models. Warranty and Roadside Assistance both valid for 3 years or 200,000km (whichever comes first) from new. Demonstrator vehicles receive balance of new vehicle warranty and Roadside Assistance. ^First 3 scheduled maintenance services capped at $349 per service on new and demonstrator Master, Trafic III and Kangoo models, based on standard scheduled servicing from new and on normal operating conditions. Scheduled maintenance services required every twelve (12) months or up to 30,000km (whichever occurs first) on Master and Trafic III, and twelve (12) month or 15,000km (whichever occurs first) on Kangoo. However, Master and Trafic III are subject to adaptive servicing requirements, as determined by the Oil Condition Sensor, and may require servicing prior to the standard twelve (12) months or 30,000km service interval. If Master, Trafic or Kangoo is not presented within three (3) months of when the scheduled service is required, right to that capped-price service under the program is forfeited.

Upgrade your business with Europe’s No.1 Van range.

renault.com.au

KANGOOfrom

$19,990*

3.0m3 of load volumeRight and left sliding cargo doorsBluetooth audio streaming

TRAFICfrom

$32,990*

Turbo charged diesel engine5.2m3 of load volume2,000kg of towing capacity

MASTERfrom

$39,990*

1.6t payload8m3 load volumeReverse parking sensorsUp to 30,000km service intervals^

2 SA BUILDER AUGUST - SEPTEMBER 2015

President: Richard Bryant

Deputy President: Peter Salveson

Vice Presidents: Mario Romaldi, Christopher Leopold

Past President: John Kennett

Treasurer: Mark Beatton

Chief Executive Offi cer: John Stokes

Councillors: Enzo Zito, Jock Merrigan, Nick Abley, Neil Mossop, Nathan O’Neill, Fred Pascale, Russell Bianco, Patrick Innes

Master Builders South Australia

PO Box 10014 Gouger St.

47 South Terrace, Adelaide, South Australia

Phone: (08) 8211 7466

Fax: (08) 8231 5240

Email: [email protected]

Executive Editor: Master Builders Association

Published by: Crowther Blayne Media Specialists

Phone: 1800 222 757

Email: [email protected]

Web: www.crowtherblayne.com.au

Business Development Manager: Trish Riley

Sales: Rose Delosreyes, Peter Shepherd, Brett Barfoot, Jenny Karalis, Ken Lane, Craig Flenley, Paul Baird

Editorial: Jessica McCabe and Samantha Regan

Graphic Design: Michelle Triana

Design Team: Byron Bailey, Andrew Crabb

Production: Yvonne Okseniuk

Printed by: Newstyle Printing

Forewords 4 CEO’s Report

6 President’s Report

Reports7 Master Builders News

Updates21 Training

22 Finance

25 Legal

27 Industrial Relations

29 Housing

32 WHS News

Features 33 Kitchens and Bathrooms

38 Building Software and Communications

41 Erosion and Sediment Control

43 Project Feature: Electra House

46 Project Feature: Flying Doctors

Our CoverElectra House heritage refurbishment by Schiavello Construction SASee pages 43 - 45 for the full story

SA BUILDER - AUGUST - SEPTEMBER 2015

Contents

• As construction professionals using non-compliant steel could be your worst decision. • Engineers, certifiers or suppliers have the responsibility and power to refuse the use of unidentifiable or non-compliant steel. • You manage the risk to human safety, reputation, livelihood and cost. Control your risks of non-compliance.• Reduce your liability through simple web downloads of ACRS Certificates at www.steelcertification.com• Check your steel products’ compliance to AS/NZS Standards and building codes.

3SA BUILDER AUGUST - SEPTEMBER 2015

Validate.(verb.) To make valid; substantiate; confirm. To give legal force to; legalize.

Can you take the risk that you might be using non-compliant steel?

Non-compliance is just not worth it. Get the facts.Demand the ACRS Certificates of Product Compliance.

Call ACRS on (02) 9965 7216, email [email protected] or visit www.steelcertification.com

ACRS – The Australasian Certification Authority for Reinforcing and Structural Steels Ltd ABN 40 096 692 545

ACRS rigorously certifies steel product compliance at over 150 locations in 15 countries and is accredited by JAS-ANZ For more detail, register for STEEL CERTIFICATION NEWS at www.steelcertification.com

• As construction professionals using non-compliant steel could be your worst decision. • Engineers, certifiers or suppliers have the responsibility and power to refuse the use of unidentifiable or non-compliant steel. • You manage the risk to human safety, reputation, livelihood and cost. Control your risks of non-compliance.• Reduce your liability through simple web downloads of ACRS Certificates at www.steelcertification.com• Check your steel products’ compliance to AS/NZS Standards and building codes.

4 SA BUILDER AUGUST - SEPTEMBER 2015

JOHN STOKES, CEO, Master Builders SA

CEO’S Report

VET funding anti-competitiveMaster Builders SA calls on the State Government to reverse its anti-competitive funding model for VET training to preserve jobs and to protect against future skills shortages and increased costs.

The South Australian Government had a clear policy to make voca-tional education training (VET) more competitive by encouraging pri-vate registered training organisations (RTO) to enter into the market and compete with TAFE for the provision of training. The Govern-ment’s policy was to bring a commercial reality to the market to provide quality, responsive training at competitive rates that would encourage TAFE to become more commercial, competitive, efficient and all-round better performing.

The private RTOs responded as their share of funding increased through access to enrol greater numbers across a greater range of qualifications and areas of training. The training industry embraced the opportunity and many RTOs were quick to differentiate themselves from TAFE by being more receptive, nimble and by providing more current, up to date industry training.

Funding flowed through Productivity Places Program (PPP), Enter-prise Based PPP (EBPPP) and Skills for All and RTOs like Master Builders SA trained entry level and up-skilled current industry partic-ipants. The training funding secured the future skills of the industry and encouraged quality young people to enter the industry.

The current State Government distribution proposal of the Federal WorkReady funding reverts to a model grossly weighted toward TAFE SA resulting in an anti-competitive VET market.

The State Government has allocated 46,000 of the 51,000 of the subsidised training placements for 2015-16 to TAFE SA under the new WorkReady scheme. Previously the funding was divided approximately evenly with TAFE SA receiving 55 percent and private RTOs 45 per-cent. The policy effectively hands TAFE SA a monopoly with more than 90 percent of funded training places reversing the State Government’s competitively based policy for VET providers.

If the policy is not redressed Master Builders SA stands to lose all funding for Certificate III and Diploma courses after 1 July 2015. Funding for those students under a contract of training signed before 1 July is secure and will continue.

The consequences of the State Government’s new funding distri-bution model are manifold and detrimental on so many levels to the future development of the State and the well-being of the economy.

Private RTOs estimate TAFE SA training costs are more than double the costs of the private sector, which clearly indicates directing the lion’s share of the funding to TAFE SA is not an effective use of tax-payers’ dollars. This equates to less candidates being trained at higher costs when private RTOs could at least double the number of partici-pants for the same cost.

Industry based private RTOs who are far more flexible and respon-sive to industry needs and present options in scheduling, facilities, locations and student support, yet they are being shut out by the State Government’s funding model.

Less students being trained at higher costs will eventually lead to skills shortages, and in the building and construction industry, limited supply of skilled persons increases costs and reduces housing affordability.

The timing of the State Government’s release of their funding model left a truncated time for consultation as to the extent the new policy will cause major disruption to private RTOs businesses with the spectre of increased unemployment across the training industry. The lack of consultation prior to the announcement has also resulted in a discon-nect between the State Government and the Federal Government’s $65 million package for training in South Australia.

The State Government’s WorkReady funding model will have adverse effects on critical industries in both metropolitan and regional areas where many businesses’ long standing relationships with private providers will be disrupted with no guarantee TAFE SA will deliver.

The cynical view is the Government’s policy of delivering a near-monopoly to TAFE SA is to prop up an ailing uncompetitive TAFE SA and reduce its drain on the budget. However, at a time of growing unemployment and greatly reduced numbers of apprentices in training it is a time to concentrate on funding efficient, competitive and cost-effective training for the future.

2015

®

WIN an AFL Grand Final experience thanks to unbreakable HiLux.

toyota.com.au

As a Master Builders Association member, you can enjoy Gold Fleet Discounts on the unbreakable HiLux or any car you choose from the Toyota range.*

Talk to your local Fleet Specialist today about the right deal for you.

To fi nd your local Fleet Specialist Dealer, call 1800 444 847.*Excluding Special Edition models.

For more information, head to myfleet.toyota.com.au/hiluxexperience

TFM

1838

MB

A 0

7/15

A deal builtfor you

TFM1838_Aug Sept_AFL experience MBA_C1.indd 1 17/07/2015 3:35 pm

6 SA BUILDER AUGUST - SEPTEMBER 2015

RICHARD BRYANT, President, Master Builders SA

President’s Report

I’m over the rhetoric of how our State is languishing, lacking in confi-dence, experiencing the highest rate of unemployment of any state…blah….blah….blah.

It’s time to change the dialogue; it’s time to take action – all of us. I’m reminded of Gough Whitlam’s famous 1972 campaign slogan

‘it’s time’ and South Australia has never been more ready for some answers and some action to get us up and going. There is no need to continue defining the problems. We all know what’s not happening. It’s time for some action and there are things that we can do.

Private enterprise risks capital, creates jobs, creates wealth and opportunity and feeds funds into both State and Federal government coffers through tax on profits and activity. Governments don’t create jobs but can prime the pump through their policies to support, assist and provide a market environment to help business flourish.

Measures can be taken to assist, establish and sustain business and to incubate the innovative entrepreneurs who willingly enter commercial risk. The easiest of these actions are for governments to remove struc-tural impediments and barriers to encourage private enterprises and reduce the burden and costs.

To a degree, the concept of intergenerational equity needs to be put aside at times of economic duress - like the present - to ensure a strong sustainable future for the next generations by making available both commercial and residential government controlled land at reduced prices which will attract and stimulate the market. Affordable commer-cial land will attract national and international investment as we have a very stable government system, an underutilised, educated and skilled workforce, good climate and pristine environment plus vacant factories and commercial industrial buildings waiting to be re-commissioned.

Our State economy had a strong manufacturing base however increased costs of labour, compliance and regulator costs caused industry to move their bases. What we have left is a vacant commercial industrial infrastructure waiting to be utilised plus many businesses that relocated have realised that doing business in other countries pre-sents a whole new set of problems.

‘It’s time’ that South Australia became the start-up state and the Government backed the strategy with real and immediate concessions to attract and nurture new ventures.

Historically a strong housing market has coincided with strong eco-nomic growth in South Australia. Increased activity in the housing sector produces investment, employment opportunities and growth. Whilst it is a bit of the chicken and egg argument, housing activity and in particular housing affordability will stimulate the South Australian economy but the recent State Budget did little to stimulate the housing market.

The Federal Treasurer at the Council of Federal Financial Rela-tions has put housing affordability on the agenda for his Depart-ment and those of all State and Territory Treasurers with the emphasis on increasing supply by removing structural impediments.

‘It’s time’The intergenerational inequity is becoming apparent with younger gen-erations finding affordable housing extremely difficult. Home owner-ship and good housing has been an indicator of our community’s social and economic wellbeing.

Streamlining the over regulated, costly and inefficient supply process will start to remove some of the impediments and barriers to the aspi-rations of home ownership for many young people.

In the Development Approval process of Planning Approval and Building Rules Consent we once thought that private certification of Building Rules Consent was a pipedream. However, through lobbying it was achieved.

Why not private certification of Planning Approval?Private certification of Planning Approval delivered by accredited

planning professionals who are regulated by State Government will establish a competitive market where turnaround times for applications could be reduced and the process would not be subject to attitudinal bias. This will also provide much needed planing approval consistency.

The Federal Government’s Harper Review into competition high-lights under supply of housing and calls for delivery of greater State and Local Government productivity abolishing inefficiencies, excessive taxes, levies and delays in the supply process as imperative to increase housing affordability.

Tax reform is high on my agenda to stimulate the State’s economy and the Master Builders SA’s submission to the Treasurer on the State Tax Review is available to read in its entirety on our website. The Treasurer in the recent State Budget commenced the process but it was a missed opportunity as there was little in the Budget for housing industry. The staged reduction in sales tax on commercial property was welcomed but the three year staged reduction might delay property transactions as purchasers may wait for three years to avoid tax.

Reform of the State tax system needs to be augmented by the reduction of public expenditure in areas of inefficiency that include duplication of services across tiers of government, unnecessary State Government spending, reducing levels of public sector employment and the intrusion of statutory corporations and government entities into the private sector.

Taxpayers commit to the payment of taxes on the understanding that such commitment is necessary to fund essential expenditure. Unfortu-nately public expenditure was not considered in the tax review.

I also advocate that a segment of essential expenditure, vital to a return to prosperity is targeted investment in urban infrastructure to support development and growth of the State. For too long our State has operated on 1960s-era infrastructure.

I encourage Members to stop talking about the negatives and start identifying the opportunities and advocate for reform so that politi-cians understand that ‘it’s time’ for action as the community and the industry are demanding and willing to accept change.

7SA BUILDER AUGUST - SEPTEMBER 2015

Master Builder News

2015 State tax reform: Major tax reform package to make South Australia the best place to do businessThe State Government released its response to the State Tax Review with a major tax reform package that will see almost $670 million in tax cuts to businesses and the community over the next four years.

Treasurer Tom Koutsantonis said the changes represent the most comprehensive tax reforms in South Australia’s history.

“We are creating a State tax system that will attract business to South Australia and reduce costs to business in South Australia so they can invest, grow and employ more South Australians,” Mr Koutsantonis said.

“Our reforms will create jobs, maintain jobs and build the enter-prises that create careers.

“In total, almost $670 million in tax reductions will be provided over the next four years as part of our tax reform package, including ongoing reductions of more than $268 million per annum from 2018–19.

“Over the next decade these tax changes will return almost $2.5 bil-lion to businesses and the community.

“This is in addition to the State Government’s reforms to WorkCover, which will deliver a reduction in business costs in South Australia of about $180 million per annum.”Key elements of the State Government’s tax reform package are:• Abolishing share duty• Abolishing stamp duty on non-real property transfers• Abolishing stamp duty on non-residential property transfers

(phased from July 2016)• Abolishing stamp duty on genuine corporate reconstructions• Abolishing the Save the River Murray Levy• No new state taxes with the State Government ruling out a broad-

based land tax on the family home.

By July 2018, all business property transactions in South Australia will be tax free – the only jurisdiction in the country to implement such reform.

The State Government will abolish the Save the River Murray Levy from 1 July 2015, which will also provide annual savings to most house-holds and businesses of more than $40 and $182 respectively.

Mr Koutsantonis said protecting and creating jobs was the State Government’s main priority as the State faced an unprecedented number of threats.

“The slow-down in the Australian economy and collapse in com-modity prices, the withdrawal of Federal Government support for our auto-manufacturing and navy shipbuilding industries and the $1.4 bil-lion in Federal Government cuts to health and education over the next four years are all threatening South Australian jobs,” he said.

“That is why South Australia needs to forge its own future by creating a State tax system that rewards effort and removes barriers for busi-nesses wanting to invest, grow and create jobs.

“Through our State Tax Review, it became clear that transactional taxes like stamp duty on business property transfers present extra costs for those seeking to create new businesses or expand existing ones - often stopping investment from occurring.

“Stamp duty on non-residential property, for example, is generally considered to have a larger negative impact on investment decisions than any other State tax.

“By abolishing stamp duty on non-real and non-residential property transfers, we will remove a large barrier to business investment and expansion, encouraging economic growth and job creation.

“More than 6800 transfers of non-residential property will benefit each year from the changes.

“It will provide a lasting improvement to the South Australian economy and encourage the creation of new businesses and new careers for South Australians.”

From 18 July, the State Government will:• Abolish share duty• Abolish stamp duty on non-real property transfers (eg. non-fixed

plant and equipment)• Abolish stamp duty on aquaculture leases and statutory licences• Abolish stamp duty on genuine corporate reconstruction• Expand the stamp duty concession for exploration tenements to

include retention tenements.

From 1 July 2015, the State Government will:• Abolish the Save the River Murray Levy• Abolish the Hindmarsh Island Bridge Levy• Introduce a new cost of living concession of up to $200 for

pensioners and low income earners• Extend the small business payroll tax rebate to 2015-16• Index land tax thresholds by up to 2.5 per cent, meaning the

tax-free threshold will increase from $316,000 to $323,000 and implement other minor amendments to the Land Tax Act 1936

• Introduce conveyance duty and land tax exemptions for principal residential properties that are transferred into Special Disability Trusts for no consideration

From 1 July 2016, the State Government will:• Phase out stamp duty on non-residential real property transfers.

From 1 July 2016, there will be a one-third reduction, with a further third reduction on 1 July 2017

HON. TOM KOUTSANTONIS, MP, Treasurer

8 SA BUILDER AUGUST - SEPTEMBER 2015

Master Builder News

From 1 July 2018, the State Government will:• Abolish stamp duty on non-residential real property transfers• Abolish stamp duty on transfers of units in unit trusts• Remove the $1 million stamp duty landholder threshold.

In addition, the tax reform package includes no new taxes. The State Government today ruled out a foreign investment tax and broad-based land tax on residential property.

Mr Koutsantonis said the cost of doing business in South Australia will fall substantially as a result of the State Government’s tax reforms.

“Based on the reference business and tax settings used by the Insti-tute of Public Affairs in its Business Bearing the Burden 2012 publica-tion, South Australia would move from being the highest taxing state to the lowest taxing state once the Government’s tax changes have been fully implemented,” he said.

South Australia’s tax effort is expected to decline significantly as a result of the tax changes the State Government is making, with South Australia’s adjusted total tax effort expected to move further below the national average.

“Our tax changes reduce the harmful impact inefficient taxes have on the economy, and are consistent with the views expressed by South Australians during the State Tax Review,” Mr Koutsantonis said.

“They will make South Australia an even more attractive place to set up business while also allowing our existing businesses to consolidate and grow.

“Through this State Budget, the Government is determined to encourage and foster growth and innovation.

“We believe the reforms will assist small and medium enterprises to expand and diversify, ensuring our small business success rate remains the highest in mainland Australia.”

IPA Business Bearing the Burden tax comparison

RANK

Lowest taxes

Highest taxes

BEFORE CHANGES AFTER CHANGES

12345678

NTVICWAQLDNSWTASSouth AustraliaACT

NTSouth AustraliaVICWAQLDNSWTASACT

* Department of Treasury and Finance calculations based on informationin the Institute of Public A�airs* publication

0.0

-0.5

-1.0

-1.5

-2.0

-2.5

-3.0

Commonwealth Grants Commission total tax e�ort

South Australia’s total tax e�ort (%)

CGC (2013-14)1 After tax changes2

1 Adjusted to remove land tax paid by the South Australian Housing trust.2Adjusted to include the Government’s tax changes and recent changes to emergency services

levy remissions and to remove land tax paid by the South Australian Housing Trust.

-0.4

-2.8

NATIONAL AVERAGE

Stamp duty payable for selected non-residential property values

500 000750 000

1 000 0005 000 000

10 000 000

21 33035 08048 830

268 830543 830

142202338732553

179220362553

7110116931627789610

181277

NO TAXNO TAXNO TAXNO TAXNO TAX

Capital value ($) Current duty ($) 1 July 2016 ($) 1 July 2017 ($) 1 July 2018 ($)

Example 1Company A and Company B both operate in the automotive supply chain. Company A decides to buy Company B to consolidate its posi-tion in the market and to achieve additional economies of scale so that it can remain competitive. The purchase of Company B involves non-residential property assets of around $1.7 million. Company A will save up to $87,330 in stamp duty once the State Government’s tax changes have been fully implemented.

Example 2A business owner wants to consolidate a business that she purchased a year ago with an existing business. The business being consolidated has non-residential property assets of about $3 million. The State Govern-ment’s changes to stamp duty relief for corporate reconstructions will mean that the owner will save $158,830 in stamp duty.

Example 3An individual purchases a shop on Jetty Road, Glenelg, to set up a continental deli. The shop has a capital value of about $1.3 million. Depending on when the property is purchased, the individual will save up to $65,330 in stamp duty.

Mr Koutsantonis said the continuation of the payroll tax rebate will also save about 2200 small businesses $11.3 million in 2015-16, with savings of up to $9800 per business.

The temporary rebate, introduced in 2013-14, has already delivered sav-ings to small business of $19.2 million over the past two financial years.

“Even without rebates, the Commonwealth Grants Commission considers South Australia’s payroll tax effort to be the most competitive in the country,” Mr Koutsantonis said.

“But we recognise our payroll tax rebate still provides an important cash-flow boost to many small businesses.”

Mr Koutsantonis said further discussions about payroll tax reform will occur at a national level as part of the Federal White Paper on the Reform of Australia’s Tax System.

In addition, the State Government is leading a national conversa-tion on how best to tax online gambling to even the playing field and increase tax neutrality between online and traditional operators.

Mr Koutsantonis said the State tax reform package also includes assistance to households and the most vulnerable.

The Save the River Murray Levy will be abolished from 1 July 2015, delivering savings of almost $109 million over four years to households and businesses – or $40 and $182 per year respectively.

The levy currently applies to the water bills of 415,000 households and 50,200 non-residential properties that are able to be supplied with River Murray water.

“We understand the cost of living pressures faced by South Aus-tralian households and want to look at ways of to ease the burden,” Mr Koutsantonis said.

ADELAIDE CONVENTION CENTRE NORTH TERRACE, ADELAIDE

TIME / 7:30PM - 12:30AM DRESS / COCKTAIL / AFTER FIVE

ENTERTAINMENTAUSTRALIAN ULTIMATE

KYLIE SHOWATTACK

DJ DUO JASON LEE & DAVE COLLINSMC BRENTON RAGLESS

APPETISER Poached prawns and smoked ocean trout

with roasted beetroot, micro herb salad and lemon chutney

MAIN COURSEOven baked lamb rack with �ngerling potatoes,

con�t garlic, vegetable medley, smoked bacon and rosemary jus

DESSERTSpicy ginger and chocolate gateau with

cherry compoteEspresso co�ee and selection of T bar teas

BEVERAGES Schild Estate Chardonnay Pinot Noir

Misty Lane MoscatoBird in Hand Semillon Sauvignon Blanc

Mr Mick RieslingThe Landing Reserve Shiraz

Coopers Pale Ale, Lager or Premium Light BeerOrange juice, mineral water and soft drinks

BOOK YOUR SEAT/TABLE ONLINE AT www.adelaidecc.com.au

For more information please contact 8210 6734

TICKETS$125.00pp (inc GST) for Friday night

$135.00pp (inc GST) for Saturday night

Price includes a 3-course meal, beverages and entertainment.

Payment in full is required at the time of booking. 10 people per table,

individual bookings accepted.

FRI 11.DECSAT 12.DEC

MENU

As strong as traditional concrete and 100% guaranteed, it’s the smarter building material. Made from clean recycled aggregate, it has a carbon footprint up to 65% less than quarried alternatives.

Our concrete has been successfully used in several projects:• InhousesandfootpathsofthegreenestateofLochiel

Park• HarrisScarfeRedevelopmentProject• RetirementVillageatAngleVale• SnowtownWindFarmStageII

To place an order call 1300 myorders.

Wingfield: Cnr Hines & Wingfield Roads, Wingfield SA Lonsdale: Meyer Road, Lonsdale SA

We also have a great range of decorative concrete finishes to choose from. Call 1300 myorders for more information.

THeRe’SnoReASonnoTTocHooSeReSouRcecoRecycLedconcReTe

10 SA BUILDER AUGUST - SEPTEMBER 2015

Master Builder News

“As part of the State Tax Review, we said everything was on the table – including concessions and levies.

“We are abolishing the Save the River Murray Levy in recognition that the original purpose of the fund has been achieved - specifically, to allow us to campaign for the health of the River in this State.”

The specific measures funded by the Save the River Murray Levy will continue to be delivered.

The State Government will also introduce an up to $200 cost of living concession for pensioners, low-income earners and self-funded retirees holding a Commonwealth Seniors Health Card who own their home or rent.

It replaces the $190 council rate concession which supported only pen-sioners, low-income earners and self-funded retirees who own their home.

“We designed this new concession in direct response to the Abbott Government’s failure to reinstate the $30 million per year it cut from pensioner concessions in South Australia in last year’s Federal Budget,” Mr Koutsantonis said.

“The State Government stepped in and covered this cruel cut for 12 months while it campaigned for the Abbott Government to reinstate the funding.

“Unlike the Abbott Government, this State Government will always fight for and protect our most vulnerable citizens - it is in our DNA.

“The new concession will enable about 205,000 households to put up to $200 towards their greatest needs, whether that is electricity, gas and water bills or council rates.

“As a result of this reform, more South Australian pensioners will be better off. Eligibility for the new concession has been expanded to include 45,000 pensioners and low-income earners in South Australia who are tenants.

“They previously received nothing under the council rate concession because they don’t own their own home. Now, they will receive an extra $100 in their pocket each year.

”The new concession is on top of existing pensioner concessions for energy, medical heating and cooling, public transport, Emergency Ser-vices Levy and water/sewerage. The arrangements for these concessions remain unchanged.

Other tax simplification measures to be implemented as part of the State Government’s tax reform package include:• Amending the Stamp Duties Act 1923 to:

• Expand the stamp duty exemption for farms transferred between family members to cover transfers that involve the use of certain types of trusts

• Extend the definition of family groups in the Stamp Duties Act 1923 to include de facto couples

• Replace the stamp duty Ex Gratia relief administrative schemes for disability service providers, incapacitated persons and property donations to charities with legislative exemptions.

• Amending the Motor Vehicles Act 1959 to replace a registration fee Ex Gratia relief administrative scheme for vehicles used to transport children with a disability with a legislative exemption

• Amending the Taxation Administration Act 1996 to require only 50 per cent of the tax in dispute to be paid before an appeal can be lodged.

For more information on the State Government’s tax reform package visit: www.statebudget.sa.gov.au

WILHELM HARNISCH, CEO, Master Builders Australia

Welcome call for inquiry into non-conforming building productsMaster Builders Australia supports the call by Senators Xenophon, Lambie and Madigan for a Senate Inquiry into Non-conforming Building Products (NCPs).

“We welcome the recognition of the seriousness of the problem NCPs pose to the building and construction industry, commercial and residential builders and the safety of the community,” Master Builders Australia CEO Wilhelm Harnisch said.

It is vital that building products comply with Australian Standards and regulations regardless of their point of origin.

Safety is paramount and the problem of non-conforming building products entering the Australian construction supply chain highlights the growing role for regulators such as the Australian Competition and

Consumer Commission (ACCC) and relevant state and territory building approval agencies, in addition to architects, designers (and others who specify building products), suppliers and builders to ensure that building products are compliant regardless of their source.

Master Builders supports the ACCC in their launch earlier this week of an awareness campaign about the dangers posed by faulty electrical cabling.

NCPs pose challenges for both commercial and residential builders and Master Builders looks forward to working with Senators Xeno-phon, Lambie and Madigan (in addition to other members of the Senate Inquiry) to review the current gaps in the system that has seen NCPs being used in buildings.

Master Builders National ConferenceJupiters, Gold Coast,12-14 November 2015

Early Bird now open — Save $200The Master Builders biennial National Conference is heading to the Gold Coast in November, for what will undoubtedly be the industry event of the year once again.

Unlike many traditional industry conferences that have a program full of just technical sessions the Building Australia conference stands out amongst the rest.

The Master Builders National Conference ‘Building Australia’ focuses on leadership and assisting members to make informed decisions in continuing to grow their business whilst developing and maintaining strong leadership attributes within their business ethos. With high profile speakers that will examine the building industry outlook and topics relevant to today’s building and construction industry.

Early Bird registration now open — Save $200 on the Standard rate by registering early! www.masterbuilders.com.au/Events/national-conference

The Master Builders Excellence in Building and Construction Awards will be presented as part of the National Conference on the Saturday evening as the grand finale to an exciting conference on the Gold Coast…………We look forward to seeing you there!

BUILDING AUSTRALIABUILDING AUSTRALIA

Images: courtesy Gold Coast Tourism

®

PLATINUM SPONSOR

conf ad full page May 2015 for WA.indd 1 4/05/2015 4:20:24 PMMBA BAC May 2015 for WA JA.indd 1 5/05/2015 3:46 pm

Master Builders National ConferenceJupiters, Gold Coast,12-14 November 2015

Early Bird now open — Save $200The Master Builders biennial National Conference is heading to the Gold Coast in November, for what will undoubtedly be the industry event of the year once again.

Unlike many traditional industry conferences that have a program full of just technical sessions the Building Australia conference stands out amongst the rest.

The Master Builders National Conference ‘Building Australia’ focuses on leadership and assisting members to make informed decisions in continuing to grow their business whilst developing and maintaining strong leadership attributes within their business ethos. With high profile speakers that will examine the building industry outlook and topics relevant to today’s building and construction industry.

Early Bird registration now open — Save $200 on the Standard rate by registering early! www.masterbuilders.com.au/Events/national-conference

The Master Builders Excellence in Building and Construction Awards will be presented as part of the National Conference on the Saturday evening as the grand finale to an exciting conference on the Gold Coast…………We look forward to seeing you there!

BUILDING AUSTRALIABUILDING AUSTRALIA

Images: courtesy Gold Coast Tourism

®

PLATINUM SPONSOR

conf ad full page May 2015 for WA.indd 1 4/05/2015 4:20:24 PMMBA BAC May 2015 for WA JA.indd 1 5/05/2015 3:46 pm

12 SA BUILDER AUGUST - SEPTEMBER 2015

Master Builder News

State Budget – overview for construction industry

HON. TOM KOUTSANTONIS, Treasurer

The 2015-16 State Budget shows the State Government forecasting a return to surplus while delivering a $985 million stimulus package including major tax reforms and targeted investments in growth industries to boost the economy and create jobs.

Treasurer Tom Koutsantonis said the 2015-16 State Budget:• Delivers a tax reform package that provides almost $670 million in

tax reductions over four years by restructuring business taxes to help businesses invest, grow and create jobs.

• Injects a further $315 million over four years into growth industries and targeted infrastructure projects to stimulate the economy and create jobs.

• Returns the Budget to balance – forecasting surpluses from 2015-16.• Protects pensioners and the vulnerable.• Locks in spending of at least $1.3 billion per year on infrastructure.

“Protecting and creating jobs is this State Government’s main pri-ority,” Mr Koutsantonis said.

“The slow-down in the Australian economy and collapse in com-modity prices, the withdrawal of Federal Government support for our auto-manufacturing and naval shipbuilding industries and the $1.4 billion in Federal Government cuts to health and education over the next four years are all threatening South Australian jobs.

“That is why South Australia needs to forge its own future by creating a State tax system that rewards effort and removes barriers for businesses wanting to invest, grow and create careers for South Australians.

“The State Government will also invest in growth industries and essential infrastructure projects to transform the economy, stimulate the construction sector and create jobs.

“We will return the Budget to balance with a forecast surplus of $43 million in 2015-16 and strong surpluses of $654 million in 2016-17, $727 million in 2017-18 and $961 million in 2018-19.

Proposed construction projects include:Schools and children’s centres • $25 million over three years for school improvements including

refurbished learning areas and upgraded information technology (IT) infrastructure.

• $25 million over three years to establish five new children’s centres and provide general improvements to existing facilities.

Public housing• $20 million in additional funding towards a $65 million public

housing package to renovate and rebuild South Australian Housing Trust homes.

Roads• $70 million over four years to improve critical road infrastructure.• $40 million over four years to improve the safety of roads.• $55 million over four years for a new 2.8 kilometre road in Gawler East.

JobsOver the next four years, the State Government will invest more than $10.8 billion in infrastructure projects to support almost 4700 jobs per annum including:• Construction - 1810 jobs per annum.• Road and rail – 1390 jobs per annum.• Water supply – 985 jobs per annum.• Hospital services – 504 jobs per annum.

Mr Koutsantonis made a guarantee that the State Government will spend at least $1.3 billion per year on infrastructure in the general gov-ernment sector to provide world-class services the public expect and deserve while also supporting jobs into the future.

“This State Government re-built the Adelaide Oval and Adelaide Convention Centre, we are building a new Royal Adelaide Hospital, we have re-introduced light rail to Adelaide’s transport system and we have built six new high schools and 42 children’s centres,” he said.

“This major capital investment program continues our long-term plan to upgrade and build essential economic and social infrastructure for South Australia including schools, hospitals, housing and roads.”

I’m Christine.This is my business.I BECAME MY OWN BOSS AT TWENTY-ONE WITH HELP FROM THE CONSTRUCTION INDUSTRY TRAINING BOARD.

THE CITB PROVIDES TRAINING ADVICE, FINANCIAL SUPPORT AND SKILLS DEVELOPMENT TO HELP BUILD CAREERS IN THE CONSTRUCTION INDUSTRY.

LEARN HOW THEY CAN HELP YOU TOO. VISIT CITB.ORG.AU

www.prospectcontractors.com.au Phone (08) 8297 6611 Mobile 0418 836 100

Australia’s Award Winning Gabion Installation Company

Gabion Applications:Erosion ControlSoil StabilisationMarineCoastal ProtectionWetlandsWeirsCreek RehabilitationDrainageRoads and RailwaysBridge AbutmentsMining Dump WallsRetaining WallsNoise Walls

S

S

S

S

S

S

S

S

S

S

S

S

S

14 SA BUILDER AUGUST - SEPTEMBER 2015

Master Builder News

IAN MARKOS, Director of Policy

Building the future – advocacy updateSouth Australia’s building, construction and property industry may have missed out on big infrastructure spends in last month’s State Budget, but proposed planning reforms provide an opportunity to have the biggest impact on day-to-day business.

More than one brick in the wallPlanning Minister John Rau is preparing to table legislation that will create a new planning body, create a statewide e-planning system and remove appeal rights on individual projects except in particular circumstances.

Th e reforms also propose introducing an urban growth boundary backed by Parliament, and introducing a greater range of penalties for non-compliance.

Master Builders SA has been in contact with the Minister and his offi ce to outline our support for any system that cuts the red tape that binds so much of our industry. In our view, it is likely to support our members every day by simplifying planning policies across both met-ropolitan and regional areas and by creating a single electronic process that combines planning, environmental and other checks. However, we have also expressed concern about the introduction of more penalties when existing penalties appear suffi cient, and reiterated our objection to a legislated boundary that is more likely to bring rim development to an end rather than create jobs.

Black, white or grey hatsMinister Rau is also responsible for the potential reform of SafeWork SA and the separation of education and compliance activities. We sup-port the concerns behind the separation: businesses should feel com-fortable working directly with SafeWork SA without being concerned about potential retribution.

We remain concerned that if an education agent sees a hazard onsite, he or she must either report it – or leave workers at risk. And as soon as a risk is reported, then the trust behind the proposed model fails. Th is obviously requires a solution for the best outcome.

Master Builders SA has instead proposed an enhanced inspectorate that is geared towards building industry trust. An inspector should have a healthy working relationship with businesses and workers, and be fully empowered to help solve small problems, but also be prepared to ensure compliance for high-risk hazards.

Industry trainingSkills Minister Gail Gago recently announced the end of the Skills for all funding for private providers, announcing a new WorkReady pro-gramme where virtually all funding would be reserved to make TAFE SA a sustainable education provider by 2018-19.

Th is shift of funding means it is more expensive for students to undertake training with industry bodies like Master Builders SA. Th is is likely to leave TAFE SA producing students with limited knowledge of industry best-practice, a phenomenon likely to cost businesses more in additional training and lost productivity as years pass.

Master Builders SA has met with Minister Gago to outline industry concerns and was told that the Government remains committed to funding TAFE SA as a near-monopoly. We are currently investigating alternatives to minimise the impact on students and members.

Construction Industry Forum – Subcontractor EngagementTh e Construction Industry Forum has been considering a proposed amendment to the Code of Practice for government-backed projects. Th e amendment proposed introducing a new Schedule focusing on subcontractor engagement on these projects.

Master Builders SA consulted extensively on this matter, which proved to be a diffi cult and, at times, emotive issue. Th e fi nal stage in our con-sultation involved an intense workshop with sector representatives, all focused on delivering a Code that would meet concerns – but with a fi rm eye on the practicalities of commercial projects. Th e original proposal required, for example, the delivery of all the entire construction pro-gramme, despite the fact it may not be fi nalised or indeed be relevant to all parties. Given our fi rm commitment to reducing administrative burdens on business, this was clearly an unacceptable proposal.

Th e revised proposal off ers a clear, concise and practical document. It will be considered by the CIF in the coming month.

Parliamentary EngagementParliament will be considering a variety of matters in coming months that are likely to impact member businesses, including planning reform, SafeWork SA’s future, and industrial manslaughter proposals. We will continue to increase our engagement with Parliamentarians as we seek to get the best outcomes for all members.

German Engineered.Australian Tested.

German Engineered.Australian Tested.

When the going gets tough the tough get a Volkswagen Amarok, which is why some of

Australia’s leading construction companies are turning to Amarok. With an 8-speed automatic

transmission for constant power and torque paired with a 4MOTION all-wheel-drive system,

it handles any situation, on or off-road. It also makes light work of loading pallets and tight

squeezes with the widest tray and cabin in its class. It’s a tried and tested workhorse, even

being awarded Best in Class Ute 2015 by 4x4 Australia Magazine.

To find out more go to amarokfleet.com.au

Contact us on [email protected] Follow Volkswagen Commercial Vehicles Australia on LinkedIn Follow Volkswagen Commercial Vehicles Australia on LinkedIn

16 SA BUILDER AUGUST - SEPTEMBER 2015

Master Builder News

WILHELM HARNISCH, CEO, Master Builders Australia

WILHELM HARNISCH, CEO, Master Builders Australia

Building industry backs sensible reforms to 457 Visa systemThe Government’s proposed reforms of the 457 Visa system will sup-port a more productive building and construction industry and more jobs for young Australians.

“Master Builders welcomes the Government’s positive approach in responding to the Independent Review of the Integrity of the 457 Subclass Program, particularly in proposed reforms to strengthen and protect the integrity of the 457 Visa program,” Wilhelm Harnisch said.

The recommendations put forward by the Assistant Minister for Immigration and Border Protection Michaelia Cash show that the Government has listened to the building industry’s call for greater flex-ibility in the system while strengthening its integrity.

Minister Cash’s response will cut red tape for builders who do the right thing while ensuring those who don’t face tougher sanctions.

Contrary to union claims, the building industry is committed to pro-viding jobs for Australians first. The skills of foreign workers are called on to meet skills deficits on projects when local workers are not available.

“Minister Cash’s proposed training fund will reduce future reliance on overseas workers by supporting building industry employers to train more young Australians and upskill existing workers,” Wilhelm Harnisch said.

Master Builders looks forward to working closely with the Gov-ernment to ensure the industry is an important driver of the training delivery model under the new training fund to ensure positive outcomes are achieved and more job ready young people can readily embark on rewarding careers in building and construction.

The Minister’s proposal that the fund should support builders to train more young people in regional and Indigenous communities will help fight youth unemployment and support the Government’s efforts to close the gap for Indigenous Australians.

Master Builders also welcomes the Government’s recommended move to more flexible labour agreements. Reducing the timeframe from two years to three months through the setting of service agree-ment by the Department is supported as is the more flexible approach in English language testing. The proposed averaging approach is a solid first step in addressing the industry’s concerns.

Minister Cash’s 457 Visa reforms will assist the building industry to meet its cyclical skills shortages while providing Australian young people with more rewarding career opportunities in a key growth industry.

Strategic plan for asbestos removal welcomedMaster Builders has long recognised the importance of a strategic approach for the removal of asbestos from existing buildings and there-fore welcomes the Asbestos Safety and Eradication Agency’s (ASEA) release of its National Strategic Plan for Asbestos Management and Awareness 2014-18.

“In particular, Master Builders strongly supports the amendments to the plan that consider the practicality of removing all asbestos-con-taining material (ACMs) from the built environment. The revised removal strategy seeks to identify priority areas where ACMs may present risks,” Wilhelm Harnisch said.

We welcome the recognition of the seriousness asbestos poses to the safety of those working in the commercial and residential building sec-tors, home owners and the wider community.

According to ASEA, Australia has one of the highest per-capita rates of mesothelioma in the world (in 2012, 652 Australians died from the dis-ease). Despite a national ban of the use and importation of asbestos in 2003, many products that contain asbestos are present in our built environment.

It is estimated that up to one in three Australian homes contain some kind of asbestos. Based on current data, ASEA predicts that as many as 25,000 Australians will die from Mesothelioma over the next 40 years.

Master Builders also welcomes the six point strategic approach of the Asbestos Safety and Eradication Agency to seek a coordinated attempt from industry stakeholders and a common one from state and territory governments in dealing with the problem of asbestos safety and eradi-cation which includes:• Awareness – increasing public awareness of the health risks of

working with and being exposed to asbestos.• Best Practice – identifying and sharing best practice in asbestos

management, education, handling, storage and disposal.• Identification – improving the identification and grading of

asbestos and sharing information regarding the location of asbestos-containing materials (ACMs).

• Removal – identifying priority areas where ACMs may be present and review removal infrastructure to estimate if safe removal is practicable.

• Research – Commissioning, monitoring and promoting research in the prevention of asbestos exposure.

• International leadership – calling for a worldwide ban of asbestos mining and manufacturing.

rylock.comWoodville North | Factory & Showroom26 Audley Street 8413 5500

Delivering World Class light, views, lifestyle & energy efficiency into quality Australian

homes for more than 30 years

Which brand of window deservesto be in your next Master Build ?

rylock.comWoodville North | Factory & Showroom26 Audley Street 8413 5500

Delivering World Class light, views, lifestyle & energy efficiency into quality Australian

homes for more than 30 years

Which brand of window deservesto be in your next Master Build ?

18 SA BUILDER AUGUST - SEPTEMBER 2015

Master Builder News

It started with an “airie”...MASTER BUILDERS SA GOLF CLUB

Our early daysAn airie is not an auspicious start to any golf game but at the MBA Golf Club’s inaugural Golf Day on 27 September 1957 the failure of the then President to connect with the ball did nothing to diminish the enthu-siasm of Master Builders SA to foster regular local golf games between Members and Associates.

Other Master Builders’ Associations interstate were also holding regular games for their members. It was not long before the South Aus-tralian Chairman proposed an annual interstate Golf Tournament to compete for the M. R. Hornibrook trophy. The first tournament, held over two days, was played in Melbourne in 1959 between South Aus-tralia, New South Wales and Victoria.

Almost 60 years later the Master Builders SA Golf Club continues to give its members and associates the opportunity to play golf with colleagues at various prestigious golf courses in South Australia and interstate.

Local CompetitionsThe Club hosts six local competitions during the year with the first game at Victor Harbor Golf Club and the final game at Kooyonga Golf Club. Both events are followed by a presentation dinner.

The remaining games are held at courses including Royal Adelaide, Grange and Glenelg. A light lunch is provided and there is the opportu-nity for socialising after the games.

The competitions are 4BBB and individual Stableford. You do not need a golf handicap to play in local games, but if you do you have more chances to win a prize.

National CompetitionA highlight of the Master Builders SA Golf Club’s year is the interstate competition for the M. R Hornibrook Cup. The tournament has grown since 1959 and now teams from Brisbane, the Gold Coast, Sydney, Newcastle, Victoria, Tasmania and South Australia rotate hosting the annual competition. South Australia has a strong record in the compe-tition, including four wins out of the last five tournaments.

Victoria is hosting the competition this year in October. Games will be played at Metropolitan, Woodlands and Sanctuary Lakes golf clubs. Players need a current GolfLink Handicap to play in the competition and to be members of the Master Builders SA Golf Club.

The program includes a welcome dinner on Sunday; games on Monday, Tuesday and Thursday; R&R on Wednesday, with the host team organising a daytime outing, and the final game on Thursday followed by a presentation Dinner that night.

Schedule of games for the rest of the year• 3 July Kooyonga Golf Club• 21 August - Royal Adelaide Golf Club (Builders vs Architects

Annual Competition).• 11-15 October - M.R Hornibrook Melbourne Victoria.• 6 November - Kooyonga Golf Club

MembershipCurrently there are 40 members in South Australia. The committee of eight, presided over by Master Builders SA member Peter Ewen, meets regularly.

The Club welcomes new members and invites you to come along and join our members for great golf on some great courses, socialising and networking. And don’t be deterred if you’re more prone to airies than a hole in one. Please note, to be a member you need to have an official handicap (GolfLink number).

For more information contact:Jim Jovanovic (Secretary) Mobile: 0438 340 294Email: [email protected] www.mbasagolf.org

19SA BUILDER AUGUST - SEPTEMBER 2015

Master Builder News

BRENDON CORBY, Development and Technical Manager

Non-Conforming Products - What does that mean for Builders?A recent Australian Institute of Building Surveyors State Conference was told that builders are being targeted in a transfer of responsibility in the wake of growing concern over the impact of non-conforming products.

It is estimated that every $1 spent on avoidance saves $160,000 in rectification costs so where good practice maximises good building and minimises problems, it is far better to avoid crises by focusing on avoiding problems in the first place.

Master Builders SA practice has been built on this adage. Failure to take note will likely cost the industry dearly.

The Australian Institute of Building Surveyors (AIBS) has been extremely concerned about increasing claims against members even though they were not responsible for material substitution or selec-tion on projects. In many cases, the builder could be targeted as being responsible. AIBS has been so concerned about not being able to access or fund affordable indemnity insurance that they have written to Prime Minister Tony Abbott to express those concerns, together with the con-cern that builders are supposed to carry out the Clerk of Works role, despite rarely carrying that responsibility today.

Builders cannot forget they need to maintain their responsibilities previously bound in the Clerk of Works role. They need to make cer-tain that appropriate due diligence is occurring on their jobs to ensure products and materials they are selecting or substituting or accepting are fit for purpose.

If builders fail to ensure products are fit for purpose or cannot demonstrate they have undertaken adequate due diligence, then liability transfer – be it partial or whole – can lie with them if the product fails.

The recent cladding failure at the Lacrosse apartment fire in Mel-bourne’s Docklands raises the prospect of many years of legal wran-gling over responsibility for the incident. Similar concerns have also been raised with regard to other product issues, including Infinity cables, hi tensile bolts and faulty glazing.

Master Builders’ National Technical Committee has identified non-conforming products as a major issue that must be addressed by the building industry as a matter of priority to avoid potentially catastrophic consequences in both physical and financial terms. Insurers may in future refuse to cover the consequences of a builder’s failure to undertake appropriate due diligence or select products that are fit for purpose.

The legal fraternity is concerned, the insurance industry is con-cerned, the building surveying community is concerned, and State and National Associations are concerned. All are warning that every builder must undertake their own due diligence to ensure they are using the appropriate products for every job or risk the consequences.

I have painted a worrying picture and make no apology for doing so because I care for our industry and am concerned about the potential repercussions of this trend. This is the most worrying period I have experienced in my 30 years in the industry, and rising pressures on commercial margins risk pushing builders into positions where price is more important than due diligence.

Alarm bells are ringing. Please heed them.Members wishing to discuss technical aspects of product performance

or seeking assistance with minimising their exposure should contact our technical department at [email protected] or at 08 8211 7466.

20 SA BUILDER AUGUST - SEPTEMBER 2015

Master Builder News

VALE – David CheneyThe built environment is the signature of our heritage and David Cheney leaves a legacy that rivals Adelaide’s most gracious and fine architecture.

The President and members acknowledge with deepest sympathy the passing of Master Builder David Cheney, aged 56, in a tragic motor accident on 23rd May. David was one of Adelaide’s most prestigious builders whose luxury homes will stand as a testament to his skill long after his unfortunate, fatal motor accident on the South Eastern Freeway at Glen Osmond.

Master Builders SA CEO John Stokes commented, “He was well respected in the industry. What builders do so more than most is they leave their mark with the buildings they construct. He will be sorely missed by not only his family and work colleagues but his client base who respected his standard of work and expertise”.

David was raised in regional South Australia on the Murray River and trained as a teacher before opening a chain of health food stores in Adelaide. Renovating houses turned into a career of building magnifi-cent, quality homes where his eye for detail and demand for excellence created beautiful family homes.

He had a love of travel and motorbikes, which he combined into grand adventures with friends with a 21-day ride through the Himalayas and

his next expedition traversing the Americas from southern Chile to northern Alaska. He had a great zest for life and energy that is reflected in his single-minded dedication to build the finest quality homes.

He had a genuine enthusiasm for recreating historical styles of architecture in the finest detail using modern techniques and materials combined with all of the contemporary conveniences for toady’s living.. Master Builders SA’s Building Ideas television program was lucky to feature his home on East Terrace some years ago as David preferred to preserve his client’s confidentiality and his own anonymity as his homes spoke for his skill and talent.

David was so well recognised as a perfectionist with a fastidious eye for detail for creating superb homes that the Saturday Advertiser pub-lished a two page feature of his five most spectacular homes including his latest at Briar Ave, Medindie as well as homes at Queens Street Norwood, East Terrace Adelaide, Keroma Drive Aldgate and Ringmer Drive Springfield.

Master Builders SA extends its sincere sympathy to his wife, family, friends and colleagues on the passing of a fine Master Builder.

Estimating - Provide accurate, cost-effective estimates.

Contracts - Variations, Purchase orders and track all your onsite activities. Add BEAMS Mobile for your Supervisor and you’ll never suffer scheduling nightmares again.

Accounts - Full accounting functions with Taxation processing and Payroll with job allocation to timesheets.

Beams Prospects - Focuses on presales where the relationship between a company and the customer is managed. This includes capturing leads from the website, emails and correspondence.

Beams Administration - Track the job as it progresses to contract or conversion. Customise as many processes as necessary to cover all your requirements.

Beams Customer Portal - Communication between your customer and your company is managed. They are given a username and password so that they can check their job status and request more information.

Scott Cam - To do a good job, it is so important to have the right tools. To run a successful business, it is just as important to have the right software. Beams has all of the features and functions in one software package and it just works. Beams has been around for over 20 years and they know what is needed.

Ph. (08) 9454 7760 fax. (08) 9454 7782Web. www.beamsbuild.com.au email. [email protected]

21SA BUILDER AUGUST - SEPTEMBER 2015

Training

Training cuts ignore long-term potentialThe State Government’s training cuts under its new WorkReady pro-gram ignore long-term student potential and more efficient ways to invest taxpayer funds, Master Builders SA says.

Director of Training David Thompson said the new list of subsidised training courses were a training cut dressed up as a reform and over-looked more cost-effective training provided by industry in the search to push up demand for TAFE SA.

“For every 50 training positions undertaken by TAFE SA, the private sector can train 100 students at the same cost to taxpayers,” he said.

“This has to raise questions about how taxpayer funds are invested, particularly at a time when households are facing a 9 per cent hike in the Emergency Services Levy. They should be rewarding efficiency, not investing in inefficiency.”

Mr Thompson said the Government appeared to be focusing on course delivery rather than building long-term opportunities for students.

“We structure our courses to support students as they moved from learning introductory trades to developing broader business devel-opment skills, and link them to industry opportunities. Our courses reflect the way the industry is moving, and we provide mentoring to support students as they grow in the industry,” he said.

“Building and construction is a career, and not just a course.“There is a very real danger that the lack of support for building and

construction training will lead to skills shortages in the future. That means tomorrow’s home owners will pay higher costs because of a lack of efficient investment now.

“When the Minister’s official release talks about making TAFE SA sustainable and not the development of the students, we have concerns about whether good policy is being foiled by immediate Budget require-ments – even as taxpayer funds are spent on less efficient outcomes.”

DAVID THOMPSON, Director of Training

22 SA BUILDER AUGUST - SEPTEMBER 2015

Finance

Time is ticking on budget outcomes

IAN MARKOS, Director of Policy

Treasurer Tom Koutsantonis’s second Budget offered some relief for South Australia’s building, construction and property sector, but the jury is still out on the long-term story of economic growth.

The winsThe State Government extended its small business payroll tax conces-sions for payrolls up to $1.2 million for one more year, as requested by Master Builders SA. This gives smaller operators some relief in the year ahead and hopefully encourages a measure of much-needed job creation.

There has also been an increasing number of pointers to innovative infrastructure funding, a matter supported by Master Builders SA in its Budget Submission. Current funding is too often linked to direct invest-ment by the State Government, which is limited by the need to meet cer-tain funding ratios. Opening up funding models may see an influx of big picture projects to free up business and improve productivity.

Cuts to stamp duty on off-market shares and underlying assets are likely to help family businesses transition between generations and also may create the right conditions for start-ups in their early years. The removal of stamp duty on equipment and other plant is also likely to provide a marginal boost to building, construction and property busi-nesses on a transactional basis.

The State Government has also signalled the end to the Save the River Murray Levy and Hindmarsh Island Bridge Levy, although it has raised the amount to be collected through the Emergency Services Levy.

Infrastructure investment was minimal in this Budget. An addi-tional $20 million was allocated for social housing renewal this year and another $45 million brought forward from the next two years. The State Government also signalled a new roads project to upgrade the intersection of Main North, Potts and Para Road and to support the expansion of the Gawler East housing development. The Gawler East Collector Link Road will cost an estimated $42.6 million.

An additional $25 million has been set aside for the refurbishment of selected school facilities including Le Fevre High School, Fremont-Elizabeth City High School and the disability unit at Christies Beach High School

The waitsThe hallmark of the Budget was the removal of stamp duty on non-resi-dential property over a three-year period. This will benefit the property sector and, effectively, remove a barrier to purchasing property. Master Builders SA holds reservations that the measure may spark prof-it-taking, but not the job creation and redevelopment needed. There are also observations that transactions may be held off for three years until the full cut occurs.

Increases of the land tax threshold to $323,000 and its future index-ation from July 1, 2016, are a similar reform that is welcome, but may take time to create real opportunities.

In short, these may provide hundreds of jobs – but South Australia needs thousands and thousands of new jobs if it is to rid itself of the country’s highest unemployment rate and rising concerns about dying industries.

The lossesAlthough the State Tax Review delivered some changes to stamp duty, it failed to outline truly fundamental reforms that could serve to boost South Australia’s economy. As economist Darryl Gobbett pointed out at the Master Builders SA Budget Breakfast last month, there was nothing “audacious” about the tax review outcome; unless more is done, he said, it remains a missed opportunity for the State.

Master Builders SA has also been upfront about the lack of public sector reform. The State now boasts 81,665 full-time equivalent public servants, compared to 65,949 in 2000. Although the size of the public sector is now stabilising, public sector wage growth has outstripped that of the private sector in 11 of the past 16 years, while about 45c of every tax dollar raised is required just to pay for public sector wages. Given the State Government’s determination to fund a less efficient TAFE SA rather than invest in industry best-practice providers, this is a disappointing outcome that saddles businesses with higher taxes until a thorough review is undertaken.

The outlookThe State Government has forecast a $43 million surplus this coming year, expanding to $654 million the year after. Net debt is forecast to peak at $6.5 billion in 2016-17, up from $6 billion forecast last year, while jobs are expected to grow 1 per cent per annum and the economy at 2 per cent per annum through to 2017-18.

The lack of big picture infrastructure investment is disappointing, but the combination of landmark planning reforms – expected to be unveiled in coming months – and cuts to stamp duty may be the spark needed to boost the building, construction and property sector. If the Economic Development Board is given free rein to explore infrastruc-ture funding and the State Government listens, there may be some excellent news on the horizon.

23SA BUILDER AUGUST - SEPTEMBER 2015

Finance

Developing a planning system that encourages innovation and growth

IAN MARKOS, Director of Policy

OverviewAn extensive review of South Australia’s planning system has recom-mended 22 key reforms designed to cut compliance costs, industry uncertainty and the rise of prescriptive rules that are seen as hindering innovation and business growth.

Th e State Government has accepted the majority of the recommenda-tions in full or in part, including the adoption of a state-wide electronic planning system and has committed to a fi ve-year implementation.

The role of Master Builders SA and its membersTh e health of the State’s planning system aff ects every member of Master Builders SA, whether it aff ects the cost base and viability of projects or the jobs that fl ow from each project.

We are committed to working with the State Government to deliver planning reforms that work in practice, and call upon our members to assist with feedback on the proposed changes.

DeadlinePlanning system reform is an ongoing process. Th e fi rst tranche of changes is expected in 2015, with additional stages dependent upon trials over coming years. We will therefore be in constant contact with members for feedback.

We urge members to contact us directly at [email protected] with your experiences, insights and suggestions as to how South Australia’s planning system can be improved for consumers, industry and its pro-fessionals and employees.

Th is is an ongoing project.

ResourcesTh e Expert Panel on Planning Reform is available here: http://bit.ly/1IKh9WzTh e State Government’s response is available here: http://bit.ly/SAPlanningResponseTh e Master Builders SA’s initial response is available here: http://bit.ly/1CWSIn4

IAN MARKOS, Director of Policy

Jobs still the real challenge for BudgetJobs will only come from this year’s Budget if its centrepiece – a $389 million stamp duty cut to encourage commercial property trans-fers – sparks real development and not mere profi t-taking according to Master Builders SA.

Policy director Ian Markos said cuts to duties on commercial transactions would open up new development opportunities but the jury was out on jobs.

“Th e building, construction and property sector is delighted with any measure that cuts the cost of business, and this ticks that box,” he said.

“But there’s a risk – are we just going to see property deals done to take a profi t rather than building a new future for South Australia? Th at’s the important question, and one the Treasurer surely is hoping is answered with a swathe of new jobs.

“And we would have liked to see more details of the costs behind the Government’s planning reforms. Th ere are scant details, so we are left guessing on what will be one of the most important job-creation initiatives this Government is developing.”

Th e cuts to stamp duty will also favour business sales but there was no hope for those hoping to buy into the housing market, Mr Markos said.

“If you want to buy a city apartment, you get to pocket your stamp duty, but if that’s not the life you want or can’t aff ord, you have to borrow to pay tax. Th e lack of matching funds is, frankly, disappointing considering the rising impact of housing aff ordability,” he said.

Master Builders SA welcomed ongoing payroll tax concessions for small businesses with payrolls less than $1.2 million, a measure likely to provide a boost to the quiet achievers in the state’s building sector.

Indexation of land tax is also welcome – but limiting indexation to one form of tax risks sinking the intent of the State Government’s $2.2 million State Tax Review, Mr Markos said.

“Th e Review was a real opportunity to create change and discussion, but it ended up a black box with little innovation. Investment in the northern suburbs is welcome for the shot it provides our industry, but real reform will help the businesses that are created by today’s apprentices in every part of South Australia – not just the northern suburbs,” he said.

“On the topic of reform, where is the attention to public sector reform? Public sector jobs are outgrowing the private sector, demanding higher taxes to pay the bill. Our Budget needs to pay serious attention to this for the good of the State – and a good start would be reversing its deci-sion on funding a more expensive TAFE sector over industry training provides that can provide a better, more connected training experience for two to three times less cost to taxpayers.

24 SA BUILDER AUGUST - SEPTEMBER 2015

Finance

HON. JOE HOCKEY, Federal Treasurer

$20,000 immediate deduction for assets passesThe hard working women and men of Australian small business were deliv-ered surety to make the most of the Federal Government’s Jobs and Small Business package with key measures passing through the Parliament.

All small businesses can immediately deduct every asset costing less than $20,000 that they have purchased since Budget night and can con-tinue to do so until the end of June 2017.

Small companies with a turnover of less than $2 million will benefit from a 1.5 per cent tax cut from 1 July 2015. This will mean we have delivered the lowest tax rate to small business since 1967.

With the passing of these measures we have delivered the lowest tax rate to small business since 1967 through our historic budget package.

The $5.5 billion Jobs and Small Business package is the biggest small business package in our nation’s history.

Since Budget night we have both travelled across the country meeting with a vast array of small business owners and their employees.

It is clear that they feel energised by the small business measures in our Budget and has given them the confidence to carefully invest in growing their business.

The Government is committed to ensuring Australia is the very best place to start and grow a small business.

Our Jobs and Small Business package is creating the right conditions for Australian businesses to thrive and grow.

JOHN STOKES, CEO, Master Builders SA

Tax Review could boost housing affordability and jobsA ‘big picture’ shift of conveyance duty from purchaser to vendor would give homebuyers a boost when they need it most and save purchasers from borrowing – just to pay a tax.