Yellow final

-

Upload

tiago-devesa -

Category

Business

-

view

483 -

download

2

description

Transcript of Yellow final

W. J. Deutsch & Sons

[ yellow tail ]

Growth analysis

1. Problem Statement

2. Key Issues

3. Context

4. Alternatives Analysis

5. Recommendation

6. Financials

7. Implementation Plan

8. Risk Management

9. Sum up

Agenda

How to maintain market leadership in face of the current crisis ?

Problem statement

2. Problem Statement

Customers

Economic Climate

Product Identity

Key Issues

3. Key Issues

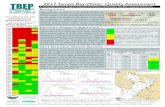

1. Industry Status

2. Wine segments

3. Yellow tail profile

4. Customer profile

Context

4. Context

Wine Consumption in the USA

1. Industry Status

4. Context

Growing trend until 2006

Stable since 2007

2. Wine Segments

4. Context

Wine Segments

TableWine

92%

Popular Premium

$3.00 - $7.00

Super premium

$7.00 - $14.00

Ultra-premium

$14.00 - $20.00

Luxury premium

> $20.00

Others (sparkling wines, wine coolers, pop

wines, fortified wines)

Highest market share31 %

Highest market share92%

- Table wines (traditionally consumed with food)

- Prices- $4.00 to the popular premium segment- $10.00 to the super premium segment

- Big portfolio of wines - 7 red - 5 white- 1 rose

- Modern brand

3. Yellow tail profile

4. Context

Age: 21 – 35

4. Customer profile

4. Context

High alcohol consumption

Alcohol consumption per age, 2006, USA

4. Customer profile

4. Context

Income above

average

Main characteristics:- Modern, young and cosmopolitan- Middle class - Sees wine as something more than a drink

“something you share with family and friends”

4. Customer profile

4. Context

How to maintain market leadership in face of the current crisis ?

Problem statement

2. Problem Statement

Wine market division

Red White Rose

Alternatives

Increase sales

Table Wine Other wines

Dessert and fortified Champagne and sparkling Aperitif

Alternatives

Alternatives

1. Business as usual

2. Consolidate marketing efforts

1. Move focus into new categories and products

1. Focus on new segments

2. Focus on new table wines

Expand & diversify Table

Maintain Table Explore other

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 20080

50000

100000

150000

200000

250000

300000

Table vs Other Wines evolutionIn thousand nine litter cases

Table Other

Table wines are growing

Alternatives

account for

92% of

the market in 2008

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 20080

5000

10000

15000

20000

25000

30000

35000

Table vs Other Wines evolutionIn thousand nine litter cases

Imported

Domestic

Total

Other wines sales have decreased 10% in 10 years

Alternatives

Yellow Tail Brand and current capacity

Successful branding strategy

The Coca-Cola of wine Wine for those who didn’t like

wine Round, fruity and user-friendly Complex, aristocatic

Mass production facilities

30,000 bottles bottled per hour 11 million cases per year

Alternatives

Alternatives assessment

Alternatives

Canada Germany Japan

Sales share 5 3 2

Growth 4 2 1

Necessary Know How 3 5 1

Brand identity 4 4 2

Total 16 14 6

Expand & diversify Table

Maintain Table Explore other

Alternatives scorecard from 1 (low) to 5 (top)

Alternatives assessment

Alternatives

Canada Germany Japan

Sales share 5 3 2

Growth 4 2 1

Necessary Know How 3 5 1

Brand identity 4 4 2

Total 16 14 6

Expand & diversify Table

Maintain Table Explore other

Alternatives scorecard from 1 (low) to 5 (top)

Alternatives assessment

Alternatives

Canada Germany Japan

Sales share 5 3 2

Growth 4 2 1

Necessary Know How 3 5 1

Brand identity 4 4 2

Total 16 14 6

Expand & diversify Table

Maintain Table Explore other

Alternatives scorecard from 1 (low) to 5 (top)

Wine “tutoring”

Widen costumer base

Adjust pricing strategy

3 Objectives:

Recommendation

Recommendation

Pro

duct

• 375 ml. Bottles

• Mix Packages

• Cock[tail]s

Pric

e

• 2$ Cage decrease in

• Chardonnay

• Shiraz

• Merlot

• Cabernet-

Sauvignon

Pla

cem

ent • [yellow tail]

Store & Lounge• 2 Pilot Stores

(NY and California)

• Lounge and sales space

• Instore Sommelier

• Online sales

Pro

mot

ion

• Curtis Stone• Advertising

campains• Weekly

videocasts

• Wine tasting Workshops

• Facebook and Youtube campaings

• Free Wine Guide

• Taxi campaigns

Initiaves – Marketing Mix

Product Price Placement Promotion

Wine Tutoring

Widen costumer base

Adjust pricing strategy

Assessment Card

Financial Impadct

Financial Impact

Investment By Item

Financials

Investment Total ($)

Rent Stores 2,700,000

Staff 200,000

Workshops 40,000

“Curtins Stone Campaign” 7,000,000

"Wine Instruction Manual" 239,600

Social Media Initiatives 900,000

The Mini Wallaby 950,000

Market Studies 1,000,000

Super-Market Staff + Initiatives 280,000

Taxi Advertising 1,200,000

Total 14,509,600

Financial Assumptions

Conservative Without Project

Financials

Without Project

Assumptions \ Calc. 2009 2010 2011 2012

Tax Rate 30%

WACC 9%

% Yellow to Total 2,82%

Total Wine Consumption -2% 10% 3% 3%

Inflation -0.40% 1.60% 3.20% 0.80%

Conservative Scenario

Assumptions \ Calc. 2009 2010 2011 2012

Tax Rate 30%

WACC 9%

% Yellow to Total 2,82% 3,5% 3,8% 4,2%

Total Wine Consumption -2% 10% 3% 3%

Inflation -0.40% 1.60% 3.20% 0.80%

Revenues Evolution

2012 2011 2010 2009 2008000

200,000,000

400,000,000

600,000,000

800,000,000

1,000,000,000

1,200,000,000

Without Project

Conservative

Best

Worst

USD

Sensitivity Analysis

Best

NPV$ 613,804,996.00

A.Payback Period1 Years

Worst

NPV$

154,270,401.00

A.Payback Period2 Years

Conservative

NPV$ 458,860,457.73

A.Payback Period

1.5 Years

Sensitivity Analysis

Conservative

NPV$ 458,860,457.73

Adjusted Payback Period 1.5 Years

Activities ObjectiveEst. Cost (Dolars)

2009 2010 2011 2012

1 Q 2 Q 3 Q 4 Q 1 Q 2 Q 3 Q 4 Q 1 Q 2 Q 3 Q 4 Q 1 Q 2 Q 3 Q 4 Q

Stores

Rent StoresCreate Proximity

Relation

$ 2,700,000.

00P E E E E

Specialist Staff Costumer Suport$

200,000.00P E E E E E

Educate Consumers

WorkshopsCreate Social Experience

$ 40,000.00

P E E E E E E E

"Wine Instruction Manual" Educate Consumer$

237,600.00P E E

Social Media InitiativesVirtual Proximity

Relation$

900,000.00P E E E

Capturate New Segments

The Mini Wallaby New product Offer$

950,000.00 P E

Pricing ExperimentEvaluate Price

Sensitivity- P E

Pricing Strategy ExpansionMarket Share

Boost- P P P P

Market StudiesUnderstand Consumers

$ 1,000,000.

00 P

Traditional Marketing

Super-Market Island Biggest Visibility - P E

Super-Market Staff Advise Consumer$

280,000.00P E E E E E

“Curtins Stone Campaign” Boost Visibility$

7,000,000.00

P E E E

Taxi ads Boost Visibility$

1,200,000.00

P E E

Activities KPI Contingency2009 2010 2011 2012

1 Q 2 Q 3 Q 4 Q 1 Q 2 Q 3 Q 4 Q 1 Q 2 Q 3 Q 4 Q 1 Q 2 Q 3 Q 4 Q

Stores

Rent StoresStore Profit >0.000

after 2nd yearDon't Expand to New

StoresP E E E E

Specialist StaffStore Profit >0.000

after 2nd yearDon't Expand to New

StoreP E E E E E

Educate Consumers

Workshops > 200 / Event Increase Divulgation P E E E E E E E

"Wine Instruction Manual"

10%\Year In SM Knowledge

Study Consumer Response

P E E

Social Media Initiatives10% Likes / Subs.

IncreaseHire SM consulting

companyP E E E

Capturate New Segments

The Mini Wallaby> 5% Share of Total

Sales

Discontinue if <2% / Increase Divulgation if

>2% P E

Pricing Experiment>10% revenues

better than expected

End Trial P E

Pricing Strategy Expansion

>2% profits than expected

End Expansion P P P P

Market StudiesSuccess of Other

InitiativesChange Consulting

Company P E

Traditional Marketing

Super-Market Island>10% Sales for specific Store

Change Store P E

Super-Market Staff>10% Sales for specific Store

Change Store P E E E E E

“Curtins Stone Campaign”

> 5% total sales Discontinue Campaign P E E E

Taxi ads> 2.5% total sales

after 1st YearDiscontinue Campaign P E E

Risk Analysis

32

1. Store flop2. Demand non-reaction

towards price decrease3. Decrease in wine

consumption

Severity

Pro

bab

ilit

y

1

2

3

Risk analysis

33

1. New and Repeat costumers may not adhere to the store concept.

Mitigation Plan:2. Organize marketing campaigns and periodic store events

Severity

Pro

bab

ilit

y

Store Flop1

34

Demand non-reaction towards price decrease 2Severity

Pro

bab

ilit

y

1. Demand may not respond to the new princing strategy

Mitigation Plan:

• Advertise price campaign

35

Decrease in wine consumption

1. Demand may contract more than expected

Mitigation Plan: • New marketing campaigns• Store launch• New product size and packages

3Severity

Pro

bab

ilit

y

Questions and Answers

Appendix

Financial Assumptions

Best Worst

Worst Scenario

Assumptions \ Calc. 2009 2010 2011 2012

Tax Rate 30%

WACC 9%

% Yellow to Total 2,82% 3% 3% 4%

Total Wine Consumption -2% 10% 3% 3%

Inflation -0.40% 1.60% 3.20% 0.80%

Best Scenario

Assumptions \ Calc. 2009 2010 2011 2012

Tax Rate 30%

WACC 9%

% Yellow to Total 2,82% 4% 4% 5%

Total Wine Consumption -2% 10% 3% 3%

Inflation -0.40% 1.60% 3.20% 0.80%

(nine liter cases) (in thousands)

USA Consumption of Wine

Year \ Item Total Consumption % Growth Total Total Yellow Tail % Growth Yellow Tail % Yellow to Total

2008294,740

0.91%8,300

3.11%2.82%

2007292,090

3.21%8,050

0.00%2.76%

2006283,000

3.40%8,050

7.33%2.84%

2005273,685

2.10%7,500

15.38%2.74%

2004268,062

3.81%6,500

51.87%2.42%

2003258,232

4.86%4,280

256.67%1.66%

2002246,268 1,200 0

Without Project

USA Consumption of Wine

Year \ Item Total Consumption % Growth Total Total Yellow Tail % Growth Yellow Tail % Yellow to Total

2012 337,079.46 3.00% 14,157 13.84%4.20%

2011 327,261.61 3.00% 12,436 11.83% 3.80%

2010 317,729.72 10.00% 11,121 36.72%3.50%

2009 288,845.20 -2.00% 8,134 -2.00%2.82%

2008 294,740.00 0.91% 8,300 3.11% 2.82%

2007 292,090.00 3.21% 8,050 0.00% 2.76%

2006 283,000.00 3.40% 8,050 7.33% 2.84%

2005273,685.00

2.10%7,500

15.38%2.74%

2004268,062.00

3.81%6,500

51.87%2.42%

2003258,232.00

4.86%4,280

256.67%1.66%

2002 246,268.00 1,200 0

Conservative Scenario

USA Consumption of Wine

Year \ Item Total Consumption % Growth Total Total Yellow Tail % Growth Yellow Tail % Yellow to Total

2012 337,079.46 3.00% 14,157 13.84% 4.20%

2011 327,261.61 3.00% 12,436 11.83% 3.80%

2010 317,729.72 10.00% 11,121 36.72% 3.50%

2009 288,845.20 -2.00% 8,134 -2.00% 2.82%

2008 294,740.00 0.91% 8,300 3.11% 2.82%

2007 292,090.00 3.21% 8,050 0.00% 2.76%

2006 283,000.00 3.40% 8,050 7.33% 2.84%

2005 273,685.00 2.10% 7,500 15.38% 2.74%

2004 268,062.00 3.81% 6,500 51.87% 2.42%

2003 258,232.00 4.86% 4,280 256.67% 1.66%

2002 246,268.00 1,200 0

Best Scenario

USA Consumption of Wine

Year \ Item Total Consumption % Growth Total Total Yellow Tail % Growth Yellow Tail

% Yellow to Total

2012 337,079.46 3.00% 15,169 15.88% 4.50%

2011 327,261.61 3.00% 13,090 3.00% 4.00%

2010 317,729.72 10.00% 12,709 56.25% 4.00%

2009 288,845.20 -2.00% 8,134 -2.00% 2.82%

2008 294,740.00 0.91% 8,300 3.11% 2.82%

2007 292,090.00 3.21% 8,050 0.00% 2.76%

2006 283,000.00 3.40% 8,050 7.33% 2.84%

2005 273,685.00 2.10% 7,500 15.38% 2.74%

2004 268,062.00 3.81% 6,500 51.87% 2.42%

2003 258,232.00 4.86% 4,280 256.67% 1.66%

2002 246,268.00 1,200 0

Capex 2008 2009 2010 2011 Total

Rent Stores 450,000 450,000 900,000 900,000 2,700,000

Staff 50,000 50,000 50,000 50,000 200,000

Workshops 10,000 10,000 10,000 10,000 40,000

Tv Ads 500,000 500,000 500,000 500,000 2,000,000

Wine Instruction Manual 61,400 59,400 59,400 59,400 239,600

Social Media 600,000 100,000 100,000 100,000 900,000

Mini Wallaby 50,000 300,000 300,000 300,000 950,000

Market Studies 1,000,000 0 0 0 1,000,000

Super Market Staff 70,000 70,000 70,000 70,000 280,000

Taxi Advertising 300,000 300,000 300,000 300,000 1,200,000

Total (M$) 2,791,400 1,539,400 1,989,400 1,989,400 9,509,600

Stores

Area (sq feet) 1500

Price \ sq feet 300

Total Stores 2

Total Stores 900000

Grand Total

Wine Instruction Material

Conception 2000

Per Bottle 0.1

Adjusted Payback Period

Cenario Year 2008 2009 2010 2011 2012

Worst Adjusted Cash Flow -2,791,400.00 -2,539,945.40 29,836,455.01 52,411,928.15 140,235,981.11

Conservative Adjusted Cash Flow -2,791,400.00 -2,539,945.40 116,647,782.04 247,990,261.81 381,059,313.02

Best Adjusted Cash Flow -2,791,400.00 -2,539,945.40 205,562,059.31 379,700,619.11 432,114,103.78

Cenario 2008 2009 2010 2011 2012

Worst

Inc. Revenues -2,791,400.00 0.00 38,576,445.60 39,733,738.97 152,161,972.92

CAGR 345%

NPV $ 154,270,401.00

Conservative

Inc. Revenues -2,791,400.00 0.00 143,427,253.20 212,527,869.89 307,892,683.42

CAGR 692%

NPV $ 458,860,457.73

Best

Inc. Revenues -2,791,400.00 0.00 248,278,060.80 255,726,402.62 374,634,416.49

CAGR 897%

NPV $ 613,804,996.00

Growth of Wine Sales

Source: Silicon Valley Banking

1. Industry Status

BACK UP

Back-up

Expected sales in volume

Expected Case Sales 2009 2010 2011

Cabernet-Merlot

Expected Case Sale 440 430 470

% Growth - -2,27% 9,30%

Shiraz-Cabernet

Expected Case Sales 375 390 430

% Growth - 4,00% 10,26%

Pinot Grigio

Expected Case Sale 585 610 660

% Growth - 4,27% 8,20%

Riesling

Expected Case Sale 410 450 480

% Growth - 9,76% 6,67%

Pinot Noir

Expected Case Sale 480 520 570

% Growth - 8,33% 9,62%

Rose

Expected Case Sale 290 320 340

% Growth - 10,34% 6,25%

Sauvignon Blanc

Expected Case Sale 220 280 350

% Growth - 27,27% 25,00%

Shiraz

Expected Case Sale 900 1090 1050

% Growth - 21,11% -3,67%

Chardonnav

Expected Case Sale 1450 1600 1650

% Growth - 10,34% 3,13%

Merlot

Expected Case Sale 950 1100 1050

% Growth - 15,79% -4,55%

Cabernet Sauvignon

Expected Case Sale 1100 1250 1200

% Growth - 13,64% -4,00%

Reserve Cabernet

Expected Case Sale 500 600 650

% Growth - 20,00% 8,33%

Total 7700 8641,226 8900,662

% Growth - 12,22% 3,00%

2009 2010 20110

200

400

600

800

1000

1200

1400

1600

1800

Expected Sales in volume until 2011

Cabernet-Merlot

Shiraz-Cabernet

Pinot Grigio

Riesling

Pinot Noir

Rose

Sauvignon Blanc

Shiraz

Chardonnav

Merlot

Cabernet Sauvignon

Reserve Cabernet

Appendix

Back up

2009 2010 2011800

900

1000

1100

1200

1300

1400

1500

1600

1700

Expected Sales in volume until 2011

Shiraz Chardonnav

Merlot Cabernet Sauvignon

Appendix

Back up

2009 2010 20110

100

200

300

400

500

600

700

Expected Sales in volume until 2011

Cabernet-Merlot

Shiraz-Cabernet

Pinot Grigio

Riesling

Pinot Noir

Rose

Sauvignon Blanc

Reserve Cabernet

Appendix

Back up

Consumption per person – Countries Compared

Supermarket sales

Nielsen also tracks varietal sales by package size (e.g., 750 ml. bottles, 1.5 liter "magnums," 187 ml. single-serve bottles, etc.). Over the past year, the biggest dollar sales increases were for varietals bottled in the 1.5 liter (+20%) and 750 ml. (+18%) sizes. During the same period, 750 ml. wines accounted for roughly 50% of supermarket dollar sales, compared to 31% for 1.5 liter magnums.Premium wineries enjoying the greatest percentage increases in supermarket sales over the past year were Sutter Home, up 23% in dollar sales, followed by Fetzer, up 18%, Robert Mondavi-Woodbridge, up 15%, and Beringer, up 12.5%.