12SEP201221572474 InRetail Peru Corp.

Transcript of 12SEP201221572474 InRetail Peru Corp.

12SEP201221572474

Strictly Confidential

Offering Memorandum

20,000,000 Common Shares

InRetail Peru Corp.

We are offering 20,000,000 shares of our common stock in this global offering. The initial offering priceis US$20.00 per share.

We have granted the initial purchasers an option for a period of 30 days to purchase up to 3,000,000additional shares to cover over-allotments, if any.

No public market currently exists for the shares. Our shares are listed on the Lima Stock Exchange(Bolsa de Valores de Lima, or the ‘‘LSE’’) under the symbol ‘‘INRETC1’’.

Investing in the shares involves a high degree of risk. See ‘‘Risk Factors’’ beginning onpage 16.

The shares have not been and will not be registered under the U.S. Securities Act of 1933, as amended.The shares may not be offered and sold within the United States or to U.S. persons, except to qualifiedinstitutional buyers in reliance on the exemption from registration provided by Rule 144A under theSecurities Act and to non-U.S. persons in offshore transactions in reliance on Regulation S under theSecurities Act. See ‘‘Transfer Restrictions’’ for a description of the restrictions regarding the purchase andtransfer of the shares.

The shares have been registered with the Peruvian Registry of Foreign Investment and DerivativesInstruments of the Peruvian Superintendency of Banks, Insurance and Private Pension Fund Administrators(Superintendencia de Banca, Seguros y Administradoras Privadas de Fondos de Pensiones, or ‘‘SBS’’) forPeruvian private pension fund eligibility as required by Peruvian law. The shares may not be offered or soldin Peru or in any other jurisdiction except in compliance with the securities laws thereof.

The initial purchasers expect to deliver the shares on or about October 10, 2012, through the facilities ofThe Depository Trust Company (‘‘DTC’’) and CAVALI S.A. ICLV. (‘‘CAVALI’’).

Global Coordinatorsand Joint Bookrunners Joint Bookrunners

Citigroup J.P. Morgan Morgan Stanley BTG Pactual

October 3, 2012

We are responsible for the information contained in this Offering Memorandum. Neither we northe initial purchasers have authorized anyone to provide you with information different from thatcontained in this Offering Memorandum, and we take no responsibility for any other informationothers may give you. The shares are being offered, and the offers to buy are being sought, only injurisdictions where such offers and sales are permitted. The information contained in this OfferingMemorandum is accurate only as of the date of this Offering Memorandum, regardless of the time ofdelivery of this Offering Memorandum or of any sale of the shares.

Table of Contents

Page

Presentation of Financial and Other Information . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ivForward-Looking Statements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . viiEnforceability of Civil Liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ixWhere You Can Find More Information . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . xiSummary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1The Offering . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11Summary Financial Information . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13Risk Factors . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16Exchange Rate Information . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34Use of Proceeds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35Capitalization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36Dividend Policy . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 37Selected Financial Information . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 38Management’s Discussion and Analysis of Financial Condition and Results of Operations . . . . . . 41Industry . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 68Business . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 74Management . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 96Principal Shareholders . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 102Related Party Transactions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 103Description of Capital Stock . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 104The Peruvian Securities Markets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 106Plan of Distribution . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 109Transfer Restrictions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 115Taxation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 116Legal Matters . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 123Independent Auditors . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 123Index to Financial Statements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F-1

This Offering Memorandum is highly confidential, and we have prepared it for use solely inconnection with the proposed offering of the shares. This Offering Memorandum is personal to theofferee to whom it has been delivered by the initial purchasers or their representatives and does notconstitute an offer to any other person or to the public in general to subscribe for or otherwise toacquire the shares. Distribution of this Offering Memorandum to any person other than the offereeand those persons, if any, retained to advise that offeree with respect thereto is unauthorized, and anydisclosure of any of its contents without our prior written consent is prohibited. Each offeree, byaccepting delivery of this Offering Memorandum, agrees to the foregoing and agrees not to makephotocopies of this Offering Memorandum.

The shares offered through this Offering Memorandum are subject to restrictions on transferabilityand resale, and may not be transferred or resold in the United States except as permitted under theSecurities Act and applicable U.S. state securities laws pursuant to registration or exemption fromthem. You should be aware that you may be required to bear the financial risks of this investment foran indefinite period of time. See ‘‘Transfer Restrictions.’’

i

You must comply with all applicable laws and regulations in force in any jurisdiction in which youpurchase, offer or sell the shares or possess or distribute this Offering Memorandum, and must obtainany consent, approval or permission required for your purchase, offer or sale of the shares under thelaws and regulations in force in any jurisdiction to which you are subject or in which you make suchpurchases, offers or sales, and neither we nor the initial purchasers or their representatives will haveany responsibility thereof.

In making an investment decision, you must rely on your own examination of our business and theterms of the offering, including the merits and risks involved.

No representation or warranty, express or implied, is made by the initial purchasers as to theaccuracy or completeness of any of the information set forth in this Offering Memorandum, andnothing contained herein is or shall be relied upon as a promise or representation by the initialpurchasers, whether as to the past or the future.

By purchasing any shares, you will be deemed to have acknowledged that: (1) you have received acopy of and have reviewed this Offering Memorandum; (2) you have had an opportunity to review allfinancial and other information considered by you to be necessary to make your investment decisionand to verify the accuracy of, or to supplement, the information contained in this OfferingMemorandum and have been offered the opportunity to ask us questions, and received answers, as youdeemed necessary in connection with your investment decision; (3) you have not relied on the initialpurchasers or any person affiliated with the initial purchasers in connection with your investigation ofthe accuracy of such information or your investment decision; (4) the initial purchasers are notresponsible for, and are not making any representation to you concerning, us, our future performanceor the accuracy or completeness of this Offering Memorandum; and (5) no person has been authorizedto give any information or to make any representation concerning us or the shares or the offer and saleof the shares, other than as contained in this Offering Memorandum, and if given or made, any suchother information or representation should not be relied upon as having been authorized by us or theinitial purchasers.

We and the initial purchasers reserve the right, to the extent permitted by applicable law, to rejectany offer to purchase, in whole or in part, and for any reason, the shares offered hereby. We and theinitial purchasers reserve the right to sell or place less than all of the shares offered hereby.

We are not providing you with any legal, business, tax or other advice in this OfferingMemorandum. You should consult your own attorney, business advisor and tax advisor for legal,business and tax advice regarding the shares. You should contact the initial purchasers with anyquestions about this offering.

NOTICE TO NEW HAMPSHIRE RESIDENTS

NEITHER THE FACT THAT A REGISTRATION STATEMENT OR AN APPLICATION FOR ALICENSE HAS BEEN FILED UNDER CHAPTER 421-B OF THE NEW HAMPSHIRE REVISEDSTATUTES WITH THE STATE OF NEW HAMPSHIRE NOR THE FACT THAT A SECURITY ISEFFECTIVELY REGISTERED OR A PERSON IS LICENSED IN THE STATE OF NEWHAMPSHIRE CONSTITUTES A FINDING BY THE SECRETARY OF STATE THAT ANYDOCUMENT FILED UNDER RSA 421-B IS TRUE, COMPLETE AND NOT MISLEADING.NEITHER ANY SUCH FACT NOR THE FACT THAT AN EXEMPTION OR EXCEPTION ISAVAILABLE FOR A SECURITY OR A TRANSACTION MEANS THAT THE SECRETARY OF STATEHAS PASSED IN ANY WAY UPON THE MERITS OR QUALIFICATIONS OF, OR RECOMMENDEDOR GIVEN APPROVAL TO, ANY PERSON, SECURITY, OR TRANSACTION. IT IS UNLAWFUL TOMAKE, OR CAUSE TO BE MADE, TO ANY PROSPECTIVE PURCHASER, CUSTOMER, ORCLIENT ANY REPRESENTATION INCONSISTENT WITH THE PROVISIONS OF THISPARAGRAPH.

ii

NOTICE TO PROSPECTIVE INVESTORS IN THE UNITED KINGDOM

This Offering Memorandum is for distribution only in circumstances in which Section 21(1) of theU.K. Financial Services and Markets Act 2000 (‘‘FSMA’’) does not apply to us (the persons in suchcircumstances together being referred to as ‘‘relevant persons’’). This Offering Memorandum is directedonly at relevant persons and must not be acted on or relied on by persons who are not relevantpersons. Any investment or investment activity to which this Offering Memorandum relates is availableonly to relevant persons and will be engaged in only with relevant persons.

NOTICE TO PROSPECTIVE INVESTORS IN THE EUROPEAN ECONOMIC AREA

This Offering Memorandum has been prepared on the basis that all offers of shares will be madepursuant to an exemption under the Prospectus Directive, as implemented in member states (each, a‘‘Relevant Member State’’) of the European Economic Area (‘‘EEA’’) from the requirement to publisha prospectus for offers of the shares. Accordingly, any person making or intending to make any offerwithin the EEA of shares which are the subject of the offering contemplated in this OfferingMemorandum should only do so in circumstances in which no obligation arises for the sellers of theshares or any of the initial purchasers to publish a prospectus pursuant to Article 3 of the ProspectusDirective, in relation to such offer. Neither we nor the initial purchasers have authorized, nor do weauthorize, the making of any offer of shares in circumstances in which an obligation arises for theissuer or the initial purchasers to publish a prospectus for such offer. ‘‘Prospectus Directive’’ meansDirective 2003/71/EC (and amendments thereto, including the 2010 PD Amending Directive); andincludes any relevant implementing measure in the Relevant Member State; and the expression ‘‘2010PD Amending Directive’’ means Directive 2010/73/EU.

iii

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

General

InRetail Peru Corp. (formerly IFH Pharma Corp.) is a corporation (sociedad anonima)incorporated under the laws of Panama. InRetail Peru Corp. owns no assets other than 99.98% of thevoting shares of Supermercados Peruanos S.A., 100% of the voting shares of Eckerd Peru S.A.(indirectly through intermediate holding companies), 100% of the voting shares of InRetail Real EstateCorp. and 99.9% of the voting shares of Inmobiliaria Espiritu Santo S.A.C.

All references to ‘‘we,’’ ‘‘us,’’ ‘‘our,’’ the ‘‘Company,’’ ‘‘InRetail Peru’’ and ‘‘InRetail’’ in thisOffering Memorandum are to InRetail Peru Corp., and, unless the context requires otherwise, itsconsolidated subsidiaries. As used in this Offering Memorandum, ‘‘Supermercados Peruanos’’ refers toSupermercados Peruanos S.A., a corporation (sociedad anonima) incorporated under the laws of Peru,and its consolidated subsidiaries; ‘‘InkaFarma’’ refers to Eckerd Peru S.A. (‘‘Eckerd Peru’’), acorporation (sociedad anonima) incorporated under the laws of Peru, and its consolidated subsidiaries;‘‘Inmobiliaria’’ refers to Inmobiliaria Espıritu Santo S.A.C., a corporation (sociedad anonima cerrada)incorporated under the laws of Peru; and ‘‘InRetail RE’’ refers to InRetail Real Estate Corp., acorporation (sociedad anonima) incorporated under the laws of Panama.

Reorganization

InRetail Peru, its immediate parent company Intercorp Retail Inc. (‘‘Intercorp Retail’’), its ultimateparent Intercorp Peru Ltd., formerly IFH Peru Ltd. (‘‘Intercorp Peru’’), and their respective subsidiariesand affiliates completed a reorganization on August 13, 2012 (the ‘‘Reorganization’’).

As a result of the Reorganization, we became the direct owner of InRetail RE, which is theholding company for the companies that comprise our shopping centers segment, consisting of RealPlaza S.R.L. (‘‘Real Plaza’’), InRetail Properties Management S.R.L., formerly InterpropertiesPeru S.A. (‘‘InRetail Properties Management’’), Patrimonio en Fideicomiso—D.S.No. 093-2002-EF-Interproperties Holding (‘‘Interproperties Holding I’’), Patrimonio en Fideicomiso—D.S. No. 093-2002-EF-Interproperties Holding II (‘‘Interproperties Holding II’’) and Patrimonio enFideicomiso—D.S. No. 093-2002-EF-Interproperties Peru (‘‘Interproperties Peru’’). InterpropertiesHolding I and Interproperties Holding II collectively own a majority participation in InterpropertiesPeru. We also became the direct owner of Supermercados Peruanos, which, along with its subsidiariesPlaza Vea Sur S.A.C. and Peruana de Tiquetes S.A.C., comprise our supermarkets segment. Wecontinue to indirectly own InkaFarma and its subsidiaries and Inmobiliaria, which comprise ourpharmacies segment. For an organization chart of our company, see ‘‘Summary—Corporate Structure’’.As Intercorp Peru has maintained effective control over InRetail Peru and InRetail Peru’s subsidiariesthroughout the Reorganization, these transactions qualify as being made among entities under commoncontrol under IFRS and qualify for the pooling-of-interest method of accounting. Therefore, ourcombined financial statements appearing in this Offering Memorandum have been prepared under theassumptions that the Reorganization took place as of January 1, 2010 and that we were operating ineach of 2010, 2011 and the six months ended June 30, 2012. See our audited combined financialstatements and related notes elsewhere in this Offering Memorandum.

iv

As of the date of this Offering Memorandum, our current shareholders are as follows:

Percentageownership

Shareholder (%)

Intercorp Retail Inc.* . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 74.76%Intercorp Peru . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.20%NG Pharma Corp. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8.12%Intercorp Financial Services Inc.* . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.00%Inteligo Bank Ltd.* . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9.80%Interseguro Companıa de Seguros S.A.* . . . . . . . . . . . . . . . . . . . . . . . . . 0.12%

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 100.00%

* Companies controlled by Intercorp Peru, directly and indirectly.

Acquisition

We entered the pharmacies segment in January 2011 with the acquisition of InkaFarma. Therefore,this segment was not part of our 2010 financial results. As a consequence, our combined financialstatements for the year ended December 31, 2011 are not comparable to our combined financialstatements for the year ended December 31, 2010.

Financial Information

Our combined financial statements and related notes included in this Offering Memorandum havebeen prepared in nuevos soles and in accordance with International Financial Reporting Standards(‘‘IFRS’’) as issued by the International Accounting Standards Board (‘‘IASB’’). For all periods up toand including the year ended December 31, 2010, the entities which currently comprise InRetail Peruprepared their financial statements in accordance with accounting principles generally accepted in Peru.The combined financial statements for the year ended December 31, 2011 are the first InRetail Peruhas prepared in accordance with IFRS. Accordingly, InRetail Peru has prepared combined financialstatements which comply with IFRS applicable for periods ending on or after December 31, 2011,together with the comparative period data as of and for the year ended December 31, 2010. InRetailPeru’s opening statement of financial position was prepared as of January 1, 2010, its date of transitionto IFRS. The combined financial statements have been prepared on a historical cost basis, except forinvestment properties, derivative financial instruments and available-for-sale investments that have beenmeasured at fair value. The financial statements included in this Offering Memorandum are deemed‘‘combined’’ because they reflect the combined operations of InRetail and its subsidiaries that, as ofJune 30, 2012, have not been consolidated. The financial information for Eckerd Peru presented in thisOffering Memorandum reflects the combined operations of Eckerd Peru and Inmobiliaria as of and forthe years ended December 31, 2010 and 2011 and is derived from the audited combined financialstatements of Eckerd Peru and Inmobiliaria that are not included in this Offering Memorandum.

In this Offering Memorandum, we present Adjusted EBITDA, Adjusted EBITDA margin andsame store sales growth, each of which are non-IFRS financial measures. A non-IFRS financialmeasure does not have a standardized meaning prescribed by IFRS. We present Adjusted EBITDA,Adjusted EBITDA margin and same store sales growth because we believe they provide investors withsupplemental measures of the financial performance of our operations that facilitate period-to-periodcomparisons on a consistent basis. Our management also uses Adjusted EBITDA, Adjusted EBITDAmargin and same store sales growth from time to time, among other measures, for internal planningand performance measurement purposes. Adjusted EBITDA, Adjusted EBITDA margin and same storesales growth should not be construed as alternatives to profit or operating profit, as indicators of

v

operating performance or as alternatives to cash flow provided by operating activities (in each case, asdetermined in accordance with IFRS). Adjusted EBITDA, Adjusted EBITDA margin and same storesales growth, as calculated by us, may not be comparable to similarly titled measures reported by othercompanies. For the definitions of Adjusted EBITDA, Adjusted EBITDA margin and same store salesgrowth and reconciliations of operating profit to Adjusted EBITDA, see ‘‘Summary FinancialInformation.’’

The term ‘‘U.S. dollar’’ and the symbol ‘‘US$’’ refer to the legal currency of the United States; andthe term ‘‘nuevo sol’’ and the symbol ‘‘S/.’’ refer to the legal currency of Peru.

We have translated some of the nuevos soles amounts contained in this Offering Memoranduminto U.S. dollars for convenience purposes only. Unless the context otherwise requires, the rate used totranslate nuevos soles amounts to U.S. dollars was S/. 2.671 to US$1.00, which was the exchange ratereported on June 30, 2012 by the SBS. The Federal Reserve Bank of New York does not report a noonbuying rate for nuevos soles. The U.S. dollar equivalent information presented in this OfferingMemorandum is provided solely for the convenience of investors and should not be construed asimplying that the nuevos soles amounts represent, or could have been or could be converted into, U.S.dollars at such rates or at any other rate. See ‘‘Exchange Rate Information’’ for information regardinghistorical exchange rates of nuevos soles to U.S. dollars.

Certain figures included in this Offering Memorandum have been subject to rounding adjustments.Accordingly, figures shown as totals in certain tables may not be arithmetic aggregations of the figuresthat precede them.

Offering Information

All amounts contained in this Offering Memorandum that have been adjusted to reflect the netproceeds of this offering are based upon the sale of 20,000,000 shares at an initial offering price ofUS$20.00 per share. Unless otherwise indicated, all information contained in this OfferingMemorandum assumes no exercise of the initial purchasers’ option to purchase up to 3,000,000additional shares to cover over-allotments, if any.

Industry and Market Data

Except where otherwise indicated, market share information and other statistical information andquantitative statements in this Offering Memorandum regarding our market position relative to ourcompetitors are not based on published statistical data or information obtained from independent thirdparties. Rather, such information and statements reflect management estimates based upon our internalrecords and surveys, statistics published by providers of industry data, information published by ourcompetitors, and information published by trade and business organizations and associations and othersources within the industries in which we operate. We have not independently verified any data producedby third parties or industry or general publications. In addition, while we believe our internal data andsurveys to be reliable, such data and surveys have not been verified by any independent sources.

vi

FORWARD-LOOKING STATEMENTS

This Offering Memorandum includes forward-looking statements. All statements other thanstatements of historical fact included in this Offering Memorandum regarding our business, financialcondition, results of operations and certain of our plans, objectives, assumptions, projections,expectations or beliefs with respect to these items and statements regarding other future events orprospects are forward-looking statements. These statements include, without limitation, thoseconcerning: our strategy and our ability to achieve it; expectations regarding sales, profitability andgrowth; our possible or assumed future results of operations; capital expenditures and investment plans;adequacy of capital; and financing plans. The words ‘‘aim,’’ ‘‘may,’’ ‘‘will,’’ ‘‘expect,’’ ‘‘is expected to,’’‘‘anticipate,’’ ‘‘believe,’’ ‘‘future,’’ ‘‘continue,’’ ‘‘help,’’ ‘‘estimate,’’ ‘‘plan,’’ ‘‘schedule,’’ ‘‘intend,’’‘‘should,’’ ‘‘would be,’’ ‘‘seeks,’’ ‘‘estimates,’’ ‘‘shall,’’ or the negative or other variations thereof, as wellas other similar expressions regarding matters that are not historical fact, are or may indicate forward-looking statements.

In addition, this Offering Memorandum includes forward-looking statements relating to ourpotential exposure to various types of market risks, such as macroeconomic risk, Peru specific risks,foreign exchange rate risk, interest rate risks and other risks related to financial performance. We havebased these forward-looking statements on our management’s current view with respect to future eventsand financial performance. These views reflect the best judgment of our management but involve anumber of risks and uncertainties which could cause actual results to differ materially from thosepredicted in our forward-looking statements and from past results, performance or achievements.Although we believe that the estimates reflected in the forward-looking statements are reasonable, suchestimates may prove to be incorrect. By their nature, forward-looking statements involve risk anduncertainty because they relate to events and depend on circumstances that will occur in the future.There are a number of factors that could cause actual results and developments to differ materiallyfrom those expressed or implied by these forward-looking statements. These factors include, amongother things:

• economic conditions that impact consumer spending;

• decreases in the purchasing power of middle- and low-income consumers;

• intense competition in each of our markets;

• rapid consolidation in our retail markets;

• existing and new regulatory requirements;

• our ability to obtain and maintain zoning, environmental, land use and other governmentalapprovals;

• our ability to successfully implement our growth and retail strategies;

• the inability to obtain the capital we need for further expansion of our businesses;

• risks associated with development and construction activities;

• food and drug safety concerns and related unfavorable publicity;

• the loss of key tenants;

• the ability to maintain and improve our distribution networks and efficiency of distributioncenters;

• risks associated with our suppliers;

• economic, political and social developments in Peru, including increased volatility of exchangerates or increased inflation;

vii

• future acquisitions may not bring anticipated benefits;

• changes in tax laws;

• severe weather, natural disasters and adverse climate changes;

• changes in regional or global markets; and

• other risk and uncertainties described in ‘‘Risk Factors.’’

We urge you to read the sections of this Offering Memorandum entitled ‘‘Risk Factors,’’‘‘Management’s Discussion and Analysis of Financial Condition and Results of Operations’’ and‘‘Business’’ for a more complete discussion of the factors that could affect our future performance andthe industries in which we operate. Additionally, new risks and uncertainties can emerge from time totime, and it is not possible for us to predict all future risks and uncertainties, nor can we assess theirpotential impact. Accordingly, you should not place undue reliance on forward-looking statements as aprediction of actual results.

All forward-looking statements included in this Offering Memorandum are based on informationavailable to us on the date of this Offering Memorandum. We undertake no obligation to updatepublicly or revise any forward-looking statement, whether as a result of new information, future eventsor otherwise, except as may be required by applicable law. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in theirentirety by the cautionary statements contained throughout this Offering Memorandum.

viii

ENFORCEABILITY OF CIVIL LIABILITIES

InRetail Peru is organized under the laws of Panama and its operating subsidiaries are organizedunder the laws of Peru. Substantially all of our directors, officers, controlling persons, and certain ofthe experts named herein, reside outside the United States, and all or a substantial portion of our andtheir assets are located outside the United States. As a result, it may not be possible for investors toeffect service of process within the United States upon such persons, including with respect to mattersarising under the federal securities laws of the United States, or to enforce against us or such personsjudgments of courts of the United States predicated upon the civil liability provisions of the federalsecurities laws of the United States.

Panama

There is no existing treaty between the United States and Panama for the reciprocal enforcementof foreign judgments of courts outside Panama, including, without limitation, judgments of U.S. courts.Panamanian courts, however, have enforced judgments rendered in the United States based on legalprinciples of reciprocity and comity. We have been advised by Arias, Aleman & Mora, our Panamaniancounsel, that judgments rendered by foreign courts may only be recognized and enforced by the courtsof Panama in the event that the Supreme Court of Panama validates such judgment by the issuance ofa writ of exequatur. Subject to a writ of exequatur, any final judgment rendered by any U.S. court willbe recognized, conclusive and enforceable in the courts of Panama without reconsideration of themerits, provided that: (1) such foreign court grants reciprocity to the enforcement of judgments ofcourts of Panama; (2) the party against which the judgment was rendered was personally served (serviceby mail not being sufficient) in such action within such foreign jurisdiction; (3) the judgment arises outof a personal action against the defendant; (4) the obligation in respect of which the judgment wasrendered is lawful in Panama and does not contradict the public policy of Panama; (5) the judgment isproperly authenticated by diplomatic or consular officers of Panama or pursuant to the 1961 HagueConvention on the Legalization of Documents; and (6) a copy of the final judgment is translated intoSpanish by a licensed translator in Panama. We have no reason to believe that any of our obligationsrelating to the shares would be contrary to Panamanian law.

Peru

Any final and conclusive judgment for a fixed and definitive sum obtained in any foreign courthaving jurisdiction in respect of any suit, action or proceeding for the enforcement of any of ourobligations under the shares that are governed by New York law will, upon request, be deemed validand enforceable in Peru through an exequatur judiciary proceeding (which does not involve thereopening of the case), provided that: (1) there is in effect a treaty between the country where saidforeign court sits and Peru regarding the recognition and enforcement of foreign judgments; or (2) inthe absence of such a treaty, the original judgment is ratified by the Peruvian courts, provided that thefollowing conditions and requirements are met:

• the judgment does not resolve matters under the exclusive jurisdiction of Peruvian courts (thematters contemplated in respect of this Offering Memorandum or the shares are not mattersunder the exclusive jurisdiction of Peruvian courts);

• such court had jurisdiction under its own conflicts of law rules and under general principles ofinternational procedural jurisdiction;

• the party against which the judgment was rendered was served process in accordance with thelaws of the jurisdiction where the proceeding took place, was granted a reasonable opportunityto appear before such foreign court, and was guaranteed due process rights;

ix

• the judgment has the status of res judicata as defined in the jurisdiction of the court renderingsuch judgment;

• no pending litigation in Peru between the same parties for the same dispute was initiated beforethe commencement of the proceeding that concluded with the foreign judgment;

• the judgment is not incompatible with another judgment that fulfills the requirements ofrecognition and enforceability established by Peruvian law, unless such foreign judgment wasrendered first;

• the judgment is not contrary to Peruvian national sovereignty, public policy or good morals;

• it has not been proven that the foreign court who issued the judgment denies enforcement ofPeruvian judgments or engages in a review of the merits thereof; and

• payment of corresponding court filing fees.

We have no reason to believe that any of our obligations relating to the shares would be contraryto Peruvian public policy, good morals and international treaties binding upon Peru or generallyaccepted principles of international law.

In the absence of an international judgment enforcement treaty, the reciprocity principle isapplicable (that is, a foreign judgment would be enforced if the courts in such foreign jurisdictionenforce judgments issued by Peruvian courts), pursuant to which a judgment issued by the courts of aforeign jurisdiction will be admissible in the courts of Peru and will be enforceable thereby, except ifaccording to the laws of such foreign jurisdiction as interpreted or applied by the courts of such foreignjurisdiction (i) judgments issued by Peruvian courts are not admissible or enforceable in the courts ofsuch foreign jurisdiction or (ii) judgments issued by Peruvian courts are subject to reexamination by thecourts of such foreign jurisdiction; in either case in compliance with the requirements described above.

Assuming that foreign judgments comply with the standards set forth in the preceding paragraphs,and in the absence of any condition referred to above which would render a foreign judgmentunenforceable, such foreign judgment would be enforceable in Peru through proceedings for theenforcement of a foreign judgment under the laws of Peru.

x

WHERE YOU CAN FIND MORE INFORMATION

We are not subject to the information reporting requirements of the U.S. Securities Exchange Actof 1934, as amended (the ‘‘Exchange Act’’). For so long as any of the shares remain outstanding andare ‘‘restricted securities’’ within the meaning of Rule 144 under the Securities Act, if at any time weare not a reporting issuer under Section 13 or 15(d) of the Exchange Act, or exempt from therequirements thereof pursuant to Rule 12g3-2(b) thereunder, we will furnish information about us, asrequired by Rule 144A(d)(4) under the Securities Act, to any holder of shares or prospective purchaserdesignated by such holder who requests such information from us in writing. Any such request may bemade to us in writing at our registered office located at Carlos Villaran 140, 19th Floor, Lima 13, Peru.

We will be required to furnish certain information periodically, including quarterly and annualreports, to the Peruvian Superintendency of Securities Markets (Superintendencia del Mercado deValores, or ‘‘SMV’’) and the LSE, which will be available in Spanish for inspections through theirrespective websites at www.smv.gob.pe and www.bvl.com.pe.

xi

(This page has been left blank intentionally.)

SUMMARY

This summary highlights selected information about us and the shares and should be read as anintroduction to the more detailed information appearing elsewhere in this Offering Memorandum. Thissummary does not contain all the information you should consider before investing in the shares. Youshould read this entire Offering Memorandum carefully for a more complete understanding of our businessand this offering, including ‘‘Risk Factors,’’ ‘‘Presentation of Financial and Other Information,’’ ‘‘SelectedFinancial Information,’’ ‘‘Management’s Discussion and Analysis of Financial Condition and Results ofOperations’’ and our combined financial statements and related notes elsewhere in this OfferingMemorandum.

Overview

We are a multi-format retailer operating exclusively in Peru with nationwide presence and leadingmarket positions in our three business segments: supermarkets, pharmacies and shopping centers. Oursupermarket chain is the second largest in Peru, based on revenues, and operates four formats, PlazaVea, Plaza Vea Super, Vivanda and EconoMax, that together target multiple socioeconomic categoriesof the Peruvian population. Our pharmacy chain is the largest in Peru, based on revenues, and operatesthe InkaFarma brand, the most recognized pharmacy brand and one of the most recognized brands inthe country. Through our Real Plaza shopping center brand, we operate the largest shopping centerchain in Peru, based on gross leasable area (‘‘GLA’’). We develop and own real estate properties thatcontribute to our retail businesses and have a large portfolio of premium locations and sites for futureexpansion. Our integrated retail and shopping center platform allows us to attract growing consumertraffic through our highly recognized retail brands and convenient locations, and enhances our ability todevelop commercial sites and attract an optimal tenant mix. As a result, we believe we are in a strongposition to capitalize on Peru’s consumption growth to drive sales and profitability in all of oursegments.

Our ultimate parent company is Intercorp Peru, one of Peru’s largest business groups, withactivities spanning financial services, retail and real estate. In 2001, Intercorp Peru began investing inthe Peruvian retail sector, attracted by its strong growth potential, increasing consumer purchasingpower and a relatively underpenetrated modern retail sector. We believe that being a locally-ownedand -operated group offers us the significant advantages of an exclusive focus on Peru and a deepunderstanding of the country in general and its retail and real estate markets in particular. On the basisof this vision, we have built our company into the premier Peruvian retailer it is today.

We believe that Peru offers attractive opportunities for significant growth based on itsmacroeconomic prospects, stable political environment, favorable demographic trends and emergingmiddle class, combined with a retail sector that continues to be underpenetrated by modern formats.Peru has been South America’s fastest growing country in terms of real GDP growth and is one of onlysix investment grade countries in the world with average annual real GDP growth over 7.0% from 2007to 2011, according to the International Monetary Fund (the ‘‘IMF’’). Over these five years,approximately 20.0% of Peru’s population, nearly 5.5 million people, has risen above the poverty level,according to the Instituto Nacional de Estadısticas e Informatica (‘‘INEI’’), Peru’s national institute ofstatistics and data. During this same period, the publicly disclosed aggregate sales of the seven largestmodern retail companies in Peru have grown at an average annual rate of 16%, approximately 1.6times faster than the average annual nominal Peruvian GDP growth rate. We focus on meeting thegrowing needs of Peruvian consumers who, as they become wealthier and demand higher qualityproducts and services, are shifting towards modern, formal retailers and away from the country’straditional retail sector.

Our business segments have grown significantly through acquisitions and organic initiatives, whilesimultaneously improving profitability. Our first shopping center, Real Plaza Primavera, was opened in

1

Lima in 2001. We have since developed an additional 12 shopping centers, increasing GLA ten-fold toover 265,000 square meters as of June 30, 2012. In 2003, Intercorp Peru acquired SupermercadosPeruanos and successfully implemented its turnaround, from losses during that year to AdjustedEBITDA of S/. 176.3 million and net profit of S/. 35.5 million in 2011, and expanded its number ofstores from 35 at the time of acquisition to 78 as of June 30, 2012. We acquired InkaFarma in January2011 and since then have opened 82 pharmacies, increasing our total number of pharmacies to 466 asof June 30, 2012, while expanding our focus on higher margin private label sales. In addition, ourexisting land bank, which currently consists of over 288,000 square meters in 29 locations for near-termdevelopment of shopping centers and supermarkets, and our expertise in sourcing and securingadditional sites, are both critical advantages for our organic growth. Our current strategy is to groworganically by taking advantage of opportunities we identify throughout Peru, both through deeperpenetration in our existing markets as well as by expanding our reach across socioeconomic andgeographic markets.

In 2011, we had combined revenues of S/. 4,242.2 million (approximately US$1,588.2 million),Adjusted EBITDA of S/. 312.7 million (approximately US$117.1 million), an Adjusted EBITDA marginof 7.4%, operating profit of S/. 263.6 million (approximately US$98.7 million) and net profit ofS/. 123.6 million (approximately US$46.3 million). For the six months ended June 30, 2012 we hadcombined revenues of S/. 2,300.7 million (approximately US$861.3 million), Adjusted EBITDA ofS/. 179.2 million (approximately US$67.1 million), an Adjusted EBITDA margin of 7.8%, operatingprofit of S/. 131.7 million (approximately US$49.3 million) and net profit of S/. 49.7 million(approximately US$18.6 million).

Our Business

Supermarkets

We operate the second largest supermarket chain in Peru, with an estimated market share ofapproximately 33% of the 2011 revenues of Peru’s three nationwide supermarket chains, according toEquilibrium CRSA, a Peruvian risk rating company affiliated with Moody’s Investor Service Inc.(‘‘Equilibrium’’). After a turnaround phase that took place from 2003 to 2006, our supermarketssegment has undergone significant growth and since 2006 has been the fastest-growing supermarketchain in terms of new sales area when compared to Peru’s two other nationwide chains. From 2007 to2011, our revenues, number of stores and sales area have increased at compounded annual growth rates(‘‘CAGR’’) of 20.7%, 13.6% and 22.6%, respectively. An important contribution to our growth has beenour entry and expansion in the unpenetrated regions of Peru outside the Lima metropolitan area(which we define as the city of Lima and the surrounding districts of Ancon, Pucusana and Chosica).We were the first modern supermarket chain to open a store outside the Lima metropolitan area,where we had 20 stores that generated approximately 29% of our supermarket revenues for the sixmonths ended June 30, 2012. As of June 30, 2012, we operated 78 stores throughout Peru with a totalsales area of over 207,000 square meters.

We have developed a strategy of operating multiple supermarket store formats with differentproduct assortments, pricing levels and shopping experiences, in order to serve different socioeconomiccategories and satisfy a wide variety of customer needs. Furthermore, the compact size of our formatsgives us the flexibility to open profitable stores in unpenetrated medium size cities and/or highly denseurban areas where large plots of land are scarce. This strategy gives us a significant competitiveadvantage in capitalizing on the growth of multiple socioeconomic categories across the country. The

2

table below shows a summary of operating metrics for our four supermarket formats as of June 30,2012:

Plaza Vea Plaza Vea Super Vivanda EconoMax/Mass

Launch year . . . . . . . . . . . . . . . . 2001 2005 2005 2011*Number of stores . . . . . . . . . . . . 42 16 8 12Average square meters per store . 3,964 1,237 1,117 1,017Net sales contribution for 2011

(% of total) . . . . . . . . . . . . . . . 76.7 12.4 8.6 2.2

* Launch year refers to EconoMax only.

Plaza Vea (compact hypermarkets): Plaza Vea is our largest store format with an average sellingarea of approximately 4,000 square meters per store. It targets the A, B and C socioeconomiccategories and is a one-stop shopping destination offering a wide range of food and non-food productsat competitive prices with attractive promotions, as well as complementary services and familyentertainment. Plaza Vea has become the most recognizable supermarket brand in Peru, according toArellano Marketing, a leading marketing consulting company in Peru. Due to its compact size, thePlaza Vea format enables us to profitably serve unpenetrated medium size cities with low populationdensity, as well as to penetrate the more developed cities where large well-located plots of land areusually scarce. We believe the combination of our attractive product and service offerings as well as ourcompact size gives us a competitive advantage, enabling us to rapidly expand geographically to capturemarket opportunities.

Plaza Vea Super (supermarkets): Plaza Vea Super targets the A, B and C socioeconomiccategories. It offers the same brand identity, shopping experience, price and promotional structure asPlaza Vea compact hypermarkets, but in a smaller, more convenient store format with a greater focuson food products. It provides greater flexibility for growth in locations where larger spaces are scarce,such as dense urban areas, leveraging our hypermarket infrastructure.

Vivanda (supermarkets): Vivanda targets the A and B socioeconomic categories and currentlyoperates only in select residential neighborhoods in Lima. It focuses on providing premium foodproducts, a distinctive shopping experience and an environment that emphasizes quality and freshness.

EconoMax/Mass (discount stores): EconoMax is our newest format and targets the C and Dsocioeconomic categories. The EconoMax stores offer approximately 6,000 basic food and non-foodproducts at everyday low prices positioned to compete with traditional open markets andindependently-owned corner stores, but with higher quality and hygiene standards. Mass is a legacyformat with only four stores.

Pharmacies

We acquired the largest retail pharmacy chain in Peru, InkaFarma, in 2011. InkaFarma had amarket share of 47% of the country’s modern retail pharmacy revenues in 2011, according to IMSHealth. InkaFarma has experienced significant growth, more than doubling its revenue from 2007 to2011 and increasing its number of stores from 154 as of December 31, 2007 to 466 as of June 30, 2012.Our pharmacies are currently present in 22 of Peru’s 24 regions. Due to our scale and private labelproduct offerings, we are successfully implementing an everyday low price strategy and achievingattractive margins. We sell pharmaceutical and personal care items to customers who value convenienceand low prices. InkaFarma was named the most recognized pharmacy brand and the sixth mostrecognized brand in Peru as of 2011, according to Arellano Marketing. As of June 30, 2012, ourpharmacies operated under two different formats: stand-alone pharmacies (410 stores) and pharmaciesin supermarkets (56 stores).

3

Shopping Centers

We operate the largest shopping center chain in Peru under the Real Plaza brand, with anestimated 18% market share based on GLA in 2011, according to the Asociacion de CentrosComerciales del Peru (the ‘‘ACCEP’’). We have developed a strategy of becoming a shopping andentertainment hub in each of our locations through an optimal tenant mix and a shopping experiencecustomized for the specific market. In addition to operating shopping centers, this segment has anin-house real estate development team focused on sourcing locations and developing new shoppingcenters and stand-alone stores. We earn rental income, which consists of the greater of minimummonthly fixed rental payments or variable payments based on the retail sales of tenants. These variablepayments allow us to benefit from the growth in sales by our tenants, who operate across a range ofretail categories.

As of June 30, 2012, we operated 13 shopping centers, ten of which we owned or leased on along-term basis and three of which we operate on behalf of related parties. Out of these 13 shoppingcenters, six are in the Lima metropolitan area and seven are elsewhere throughout the country. RealPlaza was the first chain to open shopping centers in six of the seven largest cities in Peru, excludingLima.

Through our land bank, we currently own or lease on a long-term basis over 288,000 square metersof property throughout Peru for near-term development of 29 supermarkets and four shopping centers.

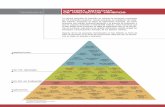

The chart below provides a summary of key financial and operating metrics for our threesegments.

For the six months ended As of and for the year endedJune 30, December 31,

2012 2012 2011 2011 2011 2010

(US$ in (S/. in (US$ in (S/. inmillions)(1)(2) millions)(1) millions)(1)(2) millions)(1)

Supermarkets:Revenues(3) . . . . . . . . . . . . . . . . . . . . 551.7 1,473.7 1,338.1 1,055.8 2,820.1 2,423.4Same store sales growth (%)(4) . . . . . . . 5.0% 3.3% 5.6% 2.9%Adjusted EBITDA(3)(5) . . . . . . . . . . . . 32.6 87.0 67.9 66.0 176.3 162.4Adjusted EBITDA margin (%)(3)(5) . . . 5.9% 5.1% 6.3% 6.7%Number of stores . . . . . . . . . . . . . . . . 78 67 75 67Total selling area (square meters) . . . . . 207,407 185,958 204,278 188,341Employees . . . . . . . . . . . . . . . . . . . . . 12,302 12,057 11,991 11,520

Pharmacies:(6)Revenues(3) . . . . . . . . . . . . . . . . . . . . 288.3 770.2 614.9 499.2 1,333.4 1184.9Same store sales growth (%)(4) . . . . . . . 20.7% 3.7% 4.7% 9.8%Adjusted EBITDA(3)(5) . . . . . . . . . . . . 24.3 64.9 37.5 34.3 91.6 82.1Adjusted EBITDA margin (%)(3)(5) . . . 8.4% 6.1% 6.9% 6.9%Number of stores(7) . . . . . . . . . . . . . . 466 409 432 384Employees . . . . . . . . . . . . . . . . . . . . . 6,670 5,811 5,848 5,477

Shopping centers:Revenues(3) . . . . . . . . . . . . . . . . . . . . 25.3 67.5 49.6 42.8 114.4 83.9Adjusted EBITDA(3)(5) . . . . . . . . . . . . 11.4 30.5 24.8 20.7 55.2 46.9Adjusted EBITDA margin (%)(3)(5) . . . 45.2% 50.1% 48.3% 55.9%Number of shopping centers(8) . . . . . . . 13 12 13 11Total GLA (square meters)(8)(9) . . . . . . 265,442 232,814 252,207 211,760Employees . . . . . . . . . . . . . . . . . . . . . 297 206 220 139

(1) Except for percentages and operating data.

4

(2) Translated to U.S. dollars for convenience only at the rate of S/. 2.671 = US$1.00, the exchange rate reportedon June 30, 2012 by the SBS. See ‘‘Exchange Rate Information.’’

(3) Before inter-segment eliminations.

(4) For our definition of same store sales, see ‘‘Summary Financial Information.’’

(5) For our definitions of Adjusted EBITDA and Adjusted EBITDA margin and reconciliations of operatingprofit to Adjusted EBITDA, see ‘‘Summary Financial Information.’’

(6) We acquired InkaFarma in January 2011. Accordingly, financial and operating data for 2010 reflects theperformance of InkaFarma prior to our management.

(7) Includes two pharmacies that are franchised to third parties.

(8) Includes 13 shopping centers as of December 31, 2011, ten with 211,303 square meters of GLA that we ownor lease on a long-term basis and three with 40,905 square meters of GLA that we operate which are ownedby related parties.

(9) These figures include GLA for leases to both InRetail companies and third parties. Total area leased toInRetail supermarkets and pharmacies as of December 31, 2011 is 72,776 square meters and 508 squaremeters, respectively.

Competitive Strengths

Leading Player in the Rapidly Growing Peruvian Market

Through a combination of acquisitions and aggressive organic growth that capitalize on the majortransformation of the Peruvian consumer markets, we have established a leading integrated platformwith No. 1 or No. 2 market positions across our three business segments. We believe that our marketshare, scale and highly recognized brands, in addition to our integrated platform and focus on Peru,strongly position us to take advantage of the continued expansion we anticipate in the Peruvian modernretail sector.

Peru has one of the most dynamic consumer markets in Latin America, benefiting from: (1) arapidly growing economy with a 7.1% average annual real GDP growth rate over the last five years,compared with 1.5% for Mexico, 3.9% for Chile, 4.2% for Brazil, and 4.4% for Colombia, according tothe IMF; (2) increasing purchasing power as measured by GDP per capita, which has more thandoubled since 2004, according to the IMF; and (3) a socioeconomic transformation, with approximately20% of Peru’s population, nearly 5.5 million people, having risen above the poverty level in the last fiveyears and the upper and middle classes (roughly equivalent to the A, B and C socioeconomiccategories) having expanded from approximately 20% of households in 2003 to approximately 29% in2011, which represents a 59% increase or approximately 3.2 million additional people, according toPeruvian market research firm Ipsos APOYO.

The Peruvian retail market continues to exhibit substantial growth potential, as evidenced by:(1) its low modern retail penetration (20% of the retail market compared to 63% in Chile, both for thefirst three months of 2012, according to ILACAD World Retail (‘‘ILACAD’’), an international retailconsulting firm), (2) its underdeveloped supermarket footprint (17 square meters per 1,000 inhabitantscompared to 61 in Chile as of 2010, according to Apoyo Consultorıa S.A.C. (‘‘Apoyo Consultorıa’’), aleading Peruvian economic and business advisory firm), (3) low healthcare expenditure per capita(US$269 compared to US$947 for Chile as of 2010, according to the World Bank), and (4) itsunderserved shopping center market (1.5 shopping centers per million inhabitants as compared to 2.9in Chile, both as of 2011, according to the ACCEP).

5

Integrated Retail Platform

Our integrated retail platform provides us with a significant competitive advantage forunderstanding our consumers’ purchasing and spending preferences, facilitating our expansion processand gaining access to attractive commercial retail spaces. In most of our shopping centers, many of theprincipal tenants are either one of our own stores, such as our supermarkets, or store brands controlledor operated by Intercorp Peru or its shareholders, such as Oechsle (department store chain), Promart(home improvement chain), Cineplanet (movie theatre chain), Bembos (fast food) and China Wok (fastfood). The early commitment of these stores to our shopping center developments creates acomplementary portfolio of retail tenants that, in turn, allows us to attract other retailers, given thehigh degree of store traffic visibility. This visibility also improves our ability to secure financing forthese developments.

Moreover, our capacity to simultaneously expand with multiple retail formats at one site makes usa preferred business partner for developers and landlords seeking diverse retail offerings. As a result,we enjoy a strong negotiating position to secure premium locations for our stores.

We believe that our multiple retail formats, along with those of our affiliates, create convenientcommercial hubs and prime cross-selling opportunities in our locations, strengthening consumer loyalty,thus attracting and maintaining substantial traffic in our shopping malls and supermarkets.

In addition, through our credit card partnership and loyalty programs, we have access toapproximately 622,500 active cards and a proprietary database of information from over six millionconsumers, or roughly 20% of Peru’s population. This broad network allows us to gain betterknowledge of consumer preferences and spending patterns. We believe that the information we gainfrom this network results in an increase in our share of the customers’ wallet by enabling us to adaptour product and service offerings to satisfy customer needs, and by generating cross-sellingopportunities both from our segments, and, more broadly, from our affiliated retail formats.

Highly Recognized Store Brands

Our highly recognized store brands represent a significant competitive advantage in developingcustomer loyalty. These brands are associated with diverse shopping experiences, exclusive private labelbrands, seasonal promotions and affordable prices. Plaza Vea was the most recognizable supermarketbrand in Peru in 2011. InkaFarma was named the most recognizable retail pharmacy brand and thesixth most recognized brand in Peru in 2011. We believe Real Plaza also enjoys a high level ofrecognition among current and prospective tenants. In addition, our well-known store brands allow usto leverage our reputation for product quality and service to sell private label products. Furthermore,we believe the recognition of our store brands gives us a significant competitive advantage ingenerating increased traffic as we expand our operations into new locations.

Diversified Real Estate Portfolio of Hard to Replicate Locations

Our supermarkets, pharmacies and shopping centers are in strategic locations in Lima, the largestand most populous city of Peru, as well as in other urban areas throughout the country. We believe thatour diversified real estate portfolio allows us to benefit from economic growth in different regions ofPeru and across our targeted socioeconomic categories. In addition, we are the first modern retail chainto have opened supermarkets and shopping centers in most of the cities outside the Lima metropolitanarea in which we operate. We believe this first-mover advantage has been critical to the consolidationof our leading market positions throughout the country.

Our real estate selection and acquisition process is spearheaded by an experienced in-housedevelopment team. This team has developed a rigorous yet efficient approval process to ensure thatstrategic decisions are made in an expedited manner. Our deep local market knowledge allows us to

6

carefully research potential locations, taking into consideration the size, density and purchasing powerof the local urban population, the competition and local growth prospects. We believe our corecompetency of executing land acquisition and development in Peru is instrumental to our expansionstrategy.

We directly own more than half of the sales area on which our supermarkets operate, whichprovides both strategic and financial advantages. Related parties own another 13% of this area, andonly 31% is owned by unrelated third parties. Through our land bank, we currently own or lease on along-term basis over 288,000 square meters of property throughout Peru for near-term development of29 supermarkets and four shopping centers. We believe our real estate portfolio is a valuable asset dueto the scarcity of prime properties in Peru, providing significant barriers to potential new entrants.

Proven Track Record of Acquisitions and Organic Growth

Our management team has a proven track record of generating profitable growth in Peru, drivenby a combination of acquisitions and organic initiatives. In 2003, Intercorp Peru acquiredSupermercados Peruanos and successfully implemented its turnaround, from losses during that year toAdjusted EBITDA of S/. 176.3 million and net profit of S/. 35.5 million in 2011. Over the same period,we developed the Plaza Vea supermarket format and created the Vivanda and EconoMax brands. Weacquired InkaFarma in January 2011 and since then have opened 82 pharmacies and focused onincreasing higher margin private label sales and developing a logistics platform to support futuregrowth. Another example of our organic growth capabilities is the development of 13 shopping centersthroughout Peru since 2001, reaching over 265,000 square meters of GLA as of June 30, 2012. Tosupport our expansion plans, we have invested in improving our operational and logistical capabilities.We believe we are best positioned to take advantage of substantial growth opportunities in the Peruvianretail sector based on our proven track record, our profound market knowledge and the flexibility anddynamism of our integrated platform.

Seasoned Management Team and Peruvian Controlling Shareholder

We are led by a seasoned management team with extensive operating experience in the retail andreal estate sectors. Several members of our senior management team have previously held executivepositions in major retail companies, consulting firms and multinational conglomerates in the UnitedStates and Latin America. In addition, our culture emphasizes teamwork and meritocracy, and focuseson attracting and retaining highly qualified personnel while maintaining a motivated workforce. As aresult, Supermercados Peruanos was ranked by the Great Place to Work Institute among the top tenplaces to work in Peru in 2009 and 2010 and the fourth best place to work in Peru in 2011 (within thecategory of more than 10,000 employees).

Our ultimate parent company, Intercorp Peru, is one of Peru’s largest business groups, withactivities spanning financial services, retail and real estate. We believe that being part of this groupoffers us advantages, when compared to multinational retailers operating in the country, because of thegroup’s exclusive focus on the Peruvian market, highly visible in-country presence and rapid decision-making capabilities. In addition, Intercorp Peru controls a complementary portfolio of retail brandswhich supports the growth of our integrated platform.

Our Strategy

Our core objective is to continue our profitable growth by focusing on meeting the evolving needsof Peruvian consumers, through the expansion of our market presence, improvement of our operationalefficiency and further development of top talent. We will seek to meet this core objective through theimplementation of the following strategies.

7

Continue Expansion Plan Throughout Peru

We intend to open new supermarkets, pharmacies and shopping centers in locations where webelieve there is high growth potential or unsatisfied demand. As such, our expansion strategy focuseson both entering new markets and strengthening our presence in existing markets across our geographicand socioeconomic target markets. Peru’s real GDP is expected to grow at an average annual rate of5.9% over the next five years, according to the IMF, and its poverty level is also expected to decreaseby 10% (or approximately 2.1 million people) from 2011 to 2015, according to the Peruvian Economyand Finance Ministry.

The compact size of our supermarket formats gives us the flexibility to open profitable stores inunpenetrated medium size cities and/or highly dense urban areas where large plots of land are scarce.Our standardized pharmacy formats require leasing of small retail spaces, which, combined with lowcapital requirements and attractive rents for landlords, support our capability to rapidly identify, secureand open new stores. This strategy gives us a significant competitive advantage in capitalizing on theincrease of purchasing power of the different socioeconomic categories across the country.

We intend to use our significant land bank to open new supermarkets and develop new shoppingcenters. Through our land bank, we currently own or lease on a long-term basis over 288,000 squaremeters of property throughout Peru for near-term development of 29 supermarkets and four shoppingcenters. Moreover, we plan to leverage the expertise and local market knowledge of our real estatedevelopment team to continue to expand our land bank and analyze additional acquisitionopportunities as they become available and fit our multi-format strategy.

Offer Targeted Value Propositions to Profitably Increase Share of Wallet

InRetail Peru, through its three business segments, is mainly focused in serving the growingPeruvian middle class. We have developed targeted value propositions based on customer experiences,convenience, price, service and product offerings in each of our retail segments. We will continue toimprove and adapt these offerings to meet the market needs of our targeted socioeconomic categories.We believe that these targeted value propositions will increase our customer loyalty and share of wallet.

In our supermarkets segment, we cluster our stores by format and location to offer productassortments that are designed by our dedicated category experts to meet the specific needs of ourbroad range of customers, using a low price positioning strategy and active promotions. We believefurther development of our private label products offers attractive opportunities for margin expansion.We offer a co-branded Plaza Vea Visa credit card through our affiliate Banco Internacional delPeru S.A.A. (‘‘Interbank’’), whereby our customers receive exclusive discounts and access to financing.There were approximately 622,500 of these cards currently outstanding and active as of June 30, 2012.

Our pharmacies segment capitalizes on our brand’s reputation for high quality and reliableproducts at everyday low prices at convenient locations throughout Peru. As a result, InkaFarma’saverage sales per store were 107% higher than those of our competitor pharmacy chains, based on 2011sales data provided by IMS Health. Furthermore, we have developed a wide assortment of private labelproducts. We offer these products at competitive prices, thereby building customer loyalty whileachieving high margins.

Real Plaza strives to create shopping and entertainment hubs in every community in which weoperate through an optimal tenant mix strategy that enhances the shopping experience. Real Plazaactively manages promotions and events to attract customers and incentivize shopping. To attracttenants, Real Plaza offers substantial traffic via its premier locations, anchor stores and sustainedmarketing investments, as well as the opportunity to expand nationwide.

8

Obtain Synergies by Leveraging our Integrated Platform

We plan to continue leveraging our integrated platform to obtain synergies and enhance ourprofitability. By having a highly specialized real estate team focused on sourcing locations anddeveloping new shopping centers and stand-alone stores, we have developed expertise to cope with thecomplexities of land remediation, permitting, construction and relations with government institutions.The effectiveness of this team grants us access to a large land bank to support our growth.

Our access to a proprietary database of information of over six million customers and anintegrated retail credit card provides us with valuable information that we plan to continue exploiting.Learning from and adapting to consumer preferences and spending patterns leads to an increase in ourshare of costumer’s wallet, and generates cross-selling opportunities both from our segments, and, morebroadly, from our affiliated retail formats.

We are focused on implementing operational improvements that drive margin expansion in ourretail segments, including investments in modern distribution centers, supply chain managementprograms, logistics and other technology systems. A primary focus of this strategy has been theimplementation of the same warehouse management system in both our supermarkets and pharmaciessegments, which we expect will be completed by the end of 2012. This investment in a comprehensivestate-of-the-art supply chain will allow us to support a significant expansion in the number of ourstores. We are undertaking the following initiatives for our supermarkets segment: (1) consolidation ofour current Lima distribution centers, (2) development of three regional distribution centers outside theLima metropolitan area and (3) centralization of our food processing plants in the Lima metropolitanarea. We are also developing a state-of-the-art-distribution center for our pharmacies segment that weexpect to be operational by the end of 2012. These projects aim to lower our operating costs as apercentage of revenues, reduce shrinkage and labor costs and lower our ongoing maintenance costs. Wealso believe these operational initiatives will enable us to provide better service to our customers,achieve significant efficiencies within our segments and better position us for capitalizing on growthopportunities.

We plan to continue obtaining back office cost synergies, by integrating decision making andstandardizing systems and processes in areas such as information technology, supply chain, treasury,accounting and payroll. In addition, we will continue using our platform to recruit and retain top talent.Our growth profile, career advancement opportunities, ability to promote mobility across businesssegments and our shareholders’ reputation are key drivers in this effort.

Risk Factors

There are a number of risks you should consider before buying the shares. These risks arediscussed more fully under ‘‘Risk Factors’’ beginning on page 16 of this Offering Memorandum. Theserisks include, but are not limited to: economic conditions that impact consumer spending; decreases inthe purchasing power of middle- and low-income consumers; intense competition in each of ourmarkets; rapid consolidation in our retail markets; existing and new regulatory requirements; our abilityto obtain and maintain zoning, environmental, land use and other governmental approvals; our abilityto successfully supplement our growth and retail strategies; the inability to obtain the capital we needfor further expansion of our businesses; risks associated with development and construction activities;food and drug safety concerns and related unfavorable publicity; the loss of key tenants; risksassociated with our suppliers; economic, political and social developments in Peru, including increasedvolatility of exchange rates or increased inflation; severe weather, natural disasters and adverse climatechanges; and other risk and uncertainties described in ‘‘Risk Factors.’’

9

12SEP201221261190

Corporate Structure

InRetail Peru has three principal subsidiaries: Supermercados Peruanos, InkaFarma andInRetail RE.

Corporate Information

Our headquarters are located at Carlos Villaran 140, 19th Floor, Lima 13, Peru. Our telephonenumber is +511-219-2000. Our website address is www.inretail.pe. The information included or referredto, on or otherwise accessible through our website is not included or incorporated by reference into thisOffering Memorandum.

10

THE OFFERING

The following is a brief summary of the terms of this offering. The summary is not intended to becomplete and should be read together with the more detailed information contained in this OfferingMemorandum.

Issuer . . . . . . . . . . . . . . . . . . . . . . . . . . . . InRetail Peru Corp., a corporation (sociedad anonima)incorporated under the laws of Panama

Shares Offered . . . . . . . . . . . . . . . . . . . . . We are offering 20,000,000 shares of our common stockin this global offering.

Global Offering . . . . . . . . . . . . . . . . . . . . This offering is being made to qualified institutionalbuyers in the United States and to non-U.S. personsoutside of the United States. Peruvian private pensionfunds are eligible to participate in the offering.

Offering Price . . . . . . . . . . . . . . . . . . . . . The initial offering price will be US$20.00 per share.

Over-Allotment Option . . . . . . . . . . . . . . . We have granted the initial purchasers an option for aperiod of 30 days to purchase up to 3,000,000 additionalshares, solely for the purpose of coveringover-allotments, if any.

Shares to be Outstanding ImmediatelyAfter this Global Offering . . . . . . . . . . . 99,807,319 shares (or 102,807,319 shares if the initial

purchasers exercise their over-allotment option in full).

Use of Proceeds . . . . . . . . . . . . . . . . . . . . The net proceeds to us from the sale of the shares beingoffered by us in this offering will be approximatelyUS$385.0 million (or US$443.2 million if the initialpurchasers exercise their over-allotment option in full),after deducting the underwriting discount and estimatedoffering expenses payable by us.

We intend to use the net proceeds from this offering tofund growth plans at our supermarkets and shoppingcenters segments with approximately US$30.0 millionand US$355.0 million, respectively.

Voting . . . . . . . . . . . . . . . . . . . . . . . . . . . Each share entitles the holder to one vote in all mattersto which our shareholders are entitled to vote, subject tocertain exceptions under our Pacto Social. See‘‘Description of Capital Stock.’’

Dividends . . . . . . . . . . . . . . . . . . . . . . . . . We do not currently intend to pay any dividends on theshares. See ‘‘Dividend Policy.’’

11

Lock-Up Agreements . . . . . . . . . . . . . . . . We and our shareholders Intercorp Retail, IntercorpPeru, NG Pharma Corp. (‘‘NG Pharma’’), IntercorpFinancial, Inteligo Bank Ltd. (‘‘Inteligo Bank’’) andInterseguro have agreed not to offer, sell or otherwisedispose of, without the prior written consent of therepresentatives of the initial purchasers, any of theshares or other securities convertible into orexchangeable for the shares for a period of 180 daysfollowing the date of this Offering Memorandum, otherthan the shares to be sold in this offering.

Settlement . . . . . . . . . . . . . . . . . . . . . . . . Investors will be required to make payment for theshares in U.S. dollars, and settlement of the shares willbe made through the facilities of DTC and CAVALI onor about October 10, 2012.

Transfer Restrictions . . . . . . . . . . . . . . . . . This offering is being made in accordance withRule 144A and Regulation S. The shares have not beenand will not be registered under the Securities Act orwith any securities regulatory authority of any U.S. stateand, accordingly, may not be offered, sold, pledged orotherwise transferred or delivered within the UnitedStates or to, or for the account or benefit of, U.S.persons (as defined in Regulation S) except as set forthin ‘‘Transfer Restrictions.’’

Transfer Agent and Registrar . . . . . . . . . . . Computershare Trust Company, N.A.

Listing . . . . . . . . . . . . . . . . . . . . . . . . . . . Our shares are listed on the LSE under the symbol‘‘INRETC1’’. Prior to this offering, there has been notrading market for the shares in Peru, the United Statesor elsewhere. We cannot assure you that a tradingmarket will develop or will continue if developed.

Risk Factors . . . . . . . . . . . . . . . . . . . . . . . See ‘‘Risk Factors’’ and other information included inthis Offering Memorandum for a discussion of the risksyou should consider before deciding to invest in theshares.

12

SUMMARY FINANCIAL INFORMATION

The following information is only a summary and should be read together with ‘‘Management’sDiscussion and Analysis of Financial Conditions and Results of Operations’’ and our combinedfinancial statements and related notes elsewhere in this Offering Memorandum. The following summaryfinancial information have been derived from our audited combined financial statements and relatednotes elsewhere in this Offering Memorandum, which have been prepared in accordance with IFRS asissued by the IASB.

For the Six Months ended June 30, For the Year ended December 31,

Income statement data: 2012 2012 2011 2011 2011 2010

(US$ (S/. in millions)(1) (US$ (S/. in millions)(1)in millions)(1)(2) in millions)(1)(2)

Revenues:Supermarkets . . . . . . . . . . . . . . . . . . . . . . . . . 551.7 1,473.7 1,338.1 1,055.8 2,820.1 2,423.4Pharmacies . . . . . . . . . . . . . . . . . . . . . . . . . . . 288.3 770.2 614.9 499.2 1,333.4 —Shopping centers . . . . . . . . . . . . . . . . . . . . . . . 25.3 67.5 49.6 42.8 114.4 83.9Intercompany transactions(3) . . . . . . . . . . . . . . . . (4.0) (10.7) (8.4) (9.6) (25.7) (17.7)

Total revenues . . . . . . . . . . . . . . . . . . . . . . . . 861.3 2,300.7 1,994.1 1,588.2 4,242.2 2,489.6

Cost of sales:Supermarkets . . . . . . . . . . . . . . . . . . . . . . . . . (409.3) (1,093.3) (1,001.4) (782.4) (2,089.8) (1,797.6)Pharmacies . . . . . . . . . . . . . . . . . . . . . . . . . . . (206.9) (552.8) (440.2) (360.9) (963.9) —Shopping centers . . . . . . . . . . . . . . . . . . . . . . . (7.4) (19.8) (14.6) (12.7) (33.9) (23.9)Intercompany transactions(4) . . . . . . . . . . . . . . . . 0.1 0.2 — 0.1 0.2 —

Total cost of sales . . . . . . . . . . . . . . . . . . . . . . (623.6) (1,665.6) (1,456.1) (1,155.9) (3,087.4) (1,821.6)

Gross profit:Supermarkets . . . . . . . . . . . . . . . . . . . . . . . . . 142.4 380.4 336.7 273.4 730.3 625.7Pharmacies . . . . . . . . . . . . . . . . . . . . . . . . . . . 81.4 217.4 174.7 138.3 369.5 —Shopping centers . . . . . . . . . . . . . . . . . . . . . . . 17.9 47.7 35.0 30.1 80.5 60.0Intercompany transactions . . . . . . . . . . . . . . . . . . (3.9) (10.5) (8.4) (9.5) (25.5) (17.7)

Total gross profit . . . . . . . . . . . . . . . . . . . . . . 237.8 635.1 538.0 432.3 1,154.8 668.0

Other operating income(5) . . . . . . . . . . . . . . . . . . . 2.2 6.0 29.3 20.1 53.6 41.6Selling expenses . . . . . . . . . . . . . . . . . . . . . . . . . (153.6) (410.3) (364.2) (291.6) (778.9) (464.5)Administrative expenses . . . . . . . . . . . . . . . . . . . . . (34.7) (92.6) (87.8) (56.9) (151.9) (69.1)Other operating expenses . . . . . . . . . . . . . . . . . . . . (2.4) (6.4) (13.1) (5.2) (14.0) (1.1)

Operating profit . . . . . . . . . . . . . . . . . . . . . . . . . 49.3 131.7 102.2 98.7 263.6 174.8Financial income(6) . . . . . . . . . . . . . . . . . . . . . . . 8.9 23.7 9.5 9.3 24.7 10.2Financial expenses . . . . . . . . . . . . . . . . . . . . . . . . (28.5) (76.1) (45.6) (38.2) (102.0) (43.9)Income tax expense . . . . . . . . . . . . . . . . . . . . . . . (11.1) (29.6) (19.9) (23.5) (62.8) (35.6)

Profit for the period . . . . . . . . . . . . . . . . . . . . . . . 18.6 49.7 46.0 46.3 123.6 105.5Non-controlling interest . . . . . . . . . . . . . . . . . . . 0.0 0.1 0.0 0.1 0.1 0.2Attributable to owners of the parent . . . . . . . . . . . . 18.6 49.6 46.0 46.2 123.4 105.4Earnings per share attributable to ordinary equity

holders of the parent(7): . . . . . . . . . . . . . . . . . . 0.23 0.62 0.65 0.67 1.78 2.28

13

As of June 30, As of December 31,

Balance sheet data: 2012 2012 2011 2011 2011 2010