1 Structured Products Delivering in Troubled Times Clive Moore Managing Director Investment Design...

-

Upload

jordan-fitzpatrick -

Category

Documents

-

view

226 -

download

8

Transcript of 1 Structured Products Delivering in Troubled Times Clive Moore Managing Director Investment Design...

11

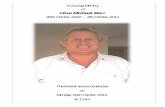

Structured ProductsStructured ProductsDelivering in Troubled TimesDelivering in Troubled Times

Clive MooreClive Moore

Managing DirectorManaging Director

Investment Design and DistributionInvestment Design and Distribution

22

Investment Design and Investment Design and DistributionDistribution

Established 2002Established 2002Consultancy with banksConsultancy with banksPrivate Client ManagersPrivate Client ManagersFund of Fund ManagersFund of Fund ManagersFamily OfficesFamily OfficesSome InternationalSome International

InternationalInternationalPrincipal Focus since 2008Principal Focus since 2008

33

ObjectivesObjectives

Learn about the history of Structured Learn about the history of Structured ProductsProducts

Develop an understanding of how Develop an understanding of how structured products workstructured products work

Why they continue to deliver market-Why they continue to deliver market-beating returns.beating returns.

44

Warning!!Warning!!

The following may make your head hurt a The following may make your head hurt a littlelittle• Don’t panic – you can get copies if you’re Don’t panic – you can get copies if you’re

interestedinterested• Ask questions as we goAsk questions as we go

It won’t take longIt won’t take long• Most people remember some of itMost people remember some of it• It’s actually easier than most people thinkIt’s actually easier than most people think

55

What is a Structured Product?What is a Structured Product?

An investment that delivers returns in a different way to An investment that delivers returns in a different way to direct investment in the underlying asset.direct investment in the underlying asset.

• Generating higher income instead of capital growthGenerating higher income instead of capital growth

• Providing capital protection on ‘higher potential’ asset classesProviding capital protection on ‘higher potential’ asset classes

• Enhancing returns from modest market gainsEnhancing returns from modest market gains

• Backing investment views in a concentrated wayBacking investment views in a concentrated way

• Accessing hard-to-buy asset classesAccessing hard-to-buy asset classes

66

Investor AttitudeInvestor Attitude

Rate FixationRate Fixation

Legacy of Building Society retail funding requirement – they Legacy of Building Society retail funding requirement – they had to get so much money from retail investors before they had to get so much money from retail investors before they could borrow any institutionally – so heavy rate competition could borrow any institutionally – so heavy rate competition (different to most other countries).(different to most other countries).

Short TermismShort Termism

British are eternal financial optimists, a better “rate” is just British are eternal financial optimists, a better “rate” is just around the corner, so don’t like to “tie-up” their money too around the corner, so don’t like to “tie-up” their money too long.long.

Like to buy products they think they understand, Like to buy products they think they understand, rather than take advice – poor image of financial rather than take advice – poor image of financial advisers, reluctance to discuss personal finances. advisers, reluctance to discuss personal finances.

77

Popularity of Structured Popularity of Structured ProductsProducts

Short and defined termShort and defined term Often promoted with a “headline” rateOften promoted with a “headline” rate Good value (normally half the price of OEIC/UT)Good value (normally half the price of OEIC/UT) Passive investment (not paying to underperform)Passive investment (not paying to underperform) Variety of structures to suit particular needsVariety of structures to suit particular needs Terms are fixed at outsetTerms are fixed at outset Generally easy to understand and evaluateGenerally easy to understand and evaluate

Deliver returns in sideways marketsDeliver returns in sideways markets

88

Massive Popularity with Massive Popularity with Wealthy ClientsWealthy Clients

Capital preservation is paramountCapital preservation is paramount

• Preserve hard earned capitalPreserve hard earned capital

• Deliver easy to understand payoffs to investors who Deliver easy to understand payoffs to investors who aren’t that interested in their portfoliosaren’t that interested in their portfolios

• Clients looking for ‘cash plus’ returnClients looking for ‘cash plus’ return

• Ability to deliver tailored solution for client needsAbility to deliver tailored solution for client needs

• Focus on absolute return to retain client relationshipFocus on absolute return to retain client relationship

99

Counterparty CollapseCounterparty Collapse

Banks took on too much riskBanks took on too much risk• Management focussed on sales – retail background led Management focussed on sales – retail background led

to desire to sell more loans (tins of beans) without credit to desire to sell more loans (tins of beans) without credit considerations.considerations.

Counterparty issue hadn’t been clearly presented Counterparty issue hadn’t been clearly presented or understoodor understood

Nothing is risk-freeNothing is risk-free Advisers should pay attention and cover their Advisers should pay attention and cover their

rears!rears! If it looks too good to be true…If it looks too good to be true…

1010

The Component PartsThe Component Parts ““Cash” Cash”

• Medium Term Notes/Zero Coupon Bonds. Debt issued by Medium Term Notes/Zero Coupon Bonds. Debt issued by banks. Just like corporate bonds. Options normally embedded banks. Just like corporate bonds. Options normally embedded in the MTN. in the MTN. Counterparty issue!Counterparty issue!

Call optionsCall options• The right (but not the obligation) to buy something at a The right (but not the obligation) to buy something at a

predetermined price at a point in the future. predetermined price at a point in the future. • For example, the right to “buy” the FTSE 100 at 6000 points in For example, the right to “buy” the FTSE 100 at 6000 points in

5 years time.5 years time.

Put optionsPut options• The right to sell something at a predetermined price at a point The right to sell something at a predetermined price at a point

in the future.in the future.• For example, the right to “sell” the FTSE Index at 6000 points For example, the right to “sell” the FTSE Index at 6000 points

in 5 years time. in 5 years time.

Option normally embedded in structure.Option normally embedded in structure.

1111

Constructing Structured Constructing Structured ProductsProducts

Simple Growth Product:

100p received from Investor: What gearing can be afforded?

Total margin of 5p to cover commission, marketing costs etc.

6 year Zero costs 83p (6 year interest rates at 3.2%)

Leaves 100 - 83 - 5 = 12p to buy FTSE upside

6 year FTSE Call option costing 20p

Gearing that can be offered = 12/20 = 60%

1212

Building BlocksBuilding Blocks

CallCall Options Options

100% Capital Return100% Capital Return

Possible BonusPossible Bonus

ChargesCharges

Cash (MTNs)Cash (MTNs)

Provides CapitalProvides CapitalReturnReturn

Simple Cash + CallSimple Cash + Call

E.G. Full capital return plus 60% FTSE growthE.G. Full capital return plus 60% FTSE growth

100%100% 100%100%

1313

Constructing Structured Constructing Structured ProductsProducts

Income Plan:

100p received from Investor: What income can be afforded?

Total margin of 5p to cover commission, marketing costs etc.

5 year Zero costs 85.5p

1% income for 5 years costs 4.6p

So annual income of 7% costs 32.2p

So cost is 122.7p!

Sell 5 year FTSE 100 Put Option = 22.7p (lose 1:1 at maturity if Index ever below 50% of start value)

1414

Building BlocksBuilding Blocks

PutPut Option Premium Option Premium

5 x 7% Income5 x 7% Income

VariableVariable Capital Capital ReturnReturn

Max 100%Max 100% ChargesCharges

Cash Cash (MTNs)(MTNs)

Provides Provides CapitalCapitalReturn and Return and IncomeIncome

Cash minus PutCash minus Put

E.G. 7% income each year,E.G. 7% income each year,but lose 1 for 1 if Index lowerbut lose 1 for 1 if Index lower

100%100%Max 100%Max 100%

1515

FeaturesFeatures

Capital ProtectionCapital Protection• ‘‘Soft’ protection – as long as the worst Index has never been Soft’ protection – as long as the worst Index has never been

below 50% of its start value.below 50% of its start value.• Check barrier level – is 60% a 40% drop or 60% drop?Check barrier level – is 60% a 40% drop or 60% drop?• American option = below 50% at any point.American option = below 50% at any point.• European option = below 50% at maturity.European option = below 50% at maturity.

Early Kick-OutsEarly Kick-Outs• Early maturity with bonus if certain levels achieved.Early maturity with bonus if certain levels achieved.• Auto-call products, single or multiple underlying.Auto-call products, single or multiple underlying.• Coupon Counter/Podium payoff – income/growth hybrid.Coupon Counter/Podium payoff – income/growth hybrid.

1616

FeaturesFeatures Stock BasketsStock Baskets

• Returns linked to a basket of stocks/indices/commodities can give Returns linked to a basket of stocks/indices/commodities can give more diversification.more diversification.

• Remember, single shares can collapse completely, but indices never Remember, single shares can collapse completely, but indices never die – they just change constituents.die – they just change constituents.

Counterparty RiskCounterparty Risk• ‘‘Riskier’ banks will pay higher returns (better looking products, wider Riskier’ banks will pay higher returns (better looking products, wider

margins).margins).• Think of your excuse in case things go wrong.Think of your excuse in case things go wrong.• Always ask – you should always be told.Always ask – you should always be told.

Always AskAlways Ask• Why is it different to everything else?Why is it different to everything else?• Make sure you understand the payoff in different scenarios.Make sure you understand the payoff in different scenarios.• Complexity may not be a bad thing, but check.Complexity may not be a bad thing, but check.

1717

Why the Bad ReputationWhy the Bad Reputation Bad news makes a good headline.Bad news makes a good headline.

Compensation culture – everyone’s a victim if there’s money in it.Compensation culture – everyone’s a victim if there’s money in it.

PR from “vested interest groups” – Threat to traditional funds.PR from “vested interest groups” – Threat to traditional funds.

““I thought it was guaranteed” - Well pay attention can’t you read!I thought it was guaranteed” - Well pay attention can’t you read!

Execution only salesExecution only salesShould have spoken to an adviser, or bought a product you understood!Should have spoken to an adviser, or bought a product you understood!

Products “sexed up” to look better than they were.Products “sexed up” to look better than they were.

Counterparty issue not clearly highlighted.Counterparty issue not clearly highlighted.

Some providers too greedy – Inappropriate counterparties used.Some providers too greedy – Inappropriate counterparties used.

1818

Investor Emotion IndexInvestor Emotion Index

Annual ReturnAnnual Return EmotionEmotion

>12%>12% Mildly enthusiasticMildly enthusiastic

+9%+9% NeutralNeutral

+3%+3% Surly (worse than cash)Surly (worse than cash)

0%0% Relieved if markets downRelieved if markets down

-5%-5% Positively hopping madPositively hopping mad

<-7%<-7% MurderousMurderous

Good to outperform, but better not to underperformGood to outperform, but better not to underperform

Investment BackdropInvestment Backdrop

Developed equity markets lagging – particularly UKDeveloped equity markets lagging – particularly UK

Changes in capitalismChanges in capitalism• Shares were owned by people with a vested interest in their Shares were owned by people with a vested interest in their

long term performance (company pension funds etc.)long term performance (company pension funds etc.)

• Shares now owned by Fund Managers – interest only in Shares now owned by Fund Managers – interest only in relative performancerelative performance

• Fund manager income from stock-lending (which also Fund manager income from stock-lending (which also encourages downward speculation)encourages downward speculation)

• Focus on attracting new investments.Focus on attracting new investments.

10 year FTSE flat – CEO remuneration up 400%*!!10 year FTSE flat – CEO remuneration up 400%*!!• Too many snouts in the trough.Too many snouts in the trough.*Source Manifest MM&K *Source Manifest MM&K

1919

2020

10 Year Fund Performance10 Year Fund Performance

Total number of fundsTotal number of funds 18,15418,154

Funds with 10 year recordFunds with 10 year record 4,217 (23%)4,217 (23%)

10 year growth greater than 10 year growth greater than 5% p.a.5% p.a.

2,047 (11%)2,047 (11%)

10 year growth greater than 10 year growth greater than 10% p.a.10% p.a.

676 (4%)676 (4%)

Source: Morningstar 16Source: Morningstar 16thth September 2011 September 2011

2121

Simplicity Leads to SuccessSimplicity Leads to Success

Product should be understandable in 2 paragraphsProduct should be understandable in 2 paragraphs

Remember, most investors are used to building society Remember, most investors are used to building society savings accountssavings accounts

Best to use recognisable underlyingsBest to use recognisable underlyings

Everyone likes a headline rateEveryone likes a headline rate

The IDAD DifferenceThe IDAD Difference

2222

Year of Issue

Autocalls Issued (GBP, USD, Euro)

Matured By First

Anniversary

Annualised Return exceeded

index

Ongoing > year 1

since issuance

Ongoing < year 1 since

issuance

2008 3 3 0

2009 16 15 6 1

2010 40 25 17 11 4

2011 59 59

How have the IDAD notes performed so far?How have the IDAD notes performed so far?

2323

Structured Products Structured Products Delivering in Troubled TimesDelivering in Troubled Times

Details of our current offers are available on our Details of our current offers are available on our website – www.idad.biz website – www.idad.biz

Or contact our IDAD Sales contactOr contact our IDAD Sales contact

Or email: Or email: [email protected]

2424

Structured Products Structured Products Delivering in Troubled TimesDelivering in Troubled Times

Clive MooreClive Moore

Managing DirectorManaging Director

Investment Design and DistributionInvestment Design and Distribution